NEWSLETTER N O R T H C O A S T B U I L D I N G I N D U S T R Y A S S O C I A T I O N ncbia, sheffield village, oh 44035 www.ncbia.com April/May 2024 - vol. MMXXIV BUILDER

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Office 5321 Meadow Lane Court Suite 23

Sheffield Village, OH 44035

Phone: 440.934.1090 info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate Ashlyn Bellan-Caskey | ashlynncbia@gmail.com

2024 NCBIA Officers

President

Tim King, K. Hovnanian Homes

Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain

Secretary

Mike Gidich, Honey Dudes Handyman Service

2024 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Joey McCormick, Bumble Bee Blinds

Dave Linna, Linna Homes & Remodeling

Sara Majzun, Majzun Construction Co.

Jon Sherer, Paraprin Construction, LLC

John Eavenson, Perpetual Development

Jason Rodriguez, The S.J.R Building Co.

Kevin Walker, Walker Wealth Managements & Great Lakes Properties & Investments

NCBIA Life Directors

Jeremy Vorndran, 84 Lumber

Tom Caruso, Caruso Cabinets

Bob Yost, Dale Yost Construction

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jim Sprague, Maloney + Novotny, LLC

Randy Strauss, Strauss Construction

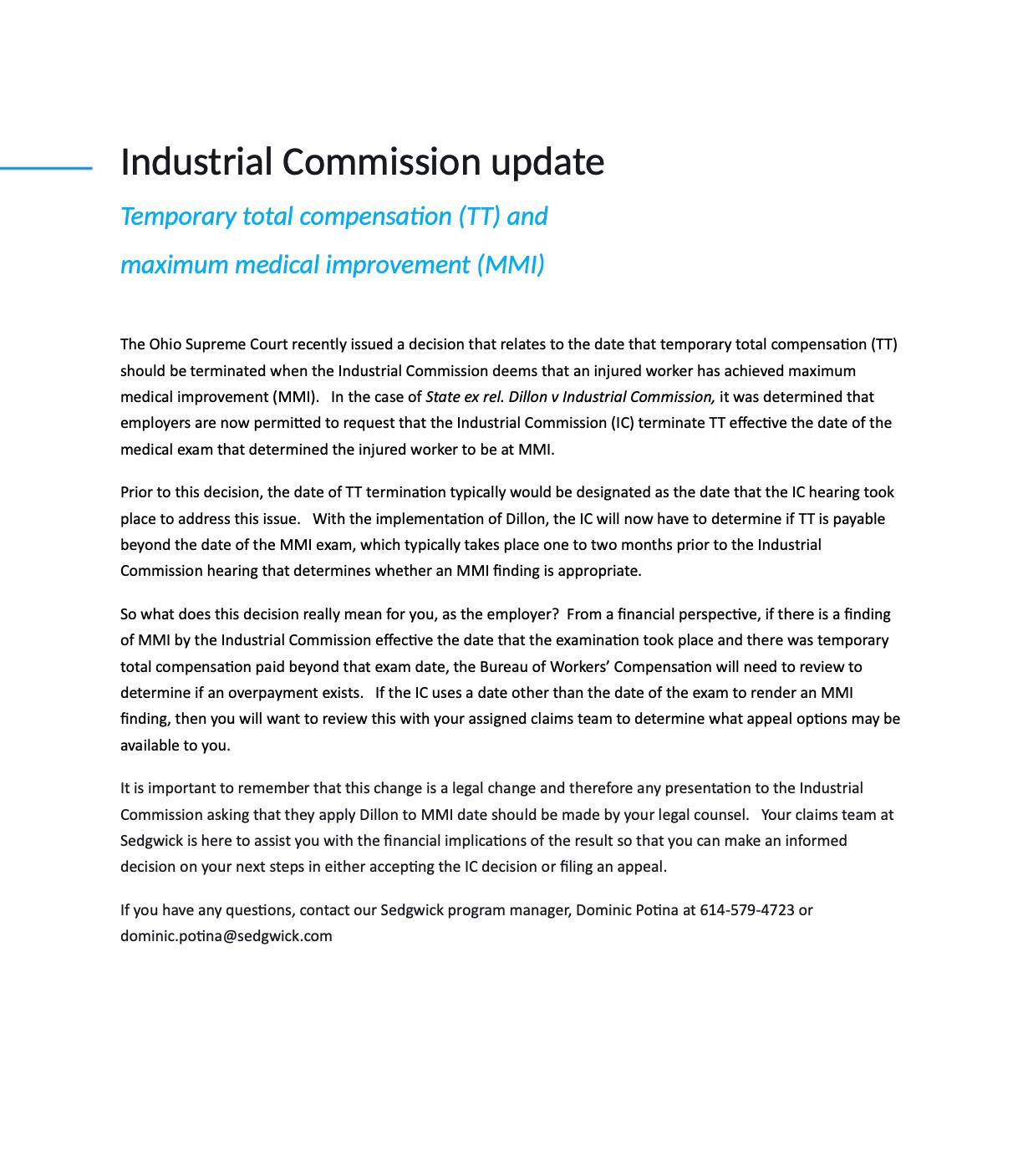

Tom Lahetta, Tom Lahetta Builders, Inc.

2024 NAHB Delegate

This member represents our local industry in Washington DC

Tim King, K. Hovnanian Homes

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2024 President

Enzo Perfetto, Enzoco Homes

OHBA Past President

Randy Strauss, 1996

2024 OHBA Trustees

Tim King, K. Hovnanian Homes

John Eavenson, Perpetual Development

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

April/May 2024 www.ncbia.com page 3

18-19

23

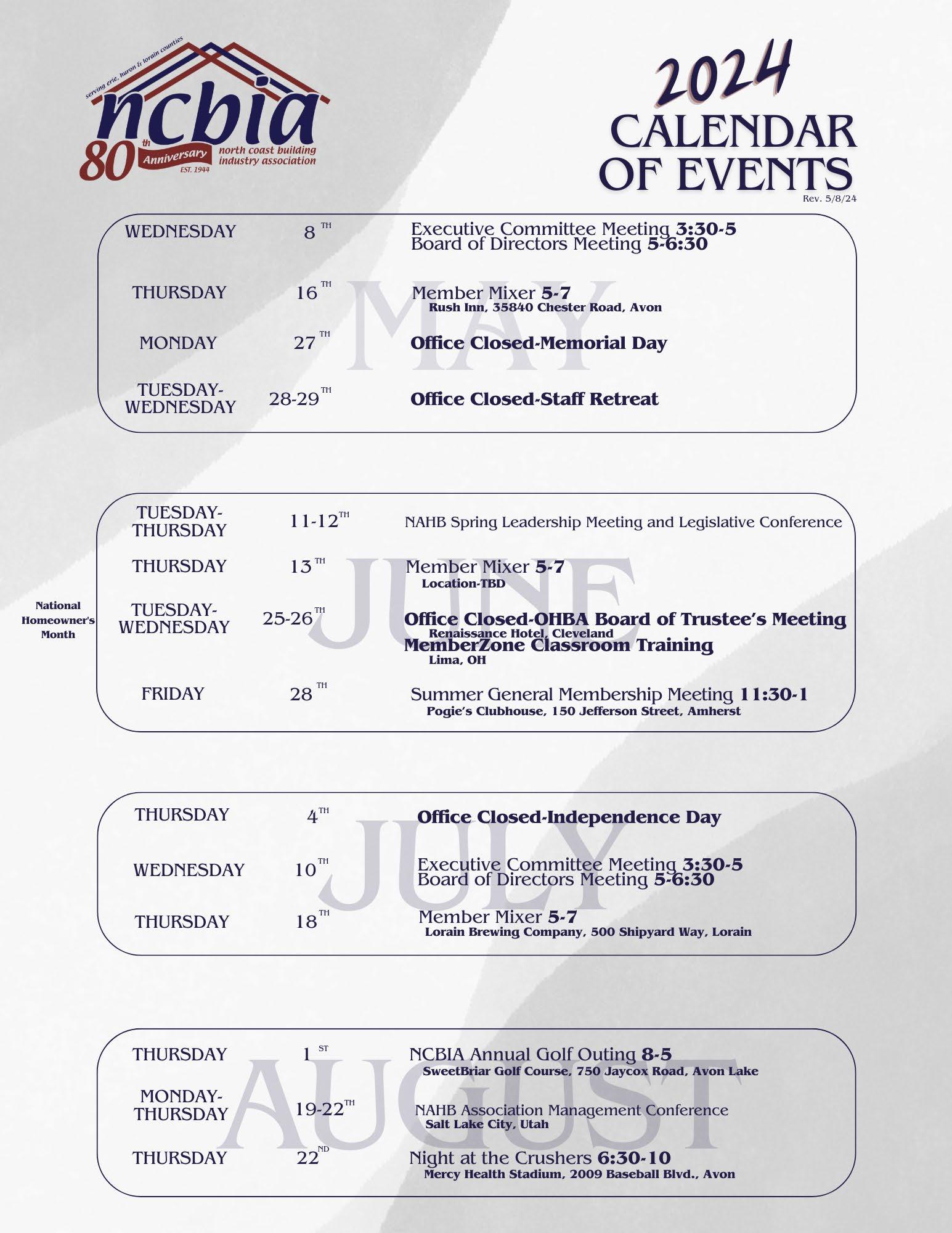

28

Table of Contents 6 - Menu of Services 7 - Member News 8Educate, Engage, & Experience - 2023-2024 NCBIA President 9THANK YOU NCBIA Members - Executive Officers Report 12 - Eye on Housing: Most Home Buyers Want One, Medium-Sized Home Office 13 - Eye on Housing: Fed on Hold with Limited Inflation Progress 14 - Thank You SPIKES! 15 - Eye on Housing: Residential Building Wages Continued to Rise 16EO Savings Update 17NAHB Monthly Update 18-19Eye on Housing: Increasing the Market for Green Building 20-212024 Calendar of Events 23 - Welcome New Members! Thanks for Renewing! Sorry to See you Go! 25Eye on the Economy: Interest Rates to Remain Higher for Longer 262024 Membership Directory 28 - NAHB Now: NAHB Leadership Lobbies Lawmakers Ahead of Legislative Conference 30-31BBS Memo 32Spring Member Mixer Flyer MAY 16th 33OHBA Executive VP Column 34 - Eye on Housing: Despite Higher Mortgage Rates, New Home Sales Post Solid Gain in March 35-392024 Night at the Races Thank You Sponsors! Photo Gallery 40-41NCBIA Annual Golf Classic Flyer 42Sedgwick Update 43Eye

Will

44 -

Attend

45

Sedgwick

46 -

47Eye

Fed

48BUILD-PAC

Fundraising Dinner 49-50

Rebates 51NAHB Now: NAHB

Over Lack

on WOTUS Rule 52Eye on

Home

Ideal Community 53-552024

Photo

56-60

Speedway/Fleetcor Flyers April/May 2024 www.ncbia.com page 5

on the Economy:

Home Inventory Levels Rise This Year?

NAHB Now:

the June 12, NAHB Legislative Conference

-

Update

General Membership Meeting & Cookout Flyer

on the Economy:

Is Set to Hold Rates Higher for Longer

Wine Pairing

HBA

Threatens Lawsuits

of Transparency

Housing:

Buyers'

Economic Forecast Thank You Sponsors!

Gallery

-

For

members are saying:

Dr. Dietz was an engaging speaker.

“ “

“ “

Such an interesting economic presentation, especially because of the focus on our area.

Dr. Dietz’s presentation will help our company plan for the future.

1. 22% off Verizon monthly access fees on Corporate liable lines. $34.99 or higher, 2 corporate lines required.*

information on any of these products &

please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

2. For a limited time, save $5/month for a year on two UNLIMITED plans by Verizon Wireless: Business Unlimited Pro 5G and Business Unlimited Plus 5G.1

Verizon 5G Business Internet

1. 10-year price guarantee, one month free, and prices as low as $69/month.2 Restrictions apply.

HELP? HOW CAN WE HELP? North Coast Building Industry Association Menu of Additional Products and Services Copies Equipment Design Services Warranty Books Black & White Black & White Color Color Color Raffle Boards, Drum & Equipment Graphic Design Services (8.5”x11”) (8.5”x14”) Black & White (11”x17”) (8.5”x11”) (8.5”x14”) (11”x17”) Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided Single Sided 2-Sided $0.10 $0.20 $0.15 $0.20 $0.50 $0.25 $0.50 $0.27 $0.52 $2.00 $100 per day $30 each (plus shipping, if applicable) NEED SOMETHING ELSE? JUST ASK! For more information on any of these products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com HOW CAN WE HELP? North Coast Building Industry Association Menu of Additional Products and Services Copies Equipment Design Services Black & White Black & White Color Color Color Raffle Boards, Drum & Equipment Graphic Design Services (8.5”x11”) (8.5”x14”) Black & White (11”x17”) (8.5”x11”) Single

Single

Single

2-Sided Single Sided 2-Sided $0.10 $0.20 $0.15 $0.20 $0.50 $0.25 $100 per day NEED SOMETHING

ASK!

$7 each (plus shipping, if applicable) Your New Home *Subject

1/30/24

per hour Contact

ashlynncbia@gmail.com $35 per hour Contact Ashlyn Bellan-Caskey at ashlynncbia@gmail.com page 6 www.ncbia.com April/May 2024

Sided 2-Sided

Sided 2-Sided

Sided

ELSE? JUST

more

services,

to change 1/30/24 *Subject to change 1/30/24

$35

Ashlyn Bellan-Caskey at

What

“

$50 $10 Verizon Wireless

“

Do you have some business news to share?

Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

Raymond Plumbing, Heating & Air Conditioning

We are proud to announce our selection as a 2024 President’s Award Recipient from Carrier Corporation! This award recognizes Carrier Dealers who demonstrate exceptional leadership in business management, customer service, HVAC expertise, and operational excellence. Our team worked tirelessly in 2023 to meet and exceed stringent criteria. Thank you to our entire team, our partners at Refrigeration Sales Corporation, and everyone who helped us achieve this prestigious award!

Buckeye Community Bank Celebrates Opening of New LaGrange Branch

Buckeye Community Bank, the only locally owned financial institution headquartered in Lorain County, proudly unveils its latest branch today in the heart of LaGrange. This strategic expansion aims to enhance the banking experience for residents and businesses in Southern Lorain and Northern Medina counties.

Located at 106 S. Center St., the new Buckeye branch offers a full range of personal and commercial banking services and a team of experienced community bankers committed to building solid relationships.

April/May 2024 www.ncbia.com page 7

EDUCATE, ENGAGE, & Experience

Working in conjunction with other members to further support our industry is extremely rewarding. If you are making your living in the building industry, you need to know what is going on and how it can affect your livelihood. Being involved will give you a better understanding of what is going on in the industry as a whole.

Being a member is more than just paying your yearly dues. It is about a family, it is about friendships, it is about housing, and we are all in this together. It is about understanding what goes into building a home, materials, costs, and the legislative process.

There are many skills one learns when navigating committees and leadership that apply in our association. This network of professionals can help your business thrive. I sincerely suggest that you join a committee, it will really help you grow both personally and professionally.

Associate members have a better connection to Builder members, not just from a networking standpoint but also ensuring a unified industry. Associate members are committed to the NCBIA and are there to help all of us and our communities grow. At the end of the day, we must all be successful. If it affects a builder, it affects all our members of the NCBIA.

Value of your membership. As a member, you can join with other professionals in the home building industry who participate in residential sales and marketing and all other aspects of homebuilding. The people you can meet through our events provide you with valuable contacts in the building industry.

All year long a full schedule of dedicated events promotes activities among members and their guests. Through this interaction with other professionals in the industry, you can contribute to your own professional growth. Take advantage of all we have to offer, our three General Membership meetings, mixers (which are free), educational sessions, our Hall of Fame/Installation of Officers/ Circle of Excellence annual event highlights our leadership and awards are given in many categories to our members. These are opportunities to gain experience and connect with fellow NCBIA industry professionals through a variety of activities and events. We also have a few fun social events in which we welcome your staff, business associates, friends, and family.

We have added a couple of new events this year - - if you missed our Night at the Races, you missed an exciting time that was enjoyed by all. Later this year we will be having a Product Night in conjunction with our October General Membership meeting. Our associates will have the opportunity to display their products and services to our builders at our 2025 Home and Remodeling Show. Local people want to work with local companies, so if you have not showcased your company to the communities we serve, you are missing out.

As always, I welcome your thoughts and ideas as this is your association!

NCBIA 2023-24 PRESIDENT page 8 www.ncbia.com April/May 2024

Tim King, K. Hovnanian Homes

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

THANK YOU NCBIA Members

I'd like to take a moment to extend my heartfelt gratitude to each and every one of you for your invaluable contributions to the NCBIA. Whether you've attended our General Membership meetings, participated in our various events, or generously supported us in any capacity, your dedication does not go unnoticed.

To those who serve on committees or hold leadership positions, your unwavering commitment is the backbone of our association, fostering an environment of camaraderie and growth. Your efforts are truly appreciated and instrumental in our collective success.

I'd like to take a moment to extend my heartfelt gratitude to each and every one of you for your invaluable contributions to the NCBIA. Whether you've attended our General Membership meetings, participated in our various events, or generously supported us in any capacity, your dedication does not go unnoticed.

To those who serve on committees or hold leadership positions, your unwavering commitment is the backbone of our association, fostering an environment of camaraderie and growth. Your efforts are truly appreciated and instrumental in our collective success.

A special mention goes to those who have sponsored our events and initiatives. Your support enables us to provide the diverse range of offerings that enrich the experiences of our members and advance our shared objectives. I also want to express my deepest gratitude to those who contributed to the establishment of our new, splendid office space. Your involvement has transformed it into a welcoming hub for our community, and we eagerly invite all members to visit and experience it firsthand.

Whether through your presence at events, volunteering your time, or extending financial support, each act of generosity reaffirms your belief in our association and our shared mission within the industry. Your investment fuels our continued growth and propels us toward even greater accomplishments.

Thank you for being an integral part of the NCBIA family. Your ongoing support and dedication are truly invaluable, and we look forward to further collaboration and success together.

April/May 2024 www.ncbia.com page 9

EXECUTIVE OFFICER’S REPORT

page 10 www.ncbia.com April/May 2024

MOST HOME BUYERS WANT ONE, Medium-Sized Home Office

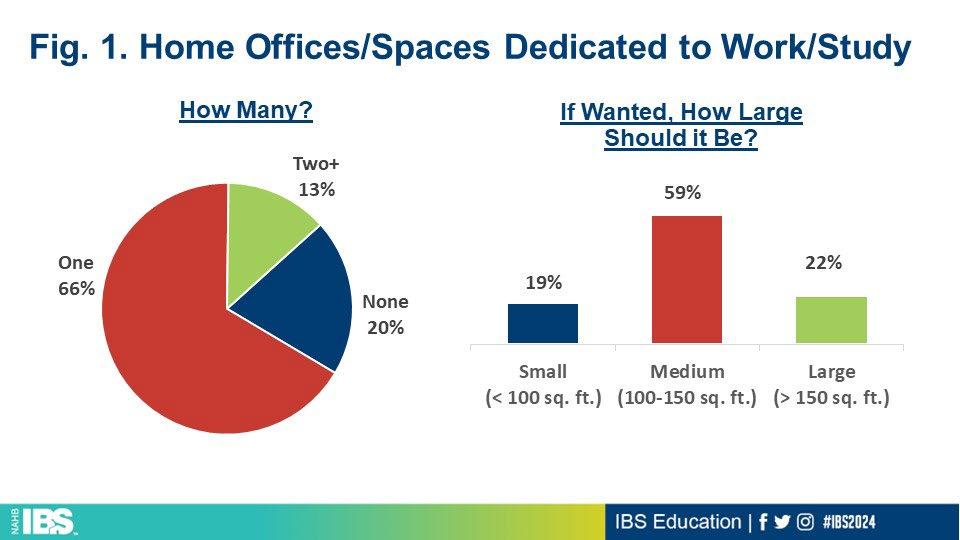

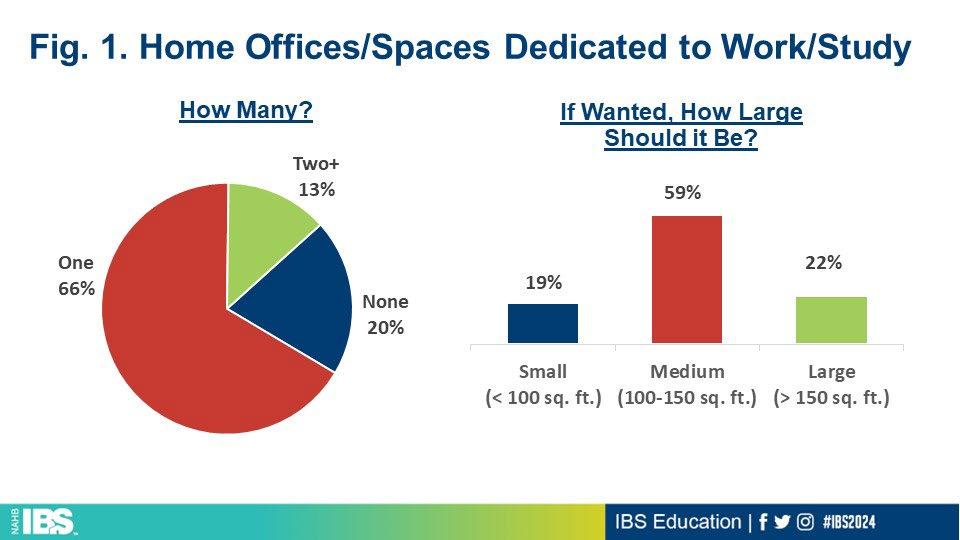

According to the latest What Home Buyers Really Want Study* , the vast majority of home buyers are looking for a home with at least one home office (or space dedicated to work/study). More specifically, 66% would prefer to buy a home with exactly one home office, 13% want at least two offices, and 20% want none (Fig. 1).

As homes continue to get smaller, understanding how much square footage buyers want to dedicate to a home office is a must. When asked, 59% of buyers interested in having a home office said it should be medium size (100 to 150 square feet). Much smaller shares of 22% and 19%, respectively, want the home office to be large (more than 150 square feet) or small (under 100 square feet).

More granular findings show that younger buyers as well as wealthier buyers are particularly in favor of home offices. Among Gen Z buyers, for example, 90% want at least one home office, compared to 75% of Boomers. Likewise, 92% of buyers in the $150,000+ income bracket would like at least one office, compared to 65% among those earning under $50,000.

BY: ROSE QUINT

BY: ROSE QUINT

* What Home Buyers Really Want, 2024 Edition sheds light on the housing preferences of the typical home buyer and is based on a national survey of more than 3,000 recent and prospective home buyers. Because of the inherent diversity in buyer backgrounds, the study provides granular specificity based on demographic factors such as generation, geographic location, race/ethnicity, income, and price point.

EYE ON HOUSING

page 12 www.ncbia.com April/May 2024

EYE ON HOUSING

FED ON HOLD WITH Limited Inflation Progress

The Federal Reserve’s monetary policy committee held constant the federal funds rate constant at a top target of 5.5% at the conclusion of its April-May meeting. In its statement, the Federal Open Market Committee (FOMC) noted:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.

The FOMC’s statement also noted:

The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

Overall, the central bank continues to look for lower inflation readings, with the data having shown limited progress in recent months. An important reason for the lack of inflation reduction remains elevated measures of shelter inflation, which can only be tamed in the long-run by increases in housing supply. Ironically, higher interest rates are preventing more construction by increasing the cost and limiting the availability of builder and developer loans necessary to construct new housing.

BY: ROBERT DIETZ

BY: ROBERT DIETZ

Despite the ongoing policy pause, the current meeting did not tilt the Fed’s policy bias toward hawkishness. For example, Fed Chair Powell noted that an additional rate hike is all but ruled out. Powell stated at his press conference, “I think it’s unlikely that the next policy rate move will be a hike.”

Furthermore, the Fed reduced the pace of its balance sheet reduction (Quantitative Tightening), although just for Treasury bonds. It is worth noting however, this change is not being done for accommodative growth purposes but rather to manage a smooth, orderly process of balance sheet normalization. In its statement the FOMC provided details on this change:

In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. Beginning in June, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion. The Committee will maintain the monthly redemption cap on agency debt and agency mortgage‑backed securities at $35 billion and will reinvest any principal payments in excess of this cap into Treasury securities.

With inflation data moderating at a slower than expected pace and economic growth remaining solid, forecasters are pushing back the timing and number of rate cuts expected for 2024. NAHB’s current forecast continues to call for two rate cuts during the second half of 2024. However, this may be reduced to just one dependent on incoming economic data.

The NAHB Economics team’s focus continues to be on the interplay between Fed monetary policy and the shelter/ housing inflation component of overall inflation. With more than half of the overall gains for consumer inflation due to shelter over the last year, increasing attainable housing supply is a key anti-inflationary strategy, one that is complicated by higher short-term rates, which increase builder financing costs and hinder home construction activity. For these reasons, policy action in other areas, such as zoning reform and streamlining permitting, can be important ways for other elements of the government to fight inflation.

April/May 2024 www.ncbia.com page 13

THANK YOU SPIKES!

STATESMAN SPIKE (500-999 SPIKE CREDITS) Bob

SUPER SPIKE (250-499 SPIKE CREDITS)

Terry

Dave

Chris

GREEN SPIKE (50-99 SPIKE CREDITS)

Jim

Chris Mead Maloney & Novotny, LLC

Jeremy Vorndran ......... 84 Lumber ....................................................

LIFE SPIKE (25-49 SPIKE CREDITS)

Tim King K. Hovnanian Homes

BLUE SPIKE (6-24 SPIKE CREDITS)

John Toth Floor Coverings International

Chris Collins Carter Lumber

Mark McClaine 84 Lumber

Ken Cassell ................... Cassell Construction...................................

Dave LeHotan .............. All Construction Services ..........................

John Blakeslee Blakeslee Excavating, Inc

Ashley Oates 84 Lumber

Scott Kosman Lakeland Glass 9.50

Tim Hinkle Green Quest Homes 6.50

Jim Tipple Maranatha Homes 6.50

Lindsay Yost Bott......... Dale Yost Construction .............................. 6.00

Mike Meszes ................ DRC Construction ...................................... 6.00

page 14 www.ncbia.com April/May 2024

Our

SPIKES are Our FOUNDATION

Yost

Dale Yost Construction .............................. 698.25 Mary

Guardian Title

543.00

........................

H. Felton.............

.............................................

Bennett Bennett Builders & Remodelers 303.75

Kousma Kousma Insulation 297.50 Chris Majzun Jr. .......... Majzun Construction Co............................ 276.00 Sara Majzun ..................... Majzun Construction Co............................ 267.50

Perritt Perritt Building Co 225.50 Jeff Hensley Lake Star Building & Remodeling 186.25 Randy K. Strauss Strauss Construction 180.50 Tom Lahetta ................. Tom Lahetta Builders ................................. 173.50

Jack

ROYAL SPIKE (150-249 SPIKE CREDITS) Bill

RED SPIKE (100-149 SPIKE CREDITS)

Linna Sr. Linna Homes & Remodeling 138.50

Scott Greyhawk Holdings, LLC 137.00 Thomas Caruso Caruso Cabinets 117.75 Patrick Shenigo ............ ShenCon Construction, LLC ..................... 111.00 Tom Sear ....................... Ryan Homes ................................................ 110.75

Jason

Majzun Sr. .......... Majzun Construction Co............................ 107.00

99.00

Sprague Maloney & Novotny, LLC

79.00

70.00

Aaron Kalizewski ........ Grande Maison Construction....................

63.00

55.00

Liz Schneider Dollar Bank

49.50

30.50

27.50

Steve Schafer ................ Schafer Development .................................

John Daly ...................... Network Land Title ....................................

17.00

16.00

14.00

13.50

12.00

11.50

10.00

EYE ON HOUSING

RESIDENTIAL BUILDING WAGES Continued to Rise

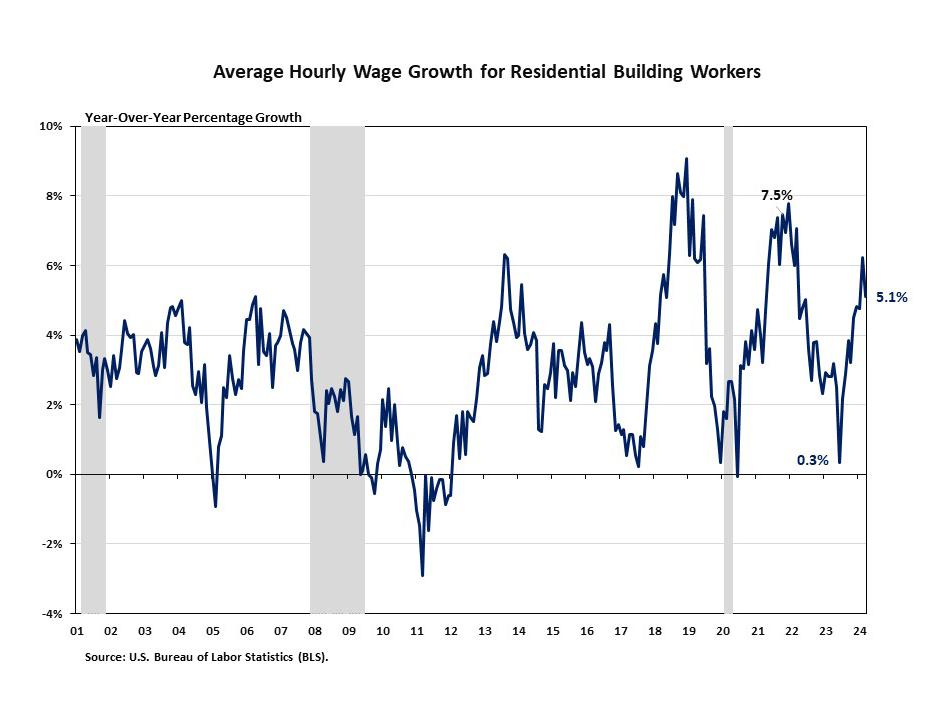

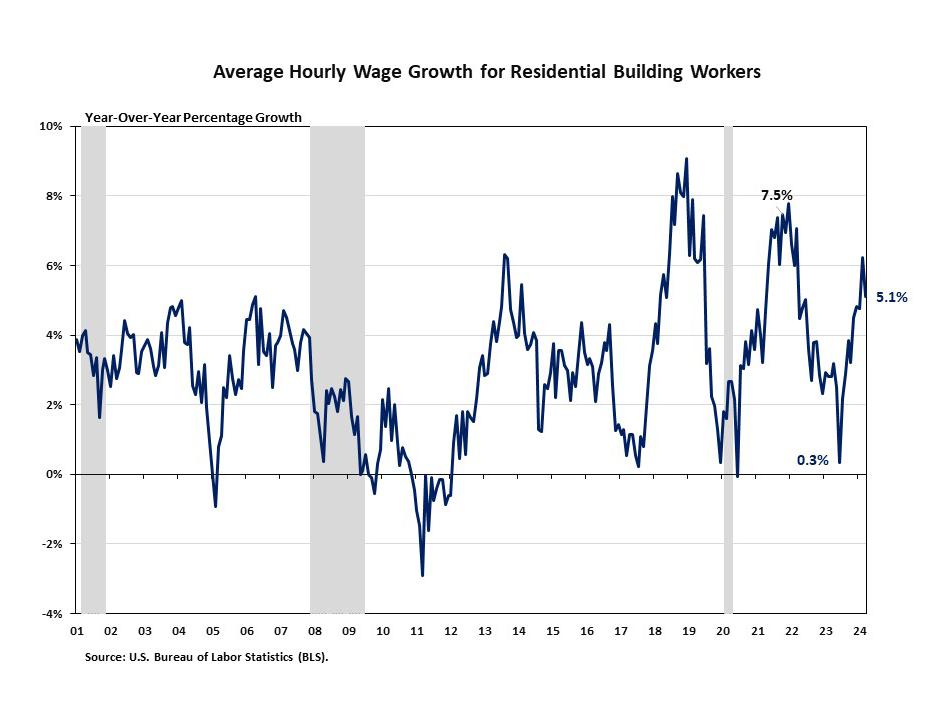

In March, residential building workers’ wages continued to grow but at a relatively slower pace. After an acceleration of a 6.2% increase in the previous month, the year-overyear (YOY) growth rate for residential building worker wages slowed to 5.1% in March.

According to the Bureau of Labor Statistics (BLS) report, average hourly earnings (AHE) for residential building workers* was $31.29 per hour in March. It increased 5.1% from $29.77 per hour a year ago but was lower than $31.41 per hour in February. In March, residential building workers’ wages were 14.0% higher than the manufacturing’s average hourly earnings of $27.45 per hour, 7.7% higher than transportation and warehousing ($29.04 per hour), and 13.7% lower than mining and logging ($36.25 per hour).

The ongoing skilled labor shortage continues to challenge the construction sector. Although the number of open construction jobs posted a surprising decline in March, demand for construction labor remained strong. This number may be revised higher in the next report, and we will keep monitoring closely for the following one- or twomonths’ data.

Note: *Data used in this post relate to production and nonsupervisory workers in the residential building industry. This group accounts for approximately two-thirds of the total employment of the residential building industry.

BY: JING FU

April/May 2024 www.ncbia.com page 15

page 16 www.ncbia.com April/May 2024

CLICK HERE April/May 2024 www.ncbia.com page 17

INCREASING THE MARKET for Green Building

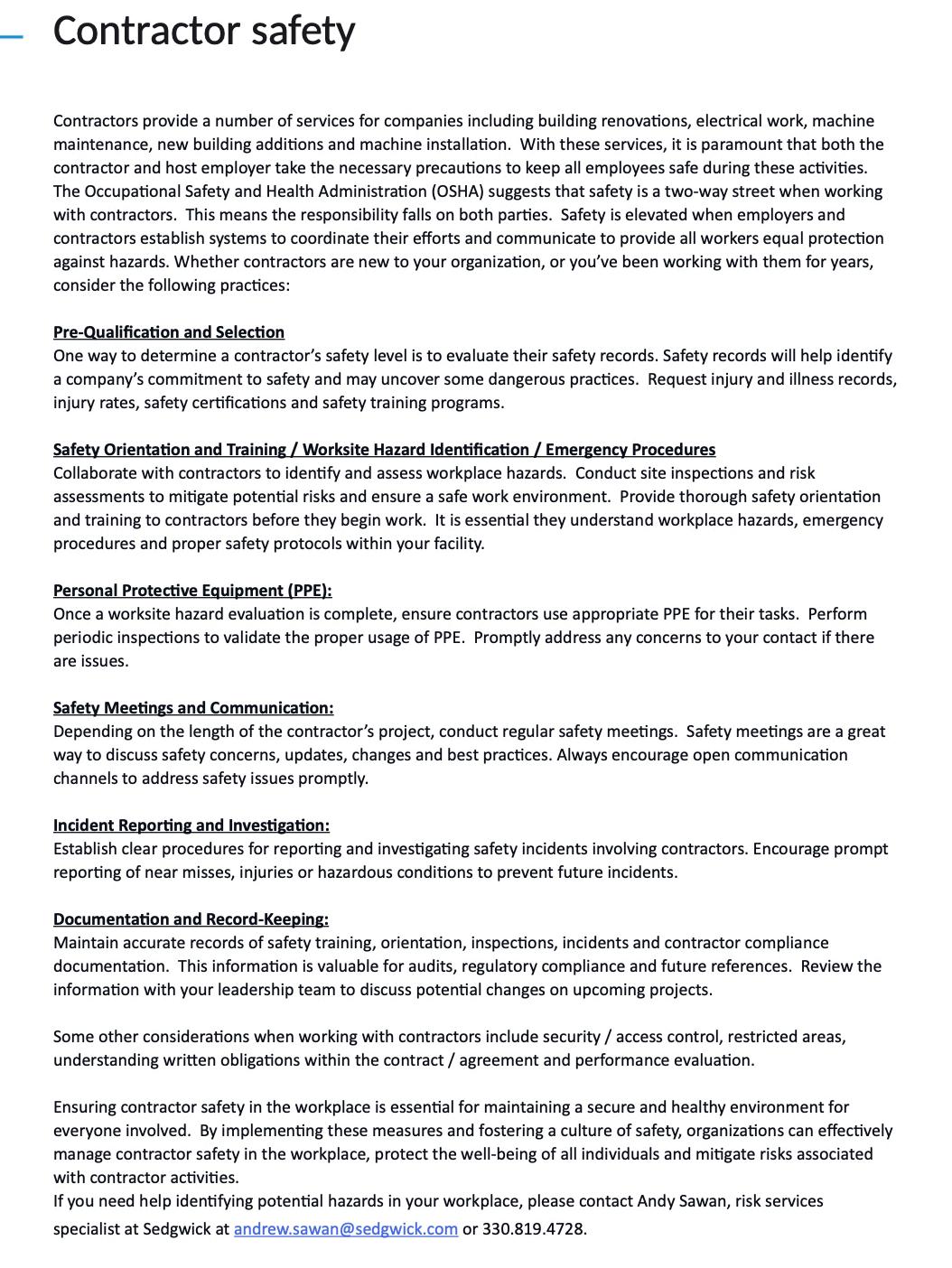

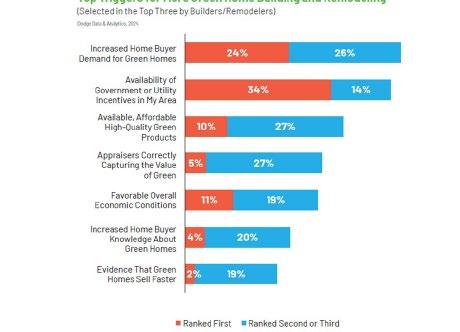

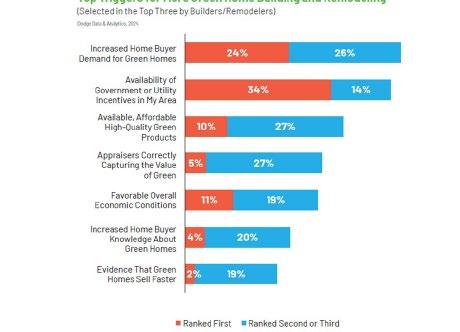

Building upon our exploration of green building trends, major practices, and resilience strategies based on The Building Sustainably: Green & Resilient SingleFamily Homes 2024 SmartMarket Brief , this article now shifts focus towards ways to increase green building within the housing market.

Top Incentives to Build Green

The survey asked all respondents to select the top three factors that would increase their engagement with green building in the future. Half of respondents listed increased home buyer demand for green homes in their top three reasons. The second highest at 48% was availability of government or utility incentives in my area. Third, at 37%, was available, affordable high-quality green products.

Methods of Showcasing Green Homes

Home builders and remodelers who have built green projects were asked if they utilized any of the six approaches provided to demonstrate their projects were green. The top method was using a Home Energy Rating System (HERS) score at 39%. This was followed by website marketing at 35%, which had notable regional differences. Website marking was most used in the Northeast (60%), then the Midwest (52%) and West (43%), but it was least common in the South (20%). The other four approaches listed were: third-party certification (34%), MLS information (33%), silent salesperson signage (20%), and green appraisal form (6%).

BY ONNAH DERESKI

Terms for Describing Green Features

Home builders and remodelers who do green home projects were asked to rank the three most effective terms for talking to their customers about green-related features from a list of 12 options. The most effective term was “High Performance” at 49%. The second highest at 46% was “Quality Construction” while third, at 44%, was “Operating Efficiency”. The complete rankings are shown in the chart below.

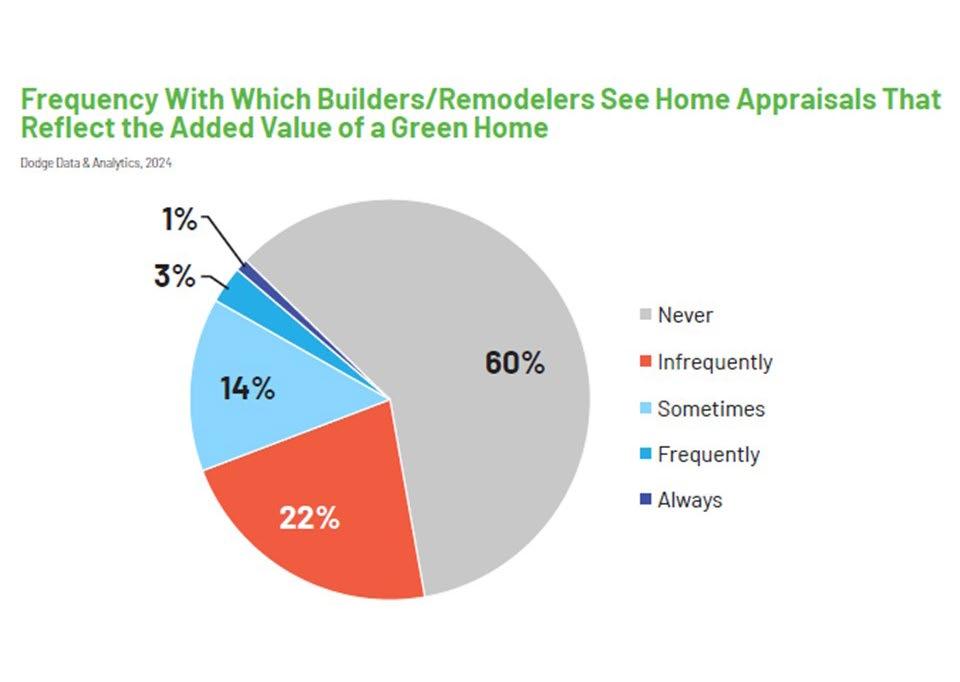

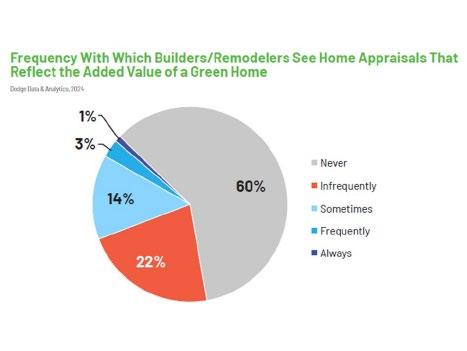

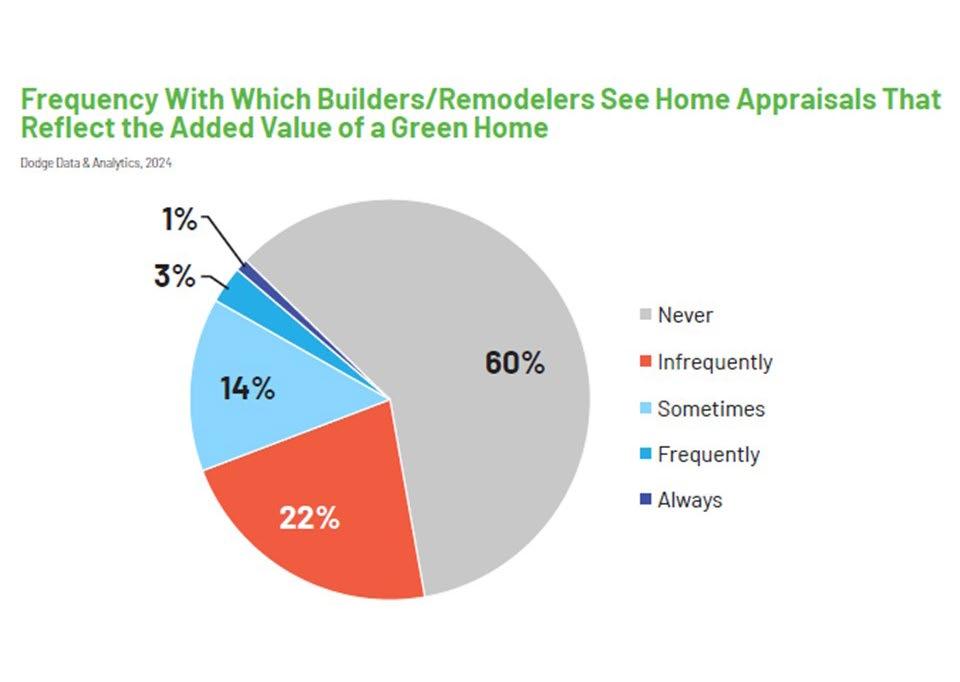

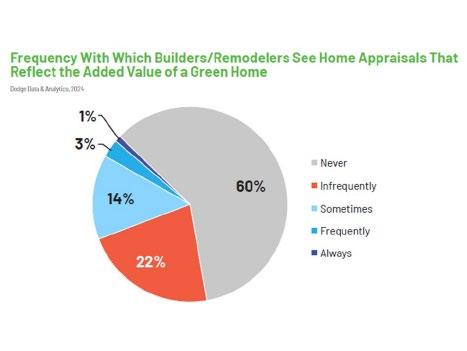

Home Appraisals

Home builders and remodelers were asked how frequently home appraisals accurately reflect the added value of a green home. The majority of respondents (60%) reported that they never see this occur. The second highest were those that said infrequently at 22%. Notably, there are no significant differences between the responses of builders and remodelers or the respondents from the four regions. This suggests accurate home appraisals are a significant challenge across the green building industry.

EYE ON HOUSING

page 18 www.ncbia.com April/May 2024

INCREASING THE MARKET for Green Building (Cont..)

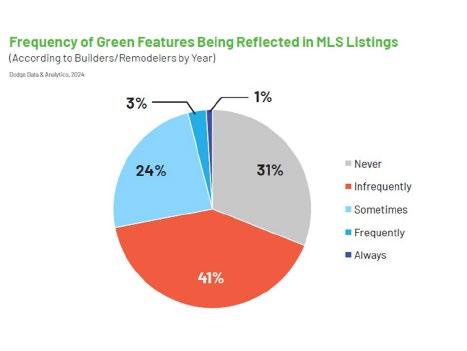

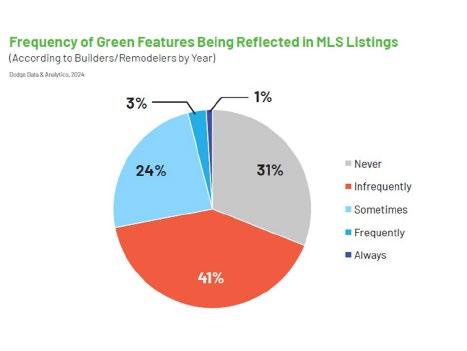

MLS Listings

Home builders and remodelers were also asked about the frequency with which green features are reflected in MLS listings, the database used by realtors for home sales. Less than one-third (31%) listed never, comparatively less than with home appraisals. However, infrequently was listed at 41%.

In order for builders to supply green homes, there needs to be a home buyer demand. As we have seen, the prevalence of green home construction has seen little growth over the past few years. Contributing to this is the fact that consumers are not able to reliably compare homes with green elements to those without them. This is seen when green home appraisals and listings do not accurately reflect the added value of green building. The sustainability & green building industry faces headwinds to gain appropriate recognition from consumers about the advantages of green homes.

BY ONNAH DERESKI

April/May 2024 www.ncbia.com page 19 EYE ON HOUSING

Exclusive Entertainment Discounts! Members have access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels, and much more.

Save up to 40% on Top Theme Parks Nationwide

Save up to 60% on Hotels Worldwide

Save up to 40% on Top Las Vegas & Broadway Show Tickets • Huge Savings on Disney & Universal Studios Tickets • Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more! Please visit https://memberdeals.com/nahb/?login=1

•

•

•

Welcome New Members!

Drew Alurovic, Buckeye Community Bank (Affiliate Associate)

106 S. Center St. LaGrange, OH 44050 (440) 258-1323

amalurovic@buckeyebank.com http://www.buckeyebank.com

Buckeye is an independent community bank focused on building relationship and serving our communities. While we offer modern banking convenience through the technology you need, Buckeye’s service also comes with friendly, familiar faces who serve as your partners for growth.

Shannon Niebes, Royalty Roofing (Primary Associate) 25047 Lorain Road North Olmsted, OH 44070 (440) 376-7607 (work) shannon.niebes@ royaltyroofs.com http://www.royaltyroofs.com

Royalty Roofing is a full-service residential and commercial roofing contractor serving Northeast Ohio. As a GAF Master Elite® contractor, Royalty Roofing is proud to offer the best warranty in the Northeast Ohio roofing industry, the GAF Golden Pledge® warranty. We also offer a wide range of products including DaVinci Roofscapes composite roofing, James Hardie® fiber cement siding, CertainTeed and Norandex vinyl siding, Mule-Hide® flat roofing systems, VELUX® skylights and seamless gutters with Xtreme Guards.

Adam Metzner, Greater Cleveland Habitat for Humanity (Primary Associate) 2110 West 110th Street Cleveland, OH 44102 (216) 973-5245 (work) AMetzner@clevelandhabitat.org http://www.clevelandhabitat.org

We work to bring affordable housing to the Greater Cleveland/Lorain area communities and the families that live in them. We build, rehab, and sell homes to families with an affordable mortgage while connecting them to the community through our neighborhood revitalization projects.

Dave LeHotan, All Construction Services, Inc.

Lindsay Yost-Bott, Dale Yost Construction

Liz Schneider, Dollar Bank

John Toth, Floor Coverings International

Max Denny, J&M Custom Construction, LLC

Craig Snodgrass, Lorain County Auditor

Mike Doran, Lorain County Recorder

Chris Majzun Jr., Majzun Construction Company

Chris Majzun Sr., Majzun Construction Company

Chris Mead, Maloney + Novotny, LLC

Steve Schafer, Schafer Development Company, Inc.

Kara Odom, Northwest Bank

Briana Harris, Fidelity National Title

Jessica Stewart, First Federal Savings of Lorain

Brian Schwab, Restorepro, Inc.

for Renewing!

Thanks

Sorry to See You Go!

April/May 2024 www.ncbia.com page 23

Welcome New Members!

Do you want to opt-out of our referral program? Just email judie@ncbia.com page 24 www.ncbia.com April/May 2024

EYE ON THE ECONOMY

INTEREST RATES TO REMAIN Higher for Longer

Interest rates moved higher in recent weeks because of disappointing progress for inflation data and solid labor market reports. In fact, Fed Chairman Powell noted this week that there has been a “lack of further progress so far this year on returning to our 2% inflation goal.” These offsetting factors — higher interest rates on the negative side but supportive macro conditions — left builder sentiment flat in April.

The benchmark 10-year Treasury rate has increased by more than 30 basis points since the start of April, placing long-term interest rates at their highest level since early November of last year. In turn, the average 30-year fixedrate mortgage has increased to almost 6.9%, per Freddie Mac in last week’s data. Mortgage rates have crept higher because of concerns that inflation reduction progress has stalled in recent quarters, but they are still well below last fall's highs when they approached 8%.

The year-over-year pace for inflation ticked up to 3.5% in March, still too far from the Fed’s 2% target. The shelter inflation component (i.e., housing) remains a leading source of cost pressure at a 5.7% year-over-year gain. The best way to reduce shelter inflation is with additional supply of affordable, attainable housing which is, for the most part, out of the Federal Reserve’s control. An NAHB estimated index of residential construction costs shows why housing costs continue to rise, with building material costs up 2.2% year over year in March. Gypsum prices reached a new high in March, up more than 2% in just that month alone.

Wages in home building are also increasing as the labor market remains tight. Residential construction wages were more than 6% higher than a year ago as of March, with this pace of growth accelerating over the last eight months. In February, there were 441,000 unfilled construction sector positions, the rate of which has been trending higher since March of 2023 as builders increased labor demand with expectations of improving construction conditions in 2024. Over the last year, home builders and remodelers added 78,800 jobs on a net basis to the industry’s workforce, which now totals 3.3 million. Aggregate U.S. labor data remains tight as well, which represents an inflation risk to the Fed. Total nonfarm payroll employment increased by 303,000 in March, with the unemployment level at just 3.8%.

BY: DR. ROBERT DIETZ

Because of the offsetting factors of higher interest rates and positive labor market conditions that support demand for new housing, the NAHB/Wells Fargo Housing Market Index, a key measure of home builder sentiment, was flat at a level of 51 in April. This relatively neutral reading of sentiment suggests the industry is set to expand construction volume later in 2024 provided interest rates move lower on improved inflation data. Fundamentally, housing itself will help this process, because as more apartments are supplied to the market, rent growth will slow, which will lower the growth rate for shelter inflation and bring overall consumer inflation closer to the Fed’s 2% target. Remodeling sentiment, as measured by the NAHB Westlake Royal Remodeling Market Index, remained positive at a level of 66 in the first quarter, indicating ongoing favorable home improvement market conditions.

Nonetheless, higher rates this spring had an effect on the construction data in March. Single-family starts decreased 12.4% to a 1.02 million seasonally adjusted annual rate. The multifamily sector, which includes apartment buildings and condos, decreased 21.7% to an annualized 299,000 pace. While apartment construction starts are down, the number of completed units entering the market is rising as a result of the previously elevated construction levels. The pace of completions for apartments in buildings with five or more units is up 27.4% for the first quarter of 2024 compared to the first quarter of 2023. A higher pace of completions in 2024 for multifamily construction will place some downward pressure on rent growth and help ease shelter inflation.

April/May 2024 www.ncbia.com page 25

Through NPP and ODP Business Solutions (formerly Office Depot) members can save on the office supplies they purchase every day. Below are a few examples of some of the prices they can access once enrolled with NPP. In addition, NPP members receive:

Did you know that NPP offers savings through Staples and ODP Business Solutions (formerly Office Depot)? As an NPP affiliate partner, your organization can offer one or both solutions.

Save on more than just office supplies:

· Computer Supplies & Toners

· Paper Products

· Janitorial/Cleaning Supplies

· Kitchen/Coffee/Breakroom Supplies

· Ergonomic Products/Programs

· Furniture

· Stamps, Nameplates & Engraving

· Print & Copy Services

· And more!

© 2019 Hastings Mutual Insurance Company SS-1 (10/19) Select Contractors Building Your Business (800) 442-8277 www.hastingsmutual.com 404 E. Woodlawn Ave. Hastings, MI 49058 For more information contact: Broadened Coverage This coverage helps if there’s damage to property used by you or your employees that belongs to someone else. It has a limit of $2,500 per occurrence, with a $100 deductible. Builders Risk and Installation Floater “Floater” coverage is for anything that oats, or moves from place to place — like your supplies and machinery. It also covers damage to the structures you’re working on, including scaffolding, foundations, and more. This has a limit of $5,000, with a $250 deductible. Portable Tools Coverage on your tools has a limit of $1,000 per tool, to a maximum of $2,500. It also has a $500 deductible. The information referred to is not a policy. Refer to your policy for speci c coverage. The Nelson Agency, Inc. 116 4th St., Elyria, OH 44035 Phone: 440-323-8002 Fax: 440-323-8055 Drywallersinsurance1@prodigy.net A member of: Theresa Riddell (440) 420-1175 tmycps@oh.rr.com -ORBrett Adams (419) 515-0506 adamsb@sprouseagency.com April/May 2024 www.ncbia.com page 27

NAHB NOW

NAHB LEADERSHIP LOBBIES LAWMAKERS Ahead of Legislative Conference

May 1, NAHB Chairman Carl Harris and First Vice Chairman Buddy Hughes met with several U.S. senators on Capitol Hill to address a wide range of important housing issues.

Harris and Hughes reiterated the importance of housing and homeownership to the economy and urged lawmakers to focus on supply chain, regulatory, codes, workforce development and tax issues to help stem rising housing costs. They also stressed that a vibrant housing market is critical to maintain robust job and economic growth. Discussions were held with the following Senate leaders:

• Sen. Ted Budd (R-N.C.)

• Sen. Mike Crapo (R-Idaho)

• Sen. Steve Daines (R-Mont.)

• Sen. Cindy Hyde-Smith (R-Miss.)

• Senior staff of Sen. Mitch McConnell (R-Ky.)

• Sen. Jerry Moran (R-Kan.)

• Sen. Jacky Rosen (D-Nev.)

• Sen. Ron Wyden (D-Ore.)

Harris and Hughes urged the senators to act on a number of key issues, including many that will be highlighted during the June 12 NAHB Legislative Conference: Transformers

• NAHB urges Congress to support an additional $1.2 billion in the fiscal 2025 appropriations process to boost production of sorely needed transformers. Costs for transformers have soared 72% since February 2020, and shortages of electrical distribution transformers are delaying housing projects across the nation.

HUD/USDA Minimum Energy Standard

• The U.S. Department of Housing and Urban Development (HUD) and U.S. Department of Agriculture (USDA) have issued a final rule that requires all HUD- and USDA-financed new singlefamily construction housing to be built to the 2021 International Energy Conservation Code (IECC) and HUD-financed multifamily housing be built to 2021 IECC or ASHRAE 90.1-2019. This mandate will curb new construction and harm housing affordability nationwide. NAHB is urging Congress to include a provision in the fiscal year 2025 Transportation, Housing and Urban Development and Related Agencies appropriations bill to prevent HUD from using federal funds to implement this costly national codes mandate.

Workforce Development

• With home builders needing to add 2.2 million new workers over the next three years just to keep up with demand, NAHB is urging Congress to support funding for building and construction trades education and to provide more placement services to job seekers.

Low-Income Housing Tax Credit

• NAHB is calling on the Senate to pass the Tax Relief for American Families and Workers Act of 2024. This legislation was passed by the House and includes tax provisions to increase resources for the Low-Income Housing Tax Credit and to help small businesses.

page 28 www.ncbia.com April/May 2024

BBS MEMO

Ohio Board of Building Standards

2023 NEC Adoption in the Residential Code of Ohio

Effective April 15, 2024, the Board of Building Standards (Board) adopted the 2023 edition of NFPA 70 National Electrical Code (NEC), for 1-, 2- & 3- family dwellings as modified by provisions in Chapter 34 of the Residential Code of Ohio (RCO).

GFCI Protection Requirements

Included in the Ohio modifications to the NEC in RCO Chapter 34 were changes to NEC § 210.8(A) to exclude Ground-Fault Circuit-Interrupter (GFCI) protection for personnel where the branch circuit is providing voltage in excess of 125 Volts and 20-amperes. This same modification was not made NEC § 210.8(D) which retains GFCI requirements for specific appliances listed in the section, creating inconsistencies between the two.

The intention of the Board was to exclude Ground-Fault Circuit-Interrupter (GFCI) protection for personnel where the branch circuit is providing voltage in excess of 125 Volts and 20-amperes. The typical electrical appliances found in a home such as ranges, dryers, ovens, etc. that are powered by 2-pole branch circuits were not intended to be included as requiring GFCI protection.

The list of specific appliances to which GFCI protection is required was based on the list of specific appliances identified under NEC § 422.5 as modified under RCO Chapter 34 and is intended to be used as the more limited list of specific appliances.

The Board will address the lack of coordination between NEC §§ 210.8(A) and 210.8(D) in the next amendment package to the RCO. Until the rule is revised, building departments should only require GFCI protection for appliances listed in NEC § 422.5 as described above.

Understanding Ohio Modifications to the 2023 NEC

Ohio modifications to the 2023 NEC are noted in amended RCO Chapter 34 effective April 15, 2024. As the published rule retains language that was struck from the previous edition of the rule, the rule has caused confusion regarding which specific provisions of the 2023 NEC have been modified. The following is a summary of the Ohio modifications made to the 2023 NEC.

• Limits GFCI protection for personnel to branch circuits up to 125 V, 20 amps.

• Exempts a single receptacle in a garage ceiling to power a garage door opener from GFCI protection.

• Exempts a single receptacle serving a sump pump from GFCI protection provided a duplex receptacle with GFCI protection is within 6 ft.

• Removes expiration of GFCI exception for outlets supplying listed outdoor HVAC equipment

• Makes surge suppression an option not a requirement.

When comparing RCO Chapter 34 changes to the 2023 NEC, the following is the complete list of Ohio modifications to the code adopted by the Board:

May

6606 Tussing Road, P.O. Box 4009, Reynoldsburg, Ohio 43068-9009 FINANCIAL INSTITUTIONS•INDUSTRIAL COMPLIANCE•LIQUOR CONTROL• REAL ESTATE AND PROFESSIONAL LICENSING•SECURITIES•STATE FIRE MARSHAL•UNCLAIMED FUNDS “An Equal Opportunity Employer and Service Provider”

3, 2024

Modify Section 210.8(A) to read:

(A) Dwelling units. All 125-volt, single phase, 15- and 20-ampere receptacles installed in locations specified in 210.8(A)(1) through (A)(12) are to have ground-fault circuit-interrupter protection for personnel.

Modify Section 210.8(A)(2) to read:

(2) Garages, and also accessory buildings that have a floor located at or below grade level not intended as habitable rooms and limited to storage areas, work areas, and areas of similar use except for the receptacle located to serve a garage door opener when the device is a single receptacle and located in the ceiling.

Add Exception (5) under Section 210.8(A) to read:

Exception No 5: A single receptacle located to serve a sump pump shall not be required to have ground-fault circuit-interrupter protection when there is a duplex receptacle with ground-fault circuit-interrupter protection within six (6) feet of the sump pump.

Modify Section 210.8(F) to read:

(F) Outdoor Outlets. All outdoor outlets for dwellings, other than those covered in 210.8(A), Exception No. 1, garages with floor level at or below grade, accessory buildings and boathouses, where the outlets are supplied by singlephase branch circuits rated 150 volts or less to ground, and 50 amperes or less, are to be provided with ground-fault circuit-interrupter protection for personnel.

If equipment supplied by an outlet covered under the requirements of this section is replaced, the outlet is to be supplied with GFCI protection.

Exception No. 1: GFCI protection is not required on lighting outlets other than those covered in 210.8(C)

Exception No. 2: GFCI protection is not required for listed HVAC equipment.

Modify Section 215.18(A) to read:

(A) Surge-Protection Device. Where provided as part of feeder supplies for the dwelling or dwelling unit, a surgeprotection device (SPD) is to be installed in accordance with this section.

Modify Section 225.42(A) to read:

(A) Surge-Protection Device. Where provided as part of feeder supplies for the dwelling or dwelling unit, a surgeprotection device (SPD) is to be installed in accordance with this section.

Modify Section 230.67(A) to read:

(A) Surge-Protection Device. Where provided as part of the service supplying the dwelling or dwelling unit, surgeprotection devices (SPD) are to be installed in accordance with this section.

Delete Item (6) Sump Pumps under Section 422.5.

FINANCIAL INSTITUTIONS•INDUSTRIAL COMPLIANCE•LIQUOR CONTROL• REAL ESTATE AND PROFESSIONAL LICENSING•SECURITIES•STATE FIRE MARSHAL•UNCLAIMED FUNDS “An Equal Opportunity Employer and Service Provider”

Sponsoredby: Sponsoredby: gister Here! M E M B E R M I X E R S p r i n g T H U R S D A Y , M A Y 1 6 5 - 7 P M T H Free Free Admission Admission and and Appetizers Appetizers CashBar CashBar Rev 4/19/24 Sponsorships ($175) are available - Includes Mic Time, Signage at the Event and Digital Promo or Call Our Office! 440-934-1090 or email judie@ncbia.com 35840 Chester Road, Avon 35840 Chester Road, Avon Come Mix and Mingle with Come Mix and Mingle with NCBIA Members & Our Guests NCBIA Members & Our Guests Get to know each other over a Get to know each other over a cold drink! cold drink!

OHBA EXECUTIVE VP COLUMN

Now that the primary elections are over its time to take a short break and prepare for the final show; the November general election. As with all elections for government office; it’s important and requires your attention. Heading the list is the POTUS; president of the USA. What at stake there, just about everything that is important.

For instance, NAHB reports that FHA will require all insured loans meet the 2021 IECC. Conservative estimates peg an increase of $30,000 per home. That is right. The code will be implemented via regulation, not a legislative enactment. NAHB is currently preparing in-detail information on the subject. This is not a surprise with the end of the presidents’ term at hand. Such a regulation does not need the approval of congress and will become effective in about 18 months. We should not be surprised if additional regulations are put into play over t he next few months.

Stateside, we continue to work with legislators who want to address the housing shortage crisis in a meaningful way. Unfortunately, local government is just not that excited about helping out. A number of interesting proposals are being discussed. We continue to press for speeding up the process for implementation of beneficial timing of assessing newly developed residential lots. We are also seeking a legislation to reverse an errant court of appeals ruling that home remodeling is not home construction.

As you can readily see, many in the law-regulatory process just don’t understand why there is a housing shortage and affordability gets worse daily. We have seen some positive activity on the subject. Both the Ohio House and Senate have introduced legislation to deal with improving housing production. We have members who are meeting with legislators and helping to increase knowledge of the land development approval process and just how expensive it has become. We are looking forward to more of our members getting involved in this effort. All these items will be discussed our summer meeting on June 25-26 in Cleveland. We look forward to seeing you there.

Ohio Home Builders Association Phone- 614/228-6647

by Vincent J. Squillace, CAE, OHBA Exec. VP

by Vincent J. Squillace, CAE, OHBA Exec. VP

April/May 2024 www.ncbia.com page 33

EYE ON HOUSING

DESPITE HIGHER MORTGAGE RATES, New Home Sales Post Solid Gain in March

DDespite higher interest rates last month, new home sales rose in March due to limited inventory of existing homes. However, the pace of new home sales will be under pressure in April as mortgage rates moved above 7% this month, which is expected to moderate sales and increase the use of builder sales incentives this Spring.

Sales of newly built, single-family homes in March rose 8.8% to a 693,000 seasonally adjusted annual rate from a downwardly revised reading in February, according to newly released data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The pace of new home sales in March is up 8.3% from a year earlier. Although consumer demand has been somewhat dampened due to higher interest rates, builders continue to supply new homes to the market to lift inventory to make up for the low resale supply.

Shelter inflation remains the largest, lingering obstacle for the challenge of lowering inflation. More housing supply will ultimately tame shelter inflation growth and lower interest rates, which in turn will improve the cost of financing for land developers and home builders, thus enabling more attainable housing supply.

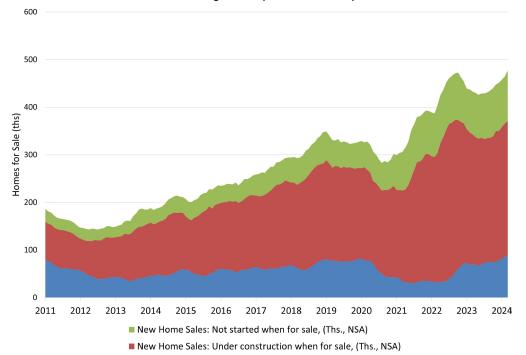

A new home sale occurs when a sales contract is signed, or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the March reading of 693,000 units is the number of homes that would sell if this pace continued for the next 12 months.

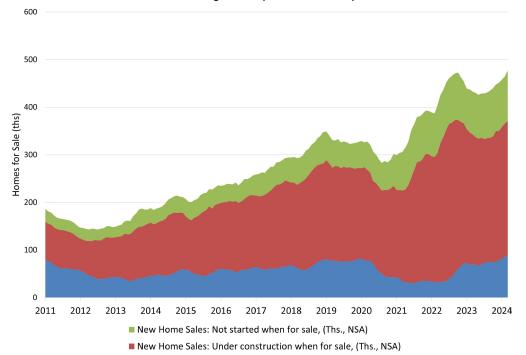

BY ROBERT DIETZ

New single-family home inventory in March remained elevated at a level of 477,000, up 2.6% from February. This represents an 8.3 months’ supply at the current building pace, which has supported by the ongoing shortage of resale homes. Data from the National Association of Realtors indicate just a 3.1 months’ supply of existing singlefamily homes in March, with a balanced market holding 5 to 6 months’ supply. Inventory of newly-built single-family homes is up 10.2% on a year-over-year basis.

The median new home sale price in March was $430,700, up nearly 6% from February, and down 1.9% compared to a year ago.

Regionally, on a year-to-date basis, new home sales are up 15.1% in the Northeast, 17.8% in the Midwest and 28.1% in the West. New home sales are down 6.6% in the South.

page 34 www.ncbia.com April/May 2024

2024 Night at the Races

Thank you Sponsors!

April/May 2024 www.ncbia.com page 35

2024 Night at the Races PHOTO GALLERY

page 36 www.ncbia.com April/May 2024

April/May 2024 www.ncbia.com page 37

page 38 www.ncbia.com April/May 2024

April/May 2024 www.ncbia.com page 39

EYE ON THE ECONOMY

WILL HOME INVENTORY LEVELS Rise This Year?

Mortgage interest rates continue to hover in the high-6% range as markets wait for inflation data that will allow the Federal Reserve to ease monetary policy. The latest data showed the Personal Consumption Expenditures Price Index (core PCE, the Fed’s preferred inflation gauge) at a 2.8% year-over-year rate. Although much improved from a year ago when inflation measured at 4.8%, the core PCE reading is still above the central bank’s 2% target.

Fed officials noted that they need to see additional improvement before cutting interest rates, with some commentary suggesting the Fed sees a greater policy risk in cutting too early rather than too late. While this commentary is consistent with what Fed officials have been saying for at least a year, it is at odds with the dovish expectations the bond market possessed at the end of 2023, resulting in a slight rise for long-term interest rates during the first quarter as investor expectations shifted forecasts.

Indeed, the Fed did not cut rates at the conclusion of its March monetary policy committee meeting. This action left the federal funds rate at 5.5%, where it has been since July 2023. Moreover, the central bank upgraded its economic outlook for 2024, raising its GDP forecast for the year from 1.4% to 2.1%. Combined with an improved labor market analysis, the new estimates indicate that the Fed believes the economy is more capable of absorbing "higher for longer" rates than in prior projections. NAHB is forecasting just two rate cuts this year from the Fed: one in the third quarter and another in the fourth quarter. The bond market is now expecting three rate reductions.

Slightly higher interest rates held back new home sales in February. Sales of newly built, single-family homes declined 0.3% to a 662,000 seasonally adjusted annual rate. While 5.9% higher than the pace from a year ago, the seasonally adjusted pace of sales remains lower than that recorded at the end of last year. Inventory increased to an 8.4-month supply, and this is expected to rise as additional completions reach the market. While ostensibly elevated (above a 6-month supply), the low level of resale inventory supports what is in effect a greater market share for new homes.

BY: DR. ROBERT DIETZ

Existing home sales improved in February, rising 9.5% to a 4.38 million rate. However, this pace is 3.3% lower than a year ago. Inventory remains tight at just a 2.9-month supply. It is important to keep in mind that existing home supply will likely increase when mortgage rates decline later in 2024 as the mortgage rate lock-in effect begins to diminish. While demand will increase with lower rates, the additional existing home inventory will represent increased competition for home builders.

Despite elevated rates, low supply continues to place upward pressure on home prices. The Case-Shiller national price index posted a 6% year-over-year gain in January. Monthly readings of home prices have shown weakness, as existing homeowners discount their homes’ values similar to actions taken by home builders over the last two years. For this reason, we expect to see home price data soften in the coming months.

April/May 2024 www.ncbia.com page 41

ATTEND THE JUNE 12

NAHB Legislative Conference

YYou can also have the opportunity to speak directly with your member of Congress on the key issues affecting your business and our industry by attending the NAHB Legislative Conference on Wednesday, June 12.

The meetings, held on Capitol Hill in Washington, D.C., are a critical part of the Federation’s advocacy efforts to keep housing issues a priority with federal lawmakers. Your participation can make a difference. Learn more at nahb.org/legcon.

NAHB NOW

page 42 www.ncbia.com April/May 2024

FED IS SET TO HOLD Rates Higher for Longer

On May 1st, the Federal Reserve will conclude its next monetary policy meeting. With inflation progress stalling in recent quarters, the Fed is set to hold rates at their current, restrictive levels until further progress is made with key price metrics. The gradual erosion of market expectations of rate cuts for 2024 has led longterm interest rates to rise. For example, the 10-year Treasury rate (which reflects both long-term inflation expectations and near-term economic growth estimates) started the year near 3.8%. However, as the bond market lowered the number of expected rate cuts for 2024 from six to two or fewer, the 10-year rate has increased, rising to above 4.6% as of this week. Consequently, the 30-year fixed-rate mortgage averaged 7.17% last week, the first time this key rate increased above 7% since November of last year.

So, why are markets — and many economists, including those at NAHB — adjusting their rate forecasts? The primary reason is a lack of progress for inflation. This is because of a rise in certain service expenditures, such as insurance which increased by 11% in cost during 2023, as well as elevated shelter pricing due to a lack of housing supply.

However, economic growth continues to be good — but not great. Real gross domestic product (GDP) expanded at a modest 1.6% annual pace in the first quarter of 2024. This was slower than a 3.4% gain in the fourth quarter of 2023 and the lowest annual growth rate in the past seven quarters. While lower than NAHB’s forecast of a 2.0% increase, it is still solid enough to prevent the economic cooling, many thoughts would help curb inflation during the first half of 2024.

BY: DR. ROBERT DIETZ

Housing’s share of GDP rose to 16.1% in the first quarter of 2024, marking its highest portion of GDP since 2022. Indeed, despite elevated interest rates, new home sales remained solid, helped by builder incentives including mortgage rate buydowns. Sales of newly built, single-family homes in March rose 8.8% to a 693,000 seasonally adjusted annual rate. The pace of new home sales in March was up 8.3% from a year earlier. Although consumer demand has been somewhat dampened by higher interest rates, builders continue to supply new homes to the market to lift inventory and compensate for the low resale supply.

In contrast, existing home sales weakened in March, declining from a 12-month high in the prior month. Total existing home sales declined 4.3% to a seasonally adjusted annual rate of 4.19 million in March. On a year-over-year basis, sales were 3.7% lower than a year ago because of ongoing challenges with inventory. Homes available for sale made up only a 3.2-month supply in March. A 5- to 6-month supply is considered balanced.

With higher-than-expected interest rates on deck for 2024 and stubbornly low levels of supply, housing affordability will continue to be challenged.

EYE ON THE ECONOMY

April/May 2024 www.ncbia.com page 45

page 46 www.ncbia.com April/May 2024

Now is the time for your Builder and Remodeler Members to claim for Q1’24. Builder and Remodeler Members may claim for manufacturer rebates for residential jobs completed between January 1 through March 31, 2024.

Q1’24 Claiming Deadline is Friday, May 17, 2024

Participating Manufacturer Updates to Q1’24 Claiming:

Zurn Pex Plumbing has discontinued their rebate program through HBA Rebates. *** NEW Participating Manufacturers ***

Uponor Pex Plumbing Products (replacing the Pex Plumbing classi fication) Mohawk Portico Flooring – Private Label Collection Flooring Majestic Fireplace

Builder members are encouraged to claim their rebates with 60+ participating manufacturers in an effort to increase their HBA Rebates total

Personalized assistance is available. Please reach out to the HBA Rebates Team with any questions. https://hbarebates.com/aboutus Claim Today, Don’t Delay! www.HBArebates.com/claimform

Q1’24 Claim Deadline: Friday, May 17, 2024

Claim for Residential Jobs Completed January 1 through March 31 , 2024.

page 48 www.ncbia.com April/May 2024

NAHB NOW

NAHB Threatens Lawsuit Over Lack of Transparency on WOTUS Rule

After more than six months of silence since NAHB filed a Freedom of Information Act (FOIA) request with the federal government for documents seeking implementation of the waters of the United States (WOTUS) rule, NAHB has formally notified the U.S. Army Corps of Engineers that it intends to file a lawsuit unless the Corps immediately releases its records relating to the regulatory definition of WOTUS.

This information is vital for builders and developers seeking federal permit approval because the Biden administration failed to provide a definition of a “relatively permanent” waterbody in its final WOTUS rule. This uncertainty regarding what waters are subject to federal jurisdiction sets the stage for continued federal overreach, bureaucratic delays during the wetlands permitting process, and regulatory confusion for home builders and land developers. NAHB has been calling on the Environmental Protection Agency (EPA) and the Corps to provide additional guidance to its field staff and the general public on the new rule to ensure clarity and action.

On Sept. 8, 2023, EPA and the Corps published a final rule in the Federal Register revising the regulatory definition of WOTUS under the Clean Water Act to conform to the U.S. Supreme Court’s decision in Sackett v. EPA.

In the final rule’s preamble, the agencies claimed that while the rule was “immediately effective,” the agencies may provide additional administrative guidance documents, memorandums, and training materials for either the public or Corps district staff on how they intend to implement the conforming WOTUS regulatory definition.

On Oct. 11, 2023, NAHB filed a FOIA request seeking various documents concerning the implementation of the Sept. 8 WOTUS regulatory definition. The Corps acknowledged receipt of NAHB’s request and said that because of the required coordination with other offices and agencies, it would take until Dec. 8, 2023, before a final response can be issued. No documents were provided on Dec. 8, and none has been forthcoming after NAHB conducted several follow-up requests.

As a result of this continued non-compliance, NAHB sent a letter on May 1 to the assistant secretary at the Army for Civil Works notifying the agency that “unless a final determination is made within 10 days NAHB will file suit seeking declaratory relief establishing that the Corps has violated FOIA. NAHB will also seek injunctive relief directing the Corps to make a final determination regarding the FOIA request and to immediately produce any agency records improperly withheld from NAHB.”

In addition to seeking legal action, NAHB will continue to meet with EPA and Corps officials to find ways to expedite the federal permitting process, offer pragmatic changes that maintain environmental protection of our nation’s waterways, and restore common sense and predictability to the federal wetlands permitting process.

April/May 2024 www.ncbia.com page 49

EYE ON HOUSING HOME BUYERS’

Ideal Community

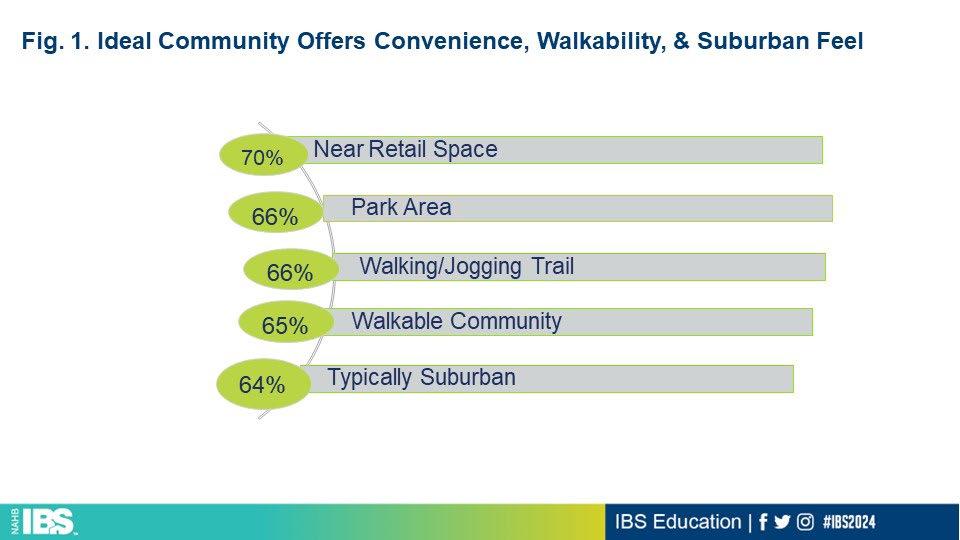

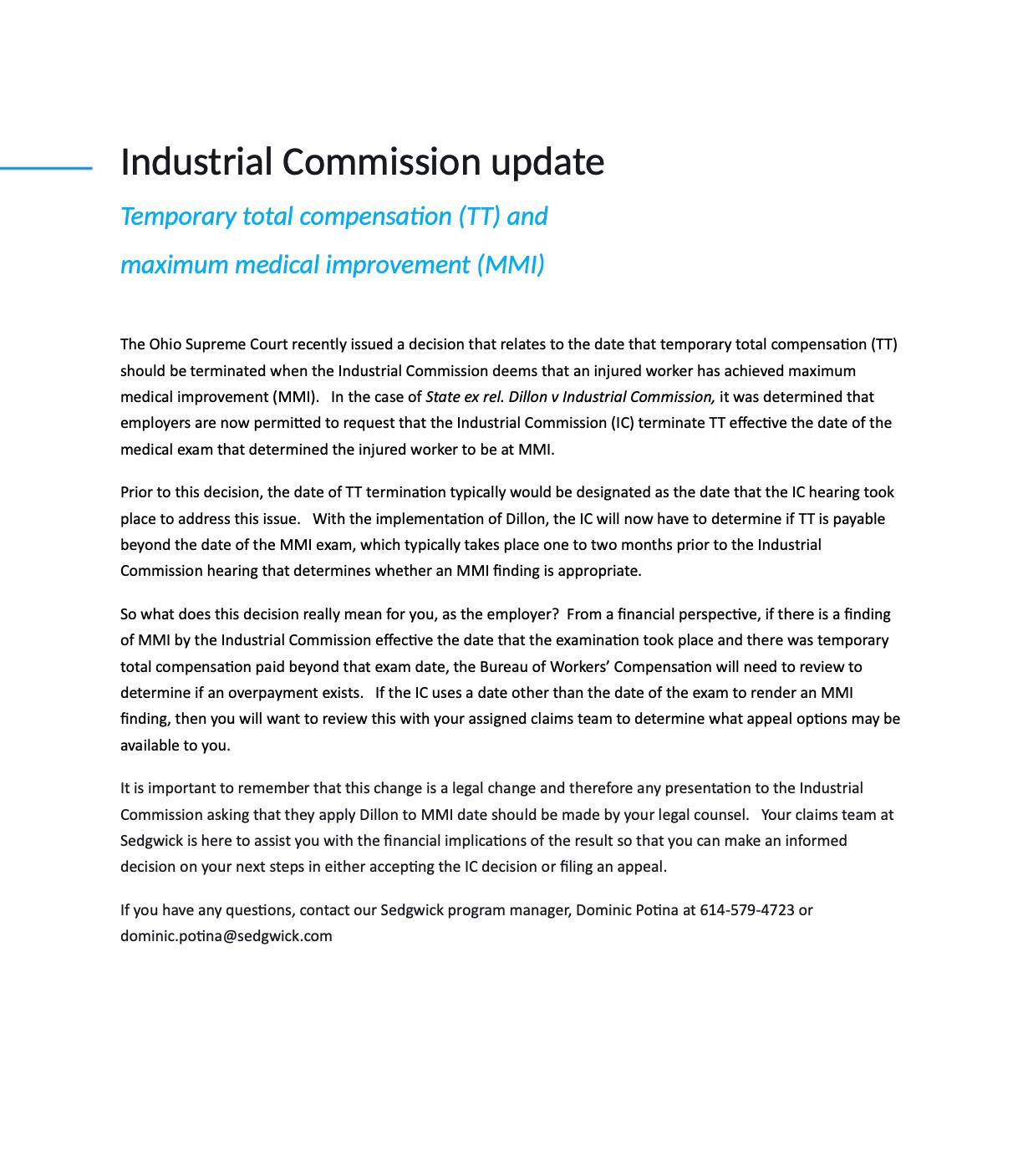

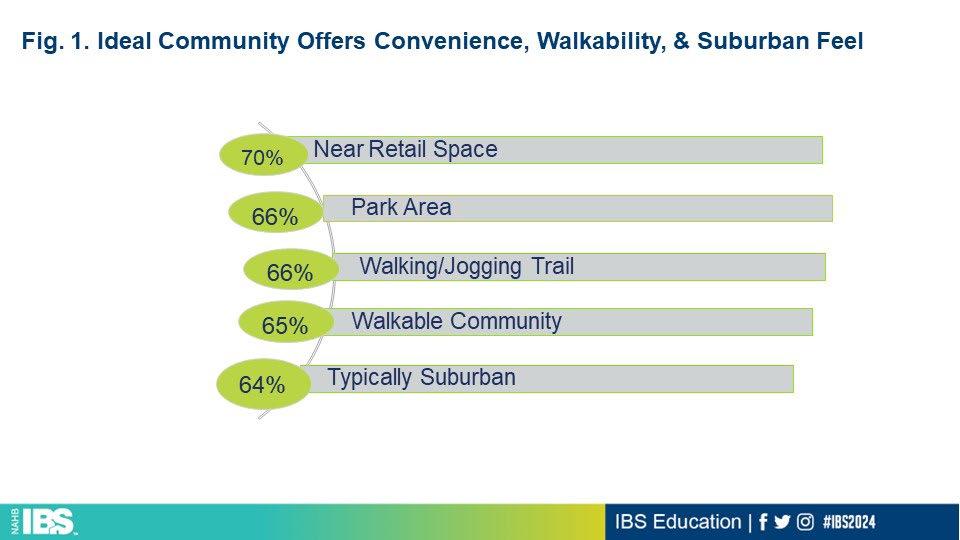

NAHB’s latest study on consumer preferences— What Home Buyers Really Want Study* — asked about the features and amenities buyers want in the home, but also about the type of community where they would like to live. The question is important because the home that successfully appeals to buyers doesn’t exist in a vacuum— it sits inside a community they evaluate as thoroughly as the home itself.

Our findings reveal that the ideal community offers three main attributes: convenience, walkability, and a suburban feel. This conclusion is gleaned from the top five features buyers most want in a community, which are being close to retail space (e.g., pharmacy, grocery store) (70%), near a park area (66%), walking/jogging trails (66%), a walkable community (pathways connecting homes to transportation, shopping, etc.) (65%), and a typically suburban community (64%).

In terms of the overall location where buyers would prefer to purchase a home, 53% would like to buy in the suburbs (either close-in or outlying), a rural area (25%), or the central city (downtown or outside of it) (23%). The study also asked buyers about the farthest distance they are willing to travel one-way from home to work. For the typical buyer, that sweet spot is 11.3 miles—which is not surprising given that most report a desire to live in the suburbs.

BY: ROSE QUINT

page 49 www.ncbia.com April/May 2024

E C O N O M I C F O R E C A S T T u e s d a y , A p r i l 1 6 , 2 0 2 4 5 : 3 0 - 7 : 3 0 p m DESSERT SPONSOR DESSERT SPONSOR

THANK YOU THANK YOU SPONSORS! SPONSORS!

EVENT SPONSOR EVENT SPONSOR

Economic Forecast PHOTO GALLERY

page 52 www.ncbia.com April/May 2024

April/May 2024 www.ncbia.com page 53

CUSTOMER NAME Earn Speedy Rewards on eligible purchases at Speedway. Special Association Discount for the North Coast Building Industry Association SuperFleet Mastercard® Association Fueling Program A fuel card program designed with associations in mind. Call Holden Moll at 1-760-918-5933 or email holden.moll@fleetcor.com to start earning your association savings! Be sure to reference the North Coast Building Industry Association for your special 25¢ discount. EARN AN ADDITIONAL 25¢ PER GALLON!† • Save 5¢ per gallon at Speedway locations* • Over 3,400 fueling locations in the U.S. • Over 175,000 locations nationwide that accept Mastercard cards** • Custom card controls and increased security • Online reporting and account management †Limited time offer valid for new Speedway SuperFleet Mastercard applications received from 3/7/2022 through 12/31/2022. New approved accounts will earn 25 cents per gallon rebate on Speedway fuel purchases in the first three months after account setup. Rebates are cents per gallon based on the number of gallons purchased at Speedway locations per calendar month. The maximum promotional rebate in any one-month period, regardless of billing terms, is $500. Rebates are subject to forfeiture if account is not in good standing. *Rebates are cents per gallon based on the number of gallons purchased at Speedway locations per calendar month. Rebates will be reflected on your billing statement in the form of a statement credit. Not valid on aviation, bulk fuel, propane or natural gas purchases. Rebates are subject to forfeiture if account is not in good standing. Program pricing is subject to change any time beginning 12 months after sign-up. **Please see Client Agreement – at www.fleetcor.com/terms/superfleet-mc – for rate, fee and other cost and payment information. Fuel purchases at locations other than Speedway locations are subject to an out-of-network transaction fee. The SuperFleet Mastercard® is issued by Regions Bank, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. © 2022 FLEETCOR, P.O. Box 1239, Covington, LA, 70434.

LIMITED TIME OFFER!

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Th e 7-Eleven Comm er ci al Fl ee t M ast er ca rd

Fleet Savings Made Easy

Perfect fit for mid-sized to larger fleets that need the added convenience of fueling where Mastercard® is accepted. With the 7-Eleven Commercial Fleet Mastercard®, your fleet can customize reports for a complete fuel management solution.

Rebates & Savings

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Security & Fraud Controls

Enjoy the security of advanced card prompts.

Earn 30¢ per gallon for the first three months once you reach 100 gallons in each calendar month. Thereafter, save 6cpg for every gallon pumped.*

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse. Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

Name

Online Control & Visibility

Set card controls and access detailed reporting online anytime.

Contact your sales representative today!

*Limited time offer for new 7-Eleven Commercial Fleet Mastercard applications received from 12/04/2023 through 2/29/2024. Once gallons purchased at 7-Eleven and Speedway locations in a calendar month reach 100, earn a 30¢ per gallon rebate on every gallon purchased at 7-Eleven & Speedway locations in each such calendar month for the first three months after account setup. The maximum promotional rebate in any one-month period is $1,200. To receive rebates, invoice must be paid in full and on time. Rebates will not apply to returns or chargebacks. Standard 6 cents per gallon rebate offer valid for first 6 months after account setup. **Fuel purchases at locations other than 7-Eleven or Speedway locations are subject to an out-of-network transaction fee. Please see Client Agreement – at www.fleetcor.com/terms/7-Eleven-mc – for rate, fee and other cost and payment information. The 7-Eleven Commercial Fleet Mastercard® is issued by Fifth Third Bank, National Association, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. ©2024 FLEETCOR, P.O. Box 1239, Covington, LA, 70434.

Holden Moll 760.918.5933 holden.moll@fleetcor.com

The 7F LEET Diesel Network Ma stercard ®

Fueling your fleet for the road ahead.

Diesel Network Mastercard offers significant discounts on diesel at the over 260 locations that make up the 7FLEET Diesel Network as well as discounts on commercial truck lane diesel across the AMBEST network.

Network Discounts

Save an average of 53cpg on truck diesel lane gallons fueled in the 7FLEET Diesel Network.*

Security & Fraud Controls

Enjoy the security of advanced card prompts.

Online Control & Visibility

Set card controls and access detailed reporting online anytime.

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse.

Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

*Average savings of 53 cents per gallon in the 7FLEET Diesel Network based on actual 7FLEET Diesel Network client transactions for Q4 of 2022. Visit www.7fleetnetwork.com/locations for a full listing of 7FLEET Diesel Network sites. Truck lane diesel transactions made with the 7FLEET Diesel Network Mastercard at AMBEST Travel Center locations will receive a Cost Plus discount when purchased at the truck lanes. Visit https:// am-best.com/Travel-Centers/Location-Map for a full listing of AMBEST sites. Not valid on unleaded, aviation, bulk fuel, propane, natural gas, or non-truck lane diesel purchases. **Please see Client Agreement – at www.fleetcor.com/terms/7-Eleven-dn – for rate, fee and other cost and payment information. Fuel purchases at locations other than 7-Eleven or Speedway locations are subject to an out-of-network transaction fee. The 7FLEET Diesel Network Mastercard® is issued by Regions Bank, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. © 2023 FLEETCOR, P.O. Box 1239, Covington, LA, 70434. Contact your sales representative today!

for fuel.

7FLEET

* Name Phone holden.moll@fleetcor.com Email Holden Moll 1-760-918-5933 Save

the 7FLEET

Perfect for diesel fleets that rely heavily on high speed truck diesel lanes

The

an average of 53¢ per gallon* on truck diesel lane gallons fueled in

Diesel Network.

7-Eleven Fleet Card Program Application

Please send the application to

INFORMATION – Required.

below.

AUTHORIZED REPRESENTATIVE – Required.

Application Terms: By signing this Application, the Authorized Representative represents, warrants, and agrees that: (a) he or she is authorized to apply to FLEETCOR TechnologiesOperating Company, LLC (“FLEETCOR”), a Louisiana limited liability company, for an unsecured, partially secured, or fully secured line of credit (“Account”) on behalf of the company identified above (“Client”); (b) FLEETCOR may obtain Client’s credit report and check Client’s credit standing when processing this Application or periodically evaluating any resulting Account’s creditworthiness; (c) this Application is subject to approval and acceptance by FLEETCOR; (d) if the Application is approved by FLEETCOR in Louisiana, the resulting Account: (i) will be governed by Louisiana law; (ii) will not be a revolving credit account and the Amount Due/Total Amount Due shown on each Account Statement will be due and payable on the Due Date shown on the Statement; (iii) will be used solely for commercial purposes and not for personal or household purposes; (iv) will be suspended, and the Client’s redit history may be reported to credit reporting agencies, if the Client’s unpaid balance ever meets the Account’s Credit/Spend Limit; and (e) acceptance, signing (in whatever form), or use of any of the Cards issued to Client will constitute Client’s acceptance of the Client Agreement available at www.fleetcor.com/terms/7-Eleven-mc or www.fleetcor.com/terms/7-Eleven-dn Equal Credit Opportunity Act Notice. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided that the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The federal agency that administers compliance with this law concerning this creditor is the Federal Trade Commission, Equal Credit Opportunity Act, Washington, D.C. 2 0580. FLEETCOR considers your privacy important. View our privacy policy available at www.fleetcor.com/privacy-policy to find out more.

I agree to the Application Terms and the Client Agreement (Please check box) ☐

BUSINESS OWNER(S) / PERSON WITH SIGNIFICANT MANAGEMENT RESPONSIBILITY – Required.

To help fight financial crimes, the U.S. Department of Treasury require financial institutions to obtain, verify, and record information about beneficial owners of entities opening accounts. Beneficial owners are persons who, directly or indirectly, own 25% or more of the entity. We may use third-party resources to verify your identity. For questions about this regulation and how FLEETCOR uses and protects this data, please speak with your sales representative. Patriot Act Notice. Section 326 of the USA PATRIOT Act mandates that FLEETCOR verify and record certain information about you (the Client, Authorized Representative, or anyco-maker or guarantor) while processing this Application.

Beneficial Owner (Individuals who own 25% or more of a Legal Entity)*

Applicable, Sole Proprietor, Government Entity, Not-For Profit or

this person have significant responsibility for managing the legal entity listed above?

more than

holden.moll@fleetcor.com

Legal Company Name (limit to 28 characters)* Subsidiary or DBA (limit to 20 characters) Create a 5 Digit Account Security Code (Required for card activation & customer service needs)* Primary Contact First Name* Last Name* Title* Card Delivery Street Address 1 (No PO boxes)* Card Delivery Street Address 2 City* State* ZIP* Company Billing Street Address 2 (If different from card delivery address) Company Billing Street Address 2 City State* ZIP Business Phone #* Cell Phone# Fax # Type of Business* Years of Business* Full Time Employees* Estimated Monthly Charges/Spending ($)* Estimated Monthly Gallons* # of Vehicles* # of Drivers* # of Cards Needed* Statement Delivery Method: ☐Electronic ☐ Paper Email Address* Site ID#* Tax ID#*

than Sole Proprietorship, Public Corporation, or Government & Education, you must complete the Business Owner Section

☐ Sole Proprietorship ☐ Partnership ☐ Public Corporation ☐ Private Corporation ☐ Non-Profit ☐Government & Education ☐ LLC ☐LLP NOTE - At FLEETCOR’s

CPA Reviewed or Audited Financial Statements during the Credit review.

BUSINESS

Type of Organization*– If your organization is any type other

discretion, we may require

☐

Public Corporation First Name* Middle Initial Last Name* Social Security#* Street Address (No PO boxes)* City* State* ZIP* Date of Birth* Home Phone # Cell Phone # Does

☐Yes ☐No Does

one person own 25% or more ofthis business?

check box)

yes,

information

required. ☐Yes ☐No Person with Significant Management Responsibility (CEO, CFO, President, Etc.)* ☐ Not Applicable, Sole Proprietor, Government Entity, or Public Corporation First Name* Middle Initial Last Name* Social Security#* Street Address (No PO boxes)* City* State* ZIP* Date of Birth* Home Phone # Cell Phone # **OFFICE USE ONLY** Market Rep ID Rep Name ATS Code (last 4 digits) *Required field 1Subject to credit review The 7-Eleven Commercial Fleet Mastercard and the 7FLEET Diesel Network Mastercard® are issued by Regions Bank, pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. FLEETCOR considers your privacy important. We are committed to protecting the privacy of those who provide us with their contact and personal information. View our privacy policy available at www.fleetcor.com/en/privacy-policy to find out more. © 2023 FLEETCOR, P.O. Box 1239, Covington, LA, 70434 SELECT CARD* 7-Eleven Commercial Fleet Mastercard ® 7FLEET Diesel Network Mastercard ®

Not

(please

If

additional

will be

7-Eleven Commercial Fleet Mastercard 7FLEET Diesel Network Mastercard

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

by Judie Docs, CSP, MCSP, MIRM, CMP, CGP

BY: ROSE QUINT

BY: ROSE QUINT

BY: ROBERT DIETZ

BY: ROBERT DIETZ

by Vincent J. Squillace, CAE, OHBA Exec. VP

by Vincent J. Squillace, CAE, OHBA Exec. VP