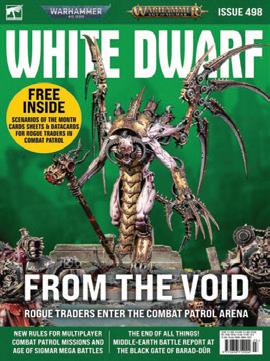

RETAIL NEWS THAT MATTERS THE LEADING TITLE FOR NEWS AND CONVENIENCE RETAILERS Page 3 » How to make the freeze-dried sweets craze your store’s next big profit driver authentic real rice rolling paper NEW Follow Us OCB - The Fastest Growing Paper Brand* *(EXT IRI MARKETPLACE VOLUME 52WKS MAT 26/11/23) Rice UNBLEACHED CHLORINEFREE GMO FREE VEGAN RESPONSIBILY HARVESTED RICE PAPER 11 Vol 135 No 11 £2.99 FOR TRADE USE ONLY FIRM SALE

NEWBRAND 2024!FOR Does your store stand out from the crowd? If the answer is YES, enter the Better Retailing Retail Innovation Award, and gain the recognition you, your store and your team deserve. From introducing new in-store systems to creative promotions and adding unique product ranges and services, retail innovation is all about making your store stand out. NEED SOME HELP? Contact: marketing@newtrade.co.uk or call Kate Daw on 07886 784465 Not sure about Retail Innovation? We have seven other exciting categories to enter, from Community Hero to Merchandising and In-store Display, and everything in between. Find the full list at betterretailing.com/ Awards-2024 or scan below: RETAIL INNOVATION AWARD AWARDS PARTNERS Sponsored by Coca-Cola Europacific Partners

RETAIL NEWS THAT MATTERS ● betterretailing.com ● 15.03.2024 THE LEADING TITLE FOR NEWS AND CONVENIENCE RETAILERS WHOLESALE ORDERS Booker rebate change Stores claim increased spend requirements are made harder by range reductions Page 5 » CATEGORY GUIDE 15 household lines you are missing Retailers reveal the lesser-known cleaning items that attract sales and shoppers Page 36 » EXPLAINED Spring Budget: The impact on your store Understand the challenges and new opportunities created by the chancellor’s tax and investment policies Page 12 » All the must-stock lines and suppliers you need to make £2.5k per month at 50% margin Page 3 » How to make the freeze-dried sweets craze your store’s next big profit driver HowMyDDPoints’ loyaltyrewardsand pricesadd20%to stores’sales OPPORTUNITYPage4»

Editor

Jack Courtez

@JackCourtez

07592 880864

News editor

Megan Humphrey

@MeganHumphrey_ 07597 588972

Features editor

Charles Whitting

@CharlieWhittin1

020 7689 3350

News reporter

Alice Brooker 07597 588955

Head of design

Anne-Claire Pickard

Senior designer

Jody Cooke

Junior designer

Lauren Jackson

Production editor

Ryan Cooper

Sub editors

Jim Findlay, Robin Jarossi

Production coordinator

Chris Gardner 020 7689 3368

Editor in chief

Louise Banham

Deputy insight & advertorial editor

Jasper Hart

@JasperAHHart 020 7689 3384

@LouiseBanham News editor

Alex Yau

@AlexYau_ 020 7689 3358

Specialist reporter

Dia Stronach 020 7689 3375

Features writer

Priya Khaira 020 7689 3379

Head of commercial

Natalie Reeve 07856 475788

Senior account director

Charlotte Jesson 07807 287607

Account director

Lindsay Hudson 07749 416544

Account managers

Megan Byrne 07530 834009

Lisa Martin 07951 461146

Managing director

Parin Gohil 020 7689 3363

Cover image credits:Getty Images/Atelier Mush

Every day, stores just like yours are ripped off by dodgy business rates agents, and little is being done about it. Rather than the total review of business rates promised by the Conservatives in their manifesto, what we’ve got is a patchwork of policies with vague guidance, meaning the treatment and relief you receive can differ from council to council, let alone country to country in the UK.

This is exploited by criminals operating behind professionallooking websites and representatives, promising significant savings on your rates. They lock retailers into contracts guaranteeing them around 25% of any reduction in your rates bill over multiple years, no matter how it is achieved.

I’ve seen stores stuck with invoices for tens of thousands of pounds when a new relief scheme automatically removed their rates bill, despite the agent not having lifted a finger.

Over the past seven years, I’ve named and shamed several, but they often pop up again with different trading names. One tried to lure me to an industrial estate and threatened to break my legs; another was sentenced for domestic violence; one was trading illegally after being banned from running a company previously; another was fraudulently using official certifications they had no right to use; and whistle-blowers warned me another had serious links to organised crime. Like many shop owners dealing with crime in their stores, I’ve handed bundles of evidence to the police, and heard nothing back. Make no mistake, business rates scams may be white-collar offences, but those behind it can be violent criminals.

I mention all of this because last week I received a tip-off about another group of scammers, and a warning that upcoming changes to rates in the new financial year present a major opportunity for these individuals to prey on all small businesses. Last week also saw the government release its plan for tackling ‘rogue’ agents, but it consists of little action against offenders and instead will generate ‘advice’, putting the burden of not being scammed on the potential victim – you.

Please remember that, despite a professional website or a well-dressed representative, the company offering you significant rates-bill savings may not be what it seems.

HEADLINES

3 INDUSTRY NEWS

Everything stores need to capitalise on the freeze-dried-sweets craze

C-stores to gain greater access to clubcard price-reward scheme

5 SYMBOLS & WHOLESALE

Booker rebate changes create challenges for stores

6 N EWS & MAGS

Reach suggests more price rises likely despite falling sales

7 FED NEWS

PayPoint increases retailer fees for its different terminals

8 YOUR VIEWS

‘Liberty Flights is breaking its promise to take back stock’

INSIGHT

9 PRODUCT NEWS

CCEP promises Monster sales from new Bad Apple variety

11 BRAND IN FIVE

What stores need to know about Cîroc

12 SPRING BUDGET EXPLAINED

The impact of the latest tax changes on your store revealed

14 PRICEWATCH

Better prices for chilled-snack lines

16 STORE ADVICE

The small changes that have a big effect

19 FASCIA GUIDE

How symbol and franchise groups are supporting stores on pricing and range

30 REFILLS

Twelve store successes with refills

32 MAGAZINE SALES

How your shelves’ titles are performing

36 HOUSEHOLD

Fifteen products missing from many stores’ ranges

39 THIS WEEK IN MAGAZINES Inside the Puzzler Junior Puzzle refresh

2 betterretailing.com // 15 March 2024 RN Newtrade Media Limited, 11 Angel Gate, City Road, London EC1V 2SD Tel 020 7689 0600 email letters@newtrade.co.uk RN is published by Newtrade Media Limited, which is wholly owned by NFRN Holdings Ltd, which is wholly owned by the Benefits Fund of the National Federation of Retail Newsagents. RN is editorially independent of the NFRN and opinions, comments and reviews included are not necessarily those of the Federation and no warranty for goods or services described is implied. Reproduction or transmission in part or whole of any item from RN may only be undertaken with the prior written agreement of the Editor. Contributions are welcomed and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. For trade use only Annual Subscription UK 1 year £165 Europe £332 2 years £297 Rest of world £389 3 years £396 To subscribe contact 020 3871 6490 Printed by Warners Midlands plc Distributor Seymour Distribution, 2 East Poultry Avenue, London, EC1A 9PT Audit Bureau of Circulations July 2022 to June 2023 average net circulation per issue 8,063 RN’s publisher Newtrade Media cares about the environment. WELCOME Editor Jack Courtez @JackCourtez

7689 3371

020

have your say on the latest news

f

for expert advice to help you grow your sales

CONTENTS facebook.com/ThisisRN

Follow on Facebook

@ThisisRN

extensive

and news

Follow RN on X Visit the website betterretailing.com

galleries

Stores cash in on craze for freeze-dried sweets

by Megan Humphrey megan.hymphrey@newtrade.co.uk

Independent retailers are generating more than £2,500 a month from selling freeze-dried sweets as social media fuels a surge in demand.

TikTok began selling freeze-dried versions of popular confectionery on its in-app shop, prompting a craze where shoppers were attempting to get their hands on different lines.

Freeze-drying involves removing water from sweets without heat, which retains their vitamins and minerals.

Store owners have described the demand from shoppers as “bigger than Prime”, and urged others to tap into the trend to benefit from margins of up to 50%.

Sophie Williams, of Premier Broadway Convenience Store in Edinburgh, began stocking the products three weeks ago when her manager, Colleen, made the order.

At first, she ordered 50 mixed bags from Exploded Sweets, for between £2.40-£3 each, and sold them for £5.99. “I wasn’t sure how they would sell,” she said. “We

put them out at 3pm, and by the time we shut the shop, all the stock had gone. I ordered another 100 bags, and they sold out in two days.”

Williams said shoppers had travelled hundreds of miles to buy them after she uploaded a video about them on TikTok.

“I’ve never seen a craze like this,” she said. “We are making roughly £600 a week. It’s more about helping our store become a destination because customers buy other things when they visit.”

Natalie Lightfoot, owner of Londis Solo Convenience in Glasgow, is awaiting her delivery from Freeze Dried Sweets, but has taken pre-orders from customers.

“It’s clear the demand is there,” she said. “We need to make sure we price them right for our demographic.”

Retailers can either buy the products in prepacked branded bags, or pay extra to have them delivered in clear packets.

Fiona Malone, owner of Tenby Stores & Post Office in Pembrokeshire, opted for the latter to help strengthen her business’s reputation.

“It’s nice to have some-

HOW TO GET FREEZE-DRIED SWEETS

Suppliers

Freezedriedsweetswholesaler.com (£100 minimum order value)

Explodedsweets.com (no minimum order requirements)

Retailers’ five most-popular lines

1. Drumstick Original Raspberry & Milk Chew Bar

2. Wham Original Chew Bar

3. Maoam Bloxx

4. Vimto Fried Eggs

5. Fruit Salad

thing with your store’s name on it,” she said. “My niece is a graphic designer and has created labels we are going to stick on.

“It’s important to think of ways in which crazes can increase loyalty and

ensure your business is remembered.”

However, due to rising demand, RN understands retailers are experiencing delays with deliveries, with some having to wait an extra few weeks.

April 2025 ban for disposable vapes

Retailers have just over a year to sell through singleuse vapes, following the government’s release of its draft regulation on the disposables ban.

Published last week for England, the draft has outlined a date of 1 April 2025 for the restriction, alongside a £200 fixed penalty for businesses caught selling illicit stock after implementation.

Further potential penalties include compliance/ stop notices, with further fines and/or prison for the most prolific offenders.

The regulations have been written for England and Wales, but currently only stand to apply to England. Further changes may yet be made, with views being accepted until 25 March.

An impact assessment

was included, predicting the retail sector would lose £648m in 2025 and £761m in 2026 due to the ban.

However, ACS chief executive James Lowman called this forecast “incredibly naïve”. He explained: “There are a wide range of fundamental problems with the impact assessment, chief of which is a drastic underestimation of the financial im-

Bestway hybrid launches

Bestway is to launch its first Best-one and Bargain Booze hybrid store in April.

As revealed by The Grocer this month, the store in Bristol will be the first time the impulse and convenience symbol has been combined with the alcohol format.

Bestway has previously combined the Bargain Booze fascia with the Costcutter and Wine Rack symbols.

The first site will be company-owned, with a second store also in the works.

Bestway Wholesale managing director Dawood Pervez said: “We want to provide retailers with the ability to enhance their store offerings to become more appealing to shoppers, and to unlock additional sales.”

Bestway’s extended own-label range will also be displayed at the new hybrid sites.

One Stop in Olio tie-up

One Stop donated more than 155,000 meals to families last year through its partnership with foodwaste charity Olio.

pact of a disposable vapes ban on retailers. Using the overall turnover figure for retail businesses to calculate the profit loss of a ban on disposables marks a complete failure in understanding the category.

“There is nothing in the regulations or the impact assessment that will deter criminals and rogue traders, who will carry on regardless.”

Olio co-founder Saasha Celestial-One said: “We couldn’t be prouder to be working alongside one of the UK’s best-loved convenience retailers to fight food waste – especially while the rising cost of living means so many are going hungry.

“It’s been great seeing our partnership going from strength to strength, and we’re even more excited for what we can achieve in 2024.”

3 RN 15 March 2024 // betterretailing.com NEWS

NEWS Budget bites stores

Retailers are to face a series of tax-based changes following the 2024 Spring Budget.

A vaping tax and oneoff increase in tobacco duty from October 2026 were among policies that could squeeze retailers’ margins, as half of the current top-10-selling vape lines will have a £3 duty applied to them.

The one-off tobacco duty will add £2 per 100 cigarettes, so the average price of a 20-pack will increase by 74p to £16.

Retailers will also face costs from a one-off rise in landfill tax for the year 2025/26 to be passed on as high waste fees for stores. Meanwhile, there was disappointment at no mention of business rates being aligned with April inflation.

l Turn to page 12 for more information on how these measures will affect stores

Unilever cabinets dropped

Unilever has terminated its free-on-loan ice-cream cabinets for new retailers in Northern Ireland, while breakdown servicing for all customers will cease from 30 September.

The changes were communicated to store owners in a letter, seen by RN, last month. Other UK nations and the Republic of Ireland are not affected. The decision is due to a change of distribution partner.

Unilever NI out-of-home ice cream director Shay Leonard said new customers wishing to purchase a cabinet must go through Wall’s directly.

MyDD Points close to launching with symbols

by Jack Courtez jack.courtez@newtrade.co.uk

Rewards scheme MyDD Points is “months away” from launching symbolgroup-backed versions.

In an exclusive interview with RN, Kandiah T Konesh, chief executive of MyDD Points, claimed 2,500 UK shops are now using the service, with convenience stores achieving a 15%-20% uplift in total sales.

“Whatever the multiples can do, independents can do through this programme,” said Konesh.

He added that it enables stores to:

• Offer shoppers members-only pricing on key lines, similar to the ‘Clubcard prices’ offered by supermarkets such as Tesco.

• Give shoppers points for every £1 spent in store that can be redeemed for goods, with the level of points and pay-out threshold set by the retailer.

• Run prize draws with entries given each time a customer spends a certain amount.

• Push targeted promotions to win back shoppers that have stopped visiting.

• Send out offers to clear short-life stock, helping to improve footfall, sales and waste levels.

• Sell gift vouchers that can be spent in their store.

At the moment, each store runs and brands its own scheme on the MyDD Points app, but a second option is coming soon.

Konesh said: “We are talking to Costcutter directly, plus Londis, Premier, Budgens, Today’s,

Unitas and Go Local. They are all talking to us to promote as their own rewards system.

“There are two or three of them months away from launching our programme. Some of them may be white labelling so they can be used at any store in their group, for instance, as Costcutter Rewards, but existing DD points app customers without any further registration would still be able to use the Costcutter Rewards service.”

The service can integrate with around 30 EPoS providers, or stores can run it from a standalone device.

Konesh added that the service has a £250 signup fee, plus a £50-permonth subscription.

Retailers then receive a half-day of in-store training for their teams, plus point-of-sale packs including printed clubcards, window stickers, shelf talkers, posters and hanging boards.

The company also runs a three-month social media campaign to promote

the service to the store’s local community.

An account manager also provides daily support during the first month.

Konesh said: “We count a success as when a retailer registers a minimum of 1,000 customers. These typically drive 15% of the shop’s revenue.

“If shops register 1,200 customers, we give the retailer the first £600 they’ve paid in set-up and monthly fees back because we know there’s no way of stopping our programme when their sales go up by 20%.”

Explaining the sales impact, Konesh said: “Registered customers come to the store 10 times more than nonregistered customers.

“It’s proven across every store we work with that promotes the service. It won’t work if you don’t promote it properly.”

He added that this advice includes displaying member prices on shelf-edge labels and promoting a sign-up offer

of free points were key parts in ensuring customers join the rewards scheme.

As well as offering independent stores similar rewards, promotion and loyalty tools to major grocers, MyDD Points says it also offers them similar data on who their customers are.

Konesh said: “Local shops might have around 20,000 customers over their trading history. They might know some by face or name, but, for most, they have not got a clue how often they visit, what they buy or why they have stopped visiting.

“A main opportunity [from using MyDD Points] is that shops can identify who their best customers are by most visits, highest spend and so on, and missing customers can be given specific offers.”

l Stores interested in finding out more can email editorial@ newtrade.co.uk with their store details and the subject ‘MyDD Points’

4 betterretailing.com // 15 March 2024 RN

EXCLUSIVE

SYMBOL NEWS

EXCLUSIVE

Booker’s new rebate terms put pressure on retailers

by Alex Yau alex.yau@newtrade.co.uk

Booker Retail Partners (BRP) is to increase its Spend & Save threshold by £500 to £4,000, making it tougher for retailers to qualify for rebates.

The changes from 18 March for Premier, Londis, Budgens and unaffiliated retailers were communicated last week in a letter sent to stores, seen by RN.

Based on spend in a four-week period, changes for retailers will be:

• 0.5% discount – £12,075 to £18,112 (up from £11,500 to £17,249)

• 1% discount – £18,113 to £30,187 (up from £17,250 to £28,749)

• 2% discount – £30,188 to £42,262 (up from £28,750 to £40,249)

• 3% discount – £42,263 to £54,337 (up from £40,250 to £51,749)

• 4% discount – £54,338 to £66,412 (up from £51,750 to £63,249)

• 5% discount – more than £66,413 (up from £63,250)

Budgens stores have an additional tier for a 6% discount, with the requirement jumping from £74,750 to £78,488.

In the letter, Booker

Group retail managing director Colm Johnson said: “By way of a reminder, your rebate level is determined by your fourweekly spend on vape, tobacco and non-tobacco purchases at Booker.

“Please note we are increasing the bands for the 2024/25 scheme, but the increase is less than non-tobacco inflation and significantly less than tobacco inflation.

“Booker is proud to serve independent retailers and continues to work hard to support you

and your businesses to improve choice, price and service for its customers.”

The decision has faced criticism from affected retailers. One unaffiliated store owner said: “The delisting at depot is out of hand – we’re missing some big-brand names such as Rowntree’s, Saxa, Dolmio and Batchelor’s.

“It was harder meeting the Spend & Save threshold as it was. Lots of retailers are finding savings at other wholesalers.”

One Londis retailer added: “Booker is getting

stricter. It seems to be a yearly trend. It’s not too much for us to meet the new requirements, but some retailers are facing more pressure because of the range cuts.”

A rival wholesaler said some Booker retailers were choosing to switch over to it, with the recent Spend & Save increase being “the final push”.

Meanwhile, one impulse supplier confirmed to RN it had been delisted by Booker for not offering a price-marked version of its product.

Unitas improving availability

Unitas is working with a procurement provider and logistics company DHL to help its wholesale members pass on cost savings and improve availability for retailers.

Speaking to RN at the wholesale group’s annual Connect 24 conference last week, managing director John Kinney said Unitas had partnered with Auditel to help its

wholesalers save money on a number of services.

He added: “We want to help our members look at how they can pass savings on their customers. Working with Auditel, we’re finding cheaper solutions to energy, fuel and stationery.

“We’re seeing some big savings. United Wholesale Scotland is saving up to £20,000 per month.”

Other members of Unitas include Blakemore, Parfetts, Dhamecha, Filshill, Dee Bee and Lioncroft Wholesale.

Meanwhile, Kinney confirmed Unitas was also working with DHL to help its members improve availability. He added: “We’ve been working with DHL to do some cost modelling as part of a supply-chain-optimisa-

Bobby’s boost in Scotland

Confectionery wholesaler

Bobby’s Foods is boosting support for stores in Scotland following “strong growth” in the region.

The company’s national sales development manager, Dave Clarke, told RN sales were positive in the country, counting Filshill, United Wholesale Scotland, Greens Retail and One-O-One stores among some of its major accounts across Scotland.

“We’re in our seventh consecutive year of growth,” he added.

To help support the growth, Bobby’s recently appointed David Strachan as key accounts executive, overseeing relationships with retail partners.

Strachan added that Bobby’s had been working with forecourt group Penny Petroleum, supplying and merchandising the company’s stores through its Apex service.

Parfetts upgrades order app

Parfetts has improved its ordering app to provide retailers with more tailored product suggestions and promotions.

tion project.

“We’re looking at order forecasting and demand planning, through to the physical movement of stock.

“DHL is helping us understand opportunities and shape whether we go through a central distribution route or not.”

l Go to betterretailing. com and search ‘Unitas’ for the full interview

Using artificial intelligence, the app will suggest more appropriate products and offers based on a store owner’s purchase history.

Retailers can also scan barcodes to instantly add products to their orders.

Parfetts digital marketing manager Melanie Bruton said: “Our mission is to help retailers maximise their margins, and our investment in AI ensures the best and most appropriate offers are available in the app.”

5 RN 15 March 2024 // betterretailing.com

EXCLUSIVE Vintage reprints praised

NEWS & MAGS Reach claims data-led price-rise success

Independent retailers are praising publishers for reprinting popular early comic books, citing sales success.

The reprints include first issues of titles such as Amazing Spider-Man and Batman.

Retailers told RN they can be ordered like regular comics through distributors, but – unlike imported comics – single purchases can be made.

James Cobley, of Newsstand Comics in Dartford, said: “There are facsimiles being reprinted of hugely valuable titles at regular price. They look great forwardfacing, and sell forever.”

He added: “They are reliable sellers because you never have to rotate them, so you don’t have to worry about them.

“These are old titles people have heard about and remain interested in. People are really excited to see them on the shelf.”

Eco plan for cover mounts

The Professional Publishers’ Association (PPA) has confirmed plans to introduce “sustainability guides” for children’s magazines.

The Children’s Magazine Pledge is in development by the PPA and has already recruited a number of publishers, including Immediate.

Although details of the plan have not been released yet, RN understands it will include a “sustainability guide” for each category of covermounted toy.

The results are expected this spring.

by Dia Stronach dia.stronach@newtrade.co.uk

Reach has cited a new “data-led” strategy as the reason it has seen a sharp rise in cover-price increases in the past year.

The publisher’s financial results for last year, published on 5 March, revealed a slight fall in print circulation.

However, Reach claimed that “volume decline is actively managed alongside circulation and cover-price increases”, as well as a decrease in printing costs.

In a call with its investors, held last week, chief executive Jim Mullen confirmed the firm is using “data” to make decisions, and that price increases over the past year had been “carefully considered”.

Chief financial officer Darren Fisher said the use of data to determine cover-price increases was the reason there had been more in 2023 than previous years, and hinted at more in the future.

“The teams have access to a significant amount of data that has built up over many years, and this is used to determine opti-

mal levels of availability and cover-price increases,” stated the report.

It continues that decision making of this kind had “offset the volume decline with circulation revenue growing 1.6%”.

However, when challenged on whether coverprice increases would cause customers to stop buying, Mullen said the Covid-19 pandemic had been “the biggest test” of its audience’s resilience, showing readers would continue to go to their local shops to buy papers even when it represented significant risk.

He agreed inflation increased the strain on purchases, but remained convinced of the resilience of these customers.

Rory O’Brien, owner of Papersdirect, told RN: “I’ve noticed there have been more cover-price increases over the past year, and it’s a worrying trend, but the most concerning factor is that we get less and less margin from Reach with each one.

“They’re putting up sales, but we’re not sitting at 19% anymore. I haven’t seen a significant dropoff in customers after any of the cover-price rises,

but overall margin is getting eroded.”

The report from Reach added: “We will continue to carefully balance cover-price increases and availability to deliver a robust circulation performance despite the falling demand for print.

“Print revenue funds the group’s financial commitments and enables investment as it continues to build its digital business.”

RN asked Reach if it would protect retailers’ margins in future price rises, but the company failed to respond.

Kids’ mags dominate launch data

Children’s magazines dominated the top launches of last year, according to Seymour.

The distributor's latest analysis, published in the Wessenden briefing, showed the top three newsstand launches last year were Lego Jurassic World, Rainbow High and Lego Discover.

The fourth spot was taken by Women’s Super

League, the only nonchildren’s title in the top five, with Disney Encanto in fifth place.

Along with children’s magazines, puzzle titles took up a large proportion of launches, but none made it into the top five.

The distributor went on to reveal that 117 titles were launched last year at a regular frequency, com-

pared with 511 one shots, specials or annuals.

Cover prices fell slightly for the average launch, down to £5.34 compared to £5.65 in 2022, but remained higher than the average of £5.10 in 2021.

However, launches for one shots were much larger, with the biggest landing in 18,000 independent stores.

RN understands some

– including football titles, such as Women’s Super League – were moved to being published more regularly after finding success.

Following Immediate Media’s culling of the Audit Bureau of Circulations figures for children’s titles, it is difficult to identify the top-selling titles in one of the most profitable categories.

6 betterretailing.com // 15 March 2024 RN

FED NEWS

Higher service fees for PayPoint retailers

by Jack Courtez jack.courtez@newtrade.co.uk

PayPoint retailers will face higher charges from April due to a 4.9% increase in its monthly service fees.

The increase is equivalent to a yearly cost increase for stores of between £26.52 and £88.32, depending on the PayPoint terminal they are using.

PayPoint said the rise was part of its annual inflation review, which is based on the higher of the

two indexes – RPI.

In a letter to store owners, seen by RN, PayPoint customer experience director Ben Ford wrote: “We made positive changes two years ago in how we deploy our field team, dedicating twothirds of our people to significantly increase the number of visits we make and to help you make the most of these new opportunities in your store.

“Working in partnership on these new opportunities will ensure that you reap the rewards and

improve earnings into your business.”

Fed national president Muntazir Dipoti said cost increases such as PayPoint’s were “difficult to accept…whether

contractual or not”, but backed PayPoint’s call for stores to “maximise the opportunity that PayPoint can bring”.

He claimed commission paid by PayPoint to Fed members had increased by 23% to £4.2m per year.

Dipoti attributed the success to Fed-backed PayPoint ‘Health Checks’ that provided members with new opportunities, such as parcels, and becoming Park Christmas Savings ‘Super Agents’.

PayPoint is also rolling out further opportunities to selected stores, including foreign-currency collection, Royal Mail parcel services and international driving permits.

South East

Reporting tool rolls out in SE

Stores covered by Thames Valley Police are to benefit from quicker crime reporting and updates, thanks to a new system currently being implemented.

Speaking to Fed members last week, Thames Valley police and crime commissioner Matthew Barber revealed the force had joined hundreds of business-improvement districts and crimereduction partnerships in rolling out crime-management tool Disc.

A pack explaining the system is to be sent to all retailers, outlining how the reporting tool is quicker than calling or using its current online system, and helps catch more shoplifters.

A new ‘victim portal’ on its website will also allow retailers to track updates on their incidents without having to call 101.

Head Office

National

CCEP and Fed demand DRS update

Senior representatives from Coca-Cola Europacific Partners, the Fed and more than 10 environmental charities have called on the government to publish its deposit return scheme (DRS) legislation as planned this spring.

In a letter to Department for Environment, Food & Rural Affairs (Defra) minister Robbie Moore, sent last week, the parties suggested the

Contact

UK is “falling behind” as more countries beat it to launching a DRS. “We urge the government to deliver its 2019 manifesto pledge by laying legislation this spring, ahead of the next General Election,” the letter read.

The call follows claims by newspapers last week that the launch of the UK’s system is to face a new delay, taking implementation from October 2025 to 2028.

While Defra said it “remains committed” to DRS, a senior industry source told RN an important meeting with Defra scheduled for late February to decide on policy guidelines was cancelled at the last minute with no reason given.

The letter highlighted the launch of Ireland’s DRS at the beginning of February this year and suggested the UK government visits to see

the “economic, social and environmental benefits”.

The latest statistics from Ireland show more than two-million containers were returned in the first month, equivalent to more than 850 returns per participating shop.

However, the footfall benefits mostly went to supermarkets, as a majority of independent stores in Ireland opted out of hosting return points.

Fed crime posters available

The Fed has produced posters for members to help deter thieves from targeting their stores.

The posters make visitors aware that CCTV is in operation and warn that evidence collected will be used in court.

It is also a legal requirement under the Data Protection Act for any public premises using CCTV, such as shops, to make customers aware they are being recorded.

Members can download and print the posters, which come in multiple sizes and themes, from the Fed’s website.

7 RN 15 March 2024 // betterretailing.com

In partnership with

Jack Courtez with your trade news on 07592 880864, jack.courtez@newtrade.co.uk or @JackCourtez

National PayPoint terminal Current weekly price Upcoming weekly price Yearly increase *New estimated weekly profit PPoS £11.55 £12.12 £29.64 61p Base £11.55 £12.12 £29.64 61p Base (additional unit) £10.40 £10.91 £26.52 £1.82 Core £23.11 £24.24 £58.76 -£11.51 Core (additional unit) £15.60 £16.36 £39.52 –Core (legacy promo) £17.33 £18.18 £44.20 -£5.45 Pro £34.67 £36.36 £87.88 -£23.63 Pro (additional unit) £15.60 £16.36 £39.52 –Mini £23.11 £24.24 £58.76 -£11.51 Mini (additional unit) £15.60 £16.36 £39.52 –*Based on average commission paid per store. Actual figures will vary based on terminal, services offered and store performance

YOUR VIEWS

Still no promised payments

Last year, our local newspaper, the Express & Star, ceased direct distribution – its copies are now supplied by Smiths News. When this happened, we were promised that bond payments of £200, made by stores to Express & Star, would be repaid.

When RN last checked with the publisher before Christmas last year, the company said: “Once the final bill has been paid and any remaining balance is cleared, we will reissue the bonds automatically.”

This final balance has long since cleared and there is still no sign of my bond being returned to me.

I understand the title was acquired by a new publisher and some of these bonds may be quite historic in terms of when they were paid by stores, but the records should be maintained and paid out automati-

cally – these are not their funds, these belong to the store owners and should have been held separately in escrow.

Narinder Randhawa

Great Haywood Spar, Stafford

Editor Jack Courtez responds: “Hi Narinder, despite numerous attempts to get an answer out of MNA Media and the new publisher, National World, I have received no response whatsoever.

“I am extremely disappointed to learn that instead of honouring its promise made to me to automatically return bonds, it is now requesting that retailers affected email katrina. brown@jpress.co.uk or call her on 01902 319381.

“As you correctly pointed out during our last call, there is a risk many stores are unaware of the funds owed due to the length of time the bonds have been held.

“I would suggest any store stocking the title that received direct supply should use the details above to chase bonds they may be owed.”

WE ARE DISAPPOINTED ABOUT THE DELAY OF DRS IN THE UK

Muntazir Dipoti, national president, the Fed

If the rumours currently circulating are true, the development of the UK’s beleaguered deposit return scheme (DRS) has been halted and its introduction further delayed from early in 2025 until 2028. If this is the case, Fed members will be deeply disappointed.

Since the implementation of a DRS was first mooted, the Fed has been hugely supportive – which even caused some eyebrows to be

Why would anyone trust this company?

Liberty Flights called us a few years back offering free stock, SOR and the ability to swap out anything that wasn’t selling. It went great for us until disposables came in and the rate of sale dropped dramatically on liquids.

When I spoke to them about this, the rep agreed as long as we buy disposables from them, we could return whatever wasn’t selling.

We didn’t have a problem until the rep left recently. Since then, we’ve been trying to arrange collections and orders, but the company is refusing to honour the agreement the rep made, asking if we have anything in writing. They must have records of this through the stock previously returned.

Frankly it’s despicable that, in their view, an agreement goes no further than the rep it was agreed with. Why would a retailer ever trust whatever anybody from that company promises them ever again?

Rav Garcha

Nisa multi-site onwner, Midlands

raised. But our members are responsible retailers who care about the local communities they serve, recognise the damage that discarded plastic bottles can do and want to play a role in protecting the environment.

We have always believed that the scheme has huge potential to boost recycling and curb litter, two issues which impact everyone’s surroundings and quality of life. By

VIEW FROM THE COUNTER with Dipak and Jayshree Shah

The government announced the Budget last week and, as expected, there were increases to tobacco duty as well as a levy to be introduced on e-liquids from 1 October 2026.

These rises always happen in every Budget and it doesn’t worry us. JTI and Imperial have also recently announced price increases themselves. We never see these announcements impact demand on tobacco products. Smokers will always buy cigarettes, regardless of any price increase.

Vaping is one of our most popular categories and we see a similar scenario to tobacco. Customers will still purchase them, despite any potential price hikes.

The past week overall has been a busy one for us. We’ve just got back from holiday to celebrate our daughter’s wedding, and following payday in February, customers are splashing out more. We’ve had a lot to catch up on since coming back.

WHAT WE’VE LEARNED THIS WEEK

Our shop is known as the first to get new products in the area and we’ve been keeping an eye on the new Blue Lucozade that’s recently launched. We’ve heard a lot about it through trade press and on social media. I’ve heard it’s been quite popular in stores that have already got it, and our nearest Bestway depot has it in stock.

learning from the flawed scheme in Scotland –which, admittedly, caused us concern – we hoped that a UK-wide scheme would be operational long before 2028.

Similar schemes have been operating successfully for many years in other countries across the world. And only last month, Ireland became the latest country to launch a DRS. While there appears to have been a few inevitable teething problems, everyone involved appears to be confident that these will soon settle down.

According to recent press reports, the latest delay is said to be down to the UK’s devolved governments disagreeing over the inclusion of glass alongside plastic.

If this is true, it means that it will have taken 10 years from a DRS first being announced to finally being implemented. Back in 2018, the then environmental minister, Michael Gove, warned that it was “absolutely vital we act now to tackle this threat and curb the millions of plastic bottles a day that go unrecycled”. How many millions of plastic bottles will have littered our streets, beaches and the sea since then?

Yes

43%

8 betterretailing.com // 15 March 2024 RN

Get in touch letters@newtrade.co.uk 020 7689 3357 YOUR SAY Are you seeing more increased case sizes from suppliers? NEXT WEEK’S QUESTION Would you be interested in introducing Tesco Clubcard-style pricing and rewards in your store? Vote now @ThisIsRN No 57%

PRODUCT NEWS

Lindt unveils ‘Golden Trails’ ad

Lindt has unveiled a new advert in the lead up to Easter for its Lindt Gold Bunny range. The advert was launched on 4 March and is airing on ITV, Channel 4, Sky Media, Discovery, Prime Video and YouTube. The ‘Golden Trails’ campaign has been created by creative agency Leo Burnett UK. The campaign aims to inspire consumers to purchase a Gold Bunny as an Easter gift, running until Easter Sunday.

Campaign spans: TV channels, video on demand and online

Cawston Press adds Cloudy Lemonade

Cawston Press has added a new Sparkling Cloudy Lemonade to its sparkling juices range. This new variety is available to on-trade distributors and wholesalers in a 24x330ml format. It joins the sparkling juice range alongside Elderflower Lemonade, Sparkling Rhubarb, Cloudy Apple, Ginger Beer and Sparkling Orange varieties. The launch aims to cater to at-home occasions and on-the-go consumption.

Available now

Rude Health reveals Organic Oat Barista

Rude Health has added new oat-based milk Organic Oat Barista to its Rude Health range. The product is available to wholesale channels now including Suma, Essential, Infinity, CLF, Greencity Queenswood and Auguste Noel. Organic Oat Barista is made using spring water, oats, organic pressed sunflower oil and sea salt. It contains 14% oat and has a sweet flavour, ideally to be used in coffee.

RRP £2.40

Chupa Chups Slush Pouch duo

Rose Marketing has collaborated with Perfetti Van Melle to launch Chupa Chups Slush Pouches. The range is available in Cola and Strawberry varieties. Cola and Strawberry are Chupa Chups’ two most popular lollipop flavours. The launch marks an extension of the partnership between Rose Marketing and Chupa Chups following the release of Squeezee Freeze Pops and Eezy Freezy Triangles last year.

RRP £1.25

‘Fingers Crossed’ on-pack promo

Mondelez International has launched its ‘Fingers Crossed’ onpack promotion across packs of Cadbury Dairy Milk Fingers. If shoppers pick up a ‘crossed fingers’ pack, they are in with a chance of winning cash prizes ranging from £50 to £20,000. There are 200 participating packs including Cadbury Dairy Milk, Bourneville, Orange and White Fingers and Cadbury Dairy Milk Fingers Family pack 189g.

Campaign spans PoS material, digital and outdoor advertising

Strongbow launch brings the Zest

Heineken UK has expanded its Strongbow cider range with the addition of Strongbow Zest. Strongbow Zest is a vegan and glutenfree apple cider blended with citrus flavours, containing no artificial flavours, sweeteners or colours. It will be made available to independents this April in 4x440ml and 500ml formats. A 10x330ml format is set to launch in June. It will be supported by a marketing campaign in May.

Available from April

RN 15 March 2024 // betterretailing.com 9

»

SPECIALIST CHOICE

Krombacher Dark Lager launches

German brand Krombacher’s Unfiltered Dark Lager (5% ABV) contains notes of roasted malt, fruit, caramel and coffee.

On sale now

Available from Morgenrot

Apeal World Organic Lemon & Mint

Apeal World is adding an Organic Lemon & Mint variety to its ‘Activate’ sparkling Apple Cider Vinegar range

The 250ml can has an RRP of £1.99.

On sale 20 March

Available from apeal.world

Divine Chocolate Easter lineup

Divine Chocolate has unveiled its 2024 Easter range, including Divine Flat Eggs (£5) and a limited-edition Divine Joyful Hot Cross Bun Bar (£4.50).

On sale now

Available from RH Amar

Bad Apple joins Monster lineup

by Priya Khaira priya.khaira@newtrade.co.uk

Coca-Cola Europacific Partners (CCEP) has added Monster Juiced Bad Apple to its range.

Available now in plain and £1.65 priced-marked cans, Monster Juiced Bad Apple aims to tap into the apple flavour’s popularity across categories including fruit juice and cider.

The Monster Juiced range is up 25% in value, now worth just over £244m in value sales.

Monster Juiced Mango Loco has contributed to much of this success and is worth £79.7m, making it the number-one flavoured energy drink in the UK, according to Nielsen data.

Bad Apple joins the eight-strong Monster Juiced range, which includes Mango Loco, Pipeline Punch, Aus-

sie Lemonade, Khaotic, Pacific Punch, Monarch, Ripper and Mixxd Punch. Retailers can request Monster Juiced Bad Apple PoS materials and download digital assets via the CCEP website.

Helen Kerr, associate director of portfolio devel-

opment at CCEP GB, said: “More than half of energy drinks’ innovation sales over the past year have come from Monster’s NPD, which has helped us grow our value sales by £111m. Our Monster Juiced range is up by 25% in value.”

Volvic launches Touch of Fruit Sparkling Sugar Free variety

Volvic has expanded its Touch of Fruit range with its new Touch of Fruit Sparkling Sugar Free variety.

The launch includes Strawberry, Mango Passion and Lemon & Lime varieties.

It is available in £1.15 single cans and £3.40 multipacks.

Single cans are available to wholesale and convenience stores. Each single 330ml can contains five calories.

Research indicates that 57% of consumers are taking steps to limit the amount of sugar in their diets, with one in four saying they would increase their fluid intake

if they found a drink that delivered on taste.

Meanwhile, the brand has also rebranded its Volvic Touch of Fruit Still range with a more modern bottle shape and label design along with a new recipe.

The brand has invested £5m in a campaign to support its rebranding and Touch of Fruit Sparkling launch.

Gemma Morgan, category marketing director for beverages at Danone, said: “We believe making water tasty helps to drive healthier habits.

“The revamp of the Volvic Touch of Fruit bottle design and a new hero Strawberry flavour recipe aims to encourage new shoppers to reappraise the flavouredwater category.”

10 betterretailing.com // 15 March 2024 RN

Khaira Features writer

7689 3379

Priya

@priyakaurkhaira 020

priya.khaira@newtrade.co.uk

the

betterretailing.com/products to find out more about product launches PRODUCT NEWS

Visit

website

BRAND IN FIVE

1. What is Cîroc Vodka?

Stock a new vibe with Cîroc

Super-premium vodka brand Cîroc has entered the RTD category. Two brandnew sparkling drinks – Summer Citrus and Tropical Passion – are capitalising on the RTD and cocktail-at-home trends

Cîroc’s core range has performed well for many years across the off-trade, with its flagship Cîroc Blue Dot vodka variety owning the highest rate of sale across the super-premium vodka category¹. The brand’s move into the readyto-drink (RTD) space feels like a natural progression, giving its customers across the wholesale and convenience channels the opportunity to excite and intrigue

their shoppers with brand-new, super-premium premix RTD options. It also comes as the UK is Europe’s biggest alcoholic RTD market, currently worth £540m and set to keep growing².

This move by Cîroc into premix RTDs provides retailers with a golden opportunity to tap into demand amongst consumers for great-tasting serves that are convenient and that can be enjoyed on the go or as a treat at home.

In partnership with

Cîroc is known for its quality and flavour innovation. As the brand is Britain’s second-biggest super-premium vodka3, consumers respond well to its new and exciting launches and are attracted to its depth and breadth of flavours within the portfolio. The most popular flavours within the range include Blue Dot, Cîroc Passion and Summer Citrus.

2. What are the latest innovations from the brand?

Innovation is something Cîroc is well known for and it’s recently entered the RTD category with two of the most-popular flavours, Cîroc Tropical Passion (5% ABV) and Cîroc Summer Citrus (5% ABV). These new RTDs provide customers with the super-premium quality of Cîroc vodka, mixed into a serve which is not only delicious, but is in a convenient format. From those surveyed, Cîroc Tropical Passion and Summer Citrus RTDs have high purchase intent of 82%4

3. What opportunities does the RTD category present?

Relevance is incredibly important to the brand when it comes to new innovations, ensuring it is offering new expressions that enable retailers to capitalise on current consumer trends. The RTD category is continuing to flourish, and it remains the fastest-growing category5, with premium RTDs driving growth6. Innovations from Cîroc enable retailers to capitalise on the ongoing demand for convenient formats, as well as high-quality premium spirits.

4. How can retailers promote Cîroc’s products in store?

Retailers can make the most of the promotional materials that have been created to support the launch of the Cîroc RTDs. There are a range of assets available, including social media content, PoS, signage and more – all of which will help to increase visibility in store. Keeping RTDs chilled is also key to encouraging impulse sales, and particularly over summer, warm RTDs could lead to missed sale opportunities. With new products, Cîroc also recommends considering placement within the chiller to be at eye-level to ensure a prime position to grab attention and encourage trial.

5. How can retailers get in touch with Cîroc?

Retailers can get in touch via the relaunched online support platform, Diageo One. The revamped site includes a range of resources specifically tailored to the off-trade, including cutting-edge insights, merchandising advice, training materials, a live chat function, and a comprehensive suite of marketing collateral to attract and engage shoppers. Live now, the site can be accessed for free via desktop, mobile and app, and aims to provide retailers with a wide range of advice, critical insight and tools to supercharge their businesses. Simply sign up to Diageo One by visiting diageo-one.com. l

11 RN 15 March 2024 // betterretailing.com

Nielsen ScanTrack, L52W to 09.09.23, 2 ISWR 2023 (drinks marker analysis) data up until end of 2022, 3 Nielsen

Total Coverage, 4 MMR DATA 2023, 5 (in TBA at +5.5% in L24

Nielsen

Coverage,

Total Coverage

06.01.2024

weeks) –

06.01.2024 Total

6 (+33% L24W) –Nielsen 06.01.2024

SPECIAL REPORT

Spring Budget

Alice Brooker, alongside retailers and industry experts, reveals what the latest government changes mean for your business

Chancellor Jeremy Hunt claims the measures announced in the government’s Spring Budget w ill boost growth and cut taxes “for working people”. However, analysis by RN shows independent retailers could see price increases and potential margin cuts on some of their bestselling lines.

A longside this, a number of calls for specific retailer support were ignored, leaving local shops in the lurch once again.

VAPES

A new levy will be placed on all eliquids from 1 October 2026, as part of wider plans to clamp down on youth vaping. Subject to consultation, the rates will be £1 per 10ml for nicotine-free liquids, £2 per 10ml on liquids that contain 0.110.9mg nicotine per ml, and £3 per 10ml on liquids that contain 11mg or more per millilitre.

The UK’s Vaping Industry Association’s director general, John Dunne, said while the tax is put on the manufacturer or importer of the products, it will “disproportionately” increase the cost of goods, and manufacturers may decide to “cook margins”, which would negatively impact store owners.

“It is fair to say that retailer margins may be maintained as, ultimately, the consumer is going to pay a higher cost at the store,” he said. “Distributors and wholesalers work in very small margins, and if their cost of goods increase, retailers could be squeezed.”

Analysis by RN, from the Retail Data Partnership, revealed that 80% of the top-10-selling vape lines in independent stores will increase in price, following the introduction of the tax, with half falling under the highest proposed £3 rate.

The £3 surge would affect 10ml bottles of Edge Open System Refill (18mg) Very Menthol E-liquid, and its 12mg bottles, Jucce Open System Refill (18mg), Liberty Flights Open System Refill (12mg) and T2 Open System Refill (18mg).

Marcus Saxton, chief executive of vape distributor Totally Wicked, said “it will be down to the retailer to manage whether their margin will be reduced” as it depends if they “want to pass the added cost onto the consumer”.

Dean Holborn, of Holborn’s in Redhill, Surrey, criticised the tax and claimed it was “another nail in the coffin” for store margins, but remained optimistic that it won’t change consumer demand, which he described as “still very buoyant”.

TOBACCO

A one-off duty increase will also be placed on tobacco products from

1 October 2026. Hunt said this was necessary “to maintain the financial incentive to choose vaping over smoking”.

The tax rise will add £2 per 100 cigarettes, or 50g of tobacco. Analysis by RN revealed the change will see the average 20-pack of cigarettes in the UK increase, on average, by 74p, up from £15.26 to £16.

The Tobacco Manufacturer’s Associations’ director, Rupert Lewis, told RN he is concerned the levy will fuel sales of illegal products even further.

“An increase in tobacco tax will undoubtedly have unintended consequences, especially for retailers,” he said. “Today, the average pack of 20 legal cigarettes costs £15.26, while a 20-pack of illegal, untaxed and unregulated cigarettes costs, on average, £5.”

He stressed: “Once consumers are priced out of buying legal tobacco, they are increasingly receptive to buying illegal tobacco, which is obtainable everywhere in the UK.”

Despite calls for funding to help combat sales of illicit tobacco and vapes, the government failed to acknowledge this.

NATIONAL INSURANCE

In a move to ease cost-of-living, and “grow the economy”, Hunt con-

12 betterretailing.com // 15 March 2024 RN

A new levy is set to be placed on all e-liquids from 1 October 2026

firmed a 2p cut on National Insurance, following a previous 2p cut in last year’s Autumn Statement.

It is claimed the move will save the average worker £450 a year, and £350 for those who are self-employed. ACS chief executive James Lowman praised the move, claiming “it will help the 400,000-plus people working in the convenience sector and encourage more people into work, relieving pressure on an incredibly tight labour market”.

The move represents a cut from 10% to 8%. Sue Nithyanandan, of Costcutter Epsom in Surrey, said the move wouldn’t have an immediate impact on her business, but it was “good for my staff, coupled with the National Living Wage (NLW) set to rise next month”.

Although not part of the Spring Budget, the government confirmed in the Autumn Budget that NLW will rise by 9.8% from £10.42 to £11.44, representing an increase of £1.02. This marks the largest-ever increase in the minimum wage.

ALCOHOL

The freeze on alcohol duty has been extended until 1 February 2025, after it was due to be unfrozen this August.

A spokesperson for the UK Spirits

Alliance welcomed the news: “Spirits continue to be the highest taxed alcohol category – most people are shocked to hear that 80% of a bottle of gin is tax. We have the highest spirits duty among G7 nations.”

FUEL

Fuel duty will also continue to be frozen at the current rate for another 12 months, maintaining the current 5p cut on petrol and diesel already in action.

The measure is a “welcome” one for retailers, with Hunt suggesting savings of £50 for the “average car driver” next year.

BUSINESS RATES

Hunt failed to address calls for business rates to be aligned with April inflation. Under current rates, two properties with a £500 difference in rateable value would result in an increased rates bill of £2,647 – a huge bill for a retailer with a rateable value of £51,000.

Collier International’s head of business rates, John Webber, said the lack of acknowledgement was a “kick in the teeth for retailers”.

Referencing the potential end of retail, leisure and hospitality relief next year, he explained: “No small shop can realistically plan for the future if they are peering over the cliff edge of a 75% increase in their

Retailers could be squeezed

rates bill next year.”

Holborn said: “It’s the second year of incredibly high energy bills, and we’ve still got no support. These things are really hurting businesses.”

WASTE

Landfill tax is to see a one-off increase for the year 2025/26, which is expected to result in high waste fees for stores.

The move is part of plans to raise £50bn for the government to incentivise a “more sustainable wastemanagement infrastructure”. The standard rate will increase from £103.70 per tonne to £126.15 per tonne, while the lower rate will go up from £3.30 to £4.05 per tonne.

INVESTMENT

In one of very few wins for small shops, Hunt confirmed that full expensing on investment is to now apply to leased assets, as well as owned assets.

Nithyanandan told RN this would benefit her business and give “more leverage for people to invest in their businesses”.

She said: “It used to be that you could expense investment for what you bought, but now it can be for what you lease. If you rent a coffee machine, you can make it part of your tax allowance.” l

RN 15 March 2024 // betterretailing.com 13

Alcohol duty is to be frozen until 1 February 2025

PRICEWATCH

Profit checker Chilled snacks

PEPERAMI ORIGINAL SALAMI 22.5G Price distribution %

50.78% of transactions are processed at 99p

Behind the numbers

Chilled snacks are an important part of a foodto-go range and can prompt additional snacking and drink purchases.

Seventy-one per cent of retailers sell Peter’s Premier Sausage Roll Extra Large Roll at above its most-common price of £1.49, with some going as high as £2.30.

TOP PRODUCTS

Peperami Minis Orignal Cheestrings Original Dairylea Strip Cheese

In terms of the gap between the mostcommon and highest prices, Ginsters Large Sausage Roll stands out: 59% are exceeding £1.49, with some going as high as £2.59. There’s also wiggle room with Peperami’s Original and Hot varieties: both are sold above their most-common prices of 99p by 43% and

We are making a steady margin of 30% and upwards on our chilled snacking range. This primarily consists of Peperami or Cheestrings varieties. As we are not part of a symbol group, we go for chilled snack brands that we can access easily from wholesalers. As we are a rural store, however, we tend to have more customer demand for fresh and locally sourced snacking items. It is sometimes difficult to facilitate this, so we are hoping to expand our packaged snack range by working with a new supplier called The Sandwich Company.

Shital Patel

TOP PRODUCTS

45% of retailers, respectively, with both reaching a highest price of £1.29.

Compare these with the two Fridge Raiders lines: just 20% (Slow Roasted) and 22% (Southern Style) exceed their £1.59 most-common price, which is very similar to last year, with the same highest price of £1.80

Our chilled snacks make a steady 25% margin. A lot of our customers purchase this category after school, so we merchandise the area close to other chilled-food items, smoothies, juices, energy drinks and other soft drinks to help drive incremental sales. We also make most of our sales within this category during lunchtime, so we keep our lunchto-go items in close proximity. Chilled snacking is quite a steady category for us, so we try to keep a core range consisting of our bestsellers, which are normally on-the-go, price-marked snacks.

14 betterretailing.com // 15 March 2024 RN

STORE Jimmy’s Store LOCATION Northampton SIZE 1,000sq ft TYPE Residential

Dairylea Dunkers Jumbo Tubes

Dairylea Cheese Stick

Dairylea Lunchables

Jonathan Cobb STORE Miserden Stores & Post Office LOCATION Stroud, Gloucestershire SIZE 350sq ft TYPE Rural

89p 79p 95p 99p £1 £1.03 £1.04 £1.05 £1.09 £1.10 £1.12 £1.13 £1.14 £1.15 £1.19 £1.20 £1.24 £1.25 £1.29 60% 54% 48% 42% 36% 30% 24% 18% 12% 6% 0%

15 RN 15 March 2024 // betterretailing.com 0 20 40 60 80 100 Below mostcommon price Most-common price Above mostcommon price Must-stock products PRODUCT NAME LOWEST PRICE MOST-COMMON PRICE HIGHEST PRICE FRIDGE RAIDERS SLOW ROASTED CHICKEN BITES 60G £1.25 £1.59 £1.80 FRIDGE RAIDERS SOUTHERN STYLE CHICKEN BITES 60G £1.25 £1.59 £1.80 GINSTERS CORNISH PASTY 227G £1.59 £2.85 £3.25 GINSTERS LARGE SAUSAGE ROLL 130G £1 £1.49 £2.59 HUNTS SAUSAGE ROLL 150G 99p £1.49 £1.79 MORRIS PORK PIE 140G £1.29 £1.50 £2.09 PEPERAMI HOT 22.5G 79p 99p £1.29 PEPERAMI ORIGINAL 22.5G 79p 99p £1.29 PETER’S JUMBO SAUSAGE ROLL 144G £1.29 £1.79 £2.40 PETER’S PREMIER SAUSAGE ROLL EXTRA LARGE ROLL 165G £1.35 £1.49 £2.30 WALL’S YOUR HEARTY SAUSAGE ROLL 130G £1.25 £1.49 £2.75 WRIGHTS JUMBO SAUSAGE ROLL 150G £1 £1.50 £1.99 Price distribution chart Percentage of stores selling above, below and at the most-common retail price Jasper Hart Deputy insight & advertorial editor @JasperAHHart 07597 588978 jasper.hart@newtrade.co.uk Visit the website betterretailing.com/ pricewatch How to use this data 1 Use the price-checker table to see what the most-common prices are for a key line in the category. 2 Use the price distribution chart to see the range of prices being charged on 12 key lines. 3 Use the must-stock products table to see the percentage of retailers charging above, below and at the most-common price. RetailDataPartnershipisaspecialistdataandEPoS suppliercommittedtoservingtheindependentretail sector.Tofindouthowtheycanhelpyouimproveyour business,call01780480562 Datasuppliedby Fridge Raiders Slow Roasted Chicken Bites 60g Fridge Raiders Southern Style Chicken Bites 60g Ginsters Cornish Pasty 227g Ginsters Large Sausage Roll 130g Hunts Sausage Roll 150g Morris Pork Pie 140g Peperami Hot 22.5g Peperami Original 22.5g Peter’s Jumbo Sausage Roll 144g Peter’s Premier Sausage Roll Extra Large Roll 165g Wall’s Your Hearty Sausage Roll 130g Wrights Jumbo Sausage Roll 150g Next week’s Pricewatch: Craft beer and ale 48% 65% 71% 79% 15% 56% 51% 70% 20% 43% 50% 50% 83% 54% 77% 40% 74% 59% 45% 21% 25% 9% 29% 17% 8% 10% 22%

STORE ADVICE

Small changes, big impact

The RN team talks to retailers about changes they’ve made in store that they wish they’d done sooner

When it comes to independent retail, it can be easy to get stuck into the day-to-day requirements and tasks that need to be done, which can result in ambitious ideas or even small-scale changes not being enforced or introduced. If they’re good ideas, every day they’re not implemented will be costing a business money.

These ideas can range from introducing new products or categories, changing the way you interact with staff and customers, or finding ways to save money.

“I’ve changed my waste manager service,” says Bart Dalla Mura, from Tysoe Village Stores in Warwickshire. “It was costing us about £100 a month and it’s unseen, so you don’t

take care of it. I changed to another service, which has saved me £40 a month. Often, we look at big savings and ignore smaller ones, but they add up. If you can save £10 a day, that’s more than £3,000 a year.”

If you’ve come up with a new way to grow footfall, sales or margins, then it’s key to get your staff on board as well, because it’s more than likely that they’ll be even more stuck in day-to-day thinking rather than the bigger picture of someone else’s business.

“ There are routine tasks and there are growth tasks,” says Dipesh Modha, from Edgware Road Post Office in London. “I’m interested in growth tasks, but most staff are interested in routine ones. I have to balance it with incentives to

encourage them to grow my business. I read a book called Measure What Matters in which the chief executive of Intel, Andy Grove, said staff will only start listening to you when you get tired of telling them.”

There’s no time like the present to be implementing the changes, no matter how small, on your business to have a significant impact.

“People often only look at things when they’re on their last legs, but if you have a maintenance plan in place you could end up saving a lot more,” says Vidur Pandya, from Kislingbury Mini Market in Northamptonshire.

To see what other stores are doing, go to betterretailing.com/advice

Often, we look at the big savings and ignore the smaller ones

BART DALLA MURA

16 betterretailing.com // 15 March 2024 RN

Set weekly goals

For Dipesh Modha, from Edgware Road Post Office in London, self-reflection and evaluation are very important parts of his life. So, he started setting and writing down his weekly goals on his Sunday mornings over a coffee. And then he started sharing those goals with his staff members, giving them goals of their own and tracking them all the way.

“When I stopped tracking them, they stopped caring,” he says. “It has to be in their minds all the time. So, I have staff meetings with all the staff and individually as well, so they know what I’ve told them to do. Our sales saw a 50% increase from 2022 to 2023 and February 2024 was up 70% on February 2023.”

Modha rewards his staff for generating Google reviews, and has a member of staff who dedicates their Saturday mornings to replying to and engaging with those reviews.

“I make a big deal of it, but it needs to become part of the routine,” he says.

Get new chillers

Vidur Pandya, from Kislingbury Mini Market in Northamptonshire, invested in new ecofriendly chillers back in July 2023 and got a return on his investment within six months

The fridges he inherited in the store two years ago had been in place for almost 20 years, and by replacing them with modern units, he was able to increase the chiller space in his store and save over 80% on his electricity bills, all at the height of summer.

“We used a Midlands company called Eurofitters and they were great,” he says.

“They have closed doors and run more efficiently, and they have timers on them so they only work when the shop’s open. The compressor is outside, which makes the shop cooler and saves on airconditioning costs.

“I recommend thinking about replacing chillers after five years and you should be getting annual services to make sure they’re running efficiently.”

17 RN 15 March 2024 // betterretailing.com

»

STORE ADVICE

Replace slow sellers with winners

Replacing slow-selling lines with more popular alternatives is a key part of retail, but 12 months ago, James Brown took things a step further when he replaced his lottery unit and put in a fresh bakery offer on his countertop instead.

“We source them from Finch Bakery in Blackburn,” he says. “They’ve got a massive social media following, so people recognise them immediately and now they travel to us to get it. We were getting a 5% margin from the lottery. It took people time to buy it and they bought nothing else.

“Now we’re getting 45% margins from the baked goods and customers will generally get a Tango Ice Blast while they’re at it, too.

“It’s boosting margin, footfall and basket spend, and the stand is the same size as the small lottery unit was. We’re making at least double the profit from the baked goods before you take incremental spend into account.”

Talk to customers

Ruth Crockett, from Hitcham Post Office & Stores in Suffolk, recently conducted a customer survey to better understand what her customers wanted from her shop.

While the respondents were made up more of existing customers than people who didn’t yet use her store, it’s inspired her to take a step and create a point of difference.

“We’re now thinking of shifting our eco refills, freezers and greetings cards out of the back of the store where they’ve been lurking invisibly, and instead we’ll put them at the front of the store. Then we’ll install a little tea shop at the back, that could lead through to our rear garden,” she says.

“In the survey, one thing that people kept saying about the village was that it needed a tea shop. We already get baked goods from a supplier in Horley, and people value that. We also get local meat, although people aren’t as aware of that.” l

18 betterretailing.com // 15 March 2024 RN

FASCIA GUIDE

Getting the best support

Charles Whitting finds out what support symbols are offering their retailers and how stores can get more out of them

One of the main reasons retailers join symbol groups instead of going it alone is the support they receive from these larger businesses.

For some, it’s about getting better prices on products delivered or picked up for their store, for others it’s about getting access to new products ahead of local competitors or learning from the acquired wisdom of a company that has more accumulated years of experience than any single retailer could ultimately hope to.

In a fast-paced shopping environment hit with cost-of-living challenges, rising costs and an insatiable customer demand for the latest viral trends, this support is more needed than ever, but are the symbols still providing it, and if they are, at what cost?

“Before joining a symbol, retailers should have a look at all the costs,” says Shumaila Malik, from Costcutter Heathside Road in Manchester. “There are lots of

hidden charges. You have to make sure it’s worth it. They might be charging you extra for deliveries or for different supplies. There might be minimum order where you’ll be charged for delivery if you don’t order enough.

“If you decide it’s not worth it, go it alone. For some retailers, it might be better to go with local symbols than national ones.”

HELP WITH THE COST-OF-LIVING CRISIS

The cost-of-living crisis shows no signs of abating, which means customers and retailers alike are searching for good value and low prices wherever they can find them, especially when it comes to essentials like milk, eggs and bread.

In response, many symbol groups have worked to keep certain prices low. January saw Spar price-matching against Tesco prices, while One Stop invested £1m to drop the price across a range of own-label goods such as bread, pasta and potatoes.

HOW THE SYMBOLS ARE SUPPORTING RETAILERS

l In January, Spar delivered a campaign across 100 stores in Wales, central and south-east England to match prices of own-label core products against Tesco.

l In December 2023, Booker launched a Fresh 4 promotional campaign, where popular products such as carrots, brussels sprouts and white potatoes were given an RRP of 39p. Despite giving customers savings of £1.30 a pack, retailers were able to maintain a 25% margin because of lowered wholesale prices.

l In January, Nisa reduced its fuel levy back from £6.10 to the £4.88 it was when the fee was introduced in February 2023.

l At the start of the year, Morrisons struck a deal with Just Eat to help boost home delivery services from nearly 60 franchised Daily stores, with plans to expand it to 650 shops.

“We’re cheaper than the supermarkets on sugar and we’ve got the same prices for pasta, rice and other items,” says Suki Khunkhun, from One Stop Woodcross in Bilston, West Midlands.

“We’ve done five years with One Stop and have signed on for another five years, which means something’s going right.”

It isn’t just prices and promotions on the products retailers are buying from their symbol, though. One Stop has teamed up with Uber Eats and Deliveroo to ensure its retailers aren’t paying the higher premiums

They’re top of the tree for advice on store layout

RN 15 March 2024 // betterretailing.com 19

»

FASCIA GUIDE

for delivery. However, the number of symbol groups now affiliated with larger groups has left some retailers feeling that it’s becoming harder to find a competitive edge as a fascia.

“I’ve got a Londis to the left and a One Stop coming up on the right, and we’re all buying off the same Tesco group, and will be selling the same products,” says Simon Dixon, from Premier Lower Darwen in Lancashire.

Ricky Dougall, who runs three Nisa stores in the West Midlands and London, as well as a Morrisons store, has found it’s still best to shop around to find the best prices.

“Nisa is more competitive on licensed products, tobacco and certain ambient lines, but in terms of fresh, I would say Morrisons has the better prices,” he says. “The brand above the door is important, but the price is now more important with the recession and interest rates and mortgages on the rise.”

GETTING HOLD OF PRODUCTS

One of the other trends of 2023 that looks to be a major force this year as well is the deluge of flash-in-the-

pan viral trends that see retailers scrabbling to be the first store in their area to stock the latest energy drink, confectionery item or crisp brand racing across the TikTok landscape.

For retailers, fast reaction times on these products can be massive points of difference to competitors, but it saves them a lot of time, stress and money if their symbol group can help them procure products early and at good prices.

“We were able to get Prime in from One Stop at a good price,” says Danny Wilson, who runs several One Stop stores in Yorkshire.

However, Dixon says it took six months for Premier to get hold of Prime for his store, by which time the excitement had died down. His concern is that Tesco gets preferential treatment, with shops like his left further down the chain.

Vrajesh Patel, from Londis Dagenham in east London, had a similar situation and ended up sourcing Prime himself. “We get about 95% of our stock from Londis, which is all delivered, and then we use a cash and carry every month,” says Patel.

The price is more important now

“When required, we go to smaller suppliers, like for US sweets, Japanese foods and just recently trending sweets, which we got from Freeze Dried Sweets.”

ADVICE AND GUIDANCE

The other major support structure that retailers should be utilising with their symbol groups comes in the form of advice about ways they can improve their business.

If you’re not in regular contact with your regional managers and mining every nugget of insight and expertise from them, then you and your symbol aren’t getting the most out of this relationship.

“My regional development manager (RDM) comes round with the local area manager and they offer advice on things like swapping my coffee machine,” says Dixon. “They’re top of the tree for advice on store layout, and they provide planograms for your store. The leaflets are free, so long as you agree to

20 betterretailing.com // 15 March 2024 RN

»

“Co-op fresh products have completely changed our business. Customers come to us now over the

Sunny Mann, Nisa Local

Fancy doubling your basket spend?

We helped Sunny grow his business through an innovative store refit, extended fresh range and great quality Co-op Own-Brand products. Our retail experts can help you grow your business too.

Give us a call on 0800 542 7490 or scan the QR code to see Sunny’s story

supermarket and we’ve doubled our basket spend.”

Mansfield

to read Sunny’s story

Scan

FASCIA GUIDE

spend a certain amount with them a year. They offer advice on margins and what vapes to stock. They move around a lot and look at other stores.

“They used to be better and help more with the financial aspect, but have stopped that completely.”

That support is also built on the relationships between retailers and RDMs, and it’s so important to be in regular contact with them to ensure you’re learning all you can and are first and foremost in their minds for any news and updates.

RETAILER VIEWPOINT

Vrajesh Patel Londis Dagenham, east London

It’s a relationship. One thing I’ve been taught is ‘you don’t know everything’. You need to listen to advice and adapt it to your local clientele.

Londis meets us every year to look at store layout. They might move some categories to another area if they don’t fit within the planograms or the shopper journey. I get monthly wholesale reports that enable me to compare what I’m doing with all the other Londis stores to see how they’re performing.

We compare sales figures with similar stores and find out where we’re purchasing more lines to see if there are categories we’re not exploiting.

Household goods were on the up in Londis stores overall, but ours was stagnant, so we looked for gaps.

We started looking for thirdparty suppliers for products Londis don’t stock, but which could complement our range within our areas.

Since we did that, we’ve seen about 5% growth in household sales over the past five weeks and we’re still waiting for more stock. That all comes from the data.

Londis and other suppliers have come up with bigger pack sizes and bigger promotions, and more people are prepared to buy the bigger bottles of softeners and detergents, which last longer.

“We’ve been with Londis for 40 years, and you build up that relationship with the sales directors and the regional directors,” says Patel.