There

North Coast Building Industry Association (NCBIA) BUILDER newsletter is the official newsletter of the NCBIA and is published monthly by the NCBIA. The NCBIA is an affiliate of the Ohio Home Builders Association (OHBA) & the National Association of Home Builders (NAHB).

NCBIA Office

5077 Waterford Dr. Suite 302 Sheffield Village, OH 44035 Phone: 440.934.1090

info@ncbia.com | www.ncbia.com

NCBIA Staff Executive Officer

Judie Docs | judie@ncbia.com

Executive Assistant

LaBreeska Bellan | labreeskancbia@gmail.com

Marketing Associate

Ashlyn Bellan | ashlynncbia@gmail.com

2023 NCBIA Officers President

Tim King, K. Hovnanian Homes - Ohio Division Vice President

Mike Meszes, DRC Construction Co.

Associate Vice President

John Toth, Floor Coverings International Treasurer

Melanie Stock, First Federal Savings of Lorain Secretary

Mike Gidich, MDG Maintenance LLC.

Immediate Past President

Sara Majzun, Majzun Construction Co.

2023 NCBIA Board of Directors

Sam Hudspath, All Construction Services

Kevin Walker, Great Lakes Properties & Investments

Dave Linna, Linna Homes & Remodeling

Jason Rodriguez, The S.J.R Building Co.

Jon Sherer, Paraprin Construction

Brian Schwab, RestorePro, Inc.

Dave Weisenberger, Tusing Builders & Roofing Services

Advertising Policy - The North Coast Building Industry Association reserves the right to reject advertising in the Builder newsletter based on content. Acceptance of advertising does not imply endorsement of the product or service advertised.

NCBIA Life Directors

Bob Yost, Dale Yost Construction

Chris Majzun Jr., Majzun Construction Co.

Chris Majzun Sr., Majzun Construction Co.

Jack Kousma, Kousma Insulation

Jeff Hensley, Lake Star Building & Remodeling

Jeremy Vorndran, 84 Lumber

Jim Sprague, Maloney + Novotny, LLC

Liz Schneider Dollar Bank

Mary H. Felton, Guardian Title

Randy Strauss, Strauss Construction

Tom Caruso, Caruso Cabinets

Tom Lahetta, Tom Lahetta Builders, Inc.

2023 NAHB Delegates

These are our members who represent our local industry in Washington DC and Columbus:

Randy Strauss, Strauss Construction

Jason Rodriguez, The S.J.R Building Co.

NAHB Senior Life Delegate

Randy Strauss, Strauss Construction

Ohio’s State Rep. to NAHB

Randy Strauss, Strauss Construction

OHBA 2023 President

Richard Bancroft, Bancroft Development

OHBA Past Presidents

Randy Strauss, 1996

2023 OHBA Trustees

Tim King, K. Hovnanian Homes - Ohio Division

Sara Majzun, Majzun Construction Co.

Mary Felton, Guardian Title (alternate)

2023 Executive Committee Appointees

Sara Majzun, Majzun Construction (Membership)

Judie Docs, NCBIA (Executive Officers Committee)

OHBA Area 2 Vice-President

Ric Johnson, CAPS Builder & Right at Home Technologies

Sedgwick

Materials Prices Higher

22-232023 Calendar of Events

24 - Eye on the Economy: Fed Chairman: Higher Rates Will Linger Longer

25 - Eye on Housing: Builder Confidence Edges Higher in March but Future Outlook Uncertain

26 - New!! Lorain County JVS, Spring Career Fair

27 - Eye on Housing: Job Gains Continue in February Amid Mixed Signals

34 - NAHB Now: Builders Speak Out Against Proposed Transformer Rule

36-37Welcome New Members!! Thanks for Renewing! Sorry to See You Go!

37"What Members are Saying"

38 - Thank You Spikes!

39NCBIA Savings with

41-42 - Sedgwick Updates!

MISS

DID

43-44- Legislative Review

Contact Ashlyn Bellan at ashlynncbia@gmail.com

NEED SOMETHING ELSE? JUST ASK!

For more information on any of these products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

Want to be a sponsor for any of these events? Let us know! Sponsor early to get maximum exposure!!!!!

Call or email Judie at judie@ncbia.com for marketing opportunities to help your bottom line!!!!!

Thursday, April 20th

1st Membership Mixer 5:00-7:00 PM

Rush Inn

35840 Chester Road, Avon

Wednesday, May 10th

Executive Committee - 3:30

Board Meeting - 5:00

Clubhouse at Preserves at French Creek 5800 Preserve Drive, Sheffield Village

If you would like to participate in a committee, please email Judie Docs at judiencbia@gmail.com.

Check the website at www.ncbia.com for up-to-date changes, additions, and corrections to these events!

$35 per hour

Contact Ashlyn Bellan at ashlynncbia@gmail.com

NEED SOMETHING ELSE? JUST ASK!

For more information on any of these products & services, please contact the NCBIA Office at (440) 934-1090 or email judie@ncbia.com

Do you have some business news to share? Business anniversaries, accomplishments, awards, publications, etc.? Send to judie@ncbia.com. We want to hear from you!

NAHB’s 2023 Membership Drive program puts an exciting focus on the growth opportunities that exist for HBAs and acknowledges the importance of ongoing recruitment and retention efforts that impact an association’s long-term success.

The 2023 Membership Drive is happening April 1 through June 30, featuring two opportunities for participating HBAs to win awards.

HBAs with 3.00%-5.99% Builder and Associate Member net growth will receive:

• One (1) complimentary IBS registration (Expo+Education)

• $1,000 stipend to assist with travel expenses

• 2x bonus Spike credits for recruiters

HBAs with more than 6.00% Builder and Associate Member net growth will receive:

• One (1) complimentary IBS registration (Expo+Education)

• $1,000 stipend to assist with travel expenses

• $500 cash award to the HBA

• 3x bonus Spike credits for recruiters

This incentive is a great way to help a member attend IBS for the first time and experience NAHB’s premier annual event. Plus, Spike Club members will receive bonus credits during the drive.

The NAHB International Builders’ Show 2024 will be held Feb. 27-29 in Las Vegas. The IBS prize can be rewarded to any member of the HBA’s choosing, but it is ideal for a member who has never attended IBS before. What a way to introduce someone to the Design and Construction Week in Las Vegas!

• 3-day access to 100+ IBS education sessions

• 3-day entry to the IBS and KBIS exhibit floors and IBS Centrals

Give Judie a call if you would like to meet and/or Discuss our 2023 Marketing Guide

(440-934-1090, option 2 or email judie@ncbia.com)

2023 Marketing Guide CLICK HERE

During my installation speech I encouraged all members to take some time and look for ways to help out this association. I am sure you are all familiar with the Theodore Roosevelt quote “Every man owes a part of his time and money to the business or industry in which he is engaged. No man has a moral right to withhold his support from an organization that is striving to improve conditions within his sphere.” I encourage all members to take some time and look for ways to help out this association reach its goals for 2023. A couple I would like to highlight are Education and Membership.

Education is a valuable tool to have in your toolbox. As a society, we put a huge value on education. We make it a priority when searching for a home to be sure that our new home is in a district with a good school system for our children. We want them to be prepared with a top-notch education so that their lives will be more full, more exciting, and more successful. We want this for you as well, and that is why education is a priority at the NCBIA.

As an association whose members are constantly looking to improve, we will be offering our members a variety of classes to improve skills to better serve their clients…to better serve YOU! Our Education Committee Chaired by Mike Meszes is working on some important and interesting classes to offer you in the coming months.

In regard to Membership. Look over the list of companies you work with. Are they ALL members of the NCBIA? You can easily check the online directory on our website (www.ncbia.com). I am sure that you will find a few companies, suppliers, manufacturers, builders, remodelers, or other associated companies, who are not members. Do us all a favor. Ask them to join the NCBIA, or better yet invite them to our upcoming Membership Mixer on April 20th from 5-7 at Rush Inn in Avon. A current application is being sent to all members for their convenience so they can share the value of membership. You will feel good about your contribution to our industry, and you will be doing a favor for your new member company as well. NCBIA committees are ALWAYS looking for volunteers to help out, give the office a call 440-934-1090 or email judie@ncbia.com if you are interested in joining a committee.

With Teddy Roosevelt’s quote in mind, get involved, help yourself, your association, and your industry!

As a volunteer-driven organization, our many committees help guide the NCBIA’s events and activities throughout the year. Consider joining one – or more - - if you want to build strong, long-lasting relationships and make a difference to your fellow NCBIA members while sharpening your leadership skills.

Chair - Brian Schwab, RestorePro, Inc. brian@restorepro.com

The Ambassadors Committee is made up of positive members who welcome new members to the association. They understand the return on investment of being involved in the association and support members in discovering what the NCBIA has to offer. They are great at generating enthusiasm and encouraging member involvement.

Co-Chairs

Liz Schneider, Dollar Bank eschneider187@dollarbank.com

Mary H. Felton, Guardian Title mfelton@guardiantitle.com

The NCBIA BuildPac Committee is the political committee for the association. It provides financial support to the political candidates who understand and support the issues of the industry, ensuring the voices of our members are heard on industry-related issues.

Co-Chairs

Melanie Stock, First Federal Savings of Lorain melanie.stock@fflorain.bank

Jen Toth, Floor Coverings International jen.toth@floorcoverings.international.com

The Clambake Committee plans the annual Clambake and Reverse Raffle event. This is a great social event for NCBIA membership and guests. Make our clambake your clambake!!

Chair - Randy Strauss, Strauss Construction Inc. randykstrauss@aol.com

The Codes Committee keeps members abreast of code changes. Government Affairs Committee focuses on local, state and national issues that affect the building industry.

Chair - Mike Meszes, DRC Construction Co. mmeszes@gmail.com

The Education Committee has oversight and responsibility for development, delivery, management and evaluation of all NCBIA education programs.

Chair - Melanie Stock, First Federal Savings of Lorain melanie.stock@fflorain.bank Oversees finances of the NCBIA.

Co-Chairs

John Toth, Floor Coverings International john.toth@floorcoveringsinternational.com

Dave Weisenberger, Tusing Builders & Roofing Services dweisenberger@trusttusing.com

The Golf Classic Committee plans the annual NCBIA golf outing that takes place the first Thursday in August. This is a business and social event, bring clients, staff, family & friends to enjoy a day of golf, prizes and delicious barbeque.

Co-Chairs

Sara Majzun, Majzun Construction Co. samajzun@gmail.com

John Toth, Floor Coverings International john.toth@floorcoveringsinternational.com

The Home Show Committee plans the annual Home Show targeting local area residents for our members to showcase their company and its products and services.

Co-Chairs

Matt Herb, Fidelity National Title matt.herb@fnf.com

Jonathan Sherer, Paraprin Construction jsherer@paragonprincipal.com

The Membership Committee is responsible for member recruitment and retention, and also planning and conducting our general membership meetings and member orientation.

Diane DeCesare, K. Hovnanian Homes ddecesare@khov.com

Connie Linkous, K. Hovnanian Homes clinkous@khov.com

The Sales and Marketing Committee provides networking and recognition for our members as well as public awareness of the NCBIA. This committee also assists in our annual Circle of Excellence awards that highlight our members’ products and achievements.

Tim King, K. Hovnanian Homes tking@khov.com

John Toth, Floor Coverings International john.toth@floorcoveringsinternational.com

The Workforce Development Committee provides input and opportunities to local schools and school-to-work programs. The committee works to provide further education and training to provide a well-trained workforce to our industry.

To get the most out of your membership in the NCBIA, contact me at judie@ncbia.com to become involved on a committee. They are great places for information, networking and skill development.

Theresa Riddell, The Nelson Agency presenting Tim King, 2023 NCBIA President with a sponsorship check from Hastings Mutual in the amount of $957.12.

If you would like to know more about the Hasting Mutual benefit for NCBIA members (Builder's Risk & Installation Floater, Tool Coverage and Broadened Coverage) give Theresa a call (440) 420-1175. This program is mutually beneficial to your business and the NCBIA.

$ 7 . 0 0 / e a

c o n t a c t j u d i e @ n c b i a . c o m t o o r d e r

Y o u r N e w H o m e a n d H o w t o T a k e C a r e o f I t h a s a n i n v i t i n g n e w l o o k a n d

c o n t i n u e s t o b e a p e r f e c t c u s t o m e r h a n d o u t a t c l o s i n g .

R e m e m b e r : c u s t o m e r c a r e i s t h e k e y t o a b u i l d e r ’ s w a r r a n t y p r o g r a m .

In 2012, the Ohio General Assembly gave some relief to Home Builders and Contractors, and carved out “home construction services” from the Consumer Sales Practices Act. The “CSPA” is the Ohio consumer protection law that can impose treble (aka, triple) damages and legal fees against contractors. See ORC 1345.02.

That carve-out and resulting statute is the Home Construction Service Suppliers Act, ORC 4722.01. The HCSSA is still homeownerfriendly, but it is far more reasonable and fair with respect to construction contract disputes. Since then, many in the home construction industry have believed they were freed from the rigidity and harshness of the CSPA, as long as their contract was for more than $25,000.

In December 2022, an Ohio appellate court denied that belief. According to Beder v. Cerha Kitchen & Bath, 2022-Ohio-4463 (Geauga County), home remodeling and renovation projects are not excepted from the CSPA. In other words, home remodeling contractors can potentially be sued for triple damages and the homeowner’s legal fees, even where their project is for more than $25,000. This ruling promptly received support from the 5th District Court of Appeals in Delaware County, which relied on Beder for the limitations of the HCSSA and held that the CSPA ruled over a swimming pool project and related home remodeling work. See Estate of Tomlinson v. Mega Pool Warehouse, Inc. (Jan. 26, 2023), 2023 Ohio 229 (Delaware County).

The HCSSA says “home construction service” means the construction of a residential building. The Beder court, and later Tomlinson, held that “construct” means to build new, not to remodel or repair. Candidly, this ignores what a residential builder/contractor does. The HCSSA also says that a “home construction service” includes work on an individual dwelling unit within a structure containing 4 or more units. This means if a contractor guts and rebuilds any portion of an apartment or condo unit in a larger building, that falls with the HCSSA. But according to these cases, if you gut and rebuild any portion of a single family home, it doesn’t – the CSPA controls.

This relates to only two appellate courts’ opinions, meaning other appellate courts in the state may disagree. It’s also certainly possible the Ohio Supreme Court and/or the General Assembly get back involved. In fact, the Ohio HBA has gotten involved and filed a “friend of the court” brief urging the Ohio Supreme Court to accept jurisdiction over the Tomlinson case to urge reversal and confirm that remodeling is “construction” under the HCSSA.

But for the foreseeable future, these recent developments do not bode well for residential construction businesses that don’t build new houses. Home remodeling and renovation contractors need to immediately (a) re-evaluate their construction contracts and processes to ensure they are not violating the CSPA, and (b) get a refresher on what acts have been deemed to be “unfair, deceptive or unconscionable.” The consequences -getting sued for three-times the value of any potential homeowner claim, plus their legal fees- are too dire not to.

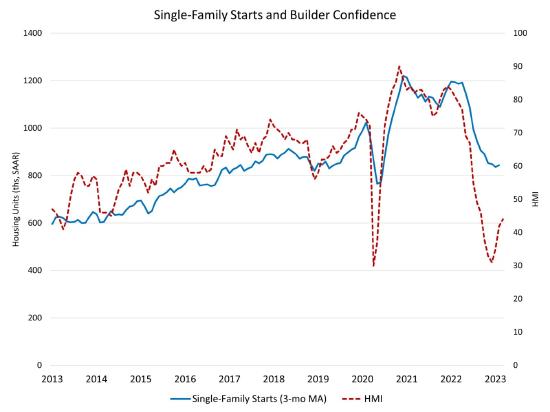

Single-family production remained at an anemic pace in February as builders continue to wrestle with elevated mortgage rates, high construction costs and tightening credit conditions that threaten to be exacerbated by recent turmoil in the banking system.

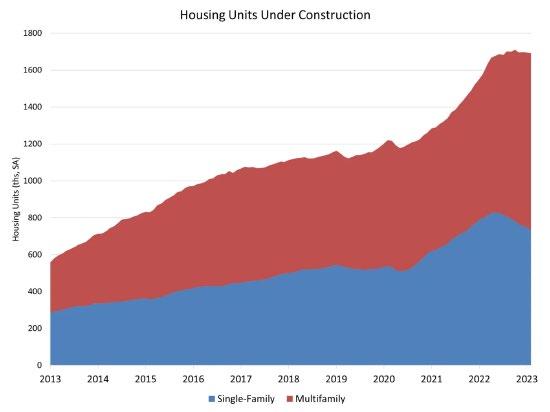

Led by gains in apartment construction, overall housing starts in February increased 9.8% to a seasonally adjusted annual rate of 1.45 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

BY: ROBERT DIETZOn a regional basis compared to the previous month, combined single-family and multifamily starts were 16.5% lower in the Northeast, 70.3% higher in the Midwest, 2.2% higher in the South and 16.8% higher in the West.

Overall permits increased 13.8% to a 1.52 million unit annualized rate in February. Single-family permits increased 7.6% to a 777,000 unit rate. Multifamily permits increased 21.1% to an annualized 747,000 pace.

Looking at regional permit data compared to the previous month, permits were 2.8% lower in the Northeast, 9.6% higher in the Midwest, 10.9% higher in the South and 30.0% higher in the West.

The number of single-family units under construction is 734,000 homes. This is down 11.4% from May 2022, the cycle peak. The number of apartments under construction is 957,000. This is the highest total since Nov 1973.

The February reading of 1.45 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, singlefamily starts increased 1.1% to an 830,000 seasonally adjusted annual rate. However, this remains 31.6% lower than a year ago. The multifamily sector, which includes apartment buildings and condos, increased 24% to an annualized 620,000 pace. Despite persistent supply-side challenges, rising builder confidence is signaling a turning point for home building later in 2023. A significant amount of housing demand exists on the sidelines and resale inventory is limited. Starts were up in February given a limited pullback for interest rates. We expect volatility in the months ahead as ongoing challenges related to construction material costs and availability continue to act as headwinds on the housing sector. However, interest rates are expected to stabilize and move lower in the coming months, and this should lead to a sustained rebound for single-family starts in the latter part of 2023.

Given the declining pace for single-family starts in 2022, more homes are being completed than starting construction. In February, 58,600 single-family homes started construction. However, 77,100 completed construction. This difference is responsible for the ongoing decline in the number of singlefamily units under construction, as displayed in the chart above.

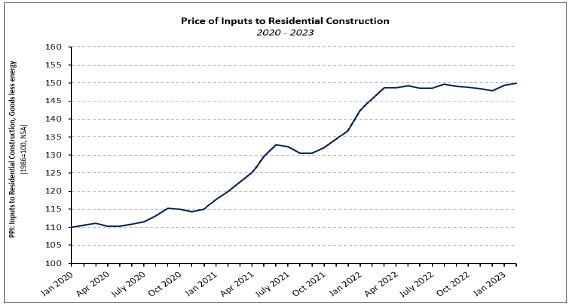

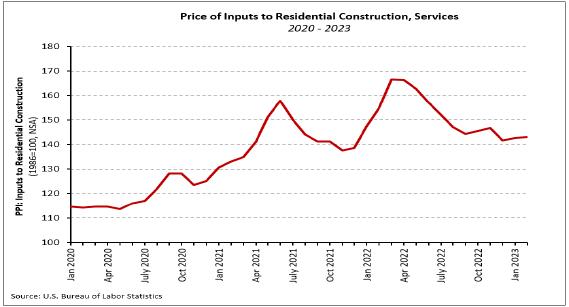

After four consecutive declines, the producer price index (PPI) for inputs to residential construction less energy (i.e., building materials) rose 0.3% in February 2023 (not seasonally adjusted) follow a 1.1% increase in January (revised), according to the latest PPI report.

BY: DAVID LOGAN

BY: DAVID LOGAN

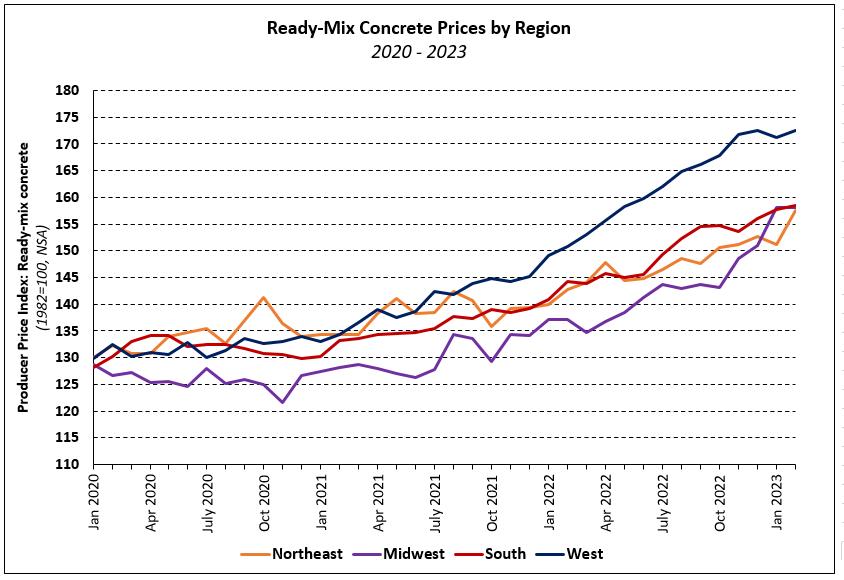

The monthly increase in the national data was broad-based geographically but was primarily driven by a 4.2% increase in the Northeast. Prices 0.8% in the West, 0.5% in the South, and were unchanged in the Midwest.

Price growth of goods inputs to residential construction, including energy, gained 0.4% over the month. Prices have increased 2.9% over the past 12 months.

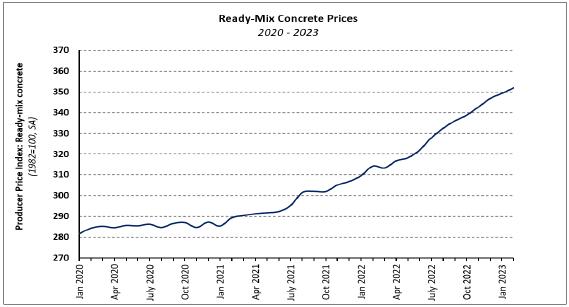

The trend of ready-mix concrete (RMC) prices continued its historic pace as the index increased 0.8% in February after gaining 0.7% in January (revised). RMC prices have increase in all but two months since January 2021.

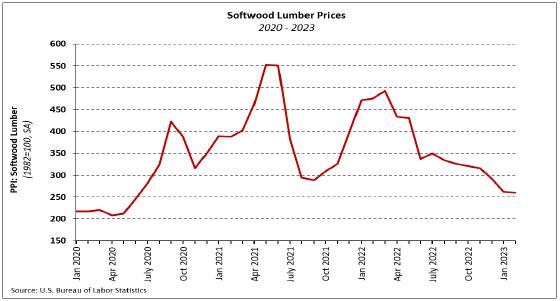

The PPI for softwood lumber (seasonally adjusted) fell 0.8% in February–the seventh consecutive monthly decline. Since peaking in March 2022, the index has fallen by nearly half (-47.1%) but is still nearly 20% above the January 2020 level.

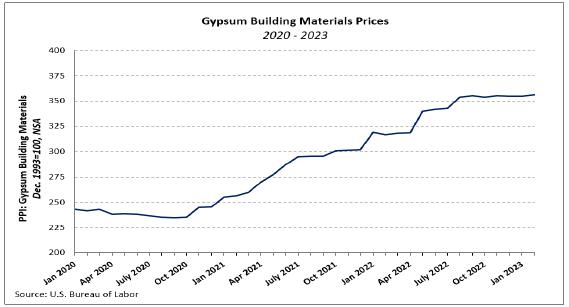

The PPI for gypsum building materials climbed 0.5% in February after edging down very slightly the month prior. Gypsum products prices are 12.5% higher than they were a year ago but began stabilizing in August 2022. Prices have been stable—up just 0.7%–in the six months since.

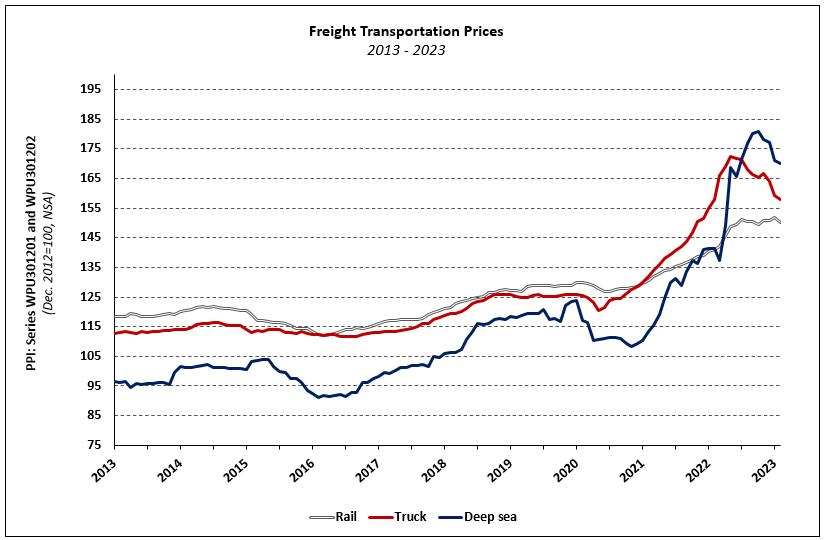

The price of truck, deep sea (i.e., ocean), and rail transportation of freight decreased 0.8%, 0.5% and 1.1%, respectively, in February. Of the three modes of shipping, trucking prices have exhibited the largest slowdown since early 2022.

Steel mill products prices increased 2.6% in February, more than offsetting the 2.4% decline seen the month prior. This was the first monthly price increase since May 2022. Even so, prices have dropped 26.0% since May 2022 and are down 21.2% over the past 12 months.

The price index of services inputs to residential construction rose 0.2% in February following a 0.7% increase in January. Prices have declined 7.7% over the past year despite increasing in four of the past five months.

Because of strong data at the start of 2023, particularly for job creation and persistent inflation pressure, Federal Reserve Chairman Jerome Powell informed Congress this week that the terminal rate (longterm target) for the Fed’s federal funds rate is likely to be higher than the Fed itself anticipated just a few months ago. Moreover, Powell also indicated the pace of tightening could accelerate again, after a recent downshift for Fed hikes that led to just a 25 basis-point increase at the start of February.

Taken together, Powell’s congressional remarks have convinced the bond market that the top federal funds rate could exceed 5.5% (it is currently 4.75%), and 50 basis-point increases could be in the cards for the March and May meetings. And rates are expected to remain at this level through the end of 2023, per the Fed's commentary. This anticipation is the reason long-term interest rates have moved higher in recent weeks, increasing from about 3.7% in early February to almost 4% this week. Mortgage rates, per Freddie Mac, were averaging 6.65% last week on the 30-year fixed-rate mortgage, and that rate will move up in the next publication of data. However, it should remain lower than the approximate 7.1% rate experienced last October.

The Fed is seeking to return inflation to a 2% level without producing a recession. The NAHB forecast projects the slowing economy will ultimately be judged as a mild recession for a portion of 2022 and 2023, as exemplified by the slowing of the housing market since the first quarter of 2022. Powell’s remarks are consistent with this outlook; however, his comments represent a moderately higher terminal rate than NAHB forecasted at the International Builders’ Show in February. Nonetheless, the Fed has moved to a data dependent mode in 2023, after the rapid tightening of rates (using 75 basis-point hikes) in 2022.

Higher interest rates will further slow new and existing home sales, despite promising data in January. New single-family home sales increased 7% in January to a 670,000 seasonally adjusted annual pace. Although this pace was more than 19% lower than the January 2022 rate, it was above forecast and an indicator that even slightly lower interest rates could spark demand for new construction. Given the reduced level of housing demand, new home inventory remains elevated at a 7.9-month supply. Median new home pricing has declined for three straight months, but at $427,500, it still stands significantly higher than pre-Covid norms.

In addition to weak conditions in the for-sale market, multifamily sentiment continues to remain low. The NAHB Multifamily Production Index increased two points from the previous quarter to 34 but remains well below the breakeven level of 50, pointing to future declines for multifamily construction starts. Even though many multifamily developers continue to see strong demand, the supply in some markets is beginning to catch up, as evidenced by multifamily starts greatly outpacing completions.

Although high construction costs and elevated interest rates continue to hamper housing affordability, builders expressed cautious optimism in March as a lack of existing inventory is shifting demand to the new home market.

Builder confidence in the market for newly built single-family homes in March rose two points to 44, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the third straight monthly increase in builder sentiment levels

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions in March rose two points to 49 and the gauge measuring traffic of prospective buyers increased three points to 31. This is the highest traffic reading since September of last year. The component charting sales expectations in the next six months fell one point to 47.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose five points to 42, the Midwest edged one-point higher to 34, the South increased five points to 45 and the West moved four points higher to 34. The HMI tables can be found at nahb.org/hmi

While financial system stress has recently reduced long-term interest rates, which will help housing demand in the coming weeks, the cost and availability of housing inventory remains a critical constraint for prospective home buyers. For example, 40% of builders in our March HMI survey currently cite lot availability as poor. And a follow-on effect of the pressure on regional banks, as well as continued Fed tightening, will be further constraints for acquisition, development and construction (AD&C) loans for builders across the nation. When AD&C loan conditions are tight, lot inventory constricts and adds an additional hurdle to housing affordability.

Meanwhile, the HMI survey shows that builders had better than anticipated new home sales during the past two months because of continued use of incentives and price discounts. Thirty-one percent of builders said they reduced home prices in March, the same share as in February, but lower than the 36% that was reported last November. And 58% provided some type of incentive in March, about the same as the 57% who did in February, but lower than the 62% of builders who offered incentives in December.

Employers, register today for the Spring Career Fair at LCJVS!

Thursday, April 13, from 9 am to 11 am

Advance registration is required by Friday, March 10.

Employers are invited to meet with our current high school juniors and seniors on Thursday, April 13! Our students will be looking for work post-graduation, after-school employment, and summer jobs/internships.

**Due to space limitations, we only have 59 employer spots available. Registration is first come, first served, with a waiting list for additional registrations. We anticipate this event filling quickly, so please register as soon as possible.* Register Today!

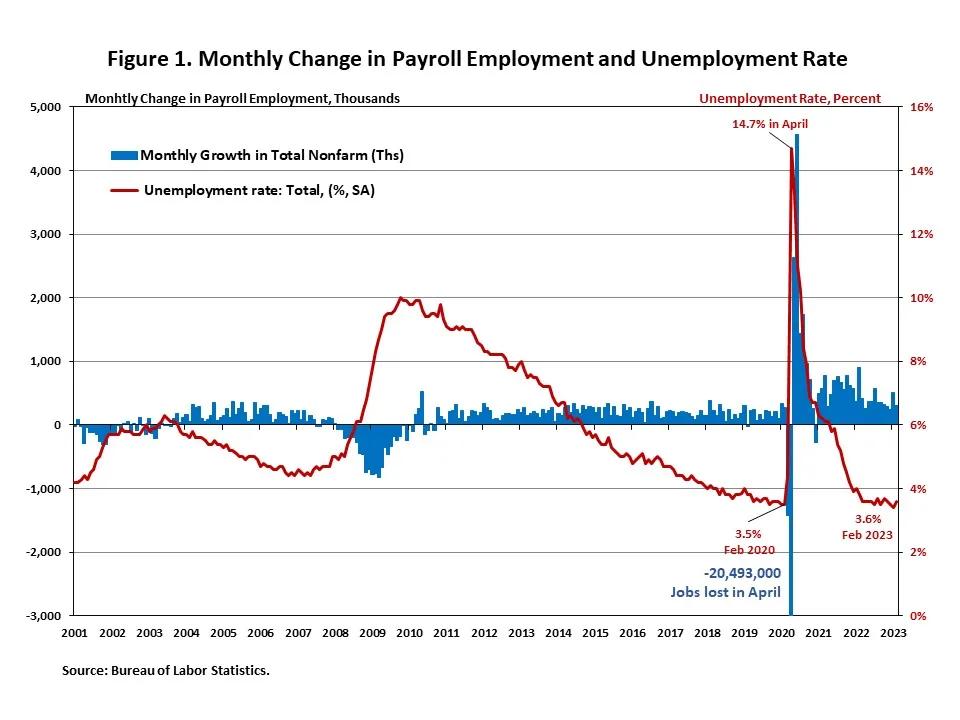

Job growth continued in February. After a revised 504,000 job gain in January, total nonfarm payroll employment increased by 311,000 in February, and the unemployment rate edged up to 3.6% from 3.4% in January. Wage growth increased to a 4.6% year-over-year gain from 4.4% last month, but down compared to February 2022. Today’s job report indicates that, overall, the labor market is still strong, but showing signs of slowing of a strong start for the year.

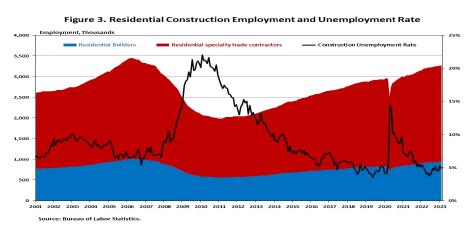

Construction industry employment (both residential and non-residential) totaled 7.9 million and exceeds its February 2020 level. Residential construction gained 12,400 jobs, while non-residential construction employment gained 11,600 jobs in February. Residential construction employment exceeds its level in February 2020, while all non-residential construction jobs lost in March and April 2020 have now been recovered.

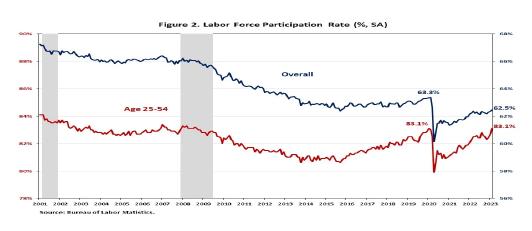

Meanwhile, the labor force participation rate, the proportion of the population either looking for a job or already holding a job, edged up 0.1 percentage point to 62.5% in February, reflecting the increase in the number of persons in the labor force (+419,000). Moreover, the labor force participation rate for people who aged between 25 and 54 increased to 83.1%. While the overall labor force participation rate is still below its pre-pandemic levels at the beginning of 2020, the rate for people who aged between 25 and 54 is back to the pre-pandemic level.

Total nonfarm payroll employment increased by 311,000 in February, following a gain of 504,000 in January, as reported in the Employment Situation Summary. The estimates for the previous two months were revised downward. The estimate for December was revised down by 21,000 from +260,000 to +239,000, while the January increase was revised down by 13,000, from +517,000 to +504,000. Despite tight monetary policy, over 4.3 million jobs have been created since March 2022, when the Fed enacted the first interest rate hike in more than three years.

The unemployment rate edged up to 3.6% in February. The number of employed persons increased 177,000, while the number of unemployed persons rose 242,000.

For industry sectors, leisure and hospitality (+105,000), retail trade (+50,000), government (+46,000), professional and business services (+45,000), and health care (+44,000) have notable job gains in February. Employment in the overall construction sector rose by 24,000 in February, following a 35,000 gain in January. Residential construction gained 12,400 jobs, while non-residential construction employment gained 11,600 jobs in February.

Residential construction employment now stands at 3.3 million in February, broken down as 939,000 builders and 2.3 million residential specialty trade contractors. The 6-month moving average of job gains for residential construction was 6,917 a month. Over the last 12 months, home builders and remodelers added 90,300 jobs on a net basis. Since the low point following the Great Recession, residential construction has gained 1,292,600 positions.

In February, the unemployment rate for construction workers decreased by 0.3 percentage points to 4.9% on a seasonally adjusted basis. The unemployment rate for construction workers has been trending lower, after reaching 14.2% in April 2020, due to the housing demand impact of the COVID-19 pandemic.

The Speedway SuperFleet Mastercard program will be rebranded to the 7-Eleven Commercial Fleet Mastercard program. This rebranding will nearly double the locations available to receive fuel rebates with acceptance at Speedway and 7-Eleven eligible locations, while still providing businesses with the same great features they enjoy today.

In support of this rebrand, your cardholding members will notice some changes with their accounts:

• SAME GREAT REBATE – WITH A BIGGER NETWORK! – The current rebate plan will not change, but now accounts will earn savings on fuel at 7-Eleven locations in addition to Speedway locations. The new savings network will grow to over 8,000 locations coast-to-coast. Find locations at: fleet.7-eleven.com/locations.

• ALL NEW CARDS! Effective March 20, 2023, any new card your member accounts receive will have an all-new look.

• NEW BRANDING! The SuperFleet Mastercard name and logo will be replaced with 7-Eleven Commercial Fleet Mastercard branding for all customers.

Perfect fit for mid-sized to larger fleets that need the added convenience of fueling where Mastercard® is accepted. With the 7-Eleven Commercial Fleet Mastercard®, your fleet can customize reports for a complete fuel management solution.

Save 5¢ per gallon with volume-based rebates!*

Enjoy the security of advanced card prompts.

Set card controls and access detailed reporting online anytime.

Earn 5¢ per gallon in rebates when you fuel at 7-Eleven & Speedway locations.*

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse.

Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

or natural gas purchases. Rebates are subject to forfeiture if your account is not in good standing. To receive rebate, invoice must be paid on time. Rebates will not apply to returns or chargebacks. Savings will be reflected as

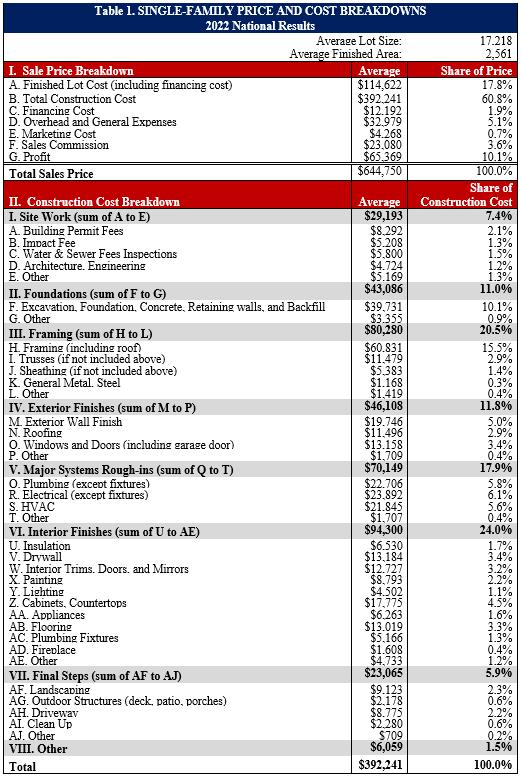

The NAHB recently published its latest Cost of Construction Survey. Results show that 60.8% of the average home sale price consisted of construction costs, essentially unchanged from the 61.1% posted in 2019. Since the inception of this series in 1998, this was the fourth time construction costs represent over 60% of the total price of the home (2013: 61.7%, 2015: 61.8%, and 2019: 61.1%).

The finished lot category was the second largest cost at 17.8% of the sales price, down from 18.5% in 2019. The average builder profit margin was 10.1% in 2022, compared to 9.1% in 2019.

At 5.1% in 2022, overhead and general expenses were also essentially unchanged when compared to 2019 (4.9%). The remainder of the average home sale price consisted of sales commission (3.6%), financing costs (1.9%), and marketing costs (0.7%). These percentages are also similar to their 2019 breakdowns.

Survey respondents broke down construction costs into 8 major construction stages. Interior finishes, at 24.0%, accounted for the largest share of construction costs, followed by framing (20.5%), major system rough-ins (17.9%), exterior finishes (11.8%), foundations (11.0%), site work (7.4%), final steps (5.9%), and other costs (1.5%).

Explore the interactive dashboard below to view the costs and percentage of construction costs for the 8 components and their 36 subcomponents. Table 1 shows the same results as the dashboard above in table format. Please click here to be redirected to the full report (which includes historical results back to 1998).

BY: ERIC LYNCHMembers have access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels, and much more.

• Save up to 40% on Top Theme Parks Nationwide

• Save up to 60% on Hotels Worldwide

• Save up to 40% on Top Las Vegas & Broadway Show Tickets

• Huge Savings on Disney & Universal Studios Tickets

• Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

Please visit https://memberdeals.com/nahb/?login=1

BY: DAVID LOGAN

BY: DAVID LOGAN

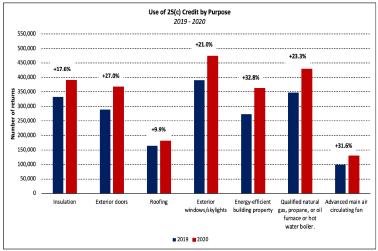

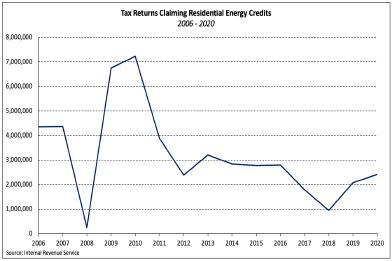

In 2005, Congress established several energy-efficiency tax incentives related to housing that benefit new-home buyers and remodeling homeowners. These policies included the tax code section 25C credit for retrofitting/remodeling existing homes, and the 25D credit for the installation of power production property in new and existing homes. Taxpayers claim these residential energy credits using Form 5695.

Including carryforwards from 2019, 2.4 million taxpayers claimed at least one residential energy credit for tax year 2020 (the most recent data available). This represents a 16.2% increase over 2019 and is more than twice the number of returns filed for 2018.

Although IRS income distribution data for these credits is not given for each line item, distribution data is published for total residential energy credits claimed on Form 5695. For tax year 2020, 86.9% of the tax returns claiming 25(c) and/or 25(d) were filed by taxpayers with an adjusted gross income (AGI) of less than $200,000. More than half of these returns—and roughly 40% of the total claimed—were filed by taxpayers with AGI less than $100,000.

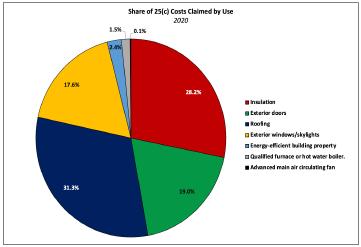

As in prior years, exterior window installation was the most prevalent use of the 25C credit in 2020. This was followed by (in descending order of the number of returns)

furnace/hot water

boiler, insulation, exterior doors, energy efficient building property, roofing, and advanced main air circulating fan. In terms of costs claimed, however, qualified roofing and insulation improvements accounted for nearly 60% of the total in 2020. More than 180,000 taxpayers claimed the credit for energy-efficient roof upgrades totaling $1.4 billion while $1.3 billion was claimed by 391,000 taxpayers for qualified insulation improvements.

Nearly half a million taxpayers claimed a 25C credit for window upgrades totaling $778 million. All categories of improvements saw increases in 2020 in both the total amount claimed as well as the number of returns filed.

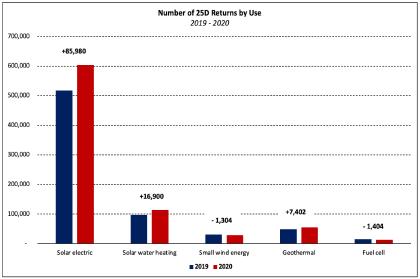

The story of 25D is more mixed. While claims related to solar electric, solar water heating, and geothermal heat pump property costs increased in 2020, those for costs related to small wind energy and fuel cell property declined. From 2019 to 2020, claims associated with solar electric power grew by 86,000 taxpayers and $2.1 billion. Conversely, during the same period, 25D claims related to small wind energy and fuel cells fell by 2,700 taxpayers and $123 million, declines of 0.6% and 8.0%, respectively.

Including 367,000 returns using carryforwards of unused credits, a total of 898,000 taxpayers claimed 25D credits amounting to $3.5 billion. The most claimed qualifying activity for the

More than 600,000 taxpayers claimed the credit for a total of almost $12.6 billion in qualifying costs of installation. The second most common installation in 2020 was for solar water heating property, which was claimed by 114,000 homeowners and totaled almost $627 million in installation costs.

More than 65 builders and members of utility organizations took part in a March 14 energy roundtable teleconference hosted by the U.S. Small Business Administration Office of Advocacy to air their strong concerns about the Department of Energy’s (DOE) proposed rule to regulate energy conservation standards for distribution transformers.

At a time when the home building industry is facing a severe shortage of electrical transformers, the proposed rule would dictate that manufacturers increase the efficiency of distribution transformers by a mere tenth of a percentage point. In order to achieve this nominal increase in efficiency, the proposed rule would require manufacturers to transition to a different type of steel that would add months to a lengthy order cycle that already takes more than 16 months to produce and deploy new transformers.

“I am very concerned that these new rules will make the supply issues we have with transformers even worse,” said Rob Myers, immediate past president of the HBA of Greater Cleveland. “We can’t get the transformers we need now. I would love to come to Washington and talk to these people and say, ‘Wake up. You are tying our hands behind our back and we are the ones who house America.’”

Delaware builder Justin Olear told the SBA officials that “we don’t have enough transformers to keep us going and that there are thousands of units in [his] state where home sales cannot be closed due to the transformer shortages.

“The ripple effect of this is bad,” Olear continued. “People are backing out of contracts on homes that are under construction. The focus needs to turn to production of transformers. We do not need to worry about future efficiency at this point.”

CONTACT: Alex

Strongastrong@nahb.org

(202) 266-8279

“We have a terrible problem with sourcing and getting transformers,” added Bobby Cleveland, an apartment developer in Georgia. “There’s an acute shortage of affordable housing, and I would be against anything that will complicate the supply chain issues we’ve already got with transformers. The payback and benefit of this kind of change is minuscule compared to the expense and damage this will cause.”

“This is a great discussion, but let's not stop here,” said NAHB First Vice Chairman Carl Harris. “We must convene with DOE and the secretary of Commerce to show how this proposed rule will do damage to housing attainability.”

NAHB will be sending comments to the DOE stating how this proposed rule will not only exacerbate the current nationwide shortage of electrical transformers, but also fuel delays in home construction projects across the country as well as aggravating the nation’s housing affordability crisis.

Comments are due by March 27. Prianka Sharma, assistant chief counsel at the SBA, encouraged those who are interested in providing comments to stress the economic impact this proposed rule would have on their business and to provide actual data whenever possible.

Ted Carson, Apollo Supply, Affiliate Associate

(Sponsored by John Marcelli, Apollo Supply

12625 Berea Road Cleveland OH 44111 614-935-2820

ted.carson@apollosupply.com

www.apollosupply.com

Family owned and operated, Apollo Supply is Cleveland’s last exterior building material distributor with multiple locations servicing Northeast Ohio. Their wholesale product offering spans from windows, siding, roofing, gutters, shutters, doors and more.

Briana Harris, Fidelity National Title, Affiliate Associate

(Sponsored by Matt Herb, Fidelity National Title)

5340 Meadow Lane Sheffield Village OH 44035 440-541-4604

Briana.harris@fnf.com

ohio.fntic.co/bharris

Committed to providing the best service possible in order to help clients grow their business without losing time or adding stress with the help of Fidelity’s products, services and people. Believing that providing transparent communications to her clients results in efficiency and trust. Committed to providing the best customer service so clients know they can always count on her and the entire team at Fidelity.

Chris Bartish, First National Bank, Primary Associate (Sponsored by Tim King, K. Hovnanian Homes)

6060 Rockside Woods Blvd., Suite #300 Independence OH 44131 bartishc@fnb-corp.com fnb-online.com/mortgage/bartishc

I am a Mortgage Loan Consultant and dedicated to providing great customer service, building long-standing relationships with his clients, and providing options to make home buying possible. In this role, I am responsible for providing purchase and refinance mortgages to individuals for New Construction, Jumbo, and Physician Financing. I specialize in new construction and providing a wide array of options for buyers who want to build their dream home.

Connie Linkous, K. Hovnanian Homes

Affiliate Builder

(Sponsored by Tim King, K. Hovnanian Homes)

3296 Columbia Road Richfield OH 44286 216-704-1130

clinkous@khov.com khov.com

K. Hovnanian Homes believes your home should clearly reflect your unique style, so diverse home designs are a trademark of our communities. We build your home as we would our own, with the utmost care, excellent materials and according to exacting standards.

Richard Romero, Primary Associate, Lakeview Granite & Quartz

(Sponsored by Tim King, K. Hovnanian Homes)

732 Idaho Avenue Lorain OH 44052

lakeviewgq@gmail.com

lakeviewgq.com

The friendly and knowledgeable team at Lakeview Granite & Quartz believe that every job is an opportunity to create a captivating space our clients love. This is why we build positive relationships with our customers to understand their unique needs and budget. We ensure your remodel turns out just how you want it, whether you want a more contemporary room or a classic touch. Lakeview Granite & Quartz provides the quality and value your family deserves. All of our quartz and granite slabs are available locally with hundreds of colors to choose from and ready for prompt delivery. Our Fabuwood Cabinets are only 2-3 weeks away and provide a great value with our custom designs!

Bill Kuhn, Affiliate Associate, Lorain County Vocational School

(Sponsored by Michelle McClintic, Lorain County Vocational School)

15181 State Route 58 Oberlin OH 44074 bkuhn@lcjvs.net lcjvs.com

Instructor – Industrial Electricity

David Morgan, Affiliate Associate, Lorain County Vocational School

(Sponsored by Michelle McClintic, Lorain County Vocational School)

15181 State Route 58 Oberlin OH 44074

dmorgan@lcjvs.net

lcjvs.com

Instructor - HVAC

Paul Papesh Affiliate Associate, Lorain County Vocational School

(Sponsored by Michelle McClintic, Lorain County Vocational School) 15181 State Route 58 Oberlin OH 44074 dmorgan@lcjvs.net lcjvs.com

Instructor - Carpentry

David Rudisill, Affiliate Associate, Lorain County Vocational School

(Sponsored by Michelle McClintic, Lorain County Vocational School) 15181 State Route 58 Oberlin OH 44074

drudisill @lcjvs.net

lcjvs.com

Instructor - Masonry

121 N. Leavitt Road, Suite #119 Amherst OH 44001 216-772-8020

james@onealtaxbook.com onealtaxbook.com

O’Neal Tax & Bookkeeping is a virtual accounting firm providing bookkeeping, payroll, and tax preparation services as well as diagnostic, cleanup and accounting launch solutions.

Jake Berger, All Construction Services

Kenneth Hutman, B.W. Plumbing Company

Matt Garland, Garland New Homes

Aaron Kalizewski, Grand Maison Construction Company, LLC.

Tim Hinkle, Green Quest Homes, LLC.

Jeff Reichert, J.L. Reichert Paving, Inc.

Jack Kousma, Kousma Insulation

Jim Tipple, Maranatha Custom Homes, Inc.

Tracy Goldsmith, Northern Ohio Basement Waterproofing, Inc.

Tom Sear, Ryan Homes

Pam Stewart Wells, Stewart’s TV & Appliance

Tom Lahetta, Tom Lahetta Builders

Dave Weisenberger, Tusing Builders & Roofing Services

Robert Palmer, Weed Pro

Mike Juhas, Arrow Lift

Pete Newstrom, Arrow Lift

Jeff Crawford, Cleveland Custom Homes

Charles Hewitt, Custom Gutter and Exteriors

Jim Strader, J&M Construction

Lisa Powers, Medina Lighting

Don Nemeth, NEM Construction

Joe Laumer, Northstar – A Division of Stewart Title

David English, WCCV Flooring

What members are saying:

Such a great idea to have something for children at your home show.

Thanks for all the hard work that you put into the Home & Remodeling Show.

“ “

Welcome New Members!

STATESMAN SPIKE (500-999 SPIKE CREDITS)

SUPER SPIKE (250-499 SPIKE CREDITS)

ROYAL

(150-249 SPIKE CREDITS)

RED

(100-149 SPIKE CREDITS)

GREEN SPIKE (50-99 SPIKE CREDITS)

Through our partnership with NPP, eligible members can save 22% OFF Verizon monthly access fees* and up to 35% OFF the latest accessories. To get started, just visit www.NCBIA.com to sign up with NPP for free.

NPP has a catalog of various offers for businesses and employees that can save you money and help you discover new goods and services to move your business forward. Membership is free and there is no obligation to purchase.

Industry eligibility requirements apply. Unlimited plans are not eligible for corporate and employee line discounts. All Verizon Wireless offers are for a limited time only and are subject to equipment availability. Verizon Wireless reserves the right to change or modify all offers at any time without notice. All terms and conditions are subject to and governed by Verizon Wireless’ Agreement with Customer including, but not limited to, customer eligibility requirements. Every effort is made to ensure the accuracy of the Verizon Wireless offers, however, Verizon Wireless is not responsible for any errors or omissions. NPP does not guarantee supplier offers or their website performance. Suppliers are solely responsible for all supplier products and services offered through NPP. Offers may be suspended or terminated at any time and may be subject to product restrictions, exclusions and eligibility requirements.

We will Registration is now open for Sedgwick’s statewide 2023 Seminar Series. This year’s half day sessions will provide employers with relevant information that is focused not only on safety and workers’ compensation, but also unemployment. In addition, we will have a special presentation on managing and understanding our aging and remote workforce. These seminars are open to Sedgwick clients and non-clients. The attachment includes a link to register for your preferred date and location. Please note that these sessions qualify for the two-hour safety credit through the Ohio Bureau of Workers’ Compensation. We look forward to seeing you at one of our locations!

More Information on page following!

Sedgwick is proud to deliver workers’ compensation claims management and cost containment strategies to nearly 60,000 hard-working Ohio employers and have the endorsement of more than 340 associations, chambers of commerce, governmental agencies and public-sector organizations.

This session will provide employers with a high-level overview of the safety gap analysis process including the different types that can be conducted, why they are important and how to interpret the results. We will also discuss ideas on how to close any gaps identified in an employer’s safety program along with available resources.

Our panel of experts will engage in a discussion of best practices that focus on how to manage the more difficult claims. We will discuss strategies for working with “challenging” providers and review best practices for managing injured employees with work restrictions as well as those who are not able to return to work. We will include a discussion on how and when to utilize vocational rehabilitation and identify the benefits to both the injured employee and the employer. Finally, we will touch on claim defense, cost mitigation and claim resolution.

How your organization manages its unemployment process can have a direct impact on the bottom line since an employer has the ability to influence workforce agency decisions. Typically, setting up a process to respond to claims filed is seen as the essential best practice, however, it is only a small piece of the overall puzzle. This session explores the other critical aspects that are required to effectively manage unemployment risk. We will give you tools to assess and improve your organization’s current process along with strategic concepts that can be utilized to ensure compliance, increase win rates, and reduce assigned rates and account benefit charges.

Two of the biggest questions in the workplace today are remote work and the aging workforce. These two realities are shaping how work is done and what employees value, need, and want in an employer. In this session we will explore these two topics and look at what an aging workforce needs, values and what a remote workforce will look like for your organization and how these realities intersect in the workplace.

Sedgwick will be holding the seminars in four convenient locations across the state. The locations and dates are:

• April 12 - Perrysburg, Hilton Garden Inn

• April 13 - Independence, Embassy Suites

• April 25 - Dublin, Embassy Suites

• April 27 - West Chester, Marriott Cincinnati North

Registration fees are $75 per person for Sedgwick clients. Tuition, educational materials, continental breakfast and a refreshment break are included in the registration costs. These sessions qualify for the two-hour safety credit through the Ohio Bureau of Workers’ Compensation. Be sure to register early as space is limited. For additional information and to register, go to https://app.certain.com/profile/web/index. cfm?PKwebID=0x1277941abcd&varPage=home We look forward to seeing you at one of our locations!

SB 76 Landlords Blessing, L. Antonio, N. To levy a tax on certain high-volume landlords.

The bill imposes a new tax on certain high-volume landlords, beginning in the first full calendar year after the tax’s effective date. The tax, referred to as the “housing market impact tax,” is imposed on any person or combined taxpayer group that owns 50 or more “taxable houses” in a single county. A taxable house is any single-family, two-family, or three-family dwelling. When a county auditor is aware that a landlord owns the requisite number of houses, the auditor must provide notice on the landlord’s tax bill. SB 76 has been introduced and received its first hearing in the Senate Ways and Means Committee earlier this week. The bill analysis can be viewed at the link below. https://www.legislature.ohio.gov/download?key=20517&format=pdf

To rename the Department of Education as the Department of Education and Workforce, to create the position of Director of Education and Workforce and to reform the functions and responsibilities of the State Board of Education and the Superintendent of Public Instruction. SB 1 passed the Senate 26-7 last week, and will now begin hearings in the House committee. OHBA continues to follow SB 1 to ensure emphasis on career tech aspects remain a priority.

To make operating appropriations for the biennium beginning July 1, 2023, and ending June 30, 2025, to levy taxes, and to provide authorization and conditions for the operation of state programs. OHBA continues to focus on the housing provisions in the Governor’s budget proposal for both the state LIHTC and singlefamily tax credit. While supportive of both, OHBA continues to emphasize the need to spur all types of housing, and look at additional measures to help the production of workforce housing. There are several proposals under discussion, and OHBA will be meeting with legislators, and the Governor’s office to work through all of the housing proposals.

Please feel free to contact OHBA with any questions at (614)228-6647.

While the Senate expected to be in session multiple days this week, those sessions have been cancelled, signaling things are still waiting to move. Stay tuned, as the movement of legislation is still to come. Meanwhile, in the House a lot uncertainty continues over which party is in charge, and who is the leader This uncertainly has led to a lot of inaction as to the future of key pieces of legislation, including the state budget.

Once Intel announced they would build and operate a massive plant in central Ohio, it kicked off many discussions about housing. Why? Ohio has a huge deficit in housing to accommodate growth not to mention for our existing population. This is not a new discovery. Those who follow OHBA know of our involvement in the anti-growth movement from not too long ago. Growth was claimed to be evil, particularly housing, as it was gobbling up farmland at such a pace, we were all soon to starve.

In many events and conferences OHBA claimed this was just not true. We demonstrated a growing housing deficit straining affordability and impeding economic growth. We also clearly rebutted any farm land loss which could even remotely impact food supply.

We were somewhat vindicated when Intel, and other industries, told state officials they had to do something to increase housing, as our lack of workforce housing negatively impacts development. Incidentally, Intel did come to Ohio and will be located on some of the most productive farmland in the state. Enough said! OHBA is pleased our state leaders now fully understand our housing stock must be expanded and updated.

HB 2 (the budget bill) and HB 3 Affordable Housing include millions of state dollars of incentives for housing. HB 3 provides up to 50 million a year for a state LIHTC and HB 2 provides for state LIHTC and tax credits for single family construction. The LIHTC proposal is like the federal program, while details for the single-family program remain in the formation stages.

There are a few other programs we are following:

• Program providing funding for certain home improvement.

• Asked the administration for their thoughts in requesting the Army Corps of Engineers to allow for a single corps district to handle all permit requests for Ohio.

• OHBA is working with the Department of Development who wants to give grants to local government to update their zoning ordinances.

Please feel free to contact OHBA with any questions at (614)228-6647.

Perfect fit for mid-sized to larger fleets that need the added convenience of fueling where Mastercard® is accepted. With the 7-Eleven Commercial Fleet Mastercard®, your fleet can customize reports for a complete fuel management solution.

Save 5¢ per gallon with volume-based rebates!*

Enjoy the security of advanced card prompts.

Set card controls and access detailed reporting online anytime.

Earn 5¢ per gallon in rebates when you fuel at 7-Eleven & Speedway locations.*

Customize and download cost and performance reports monthly or in real-time.

Monitor transactions and manage your account online, in real-time.

Use card prompts to help prevent misuse.

Simple online access.

Accepted at your favorite 7-Eleven & Speedway locations and anywhere Mastercard is accepted, regardless of fuel brand.**

or natural gas purchases. Rebates are subject to forfeiture if your account is not in good standing. To receive rebate, invoice must be paid on time. Rebates will not apply to returns or chargebacks. Savings will be reflected

Please

Type of

If your organization is any type other than Sole Proprietorship, Public Corporation, or Government & Education, you must complete the

Section below.

NOTE - At FLEETCOR’s discretion, we may require CPA Reviewed or Audited Financial Statements during the Credit review.

AUTHORIZED REPRESENTATIVE – Required.

Application Terms: By signing this Application, the Authorized Representative represents, warrants, and agrees that: (a) he or she is authorized to apply to FLEETCOR TechnologiesOperating Company, LLC (“FLEETCOR”), a Louisiana limited liability company, for an unsecured, partially secured, or fully secured line of credit (“Account”) on behalf of the company identified above (“Client”); (b) FLEETCOR may obtain Client’s credit report and check Client’s credit standing when processing this Application or periodically evaluating any resulting Account’s creditworthiness; (c) this Application is subject to approval and acceptance by FLEETCOR; (d) if the Application is approved by FLEETCOR in Louisiana, the resulting Account: (i) will be governed by Louisiana law; (ii) will not be a revolving credit account and the Amount Due/Total Amount Due shown on each Account Statement will be due and payable on the Due Date shown on the Statement; (iii) will be used solely for commercial purposes and not for personal or household purposes; (iv) will be suspended, and the Client’s redit history may be reported to credit reporting agencies, if the Client’s unpaid balance ever meets the Account’s Credit/Spend Limit; and (e) acceptance, signing (in whatever form), or use of any of the Cards issued to Client will constitute Client’s acceptance of the Client Agreement available at www.fleetcor.com/terms/7-Eleven-mc or www.fleetcor.com/terms/7-Eleven-dn Equal Credit Opportunity Act Notice. The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided that the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The federal agency that administers compliance with this law concerning this creditor is the Federal Trade Commission, Equal Credit Opportunity Act, Washington, D.C. 2 0580. FLEETCOR considers your privacy important. View our privacy policy available at www.fleetcor.com/privacy-policy to find out more.

I agree to the Application Terms and the Client Agreement (Please check box) ☐ BUSINESS OWNER(S) / PERSON WITH SIGNIFICANT MANAGEMENT RESPONSIBILITY – Required.

To help fight financial crimes, the U.S. Department of Treasury require financial institutions to obtain, verify, and record information about beneficial owners of entities opening accounts. Beneficial owners are persons who, directly or indirectly, own 25% or more of the entity. We may use third-party resources to verify your identity. For questions about this regulation and how FLEETCOR uses and protects this data, please speak with your sales representative. Patriot Act Notice. Section 326 of the USA PATRIOT Act mandates that FLEETCOR verify and record certain information about you (the Client, Authorized Representative, or anyco-maker or guarantor) while processing this Application.

Beneficial Owner

who own 25%

Does

Does more than one person own 25% or more ofthis business? (please check box) If yes, additional information will be required.