Alex Yau, editor

THE government certainly hasn’t held back in making your lives as independent retailers more challenging.

Its shock announcement that it would be axing the “failed experiment” of police and crime commissioners (PCC) in 2028 could have repercussions on how shopliers and shop crime is dealt with.

Last month, ITV aired an investigation into shopli ing, highlighting the importance of an active police presence on preventing shop crime and protecting independent retailers. It featured an interview with south London retailer Kaual Patel, who voiced his frustrations over failures from law enforcement to protect himself, his family and sta members from o enders in his shop. It’s gotten so bad that Patel has considered leaving the industry entirely. I recommend watching it online when you have the time.

Last week’s Autumn Budget was similarly less optimistic for small business owners, although this won’t come as a surprise to many of you.

ALEX YAU

SENIOR �igures who have spearheaded crucial crime�ighting initiatives in convenience stores are to be sacked, as the government has dubbed them “a failed experiment”.

Last month, home secretary Shabana Mahmood announced the decision to scrap police and crime commission-

er (PCC) roles after the 2028 election, claiming it would result in £20m of £100m in annual savings “better spent on restoring neighbourhood policing”.

Despite Mahmood’s claims, several PCCs had focused on cracking down on crime in small shops and helping independent retailers. Sussex PCC Katy Bourne recently launched a pilot to electroni-

cally tag shoplifters in her area. The Opal anti-shoplifting police unit was also funded by Bourne. Since May 2025, Opal has led to 187 arrests and reduced shoplifting by organised gangs by 50%.

Elsewhere, PCCs in Devon, Cornwall, Thames Valley, Hampshire and Merseyside, among other areas, have funded free tools to help shop staff report and share infor-

mation on offenders. The Retail Crime Action Plan was also spearheaded by PCCs, which made every police authority promise to “prioritise” violent shop incidents. The responsibilities will be handed over to regional mayors and council leaders in 2028. However, it has not been con�irmed whether any initiatives launched by PCCs will be continued.

THE AUTUMN BUDGET DIDN’T HAVE MANY SURPRISES

Announcements on rises in wages and changes to business rates haven’t landed well with retailers and trade bodies, but this was to be expected by many store owners. However, there is some reprieve with measures announced to crack down on the illicit trade. These include tougher new penalties on dodgy vape sellers, alongside increased funding to help HMRC with enforcement. Many of you have previously voiced your frustrations to me around this area.

For the full coverage on the Autumn Budget measures which will impact you, turn to page 3.

@retailexpress betterretailing.com facebook.com/betterretailing

Editor Alex Yau

alex.yau@ newtrade.co.uk 020 7689 3358

News editor Ciarán Donnelly ciaran.donnelly@ newtrade.co.uk 07743 936703

News reporter

Kwame Boakye kwame.boakye@ newtrade.co.uk

Production manager Chris Gardner 020 7689 3368

Senior production & content editor Ryan Cooper 020 7689 3354

Copy editor Minhaj Zia

Senior designer Jody Cooke 020 7689 3380

Designer Lauren Jackson

Editor – news Jack Courtez jack.courtez@ newtrade.co.uk 020 7689 3371

Features editor Charles Whitting charles.whitting@ newtrade.co.uk 020 7689 3350

Features and advertorial writer Shyama Laxman shyama.laxman@ newtrade.co.uk

Head of marketing

Kate Daw 020 7689 3363

Head of commercial Natalie Reeve 07856 475 788

Senior account director Lindsay Hudson 07749 416 544

Senior account manager Tommy King 020 7689 3387

Editor in chief Louise Banham louise.banham@ newtrade.co.uk

Features writer Jasper Hart jasper.hart@ newtrade.co.uk 020 7689 3384

Finance manager Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital Luthfa Begum 07909 254 949

42,624

BOOKER has hit the 5,000-store milestone for its Premier fascia.

The store – Premier Queensway in Wellingborough – is badged under Premier’s �lag-

the full story, go to betterretailing.com and search ‘PCC’ For the full story, go to betterretailing.com and search ‘Premier’

ship format. To celebrate, eight Premier retailers will be selected to receive £1,000 to donate to a local cause chosen by their customers. One lucky retailer will also get the chance to win a Premierbranded delivery van.

COCA-COLAEuropaci�ic Partners (CCEP) is still yet to con�irm whether it will provide �inancial support for retailers with the upcoming Deposit Return Scheme in 2027.

The supplier’s corporate affairs director Anna Lucuk

said: “The speci�ication for reverse vending machines in the UK hasn’t been set. We can raise awareness of some of the logistical and practical challenges, and make sure the scheme takes consideration of those.”

For the full story, go to betterretailing.com and search ‘DRS’

SERVICES at Snappy Shopper and Co-op Wholesale went of�line temporarily due to an outage at Cloud�lare.

The disruption occurred on 18 November but was resolved by 3pm on the same day. It highlights major security �laws linked to shop payment and ordering systems. Previously, Co-op and Morrisons had been impacted by cyber attacks, while retailers lost signi�icant trade through outages at card merchant service providers.

SHOP thefts in stores across Scotland have risen by 15% to more than 48,000 incidents.

Responding to the latest �igures across the country, Scottish Retail Consortium director David Lonsdale said: “Thieving from stores isn’t a victimless crime, indeed, it’s a key factor behind rising levels of abuse and threats towards shop workers and we know from member feedback that thieves are becoming bolder and more aggressive.”

ILLICIT vape sellers are to face harsher penalties and potential jail sentences, as the government has announced tough new crackdowns on dodgy sellers, alongside new taxes and regulations on the category.

The measures were announced last week by chancellor Rachel Reeves in the Autumn Budget. These include a “strengthened reward scheme” for those who report “valuable information” on suspected illicit traders to HMRC, modelled on a scheme used in the US. Other punishments include �ines of up to £10,000 and potential prison sentences for rogue sellers.

The government added:

“The government is clamping down on illegal high street activity in premises like mini marts, barbershops, vape shops, nail bars and car washes. These activities can be used to make the proceeds of crime appear legitimate, while being used to sell illicit products and evade tax.”

To support the move, £10m of funding and 350 new criminal investigators will be given to HMRC.

The government also con�irmed it will be going ahead with the introduction of a licensing scheme on vape products, with all vapes manufactured and imported into the UK required to have a duty stamp

from 1 October 2026.

A �lat rate excise duty of £2.20 per 10ml of vaping liquid will be implemented from the same date.”

Regarding tobacco duty, a 2% increase plus RPI was introduced on 26 November, with an additional oneoff rise of £2.20 per 100 cigarettes of 50g of tobacco to take effect from October 2026. Alcohol duty will increase with RPI from February next year.

As expected by many retailers, Reeves announced an increase in wages. From April 2026, the national minimum wage for 18- to 20-year-olds will increase from £10 to £10.85 per hour, while the National Living Wage will rise from £12.21 to £12.71 per hour. Personal tax and National

“HEALTH comes rst for customers looking to get their resolutions o to the best start, but apart from that, most of our sales come from alcohol, soft drinks and snacks. It’s similar to Christmas, but at Christmas, we see more sales from party food. Shoppers are also trying own-label protein bars and buying them in preparation for their New Year’s resolutions when they hit the gym.” Bobby Singh, BB Nevison Stores & Post O ce, Pontefract

Insurance contribution thresholds will also be frozen for a further three years until 2031.

Meanwhile, business rates in England will see a change, with the government announcing new retail, hospitality and leisure (RHL) business rates multipliers which are 5p lower than existing small business and regular multipliers.

From April 2026, the RHL multiplier for small businesses will be 38.2p, with the standard rate at 43p.

Commenting on the Budget announcement, Fed national president Hetal Patel said: “Following last year’s Budget, which saw tax rises of £40bn disproportionately affecting business, the Fed remains concerned about the high

costs that will continue to face small shops in the next �inancial year, with above in�lation increases in the National Living Wage and concern about the threeyearly business rates revaluation due to take effect in April, despite a 5% downward readjustment in Small Business Rates multiplier and some transitional rates relief for small businesses.

“The Fed was pleased by measures the government has announced to tackle the illicit trade, including new resources for trading standards. These were requested by the Fed in correspondence with the chancellor and other government ministers.

“We want there to be a continued close partnership between retailers and

all branches of law enforcement to effectively tackle the scourge of retail crime.”

ACS chief executive James Lowman claimed the changes to business rates would lead to increases in the rates bills of many small shops.

Lowman explained: “A convenience store has a rateable value of £30,000. Under the current system, they use the small business multiplier (0.499) to get an initial rates bill of £14,970, which is then reduced by 40% through the RHL relief, resulting in a bill of £8,982.

“Under the new system, the convenience store with a rateable value of £30,000 would use the RHL multiplier (0.382) to get a rates bill of £11,460.”

New Year: How are you making the most of the sales opportunity?

“ON New Year’s Eve, it’s all about top-ups and last-minute purchases, such as ice, lemons, soft drinks, vapes and forgotten nibbles. At our site, we increase stock holdings to meet this uplift and also prepare for a huge spike in online sales. In short, Christmas is about family. The new year is about reliability and celebration. During this period, sales triple compared to regular daily sales of £3,000.”

Priyesh Vekaria, One Stop Carlton Convenience, Salford

BLAKEMORE: The wholesaler has appointed former One Stop and Co-op Wholesale director Taranjit Singh Dhillon to lead its recruitment of independent retailers. Taking up the role from 29 December, he will be responsible for developing Blakemore’s Trade Partner Plus programme. The scheme includes bespoke planograms and new products.

For the full story, go to betterretailing.com and search ‘Blakemore’

MORRISONS: The supermarket has extended its exclusive More loyalty scheme for Daily franchisees. Under the scheme, More Card holders can earn 1,000 points when they spend £10 or more on Morrisons own label in participating stores.

For the full story, go to betterretailing.com and search ‘Morrisons’

SPAR: The symbol group’s Scotland operator CJ Lang has admitted a six-month recruitment campaign for independent retailers, which ended in October, did not perform as expected. CEO Colin McLean told Retail Express: “I think it’s fair to say it’s been a slow build. There are current challenges in the market.”

For the full story, go to betterretailing.com and search ‘CJ Lang’

SUGAR TAX: The soft drinks sugar levy has been extended to more drinks, with the threshold lowering from 5g to 4.5g of sugar per 100ml. The levy will now include pre-packaged milk-based and milk-alternative drinks with added sugar.

For the full story, go to betterretailing.com and search ‘sugar levy’

“WE have a 10-12% sales uplift on New Year’s Eve compared to a standard store day, due to having the right range in the right places. For New Year’s Eve, we’ll have prosecco and champagne at the entrance to the store, as well as empty boxes of fragrances that shoppers can pick up and collect at the till. We sell a lot of Corona, Peroni and Moretti, as shoppers want to experiment on the special occasion.”

Jeet Bansi, Meon Vale Londis, Stratford-upon-Avon

ALEX YAU

RETAILERS on PayPoint’s Collect+ network lost out on footfall and commission, due to “significant disruption” caused by InPost’s acquisition of Yodel in April.

Speaking to Retail Express during a call about PayPoint’s half-year results last month, PayPoint CEO Nick Wiles admitted pressures managing a larger network had resulted

in some sites receiving no parcel collections or being switched off entirely for a temporary period.

He added: “This contract recognised the continued importance of the long-term partnership between InPost and PayPoint, including a commitment to a minimum level of volume through the Collect+ network and an expansion of the number of sites offered to InPost cus-

tomers to reflect the existing Yodel network, albeit on less favourable commercial terms to PayPoint.

“Our expectation has been that the enlarged Collect+ network for InPost/Yodel customers would result in increased volumes to mitigate these less favourable commercial terms,” Wiles explained. “In the second quarter this has not been the case, with the initiatives from

InPost to harmonise the enlarged InPost/Yodel business resulting in significant disruption to service and parcel volumes across the Collect+ network.”

Disruption was minimised by PayPoint prioritising collection from sites with the highest parcel volumes.

The disruption has been reduced, with those stores taken off the network being re-added.

RETAILERS are getting tougher on refusing sales of energy drinks and vapes to underage customers, according to 200,000 test purchases conducted by Serve Legal.

This year, 77% of energy drink test purchases by underage customers were refused, up from 75% last year. In vapes, test purchase compliance rose from 74% to 78%.

Figures showed test purchases on evenings and weekends achieved lower rates.

EG ON The Move has announced an expansion of its electric vehicle (EV) charging network to reach 250 locations by 2030.

Speaking at the ACS Forecourt, Power and Convenience Conference last month, commercial director Ilyas Munshi said: “In the 15-20 minutes it takes to charge to 80% of the vehicle, someone can go in to pick up a bite to eat.”

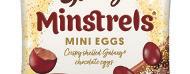

SECURITY firm Retail AI is helping retailers tackle shoplifting by linking its in-store theft alerts to smart devices.

Using artificial intelligence, the tool detects if someone has taken an item from the shelf and placed it into their pocket.

The notification is then triggered on the store tannoy, alerting all in the store. It is also linked to CCTV, providing footage of the suspected shoplifter in action.

Smartwatch features are currently being piloted nationwide.

SHYAMA LAXMAN

EXCLUSIVE: MARS Wrigley has unveiled its 2026 Easter line-up, available from 1 January.

The range comprises new launches and returning favourites, capitalising on Easter egg hunt and gifting missions. With 56% of households with children under 10 participating in an Easter egg hunt last year, it continues to be a key Easter routine for families, according to the supplier. Towards that end, the brand will launch Maltesers Mini Eggs, which combine crunchy Maltesers pieces with smooth milk chocolate available in bite-sized format, ideal

for egg hunts, gifting and sharing. Meanwhile, Galaxy Minstrels Mini Egg, featuring a crisp outer shell and a silky chocolate centre, will prompt cross-category trade-up.

Gifting is worth £75 million annually and a key driver of trade-up across the category, the supplier added.

The brand will expand its gifting portfolio with two new products designed to attract attention on shelf. The MilkyWay Large Egg will appeal to families and younger audiences. Meanwhile, the Twix White XL Egg – combining Twix’s signature biscuit, caramel and creamy white chocolate – taps into the trend for white chocolate variants.

TENNENT’S has marked its 140th year with the launch of the limited-edition Tennent’s Bavarian Pilsner.

Bavarian Pilsner has an ABV of 4.7% and is brewed using German hops and Scottish barley, delivering a smooth �inish that’s refreshing and rooted in tradition, according to the supplier.

This is the �irst launch in a new series called Tennent’s Vault – where the Wellparkbased brewing team will draw on over 500 years of experience to bring forgotten favourites to the shelves in Scotland, the supplier added. It will be supported by a digital marketing and PR campaign.

RRP: £6 (4x440ml)

RADNOR Hills has launched a new carbonated soft drink range called Radnor Spring. It will be available to convenience retailers from January 2026.

The �lavours include Black Cherry & Blackcurrant, Mango & Passion Fruit, Pineapple & Grapefruit and Strawberry & Raspberry.

The bottles are 100% recyclable and made from 30% recycled plastic, according to the supplier. The UK carbonated market size was valued at £10.2bn in 2024, and three in 10 customers drink a carbonated soft drink daily, the supplier added. RRP: £1 price-marked packs of 500ml

HOVIS has relaunched its ‘Ho Ho Hovis’ limited-edition seasonal packaging across its core 800g range to capitalise on the festive period.

an unmissable opportunity for retailers to drive incremental sales.”

GEORGIAN wines have secured UK distribution for its Bolero winery. Bolero has also launched an exclusive label with CN Foods, comprising three wines – a red, white and orange.

The bottles feature striking labels designed to stand out on-shelf and appeal to younger wine drinkers. The

The festive design features across Medium, Thick, and Extra Thick variants. To further support the launch and drive consumer awareness, Hovis has activated ‘Ho Ho Hovis’ across social media, including opportunities for consumers to win exclusive Hovis seasonal merchandise.

Mark Brown, chief marketing of�icer at Hovis, said:

“This limited-edition packaging is a unique way for us to bring some festive cheer to the bread �ixture, making it

range will reach over 1,000 Greater London independent retailers, including 250 larger-format premium stores.

The Bolero Red & White has an RRP of £12.95, while Bolero Orange retails at £15.95.

Several larger-format shops will also stock two of Bolero’s Qvevri wines: Qvevri Saperavi and Qvevri Khikhvi.

The Bolero Qvevri Range has an RRP of £19.95.

SPAR has added a four-pack format to its Blue Bear ownlabel energy drink range, available in the brand’s original �lavour.

The launch of the 4x250ml pack (RRP £2.50) marks Spar’s debut into the takehome energy segment, as it looks to capitalise on the category’s continued growth. It follows on from the launch of Berry Burst and Tropical Surge Zero varieties earlier this year. According to Nielsen �igures, in the 52 weeks to June 2025, the total energy drinks market has continued to grow, with branded unit sales up 3.9% year-on-year and private label outperforming brands with 6.7% growth in the same period.

JAM Shed has launched a new campaign called ‘There’s No Such Thing As Too Jammy’. Estimated to reach 21 million UK adults, the 30-second ad highlights the brand’s Jam Shed Shiraz, featuring a cameo from wine specialist and content creator Tom Gilbey.

Backed by a £2 million investment, the campaign will run across broadcast TV, streaming platforms, and digital OOH screens. Jam Shed has also launched The Jammy Drop, a new on-pack competition offering shoppers a chance to win a share of £20,000.

PHILIP Morris Limited (PML) has refreshed the packaging of its Terea range of heated tobacco sticks.

The updated design will roll out across all 16 Terea variants in the UK. The clearer cohesive appearance promises to make on-shelf navigation easier and strengthens Terea’s premium

brand recognition, according to the supplier. There has been no change in formulation of any variety, the supplier added.

Anthony Loinsard, head of Iqos, UK and Ireland at PML said: “Retailers can expect the same trusted quality and performance across the portfolio.”

SHYAMA LAXMAN

MONDELEZ International has unveiled its Easter 2026 range.

The launches include Cadbury Biscoff Filled Egg, available in single (RRP 99p) and three-pack (RRP £3.65) formats. Meanwhile, Cadbury Oreo Filled Egg is available in a �ive-pack (RRP £5.82). The supplier has launched two Mixed Packs. One contains two classic Creme Eggs (RRP £5.82), while the other has four classic Creme Eggs and four Caramel Filled Eggs).

The supplier says retailers should split Easter into three phases: getting off to a ‘fast start’ (from 1 January to Valentine’s Day), ‘building

momentum’ (from Valentine’s Day to Mother’s Day on 10 March), and gearing up for a ‘gifting �inish’ for the �inal three-and-a-half weeks until Easter on 5 April.

Mondelez has also brought back its convenience-exclusive retailer competition ‘How Do You Display Yours?’, encouraging retailers to share their Creme Egg instore displays for a chance to win £1,000 in vouchers. The competition runs until 27 February 2026. Retailers can enter via Mondelez’ Snack Display website.

COCA-COLA Europaci�ic Partners (CCEP) has launched an on-pack Christmas promotion for its CocaCola range.

Shoppers can win a trip to Sweden’s famous Icehotel, alongside thousands of seasonal prizes.

Running until 31 December, the promotion is available across select packs of Coca-Cola Original Taste and Coca-Cola Zero Sugar 500ml (PMP and non-PMP), 1.25L, 1.75L, and 2L bottles, as well as multipacks of 330ml cans (8, 24 and 30-packs).

Shoppers can enter by scanning QR codes on promotional packs to access the Coca-Cola app.

XIX VODKA has announced a partnership with Red Star Brands in a bid to expand distribution.

The premium brand, founded by YouTube collective the Sidemen, has �ive varieties: Original (40% ABV), Gumball Orange, Tropical Ice, Mixed Berry and Toffee Apple (all 37.5% ABV).

According to Nielsen �igures, the Original variety has become a top-10 vodka line, seeing double-digit year-on-year volume growth in UK retail.

Ryan McCann, �inance director at Red

Star Brands, said XIX Vodka is a “dynamic, culturally relevant brand with huge potential, and we’re excited to work closely with the XIX team and our customers to grow the brand in both the on- and off-trade.”

EAST Pizzas has launched its �irst retail range available to convenience retailers.

The range includes individual 250g pizza dough balls, 12” pizza bases and ready-tocook topped pizzas in three popular �lavours – Margherita, Pepperoni and Spicy.

The dough is made with three ingredients – �lour,

SPAR has returned with its own-label Christmas sandwiches, to raise funds for Marie Curie, Spar’s national charity partner.

The limited-edition Festive Meat Feast and Brie & Cranberry sandwiches are available at an RRP of £3.99. Additionally, 10p from every sale will go towards funding vital nursing care and support for people living with a terminal illness this Christmas.

Available in participating Spar stores across England, Wales and Scotland until 24 December 2025, the limitededition range continues a long-running partnership that has seen the symbol group raise funds for Marie

IMPERIAL Brands has launched its Zone nicotine pouch brand in the UK, following a 2024 US launch. The range is launching in �ive varieties: Sweet Mint, Cool Mint, Watermelon Ice, Juicy Peach and Berry Blast. Each pack contains 20 pouches.

RRP: £6.50 contains

The �irst four �lavours will be available at a 10mg strength, while Cool Mint

is also available in 11mg strength alongside Berry Blast. According to the supplier, 9-12mg strength products currently account for 43.4% of the total nicotine pouch market, while mint �lavours account for 70% of purchases.

water and salt – and developed using the company’s unique natural fermentation and 72-hour proving process, according to the supplier.

The doughballs and bases are additive and preservative-free.

RRP: £2 (dough ball), £3.50 (pizza base), £7.50-£9 (ready-topped pizzas)

BEBETO has launched its �irst-ever limited-edition Christmas range.

The range includes Rudolph Red Noses, Festive Mix Bag and Festive Mix Tub. Rudolph Red Noses are red nose-shaped foam backed gummies in cherry and strawberry �lavour with a raspberry �lavoured centre. Festive Mix bag and tub comprise mixed fruit �lavoured gummy sweets, with a foam back in snowman, penguin, star and tree shapes. It’s available in pineapple, blackcurrant, strawberry and

green apple �lavours. The range is free from arti�icial colours and �lavours, and is Halal certi�ied, according to the supplier.

RRP: £1-£2

SKE has launched its �irst 15,000-puff device, SKE BAR 15K, to the UK retail market.

SKE launches 15K big pu device

The device follows the success of SKE’s 6,000-puff model, SKE CL6000, which has sold tens of millions of units globally. The rechargeable device features a 2ml pod and 10ml e-liquid container and comes in 16 of the brand’s best-selling 600-puff vape �lavours.

The device also includes a battery that lasts up to 48 hours on a single charge and a smart display.

RRP: £12.99

RADNOR Hills has launched a new variant called Radnor Hydrate.

Radnor Hydrate is formed of 60% tropical juice and 40% natural spring water and is HFSS compliant. It follows the launch of Radnor Spring, a low-calorie sparkling spring water in four fruity �lavours.

Radnor Hydrate will be available in �lavours including Summer Berries, Apple & Raspberry and Tropical. Chris Sanders, sales &

marketing director of Radnor Hills, said: “We’ve made our beautiful spring water and delicious fruit juices the hero ingredients for simple, healthy hydration.”

Available: January 2026

CHOCOLATE brand Poppets has partnered with Universal Studios to launch limitededition packs of its Toffee and Mint variants, marking the release of Wicked: For Good.

Michael Inpong, chief marketing of�icer at Valeo Foods UK said: “Poppets has always been part of Britain’s cinema story, and our partnership with Wicked: For Good is a perfect way to celebrate that heritage.

“It’s a brand that connects generations, nostalgic for some, yet new and exciting for others. Just as Wicked: For Good reimagines a classic tale, we’re bringing a timeless treat into a new era.”

Available: Hancocks, Heron Foods, Bestway, Booker

OATLY is set to launch Oatly Baristamatic, an oat drink created especially for automated coffee machines.

Baristamatic optimises machine performance by reducing the risk of sedimentation in milk containers, supporting overall machine �low, according to the supplier. Developed from the original Oatly Barista recipe, Baristamatic delivers the same functionality with a slightly higher fat content to support foam stability, as

well as a lower viscosity for better �low through automated machines. Baristamatic is also forti�ied with Vitamin D, B12, ribo�lavin and calcium, the supplier added.

Available: January 2026

EMPOWERMENT is something every convenience store owner owes to themselves and their team.

COCA-COLA has announced the return of its iconic Christmas Truck Tour – marking 15 years since the �irst tour –inviting everyone to ‘Refresh Your Holidays.’

food redistribution charity FareShare, by making a direct donation equivalent to one million meals.

Where I started is not where I am today. Growth came from intentionally empowering myself and those around me so that no one was le behind.

COCA-COLA Europaci�ic Partners has unveiled its ‘Fizz it Up’ campaign for Schweppes, including a mixology gift box promotion and a limitededition ‘Made to Mix’ pack. The promotion – running until 2 January – gives shoppers the chance to win one of 500 exclusive Schweppes mixology gift boxes, comprising bar-quality tools to elevate at-home hosting. Consumers can scan QR codes on participating packs and enter their details. The limitededition ‘Made to Mix’ variety pack features Schweppes

The truck will visit 15 locations across the country, where visitors can participate in festive games and win exclusive Coca-Cola merchandise. The brand will also continue its partnership with

Coca-Cola’s Christmas campaign this year also includes updated packaging for Coca-Cola and Diet Coke, featuring brand-new Christmas designs. The festive packs also feature a promotion inviting people to scan on-pack QR codes to win prizes.

For me, empowerment starts with learning. Beyond the required licensing training, I actively study retail trends and encourage my team to take up relevant training opportunities, too. A regular skills audit helps me understand my strengths and weaknesses, ensuring our hiring lls real gaps.

Networking is also key. LinkedIn, WhatsApp groups, initiatives like Women in Convenience and trade shows keep me inspired and connected. They remind me that we’re part of something bigger.

We also invest in team building. We meet outside the shop to reconnect and share ideas. Initiatives such as Sta of the Month give everyone something to aim for, while open communication keeps morale high. Finally, I never lose sight of our ‘why’. Remembering why I started this business helps me bounce back on tough days. Empowerment isn’t a one-o act – it’s a daily decision to grow, upli , and believe in ourselves and our teams.

FOLLOWING its 2024 success, alcohol-free brand Nirvana Brewery has brought back its Chocolate Milk Stout in time for winter. The beer combines �lavours of dark chocolate, vanilla and dark roasted malt, with notes of toffee, caramel and lightly roasted coffee. The seasonal special joins Nirvana’s seven core brews. To complement and celebrate the return of Chocolate Milk Stout, Nirvana has also produced �ive golden cans containing the stout. The lucky shopper who �inds the can will be rewarded with a month’s worth of beer from the brewery.

ABV: 0.5%

RRP: £2.50 (330ml can)

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

Rachel Reeves took the time to listen to me

SCHOOLS: What are you doing to engage with pupils?

“I REPRESENTED our Mayor of St Helens Borough at the AntiBullying Schools Project’s 5th Anniversary Celebration. The performances from the pupils and the Liverpool Sign Language Choir were inspiring. Their sign language rendition of This Is Me was moving.”

Bisi Osundeko, Go Local

“I HAD the pleasure of speaking to pupils at the Glasgow Academy about my journey. It’s a joy to share a bit about the highs and lessons learned along the way. What I took away was a sense of optimism. If this is the next generation, the future is bright indeed.”

Shamly Sud, Premier RaceTrack, Glasgow

AMAZON: Why are you using it instead of your usual wholesaler?

“THE products I use it for speci�ically are Heinz Baked Beans and Coca-Cola, which are signi�icantly cheaper than any other wholesaler. The margins are massive in comparison and I save around £2,600 a year. You can order in single quantities, which bene�its us being a small shop.”

Jonathan Cobb, Miserden Village Stores, Gloucestershire

“I CAN’T seem to get Pritt gluesticks from anywhere else, but Amazon stocks them. I’ve been getting products such as Mutti tomato paste. Amazon helps to �ill gaps in my store. The price can be cheaper and, on some lines, you get an extra 5-10% discount if you add more items to your basket.”

Vas Vekaria, of Kegs’n’Blades, Bolton

The margins are massive in comparison

GOVERNMENT: How are you engaging with your MP?

“I FEEL privileged to have been invited to Downing Street to be recognised, alongside other small businesses, in the presence of the Chancellor. Rachel Reeves kindly took the time to listen to my views and congratulated us on being an important part of such a wonderful community.”

George Phillips, TJs Late Shop, Hemel Hempstead

“I WOULD like to thank my MP Mike Tapp for visiting my business, along with his team. We talked about the products I offer and the central role of the business. We discussed the success of the shop in recent years and sales – which remain strong – but also rising costs, as well as counterfeit goods.”

The

future is looking very bright indeed

Customers have less disposable income

CHRISTMAS: How are you preparing for the festive season?

“SEASONAL trade is down in comparison compared to previous years, as customers have less disposable income. We used to get long queues in the run up to Christmas. Now customers are choosing to come into the store more frequently, but spend less. They might splurge the closer it gets to Christmas.”

Anonymous retailer

“UNIQUE products are what we’re using to boost seasonal trade this year. Mini kegs, which customers can use to pour draught alcohol at home, are different and we’ve stocked up on these ahead of the expected rush. Last year we had availability issues, so we’re trying to avoid a repeat this year.”

Kevin Polley, Kash Retail, Bedale

LAST month, I appeared on an ITV documentary highlighting the impact of shoplifting on small businesses like mine.

I’ve had to spend thousands on security because shoplifting has become so common. Anything of value has seen a huge increase in thefts. I’ve had to put secu-

rity tags on wine bottles, and electronic security stickers on laundry items. When someone has no regard for the law or society, it doesn’t matter what security you use. They’ll pick up those items and leave. Do I apprehend them, do I call the police or do I let them go? What I fear worst is some-

COMMUNITY RETAILER OF THE WEEK

Vimal Pandya, Halai General Stores, London

‘Community spirit still matters’

“WE are incredibly proud and humbled to be named a Local Retail Champion for the second year running a er being nominated by our customers, and to take home the national prize this time is truly amazing. This award from Allwyn, which was presented during an event last month, means so much to our whole team. National Lottery retailers and local shops like ours are the heart of our communities across the country. I urge everyone to support them whenever they can. Awards like this remind us that kindness, connection and community spirit still matter most.”

one getting seriously hurt, whether that’s myself, family or staff. It’s a heavy weight, and I can’t protect everyone. The levels of shoplifting have made me consider quitting the business. I’ve lost con�idence in the police. I’ve asked whether we should throw in the towel. We’ve apprehended people

and we’ve had police attend. There have been times where they haven’t attended. There have been times where we’ve sent in CCTV images. Half the time, I don’t even bother. We’re asking for help. We feel abandoned.

Kaual Patel, Nisa Torridon, London

THE important thing to think about when you’re doing an activation, product launch or national event is to understand your own local demographic.

There’s no point doing a big campaign to promote a new product that has no relevance in your area. But then when you do nd a national or global campaign that is relevant, you need to work hard to make it hyperlocal and especially relevant to your own customers.

We have done a rework display for customers for Bon re Night. We have a balcony above the shop, and we do it from there. We don’t make any more money on the day itself, but it’s about making and building those community ties. It’s a long-term approach, and we are committed to supporting longer-term campaigns.

With product launches, we work closely with the supplier to get the right activations in place that will resonate most e ectively with our customers. When the Bacardi and Coke RTD was launched, we had two heritage brands coming together. But that’s not what the customer cares about. You have to work with them on their own journey, and we did that by sharing gi s with them.

We got stock from Coca-Cola Europaci c Partners –sunglasses, T-shirts and shirts – and we told people that if they bought four cans, they’d get a free gi . We had a two-for-£4 promotion on them as well, so that was up for grabs for people. It turned it into an immersive experience for them, and there’s a feel-good factor as well.

We also worked with Lucozade and our local football teams. Lucozade themselves wouldn’t necessarily have worked with an under-16s team, but we got some merchandise from them, and we did it instead with the four teams we support in the area. We gave the kids branded football and water bottles like they see on the TV. It gives us that long-term positive exposure. We’re not just plugging a product o a big-ticket activation. We’re working closely with people to support them and be seen by them for the whole year. It creates more organic demand.

“I WAS having a deep conversation just last month with someone who ended up losing their brother due to issues with mental health. I’ve also lost my uncle the same way. Similarly, the news reported that famous boxer Ricky Hatton took his own life in September this year, and then there was a top guy in Dallam who was a cage ghter who also took his own life. Men’s mental health matters. I’ll be supporting men’s mental health initiatives, and I would also encourage anyone to reach out for a chat. There will be no judgement from anyone at all. I’ll do my best to get you help and support.”

CHARLES WHITTING nds out how retailers can nd the right food-to-go o er for their store and then implement it successfully

FOOD to go has become one of the major trends within convenience retail, with the o er continuing to evolve and provide retailers with new ways to stand out from the crowd.

At its most simplistic, food to go represents food that will be eaten almost immediately upon leaving the shop, meaning a single chocolate bar and a packet of crisps t into this category nicely.

“Food to go is certainly a growing opportunity within the sector,” says Susan Nash, trade communications manager at Mondelez International. “We are seeing consumers looking for a range of snacks, alongside some consumers replacing meals with snacks as they take advantage of

being out and about more frequently.”

But convenience stores have been o ering more than that in recent years, from home-made sandwiches to hot pre-made options to entire meals cooked from scratch in a kitchen.

“Compact countertop ‘hot spots’ and freestanding hot/ chilled/ambient units now make it possible for even the smallest sites to serve freshly prepared food to go,” says Imogen Adams, marketing executive at Country Choice. “Meal deals have also evolved, expanding beyond the traditional sandwich and drink combination to include sausage rolls, handheld bakes, hot dogs and pizza.”

Brands

Stock recognisable brands that will attract customers and prompt impulse purchases.

Point of sale

Make use of PoS materials to ensure your food-togo o ering is unmissable.

A food-to-go section

Maintaining a dedicated area for food to go is a must. This can also be elevated by situating the xture close to the entrance to ensure customers won’t miss it, or near a selection of on-the-go drink formats as the purchase of food and drink are often made together.

All-day availability

Availability is key. Despite lunchtime remaining the primary hot food-to-go opportunity, other occasions throughout the day, such as breakfast, are still growing. Ensuring food-to-go options are available all day is key to maximising sales in the category.

Promotions

Promotions such as meal deals will help retailers to boost spend and impulse purchases. For example, pairing breakfast options with co ee, or lunchtime o erings with a drink and snack.

Value is key

As shoppers continue to monitor their spend, retailers should make the most of meal deals to communicate value and encourage repeat purchases.

Premiumisation

Hold space for premium. We have seen an increase in o ering multiple meal deal formats to provide both value and premium propositions to shoppers.

Sophie Williams Premier Broadway Convenience, Edinburgh

“WE’VE had our hot-food counter for eight years now. It’s open Monday to Saturday. We have hot lunch specials, made fresh every day, homemade soups that my mum is quite famous for, hot rolls, paninis, toasties, salads, omelettes, baguettes and pasta. It’s all made on site every day, so it’s become a bit of a beast.

“We’ve had a food-to-go o er at this level for three or four years and we’ve needed to hire extra sta because it is a lot of work. We put it in because an Aldi opened down the road from us and we needed a point of di erence. It saved our business. It doesn’t just bring in strong sales – we take about £5,000 a week from our deli counter – it’s also a footfall driver. I’ll have workmen come into the shop three times in a morning to get their breakfast, morning snack and lunchtime meal from us.

“If you’re not doing food to go now, you’re missing out, I think. There are de nitely opportunities for smaller-scale versions of what we do. If you have a bit of space, talk to a local butcher and get some pies in. Then you just need a microwave and a small hot cabinet to get started.”

WHEN it comes to food to go, there are four key occasions to seize on – breakfast, lunch, dinner and in-between snacks – and each has a di erent customer demand and potential menu.

“You can adapt your range throughout the day, making sure you’ve got breakfast op-

tions in the morning, lunch and snack choices in the afternoon, and dinner solutions later in the day,” says Tash Jones, commercial director at Fair elds Farm. “This helps meet customers’ needs without overwhelming them, and keeps the range relevant.” Breakfast o ers could in-

clude things like bacon baps, pastries and hot co ee – and if you can introduce a meal deal-type o er within this that could further boost sales and return footfall.

At lunchtime, it’s worth thinking about things that are quick and easy to eat on the go or at one’s desk, but also hot

options that constitute a larger meal. Once the afternoon starts to kick in, retailers can look at indulgent treats and pick-meups, before considering the opportunities for o ering evening meals, especially if they are linked to a home delivery service.

Delice de France Christmas range

Delice de France has unveiled its winter range of limited-edition sweet and savoury products, which includes doughnuts in Apple Pie and Chocolate Orange flavours, and mu ns in Spiced Stollen, Gingerbread and Cranberry & Orange varieties. Also available are Shortcrust Mince Crowns, Pu Lattice Mince Pies, a Rich Fruit Cake, a Christmas Cracker Roll and the return of Pigs in Blankets Slices.

Country Choice adds to its Savour It range

Country Choice has introduced two new flavours –Chicken & Bacon Toastie and Chicken Tikka Naan –to its 13-strong Savour It range. Each product in the Savour It range comes fully assembled, individually packaged in ovenable lm and can be cooked from frozen in around 25 minutes. Once baked, they can be displayed in a suitable hot merchandising unit for up to four hours.

Spar’s seasonal sandwiches

Spar’s own-label Christmas sandwiches returned on 15 November this year. The limited-edition Festive Meat Feast returned to shelves, followed by the Brie and Cranberry. 10p from every sale goes to Marie Curie. They are available until 24 December and have an RRP of £3.99.

Peperami Chicken Bites

In May, Peperami expanded its chilled snacking range with the launch of a new range of £1 price-marked Chicken Bites single packs. They are available in two flavours, Tikka and Roasted, and each variant comes in 45g packs and contains 95 kcal.

YOUR store’s location will have a marked impact on the kind of food-to-go o er that you can put into practice. Finding a gap in the market for a kind of international cuisine might be a way to go, or it might be more important to focus on value-led options and deals.

Mike Nicholls, from Costcutter Dringhouses in Yorkshire, has recently opened a new store in Manchester, which has

a very strong food-to-go o er focused on a nearby hospital and university.

“We’ve got a Henderson’s Barista Bar co ee machine, which is a rst for Manchester and helps us create a point of di erence,” he says. “We’re linking it next to sandwiches and other fresh food. It caters to a lot of students and hospital workers nearby. We are a Morrisons, but the majority of

the food is dedicated to food to go and not grocery. There’s a lot of inspiration from Irish retailing.”

It is important to look at what your competition is doing to identify where gaps in the market might be. And with so many potential food-to-go partners out there, it’s worth seeking advice from them about how their machines might work in your store. Talk

Country Choice Christmas range

Country Choice has added two new sweet and four new savoury options to its Christmas range. Salted Caramel Cupcake and Boston’s Chocolate Orange Doughnut join a line-up of returning festive items such as Gingerbread Reindeer. Additionally, savoury launches include the Jerk Turkey, the Festive Bake, the Festive Sausage Roll and the Caramelised Onion & Camembert Tart.

Clare Newton, trade and shopper marketing manager, Swizzels

to other retailers as well to get a fuller picture of what you might expect.

“We take an insight-led approach that enables us to introduce the right products, in the right store formats and right locations to target consumers at the right time,” says Stephen Hatton, concept manager at Delice de France. “That success hinges on being able to site the right solutions.”

“AS we move into 2026, retailers should be mindful of catering to di erent customer dietary requirements and events throughout the year.

“Veganuary is the perfect time of year for this; with our range of hanging bags such as Scrumptious Sweets, Curious Chews and Luscious Lollies being fully vegan, they’re the perfect lines to stock year round.

“Kids’ singles such as our chew bars, which are also vegan, are the perfect pick up lines to increase basket value, while catering to those with speci c dietary requirements.”

Premiumisation

food to go generally offers great margins for retailers, the potential for high wastage can eat into that quickly and signi cantly. Retailers need to keep a close eye on their sales data to nd out what is selling and at what time of day to build a framework that provides good availability without

right quantities for each part of the day.

“Using pre-portioned ingredients, cross-utilising items across di erent menu lines, and reducing batch sizes toward closing time can all cut waste. Regularly review slow sellers to ensure e ciency, while maintaining freshness and pro t margins.”

customers are looking for so you can evolve things appropriately.

forecasting is essential,” says Cheryl Hope, trading director at Parfetts. “Monitoring sales patterns helps retailers prepare the

Starting small and making small, regular changes with your food to go is also a good way to hone your range and work out exactly what your

“We’ve started making our own sandwiches again,” says Susan Connolly, from Spar Tidworth in Wiltshire. “We had made them originally, then we went to pre-packaged versions from Samworth Brothers. But people said they missed our sandwiches and that homemade feel. So we’re back making them ourselves, with BLT and egg mayo among our favourites.”

“Comfort and convenience are the guiding themes, with pizza and hot snacks in particular proving strong sellers for lunch and early evening,” says Country Choice’s Adams. “Sweet and indulgent lines are also seeing strong growth.”

“Across all segments, personalisation and premiumisation are driving factors,” says Adams. “Shoppers want to choose their bread, toppings and sauces, and are willing to pay a little more for something that feels special.

Pizza

“The UK pizza market is experiencing remarkable growth, now valued at £3.9bn and expanding at an impressive rate of 20.3% year on year,” says Dez Paterson, commercial director at Rich’s. “Pizza now accounts for 8.3% of all food visit purchases and is increasingly chosen over other food-to-go options.”

“Over the past year, customer demand for hot drinks has grown signi cantly, especially for premium and speciality co ee, reflecting a broader consumer shift toward a better-quality cup,” says Thierry Cacaly, CEO of Delice de France. “Consumers now expect bean-to-cup and barista-style experiences even in convenience settings.”

“FOOD to go creates daily footfall and adds consistent sales beyond traditional grocery purchases. It appeals to time-pressed shoppers looking for fast, good-quality options close to home or work. A well-planned o er can build repeat custom, increase overall spend, and strengthen the store’s local reputation. It also makes better use of trading hours by capturing breakfast, lunch and evening trade, creating an important income stream in a competitive market.

“Start simple and focus on products with high demand and minimal preparation. Fresh co ee, pastries and pre-packed sandwiches are ideal entry points. Using compact and easy-to-clean equipment will help to maintain strong standards of hygiene and presentation. Position the o er where it is visible and accessible. Consistency and freshness matter more than scale, and even a small, well-executed range can make a strong impression with regular customers.”

TAMARA BIRCH explores the upcoming legislative tobacco changes and how retailers are preparing for them

THE Tobacco and Vapes Bill has proven to be controversial among retailers. Most welcome a licensing scheme around vapes, but within tobacco, they’re less enthusiastic about the proposed changes. More speci cally, the proposed generational ban has been met with confusion.

“We had this conversation recently. How can you police this ban?” says Chloe TaylorGreen, of Spar Western Downs in Sta ord. “A lot of it is quite stupid. We’re all for legislation, but how much will it drive out of our business?”

Asim Iqbal, of Roslin Con-

venience Store & Post O ce (Premier) in Roslin, Edinburgh, echoes this, but says he wants to see how the Bill goes before making a nal judgment.

“We don’t see many younger people buying tobacco these days, most are after vapes or pouches,” he says. “I would need to see how things go.”

Both Taylor-Green and Iqbal say they’ll have to update and rely on their till prompts to ensure they comply with the proposed generational ban, which could result in higher costs.

“Right now, it’s easy to check if someone is above 18,” Iqbal says. “But eventually,

the tills will need updating and, eventually, it will probably drive our costs up. It has to come from somewhere.”

Taylor-Green currently uses MyChecker and AI to identify how old someone looks, but says it won’t be able to determine a speci c year someone was born.

“It will advance, but, for now, we’ll need to deal with it. I understand it needs to be looked at, but the government needs to talk to those directly selling it,” she says.

“There is no doubt that retailers are worried about the generational ban as part of the

Tobacco and Vapes Bill, fearing it will result in increased violent behaviour in stores and more counterfeit tobacco in their communities,” says Nicky Small, corporate a airs and communications manager at JTI UK, says. “The proposed generational smoking ban is likely to exacerbate the issue of illicit tobacco and turn more people towards the black market as it will restrict adults’ purchasing choices for legal tobacco products.

“Retailers fear that the proposed generational smoking ban will play into the hands of criminals.”

CUSTOMERS are consistently asking for the “cheapest” line if they’re buying cigarettes and tobacco, according to Taylor-Green.

“Our cheapest lines are Mayfair Gold at £12.50, which is the lowest price brand we can go into for our demographic,” she says. “It’s the same as Carlton and Chester eld.”

Iqbal says Marlboro and Regal Signature (FMG) are his bestselling factory-made cigarettes, but says within rollyour-own (RYO), Kensitas Club

and Sterling sell best for him.

“It’s quite interesting actually, Marlboro and Regal Signature both have strong and competitive RRPs, whereas they used to be quite premium brands,” he says.

“With RYO, I’m not sure if it’s because Kensitas was once advertised as Scottish and customers are loyal to that brand, but it’s been a consistently strong seller for quite some time.

“Customers are also choosing value in RYO by buying

combi-packs. Sterling, for example, is sold in my store as a three-in-one, and some shoppers buy Amber Leaf three-inone, too.”

Another retailer in the UK, who wished to remain anonymous, said that Players was a core seller in their store after receiving a rebate, making them one of the only stores in the area to o er a below RRP of the brand. They said the RRP was £14.80 for Players King Size and if sold cheaper, they received a rebate.

FOR many, tobacco is a declining category, but Iqbal says it remains a strong footfall driver.

“If I didn’t care about footfall, I probably would have delisted them already,” he says. “But as long as it brings people in, we’ll stock it.”

But tobacco is expensive, so how are retailers reducing the amount of cashflow stuck in tobacco, without hampering availability?

Taylor-Green maintains tobacco availability levels by doing a suggested order.

“Our system creates an order based on four weeks of data, so we never carry more than we need to,” she says. “Having more is not worth the risk of them being taken or the store being broken into.”

Nicky Small, Corporate a airs and communications director, JTI UK

Taylor-Green can review up to 13 weeks of data, so she’s able to see any lines that have stopped selling.

Imperial extends Paramount cigarette availability to Northern Ireland

Imperial Brands is set to launch its value cigarette brand Paramount in Northern Ireland after a successful rollout in the rest of the UK. For the launch, the supplier has maintained the RRP of £12.50 and Paramount is available to Northern Irish retailers in king-size and superking formats. According to the supplier, Paramount has become the fastest-growing cigarette brand in the UK in 2025 since launch last November, achieving more than 5% market share in independent stores.

STG’s new 17-pack format

In August, Scandinavian Tobacco Group (STG) introduced a new Signature Action 17-pack format to complement the existing two 10-pack o erings. Featuring the same menthol flavour that has been synonymous with the brand since its launch back in 2020, it has an RRP of £9.89, including a pricemarked version.

“WHEN it comes to the proposed generational smoking ban, a 2025 survey of retailers by JTI found that 71% of those surveyed agree that the Labour Party has not listened to the views of independent retailers on this topic. Overall, 58% of retailers believe the generational smoking ban would have a negative impact on their store, up 15% from when the same question was asked in September 2024.

“A recent survey of retailers by JTI also found that 87% of retailers agree that the proposed generational smoking ban would lead to more illegal tobacco activity in their local area. The survey found that 84% of retailers believe the implementation of a generational smoking ban would lead to loss of income through lost tobacco sales.

“Tackling illicit tobacco is one of our top priorities. This is why this year we launched a national campaign calling on the government to do more to tackle the sale of illegal tobacco. The ‘It costs more than you think’ campaign provides retailers and consumers with the tools to report the illicit sale of tobacco and to raise awareness of the impact on local communities. The trade of illegal tobacco funds serious organised crime groups and takes footfall and revenue away from lawabiding stores.”

THE future of tobacco is unknown, but it’s no stranger to change.

In the past decade or two, retailers have had to deal with plain packaging, track and trace and the menthol ban, so it’s safe to say tobacco is quite resilient.

Iqbal believes that even with the generational ban, it

will take a while before retailers see a true impact.

“It won’t cause that much di erence initially, and it’ll maybe take ve or more years before it makes a di erence to our sales,” he says.

Taylor-Green adds that tobacco and cigarettes have a very loyal customer base, and previous legislation hasn’t de-

terred people before.

“The reality is that smokers will smoke whether they can see it or not,” she says. “I don’t know what the future of tobacco is, but I think it could be similar to the disposable ban – sales will drop as people stock up, but ultimately, they’ll come in and buy what they want.”

BAT trials facial age estimation in Jersey Co-op stores

BAT UK has partnered with the Channel Islands Co-operative Society Limited and digital identity provider Yoti to trial facial-age estimation technology in Co-op stores.

The technology is live in 10 Co-op stores across Jersey. BAT currently uses Yoti in more than 600 stores across Europe, with plans to extend to 1,000 by the end of 2025.

Yoti’s system estimates a customer’s age when they scan a QR code on their phone or use an in-store device, such as a tablet, to take a picture. The image is deleted immediately after the estimate. Customers veri ed as over 18 can proceed with their purchase; those under 18 must provide additional proof of age.

BAT uses Yoti’s solutions, including facial-age estimation, age veri cation and identify veri cation, in several of its markets. Since August 2023, it has also used Yoti across BAT-owned vending machines in the UK, with further expansion planned.

Prianka Jhingan, head of marketing, Scandinavian Tobacco Group UK

“FOR the cigar category, 2025 has seen a year of slight value increase and volume decline. The cigarillo segment remains the success story compared to the other three cigar segments. With cigars, the typical drivers of purchase are usually things like size, flavour or price. However, at this time of year many adult smokers like to enjoy a cigar as part of their festive celebrations.

“With cigars, it’s more important to stock the right range rather than a big range, so we usually advise retailers to consider stocking the top two or three brands in each of the four main cigar segments, as the top 10 biggest sellers overall account for well over 90% of total sales, so there’s no point tying up your cashflow with slow-moving brands.”

SIMON KING reports on the opportunity facing retailers, with more people cutting meat and other ingredients from their diets

THE overall UK free-from market is now worth £3.9bn – almost double its value from ve years ago – with demand strong for brands and own label.

Carmen Ferguson, brand manager at Windmill Organics, says the rise in concern around ultra-processed foods is fuel-

ling a shift towards organic as the ‘gold standard’ in freefrom. “Within organic, we nd many consumers prefer the reassurance that brands o er them over own label, both in terms of quality and traceability,” Ferguson says.

Avtar Sidhu, owner of St John’s Budgens in Kenilworth,

Warwickshire, rst started selling free-from products in his store more than 12 years ago, and says the category now accounts for 7.5% of his total sales.

“We embraced the whole category approach on freefrom,” Sidhu says. “The majority of free-from sales come

TASH Jones, commercial director at Fair elds Farm, says retailers should de ne their target shoppers and mission to understand what they might want from their store.

“There is no point having four di erent vegan burgers if there is little appetite for it in their location,” Jones says.

“Where retailers are not sure which brand to choose, consider running a trial between two products and whittling down the range after six-to-eight weeks to the best performer.”

Judith Smitham, owner of The Old Dairy – Pydar Stores in Truro, Cornwall, says free-from sales in her store account for

around 10% of sales, and she has allocated 1.25 metres of shelving to free-from products.

“In our experience, it is still quite a small percentage of people who buy these products, but it would be unwise not to stock them,” Smitham says.

“Repeated customer re-

from people buying their normal shopping, but they are also buying free-from products for one member of the family.

“Whether it’s free-from bread, cakes, chilled or soups, customers know what they’re looking for. There are free-from products across all the most popular categories.”

Carmen Ferguson, brand manager, Windmill Organics SUPPLIER VIEW

quests build up a picture of expectations, and knowing your demographic is key. Many free-from products are more expensive, and deep cuts by supermarkets are hard to match. If the grocery spend is high, that would indicate shoppers see your store as a place to do a complete shop.”

“OUR Amisa survey revealed that quality is the number one factor gluten-free consumers state that influences their purchasing decision the most, followed by taste and trust in the brand. The majority (52.5%) also stated that the biggest challenge they face when buying gluten-free products is price.

“In general, consumers will be prepared to pay more for the right product, but certain plantbased foods sales have su ered as many of the products o ered are expensive, and there’s a growing consumer awareness that ultra-processed and arti cial vegan and vegetarian foods are not as healthy as they look, leading to an increase in demand for natural alternatives.”

Tash Jones, commercial director, Fair elds Farm

“CREATING a dedicated section in store can signi cantly boost basket spend. It helps drive foot tra c and simpli es the shopping process for customers. This area should be made highly visible with clear signage and attractive shelf displays.

Consider placing it next to other high-tra c areas to encourage shoppers to browse.

“Retailers can also drive incremental spend and build a reputation for excellence in this category by o ering exclusive or limited-edition products that aren’t available elsewhere.”

SIDHU says that as sales of free-from products have evolved in his store, he has changed how he displays them.

“We’ve now gone away from a dedicated bay approach,” Sidhu says. “We now put all of

the lines in with the standard categories around the store.

We’ve got little header cards, which will say ‘free-from’, ‘gluten-free’ and ‘vegan’, for example.

“Customers know that we

have a sizable range, and it’s now more of a mainstream mission than a nite number of people who are only coming in to buy these products.”

Sidhu says the challenge of driving sales is all about ex-

ecution and signposting.

“If you are going to go by category like we have, you need to make it stand out on the shelf, to let people know that these products are freefrom,” Sidhu says.

FIONA Malone, owner of Tenby Stores and Post O ce in Pembrokeshire, points out that free-from sales in her store are very seasonal, with summer seeing a spike in demand and winter experiencing a signicant decline.

“It’s quite hard to get the message out to everyone that’s coming into town that we’ve got these types of prod-

ucts,” she says.

However, Jones says tapping into calendar months can be a powerful way to drive tra c and boost sales.

“Retailers can create themed promotions around key dates like Veganuary to make the event feel special,” Jones says. “This could include exclusive discounts on Veganuary products, such as

10% o all items to kickstart the month.”

Sidhu says the biggest time of the year for free-from products in his store is Christmas, not Veganuary.

“At Christmas, people want to please everybody, and they’re happy to spend a lot more to make sure that everyone’s needs are met,” Sidhu says.

SIDHU says Schär gluten-free bread is a good seller, and he also singled out the glutenfree soup range from Campbell’s, as well as products from Amy’s Kitchen as popular freefrom products.

Smitham says the trend for nicer meals at home, driven by the cost-of-living crisis, has made the suppliers who make vegetarian and vegan ready meals think outside the box.

“Cook does some superb

meals, as does Praveen Kumar,” Smitham says. “Quorn and Linda McCartney sausages and mince are an all-year line, and Plant Power Burgers, which are vegan and glutenfree, are also popular.”

Free-from products coming to your shelves

Babybel Hell re

Babybel Hell re, a limited-edition vegan cheese, launched in September to coincide with the fth and nal series of Stranger Things on Netflix.

Amisa White Ciabatta Rolls

Earlier this year, Windmill Organics launched Amisa White Ciabatta Rolls, which come in a 180g pack containing three rolls, with an RRP of £3.49. They are gluten-free and certi ed organic.

CHARLES WHITTING nds out what retailers are doing to boost sales in the January slump and prepare for the year ahead

1

Fiona Malone, Tenby Post O ce and Stores, Pembrokeshire

“WE do a lot of deep cleaning, stock takes and things like that in January because it’s quieter. But you’ve still got to think about the customer and what they want.

“In January, people are thinking about diets and the ‘new year, new me’ idea. So retailers should be asking themselves if there’s anything they can do in the shop to encourage that. Have you got a protein range you can push? Can you offer some dieting products? Is there anything else that people might want in January – maybe more black coffee?

“After that, it’s important to line up some social media posts about it so customers know you’ve got it. Because the weather is bad, people will be venturing out less often, so social media and home delivery become more important. Last year, we started with Snappy Shopper and put out a post that said ‘let us bring the shop to you’. It worked really well.”

the next issue, the Retail

problems

2

Kevin Polley, Kash Retail, north-east England

3

Barry Patel, Nisa Marsh Farm, Luton, Bedfordshire

“WE’RE going to be attacking protein quite hard this January. People will be looking to start a health kick in the new year, so we want to be ‘protein-ready’ for that. From the start of the new year, we’ll have an entire end of an aisle dedicated to protein to give it a proper launch. We’re still looking at exactly which brands we’ll bring in, but we want it to be comprehensive.

“We’re also going to attack Dry January with a vengeance as well. We’ve started our low- and no-alcohol range strongly for Christmas to focus on the designated drivers, with the campaign starting on 1 December and then running for eight weeks.

“While some retailers use the quiet time of January to do housekeeping, we try to ensure that it’s happening all year round. So things won’t be too different in that respect in the new year.”

“WE like to start our January offers early, almost as soon as Christmas is over. People aren’t generally buying alcohol after Christmas, so we start putting offers on other things to incentivise them to come into the store.

“January is generally the coldest and darkest month of the year, so you’ve got make sure the store is well-heated and welllit. That means that it’s a comfortable shopping environment, which means they won’t be in a rush to leave. That will encourage customers to do some proper shopping instead of whizzing in to get what they need. So they’ll �ind things they want to buy and will see all our promotions.

“It’s also a time to be getting prepared because there are lots of big occasions in early spring – Valentine’s Day, Pancake Day, Easter and Mother’s Day – so you need to be working on those in January.”