North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

NCBIA Office

5077 Waterford Dr. Suite 302 Sheffield Village, OH 44035 Phone: 440.934.1090

info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate

Ashlyn Bellan | ashlynncbia@gmail.com

2023 NCBIA Officers President

Tim King, K. Hovnanian Homes - Ohio Division Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain Secretary

Mike Gidich, MDG Maintenance LLC.

Immediate Past President

Sara Majzun, Majzun Construction Co.

2023 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Kevin Walker, Great Lakes Properties & Investments

Dave Linna, Linna Homes & Remodeling

Jason Rodriguez, The S.J.R Building Co.

Jon Sherer, Paraprin Construction

Brian Schwab, RestorePro, Inc.

Dave Weisenberger, Tusing Builders & Roofing Services

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Life Directors

Bob Yost, Dale Yost Construction

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Jeremy Vorndran, 84 Lumber

Jim Sprague, Maloney + Novotny, LLC

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Randy Strauss, Strauss Construction

Tom Caruso, Caruso Cabinets

Tom Lahetta, Tom Lahetta Builders, Inc.

2023 NAHB Delegates

These are our members who represent our local industry in Washington DC and Columbus:

Randy Strauss, Strauss Construction

Jason Rodriguez, The S.J.R Building Co.

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2023 President

Richard Bancroft, Bancroft Development

OHBA Past Presidents

Randy Strauss, 1996

2023 OHBA Trustees

Tim King, K. Hovnanian Homes - Ohio Division

Sara Majzun, Majzun Construction Co.

Mary Felton, Guardian Title (alternate)

2023 Executive Committee Appointees

Sara Majzun, Majzun Construction (Membership)

Judie Docs, NCBIA (Executive Officers Committee)

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

April 2023 www.ncbia.com page 3

10 11-19 GUIDE 2023 MARKETING North Coast Building Industry Association, 5077 Waterford Dr., Suite #302 Sheffield Village, OH 44035 (440) 934-1090 Build your business with a customized marketing plan using this complete guide to North Coast Building IndustryAssociation 20-22

Table of Contents

25 - Eye on Housing: Consumer Confidence Increased Slightly in March

26-Eye on Housing: Affordability Pyramid Shows 64.8 Million Households Cannot Buy a $250,000 Home

27-282023 Calendar of Events

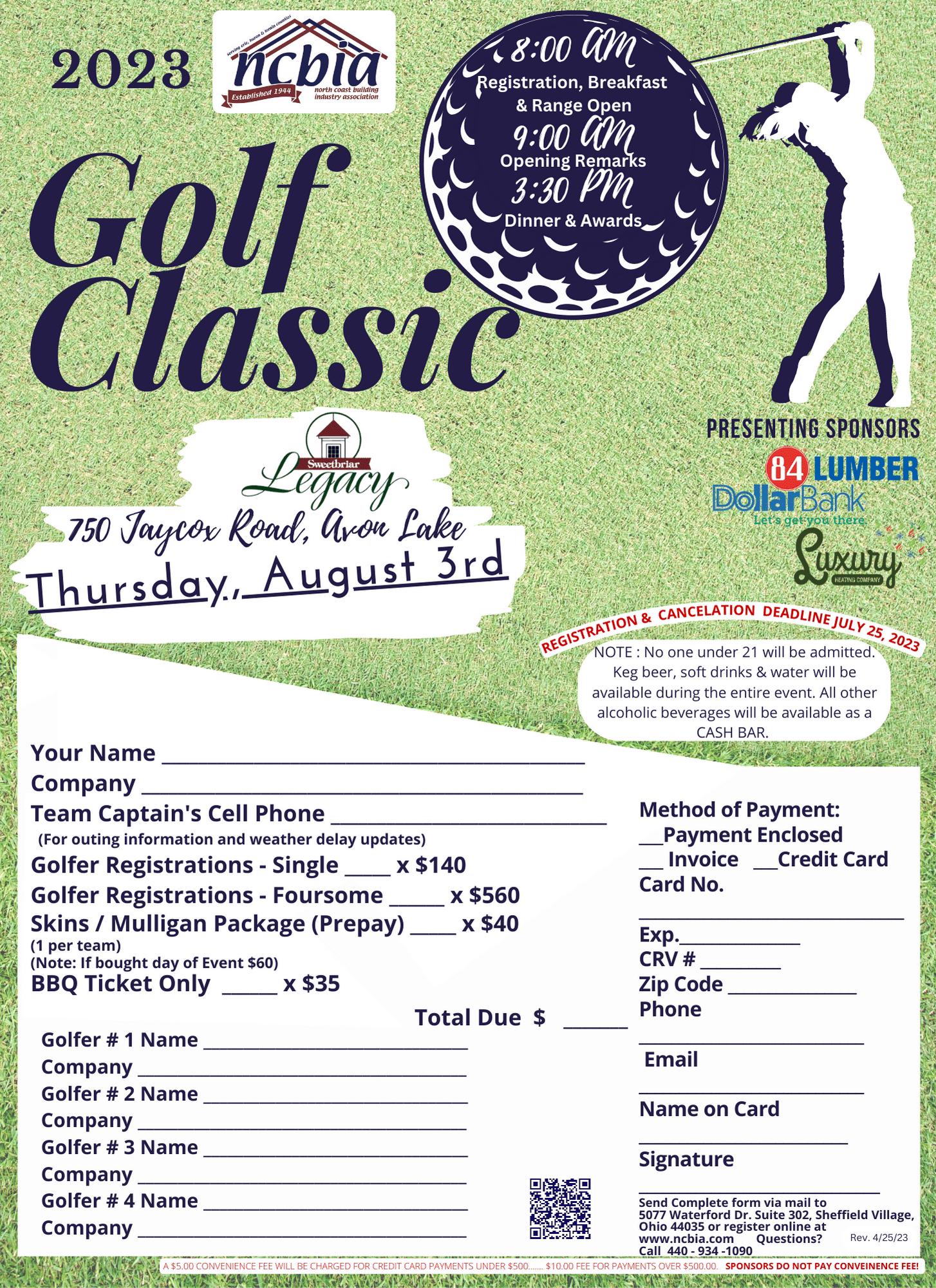

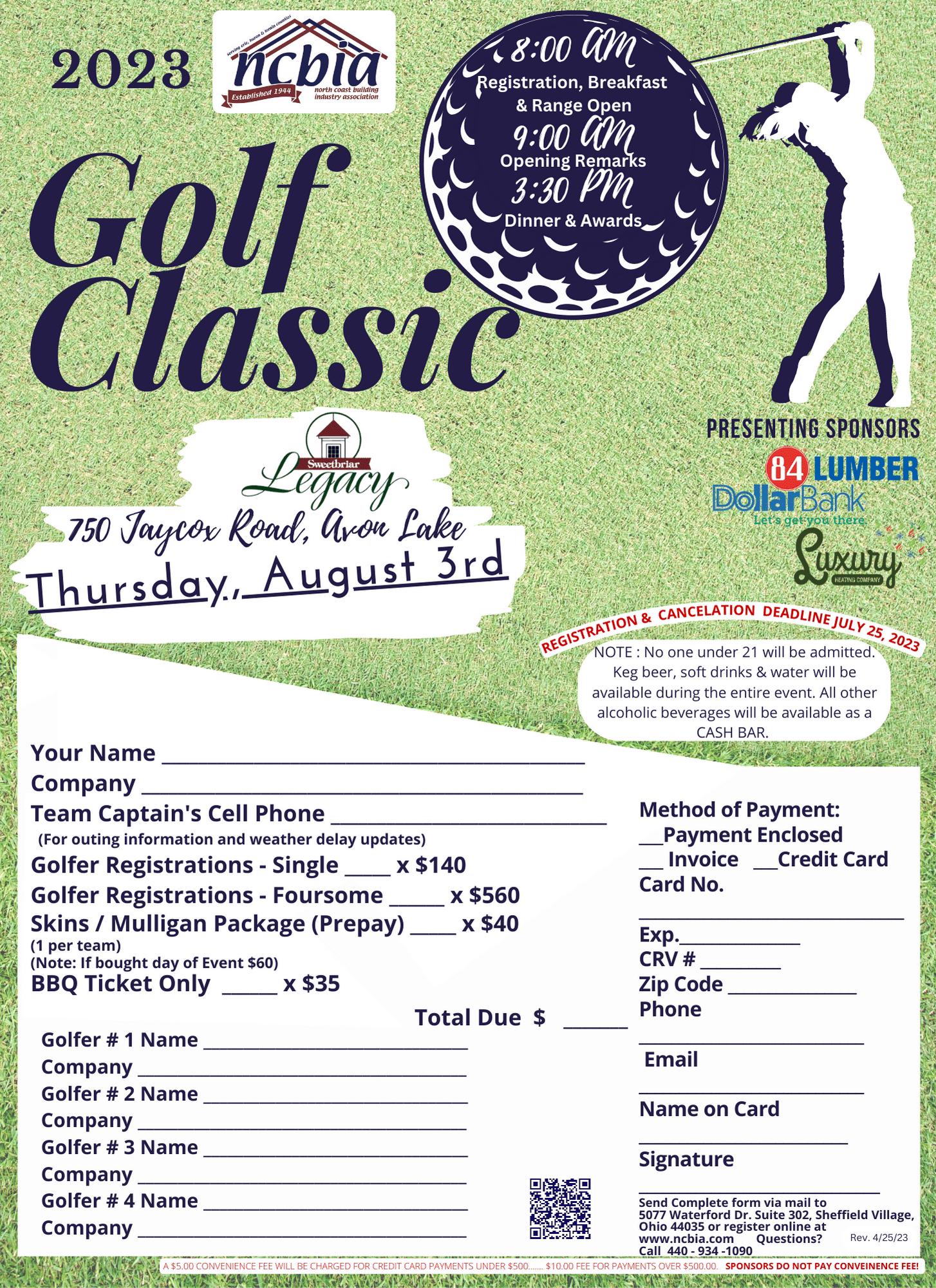

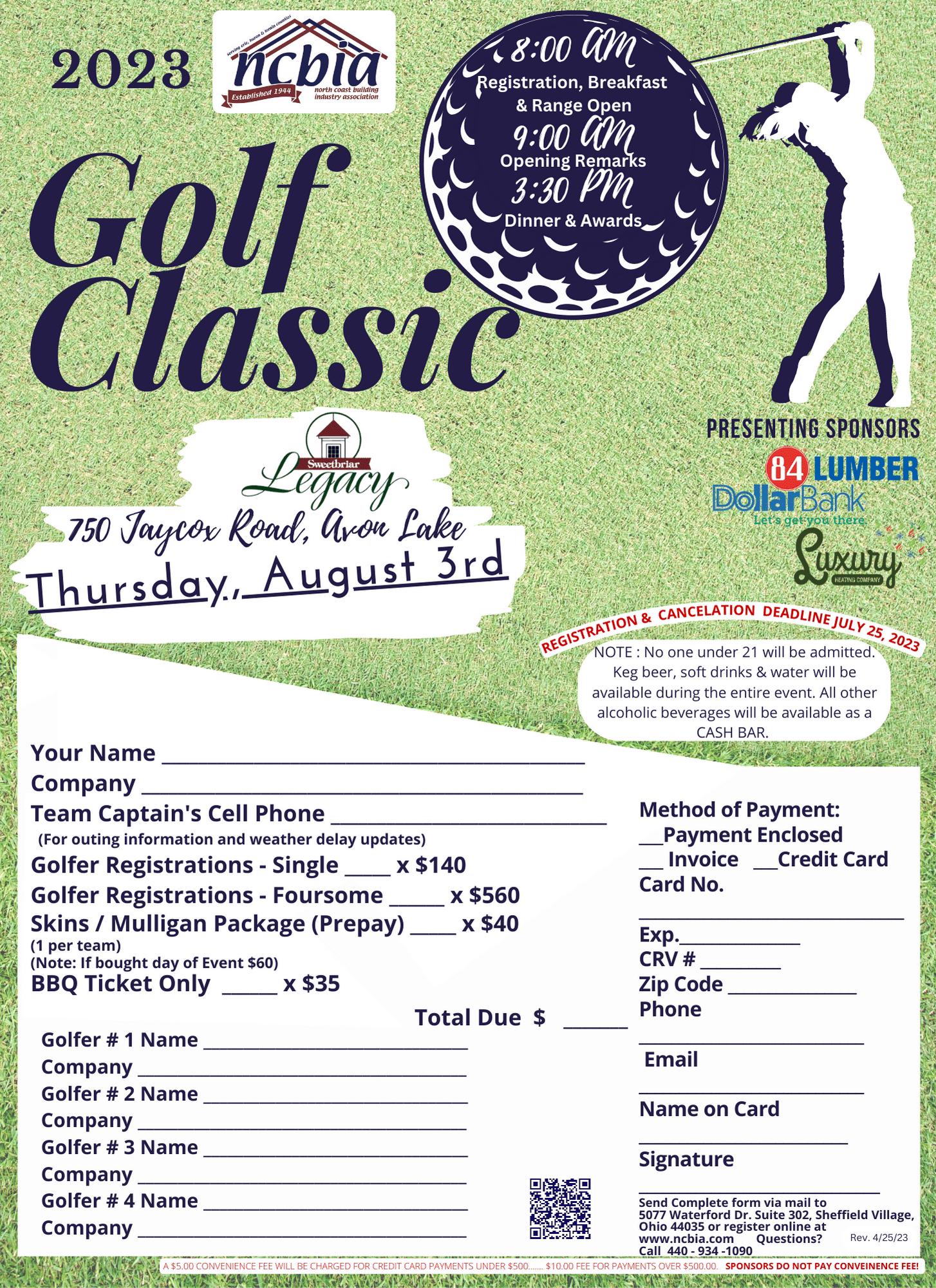

36-372023 Annual Golf Outing Flyer

SPONSORSHIP

OPPORTUNITIES

GOING QUICK!!

38Thanks for Renewing! Applying for Membership Sorry to See You Go!

-

- THANK

29 - Eye on the Economy: End of Fed Tightening in View? Stress Weighs on Banking System

31 - Eye on Housing: Fed Raises Rates as Economy Shows Signs of Weakening

33 - Eye on Housing: Consumer Confidence Increased Slightly in March

35 - NAHB Now: 64 Lawmakers Call on DOE to Scrap Proposed Transformer Rule

39 - Thank You Spikes!

40NCBIA Savings with

42-43Sedgwick Updates!

44 - NAHB Now: Help Your State Make the Right Choice on Energy Codes

45 - NAHB Now: Biden WOTUS Rule in Effect in 48 States

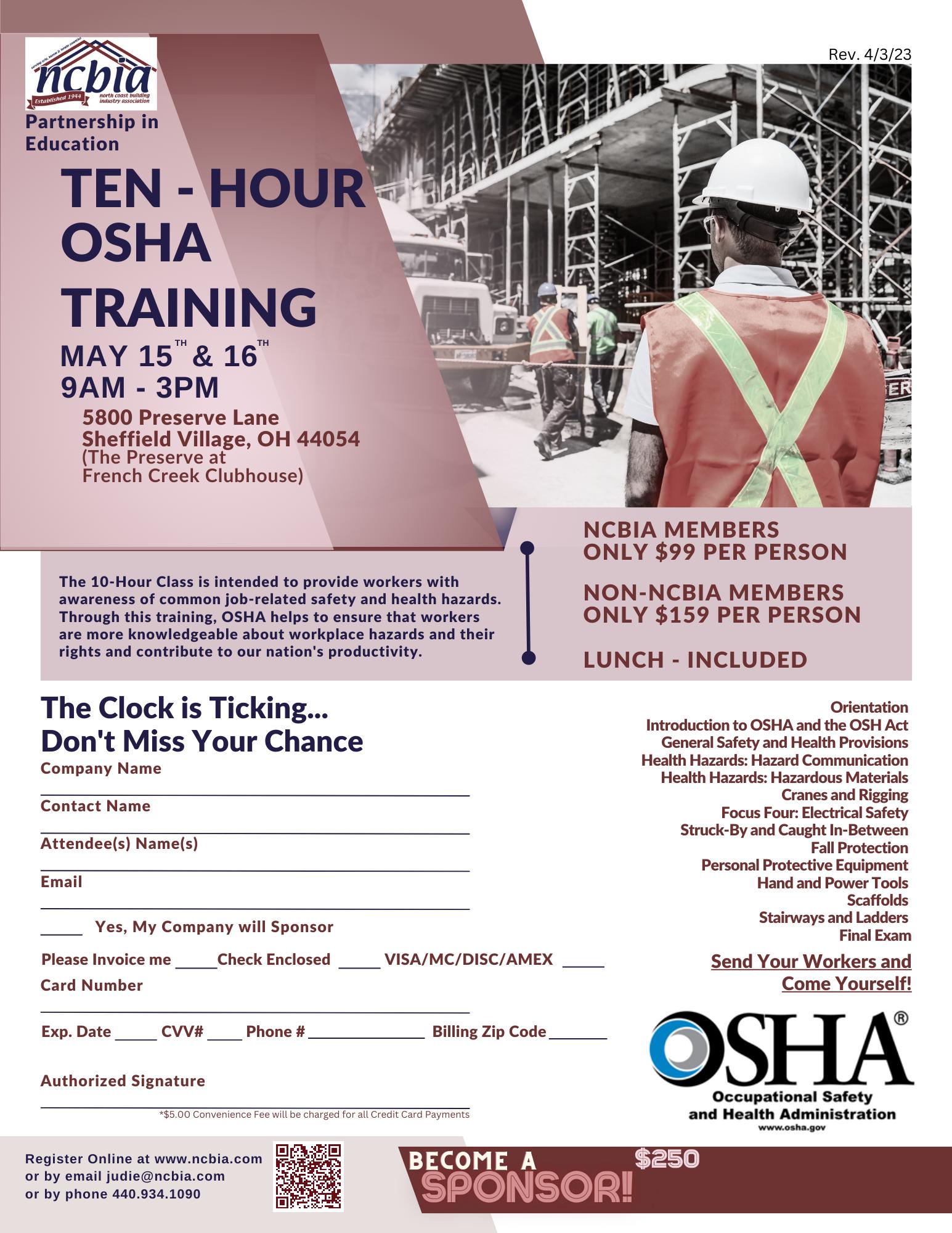

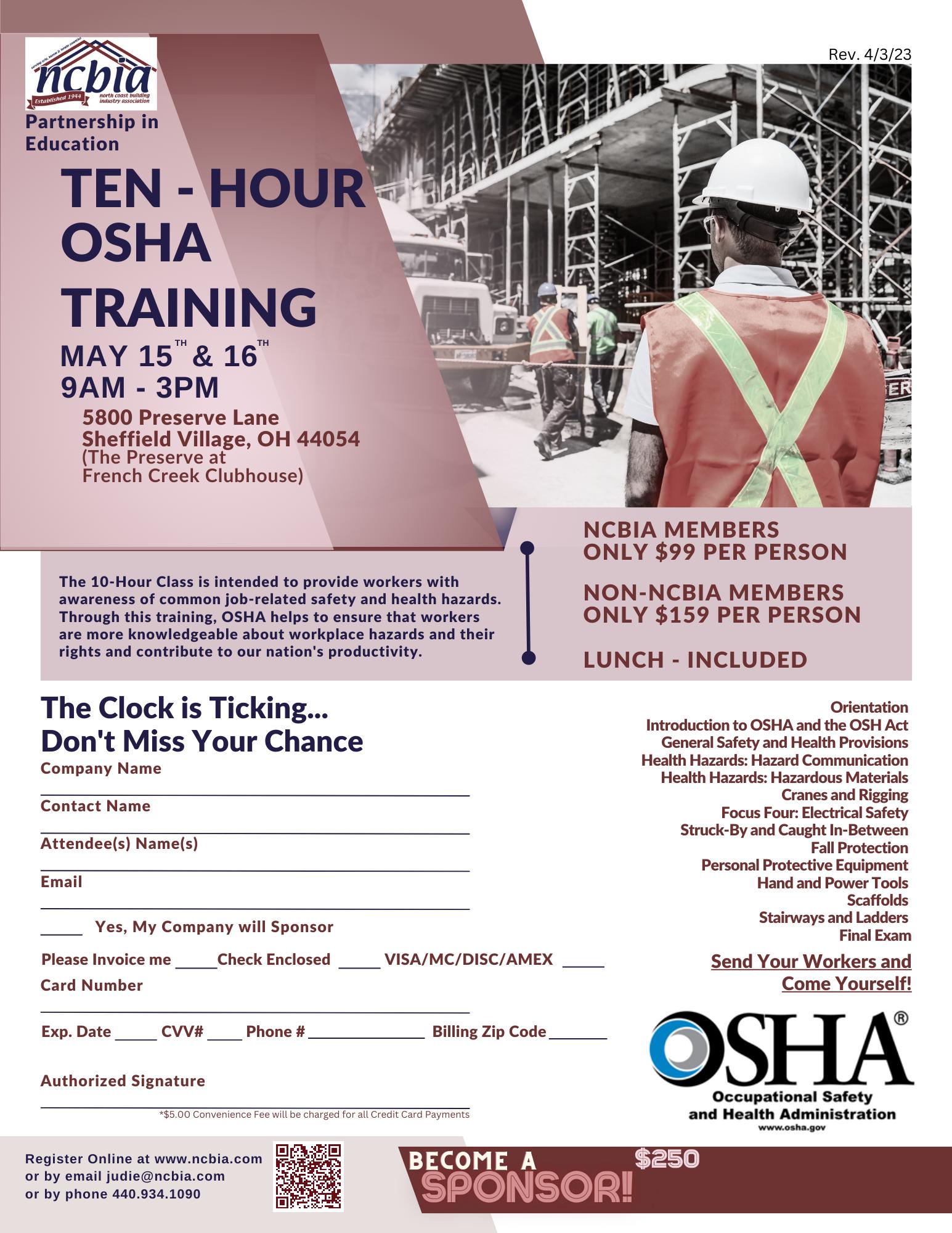

46 - 10 Hour OSHA Training

6 -Menu of Services 7 -Save the Dates 8 -April is New Homes Month - 2023 NCBIA President 9 -Executive Officers Report 10

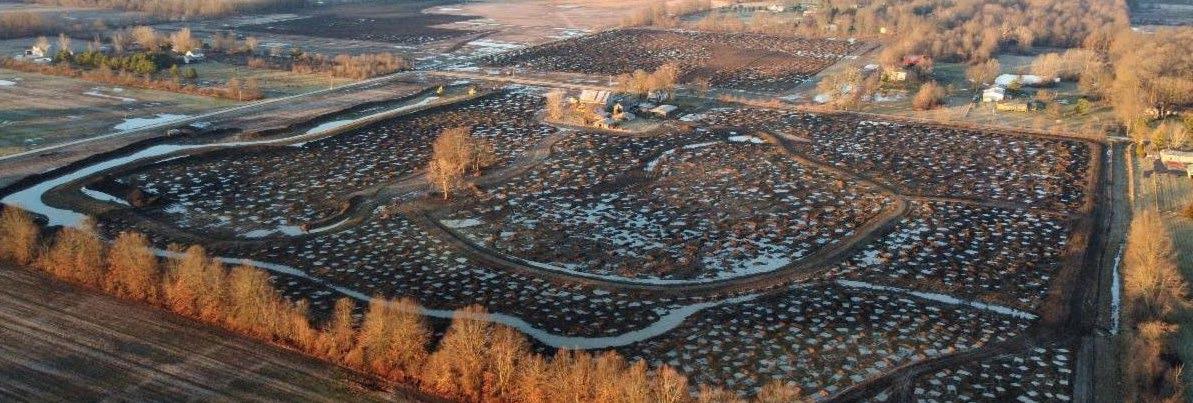

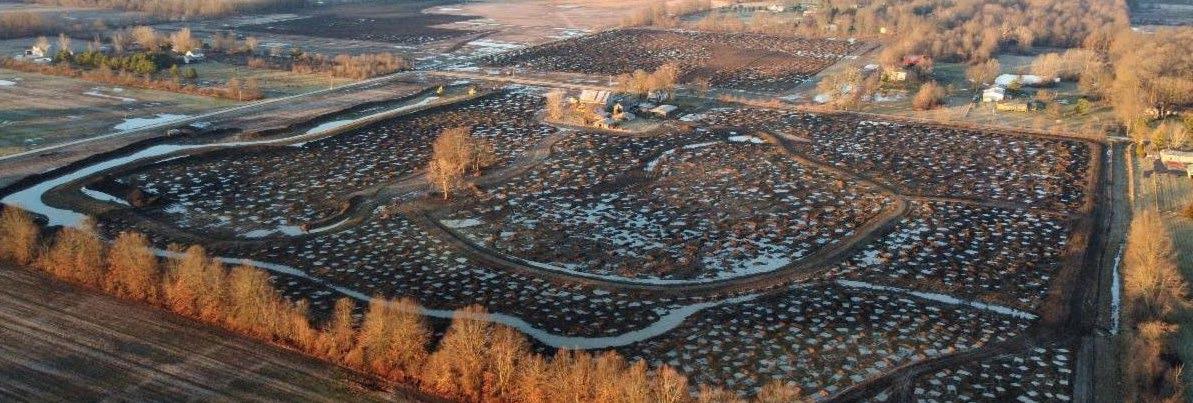

Stream + Wetlands Project to Become Future Parkland!

11-192023 Marketing Guide!

to

and

20

YOU! April Member Mixer Sponsor! 21-22April Member Mixer Photo Gallery 23-24 - NAHB Now: NAHB, Other Organizations Urge FTC

Act on Government

Business Imposters

April 2023 www.ncbia.com page 5

For more information on any of these products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

HOW CAN WE HELP?

HELP?

North Coast Building Industry Association Menu of Additional Products and Services Copies Equipment Design Services

Books Black & White Black & White Color Color Color Raffle Boards, Drum & Equipment Graphic Design Services (8.5”x11”) (8.5”x14”) Black & White (11”x17”) (8.5”x11”) (8.5”x14”) (11”x17”) Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided $0.10 $0.20 $0.15 $0.20 $0.50 $0.25 $0.50 $0.27 $0.52 $2.00 $100 per day $30 each (plus shipping, if applicable) $35 per hour Contact Ashlyn Bellan at ashlynncbia@gmail.com

HOW CAN WE HELP?

Warranty

NEED SOMETHING ELSE? JUST ASK!

North Coast Building Industry Association Menu of Additional Products and Services

Equipment Black & White Black & White Raffle Boards, Drum & Equipment (8.5”x11”) (8.5”x14”) Single Sided 2-Sided $0.10 $0.20 $100 per day Home

New Home page 6 www.ncbia.com April 2023

Copies

$7 each (plus shipping, if applicable) Your

Save the Date!

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!!!!!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!!!!!

Wednesday, May 10th

Executive Committee - 3:30

Board Meeting - 5:00

Clubhouse at Preserves at French Creek 5800 Preserve Drive, Sheffield Village

Monday-Tuesday, May 15th-16th

10 Hour OSHA Certification 9:00 AM-3:00 PM

Clubhouse at Preserves at French Creek 5800 Preserve Drive, Sheffield Village

If you would like to participate in a committee, please email Judie Docs at judiencbia@gmail.com.

Check the website at www.ncbia.com for up-to-date changes, additions, and corrections to these events!

Do you have some business news to share?

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

2023 Marketing Guide

Give Judie a call if you would like to meet

and/or Discuss our 2023 Marketing Guide

(440-934-1090, option 2 or email judie@ncbia.com)

2023 Marketing Guide CLICK HERE

April 2023 www.ncbia.com page 7

APRIL IS

New Homes Month

It’s no coincidence that people are generally happier in springtime. Compared to the colder, darker days of winter, spring is the opportunity for a fresh start. And for many Americans, it’s when they plan to buy a new home.

As the momentum of home buying season continues to grow, the home building industry celebrates New Homes Month in April. At this time of year, millions of people are starting their search for a new home that’s perfect for their lifestyle. That is why I want to take this opportunity to showcase the many advantages of owning a newly constructed home.

Many home buyers are seeking a unique new home that offers energy efficiency, spaciousness, and warranties. They also want the ability to select their favorite appliances, flooring, paint colors and other design elements to give their home a personal touch from the day they move in.

But those characteristics are just some of the countless advantages of buying a new home. There are many other benefits of owning a new home that might be less obvious but are often found to be just as valuable.

Strong Sense of Community

One of the built-in benefits of many new homes is the new neighborhood. When families move into a new community at the same time, lasting bonds of friendship and neighborliness often form right away. Many home builders will host community block parties in these developments to help neighbors of all ages meet and connect.

Ability to Entertain

Older homes are often smaller and therefore more challenging in which to host gatherings with friends and family. Today’s home builders are creating more open spaces with higher ceilings, larger windows, and expansive great rooms for added convenience and modern living.

A Clean Slate

When moving into a new home, you won’t have to spend hours stripping dated wallpaper or painting over an ugly wall color. There are no oil stains to remove in the garage, no windows to replace, no walls to be torn down. Everything is already just the way you want it.

Peace of Mind

Building standards have changed a great deal over the decades, almost as fast as technology has evolved. New homes can accommodate today’s advanced technology and be customized to meet the individual homeowner’s needs. And knowing that the home was built to the latest safety codes gives the owner added assurance.

Build Wealth

What a great industry we are a part of!!!! Homeownership benefits millions of Americans across the country. In addition to having a place to call home and a sense of community, many people purchase homes to help build their wealth. A primary residence was the largest asset among households. How does housing measure up to other investments, like the stock market? Not surprising, many Americans view homeownership as a sound investment to provide financial security, and we build these homes alongside our associates and that is something to be proud of!

NCBIA 2023 PRESIDENT page 8 www.ncbia.com April 2023

Tim King, K. Hovnanian Homes

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

COME Build with Us!

Build your business with a customized marketing plan to the NCBIA marketing opportunities through digital, print, and various event sponsorships. Offering numerous opportunities for sponsorships and advertising. With many events on a yearly basis, you can choose the highest level of sponsorship as an event sponsor or to the lowest. We appreciate your help to continue us to help you. We advertise on our website, on social media, and through our emails and newsletters. There is something for everyone.!

We provide an abundance of ways to achieve professional development and generate recognition. Our marketing was developed to help you plan your involvement in a mutually beneficial way. Each marketing opportunity not only includes an investment amount, but also the recognition you can expect in return.

I would be happy to personally meet with you to discuss how we can help you, just email me at judie@ncbia.com or give me a call 440-934-1090. We have marketing specifically target to fellow members, consumers and both members and consumers. There are also ways to help you at no cost, which include job posting, hot deals for consumers, and hot deals for members.

Remember I am here to help you in any way that I can to help you get the most out of your membership.

Please refer to our updated 2023 Marketing Guide in this newsletter.

EXECUTIVE OFFICER’S REPORT

April 2023 www.ncbia.com page 9

Stream + Wetlands Project To Become Future Parkland

By Vince Messerly, PE, President

By Vince Messerly, PE, President

Stream and Wetlands Foundation has entered into an agreement with Preservation Parks of Delaware County for the future ownership and long-term management of the Whetstone Highlands wetlands mitigation site. The 182-acre project is located at the western end of Ford Road and perched along the highpoint, or watershed divide, between the Scioto and the Olentangy river basins. The project, which is currently under construction, will be planted with a wide array of native species including more than 100,000 trees and shrubs as well as hundreds of pounds of various seed mixes. S+W will initially manage the project to ensure it is well on its way to achieving the overall goal of reestablishing a high-quality swamp forest. Once the land is donated, Preservation Parks will provide management of stewardship of the site and use the site as a future park.

“S+W is very excited to work with Preservation Parks on the development of the Whetstone Highlands project to ensure that, when it becomes available for public use, it provides a place for enjoyment and connection to nature,” said Vince Messerly, president of S+W. “We are especially proud that we can establish this substantial habitat restoration project in an area that is rapidly developing. Balancing development with the protection and restoration of wildlife habitat in this region is critically important.”

We will provide updates on this important project in upcoming eblasts!

page 10 www.ncbia.com April 2023

GUIDE 2023 MARKETING North Coast Building Industry Association, 5077 Waterford Dr., Suite #302 Sheffield Village, OH 44035 (440) 934-1090 Build your business with a customized marketing plan using this complete guide to North Coast Building Industry Association marketing opportunities through digital, print and various event sponsorships. Come BUILD with Us!! digital print events

Dear Members -

The North Coast Building Industry Association provides members an abundance of ways to achieve professional development and generate recognition. The 2023 Marketing Guide was developed to help you plan your involvement and budget for 2023 Lock in pricing now as it is subject to change All opportunities featured are accompanied by descriptions to give you a better understanding of the events. Each marketing opportunity not only includes an investment amount, but also the recognition you can expect in return.

Getting the most of your membership also means getting involved. We invite you to consider joining a committee or volunteering during events. This will lead you to that pivotal next step of building relationships and subsequently gaining more business. Please look over the choices in this packet. For sponsorship and participation opportunities, mark your choices in this guide and return a copy, along with the completed selection sheet to the NCBIA. We are here to help you determine what works best for you and your organization.

Call us any time at (440) 934-1090

Let’s Build a GREAT Year TOGETHER!

General Membership Meetings

3 General meetings per year Your Company Logo on Registration materials; promotion in NCBIA Media in print & online

o March 15, 2023 $275 (General Membership Meeting)

o June 23, 2023 ................................$275 (Membership Cookout)

o October 18, 2023 ............................$275 (GM Meeting & Election Night)

* Sponsor all three and save $75 ($250 ea.)

TARGET AUDIENCE CODES

Denotes Member to Member

Denotes Member to Consumer

Use these color-coded stars to quickly find the best marketing options for your business!

If your business focuses on serving other members, look for the GREEN stars on the following pages.

Or if your business is geared more towards selling to consumers, look for the best marketing opportunities to reach consumers, marked with a RED star!

If you’d like help putting together a marketing plan for your business, please contact me at judie@ncbia.com or (440) 934-1090 and I’d be happy to help!

Member Mixer EventsScheduled throughout the year; promotion in NCBIA Media in print & online

o Member Mixer Event Sponsor...............................$150

-Judie

Docs

Come Build with Us...

202

#302 Sheffield Village,

(440)

3 NCBIA M ar k eting Guide 5077 Waterford Dr., Suite

OH 44035 www.ncbia.com

934-1090

digital print events 1 Issued April 20, 2023

M ar k eting Guide

Golf Classic - August 3, 2023 - Sweetbriar Golf Course

o Presenting Sponsor......................................................................................................................................... $2,000

Includes one foursome; company name/logo on banner (you provide) placed prominently at outing; presentation at BBQ & mic time Unlimited Sponsorships Available

o Hole-in-One Sponsor ....................................................................................................................................... $TBD

Includes the opportunity to sit at the hole-in-one hole with a partner/staffer to determine a potential winner

o Golf Cart Sponsor ........................................................................................................................................... $1,300 Provide signage for every golf cart, 2 BBQ Tickets

o BBQ Sponsor .................................................................................................................................................... $750

You may bring a banner to hang at the pavilion, 4 Sponsorships Available

o Scorecard Sponsor $600

Includes company logo on all scorecards placed on all carts for event

o

Skill

Prize Sponsorship .............................................................................................................................

Breakfast Sponsorship .....................................................................................................................................$300

Includes signage with company name at breakfast area;

Photo Sponsorship .......................................................................................................................................... $300

Provides for foursome photos to be taken & mailed out after the outing to each golfer; includes signage with company name on golf course 4 Sponsorships Available

o Raffle Sponsorship .......................................................................................................................................... $250

Announces the winner of the 50/50 raffle during BBQ; includes signage with company name on golf course

o “Pink” Ball Sponsor $250 Opportunity to sell pink balls for contest at registration area; includes signage with company name on course

o Keg Sponsor .....................................................................................................................................................$250

Includes signage with company name on golf course

...........

o Soft Drink Sponsor ...........................................................................................................................................$150

Includes signage with company name on golf course - 4 Sponsorships Available

Clambake - October 14, 2023

o Event Sponsors $725

Includes: 8 dinner tickets - Banner (you provide) to hang at the front of the venue - Recognition at event, Builder newsletterCompany Logo on placemat, registration form and event online - Mic time

Bar Sponsor $300

Includes: Company Logo bar napkins - Recognition at event, Builder newsletter - Company Logo on placemat, registration form and event online

Raffle Board Sponsors (2 available)

Includes: Company logo on raffle tickets - Recognition at event, Builder newsletter - Company Logo on placemat, registration form and event online

Dessert Sponsors $300

$300 P Patron Sponsors $100

Raffle Basket

o Please make a Basket for me.................................... $100

o Yes.....I will provide a basket for the Chinese Basket Raffle.(You create your own basket)

o

o

o

202 3 NCBIA

digital print events 2 Issued April 20, 2023

o

o Yes... I will provide a gift card. o

o

Includes: Recognition at event, Builder newsletter - Company Logo on placemat, registration form and event online

Includes: Recognition at event, Builder newsletter - Company Logo on placemat, registration form and event online

........$500

Includes company name on sign at skill hole; NCBIA will provide prizes to winner - 4 Sponsorships Available Opportunity to sit at the hole with a partner/staff

o

Hole Sponsor ........................................................................................................................................

..$150 Includes signage with company name on golf course (Non-Members price $225)

202 3 NCBIA M ar k eting Guide

Monthly BUILDER Newsletter

A NEW ISSUE EVERY MONTH ONLINE AT www.ncbia.com AND EMAILED TO EVERY INBOX

BACK COVER

o 4 issues per year $625 per issue

o 8 issues per year $495 per issue

o 12 issues per year $365 per issue

INSIDE FRONT COVER

o 4 issues per year $575 per issue

o 8 issues per year $470 per issue

o 12 issues per year $340 per issue

INSIDE BACK COVER

o 4 issues per year $545 per issue

o 8 issues per year $430 per issue

o 12 issues per year $315 per issue

FULL PAGE

o 4 issues per year $490 per issue

o 8 issues per year $385 per issue

o 12 issues per year $285 per issue

1/2 PAGE

o 4 issues per year $325 per issue

o 8 issues per year $275 per issue

o 12 issues per year $200 per issue

1/4 PAGE

o 4 issues per year $185 per issue

o 8 issues per year $165 per issue

o 12 issues per year $135 per issue

BUSINESS CARD (1/8 PAGE)

o 4 issues per year $135 per issue

o 8 issues per year $125 per issue

o 12 issues per year $110 per issue

CHOOSE THE MONTHS FOR YOUR ADS

o JAN o MAY o SEP

o FEB o JUN o OCT

o MAR o JUL o NOV

o APR o AUG o DEC

he NCBIA online BUILDER NEWSLETTER is issued at the end of each month. It is posted online at www.ncbia.com and back issues can be obtained by contacting the NCBIA at (440) 934-1090 or email the NCBIA at judie@ncbia.com.

Enhanced Online Membership Directory Listing

(based on 12-month commitment)

o Featured Listing $150

Your Company Logo linked to your website

o Enhanced Listing $325

Your Company Logo; photos and company description all linked back to your website.

NEW this year! bundled together with your Enhanced Listing, your logo will also be placed in the “Featured Members” area of our website on the home page where you get even more exposure!

digital print events 3 Issued April 20, 2023

Membership Directory & Consumer Guide

Don’t miss this marketing opportunity! The 2024 Membership Directory & Consumer Guide is mailed out to consumers and fellow members. Also available as a PDF download on www.ncbia.com, at our Home & Remodeling Show or in print from the NCBIA upon request. 2-PAGE

*First Come, First Served

Weekly What's Happening Wednesday Update

Published weekly online and delivered via email to all members and VIP Partners (with the exception of the end of the month when the BUILDER Newsletter is published).

Get 550 pixels wide of ad space. Coordinate your What's Happening Wednesday sponsorship ad with your seasonal promotions!

Total Cost

o 3 Placements $100

o 6 Placements $190

o 9 Placements $280

o 12 Placements $375

WEBSITE

BANNER ADS

NCBIA.COM HOME PAGE

Your custom ad will appear on the NCBIA home page at the top in the rotating slide section alongside current events.

o Rotating Slide, Full Year $1000

o Home Page, below slideshow..........$600

o Consumer/Member Page.................$350

Want your logo featured on our website home page? See the listing on page 3 for Enhanced Online Membership Directory Listing. It’s now bundled together!

CENTER SPREAD.............................................$1425 BACK COVER* $1125 INSIDE FRONT COVER* ..................................................$1050 INSIDE BACK COVER* ....................................................$975 FULL PAGE......................................................................$925 HALF PAGE.....................................................................$675 QUARTER PAGE.............................................................$475 BUSINESS CARD ...........................................................$200

Issued November 2017

202 3 NCBIA M ar k eting Guide digital print events 4 Issued April 20, 2023

5077 Waterford Dr., Suite #302 Sheffield Village, OH 44035 www.ncbia.com (440) 934-1090

3rd Most Visited Page on NCBIA.com!!!

VIRTUAL PARADE OF HOMES - Sponsorships (can be PRO-Rated)

o Grand Sponsor.............................................................................................................

Includes company logo featured prominently on the landing page of the Virtual Parade of Homes site; link to your company website; your company logo/name featured in all marketing efforts

$1200

o Home Sponsor...............................................................................................................$700

Includes company logo/name featured on the landing page of the Virtual Parade of Homes site; your company logo/name featured in all marketing efforts

o Sustaining Sponsor........................................................................................................$425

Includes company name featured on the landing page of the Virtual Parade of Homes site

o Patron Sponsor..............................................................................................................$350

Includes company name featured on the landing page of the Virtual Parade of Homes site

Keeping up on the times, today’s consumers know what they want and use the internet to find what they are looking for.

Leverage your visibility with the NCBIA Virtual Parade of Homes. Your homes and/or remodeling projects will be open 24/7 on a mobile device or computer. You will have a qualified prospect when they come to visit or call you for an appointment.

This marketing opportunity is widely publicized digital, print and at events.

202 3 NCBIA

digital print events Come

5 Issued April 20, 2023

M ar k eting Guide

Build with Us...

HOME SHOW 2023 - Feb. 25 & 26, 2023

SPONSORSHIP FEES

Event Sponsor .................................................................................................................................................

$2000

o Everything on Supporting Sponsor list, PLUS radio interview, booth space, logo on staff t-shirts and all printed advertising, mention in radio advertisements, option to have your company’s banner hung at show entrance and studio quality videos to promote your business; option to put promotional items in swag bag and recognition in BUILDER Newsletter

Supporting Sponsor

$300

o Includes: mention in radio ads, your logo in event program, Facebook event page, slideshow during event, option to put promotional items in swag bag, and recognition in BUILDER newsletter.

Bag Sponsor SOLD

o Your company to provide bags; promotion in the NCBIA Newsletter and in all social media

Issued November 2017

- Member Booth Fees.........................................................................................................................

NCBIA

$399

202 3 NCBIA M ar k eting Guide digital print events 6 Issued April 20 2023 Want a Customized Marketing Plan? Website BUILDER Email Events Directory Home Show Call or email Judie Docs: (440) 934-1090 or judie@ncbia.com Lunch is provided for ALL sponsors

*Refer to page 3 for Builder Newsletter pricing and page 4 for Membership Directory & Consumer Guide pricing

Quarter page H: 5.25 in W: 3.195 in Half page H: 5.25 in W: 8.0 in

H: 10.5 in W: 8.0 in

page

H: 11.0 in W: 8.5 in

H: 10.5 in W: 16.0

H: 11.0 in W: 17.0 in GUIDE 2023 MARKETING Advertising Spec Sheet North Coast Building Industry Association, 5077 Waterford Dr., Suite #302 Sheffield Village, OH 44035 (440) 934-1090 Business card H: 2.0 in W: 3.195 in 7 Issued April 20, 2023

Full page (no bleed)

Full

(with bleed)

Two-page spread (no bleed)

in Two-page spread (with bleed)

General Membership Meetings

o March 15, 2023..............................$275

o June 23, 2023 Cookout..................$275

o October 18, 2023............................$275

($250 each if you sponsor all three for the year!)

Golf Classic

o Tournament Sponsors .....$2,000

o Hole-in-One Sponsor ..$TBD

o Golf Cart Sponsor............................ ..$1,300

o BBQ Sponsors .$750

o Scorecard Sponsor $600

o Breakfast Sponsor $300

o Photo Sponsorship ...$300

o Raffle Sponsor ...$250

o “Pink” Ball Sponsor ...$250

o Hole Sponsors .............$150

Clambake

o Event Sponsors $725

o Bar Sponsors $300

o Raffle Board Sponsors $300

Sponsor $100

Monthly BUILDER Newsletter

BACK COVER

o 4 issues per year.........$625 per issue

o 8 issues per year.........$495 per issue

o 12 issues per year.......$365 per issue

INSIDE FRONT COVER

o 4 issues per year $575 per issue

o 8 issues per year........ $470 per issue

o 12 issues per year.......$340 per issue

INSIDE BACK COVER

o 4 issues per year.........$545 per issue

o 8 issues per year.........$430 per issue

o 12 issues per year.......$315 per issue

FULL PAGE

o 4 issues per year.........$490 per issue

o 8 issues per year.........$385 per issue

o 12 issues per year.......$285 per issue

1/2 PAGE

o 4 issues per year.........$325 per issue

o 8 issues per year.........$275 per issue

o 12 issues per year.......$200 per issue

1/4 PAGE

o 4 issues per year.........$185 per issue

o 8 issues per year.........$165 per issue

o 12 issues per year.......$135 per issue

BUSINESS CARD (1/8 PAGE)

o 4 issues per year.........$135 per issue

o 8 issues per year.........$125 per issue

o 12 issues per year.......$110 per issue

CHOOSE MONTH(S) FOR YOUR AD(S)

325

E-News Update o 3 Placements ...$100 o 6 Placements ...$190

o 9 Placements ...$280

o 12 Placements ...$375

NCBIA.COM WEBSITE ADS

BANNER ADS

o Home Page ...........$600

o Consumer/Member Page ............$350

HOME PAGE ROTATING SLIDE

o One Year .........$1,000

Member

Featured

Mobile

Weekly

Patron

Mixer Social Events o Member Mixer Social Event Sponsor...$150

& Enhanced Online

Membership Directory Listing o Featured Listing ..$150 o Enhanced Listing ..$

JAN-FEN

FEB-MAR o MAR-APR o APR-MAY o MAY-JUN o JUN-JUL o JULY-AUG o AUG-SEP o SEP-OCT o OCT-NOV o NOV-DEC o DEC-JAN

o

o

2024 Membership Directory & Consumer Guide 2-PAGE CENTER SPREAD* $1425 BACK COVER* $1125 INSIDE FRONT COVER* $1050 INSIDE BACK COVER* $975 FULL PAGE $925 HALF PAGE $675 QUARTER PAGE $475 BUSINESS CARD* . $200 VIRTUAL PARADE OF HOMES - Sponsorships o Grand Sponsor $1200 o Home Sponsor.................................$700 o Sustaining Sponsor $425 o Patron Sponsor................................$350 Please complete the information below to finalize your sponsorships Company Name _________________________ Contact Name ___________________________ Phone _________________________________ Email __________________________________ Total Amount Due ___________ **A $5 Convenience Fee will be charged for all Credit Card Payments under $500; $10 for payments Over $500 Please Invoice Me ______ Check Enclosed_____ Visa/MC/Disc/Amex _____ Card Number ______________________________ Exp. Date____________CVV# ___________ Billing Zip Code Authorized Signature _______________________ Register online at www.ncbia.com, by email: judie@ncbia.com or by phone (440) 934-1090 All Rates and Fees Subject to Change Without Notice 202 3 NCBIA Marke ting Guide Selec tion S heet Issued April 20, 2023 8 5077 Waterford Dr., Suite #302 Sheffield Village, OH 44035 www.ncbia.com (440) 934-1090 Come Build with Us... o Booth Space $399 SPONSORSHIP FEES o Event Sponsorship.......................$2000 o Supporting Sponsorship $300 o Bag Sponsorship..........................SOLD *First Come, First Served o Soft Drink Sponsors $150 o Dessert Sponsors $300 o I will provide a Raffle Basket o Raffle Baskets o Gift Card o Please make me a Raffle Basket........$100 o Skill Prize Sponsors .$500 o Keg Sponsors ..$250

HOME SHOW 2023

2023 Spring Member Mixer PHOTO GALLERY

April 2023 www.ncbia.com page 21

page 22 www.ncbia.com April 2023

NAHB, OTHER ORGANIZATIONS Urge FTC to Act on Government and Business Imposters

NAHB's other trade associations and organizations with business events have sent a letter to the Federal Trade Commission (FTC) to urge the agency to finalize its proposed rule targeting government and business imposters.

Comments were submitted more than three months ago to the FTC’s Notice of Proposed Rulemaking on Government and Business Impersonation Fraud, and the initial Advance Notice of Proposed Rulemaking was published in December 2021.

In that time, impersonation scams impacting organizations, including trade shows such as the International Builders’ Show (IBS), have continued to increase. These increasingly sophisticated impersonation scams often use trademarked event names, logos, and fake email signatures to create the illusion that the efforts of the scammers are conducted with the approval of the event organizers and service providers.

The FTC itself noted in a recent blog post that impersonator scams were the most reported type of scam in 2022, with an estimated $2.6 billion in losses. Unlike many other forms of fraud that primarily target consumers, these impersonation scams have serious economic consequences for businesses, including nonprofits. Reported losses from scammers impersonating businesses grew nearly 50% compared to 2021.

The coalition is requesting the FTC adopt a final rule as soon as possible.

March 31, 2023

Federal Trade Commission

600 Pennsylvania Avenue, NW

Washington, DC 20580

Re: Trade Regulation Rule on Impersonation of Government and Businesses, R207000, Docket No. FTC2022-0064

CONTACT:

April 2023 www.ncbia.com page 23

NAHB NOW

Alex Strong astrong@nahb.org (202) 266-8279

NAHB, OTHER ORGANIZATIONS Urge FTC to Act on Goverment and Business Imposters

To the Federal Trade Commission:

We write to you as a coalition of trade associations and professional organizations in the face-to-face business events industry, urging you to proceed expeditiously to a final rule targeting government and business imposters. As the Commission noted in a recent blog post, impersonator scams were the most reported type of scam in 2022, with an estimated $2.6 billion in losses.12 These impersonation scams have serious economic consequences for businesses, including non-profits. Notably, reported losses from scammers impersonating businesses grew nearly 50 percent compared to 2021. It has been three months since comments were submitted in response to the Commission’s Notice of Proposed Rulemaking on Government and Business Impersonation Fraud (“NPRM”)3 , and more than a year since the launch of the Advance Notice of Proposed Rulemaking (ANPRM) on this matter. 4 In that time, impersonation scams impacting non-profits, including trade shows have continued to increase. For example, the Consumer Technology Association® (CTA), which owns and produces CES®, has received at least a half dozen reports of impersonation scams using the CES logo, during and in the two months following this year ’s show. These impersonation scams varied from the sale of false discounted badges to fraudulent websites offering hotel bookings for CES. 1 The top scams of 2022, Federal Trade Commission, https://consumer.ftc.gov/consumer-alerts/2023/02/ topscams-2022. 2 Id. 3 Trade Regulation Rule on Impersonation of Government and Businesses, 87 Fed. Reg. 62,741 (Oct. 17, 2022) (“NPRM”). 4 Trade Regulation Rule on Impersonation of Government and Businesses, Proposed Rule, 86 Fed. Reg. 72,901 (Dec. 23, 2021) (“ANPRM”). 2 Similarly, Exhibitions & Conferences Alliance (ECA) members have experienced an uptick in event attendee list sale scams. These increasingly sophisticated impersonation scams use copyrighted event names, logos, and fake email signatures to create the illusion that the efforts of the scammers are conducted with the approval of the event organizers and service providers. Several National Association of Broadcasters (NAB) Show attendees and exhibitors have alerted NAB staff of emails and phone calls from impersonators purporting to sell attendee contact information. One exhibitor received as many as 50 impersonator solicitations and reported that the frequent calls and emails are “overwhelming and hard to manage.” Many NAB Show exhibitors are small businesses that are ill-equipped to handle the apparent onslaught of impersonator solicitations. Yet another trade association, the American Apparel & Footwear Association (AAFA) reports that in the first three months of 2023 alone, its members received more than 75 phishing and impersonation emails and texts connected to its Product Safety Conference in February and its Annual Executive Summit in March. These emails peddled fake contact lists and deployed other techniques, including the unauthorized use of the AAFA logo, in an effort to appear legitimate and lure unsuspecting recipients into fraudulent transactions. We commend the Commission for its proposed rule targeting government and business imposters, and were pleased that the NPRM included nonprofit organizations in the proposed definition of “business.”5 With millions of Americans expected to attend in-person conferences and events this year, continued impersonation scams such as those involving hotel bookings, the sale of attendee lists, and event space fraud, remain an on-going threat to the reputations of each of our organizations. We implore the Commission to proceed to adopting a final rule as soon as possible.

page 24 www.ncbia.com April 2023

NAHB NOW

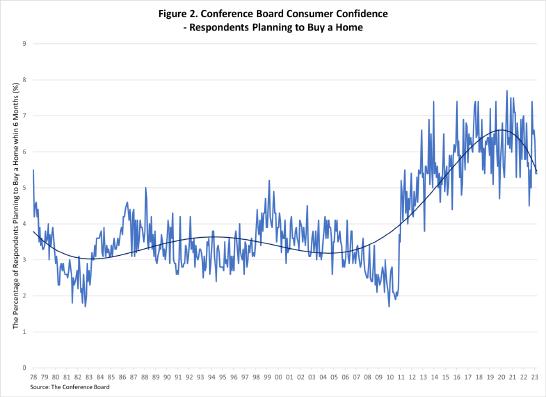

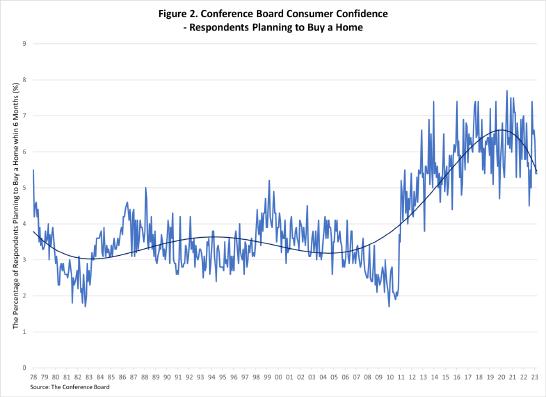

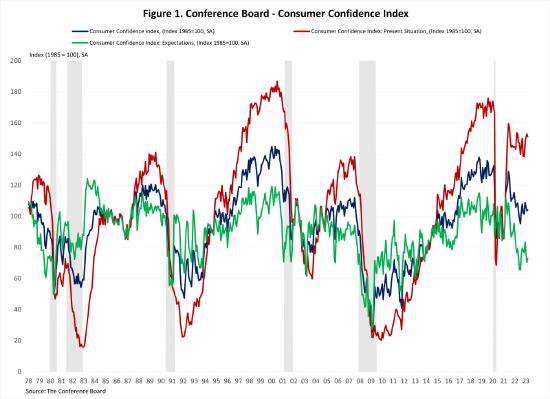

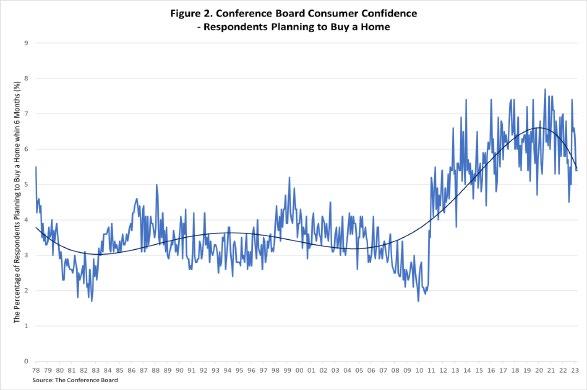

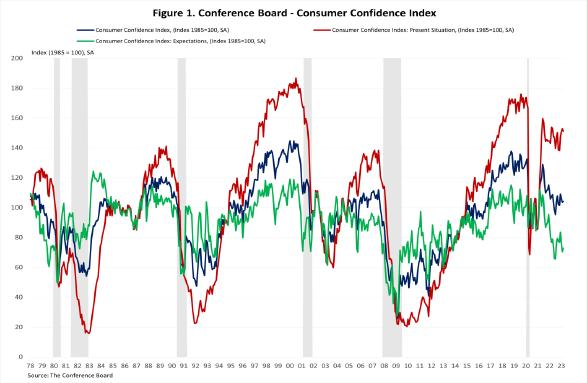

CONSUMER CONFIDENCE Increased Slightly in March

BY: JESSE WADE

Consumer confidence rose slightly following two months of declines thanks to the optimism in the short-term outlook. Even though confidence rose in March, consumers are planning to spend less on highly discretionary categories such as concerts and dining. As a result, consumers are planning to spend more on less discretionary categories such as home maintenance and repair.

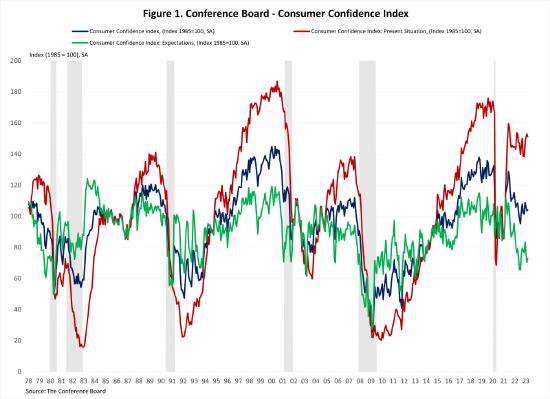

The Consumer Confidence Index, reported by The Conference Board, increased 0.8 points from 103.4 to 104.2 in March. The Present Situation Index fell 1.9 points from 153.0 to 151.1, and the Expectation Situation Index rose 2.6 points from 70.4 to 73.0. The Expectation Situation Index continues to be near 80 –a level associated with a recession.

Consumers were slightly less pessimistic about the shortterm outlook. The share of respondents expecting business conditions to improve rose from 14.6% to 15.5%, while those expecting business conditions to deteriorate fell from 21.6% to 18.5%. Similarly, expectations of employment over the next six months were more positive. The share of respondents expecting “more jobs” increased by 0.5 percentage points to 15.0%, and those anticipating “fewer jobs” decreased by 1.3 percentage points to 19.9%.

Consumers’ assessment of current business conditions declined in March. The share of respondents rating business conditions “good” rose by 0.4 percentage points to 18.4%. The share claiming business conditions “bad” rose by 1.9 percentage points to 19.3%. Meanwhile, consumers’ assessment of the labor market was also less favorable. The share of respondents reporting that jobs were “plentiful” fell by 2.1 percentage points to 49.1%, while those saw jobs as “hard to get” remained unchanged at 10.3%.

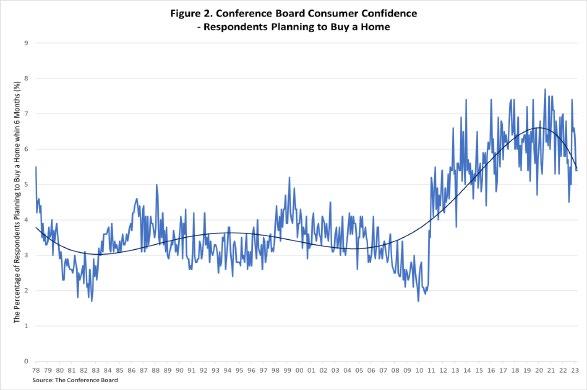

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home remained at 5.4% in March. The share of respondents planning to buy a newly constructed home increased to 0.8%, while for those who planning to buy an existing home increased to 2.5%.

EYE ON HOUSING

April 2023 www.ncbia.com page 25

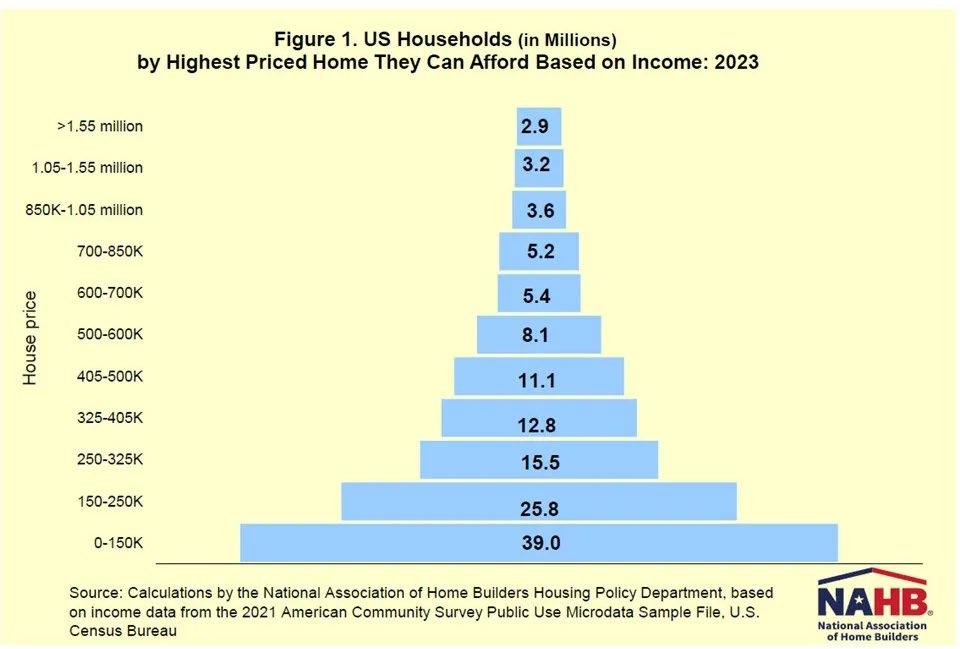

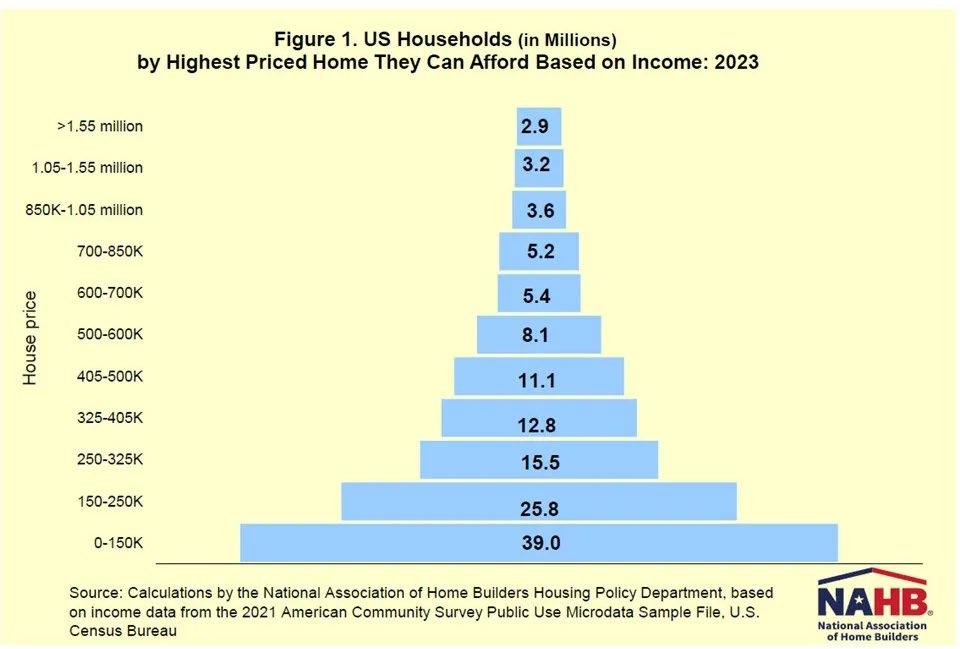

AFFORDABLILTY PYRAMID SHOWS 64.8 Million Households Cannot Buy a $250,000 Home

As described in a previous post , NAHB’s recently released its 2023 Priced-Out Estimates , show that 96.5 million households are not able to afford a median priced new home, and that an additional 140,436 households would be priced out if the price goes up by $1,000. This post focuses on the related U.S. housing affordability pyramid, showing how many households have enough income to afford homes at various price thresholds.

BY: NA ZHAO

The pyramid uses the same standard underwriting criterion as the priced-out estimates to determine affordability: that the sum of mortgage payments, property taxes, homeowners and private mortgage insurance premiums should be no more than 28% of the household income.

Based on this, the minimum income required to purchase a $150,000 home at the mortgage rate of 6.25% is $45,672.63. In 2023, about 39 million households in the U.S. are estimated to have incomes no more than that threshold and, therefore, can only afford to buy homes priced no more than $150,000. These 39 million households form the bottom step of the pyramid. Another 25.8 million can only afford to pay a top price of somewhere between $150,000 and $250,000 (the second step on the pyramid). Each step represents a maximum affordable price range for fewer and fewer households. Obviously, housing affordability is a greater concern for households with annual income at the lower end of the distribution.

The top step of the pyramid shows that around 3 million households can buy a home priced above $1.55 million. While this market is significant and important, market analysts should never only focus on them to the exclusion of the larger number of Americans with more modest incomes that support the pyramid’s base.

EYE ON HOUSING

page 26 www.ncbia.com April 2023

END OF FED TIGHTENING in View? Stress Weighs on Banking System

BY: ROBERT DIETZ

The Federal Reserve’s monetary policy committee on Wednesday raised the federal funds target rate by 25 basis points but indicated that it was moving to a more data-dependent mode as markets digest incoming risks for banks. The Fed is balancing two economic risks: ongoing elevated inflation and emerging risks to the banking system. Chair Powell noted that near-term uncertainty is high because of these risks, as well as impacts from policy actions taken to shore up liquidity

Three banks have failed, in part, because of the rapid rise in interest rates that reduced the market value of bonds, producing a liquidity issue for a few banks as depositors shifted their funds. When the banks move to sell these bonds, they will have to do so at a loss because of riskmanagement failures.

With respect to broader monetary policy, this week’s increase of the federal funds rate moved that target to an upper rate of 5%. The Fed’s projections indicate that additional increases may be needed to achieve the level of tightening necessary to ultimately bring inflation back to the Fed’s target of 2%. For example, it seems reasonable to expect one more 25 basis-point increase at either the Fed’s May or June meeting, which would end the tightening cycle. Tightening of financial conditions, including risks for the availability of credit for AD&C loan purposes, will also slow the economy and generate disinflationary forces.

Before this meeting, housing data were benefitting from lower longterm rates. Total existing home sales, including single-family homes, townhomes, condominiums, and co-ops, rose 14.5% to a seasonally adjusted annual rate of 4.58 million in February, per the National Association of Realtors — the largest monthly gain since July 2020. However, on a year-over-year basis, sales were still 22.6% lower than a year ago. Although inventory remains tight at just a 2.9-month supply, home prices in the resale market declined because of higher interest rates — the first retreat after 131 consecutive monthly gains.

Builders remained in a positive mood prior to the recent banking and monetary policy news. Although high construction costs and elevated interest rates continue to hamper housing affordability, the limited inventory of existing homes is shifting demand to the new homes market and giving builders reason for cautious optimism. The NAHB/Wells Fargo Housing Market Index rose two points in March to a level of 44, the third straight monthly increase.

Home building posted gains in February, although the prior downward trend will likely continue until the second half of the year. Single-family starts increased 1.1% to an 830,000 seasonally adjusted annual rate. However, this remains 31.6% lower than a year ago. The multifamily sector increased 24% to an annualized 620,000 pace. Multifamily construction will slow in 2023 because of tighter lending conditions and the highest level of apartments under construction since 1973. The slowing of overall home building activity is consistent with a recent decline in the number of open, unfilled construction jobs, which declined from 488,000 in December of last year to just 248,000 in January

EYE ON THE ECONOMY

April 2023 www.ncbia.com page 29

Do you want to opt-out of our referral program? Just email judie@ncbia.com page 30 www.ncbia.com April 2023 $ 7 . 0 0 / e a c o n t a c t j u d i e @ n c b i a . c o m t o o r d e r Y o u r N e w H o m e a n d H o w t o T a k e C a r e o f I t h a s a n i n v i t i n g n e w l o o k a n d c o n t i n u e s t o b e a p e r f e c t c u s t o m e r h a n d o u t a t c l o s i n g . R e m e m b e r : c u s t o m e r c a r e i s t h e k e y t o a b u i l d e r ’ s w a r r a n t y p r o g r a m .

FED RAISES RATES AS Economy Shows Signs of Weakening

BY: ROBERT DIETZ

Last week, the Federal Reserve’s monetary policy committee raised the federal funds target rate by 25 basis points but indicated that it was moving to a more data-dependent mode as markets digest incoming risks for banks. The Fed is balancing two economic risks: ongoing elevated inflation and emerging risks to the banking system. Because of these conditions, Fed Chairman Jerome Powell noted that near-term uncertainty is high.

The Fed moved the federal funds upper rate to 5%, and its projections indicate additional increases may be in store to ultimately bring inflation back, over time, to the Fed’s target of 2%. The “may” in the prior sentence is intentional, as the more dovish tone of the Fed’s communication moves away from prior statements that additional firming of monetary policy is required without question. In fact, strains on the regional bank system point to further slowing of the economy — beyond housing and manufacturing, which were already contracting — and gradually reducing inflationary pressure. NAHB is forecasting one final increase of 25 basis points, as ongoing pressure on regional banks likely acts as a 25-basis point increase by itself.

The bond market appears to be expecting the Fed to cut rates during the second half of the year. However, this runs counter to communication from Fed leadership, who have suggested that higher rates need to remain in place over a longer period of time to successfully bring inflation lower. Nonetheless, the 1-year Treasury rate has declined from 4% at the start of March to below 3.3% today, correspondingly reducing mortgage rates.

The decline in rates from November has increased demand for home purchases. At the start of November, the 30-year fixed-rate mortgage was just below 7.1%. Per Freddie Mac, it has fallen to near 6.3% as of last week. As a result, total existing home sales, including singlefamily homes, townhomes, condominiums, and co-ops, rose 14.5% from January to a seasonally adjusted annual rate of 4.58 million in February — the largest monthly gain since July 2020. On a year-over-year basis, sales were still 22.6% lower than a year ago. However, the recent monthly gains illustrate the market’s ability to price in demand with some reduction for interest rates.

With limited resale inventory (currently just a 2.6-month supply), any increase in demand means additional traffic for home builders. Sales of newly built, single-family homes in February increased 1.1% to a 640,000 seasonally adjusted annual. However, new home sales are down 19% compared to a year ago. New single-family home inventory fell for the fifth straight month. The February reading indicated an 8.2-month supply at the current building pace, which remains elevated because of pricing out that occurred in 2022 as interest rates increased.

The future of housing demand depends on progress on the inflation fight. Labor market data indicate that business hiring is softening. The count of open, unfilled jobs for the overall economy declined again in February, falling to 9.9 million. From an inflation perspective, the count of open, unfilled positions would ideally slow to the 8 million range in the coming quarters as the Fed’s actions cool inflation. And as noted earlier, tightening conditions for regional banks will slow lending for some sectors, including some construction development financing. The majority of 1–4-unit residential construction loans are still held by small banks with less than $10 billion in assets, so this is an area worth watching as the Fed’s policies produce impacts on the overall economy.

EYE ON THE ECONOMY

April 2023 www.ncbia.com page 31

Exclusive Entertainment Discounts!

Members have access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels, and much more.

• Save up to 40% on Top Theme Parks Nationwide

• Save up to 60% on Hotels Worldwide

• Save up to 40% on Top Las Vegas & Broadway Show Tickets

• Huge Savings on Disney & Universal Studios Tickets

• Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

Please visit https://memberdeals.com/nahb/?login=1

page 32 www.ncbia.com April 2023

CONSUMER CONFIDENCE Increased Slightly in March

BY: JESSE WADE

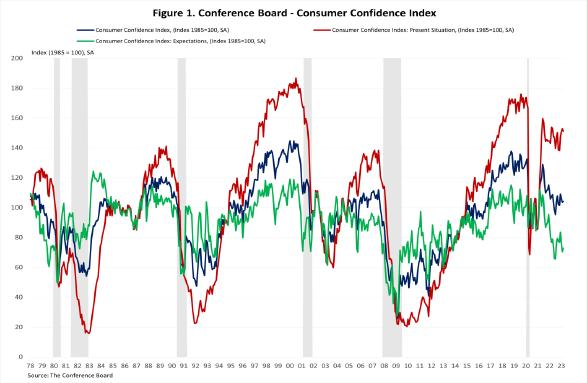

Consumer confidence rose slightly following two months of declines thanks to the optimism in the short-term outlook. Even though confidence rose in March, consumers are planning to spend less on highly discretionary categories such as concerts and dining. As a result, consumers are planning to spend more on less discretionary categories such as home maintenance and repair.

The Consumer Confidence Index, reported by The Conference Board, increased 0.8 points from 103.4 to 104.2 in March. The Present Situation Index fell 1.9 points from 153.0 to 151.1, and the Expectation Situation Index rose 2.6 points from 70.4 to 73.0. The Expectation Situation Index continues to be near 80 –a level associated with a recession.

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home remained at 5.4% in March. The share of respondents planning to buy a newly constructed home increased to 0.8%, while for those who planning to buy an existing home increased to 2.5%.

Consumers’ assessment of current business conditions declined in March. The share of respondents rating business conditions “good” rose by 0.4 percentage points to 18.4%. The share claiming business conditions “bad” rose by 1.9 percentage points to 19.3%. Meanwhile, consumers’ assessment of the labor market was also less favorable. The share of respondents reporting that jobs were “plentiful” fell by 2.1 percentage points to 49.1%, while those saw jobs as “hard to get” remained unchanged at 10.3%.

Consumers were slightly less pessimistic about the shortterm outlook. The share of respondents expecting business conditions to improve rose from 14.6% to 15.5%, while those expecting business conditions to deteriorate fell from 21.6% to 18.5%. Similarly, expectations of employment over the next six months were more positive. The share of respondents expecting “more jobs” increased by 0.5 percentage points to 15.0%, and those anticipating “fewer jobs” decreased by 1.3 percentage points to 19.9%.

EYE ON HOUSING

April 2023 www.ncbia.com page 33

64 LAWMAKERS CALL on DOE to Scrap Proposed Transformer Rule

At NAHB's urging, a bipartisan group of 64 House lawmakers have sent a letter to Sec. Jennifer Granholm urging the Department of Energy (DOE) to withdraw its proposed rule to regulate energy conservation standards for distribution transformers.

At a time when the home building industry is facing a severe shortage of electrical transformers, the proposed rule would dictate that manufacturers increase the efficiency of distribution transformers by a mere tenth of a percentage point. In order to achieve this nominal increase in efficiency, the proposed rule would require manufacturers to transition to a different type of steel that would add months to a lengthy order cycle that already takes more than 16 months to produce and deploy new transformers.

The letter stated that “prolonged lead times and the lack of availability have made it difficult for utilities to provide transformers to home builders, city planners, and economic developers to get power to end users in new development areas.”

Lawmakers emphasized that demand for transformers was far outstripping supply before DOE issued its proposed rule and that this regulation would only make a bad situation worse.

“A new efficiency regulation that completely overhauls the manufacturing process will further exacerbate the significant delays in delivering distribution transformers,” the House letter stated. “Until the industry receives the regulatory certainty it needs, the production backlog will only worsen.”

CONTACT:

Alex Strong

astrong@nahb.org

(202) 266-8279

NAHB has also sent comments to DOE stating how this proposed rule will not only exacerbate the current nationwide shortage of electrical transformers, but also fuel delays in home construction projects across the country as well as aggravating the nation’s housing affordability crisis.

NAHB continues to work with lawmakers to seek additional congressional funding aimed solely at boosting production of distribution transformers to meet market demand.

NAHB NOW

April 2023 www.ncbia.com page 35

Thanks for Renewing!

George Douzos, 5D Construction, LLC

David Heider, 84 Lumber

David Lehotan, All Construction Services

Tim Bennett, Bennett Builders & Remodelers

Robert Goede, Bosh Housing Group

Steve Ross, CBRE, Inc.

Lindsay Yost-Bott, Dale Yost Construction

Liz Schneider, Dollar Bank

Thomas Eschtruth, Environment & Renovation Services, Inc,

Jessica Stewart, First Federal Savings of Lorain

Darrell Myers, Floor Coverings International

Jen Toth, Floor Coverings International

John Toth, Floor Coverings International

Matt Smith, Hometown Electrical Doctor

Eddie James, James Home Construction, LLC

Jim Berlekamp, Kitchen Tune-Up (Cleveland West)

Craig Snodgrass, Lorain County Auditor

Mike Doran, Lorain County Recorder

Chris Majzun Jr., Majzun Construction

Chris Majzun Sr. Majzun Construction

Chris Mead, Maloney+Novotny LLC

John Daly, Network Land Title Agency

Jon Sherer, Paraprin Construction

Brian Schwab, Restorepro, Inc.

Andrew Teetzel, Screenmobile of West Cleveland

Bob Nicoll, Sedgwick

Applying for Membership

Sorry

Tom Anderson, BAS Broadcasting

Ashley Oates, Cambria

Matthew Denomme, The Brothers That Do Gutters

page 38 www.ncbia.com April 2023

George Litten, See Thru Window Cleaning, Inc. to See You Go!

Mark Ballock, 84 Lumber

Ashley Oates, 84 Lumber

STATESMAN SPIKE (500-999 SPIKE CREDITS)

Our SPIKES are Our FOUNDATION

SUPER SPIKE (250-499 SPIKE CREDITS)

ROYAL SPIKE (150-249 SPIKE CREDITS)

RED

(100-149 SPIKE CREDITS)

GREEN

(50-99 SPIKE CREDITS)

LIFE SPIKE (25-49 SPIKE CREDITS)

BLUE SPIKE (6-24 SPIKE CREDITS)

April 2023 www.ncbia.com page 39

THANK YOU SPIKES!

Bob Yost ........................ Dale Yost Construction .............................. 685.25 Mary H. Felton............. Guardian Title ............................................. 525.00

Terry Bennett Bennett Builders & Remodelers 302.25 Jack Kousma Kousma Insulation 293.00 Chris Majzun Jr. Majzun Construction Co. 269.00

Sara Majzun Majzun Construction Co. 240.50 Bill Perritt Perritt Building Co 225.50 Bucky Kopf Kopf Construction Corp. 204.50 Jeff Hensley Lake Star Building & Remodeling 182.75 Randy K. Strauss ......... Strauss Construction .................................. 179.50 Tom Lahetta ................. Tom Lahetta Builders ................................. 167.50

SPIKE

Dave Linna Sr. Linna Homes & Remodeling 137.50 Jason Scott North Star Builders 127.00 Thomas Caruso Caruso Cabinets 115.25 Patrick Shenigo ............ ShenCon Construction, LLC ..................... 108.50 Chris Majzun Sr. .......... Majzun Construction Co............................ 106.50 Tom Sear Ryan Homes 103.25

SPIKE

Jim Sprague Maloney & Novotny, LLC 99.00 Chris Mead Maloney & Novotny, LLC 77.50 Aaron Kalizewski ........ Grande Maison Construction.................... 69.50 Tim Conrad .................. Graves Lumber............................................ 67.00 Ray Allen Thom Thom Concrete 60.50 Jeremy Vorndran 84 Lumber 58.50 Liz Schneider Dollar Bank 50.50

Steve Schafer ................ Schafer Development ................................. 30.50 John Daly Network Land Title 26.50

Chris Collins Carter Lumber 16.00 John Toth Floor Coverings International 14.00 Ken Cassell ................... Cassell Construction................................... 13.50 John Blakeslee .............. Blakeslee Excavating, Inc ........................... 11.00 Steve Fleming Shamrock Development 11.00 Dave LeHotan All Construction Services 10.50 Mike Warden Huntington 10.00 Scott Kosman Lakeland Glass 9.50 Mark McClaine ............ 84 Lumber .................................................... 9.00 Tim Hinkle ................. Green Quest Homes ............................... 6.50 Tim King ..................... K. Hovnanian Homes ............................. 6.50 Lindsay Yost Bott Dale Yost Construction 6.00 Jim Tipple Maranatha Homes 6.00 © 2019 Hastings Mutual Insurance Company SS-1 (10/19) Select Contractors Building Your Business (800) 442-8277 www.hastingsmutual.com 404 E. Woodlawn Ave. Hastings, MI 49058 For more information contact: Broadened Coverage This coverage helps if there’s damage to property used by you or your employees that belongs to someone else. It has a limit of $2,500 per occurrence, with a $100 deductible. Builders Risk and Installation Floater “Floater” coverage is for anything that oats, or moves from place to place — like your supplies and machinery. It also covers damage to the structures you’re working on, including scaffolding, foundations, and more. This has a limit of $5,000, with a $250 deductible. Portable Tools Coverage on your tools has a limit of $1,000 per tool, to a maximum of $2,500. It also has a $500 deductible. The information referred to is not a policy. Refer to your policy for speci c coverage. The Nelson Agency, Inc. 116 4th St., Elyria, OH 44035 Phone: 440-323-8002 Fax: 440-323-8055 Drywallersinsurance1@prodigy.net A member of: Theresa Riddell (440) 420-1175 tmycps@oh.rr.com -ORBrett Adams (419) 515-0506 adamsb@sprouseagency.com

NCBIA Members,

NPP is a member benefit provider of NCBIA.

Through our partnership with NPP, eligible members can save 22% OFF Verizon monthly access fees* and up to 35% OFF the latest accessories. To get started, just visit www.NCBIA.com to sign up with NPP for free.

What is NPP?

NPP has a catalog of various offers for businesses and employees that can save you money and help you discover new goods and services to move your business forward. Membership is free and there is no obligation to purchase.

Industry eligibility requirements apply. Unlimited plans are not eligible for corporate and employee line discounts. All Verizon Wireless offers are for a limited time only and are subject to equipment availability. Verizon Wireless reserves the right to change or modify all offers at any time without notice. All terms and conditions are subject to and governed by Verizon Wireless’ Agreement with Customer including, but not limited to, customer eligibility requirements. Every effort is made to ensure the accuracy of the Verizon Wireless offers, however, Verizon Wireless is not responsible for any errors or omissions. NPP does not guarantee supplier offers or their website performance. Suppliers are solely responsible for all supplier products and services offered through NPP. Offers may be suspended or terminated at any time and may be subject to product restrictions, exclusions and eligibility requirements.

NAHB MEMBERS SAVE 25% off Houzz Pro Call 1 (888) 225-3051 today! Houzz Pro is one simple solution for builders and remodelers. Attract and win better clients, manage projects and teams, and deliver a standout customer experience.

Controlling Costs with the handicap reimbursement program

The Ohio Bureau of Workers’ Compensation (BWC) offers the Handicap Reimbursement Program to potentially off-set claim costs and encourage employers to hire and retain employees with a handicapped condition. Ohio Revised Code 4123.343 recognizes 26 conditions / disabilities in which, under some circumstances, the employer may be eligible for reimbursement of partial claim costs. The handicap percentage awarded by BWC will reduce claim costs without reducing the benefits to the injured worker. The reduced claim costs can result in sizable premium reductions.

Eligibility Requirements

If an employee suffers a lost-time industrial injury/ occupational injury or death, the claim may be eligible for handicap reimbursement if it can be shown that the handicapped condition pre-existed the industrial injury or occupational disease and either caused the claim or contributed to increased costs or delay in recovery

Additionally, one of the following benefit types must have been paid in the claim:

• Temporary total compensation

• Permanent total disability

• Permanent partial-scheduled loss

• Survivor benefits

• Wages in lieu of temporary total disability

Application Filing Deadlines

Private Employers:

• If the date of injury is between Jan. 1 and June 30, the application must be filed by June 30 of the year no more than six years from the year of the date of injury or occupational disease.

• If the date of injury is between July 1 and Dec. 31, the application must be filed by June 30 of the year no more than seven years from the year of the date of the injury or occupational disease.

Public Employers:

• A public employer must file the application by Dec. 31 of the year no more than six years from the year of the date of the injury or occupational disease.

The Sedgwick cost containment team conducts reviews on claims which meet the eligibility requirements for handicap reimbursement, files the application and attends the handicap hearing on behalf of our Ohio TPA clients. If you have any questions, contact our Sedgwick program manager, Bob Nicoll at (330) 418-1824 or robert.nicoll@sedgwick.com.

page 42 www.ncbia.com April 2023

Spring Safety

Here we are in 2023 and the first day of spring has come and gone. This is a great time for us all to leave the cold weather behind and look forward to warmer weather. The hazards we face in the winter may be different than the hazards we face in the spring. If your employees are working outside this spring, they should be made aware of those dangers. Below is a list of work your employees may be performing outdoors, the hazards they may face, and tips on staying safe.

Outdoor power equipment

1. Be sure to wear gloves, safety goggles/glasses, sturdy shoes, pants, and any other necessary PPE.

2. Follow all the manufacturer’s operation and safety guidelines and do not take short cuts. The guidelines are designed for your safety.

3. Perform a maintenance tune up on your equipment such as oil/fuel change, sparkplug, filter, etc.

4. Ensure your blades on equipment are kept sharp as this will make the job easier and lower the chances of getting injured.

5. Remember to protect your hearing. Outdoor power equipment can damage your hearing.

Working at heights

1. When using a ladder, inspect it for damage and be sure to use the right ladder for the job.

2. Extension ladders should extend at least 3 feet above the working platform or roof.

3. Always maintain a three-point contact and if you need to carry tools, use a tool belt.

4. Scaffolding must be built per the manufacture’s specifications and by a competent person.

5. Use the appropriate fall protection when working at heights.

6. When removing material from the back of a truck, ensure the truck bed is organized to eliminate any trip hazards.

Outdoor hazards

1. Reduce the risk of sunburn and skin cancer by wearing long sleeves, a wide-brimmed hat, and sunshades. Use sunscreen with an SPF of 15 or higher.

2. Be sure to wear insect repellant to prevent insect bites.

3. When using chemicals, be sure to follow the manufacturer’s recommendations. Heed all safety warnings!!!

4. Keep an eye on the thermometer and take precautions if it gets too hot. Don’t forget to drink water or hydrating liquids.

5. Learn the warning signs of heat-related illnesses and share them with others. These include symptoms like headache, dizziness, rapid pulse, nausea, and confusion.

Working outside as the weather warms up can be beneficial, mentally, and physically. The warm sun, cool breeze and new blossoms are just a few benefits. But we must remember there are some hidden hazards. Be sure to take the appropriate precautions, as this will make working outdoors safer and more enjoyable!

For more information, please contact Sedgwick’s Andy Sawan at 330.819.4728 or andrew.sawan@sedgwick.com

April 2023 www.ncbia.com page 43

HELP YOUR STATE Make the Right Choice on Energy Codes

CONTACT:

States and large municipalities across the United States are engaged in a review of their energy codes for residential construction with an eye toward adopting updated energy conservation requirements. They’re doing it because the federal government is offering more than $1 billion in incentives. But there are choices to be made as two separately funded programs are offering grants for energy code updates. NAHB members and HBAs have an opportunity to help guide state and local decision-making.

• The Infrastructure Investment and Jobs Act (IIJA), signed in November 2021, provides $225 million ($45 million per year from FY22 through FY26) for the Department of Energy’s Resilient and Efficient Codes Implementation (RECI) program for states to adopt updated energy codes, without specifying an edition. This means if a state is currently on the 2012 International Energy Conservation Code (IECC), for example, if it moves to the 2018 edition, it may be eligible for a grant.

• The Inflation Reduction Act (IRA), signed into law in August 2022, provides $1 billion to support state and local governments’ adoption of the most recent energy codes, which currently is the 2021 IECC. Only moves to the 2021 IECC will be funded.

It’s important that NAHB members and HBAs emphasize that there is no need for a state to update its energy codes in most cases. Adopting new building codes is expensive, as building departments need to update their procedures, resources, and training, which is why federal money was appropriated to help, and can be confusing for both builders and building officials. And increased energy conservation requirements, which always cost more upfront, do not offer homeowners the paybacks they are promised.

Neil Burning nburning@nahb.org

(202266-8565

Karl Eckhart keckhart@nahb.org

(202266-8279

But if a state must take grant money, NAHB members and HBAs should encourage state and local governments to apply for IIJA (RECImoney rather than IRA money because the infrastructure bill funding does not mandate the adoption of the 2021 edition of the IECC. The first round of applications for infrastructure bill funding are due March 27, 2023. But this is just the first cycle of funding that will last at least five years. It is important to engage your state’s energy offices and officials.

Funding applications that have partnerships are given preference. The Department of Energy specifically lists “associations of builders and design and construction professionals,” such as state and local HBAs in the NAHB Federation, as acceptable partners for states on applications.

Engage your state and local officials and HBAs now to see if there is an opportunity to partner on an application. Check out these NAHB resources to see which version of the IECC your state currently uses and for more information on partnering with states.

NAHB NOW

page 44 www.ncbia.com April 2023

BIDEN WOTUS Rule in Effect in 48 States

CONTACT:

The Biden administration’s new “waters of the United States” (WOTUS) rule is in effect in 48 states across the nation, but the rule could be short-lived because the Supreme Court’s upcoming ruling under Sackett v. EPA is squarely focused on the legality of the significant nexus test, which is a critical part of the final rule. The verdict could come anytime within the next few weeks. Meanwhile, a Texas federal court has blocked the Biden WOTUS rule from taking effect in Texas and Idaho, and specifically cited serious concerns regarding the significant nexus text. NAHB and other groups had sought a nationwide injunction, but the judge in the case ruled that it would only apply to those two states. There are also two other cases in Kentucky and North Dakota where states and businesses are challenging the rule. NAHB participated in the Texas lawsuit and has sought to intervene in North Dakota. In practice, the significant nexus test has proven extremely difficult to apply consistently in the field, leaving developers and builders unable to discern for themselves which isolated wetlands, ephemeral streams, or even human-made drainage features, like roadside ditches, are federally jurisdictional under the Clean Water Act. The new WOTUS rule radically extends the areas in which home builders are required to get federal permits. This will result in continued regulatory barriers to affordable housing as single-family and multifamily developers struggle to find the developable land necessary to produce the new affordable housing units this nation desperately needs.

As of now, if a developer or builder approaches the U.S. Army Corps of Engineers seeking a jurisdictional determination or a federal wetlands permit, the noweffective final rule applies nationwide except for Texas and Idaho. If the same developer or builder had an approved jurisdictional determination under the prior Trump WOTUS rule but now wants to proceed and get a federal wetlands permit, they would have to move forward under the new Biden WOTUS rule.

Thomas Ward

tward@nahb.org

(202) 266-8230

Michael Mittelholzer mmittelholzer@nahb.org

(202) 266-8660

On the legislative front, NAHB worked aggressively to get a bipartisan House resolution passed recently that would rescind the Biden WOTUS rule. A Senate vote on the same resolution is expected within the next week or two. If the Senate resolution is approved, NAHB will urge Biden to sign the measure into law. However, the president is expected to veto the measure if it reaches his desk.

NAHB will keep fighting on the legislative and legal fronts, and continue to call on the president to heed the will of the people by signing this resolution into law if it passes the Senate and directing his administration to craft a new WOTUS rule that restores common sense and predictability to the federal wetlands permitting process while maintaining environmental protection of our nation’s waterways.

April 2023 www.ncbia.com page 45

NAHB NOW

The 7-Elev en Commercial Fleet Mastercard ®

Fleet savings made easy.

Perfect fit for mid-sized to larger fleets that need the added convenience of fueling where Mastercard® is accepted. With the 7-Eleven Commercial Fleet Mastercard®, your fleet can customize reports for a complete fuel management solution.

Rebates & Savings

Save 5¢ per gallon with volume-based rebates!*

Security & Fraud Controls

Enjoy the security of advanced card prompts.

Online Control & Visibility

Set card controls and access detailed reporting online anytime.

Earn 5¢ per gallon in rebates when you fuel at 7-Eleven & Speedway locations.*

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse.

Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

or natural gas purchases. Rebates are subject to forfeiture if your account is not in good standing. To receive rebate, invoice must be paid on time. Rebates will not apply to returns or chargebacks. Savings will be reflected

Call Holden Moll now at 1-760-918-5933 or email holden.moll@fleetcor.com to start earning your association savings today! Special Association Discount for the North Coast Building Industry Association Limited time offer valid for new 7-Eleven Commercial Fleet MasterCard applications received from 1/1/2023 through 12/31/2023. New approved accounts will earn 15 cents per gallon rebate on 7-Eleven & Speedway fuel purchases in the first six months after account setup. Rebates are cents per gallon based on the number of gallons purchased at 7-Eleven & Speedway locations per calendar month. The maximum promotional rebate in any one-month period, regardless of billing terms, is $600. Rebates are subject to forfeiture if your account is not in good standing. To receive rebate, invoice must be paid on time. Rebates will not apply to returns or chargebacks. Savings will be reflected as a rebate on your filling statement in the form of a statement credit. Rebate offer valid for first 12 months after account set-up. *Rebates are cents per gallon based on the number of gallons purchased at 7-Eleven & Speedway locations per calendar month. Not valid on aviation, bulk fuel, propane

form of a statement credit. Rebate offer valid for first 12 months after

set-up. **Please

payment information. Fuel purchases at locations other than 7-Eleven or Speedway locations are subject to an out-of-network transaction fee. The 7-Eleven Commercial Fleet Mastercard® is issued by Regions Bank, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. ©2023 FLEETCOR, P.O. Box 1239, Covington, LA, 70434.

as a rebate on your filling statement in the

account

see Client Agreement – at www.fleetcor.com/terms/7-Eleven-mc – for rate, fee and other cost and

Please

7-Eleven Fleet Card Program Application

If your organization is any type other than Sole Proprietorship, Public Corporation, or Government &

Section below.

- At FLEETCOR’s discretion, we may require CPA Reviewed or Audited Financial Statements during the Credit review.

AUTHORIZED REPRESENTATIVE – Required.