Tom’s Country Place 3442 Stoney Ridge Road, Avon Carl Harris 2024 Chairman March 20 Wednesday 5 - 7 PM March General Membership Meeting Meet Carl Harris C a r l H a r r i s w i l l P r o v i d e V a l u a b l e I n s i g h t s i n t o t h e I m p o r t a n c e o f M e m b e r s h i p , t h e F e d e r a t i o n a n d t h e G o a l s o f N A H B . T h i s w i l l b e a g r e a t O p p o r t u n i t y f o r y o u t o G a i n K n o w l e d g e a n d U n d e r s t a n d i n g o f t h e I n d u s t r y a n d O b j e c t i v e s . NEWSLETTER N O R T H C O A S T B U I L D I N G I N D U S T R Y A S S O C I A T I O N north coast bia, sheffield village, oh 44035 www ncbia com February/March 2024 - vol MMXXIV BUILDER

Your One Stop for Tile, Cabinetry, and Countertops Avon Lake: 440.934.1751 Brooklyn Heights: 440.799.8285 Canton: 330.456.8408 Willoughby: 440.373.1195 www.sims-lohman.com

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB). Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Office

5321 Meadow Lane Court Suite 23

Sheffield Village, OH 44035

Phone: 440.934.1090

info@ncbia.com | www.ncbia.com

NCBIA Staff

Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate

Ashlyn Bellan-Caskey | ashlynncbia@gmail.com

2024 NCBIA Officers

President

Tim King, K. Hovnanian Homes

Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain Secretary

Mike Gidich, Honey Dudes Handyman Service

2024 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Dave Linna, Linna Homes & Remodeling

Sara Majzun, Majzun Construction Co.

Jon Sherer, Paraprin Construction, LLC

Brian Schwab, RestorePro

Jason Rodriguez, The S.J.R Building Co.

Kevin Walker, Walker Wealth Managements & Great Lakes Properties & Investments

NCBIA Life Directors

Jeremy Vorndran, 84 Lumber

Tom Caruso, Caruso Cabinets

Bob Yost, Dale Yost Construction

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jim Sprague, Maloney + Novotny, LLC

Randy Strauss, Strauss Construction

Tom Lahetta, Tom Lahetta Builders, Inc.

2024 NAHB Delegate

This member represents our local industry in Washington DC

Tim King, K. Hovnanian Homes

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2024 President

Enzo Perfetto, Enzoco Homes

OHBA Past President

Randy Strauss, 1996

2024 OHBA Trustees

Tim King, K. Hovnanian Homes

John Eavenson, Perpetual Development

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

February/March 2024 www.ncbia.com page 3

14

41-42 2024 MEMBER DIRECTORY & CONSUMER GUIDE ncbia.com OurNCBIAMembers are OurNCBIAMembers are Reputable & Dependable Reputable & Dependable

12-13

Table of Contents

6 - Menu of Services

7 - Save the Dates

8 -

2024 International Builders’ Show Attracts Largest Attendance in 15 Years - 2023-2024 NCBIA President

9Our Beginning- 80 Years Ago - Executive Officers Report

10 -

Eye on Housing: New Home Sales Up at the Start of 2024

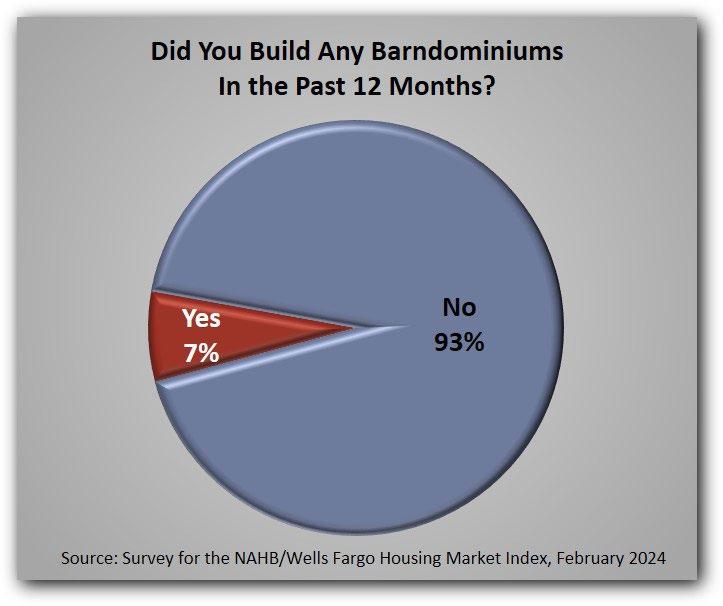

11 - Eye on Housing: Seven Percent of Builders Now Build Barndominiums

12-13 -

Night at the Races Flyer

14 -

We've Moved!

15-16 -

Eye on Housing: Homeownership is Key to Household Wealth

18 - Thank You SPIKES!

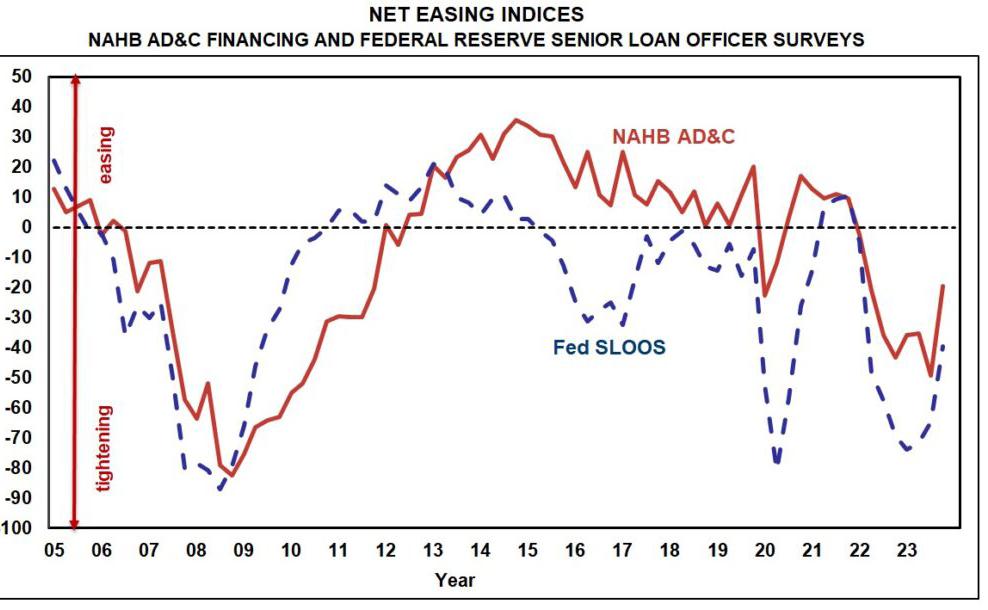

19 - Eye on Housing: Credit for Builders Remains Tight, But Tightening is Less Widespread

21Applying for Membership! Thanks for Renewing! Sorry to See you Go!

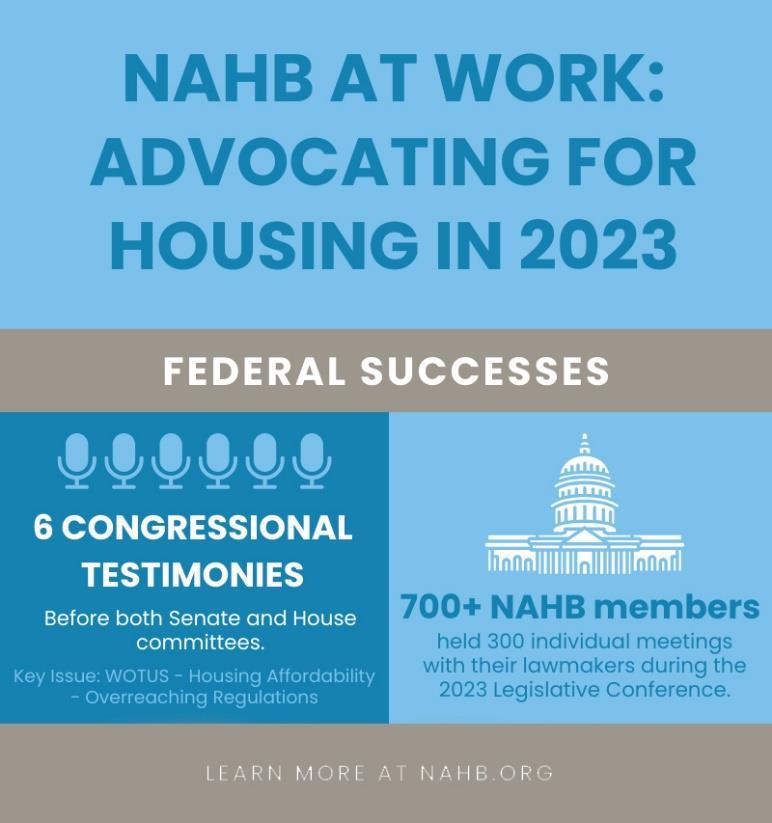

24 - NAHB Now:

NAHB/Wells Fargo Housing Opportunity Index (HOI)

25 - Eye on the Economy: Solid Economic Data Indicate a Promising Outlook for Housing

26 - Eye on the Economy: Will Strong Economic Growth Affect 2024 Fed Rate Cuts?

27 -

OHBA Executive VP Column: The NAHB Convention: A Great Event

28-33 -

Thank You to Our Sponsors! 2024 NCBIA Home and Remodeling Show Photo Gallery

34-36Sedgwick Update

37-40NAHB at Work Advocating for Housing

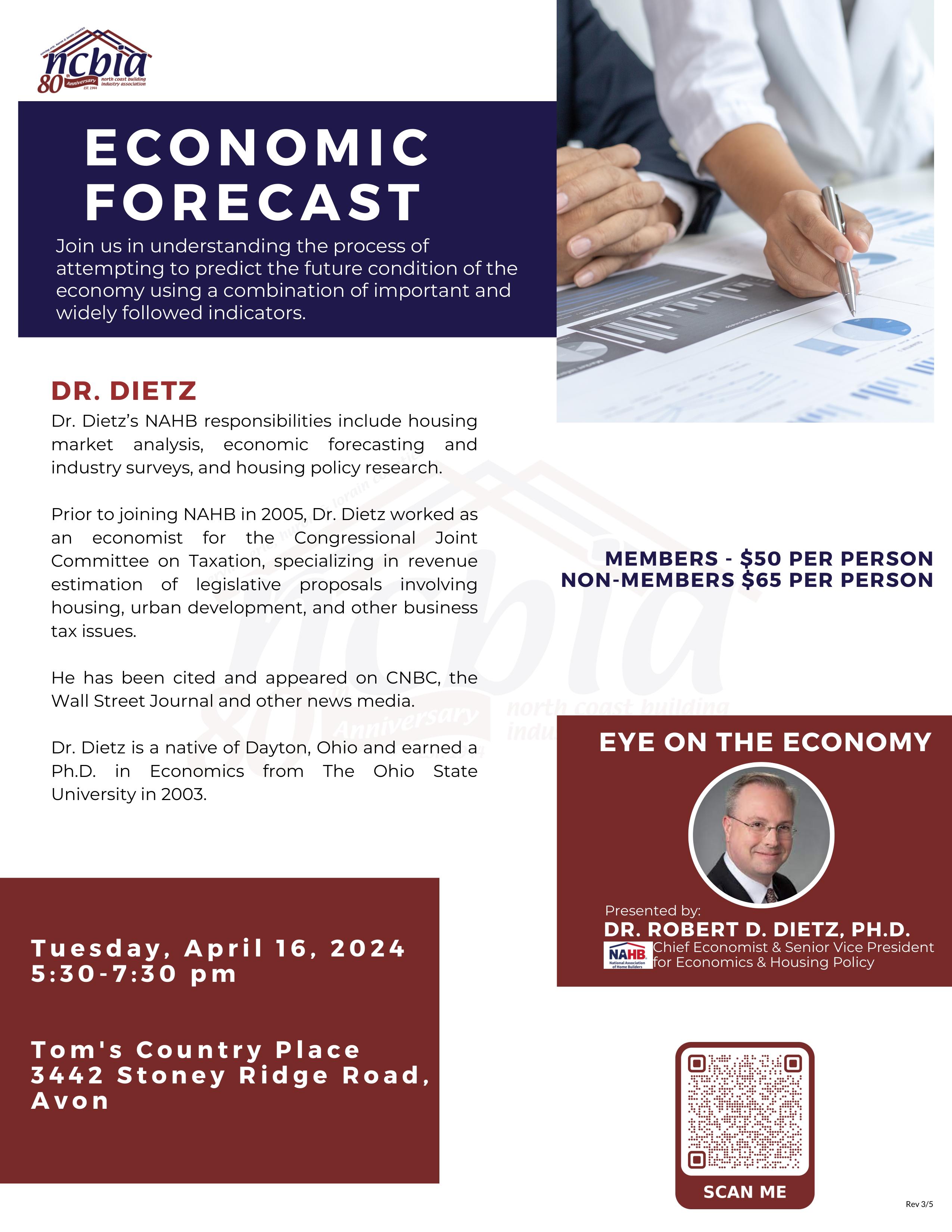

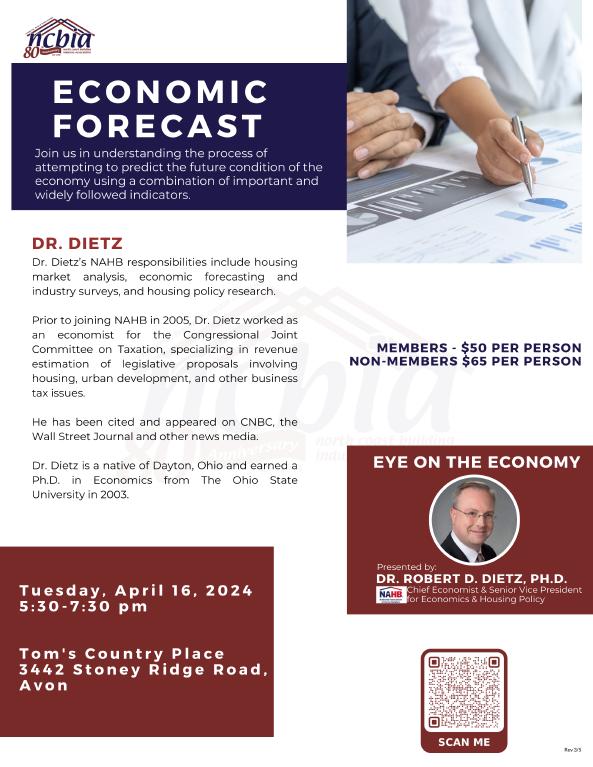

41-42Economic Forecast Flyer

432024 Membership Directory

47-482024 Calendar of Events

49-502024 March General Membership Meeting Flyer

51-55Speedway/Fleetcor Flyers

February/March 2024 www.ncbia.com page 5

For

information on any of these products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

What members are saying: What a great

“ So nice to see new categories and being able to recognize those who do a great job

us.

Such a nice event, I recommend others to attend this in the future.

HELP?

CAN WE HELP? North Coast Building Industry Association Menu of Additional Products and Services Copies Equipment

Black & White Black & White Color Color Color Raffle Boards, Drum & Equipment Graphic Design Services (8.5”x11”) (8.5”x14”) Black & White (11”x17”) (8.5”x11”) (8.5”x14”) (11”x17”) Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided $0.10 $0.20 $0.15 $0.20 $0.50 $0.25 $0.50 $0.27 $0.52 $2.00 $100 per day $30 each (plus shipping, if applicable)

HOW

Design Services Warranty Books

NEED SOMETHING ELSE? JUST ASK!

more

North Coast Building Industry Association Menu of Additional Products and Services Copies

HOW CAN WE HELP?

Black & White Black & White Color Color Color Graphic Design Services Black & White (11”x17”) (8.5”x11”) (8.5”x14”) (11”x17”) Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided $0.50 $0.25 $0.50 $0.27 $0.52 $2.00 $30 each (plus shipping, if applicable)

SOMETHING ELSE? JUST ASK!

more information on any of these products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com $7 each (plus shipping, if applicable) Your New Home $7 each (plus shipping, if applicable) Your New Home *Subject to change 1/30/24 *Subject to change 1/30/24 1/30/24 $35 per hour Contact Ashlyn Bellan-Caskey at ashlynncbia@gmail.com $35 per hour Contact Ashlyn Bellan-Caskey at ashlynncbia@gmail.com page 6 www.ncbia.com February/March 2024

Design Services Warranty Books

NEED

For

evening!

“ “

“

for

“ “

Save the Date!

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!

Wednesday, March 20, 2024

March General Membership Meeting

With Carl Harris, NAHB Chairman

5 PM - 7 PM

Tom's Country Place

3442 Stoney Ridge Road Avon, OH 44011

Tuesday, April 16, 2024

Economic Forecast

Presented By: Rob Dietz, NAHB Chief Economist

5:30 PM - 7:30 PM

Tom's Country Place

3442 Stoney Ridge Road Avon, OH 44011

Saturday, April 20, 2024

Night at the Races

5:30 PM

American Legion Post 211 31972 Walker Road Avon Lake, OH 44012

If you would like to participate in a committee, please email Judie Docs at judiencbia@gmail.com.

Check the website at www.ncbia.com for up-to-date changes, additions, and corrections to these events!

Do you have some business news to share?

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

February/March 2024 www.ncbia.com page 7

2024 INTERNATIONAL BUILDERS' SHOW

Attracts Largest Attendence in 15 Years

More than 76,000 builders, remodelers, developers, and other home building professionals filled the exhibit halls of the Las Vegas Convention Center as the National Association of Home Builders (NAHB) hosted the 80th NAHB International Builders’ Show® (IBS), the largest annual light construction show in the world, Feb. 27-29. This milestone attendance, representing more than 100 countries and the highest level since 2009, reflects the bullish outlook of the residential construction industry.

The show had amazing energy! Attendees visited more than 1,800 exhibitors – including 800 new exhibitors – over 678,000 net square feet, exploring innovative building products and technology to advance the industry and enhance new homes. 100s of incredible new products and trends made their debut. Live demos taught new techniques and new uses for products.

The show floor, education sessions, networking events and social events created 1,000s of connections with some new suppliers and vendors. Awards celebrated the best in the industry. Reflecting the strong growth of the show over its 80-year history, the size of the show floor increased nearly 12% from the 2023 show.

“The energy and enthusiasm of attendees on the exhibit floor matched the positive feedback we received from our exhibitors,” said NAHB Chief Revenue Officer Geoff Cassidy. “To help attendees maximize their experience; we organized this year’s exhibit floor into six distinct product segments. Many IBS attendees told us they wanted floor segmentation, so this was a direct result of us listening to their needs.”

This year also marked the 11th anniversary of Design & Construction Week® (DCW), the colocation of IBS and the National Kitchen & Bath Association’s (NKBA’s) Kitchen & Bath Industry Show (KBIS). DCW drew over 117,000 attendees, and more than 2,400 exhibitors occupied over one million net square feet of indoor and outdoor exhibits.

IBS attendees enhanced their industry knowledge by attending any of more than 120 education sessions led by experts on a wide range of industry topics, including artificial intelligence, building technology, research, and trends. Attendees also took advantage of numerous networking events throughout week and visited The New American Home™ that showcased the latest trends and innovations in home building.

Think about what you struggle with and there is somebody at the show that can help you with it. There is nothing that you run into at any point in your business that you can’t find an answer to there. Next year, the show will return to Las Vegas, Feb. 25-27.

NCBIA 2023-24 PRESIDENT page 8 www.ncbia.com February/March 2024

Tim King, K. Hovnanian Homes

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

Our Beginning - 80 Years Ago

1970-1980 (Part 2 of 4)

Years Ago

OUR BEGINNING80

Economic Rollercoaster – 1970’s

The 1970’s brought to Lorain County periods of both high and low economic change. The early 70’s witnessed a stable housing market as well as an upsurge in apartment building. The mid 70’s brought very high unemployment to our area causing an extreme decrease in memberships.

The major issue for builders was the curtailment of the residential gas supply in our area resulting in many developers redesigning utility services for their developments.

From the fall of 1974 to October 1976 the association was without an executive officer. In 1975, Carmine Torio was hired to serve as the new executive officer and our association was relocated to Sheffield Shopping Center.

The ‘70s, to paraphrase the Charles Dickens quote, “It was the best of times; it was the worst of times.” Early on was stable with increased apartment construction and then traumatic high unemployment caused the bottom to drop out.

Decade of Change – 1980

It was tough being in the building trades in the early ‘80s. If a deep recession wasn’t enough, all-time interest rates, as high as 21%, seemingly was a conspiracy to strangle any growth in the housing industry. Literally, all new construction was halted, and local builders turned to remodeling to stay alive. Foreclosures reached staggering heights.

The Remodelers® Council was formed to support the many contractors who were turning to remodeling to compensate for the downturn in housing starts. By the end of 1983, those builders still around could see signs of an improving economy as interest rates began to fall. Many builders had gone out of business or simply quit. Those who had struggled and survived became better builders; more knowledgeable about their industry, more competent business managers and much more professional. In an effort to address a membership which had declined to a low of 164 in 1984, the association decided to more accurately reflect the business of its membership by changing its name to Building Industries Association of Lorain County.

The later years of 1980’s proved to be profitable for our association as our industry again led the way out of a recession. The association began to formulate plans for the construction of its own office building.

February/March 2024 www.ncbia.com page 9

EXECUTIVE OFFICER’S REPORT

NEW HOME SALES UP at the Start of 2024

Stable mortgage rates at the beginning of 2024 helped new home sales to increase in January. Sales of newly built, single-family homes in January increased 1.5% to a 661,000 seasonally adjusted annual rate from a downwardly revised reading in December, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The pace of new home sales in January is up 1.8% from a year earlier.

A new home sale occurs when a sales contract is signed, or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the January reading of 661,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory in January remained elevated at a level of 456,000, up 3.9% compared to a year earlier. This represents an 8.3 months’ supply at the current building pace. A measure near a six months’ supply is considered balanced.

BY: DANUSHKA NANAYAKKARA-SKILLINGTON

BY: DANUSHKA NANAYAKKARA-SKILLINGTON

A year ago, there were 72,000 completed, ready-to-occupy homes available for sale (not seasonally adjusted). By the end of January 2024, that number increased 19.4% to 86,000. However, completed, ready-to-occupy inventory remains just 19% of total inventory, while homes under construction account for 58% of the inventory. The remaining 23% of new homes sold in January were homes that had not started construction when the sales contract was signed.

The median new home sale price in January was $420,700, up 1.8% from December, but down 2.6% compared to a year ago. In terms of affordability, the share of entry-level homes priced below $300,000 has been steadily falling in recent years. Only 15% of the homes were priced in this entry-level affordable range, while 34% of the homes were priced above $500,000. Most of the homes were priced between $300,000-$500,000.

Regionally, on a year-over-year basis, new home sales are up 4.9% in the Northeast and are up 57.0% in the West but down 4.1% in the Midwest and down 13.5% in the South.

EYE ON HOUSING

page 10 www.ncbia.com February/March 2024

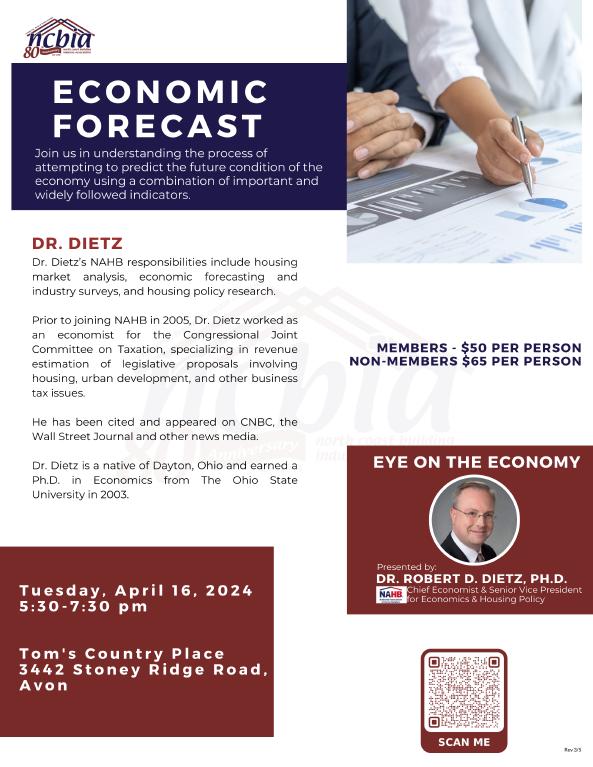

SEVEN PERCENT OF BUILDERS Now Build Barndominiums

Over the past decade, use of the term “barndominium” (indicating a structure that is, in some sense, a combination barn and condominium) has become increasingly widespread in real estate media outlets. In fact, the term has become popular enough for NAHB to include a question about it in its survey for the February 2024 NAHB/Wells Fargo Housing Market Index. In response to that survey, a total of 7% of single-family builders reported that they did, indeed, build barndominiums sometime during the past 12 months.

That result, however, leaves open the question of what a builder means by a barndominium. Unlike a term with a consistent definition maintained by, say, an academic organization or government agency, “barndominium” has meant different things to different reporters over the years. When the term was first gaining popularity, reporters were usually using it to describe a metal frame structure that was used as a primary residence. But that usage has been far from consistent.

BY: PAUL EMRATH

When NAHB’s builders were asked about the type of barndominiums they built, the vast majority (70%) indicated that their barndos were a combination of residential space and a large shop area—a criterion that doesn’t even consider the structure’s framing. The percentages referring to framing-based criteria were smaller but still significant: 30% of builders reported that their barndos were a combination of traditional residential and post-frame construction, and 26% said they were post-framed residential structures with sheet metal siding (26%). Only 9% said their barndos were created by actually converting a barn into a primary residence.

Whichever of these techniques a builder uses, the result of creating a barndominium is a new housing unit which, in the typical jurisdiction, requires a residential building permit.

EYE ON HOUSING

February/March 2024 www.ncbia.com page 11

Night at the Races!

April 20th, 2024

Time:

Doors Open: 5:30pm

Dinner: 6:30pm

Races: 7:30pm

Your

American Legion Post 211

31972 Walker Road

Avon Lake, Ohio

$25 per person

*Includes Buffet Dinner, Desserts and Cash Bar

*21 and Older Only Please

Name: ___________________________________ Company Name: ______________________________ Qty. Price Subtotal ____ $20 ________ ____ $25 ________ ____ $100 ________ ____ $150 ________ Item Name a Horse Event Tickets Table Sponsor Name a Race Bar Sponsor ____ $400 ________ Winner Circle Sponsor ____ $500 ________ Stable Sponsor ____ $1,000 ________ Win/Place/Show Sponsor Sold Out! Total ________ Payment Options □ Check Enclosed □ Invoice □ Credit Card *Email completed form to Judie@NCBIA.com or mail to: 5321 Meadow Lane Court, Suite 23, Sheffield Village, 44035 Sponsorship Details on Back! *Reservation Made is a Reservation Paid *RSVP Deadline 4/12/24

Sponsorship Opportunities

Win Place Or Show Sponsor - Sold Out!

•Includes 8 tickets to the event

•Logo on Placemats and On Program Cover, Mic Time, Verbal Recognition, and Ad on All Social Media Platforms

Stable Sponsor: $1000 - Unlimited

•Includes 8 tickets to the event,

•Logo on Placemats and in Program, Mic Time, Verbal Recognition

Winners Circle Sponsor: $500 - Unlimited

•Includes 4 tickets to the Event

•Logo on Table Placemats and in Program, Verbal Recognition

Bar Sponsor: $400 - Only 1 Available

•Includes 2 tickets to event

•Logo on Napkins for Bar, Ad in Program

Name a Race**: $150 - Only 8 Available

•Listed in Program and Announced During Racing Event.

Table Sponsor: $100 - Unlimited

•Ad in program and on Placemats;

•Verbal recognition

Name a Horse**: $20 - Only 90 Available

•Horse Name and Owner Listed in Program and Announced During Racing Event.

•If Your Horse Wins its Race You Win $50!

** If You Choose to “Name a Horse” or “Name a Race” a Committee Member Will Reach Out to You

Prior to the Event for Naming Selections

Questions? Call a Committee Member:

Sara Majzun 440-752-7061

John Toth 216-409-7277

Jeremy Vorndran 440-213-6729

HOMEOWNERSHIP IS KEY to Household Wealth

Homeownersip provides a wide range of benefits to households. In addition to providing households with a stable place to live, homeownership also offers an opportunity for households to accumulate assets and build wealth over time through equity. As of 2022, 66.1% of U.S. households owned their homes. For families that owned a home, the median net housing value (the value of a home minus home-secured debt) increased from $139,000 in 2019 to $201,000 in 2022, as home prices rose, and home mortgage debt was approximately flat1.

In this article, we use the 2022 data from the Survey of Consumer Finances (SCF) to examine household balance sheets, especially their primary residence, across age and education categories. The 2022 SCF is a detailed triennial cross-sectional survey of U.S. family finances, published by the Board of Governors of the Federal Reserve System. Compared to the quarterly Financial Accounts of the United States (previously known as the Flow of Funds Accounts), which provides aggregate information on household balance sheets, the SCF provides family-level data2 about U.S. household balance sheets every three years since 1989.

Homeownership plays an integral role in a household’s accumulation of wealth.

According to the analysis of the 2022 SCF, nationally, the primary residence remained the largest asset category on the balance sheets of households in 2022 (as shown in Figure 1 above). At $40.9 trillion, the primary residence accounted for more than one quarter of all assets held by households in 2022, surpassing business interests (20%, $30.8 trillion), other financial assets3 (19%, $29.8 trillion) and retirement accounts (15%, $23.8 trillion).

BY: JING FU

Playing an important role in household wealth accumulation, the primary residence not only represents the largest asset category on the household balance sheet, but also is a widely held category of nonfinancial assets by households. As mentioned earlier, about two out of every three households, 66%, owned a primary residence in 2022. Within the categories of financial assets, just over half of households, 54%, held retirement accounts, and 21% of households owned either stocks or bonds. Other financial assets, which were held by 99% of households, include items such as checking accounts, money market accounts, and prepaid debit cards, which are often held more to facilitate financial transactions than to build wealth.

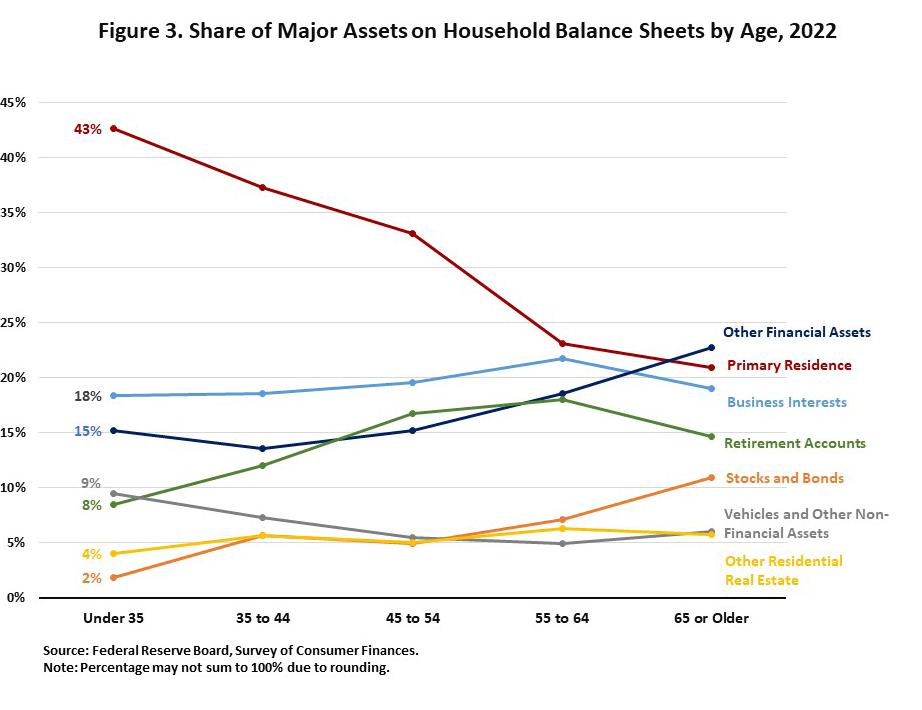

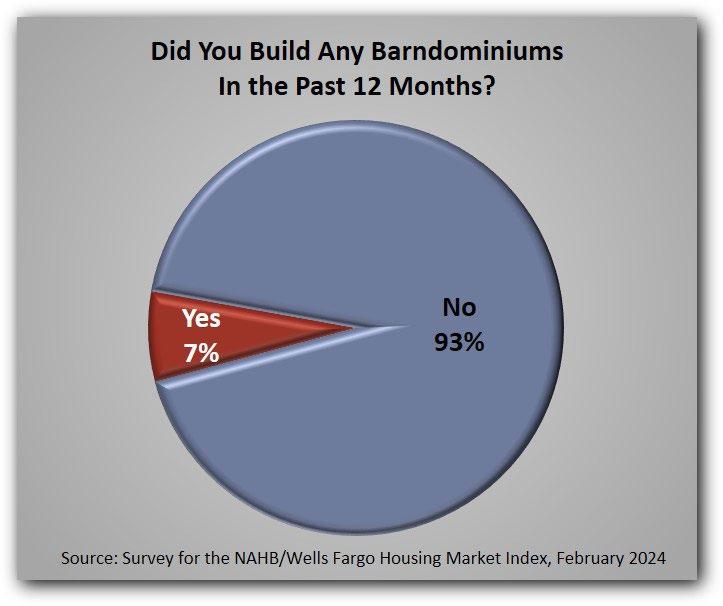

In Figure 2, the bars represent the distribution of major assets on household balance sheets by age categories in 2022.

The results shown in Figure 2 suggest that households generally accumulate more assets as they age. Total assets were $7.6 trillion for households under age 35, while they were $65.9 trillion for households aged 65 or older. The aggregate value of assets held by families where the head was aged 65 or older was approximately nine times larger than those held by families where the head was under age 35. The increases in the total assets among age groups indicate that the value of assets grows with age groups.

Moreover, the distribution of major assets on household balance sheets varies by age group. Across age groups where households were under the age of 65, the aggregate value of the primary residence was the largest asset category on these households’ balance sheets. For households aged 65 or older, the primary residence became the second largest asset category, less than other financial assets.

EYE ON HOUSING

February/March 2024 www.ncbia.com page 15

HOMEOWNERSHIP IS KEY to Household Wealth (cont.)

Although the aggregate value of the primary residence increases with age, partly reflecting higher homeownership rates across age categories, the aggregate value of the primary residence as a share of total assets declined with age, as shown in Figure 3. The decline in the share of total assets represented by the aggregate value of the primary residence was offset by growth in the share of other asset categories in aggregate, most notably stocks and bonds, other financial assets, and retirement accounts.

BY: JING FU

BY: JING FU

An analysis of the SCF reveals that higher educational attainment is associated with higher value of asset holdings. The aggregate value of assets held by households with a bachelor’s degree or higher was five times higher than the aggregate value of assets held by those with some college or associate degrees.

Notably, the primary residence remains the largest asset category for each educational attainment category. However, the aggregate value of the primary residence as a share of total assets varies by educational attainment categories. For households with a bachelor’s degree or higher, the aggregate value of the primary residence as a share of total assets was 23%, as these households held a greater amount of other assets, such as business interests, other financial assets, and retirement accounts. Meanwhile, for households with no high school diploma or GED, the primary residence accounted for half of their total assets.

EYE ON HOUSING

page 16 www.ncbia.com February/March 2024

Your Next Adventure Awaits.

Book your GETAWAY and GET up to 30% OFF with Pay Now*

Enjoy the open road with deals from your NAHB Avis and Budget Car Rental Savings Program. With the Pay Now feature members can save up to 30% off base rates on every rental, plus receive additional offers like dollars off, a complimentary upgrade or a free weekend day.

To make a reservations with Avis, visit: www.avis.com/nahb and use your AWD #G572900 when booking to save.

To book with Budget, visit: www.budget.com/nahb and use your BCD #Z536900 to apply savings.

*Terms Apply.

STATESMAN

Bob

Mary

SUPER SPIKE (250-499 SPIKE CREDITS)

Terry

Jack

Chris

Sara

ROYAL

Bill

Randy

RED

Dave

GREEN SPIKE (50-99 SPIKE

Jim

LIFE

BLUE

Our SPIKES are Our FOUNDATION

page 18 www.ncbia.com February/March 2024

YOU SPIKES!

THANK

SPIKE (500-999 SPIKE CREDITS)

698.25

Yost Dale Yost Construction

............................................. 543.00

H. Felton............. Guardian Title

Remodelers 303.75

Bennett Bennett Builders &

Kousma

297.50

Kousma

Insulation

Majzun Jr. Majzun

Co. 276.00

Construction

Majzun ..................... Majzun Construction Co............................ 267.50

SPIKE (150-249 SPIKE CREDITS)

Perritt Perritt Building Co 225.50

Hensley Lake Star Building & Remodeling 186.25

Jeff

K. Strauss Strauss Construction 180.50 Tom Lahetta Tom Lahetta Builders 173.50

SPIKE (100-149 SPIKE CREDITS)

Linna Sr. Linna Homes & Remodeling 138.50

Scott Greyhawk Holdings, LLC 137.00 Thomas Caruso Caruso Cabinets 117.75 Patrick Shenigo ShenCon Construction, LLC 111.00 Tom Sear Ryan Homes 110.75 Chris Majzun Sr. .......... Majzun Construction Co............................ 107.00

Jason

CREDITS)

Sprague Maloney & Novotny, LLC 99.00

Mead Maloney & Novotny, LLC 79.00

Kalizewski Grande Maison Construction 70.00 Jeremy Vorndran ......... 84 Lumber .................................................... 63.00

Schneider ............... Dollar Bank .................................................. 55.00

Chris

Aaron

Liz

SPIKE (25-49 SPIKE CREDITS) Tim King K. Hovnanian Homes 49.50 Steve Schafer Schafer Development 30.50 John Daly Network Land Title 27.50

SPIKE (6-24 SPIKE CREDITS) John Toth Floor Coverings International 17.00 Chris Collins Carter Lumber 16.00 Mark McClaine 84 Lumber 14.00 Ken Cassell Cassell Construction 13.50 Dave LeHotan .............. All Construction Services .......................... 12.00 John Blakeslee .............. Blakeslee Excavating, Inc ........................... 11.50 Steve Fleming .............. Shamrock Development ............................ 11.50 Ashley Oates 84 Lumber 10.00 Scott Kosman Lakeland Glass 9.50 Tim Hinkle Green Quest Homes 6.50 Jim Tipple Maranatha Homes 6.50 Lindsay Yost Bott......... Dale Yost Construction .............................. 6.00 Mike Meszes ................ DRC Construction ...................................... 6.00

EYE ON HOUSING CREDIT FOR BUILDERS REMAINS TIGHT, But Tightening is Less Widespread

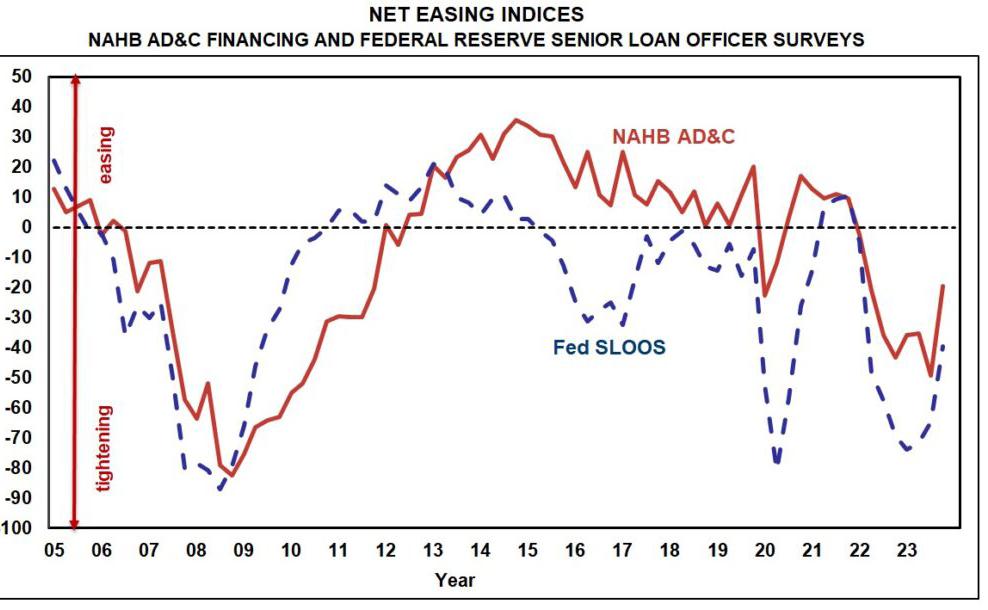

During the fourth quarter of 2023, credit for residential Land Acquisition, Development & Construction (AD&C) remained tight, according to both NAHB’s survey on AD&C Financing and the Federal Reserve’s . However, the tightening was not as widespread as it was in recent quarters. The net easing indices derived from both surveys were negative once again in the fourth quarter, indicating net tightening of credit, but not as negative as they were in the third quarter. The NAHB index posted a reading of -19.7, compared to -49.3 in the third quarter, while the Fed’s index posted a reading of -39.7 compared to -64.9 in the third quarter. Although both the NAHB and Fed indices have been in negative territory for eight consecutive quarters, the fourth quarter 2023 readings were as close to positive as either index has been since the first quarter of 2022.

According to the NAHB survey, the most common ways in which lenders tightened in the fourth quarter were by reducing the amount they are willing to lend (cited by 73% of the builders and developers who reported tighter credit conditions), increasing the interest rate on the loans (69%), and lowering the allowable Loan-to-Value or Loanto-Cost ratio (65%).

Meanwhile, results from the NAHB survey on the cost of the credit were mixed. Quarter-over-quarter, the average contract rate remained the same on loans for land acquisition at 8.31% but increased from 7.78% to 8.12% on loans for land development, and from 8.37% to 8.40% on loans for pre-sold single-family construction. In contrast, the average contract rate declined from 8.66% to 8.41% on loans for speculative single-family construction.

BY: PAUL EMRATH

The average initial points paid on the loans declined from 0.86% to 0.71% on loans for land acquisition and from 0.93% to 0.73% on loans for speculative single-family construction but increased from 0.58% to 0.60% on loans for land development, and from 0.86% to 1.08% on loans for pre-sold single-family construction that are tracked in the NAHB AD&C survey.

The above changes caused the average effective interest rates (rate of return to the lender over the assumed life of the loan, taking both the contract interest rate and initial points into account) to move in different directions. There was a relatively small decline (from 10.85% to 10.58%) on loans for land acquisition, and a more substantial decline (from 13.74% to 12.96%) on loans for speculative singlefamily construction. On the other hand, the average effective rate increased from 10.76% to 11.25% on loans for land development, and from 14.57% to 15.65% on loans for presold single-family construction.

More detail on credit conditions for builders and developers is available on NAHB’s AD&C Financing Survey web page.

February/March 2024 www.ncbia.com page 19

Exclusive Entertainment Discounts! Members have access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels, and much more. • Save up to 40% on Top Theme Parks Nationwide • Save up to 60% on Hotels Worldwide

Save up to 40% on Top Las Vegas & Broadway Show Tickets • Huge Savings on Disney & Universal Studios Tickets • Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more! Please visit https://memberdeals.com/nahb/?login=1

•

Danny Reaser, On Time Gutter, LLC

Kyle Brown, On Time Gutter, LLC

Steve Whitman, Advanced Comfort Systems

Jake Berger, All Construction Services

Kenneth Hutman, B.W. Plumbing Company

Tim Hinkle, Green Quest Homes, LLC

Jeff Reichert, J.L. Reichert Paving, Inc.

Max Denny, J&M Custom Construction, LLC

Jim Tipple, Maranatha Custom Homes, Inc.

John Daly, Network Land Title Agency

Tracy Goldsmith, Northern Ohio Basement Waterproofing, Inc.

Pamela Stewart Wells, Stewart's TV & Appliance

James Sturgill, Sturgill's Drywall, Inc.

Tom Lahetta, Tom Lahetta Builders, Inc.

Robert Palmer, Weed Pro

Thanks for Renewing!

Sorry to See You Go! © 2019 Hastings Mutual Insurance Company SS-1 (10/19) Select Contractors Building Your Business (800) 442-8277 www.hastingsmutual.com 404 E. Woodlawn Ave. Hastings, MI 49058 For more information contact: Broadened Coverage This coverage helps if there’s damage to property used by you or your employees that belongs to someone else. It has a limit of $2,500 per occurrence, with a $100 deductible. Builders Risk and Installation Floater “Floater” coverage is for anything that oats, or moves from place to place — like your supplies and machinery. It also covers damage to the structures you’re working on, including scaffolding, foundations, and more. This has a limit of $5,000, with a $250 deductible. Portable Tools Coverage on your tools has a limit of $1,000 per tool, to a maximum of $2,500. It also has a $500 deductible. The information referred to is not a policy. Refer to your policy for speci c coverage. The Nelson Agency, Inc. 116 4th St., Elyria, OH 44035 Phone: 440-323-8002 Fax: 440-323-8055 Drywallersinsurance1@prodigy.net A member of: Theresa Riddell (440) 420-1175 tmycps@oh.rr.com -ORBrett Adams (419) 515-0506 adamsb@sprouseagency.com

February/March 2024 www.ncbia.com page 21 Applying for Membership!

Do you want to opt-out of our referral program? Just email judie@ncbia.com page 22 www.ncbia.com February/March 2024

NAHB NOW

NAHB/Wells Fargo Housing Opportunity Index (HOI)

The NAHB/Wells Fargo Housing Opportunity Index (HOI) for a given area is defined as the share of homes sold in that area that would have been affordable to a family earning the local median income, based on standard mortgage underwriting criteria. Therefore, there are really two major components — income and housing cost.

Current Data

In all, just 37.7% of new and existing homes sold between the beginning of October and end of December were affordable to families earning the U.S. median income of $96,300. This is nearly identical to the 37.4% posted in the third quarter of last year, which was the lowest reading since NAHB began tracking affordability on a consistent basis in 2012.

The NAHB/Wells Fargo Housing Opportunity Index (2012-Current)

The NAHB/Wells Fargo Housing Opportunity Index: Complete History by Metropolitan Area (2012-Current)

The NAHB/Wells Fargo Housing Opportunity Index: History of Least and Most Affordable Areas

The NAHB/Wells Fargo Housing Opportunity Index:

Complete Listing by Affordability Rank

The NAHB/Wells Fargo Housing Opportunity Index:

Complete Listing, Sorted Alphabetically

The NAHB/Wells Fargo Housing Opportunity Index: Least and Most Affordable Areas by Population

The NAHB/Wells Fargo Housing Opportunity Index: Regional Listing by Affordability Rank

The NAHB/Wells Fargo Housing Opportunity Index: Regional Listing, Sorted Alphabetically

Methodology

For income, NAHB uses the annual median family income estimates for metropolitan areas published by the Department of Housing and Urban Development. NAHB assumes that a family can afford to spend 28 percent of its gross income on housing; this is a conventional assumption in the lending industry. That share of median income is then divided by twelve to arrive at a monthly figure.

On the cost side, NAHB receives every month a CD of sales transaction records from CoreLogic. The data include information on state, county, date of sale, and sales price of homes sold. The monthly principal and interest that an owner would pay is based on the assumption of a 30-year fixed rate mortgage, with a loan for 90 percent of the sales price (i.e., 10 percent downpayment). The interest rate is an average of the 30-year fixed effective rate from Freddie Mac’s Primary Mortgage Market Survey during that quarter. In addition to principal and interest, cost also includes estimated property taxes and property insurance for that home. This is based on metropolitan estimates of tax and insurance rates from the most recent American Community Survey. Mortgage insurance is not currently a component of the HOI.

Therefore, for each record, there is an estimated monthly cost and available income share. The HOI is the share of records in a metropolitan area for which the monthly income available for housing is at or above the monthly cost for that unit.

page 24 www.ncbia.com February/March 2024

SOLID ECONOMIC DATA INDICATE a Promising Outlook for Housing

The economy continues to post solid gains, leading the bond market to reverse earlier bets that the Federal Reserve would begin cutting the benchmark federal funds interest rate as early as March. Better-than-expected economic performance will reduce the rate of improvement for inflation data, meaning the Fed will need to maintain its long-stated monetary policy of higher rates for longer. In January, the Consumer Price Index increased by 3.1%, following a 3.4% increase in December.

Improved expectations for macroeconomic conditions led the 10-year Treasury to test a 4.3% rate this week, after starting the year just below 3.8%. This has led the 30-year fixed-rate mortgage to rise, albeit by a smaller amount, from 6.6% to approximately 6.8% over the same period. Nonetheless, the NAHB forecast continues to call for mortgage rates to move moderately lower over the course of 2024 and 2025 before settling in the high-5% range.

Ongoing elevated interest rates left the NAHB/Wells Fargo Housing Opportunity Index (HOI) at a 37.7 reading, meaning only 37.7% of new and existing home sales during the fourth quarter of 2023 were affordable for a medianincome household. (This was the final edition of the HOI, which will be replaced in May by a new affordability index: the Cost of Housing Index.) The final read of the HOI was near a multidecade low for housing affordability because of both high interest rates and limited housing inventory.

Despite the recent uptick for interest rates, a combination of several key factors — including expectations that mortgage rates will continue to moderate in the coming months, the prospect of future rate cuts by the Federal Reserve later this year, and a protracted lack of existing inventory — provided a boost to builder sentiment for the third straight month. Builder confidence in the market for newly built single-family homes climbed four points to 48 in February, according to the NAHB/Wells Fargo Housing Market Index. This is the highest level since August 2023, and it suggests gains for single-family starts ahead.

BY: ROBERT DIETZ

January construction data suggest competing directions for multifamily and single-family construction volume in 2024. For the first month of the year, single-family construction starts decreased 4.7% to an annual rate of 1 million. However, single-family starts are up 22% compared to a year ago, and single-family permits have increased 1.6% to an annual rate of 1.02 million — the highest since May 2022. Meanwhile, multifamily construction starts decreased 35.6% to an annualized 327,000 pace in January, and multifamily permits decreased 7.9% to an annualized 455,000 pace — their lowest since April 2020.

Residential building material costs may heat up in 2024 as single-family construction volume increases. The latest Producer Price Index indicated that prices of residential building materials increased 1.28% between December 2023 and January 2024. This was the largest monthly change for the index since March 2022.

Finally, new data indicate that the long-run demand for home construction may be larger than many analysts expect. The Congressional Budget Office released new 30year population growth projections that include substantial upward revisions. The latest estimates include an additional 8.9 million people in 2053, a 2.4% increase from its previous forecast. A faster growing population will undoubtedly increase demand for housing (including both for-sale and for-rent multifamily and single-family), creating added pressure on the persistently underbuilt housing market.

EYE ON THE ECONOMY

February/March 2024 www.ncbia.com page 25

WILL STRONG ECONOMIC GROWTH Affect 2024 Fed Rate Cuts?

Economic growth has outperformed consensus forecasts (including NAHB’s) as the economy continues to expand despite elevated interest rates. Real gross domestic product (GDP) increased at an annual rate of 3.3% in the fourth quarter of 2023, following a striking 4.9% gain in the third quarter. This marks the sixth consecutive quarter of growth. NAHB’s forecast was for growth near a 1% annualized rate. For all of 2023, real GDP increased 2.5%, slightly better than NAHB’s forecast of 2.4%.

The labor market continues to show strong performance as well. Total nonfarm payroll employment increased by 353,000 in January, faster than the upwardly revised increase of 333,000 jobs in December. Despite restrictive monetary policy, about 6.8 million jobs have been created since March 2022, when the Fed enacted the first interest rate hike of this cycle. In January, the unemployment rate remained at 3.7% for the third consecutive month. In the last 12 months, residential construction has added 60,100 jobs on a net basis, including 2,700 jobs in January. The number of open construction sector jobs was relatively unchanged in the most recent data, declining from 470,000 in November to a still elevated 449,000 in December. A recent, increasing trend for unfilled construction sector positions is consistent with the industry’s ongoing skilled labor shortage.

Do these strong economic growth and labor market reports suggest inflation risk has returned? According to the Federal Reserve’s January meeting, that does not appear to be the case. For the fourth consecutive meeting, the Fed’s monetary policy committee held the federal funds rate constant at a top target of 5.5%. The Fed is now setting the ground for rate cuts later in 2024 by noting that risks to its inflation and labor market objectives have moved into “better balance.” The strong economic data almost certainly rule out a first rate cut for this cycle in March. However, two or three rate cuts during the second half of 2024 appear likely as inflation moderates and the Fed cuts nominal rates to maintain constant, inflation-adjusted monetary policy. For long-term rates, the opposing pressure from strong economic performance (upward) and expected nominal rate easing from the central bank (downward) are likely to offset in the near-term, leaving the 10-year Treasury rate near 4% and mortgage rates in the mid-6% range.

BY: ROBERT DIETZ

Ongoing challenging affordability conditions are restraining sales activity for the overall housing market. Consequently, the overall homeownership rate fell to 65.7% in the final quarter of 2023, while the rate for those under age 35 decreased to 38.1%. This age group, particularly sensitive to mortgage rates and the inventory of entry-level homes, saw the largest decline among all age categories.

And while a persistent lack of existing home inventory is depressing existing home sales, it helped boost sales of newly built, single-family homes by 8% in December. On an annual basis, new home sales totaled 668,000 in 2023, up 4.2% from 2022. New home sales will face increased competition in 2024 as existing home inventory increase with a gradual loosening of the mortgage rate lock-in effect.

Besides increased competition from the resale market, builders noted in a recent NAHB survey several more of the top challenges they expect to face in 2024. According to the January NAHB/Wells Fargo Housing Market Index, 77% of builders expect high interest rates to be a problem in 2024 (down from 90% in 2023). Only about half (52%) of builders cited rising inflation as a concern for 2024 (down considerably from 83% in 2023). And the issue experiencing the largest rise of concern, dwindling supply of lots, moved from being cited by 57% of builders in 2023 to 64% in 2024. This factor is a natural consequence of improving demand and the lagging effects of tight construction financing, particularly for private builders.

EYE ON THE ECONOMY

page 26 www.ncbia.com February/March 2024

THE NAHB CONVENTION: a Great Event

I’m off to the IBS 2024. This event is a showcase for our industry and the many services and benefits they provide for all in our business across America. Tens of thousands of members will attend and over one million square feet of exhibitor space will be showcasing the latest products available. Moreover, the educational sessions are on the cutting edge of the information you need to be successful.

NAHB, our federal partner, will be reviewing the latest on the legislative, legal, and regulatory front. Let me assure you all those agendas are full. These agendas are a great example of your association asserting and advocating on your behalf. A big question, now in the formulation stages, is who may be controlling the federal government next year? There is a lot to think about on that point.

OHBA continues its appointed path to represent the industry before state government. In just a few weeks, we will be presenting an up-to-the-moment status on many important issues. The upcoming Ohio primary will result in some, possibly, game changing results. We will be discussing that activity as well.

We look forward to seeing you in Columbus March 11-12, 2024, at our Spring Organizational Meeting at the Hilton Easton.

Ohio Home Builders Association

Phone- 614/228-6647

by Vincent J. Squillace, CAE, OHBA Exec. VP

by Vincent J. Squillace, CAE, OHBA Exec. VP

OHBA EXECUTIVE VP COLUMN

February/March 2024 www.ncbia.com page 27

2024 Home & Remodeling Show PHOTO GALLERY page 30 www.ncbia.com February/March 2024

February/March 2024 www.ncbia.com page 31

page 32 www.ncbia.com February/March 2024

February/March 2024 www.ncbia.com page 33

Fall protec+on & working from heights

The Occupa*onal Safety and Health Administra*on's (OSHA's) Fall Protec*on standard focuses primarily on the construc*on industry. However, it pertains to all companies regardless of their opera*on if they perform work at heights. Although the standard falls under the Construc*on Industry, OSHA can use the Construc*on Fall Protec*on standard against any company if they iden*fy a poten*al fall hazard. General Requirements for Fall Protec*on, 29 CFR 1926.501 and Training Requirements for Fall Protec*on, 29 CFR 1926.503 are almost always found on OSHA’s Top Ten viola*ons, year aRer year. It is essen*al to evaluate if your company falls under these standards.

Since the Fall Protec*on standard includes a large number of individual regula*ons, it is important to understand what the specific rules are that are commonly violated. Here are the top 5 sub-sec*ons OSHA is ci*ng companies for under General Requirements for Fall Protec*on.

29 CFR 1926.501, General Requirements for Fall Protec*on

1) 1926.501(b)(13) – States that anyone performing construc*on work at heights of 6 feet or more shall be protected from falls using approved guardrail systems, safety net systems, or personal fall arrest systems.

2) 1926.501(b)(1) – Employees working on plaXorms 6 feet or higher with unprotected sides or edges shall be protected by guardrail systems, safety net systems, or personal fall arrest systems.

3) 1926.501(b)(10) – Employees engaged in roofing ac*vi*es on low-slope roofs with unprotected sides and edges 6 feet or more above lower levels shall be protected by use of a guardrail systems, safety net systems, or personal fall arrest systems.

4) 1926.501(b)(11) – Steep roofs that are 6 feet or higher from a lower level shall be protected from falling by guardrail systems with toeboards, safety net systems or personal fall arrest systems.

5) 1926.501(b)(4) – Holes- Each employee on walking/working surfaces shall be protected from falling through holes (including skylights) more than 6 feet above lower levels, by personal fall arrest systems, covers, or guardrail systems erected around such holes. Addi*onally, employees must be protected from tripping hazards and employees below must be protected from falling objects from holes.

These five cita*ons tell us that if your employees are working at heights 6 feet or higher in the construc*on industry, you must have some type of fall protec*on. Keep in mind that this is for Construc*on. If you are in the General Industry, the height is 4 feet, the Shipyard Industry is 5 feet and the Longshoring Industry is 8 feet.

OSHA suggests three types of fall protec*on employers can use to protect workers.

1) Personal fall arrest systems – System used to safely stop (arrest) a worker who is falling from a working level. Specifics on Fall Arrest Systems can be found at 29 CFR 1926.502(d).

2) Safety net systems - Safety net systems are designed to catch a falling worker. Safety nets are intended to decrease the fall distance, absorb the energy of a fall, and reduce the likelihood or seriousness of an injury. Specifics on Safety Net Systems can be found at 29 CFR 1926.502(c).

3) Guardrail systems – Guardrail systems are barriers erected to prevent workers from falling to lower levels. Specifics on Guardrail Systems can be found at 29 CFR 1926.502(b).

29 CFR 1926.503, Training Requirements for Fall Protec*on

Here are the top five sub-sec*ons OSHA is ci*ng companies for under Training Requirements for Fall Protec*on.

1) 1926.503(a)(1) –Employees who are exposed to fall hazards must be appropriately trained on how to recognize and correct those hazards.

2) 1926.503(b)(1) – The wriaen cer*fica*on record shall contain the name or other iden*ty of the employee trained, the date(s) of the training, and the signature of the person who conducted the training or the signature of the employer.

3) 1926.503(a)(2) – Employer shall ensure each employee has been trained, as necessary, by a competent person. (94) Competent Person - one who is capable of iden9fying exis9ng and predictable hazards in the surroundings or working condi9ons which are unsanitary, hazardous, or dangerous to employees, and who has authoriza9on to take prompt correc9ve measures to eliminate them.

4) 1926.503(c)(3) – Inadequacies in an affected employee's knowledge indicate that the employee has not retained the required understanding or skill.

5) 1926.503(c) – Retraining. If you feel an employee does not have the understanding or required skill aRer training, they shall be retrained.

These 5 cita*ons are telling us that employees were not trained in using fall protec*on, unable to iden*fy a poten*al fall hazard and unable to retain the knowledge of fall hazards, even aRer the training. Addi*onally, employers failed to document training for employees.

Fall protec*on and training con*nue to be a serious problem in the workplace and they con*nue to appear on OSHA’s Top Ten list. To iden*fy poten*al hazards in your workplace or the job site, compare the cita*ons above and see if your organiza*on complies with them. If you iden*fy any gaps, take the necessary steps to close those gaps, protect employees and minimize poten*al fines.

If you need help iden*fying poten*al hazards in your workplace, please contact Andy Sawan, Risk Services Specialist at Sedgwick at andrew.sawan@sedgwick.com or 330-819-4728.

Employer Handicap Reimbursement Program name change

The Bureau of Workers’ Compensa3on (BWC) Employer Handicap Reimbursement Program is designed to encourage employers to hire and retain employees with pre-exis3ng medical condi3ons. In some circumstances the employer may be eligible for reimbursement of a percentage of claim charges if an employee with a pre-exis3ng condi3on suffers a lost 3me industrial injury or occupa3onal disease and documenta3on supports that the preexis3ng condi3on delayed the employee’s recovery.

The BWC has recently proposed terminology changes related to this program. Effec3ve April 6, 2023, Ohio Revised Code 4123.343 was revised, and the term “handicapped employee” was replaced with “employee with a disability”. To align with the 2023 change, the BWC is upda3ng references from “handicap reimbursement” to “disability relief”. These updates affect code terminology only and do not change program eligibly criteria.

To prepare for this upcoming terminology change, Sedgwick has begun upda3ng correspondence materials to reflect the change from “handicap reimbursement” to “disability relief” and expect those updates to be completed soon. Although the program name is changing, Sedgwick cost containment services will con3nue to be best-inclass. Our dedicated team of experienced disability relief colleagues will con3nue to review eligible claims for relief opportunity, file disability relief applica3ons, and achieve favorable outcomes on behalf of our clients.

If you have any ques3ons, contact our Sedgwick program manager, Dominic Po3na at 614-579-4723 or dominic.po3na@sedgwick.com

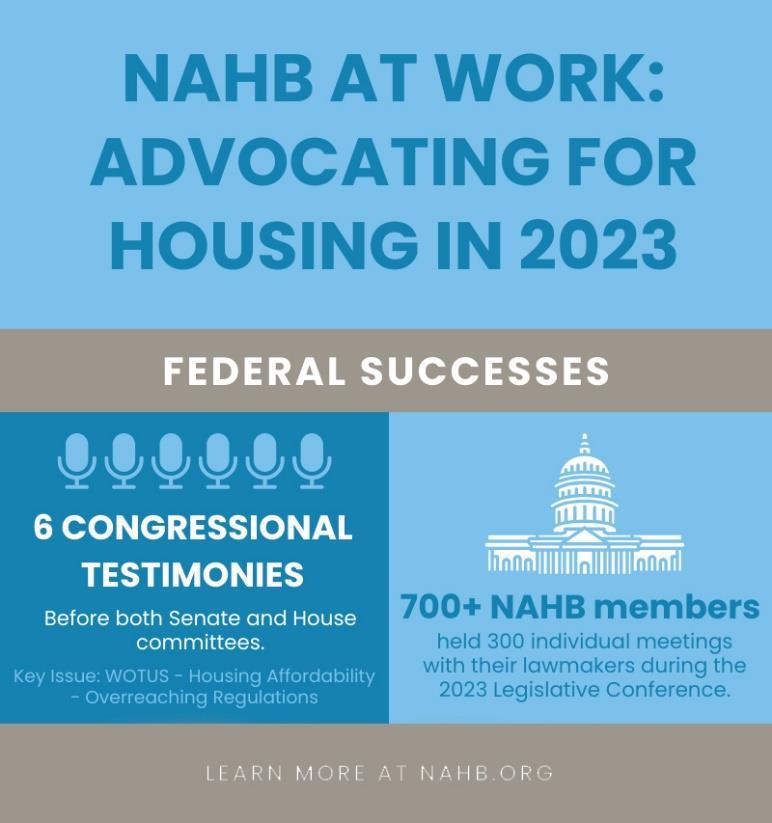

NAHB at Work: Advocating for Housing

NAHB’s Government Affairs Team Posts Key Wins for Our Members in 2023

In a year of hyper-partisan gridlock that produced less than two dozen bills enacted into law (the fewest number in decades), NAHB was able to establish a formidable presence on Capitol Hill and move the ball forward on a number of high -priority legislative objectives.

Congressional Hearings: A Quick Start Out of the Gate

In a sign of NAHB’s clout, the association was front and center at two congressional hearings at the start of the new Congress.

NAHB Chairman Alicia Huey on Feb. 8 testified before House lawmakers on the Biden administration’s new waters of the U.S. (WOTUS) rule, calling it “fatally flawed” and urging lawmakers to direct the Environmental Protection Agency to implement a new durable and practical definition of WOTUS. Texas builder Frank Murphy testifie d before the House Small Business Committee against the WOTUS rule on March 8, and these efforts led to both the House and Senate using a rarely used Congressional Review Act to pass a joint resolution of disapproval calling on Biden to rescind the WOTUS rule .

On Feb. 9, Chief Economist Robert Dietz testified before the Senate Banking Committee on the barriers the industry faces to increase the production of quality, affordable housing. Dietz said that boosting housing production is the best way to ease the affordability crisis and called on Congress to pass legislation to alleviate supply -side bottlenecks, ease burdensome federal regulations and promote careers in the skilled trades.

From February through November, NAHB testified before Congr ess six times on a host of issues of importance to the housing industry, including the need to:

• Help builders boost the housing supply to ease growing housing affordability challenges;

• Repeal inefficient regulatory rules; and

• Speed up permit approval times .

Page 1 | 4

Legislative Conference

Yields Key Wins

On June 7, more than 700 NAHB members participated in our annual Legislative Conference and went to Capitol Hill to discuss critical housing issues with their lawmakers. At the top of the agenda was the need to:

• Increase the production of distribution transformers and oppose efforts by the Department of Energy (DOE) to increase the energy conservation standards for the production of transformers because it will severely exacerbate the current supply shortage.

• Curb excessive regulations that are harming housing affordability.

• Take a stand against excessive energy codes and repeal $1 billion in grants provided to state and local governments to ad opt updated energy codes that are more costly and restrictive.

• Support job training programs to help ease the construction industry’s severe workforce shortage and to fully fund the Job Corps program, which is a vital source of skilled labor for our industry.

It is no coincidence that one week after the Legislative Conference, the House approved the REINS Act. The legislation would restore meaningful congressional oversight to regulator y rulemaking by requiring Congress to approve all federal agency regulations that have an annual economic impact of $100 million or more.

Gas Stoves

• Again, days after the Legislative Conference, the House approved two NAHB-supported gas stove bills that would defend consumer access to gas stoves and ensure that Americans have the option of using natural gas to fuel their homes.

Transformers

• On June 15, Rep. Richard Hudson introduced the Protecting America’s Distribution Transformer Supply Chain Act (H.R. 4167), which would repeal the DOE’s authority to implement or enforce any energy efficiency standards for distribution transformer s for the next five years. Thanks to NAHB’s efforts, the House Energy and Commerce Committee passed H.R. 4167 in December

Page 2 | 4

• The Senate Appropriations Committee in July passed la nguage that includes $1.2 billion in supplemental funding to boost the production of distribution transformers.

• And at NAHB’s urging, 47 bipartisan senators on June 1 sent a letter to DOE Secretary Jennifer Granholm that called on the DOE not to move forward on its proposed transformer rule because it will exacerbate an already acute supply chain shortage.

Codes

• NAHB was able to get two bills passed in the House the Lower Energy Costs Act (H.R. 1) and the Limit, Save, Grow Act of 2023 (H.R. 2811) that would repeal the $1 billion energy code grant program. Companion legislation to H.R. 2811 (the Homeowner Energy Freedom Act, S. 2806) was introduced in the Senate in late summer.

• At NAHB’s urging, the House on Dec. 11 passed the Promoting Resilient Buildings Act (H.R. 5473), which would allow FEMA to consider whether a jurisdiction has adopted one of the two latest editions of building codes, rather than just the single latest edition , when awarding funds from its pre-disaster mitigation program.

• NAHB continues to pursue legislative solutions to prevent a proposed rule that sets the 2021 IECC as the minimum energy standard for HUD - and USDA-financed new construction housing. Twenty-six senators sent a letter to HUD Sec. Marcia Fudge and USDA Sec Tom Vilsack urging them to reconsider this proposal, and legislation to prevent implementation of this rule was narrowly defeated in the Senate.

Tax Policy

• The House and Senate on May 11 introduced the Affordable Housing Credit Improvement Act, legislation that would improve the Low-Income Housing Tax Credit and allow builders to increase production of badly needed affordable housing. This bill garnered the most bipartisan support of any tax bill in this current session of Congress.

Workforce/Labor

• The House Committee on Education and the Workforce on Dec. 12 approved NAHBsupported legislation (A Stronger Workforce for America Act, H.R. 6655) that would reaffirm congressional support for Job Corps and help address the nation’s skilled labor shortage. NAHB also fought for Job Corps funding through the appropriations process.

State and Local: NAHB Gives Nearly $300,000 to 18 HBAs in 2023

While NAHB has established a well -deserved reputation on Capitol Hill as an elite power player that wields influence to get pro -housing bills introduced and passed, the association’s Intergovernmental Affairs team is also delivering concrete results by fighting every day on

Page 3 | 4

behalf of our state and local home builders associations on major issues that affect our members’ bottom lines. In 2023, NAHB tra cked 360 housing-related bills across all 50 states. Through its State and Local Issues Fund , which provides financial assistance to HBAs involved in advocacy efforts on issues affecting the affordability of homeownership, NAHB distributed $298,000 to 18 HBAs in 14 states during 2023. Here are a few notable success stories:

• The HBA of Delaware worked to overcome potential mandatory fire sprinkler installation requirements in all new construction in New Castle County, Del., which would have added thousands of dollars to the cost of a home.

• NAHB helped the HBA of Greater Portland to defeat a ballot measure that would have established a countywide 0.75% capital gains tax to fund a tenant resource program designed to provide legal representation for tenants in eviction proceedings.

• The HBA of Greater Austin worked with the Austin City Council to pass new code amendments for the first phase of the “Home Options for Middle-Income Empowerment” Initiative. The approved code amendments are among a series of updates to the city’s Land Development Code, which governs land-use regulations in Austin, intending to provide more housing types and increase housing supply within single-family zoned areas of Austin.

BUILD-PAC

BUILD-PAC, NAHB’s political action committee , helps elect the most qualified pro -housing, probusiness candidates to Congress. By supporting Democratic and Republican candidates, BUILDPAC opens doors on Capitol Hill an d ensures housing remains a top priority in Washington.

As we look to the pivotal 2024 November elections, BUILD -PAC at the end of 2023 was more than halfway to its goal of raising $3.25 million for pro -housing candidates in this election cycle.

Page 4 | 4

2024 MEMBER DIRECTORY & CONSUMER GUIDE ncbia.com OurNCBIAMembers are OurNCBIAMembers are Reputable & Dependable Reputable & Dependable

NAHB MEMBERS SAVE 25% off Houzz Pro Call 1 (888) 225-3051 today! Houzz Pro is one simple solution for builders and remodelers. Attract and win better clients, manage projects and teams, and deliver a standout customer experience.

Tom’s Country Place 3442 Stoney Ridge Road, Avon Carl Harris 2024 Chairman March 20 Wednesday 5 - 7 PM March General Membership Meeting

Carl

C a r l H a r r i s w i l l P r o v i d e V a l u a b l e I n s i g h t s i n t o t h e I m p o r t a n c e o f M e m b e r s h i p , t h e F e d e r a t i o n a n d t h e G o a l s o f N A H B . T h i s w i l l b e a g r e a t O p p o r t u n i t y f o r y o u t o G a i n K n o w l e d g e a n d U n d e r s t a n d i n g o f t h e I n d u s t r y a n d O b j e c t i v e s . 3/7/24

Meet

Harris

RSVP & CANCELLATIONS BY MARCH 14, 2024

REMEMBER, A RESERVATION MADE, IS A RESERVATION PAID

COMPANY NAME

ATTENDEE(S) NAME

EMAIL

# OF MEMBER ATTENDEES @ $45 EACH

# OF NON-MEMBER ATTENDEES @ $65 EACH

TABLETOP DISPLAY @ $150 EACH

SPONSORSHIP

TOTAL AMOUNT DUE

INVOICE VISA/MC/AMEX CHECK ENCLOSED CALL NCBIA OFFICE WITH CREDIT CARD INFORMATION. ($5.00 CONVENIENCE FEE FOR CREDIT CARDS.)

NAHB SPEAKER SPONSOR

NAHB SPEAKER SPONSOR

Includes 2 tickets to event, mic time, (including speaker introduction) tabletop, logo on flyer, promotion in NCBIA print & online media, signage at the event.

EVENT SPONSOR EVENT SPONSOR

Includes 1 tickets to event, mic time, tabletop, logo on flyer, promotion in NCBIA print & online media, signage at the event.

DRINK SPONSOR DRINK SPONSOR

Includes logo on flyer, promotion in NCBIA print & online media, signage at the event.

DESSERT SPONSOR DESSERT SPONSOR

Includes logo on flyer, promotion in NCBIA print & online media, signage at the event.

TABLE SPONSOR TABLE SPONSOR

Includes logo on flyer, promotion in NCBIA print & online media, signage at the event.

$500 $500 $300 $300 $250 $250 $200 $200 $150 $150

R e g i s t e r O n l i n e : R e g i s t e r O n l i n e : w w w . n c b i a . c o m w w w . n c b i a . c o m B y E m a i l : B y E m a i l : j u d i e @ n c b i a . c o m j u d i e @ n c b i a . c o m B y P h o n e : 4 4 0 . 9 3 4 . 1 0 9 0 B y P h o n e : 4 4 0 . 9 3 4 . 1 0 9 0 B y M a i l : 5 3 2 1 M e a d o w L a n e C o u r t , S u i t e 2 3 B y M a i l : 5 3 2 1 M e a d o w L a n e C o u r t , S u i t e 2 3 S h e f f i e l d V i l l a g e , O H 4 4 0 3 5 S h e f f i e l d V i l l a g e , O H 4 4 0 3 5 MARCH GENERAL MARCH GENERAL MEMBERSHIP MEMBERSHIP MEETING MEETING

WEDNESDAY WEDNESDAY MARCH 20, 2024 MARCH 20, 2024 5-7 PM 5-7 PM 3/7/24

CUSTOMER NAME Earn Speedy Rewards on eligible purchases at Speedway. Special Association Discount for the North Coast Building Industry Association SuperFleet Mastercard® Association Fueling Program A fuel card program designed with associations in mind. Call Holden Moll at 1-760-918-5933 or email holden.moll@fleetcor.com to start earning your association savings! Be sure to reference the North Coast Building Industry Association for your special 25¢ discount. EARN AN ADDITIONAL 25¢ PER GALLON!† • Save 5¢ per gallon at Speedway locations* • Over 3,400 fueling locations in the U.S. • Over 175,000 locations nationwide that accept Mastercard cards** • Custom card controls and increased security • Online reporting and account management †Limited time offer valid for new Speedway SuperFleet Mastercard applications received from 3/7/2022 through 12/31/2022. New approved accounts will earn 25 cents per gallon rebate on Speedway fuel purchases in the first three months after account setup. Rebates are cents per gallon based on the number of gallons purchased at Speedway locations per calendar month. The maximum promotional rebate in any one-month period, regardless of billing terms, is $500. Rebates are subject to forfeiture if account is not in good standing. *Rebates are cents per gallon based on the number of gallons purchased at Speedway locations per calendar month. Rebates will be reflected on your billing statement in the form of a statement credit. Not valid on aviation, bulk fuel, propane or natural gas purchases. Rebates are subject to forfeiture if account is not in good standing. Program pricing is subject to change any time beginning 12 months after sign-up. **Please see Client Agreement – at www.fleetcor.com/terms/superfleet-mc – for rate, fee and other cost and payment information. Fuel purchases at locations other than Speedway locations are subject to an out-of-network transaction fee. The SuperFleet Mastercard® is issued by Regions Bank, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. © 2022 FLEETCOR, P.O. Box 1239, Covington, LA, 70434.

Fleet Savings Made Easy

Perfect fit for mid-sized to larger fleets that need the added convenience of fueling where Mastercard® is accepted. With the 7-Eleven Commercial Fleet Mastercard®, your fleet can customize reports for a complete fuel management solution.

Rebates & Savings

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Security & Fraud Controls

Enjoy the security of advanced card prompts.

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse.

Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

Contact your sales representative today! Name

Online Control & Visibility

Set card controls and access detailed reporting online anytime.

Th e 7-Eleven Comm er ci al Fl ee t M ast er ca rd

*Limited time offer for new 7-Eleven Commercial Fleet Mastercard applications received from 12/04/2023 through 2/29/2024. Once gallons purchased at 7-Eleven and Speedway locations in a calendar month reach 100, earn a 30¢ per gallon rebate on every gallon purchased at 7-Eleven & Speedway locations in each such calendar month for the first three months after account setup. The maximum promotional rebate in any one-month period is $1,200. To receive rebates, invoice must be paid in full and on time. Rebates will not apply to returns or chargebacks. Standard 6 cents per gallon rebate offer valid for first 6 months after account setup. **Fuel purchases at locations other than 7-Eleven or Speedway locations are subject to an out-of-network transaction fee. Please see Client Agreement – at www.fleetcor.com/terms/7-Eleven-mc – for rate, fee and other cost and payment information. The 7-Eleven Commercial Fleet Mastercard® is issued by Fifth Third Bank, National Association, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. ©2024 FLEETCOR, P.O. Box 1239, Covington, LA, 70434. LIMITED TIME OFFER! Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.* Holden Moll 760.918.5933 holden.moll@fleetcor.com

The 7F LEET Diesel Network Ma stercard ® Customize and download cost and performance reports monthly or in real-time. Monitor transactions and manage your account online, in real-time. Use card prompts to help prevent misuse. Simple online access. Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.** Online Control & Visibility Set card controls and access detailed reporting online anytime. Security & Fraud Controls Enjoy the security of advanced card prompts. Network Discounts Save an average of 53cpg on truck diesel lane gallons fueled in the 7FLEET Diesel Network.* *Average savings of 53 cents per gallon in the 7FLEET Diesel Network based on actual 7FLEET Diesel Network client transactions for Q4 of 2022. Visit www.7fleetnetwork.com/locations for a full listing of 7FLEET Diesel Network sites. Truck lane diesel transactions made with the 7FLEET Diesel Network Mastercard at AMBEST Travel Center locations will receive a Cost Plus discount when purchased at the truck lanes. Visit https:// am-best.com/Travel-Centers/Location-Map for a full listing of AMBEST sites. Not valid on unleaded, aviation, bulk fuel, propane, natural gas, or non-truck lane diesel purchases. **Please see Client Agreement – at www.fleetcor.com/terms/7-Eleven-dn – for rate, fee and other cost and payment information. Fuel purchases at locations other than 7-Eleven or Speedway locations are subject to an out-of-network transaction fee. The 7FLEET Diesel Network Mastercard® is issued by Regions Bank, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. © 2023 FLEETCOR, P.O. Box 1239, Covington, LA, 70434. Contact your sales representative today! Fueling your fleet for the road ahead. Perfect for diesel fleets that rely heavily on high speed truck diesel lanes for fuel. The 7FLEET Diesel Network Mastercard offers significant discounts on diesel at the over 260 locations that make up the 7FLEET Diesel Network as well as discounts on commercial truck lane diesel across the AMBEST network. * Name Phone holden.moll@fleetcor.com Email Holden Moll 1-760-918-5933 Save an average of 53¢ per gallon* on truck diesel lane gallons fueled in the 7FLEET Diesel Network.

7-Eleven Fleet Card Program Application

Please send the application to

(“FLEETCOR”),

(“Account”) on behalf of the company identified above (“Client”); (b) FLEETCOR may obtain Client’s credit report and check

this Application or periodically evaluating any resulting Account’s creditworthiness; (c) this Application is subject to approval and acceptance by FLEETCOR; (d) if the Application is approved by FLEETCOR in Louisiana, the resulting Account: (i) will be governed by Louisiana law; (ii) will not be a revolving credit account and the Amount Due/Total Amount Due shown on each Account Statement will be due and payable on the Due Date shown on the Statement; (iii) will be used solely for commercial purposes and not for personal or household purposes; (iv) will be suspended, and the Client’s redit history may be reported to credit reporting agencies, if the Client’s unpaid balance ever meets the Account’s Credit/Spend Limit; and (e) acceptance, signing (in whatever form), or use of any of the Cards issued to Client will constitute Client’s acceptance of the Client Agreement available at www.fleetcor.com/terms/7-Eleven-mc or www.fleetcor.com/terms/7-Eleven-dn

Equal Credit Opportunity Act Notice. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided that the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The federal agency that administers compliance with this law concerning this creditor is the Federal Trade Commission, Equal Credit Opportunity Act, Washington, D.C. 2 0580.

FLEETCOR considers your privacy important. View our privacy policy available at www.fleetcor.com/privacy-policy to find out more.

I agree to the Application Terms and the Client Agreement (Please check box) ☐

BUSINESS

OWNER(S) / PERSON WITH SIGNIFICANT MANAGEMENT RESPONSIBILITY – Required.

To help fight financial crimes, the U.S. Department of Treasury require financial institutions to obtain, verify, and record information about beneficial owners of entities opening accounts. Beneficial owners are persons who, directly or indirectly, own 25% or more of the entity. We may use third-party resources to verify your identity. For questions about this regulation and how FLEETCOR uses and protects this data, please speak with your sales representative.

Patriot Act Notice. Section 326 of the USA PATRIOT Act mandates that

verify and record certain information about you (the Client, Authorized Representative, or anyco-maker or guarantor) while processing this Application.

Beneficial

holden.moll@fleetcor.com BUSINESS INFORMATION – Required. Legal Company Name (limit to 28 characters)* Subsidiary or DBA (limit to 20 characters) Create a 5 Digit Account Security Code (Required for card activation & customer service needs)* Primary Contact First Name* Last Name* Title* Card Delivery Street Address 1 (No PO boxes)* Card Delivery Street Address 2 City* State* ZIP* Company Billing Street Address 2 (If different from card delivery address) Company Billing Street Address 2 City State* ZIP Business Phone #* Cell Phone# Fax # Type of Business* Years of Business* Full Time Employees* Estimated Monthly Charges/Spending ($)* Estimated Monthly Gallons* # of Vehicles* # of Drivers* # of Cards Needed* Statement Delivery Method: ☐Electronic ☐ Paper Email Address* Site ID#* Tax ID#* Type of Organization*– If your organization is any type other than Sole Proprietorship, Public Corporation, or Government & Education, you must complete the Business Owner Section below. ☐ Sole Proprietorship ☐ Partnership ☐ Public Corporation ☐ Private Corporation ☐ Non-Profit ☐Government & Education ☐ LLC ☐LLP NOTE - At FLEETCOR’s discretion, we may require CPA Reviewed or Audited Financial Statements during the Credit review. AUTHORIZED REPRESENTATIVE – Required. Application Terms: By signing this Application, the Authorized Representative represents, warrants, and agrees that:

c

an unsecured, partially secured, or fully secured line

credit

Client’s credit standing

(a) he or she is authorized to apply to FLEETCOR TechnologiesOperating Company, LLC

a Louisiana limited liability

ompany, for

of

when processing

FLEETCOR

Owner (Individuals who own 25% or more of a Legal Entity)* ☐ Not Applicable, Sole Proprietor,

Entity,

or Public Corporation First Name* Middle Initial Last Name* Social Security#* Street Address (No PO boxes)* City* State* ZIP* Date of Birth* Home Phone # Cell Phone # Does this person have significant responsibility for managing the legal entity listed above? ☐Yes ☐No Does more than one person own 25% or more ofthis business? (please check box) If yes, additional information will be required. ☐Yes ☐No Person with Significant Management Responsibility (CEO, CFO, President, Etc.)* ☐ Not Applicable, Sole Proprietor, Government Entity, or Public Corporation First Name* Middle Initial Last Name* Social Security#* Street Address (No PO boxes)* City* State* ZIP* Date of Birth* Home Phone # Cell Phone # **OFFICE USE ONLY** Market Rep ID Rep Name ATS Code (last 4 digits) *Required field 1Subject to credit review The 7-Eleven Commercial Fleet Mastercard and the 7FLEET Diesel Network Mastercard® are issued by Regions Bank, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. FLEETCOR considers your privacy important. We are committed to protecting the privacy of those who provide us with their contact and personal information. View our privacy policy available at www.fleetcor.com/en/privacy-policy to find out more. © 2023 FLEETCOR, P.O. Box 1239, Covington, LA, 70434 SELECT CARD* 7-Eleven Commercial Fleet Mastercard ® 7FLEET Diesel Network Mastercard ®

Government

Not-For Profit

7-Eleven Commercial Fleet Mastercard 7FLEET Diesel Network Mastercard

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

BY: DANUSHKA NANAYAKKARA-SKILLINGTON

BY: DANUSHKA NANAYAKKARA-SKILLINGTON

BY: JING FU

BY: JING FU

by Vincent J. Squillace, CAE, OHBA Exec. VP

by Vincent J. Squillace, CAE, OHBA Exec. VP