Your One Stop for Tile, Cabinetry, and Countertops Avon Lake: 440.934.1751 Brooklyn Heights: 440.799.8285 Canton: 330.456.8408 Willoughby: 440.373.1195 www.sims-lohman.com

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

NCBIA Office

5077 Waterford Dr. Suite 302

Sheffield illage, OH 44035 Phone: 440.934.1090

info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate

Ashlyn Bellan | ashlynncbia@gmail.com

2023 NCBIA Officers President

Tim King, K. Hovnanian Homes - Ohio Division Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain Secretary

Mike Gidich, MDG Maintenance LLC.

Immediate Past President

Sara Majzun, Majzun Construction Co.

2023 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Kevin Walker, Great Lakes Properties & Investments

Dave Linna, Linna Homes & Remodeling

Jason Rodriguez, The S.J.R Building Co.

Jon Sherer, Paraprin Construction

Brian Schwab, RestorePro, Inc.

Dave Weisenberger, Tusing Builders & Roofing Service

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Life Directors

Bob Yost, Dale Yost Construction

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Jeremy Vorndran, 84 Lumber

Jim Sprague, Maloney + Novotny, LLC

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Randy Strauss, Strauss Construction

Tom Caruso, Caruso Cabinets

Tom Lahetta, Tom Lahetta Builders, Inc.

2023 NAHB Delegates

These are our members who represent our local industry in Washington DC and Columbus:

Randy Strauss, Strauss Construction

Jason Rodriguez, The S.J.R Building Co.

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2023 President

Richard Bancroft, Bancroft Development

OHBA Past Presidents

Randy Strauss, 1996

2023 OHBA Trustees

Tim King, K. Hovnanian Homes - Ohio Division

Sara Majzun, Majzun Construction Co.

Mary Felton, Guardian Title (alternate)

2023 Executive Committee Appointees

Sara Majzun, Majzun Construction (Membership)

Judie Docs, NCBIA (Executive Officers Committee

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

March 2023 www.ncbia.com page 3

17 14-15 38 30-31 2023MEMBER

of Contents

21- Eye on Housing: Lower Rates Spark Housing Demand

22Monthly Member Savings Update

23-24Legislative Review

25NCBIA Education Event DATE CHANGE!!

26 - NAHB Now: More Than 50 Lawmakers Express Concerns over FEMA's Flood Insurance Pricing

27 - NAHB Now: New NAHB Resources Available on Single-Family Built-for-Rent Housing

28 - Eye on Housing: Lack of Existing Inventory Boosts Builder Confidence to Key Marker 29 - Eye on Housing: The Fed Hints at an End for Spike Rates 30-31 - NCBIA 2023

34 - Sedgwick Open Enrollemnt Reminder!

36 - Eye on Housing: Improved Affordability Expectations Lead to More Engaged Buyers

38 - NAHB Now: New CEO to Take the Helm at the National Association of Home Builders

39 - NAHB Now: Gain Insights to Prepare for NAHB's 2023 Legislative Conference

40-41Welcome New Members! Thanks for Renewing! Sorry to See You Go! "What Members are Saying"

42- Thank You Spikes!

44-45Sedgwick Updates!

46-47 - 2023 Annual Golf Outing Flyer SPONSORSHIP OPPORTUNITIES GOING QUICK!!

48 - NEW!

2023 General Membership Meeting & Cookout Flyer

49-51 - NEW! Speedway/Fleetcor Flyers

Table

6 -Menu of Services 7 -Save the Dates

UMBIs +

They And

17

2023

Guide 18

19

8-9 -National Association of Home Builders (NAHB) - A GREAT Resource - 2023 NCBIA President 10-13 Our Success Starts with YOU! -Executive Officers Repor 14-15 - Stream + Wetlands

ILF Credits: What Are

How Do They Work? 16 - THANK YOU! OSHA Training Sponsors!

-

Official Membership Directory and Consumer

- NAHB Now: How to Start Planning for a Summer Intern

- NAHB Now: 2023 Spring Leadership Meeting and Legislative Conference 20-Eye on Housing: Share of FHA-Backed New Home Sales Climbs in Q1 of 2023

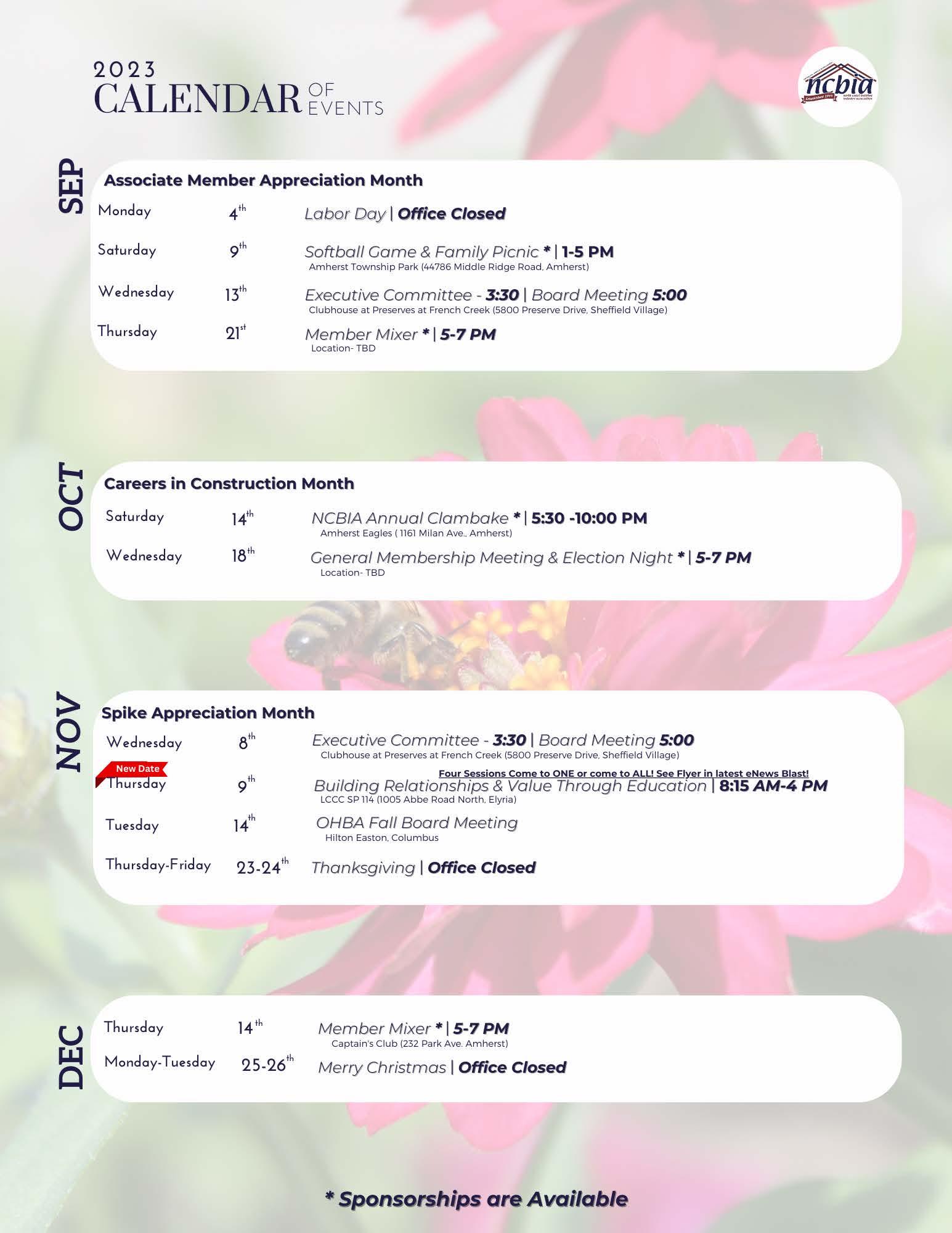

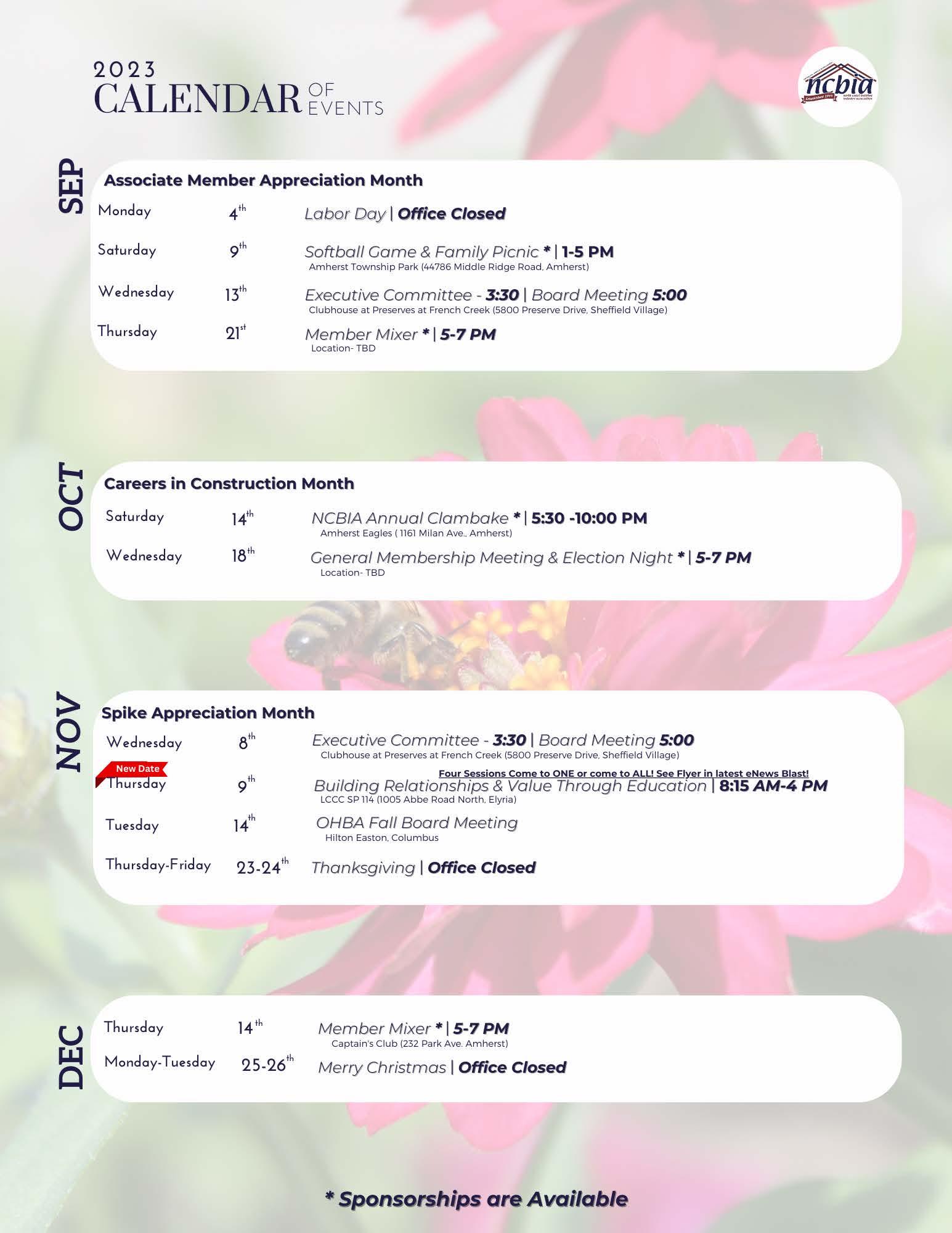

Calendar of

Updated!

Events

32 - Eye on the Economy: Inflation Cools as Builder Sentiment Rises

May 2023 www.ncbia.com page 5

For more information on any of these products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

HOW CAN WE HELP?

HELP?

North Coast Building Industry Association Menu of Additional Products and Services Copies Equipment Design Services

Books Black & White Black & White Color Color Color Raffle Boards, Drum & Equipment Graphic Design Services (8.5”x11”) (8.5”x14”) Black & White (11”x17”) (8.5”x11”) (8.5”x14”) (11”x17”) Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided $0.10 $0.20 $0.15 $0.20 $0.50 $0.25 $0.50 $0.27 $0.52 $2.00 $100 per day $30 each (plus shipping, if applicable) $35 per hour Contact Ashlyn Bellan at ashlynncbia@gmail.com

HOW CAN WE HELP?

Warranty

NEED SOMETHING ELSE? JUST ASK!

North Coast Building Industry Association Menu of Additional Products and Services

Equipment Black & White Black & White Raffle Boards, Drum & Equipment (8.5”x11”) (8.5”x14”) Single Sided 2-Sided $0.10 $0.20 $100 per day Home

New

page 6 www.ncbia.com May 2023

Copies

$7 each (plus shipping, if applicable) Your

Home

Save the Date!

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!!!!!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!!!!!

Thursday, June 23rd

June General Membership Meeting & Cookout

11:30 AM - 1:00 PM

Pogie's Clubhouse

150 Jefferson Street, Amherst

More info coming soon!

Thursday, July 27th Night at the Crushers

6:30 PM

Mercy Health Stadium

2009 Baseball Boulevard, Avon

Do you have some business news to share?

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

2023 Marketing Guide

Give Judie a call if you would like to meet

and/or Discuss our 2023 Marketing Guide

(440-934-1090, option 2 or email judie@ncbia.com)

2023 Marketing Guide CLICK HERE

May 2023 www.ncbia.com page 7

NAHB Member Services

NATIONAL ASSOCIATION OF Home

Builders (NAHB)

A Great Resource

NAHB was founded in 1942 with 700 members. Today, it has more than 140,000 members and more than 800 state and local associations.

NAHB is a federation headquartered at the National Housing Center in Washington, D.C. NAHB members join the association at the local level and pay their dues to the local. Local associations are affiliatedwith the state and national associations. NAHB is represented in all 50 states and Canada.

NAHB is governed by more than 2,000 members of leadership, comprised of elected representatives from local and state associations, including our own Randy Strauss. Meeting three times a year, in winter (in conjunction with the International Builders' Show), spring and fall to vote on the policies and procedures of the association. At the winter meeting, the national senior officers are elected

While many NAHB members are aware of the services provided by their local or state associations, the national services may seem less tangible.

Industry Research

• The Home Innovation Research Labs runs tests on building supplies and equipment and approves qualifiedproducts. Home Innovation Research Labs also works on the development of innovative technologies and answers members’ technical questions through its Home-Based Hotline, 800-8982842. The general number for Home Innovation Research Labs is 800-638-8556.

• The Local Impact of Home Building provides demographic, economic, and housing data. (Contact NAHB’s Economics Department, x8441.)

• HousingEconomics.com provides the latest housing forecasts, market trends, in-depth economic analysis and archival data relating to the housing industry.

Legislative Activities

NAHB monitors all action on issues related to the building industry, lobbies on behalf of member interests, collects data on state and local activities and promotes grassroots campaigns.

Education and Training

• NAHB Education. To provide easier access, more efficientmanagement, enhanced program quality and comprehensive information about educational opportunities, NAHB Education was formed to consolidate educational offerings into one location. Members may invest in their professional growth and the success of their business by earning a designation, attending an event, or simply taking a course or two.

NCBIA 2023 PRESIDENT page 8 www.ncbia.com May 2023

Tim King, K. Hovnanian Homes

NATIONAL ASSOCIATION OF Home Builders (NAHB) A Great Resource

Designation Programs

• NAHB works with local and state associations to implement educational designation programs to foster professionalism in the industry. NAHB works with state and local associations to provide these programs to members.

• Webinars and Online Courses. NAHB regularly offers webinars on topics such as land development, business management or design, to name a few. Marketing for these programs is done via email and on the NAHB website, nahb.org/webinars.

• In-Person Courses. In-person courses cover specifictopics to sharpen your skills and advance your industry knowledge.

• Spokesperson Training. NAHB’s Spokesperson Training Seminars (x8445) are designed to help association leaders be more persuasive and effective in all communication environments. The training provides techniques to deal with difficultmedia situations and gives participants the confidenceand skills to communicate more effectively in their own businesses, in presentations to industry and public groups, testimony and media interviews.

• Education Opportunities at IBS. The International Builders' Show offers attendees more than 100 education sessions during the three days of the show. Attendees findhigh-impact sessions with ideas, information, tips and techniques they can put to work right away. Sessions cover a huge array of topics of interest to those in the home building industry, including economic trends, business opportunities and new markets, technology, high-performance building, sales and customer focus, construction methods, business management, legal issues, government regulation, architecture, design and community planning (x8387).

Business, Construction, and Legal Assistance

• Builder Business Management. Information on applications and accounting systems for builders is available from Business Management Services. (x8388).

• Land Development. Information on all aspects of land development, including plan processing, site design, sediment control and utilities is available from the Land Development department (x8443).

• Construction Techniques and Codes. The Construction, Codes and Standards department provides information on national building and related codes and on the latest construction techniques and products (x8300).

Industry Information

• Publications. Print and electronic newsletters and magazines provide information on the association, the industry, and related topics. Builder magazine features in-depth articles and pictorial essays on all aspects of the housing industry. Specialized publications from NAHB departments focus on builder and associate interests.

• Communications. The Communications department develops programs and publications to increase consumer awareness of rapidly changing conditions in the housing market. In addition, Communications develops materials to publicize the programs, policies, and goals of NAHB (x8409).

Since you are already a member of NAHB, do not be afraid to use their resources for help in any areas you may have.

As you can see NAHB offers a wealth of information and it is all part of your membership!

NCBIA 2023 PRESIDENT May 2023 www.ncbia.com page 9

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

OUR SUCCESS Starts with YOU!

Members report that they get the most out of their membership by becoming active participants in various areas of the association. This month I ask you to focus your energy on membership recruitment and member retention to strengthen the NCBIA. It is a great way to get to know other industry professionals within our community and association. Your involvement can make a difference for our association and for your business.

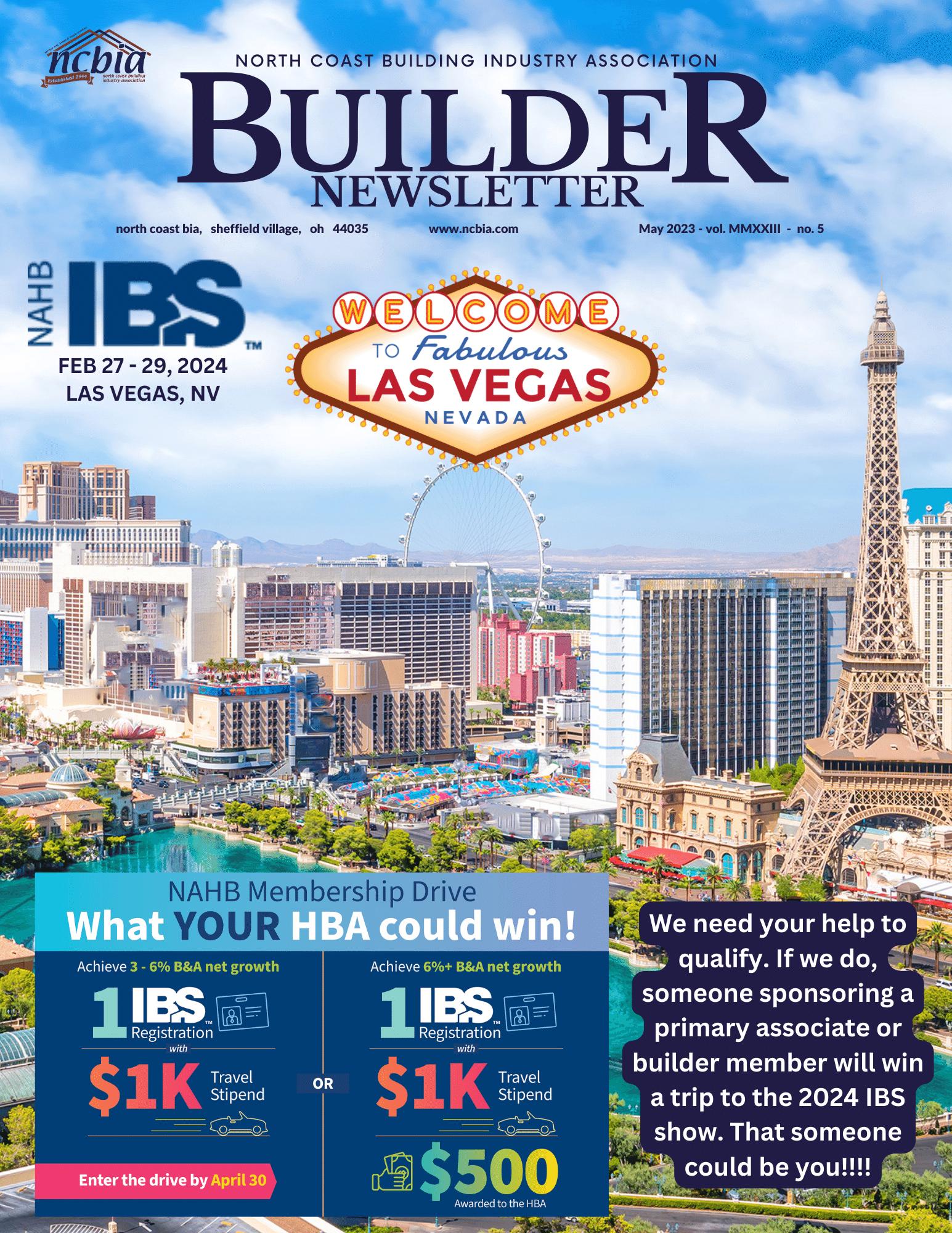

NAHB recently kicked off its annual membership drive, which not only aims to recruit new members, but also highlights the value of membership in the Federation to current members as well.

From April 1 to June 30, members of local associations across the nation participate in the drive by reaching out to coworkers, colleagues and friends in the industry to promote the numerous benefitsof membership. Whether they want to save money on business expenses, expand their knowledge with industry-leading education or network with more people in the industry, members can receive a significant return on their investment

• Member-Exclusive Savings — The NAHB Member Savings Program offers exclusive deals with popular vendors to help members save on personal and business expenses. T-Mobile, Farmers Insurance, Goodyear Tires and Voyager Fuel & Fleet Management Mastercard are the latest companies to join. Plus, the program continues to feature significantdiscounts through Lowe’s, Dell Technologies, UPS and many other leading companies.

• Industry-Specific Education — Membership unlocks discounts on numerous instructor-led courses and webinars to help members stay in the know and ahead of the competition. Courses cover a range of topics, including business management, building technology, housing economics and strategic marketing.

• Numerous Networking Opportunities — With more than 140,000 members worldwide and countless events throughout the year, there are always opportunities to expand your network. Catching up with local builders at HBA meetings, attending the annual International Builders’ Show (IBS) and participating in councils such as NAHB Remodelers and Professional Women in Building are some of the best ways to build business.

Incentives for Successful Membership Drives

For the firsttime, NAHB is offering local HBAs that meet recruitment goals during the drive a free pass and travel stipend to IBS 2024 in Las Vegas. HBAs can also receive a $500 cash bonus for achieving more than 6% net member growth during the drive.

A free pass to IBS opens the door to the home building industry’s premier annual event, where tens of thousands of attendees meet with vendors, network with colleagues and attend educational sessions. Following this article, you will findthe spike rolodex which lists professions that we are looking for as well as an application for membership for you to share with potential members.

Your involvement can make a difference for our association and for your business.

EXECUTIVE OFFICER’S REPORT

May 2023 www.ncbia.com page 10

Your Prospect Rolodex How to find 101 potential new members without leaving your desk! BUSINESS CATEGORY PRO SPECTIVE MEMBERS CONTACT NUMBER Email NAHB MEMBER? YES NO Accounting, Bookkeeping Service, CPA Advertising Agency, Public Relations Firm Air Conditioning and Heating Contractors and Suppliers Alarm Systems, Security Contractors and Suppliers Aluminum, Sheet Metal Fabricators and Suppliers Appliance Suppliers, Manufacturing Representatives Appliances Architects-Draftsmen Asphalt Contractors and Suppliers Attorneys Automobile/Truck Sales, Services, Dealerships Awnings-Metal and Cloth Banks, Savings & Loans, Mortgage Companies Blinds, Venetian Blinds Brick Mason Brick Suppliers and Manufacturers Building Material Suppliers Cabinets and Shelving-Manufacturers, Contractors, Suppliers Carpets-Suppliers,Manufacuters, Installers Ceiling Fans Ceramic Tile-Manufacturers, Suppliers, Installers Communications and Telephone Companies Computers and Computer Suppliers Concrete Manufacturers and Suppliers Concrete Finishing Contractors Credit Bureaus Construction/Heavy Equipment Dealers Decoration/Design, Interior Decorators Dirt-Suppliers and Haulers Doors/Millwork Drywall Finishing Electricians Electrical Supplies Engineers Spike Rolodex

Your Prospect Rolodex How to find 101 potential new members without leaving your desk! BUSINESS CATEGORY PROSPECTIVE MEMBERS CONTACT NUMBER Email NAHB MEMBER? YES NO Exterminators Fences-Suppliers and Installers Fire Equipment Fireplaces/Woodstoves Flooring-Hardwood, Tile Supplies and Sales Framing Contractors Furniture Company and Suppliers Gas/Propane Glass, Mirrors, Stain Glass Gutters, Downspouts Hardware Insulation-Suppliers and Contractors Insurance Agents and Companies Intercoms Janitorial and House Cleaning Landscape Contractor and Lawn Service Landscape Lighting Fixtures Lot and Land Clearing Contractors Lumber/Plywood Dealers and Distributors Marble-Suppliers Manufacturers, and Contractors Masonry and Brick Contractors Moving and Storage Companies Office Supplies and Machines Paging, Answering Services, Cell Phones Paint Stores and Supplies Paint Contractors Paper Hangers Plumbing Contractors Plumbing Fixtures Portable Toilets Prefab Building Supplies and Manufacturers Printing/Typesetting Realtors Real Estate Developers Remodelers

Your Prospect Rolodex How to find 101 potential new members without leaving your desk! BUSINESS CATEGORY PROSPECTIVE MEMBERS CONTACT NUMBER Email NAHB MEMBER? YES NO Rental Equipment and Machinery Restaurants, Hotels, Meeting Rooms Road Builders Roofing Contractors Roofing Materials and Supplies Sand/Gravel Saunas/Spas Septic Tanks Signs/Sign Companies Solar Systems Stereos/Radios Surveyors Swimming Pools Telephone Systems and Equipment Telephone Prewiring Television/Cable/Video Equipment and Services Title Insurance Companies Tools Tire Dealers Travel Agencies Trim Carpenters Trim and Millwork Suppliers Tub Enclosures Upholstering Utility Companies Vacuum Systems Wallcovering Supplies Waste Disposal Windows-Manufacturers, Suppliers Wood Flooring Other Builders

Protecting our environment, enhancing our ecosystems and restoring our streams + wetlands since 1992.

UMBIs + ILF Credits: What Are They And How Do They Work?

By Kellie Griffin + Chelsea Keefe

State and federal laws (sections 401 and 404 of the Clean Water Act, as well as Ohio Revised Code 6111) require impacts to aquatic resources, including wetlands and streams, to be offset with compensatory mitigation. One way to provide the required mitigation is for applicants to purchase mitigation credits from mitigation banks or inlieu fee (ILF) program sponsors. The Stream + Wetlands Foundation (S+W) is the sponsor of multiple mitigation banks and ILF programs.

May 2023 www.ncbia.com page 13

Protecting our environment, enhancing our ecosystems and restoring our streams + wetlands since 1992.

What are UMBIs?

Mitigation banks are typically single site projects. However, in some instances, sponsors may choose to establish an Umbrella Mitigation Bank Instrument (UMBI). The instrument that establishes an UMBI sets out the parameters for the establishment of bank sites that will be operated under the UMBI. Multiple bank sites can then be added to the UMBI over time. UMBIs can help streamline the review and approval process for new sites and be used for tracking no-net loss of wetland acreage within the watershed.

What Does This Mean for Permittees?

Rather than purchasing credits from a specific mitigation bank, permittees will buy from the approved UMBI. For example, in northeast Ohio, a permit applicant could buy credits from the Black-Rocky UMBI, which currently has one approved site, the Grafton Swamp Wetlands Mitigation Bank. Click to see our other approved UMBIs and associated bank sites.

In-Lieu Fee (ILF) Advance, Fulfilled, and Released Credit

ILF mitigation credits work essentially the same way as credits purchased from a mitigation bank, as far as a permit applicant is concerned, although banks do have preference in the mitigation hierarchy. There are three types of credits described in the federal mitigation rule: advance credits, fulfilled credits and released credits. Read more about ILF credits and mitigation banking and UMBIs by visiting our website.

Each type of mitigation option has unique features and requirements, and the choice of which one to use depends on various factors, including the type of wetland impacted, the type and scope of the project, and whether or not it is a state and/or federally regulated aquatic resource. Whether using mitigation bank or ILF credits, once a permit applicant completes payment to the sponsor, the applicant has fulfilled the requirements of their permit.

S+W is one of the only mitigation providers in the country that sells both mitigation bank and ILF credits! Reach out through our website or by contacting me.

page 14 www.ncbia.com May 2023

2023MEMBER

HOW TO START PLANNING for a Summer Inter n

Schools will be out for the summer soon, which means now is the perfect time to start laying the groundwork for an internship program. Working with interns helps companies meet their own workforce needs and helps the industry build the pipeline of new workers needed to meet the demand for new housing.

There are many considerations when planning for a trainee on your jobsite. To help you establish a program, NAHB has a step-by-step guide to setting up an internship program.

The Student Internship Resources for NAHB Members guide focuses on how builders can engage with three different talent resources: secondary (high school) students in career and technical (CTE) education programs, community college students, and university students.

The comprehensive guide covers topics such as:

• How to evaluate your workplace needs

• How to research the legalities

• Tips for developing a training plan

• How to find, hire and manage intern

• How to retain good prospects as employees

In addition, to help students and young professionals develop their careers in the trades, NAHB has a robust collection of one page “how-to” guides, such as interviewing and building a network available for download and print.

NAHB invites all members to share their workforce development opportunities and challenges during the next in-person Workforce Development Champions Forum on Friday, June 9, at 10:30 a.m. ET, during the Spring Leadership Meeting in Washington, D.C.

CONTACT: Greg

Zick

gzick@nahb.org (202)266-8493

May 2023 www.ncbia.com page 18

NAHB NOW

2023 SPRING LEADERSHIP Meeting and Legislative Conference

Jun 06-10, 2023

Washington Hilton

1919 Connecticut Avenue, N.W. Washington, DC 20009

NAHB leadership will gather in Washington, D.C. for the 2023 Spring Leadership Meeting and Legislative Conference, June 6-10.

View the draft meeting schedule.

For travel planning purposes, please refer to the meeting schedule. The Legislative Conference on June 7 begins with a 7:30 a.m. issues briefing at the Washington Hilton.

Hotel Information

Make your reservations at the Washington Hilton by May 8 in order to receive the NAHB group rate.

Please email Sean Lenahan with any questions about the hotel.

NAHB NOW page 19 www.ncbia.com May 2023

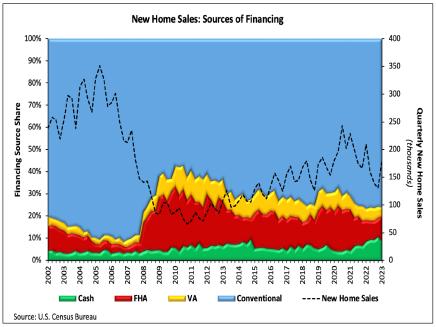

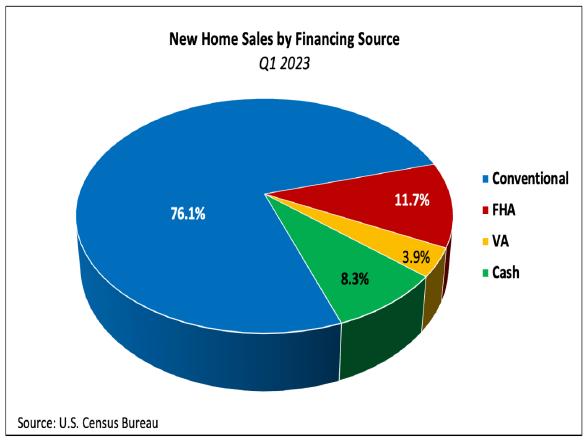

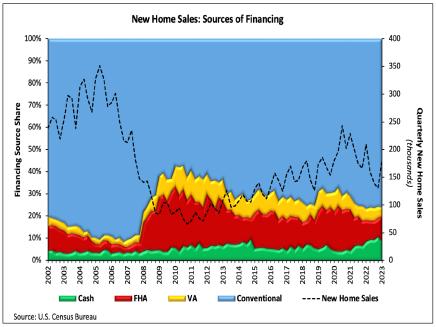

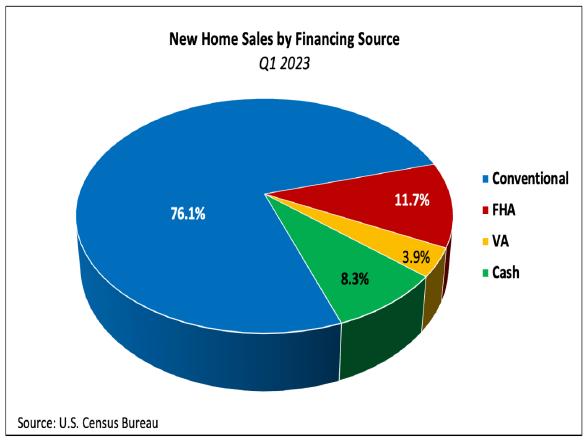

SHARE OF FHA-BACKED NEW Home Sales Climbs in Q1 of 2023

NAHB analysis of the most recent Quarterly Sales by Price and Financing report published by the U.S. Census Bureau reveals that the share of new home sales backed by FHA loans jumped from 8.4% to 11.7% in the firstquarter of 2023. It is the largest share since 2007 but remains 30% lower than the postGreat Recession average.

Conventional loans financed76.1% of new home sales, up 0.5 percentage point and near a 15-year high. The share of VAbacked sales fell 1.4 percentage points to 3.9%, the lowest since Q4 2007.

BY: DAVID LOGAN

Although cash sales make up a small portion of new home sales, they constitute a larger share of existing home sales. According to estimates from the National Association of Realtors, 27% of existing home transactions were all-cash sales in March 2023, down from 28.0% in February and one year ago.

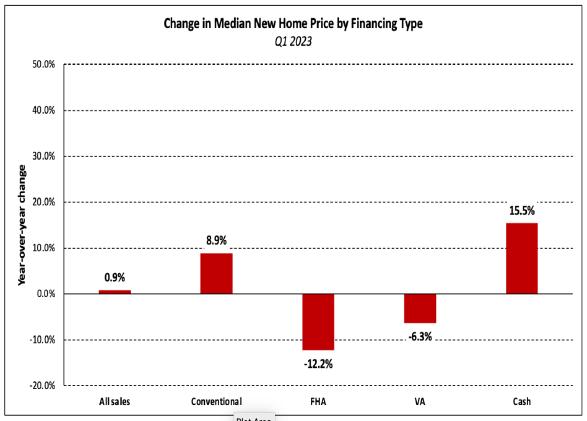

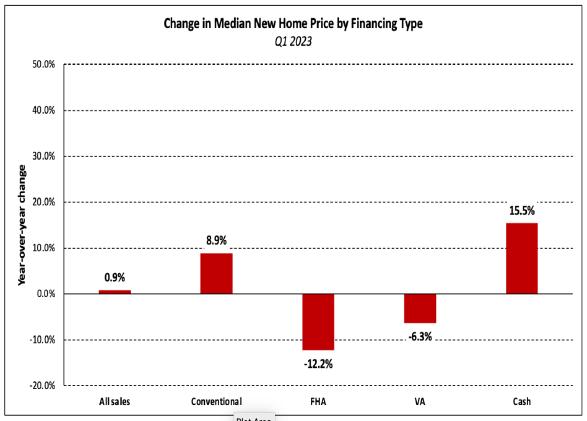

Price by Type of Financing

Different sources of financingalso serve distinct market segments, which is revealed in part by the median new home price associated with each. In the fourth quarter, the national median sales price of a new home was $436,800. Split by types of financing,the median prices of new homes financed with conventional loans, FHA loans, VA loans, and cash were $515,900, $323,300, $392,500, and $448,300, respectively.

Over the past year, the price of homes bought with FHA and VA loans fell 12.2% and 6.3%, respectively. The median price of a home purchased with a conventional loan (+8.9%) and cash (+15.5%) both increased.

After accounting for 10.7% of sales in the fourth quarter of 2022, cash purchases made up 8.3% of new home sales in the first quarter of 2023. Although the share of cash purchases was roughly unchanged from one year ago, it remains elevated in historical terms and is nearly twice as large as it was in Q1 2021.

EYE ON HOUSING

May 2023 www.ncbia.com page 20

LOWER RATES SPARK Housing Demand

The retreat in mortgage interest rates during the first quarter of 2023 (from the 20-year peak reached in the fall of 2022 led a record share of adults in the US – 18 percent – to declare having plans to buy a home within a year – the largest share since the inception of this series in 2018. The finding also means the share of prospective buyers jumped 5 points in a single quarter, rising from 13 percent in the final quarter of 2022.

Relatively lower interest rates in the first quarter of 2023 also pushed more 1st-time home buyers to enter the market: 71% of all prospective buyers (a series-high reported this would be their first time buying a home, up from 61% in the final quarter of 2022.

The share of adults with plans to buy a home in the next 12 months rose in all regions of the country between the final quarter of 2022 and the first quarter of 2023: Northeast (11% to 19%, Midwest (10% to 14%, South (14% to 17%, and West (14% to 23%.

Similarly, the 1st-timer share gained ground in all four regions between the fourth quarter of 2022 and the first quarter of 2023: Northeast (64% to 66%, Midwest (58% to 67%, South (60% to 68%, and West (62% to 75%.

* Results come from the Housing Trends Report (HTR) – a research product created by the NAHB Economics team with the goal of measuring prospective home buyers’ perceptions about the availability and affordability of homes for-sale in their markets. The HTR is produced quarterly to track changes in buyers’ perceptions over time. All data are derived from national polls of representative samples ofAmerican adults conducted for NAHB by Morning Consult. Results are seasonally adjusted. A description of the poll’s methodology and sample characteristics can be found here

BY: ROSE QUINT

EYE ON HOUSING page 21 www.ncbia.com May 2023

Farmers Insurance

NEW! Discover discounted auto, home, and renter’s insurance through Farmers Insurance ChoiceSM. Now available for NAHB Members!

LEARN MORE

Lowe's

Did you know?

You could add ANY credit card to your Lowe’s Pro Wallet, and save additional 2% with a Lowe’s Commercial or Business Advantage account

LEARN MORE

Offers for YOU and YOUR MEMBERS DISCOVER

MORE OFFERS BELOW!

MAY 10, 2023 REPORT #5

DUALING APPROACHES TO ADDRESS HOUSING SHORTAGE CONTINUE

As the budget process continues, several approaches are being presented and discussed in the House and Senate as the response to housing need. It has also highlighted the resistance to promote housing in the state. While the provisions addressing the increased property taxes on subdivided residential property are currently in the House version of the budget (HB 33), two other proposals are also very much in the mix. Three of the approaches are highlighted below, and OHBA is meeting regularly with the legislature and stakeholders on the property tax language, as well as, alternative proposals.

• HB 33 As Passed By the House includes Property tax exemption: residential development land 83 R.C. 5709.56 Exempts from property tax the value of unimproved land subdivided for residential development in excess of the fair market value of the property from which that land was subdivided, apportioned according to the relative value of each subdivided parcel. Authorizes the exemption for up to eight years, or until construction begins or the land is sold. Does not apply to land included in a tax increment financing (TIF) project. There has been opposition from local government.

• State LIHTC Program-Proposed in the Governor ’s budget and modified in the House version of HB 33 before being sent to the Senate. Opposition from the Senate President makes it unlikely to survive in the Senate version of HB 33.

• HOPE (SB 118) Authorizes a nonrefundable, transferable income tax credit for the construction of new, or conversion of rental housing into, owner-occupied single-family home. Creates the Home Ownership Potential Energized (HOPE) program in the Department of Development, authorizing a nonrefundable income tax credit for the creation of certain owner-occupied single-family housing in municipalities in which a majority of the housing stock is rented. § Allows such municipalities to exclude parts of their territory from credit eligibility. § Limits credits to the lesser of $50,000 or 50% of the cost to prepare a rental home for sale to an owner occupant or to construct a new home for owner-occupancy, with a $100 million per fiscal year credit cap. §Allows unused portions of the credit to be carried forward for five years, or to be transferred, in whole or in part. This is a recent proposal put forth by the Senate, but is in the mix of discussion for housing provisions to be included in the budget. The bill can be found at this link:

https://searchprod.lis.state.oh.us/solarapi/v1/general_assembly_135/bills/sb118/IN/00/sb118_00_ IN?format=pdf

OHBA encourages you to contact your Senator asking them to pay attention to these housing issues and urge meaningful action. OHBA is meeting regularly on these issues, with more discussion on the property tax language this week. Stay tuned, and please feel free to contact OHBA with any questions at (614) 228-6647.

LEGISLATIVE REVIEW

page 23 www.ncbia.com May 2023

OHBA SUMMER BOARD OF TRUSTEES MEETING

As the budget process continues, several approaches are being presented and discussed in the House and Senate as the response to housing need. It has also highlighted the resistance to promote housing in the state. While the provisions addressing the increased property taxes on subdivided residential property are currently in the House version of the budget (HB 33), two other proposals are also very much in the mix. Three of the approaches are highlighted below, and OHBA is meeting regularly with the legislature and stakeholders on the property tax language, as well as, alternative proposals.

OHBA Summer Meeting is scheduled for June 20-22 at Kent State University Hotel & Conference Center. Now is the time to sign-up for this event. Highlights of this meeting is listed below

• Tuesday, June 20th – Golf at Congress Lake Club and Drinks and Dinner (Limited tee times available, must sign-up)

• Wednesday, June 21st – Membership Meeting, Combined Gov’t Affairs Update and Cocktail Reception

• Thursday, June 22nd – Board of Trustees Meeting

If you would like to sign-up for any of these events, please contact OHBA at 614-228-6648 or mpatel@ohiohba.com Hope to see you there!

LEGISLATIVE REVIEW

page 24 www.ncbia.com May 2023

RescheduledforThursday, November9th!

MORE THAN 50 LAWMAKERS Express Concerns Over FEMA's Flood Insurance Pricing

More than 50 House lawmakers have sent a letter to Federal Emergency Management Agency (FEMA) Administrator Deanne Criswell expressing concerns over the National Flood Insurance Program’s (NFIP’s) new Risk Rating 2.0 mechanism that has resulted in increased premiums for millions of Americans.

Lawmakers are requesting information from FEMA on how the agency determines which communities are hit by flood insurance rate increases, asserting that the process “has been less than transparent” and that the “new methodology for determining risk and therefore policyholder premiums has accelerated homeowners simply giving up and dropping their policies.”

NAHB has been advocating on Capitol Hill about the lack of transparency in setting flood insurance rate increases and we are pleased that lawmakers have responded positively and are sharing these concerns with the FEMA administrator.

Communities and homeowners across the nation are being hit with rate hikes. In their letter to the FEMA director, House lawmakers noted that Louisiana Insurance Commissioner Jim Donelson stated: “Without changes to the NFIP’s plan, these premium increases will cause many Louisiana policy holders – especially lower income households in the most flood-prone areas – to drop their flood insurance altogethe.”

The lawmakers noted that approximately 12,000 New Jersey policy holders have dropped their insurance since FEMA moved forward with Risk Rating 2.0 premium hikes and that it has been reported that 91% of Harris County, Texas homeowners have seen a rate increase under Risk Rating 2.0.

“Homeowners, particularly those who are financially vulnerable, need affordable flood insurance policies to protect against catastrophic financial loss when future storms befall,” the House letter stated. “Additionally, a precipitous drop in policyholders could lead to program insolvency.”

Members of Congress are calling on FEMA to provide lawmakers a briefing that addresses all factors taken into account in the Risk Rating 2.0 calculations as well as the stability and affordability of the NFIP.

CONTACT: Lake

Coulson

lcoulson@nahb.org

May 2023 www.ncbia.com page 26

NAHB NOW

NEW NAHB RESOURCE Available on Single-Family Built-for-Rent Housing

Developers are exploring new ways to meet continued housing demand. One of the latest trends is built-for-rent housing. This type of housing is becoming increasingly popular, particularly among younger adults who are looking for affordable, flexible housing options

There is an important distinction between built-for-rent housing and flip-for-rent housing, which converts for sale housing to for-rent. Most of the built-for-rent product produced by NAHB members adds to the existing housing stock to meet a specific market demand for rental units with unique amenities relative to traditional apartments.

To alleviate confusion and potential concerns around built-for-rent housing, NAHB’s Land Development Committee formed a working group to study and produce education on the topic. The group created an introductory primer, “Renters by Choice: The Truth about SingleFamily Built-for-Rent Housing,” to describe what the phrase “renters by choice” means: The people who live in these communities are there because they want to be.

Single-family built-for-rent housing provides a lifestyle option to those seeking additional flexibility compared to buying, and amenities such as yards and garages that many large apartments do not offer. This type of housing can be a steppingstone between renting and buying for young families and be a good downsizing option for aging adults. Offering additional housing options to meet the diverse needs of families and individuals can help chip away at the housing crisis.

The document further describes benefits to home builders and local communities and can serve as a great introductory piece for NAHB members and all engaged in housing to start a discussion on this type of housing.

For more information, visit NAHB’s Land Use 101 Toolkit.

CONTACT: Nicholas Julian njulian@nahb.org (202)266-8309

NAHB NOW

page 27 www.ncbia.com May 2023

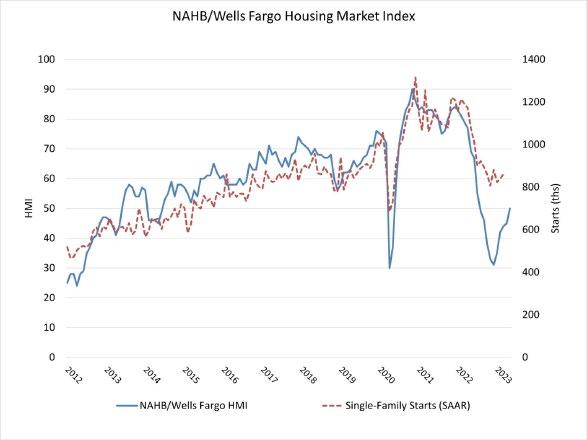

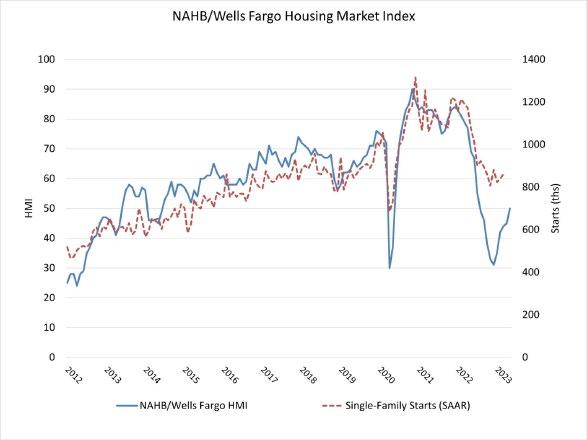

LACK OF EXISTING INVENTORY Boosts Builder Confidence to Key Marker

Limited existing inventory, which has put a renewed emphasis on new construction, resulted in a solid gain for builder confidencein May even as the industry continues to face several challenges, including building material supply chain disruptions and tightening credit conditions for construction loans. Builder confidencein the market for newly built single-family homes in May rose fivepoints to 50, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This marks the fifthstraight month that builder confidnce has increased and is the firsttime that sentiment levels have reached the midpoint mark of 50 since July 2022.

BY: ROBERT DIETZ

While this is fueling cautious optimism among builders, they continue to face ongoing challenges to meet a growing demand for new construction. These include shortages of transformers and other building materials and tightening credit conditions for residential real estate development and construction brought on by the actions of the Federal Reserve to raise interest rates.

And with interest rates more than doubling from 2021, the HMI survey shows incentives have played a key role in attracting buyers in this new economic climate and that the use of these sales inducements are gradually slowing across the board:

• The share of builders reducing home prices dropped to 27% in May, down from 30% in April, 31% in Feb. and March, and 36% last November.

• The average price reduction remains at 6%, unchanged for the past four months.

• 54% offered some type of incentive to bolster sales in May, down from 59% in April and 62% last December.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate trafficof prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

New home construction is taking on an increased role in the marketplace because many home owners with loans well below current mortgage rates are electing to stay put, and this is keeping the supply of existing homes at a very low level. In March, 33% of homes listed for sale were new homes in various stages of construction. That share from 2000-2019 was a 12.7% average. With limited available housing inventory, new construction will continue to be a significantpart of prospective buyers’ search in the quarters ahead.

All three major HMI indices posted gains in May. The HMI index gauging current sales conditions rose fivepoints to 56, the component charting sales expectations in the next six months increased seven points to 57 and the gauge measuring trafficof prospective buyers increased two points to 33.

Looking at the three-month moving averages for regional HMI scores, the, the Midwest edged up two points to 39, the South increased three points to 52 and the West moved three points higher to 41. The Northeast held steady at 45.

The HMI tables can be found at nahb.org/hmi.

EYE ON HOUSING

May 2023 www.ncbia.com page 28

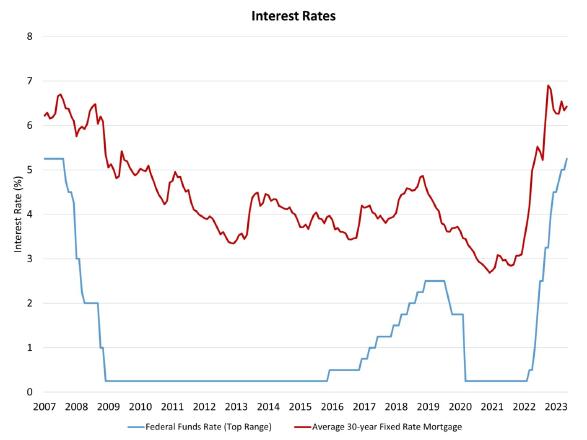

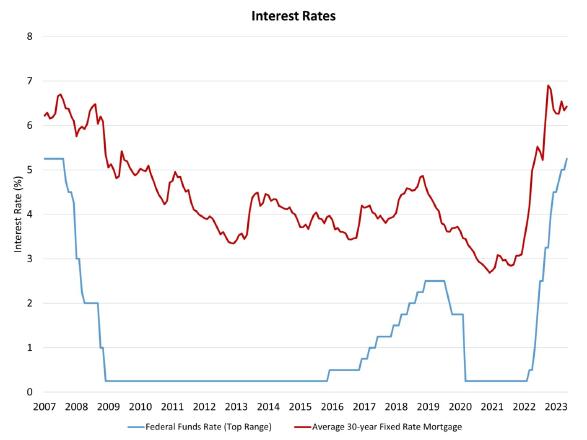

THE FED HINTS AT AN End for Spike Rates

The Federal Reserve’s monetary policy committee raised the federal funds target rate by 25 basis points at the conclusion of its May meeting. Although the communication from the Fed did not explicitly indicate that they are done tightening, language used in their statement signals the Fed is moving toward a more data-dependent posture, albeit one that retains a hawkish bias. The Fed faces competing risks: elevated but trending lower inflation combined with emerging risks to the banking system and macroeconomic slowing. Chair Powell has previously noted that near-term uncertainty is high due to these risks.

Today’s increase of the fed funds rate moved that target to an upper rate of 5.25%, the fastest increase for rates in decades. The Fed noted: “The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” While not explicit, this language represents a pivot to a more data-dependent stance. Previously, the Fed had asserted that additional rate hikes would be required, it was only a matter of how large.

Nonetheless, the Fed left room to continue rate hikes, if needed. The Fed asserted: “The Committee is strongly committed to returning inflation to its 2 percent objective.” They also stated: “The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.” This means the bias for the Fed leans to the hawkish side if data suggest that inflation is not continuing to trend lower.

BY: ROBERT DIETZ

Nonetheless, ongoing challenges for regional banks, as well as sector weakness in real estate and manufacturing represent caution signals for the Fed. In fact, the risks for smaller banks will result in tighter credit conditions, which will slow the economy and reduce inflation.Thus, these financialchallenges act as additional surrogate rate hikes in terms of tightening credit availability, doing some of the work for the Fed.

Caution would suggest the Fed pause and evaluate conditions in the coming months. As we noted with the release of the March NAHB/Wells Fargo Housing Market Index, the health of the regional and community bank system is critical to the availability of builder and developer financin , for for-sale, for-rent and affordable housing construction. We expect these conditions to tighten and will continue to monitor lending conditions via NAHB industry surveys.

Keep in mind that approximately 40% of overall inflationis generated from shelter inflation,which can only be tamed by additional affordable attainable housing supply. Higher rates for developer and construction loans move the ball in the wrong direction with respect to this objective. Moreover, financialmarket stress has increased the spread between the 10-year Treasury rate and the typical 30-year fixedrate mortgage. Last week, the spread widened to almost 300 basis points again, which is well above normalized levels.

Looking forward, the bond market appears to be expecting the Fed to cut rates during the second half of the year. However, this runs counter to communication from Fed leadership, who have suggested that higher rates need to remain in place over a longer period of time to successfully bring inflationlower. Indeed, the NAHB forecast does not include any Fed rate cuts until 2024.

EYE ON HOUSING

page 29 www.ncbia.com May 2023

INFLATION COOLS AS Builder Sentiment Rises

BY: ROBERT DIETZ

Data continue to show easing inflation,although certainly not at the rate the Federal Reserve and markets would wish. Nonetheless, signs suggest the Fed is near the end of its tightening cycle, which in turn sets the single-family sector on the path toward a rebound later this year and an outright calendar year increase in 2024.

Consumer prices in March saw the smallest year-over-year gain since May 2021, decelerating for the ninth consecutive month. While the shelter index (housing inflation)experienced its smallest monthly gain since November 2022, it continued to be the largest contributor (60%) of the total increase, less food and energy. Overall inflationwas up 5% year over year in March, while shelter inflation was up 8.2%

The Fed’s ability to address rising housing costs is limited, as shelter cost increases are driven by a lack of affordable supply and increasing development costs. Additional housing supply is the primary solution to tame housing inflation.The Fed’s tools for promoting housing supply are at best limited. In fact, further tightening of monetary policy will hurt housing supply by increasing the cost of AD&C financing.Nonetheless, the NAHB forecast expects to see shelter costs decline later in 2023.

Building material prices, as measured in the Producer Price Index (PPI) data, actually posted a 1% year-over-year decline in March — an indication of an overall slowing economy and an important leading indicator of where shelter prices are headed. That said, some items like electrical transformers remain a challenge for builders. As the shortage of distribution transformers continues, the PPI for power and distribution transformers increased 2% in March. Prices have surged 63.9% over the past two years and declined in just two months during that span.

The overall trend of somewhat stronger macroeconomic data has helped support industry sentiment. The NAHB/Westlake Royal Remodeling Market Index for the first quarter of 2023 posted a readingof 70, edging up one point from the fourth quarter of 2022. While remodelers are generally more optimistic than their single-family builder counterparts, some are noting negative effects within the market, including continued material shortages and higher interest rates. NAHB forecasts the remodeling sector will experience growth in 2023, but at a slower pace than in 2022.

Builders remained cautiously optimistic in April, as limited resale inventory helped to increase demand in the new home market. Singlefamily builder confidencein April rose one point to 45, according to the NAHB/Wells Fargo Housing Market Index. Currently, one-third of housing inventory is new construction, compared to historical norms of around 10%. More buyers looking at new homes, along with the use of sales incentives, have supported new home sales since the start of 2023. Builders note that additional declines in mortgage rates (to below 6%) will further boost demand.

Finally, single-family production showed signs of a gradual upturn in March. Overall housing starts in March decreased 0.8% to a seasonally adjusted annual rate of 1.42 million units. Single-family starts increased 2.7% to an 861,000 seasonally adjusted annual rate. However, on a yearover-year basis, single-family housing starts are down 27.7% compared to March 2022. Meanwhile, multifamily construction decreased 5.9% to an annualized 559,000 pace in March. On a year-over-year basis, multifamily construction is up a surprising 6.5%. However, NAHB expects a significantdecline in the months ahead because there are now more than 950,000 apartments under construction — the highest total since November 1973.

EYE ON THE ECONOMY

May 2023 www.ncbia.com page 32

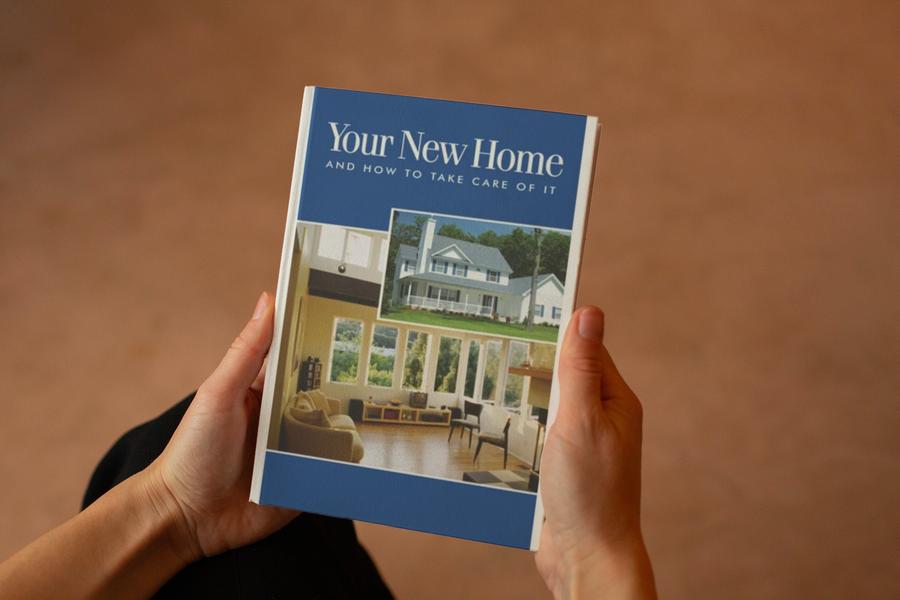

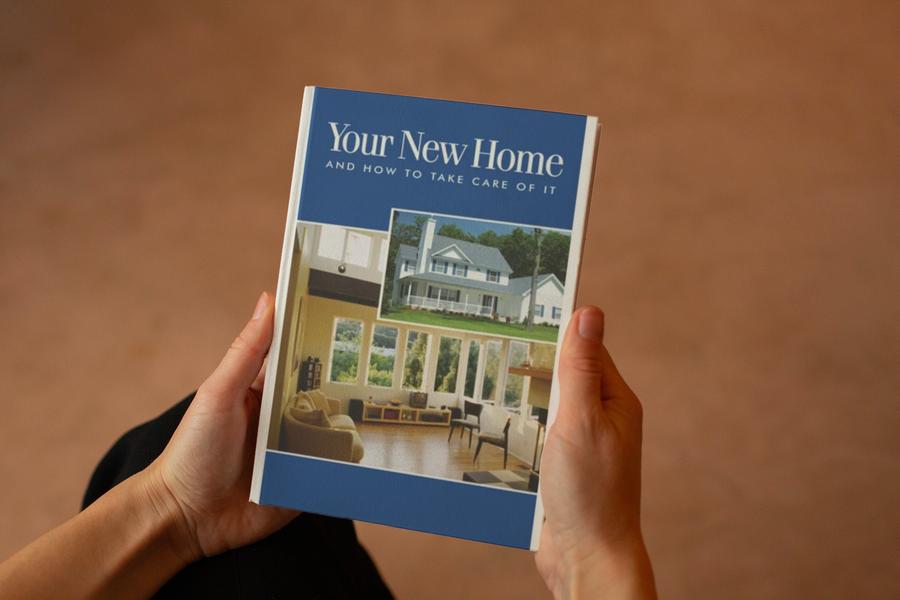

Do you want to opt-out of our referral program? Just email judie@ncbia.com page 33 www.ncbia.com May 2023 $7.00 / ea contact judie@ncbia.com to order Your New Home and How to Take Care of It has an inviting new look and continues to be a perfect customer handout at closing. Remember: customer care is the key to a builder’s warranty program.

Open Enrollment for the selection of your managed care organization (MCO) is May 1-26, 2023. Ohio Home Builders Association endorses Sedgwick Managed Care Ohio (Sedgwick MCO) as the clear MCO of choice for our members.

Your managed care organization plays a vital role in your ability to control claim costs, care for injured employees, and preserve your options for premium savings. We have partnered with and endorse Sedgwick MCO and encourage all of our members to join Sedgwick MCO because of their clear focus on helping injured employees recover and successfully return to work. Our members benefitthrough lower medical and claim costs, reduced lost time, improved employee health and productivity, and a well-organized workers’ compensation program.

Sedgwick MCO is an essential component of our workers’ compensation solution, and the data continues to validate their effectiveness for our members. There are no fees or contracts involved with the MCO enrollment. If you are already enrolled with Sedgwick MCO, no action is required, and your enrollment will renew automatically

Enrollment is simple. Click Here to learn more about Sedgwick MCO, their key performance metrics, and to access the enrollment form. If you would like to discuss your workers’ compensation program, you can reach out to Sedgwick MCO by email at ClientServices@Sedwgickmco.com or by phone at 888-627-7586.

Bob Nicoll, | Business Development Manager Sedgwick

Dublin, OH CELL 330.418.1824

EMAIL robert.nicoll@sedgwick.com www.sedgwick.com/ohiotpa| Caring counts®

May 2023 www.ncbia.com page 34

Exclusive Entertainment Discounts!

Members have access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels, and much more.

• Save up to 40% on Top Theme Parks Nationwide

• Save up to 60% on Hotels Worldwide

• Save up to 40% on Top Las Vegas & Broadway Show Tickets

• Huge Savings on Disney & Universal Studios Tickets

• Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

Please visit https://memberdeals.com/nahb/?login=1

page 35 www.ncbia.com May 2023

IMPROVED AFFORDABILITY Expectations Lead to More Engaged Buyers

BY: ROSE QUINT

Improvements in affordability expectations have led to an increase in the share of prospective buyers who have moved beyond just the planning phase of their home search: 56% report being actively engaged in the purchase process in the first quarter of 2023, up from 46% a quarter earlie.

The share of prospective buyers actively searching for a home rose in every region between the finalquarter of 2022 and the firstquarter of 2023: Northeast (50% to 63%), Midwest (42% to 45%), South (47% to 51%), and West (44% to 66%).

Improved affordability, however, has intensifieddemand and increased competition. Buyers actively looking for a home are having a harder time findingwhat they want. In the firstquarter of 2023, a series high of 71% have spent 3+ months searching, up from 65% a quarter earlier.

* Results come from the Housing Trends Report (HTR) – a research product created by the NAHB Economics team with the goal of measuring prospective home buyers’ perceptions about the availability and affordability of homes for-sale in their markets. The HTR is produced quarterly to track changes in buyers’ perceptions over time. All data are derived from national polls of representative samples of American adults conducted for NAHB by Morning Consult. Results are seasonally adjusted. A description of the poll’s methodology and sample characteristics can be found here. This is the fifth in a series of six posts highlighting results for the 1st quarter of 2023. See previous post on plans to buy and new vs. existing preferences, and housing availability, and housing affordability.

EYE ON HOUSING

May 2023 www.ncbia.com page 36

NEW CEO TO TAKE THE HELM at the National Association of Home Builders

The National Association of Home Builders (NAHB), a Washington, D.C.-based trade association representing the housing industry, has named James W. Tobin III as the association’s new president and chief executive office. Tobin, executive vice president and chief lobbyist at NAHB, will succeed CEO Jerry Howard, who is leaving NAHB after more than 30 years. Tobin will assume the new post effective June 1, 2023.

Following an extensive search process, the NAHB Board of Directors on May 3 ratified the selection of the CEO Executive Search Committee to appoint Tobin to lead the 140,000-member association.

“Today is a big day for the future of our association. After a comprehensive search process and transition plan, we feel very confident that we have selected the best person to represent NAHB and serve as a key voice of the housing industry,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “Jim brings more than 20 years of experience in the housing industry to the post. His proven track record of success in leading NAHB’s federal legislative advocacy makes him uniquely qualified to lead our association in the years ahead.”

Tobin joined NAHB in 1998. In his role as EVP, government affairs and chief lobbyist he directed the federal, state, and local lobbying, as well as political activities for NAHB. He also guided the activities of the association’s political action committee, BUILD-PAC, and grassroots network. Before becoming NAHB’s chief lobbyist, Tobin was NAHB’s vice president for federal relations. Prior to NAHB, he was senior legislative assistant to former U.S. Representative Frank Riggs (Calif.) and former U.S. Representative Gary Franks (Conn.).

“I’m honored to have been selected as CEO of this outstanding organization,” said Tobin. “The work that our members do is incredibly important and has a huge impact in every community across this country. I look forward to representing our staff and members in advocating for the future of the housing industry.”

Tobin will be based at NAHB’s headquarters in Washington, D.C., where he will lead NAHB’s more than 200 staff. The CEO is also part of NAHB’s national leadership team which also includes the Senior Officers of the Board, who are elected annually by the Leadership Council.

CONTACT:

Elizabeth Thompson

ethompson@nahb.org

(202) 266-8495

Stephanie Pagan

spagan@nahb.org

Media Relations Manager

(202) 266-8254

NAHB NOW

May 2023 www.ncbia.com page 38

GAIN INSIGHTS TO PREPARE for NAHB's 2023 Legislative Conference

CONTACT:

In preparation for the 2023 Legislative Conference on June 7 in Washington, D.C., NAHB members are encouraged to attend a live webinar on Wednesday, May 10, at 11 a.m. ET to learn more about the key issues to discuss with their legislators.

The Issues Briefing ebinar will feature NAHB policy experts who will provide members with the most impactful and timely information on the housing industry’s challenges. These high-priority topics will include strategies to address:

• The shortage of distribution transformers aggravating the nation’s housing affordability crisis;

• Making the right choice on energy codes; and

• Investing in workforce development programs to help the industry build the pipeline of new workers needed to meet the demand for new housing.

In addition to the webinar, the NAHB Government Affairs team has compiled various resources on nahb.org for members to help ensure their Legislative Conference meetings are a success. These tools include U.S. Senate and House directories, lobbying tips, and template meeting invitations. Plus, issue videos to help prepare meeting talking points will be available in the coming weeks.

Registration information will be available on the 2023 Legislative Conference page soon. A recording of the webinar will be available on nahb.org.

Karl Eckhart

keckhart@nahb.org (202) 266-8319

NAHB NOW

page 39 www.ncbia.com May 2023

Welcome New Members!

Mark Ballock, 84 Lumber, Affiliate Builde

(Sponsored by Sara Majzun, Majzun Construction)

84 Lumber

34457 East Royalton Road Columbia Station, OH 44028

440- 748-2104

mark.ballock@84lumber.com

http://www.84Lumber.com

Our 310 facilities nationwide include stores, component manufacturing plants, custom door shops and engineered wood product centers in 35 states. 84 Lumber is an industry leader in building supplies, manufactured components, and services for singleand multi-family residences and commercial buildings.

Ashley Oates, 84 Lumber, Affiliate Builder

(Sponsored by Jeremy Vorndran, 84 Lumber)

84 Lumber

34457 East Royalton Road Columbia Station, OH 44028

(440) 748-2104

ashley.oates@84lumber.com

http://www.84Lumber.com

We are able to source a full selection of the latest trends and styles of cabinets and hardware from the top name brand manufacturers. We also work with local countertop suppliers to make your kitchen or bath design experience as seamless as possible. There are two ways you can work with 84 Lumber on your kitchen or bath project: through our Kitchen and Bath Design Studio inside 84 Lumber or with an 84 Lumber give me a call.

Emilie Katcher, Ryan Homes, Affiliate Builder

(Sponsored by Tom Sear, Ryan Homes)

Ryan Homes

6770 Snowville Road

Brecksville, OH 44141

(440) 381-2127

ekatcher@nvrinc.com

http://www.nvrinc.com

Where you live is our life's work. Home is where the heart is— yours and ours. Our passion—and our purpose— is making places people love to call home. What began in 1948 as a small, family-run business in Pittsburgh has evolved into one of the top five home builders in the nation.Today, Ryan Homes builds new homes in 31 metropolitan areas in 14 states and the nation's capital. We're a proud member of the NVR family, a distinguished group that also includes NVHomes, Heartland Homes and NVR Mortgage. What is the secret of our success? There are several: unparalleled customer service, innovative designs, quality construction, affordable prices, and desirable communities in prime locations. Not to mention our industryleading comprehensive warranty coverage and customer care after move-in. It's no coincidence that customer referrals are responsible for a large percentage of our home sales. First-time buyer, move-up buyer, empty nester—buyers of all ages and stages of life can find exactly what they are looking for in a Ryan home.

(Sponsored by Tom Sear, Ryan Homes) Ryan Homes

6770 Snowville Road

Brecksville, OH 44141 (440) 381-2127

nsommer@nvrinc.com

http://www.nvrinc.com

Where you live is our life's work. Home is where the heart is— yours and ours. Our passion—and our purpose—is making places people love to call home. What began in 1948 as a small, family-run business in Pittsburgh has evolved into one of the top five home builders in the nation. Today, Ryan Homes builds new homes in 31 metropolitan areas in 14 states and the nation's capital. We're a proud member of the NVR family, a distinguished group that also includes NVHomes, Heartland Homes and NVR Mortgage. What is the secret of our success? There are several: unparalleled customer service, innovative designs, quality construction, affordable prices, and desirable communities in prime locations. Not to mention our industry-leading comprehensive warranty coverage and customer care after move-in. It's no coincidence that customer referrals are responsible for a large percentage of our home sales. First-time buyer, move-up buyer, empty nester—buyers of all ages and stages of life can find exactly what they are looking for in a Ryan home.

Simpson Strong Tie 33269 Canterbury Road Avon Lake, OH 44012 (440) 370-4821

dkaple@strongtie.com

http://www.strongtie.com

A leader in structural systems research and technology, Simpson Strong-Tie is one of the world's largest suppliers of structural building products. Simpson Strong-Tie is committed to providing exceptional products and services to its customers, including engineering and field support, product testing and training

Nicholas Sommer , Ryan Homes, Affiliate Builder

Derek Kaple, Simpson Strong Tie, Primary Associate (Sponsored by Tim King, K. Hovnanian Homes)

May 2023 www.ncbia.com page 40

Thanks for Renewing!

Colin Coyne, 84 Lumber

Joe Mancuso, 84 Lumber

Mark Bennett, Bennett Builders & Remodelers

Ken Cassell, Cassell Builders & Remodelers

Irene Berlovan, Dollar Bank

Doug Rogers, Dollar Bank

Don Foster, E.H. Roberts Company

David Fox, Fraley & Fox

Kevin Walker, Great Lakes Properties & Investments

Chris Igielinski, Henkel Corporation

Mike Johnston, Homenik Door Company, Inc.

Chris Pinter, K. Hovnanian Homes

Paul Samek, Luxury Heating Company

Jason Mitchell, Mitchell Woodworking, Inc.

Jeremy Nichols, Nichols Construction, Inc.

T.J. McAdams, Shamrock Development

Phil Truax, Truax Law Group LLC

Ashley Oates, Cambria

Scott Herrington, Consumer Supply

Matthew Denomme, The Brothers That Do Gutters

What members are saying:

Thank you for providing OSHA training locally, it is gr eatly appr eciated

Sorry to See You Go!

“ “

Jason Rodriguez is an exceptional instructor; he is very knowledgeable and engaging page 41 www.ncbia.com May 2023

“

“

STATESMAN SPIKE (500-999 SPIKE CREDITS)

Our SPIKES are Our FOUNDATION

SUPER SPIKE (250-499 SPIKE CREDITS)

ROYAL SPIKE (150-249 SPIKE CREDITS)

RED

(100-149 SPIKE CREDITS)

GREEN SPIKE (50-99 SPIKE CREDITS)

LIFE SPIKE (25-49 SPIKE CREDITS)

BLUE

(6-24 SPIKE CREDITS)

May 2023 www.ncbia.com page 42

THANK YOU SPIKES!

Bob Yost ........................ Dale Yost Construction .............................. 685.75 Mary H. Felton.............Guardian Title ............................................. 530.50

Terry Bennett Bennett Builders & Remodelers 302.25 Jack Kousma Kousma Insulation 293.00 Chris Majzun Jr. Majzun Construction Co. 269.50

Sara Majzun Majzun Construction Co. 241.00 Bill Perritt Perritt Building Co 225.50 Bucky Kopf Kopf Construction Corp. 204.50 Jeff Hensley Lake Star Building & Remodeling............182.75 Randy K. Strauss ......... Strauss Construction .................................. 179.50 Tom Lahetta ................. Tom Lahetta Builders ................................. 167.50

SPIKE

Dave Linna Sr. Linna Homes & Remodeling.....................138.50 Jason Scott North Star Builders 128.00 Thomas Caruso Caruso Cabinets 115.25 Patrick Shenigo ............ ShenCon Construction, LLC ..................... 108.50 Tom Sear ....................... Ryan Homes ................................................ 108.25 Chris Majzun Sr. Majzun Construction Co 107.00

Jim Sprague Maloney & Novotny, LLC 99.00 Chris Mead Maloney & Novotny, LLC 77.50 Aaron Kalizewski ........ Grande Maison Construction.................... 69.50 Tim Conrad .................. Graves Lumber............................................67.00 Ray Allen Thom Thom Concrete 60.50 Jeremy Vorndran 84 Lumber 58.50 Liz Schneider Dollar Bank 50.50

Steve Schafer ................ Schafer Development ................................. 30.50 John Daly ...................... Network Land Title .................................... 26.50

Chris Collins Carter Lumber 16.00 John Toth Floor Coverings International 14.00 Ken Cassell ................... Cassell Construction................................... 13.50 Dave LeHotan .............. All Construction Services .......................... 11.50 John Blakeslee Blakeslee Excavating, Inc 11.00 Steve Fleming Shamrock Development 11.00 Mike Warden Huntington 10.00 Scott Kosman Lakeland Glass 9.50 Mark McClaine 84 Lumber 9.50 Tim King ..................... K. Hovnanian Homes ............................. 7.50 Tim Hinkle ................. Green Quest Homes ............................... 6.50 Lindsay Yost Bott Dale Yost Construction 6.00 Jim Tipple Maranatha Homes 6.00 © 2019 Hastings Mutual Insurance Company SS-1 (10/19) Select Contractors Building Your Business (800) 442-8277 www.hastingsmutual.com 404 E. Woodlawn Ave. Hastings, MI 49058 For more information contact: Broadened Coverage This coverage helps if there’s damage to property used by you or your employees that belongs to someone else. It has a limit of $2,500 per occurrence, with a $100 deductible. Builders Risk and Installation Floater “Floater” coverage is for anything that oats, or moves from place to place — like your supplies and machinery. It also covers damage to the structures you’re working on, including scaffolding, foundations, and more. This has a limit of $5,000, with a $250 deductible. Portable Tools Coverage on your tools has a limit of $1,000 per tool, to a maximum of $2,500. It also has a $500 deductible. The information referred to is not a policy. Refer to your policy for speci c coverage. The Nelson Agency, Inc. 116 4th St., Elyria, OH 44035 Phone: 440-323-8002 Fax: 440-323-8055 Drywallersinsurance1@prodigy.net A member of: Theresa Riddell (440) 420-1175 tmycps@oh.rr.com -ORBrett Adams (419) 515-0506 adamsb@sprouseagency.com

SPIKE

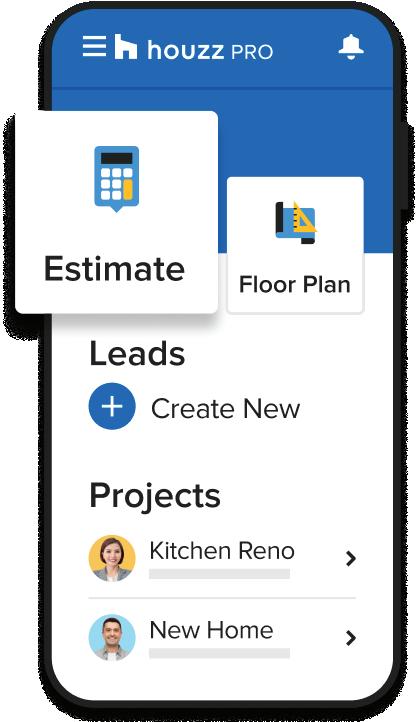

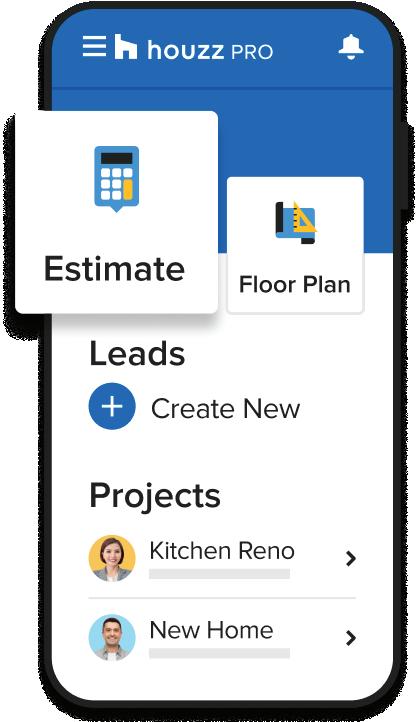

NAHB MEMBERS SAVE 25% off Houzz Pro Call 1 (888) 225-3051 today! Houzz Pro is one simple solution for builders and remodelers. Attract and win better clients, manage projects and teams, and deliver a standout customer experience.

Temporary employees and safety

Staffingagencies and host employers both have the responsibility of ensuring a safe workplace for temporary employees. Whether these temporary employees work seasonally or are permanent, they have the right to a safe workplace and proper safety training. To keep these employees safe, both the staffingagency and host employer must communicate with each other on appropriate training. Why is this important.... because both parties can be held liable if OSHA believes safety was neglected.

The following list identifies some of the shared responsibilities between the two party’s when using temporary employees.

1. Be sure to communicate, identify and outline the safety goals each party is responsible for, such as training, education and awareness.

2. Although the staffingagency may not be an expert at a specificworkplace, they should communicate with the host employer about the hazards that exist in the work environment so they can be communicated to their temporary employees.

3. Host employers should treat temporary employees as their own and train them just like any other employee.

4. Staffing agency should inquire about host companies training programs and ensure they are fulfillingtheir responsibilities.

5. Both parties should encourage temporary employees to speak up if they witness an unsafe work practice and/or condition.

Here is a list of some worker initiatives the temporary agency and host employer should consider before work begins.

1. The nature of the work. Consider low hazard positions since the temporary employees may be inexperienced.

2. Hazard Communication. Temporary employees have the right to know about the chemical hazards they may be exposed to.

3. Lockout Tagout. Temporary employees need to have a basic understanding of what lockout/tagout is and how to identify when a lockout/tagout is occurring.

4. Powered Industrial Trucks (PITs). Temporary employees must go through the same training and certification of a full-time employee if they are going to operate PITs.

5. Recordkeeping and Reporting. Serious injuries to temporary employees, whether under the supervision of the agency or host employer, must still be recorded on the OSHA log. The recording responsibility falls on the party who supervises the injured employee on a day-to-day basis.

6. Personal protective equipment. Ensure temporary employees are trained on the appropriate PPE for the work they perform.

7. Exposure to indoor and outdoor heat-related hazards. If temporary employees are exposed to heat-related hazards, they need to understand how to protect themselves in these situations.

8. Be sure you evaluate your facility for other hazards and communicate them appropriately

As you can see, the responsibility for the safety of temporary employees falls on both the staffingagency and the host employer. Each party is responsible to offer training and to assure training responsibilities are fulfilled and documented. If these are not completed, unsafe work environments may exist resulting in a dangerous workplace and injuries. If you are a staffingagency or host employer, communicate with each other to make certain temporary employees are kept safe.

For more information, please contact Sedgwick’s Andy Sawan at 330.819.4728 or andrew.sawan@sedgwick.com

May 2023 www.ncbia.com page 44

Managed care best practices for recordkeeping, documentation and injury reporting

The month of May is Open Enrollment – an opportunity for Ohio employers that have state-funded workers’ compensation coverage to select their Managed Care Organization (MCO). Sedgwick Managed Care Ohio is a key partner for our workers’ compensation program and happens to be Ohio’s largest MCO – by far – in both claims managed and employers served.

Recordkeeping and documentation

One of the roles of an MCO is to collect the essential data elements of a workplace injury to initiate a workers’ compensation claim. Depending on the approach to collecting and arranging this information, the MCO can be an excellent warehousing partner for injury-related data.

Sedgwick MCO provides clients are a series of value-added reports designed to facilitate record keeping obligations of OSHA and PERRP. Many report options include an ongoing tally of lost workdays associated with each claim, as well as the number of modifiedduty workdays. Access to this information on a monthly, quarterly and especially an annual basis (early January) can help employers complete their OSHA 300 and PERRP posting that is due each February. MCOs should also be able to account for additional datapoints to help determine whether a workers’ compensation claim is OSHA-recordable. For example, if medications are prescribed in the treatment of a workplace injury, it may be OSHA recordable despite having incurred no lost or modifid workdays. Similarly, if treatment for an injury includes services that exceed what is considered first-aidin nature, the injury may also be recordable despite involving no lost time. An example of this would be a laceration that involves stitches, but the employee returns to work immediately. Referencing medical billing codes to identify specificcovered treatments can be a simple way to gather information that simplifiesthe OSHA and PERRP reporting process.

Injury reporting

The claim filingprocess depends on information from multiple parties, including the injured employee and the treating physician. But Sedgwick MCO encourages employers to take action as quickly as possible after a workplace incident to control this vital early stage of the process. Establishing post-injury protocols that include thorough documentation of the incident, as well as compiling information required by BWC, can accelerate a sound claim allowance decision. Early clarity on the nature of incident and injury can help frame the scope of the claim and definethe medical conditions that are included for treatment.

The First Report of Injury (FROI) is the standard BWC form that accommodates the required information and typically initiates a new claim. Many employers keep the FROI on-hand to serve as an incident report. Sedgwick Managed Care Ohio will provide clients with an Injury Reporting Packet, which can include the FROI and other forms and information to help guide both the employer and the injured employee through the claim process. Many employers have developed an incident report that collects much of the information required for the workers’ compensation claim. Consider modificationsto your incident report that may facilitate a more efficientclaim filingprocess. One of the best steps an employer can take to promote speed and accuracy in claim filingis to have an incident report completed quickly and sent directly to the managed care organization.

Contact Sedgwick Managed Care Ohio

If you feel there is room for improvement with your organization’s injury management program, or if you can use assistance organizing data for OSHA recording, Sedgwick MCO can help. Every work environment is different, and Sedgwick can talk through your circumstances to build a process that works for you and your employees. Visit Sedgwick MCO online to explore performance metrics and service features, or reach out directly at ClientServices@Sedgwickmco.com.

page 45 www.ncbia.com May 2023

2023

Golf Classic

8:00 AM 9:00 AM 3:30 PM

Registration, Breakfast & Range Open

Opening Remarks Dinner & Awards

PRESENTING SPONSORs

REGISTRATION

Your Name ______________________________________________

Company ________________________________________________

Team Captain's Cell Phone ______________________________

(For outing information and weather delay updates)

Golfer Registrations - Single _____ x $140

Golfer Registrations - Foursome ______ x $560

Skins / Mulligan Package (Prepay) _____ x $40 (1 per team)

BBQ Ticket Only ______ x $35

Company _________________________________________

Golfer # 2 Name _________________________________

Company _________________________________________

Golfer # 3 Name _________________________________

Company _________________________________________

Golfer # 4 Name _________________________________

Company _________________________________________

CANCELATION DEADLINE JULY 25, 2023

Method of Payment: ___Payment Enclosed

___ Invoice ___Credit Card

Card No.

Exp._______________

CRV # __________

Zip Code ________________

Phone ____________________________

Send Complete form via mail to 5077 Waterford Dr. Suite 302, Sheffield Village, Ohio 44035 or register online at www.ncbia.com Questions? Call 440 - 934 -1090 A $5.00 CONVENIENCE FEE WILL BE CHARGED FOR CREDIT CARD PAYMENTS UNDER $500....... $10.00 FEE FOR PAYMENTS OVER $500.00. SPONSORS DO NOT PAY CONVEINENCE FEE! Rev. 5/1/23

(Note: If bought day of Event $60) Total Due $ _______ &

NOTE : No one under 21 will be admitted. Keg beer, soft drinks & water will be available during the entire event. All other alcoholic beverages will be available as a CASH BAR.

Email Name on Card Signature

Thursday, August 3rd 750 Jaycox Road, Avon Lake

Golfer # 1 Name _________________________________

Marketing Opportunities

Lunch & Driving Range

compliments of

ALL SPONSORSHIPS INCLUDE: RECOGNITION AT THE OPENING REMARKS OF THE OUTING ALONG WITH YOUR COMPANY NAME AND/OR LOGO IN THE NCBIA BUILDER NEWSLETTER AND IN THE EVENT PROGRAM

PRESENTING SPONSORship | $2,000

Includes 1 Complimentary foursome(W/BBQ Dinner) and Pink Ball & Mulligan Package Included Company name/logo on banner, placed, prominently at outing. Presentation at 9AM Opening Remarks (Presented by the Sponsor)& Mic time

Unlimited Sponsorships Available

Hole-in-one sponsorship| $tbd

Includes the opportunity to sit at the hole-in-one hole with a partner/staff member to determine potential winner

Total of 1 Sponsorship Available

golf cart SPONSORship | $1,300

Provides for signage on every cart used at the outing

Includes 2 BBQ tickets for event

Total of 1 Sponsorship Available

bbq sponsorship| $750

You may bring a banner to hang near the pavilion

Total of 4 Sponsorships Available

scorecard sponsorship| $600

Includes company logo on all scorecards placed on the golf carts for event

Total of 2 Sponsorships Available

Skill prize sponsorship| $500

Opportunity to sit at the hole with partner

Includes company name/logo on sign at skill hole NCBIA will provide prizes to winner(s)

Total of 4 Sponsorships Available

breakfast sponsorship| $300

Includes signage with company name at breakfast area

Total of 1 Sponsorship Available

Photo sponsorship| $300

Provides foursome photos to be taken &

Thursday, August 3rd

DOOR PRIZES & DONATIONS ACCEPTED: DROP OFF AT THE NCBIA OFFICE OR BRING TO THE COURSE

Includes signage with company name

Total of 4 Sponsorships Available mailed out following the outing to each golfer

Raffle sponsorship| $250

Announces the Winner of the 50/50 raffle during dinner

Includes signage with company name on golf course

Total of 1 Sponsorship Available

Pink Ball sponsorship| $250

Opportunity to sell pink balls for contest at registration

Includes signage with company name on course

Total of 1 Sponsorship Available

keg sponsorship| $250

Includes signage with company name on golf course

Total of 4 Sponsorships Available

Hole sponsorship| $150

Includes signage with company name on golf course

Unlimited sponsorships available

Note: members' vendors (non-members $225)

Soft Drink SPONSORship | $150

Includes Signage with company name on golf course

Total of 4 Sponsorships Available

Sponsor Here!

2023

Golf Classic

The 7F LEET Diesel Network Ma stercard ®

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse.

Simple online access.