A PERSONAL PERSPECTIVE pg. 5

President

Jeremy D. Puglia

Vice President/President Elect

Melanie J. Wender

Secretary

Elaine T. Yandrisevits

Treasurer

Stephanie M. Shortall

Immediate Past President

R. Tyler Tomlinson

Past Presidents’ Representative

Daniel M. Keane

Board of Directors

Hon. Robert O. Baldi

Abigail C. S. Bukowski

Brendan M. Callahan

Joseph A. Cullen

Steven M. Jones

Jeffrey A. Liebmann

Kimberly Litzke

Tina Mazaheri

Joanne M. Murray

Travis P. Nelson

Thomas E. Panzer

Mindy J. Snyder

Writs Editor

Travis P. Nelson

Writs Photographer

Emily McGee

Bar Association Office

Heather Cevasco, Executive Director 135 East State Street Doylestown, PA 18901 215.348.9413 • www.bucksbar.org email submissions to BucksWritsEditor@gmail.com

Publishing Group 2669 Shillington Road, #438 Sinking Spring, PA 19608 610.685.0914 HoffPubs.com

An Affair to Remember: Lessons Learned From the Coldplay Concert

In Coldplay’s song “Fix You,” Chris Martin sings: “And...

On the Way to the Super Bowl of Weddings, Don’t Forget the Prenup!

Any Taylor Swift fan will tell you that the current...

Client Thinking of Selling Their Business?

Selling a business is a time-consuming, emotional...

Impact of the Big Beautiful Bill on Small Business Owners

The One Big Beautiful Bill Act (the “OBBB”) was...

Federal Regulators Move to Combat Politicization of Banking

Politicians have long debated and criticized some...

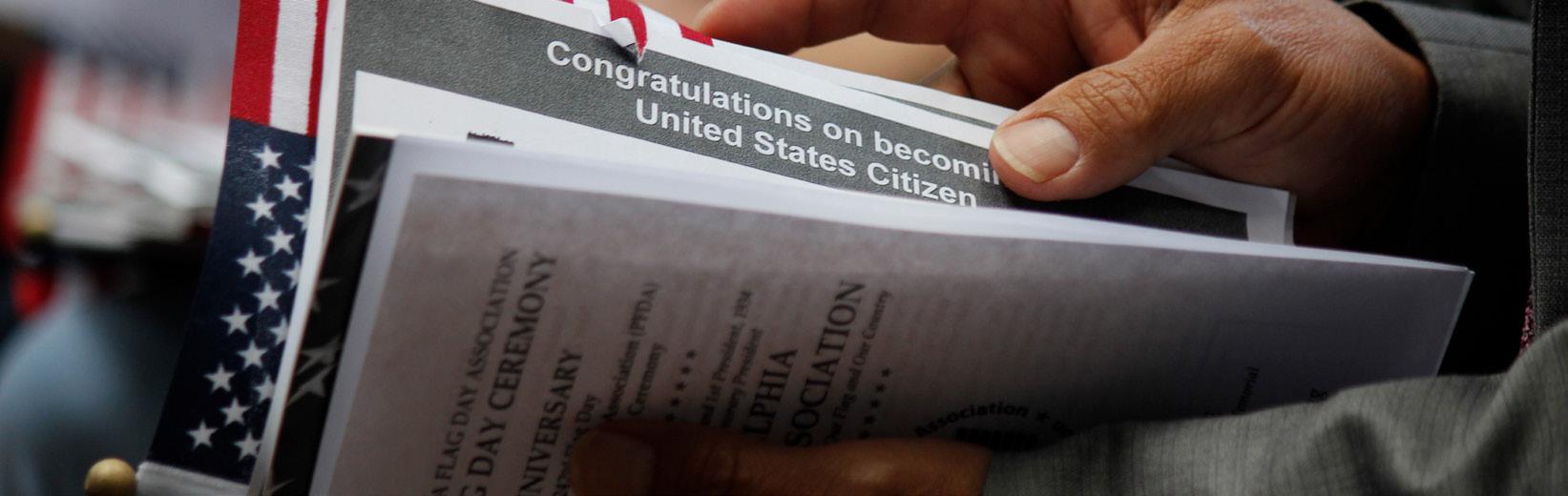

Earlier this year, I had the privilege of representing the Bucks County Bar Association at a naturalization ceremony for new United States citizens. It’s not an event I’ll soon forget.

Families, court officials and local leaders attended—but the real energy came from the new citizens themselves. They hailed from dozens of different countries, speaking different languages and bringing different cultures. Each had their own story of how they arrived at this moment. What they shared was the same dream: to call America home—not just in spirit, but in law.

Standing before them to deliver remarks on behalf of our legal community was both humbling and deeply personal. My own mother became a U.S. citizen just eight years ago (born in Italy). My wife also went through the process three years ago after moving to the U.S. from Germany. I’ve seen firsthand the challenges—the language barriers, the endless paperwork, the complexity of our immigration system—and I’ve also seen the pride and joy when that certificate of citizenship is finally in hand.

In the legal profession, it’s easy to get caught up in the structure and formality of the law. But this moment reminded me what the law is for. Naturalization is not just a legal process—it’s a reaffirmation of the American ideal: that citizenship isn’t about where you’re from, but about who you choose to be and the values you commit to uphold.

During my speech, I asked a couple of spontaneous questions: Who has lived in the U.S. the longest? Who was the oldest? Who was the youngest? The answers sparked smiles and a sense of shared experience. Some had been waiting decades for this moment. Others were more recent arrivals. All had persevered.

What struck me most was the hope they all shared that got them to this point. These individuals weren’t taking American Citizenship for granted. They’d worked hard for it. They’d been patient. And they understood—maybe even more than many of us born into it—what it means to be an American.

I then reminded them of two key responsibilities that come with citizenship. First, to vote. Not for one party or another, but simply to participate, to make their voice heard. And second, to give back. The strength of this country has always come from its people, and I encouraged them to serve their communities, just as so many before them have.

As lawyers, we are uniquely positioned to witness both the fragility and the strength of the rights we often take for granted. Seeing this ceremony reminded me that the work we do matters—not just in courtrooms or conference rooms, but in the lives of the individuals and families we represent who are trying to build something better.

To my fellow members of the Bucks County Bar Association, I would say this: if you ever get the chance to attend a naturalization ceremony, do it. It will remind you of why you went into this profession. It will reconnect you to the foundational principles of justice, equality, and opportunity. And, as it was for me, it might just be the most inspiring experience you’ll have all year.

On behalf of our Bar Association, I was honored to welcome our newest citizens—with pride, with gratitude, and with open arms.

Let us all be reminded that the American dream is not something finished—it is something constantly renewed by those who still believe in it.

– Jeremy Puglia, Esquire Bucks County Bar Association President

Jeremy D. Puglia is a shareholder at Drake, Hileman & Davis, P.C., where he handles personal injury as well as other general civil litigation matters. Jeremy is the President of the Bucks County Bar Association.

Thanks for your interest in the WRITS. Please send all comments, questions, submissions to: BucksWritsEditor@gmail.com

consultation and expert testimony in disciplinary matters and matters involving ethical issues, bar admissions and the Rules of Professional Conduct

• Judge, Court of Judicial Discipline

• Former Chairman, Judicial Conduct Board of Pennsylvania

• Former Chairman, Disciplinary Board of the Supreme Court of Pennsylvania

• Former Chairman, Continuing Legal Education Board of the Supreme Court of Pennsylvania

• Former Chairman, Supreme Court of Pennsylvania Interest on Lawyers Trust Account Board

• Former Federal Prosecutor

• Selected by his peers as one of the top 100 Super Lawyers in PA and the top 100 Super Lawyers in Philadelphia

• Named by his peers as Best Lawyers in America 2022 and 2015 Philadelphia “Lawyer of the Year” Ethics and Professional Responsibility Law and Legal Malpractice Law

1500 Market Street, East Tower, Suite 1800 • Philadelphia, PA 19102 (215) 751-2863

In reflecting on an appropriate topic for the Editor’s Note for this edition of the Writs, I tried to think about any themes that can be seen in the articles of this edition, which is usually a good approach. I also looked to upcoming events in the Bar Association for inspiration, sort of a preview of coming attractions. However, my mind cannot escape some of the tragedies that have occurred over the past few months, how those events have impacted our communities, and what we can do about it.

In the Book of Ecclesiastes, we read that “there is a season, and a time for every matter under heaven,” and that among those times is a “time to be born, and a time to die.” Ecclesiastes 3:1-2. The headlines seem too populated with the latter in recent weeks. There has been political violence, such as the deaths of conservative activist Charlie Kirk and Minnesota Democratic state Rep. Melissa Hortman. There has been violence that targeted children, such as the murder of young children during a Catholic Mass at Annunciation Catholic Church in Minneapolis, or at Evergreen High School in Colorado. Violence is not limited to the use of guns, as we saw in the death of Iryna Zarutska, in Charlotte, NC, in August. And these are only the incidents that have garnered more publicity.

For those who believe in some higher power, these recent examples of violence make us ask: Why does God let such things happen? As an attorney, I sometimes find myself (perhaps mistakenly) applying a tort model to God. Does God have a duty to protect his creation, and has he breached that duty? I think of my own children, and if I see them run out into traffic, and I have the ability to save them but do not, what sort of father would that make me? How does a God that visited plagues upon Egypt, parted the Red Sea, caused water to pour forth from a rock at Rephidim, cured the lepers, gave sight to the blind, called Lazarus from the tomb, and himself rose from the dead, not now intervene to work small miracles? In Psalms 34:17, we read: “When the righteous cry for help, the LORD hears and delivers them out of all their troubles.” Regarding the assailant who attacked the children at Mass in Minneapolis, why didn’t God create a weather event that caused the perpetrator to be delayed, or cause another perpetrator to suffer a heart attack before the attack? A friend with far greater faith than I suggested that these are just acts of evil that God allows to occur, that such is just part of the duality of life, that with freedom of choice comes freedom to choose evil. I spent 20 years in Catholic schools (from kindergarten through Catholic

University Law School), and taught Sunday school for eight years at a Central Bucks Catholic Church, but I do not have the answers to these questions. These certainly are times that try our faith. Some may suggest that it is easy to have faith in good times, and the true test is whether we can sustain our faith in times of tribulation. “There were many moments when my faith in humanity was sorely tested, but I would not and could not give myself up to despair. That way lays to defeat and death” (Nelson Mandela). Perhaps questions as to why God allows evil to happen are better left to the clergy.

Some suggest gun control is needed—if people do not have access to guns, then they cannot perpetrate violence with those guns. Others respond that gun control laws are ineffective because criminals will not obey those laws and such laws restrict the ability of law abiding people to defend themselves. Some suggest that increased access to mental health is key, so that professionals can help to identify and address at-risk people before they turn to violence. I have not heard of a good rebuttal to that need. Some have suggested that we should make our schools as hardened as courthouses, federal buildings, and banks. I am not sure what the rebuttal to that one is either.

As attorneys we can do more to elevate open discourse that stops hate, identifies and combats evil, and furthers civility. Our Bar Association President, Jeremy D. Puglia, in his Sept. 11th message to the Bar Association, noted that “Lawyers can, and should, be among those who help weave us back together. We have both the training and the responsibility to lead by example.” Mr. Puglia further encouraged that while on an individual level we cannot control politics or the news, “We can control how we treat one another in our professional lives, and how we model civility in our communities. We can tone down the rhetoric. We can choose to speak with clarity but also with respect. We can remember that behind every argument is a human being with dignity.” While individually we are limited in our ability to affect regional or national change, collectively there is perhaps no profession better suited to affecting real, systemic change than the legal profession. No other profession has its hands so much in the levers and corridors of power. For example, a December 12, 2024 report by the Congressional Research Service noted that 30 percent of House Members, and 51 percent of Senators, have law degrees and have practiced law. The Philadelphia Inquirer reported that as of August 2014, 13 percent of Pennsylvania’s state legislators are lawyers. And of course, the majority of judges are lawyers.

There are many different ways that members of the legal profession can work to combat evil and prevent violence. For some legal niches, attorneys already have specific knowledge and experience. For example, family law attorneys are already well-equipped to address the issue of violence within families. There are also ways for attorneys who do not routinely

practice in that area to serve, such as volunteers in PFA court. There are also many ways to advocate for children, such as through Legal Aid of Southeastern Pennsylvania, or Philadelphia’s Support Center for Child Advocates.

For those of us who are not in legal fields that readily lend themselves to advocacy for at-risk groups, we can build relationships with legal organizations that support at-risk populations. There are many organizations throughout Bucks County that work tirelessly to serve at-risk groups, and many have volunteer opportunities. Due to our extensive training and experience in the law, we are also well-positioned to advocate before state and federal officials for changes in laws that will help to curtail violence.

St. John Paul the Great, who spent much of his life fighting against forces that were intent on silencing the ideals of tolerance and freedom, said: “I plead with you—never, ever give up on hope; never doubt, never tire and never become discouraged. Be not afraid.” As the foregoing may reflect, I am not sure what the answer is to address the repeated and seemingly unending pattern of violence. If I did, I would not be practicing bank regulatory law, or at least I would ask for a rate increase. It may be that we need to focus on changing the world with one small deed at a time, with the unwavering hope that if we do enough small acts of kindness, enough isolated corporal works of mercy, that we will change the

hearts and minds of our communities and our world. As Ghandi said: “We but mirror the world. All the tendencies present in the outer world are to be found in the world of our body. If we could change ourselves, the tendencies in the world would also change. As a man changes his own nature, so does the attitude of the world change towards him... We need not wait to see what others do.” Now, of course, Ghandi did not live in a world of 24-hour news outlets that sound more like partisan mouthpieces than Edward R. Murrow-caliber journalism, however, his message is still applicable—change ourselves, then change the world around us. As Mr. Puglia noted in his Sept. 11th message: “Let us be healers in a time of division. Let us be voices of reason and calm in a world that too often rewards the opposite.” It will be difficult, but if we work together, and band together in civility and unity, our voices of reason and calm can drown out the voices of division and hate. We must not be afraid to redouble our efforts at promoting civility, kindness, and understanding, so that we can become beacons of hope in a world that seems to be growing increasingly in despair.

– Travis P. Nelson, Esquire

Travis P. Nelson is a partner at Polsinelli, P.C. in the Philadelphia Office, where he practices financial services regulatory and enforcement law, and is a resident of Doylestown, PA. Mr. Nelson is the Editor of the Writs.

By Melanie J. Wender, Esquire

IN COLDPLAY’S SONG “FIX YOU,” CHRIS MARTIN SINGS: “AND THE TEARS COME STREAMIN’ DOWN YOUR FACE / WHEN YOU LOSE SOMETHIN’ YOU CAN’T REPLACE / WHEN YOU LOVE SOMEONE, BUT IT GOES TO WASTE / COULD IT BE WORSE?” Yes, Mr. Martin, it could indeed be worse.

In July 2025, a Coldplay concert went viral and for very unexpected reasons. It was not for new music or remixes of Coldplay greats, but what appeared to be an unsuspecting couple caught in an embrace on the jumbotron. Most people would think nothing of this incident. It was simply a couple who were shocked to see themselves on the jumbotron. But, then more came out. These people were a couple and successful, but just happened to be married to other people. It was at that moment that a simple embrace became a very public affair.

Why am I discussing what is now known as Coldplay Gate? Because there is an important lesson to learn here. What is that lesson? DO NOT CHEAT. Adultery is not worth it. Consider what these two people lost as a result of this affair. They lost

their jobs, their families, their friends, and their self-respect. That seems like a lot to lose to attend a Coldplay concert. In the alternative, if you are going to cheat, maybe don’t cheat at a Coldplay concert. I hear this does not happen at Blood, Sweat and Tears reunion concerts.

Now, let me put my divorce attorney hat on. What impact does this cheating scandal have on either of these individual’s now-pending divorce? As a licensed attorney in Pennsylvania, I can only speak on the impact the scandal would have if their divorces were in Pennsylvania. If that were the case, the spouses of both of these parties could raise a fault-based claim for adultery. When you raise a fault-based claim, you need to be able to prove that the fault you allege actually occurred. In this case, it’s beyond easy to prove. Not only are there pictures of the cheating, the cheating parties issued statements, as did their spouses.

However, when it come to the equitable distribution of their marital estate, under Pennsylvania law, equitable distribution

is done on a no fault basis. Under 23 Pa. C.S. section 3502, there are eleven factors considered in determining the distribution of the parties’ marital estate. Of those eleven factors, none of them relate to adultery or other marital misconduct.

In terms of alimony, which I would expect to be part of these divorces, in Pennsylvania, seventeen (17) factors are considered in determining whether an alimony award is appropriate. Of those seventeen factors, one is marital misconduct. Marital misconduct refers to adultery, as well as other misconduct, such as abuse. While an argument could be made in these cases that the alimony should be for a longer term due to the cheating that occurred, it is the other factors, such as the length of the marriage, that have more of an impact.

Naturally, when speaking about alimony, the primary factor is the incomes of the parties. But, as a result of this scandal, the parties lost their jobs and, therefore their incomes. The question then becomes, is there an alimony obligation or other type of spousal support available in this scenario? The answer is yes. The parties involved in this scandal continue to have earning capacities and likely will be considered to have the ability to earn the same or similar incomes as they did in their prior employment. Under Pennsylvania law, they will likely be held to their prior earning capacities due to the fact that they lost their jobs not due to economic struggles by the companies they were employed by, but due to their own behavior. In Pennsylvania, when a support obligor (person paying support) loses his/her employment due to his/her own fault, then that person will be assessed as still having the ability to earn that same income. The reasoning behind that holding is that the obligee (party receiving support) should not be punished due to the other party’s poor behavior.

The above is a short summary of what could occur, but, again, the major lesson here is just do not cheat. It is not worth it and this Coldplay scandal is a clear example of that.

Melanie J. Wender is a partner at Antheil, Maslow & MacMinn, LLP, in Doylestown, PA, where she practices family law. Ms. Wender is also the President-Elect of the Bucks County Bar Association.

By Sarah A. Steers

Because I am both terminally online and tragically old, I am familiar with the term “Karen.” My deep-dive etymological research (i.e., a Google search) suggests it originated several years ago as a snide categorization of older white women who acted cruelly towards Black children engaged in adorable, innocent, and timeless activities like running a lemonade stand or coloring sidewalks with bright chalk. It has subsequently devolved into a catch-all for jerkface white “lady” behavior (“lady” being a term I use loosely), the kind of people who absolutely lose their minds in public over low-stakes perceived slights.

Were I to misbehave, I would be given the Karen moniker immediately. I am the quintessential Karen demographic. I am invisible to all direct-to-consumer marketing strategies but for pro-biotic yogurt and designer pickleball equipment. But I have absolutely no desire to be found guilty in the court of public opinion when some tween posts a video of me going berserk on a server at Buffalo Wild Wings for bringing me the wrong dipping sauce.

Rather, I would like to be a crone. (And, ummmmmm, given the ferociousness of a few nascent hot flashes, I will be a crone sooner rather than later.) A crone is a confident woman who has seen an equal share of beauty and hardship. Unsparing with her words and unflinching in her wisdom. She has lived through what has come before and knows what is coming next. And she’ll tackle what’s coming next with grace, making sure to represent herself with authenticity in the face of adversity. Crones protect small children and animals, and speak truth to power. If a Karen thought a crone was an ally, the Karen would be sorely mistaken. A crone would stop a Karen mid-hissy fit, ruthlessly skewering her behavior while simultaneously protecting the innocent crying server, hysterical about losing out on tips.

I want to live in a world where a rising tide lifts all boats, where we all work hard to elevate and help one another. The crone’s wisdom does just that, showering us with bon mots and protecting those who need it most. A Karen … well … a Karen only knows how to complain and embarrass herself.

Maybe I need to fall flat on my face a few more times, smudge my lipstick, look a mess and learn a few more life lessons before I can assume the mantle of crone. It’s an earned title, as opposed to a pejorative. We’re all a part of a collective, of a community. If you ever catch me on a bad day about to blow my stack, please pat my arm gently and whisper “Karen.” I promise to re-set my impatience meter back to zero.

Sarah Steers is in the process of getting her butt kicked by life and does not have a professional byline at this very moment. She will soon, though. She is the Unsinkable Molly Brown.

On the Way to the Super Bowl of Weddings, DON’T

By Travis P. Nelson, Esquire

ANY TAYLOR SWIFT FAN WILL TELL YOU THAT THE CURRENT PRINCESS OF THE CHARTS IS WELL-AWARE OF THE UPS AND DOWNS OF RELATIONSHIPS. From marching head-first into love—“Marry me, Juliet / You’ll never have to be alone / I love you and that’s all I really know / I talked to your dad, go pick out a white dress / It’s a love story, baby, just say, “Yes,” to acknowledging the difficulty of romance: “This love is difficult, but it’s real / Don’t be afraid, we’ll make it out of this mess.” And that is from just one song (Love Story, 2008). Yes Taylor, you will make it out of this mess—if you have a prenuptial agreement.

While the vast majority of Swifties around the globe are rejoicing that the most popular woman in music is marrying the most eligible bachelor in football (although some might wonder whether there were any other Travis’s in the world who she could have picked), those of us in the legal profession are saying: “Wait! What about the prenup!”

Whether you are a seasoned family law attorney, or practice in another area but have individual clients who have prenuptial wealth to protect, or who just emerged from an expensive divorce and are thinking, much like after a visit to a proctologist with big hands: “Ouch! I’m not going through that again!”—this is a good time to revisit the romantic nuances of prenuptial agreement law.

A key point to remember in the concept of a prenuptial agreement is that merely because one party is raising the possibility of a prenuptial agreement does not mean that the relationship is on the rocks, nor is it a predictor for the relationship’s eventual demise. According to one study, between 35% and 50% of first-time marriages end in divorce, increasing to around 60% for second marriages, and more than 70% for marriages beyond the second. With this statistically significant possibility, where parties get divorced their property rights will be decided either by the state government, or by the parties themselves. Why let the state decide?

A prenuptial agreement is essentially a contract prior, but in contemplation and consideration of, a marriage,1 with the goal of allowing individuals to order their personal affairs as they choose, in the unlikely (or not so unlikely) event that they may eventually part ways. Kim Litzke, Esq., of the family law group at Eastburn & Gray, P.C., explains: “Most people get married because that is what people do when they are in a happy relationship. Most people do not think through the legal ramifications of doing so. Before getting married it is a great idea to think through the concepts of what divorce or death of either party would mean. If both parties have the same expectations and they are consistent with the law, then they don’t need a prenuptial agreement.

If they are on the same page as to their expectations, but those are not necessarily consistent with the law then the prenuptial agreement changes how the law will affect their divorce or death.”

Prenuptial agreements can have expanding and limiting effects on spousal rights. For example, a prenuptial agreement can alter or extinguish alimony or spousal support rights,2 or it may extend maintenance and support obligations beyond the obligor’s death, or require a decedent’s estate to support the surviving ex-spouse.3

At their essence, a prenuptial agreement is a contract, and therefore governed by basic contract law.4 Just like any other contract, prenuptial agreements are subject to classic contract defenses, such as fraud, misrepresentation, and duress.5 Prenuptial agreements are presumptively valid in Pennsylvania, however, they may be set aside and rendered unenforceable if the party seeking to invalidate the agreement provides, by clear and convincing evidence that the party did not execute the agreement voluntarily, or that such party, prior to executing the agreement: (1) was not provided a fair and reasonable disclosure of the property or financial obligations of the other party; (2) did not voluntarily and expressly waive, in writing, any right to disclosure of the property or financial obligations of the other party beyond the disclosure provided; and (3) did not have an adequate knowledge of the property or financial obligations of the other party.6

As the statutory defenses to enforcement of a prenuptial agreement contained in § 3106(a)(2) illustrate, perhaps the greatest threat to enforceability of the agreement is the lack of fair and reasonable disclosure of the obligations of the parties. This need for full and fair disclosure is necessary because the parties are not involved in an arm’s length transaction, rather, they are involved in a relationship of mutual confidence and trust that requires full and fair disclosure.7 In Pennsylvania, there is a rebuttable presumption that full and fair disclosure has been made if the prenuptial agreement contains a recital to the effect. Therefore, the agreement does not need to contain attached exhibits and schedules providing financial and asset disclosures. Rather, merely the recital will do.8 However, even where a recital is present, a party may rebut the presumption by clear and convincing evidence.9 In order for disclosure to be full and fair, the parties need not provide disclosures with mathematical precision, as all that is required is that the disclosure provide sufficient information so as not to obscure the general financial resources of each party.10 This presents a factual issue as to whether general disclosures are sufficient to reflect the true nature of the disclosing

party’s assets. This risk of a factual issue may caution some practitioners to include financial documents as exhibits, such as recent tax returns, corporate financial statements, and a list of major prenuptial assets. The key here is to put the other party on notice that the disclosing party may have certain appreciating tangible assets, or that they have a history of high earnings – either of which might be of interest to a potential recipient of alimony, spousal support, spousal elective share in the event of a divorce, or recipient of appreciation on the value of prenuptial assets. Moreover, the disclosing party is generally not required to disclose future or expected assets. These may include earning capacity, salary, expected gifts, possible inheritances, and life estates.11 While navigating what constitutes full and fair disclosure is much an art as it is a science, one rule that some practitioners follow is that it is better to over-disclose than under-disclose, as the goal is to provide sufficient transparency to overcome any challenge in the event that the relationship follows the statistical trajectory and ends in divorce.

of the Court’s opinion is Justice Eakin’s rhyming dissent: “A groom must expect matrimonial pandemonium / when his spouse finds he’s given her a cubic zirconium / instead of a diamond in her engagement band, / the one he said was worth twenty-one grand.” The rhyme went on for seven stanzas.13 Justice Eakin’s creative writing style drew some critics, among them Chief Justice Zappala, who wrote in a concurring opinion of his “grave concern that the filing of an opinion that expresses itself in rhyme reflects poorly on the Supreme Court of Pennsylvania.”14 Justice Cappy wrote a separate concurrence echoing the Chief Justice’s views.

“There is no issue with providing your fiancé with funds to pay for an attorney for representation with regard to a prenuptial agreement. Under no circumstances should the attorney be employed by the other (paying) party, nor is it good form to recommend an attorney.

Independent counsel should truly be independent counsel.”

— Tina Mazaheri, Esq., of Mazaheri Law, LLP

There have been some interesting challenges to prenuptial agreements based on misrepresentation. For example, in Porreco v. Porreco, 12 the wife alleged that the husband misrepresented the premarital assets by overstating the value of the engagement ring given to the wife. Rather than present his beloved with a diamond, of whatever carat, he gave her genuine cubic zirconium. The Pennsylvania Supreme Court’s majority opinion rejected the wife’s claims that the husband’s overstatement of the value of the ring was sufficiently material to invalidate the prenuptial agreement because, among other factors, the wife had possession of the ring and was not impeded from doing what she ultimately did when the parties separated: obtain an appraisal of the ring. She also had sufficient opportunity to inform herself fully of the nature and extent of her own assets, rather than rely on the other party’s statements concerning the valuation of her holdings. The Court concluded that her failure to do this simple investigation was unreasonable, and declined to grant the harsh remedy of invalidating the prenuptial agreement. Perhaps even more than the nuances

As in other contracts, the parties to a prenuptial agreement have the option to obtain independent counsel to review the terms and conditions of the document, however, it is not required. In fact, the fact that one or both parties are not represented by separate counsel does not invalidate the prenuptial agreement.15 However, in the interests of each party being fully informed as to the consequences of the agreement, which may have severe ramifications on the financial interests of each party, it is highly recommended that each party be represented by separate counsel. Tina Mazaheri, Esq., of Mazaheri Law, LLP in Doylestown advises: “There is no issue with providing your fiancé with funds to pay for an attorney for representation with regard to a prenuptial agreement. Under no circumstances should the attorney be employed by the other (paying) party, nor is it good form to recommend an attorney. Independent counsel should truly be independent counsel.” In fact, where a party asserts duress as a basis to invalidate a prenuptial agreement, the ability of the party claiming duress to have consulted with independent counsel has been held as sufficient to overcome an allegation of duress (absent duress involving threat of actual bodily harm).16 Even daily badgering by a spouse for the other to sign the prenuptial agreement coupled with “pressure and negotiations” did not constitute duress where the moving spouse could have consulted with counsel.17 In another case, the court rejected claims of duress where the claimant alleged she was told that without a prenuptial agreement, there would be no wedding, notwithstanding

the fact that “she was pregnant, unemployed, and probably frightened.”18 In another case, a wife alleged she entered her marriage settlement agreement under duress. The trial court denied her claim. On appeal, the wife argued “the court failed to recognize her low self-esteem, dominance by an abusive husband, fear of the judicial system, treatment for attention deficit disorder, and alcoholism as evidence of her incapacity to assent.”19 The Pennsylvania Superior Court disagreed and affirmed the trial court.

In other agreements arising from matrimonial law, a material change in circumstances may trigger an opportunity to review the respective obligations of the parties. However, a change in circumstances is not a basis to modify the terms and conditions of a prenuptial agreement. Various life events, such as illness, birth of children, job loss or income gain, are not considered unexpected events that warrant a change in the prenuptial agreement. Rather, the courts consider such events as risks that the parties must provide for in the agreement itself, or consider them assumed risks.20

As with any contract, parties to prenuptial agreements are free to bargain for virtually any terms or conditions that they desire. It is for the parties themselves to determine whether the terms of the agreement reflect reasonable and good bargains.21 This preference for enforcing even outlandish prenuptial agreement terms was illustrated by New York City divorce attorney, and podcast sensation, James J. Sexton, Esq., who explained the “worst prenup” that he ever handled. The agreement had a clause that for every 10 pounds that the wife gained during the marriage, she would lose $10,000 per month in alimony in the event that they divorced.22 Such clauses are referred to as “lifestyle” clauses. Sexton remarked as to the clause: “This [weight gain clause] was enforceable, meaning they tried to challenge and set aside that provision, and the court said ‘this is a disgusting provision, I don’t know why you married this person, but it’s enforceable. It’s a contract, the two of you signed it[.]” In other cases, the parties have attempted to incorporate so-called “infidelity clauses” into the prenuptial agreement. In Diosdado v. Diosdado, 23 a California court considered a prenuptial agreement that provided for a $50,000 penalty for adultery (an “Infidelity” clause). The court refused to enforce the penalty provision on the basis that it was unenforceable as against public policy, specifically, the public policy underlying no-fault divorce.24 Practitioners have divergent views as to the enforceability of such “lifestyle” clauses in prenuptial agreements.25

So how do you bring up the topic of a prenuptial agreement? Springing it on them the night before the

wedding is probably a bad idea, however, so is raising it on the first date. The following tips commonly offered by family law practitioners:

1. Be straightforward: Just get to the point—show your prospective spouse that you are behaving in a clearheaded way. As Billy Joel advises: “Tell her about it, tell her everything you feel / Give her every reason to accept that you’re for real / Tell her about it, tell her all your crazy dreams.”26 Well, perhaps not every crazy dream, save that for your therapist and clergyman, or at least much, much later in the relationship (why not leave a little mystery), but telling your future partner about your concerns as to the legal and financial structure of the marriage, and getting their feedback is helpful.

2. Timing is everything: Don’t raise the topic after a heated discussion, or after having lunch with the soon-to-be in-laws. Raise the topic when you are cool and collected— when things are going well. Tina Mazaheri, Esq., of Mazaheri Law, LLP in Doylestown, suggests as to timing: “The issue of a prenuptial agreement should be discussed before your engagement to avoid later disaster. In this day and age, with individuals marrying later in life, and both parties typically having careers, prenuptial agreements have become less taboo.”

3. Choose your words carefully: Don’t say in anger “I want a prenup!” Ease into the conversation, and know your audience. Remember the episode of Seinfeld when George Costanza asked his fiancée for a prenup, not realizing that she made a lot more money than he did? Her reaction was: “Yeah, gimme the papers. I’ll sign ’em.” Be the opposite of George.

4. The lawyer made me do it: Ever since Shakespeare expressed his infamous disdain for lawyers in Henry VI, it has been easy to blame lawyers for many of the ills of society. Well, that’s an easy excuse for prenuptial agreements: “I didn’t want to raise this, but my lawyer made me.”

5. Choose your ending: Taylor Swift once lamented: “I think I’ve seen this film before / And I don’t like the ending / You’re not my homeland anymore.”27 Choosing your own path won’t make the ending like rainbows and moonbeams, but it may make it less rocky. Remind your partner that most marriages end, and the way it ends will be decided either by the state legislature, or by the parties themselves. Wouldn’t the latter be the better option? After all, we make wills

because we want to decide who gets our collection of Columbia House CDs and our adult size Star Wars bedsheets (admittedly yes, I have three sets of Star Wars bedsheets – totally normal for a middle-aged man to have). The same principle applies to prenups.

6. Protecting financial independence: Note that the goal of many prenuptial agreements is to protect the parties’ financial independence, and preserve the parties’ ability to care for children from a previous marriage or elderly parents. The prenuptial agreement helps to preserve that ability.

7. Discuss expectations: This is an opportunity to discuss and share your respective expectations. Who will keep the house? What will be the parties’ respective work obligations? What if one party wants to be a stay-at-home spouse? How will you handle marital debt? While some of these issues are ones that should naturally come up in the context of any relationship, if they have not, the prenuptial agreement is an opportunity to have that discussion.

8. Your right to remain silent, and open your ears: One helpful skill for attorneys and people in general is to be a good listener, and that good listening is not just about remaining quiet, merely waiting until it is your chance to hear your own voice. Rather, good listening is about sitting back and really appreciating the other person’s viewpoint, and asking clarifying questions to ensure that you are getting their perspective.

9. This is the first of many rounds: In all likelihood, the discussion surrounding a proposed prenuptial agreement will not be resolved over dinner at Stella’s in New Hope overlooking the Delaware River. No such luck. Bringing up the prospect of a prenuptial agreement may be just the start of a much longer conversation about the parties’ respective plans, goals, and expectations. Marriage is full of many strained discussions, so the concept of a prenuptial agreement should not be avoided merely because it might be a sensitive topic. Moreover, arguably never in your relationship will you be happier than during your engagement stage.

10. This is ultimately about discussion and compromise: Some parts of the discussion on prenuptial agreements may raise difficult issues, that may be uncomfortable for some parties. For parties that come from divorced families, or parties who have already been through messy divorces, these conversations may be triggering

Another consideration regarding prenuptial agreements is that they are a shield, not a sword. Hopefully they are papers that you can file away in your drawer, or at your attorney’s office, and never think of them ever again.

and could raise false flags of doubt. But ultimately, marriage is about the ability to come together, express potentially conflicting needs, desires and viewpoints, and trying to come to a compromise that both parties can not only live with but thrive under. The elevator lobby of the parking garage near my office (located near the Franklin Institute) has a quote from Ben Franklin on the wall that addresses compromise: “When a broad table is to be made, and the edges of the planks do not fit, the artist takes a little from both, and makes a good joint. In like manner here, both sides must part with some of their demands in order that they may join in some accommodating purpose." In negotiating a prenuptial agreement both sides must be willing to take from their side of the table. Being able to arrive at an agreement through finding common ground is essential to any relationship. As Ms. Litzke notes: “If they can’t come to an agreement then maybe they shouldn’t get married.”

Another consideration regarding prenuptial agreements is that they are a shield, not a sword. Hopefully they are papers that you can file away in your drawer, or at your attorney’s office, and never think of them ever again. The existence of prenuptial agreement will never be the real cause for the failure of the marriage. And it will only become relevant where the parties’ relationship has soured.

While the above discussion provides a useful overview of an important, and thanks to Travis and Taylor also a timely topic, the nuances of a prenuptial agreement are very fact-specific (just like estate planning documents), and require thoughtful and considered discussions with a seasoned family law attorney, plenty of which can be found in Bucks County.

Travis P. Nelson is a partner at Polsinelli, P.C. in the Philadelphia Office, where he practices financial services regulatory and enforcement law, and is a resident of Doylestown, PA. Mr. Nelson is the Editor of the Writs

References:

1. 23 Pa.C.S. § 3106(b).

2. Simeone v. Simeone, 581 A.2d 162 (Pa. 1990).

3. In re Rosciolo’s Estate, 258 A.2d 623 (Pa. 1969); see also, In re Estate of Ratony, 277 A.2d 791 (Pa. 1971) (holding that postnuptial separation agreement, whereby decedent and his widow agreed to divide net proceeds from sale of home they had owned as tenants by the entireties, to divide furniture, to retain all personal articles, and that neither party would have property interests thereafter in any property owned by the other, was valid; thus, widow was not entitled to elect to take against certain of decedent’s inter vivos conveyances after his death 27 years after agreement was signed).

4. Porreco v. Porreco, 811 A.2d 566 (Pa. 2002).

5. Harvey v. Harvey, 167 A.3d 6 (Pa.Super. 2017).

6. 23 Pa.C.S. § 3106(a)(2).

7. Colonna v. Colonna, 791 A.2d 353 (Pa.Super. 2001); see also, Zabrosky v. Smithbower-Zabrosky, 273 A.3d 1108 (Pa.Super. 2022).

8. In re O’Brien, 898 A.2d 1075 (2006).

9. Id.

10. In re Estate of Hoffman, 582 A.2d 648 (Pa.Super. 1990).

11. In re Perelman’s Estate, 263 A.2d 375 (Pa. 1970).

12. Porreco v. Porreco, 811 A.2d 566 (Pa. 2002).

13. Id. at 575.

14. Id. at 572.

15. Simeone v. Simeone, 581 A.2d 162 (Pa. 1990); Hess v. Hess, 2016 WL 3060604 (Pa.Super. May 27, 2016).

16. Hamilton v. Hamilton, 591 A.2d 720 (Pa.Super. 1991).

17. Lugg v. Lugg, 64 A.3d 1109 (Pa.Super. 2013).

18. Layton v. Layton, 339 A.3d 469 (Pa.Super. 2025), citing Hamilton v. Hamilton, 591 A.2d 720, 722 (Pa.Super. 1991).

19. Layton at 478, citing Adams v. Adams, 848 A.2d 991 (Pa.Super. 2004).

20. Simeone v. Simeone, 581 A.2d 162 (Pa. 1990).

21. Simeone v. Simeone, 581 A.2d 162 (Pa. 1990).

22. James Sexton discusses this weight gain prenuptial agreement on the Lex Clip podcast, available at: https://www.youtube.com/watch?v=Ch6gw1zxdf0 (last visited Sept. 5, 2025); see also, “Shocking Weight Gain Clause in Prenup Horrifies Internet,” Hello Prenup Website, available at: https://helloprenup.com/clauses/for-every-10-pounds-you-lose-10000shocking-prenup-clause-horrifies-internet/ (last visited Sept. 5, 2025).

23. 97 Cal.Rptr.App.4th 470 (2002).

24. Id. at 474.

25. See, e.g., “Prenuptial Agreements and Lifestyle Clauses,” Law Office of Gregory P. LaMonaca, P.C., available at: https://www.lamonacalaw. com/prenuptial-agreements-lifestyle-clauses/#:~:text=So%2Dcalled%20 %E2%80%9Clifestyle%20clauses%E2%80%9D,pound%20over%20 the%20stipulated%20150. (last visited Sept. 3, 2025) (“These clauses are rarely enforceable in court, however, and are often included to memorialize agreements or ideals regarding each party’s expectations throughout the marriage and to represent each parties’ commitment to satisfying the expectations of the other.”); “Lifestyle Provisions in Prenups: What is Allowed,” Petrelli Previtera, LLC, available at: https://www.petrellilaw.com/ lifestyle-provisions-in-prenups-raises-question-what-is-allowed/ (last visited Sept. 3, 2025) (“Provisions within these documents that address conduct during the marital relationship are generally not enforceable. Something regarding weight gain during the marriage, as noted above, or religious affiliations would not likely survive if challenged. However, a reduction in the divorce settlement agreement for infidelity may survive.”).

26. “Tell Her About It,” Billy Joel (1983).

• MLM has returned a dividend to policyholders annually since 1988, over $83 million total

• First dollar defense- a loss only deductible can produce a substantial savings for firms facing nuisance type claims

• Full prior acts coverage

• Offers an array of services to mitigate risks including three free CLEs for policyholders each policy year, $165 value

27. “Exile,” Taylor Swift, 2020. Get a fast quote today! Kiernan Waters, Esq. 443-293-6038 kwaters@mlmins.com www.mlmins.com

By Lisa A. Bothwell, Esquire

Selling a business is a time-consuming, emotional process. Business owners usually have spent years, if not decades, building the business, sacrificing time with their families to ensure its success. A business owner that is considering selling usually has some understanding of what a huge undertaking it is and that there are professionals that specialize in the area. Even if you are not a business attorney, you want to ensure that a client or friend is taken care of and you remain their first call. Below are some talking points about the transaction process before you make a referral:

Potential buyers almost always want to do some due diligence before they spend the time and incur the expense of drafting a letter of intent or term sheet. A seller should safeguard their sensitive information during this phase through a non-disclosure or confidentiality agreement (an “NDA”). At a minimum, the seller’s financial information, customer list, supplier or vendor list, pricing lists, and business strategies should be deemed confidential information under the NDA.

The NDA should also include a non-solicit provision for customers and employees for a specified period of time (three (3) to five (5) years is the normal time period). The purpose of these provisions is to ensure that a potential buyer cannot find out who is the key talent or key customers, terminate negotiations, and then use that information to compete with disclosing party. A carveout for employees or independent contractors that respond to a general advertisement of the buyer can be included. Another way to prevent the misuse of information at this time is not list the customer or employee name on a list of top ten (10) or top twenty-five (25) customers or an employee list. Instead, the seller should list the sales information but refer to the customers as customer A, customer B, etc., and the employees by their title. The seller can include the relevant information, but avoid identifying the customer or employee.

Ideally, a seller will have a form NDA that they give to all potential buyers to ensure uniformity and minimize legal fees at this stage. Often a buyer, especially a sophisticated buyer, will insist on using their form NDA. Not all NDAs are created equal and another party’s form needs to be reviewed before it is signed. Some NDAs include unusual provisions, such as confidential information no longer being deemed confidential after one (1) year or the buyer has no obligation to return or destroy confidential information if the transaction does not move forward.

A seller will never have more negotiating power than during the letter of intent or term sheet phase of the transaction. My firm often tells sellers to think of it like the dating phase; the buyer is putting their best foot forward and is the most agreeable during this time. Therefore, this is also the time the seller’s attorney can add the most value.

Sellers benefit from having a detailed letter of intent that addresses multiple issues while buyers benefit from having a less detailed letter of intent so the issues must be negotiated after the seller has already spent time and money on the current transaction. The letter of intent should address the treatment of accounts receivable and accounts payable, any working capital calculation, an earnout, if applicable, the survival period for representations and warranties, and the cap and basket for indemnification claims. The letter of intent should also address any other issues that are important to a particular seller. If there is an agreement that will have a hefty termination fee if the buyer does not assume it, that should be discussed at this phase and incorporated into the letter of intent if the buyer agrees to assume the agreement. If a seller has a lot of employees that have accrued time off, the seller

and buyer should discuss whether the buyer will assume the paid time off for the current year or if the seller will have to pay out that time at closing.

Often, buyer’s attorneys, especially if the buyer is highly sophisticated and private equity backed, try to tell seller’s attorneys that they cannot possibly agree to specific terms in the letter of intent because due diligence is not complete. Often these buyers and their attorneys have a range of what they have agreed to in prior transactions and know what

LAW, LLC

Tina Mazaheri, Esquire

Tina Mazaheri, Esquire 116 Union Street n Doylestown 215-345- 6 4 00 www.mazaherilawllc.com

Over 30 Years of Experience Serving Bucks and Montgomery Counties

is market. Further, you can always include a clause that the terms of the letter of intent are subject to due diligence.

Time Commitment. Selling a business is a full-time job on top of having a full-time job. After a client signs a letter of intent or a term sheet, the due diligence process starts, which is very time consuming. Potential sellers should be advised not to schedule any big vacations during this time. Transactions usually proceed under compressed timelines since COVID, and there is often multiple follow-up or clarifying due diligence requests. The seller can take an expensive, relaxing vacation after the transaction closes.

Organize Ahead of the Sale. The more a seller can organize ahead of time, the easier the transaction. Sellers should be advised to gather copies of formation documents (Articles of Incorporation, Certificate of Formation), governing agreements (Shareholders’ Agreement, operating agreement), and its cap table. If the seller purchased the business from someone else or bought out a former business partner, the buyer will likely want to see that paperwork. If the seller has or had a phantom interest plan or offered stock options to employees, the buyer is going to want to see those documents. A seller also needs to ensure that all reports have been filed with the states in which it does business and that all taxes have been paid.

Compile and Review Agreements. One of the steps of due diligence that people often underestimate is the process of compiling and reviewing agreements to determine whether the agreements are assignable to the buyer. Clients often discover that only partially executed copies of the agreements were saved and it takes time to track down a fully executed copy. If the agreements are assignable, does the agreement require the other party’s written consent or a specific notice period?

Identify Intellectual Property. A seller should identify what intellectual property the seller owns (trademarks, software, inventions, etc.). Does the seller want all of that intellectual property included in the sale or does the seller want to exclude something? One of my clients excluded one trademark from the sale that had sentimental value to the family. Does the seller own the rights to the intellectual property? If an employee or independent contractor worked on a software program or the development of the product, is there an agreement that clearly assigns any rights in the intellectual property to the seller?

Control When Your Employees Find Out. An owner wants to control how its employees find out the owner is selling to avoid panic and confusion. One of the ways that employees suspect something is up is if the owner starts asking for

all types of reports or documents that he or she normally does not ask for or review. If an owner is on a compressed timetable or does not know how to pull certain reports, the owner should consider approaching one employee that can help gather the requested due diligence documents. The owner can offer such employee a Stay Bonus Agreement that includes a confidentiality provision and provides that the Seller pay such employee a bonus, usually split over two (2) or more payments, where the last payment would be paid at the closing of the transaction. It does not have to be a very large amount of money; I have drafted Stay Bonus Agreements that the total payment was $5,000.

The above talking points can demonstrate that you understand the sale process even if you are not handling the transaction, and grasp the complexity and emotional toll of the experience. Most letters of intent contain a confidentiality provision so the client cannot speak to you about the transaction but most will appreciate a general check-in from time to time.

Lisa A. Bothwell is a partner at Antheil, Maslow & MacMinn, LLP, in Doylestown, PA, where she practices corporate law. Ms. Bothwell is the Vice Chair of the Women Lawyers’ Division of the Bucks County Bar Association.

“Everyone has the power to transform their life and overcome the challenges of obesity. At Roxborough Memorial Hospital, we’re here to support your journey toward better health and a brighter future.” — Dr. Piotr Krecioch, General and Bariatric Surgeon

Beyond Driving with Dignity A trained professional facilitates an in-home self-assessment to evaluate:

• Cognitive, physical & emotional abilities

• Driving safety & decisionmaking

By Lisa Bothwell, Esquire

THE ONE BIG BEAUTIFUL BILL ACT (THE “OBBB”) WAS SIGNED INTO LAW ON JULY 4, 20251 AND IS INTENDED, IN PART, TO INCREASE BUSINESS COMPETITIVENESS AND INVESTMENT OPPORTUNITIES, AND FREE UP CASH FLOW FOR SMALL BUSINESSES. The legislation makes several provisions from 2017 Tax Cuts and Jobs Act (the “TJCA”) permanent, introduces additional changes and incentives, and sunsets certain tax benefits. Below are some of the biggest changes for small business owners:

1. QBI Deduction. The Qualified Business Income (QBI) deduction, also known as the Section 199A deduction, is now permanent, preventing a significant tax hike that was scheduled for 2026.2 This deduction allows sole proprietorships, partnerships, S-corps, llcs, and some trusts and estates to deduct up to twenty percent (20%) of its qualified business income, plus twenty percent (20%) of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.3 The deduction is available regardless of whether the taxpayer itemizes deductions or takes the standard deduction. If the business is considered a specified service trade or business (i.e., law, healthcare, consulting, or accounting), the phaseout thresholds are now higher, with $75,000 for single filers (up from $50,000) and $150,000 for joint filers (up from $100,000). A new, inflation adjusted minimum deduction of $400 is available for taxpayers who have at least $1,000 of QBI from an actively run trade or business.4 The taxpayer must “materially participate” in the business in order to qualify for the minimum deduction.

2. Section 179 Deduction. Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software in the year it is placed in service, rather than depreciating it over several years. The OBBB significantly increased the Section 179 deduction from a maximum deduction of $1.22 million to $2.5 million, and increased the phase-out threshold from $3.05 million to $4 million.5 The OBBB also reinstates the 100% bonus depreciation (initially introduced under the TJCA) for acquired qualified property (both new and used equipment qualify, the equipment just needs to be “new” to the taxpayer).6 This tax incentive is primarily targeted for small to mediumsized businesses.

3. Immediate R&D Expensing. Businesses that have United States-based research and development (R&D) expenses can now immediately deduct such costs in the year such expenses are incurred (the fifteen (15) year amortization for foreign R&D remains in place).7 This provision reverses a prior rule that required R&D expenses to be amortized over five (5) years, which could pose a cash flow issue for small business owners. The OBBB also provides for some retroactive R&D expensing for expenses incurred between 2021 and 2025 for certain firms or allows for those investments to be deducted over one (1) or (2) years.

4. Third Party Payment Apps Reporting. For tax year 2025, the threshold to issue a Form 1099-K was raised from $600 to $20,000 in payments and at least 200 transactions. This

is intended to reduce the tax paperwork burden on gig workers and small business owners.8

5. Qualified Small Business Stock. The OBBB included an expansion of the qualified small business stock (QSBS) rules that provides certain taxpayers with an exemption of gain upon a disposition of stock in qualified C corporations. The three (3) key changes to the QSBS rules are as follows: (i) the required holding period was shortened from five (5) years to three (3); (ii) the size of the eligible business was expanded from $50 million of gross asset value to $75 million; and (iii) the flat cap on the maximum amount of capital gain excludable from the QSBS of a single issuer was increased from $10 million to $15 million (the alternative cap continues to be available).9 Certain QSBS rules remain unchanged, importantly, the types of business activities that may be treated as a “qualified trade or business.” These changes make it easier for startups and investors to cash out with lower tax burdens and provides greater flexibility to plan an exit, thus increasing the value to startups and investors in considering QSBS qualification.

6. Expansion of

The special limitation under the TJCA on the deductibility of excess business losses of non-corporate taxpayers under Section 461(l) was set to expire at the end of 2028.10

The OBBB makes the limitation permanent. An excess business loss that is disallowed in one year is treated as a net operating loss, rather than an excess business loss, in the next year.

The OBBB rolls back some of the Internal Revenue Code’s credits, deductions, and other preferences.11 The largest area is the green energy tax credits in Inflation Reduction Act, which was passed in 2022.12 Tax credits for certain clean energy projects will now phase out much sooner, and will likely cause businesses to accelerate project timelines to take advantage of the tax credits before they expire. As a result, the OBBB is expected to have a significant impact on the clean energy or renewable energy industry. Projects that began before 2025 are generally unaffected by the OBBB. Projects have to either begin construction before July 5, 2026, or be placed in service by December 31, 2027 to qualify for the credits.13

The Clean Electricity Production Credit was terminated under the OBBB, with an exception for projects on which construction begins on or before July 4, 2026 and are placed in service by end of 2027.14 The Clean Electricity Production Credit was a two-tier tech-neutral production tax credit that provides a set amount for each unit of electricity generated from a zero-emission facility. The credit

was neutral and flexible between clean electricity technologies and available to taxpayers with a qualified facility and energy storage technology placed in service after December 31, 2024. This credit encouraged the ongoing production of zero-emission electricity over the long term.

B. Clean Electricity Investment Credit (Section 48E). The Clean Electricity Investment Credit was almost terminated under the OBBB with the same exceptions as the Clean Electricity Production Credit.15 As with the Clean Electricity Production Credit, the Clean Electricity Investment Credit was also a tech-neutral production tax credit, but was based on the percentage of capital cost of a qualifying clean energy or storage project. This credit encouraged upfront investment in clean energy and storage technologies.

C. Clean Vehicle and Charging Credits (Sections 30D, 25e, 45W, and 30C). Tax credits for a new plug-in electric vehicle or a fuel cell vehicle now expire after September 30, 2025, and tax credits for EV chargers now expire after June 30, 2026.16 The new plug-in electric vehicle or fuel cell vehicle must be purchased for a taxpayer’s own use and not for resale. The taxpayer’s modified adjusted gross income must not exceed the limit to qualify for a credit up to $7,500.

D. Residential Clean Energy Credit (Section 25D). The Residential Clean Energy Credit expires after December 31, 2025. The nonrefundable federal incentive was a significant tax-saving opportunity for homeowners, allowing them to deduct thirty percent (30%) of the cost of a new clean energy system (solar electric panels, solar water heaters, wind turbines, geothermal heat pumps, fuel cells, batter storage technology) for their home from their taxes.17 If the home is used partly for business, the taxpayer can take the full credit if the business use is less than twenty percent (20%). If the business use is more than twenty percent (20%), the credit is based on the share of expenses allocable to nonbusiness use.

E. Energy-Efficient Home Improvement

(Section 25C). This credit will not be allowed for any property placed in service after December 31, 2025.18 A taxpayer that makes energy-efficient home improvements to their primary residence may deduct thirty percent (30%) of expenses related to qualified upgrades. Eligible improvements includes the installation of exterior doors, windows, skylights, and insulation materials or systems, all of which must meet specific energy efficiency requirements.

F. New Energy Efficient Home Credit (Section 45L). The OBBB changed the expiration date of the New Energy

Efficient Home Credit to June 30, 2026.19 The New Energy Efficient Home Credit is a tax credit for eligible contractors who build or substantially reconstruct qualified energy-efficient homes. The amount of the credit depends on the type of home, the home’s energy efficiency, and the date when someone buys or leases the home.

An executive order was issued on July 7, 2025 regarding clean energy subsidiaries (the “Executive Order”).20 In the Executive Order, the Secretary of the Treasury was directed to take all action within forty-five (45) days of the enactment of OBBB to “strictly enforce the termination” of the clean energy production and investment tax credits for wind and solar facilities. Such action included issuing new and revised guidance to ensure that policies regarding the “beginning of construction” are not circumvented. The U.S. Treasury Department released IRS Notice 2025-42 on August 15, 2025 which provided such guidance for determining whether an applicable facility is eligible for a “beginning of construction exception” to be placed in-service.21

The State and Local Tax (SALT) deduction cap is temporarily raised to $40,000 for taxpayers (indexed at one percent (1%) annually through 2029) earning under $500,000 between 2025 and 2029, providing more tax deductions for high earners.22 The SALT deduction is a federal itemized deduction that allows taxpayers to subtract certain taxes paid to state and local governments from their federal taxable income. Prior to the TJCA, there was no cap on the amount of state and local taxes that could be deducted. The TJCA capped the deduction at $10,000 for individual filers, which significantly impacted taxpayers in high-tax states like New York and California. The OBBB removed prior limitations for specified services or business so all types of pass-through entities can take advantage of the SALT cap workaround.23 The temporary cap is set to expire after 2029, reverting back to the prior $10,000 limit unless Congress intervenes. The SALT deduction encourages itemizing rather than the standard deduction.

The OBBB provides near-term clarity for small businesses but clients need to be advised on their current and future tax positions and should consult with their tax professionals. Clients may need to pivot planning strategies to take advantage of certain credits before they expire and then pivot to other tax-efficient strategies.

Lisa A. Bothwell is a partner at Antheil, Maslow & MacMinn, LLP, in Doylestown, PA, where she practices corporate law. Ms. Bothwell is the Vice Chair of the Women Lawyers’ Division of the Bucks County Bar Association.

References:

1. One Big Beautiful Bill Act, Pub. L. No. 119-21, 139 Stat. 72 (July 4, 2025).

2. Randa Kriss, How the ‘Big, Beautiful Bill’ Impacts Small-Business Owners, NerdWallet (July 17, 2025), https://www.nerdwallet.com/ article/small-business/big-beautiful-bill-small-business.

3. Internal Revenue Service (last updated July 9, 2025). Qualified business income deduction. Retrieved from https://www.irs.gov/ newsroom/qualified-business-income-deduction.

4. Kriss, supra note 2.

5. Federal implications of the ‘One Big Beautiful Bill’: What’s changing and how to respond, Thomas Reuters Tax & Accounting (July 21, 2025), https://tax.thomsonreuters.com/blog/impact-of-the-one-bigbeautiful-bill-act/.

6. Kriss, supra note 2.

7. Id.

8. Id.

9. One Big Beautiful Bill Act: An Overview of Impacts on the Tax Code for Business Owners, Greenbaum, Rowe, Smith & Davis LLP Client Alert (Aug. 7, 2025), https://www.greenbaumlaw.com/insights-alertsOne-Big-Beautiful-Bill-Act-An-Overview-of-Impacts-on-the-Tax-Codefor-Business-Owners.html.

10. Laura Halferty, Charley Jensen, Thomas Molins, Jay Simpson, Charles Hutchinson, and Caroline Rice, One Big Beautiful Bill Explained, Stinson (July 8, 2025), https://www.stinson.com/newsroom-publications-one-big-beautiful-bill-explained.

11. Id.

12. Public Law 117-169, 136 Stat. 188, 1982 (August 16, 2022).

13. Executive Order 14315 of July 7, 2025, Ending Market Distorting Subsidies for Unreliable, Foreign-Controlled Energy Sources, 90 F.R. 30821 (Executive Order 14316).

14. Explained: The Clean Energy Provisions in the ‘One Big Beautiful Bill”, Solar Energy Industries Association (July 21, 2025), https://seia. org/research-resources/clean-energy-provisions-big-beautiful-bill/.

15. Id.

16. FAQs for modification of sections 25C, 25D, 25E, 30C, 30D, 45L, 45W, and 179 under Public Law 119-21, 139 Stat. 72 (July 4, 2025), commonly known as the One, Big, Beautiful Bill Act (OBBB), Internal Revenue Service (Aug. 21, 2025), https://www.irs.gov/newsroom/ faqs-for-modification-of-sections-25c-25d-25e-30c-30d-45l-45wand-179d-under-public-law-119-21-139-stat-72-july-4-2025-commonly-known-as-the-one-big-beautiful-bill-act-obbb.

17. Id.

18. Id.

19. Id.

20. Executive Order, supra note 13.

21. Notice 2025-42, 2025-36 I.R.B. 351.

22. Thomas Reuters Tax & Accounting, supra note 5.

23. Daniel Bunn, Alex Muresianu, William McBride, The Good, the Bad, and the Ugly in the One Big Beautiful Bill Act, Tax Foundation (July 9, 2025), https://taxfoundation.org/blog/one-big-beautifulbill-pros-cons/.

By Travis P. Nelson, Esquire

Politicians have long debated and criticized some banks’practice of gatekeeping products and services from customers based on their political affiliation or the industries they support. Some banks have chosen, for example, to avoid serving customers engaged in the firearms industry, the marijuana industry, or other industries perceived as less reputable. Echoing these critiques and broader Republican complaints about “woke capitalism,”1 President Trump has previously accused certain major bank CEOs of denying services to conservatives.

That debate has now shifted into concrete policy. In a move with significant implications for financial institutions, the administration issued an executive order aimed at curbing the politicization of banking. That order was directly reinforced by the Office of the Comptroller of the Currency (OCC) in a Sept. 8 bulletin.2 Together, the executive order and the OCC’s new action—each carrying definite enforcement consequences—are likely to create significant and potentially difficult dilemmas for banks.

The executive order defines “politicized or unlawful debanking” as any act by a bank, savings association, credit union or other financial services provider that denies or restricts services to customers based on their political or religious beliefs or based on their “lawful business activities that the financial service provider disagrees with or disfavors for political reasons.”3 It further directs federal banking regulators to remove “reputation risk” from their supervisory

guidance, along with any “equivalent concepts that could result in politicized or unlawful debanking.”4

The OCC’s new guidance makes it clear that evidence of “politicized or unlawful banking” will weigh against a bank in supervisory reviews. Examiners will consider whether the bank is meeting the “convenience and needs of the community”; providing fair access and treatment to customers; and protecting depositors and other creditors. Those factors will be applied across a wide range of corporate applications, including new charters, conversions, fiduciary powers, branching, business combinations, voluntary liquidation, changes in bank control, changes in directors and senior executive officers and substantial asset changes.5

Comptroller Jonathan Gould reinforced the bulletin’s intent, stating that the OCC is “taking steps to end the weaponization of the financial system,” and “working to root out bank activities that unlawfully debank or discriminate against customers on the basis of political or religious beliefs or lawful business activities.” If and when the OCC identifies such activity, said Gould, “it will take action to end it.”

The OCC’s new policy appears directed at rebuffing exactly the sort of public pressure on banks to debank certain industries on political grounds. Under the new policy, banks will be equally prohibited from unlawfully discriminating against conservative causes as against liberal causes. Notably, the OCC did not explicitly state that the practice of debanking would be considered an “unsafe or unsound banking practice”— the fairly amorphous standard that examiners typically use

to curtail conduct that supervisors disfavor, but which is not expressly barred by statute or regulation. This omission was likely intentional, and the OCC bulletin—coupled with the strong statements in the Comptroller’s announcing statement—make clear that practicing politicized or unlawful debanking will have definite supervisory consequences.

So, what’s a financial institution to do?

Banks may find themselves caught between attempting to appease public outcry on divisive political issues and facing supervisory actions and negative examination findings for declining to serve customers in those same industries. For example, in the wake of George Floyd’s murder in 2020, many of corporate America’s largest banks expressed support for the Black Lives Matter movement and unveiled billions in initiatives intended to address the nation’s racial wealth gap.6 And in 2018, “the New York State Department of Financial Services urged state-chartered banks to reassess any ties with the National Rifle Association and other groups, citing reputational risk concerns.”7

With the President’s executive order and the OCC’s new policy, banks will need to resist the temptation to change their lending or deposit-taking policies based on voiceful and well-meaning special interest groups. Instead, they will need to carefully consider the supervisory consequences of refusing to do business with politically divisive organizations or industries solely because of the substantive messages those groups advance.

Let’s not forget: Americans aren’t left without ways to influence companies to achieve their political goals (the Administration’s recent actions notwithstanding). The public is still free to decline to patronize merchants who do not share their political beliefs, within legal limits. They might just need to find a target of their political ire besides regulated banks.

And perhaps that’s a good thing, because banks aren’t like other companies. For one, they are federally insured by the Federal Deposit Insurance Corporation. They also provide one of the most sought-after, life changing products on the market: credit. We’ve seen through laws like the Equal Credit Opportunity Act and the Community Reinvestment Act, and in the emergency legislation that followed the subprime mortgage crisis of the late 2000s and the COVID crisis, how access to credit can uplift communities and give ordinary Americans the opportunity to achieve extraordinary things.

Regardless of their own political motives, the Administration’s actions through EO 14331 and the OCC bulletin may have the effect of depoliticizing the banking industry for all sides.

And that may be something that we can all bank on.

Travis P. Nelson is a partner at Polsinelli, P.C. in the Philadelphia Office, where he practices financial services regulatory and enforcement law, and is a resident of Doylestown, PA. Mr. Nelson is the Editor of the Writs.

References:

1. 1 See “Cannabis Advocates See Banking Opportunities Under Trump,” American Banker, 2025 WLNR 2524688 (Jan. 31, 2025).

2. 2 OCC Bulletin 2025-22 (Sept. 8, 2025), available at: https://www. occ.gov/news-issuances/bulletins/2025/bulletin-2025-22.html.

3. 3 Guaranteeing Fair Banking for All Americans, 90 Fed. Reg. 38925 (Aug. 12, 2025) (“EO 14331”).

4. 4 Id. at § 4.

5. 5 Id., citing 12 C.F.R. § 5.20, § 5.23, § 5.24, § 5.26, § 5.30, § 5.31, § 5.33, § 5.48, § 5.50, § 5.51, and § 5.53.

6. 6 See “Banks Change Their Tack in Navigating the Culture War,” American Banker, 2022 WLNR 10831767 (Apr. 6, 2022).

7. 7 “Democratic Senators Urge More Banks to Crack Down on Gun Sellers,” American Banker, 2018 WLNR 13412273 (May 3, 2018).sss

The Burgman Financial Group is a multi-generational Financial Planning and Wealth Management firm with a zeal to educate and serve our clients. We partner with them, explaining their options, building and implementing their financial plan to realize their unique dreams and goals.

Perhaps that sounds a bit different? Candidly, we hope it does. We are trained as educators and planners, and our entire team is dedicated to helping you achieve financial security.

Our clients believe in the choices they’ve made with us and are confident their plan will succeed.

Michael

D. Burgman CFP®, ChFC®, CLU®, CLTC®

Jay C. Burgman CFP®, AEP®

Contact Us: 267.337.7471

Email : burgmanfinancial@nm.com

Website : https://burgmanfinancial.nm.com/

By: Lawrence R. Scheetz, Jr., Esquire

Although this column is titled “Managing Partner’s Corner,” the Law Offices of Williams & Scheetz is jointly managed by its two Members/Owners, my sister Anne Scheetz and me. We share equally in the firm’s leadership, each bringing professional strengths to the management of daily operations and long-term strategy. One of the great advantages of operating a boutique practice is the ability to set our own course. We determine the management structure, articulate our vision, and ensure that the values guiding our work are fully aligned with the reputation we continue to build.

Sharing management responsibilities with a sibling provides unique benefits. Having been raised with the same principles, moral compass, and professional aspirations, we bring mutual trust and support to every decision. That trust is not only a personal comfort but also a professional strength, allowing us to focus on the needs of our clients and the continued growth of the firm with confidence and stability.

The Law Offices of Williams & Scheetz has always felt like more than a workplace—it is a home. Pulling into our office each morning, we know we are making a difference in our community and supporting families when they need it most. The practice of law is in our blood, and we remain grateful for the opportunity to make a meaningful difference in the lives of our community.

Williams & Scheetz was founded in 1977 by Lawrence R. Scheetz, Esquire, and Frank K. Williams, Esquire, one of the first African-American law firm owners in Bucks County. From the heart of Richboro, Williams & Scheetz quickly earned a reputation for exceptional legal representation and trusted counsel. That reputation, built on long-term client relationships, is the true testament to the firm’s longevity.

Both founders were decorated Vietnam War veterans who forged their friendship in the United States Army and later at Temple University Law School. Mr. Williams’s untimely passing in 1978 left Mr. Scheetz to continue the mission, which he carried out proudly until his death in 2007. Today, Anne and I remain honored to uphold the legacy of excellence they began.