BUILDER

W e d n e s d a y , M a y 7 , 2 0 2 5 4 - 7 : 3 0 P M T o m ’ s C o u n t r y P l a c e 3 4 4 2 S t o n e y R i d g e R o a d , A v o n

4 : 0 0 - 5 : 0 0 P M

C o d e s F o r u m w i t h

R i c J o h n s o n C A P S & D H T I + C e r t i f i e d

P r o f e s s i o n a l

O H B A A r e a Vi c e P r e s i d e n t

M e m b e r o f t h e O h i o R e s i d e n t i a l

C o n s t r u c t i o n & A d v i s o r y C o m m i t t e e

5 : 0 0 - 6 : 3 0 P M

G e n e r a l M e m b e r s h i p M e e t i n g & D i n n e r F e a t u r i n g B i l l O w e n s N A H B ’s 2 0 2 5 F i r s t Vi c e C h a i r m a n N A H B M e m b e r S a v i n g s R e v i e w

6 : 3 0 - 7 : 3 0 P M

H o n o r i n g t h e m o s t o u t s t a n d i

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Office

5321 Meadow Lane Court - B Suite 23

Sheffield Village, OH 44035

Phone: 440.934.1090 info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate

Ashlyn Bellan-Caskey | ashlynncbia@gmail.com

2025 NCBIA Officers

President

John Toth, Floor Coverings International

Vice President

Mike Meszes, DRC Construction Company

Associate Vice President

Melanie Stock, First Federal Savings of Lorain Treasurer

Sara Majzun, Majzun Construction Company

Secretary

Jon Sherer, Ascent Custom Homes and Remodeling

Immediate Past President

Tim King, K. Hovnanian Homes

2025 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Joey McCormick, Bumble Bee Blinds

Shannon Niebes, Royalty Roofing

Jason Rodriguez, The S.J.R. Building Co.

Theresa Riddell, The Nelson Agency

Kevin Walker, Walker Wealth Managements

NCBIA Life Directors

Jeremy Vorndran, 84 Lumber

Tom Caruso, Caruso Cabinets

Bob Yost, Dale Yost Construction

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Dave Linna, Linna Homes & Remodeling

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jim Sprague, Maloney + Novotny, LLC

Randy Strauss, Strauss Construction

Tom Lahetta, Tom Lahetta Builders, Inc.

2025 NAHB Delegate

This member represents our local industry in Washington DC

Jason Scott, Greyhawk Development

John Toth, Floor Coverings International (Alternate)

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2025 President

Merle Stuzman, Weaver Custom Homes

OHBA Past President

Randy Strauss, 1996

2025 OHBA Trustees

Jason Scott, Greyhawk Development

John Toth, Floor Coverings International

Mary H. Felton, Guardian Title (Alternate)

Jason Rodriguez, The S.J.R. Building Co. (Alternate)

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

Blueprint/Drawing

Save the Date!

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!

Saturday, April 26, 2025

Night at the Races

5:30-11 PM

American Legion Post 211 31972 Walker Road, Avon Lake

Tuesaday, April 29, 2025

Home Show Committee Meeting (2025 Recap & 2026 Planning)

9:30-10:30 AM

NCBIA Office

5321 Meadow Lane Court - B, Suite #23 Sheffield Village, OH

Wednesday, May 7, 2025

Builder's Forum Codes Update with Ric Johnson Residential Construction Advisory Committee Ohio Board of Building Standards

4-5 PM

General Membership Meeting/Circle of Excellence Awards

5-7:30 PM

Tom's Country Place 3442 Stoney Ridge Road, Avon

Monday, May 19, 2025

Learn Your WHY and Make More Impact Workshop - FREE Facilitated by: Maria Leali of ActionCOACH Certified WHY.os Coach More Info To Come 11AM - 12:30 PM

NCBIA Office

5321 Meadow Lane Court - B, Suite #23

Sheffield Village, OH

Check the website at www.ncbia.com for up-to-date changes, additions, and corrections to these events!

Do you have some business news to share?

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com.

We want to hear from you!

Kevin Douglas Henceroth was an incredible man. He was a big guy, but even bigger was his heart. He was kind, positive, and always ready for the next adventure. Whether it was talking about his job, his Maine property, or his family, he had a smile on his face and always had something to say.

There aren't many people who had such a positive outlook on life, but Kevin always did. He had many accomplishments, but one of his greatest ones was being part of the Amherst fire department, where he passed down the love of firefighting to his son. He was a great storyteller who could go on and on about his past jobs, his childhood, or fire calls that always amazed his family and friends.

Henceroth Construction, which he had started right after graduating from Lorain County JVS, was his biggest challenge and reward in life. He always said, 'We'll get it done, and not just done, but done right and to last for years to come.' His expertise in construction and masonry made his business a success, with a reputation that no one else in the area could match.

APRIL IS New Homes Month

John Toth, Floor Coverings International

The Many Benefits of a New Home

The homebuilding industry is a remarkable collaboration of skilled professionals, with an average of 22 different subcontractors coming together to construct a single-family home. It’s more than just building houses, it’s about creating spaces where families grow, dreams flourish, and memories are made. Your work doesn’t just shape structures; it transforms lives and helps realize the American dream.

Spring is a season of renewal time when nature reawakens, and so do our hopes for new beginnings. It’s no surprise that as the days grow longer and the weather warms, many Americans begin their search for a new home. The home buying season blooms in April, and with it, the home building industry proudly celebrates New Homes Month to highlight the many advantages of owning a newly constructed home.

New homes offer far more than just fresh paint and modern finishes. They represent a unique opportunity to create a living space that fits your lifestyle right from the start. Whether it’s energy efficiency, open-concept designs, or the ability to choose your favorite appliances, flooring, and color schemes, new construction puts customization in your hands.

But beyond the obvious perks, there are deeper, often less recognized benefits to choosing a new home:

A Strong Sense of Community

When families move into a new neighborhood together, connections form quickly. There’s a shared sense of excitement, discovery, and possibility. Many home builders help foster these bonds by organizing block parties and neighborhood events, encouraging residents to meet, connect, and build friendships that can last a lifetime.

Designed for Entertaining

Older homes, while charming, often come with smaller, segmented spaces that can make hosting difficult. Today’s home builders understand modern lifestyles—favoring open floor plans, high ceilings, expansive great rooms, and larger windows to create bright, welcoming spaces ideal for gathering with family and friends.

A Clean Slate

Say goodbye to dated wallpaper, worn-out carpet, and questionable DIY projects. With a new home, you get a blank canvas that reflects your taste from day one. No major renovations. No surprises. Just a home that’s movein ready and exactly as you envisioned.

Peace of Mind

Modern homes are built with the latest safety codes and energy standards, with technology-ready infrastructure and high-quality materials. From improved insulation and ventilation to smart home features, a newly constructed home offers lasting peace of mind—both for your comfort and your safety.

A Foundation for Building Wealth

Homeownership continues to be one of the most reliable ways for Americans to build long-term wealth. A primary residence is often the largest asset for most households, and unlike rent, mortgage payments contribute directly to your financial future. New homes, in particular, can offer greater value with fewer maintenance costs and higher resale appeal.

A Profession with Purpose

Home builders don’t just construct houses, we create spaces where families grow, memories are made, and futures are shaped. There’s deep pride in knowing that every foundation poured, and roof raised contributes to a greater sense of stability, community, and opportunity.

So, as we celebrate New Homes Month, let’s reflect on all that a newly constructed home offers. It’s more than just a fresh start—it’s a powerful investment in comfort, community, and the American dream.

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

Builder’s Codes Forum | 4:00 PM

DON'T LEAVE MONEY On

the Table

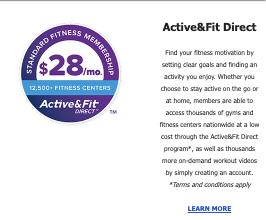

Join us for one of the biggest events of the year, our General Membership Meeting and Circle of Excellence on Wednesday, May 7th!

Featured Highlights:

NAHB Member Benefits Presentation

Amanda Scharff from the NAHB Member Savings Program will share how members saved over $40 million in 2024 through exclusive discounts and offerings. Learn what’s in store for 2025 and beyond!

Insurance Q&A with Theresa Riddell – The Nelson Agency

• Get expert advice on all your coverage needs:

• Broadened Coverage

• Builders Risk & Installation Floater

• Portable Tools

New Program

• 7-11 Speedway Program Info

Featuring Ric Johnson, CAPS & DHTI+ Certified Professional, OHBA Area Vice President, and Member of the Ohio Residential Construction & Advisory Committee.

General Membership Meeting 5:00 PM

Bill Owens, NAHB’s 2025 First Vice Chairman – Featured Speaker

Circle of Excellence Awards Ceremony – 6:30 PM

Celebrate with us as we honor 29 of the most outstanding projects and members of the NCBIA!

June GM Meeting – With a Twist!

We’re shaking things up this year! Join us Thursday, June 26th at Avon Isle for a fresh take on our annual cookout — a vintage car show!

Many of our members have some truly amazing classic cars, and now’s the time to show them off. Whether you're bringing a car or just coming to admire, it's going to be a great time!

As always, Pogie will be firing up the grill and serving up all your cookout favorites. And we’ll be joined by National Purchasing Partners, who will be there to show you how their program can help you save in a big way.

Mark your calendar – you don’t want to miss these two General Membership Meetings.!

Wednesday May 7th and Thursday, June 26th.

APRIL 7, 2025 REPORT #3 LEGISLATIVE UPDATE

COMMERCIAL ROOFING LICENSING LEGISLATION CONCERNS

SB 125 Roofing Licensure has received two hearings in the Senate Workforce Development Committee with proponents testifying last week. The proponent hearing can be seen at the link below. As in prior versions, the bill proposes to extend the current Ohio Construction Industry Licensing Board (OCILB) licensing requirements to commercial roofing contractors. While ‘roofing’ is not defined, the bill would add commercial roofing contractors to the list of specialty contractors to be licensed under the OCILB. There is an exemption for 1, 2, 3-family dwellings, but otherwise ANY and ALL other structures would be considered commercial and require a licensed roofing contractor to perform the work. Further, the current restrictions on the use of subcontractors versus employees would also apply. Given the Ohio Building Code definition of ‘roofing assemblies’, the scope of the licensure could apply to the structure supporting the roof. There are numerous issues with the current proposal to add roofing contractors to the specialty contractor licensing under the OCILB, as its potential impacts to small commercial and residential structures which are regulated under the Ohio Building Code.

https://ohiochannel.org/collections/ohio-senate-workforce-devel opment-committee Minute 12:46

If there are builders and remodelers doing any small commercial projects, or any residential units, above 3-family dwellings, even if using the same shingled roofing as the residential exemption, the roofing contractor will be required to obtain the same license as any other commercial roofing contractor.

The sponsor and committee members contacts and respective districts can be found at the link below. There is a sense of urgency, if you have concerns, as the sponsor is determined and has had movement with prior bills. Contact the members listed below to express your concern with the potential impact of such broad licensing requirements. Feel free to contact OHBA with any questions.

https://www.ohiosenate.gov/committees/workforce-development

https://www.ohiosenate.gov/members/thomas-f-patton

RESIDENTIAL DEVELOPMENT TOOLS UNDER ATTACK

HB 113

Annexation and Property Tax Exemptions Bird, A. Newman, J.

To modify the law regarding annexation and financial disclosure forms, and to require school district approval of residential community reinvestment area property tax exemptions.

Text & Analysis

HB 154

Community Reinvestment Areas Thomas, D. Glassburn, C.

To require school district approval of residential community reinvestment area property tax exemptions.

Text & Analysis

Committee Hearing in House Local Government Committee (4/2/2025 ; CONTINUED)

OHBA continues to have meetings with the Chairwoman of the House Local Government Committee and Sponsors of HB 113 and 154 to express concerns over the changes proposed to Type II Annexations and Residential CRAs. OHBA urges members to contact members of the committee to express th e benefits of current CRA and Annexation policies. Most recently, OHBA Area VPs, NAIOP, and multifamily developers from Columbus met with Representative Dave Thomas on the difference between CRA and TIFs, and importance of such residential development tools. Sponsor testimony for HB 154 can be found at the link below. The link to the committee contacts is also below. https://ohiochannel.org/video/ohio-house-local-government-commi ttee-4-2-2025

https://ohiohouse.gov/committees/local-government

Please contact OHBA with any comments or questions.

OHBA SUMMER BOARD OF TRUSTEES MEETING

Save the date for June 24 & 25 for OHBA’s Summer Board of Trustees Meeting. This meeting will be held in President Merle Stutzman’s hometown of Wooster.

June 24-25, 2025

Best Western Plus & Conference Center 243 E. Liberty, Wooster, OH 44691 The Trustees of Ohio Home Builders Association will be meeting and at this meeting you will obtain updated information on issues affecting the industry, network with your peers from Ohio and exchange viewpoints.

There are limited sleeping rooms available at Best Western Hotel. The room rate is $135.99 plus tax. If you need a room, copy this link to reserve- https://www.bestwestern.com/en_US/book/hotel-rooms.36082.html?groupId=L65NC0D1

Room cut-off date is May 24th. Reserve today if you need a room. Meeting registration can be emailed to build@ohiohba.com or fax ed to (614)228-5149. Questions, contact OHBA at (800)282-3403 ext. 1.

Thank you to our sponsors-

Sugarcreek Concrete Finishers Inc.

Riceland Flow Care

All Construction Services

Eco Seal

Dave Miller Electric

Spring General Spring General

W e d n e s d a y , M a y 7 , 2 0 2 5 4 - 7 : 3 0 P M T o m ’ s C o u n t r y P l a c e 3 4 4 2 S t o n e y R i d g e R o a d , A v o n

4 : 0 0 - 5 : 0 0 P M

C o d e s F o r u m w i t h

R i c J o h n s o n C A P S & D H T I + C e r t i f i e d

P r o f e s s i o n a l

O H B A A r e a Vi c e P r e s i d e n t

M e m b e r o f t h e O h i o R e s i d e n t i a l

C o n s t r u c t i o n & A d v i s o r y C o m m i t t e e

N A H B S p e a k e r S p o n s o r $ 5 0 0

5 : 0 0 - 6 : 3 0 P M

G e n e r a l M e m b e r s h i p

M e e t i n g & D i n n e r

F e a t u r i n g B i l l O w e n s N A H B ’s 2 0 2 5 F i r s t Vi c e C h a i r m a n

N A H B M e m b e r S a v i n g s R e v i e w

A l s o I n c l u d e s : 2 t i c k e t s t o e v e n t & N A H B S p e a k e r I n t r o d u c t i o n

C i r c l e o f E x c e l l e n c e S p o n s o r $ 5 0 0

G e n e r a l M e m b e r s h i p M e e t i n g S p o n s o r $ 3 2 5

C o d e s S p e a k e r S p o n s o r $ 2 7 5

D e s s e r t S p o n s o r s $ 2 5 0

D r i n k S p o n s o r $ 2 5 0

T a b l e S p o n s o r $ 1 5 0

6 : 3 0 - 7 : 3 0 P M

H o n o r i n g t h e m o s t o u t s t a n d i n g

p r o j e c t s c o m p l e t e d b y t h e p r e m i e r

b u i l d e r s , r e m o d e l e r s , a n d i n d u s t r y p r o f e s s i o n a l s o f t h e N C B I A

R S V P a n d C a n c e l l a t i o n s b y A p r i l 3 0 , 2 0 2 5

C o m p a n y N a m e _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

A t t e n d e e ( s ) N a m e ( s )

A t t e n d e e ( s ) N a m e ( s )

# o f M e m b e r A t t e n d e e s @ $ 4 5 e a c h _ _ _ _ _ _

# o f N o n - M e m b e r A t t e n d e e s @ $ 6 5 e a c h

T o t a l A m o u n t D u e $ A R e s e r v a t i o n M a d e i s A R e s e r v a t i o n P a i d

P l e a s e I n v o i c e

C h e c k E n c l o s e d

C r e d i t C a r d ( C a l l o r F i l l O u t B e l o w )

R e g i s t e r o n l i n e a t w w w . n c b i a . c o m

b y e m a i l : j u d i e @ n c b i a . c o m

b y p h o n e : ( 4 4 0 ) 9 3 4 - 1 0 9 0

b y m a i l : 5 3 2 1 M e a d o w L a n

BUILDER CONFIDENCE LEVELS INDICATE Slow Start for Spring Housing Season

Growing economic uncertainty stemming from tariff concerns and elevated building material costs kept builder sentiment in negative territory in April, despite a modest bump in confidence likely due to a slight retreat in mortgage interest rates in recent weeks.

Builder confidence in the market for newly built singlefamily homes was 40 in April, edging up one point from March, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

The March dip in mortgage rates may have stimulated some sales activity in recent weeks. However, builders have expressed growing uncertainty over market conditions as tariffs have increased price volatility for building materials at a time when the industry continues to grapple with labor shortages and a lack of buildable lots.

Policy uncertainty is making it difficult for builders to accurately price homes and make critical business decisions. The April HMI data indicates that the tariff cost effect is already taking hold, with the majority of builders reporting cost increases on building materials due to tariffs.

When asked about the impact of tariffs on their business, 60% of builders reported their suppliers have already increased or announced increases of material prices due to tariffs. On average, suppliers have increased their prices by 6.3% in response to announced, enacted, or expected tariffs. This means builders estimate a typical cost effect from recent tariff actions at $10,900 per home.

The latest HMI survey also revealed that 29% of builders cut home prices in April, unchanged from March. Meanwhile, the average price reduction was 5% in April, the same rate as the previous month. The use of sales incentives was 61% in April, up from 59% in March.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions rose two points in April to a level of 45. The gauge charting traffic of prospective buyers increased one point to 25 while the component measuring sales expectations in the next six months fell four points to 43.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell seven points in April to 47, the Midwest moved one point lower to 41, the South dropped three points to 39 and the West posted a two-point decline to 35.

The HMI tables can be found at nahb.org/hmi.

mynpp.com/north-coast-bia/

BUILDING MATERIAL PRICES CONTINUE to Grow at Slower Pace

Prices for inputs to new residential construction— excluding capital investment, labor, and imports—were up 0.6% in March according to the most recent Producer Price Index (PPI) report published by the U.S. Bureau of Labor Statistics. The increase in February was revised upward to 0.7%. The Producer Price Index measures prices that domestic producers receive for their goods and services; this differs from the Consumer Price Index which measures what consumers pay and includes both domestic products as well as imports.

The inputs to the New Residential Construction Price Index grew 1.3% from March of last year. The index can be broken into two components—the goods component also increased 1.3% over the year, with services increasing 1.3% as well. For comparison, the total final demand index, which measures all goods and services across the economy, increased 2.7% over the year, with final demand with respect to goods up 0.9% and final demand for services up 3.6% over the year.

Input Goods

The goods component has a larger importance to the total residential construction inputs price index, representing around 60%. For the month, the price of input goods to new residential construction was up 0.5% in March.

The input goods to residential construction index can be further broken down into two separate components, one measuring energy inputs with the other measuring goods less energy inputs. The latter of these two components simply represents building materials used in residential construction, which makes up around 93% of the goods index.

Energy input prices fell 3.9% between February and March and were 14.9% lower than one year ago. Building material prices were up 0.8% between February and March and up 2.7% compared to one year ago. Energy costs have continued to fall on a year-over-year basis, as this marks the eighth consecutive month of lower input energy costs.

BY: JESSE WADE

Metal products used in residential construction saw the largest price increases in the month of March. Across all inputs to new residential construction, ornamental and architectural metal work increased the most, up 21.0%. Ornamental and architectural metal work products increased 11.2% on a month-to-month basis, by far their largest monthly increase for the product, with the next closes being 7.9% back in October of 2021.

Input Services

While prices of inputs to residential construction for services were down 0.1% over the year, they were up 1.1% in March from February. The price index for service inputs to residential construction can be broken out into three separate components: a trade services component, a transportation and warehousing services component, and a services excluding trade, transportation and warehousing component (other services). The most significant component is trade services (around 60%), followed by other services (around 29%), and finally transportation and warehousing services (around 11%). The largest component, trade services, was up 0.7% from a year ago. The other services component was up 1.6% over the year. Lastly, prices for transportation and warehousing services advanced 3.6% compared to March last year.

INFLATION COOLED in March

Inflation slowed to a 6-month low in March, largely driven by lower energy costs, especially in gasoline prices. Despite the easing, the report likely only captures part of the first wave of global tariffs announcement. The inflationary pressure from tariffs and escalating trade war continues to threaten the economic growth and complicate the Fed’s path to its 2% target. Meanwhile, while housing inflation remains elevated, it continues to show signs of cooling –the year-over-year change in the shelter index remained below 5% for a seven straight month and posted its lowest annual gain since November 2021.

While the Fed’s interest rate cuts could help ease some pressure on the housing market, its ability to address rising housing costs is limited, as these increases are driven by a lack of affordable supply and increasing development costs. In fact, tight monetary policy hurts housing supply because it increases the cost of AD&C financing. This can be seen on the graph below, as shelter costs continue to rise at an elevated pace despite Fed policy tightening. Additional housing supply is the primary solution to tame housing inflation and with it, overall inflation. This emphasizes why the cost of construction, including the cost of building materials, matters not just for housing but also the inflation outlook and the path of future monetary policy.

Consequently, the election result has put inflation back in the spotlight and added additional upside and downside risks to the economic outlook. Proposed tax cuts and tariffs could increase inflationary pressures, suggesting a more gradual easing cycle with a slightly higher terminal federal funds rate. However, economic growth could also be higher with lower regulatory burdens. Given the housing market’s sensitivity to interest rates, a higher inflation path could extend the affordability crisis and constrain housing supply as builders continue to grapple with lingering supply chain challenges.

During the past twelve months, on a non-seasonally adjusted basis, the Consumer Price Index rose by 2.4% in March, according to the Bureau of Labor Statistics’ report. This followed a 2.8% year-over-year increase in February. Excluding the volatile food and energy components, the “core” CPI increased by 2.8% over the past twelve months, the smallest increase since March 2021. A large portion of the “core” CPI is the housing shelter index, which increased 4.0% over the year, the smallest year-over-year increase since November 2021. Meanwhile, the component index of food rose by 3.0%, and the energy component index fell by 3.3%.

On a monthly basis, the CPI fell by 0.1% in March (seasonally-adjusted), after a 0.2% increase in February. This was the first time the monthly CPI has fallen since May 2020. The “core” CPI increased by 0.1% in March.

The price index for a broad set of energy sources fell by 2.4% in March, with declines in gasoline (-6.3%) offset by increases in electricity (+0.9%) andnatural gas (+3.6%). Meanwhile, the food index rose 0.4%, after a 0.2% increase in February. The index for food away from home increased by 0.4% and the index for food at home rose by 0.5%.

Despite the overall monthly CPI decline, several indexes increased in March including personal care (+1.0%), medical care (+0.2%), education (+0.4%), apparel (+0.4%), as well as new vehicles (+0.1%). Meanwhile, the index for airline fares (-5.3%), used cars and trucks (-0.7%) and recreation (-0.3%) were among the major indexes that decreased over the month.

The index for shelter makes up more than 40% of the “core” CPI, rose by 0.2% in March, following an increase of 0.3% in February. The index for owners’ equivalent rent (OER) rose by 0.4% and index for rent of primary residence (RPR) increased by 0.3% over the month. Despite the moderation, shelter costs remained the largest contributors to headline inflation.

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than core inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster than core inflation, the real rent index rises and vice versa. The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

In March, the Real Rent Index rose by 0.3%. Over the first three months of 2025, the monthly growth rate of the Real Rent Index averaged at 0.1%, higher than 0.0% from the same period in 2024.

Full Article HERE

EYE ON HOUSING

U.S. ECONOMY ADDED 228,000 Jobs in March

The U.S. job market unexpectedly accelerated in March, while the figures for January and February were revised downward substantially. The unemployment rate ticked up slightly to 4.2% in March, from 4.1% the previous month. This month’s jobs report highlights the continued resilience of the labor market despite sticky inflation, a drop in consumer confidence , mass federal government layoffs, and growing economic uncertainty.

Noticeably, residential construction employment has shown signs of weakness in recent months. In March, the six-month moving average of job gains for residential construction turned negative for the first time since August 2020. It reflects three significant drops in employment: 8,400 jobs in October 2024, 6,700 jobs in January 2025, and 9,800 jobs in March 2025. Additionally, the construction job openings rate has returned to 2019 levels, driven by a slowdown in construction activity.

In March, wage growth slowed. Year-over-year, wages grew at a 3.8% rate, down 0.3 percentage points from a year ago. Wage growth has been outpacing inflation for nearly two years, which typically occurs as productivity increases.

National Employment

According to the Employment Situation Summary reported by the Bureau of Labor Statistics (BLS), total nonfarm payroll employment rose by 228,000 in March, following a downwardly revised increase of 117,000 jobs in February. Since January 2021, the U.S. job market has added jobs for 51 consecutive months, making it the third-longest period of employment expansion on record.

The estimates for the previous two months were revised down. The monthly change in total nonfarm payroll employment for January was revised down by 14,000 from +125,000 to +111,000, while the change for February was revised down by 34,000 from +151,000 to +117,000. Combined, the revisions were 48,000 lower than previously reported.

The unemployment rate rose to 4.2% in March. While the number of employed persons increased by 201,000, the number of unemployed persons increased by 31,000.

Meanwhile, the labor force participation rate—the proportion of the population either looking for a job or already holding a job—rose one percentage point to 62.5%. For people aged between 25 and 54, the participation rate decreased two percentage points to 83.3%. While the overall labor force participation rate remains below its pre-pandemic levels of 63.3% at the beginning of 2020, the rate for people aged between 25 and 54 has been trending down since it peaked at 83.9% last summer.

Construction

Employment

Employment in the overall construction sector increased by 13,000 in March, following a gain of 14,000 in February. While residential construction saw a decline of 9,800 jobs, non-residential construction employment added 22,300 jobs for the month.

Residential construction employment now stands at 3.4 million in March, broken down as 958,000 builders and 2.4 million residential specialty trade contractors. The six-month moving average of job gains for residential construction was -2,883 a month, mainly reflecting the three months’ job loss over the past six months (October 2024, January 2025 and March 2025). Over the last 12 months, home builders and remodelers added 14,000 jobs on a net basis. Since the low point following the Great Recession, residential construction has gained 1,367,600 positions.

In March, the unemployment rate for construction workers declined to 4.3% on a seasonally adjusted basis. The unemployment rate for construction workers has remained at a relatively lower level, after reaching 15.3% in April 2020 due to the housing demand impact of the COVID-19 pandemic.

American Legion Post 211 31972 Walker Road Avon Lake, Ohio

Buffet Dinner, Desserts and Cash Bar *21 and Older Only Please

Sponsorship Opportunities

Win Place Or Show Sponsor - Sold Out!

• Includes 8 tickets to the event

• Logo on Placemats and On Program Cover, Mic Time, Verbal Recognition, and Ad on All Social Media Platforms

Stable Sponsor: $1000 - Unlimited

• Includes 8 tickets to the event,

• Logo on Placemats and in Program, Mic Time, Verbal Recognition

Winners Circle Sponsor: $500 - Unlimited

• Includes 4 tickets to the Event

• Logo on Table Placemats and in Program, Verbal Recognition

Bar Sponsor: $400 - SOLD OUT!

• Includes 2 tickets to event

• Logo on Napkins for Bar, Ad in Program

Name a Race**: $150 - 8 Available

• Listed in Program and Announced During Racing Event.

Table Sponsor: $100 - Unlimited

• Ad in program and on Placemats;

• Verbal recognition

Name a Horse**: $20 - Only 90 Available

• Horse Name and Owner Listed in Program and Announced During Racing Event.

• If Your Horse Wins its Race You Win $50!

** If You Choose to “Name a Horse” or “Name a Race” a Committee Member Will Reach Out to You Prior to the Event for Naming Selections

Questions? Call a Committee Member:

Sara Majzun 440-752-7061

John Toth 216-409-7277

Jeremy Vorndran 440-213-6729

ON THE ECONOMY

TRADE WAR WILL CREATE FURTHER Economic and Financial Market Stress

Nahb Chief Economist Robert Dietz provided this economic and housing industry overview in the bi-weekly newsletter Eye On the Economy.

A global trade war is underway, causing significant economic and financial market disruptions. As initially announced, the U.S. imposed trade sanctions including a 10% minimum tariff rate on virtually all U.S. trading partners, combined with higher “reciprocal” tariff rates — which were, in fact, taxes on bilateral U.S. goods deficits rather than tied to specific foreign tariff or non-trade-based rules. However, even those rates were four times higher than they should have been, given the equation specified. It appears these higher rates were designed as leverage for negotiations.

As these rates were set to apply on the evening of April 8, financial markets shuddered. The 10-year Treasury rate spiked to 4.5%, alarming investors as a bond market repricing occurred. On April 9, President Trump set a general 90-day pause on the applicable reciprocal rates (leaving in place the 10% baseline tariffs on all countries except for Canada and Mexico), subject to bilateral trade negotiations.

However, this pause also excluded China, which is now subject to a prohibitive (perhaps a virtual trade embargo) 145% tariff rate. This rate will disrupt supply chains for Chinese goods, raise prices for these items, and cause financial market repricing. Recognizing this risk, an exemption of this tariff was set on Friday of last week for computer chips and other electronic items.

For financial markets, the 10-year Treasury rate is settling at near 4.5%, as an additional risk premium for U.S. government debt is imposed by investors. The rate has also increased due to expectations for higher inflation in 2025. Separately, duties on Canadian lumber are set to rise from 14.5% to 34.5% later this year.

BY: ROBERT DIETZ

Treasury rates are worth watching in the weeks ahead. There remains a liquidity risk if a significant portfolio reshuffling occurs. Such liquidity risks can produce significant financial and economic distress. However, the bond market appears orderly, for the time being. The other risk for bonds, including mortgage-backed securities and mortgage interest rates, remains a political retaliation via a large-scale sale of foreignowned debt. Such an action would spike interest rates.

Although the negotiations may yield growth opportunities for U.S. energy firms and other exporters, most forecasters are now saying a recession is more likely than not for 2025. NAHB’s forecast for GDP growth in 2025 has been revised lower to near 1%, with flat readings for several quarters as we believe negotiations and carveouts will continue. Our probability for a 2025 recession is a smaller, one-inthree chance. Nonetheless, we expect inflation to rise in the quarters ahead above a 3% annual rate and for the unemployment rate to approach 5% as a growth slowdown occurs.

While we expect distress as trade flows from China are interrupted, it is important to recall recent data that showed solid economic momentum. Inflation data surprised to the good side for March: The Consumer Price Index measure of inflation slowed to a 2.4% year-over-year rate, with shelter inflation slowing to 4%. Absent the trade war, these data would have set the Federal Reserve on pace for additional short-term interest rate cuts. And while overall producer prices fell in March, the prices for residential construction materials rose just 1.3% year over year.

And despite recent government job cuts, the economy created 228,000 jobs in March, with home builders and remodelers adding 13,000 positions . The job openings count for construction remained low, at just 242,000.

Also, NAHB Remodelers continue to report relatively good market conditions. The NAHB Westlake/Royal Remodeling Market Index declined five points in the first quarter, but fell to an otherwise positive reading of 63. NAHB is bullish on the future of the home improvement sector for a variety reasons, including an aging housing stock. New NAHB research finds that almost half of owner-occupied homes were built before 1980.

GREEN

THANK YOU SPIKES!

Lou LaGuardia, Repros Engineering