in

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Office

5077 Waterford Dr. Suite 302

Sheffield Village, OH 44035 Phone: 440.934.1090

info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate

Ashlyn Bellan | ashlynncbia@gmail.com

NCBIA Life Directors

Jeremy Vorndran, 84 Lumber

Tom Caruso, Caruso Cabinets

Bob Yost, Dale Yost Construction

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Chris Majzun Sr., Majzun Construction Co.

Chris S. Majzun Jr., Majzun Construction Co.

Jim Sprague, Maloney + Novotny, LLC

Randy Strauss, Strauss Construction

Tom Lahetta, Tom Lahetta Builders, Inc.

2022 NAHB Delegates

These are our members who represent our local industry in Washington DC and Columbus:

Randy Strauss, Strauss Construction

2022 NCBIA Officers

President

Sara Majzun, Majzun Construction Co.

Vice President

Tim King, K. Hovnanian Homes - Ohio Division

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, Treasurer, First Federal Savings of Lorain Secretary

Mike Meszes, Secretary, DRC Construction Co.

2022 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Dan Bennett, Bennett Builders & Remodelers

Kevin Walker, Great Lakes Properties & Investments

Dave Linna, Linna Homes & Remodeling

Jason Rodriguez, Lorain County Joint Vocational School

Mike Gidich, MDG Maintenance, LLC

Brian Schwab, RestorePro, Inc.

Dave Weisenberger, Tusing Builders & Roofing Services

Jack Kousma, Kousma Insulation (alternate)

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Ric Johnson, CAPS Builder & Right at Home Technologies

OHBA Past Presidents

Randy Strauss, 1996

2022 OHBA Trustees

Randy Strauss, Strauss Construction Sara Majzun, Majzun Construction Co. (alternate)

Mary Felton, Guardian Title (alternate)

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

Build Across AmericaBuild Across America

Event Sponsors

Table of Contents

- Menu of Services

- Save the Dates

8- Executive Officer’s Report

9-10 - NEW EVENT! Build Across America!!

11 - Eye on Housing: NAHB Builders' Businesses Showed Significant Growth in 2021

12 - 2022 Calendar of Events

13 - Eye on the Economy: Keeping A Watch on Rising Rates

14 - NAHB NOW: NAHB Launches New Podcast, The Daily Drill

15 - Eye on Housing: Consumer Confidence Rises To A 5-Month High in September

16 - Eye on Housing: Almost Even Split Between Natural Gas and Electric Heating Systems in New Homes

17 - Eye on the Economy: Fed Raises Rates Again, Puts more Pressure on Housing

18 THANK YOU 2022 ANNUAL CLAMBAKE SPONSORS!

19-22 - 2022 Annual Clambake Photo Gallery

24 - Eye on Housing: Covid Era Impacts on Working from Home and Housing Market Impacts 27OHBA Executive VP Column 28-30 - NEW! 2023 Annual Home Show Flyers

31 - NAHB NOW:

Statement From NAHB CEO Jerry Howard on White House Meeting on Housing

32 - NAHB NOW: Revised Definition of WOTUS Advances to Final Review

33 - NAHB NOW: 2023 IBS Education Updates

34Thanks for Renewing! Sorry to See You Go!

What Members are Saying

36 - Thank you, Spikes!

37-46 -

2023 Circle of Excellence Call for Entries

- Vote for Housing in This Election Year

- Sedgwick Update

-NAHB NOW: Builder Business Grew Significantly in 2021

- 2023 NCBIA Hall of Fame Nomination Form

HOW CAN WE HELP?

Copies Equipment

Black & White

Single Sided 2-Sided

Black & White

Single Sided 2-Sided

Black & White (11”x17”)

Color Color

Single Sided 2-Sided

Single Sided 2-Sided

Color

$0.10 $0.20

$0.15 $0.20 $0.50 $0.25 $0.50

$0.27 $0.52 $2.00

Design Services

Design Services

$35 per hour

Contact Ashlyn Bellan at ashlynncbia@gmail.com

Raffle Boards, Drum & Equipment

$100 per day

HOW CAN WE HELP?

and

Copies Equipment

Black & White

Warranty Books

$30 each (plus shipping, if applicable)

NEED SOMETHING ELSE? JUST ASK!

For more information on any of these products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

Now is the time to switch to Verizon 5G Business Internet!

Black & White Color Color

Raffle Boards, Drum & Equipment

Color

Design Services

Design Services

Warranty Books

NEED SOMETHING ELSE? JUST ASK!

Save the Date!

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!!!!!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!!!!!

Wednesday, October 19th General Membership Meeting & Election Night

5:00-7:00 PM

Ahern's Banquet Center 726 Avon Belden Road, Avon Lake

Saturday, October 29th Build Across America

1:00-4:00 PM

Harvest Meadows 105 Harvest Way, Elyria

If you would like to participate in a committee, please email Judie Docs at judiencbia@gmail.com.

Check the website at www.ncbia.com for upto-date changes, additions, and corrections to these events!

Do you have some business news to share? Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

ONE YEAR AGO, Builder Books...

by Judie Docs, CSP, MCSP, MIRM, CMP, CGPOne year ago, Builder Books, the publishing arm of the National Association of Home Builders (NAHB) (which NCBIA is a local association of) released a new children’s book, The House That She Built. The publication, written by Mollie Elkman, aims to help bring the gap of the industry’s skilled labor shortage by educating and exposing children to STEAM (Science, Technology, Engineering, Art & Math) and construction careers, and evaluating diversity in the industry. The book was inspired by the team of real women who came together from around the country to build a one-of-a-kind home in Utah. The House That She Built.

This past spring, The House That She Built was one of 150 books selected to receive the prestigious IBPA (Benjamin Franklin Award). The book won Gold for the best Children’s/Young Adult Cover Design. The Independent Book Publishers Association (IBPA) had received a record-breaking 1,894 entries.

What started as a house turned into a book, has now evolved into a full national movement to show girls that they can accomplish anything.

“We are so proud of the impact that The House That She Built has had on educating young people on careers in construction and highlighting the importance of women’s representation in the industry,” said NAHB First Vice Chairman Alicia Huey, a custom home builder and developer from Birmingham, Alabama “It is great to see the success and recognition the book has received over the past year, and we look forward to seeing what is yet to come with this movement.”

The House That She Built has received widespread industry support and is making an impact in many ways, including:

• Creating The House That She Built Girls Scout Patch Program

• Hosting activities for the Boys and Girls Clubs of America

• Translation of The House That She Built into Vietnamese

• Printing of 50,000 copies within the first year

• Support from social media influencers in the trades

• Featured at industry shows such the NAHB International Builders’ Show, the International Roofing Expo and the Floor Coverings International Convention and Women in Residential Construction Conference

• The House That She Built limited edition jewelry line created by Goldfine Jewelry to inspire the younger generations. Proceeds from the collection will support skilled workforce development, diversity, and inclusion in the construction industry.

• NAHB’s Professional Women in Building participation around the country

The House That She Built is only the beginning of inspiring diversity and inclusion for future generations of the skilled workforce for the housing industry. Industry leaders 84 Lumber and Andersen Corporation continue to be sponsors of the book and support its mission to further development initiatives in home building by generating awareness of the skilled trades to underrepresented communities.

If you are interested in this free event on Saturday, October 29th from 1-4 please contact judie@ncbia.com for more information and registration form. Seating is limited – children K-6th grade.

If you are interested in helping with this event – we are looking for sponsors and participants for a small panel to share why you chose your trade and skills that you use – or if you just want to help with the event, please contact judie@ncbia.com Thanking you in advance for your help!

Presents

Build Across AmericaBuild Across America

An Event for K-6 Graders

Saturday, October 29, 2022 1-4 PM H t d b

Harvest Meadows

105 Harvest Way, Elyria

Schedule

1:00-1:40 The day will start as the children meet & engage with the author of The House That She Built, Mollie Elkman & the builder via Zoom.

1:40 2:10 Meet our diverse panel who share why they chose their trade and the skills used.

2:10 4:00 Creative activities (construction snack tivity and other fun activities.)

This is only the beginning of inspiring diversity and inclusion for future generations of the skilled workforce in the housing industry.

This Book was inspired by a team of women who came together from around the country to build a one of a kind home in Utah

Event Sponsors

Please Email Judie@ncbia.com or call 440-934-1090 with the names & grades of the children attending and contact information. (Or Scan QR Code Below to Register Online)

Must be Accompanied by

EYE ON HOUSING

NAHB BUILDERS' BUSINESSES SHOWED Significant Growth in 2021

BY: PAUL EMRATHThe business of the typical NAHB (National Association of Home Builders) builder grew significantly between 2020 and 2021, according to results from NAHB’s latest member census. The 2021 NAHB census shows that the median gross revenue of an NAHB builder in 2021 was $3.3 million, up 26.9 percent from the previous year.

NAHB reinstated its member census during the industry-wide downturn of 2008, when median annual revenue of builder members was only around $1.0 million. Median annual revenue began rising in 2013, plateauing at $2.6 to $2.7 million from 2017 through 2020. The $3.3 million recorded in 2021 thus represents an all-time high, as well as a substantial 26.9 percent increase from the 2020 number.

Although their median revenue has increased recently, most NAHB builders remain relatively small businesses by conventional standards.

In the 2021 NAHB census, 14 percent of NAHB’s builder members reported a dollar volume of less than $500,000, 13 percent reported between $500,000 and $999,999, 38 percent between $1.0 million and $4.9 million, 15 percent between $5.0 million and $9.9 million, 6 percent between $10.0 million and $14.9 million, and 13 percent reported dollar volume of $15.0 million or more. In comparison, the Small Business Administration’s size standards classify most types of construction businesses as small if they have average annual receipts of less than $39.5 million.

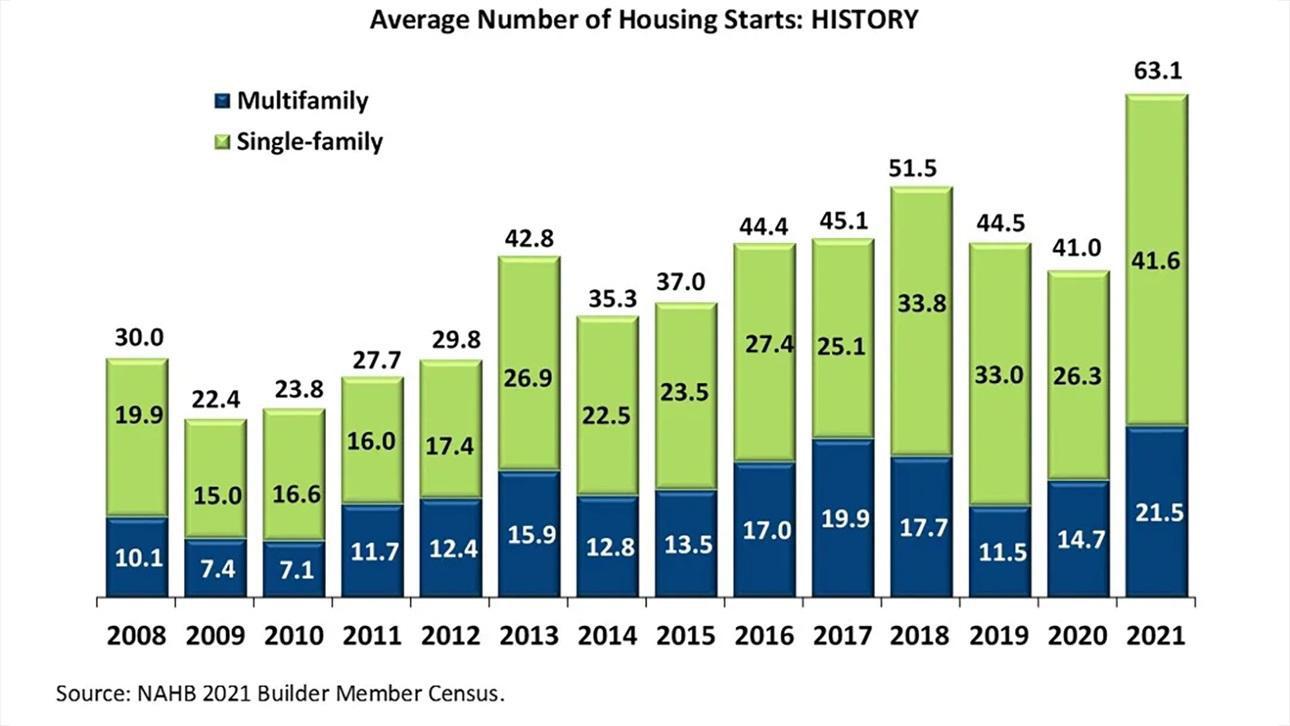

The NAHB census also asks builder members about the number of homes started. On average, NAHB builders started an average of 63.1 homes in 2021 (41.6 single-family units and 21.5 multifamily homes).

The median number of housing starts was 6. Because the data on starts include a small percentage of very large builders, the average number of starts is much higher than the median, and for many purposes the median number of 6 housing starts is more representative of the typical builder.

The median number of starts increased by an even 20.0 percent, from 5 in 2020 to 6 in 2021. Although the average number of starts is more sensitive than the median to results reported by a relatively small number of large builders, the average can be useful for illustrating industry trends. The trend in average starts per builder has been generally upward over the long term. Agreeing with the increase in builder revenue, there was a particularly strong surge in the average number of housing starts per builder between 2020 and 2021. The increase was 53.9 percent—from 41.0 in 2020 to 63.1. The average number of single-family starts grew by 58.2 percent (from 26.3 to 41.6), while the average number of multifamily starts increased by 46.3 percent (from 14.7 to 21.5).

Not surprisingly, multifamily builders tend to start more homes per year than single-family builders. NAHB’s multifamily builders reported a median of 84 housing starts in 2021, compared to 6 for single-family builders.

This information was originally published in the August 2022 Special Study available on NAHB’s Housing Economics web page. For more information, including median dollar volume, starts and employment as well as basic demographics for each of the major types of NAHB builder member, please consult the longer special study.

CALENDAR

OF EVENTS

CAREERS IN CONSTRUCTION MONTH

Wednesday

GENERAL MEMBERSHIP MEETING & ELECTION NIGHT

Tuesday-Thursday

SPIKE APPRECIATION MONTH

5:00-7:00 PM Ahern’s Banquet Center, Avon Lake 3:00 & 5:00 PM

NAHB Fall Leadership Meeting

Thursday

5:00-7:00 PM

EXECUTIVE COMMITTEE & BOARD MEETINGS

OHBA FALL BOARD

Kansas City, Mo. Columbus

THANKSGIVING | OFFICE CLOSED

UGL Y SWEATER MIX ER Captains Club, 232 Park Ave Ste L, Amherst

CHRISTMAS ( OBSERVED) O F FICE C LOSED

EYE ON THE ECONOMY

KEEPING A WATCH on Rising Rates

Rising interest rates and declining housing affordability are the primary culprits for the ongoing weakness for home sales and housing starts in recent months. Since the start of 2022, the benchmark 10-year Treasury rate (which often moves in tandem with mortgage rates) has increased from 1.51% to approximately 3.7% this morning. The average 30-year fixed mortgage interest rate, as measured by Freddie Mac, has increased even more, rising from 3.11% at the start of the year to 6.7% this week. Combined with higher construction costs and rising home prices, these market dynamics have pushed housing affordability to more than decade-lows.

Builder confidence in the single-family housing market has closely reflected deteriorating affordability conditions, falling for nine consecutive months as registered by the NAHB/Wells Fargo Housing Market Index (HMI).

With the NAHB Economics team closely tracking housing market conditions, NAHB was ahead of the curve with other market analysts when in April we noted the single-family market faced an inflection point as interest rates increased. And in August, NAHB’s HMI reading led our economists to declare a “housing recession” — and other major news outlets and economists soon followed our lead when describing the weakening housing market.

Reasons for the Rapid Rise in Rates

The economic drivers of these conditions are a nearly 40-year high for inflation, produced by too much Covid-era stimulus, supply-chain issues and global market disruptions, including the Russian war against Ukraine. While the Federal Reserve is now aggressively tightening monetary policy, via higher short-term rates and balance sheet reductions of ultimately tens of billions of dollars worth of assets off its massive near-$9 trillion bond portfolio, it waited too long to act.

The central bank’s call last year that inflation was “transitory” was a forecasting error. Further exacerbating the situation was a failure at the local, state and national levels to properly and effectively address the supply side of the economy, where inflation can be more efficiently fought. With the Fed falling behind the inflation curve, its leadership has now adopted a stark, hawkish stance to convince markets that it is in the inflation fight to win.

As a result of the Fed’s aggressive monetary policy stance, interest rates have increased significantly in 2022 and particularly in recent weeks. Since the start of August, the 10-year Treasury rate has increased from 2.6% to approximately 3.7%. And as the bond market decline gathered speed this week (a falling bond market often means rising mortgage rates), the 10-year Treasury rate briefly increased above 4%, the highest rate in 15 years. Rates then fell back on global issues and a focus on macroeconomic weakness at the end of the week.

BY: ROBERT DIETZAdditionally, mortgage interest rates have moved much higher because the spread between the 10-year Treasury and the 30-year fixed rate mortgage has expanded because of market uncertainty, mortgage pre-payment risk, and the Fed’s plan to allow for tens of billions of dollars of mortgage-backed securities each month to roll off its balance sheet.

The Outlook Moving Forward

The consequences of this credit market are clear to builders. Buyers are priced out of the market, especially first-time buyers. Profit margins compressed by residential construction market costs are under pressure from the need to adjust pricing and incentives to attract buyers. And a housing market that needs more supply to address a significant, structural housing deficit of about 1 million homes has to put this long-run project on hold as real-time market demand, weakened by declining housing affordability, retreats.

Given this macro environment, 2022 will be the first year since 2011 to see a decline for single-family construction starts. The housing market, and other elements of the economy, are clearly slowing. The Fed, which many market observers now believe has adopted a stance that is too hawkish, should focus on the inflation data coming in the end of the year and slow its path of tightening to examine whether its policy is working to bring inflation down.

And other regulatory and fiscal policymakers should do what they can to reduce regulatory cost burdens and other ineffective rules that artificially increase the cost of remodeling homes, building apartments and supplying for-rent and for-sale housing to the market.

In the meantime, builders should continue to be cautious with respect to operations. The Fed has indicated that it plans to hold interest rates higher for longer. Unless a severe recession takes hold in 2023, interest rates are unlikely to ease until 2024. However, at that time, the housing market will rebound as interest rates fall back and a pool of frustrated, prospective home buyers comes back to the market in greater numbers. This means, unfortunately, the homeownership rate will decline in 2023, which places housing firmly on the political agenda heading into the 2024 elections.

NAHB LAUNCHES NEW PODCAST, The Daily Drill

NAHB recently launched a new series in the Housing Developments podcast, The Daily Drill, featuring bite-sized episodes hosted by NAHB Senior Vice President Paul Lopez. The daily episodes provide insight on the latest headlines in housing news, economics, the supply chain and more in about two minutes.

The Daily Drill complements the more in-depth Housing Developments podcast episodes hosted by CEO Jerry Howard and Chief Lobbyist Jim Tobin to keep you updated on important housing news.

The show can be found wherever you listen to podcasts, including Apple Podcasts, Spotify, SoundCloud and Stitcher. Be sure to subscribe to the podcast so you never miss an episode.

CONTACT: PAUL LOPEZ plopez@nahb.org (202) 266-8409

EYE ON HOUSING

CONSUMER CONFIDENCE RISES

To 5-Month High in September

BY: FAN-YU KUOConsumer confidence increased for the second straight month to the highest level since April, as solid job gains, declining gas prices and easing inflation contributed to more optimistic views of economy. However, spending plans were mixed. The purchasing intention to buy cars and major appliances increased, while the intention to buy homes fell due to the rising mortgage rates. Looking forward, consumer spending will continue to face headwinds from inflation and interest rate hikes.

The Consumer Confidence Index, reported by the Conference Board, increased 4.4 points from 103.6 to 108.0 in September, the highest level since April 2022. The Present Situation Index increased 4.3 points from 145.3 to 149.6, and the Expectation Situation Index climbed 4.5 points from 75.8 to 80.3, the highest since February 2022.

Consumers were more optimistic about the short-term outlook. The share of respondents expecting business conditions to improve rose from 17.3% to 19.3%, while those expecting business conditions to deteriorate fell from 21.7% to 21.0%. Similarly, expectations of employment over the next six months were more positive. The share of respondents expecting “more jobs” increased by 0.4 percentage points to 17.5%, and those anticipating “fewer jobs” decreased by 1.9 percentage points to 17.7%

Consumers’ assessment of current business conditions improved in September. The shares of respondents rating business conditions “good” rose by 1.8 percentage points to 20.8%, while those claiming business conditions “bad” fell by 1.4 percentage points to 21.2%. Meanwhile, consumers’ assessment of the labor market was more favorable. The share of respondents reporting that jobs were “plentiful” increased by 1.8 percentage points, while those saw jobs as “hard to get” declined by 0.2 percentage points.

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home stayed slightly fell to 5.3% in September, the lowest level since September 2021. The share of respondents planning to buy a newly constructed home remained at 0.6%, while for those who planning to buy an existing home rose to 2.3%.

ALMOST EVEN SPLIT BETWEEN NATURAL GAS And Electric Heating Systems in New Homes

BY: FAN-YU KUO

BY: FAN-YU KUO

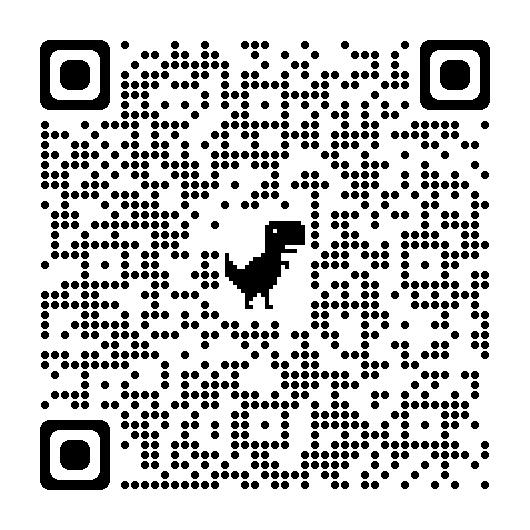

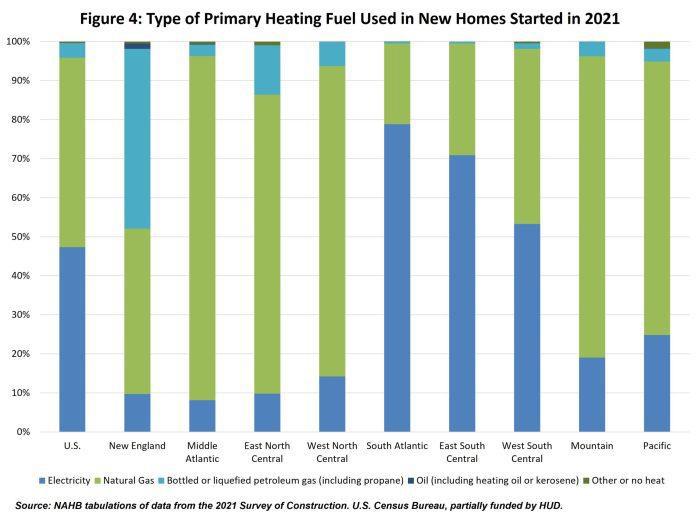

The census Bureau’s Survey of Construction (SOC) provides valuable information on the characteristics of new homes started construction, such as air conditioning and heating system installations.

Air Conditioning

In 2021, 97 percent of new single-family homes started had a central AC system, higher than 95.4 percent in 2020. The trend, going back to 2000, shows a steady rise in the share of new homes with central AC, increasing from 86 percent in 2000 to 97 percent in 2021 (Figure 1).

Heating Systems

Almost all of new single-family homes started use either an air/ground source heat pump or a forced air system for the primary heating equipment (99 percent in 2021). Eighteen percent of homes also used a secondary type of heating equipment. In general, the share of new homes using an air or ground source heat pump as the primary means of providing heat has increased, going from 23 percent in 2000 to 40 percent in 2021. Meanwhile, the share relying on a forced air system has slipped, going from 71 percent to 58 percent in the same time frame. The type of heating system installed varies significantly by Census Division. Figure 3 displays the share of new homes with an air or ground heat pump in 2020. In warmer regions of the country, these systems are more common: 78 percent in the South Atlantic,75 percent in the East South Central, and 23 percent in Pacific. In colder regions, very few homes have air or ground heat pumps: only 9 percent of new homes started in Middle Atlantic and 11 percent in the New England. In colder climates, air source heat pumps (traditionally the most common type) become less efficient and rely more heavily on a back-up heating system during the winter.

Though the share of new single-family homes started with central AC differs across the country’s nine Census divisions (Figure 2), the highest share is concentrated in the Midwest and South region. One hundred percent of homes started in the South Atlantic and East South-Central divisions had central AC installed, followed by 99 percent in the West North Central as well as West South Central. The divisions with the lowest shares of new homes with central AC are New England (90 percent) and the Pacific (86 percent), albeit both shares have steadily increased over the past three years.

The SOC also provides data on the primary fuel used to heat new single-family homes (Figure 4). Approximately 49 percent of new homes started in 2021 use natural gas as the primary heating fuel, compared to 47 percent powered by electricity. The shares of new homes with electricity and natural gas as the primary heating fuel have been stable since 2012. Like heating and AC systems, the primary heating fuel source varies significantly by region of the country. For example, in New England, only 10 percent of new homes use electricity as the primary heating source. In contrast, 79 percent and 71 percent of new homes started in the South Atlantic and the East South-Central use it. These are the same two divisions where heat pumps, which run on electricity, are most common. This is also in line with findings from NAHB’s What Home Buyers Really Want, 2021 Edition, in which consumers in South region generally prefer electricity for their heating and cooling system.

EYE ON THE ECONOMY

FED RAISES RATES AGAIN, Puts More Pressure on Housing

Continuing its aggressive strategy to bring the rate of inflation lower, the Federal Reserve’s monetary policy committee raised the federal funds target rate by 75 basis points, increasing that target to an upper bound of 3.25%. This marks the third consecutive meeting with an increase of 75 basis points. And the Fed’s leadership has signaled they intend to preserve these elevated rates for a substantial period of time — well into 2024 — placing added pressure on the housing industry.

Indeed, the central bank expects the target for the federal funds rate will increase by 75 more basis points in November, 50 in December, and then conclude with 25 points at the start of 2023. These increases would ultimately push the federal funds top rate to near 4.8% and, in turn, raise mortgage rates higher still. For example, the average 30-year fixed mortgage rate will likely surpass 6.5% before the end of this year.

The current monetary policy path all but guarantees a mild recession, along with a notable rise in the unemployment rate. In fact, the Fed is risking an overshoot given the lagging contributors of inflation, such as rent, which will show gains in the data several months after the actual economy has stalled. The Fed’s current path is thus overly hawkish, particularly given the previous two quarters of declining GDP.

Housing data continue to show the negative impacts of higher interest rates. Builder confidence in the market for newly built single-family homes fell three points in September to 46 — the lowest level since May 2014 (apart from the spring of 2020) according to the NAHB/Wells Fargo Housing Market Index (HMI). This was the ninth straight monthly decline for the HMI, which also projects ongoing declines for the volume of singlefamily housing starts in the months ahead. Additionally, 24% of builders reported reducing home prices, up from 19% last month.

BY: ROBERT DIETZHousing starts posted a gain in August but permits continued a downward trend that will likely prevail into next year. NAHB is forecasting 2022 to be the first year since 2011 to record an annual decline in single-family home building. In contrast, the number of multifamily 5+ units currently under construction is up 26.5% from a year ago. The current total of 890,000 multifamily units under construction is the largest since 1974.

Despite a slight improvement because of recent declines in energy prices, the annual rate of inflation remains above 8% for the sixth straight month. The Fed remains intent on bringing inflation back to a 2% target rate, regardless of the recession risks. This outlook reinforces the fact that fiscal and regulatory policy have failed to address many of the root causes of today’s elevated inflation: too much stimulus and not enough effective policy to address supply chains and costly regulations. The Fed itself is projecting interest rate declines in 2024, when a housing rebound will likely take hold.

T H A N K Y O U T O

U R S P O N S O R S !

R T

N S O R S

T A B L E

Vorndran

F F L E B O A R D

P O N S O R S

P O N S O R S

E V E N T

P O N S O R S

2022 Annual Clambake

PHOTO GALLERY

2022 Annual Clambake

Gallery

2022 Annual Clambake

Gallery

2022 Annual Clambake Photo Gallery

NAHB Member

Put your membership to work.

EYE ON HOUSING

COVID ERA IMPACTS ON WORKING FROM HOME and Housing Market Impacts

BY: JING FUWhile the COVID-19 pandemic has triggered many social and economic disruptions, it has also changed working arrangements and has accelerated the shift to work from home (WFH). During the COVID-19 outbreak in the early of 2020, many businesses across the United States closed and millions of workers experienced the work from home trend out of necessity. This sudden and massive work from home experiment generated major lifestyle changes for workers, homeowners, business owners, and our communities.

A new NBER working paper, “Working from Home Around the World1,” provides some insight into the big shift to WFH and discusses implications for workers, organizations, cities, and the pace of innovation. The study surveyed full-time workers who finished primary school in 27 countries as of mid-2021 and early 2022 and found strong support for a three-part explanation of how and why the pandemic catalyzed the big shift to WFH. The pandemic has driven a mass, compulsory social experiment in WFH, which generated a tremendous flow of new information and greatly altered perceptions about the feasibility and productivity of WFH. Individuals and organizations have re-optimized accordingly and allowed much more WFH days than prior to the pandemic.

The NBER paper also examined WFH levels during the pandemic, people’s plans, and desires to work from home. It stated that full WFH days averaged 1.5 days per week across 27 countries, and employees wanted more WFH days than employers’ plans in every country after the pandemic. Moreover, it presented that people placed a sizeable value on the option to WFH a few days per week, as WFH saved time and costs of commuting and grooming and provided more flexibility in time use over the day. Specifically, the study concluded that employees valued the option to WFH 2-3 days per week at 5 percent of pay, on average, with higher valuations for women, people living with children and those with longer commutes.

Additionally, when this study investigated post-pandemic WFH levels, the results showed that employers’ plans for WFH levels after the pandemic correlated strongly with WFH productivity surprise gains during the pandemic. Across different countries, there was evidence that planned WFH levels rose with the cumulative stringency of governmentmandated lockdowns during the pandemic. However, there was no evidence that cumulative COVID death rates affected employers’ plans for post-pandemic WFH levels or current WFH levels.

While “the big shift to WFH presents especially acute challenges for dense urban centers,” it also had a significant impact on the housing market as WFH has enabled homebuyers to relocate to low-density areas that have higher housing affordability conditions. The most recent analyses of NAHB Home Building Geography Index (HBGI) showed that home building activities have shifted from higher density core areas to low-density and low-cost markets since the beginning of the COVID-19 pandemic. The analyses also indicated that the market share of singlefamily and multifamily construction in large metro core and inner suburbs dropped in the second quarter of 2022, compared to the fourth quarter of 2019 (pre-COVID).

WFH does not only change where we work but also where we live. Homebuyers with WFH options have more choice when they choose where to live. As homebuyers are looking to relocate to low-density areas (residential outmigration), many populous urban areas have experienced especially large declines for inward commuting. Consequently, WFH has raised the preference and attractiveness of the suburban and exurban living and reshaped the housing market in many remarkable ways.

ITS TIME TO Get Out And Vote

The right, election day is upon us. With early voting citizens can visit their election board vote or start mailing in their choices. The continuous ads on TV, radio and political pieces placed in your mailbox continues too. In select neighborhoods, candidates and their volunteers will be visiting with lit drops and the like. While it’s not a presidential year, much is at stake.

Headlining offices up in Ohio begin with the governor. The governor holds vast power and has great influence over the regulatory mechanism statewide. Next is likely the open US Senate seat. While there are100 US Senators, the open Ohio seat could be the deciding vote to control the Senate. With a democratic president for two more years, that extends a lot of power. The obvious concern is if vacancies open up on the US Supreme Court. As of today, the polls show a dead heat. Most around the nation’s capital expect republicans to retake control of the House, not so sure about the Senate.

Likely the biggest concern for the business community in Ohio is control of the Ohio Supreme Court which could be affected by the winners. The business community has been favored in some high visibility tort and tax issues. Still brewing however are how legislative districts are drawn. Essentially, the current maps have been adjudged unconstitutional, but a Federal Court has authorized them to proceed for this election cycle only. Whoever controls the court next year will determine which parties favored districts will prevail for the ensuing eight years.

We have done well with the current majorities in both the Ohio House and Senate. Currently, there is no indication that party control will change. The big issue now who; will be the eventual Speaker as current Speaker Bob Cupp is term limited. Behind the scenes politicking has been in the works for months to win the Speaker’s chair when the new assembly is seated in January.

by Vincent J. Squillace, CAE, OHBA Exec. VP

by Vincent J. Squillace, CAE, OHBA Exec. VP

METHOD:

RULES AND REGULATIONS GOVERNING EXHIBITS

MANAGEMENT: The North Coast Building Industry Association (NCBIA) shall be deemed Event Management and shall have all rights thereto assigned. (From here on the North Coast Building Industry Association will be referred to as NCBIA).

CHARACTER OF EXHIBITS: NCBIA reserves the right to approve all exhibits. The exhibits and the distribution of promotional material shall be limited to the confines of the Exhibitor’s space. Under no circumstances shall any Exhibitor be permitted to attract attention to his/her exhibit in such a way as to distract or interfere with the other exhibitors.

REGISTRATION: Exhibitors and their employees at the Event should wear a registra tion badge and/or tag for proper identification.

SET UP/REMOVAL OF EXHIBITS: All exhibits must be placed and ready at the opening of the show and no movement of exhibits will be permitted until after the close of the show. Exhibits must remain intact until after closing of the show and be removed within such time as may be specified by the NCBIA. Strict compliance with move in and move out times is mandatory. A fine for late move in and/or early move out will be assessed at the discretion of the NCBIA.

RAFFLES: Exhibitors are encouraged to conduct games, lotteries and/or similar activities to increase patron participation, so long as it does not interfere with the other exhibitors.

CARE OF EXHIBITS/AISLES: Aisles must be kept clear at all times. Seating for buyers must be confined within the exhibitor’s space. Exhibitors are requested at all times to cooperate with the NCBIA in maintaining all exhibits in appropriate condition.

*In the event that the Exhibitor does not exhibit as provided herein or fails to comply in any respect with the terms of this agreement, the NCBIA management shall have the right without notice to the Exhibitor, to license the use of said space to any other company, enterprise, person or persons and the Exhibitor agrees to pay any deficien cy, loss and/or damage sustained by the NCBIA as a consequence of such failure to occupy space as provided in this agreement. In addition, it is agreed that should the NCBIA be unable to license the use of said space as herein provided, it shall have the right to occupy said space for its own purposes without prejudice to its rights against Exhibitor pursuant to this agreement, including but not limited to the payment of a license fee.

*Exhibitor will not sub license any part of the space herein provided for without the express written consent of the NCBIA. In the event the exhibit premises are destroyed or rendered unavailable for any reason whatsoever (whether before or during the scheduled exhibition), the rights of the Exhibitor under this agreement shall be limited to a pro-rated refund of the amount paid for the space licensed.

DIRECT SALES: All direct sales vendors must make the payment for their space in full at the time of registration.

REFRESHMENTS: No sample food and/or beverage products may be distributed by exhibitors except upon written authorization of the NCBIA.

COMPLIANCE WITH LAWS: Exhibitors must comply with all federal, state and local laws, regulations and rules that may be in force during the exhibit.

INSURANCE: Exhibitors who desire insurance on their exhibits must procure same at their own expense. The NCBIA will not be responsible for any losses incurred by the Exhibitor or its employees because of theft, damage or for any cause whatsoev er nor to any property of employee(s) or Exhibitor(s) while en route to or from exhibit. The Exhibitor agrees to make no claim for any reason whatsoever, including negligence, against the NCBIA or NCBIA management, its agents or employees while in the show quarters. Exhibitor agrees to indemnify and hold harmless the NCBIA against any loss, damage or expense (including reasonable attorney’s fees) act or omission of Exhibitor or its agents connected in any way with its exhibits.

DECORATIONS, SIGNS, ETC: All equipment in conjunction with the exhibit must be provided by the Exhibitor. However, only the sign of the firm covered by the Exhibitor’s agreement may be placed in the booth or upon printed list of exhibitors or program. All decorations must conform to fire regulations. No exhibit is permitted that is more than eight feet high, or that obstructs other exhibits due to its design or size or that presents a safety hazard to other exhibitors and/or attendees.

PAYMENT DEFAULT: A service charge of 15% per month is applicable on all balances after 30 days. In the event any unpaid amount is placed for collection, client and/or agent agree to pay all collection costs, including reasonable attorney’s fees.

REFUND POLICY: A partial refund will only be given with a minimum of 45 days notice prior to the event. The NCBIA retains the right to use their own discretion when deeming the reason for refund as a viable one to determine whether refund shall be granted.

*The NCBIA shall have the right to make such rules and regulations in connection with the Exhibition as it may deem proper and may amend them at any time, and the NCBIA shall have the full power in the matter of interpretation and enforcement thereof. The rules and regulations heretofore referred to are printed on this agreement and are incorporated herein by reference. Exhibitor agrees to abide by said rules and regulations.

*It is agreed that this instrument is a license, and not a lease, and that no leasehold or tenancy is intended to be or shall be created hereby.

*This agreement cannot be varied, modified or canceled by the Exhibitor without the express written consent of the NCBIA.

*IN WITNESS THEREOF, the Exhibitor has caused this application and agreement to be executed by authorized representative.

STATEMENT FROM NAHB CEO JERRY HOWARD ON White House Meeting on Housing

Adiverse group of affordable housing leaders met today with National Economic Council Director Brian Deese, Domestic Policy Council Director Ambassador Susan Rice, Housing and Urban Development Secretary Marcia Fudge, and Federal Housing Finance Agency Director Sandra Thompson to discuss legislative, administrative, private sector, and state and local actions to address housing supply and affordability challenges across the country.

Jerry Howard, chief executive officer of the National Association of Home Builders (NAHB), issued the following statement after attending the White House meeting:

“With the housing market currently in a recession and the nation facing a growing housing affordability crisis, NAHB welcomed the opportunity to meet with top administration officials today to discuss actions policymakers can take to move the housing market forward and boost the economy.

“Specifically, NAHB urged the administration to focus on helping to ease building material supply chain shortages that are resulting in housing construction delays and higher home building costs. Of note, builders are reporting concrete shortages in several states and a dearth of transformers that provide electricity to homes which is halting development across much of the country

“We also asked the White House to make it a priority to ensure sufficient liquidity for the housing market and to eliminate unnecessary regulations that slow the home building process and raise housing costs for home buyers and renters.”

REVISED DEFINITION OF WOTUS Advances to Final Review

On Sept.12, the Environmental Protection Agency (EPA) and U.S. Army Corps of Engineers advanced the revised Clean Water Act (CWA) definition of "waters of the United States" (WOTUS) rule to the Office of Management and Budget's Office of Information and Regulatory Affairs (OIRA) for final review. Per Executive Order 12866, OIRA has 90 days to review the proposed final rule before publication.

NAHB will request a meeting with the White House's OIRA staff and representatives from the agencies to discuss NAHB's concerns with the proposed WOTUS rule. EPA's political leadership has already stated they expect to finalize the proposed WOTUS rule by year's end. Once published, the proposed rule will rescind the Trump administration's WOTUS regulatory definition under the 2020 Navigable Waters Protection rule.

This final rule will state when the new WOTUS regulatory definition will become effective. Currently, the agencies are enforcing the pre-2015 rules including guidance, following U.S. Supreme Court's wetlands rulings under Rapanos and SWANCC

The pending rule at OIRA stems from the revised definition of WOTUS published by the agencies in December 2021. NAHB submitted public comments on the revised definition in February 2022.

In short, if the agencies do not alter the revised definition, they will return to a problematic WOTUS regulatory definition that requires them to perform problematic "significant nexus tests" for most non-navigable, isolated, and ephemeral features before providing landowners with their requested CWA jurisdictional determinations. NAHB members' prior experiences with the agencies' application of the significant nexus test during jurisdictional determinations have proven to be a near limitless review process that, more likely than not, will result in the agencies finding federal jurisdiction.

Meanwhile, the U.S. Supreme Court is expected to hear oral arguments of Sacketts v. EPA on Oct. 3. The question presented to the Supreme Court is, "Should Rapanos be revisited to adopt the plurality's test for wetlands jurisdiction under the Clean Water Act?" The plurality opinion under Rapanos offered by the late Justice Scalia argued that only those wetlands with a continuous surface water connection to regulated waters should be considered jurisdictional and may be regulated under the CWA. The agencies seem likely to finalize a proposed WOTUS definition that relies upon the significant nexus test, despite the Supreme Court’s decision to hear the Sacketts v. EPA wetlands case. In March, all 50 Republican senators and more than 200 House Republican members sent a letter to EPA Administrator Michael Regan urging the agencies not to finalize the proposed WOTUS definition until after the Supreme Court issued a ruling in Sacketts. Depending on the outcome of the court’s ruling under the Sacketts case, the agencies could have to issue supplemental guidance or propose another WOTUS regulatory definition to comply with the court's ruling.

Learn more about the recent steps taken by the agencies on nahb.org.

•

Members, check out what's new & making a comeback for 2023 IBS Education IBS Education is coming in HOT for 2023 and expected to be a crowd pleaser (like always) at the Builders' Show. Get a glimpse into what IBS Education has in store for you:

Fan favorites like Game Changers are making a comeback

• NEW Super Sessions (Transformed 3 of our most popular IBS sessions into super-charged educational experiences)

• NEW Learning Labs (think lightning rounds and Ted-talk style)

Thanks for Renewing!

Advanced Comfort Systems, Steve Whitman

Sam Hudspath, All Construction Services

Brady 2 Custom Homes & Remodeling, Trevor Miller

Forever Fence & Rail, Ken Throckmorton

Landscaping by Gerber, Doug Gerber

Lorain County Joint Vocational School, Jason Rodriguez

North Star Builders, Jason Scott

Sorry to See You Go!

Brett Adams, Genoa Bank

Brian Mastellone, Lighthouse Insurance Agency, LLC

Ryan Puzzitiello, Parkview Homes

Broadened Coverage

Builders Risk and Installation Floater

So Sorry that I missed the clambake this year- it is the best social event!!

“

What members are saying:

Appreciate all the hard work you do to put the annual clambake on.

“

“

The clambake is always something me and my group look forward to. “

THANK YOU SPIKES!

STATESMAN SPIKE (500-999 SPIKE CREDITS)

Bob Yost

Dale Yost Construction

679.75

Mary H. Felton Guardian Title 516.00

SUPER SPIKE (250-499 SPIKE CREDITS)

Terry Bennett Bennett Builders & Remodelers 302.25

Jack Kousma

Chris Majzun Jr.

Kousma Insulation

287.50

Majzun Construction Co............................ 266.00

ROYAL SPIKE (150-249 SPIKE CREDITS)

Bill Perritt Perritt Building Co 225.50

Sara Majzun Majzun Construction Co. 216.50

Bucky Kopf Kopf Construction Corp. 203.50

Jeff Hensley

Randy K. Strauss

Lake Star Building & Remodeling............ 182.25

Strauss Construction

179.50

Tom Lahetta Tom Lahetta Builders 166.50

RED SPIKE (100-149 SPIKE CREDITS)

Dave Linna Sr. Linna Homes & Remodeling 137.50

Jason Scott North Star Builders 122.50

Thomas Caruso

Patrick Shenigo

Caruso Cabinets

ShenCon Construction, LLC

113.75

107.50

Chris Majzun Sr. Majzun Construction Co 106.50

Tom Sear Ryan Homes 102.25

GREEN SPIKE (50-99 SPIKE CREDITS)

Jim Sprague

Chris Mead

Maloney & Novotny, LLC

Maloney & Novotny, LLC

94.00

77.50

Aaron Kalizewski Grande Maison Construction 69.50

Tim Conrad Graves Lumber 67.00

Ray Allen Thom Thom Concrete 59.50

Jeremy Vorndran 84 Lumber 55.50

LIFE SPIKE (25-49 SPIKE CREDITS)

Liz Schneider

Dollar Bank

46.00

Steve Schafer Schafer Development 30.50

John Daly Network Land Title 26.50

BLUE SPIKE (6-24 SPIKE CREDITS)

Chris Collins

Ken Cassell

John Toth

Carter Lumber

16.00

Cassell Construction................................... 13.50

Floor Coverings International

12.00

Dave LeHotan All Construction Services 10.00

John Blakeslee Blakeslee Excavating, Inc 10.00

Mike Warden Huntington 10.00

Mark McClaine 84 Lumber 9.00

Ashley Oates

Steve Fleming

Our SPIKES are Our FOUNDATION

Cambria

Shamrock Development

9.00

9.00

Mike Chambers Charles, Morgan & Company 8.50

Scott Kosman Lakeland Glass 7.50

Tim Hinkle Green Quest Homes 6.50

Lindsay Yost Bott Dale Yost Construction 6.00 Jim Tipple Maranatha Homes 6.00

Call for Entries

Why Enter?

Circle of Excellence celebrates the top projects completed by the builders, remodelers, and associates of the North Coast Building Industry Association (NCBIA).

Winning a Circle of Excellence award allows your company to advertise to consumers as an “awardwinning” company.

Eligibility

The candidate must be a NCBIA member in good standing.

Entry must have been created, produced, or marketed between November 1, 2021and October 31, 2022.

Entry Preparation

Complete entry must be received by the NCBIA no later than December 15, 2022. There will be no exceptions to entry deadline.

Entry may be submitted via email with one attachment of required items, or in a binder delivered to the NCBIA

Payment of the entry fee must accompany entry.

Each entry must be sent separately, clearly marked with what category it is for and who is submitting it.

AWARD CATEGORIES

BUILDER OF THE YEAR

Fee:

Entry Requirements:

Candidate must be a full-time builder.

Please submit a paragraph explaining why you (or the person you are nominating) deserves this award.

Community Involvement:

Provide a list of community events that your company was involved in.

Customer Service:

Provide two testimonials from homeowners whose homes you have completed within the contest time frame.

Marketing:

Provide a set of plans (front elevation & plans) without identifying your company name or location of home.

Submit photos of front elevation, kitchen, master suite and one room of choice.

Include an explanation of why this is your most impressive project during this time frame.

REMODELER OF THE YEAR Entry Fee: $75

Entry Requirements:

Please submit a paragraph explaining why you (or the person you are nominating) deserves this award.

Community Involvement:

Provide a list of community events that your company was involved in.

Customer Service:

Provide two testimonials from homeowners or business owners whose projects you have completed within the contest time frame.

Marketing:

Submit four photos (before and after) of your most impressive project.

Include an explanation of why this is your most impressive project during this time frame.

ASSOCIATE OF THE YEAR Entry Fee: $75

Entry Requirements:

Candidate must be a member in good standing of the NCBIA.

Please submit a paragraph explaining why you (or the person you are nominating) deserves this award.

NCBIA Involvement:

List committee(s) on which you have served.

List special events with which you were involved.

Community Involvement:

Provide a list of community events that your company was involved in.

Marketing:

Provide 2 testimonials from customers.

BEST PRODUCTION HOME

Best Single-Family Product Design

Under 2,000 square feet

Best Condo/Cluster Product Design

Under 2,000 square feet

2,001-3,000 square feet 3,001-4,000 square feet 3,001-4,000 square feet Over 4,000 square feet Over 4,000 square feet Entry Fee: $75 per entry

2,001-3,000 square feet

Entry Requirements:

Submit one copy of the plan.

Submit color photo of each: exterior, main living area, master suite, kitchen, and rooms/area of your

choice.

Brief description of the project.

BEST CUSTOM HOME

Entry Fee: $75 per entry

Entry Requirements:

Submit one copy of the plan.

Submit color photo of each: exterior, main living area, master suite, kitchen, and rooms/area of your choice.

Brief description of the project.

Best Single-Family Custom Home

Under 2,000 square feet

2,001-3,000 square feet

3,001-4,000 square feet Over 4,000 square feet

BEST LANDSCAPE DESIGN

Categories:

Best Residential Landscape

Best Commercial Landscape

Entry Fee: $75 per entry

Entry Requirements:

Submit before and after photo(s).

Brief description of the project.

BEST COMMUNITY

Categories:

Best Single-Family Community

Best Cluster/Condo Community

Entry Fee: $75 per entry

Entry Requirements:

Submit description of community.

Submit plat.

BEST SUPERINTENDENT/PRODUCTION MANAGER

Entry Fee $75

Describe the primary responsibilities of the nominated person.

Explain why this person should be recognized.

BEST ACHIEVEMENT IN NEW HOME SALES

Categories:

Bronze Award $1,000,000-$2,000,000

Silver Award $2,000,001-$5,000,000

Gold Award $5,000,001-$10,000,000

Platinum Award $10,000,001 and over

Entry Fee: $75 per entry

Entry Requirements:

Must be a salesperson representing a builder.

Must be new home construction sales.

Total volume closed transactions between November 1, 2021 and October 31, 2022.

All entry forms must be validated by the builder with list of transaction, total volume of transaction and date transaction closed.

BEST MARKETING

Builder Categories Associate Categories

Best Marketing Piece (online or print - Best Marketing Piece (online or printAd, Brochure, Flyer, Newsletter) Ad, Brochure, Flyer, Newsletter) Best Website Best Website

Entry Fee: $75 per entry

Entry Requirements:

Submit copy of marketing piece

BEST KITCHEN REMODEL

Entry Fee: $75 per entry

Requirements:

Submit before and after photo(s).

Brief description of the project.

$50,000

BEST BATHROOM REMODEL

Entry Fee: $75 per entry

Entry Requirements:

Submit before and after photo(s).

Brief description of the project.

Under $25,000 $25,001 $50,000 Over $50,000

BEST BASEMENT REMODEL

Entry Fee: $75 per entry

Entry Requirements:

Submit before and after photo(s).

Brief description of the project.

Under $50,000 $50,001 $100,000 Over $100,000

BEST ADDITION

Entry Fee: $75 per entry

Entry Requirements:

Submit before and after photo(s).

Brief description of the project.

Under $50,000 $50,001 - $100,000 Over $100,000

BEST COMMERCIAL BUILD

Entry Fee: $75 per entry

Entry Requirements:

Submit one copy of the plan.

Submit color photo of each: exterior & up to 4 interior photos.

Brief description of the project.

Under 3,000 square feet

Over 3,000 square feet

BEST COMMERCIAL REMODEL

Entry Fee: $75 per entry

Entry Requirements:

Submit before and after photos.

Brief description of the project.

Under $150,000 Over $150,000

Register for Your Categories Today!

Important Dates:

Entries: Please check the categories below that you are

BUILDER OF THE YEAR

REMODELER OF THE YEAR

OF THE YEAR

BEST PRODUCTION HOME – SINGLE FAMILY PRODUCT DESIGN

Under 2,000 square feet

2,001-3,000 square feet

3,001-4,000 square feet

Over 4,000 square feet

BEST PRODUCTION HOME – BEST CONDO/CLUSTER PRODUCT DESIGN

Under 2,000 square feet

2,001-3,000 square feet

3,001-4,000 square feet

Over 4,000 square feet

BEST CUSTOM HOME - BEST SINGLE-FAMILY CUSTOM HOME

Under 2,000 square feet

2,001-3,000 square feet

3,001-4,000 square feet

Over 4,000 square feet

LANDSCAPE DESIGN

COMMUNITY

SUPERINTENDENT/PRODUCTION MANAGER

BEST ACHIEVEMENT IN NEW HOME SALES

Bronze Award $1,000,000-$2,000,000

Silver Award $2,000,001-$5,000,000

Gold Award $5,000,001-$10,000,000

Platinum Award $10,000,001 and over

BEST ADVERTISEMENT - BUILDER CATEGORIES

Best Marketing Piece (Ad, Brochure, Flyer, Newsletter)

Best Website

BEST ADVERTISEMENT - ASSOCIATE CATEGORIES

Best Marketing Piece (Ad, Brochure, Flyer, Newsletter)

Best Website

BEST KITCHEN REMODEL

Under $50,000

$50,001 - $100,000

Over $100,000

BEST BATHROOM REMODEL

Under $25,000

$25,001 - $50,000

Over $50,000

BEST BASEMENT REMODEL

Under $50,000

$50,001 - $100,000

Over $100,000

BEST ADDITION

Under $50,000

$50,001 - $100,000

Over $100,000

BEST COMMERCIAL BUILD

Under 3,000 square feet

Over 3,000 square feet

BEST COMMERCIAL REMODEL

Under $150,000

Over $150,000

VOTE FOR HOUSING IN This Election Year

As the saying goes, "If you're in business, you're in politics." From land use to taxes, elected officials at all levels shape policies related to the residential construction industry and small businesses. As business leaders, you must take part in the elections process this year by voting before or on election day, Tuesday, Nov. 8, 2022.

NAHB has several resources for members to learn where, when and how to vote available on nahb.org. HBAs and members can visit the Vote for Housing page to download the videos "If You're in Business, You're in Politics," "Every Election Is Important," and "Your Business News Your Vote" to share on websites or social media. Make sure to include a link to the nahb.org/vote page and use the hashtags #voteforhousing #2022elections in your messages.

To ensure continued community growth it is important to elect prohousing, pro-business candidates so that housing affordability remains within reach for families nationwide.

NAHB is again endorsing candidates for the U.S. House and Senate in the upcoming Nov. 8 elections. NAHB endorses candidates committed to policies that promote homeownership and rental housing opportunities for all Americans. NAHB makes endorsement decisions in concert with the state and local HBAs in those legislative districts.

You can view the endorsements below and on nahb.org/vote.

Houzz Pro

Scan a room with the Houzz Pro app to create 2D & 3D plans. Complete takeoffs online. Start your 30 Day Free Trial. NAHB members save 25% on any subscription.

LEARN MORE

LEARN MORE

Goodyear

NAHB members save 15% on Goodyear tires and service when you buy online. We'll help you find the right tires and install them in store. Create an accout or log into nahb.org to see your exclusive member savings.

LEARN MORE

LEARN MORE

Lowe's Pro

NAHB members build more savings as you build your business through Lowe's Business Credit savings. As a Lowe's Credit cardholder you receive 5% off everyday purchases. Make sure you're receiving the exclusive NAHB member 2% statement credit to save a total of 7% monthly. Don't miss out on your exclusive ways to save!

LEARN MORE

LEARN MORE

HotelPlanner

Book now for your next getaway. Save at over 800,000 hotels worldwide.

LEARN MORE

LEARN MORE

MotleyFool

Can you beat the stock market 4x for $1.90/week? Discover our Top Stocks to Buy Now. Claim your NAHB Savings Today!

LEARN MORERingCentral

In today's mobile world of offices and job sites, RingCentral gives teams the ability to communicate, collaborate, and connect the way they want on any device, anywhere, anytime. Plus, don't miss out on the special End of Summer offer! Right now, new customers will receive 2 free months of service at signup, in addition to the great benefits that NAHB Members already receive from RingCentral..

LEARN MOREGeneral Motors

General Motors is proud to offer NAHB Members a Private Offer of $500 towards your next purchase or lease of select Chevrolet, Buick and GMC vehicles.

LEARN MORE

LEARN MORE

UPS

It's that time of year again. Time to get ready for the peak shopping – and peak shipping season. Use your NAHB UPS® Savings Program and get up to 50% off all of your shipments this holiday season. productivity.

LEARN MOREMemberDeals

Celebrate 50 years of the most magical place on earth! Throughout this incredible 18-month event, discover classic favorites and exciting adventures across all four Disney parks – Magic Kingdom, Epcot, Disney's Animal Kingdom, and Hollywood Studios. NAHB members can save up to $80 off gate prices!

LEARN MORE

Estimating Payroll for Workers' Compensation Premium

Reportable payroll & true-up

Reportable payroll

In defining payroll, the Ohio Bureau of Workers’ Compensation (BWC) generally follows the guidelines of the Ohio Department of Job and Family Services, as well as the Federal Unemployment Tax Authority (FUTA) in the businesses section.

How to report payroll and complete the true-up

The Bureau of Workers’ Compensation (BWC) has begun installment billings for Private Employers for the July 1, 2022, rate year. Your premium payments for the rate year are based on the installment schedule that you selected. In July of 2023, you will receive your annual Payroll True Up Report from the BWC, where you will report your actual payroll for the July 1, 2022, rate year. If your actual payroll was lower than the BWC’s estimate of your payroll, you will receive a refund on your premium. If your actual payroll was higher than the BWC’s estimate of your payroll, you will pay additional premium based on your higher payroll.

Examples of reportable payroll

The more common types of reportable payroll include gross hourly wages and gross salaries less qualifying deductions for section 125 cafeteria plan benefits, sick pay and vacation pay, bonus payments, including stock given as a bonus, sales commission and tips. Contact BWC or go to www.bwc.ohio.gov, select For Employers/Compliance/ Reporting Payroll for a complete list of reportable payroll. You may also contact Sedgwick’s Rate Department at (800) 825-6755 with any questions.

Although employers may contact BWC at (800) OHIO-BWC (800.644.6292) and complete their true-up report over the phone, BWC anticipates high call volumes and long wait times. They strongly encourage employers to complete their true-up report online through their BWC e-account at www.bwc.ohio.gov. If you do not have an e-account, simply select the Create E-Account Link to begin. You will need your BWC policy number and/or Federal Tax Identification Number.

To determine your estimated payroll for the July 1, 2022, rate year, the BWC is using the payroll that you reported for the July 1, 2020, through June 30, 2021, period. For many businesses, the July 1, 2020 through June 30, 2021, payroll is much different than today’s payroll. Due to that, you could see a larger than expected billing when the BWC sends the annual True Up Report in July of 2023. You have the ability to review the estimated payroll that the BWC is using for your business, and request a change to your estimated payroll, if needed. In doing so, the BWC will adjust future Premium Installment Payments to reflect the new estimated payroll. This could help limit any surprises that may occur when you receive your annual Payroll True Up Report in July of 2023. If you have more than one active policy with the Ohio BWC, you will want to review all estimated payroll amounts for each policy. To review your payroll, you can log in to your BWC account at www.bwc.ohio.gov or by calling the BWC at 800.644.6292.

Additional rebates

Additional rebates are available should an employer utilize their e-account through the BWC’s website. Eligible employers will qualify for a 1 percent Go Green premium rebate (up to $2,000 maximum) by filing electronically. To be eligible for the Go-Green Rebate, you must complete the true-up online and pay any balance at that time as well as opt in to invoice email notifications.

If you have any questions, contact our Sedgwick program manager, Bob Nicoll, at (330) 418-1824 or robert.nicoll@sedgwick.com.

True-up process

Hierarchy of hazard control

BWC provides workers’ compensation coverage based on estimated payroll. Therefore at the end of the policy year, BWC asks employers to report their actual payroll for the prior policy year and pay any shortage (or receive a refund for any overage) in premium. This process is called a true-up. If the true-up is not completed timely, the following may occur:

Deadlines

PRIVATE EMPLOYERS

One of the keys to a safe workplace is evaluating, identifying, and eliminating hazards. There is a step-by-step process available called the “Hierarchy of Controls.” The hierarchy of controls can be an effective tool to reduce the frequency and or the severity of injuries at your workplace and ultimately help reduce workers’ compensation costs. This 5-step process was created in the 1950’s and is still used today.

• True-up report must be completed and payment received no later than August 13, 2021.

• Employer will not be eligible for prior year rebates and incentives

• Employer will be removed from current year programs

The chart identifies the preferred way to control a hazard from the most effective which is elimination. Then the order follows the next preferred method using Substitution, then Engineering Controls, Administrative Controls then the least effective, Personal Protective Equipment (PPE).

PUBLIC EMPLOYERS

Let’s take a deeper look into each “Hierarchy of Control.”

• Employer will become ineligible for programs the following year and will continue to remain ineligible for all future years until all past true-ups are completed.

• True-up report must be completed and payment received no later than February 15, 2022.

Reportable payroll & true-up

1. Elimination – This is where the hazard is removed. This can be achieved by either changing the work process like removing a sharp or heavy object. As you can see this is the preferred control method because it completely removes the hazard from the employee.

Reportable payroll

In defining payroll, the Ohio Bureau of Workers’ Compensation (BWC) generally follows the guidelines of the Ohio Department of Job and Family Services, as well as the Federal Unemployment Tax Authority (FUTA) in the businesses section.

How to report payroll and complete the true-up

2. Substitution – The second preferred method relies on substituting the hazard with a safer alternative. For example, eliminating a chemical by using those made from eco-friendly or plant-based products. If you choose substitution be sure to review and understand the new potential risks of the product, if there are any.

3. Engineering Controls – This option prevents or reduces the hazard from coming into contact with the employee. Some examples of engineering controls are workspace or equipment modification, creating protective barriers or installing ventilation.

Examples of reportable payroll

4. Administrative Controls – This option for reducing workplace hazards relies on work practices that reduce duration, frequency, or intensity of the job. Examples include work process training, job rotation, adequate rest breaks or adjusting line speeds.

The more common types of reportable payroll include gross hourly wages and gross salaries less qualifying deductions for section 125 cafeteria plan benefits, sick pay and vacation pay, bonus payments, including stock given as a bonus, sales commission and tips. Contact BWC or go to www.bwc.ohio.gov, select For Employers/Compliance/ Reporting Payroll for a complete list of reportable payroll. You may also contact Sedgwick’s Rate Department at (800) 825-6755 with any questions.

Although employers may contact BWC at (800) OHIO-BWC (800.644.6292) and complete their true-up report over the phone, BWC anticipates high call volumes and long wait times. They strongly encourage employers to complete their true-up report online through their BWC e-account at www.bwc.ohio.gov. If you do not have an e-account, simply select the Create E-Account Link to begin. You will need your BWC policy number and/or Federal Tax Identification Number.

Additional rebates

Additional rebates are available should an employer utilize their e-account through the BWC’s website. Eligible employers will qualify for a 1 percent Go Green premium rebate (up to $2,000 maximum) by filing electronically. To be eligible for the Go-Green Rebate, you must complete the true-up online and pay any balance at that time as well as opt in to invoice email notifications.

5. Personal Protective Equipment – The last option which is the least effective is PPE. This is where employees are required to wear items, such as safety glasses, gloves, hearing protection, hard hats, and respirators. Many times, PPE will be used temporarily while other controls are under development.

True-up process

BWC provides workers’ compensation coverage based on estimated payroll. Therefore at the end of the policy year, BWC asks employers to report their actual payroll for the prior policy year and pay any shortage (or receive a refund for any overage) in premium. This process is called a true-up. If the true-up is not completed timely, the following may occur:

• Employer will not be eligible for prior year rebates and incentives

• Employer will be removed from current year programs

For more information, please contact Sedgwick’s Andy Sawan at 330.819.4728 or andrew.sawan@sedgwick.com

• Employer will become ineligible for programs the following year and will continue to remain ineligible for all future years until all past true-ups are completed.

Deadlines

PRIVATE EMPLOYERS

• True-up report must be completed and payment received no later than August 13, 2021.

Before implementing the “Hierarchy of Controls,” you must first identify the hazards. A good way to achieve this is to create a team with areas of expertise (Maintenance, Department Managers/Supervisors, Employees, EHS, etc.). Once the hazards are identified, the team should discuss the “Hierarchy of Controls” and identify the most effective means of dealing with the hazard. Then, work your way down until you find a solution. Remember to periodically re-evaluate the control method as new technology may allow you to implement a more effective control means.

PUBLIC EMPLOYERS

• True-up report must be completed and payment received no later than February 15, 2022

BUILDER BUSINESS GREW Significantly in 2021

The business of the typical NAHB builder grew significantly between 2020 and 2021, according to results from NAHB's latest member census The 2021 NAHB census shows that the median gross revenue of an NAHB builder in 2021 was an all-time high of $3.3 million, up 26.9% from the previous year.

NAHB reinstated its member census during the industry-wide downturn of 2008, when median annual revenue of builder members was only around $1 million. Median annual revenue began rising in 2013, plateauing at $2.6 million to $2.7 million from 2017 through 2020.

Although their median revenue has increased recently, most NAHB builders remain relatively small businesses by conventional standards. According to the 2021 NAHB census:

• 14% of NAHB's builder members reported a dollar volume of less than $500,000,

• 13% reported between $500,000 and $999,999,

• 38% reported between $1 million and $4.9 million,

• 15% reported between $5 million and $9.9 million,

• 6% reported between $10 million and $14.9 million, and

• 13% reported $15 million or more.

In comparison, the Small Business Administration's size standards classify most types of construction businesses as small if they have average annual receipts of less than $39.5 million.

Agreeing with the increase in builder revenue, there was a particularly strong surge in the average number of housing starts per builder between 2020 and 2021 from 41 in 2020 to 63.1. The average number of single-family starts grew by 58.2% (from 26.3 to 41.6), while the average number of multifamily starts increased by 46.3% (from 14.7 to 21.5).

This information was originally published in the August 2022 special study available on NAHB's Housing Economics webpage. Paul Emrath, NAHB vice president for survey and housing policy research, provides additional insights in this Eye on Housing post.

Fame Members

of

North Coast Building Industry Association Hall of Fame Nominating Form

The North Coast BIA Hall of Fame was established to honor individuals who have made a lasting contribution to the housing industry through their work in building and development, public service and housing-related areas. To nominate an individual for Hall of Fame induction, you must be a member of the NCBIA in good standing, complete this form on both sides and return it to the NCBIA office by November 30, 2021.

November 30, 2022

Hall of Fame Candidate Name:

Title: Company Name: Address: City/State/Zip: Phone

Submitted

the completed form to: Hall of Fame Committee c/o NCBIA 5077 Waterford Dr , STE 302 Sheffield Village, OH 44035 Phone: 440 934 1090

NCBIA Hall of Fame Nominating Form (continued)

If you want to check on the criteria for your nominee, please contact the NCBIA office at (440) 934-1090.

Hall of Fame Core Criteria

-At least ten (10) years of NCBIA membership

-Served on committee(s) and/or councils during the time of membership for a total of seven (7) years

-Chaired one (1) committee and/or council- or - Served as President

-At least five (5) years as a board member

-Must have achieved Life Spike Status

-Involvement defined as something that takes a time commitment (not just a monetary one)

-Speaking engagements, home show participation, LCJVS or EHOVE liaison, use of logo in advertising, etc.

Other Criteria Considered

~OHBA and/or NAHB involvement

~Sponsorships (e.g. sponsorship program or event sponsorships)

~Task Force Involvement (e.g. Expansion Development Task Force)

~Special Stories/Circumstances (e.g. radio show, 24-hour house)

~Awards received (NCBIA & others)

~Complaints or lack thereof (NCBIA records will be checked for complaints)

List any OHBA and/or NAHB involvement

Use additional sheets as needed and please type information when possible.

Member from to .

Industry & Community Involvement

Awards Received (NCBIA and others)

Special Stories or Circumstances that are pertinent

List committees, councils &/or task forces that nominee has served on and indicate chair positions as they apply.

year year committee/council/task force name

Ex. Clambake

List NCBIA offices held office/directorship

Summary Statement: I believe that should be named to the NCBIA Hall of Fame because...

SuperFleet

BUSINESS INFORMATION (Required) Please tell us about your business:

Authorized Signature Required (Representative acknowledges receiving fuel pricing and payment terms) Initial Here: