North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

NCBIA Office

5077 Waterford Dr. Suite 302 Sheffield Village, OH 44035 Phone: 440.934.1090

info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate

Ashlyn Bellan | ashlynncbia@gmail.com

2023 NCBIA Officers President

Tim King, K. Hovnanian Homes - Ohio Division Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain Secretary

Mike Gidich, MDG Maintenance LLC.

Immediate Past President

Sara Majzun, Majzun Construction Co.

2023 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Kevin Walker, Great Lakes Properties & Investments

Dave Linna, Linna Homes & Remodeling

Jason Rodriguez, The S.J.R Building Co.

Jon Sherer, Paraprin Construction

Brian Schwab, RestorePro, Inc.

Dave Weisenberger, Tusing Builders & Roofing Services

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Life Directors

Bob Yost, Dale Yost Construction

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling Jeremy Vorndran, 84 Lumber

Jim Sprague, Maloney + Novotny, LLC

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Randy Strauss, Strauss Construction

Tom Caruso, Caruso Cabinets

Tom Lahetta, Tom Lahetta Builders, Inc.

2023 NAHB Delegates

These are our members who represent our local industry in Washington DC and Columbus:

Randy Strauss, Strauss Construction

Jason Rodriguez, The S.J.R Building Co.

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2023 President

Richard Bancroft, Bancroft Development

OHBA Past Presidents

Randy Strauss, 1996

2023 OHBA Trustees

Tim King, K. Hovnanian Homes - Ohio Division

Sara Majzun, Majzun Construction Co.

Mary Felton, Guardian Title (alternate)

2023 OHBA Executive Committee Appointees

Sara Majzun, Majzun Construction (Membership)

Judie Docs, NCBIA (Executive Officers Committee)

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

June 2023 www.ncbia.com page 3

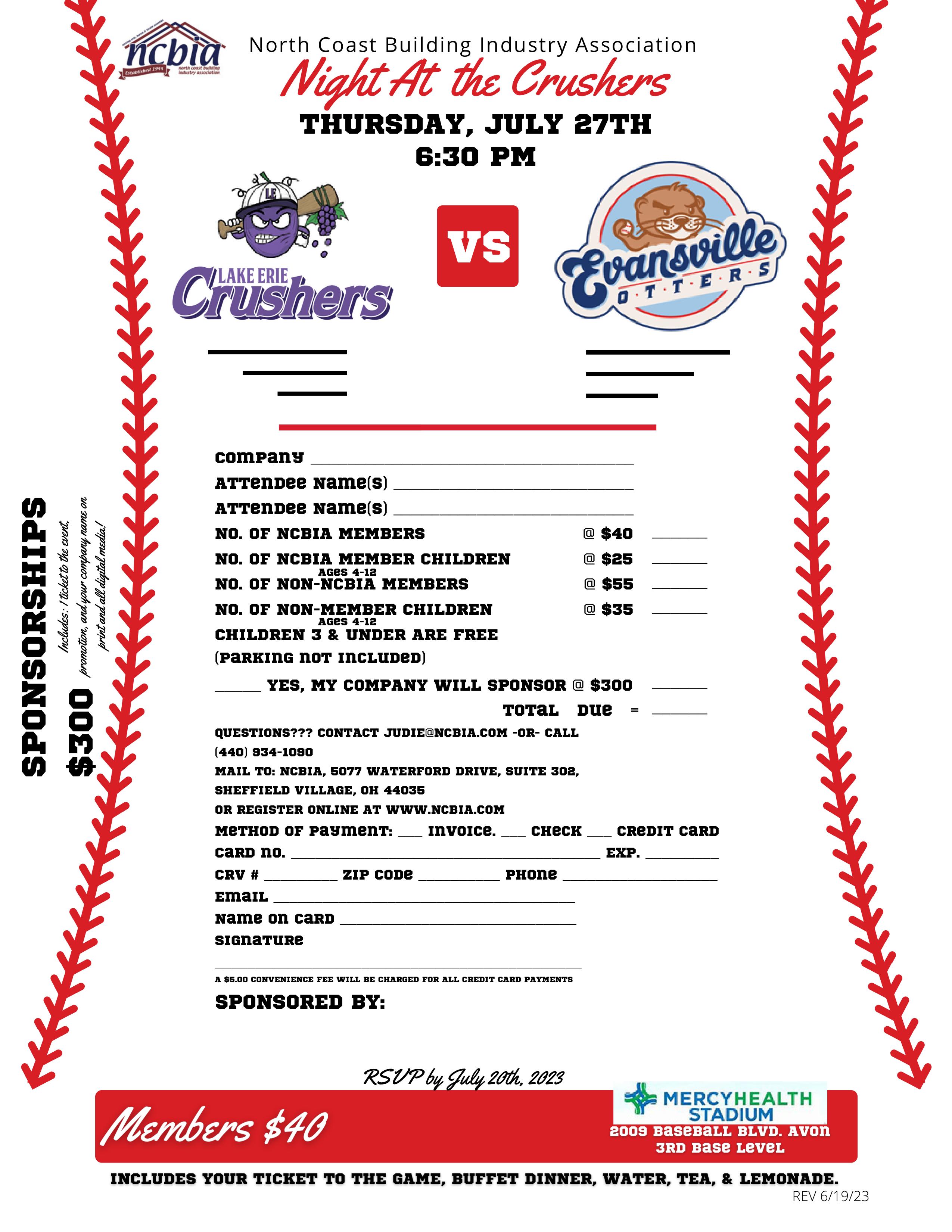

24 18 39 JUL 4th Independence Day Independence Day | OfficeClosed Office Closed Night at theCrushers Night at the Crushers ** | 6:30 6:30 Mercy Health Stadium (2009 Baseball Boulevard, Avon) 27th Thursday Tuesday CALENDAR OF EVENTS 2023 AUG 3 rd Golf Classic Golf Classic ** || 8 AM 8AM Legacy@SweetbriarGolfCourse(750JaycoxRd.,AvonLake) Thursday 17th Membership Mixer MembershipMixer ** | 5-7 PM 5-7PM Thursday th NAHB Association Management Conference NAHBAssociationManagementConference | OfficeClosed - Staff Attending OfficeClosed-StaffAttending Monday-Thursday 21-24 Cincinnati,OH HarborHouse(132MainStreet,Huron) 9 th Executive Committee ExecutiveCommittee-- 3:30 3:30 || Board Meeting BoardMeeting 5:00 ClubhouseatPreservesatFrenchCreek(5800PreserveDrive,SheffieldVillage) Wednesday JUN 23rd General Membership Meeting/Cookout General Membership Meeting/Cookout ** || 11:30 AM-1 PM 11:30AM-1 PM Pogie's Clubhouse (150 Jefferson St. Amherst) National Homeownership Month National NAHB Leadership Meetings NAHB //Legislative Conference LegislativeConference 6-10th Washington D.C. 20-22 OHBA Summer Board Meeting OHBA Summer Board Meeting nd Kent State University Hotel & Conference Center Friday Tuesday-Thursday Tuesday-Saturday Codes Session Session ||1 PM - 2 PM 1 PM- 2 ClubhouseatPreservesatFrenchCreek(5800PreserveDrive,SheffieldVillage) SEP Associate Member Appreciation Month AssociateMemberAppreciationMonth 4 th 9th Softball Game & Family Picnic SoftballGame&FamilyPicnic ** || 1-5PM 1-5PM Labor Day LaborDay || Office Closed OfficeClosed Saturday Monday ClubhouseatPreservesatFrenchCreek(5800PreserveDrive,SheffieldVillage) 13th 21st Executive Committee ExecutiveCommittee-- 3:30 3:30 || Board Meeting BoardMeeting 5:00 5:00 Member Mixer MemberMixer ** || 5-7 PM 5-7PM Thursday Wednesday AmherstTownshipPark(44786MiddleRidgeRoad,Amherst) Location-TBD 19-21st NAHB Leadership Meeting NAHBLeadershipMeeting Tuesday-Thursday JWMarriotDesertSpringsResortPalmSprings,CA 25-26 2023MEMBER

Table of Contents

6 -Menu of Services

7 -Save the Dates

8 -The Value of Your Membership (NCBIA-OHBA-NCBIA) - 2023 NCBIA President

9-10 Don't Leave Money on the Table! - Executive Officers Report

11 - Eye on the Economy: Stabilizing Data for Home Building

12 - NAHB Now: Lake Coulson Named Chief Lobbyist for NAHB

13- Eye on Housing: Lack of Existing Inventory Boosts Builder Confidence to Key Marker

14- Eye on Housing: Grab Bars Remain the Most Common Aging-in-Place Remodel

15- NAHB Education: Exclusive NAHB Education Opportunities

16 -17 - Legislative Review

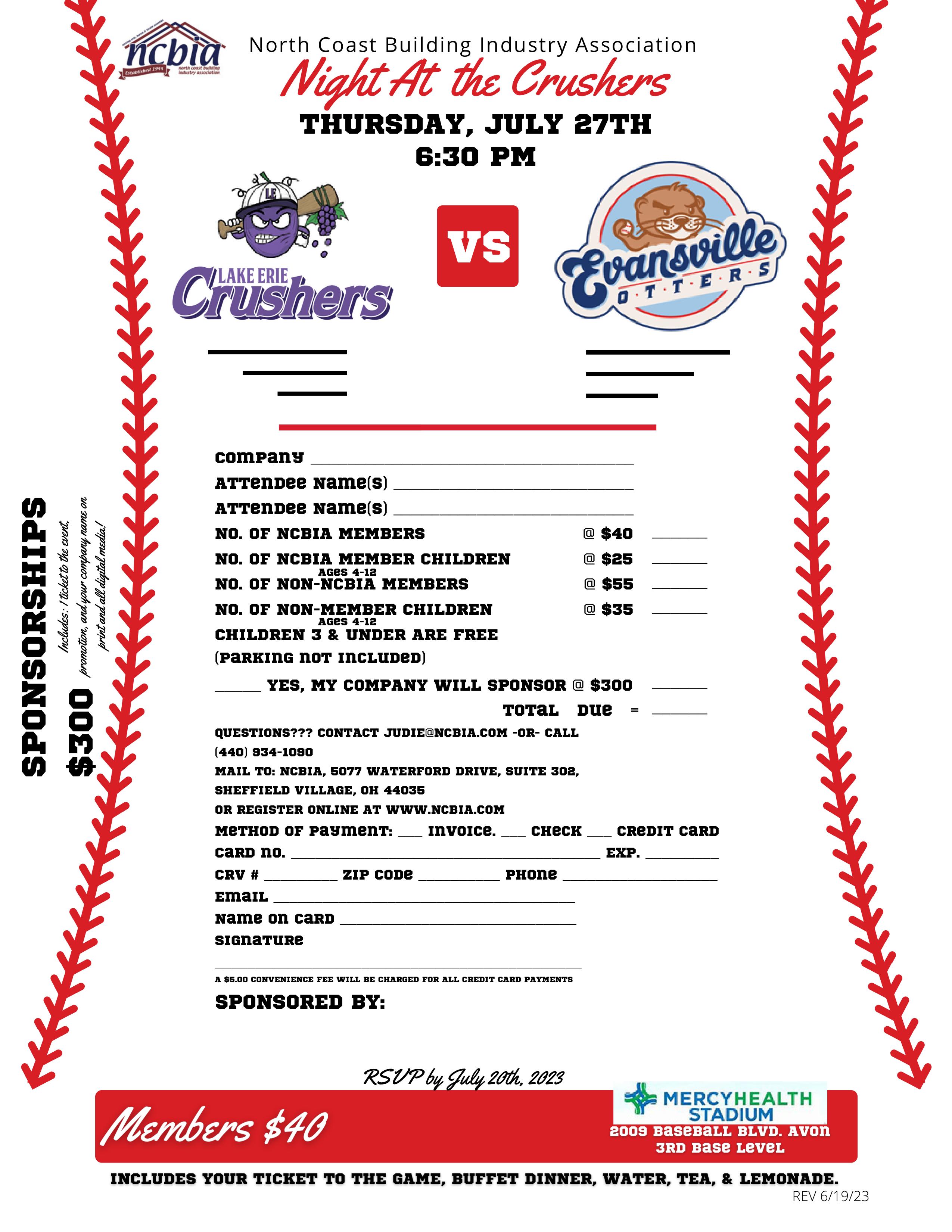

18 - NEW! Night at the Crushers Flyer

19 - NAHB Now: NAHB, Builders Score Big Win in SCOTUS Decision on WOTUS

20-22NAHB Industry Issues: Emergency Prepardness and Response

23 - Eye on Housing: Age Distribution of the Construction Labor Force

242023 Official Membership Directory and Consumer Guide

25-26 - NCBIA 2023 Calendar of Events Updated!

27-Eye on the Economy: All Eyes on The Fed

31 - NAHB Now: More Than 700 Residential Construction Workers Discuss Housing Issues in Hill Visits

32-33 - NEW! Hall of Fame Flyer

34Do Not Rely Only on Your Invoice

-Phil J. Truax

35Thanks for Renewing! Sorry to See You Go!

36- Thank You Spikes!

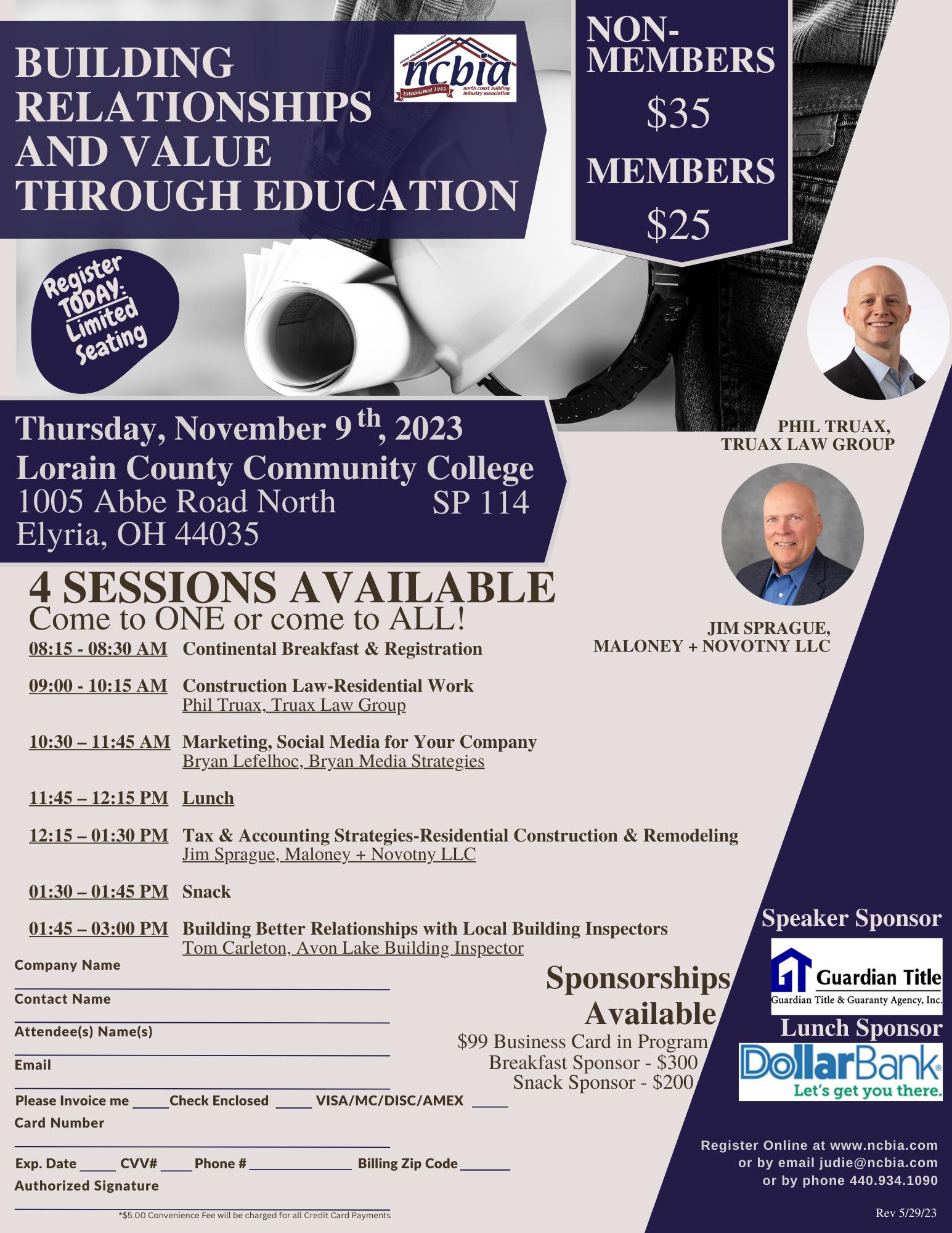

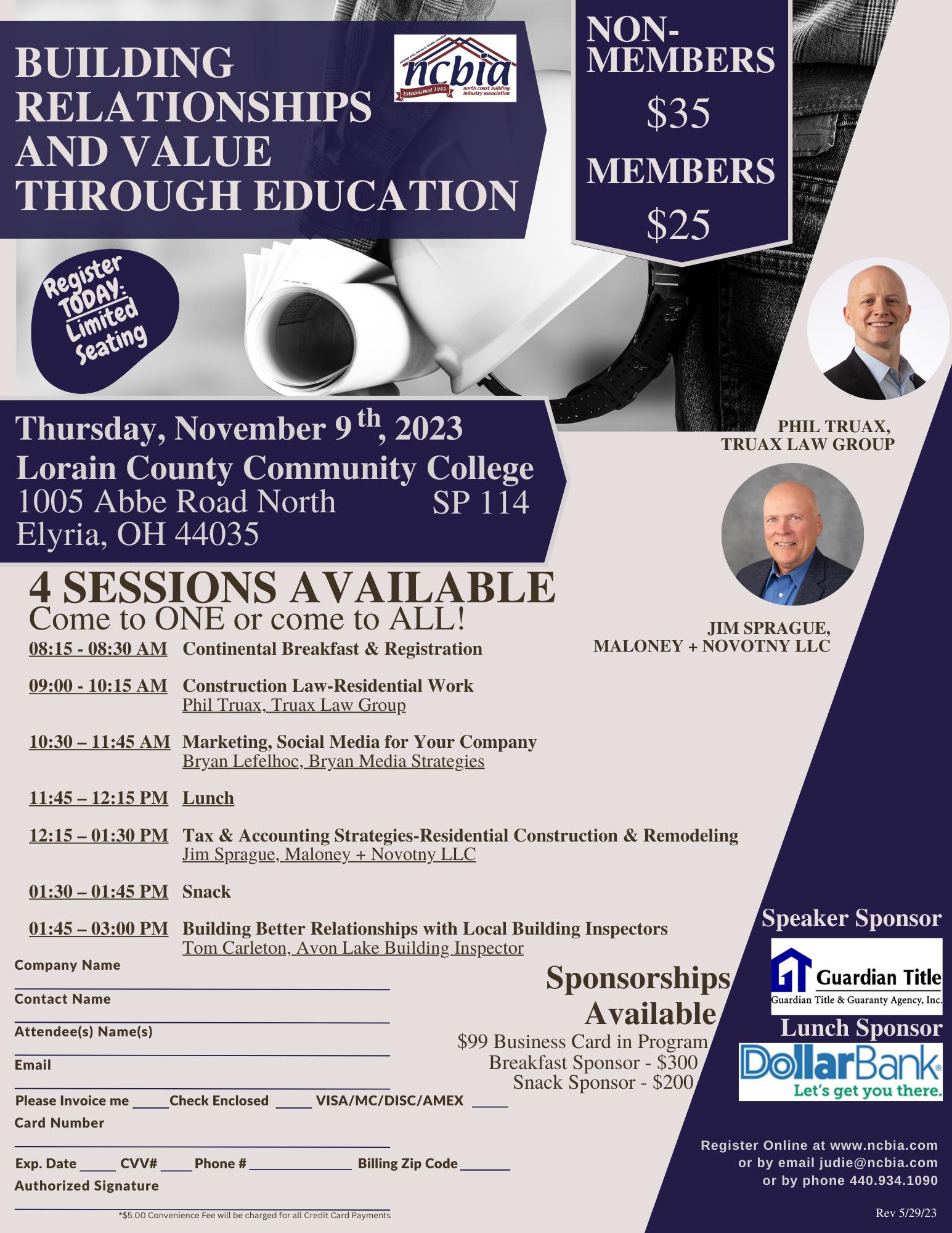

37 - NCBIA Education Event Revised Date

38 - Sedgwick Updates!

39 - NEW! August Member Mixer Flyer

40Sedgwick Updates!

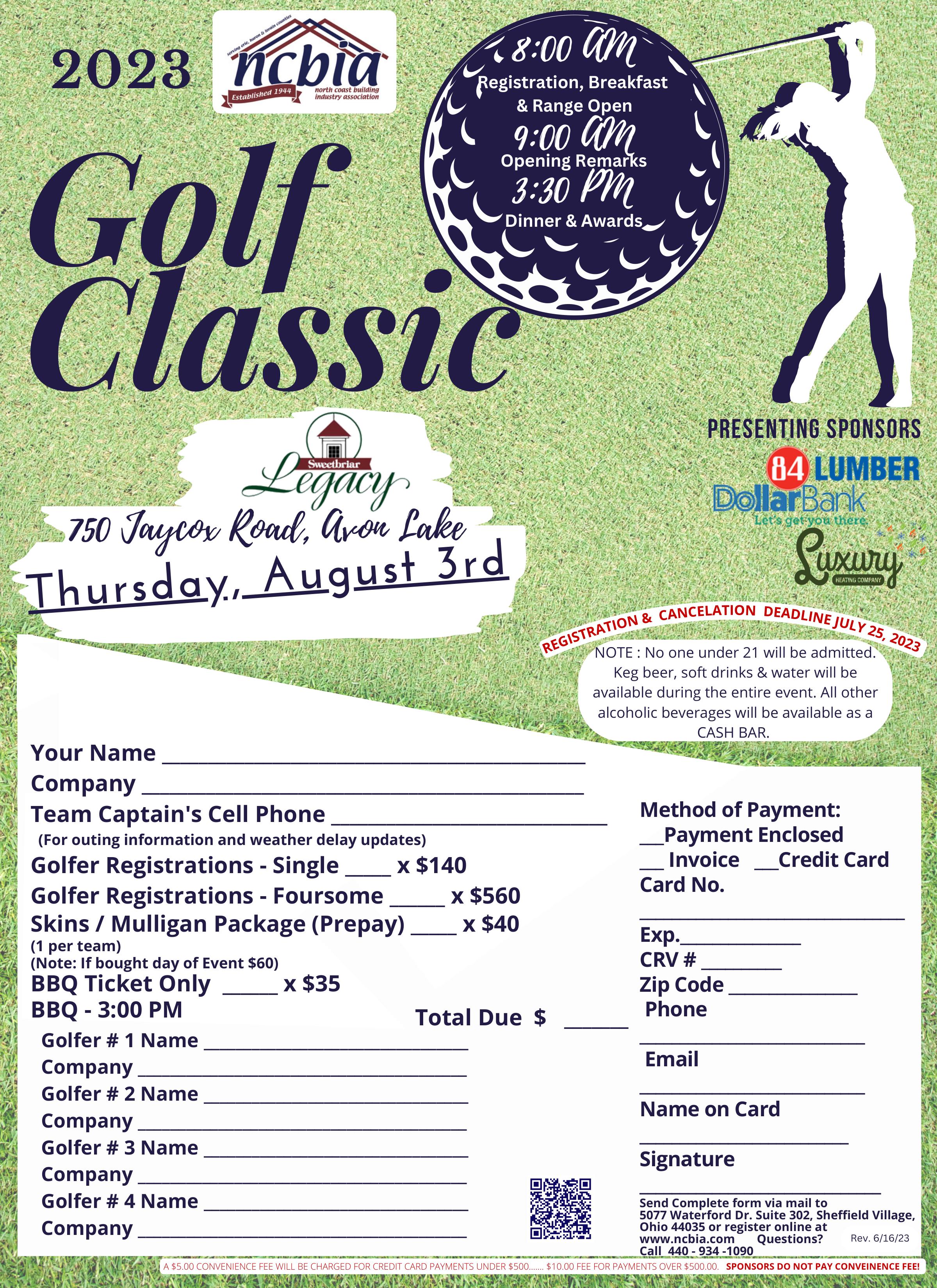

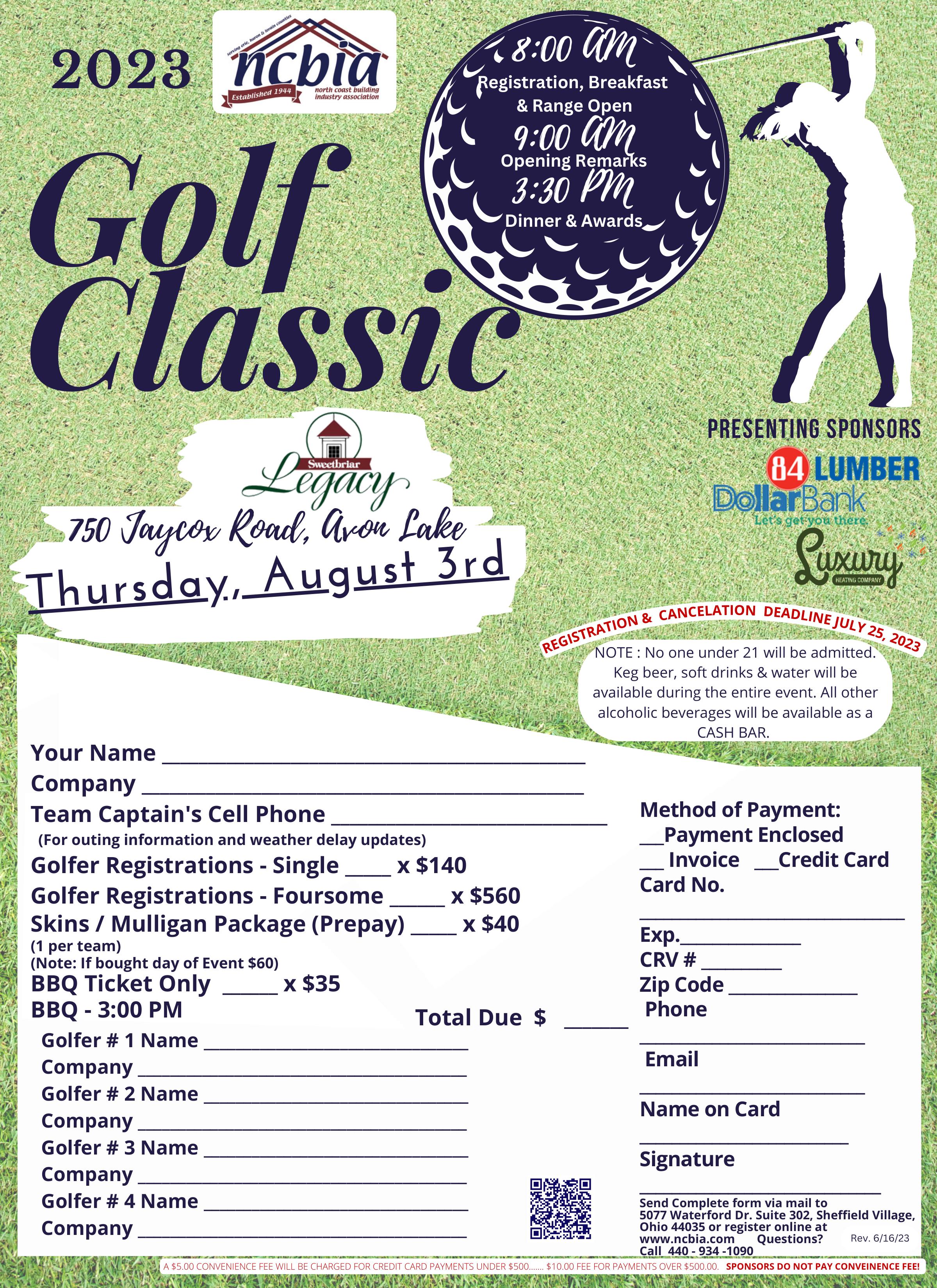

41-42 - 2023 Annual Golf Outing Flyer SPONSORSHIP OPPORTUNITIES GOING QUICK!!

43-44 - NEW! OHBA Workers' Comp

45-47 - NEW! Speedway/Fleetcor Flyers

June 2023 www.ncbia.com page 5

HOW CAN WE HELP?

HOW CAN WE HELP?

Your New Home

Do you rely on phones or tablets to run their businesses? Through NPP and Batteries Plus, you can save on the cost of replacing broken devices by repairing them instead. Services from Batteries Plus include:

Warranty

● Screen repair

● Battery replacement

●Back glass repair

Design

Contact Ashlyn Bellan at ashlynncbia@gmail.com

NEED SOMETHING ELSE? JUST ASK!

For more information on any of these products & services, please contact the NCBIA Office at (440)934-1090 or email judie@ncbia.com

each (plus shipping, if applicable)

● Front- & rear-facing camera repair

● Charge port repair & cleaning

$35 per hour

● Speaker & headphone jack repair

Contact Ashlyn Bellan at ashlynncbia@gmail.com

● Button repair

NEED SOMETHING ELSE? JUSTASK!

Members Can Receive:

For more information on any ofthese products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

• Approximately 7% savings on repair services

• Up to 73% off regular retail pricing on approximately 200 core items

• Up to 40% off retail pricing on 60,000+ batteries, light bulbs, accessories, and more

HELP?

North Coast Building Industry Association Menu of Additional Products and Services Copies Equipment Design Services Warranty Books Black & White Black & White Color Color Color Raffle Boards, Drum & Equipment Graphic Design Services (8.5”x11”) (8.5”x14”) Black & White (11”x17”) (8.5”x11”) (8.5”x14”) (11”x17”) Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided $0.10 $0.20 $0.15 $0.20 $0.50 $0.25 $0.50 $0.27 $0.52 $2.00 $100 per day $30 each (plus shipping, if applicable)

hour

$35 per

North Coast Building IndustryAssociation Menu ofAdditional Products and Services

Services

Books Black& White Black& White Color Color Color Graphic Design Services Black & White (8.5”x11”) (8.5”x14”) (11”x17”) Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided $0.25 $0.50 $0.27 $0.52 $2.00 $30 each

shipping,

applicable)

(plus

if

Home

$7

$7 each (plus shipping, if applicable) Your New Home page 6 www.ncbia.com June 2023

Save the Date!

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!!!!!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!!!!!

Thursday, July 27th Night at the Crushers

6:30 PM

Crushers vs. Evansville Otters

2009 Baseball Boulevard, Avon

Thursday, August 3rd

2023 Annual Golf Outing

8:00 a.m-5:00pm BBQ at 3:30 p.m.

Sweetbriar Golf Course

750 Jaycox Road, Avon Lake

Thursday, August 17th

Summer Membership Mixer

5-7 PM

Harbor House

132 N. Main Street

Huron

Saturday, September 9th

Annual NCBIA Softball Game & Picnic

1-5 PM

Amherst Township Park

44786 Middle Ridge Road

Amherst Township

If you would like to participate in a committee, please email Judie Docs at judiencbia@gmail.com.

Check the website at www.ncbia.com for up-todate changes, additions, and corrections to these events!

Do you have some business news to share?

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

June 2023

Tim

King, K. Hovnanian Homes

THE VALUE OF Your Membership (NCBIA-OHBA-NCBIA)

NAHB is Working to Help You Succeed

$6,250 - That’s the average dollar value in recent years of NAHB services and advocacy victories. This number represents the value per housing start a typical builder will see in 2023 as a result of NAHB’s efforts on behalf of its members. While some members will experience more of these benefits than others, all will experience the rewards of this work. Among the advocacy victories achieved last year:

Legislative Successes - NAHB’s Federal Government Affairs team worked with other stakeholders and key legislators to block harmful changes to the Inflation Reduction Act relating to carried interest, capital gains, and the Net Investment Income Tax. Workforce Development –

The Home Builders Institute (HBI), NAHB’s nonprofit workforce development partner, prepared more than 15,000 young people for careers in residential construction through training programs that leverage its industry-recognized curriculum.

NAHB also offers members education, networking, expertise, and savings.

OHBA our Advocate

OHBA services its membership by promoting proactive involvement on state issues and legislation impacting the residential building industry such as wetlands and affordable housing. OHBA serves its members as the voice of the building industry on a state level.

Ohio is the envy of many local and state associations, as we are very fortunate to be one of the very few who have a state building code. OHBA fought hard for many years in order for this to come to fruition. Our building code is governed by The Ohio Board of Building Standards which is comprised of fifteen members appointed by the Governor and confirmed by the Senate. One of our very own members, Lindsay YostBott, Dale Yost Construction, our Area Vice President, Ric Johnson are on the Residential Construction Advisory Committee (RCAC) which makes recommendations to the Board of Board of Building Standards on proposed changes to the Residential Code of Ohio. Members of the RCAC are appointed by the Director of Commerce. Ric will be presenting a codes session directly

NCBIA – Our Strength is Your Success

For almost 80 years, consistency has been an essential part of our approach to building lasting communities, and our association builds lasting value. We are the driving force behind our local home building industry. Our members reach higher, work together, and achieve more collectively than they ever could alone. They are leaders, learners, innovators, and facilitators behind the stabilization and growth of our association. As a member, your benefits are tangible. They range from business-building resources to money-saving discounts to an effective grassroots network that shape the views of our elected officials and lawmakers. Whether you aim to enhance your competency in the functional management of your business, develop your professional reputation or add your voice to the chorus of members who truly understand our environment –membership provides you unparalleled access to these opportunities and more.

Our association is dedicated to promoting, protecting, strengthening, and informing our local home building industry markets and those who work within them to ensure we are, independently and collectively, a viable economic engine of growth now and in the future.

Now more than ever, get involved and put our experience to work for you. By actively participating you will grow your passion for the industry. It is a great industry that we are involved in and should be proud of. We are providing safe and affordable housing, giving people a part of the American Dream. Building stronger communities, providing a solid foundation for family and personal achievement, and improving the quality of life for thousands of people. It is truly the cornerstone of the American way of life. I hope you join me and our leadership in building and strengthening this great association.

NCBIA 2023 PRESIDENT page 8 www.ncbia.com June 2023

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

DON'T LEAVE MONEY On the Table!

It has come to my attention that many of you have no knowledge of the benefits available to you as a member of the NCBIA which includes NAHB and OHBA…OR…what to tell others when asked “WHY Should I Join the NCBIA?”

The NAHB Member Savings Program continues to make a big impact in boosting members’ bottom lines. Through the exclusive discounts from a variety of leading companies, NAHB members saved an estimated total of $37 million in 2022.

Much of that savings can be attributed to the program's growing list of participating companies. During the past year, two new savings programs were added: Goodyear Tires and Voyager Fuel & Fleet Management Mastercard, giving members the chance to save thousands on automobile expenses.

And the Member Savings Program will add even more value in 2023 with new opportunities for members to save money on personal and business-related items. Within the first quarter of 2023, new member-exclusive discounts will be available through T-Mobile and Farmers Insurance.

In addition to the four newest programs, the Member Savings Program feature 14 other prominent companies in 2023, including:

• Avis

• Budget

• ConstructionJobs.com

• Dell

• Heartland

• HotelPlanner

• HouzzPro

• Lowe’s

• MemberDeals

• Nissan

• ODP Business Solutions

• Ring Central

• UPS

• YRC Freight

Notable changes include the American Express program, which ended last fall, and General Motors, which will be pausing its member savings program after Jan. 3, 2023. However, NAHB’s member savings team is continually pursuing new partnership opportunities to bring as much value as possible to NAHB members.

National Purchasing Partners - Savings for your business visit NPP (National Purchasing Partners) | Group Purchasing Organization & Negotiated Contract Pricing (mynpp.com)

NPP offers a broad variety of recognized brands that help businesses thrive. Discover exclusive savings for companies of all sizes.

OHBA offers Comprehensive Insurance Programs through DoveTail Consulting and they are NOT just another insurance agency. DoveTail Consulting is the endorsed agency for the OHBA. We work with members to make sure that they have the right coverage for all of their insurance needs. We have experts working along with us that can provide you with savings and the knowledge of the products that you invest in.

EXECUTIVE OFFICER’S REPORT

June 2023 www.ncbia.com page 9

DON'T LEAVE MONEY On the Table!

For more information or to receive insurance needs assessment and no-obligation quote, please contact Molly Kane at 1.855.368.3467 or visit us at www.dovetailins.com.

Group Health

• Voluntary Benefits – Short Term Disability/Life/ Dental/Vision

• Individual Life Insurance

• Telemedicine Programs

• OHBA Aflac Association Plan

Ohio Member Rebate Program - In 2002, Supply and Install LLC was founded by Richard and Rich Robinson to help small to mid-size Builders be rewarded for their loyalty the same way as the largest volume Builders. In 2006, with 12 participating Manufacturers, they partnered with the Pennsylvania and Michigan Home Builders Associations becoming their Member Rebate Program. Today, the Member Rebate Program is a member benefit of 44 State HBA’s and over 600 Local HBA’s. There are dozens of participating Manufacturers exclusive to their given product category.

Personalized assistance is available. Please reach out to us with any questions. Claim Today, Don’t Delay! https://hbarebates.com/claimform/

Kim Klein

HBA Rebates

www.HBArebates.com

Office - 732-612-3865

Mobile - 732-859-1935

On a local level, we offer the following: Workers Comp group rating program. You can save up to 53% on your premiums. Our members 40 members currently participating have saved over $105,000! See their info and application in this newsletter.

Gasoline Savings – Speedway is now offering a new promo 25 cents off per gallon at any Speedway & 7-11 for 90 days as well as the 5 cents on going discount for any new account. The new Universal card allows you to fuel at all gas and diesel stations. They have diesel at cost plus. An application is included in this newsletter.

Risk Insurance – Risk Insurance Broadened Cover, Builder’s Risk and Installation Floater, Portable tools and more. Contact Theresa Riddell of The Nelson Agency 440-420-1175 or tmycps@oh.rr.com to find out more.

By using these National, State and Local Benefits, you can MORE than pay for your annual dues in this association.

We’ve given each of you a breakdown of the Benefits companies involved with state and national (SHOW PAPER) and our local benefit providers are HERE.

I encourage you to talk to them and get their information. In most cases, it’s EASY to apply for your discount.

Your money is now on the table…are you going to leave it there? I hope not.

EXECUTIVE OFFICER’S REPORT

page 10 www.ncbia.com June 2023

STABILIZING DATA for Home Building

BY: ROBERT DIETZ

Incoming economic data suggest that single-family home construction is stabilizing after declines in 2022. And inflation data, while still too high, is improving. This sets up an environment in which home building will realize monthly gains later in 2023 and experience an outright gain for 2024.

New home construction is taking on an increasing role because many homeowners with loans well below current mortgage rates are electing to stay put, thus keeping the supply of existing homes for sale at a very low level. In March, 33% of homes listed for sale were new homes in various stages of construction. That share averaged 12.7% from 2000-2019. With limited available housing inventory, new construction will continue to be a significant part of prospective buyers’ search in the quarters ahead.

The NAHB/Wells Fargo Housing Market Index in May rose five points to 50. This marks the fifth straight month that builder confidence has increased and is the first time that sentiment levels have reached the midpoint mark of 50 since July 2022. Reflecting this increase in confidence, single-family starts increased 1.6% to an 846,000 seasonally adjusted annual rate. However, this remains 28.1% lower than a year ago. In a sign of improving conditions, single-family permits increased to a rate of 855,000 units, but are down 21.2% from a year ago. The pace of single-family permits has improved every month in 2023 thus far.

The multifamily sector saw starts increase 3.2% to an annualized 555,000 pace. However, multifamily permits decreased 7.7% to an annualized 561,000 pace. Multifamily permits are down 23% year over year, which is an indication of a slowdown for apartment construction in 2023 due to a tighter lending environment and a near 50-year high of apartments under construction.

Lending standards and availability are going to be a challenge for builders as the year progresses. According to the Federal Reserve’s Senior Loan Officer Opinion Survey, banks tightened standards for all types of commercial real estate loans. For multifamily and construction and land development loans, a substantial net share of banks widened the spread on loan rates, lowered the loan-to-value ratio, increased debt service coverage and decreased maximum loan size.

Lending standards are higher because of tightening financial conditions from the Federal Reserve’s policy actions. However, current inflation data are consistent with the argument that the Fed should pause and adopt a data-dependent posture. And because the solid labor market will need additional cooling before the Fed can ease the federal funds rate, NAHB’s forecast contains no Fed rate cuts until 2024.

Consumer prices in April saw the smallest year-over-year gain since April 2021. This marked the tenth consecutive month of deceleration and the first time the rate has fallen below 5% in two years. While the shelter index (housing inflation) experienced its smallest monthly gain since January 2022, it continued to be the largest contributor to the total increase, accounting for more than 60% of the increase in all items less food and energy.

And building material price growth has slowed as well. According to the latest Producer Price Index report, the prices of building materials, in aggregate, decreased 0.2% in April 2023. The index has gained 0.5%, year to date, which is the smallest April YTD increase since 2020. However, some prices continue to rise. Ready-mix concrete prices have risen 1.8%, year to date, and 12.4% over the past 12 months.

EYE ON THE ECONOMY

June 2023 www.ncbia.com page 11

LAKE COULSON NAMED Chief Lobbyist for NAHB

The National Association of Home Builders (NAHB) announced today that Lake Coulson has been named as its new senior vice president for government affairs and chief lobbyist, taking over for Jim Tobin who was recently appointed CEO of the association. A dedicated government affairs professional with more than 20 years of policy and management experience, Coulson will serve as the association’s lead lobbyist and oversee its federal, state and local lobbying, as well as guiding the activities of NAHB’s political action committee, BUILD-PAC, and its grassroots network.

“Having worked closely with Lake for more than the past decade, I know he is the right person to lead NAHB’s government affairs team forward as our industry faces a number of challenging issues,” said NAHB CEO Jim Tobin. “I am certain he will do an outstanding job in promoting and advancing NAHB’s political, legislative and strategic objectives.”

For the past 11 years, Coulson has represented NAHB on Capitol Hill in a senior management position as vice president of government affairs. Before joining NAHB in 2012, he was the executive director of government affairs for the National Electrical Contractors Association.

“Lake’s extensive housing policy background, which includes tax, energy, environmental and appropriations issues, along with his proven leadership and management skills working previously as NAHB’s vice president of government affairs, makes him the perfect candidate to lead one of the premier lobbying shops in Washington,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala.

CONTACT: Elizabeth Thompson

ethompson@nahb.org

(202)266-8495

Stephanie Pagan

spagan@nahb.org

Media Relations Manager

(202)266-8254

NAHB NOW page 12 www.ncbia.com June 2023

LACK OF EXISTING INVENTORY Boosts Builder Confidence to Key Marker

Limited existing inventory, which has put a renewed emphasis on new construction, resulted in a solid gain for builder confidence in May even as the industry continues to face several challenges, including building material supply chain disruptions and tightening credit conditions for construction loans.

Builder confidence in the market for newly built single-family homes in May rose five points to 50, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This marks the fifth straight month that builder confidence has increased and is the first time that sentiment levels have reached the midpoint mark of 50 since July 2022.

“New home construction is taking on an increased role in the marketplace because many homeowners with loans well below current mortgage rates are electing to stay put, and this is keeping the supply of existing homes at a very low level,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “While this is fueling cautious optimism among builders, they continue to face ongoing challenges to meet a growing demand for new construction. These include shortages of transformers and other building materials and tightening credit conditions for residential real estate development and construction brought on by the actions of the Federal Reserve to raise interest rates.”

“Lack of existing inventory continues to drive buyers to new construction,” said NAHB Chief Economist Robert Dietz. “In March, 33% of homes listed for sale were new homes in various stages of construction. That share from 2000-2019 was a 12.7% average. With limited available housing inventory, new construction will continue to be a significant part of prospective buyers’ search in the quarters ahead.”

And with interest rates more than doubling from 2021, the HMI survey shows incentives have played a key role in attracting buyers in this new economic climate and that the use of these sales inducements are gradually slowing across the board:

• The share of builders reducing home prices dropped to 27% in May, down from 30% in April, 31% in Feb. and March, and 36% last November.

• The average price reduction remains at 6%, unchanged for the past four months.

• 54% offered some type of incentive to bolster sales in May, down from 59% in April and 62% last December.

CONTACT: Elizabeth Thompson ethompson@nahb.org (202)266-8495

Stephanie Pagan spagan@nahb.org

Media Relations Manager

(202)266-8254

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three major HMI indices posted gains in May. The HMI index gauging current sales conditions rose five points to 56, the component charting sales expectations in the next six months increased seven points to 57 and the gauge measuring traffic of prospective buyers increased two points to 33.

Looking at the three-month moving averages for regional HMI scores, the, the Midwest edged up two points to 39, the South increased three points to 52 and the West moved three points higher to 41. The Northeast held steady at 45.

HMI tables can be found at nahb.org/hmi. More information on housing statistics is also available at Housing Economics PLUS (formerly housingeconomics.com)

EYE ON HOUSING June 2023 www.ncbia.com page 13

GRAB BARS REMAIN THE MOST Common Aging-in-Place Remodel

BY: ERIC LYNCH

The NAHB's ’s Remodeling Market Index (RMI) survey has asked questions about Aging-in-Place (AIP) periodically, beginning in 2004. According to results from the Q1 2023 survey, 63 percent of professional remodelers undertake projects designed to allow homeowners to Agein-Place, down from 77 percent in Q4 2018. This is the lowest percentage since the Q2 2006 survey (60 percent). When asked about the age groups of homeowners who request Aging-in-Place work, 75 percent of remodelers indicated that homeowners are 65 years or older, followed by 55 to 64 years at 70 percent. These two age groups have consistently been above 70 percent since the Q2 2013 survey.

Ninety-eight percent of remodelers cited that most or some of their consumers are familiar with the Aging-in-Place concept. That share was 75 percent in Q4 2004, indicating a significant increase in awareness among consumers over the last two decades.

Grab bars are the most common AIP project, with 93 percent of remodelers reporting this job in the last year. They are followed by curb-less shower at 83 percent, installing higher toilets at 77 percent, widening doorways at 63 percent, and adding lighting/task lighting at 49 percent.

Seventy-six percent of remodelers indicated that requests for Aging-in-Place features have significantly or somewhat increased over the past 5 years. This figure has not changed much since the inception of the series in 2004.

As for the reason why, customers are undertaking Agingin-Place projects, 88 percent of remodelers stated that customers are planning ahead for future needs, followed by living with older parents at 50 percent.

Sixty-two percent of remodelers indicated that a majority of their Aging-in-Place work was determined by the client, whereas the other 38 percent said it was mostly suggested by the contractor. Across its history, determined by client has consistently been above 50 percent.

When asked how receptive potential clients are to incorporating suggested Aging-in-Place modifications, 55 percent indicated that their customers were very receptive, and 45 percent were somewhat receptive. Only 1 percent stated that customers were not at all receptive to these modifications.

To view the results from NAHB’s RMI survey in tandem with the Aging-in-Place (AIP) Special Questions, please consult the full survey report

EYE ON HOUSING page 14 www.ncbia.com June 2023

Take advantage of the best educational opportunities available in the home building industry.

Congratulations! You’ve made the smart decision to join North Coast Building IndustryAssociation.And now, that choice can make you even more brilliant! Your local membership automatically makes you a member of the state and the National Association of Home Builders. This means you have access to NAHB Education programs – the best available in the industry.

NAHB Education has courses for everyone, from the novice to the experienced professional. Do you have a special interest or a knowledge gap you need to fill? Do you want to amaze clients and boost your bottom line? Check out nahb.org/education for 44 diverse courses that support 13 professional designantions representing various topic areas like sales and marketing, business management, green building, agingin-place, land development and more. Many members earn designations to differentiate themselves from their competitors and provide their clients added value by staying abreast of an ever-changing industry

INDIVIDUAL COURSES

Or you can take the individual courses that fit your needs. Courses are hosted by over 100 HBAs around the country and also take place at the International Builders’ Show® (IBS). Visit nahb.org/education to find a class near you.

WEBINARS

Can’t take time away from the office for a course? Let the learning come to you in the form of webinars and online courses you can take in your own time. Visit nahb.org/elearning for more information.

BUILDERBOOKS

Finally, BuilderBooks.com is another valuable source for education and training products. As NAHB’s official bookstore, BuilderBooks.com offers award-winning publications, software, brochures and more, with many available in both English and Spanish.

The more you learn, the more you can grow your business strategically, effectively and profitably.

June 2023 www.ncbia.com page 15

JUNE 15, 2023 - REPORT #8 LEGISLATIVE UPDATE

SENATE APPROVES ITS VERSION OF HB 33 MAIN OPERATING BUDGET; NEXT STOP CONFERENCE COMMITTEE

The Senate is set to vote on its version of the budget today. The House will meet next week to reject the changes before a conference committee is named to work out the final product to be accepted by the House and Senate and sent to the Governor. Many housing topics are still in the midst of review and discussion. All of these topics and more will be discussed at the OHBA summer board meeting June 21st.

• Commercial Activity Tax (CAT) Exclusions

oExcludes, for tax period beginning in 2024, businesses with taxable gross income receipts of $3 million or less and, for tax periods beginning 2025 and thereafter, businesses with taxable gross receipts of $6 million or less from the CAT.

• State LIHTC

o The Senate version includes funding for a state LIHTC as proposed in the Governor ’s Budget.

• Single-Family housing development tax credit

oReinstates program set out in Governor ’s proposal for a nonrefundable tax credit for investment in the development and construction of affordable single-family housing. Requires local government and economic development entities to submit application for the credit for an amount by which the fair market value of the project’s homes exceed the projects development costs.

• Welcome Home Ohio Program

oCreates the WHO under ODOD, which allows the Development Director to administer a grant program by which land banks may apply for funds to purchase certain residential property, rehabilitate or construct residential property held by the land bank, up to $30,000, for income restricted owner occupancy

oTax credits claimed by qualifying developers and land banks that rehab or build residences and sell them to lower income occupants.

• Transfers the Ohio Housing Finance Agency (OHFA) authority, duties, assets, and liabilities to the Governor’s Office of Housing Transformation under ODOD; allows TOS to issue bonds on behalf of the office.

o• Removes the House’s property tax valuation proposal, which would implement a uniform way of accounting for affordable housing developments’ operating income and expenses to assess local property taxes (pg. 747).

• Expands the ban on "twinning" state historic rehabilitation tax credits beyond Low Income Housing Tax Credits to any other federally subsidized residential rental property

oAuthorizes the State Auditor to audit the construction and rehabilitation costs of any project that has received federal subsidies or tax credits to construct or renovate rental housing (pg. 63).

• Property Tax Assessment for Residential Development

oOHBA supported language is in the As Passed by the House version of HB 33. The Senate version maintains these provisions with the addition of language ensuring that any development property that is no longer used as farmland cannot continue to be valued as such for property tax.

LEGISLATIVE REVIEW

page 16 www.ncbia.com June 2023

• TIF/CRA/OZ Restrictions Removed Prohibitions for investment in rental housing in Ohio’s Opportunity Zones, Community Reinvestment Areas (CRAs), and Tax Increment Financing (TIF) plans were removed in the final Senate version

• Referenda Signature Increase

oSenate included proposed increase to township signature requirement to 25%.

• Homeownership Savings Linked Deposit Program

oOHBA has partnered with eight of the state's leading real estate and business organizations encouraging the Ohio Senate to approve the Homeownership Savings Linked Deposit Program contained in the House of Representativespassed version of the state operating budget. The program creates tax-advantage savings accounts that leverage above-market interest rates. Homeownership Savings Linked Deposit Program contained in the House of Representatives-passed version of the state operating budget. The program creates tax-advantage savings accounts that leverage above-market interest rates.

• Policies of the OEPA

oProhibits a policy from establishing any substantive duty, obligation, prohibition, or regulatory burden not imposed by statute or rule and other prohibitions on the application of policies by OEPA Director.

OHBA SUMMER BOARD OF TRUSTEES MEETING

OHBA Summer Meeting is scheduled for June 20-22 at Kent State University Hotel & Conference Center. Now is the time to sign-up for this event. Highlights of this meeting is listed below

• Tuesday, June 20th – Golf at Congress Lake Club and Drinks and Dinner (Limited tee times available, must sign-up)

• Wednesday, June 21st – Membership Meeting, Combined Gov’t Affairs Update and Cocktail Reception

• Thursday, June 22nd – Board of Trustees Meeting

If you would like to sign-up for any of these events, please contact OHBA at 614-228-6648 or mpatel@ohiohba.com Hope to see you there!

LEGISLATIVE

REVIEW

June 2023 www.ncbia.com page 17

NAHB, BUILDERS SCORE BIG Win in SCOTUS Decision on Wotus

In a major victory for NAHB, builders, developers and property owners, the Supreme Court on May 25 issued a unanimous decision in Sackett v. Environmental Protection Agency that will force the Biden administration to overhaul its “waters of the U.S.” (WOTUS) rule and ultimately provide builders and developers more certainty in the federal permitting process.

“The decision represents a victory against federal overreach and a win for common-sense regulations and housing affordability,” said NAHB Chairman Alicia Huey.

The Sackett case revolved around the government regulation of a wetland near a roadside ditch. The government believed that it had Clean Water Act (CWA) authority over the wetland because the government claimed that this wetland, in combination with other nearby wetlands, had a “significant nexus” to Priest Lake, Idaho.

The significant nexus test that establishes federal jurisdiction over minor waterbodies such as isolated wetlands or human-made ditches is a critical part of the Biden administration WOTUS rule.

The Supreme Court essentially rejected the significant nexus test and the EPA’s reasoning. Five justices joined the opinion of the court, which began its analysis by explaining that the CWA’s use of the term “waters” encompasses only relatively permanent, standing or continuously flowing bodies of water that form geographic features that are ordinarily described as streams, oceans, rivers and lakes.

With respect to wetlands, the Supreme Court explained that in order for a wetland to be regulated under the Clean Water Act, it must have “a continuous surface connection to bodies that are ‘waters of the United States’ in their own right, so that there is no clear demarcation between ‘waters’ and wetlands.” As a practical matter, the court found only wetlands that are indistinguishable from waters of the United States are covered by the CWA.

NAHB had filed a friend-of-the-court brief in the Sackett case, arguing that it does not make sense for isolated wetlands, isolated ponds or human-made ditches on private property to be subject to federal jurisdiction.

Although the Sackett case did not directly address the Biden administration’s newest rule defining “waters of the United States,” this decision has an enormous impact on that rule. The current Biden WOTUS rule is based on the significant nexus analysis the Supreme Court has clearly rejected. Therefore, the administration will have to make extensive changes to the rule.

It should also be noted that the Biden WOTUS rule is now in effect in only 23 states because three U.S. district courts (North Dakota, Kentucky and Texas) have decided that the rule cannot be implemented in 27 states as a result of legal challenges. NAHB was involved in the Texas and North Dakota cases, which covered 26 of the 27 states affected.

As a result, the WOTUS rule has reverted to a pre-2015 regulation in those 27 states. But the pre-2015 rule also relies on the significant nexus test.

What this means going forward is that EPA and the U.S. Army Corps of Engineers will most likely need to go back to the drawing board to craft a revised regulation applicable to all 50 states. This process is expected to take several months.

As the government moves to revamp its WOTUS rule, NAHB will be urging the federal agencies to implement a durable and practical definition of WOTUS that will truly protect our nation’s water resources without infringing on states’ authority and triggering additional expensive, time-consuming permitting and compliance requirements.

June 2023 www.ncbia.com page 19

NAHB NOW

EMERGENCY PREPARDNESS and Response

Disaster Preparedness

Disasters can happen anywhere, at any time Home building industry members must prepare their homes and businesses to keep their families and employees safe if the worst should occur.

Preparing your Business for Natural Disasters

As the summer approaches, so does the risk of hurricanes, wildfires, and other natural disasters, often posing severe risks to workers in the construction and contracting industry. Preparedness is essential to home builders and contractors because adverse conditions can present direct emergent threats to those on a worksite and frequently do so quickly. That's why it's recommended that all builders need to have an Emergency Action Plan (EAP) and a Continuity of Operations Plan (COOP) prepared in advance, so that should a disaster happen, they are prepared for emergencies on the worksite and minimize potential business disruptions that may follow.

In case of an impending weather event or wildfire, some preparedness actions recommended for the worksite include:

Pay close attention to local official's reports regarding changing weather conditions and evacuation orders.

Secure the jobsite and a reasonable area around the construction zones to be sure all loose debris or equipment is removed or properly secured to prevent damage to the project or the surrounding area. Cover any work that is highly vulnerable to damage by wind or rain.

Create a safety zone around the project or building, remove combustible or loose materials and keep the volume of vegetation to a minimum.

Make sure your offices and job site trailers are properly secured with any copies of records either removed or copied. Back up all electronics.

Communicate any changes in planning, worksite activities and disaster preparations to workers, ensuring that all stakeholders are aware of emergency alerts and communication systems.

Disaster Preparedness and Response Safety Videos

NAHB has produced disaster safety videos for the worksite for those preparing for and responding to natural disasters. The videos outline best practices in preparing worksites and starting work after a disaster for those in the home building industry. All videos and materials are also available in Spanish. Watch the videos here.

NAHB INDUSTRY ISSUES page 20 www.ncbia.com June 2023

EMERGENCY PREPARDNESS and Response

Emergency Kits for the Jobsite or Office

Natural Disasters can develop and strengthen rapidly, sometimes with little notice. A recommendation for those in the home building industry is to prepare emergency kits for vehicles or offices that can be quickly accessed should the weather turn for the worse or an An evacuation order is called. Kits can be assembled in a bag or case and should include items that can be useful in an emergency. Items such as:

• Battery-operated emergency radio

• External battery bank for phones and electronics

• Manual can opener

• Lighter

• Tire plug kit

• Small fire extinguisher

• Small multi tool

• Small LED lantern

• Headlamps with batteries

• Small first aid kit

• Contract or bags, duct tape, and heavy gloves

• 5-gallon water cube or several 1-liter bottles of water

• Box of small nonperishable foods

• Paper map

It is also a best practice to include copies of any important documents in a waterproof document holder and a small amount of petty cash, should it be needed for purchases during an electrical outage.

Be Prepared with a Continuity of Operations Plan

Prepare for potential business operations outages or challenges associated with the disaster with a Continuity of Operations Plan (COOP). A basic COOP plan for the home building industry should answer questions such as these:

What weather events are most likely to affect my business? Buildings, storage, vehicles, tools, materials, and IT equipment could all be vulnerable to hazards or disasters.

How do I continue operations and business functions during or after a disaster while ensuring the safety of employees and other stakeholders?What can be done to ensure financial viability in case of decreased cash flow?

How will I ensure my stakeholders know and understand my plan in case of an emergency or a pending event? When will I alert them, and using what communications channels?

What preparedness actions, processes, or physical improvements must be made before an event to mitigate or insure against weather-related risks?

When it comes to severe weather, an ounce of preparedness is worth a pound of response. Taking the time to work on preparedness and mitigation measures can help builders avoid unnecessary losses, keep their workers safe, and ensure the job continues as quickly as possible, no matter the event.

Make Use of NAHB's Disaster Response Toolkit

NAHB offers a variety of resources through the Disaster Response and Recovery Toolkit to help builders, remodelers, and contractors prepare for and respond to adverse events. The toolkit features workplace and consumer information, templates, worksheets and videos to support professionals working in the home building industry.

NAHB INDUSTRY ISSUES June 2023 www.ncbia.com page 21

EMERGENCY PREPARDNESS and Response

Other Helpful Links

Prepare your operations for disaster with NAHB's Continuity Planning Tool

Learn more about how to prepare job sites for natural disasters

Draft a communications plan

Safety 365 offers the full range of NAHB jobsite safety resources

Prepare, plan and stay informed with Ready.Gov

Review preparedness tips from OSHA

Construction Industry Disaster Preparedness Checklist

Disasters such as hurricanes, wildfires, floods, and severe weather can affect construction worksites. Preparedness measures taken before a disaster can help builders keep workers safe, avoid unnecessary losses, and ensure that work resumes as quickly as possible once the danger passes.

Recommended everyday preparedness measures

Clean the jobsite daily

Inspect and secure tie-downs for all construction trailers

Reschedule material deliveries that have little impact on your production Your staff should be aware of your disaster contingency and communications plan Make sure subcontractors know your contingency plan and have your key phone numbers Your vehicles should be fully fueled and have flashlights, water and emergency go-kits Make sure computers and electronics are surge-protected and registered in case of loss Have external batteries to charge small electronic devices like cell phones or tablets

Back-up all computer records either to an external hard drive or cloud-based system

Recommended when adverse conditions are possible in your area

Clean up construction zones to assure loose debris or equipment is removed or secured Arrange to have dumpsters removed

Halt material deliveries with suppliers

Stop any work that is highly vulnerable to damage by wind or rain

Complete tasks such as concrete work if it may prevent damage to the job site Have subcontractors secure or remove unnecessary materials or equipment from job sites Job sites with cranes should take precautions as these could be affected by high winds Prepare to cover windows and glass doors

Communicate plans for worksite activities and hurricane preparations to employees

Recommended when adverse conditions are imminent in your area

Make sure the dumpsters or shipping containers have been emptied, removed or secured Remove scaffolding

Secure or remove all building materials

Turn off power at circuit breakers to homes under construction

Close and cover all windows with plywood

Make sure your offices and job site trailers are properly secured

If authorities call for mandatory evacuations, make sure employees leave immediately

nahb.org/Advocacy/Industry-Issues/EmergencyPreparedness-and-Response

NAHB INDUSTRY ISSUES page 22 www.ncbia.com June 2023

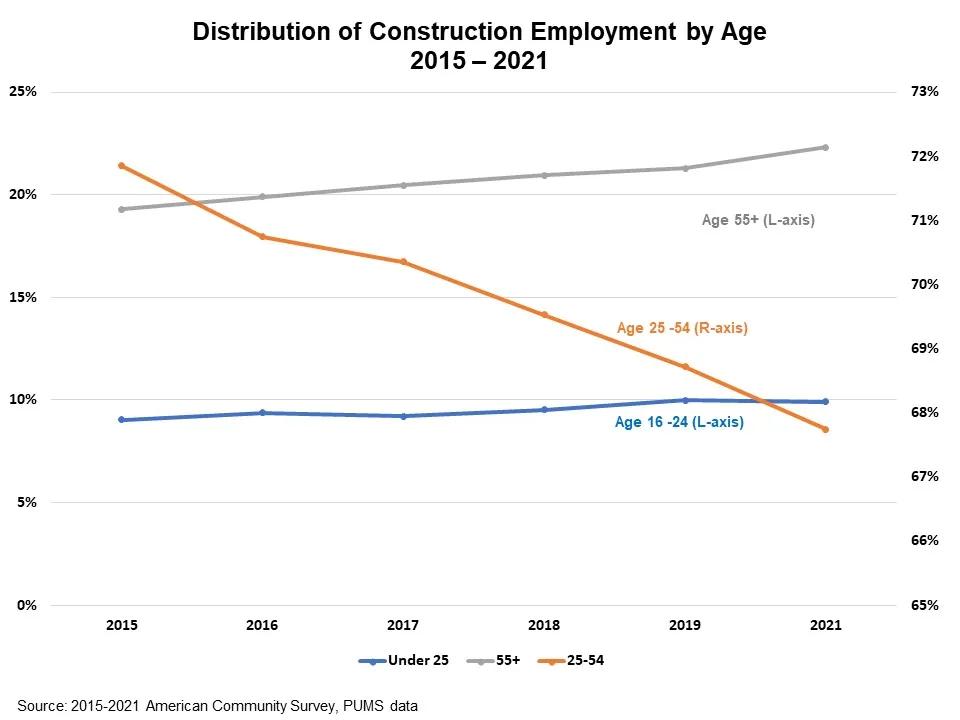

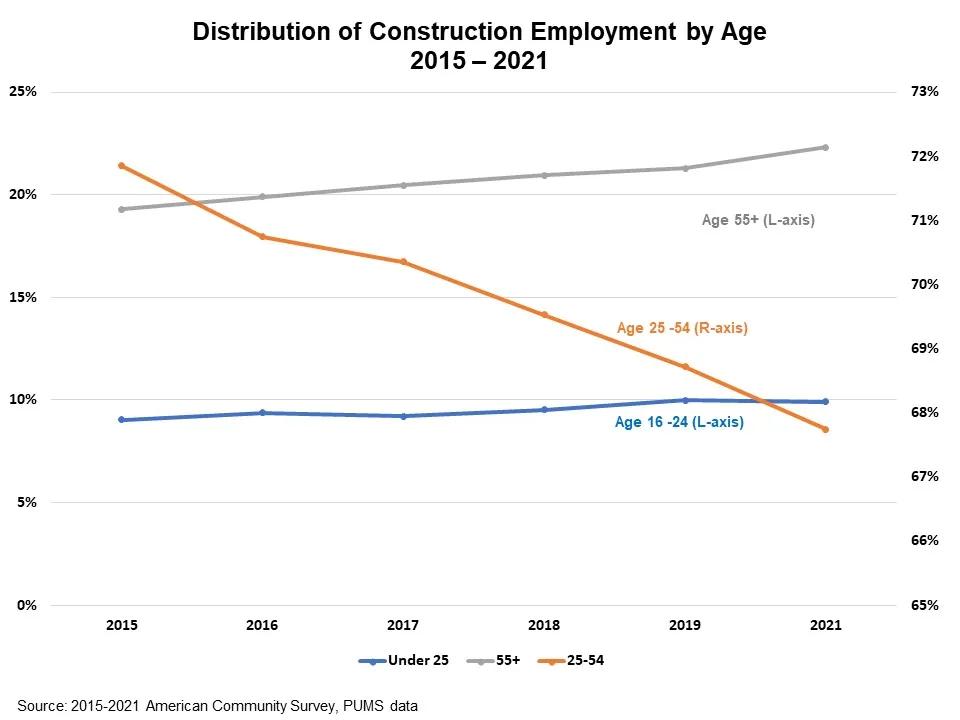

AGE DISTRIBUTION OF the Construction Labor Force

The latest labor force statistics from the 2021 American Community Survey show that the construction industry continues to struggle to attract younger workers. While workers under the age of 25 comprised 13.6% of the US labor force, their share in the construction industry reached only 10.0% in 2021. Meanwhile, the share of older construction workers ages 55+ increased from less than 19.3% in 2015 to almost 22.3% in 2021.

BY: NA ZHAO

BY: NA ZHAO

An earlier post showed that the median age of the construction workforce is 42. Compared to the workforce in all industries, construction has a relatively smaller share of younger workers, but a larger proportion of workers in their prime-working age. The chart above shows that, as of 2021, only about 10% of construction workers were 16-24 years old, less than the employment share of this age group in all industries. Around 67.7% of the construction workforce were in the prime working years of 25-54, compared to 63.5% in overall workforce. The relative greater share of workers in construction in the 35-55 age group, mostly Gen X-ers, reveals the current challenge. Gen X is a smaller generational group than the Baby Boomers. The share of workers ages 55 and older was 22.3% in construction, implying that a substantial portion of workforce would retire in near future. Attracting more skilled labor remains the primary long-term goal for the construction industry.

Analysis of the age distribution of construction workers over time reveals that the construction workforce is aging, with the share of older workers ages 55+ rising from 19.3% in 2015 to 22.3% in 2021. At the same time, the proportion of workers ages 25 to 54 declined from 71.9% to 67.7%. This change in age composition of construction labor force is largely because the last elements of the Baby Boomer generation are entering the 55+ age group. The share of younger construction workers ages 25 under edged up to 9% from 10%.

EYE ON HOUSING

June 2023 www.ncbia.com page 23

2023MEMBER

J U L 4th Independence Day Independence Day || Office Closed Office Closed Night at the Crushers Night at the Crushers ** || 6:30 6:30 Mercy Health Stadium (2009 Baseball Boulevard, Avon) 27 th Thursday Tuesday CALENDAR O F E V E N T S 2 0 2 3 Rev 6/5/23 * Sponsorships are Available * Sponsorships are Available A U G 3 rd Golf Classic Golf Classic ** || 8 AM 8 AM Legacy@Sweetbriar Golf Course ( 750 Jaycox Rd Avon Lake) Thursday 17th Membership Mixer Membership Mixer ** || 5-7 PM 5-7 PM Thursday th NAHB Association Management Conference NAHB Association Management Conference || Office Closed - Staff Attending Office Closed - Staff Attending Monday-Thursday 21-24 Cincinnati OH Harbor House (132 Main Street, Huron) 9 th Executive Committee - Executive Committee - 3:30 3:30 || Board Meeting Board Meeting 5:00 5:00 Clubhouse at Preserves at French Creek (5800 Preserve Drive, Sheffield Village) Wednesday J U N 23rd General Membership Meeting/Cookout General Membership Meeting/Cookout ** || 11:30 AM-1 PM 11:30 AM-1 PM Pogie's Clubhouse (150 Jefferson St Amherst) National Homeownership Month National Homeownership Month NAHB Leadership Meetings NAHB Leadership Meetings//Legislative Conference Legislative Conference 6-10th Washington D C 20-22 OHBA Summer Board Meeting OHBA Summer Board Meeting nd Kent State University Hotel & Conference Center Friday Tuesday-Thursday Tuesday-Saturday Codes Session Codes Session ||1 PM - 2 PM 1 PM - 2 PM Clubhouse at Preserves at French Creek (5800 Preserve Drive Sheffield Village) S E P Associate Member Appreciation Month Associate Member Appreciation Month 4 th 9th Softball Game & Family Picnic Softball Game & Family Picnic ** || 1-5 PM 1-5 PM Labor Day Labor Day || Office Closed Office Closed Saturday Monday Clubhouse at Preserves at French Creek (5800 Preserve Drive Sheffield Village) 13th 21st Executive Committee - Executive Committee - 3:30 3:30 || Board Meeting Board Meeting 5:00 5:00 Member Mixer Member Mixer ** || 5-7 PM 5-7 PM Thursday Wednesday Amherst Township Park (44786 Middle Ridge Road Amherst) Location- TBD 19-21st NAHB Leadership Meeting NAHB Leadership Meeting Tuesday-Thursday JW Marriot Desert Springs Resort Palm Springs CA

O

Careers in Construction Month Careers in Construction Month NCBIA Annual Clambake NCBIA Annual Clambake ** || 5:30 -10:00 PM 5:30 -10:00 PM Amherst Eagles ( 1161 Milan Ave Amherst) 14th 18 th General Membership Meeting & Election Night General Membership & Election Night ** || 5-7 PM 5-7 PM Location- TBD Wednesday Saturday CALENDAR O F E V E N T S 2 0 2 3 * Sponsorships are Available * Sponsorships are Available 9 Thursday Wednesday

O

Spike Appreciation Month Spike Appreciation Month Executive Committee - Executive Committee - 3:30 3:30 || Board Meeting Board Meeting 5:00 5:00 Clubhouse at Preserves at French Creek (5800 Preserve Drive Sheffield Village) Thanksgiving Thanksgiving || Office Closed Office Closed 23-24 th 8th OHBA Fall Board Meeting OHBA Fall Board Meeting Hilton Easton Columbus 14th Thursday-Friday Tuesday Building Relationships & Value Through Education Building Relationships & Value Through Education || 8:15 8:15 AM-4 PM AM-4 PM th LCCC SP 114 (1005 Abbe Road North Elyria) Four Sessions Come to ONE or come to ALL! See Flyer in latest eNews Blast! New Date

Merry Christmas Merry Christmas || Office Closed Office Closed 25-26 th Monday-Tuesday Member Mixer Member Mixer ** || 5-7 PM 5-7 PM 14 th Thursday Captain s Club (232 Park Ave Amherst) NAHB Leadership Meeting NAHB Leadership Meeting 4-5th Monday-Tuesday Virtual

C T

N

V

D E C

Economic data, and particularly inflation data, continue to describe an economy running hotter than the nation’s central bank wants, given its target of 2% inflation. After a slightly improved 4.6% Core PCE inflation rate in March, the data accelerated slightly to a 4.7% rate in April. Consequently, markets are pricing in a solid possibility of an additional rate hike in June or July. Another hike would require changes to previous forecasts (including the NAHB economic outlook) that the May increase to top the federal funds rate of 5.25% was the end of the tightening cycle.

The challenge for the Fed is that the inflation data is lagging. Indeed, shelter inflation is likely to trend lower in the months ahead as realtime data for rent show a slowing pace. Moreover, a significant number of apartments will be placed into service in the next few quarters, as the number of multifamily units under construction is the highest since 1973. Despite these headwinds, the newly revised NAHB Multifamily Production Index held at a neutral reading of 50 during the first quarter of the year.

Moreover, higher short-term interest rates will lower the availability of acquisition, development and construction loans. Indeed, NAHB surveys indicate that the average annualized rate for spec single-family home construction financing was 12.6% in the first quarter of 2023. Higher rates mean reduced supply, which in turn produces the opposite effect on inflation than the Fed intends. And this is in addition to the fact that higher rates will produce additional bond losses for regional banks, which could result in a financial crisis.

The repricing of monetary policy risk, combined with concerns over the last-minute debt ceiling fight, has increased the 10-year Treasury rate from 3.4% in mid-May to above 3.8% at the end of last week. Fortunately, the debt ceiling “deal in principle” has relaxed bond markets and caused some retreat for interest rates. Before that recent rise, mortgages rates averaged below 6.4%.

ALL EYES on the Fed

BY: ROBERT DIETZ

The lack of resale inventory (a very low 2.9-month supply) coupled with lower rates helped boost new home sales. Sales of newly built, singlefamily homes in April increased 4.1% to a 683,000 seasonally adjusted annual rate. Despite the gain, sales are down almost 10% on a year-todate basis. The median new home sale price fell in April to $420,800, down 8% compared to a year ago. In March, 33% of homes listed for sale were new homes in various stages of construction. That share from 2000-2019 was a 12.7% average.

Whether the recent improvement for the housing outlook is sustainable is dependent on the interaction of monetary policy and long-term interest rates. It is growing more likely the Fed will increase again at its June meeting. Yet, lowered growth expectations because of tighter policy will reduce long-term rates.

Amidst the uncertainty, it appears the chance of the Fed making a mistake is as high as it has been during this cycle. Now more than ever, more single-family housing would help reduce shelter inflation and could be spurred by more effective fiscal and regulatory policy. In that vein, last week’s 9-0 Supreme Court decision that forces the administration to overhaul its proposed “waters of the U.S.” regulation and enable more permitting is certainly good news for housing.

EYE ON THE ECONOMY

June 2023 www.ncbia.com page 27

Do you want to opt-out of our referral program? Just email judie@ncbia.com page 28 www.ncbia.com June 2023 $ 7 . 0 0 / e a c o n t a c t j u d i e @ n c b i a . c o m t o o r d e r Y o u r N e w H o m e a n d H o w t o T a k e C a r e o f I t h a s a n i n v i t i n g n e w l o o k a n d c o n t i n u e s t o b e a p e r f e c t c u s t o m e r h a n d o u t a t c l o s i n g . R e m e m b e r : c u s t o m e r c a r e i s t h e k e y t o a b u i l d e r ’ s w a r r a n t y p r o g r a m .

Exclusive Entertainment Discounts!

Members have access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels, and much more.

• Save up to 40% on Top Theme Parks Nationwide

• Save up to 60% on Hotels Worldwide

• Save up to 40% on Top Las Vegas & Broadway Show Tickets

• Huge Savings on Disney & Universal Studios Tickets

• Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

Please visit https://memberdeals.com/nahb/?login=1

page 30 www.ncbia.com June 2023

MORE THAN 700 RESIDENTIAL

Construction Workers Discuss Housing Issues in Hill Visits

CONTACT:

More than 700 than, remodelers and associates engaged in all facets of residential construction marched on Capitol Hill today to call on Congress to take steps to ease the nation’s housing affordability crisis and make housing and homeownership a national priority.

“From coast to coast, members of the housing community have come to Washington for the National Association of Home Builders (NAHB) 2023 Legislative Conference to deliver a simple message to lawmakers: ‘As housing goes, so goes the economy,’” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. With a nationwide shortage of 1.5 million housing units, Huey noted that “building more homes is the only way to tame inflation, satisfy unmet demand, achieve a healthy supplydemand balance in the for-sale and rental markets, and ease the nation’s housing affordability crisis.”

In more than 250 individual meetings with their representatives and senators, housing advocates urged lawmakers to act on the following three issues to help keep housing affordable and spur the production of attainable housing:

• Transformers. A shortage of distribution transformers is delaying housing projects across the nation and the cost of transformers has soared by more than 70% over the past three years. NAHB is urging Congress to: 1) Utilize the Defense Production Act to boost output at existing facilities to address the growing supply chain crisis for distribution transformers, and 2) Oppose efforts by the Department of Energy to increase the energy conservation standards for the production of distribution transformers because it will severely exacerbate the current supply shortage.

• Energy codes. NAHB is urging the Senate to introduce and advance legislation which includes the provision in House-passed bill H.R. 1 that would repeal $1 billion in grants provided to state and local governments to adopt updated energy codes that are more costly and restrictive. Forcing the adoption of more stringent energy codes to qualify for these grants will exacerbate the current housing affordability crisis and limit energy choices for consumers.

• Workforce development funding. There is a shortage of more than 400,000 workers in the construction industry, and this is resulting in housing construction delays and higher home building costs. NAHB is urging Congress to reauthorize the Workplace Innovation and Opportunity Act to help meet the residential construction industry’s severe workforce needs and to fully fund the Job Corps program, which is a vital source of skilled labor for our industry.

Elizabeth Thompson

ethompson@nahb.org

(202) 266-8495

Stephanie Pagan

spagan@nahb.org

Media Relations Manager

(202) 266-8254

The lack of resale inventory (a very low 2.9-month supply) coupled with lower rates helped boost new home sales. Sales of newly built, singlefamily homes in April increased 4.1% to a 683,000 seasonally adjusted annual rate. Despite the gain, sales are down almost 10% on a year-todate basis. The median new home sale price fell in April to $420,800, down 8% compared to a year ago. In March, 33% of homes listed for sale were new homes in various stages of construction. That share from 2000-2019 was a 12.7% average.

Whether the recent improvement for the housing outlook is sustainable is dependent on the interaction of monetary policy and long-term interest rates. It is growing more likely the Fed will increase again at its June meeting. Yet, lowered growth expectations because of tighter policy will reduce long-term rates.

Amidst the uncertainty, it appears the chance of the Fed making a mistake is as high as it has been during this cycle. Now more than ever, more single-family housing would help reduce shelter inflation and could be spurred by more effective fiscal and regulatory policy. In that vein, last week’s 9-0 Supreme Court decision that forces the administration to overhaul its proposed “waters of the U.S.” regulation and enable more permitting is certainly good news for housing.

NAHB NOW

June 2023 www.ncbia.com page 31

NCBIA Hall of Fame Members

FAME Hall of

North Coast Building Industry Association Hall of Fame Nominating Form

The NCBIA Hall of Fame was established to honor individuals who have made a lasting contribution to the housing industry through their work in building and development, public service and housing-related areas. To nominate an individual for Hall of Fame induction, you must be a member of the NCBIA in good standing, complete this form on both sides and return it to the NCBIA office by November 30, 2023.

Hall of Fame Candidate Name:

Title:

Company Name: Address: City/State/Zip: Phone

Nomination Submitted by:

Company: Phone

(continued on reverse side)

Terry Goode Inaugural Class 2001

Bucky Kopf Inaugural Class 2001

Robert Nickoloff Inaugural Class 2001

Ernie Parsons Inaugural Class 2001

Calvin Smith Inaugural Class 2001

Dan Strauss Inaugural Class 2001

Randy Strauss Inaugural Class 2001

Dale Yost Inaugural Class 2001

Jim Schmidt Class of 2002

Robert Yost Class of 2002

Chris Majzun Class of 2003

Bill Perritt Class of 2003

Mick Mackert Class of 2004

John Sarnovsky Class of 2004

Chris S. Majzun, Jr. Class of 2004

Gene Henes Class of 2004

Andy Kerchmar Class of 2005

LeRoy Forthofer Class of 2006

Ray Yunker Class of 2006

Larry Franklin Class of 2005

Mary Felton Class of 2009

Linda Kacher Class of 2009

Joe Scaletta Class of 2010

Rich Smothers Class of 2010

Jeff Hensley Class of 2020

Jeremy Vorndran Class of 2020

Jim Sprague Class of 2021

Terry Bennett Class of 2021

Tom Caruso Class of 2022

Liz Schneider Class of 2022

NCBIA Hall of Fame Nominating Form (continued)

If you want to check on the criteria for your nominee, please contact the NCBIA office at (440) 934-1090.

Hall of Fame Core Criteria

- At least ten (10) years of NCBIA membership

- Served on committee(s) and/or councils during the time of membership for a total of seven (7) years

- Chaired one (1) committee and/or council- or - Served as President

- At least five (5) years as a board member

- Must have achieved Life Spike Status

- Involvement defined as something that takes a time commitment (not just a monetary one)

- Speaking engagements, home show participation, LCJVS or EHOVE liaison, use of logo in advertising, etc.

Other Criteria Considered

~OHBA and/or NAHB involvement

~Sponsorships (e.g. sponsorship program or event sponsorships)

~Task Force Involvement

~Special Stories/Circumstances

~Awards received (NCBIA & others)

~Complaints or lack thereof (NCBIA records will be checked for compliance)

List any OHBA and/or NAHB involvement

Use additional sheets as needed and please type information when possible.

Member from to .

year year

List committees, councils &/or task forces that nominee has served on and indicate chair positions as they apply.

committee/council/task force name

List NCBIA offices held office/directorship

Industry & Community Involvement

Awards Received (NCBIA and others)

Special Stories or Circumstances that are pertinent

Summary Statement: I believe that should be named to the NCBIA Hall of Fame because...

Ex. Clambake

DO NOT RELY ONLY on Your Invoice

As a contractor, invoices can often be your lifeblood to cash. You perform your work or your services, and you provide your customer with an invoice, whether to obtain a partial payment or full payment for that work or those services. In fact, many of your customers will not make payment without an invoice. Nine times out of ten, without an invoice, you are not getting paid. So they are crucial to your business. Because of the prevalence and popularity of invoices and the seeming “reflex” it generates to customers for payment, contractors and vendors have long adopted the practice of putting terms on invoices in addition to simply detailing the work or services furnished and the amount(s) due. Among them are interest and/or collections costs and legal fees that are due if invoices are not paid within a certain number of days. Vendors include a reference to “18% interest” or “18% financing charge” and think that if their customers do not timely pay the invoiced amount, they will also owe an 18% charge. This is not true. While there may be a strategic reason to include references to interest or service fees or legal fees on your invoices, doing so is legally insignificant. Under the law, in order to have a right to enforce a claim to a particular interest or service charge (or legal fees or “collections costs”), the customer must have contractually agreed to pay that interest rate or service charge. There must be a written contract or written evidence of an agreement in which the contractor and customer agree to interest or service fees or legal fees that will become due in the event of late or failed payment. Without that advance agreement, the contractor has no right to recover interest or service fees or legal fees (except for simple interest under the statutory rate, which in Ohio is currently only 3%).

By: Phil J. Truax

purchase orders or contracts are (1) actually being used for include clear descriptions of the consequences you intend to

due in the event of late payment is really nothing more than an

page 34 www.ncbia.com June 2023

Thanks for Renewing!

John Marcelli, Apollo Supply

Fred Miller, Azek Co., Building Products Division

William Butchko, Butchko Electric, Inc.

Michael McCourt, Erie Shores Contracting, LLC

Michelle Williamson, Fidelity National Title

Fred Westbrook, Lorain County Auditor

Mike Gidich, MDG Maintenance, LLC

Jennifer Gonzales, National Design Mart

Denny Reaser, Reaser Construction

Rob Kreimes, The Kreimes Co.

Sorry to See You Go!

June 2023 www.ncbia.com page 35

Mike Warden, Huntington Bank

THANK YOU SPIKES!

STATESMAN SPIKE (500-999 SPIKE CREDITS)

Our SPIKES are Our FOUNDATION

SUPER

(250-499 SPIKE CREDITS)

ROYAL

(150-249 SPIKE CREDITS)

RED

(100-149 SPIKE CREDITS)

GREEN

(50-99 SPIKE CREDITS)

LIFE

(25-49 SPIKE CREDITS)

BLUE

(6-24 SPIKE CREDITS)

Bob Yost ........................ Dale Yost Construction .............................. 689.75 Mary H. Felton.............Guardian Title ............................................. 537.50

Terry Bennett Bennett Builders & Remodelers 302.75 Jack Kousma Kousma Insulation 294.00 Chris Majzun Jr Majzun Construction Co. 271.00

SPIKE

SPIKE

Sara Majzun Majzun Construction Co. 248.50 Bill Perritt Perritt Building Co 225.50 Bucky Kopf Kopf Construction Corp. 204.50 Jeff Hensley Lake Star Building & Remodeling............185.75 Randy K. Strauss ......... Strauss Construction .................................. 180.50 Tom Lahetta ................. Tom Lahetta Builders ................................. 171.00

SPIKE

Dave Linna Sr Linna Homes & Remodeling.....................138.50 Jason Scott North Star Builders 129.00 Thomas Caruso Caruso Cabinets 116.75 Patrick Shenigo ............ ShenCon Construction, LLC ..................... 109.50 Tom Sear ....................... Ryan Homes ................................................ 108.25 Chris Majzun Sr Majzun Construction Co 107.00

SPIKE

Jim Sprague Maloney & Novotny, LLC 99.00 Chris Mead Maloney & Novotny, LLC 77.50 Aaron Kalizewski ........ Grande Maison Construction.................... 70.00 Tim Conrad .................. Graves Lumber............................................67.00 Ray Allen Thom Thom Concrete 60.50 Jeremy Vorndran 84 Lumber 59.50 Liz Schneider Dollar Bank 51.50

SPIKE

Steve Schafer ................ Schafer Development ................................. 30.50 John Daly ...................... Network Land Title .................................... 26.50

SPIKE

Tim King K. Hovnanian Homes 18.00 John Toth Floor Coverings International 16.50 Chris Collins ................ Carter Lumber ............................................. 16.00 Mark McClaine ............ 84 Lumber .................................................... 14.00 Ken Cassell Cassell Construction 13.50 Dave LeHotan All Construction Services 12.00 Steve Fleming Shamrock Development 11.50 John Blakeslee Blakeslee Excavating, Inc 11.00 Ashley Oates 84 Lumber 10.00 Scott Kosman ............... Lakeland Glass ............................................ 9.50 Tim Hinkle ................. Green Quest Homes ............................... 6.50 Jim Tipple Maranatha Homes 6.50 Lindsay Yost Bott Dale Yost Construction 6.00 page 36 www.ncbia.com June 2023 © 2019 Hastings Mutual Insurance Company SS-1 (10/19) Select Contractors Building Your Business (800) 442-8277 www.hastingsmutual.com 404 E. Woodlawn Ave. Hastings, MI 49058 For more information contact: Broadened Coverage This coverage helps if there’s damage to property used by you or your employees that belongs to someone else. It has a limit of $2,500 per occurrence, with a $100 deductible. Builders Risk and Installation Floater “Floater” coverage is for anything that oats, or moves from place to place — like your supplies and machinery. It also covers damage to the structures you’re working on, including scaffolding, foundations, and more. This has a limit of $5,000, with a $250 deductible. Portable Tools Coverage on your tools has a limit of $1,000 per tool, to a maximum of $2,500. It also has a $500 deductible. The information referred to is not a policy. Refer to your policy for speci c coverage. 116 4th St., Elyria, OH 44035 Phone: 440-323-8002 A member of: Theresa Riddell (440) 420-1175 The , Inc. tmycps@oh.rr Nelson Agency .com -ORFax: 440-323-8055 Drywallersinsurance1@prodigy.net Brett Adams (419) 515-0506 adamsb@sprouseagency.com

OSHA’s National Emphasis Program Fall Protection

On May 1, 2023, the Occupational Safety and Health Administration (OSHA) announced it began a National Emphasis Program (NEP) designed to prevent falls ( https://www.osha.gov/news/newsreleases/national/05012023 ). Falls are among the most common causes of serious work -related injuries and deaths. According to OSHA and the Bureau of Labor Statistics (BLS), since 2014 there have been a total of 12,049 fatal workplace injuries due to falls. Of those 12,049 fatalities, 5,369 were” Fatal falls to lower levels” and 6,680 were due to “Slips, trips and falls.” These injuries and fatalities are preventable, so a National Emphasis Program is necessary to ensure these hazards are being addressed. In fact, year after year, both Fall Protection – General Requirements (29 CFR 1926.501) and Fall Protection – Training Requirements (29 CFR 1926.503) are among OSHA’s Top 10 Violations.

This NEP will establish guidelines for OSHA compliance and safety officers to initiate inspections under the scope of the NEP whenever they observe someone working at heights. This may occur during an inspector’s normal w orkday travel while enroute to, from or during other OSHA inspections. As with all NEP’s, OSHA will have a 90 -day outreach program for industry to focus on educating employers about effective ways to keep employees safe. Although this NEP is geared towards the construction industry, general industry and agriculture will be targeted as well.

Employers, according to OSHA, are required to keep a safe workplace for their employees by:

1) Providing working conditions that are that are free of known hazards,

2) Ensuring work areas and floors are clean and dry, as far as possible,

3) Selecting and providing required personal protective equipment at no cost to workers, and

4) Training workers about hazards in languages they understand.

In addition, employers should follow the guidelines below to prevent falls and help minimize inspections.

1) Ensure every floor hole into which a worker can accidentally walk is properly guarded. Using a railing and a toe board or a floor hole cover are acceptable means.

2) If there are open si ded platforms, floors or runways, provide a guard rail and toe-board around them.

3) Regardless of height, if a worker can fall into or onto dangerous machines or equipment (such as a vat of acid or a conveyor belt) employers must provide guardrails and toe -boards to prevent workers from falling and getting injured.

4) Evaluate all other jobs that require fall protection that include safety harness and line, safety nets, stair railing and handrails.

As you can see, OSHA is taking injuries and fatalities due to f alls, very seriously. They will be increasing inspections and enforcement at any time they see employees working at heights. Employers can minimize the impact of these inspections and enforcement activities and protect employees by following fall protect ion regulations for construction, general industry, and agriculture.

For more information on the National Emphasis Program on Fall Protection, go to the following link https://www.osha.gov/fall-protection or to view other National Emphasis Programs implemented by OSHA, go to https://www.osha.gov/enforcement/directives/nep . You may also contact Sedgwick’s Andy Sawan at 330.819.4728 or andrew.sawan @sedgwick.com

Premium installment & true-up reporting for private employers

Employers must pay premiums timely to the Ohio Bureau of Workers’ Compensation (BWC) to receive and maintain workers' compensation coverage .

Through the year, employers have been making premium installment payments based on estimated payroll. As we near the conclusion of the 2022 policy year (July 1, 2022 through June 30, 2023), BWC will be requiring all employers to reconcile (“true -up”) the payroll that was used to es timate their premium with their actual payroll for the policy year.

Important reminders

BWC mailed 2023 estimated annual premium notices along with your installment schedule around May 1, 2023.

• If you expect your payroll to change during the 202 3 rating year from the estimate provided, you can call BWC at 800-644-6292 and request a change to your payroll and installment schedule.