Dear Clients, Colleagues and Friends:

For over 60 years, Northern Bank has been driven by an entrepreneurial spirit and guided by common sense. No matter the economic cycle, we stay true to our beliefs and stick to our business model. It’s very simple — we seek out and invest in small and medium size businesses run by ambitious people who are driven by the same type of entrepreneurial spirit. When others were distracted by massive and immediate gains to be had financing crypto currency operations, we stuck to our model. When our peers deployed excess liquidity into large, low-yielding, long-term securities portfolios, we stuck to our model. We have consistently dedicated our capital and resources to help our clients grow their businesses and realize their dreams, and we always will.

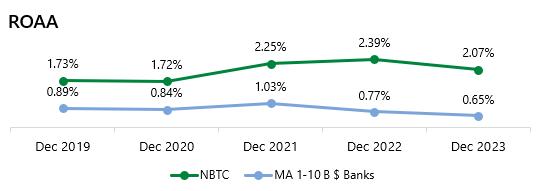

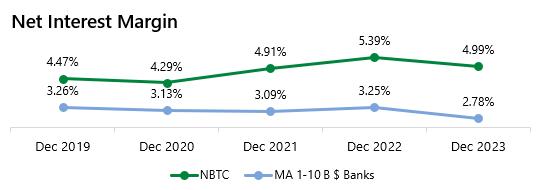

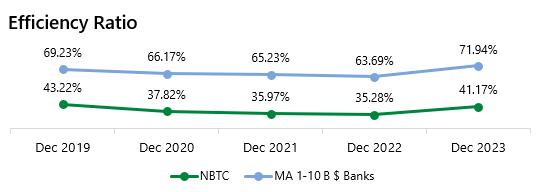

Our commonsense approach has served the Bank and our clients well. As predicted, 2023 closed with an exceptionally strong Return On Average Assets (ROAA), Return on Average Equity (ROAE), Net Interest Margin (NIM), and Efficiency Ratio. Our strong financial performance was realized on top of significant investments in our operational capabilities.

When we say that we are “your partner for growth,” we not only mean it, we live it. Our capital position is as strong as it has been in our history. Our loan and funding portfolios are diverse and able to absorb rapid interest rate increases like we have seen over the past twelve months, and then some.

As always, we remain committed to supporting and giving back to our communities through employee volunteerism, corporate sponsorships, and donations from the Northern Bank Charitable Foundation.

We have never been satisfied with the status quo and we never will be. We strive to be a true partner to our clients, employees and communities, and to be the best commercial bank. No reservations. No excuses. The best commercial bank.

I am confident about our future and the opportunities for growth that lie ahead in 2024.

Very truly yours,

JAMES J. MAWN President & CEO Northern Bank, 275 Mishawum Road, Woburn, MA

JAMES J. MAWN President & CEO Northern Bank, 275 Mishawum Road, Woburn, MA

01801

WHERE WE STARTED Founded in 1960

WHERE WE ARE TODAY

32,000+ clients

273 employees

13 branches

From humble beginnings to nationwide reach.

Over 60 years ago, Northern Bank was started by two brothers in order to aid small businesses in Woburn, Massachusetts. Today, we serve communities throughout Massachusetts and partner with businesses across the country. Wherever our clients are and whatever they need, we’re here to get the deal done. MORE THAN JUST A

WHAT WE’VE ACHIEVED 3x increase in assets in 10 years

83% employee headcount increase in 10 years 4x+

Cash and Balances Due from Depository Institutions

Noninterest Bearing Balances

Balances

You can depend on us to be financially safe and sound — since 1960.

Return on average assets, as compared to return on equity, shows a balance sheet with strong performance that does not rely on “levering up” to fund a low-yielding securities portfolio. *Northern Bank’s return on equity is also strong, providing substantial capital accretion over time.

Higher net interest margin reflects an operating model built on commercial lending, without leveraging the balance sheet to fund a low yielding securities portfolio.

Return on average equity is a financial ratio that measures the performance of a bank based on its average shareholders’ equity outstanding. Typically, ROAE refers to a company’s performance over a fiscal year.

An efficiency ratio is a calculation that illustrates a bank’s profitability. It shows how much a bank spends to generate each dollar of revenue.

MORE THAN JUST A BANK.

During the summer, we advanced Northern Digital Solutions (NDS), whose mission is to develop cutting edge, proprietary digital products and customer solutions for Northern Bank that can also be sold to other institutions. NDS combines deep expertise in financial technologies and operations to help develop business agility and intelligence. Its solutions improve a financial institution’s bottom-line, increase operational efficiency and manage risk.

In 2023, Northern Bank established a collection of companies and digital financial solutions all aimed at improving the banking experience for both customers and fellow bankers.

NDS’s first product is its Cash Consolidator (CC) solution, reshaping the commercial lending business by reducing lending risk, and streamlining cash management for bank customers. For bankers, the CC solution automates the process of protecting cash collateral and accelerates deposit inflows. For business customers, CC provides one-stop visibility and consolidating and reconciling cash from all their CC connected banks and accounts.

During the spring, Northern Bank — in partnership with ZSuite Technologies, Inc. — began offering a pair of digital solutions aimed at making banking easier for landlords and property owners.

During January 2023, we launched Northern Home Loans (NHL), a new subsidiary that now manages all current and future residential lending.

By expanding our mortgage operation, Northern Bank can now provide customers with more flexibility, increased lending options and greater access to competitive rates. NHL widens the Bank’s geographical reach and is now ready to serve customers who are in the market for a vacation home or move to another state.

ZEscrow automates the processes and procedures necessary to open, close, maintain and service escrow, trust and custodial accounts. It is an ideal solution for Northern Bank customers who require escrow solutions with self-serve capabilities.

ZRent is a digital ACH rent collection tool that simplifies the monthly rent collection process for landlords and property managers. With ZRent, customers no longer need to collect and process paper checks.

The addition of ZEscrow and ZRent bolsters Northern Bank’s cash management service offerings to property management professionals.

Northern Bank’s deposit suite specifically provides property management companies with escrow master, tenant escrow savings and HOA reserve savings accounts.

MORE THAN JUST A BANK.

CUSTOMER SERVICE

Responsive service kept customer satisfaction high.

OUR U.S.-BASED, EMPLOYEE-STAFFED CONTACT CENTER EXPERIENCED A BUSY 2023

56,000 calls received

12% increase in calls received year-over-year

23,000 calls made

15% increase in calls made year-over-year

CUSTOMERS ARE EXTREMELY SATISFIED WITH NORTHERN BANK’S PRODUCTS AND SERVICES 4.4/5.0

189

When choosing a 1031 Exchange partner, many opt for the safety and soundness of one backed by an FDIC insured bank.

Leveraging 1031 Exchange — where homeowners can defer capital gains taxes on rental or investment properties — is a hands-on business because of the many intricacies related to tax codes. Our experts canvassed the U.S. in 2023, educating realtors, commercial brokers, attorneys, CPAs and investors about the process.

The team attended or hosted more than 40 webinars, podcasts, continuing education classes and industry conferences all aimed at creating greater awareness and understanding of the 1031 Exchange business.

Northern Bank was started by two entrepreneurs who had the vision, ingenuity and perseverance to pave their own way. It should be no surprise that those are exactly the same attributes we look for in our employees. We don’t follow a traditional path, but we are confident that our compass is true.

OUR VALUES

The “Northern PEAK” has four core company values that guide all employees:

We perform each task with professionalism. We are committed to operational excellence and outstanding customer service.

We focus on executing each task in a timely and efficient manner. We deliver on our commitments.

We demonstrate pride in Northern Bank. We are enthusiastic and create positive energy. We maintain a positive and open attitude toward new ideas.

We master every aspect of our jobs and always pursue growth. We learn from our experiences. We expand our knowledge through development opportunities and learning from colleagues.

At Northern Bank, we recognize, respect and celebrate the diverse backgrounds and perspectives of all people and value the learning and cultural opportunities a richly diverse workplace and community provide. We are committed to creating a culture and environment that is inclusive of all our employees, because it is their uniqueness and individual traits and characteristics that make them who they are and enable them to contribute in a way no one else can.

Words matter. Some words are empty slogans, others are meant to stifle any conversation or debate, but some words mean a lot — like “stay true” or “true partner.” These words carry deep meaning. We’re not interested in window dressing, but rather real actions that help us stay true to our foundational principles.

KATHY HARRIS Chief Human Resources Officer, SVP

Together we celebrate our employees’ dedication.

Every year, we recognize our employees in March as part of Northern Bank’s “Employee Appreciation Week.” A daily trivia contest, free Red Sox tickets, cheesecake and the return of “Pizza Friday” were among the many highlights of this year’s celebration.

Morning coffee and bagels kept employees running throughout the day and everyone was busy deciding on a gift from The Northern Shop. The online store features hats, sweatshirts, mobile power banks, vests and more.

Our team is now as strong as it has ever been. We’re projecting that strength to our clients and the communities we serve. Our success and that strength is a direct result of your (employee) commitment.

JIM MAWN President and CEO

At Northern Bank, we know what drives entrepreneurs. It’s the desire to fill a need in the community that no one else can. That’s why our founders started Northern bank all those decades ago, to give entrepreneurs a place to bank that understood their needs and shared their dreams.

Northern Bank’s commitment to serving small business customers was on full display in 2023 when it launched its “True Partner” advertising campaign during all Boston Red Sox home game broadcasts on WEEI-FM Boston (93.7).

Northern Bank’s “success stories” brought to life the various financial challenges and solutions a variety of small businesses face.

The series kicked off highlighting four clients, including the owner of a national computer coding education business, a child daycare owner in Woburn, MA, a local Crumbl Cookies franchisee in Saugus, MA and an insurance agency operator in Stoneham, MA.

You can find Northern Bank employees all over Middlesex County and beyond. We sit on various nonprofit boards and are very active in local area chamber of commerce and rotary clubs. We coach youth sports, attend town wide parades and make charitable donations to those who need it most in the communities we serve.

Twice a year, we offer the community a free service that safely and privately destroys personal documents through a partnership with Shred-it®, a leading provider in information destruction.

We believe that helping our communities grow, helps us all.

Through charitable foundation grants, community sponsorships and corporate giving in 2023, the Northern Bank Charitable Foundation awarded:

$703,653 donated ACROSS

84 organizations

VOLUNTEERISM

Over the course of 2023, Northern Bank employees volunteered for a number of event and activities.

991 hours logged

91 employees

293 activities

34 organizations

A portion of volunteer hours were driven by 24 Northern Bank hosted events that include:

Financial literacy through Junior Achievement and the FDIC Money Smart Program with three onsite events for Somerville High School students to learn from Northern Bank employees.

The fight against homelessness with Heading Home through two “Up & Out Moves”, the adoption of the Medford Family Life Shelter through seasonal activities, and the 2023 Heading4Home campaign which brought together eight community banks to raise awareness and $300,000 in fundraising.

Boys & Girls Club, “After the Bell” Program, at the Altavesta and Shamrock Elementary Schools where Northern Bank employees helped students with schoolwork.

Northern Bank’s Heading4Home campaign organized an effort to raise $300,000 for nonprofit Heading Home, which works to end homelessness in Greater Boston.

Northern Bank and representatives from seven other community banks in September presented Heading Home with a check on the Fenway Park diamond prior to a Red Sox game. The effort — created to raise funds and awareness for homelessness prevention — was advertised on WEEI-FM during select Sox broadcasted in 2023.

“We are excited and proud to see community banks in Massachusetts come together in the fight against homelessness,” said Northern Bank President and CEO Jim Mawn.

“As community bankers, we represent a powerful force because of our collective commitment to the communities we serve. We are uniquely positioned to give back in a meaningful way.

Thank you to all the banks for your participation — we cannot wait to do this again next year!”

Last year, Heading Home, established in 1974, supported more than 2,000 people and secured permanent housing for 150 families. This included 1,128 children, whose average age was 8-years-old.

The Northern Bank Charitable Foundation annually administers the James E. McGarry Jr. Scholarship Fund. The $5,000 college scholarship, established in 2014, honors the late “Jim” McGarry of Woburn for his 50 years of service to Northern Bank. It also pays tribute to his lifelong affinity for local fire and police departments.

Ryan T. Bellemore, of Westford Academy, earned the 2023 scholarship in recognition of his seven academic awards, excellent test scores and high GPA. Bellemore, whose father Timothy is a Westford firefighter, regularly volunteers at local fire departments and works as a ski patroller at Nashoba Valley Ski Area in Westford, MA.

“Ryan impressed us with his commitment to academic success and community service,” said Michelle Arnold, Northern Bank Charitable Foundation Committee Member. “We look forward to awarding another deserving candidate in 2024.”

Northern Bank employees helped a displaced family move into permanent housing through nonprofit Heading Home’s “Up & Out” program.

Employee volunteers moved the family of three into its new home in Dorchester, Massachusetts and outfitted it with a variety of household essentials donated by their bank colleagues.

The benefiting family — a single mom with two kids ages 13 and 11 — was ecstatic when the home was revealed to them in June 2023.

A non-profit organization, Heading Home’s mission is to end homelessness in Greater Boston by providing a supported pathway to self-sufficiency that begins with a home, together with critical services such as life skills, financial literacy, and job training.

Big Brothers Big Sisters of Central Mass/MetroWest

Birthday Wishes

Boys and Girls Club of Greater Billerica

Boys & Girls Clubs of MetroWest

Chesterbrook Community Foundation

City Kids Inc.

Council of Social Concern

Cradles to Crayons

Dignity Matters, Inc.

Dunkin’ Joy in Childhood Foundation Inc.

Gifts of Hope Unlimited, Inc.

Habitat for Humanity

North Central Massachusetts, Inc.

Habitat for Humanity of Greater Lowell

Heading Home, Inc.

Junior Achievement of Greater Boston (aka JA of Northern NE)

Just A Start

Lazarus House Ministries

Melrose Farmer’s Market — The Snap Program — Melrose Market Community LLC DBA Melrose Farmer’s Market

Merrimack Valley Housing Partnership Inc. (MVHP)

Metropolitan Boston Housing Partnership, Inc. (dba Metro Housing | Boston)

Minuteman Senior Services

Mission of Deeds, Inc.

Mystic Valley Elder Services

Nashoba Learning Group

National Brain Tumor Society

NuPath Inc.

People Helping People, Inc. — Burlington Food Pantry

Raising A Reader Massachusetts (RAR-MA)

Rise Above Foundation

Ron Burton Training Village

Second Chances, Inc.

Sudbury Community Food Pantry

The Elizabeth Peabody House

The Hillinger PIL Fund

The James E. McGarry Jr. Scholarship Fund

The Joey Domenici Foundation

Woburn Host Lions Charities Inc.

YMCA of Greater Boston (North Suburban — Woburn, Burbank-Reading, Waltham Y’s)

Northern Bank 2023 Donations

AAPIEC Inc. — Asian American Pacific Islanders for Equality and Change Inc.

Boys & Girls Clubs of Woburn

Breakthrough Greater Boston

Cambridge Center for Adult Education

Camp Casco

Cystic Fibrosis Foundation

Daniel’s Table Inc.

Drake Academy of Excellence

English At Large

Frances Drake PTO

Friends of Horn Pond

Friends of Melrose Memorial Hall

Friends of Roberts Field Inc.

Friends of Stoneham — Troop 513

Friends of the JV Fletcher Library

Friends of Woburn Basketball

General John Nixon Elementary School PTO

Girls Incorporated of Greater Lowell

Goodnow Library Foundation

Greater Boston Stage Company

Kaylash

Lions Club International — Woburn Breakfast

Lions Club International — Woburn Middlesex

Massachusetts 4-H Foundation

Minuteman Senior Services

Mission Ready

Reading Scholarship Foundation, Inc.

St. Charles School

Stoneham Business & Community Educational Foundation

Stoneham Central Middle School PTO

Stoneham Coalition for a Safe and Healthy Community

Stoneham Community Development Corporation

Stoneham Historical Society & Museum

Stoneham Little League

Stoneham Sabers Baseball

Stoneham Veterans Committee (Veterans Day Memorial Run & Field of Honor)

Stoneham Youth Lacrosse

Thangaat Raas Garba Event

The Food Drive

The Guild for Human Services

The James E. McGarry Jr. Scholarship Fund

The Silver Unicorn Bookstore

VNA Hospice & Palliative Care

Westford Historical Society and Museum

Woburn Memorial High School

Woburn Pee Wee Football

American Cancer Society (Multiple Locations/Events)

STOP BY FOR A CHAT

Find your local branch at NBTC.com/Locations

We welcome you in to discuss your financial goals and dreams.

DIAL OUR DIRECT LINE

Talk with our helpful customer service representatives who are ready to take your call at 800-273-6908, option “0”.

VISIT OUR WEBSITE

Learn more about our banking services and solutions at NBTC.com