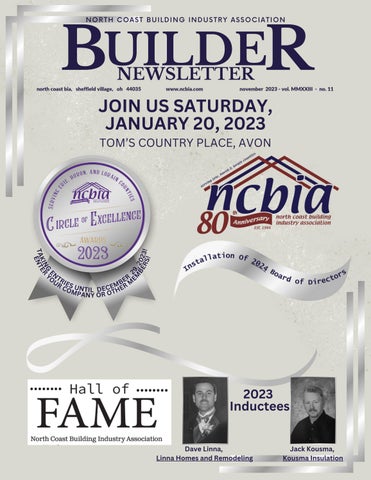

BUILDER NORTH COAST BUILDING INDUSTRY ASSOCIATION

NEWSLETTER

north coast bia, sheffield village, oh 44035

www.ncbia.com

november 2023 - vol. MMXXIII - no. 11

JOIN US SATURDAY, JANUARY 20, 2023

E G Y IN R TAEKNTE

2 M 9, 2 BE 02 RS 3! !

TOM’S COUNTRY PLACE, AVON

N R E O TR U R IE BE M S M C O U N TIL D E C E HER MPA NY OR OT

2023 Inductees

Dave Linna, Linna Homes and Remodeling

Jack Kousma, Kousma Insulation