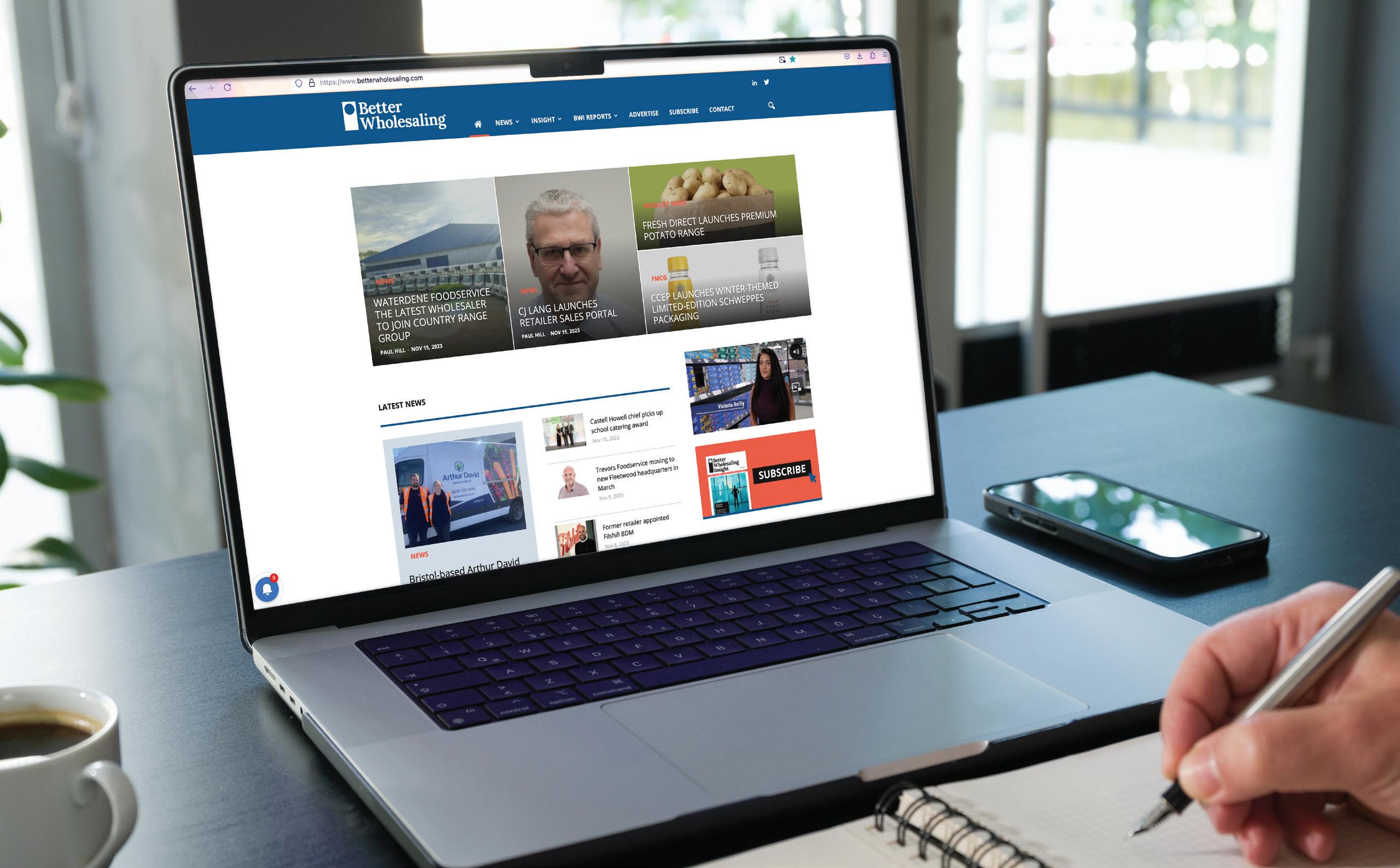

In-depth analysis, insight and advice for convenience and foodservice wholesalers

The most innovative measures wholesalers are taking to improve the sustainability credentials of their operations

In-depth analysis, insight and advice for convenience and foodservice wholesalers

The most innovative measures wholesalers are taking to improve the sustainability credentials of their operations

Paul Hill

Editor

Wholesalers continue to redefine resilience, relevance and responsibility in a rapidly changing world, and they’re doing that through two key things: sustainability and innovation.

As pressures mount across supply chains, innovation is no longer a luxury, but a necessity, and sustainability has become a core commercial driver rather than a side project. This edition analyses the businesses and leaders who are proving that progress and

EDITORIAL

Editor Paul Hill

Editor in chief Louise Banham

Senior content and production

editor Ryan Cooper

Copy editor Minhaj Zia

Senior designer Jody Cooke

Designer Lauren Jackson

Contributors Tamara Birch, David Gilroy, Tom Gockelen-Kozlowski, Tim Murray

Production manager

Chris Gardner

profitability can go hand in hand.

I recently travelled north of the border to Glasgow to visit Greencity Wholefoods, a striking example of values-led business in action.

Speaking with the team, it was clear how their cooperative structure empowers every employee with an equal voice, shaping decisions rooted in fairness and transparency. Their commitment to ethical sourcing, low-impact operations and strong community ties demonstrates how a wholesaler can put people and the planet first while still thriving commercially. From supporting small local producers to championing fair trade, Greencity provides a compelling blueprint for what a purpose-driven model can achieve.

Beyond this profile, the issue casts a wider lens across the sector. We explore the technologies, strategies and fresh thinking pushing sustainability and innovation forward.

If wholesalers can nail down a longterm innovation and sustainability strategy, this will naturally offer them a profitable roadmap for the future that is smarter, fairer and built to last.

SALES

Head of commercial Natalie Reeve 020 7689 3367

Account director Lindsay Hudson 020 7689 3366

Senior account manager Tommy King 07799 218674

Printed by Acorn Web Offset Ltd, Loscoe Close, Normanton Industrial Estate, Normanton, West Yorkshire, WF6 1TW

Distributor Seymour Distribution, 2 East Poultry Avenue, London, EC1A 9PT

Newtrade Media Limited, 11 Angel Gate, City Road, London EC1V 2SD Tel 020 7689 0600

Better Wholesaling Insight is published by Newtrade Media Limited, which is wholly owned by NFRN Holdings Ltd, which is wholly owned by the Benefits Fund of the National Federation of Retail Newsagents. Reproduction or transmission in part or whole of any item from Better Wholesaling may only be undertaken with the prior written agreement of the Editor. Contributions are welcomed and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information.

P6-8: Viewpoint

David Gilroy assesses the state of the wholesale industry as we enter 2026

P10-11: Interview

How a co-operative business model is seeing Glasgow’s Greencity increase profits

P12-14: Innovation

Case studies of innovation from around the channel

P15-16: WhatsApp

The most innovative practices for B2B campaign strategy

P18-19: Climate change

A look at an SWA guide that identifies practical actions to protect operations

P20-21: Redistribution

How City Harvest works with wholesalers to reduce food waste

ADVICE & INSIGHT

P4-5: Anniversary

We speak to Bestway’s MD as the wholesaler enters its 50th year in business

P22-25: Foodservice Focus

Tim Murray reports on the latest trends and developments within catering and OOH

P26-29: Buying groups

A round-up of the latest news and developments across the major buying groups

P30: Wholesale Must-Stock

Helix talks through the benefits of stocking its products in depot

P32: Wholesale Must-Stock

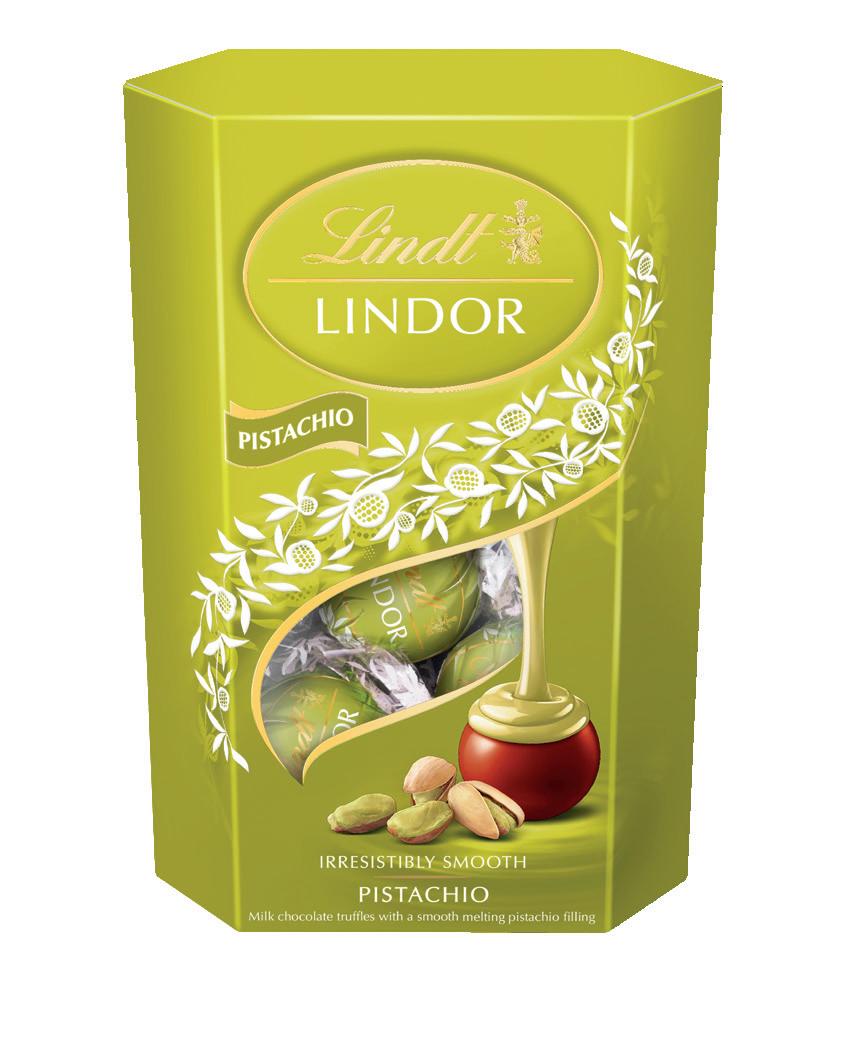

Chocolate producer Lindt gives an overview of what it can offer wholesalers

P34: Wholesale Must-Stock

Westons Cider on the benefits of stocking its range in cash and carries

P36-40: Sector review

The latest trends within hot beverages and cold brews

P42-46: Sector review

All the recent developments and product news in confectionery https://bit.ly/3lvj7FC Join the conversation: @BW_mag Cover image credit: Getty Images/Booblgum

In partnership with

Hill speaks to Bestway

How does a business with nearly £5bn turnover stay in tune with the needs of independent retailers and foodservice outlet owners, and maintain its independent mentality?

Our mantra – ‘for independent retailers, by independent retailers’ – isn’t just a slogan; it’s the foundation of everything we do.

Although Bestway Group now turns over nearly £5bn, with wholesale contributing close to £3bn, our mindset has never changed. We began as independent retailers ourselves, and that lived experience still shapes how we think and act today.

We stay close to our retailers by listening – through feedback forums, store visits, trading groups and real-time data insight – all of which help us refine pricing, promotions and own-label strategy. Every decision we make is tested against one question: does this help our retailers grow?

Our independence gives us flexibility and long-term focus –investing where it matters most, from price support to digital tools. Scale gives us strength; independence keeps us close. It’s this balance that sets Bestway apart.

Sir Anwar Pervez’s stores thrived on spotting a gap in the market for extended trading hours. Bestway thrived on spotting a gap in the market for more competitive wholesale pricing fuelled by a leaner operating model. Do you believe there are any similar emerging opportunities today that will be crucial to the continued success

of Bestway and its customers?

Spotting opportunities ahead of the curve has always been in Bestway’s DNA. From Sir Anwar recognising the need for better pricing and a demand for extended trading hours in the 1970s, to building a leaner wholesale model that empowered independents, our focus has always been on helping retailers compete and grow.

Today’s opportunities look different, but the principle is the same. The winners will be those who blend physical retail with digital convenience – click & collect, delivery, loyalty and personal service. That’s why we’re investing heavily in data, digital tools

and our delivered model, ensuring retailers have the flexibility and reach their customers expect.

Sustainability and local sourcing also present major potential, with shoppers seeking brands that share their values. Ultimately, the opportunity remains what it’s always been: giving independents great prices, great service and the support to stay relevant in a changing world.

Analysts frequently tote the introduction of greater foodservice, own label, fresh and chilled into convenience stores as vital for their future. Does Bestway agree, and if so,

what steps are being taken to support this?

We absolutely agree that the future of convenience lies in fresh, chilled and food to go. Today’s shopper expects quality, choice and immediacy, whether that’s coffee and breakfast on the go, a healthy lunch or a premium evening meal.

We’ve invested heavily in chilled supply-chain capability, partnering with trusted suppliers to extend freshness, reduce waste and simplify ranging for independents.

Our expanding own-label ranges reflect new shopper missions – from everyday essentials to healthier options – always underpinned by strong value.

Through our Retail Development Programme, we support stores with layout, equipment and merchandising advice, so chilled and food to go work commercially, not just visually. Combined with insight from our data and loyalty platforms, retailers know what they can stock and what sells, when and why. Ultimately, success in convenience is about relevance and freshness. Those who master food to go and chilled will thrive – and Bestway is right behind them.

Bestway plays a pivotal role in engaging ministers on the needs of the independent convenience sector. What three changes to current or upcoming policy

would you urge the government to consider?

We work closely with the FWD, which represents the wholesale and convenience sector at the highest level. From my perspective, there are three key policy areas the government must address.

• Firstly, business rates reform. The current system penalises local shops and high streets while rewarding out-of-town and e-commerce operators that retail from warehouses paying lower industrial rates. This creates an imbalance that disadvantages the very businesses that sustain communities and local employment. Reform should level the playing field by exempting smaller local

retailers, ensuring those who retail from industrial premises pay appropriate rates, and revisiting the reliefs afforded to large supermarkets that detract from, rather than add to, local amenity.

• Secondly, food policy must distinguish between convenience and supermarket models, recognising the role of single-serve, on-the-go food rather than applying onesize-fits-all regulation.

• Finally, the October 2027 Deposit Return Scheme must be implemented UK-wide, consistently and cost-neutrally, supporting local stores through practical logistics, fair compensation and streamlined processes that avoid burdening independents or driving footfall to larger competitors. l

Conjuring up visions of a Bavarian forest location great for a weekend break, I have no idea why it was called the Hunting Lodge. This well-established pub on a large housing estate bore absolutely no resemblance to a lodge of any type, and apart from stray dogs, there had never been a trace of wildlife to hunt within 50-mile radius.

It was a drinkers and smokers community pub. Darts, dominoes, pool table, football teams on a Sunday. The nearest thing to a meal on offer was a bag of crisps and a packet of nuts.

The pub was a flourishing business with a seemingly loyal clientele and secure future.

Like many other pubs of its type, the smoking ban came along, and its days were numbered. Within two years, it was shuttered and is now a McDonald’s restaurant.

The number of UK pubs has been in decline since 2007. Lumina Intelligence reports that pubs continue to close, especially smaller independent ones. The number of pubs has dropped from around 45,000 in 2019 to a projected 41,000 this year. According to Lumina, the pub market is now growing slowly. Inflation, premiumisation, consumer spending on eating and drinking out are helping. Value growth is moderate and fragile (1-2% annually), and there are pressures on margins. There is a structural shift, too, with more investment in managed, branded and franchised pubs, and in higher-end, premium offerings. These tend to perform better than smaller, low-margin traditional pubs. Then there’s JD Wetherspoon – the behemoth of the pub sector in the UK with nearly 800 outlets. This is a seriously well-run business with incredible attention to detail and shows what can be done even in a segment under such pressure.

The founder and chief executive, Sir Tim Martin, is all over it, and it is no accident that its latest financials reported sales up 5.1% to £2.7bn and pre-tax profits up 10% to £81.4m. Wetherspoon’s success is not down to a single factor, but rather a combination of tight operational discipline, a strong value proposition, efficient use of property, motivated employees, adaptability and a diversified revenue base. Its culture of incremental improvement, regular in-

vestment and cautious but opportunistic expansion are all helping it to weather economic turbulence.

The value of the pub sector is around £24bn in a UK hospitality/foodservice market worth some £71bn. There are various sources of data and some contradictory. They indicate that the sector is in single-digit growth supported by inflation. That said, the hospitality sector’s segments are not uniformly strong, and the consensus is that, overall, it remains below pre-pandemic levels. Pubs are effectively static right now, accommodation/hotels seem to be recovering, but it is too early to draw conclusions.

The UK fast food, quick service, takeaway market is growing, but the growth rate appears to be moderating. It is currently valued at some £30bn, but some estimates put it at £40bn. Forecasts show mid-single-digit annual growth (around 5% per annum) for the next several years.

Eric Chappell could see the world around him changing and knew his days were numbered. His store, Chappell’s News – on the same estate as the Hunting Lodge – was dated and needed serious investment to change the format from confectionery, tobacco and news to convenience. He’d traded it for more than 40 years, earning a decent living on six days a week, but now was the time. He sold the freehold to One Stop. They gutted the store and modelled it into a convenience-format trading from 6am to 9pm, seven days a week.

It has traded strongly, but is about to be refurbished again and converted to a Tesco Express. It will be interesting to see how it performs and the impact it has on the fragile traffic and parking infrastructure. Tesco is the dominant player with more than 28% share in the UK grocery market, roughly valued at some £240bn. The market is growing, but not strongly. Estimates put it at around 2% with a five-year forecast at 3.8%. Many of the gains reflect price inflation and shifts in channel (online, etc) rather than volume increases. Separately, household food spending (in real constant prices) decreased from £109bn in 2022 to £106bn in 2024, suggesting that volumes are flat

to declining even if nominal value is up. According to the Association of Convenience Stores’ (ACS) Local Shop Report 2025, there are more than 50,000 convenience stores across the UK. The estimated market size is around £48.8bn, and growth overall has declined, which seems to be underperforming against the grocery market in total. Some experts are predicting a hard time for convenience stores –already in decline. Other forecasters (Mintel Store) indicate a positive outlook at around 12% growth over the 2025-29 horizon.

The number of small stores is holding up – notably, unaffiliated independent stores and investment in the convenience store sector is rising. In 2024, convenience retailers invested £1bn in refitting stores and upgrading/ installing technology.

Just as Sir Tim Martin, Ken Murphy, chief executive of Tesco, is across the detail in his firm. In a recent article, he outlined his approach to driving the business. Three key principles: at least hold market share, move away from operating margin obsession to become more focused on cash optimisation and to be more ambitious on save to invest in terms of capital investment and more in price. He is technology-led and highly tuned to consumer trends. He has simplified the Tesco app, driving all traffic through one customer experience, making the journey as slick as possible and then trading people into as many different propositions as they are interested in.

Clubcard membership has increased from 14 million to 23 million, and the app usage from two million to around 15 million. The nationwide convenience-focused rapid delivery capability Whoosh has taken off, doubling over the past 12 months. The Tesco online marketplace has become a huge success, with more than 600,000 SKUs on the site since launch in 2024, and it has just recently partnered with Myrakl. Murphy is pushing hard on AI development and retail media (a huge revenue generator) while keeping a keen eye on the basic trading principles such as Clubcard pricing, Aldi price-matching and range optimisation to eliminate the long tail of slow sellers on valuable shelf space. This is all borne out by half-year results, which show sales up

by 4.9% and a full-year profit forecast between £2.9bn and £3.1bn.

Despite relative success in their respective fields, both Sir Tim Martin and Ken Murphy cite serious headwinds due to higher taxes, rising labour costs, and government-initiated price increases in areas such as energy and potential business rates. Add to this inflation, which is stubbornly high and remains at 3.8% at time of writing. Consumer behaviour is another factor to consider. David Smith, of The Sunday Times, says that consumer-facing services fell by 0.6% in the three months to August – in stark contrast to previous behaviour when the UK economy could rely on consumers to pull it through to growth.

Consumer spending over the past three years, comparing the second quarters of 2022 and 2025, is down by 0.1%. Stagnant, in other words. Consumer spending in the UK is down on pre-pandemic levels, the lowest in the G7 countries, with the silent majority of people reducing their spending and personal debt. The view is that inflation and price attentiveness continue to weigh on consumption and saving decisions. David Smith’s and other economists’ opinions are that future potential price rises, taxes, higher borrowing costs and a real squeeze on incomes are

prompting people to hold back spending and search hard for value.

How does wholesale fit in?

The grocery wholesaling market in the UK comprises retail customers with 52% share, foodservice (29%), contract caterers (10%), and other channels such as exports and specialists (9%). The market is valued at around £44bn and growing slowly between 1% and 2%. But growth is largely inflation-driven with very weak volume growth. Looking at the bigger picture, the major categories of wholesaler customers, retailers and foodservice/hospitality operators are experiencing pressures brought about by structural changes, socio-economic factors, consumer behaviour and government-induced tax policies.

Firms can no longer count on broad market expansion to lift revenues. There is no doubt that the market is consolidating, with a battle for market share well underway. And there have been several wholesaler business failures recently. At this point, one could be forgiven for taking a downbeat view of the wholesale landscape, but take a look at the top 30 wholesalers, which accounts for more than 85% of the total market value, and this tells a different,

more positive story. Most are in good health and bucking market trends. The exceptional recent financial results from Booker, Parfetts and Fillshill, for example, show what can be achieved in this tough climate.

We can see how industry leaders like Tesco and Wetherspoon are continuing to make progress against strong headwinds, and how important it is to be close to customers and every aspect of the business. There are some basic principles to be applied in a static market. It is important to distinguish if the market is static in volume (units sold) or value (revenues). Recent studies and sector analyses repeatedly show that headline revenue growth in food retail or wholesale can mask flat or falling volumes, with inflation and input cost increases inflating turnover figures.

That matters because volume stagnation calls for different fixes (e.g. demand stimulation, assortment refresh) than value-only stagnation (margin recovery, cost control). When growth is limited, the best operators manage categories tightly: optimising assortment, implementing pricing ladders and merchandising to maximise profit per square metre (or per click). Category management, when executed empirically, can improve gross margin

and customer relevance, but it must be tailored to customer demand to avoid bloated SKUs that cannibalise sales.

Controlling the controllables is critical. Cash management, stock, debt control, gross margins, wastage and control of overheads all must be tightly managed. Simplicity allied to excellent service is the name of the game. Introducing measures to streamline operational processes to facilitate great service at the lowest possible cost will insulate against competitive impacts.

There’s gold in the customer file. Acquiring customers in a static market is expensive and often futile; retention and higher lifetime value are better bets. Wholesalers have had superb customer data for years, and now is the time to exploit it. Prioritising highvalue customers, increasing transaction values, improving margin mix, reactivating lapsed customers and improving purchasing frequency will all bear fruit.

Omnichannel is moving from becoming desirable to essential. Growing online share often outpaces total market growth, so a focus on channels that expand share without destroying margin will pay dividends. Profitable omnichannel requires tight integration

of inventory systems to avoid doubleselling and to enable fast fulfilment (click & collect, ship from unit). Many wholesalers are already down the track with online and app ordering for customers, but is it all joined up? They should also consider partnering with digital marketplaces – witness Tesco’s rapid success in this area.

Businesses and consumers are under severe financial stress. We are operating in a tough trading climate, and effective operating in a static market is iterative, not binary. Managing a wholesale business in a static market requires a portfolio of small, reinforcing moves: extracting cost and processing efficiencies; sharpening customer relevance; reconfiguring commercial partnerships; and testing selective innovations. No single tactic suffices; the persistent advantage comes from aligning data, governance and culture so these tactics compound. Starting with diagnostic metrics (volume versus value), maybe picking two high-impact pilots (one on margin management, one on customer relevance) and scaling what raises contribution per customer rather than chasing top-line growth. Despite the challenges, there are many examples of great businesses in our industry doing exceptionally well. l

Paul Hill travelled to Glasgow to find out how this co-operative wholesaler is doing things differently

Answers come from a selection of the membership

How does the co-op model shape how decisions are made day to day as a wholesaler?

At Greencity, being a worker co-operative means doing business differently. We don’t have bosses or hierarchies – instead, we work together as equals, with a flat pay structure and shared responsibility for how our co-op runs. People are at the centre of everything we do.

Our teams each take care of different parts of the business –from accounts, warehouse and buying to IT, marketing, HR, driving, cleaning and maintenance. Day to day, we make decisions much like any other workplace, but what makes us different is how we make them.

The environment we work in – the trust, respect and shared ownership – has been shaped collectively by all of us. Every decision, big or small, affects us equally, and we stand by one another in the choices we make.

When Covid hit in 2020, it tested these values in real time.

Some of our members needed to be furloughed, and rather than making decisions based purely on business needs, we balanced these with what was best for each person – their health, well-being and personal circumstances. It was a moment that reminded us of what being a worker co-operative means: collective actions, taking shared responsibility and making sure everyone moves forward together.

Can you explain how membership works, and how do you balance collective decisionmaking with the need to act

efficiently as a business?

Membership of the co-op is voluntary. Individuals may choose not to become members and will still retain the same employment rights. However, very few people opt out of membership, as the benefits are numerous – most notably, having a direct voice and influence in how we run our business.

All Greencity employees initially join as probationary members, serving a nine-month probationary period. This period includes regular reviews, opportunities to work across different departments and, upon successful

completion, formal approval of membership by the co-op.

In addition to their individual primary roles, all members share collective responsibilities, including:

• Respecting and abiding by collectively agreed decisions made at full members meetings.

• Developing, promoting and adhering to best practice, as well as agreed systems and procedures within their team.

• Engaging with key co-op matters, attending all Greencity meetings (unless absence is unavoidable) and actively contributing to collective decision-making

at both departmental and co-operative levels.

• Being open to multi-tasking and training as required to support the smooth running of the business.

• Upholding and promoting general co-operative principles and values.

We hold several members meetings each year to discuss the business plan, share departmental updates, and raise proposals for consideration and voting. Proposals are our mechanism for making significant decisions or implementing changes that affect all members. Each proposal is discussed collectively before a vote is taken, and a majority is required for approval. Any member may submit a proposal for discussion.

While major decisions are made collectively, many operational decisions are taken at a departmental level to ensure the business continues to run efficiently.

Are there any memorable examples of decisions where the co-op structure made a difference compared to a traditional structure of a wholesaler?

During the Covid pandemic, we rapidly introduced home working to reduce the number of people in the office. Since then, we have retained a hybrid working model. Recognising that some departments have roles that must be performed on site, we carefully considered the implications of continuing homeworking. Many members found the flexibility of homeworking beneficial; however, we also needed to balance this with the fact that not all members could access this option. To ensure fairness and inclusivity, we conducted a survey presenting several hybrid-working models. All members were invited to vote, and the results led to the adoption of an agreed homeworking model supported by all departments. l

United Wholesale Grocers has partnered with EPoS provider ShopMate for new product software claimed to bring together best-in-class retail technology and trusted service.

United EPoS, powered by ShopMate, will allow the Glasgow-based wholesaler’s retailers using United EPoS to benefit from integration of stock and pricing, centralised promotions and access to digital media screens.

Parfetts has reached a new digital milestone, with online orders consistently accounting for more than 50% of total sales.

The wholesaler said 40% of those online sales come through its website and 60% through its app, which has seen increased engagement since a major update in April. Time spent on the app has risen by 20%, while orders placed through it are up by 10%.

The Parfetts app has been downloaded 30,000 times, with 40% of users active each week. Data shows Sunday is now the most popular day for orders, followed by Monday, as retailers plan their week through the platform.

The UniCo Food Group has revealed the development of a new R&D centre and test kitchen built specifically for the independent QSR sector.

The buying group’s R&D centre has been modelled on a realworld, modern-day fast-food QSR concept, with the company claiming it will be used for menu innovation and development, supplier product testing, as well as collaborative creation between QSR operators and foodservice manufacturers.

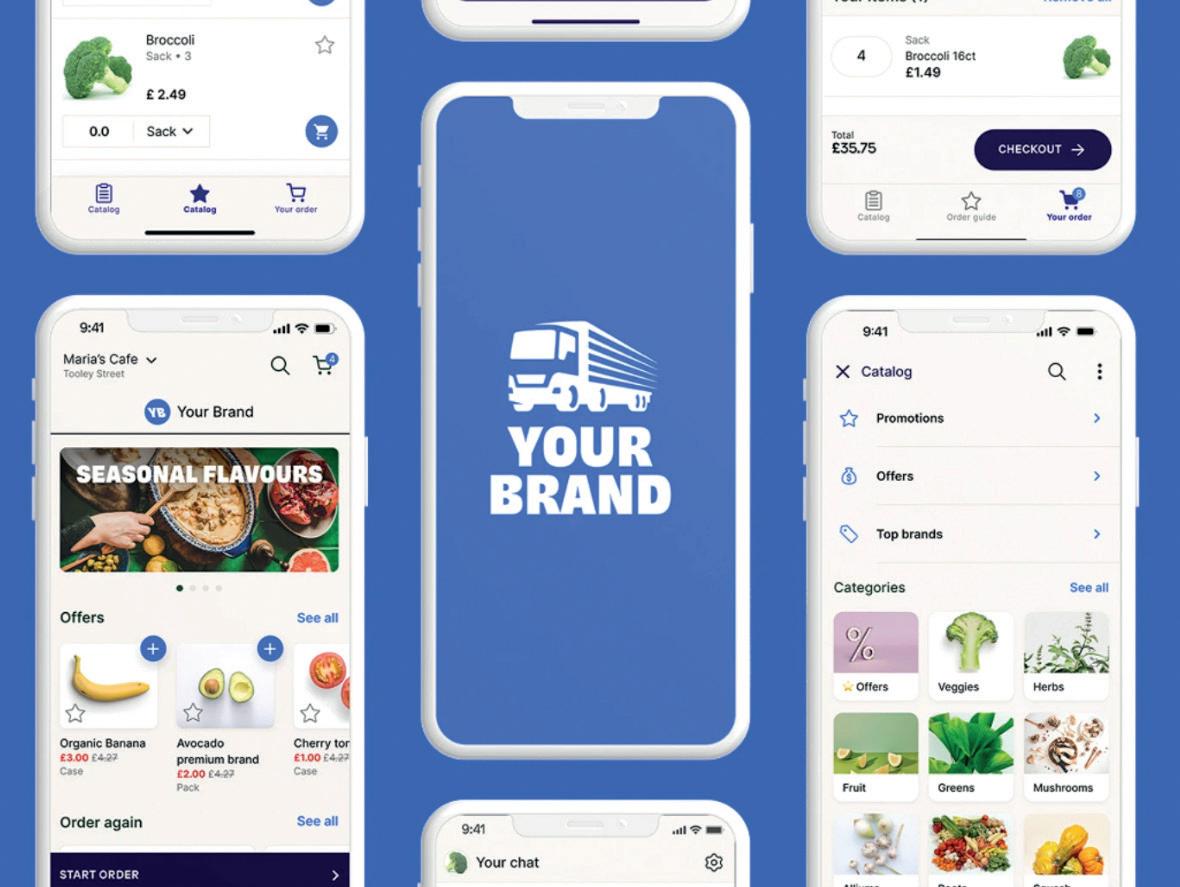

A white-label digital storefront and mobile app solution has been designed to transform how wholesalers sell to their customers, as well as help move beyond manual phone and email orders to a mobile-first ordering experience.

Choco eCommerce is offering wholesalers the chance to offer their clients a branded webshop and app using AI-driven order processing. Daniel Khachab, chief executive and founder of Choco, commented: “Food distribution is one of the last industries to fully digitise. With Choco eCommerce, we’re giving wholesalers the tools to grow faster, serve customers better and operate smarter.”

We are making sure our snacks are not only right for people but also getting better for the planet - from the raw materials we rely on, to the communities we live in and the climate we all need to care for.

At Mondelez International, we are working toward our goal to source all cocoa volumes needed for Chocolate brands, through Cocoa Life, our signature cocoa sustainability sourcing program by the end of the year. Cocoa Life focuses on tackling the root causes of complex systemic issues in cocoa farming. As of the end of 2024, approximately 91% of cocoa volume for Mondelēz International chocolate brands was sourced through Cocoa Life* (representing progress from 80% in 2022).

We’re focused on making our snacks more sustainably. Since 2021, we have purchased renewable electricity for six sites across the UK.

a range of great prizes

pack light and pack Right

~100% wheat volume needed for Europe business biscuits production is grown under the Harmony charter**

a range of great prizes

From 2025, Cadbury’s iconic purple sharing bars will be wrapped in 80% certified recycled plastic. This will wrap over ~300 million bars per year across the UK & Ireland, using 600 tonnes of post-consumer recycled plastic.*** That’s the equivalent of 40 double decker buses!

a range of great prizes a range of great prizes a range of great prizes a range of great prizes

* Based on a mass balance approach, which means that the equivalent volume of cocoa needed for the products sold under our chocolate brands is sourced from the Cocoa Life program. Excludes organic certified consumer offers for Green & Black’s. For more information, visit cocoalife.org.

** Goal and reported information for wheat volume sourced under Harmony is based on a controlled blending approach, which means that we aim to have a minimum of 70% of Harmony wheat in our products under our biscuit brands in Europe. For the remaining 30%, equivalent volumes for that portion are grown under the Harmony program but may not be purchased by Mondelēz International. For more information, visit Harmony.info

*** 300 million Cadbury sharing bars per year: Based on forecasted 2026 sales volumes, excluding non-certified wrappers and considering the use of mass balance material, Sept 2024. 600 tonnes of post-consumer plastic each year: This figure is the forecasted volume for the first full year on the market (2026), Sep. 2024 See our progress and

Bidfood has added a further eight suppliers to its SME scheme, Open Doors, with the number now at 23. Aimed at small food and beverage suppliers, the Open Doors Programme identifies the most innovative businesses trying to establish themselves within the industry and raises awareness of their products so they can make their mark in wholesale.

Following a three-step development journey to nurture, champion and accelerate, the initiative has resulted in seven brands being officially listed with Bidfood, along with a selection of their products.

Booker has launched a new website and app, as well as new corporate branding, which is claimed to improve the shopping experience for customers.

Targeting both the retail and catering sectors, the new platforms include visual shopping lists, personalised homepages tailored to their fascia or sector and product recommendations for pairing suggestions that complement chosen items. The website also offers smarter ordering tools, enhanced search functionality and improved print layouts for lists and favourites.

A B2B AI workshop recently discussed several wholesale-specific AI uses including the setting up of reports on local economic conditions to understand more about the territories, as well as the detection of churn of customers before they lapsed, and automating document translation.

Hosted by b2b.store, the company worked with Ramsden International’s senior team to identify the need to become more familiar with AI and tasked the software firm to educate a cross-departmental group to help them discover ways to improve productivity and deliver

b2b.store has released a report on business WhatsApp within wholesale that highlights the most innovative practices for campaign strategy

Built from data gathered from users of b2b.store’s WhatsApp Business API platform, ProConnect, the company has gleaned what works well – and what doesn’t.

By combining the read data and analysing the engagement, the software provider has created a comprehensive focus on B2B WhatsApp usage.

As one of the only global WhatsApp service providers that specialises in B2B and creates tailored features for those user cases, chief executive Rob Mannion and the rest of his team are using their experience to offer wholesalers advice. l

1. WhatsApp delivers high engagement at speed, with most reads in the first 24 hours after a message is sent.

2. WhatsApp message open rates are comfortably the largest of any other B2B communication, dwarfing email in second.

3. Targeted segmentation is worth up to 11% of message open rates within a day.

4. There is a sweet spot for message frequency when it comes to non-segmented WhatsApps to similar audiences.

5. Quality content and understanding successful strategies is the biggest differentiator.

• Supplier promotions

• Flash sales

• Business updates

• New product information

• Weekly offers

• Merchandising/category advice

• Building brand loyalty

While content of messages can’t be monitored using these metrics, the numbers suggest the following as a good plan to follow.

1. Warm up your audience so they expect a message

2. Send the first welcome on Tuesday between 2pm and 3pm

3. A friendly, straightforward message delivers 8% strong first-hour and day-one reads than more functional introductions

4. Follow up within 24 hours while attention is high

5. For open-invite lists, use a two-step warm-up, with an initial welcome followed by a value teaser before the first promotion

• Are you struggling with household bills or financial commitments outside of your business?

• Have you experienced retail crime?

If you have experienced a drop in income as a result of unexpected change, disability bereavement or illness, we may be able to support you with a financial grant as well as provide emotional support.

www.newstraid.org.uk/retailer-support-scheme/

An SWA guide has been designed to support wholesalers in understanding the risks posed by climate change and identifying actions to protect operations

Outlining key climate trends affecting the sector, the guide points out potential disruptions, as well as steps businesses can take to strengthen resilience.

By preparing for climate impacts now, wholesalers can safeguard supply chains, manage costs and explore new opportunities in a changing market.

Adaptation actions for wholesalers:

Severe weather planning

Having clear contingency plans for events like flooding, droughts, heatwaves or strong winds enables wholesalers to respond quickly to protect people, buildings and products. This may include site-specific response protocols, training for staff and early-warning systems, such as the SEPA Floodline alert service, and following the Severe Weather: Fair Work charter principles.

Working alongside staff in all areas and roles within the business, undertake a full site survey to identify any risks that may be exacerbated by climate change impacts. Use the Climate Hazards and Resilience in the Workplace site risk assessment checklist, which can be found and downloaded online.

Vulnerable customers and communities

Prioritising distribution to locations most affected by severe weather, or those likely to be affected by a forthcoming severe weather event, can ensure that locations that may be temporarily ‘cut off’, particularly those in rural and island communities, can still access vital goods from wholesalers.

Flood-resilience measures

Installing flood protection measures such as non-return valves, flood doors and waterresistant fixtures, can help older buildings withstand more frequent and intense storms. These upgrades help reduce downtime and repair costs.

management

Retrofitting passive cooling and ventilation technologies can support heat and humidity management. External shading fixtures, such as roof overhangs, and green roofing can also support heat and humidity management in both new and existing buildings.

Raised and protected storage

Elevating stock from the ground is a simple, low-cost measure to reduce damage from any flood-water intrusion. Ensuring that high-value and businesscritical assets, such as IT services, are not located in areas at risk of flooding (e.g. basements) minimises the flood risks posed.

Using sensors to monitor humidity

These can help detect potential issues early, allowing businesses to take action before stock is affected. Increasing stockpiles of non-perishable goods ahead of forecasted storms ensures continuity of supply, helping wholesalers meet demand even if deliveries are temporarily delayed.

maintenance

The impact of climate change on modern and historic buildings will depend on their condition and how well they are maintained. A guide from Edinburgh World Heritage helps you to develop a maintenance plan, and includes a checklist and helpful resources.

Supply chain resilience

Relying on just one supplier can be risky, especially if severe weather or other problems affect that area. By working with suppliers in different regions, wholesale businesses can reduce the risk of running out of stock when disruptions happen. It is not just about having more suppliers; collaborating with and supporting suppliers to build their own resilience to climate shocks is also crucial. Wholesalers can work with suppliers to improve their adaptation planning, share ideas for managing risks and encourage more climate-friendly ways of

working. A stronger supply chain benefits everyone, making sure goods keep moving even when unexpected events occur.

Investing in energy-efficient refrigeration

Upgrading to more energyefficient refrigeration and freezer units can help cut electricity bills and lower greenhouse gas emissions. It also helps keep food fresh and safe, even during hot weather, by making sure cooling systems can cope with rising temperatures.

Improving logistics flexibility

Extreme weather and other disruptions can make it difficult to stick to the usual delivery routes. Wholesalers can use adaptive route management to keep goods moving. This means using real-time traffic and weather data to adjust routes on the go, helping drivers avoid flooded roads, road closures or severe weather conditions.

During disruptions, it is also important to prioritise deliveries based on urgency and customer needs. Ensuring essential supplies reach key customers first, such as hospitals, care homes or retailers with perishable goods, can help minimise wider impacts.

Upgrading vehicle fleet

To keep deliveries running smoothly in all weather conditions, wholesalers can make practical upgrades to their vehicle

fleets. Switching between winter and summer tyre profiles ensures better grip on the roads, reducing the risk of accidents during extreme heat, heavy rain or icy conditions.

Tinted windows and improved ventilation can help regulate temperatures inside the vehicle, making long journeys more comfortable for drivers and reducing reliance on air conditioning, which in turn improves fuel efficiency.

Early warning alerts and systems

Planning ahead is also key. Incorporating the SEPA flood map into logistics systems allows wholesalers to identify highrisk areas and reroute deliveries as needed, helping to prevent delays and protect stock from damage. l

Paul Hill chats to the charity’s head of food about its work in the wholesale channel

For wholesalers who may not know City Harvest well, can you briefly explain your mission and how you work with the food supply chain?

City Harvest is the UK’s thirdlargest food redistribution charity, rescuing surplus food and delivering it to people who need it most.

Our mission is simple: to rescue food, support communities and reduce environmental impact by not letting food go to waste. We work closely with businesses across the supply chain, from farms and wholesalers to retailers and manufacturers, collecting surplus that would otherwise go to waste and redistributing it free of charge to more than 375 community partners, including food banks, schools, shelters and refugee centres.

By providing a simple, reliable way for businesses to donate surplus, we help the supply chain

reduce waste, meet sustainability goals and make a real social impact.

Where in the wholesale supply chain do you see the biggest opportunities to reduce food waste through redistribution?

The wholesale supply chain presents several key points where surplus food can be redirected. Often, waste occurs at the point of overproduction, minor quality deviations or when orders are cancelled or delayed.

We see huge opportunities at packhouses and wholesale markets, where volume, timing and stringent retailer specifications can lead to perfectly edible produce being rejected. Short-dated or imperfect stock is particularly common here.

By partnering with wholesalers, we can rescue this food

by considering perishability, portion sizes and nutritional value. Planning surplus collections in advance, communicating volumes and types, and understanding the dietary requirements of the organisations we serve helps ensure food reaches those who can benefit most. Timely, predictable donations make a significant difference to the charities and people relying on them.

Could you share examples of successful partnerships with wholesalers that have led to meaningful sustainability impact?

We have partnered with a number of wholesalers across London and the UK to collect surplus fruit and vegetables that might otherwise be wasted.

These partnerships have rescued thousands of tonnes of food, prevented tens of thousands of tonnes of carbon emissions, and provided millions of meals to families, schools and shelters. By integrating our collection process into wholesalers’ existing operations, we’ve made it simple to turn potential waste into tangible social and environmental impact.

before it reaches landfill, keeping it fresh and distributing it quickly to communities. Efficient collection from these points not only reduces waste, but also strengthens the resilience and sustainability of the entire supply chain.

What kinds of surplus food are most useful to City Harvest, and how can wholesalers better align their donations with community needs?

We welcome a wide range of fresh produce, ambient goods, bakery items, dairy and chilled products – essentially, anything safe, nutritious and suitable for immediate consumption. Fresh fruit and vegetables are particularly valuable, as they are often hardest for low-income households to access.

Wholesalers can better align donations with community needs

What misconceptions do wholesalers sometimes have about donating surplus food, and how do you address them?

Some wholesalers worry about legal liability, food safety or the administrative burden of donating surplus. Others assume the process will disrupt their operations or that only perfect-looking products are suitable. In reality, surplus food redistribution is safe and straightforward.

City Harvest provides practical support, including free collection, storage guidance and simple scheduling through our Harvest for Hunger scheme. We reassure partners that imperfect or short-dated produce can still have tremendous value for those in need, and that redistribution does not compete with paying customers.

Once these concerns are

addressed, wholesalers often become some of our most engaged and consistent partners.

Beyond food donations, what other ways can wholesalers support your work, whether through logistics, funding or sustainability initiatives?

Wholesalers can play a crucial role beyond donations. They can offer logistical support, such as providing storage space, vehicles or route-planning expertise, to help us collect more food efficiently.

Financial support through sponsorships or grants allows us to expand depot capacity, improve fleet efficiency and develop new redistribution programmes.

Many wholesalers also collaborate on sustainability initiatives, including awareness campaigns, staff volunteering and tracking waste-reduction metrics.

By integrating City Harvest into broader ESG or corporate social responsibility strategies, wholesalers can amplify their impact while demonstrating leadership in sustainability and community engagement.

Looking ahead, how do you see wholesalers playing a larger role in building a more sustainable, waste-free food system with City Harvest?

Wholesalers are uniquely positioned to reduce food waste at scale. By embedding redistribution into routine operations, planning ahead for surplus and actively partnering with organisations like City Harvest, they can prevent millions of tonnes of food from being lost each year.

We see a future where food redistribution is standard practice across wholesale markets, with surplus food viewed as a resource rather than a liability.

With support from Defra and initiatives like Harvest for Hunger, wholesalers can strengthen their sustainability credentials, reduce environmental impact and directly improve food access in communities. l

Half of all consumers are keen to taste the latest food trends when eating out, with 18--to-39-year-olds even more adventurous, and 65% keen to try the latest food craze, according to Bidfood’s latest report.

The desire to explore different flavours from around the world is one of the key trends identified by the wholesale giant in

its annual document looking at where the out-of-home market is heading.

While value, quality and “elevated experiences” are still key, emotional elements such as comfort, adventure, tradition and sharing are also driving trends, and consumers are making healthier and more sustainable choices.

Key trends highlighted by Bidfood include ‘topped’ and

‘loaded’ (dishes piled high with delicious toppings), as well as fast forward flavours (high-quality, exciting ingredients such as chilli jam, hot honey, gochujang and caramelised onion). Key global cuisines growing in popularity include Korean, Malaysian, and dishes and ingredients from South American countries such as Venezuela, Colombia, Brazil and Peru.

Lamb Weston has also pointed

to a report that suggests consumers are swapping dinners in favour of gastro snacks, as well as its own research that shows more than half of pub dinners include chips, fries or wedges.

“For 2025/26, we’re expecting growth in formats that align with the ‘anytime eating’ trend – think hash browns beyond breakfast, served up as snacks or as an integral part of a meal, not just side of plate,” explains Lamb Weston

marketing manager Ash Liles.

“Beyond this, loaded fries with bold global flavours (shawarma, gochujang, Mexican) continue to be a hit across foodservice, and we see opportunities in using potatoes as a carrier for trending concepts. Lamb Weston products that lend themselves well to loading up include Stealth Fries and our latest innovation, Frenzy Fries.”

Elsewhere, as diners become increasingly aware of the importance of a diet rich

in protein, QuornPro says it is “on a mission to become the protein of choice for chefs”. The company, while also highlighting its key mycoprotein products, such as its Vegan Beef Burgers, Kitchen Kings gluten-free range and Vegan Savoury Bites Vegan Pieces, says it is working with customers to show consumers that Quorn is for everyone.

QuornPro head of culinary, UK and Nordics Mark Wetherill says:

“We are working with our foodservice partners to make Quorn

available and accessible to everyone, whenever and wherever they are making food decisions.”

Meanwhile, Asahi UK has unveiled its Christmas marketing plans for its Peroni Nastro Azzurro brand, aimed at not only driving sales, but also supporting wholesalers and encouraging responsible drinking. A national campaign offers up prizes including Italian alpine escape, Italian hampers and delivery vouchers

for signing up to Club Peroni, with paid social ads and PoS kits for the on-trade. There’s also a 12 Pubs Of Christmas campaign across bars and pubs in London, with one of them being decided by regulars, and further bespoke activity with on-trade partners.

“We’re proud to be supporting the trade with bespoke, relevant activations and offers that will help them engage their customers at this crucial time, drive their festive sales and profits, and support responsible drinking,” says Asahi UK marketing director Rob Hobart.

Sticking with Christmas, Delice de France has revealed its seasonal range of limited-edition sweet and savoury products. For the former, it has two different doughnuts – Apple Pie and Chocolate Orange flavours – as well as three muffins, taking in Spiced Stollen, Gingerbread and Cranberry & Orange flavours.

There are also Shortcrust Mince Crowns, Puff Lattice Mince Pies and a Rich Fruit Cake, with four further festive foodservice exclusives, headed by a Christmas Pudding Baked Cheesecake.

There are also Mini Mince

Savoury-wise, there’s a Christmas Cracker Roll, as well as the return of the Pigs in Blankets Slice. After demand for stollen saw the company sell out of Stollen Muffins two weeks before Christmas last year, Delice de France has increased stock levels, as well as introducing a new pre-portioned Stollen Cake.

The bakery supplier’s chief executive, Thierry Cacaly, says: “We’re confident this year’s range is our strongest ever, and we have upweighted our availability to help customers drive sales.”

Meanwhile, Baker & Baker has launched a Christmas dough-

the company will “support our customers in driving sales during this crucial period”.

Meanwhile, in the world of foodservice buying groups, Caterforce has introduced five new products to its Chefs’ Selections Premium Collection, including seabass fillets, prawns and two desserts ahead of the festive season. The company is reducing the salt content of its Chefs’ Selection range to tie in with Public Health England’s 2024 targets, and is also cutting palm oil from the range.

JJ Foodservice has announced

plans to open a new branch in the Midlands, with a further eight branches to be added, as well as the company’s first overseas site in the Netherlands. It is also investing in a 25,000sq ft multi-temperature facility at its Enfield, north London, HQ.

Speaking at the JJ Connect conference, chief operating officer Kaan Hendekli said it was on the lookout for more locations. The company has also secured a two-year, £3m annual contract to supply councils in the northeast, taking in schools, nurseries, cafés, theatres, leisure centres, civic buildings and care services.

In Derbyshire, Holdsworth Foods is expanding, but on the fleet front, with a further 19 vehicles, taking it to more than 140 multi-temperature transporters.

Spanish food distributor Mevalco, meanwhile, is spreading its tentacles with the launch of a new premium range of octopus. It comes from two different sources – the first off the

South Devon coast in the shape of Royal Salcombe Octopus Leg and Imperial Salcombe Octopus Leg, and off the coast of Asturias, Spain, with MSC Cantabric El Viejo Pescador and Cantabric El Viejo Pescador.

And we’ll end in Belgium, with pears and potatoes. The conference pear has become increasingly popular among wholesalers as the country consolidates its position as the main pear-growing region of Europe. The UK now consumes 110,000 tonnes of pears, only 10% of which come from the UK.

“Due to their proximity, sustainability and reliable supply, Belgian conference pears are a great choice for British retailers and shoppers alike,” says the fruit and vegetable marketing manager at VLAM, Flanders’ Agricultural Marketing Board. Britain is becoming increasingly reliant on Belgian potatoes, too, and is Europe’s top exporter of the vegetable. l

Paul Hill looks at the latest developments across wholesale buying groups

Welcome to the Buying Group Briefing – a quarterly that highlights the latest trends, insights and best practices within the world of wholesale buying groups

The group has partnered with TWC for a wholesale shipments data service that will provide the buying group’s suppliers with insights into group and member performance.

This service is said to enable more informed decision making and stronger collaboration across the group, offering trade customer purchasing behaviour and category trends data.

Tom Workman, commercial director at CFBG, said: “We are excited to launch this new data service in partnership with TWC Group for our key suppliers. We want suppliers to access and utilise our members’ data to identify and unlock areas of sales growth for all parties and know that harnessing supplier support via data sharing is critical to support our ambitious growth plans.”

The recently formed group has hinted at the launch of an ownlabel range within its retail division as part of its ambition to grow wholesale membership collective turnover to £5bn by 2027.

The buying group was formed at the start of the year following the merger of Confex and Fairway Foodservice, with the new company now covering both the convenience and foodservice sectors.

“The retail own label is not confirmed yet, but we’re already working with some of our mem-

bership and suppliers to see what would be possible and if it makes sense,” said managing director of foodservice Coral Rose. “We’re going to be strategic, wait for the right opportunity and discuss with all parties first.”

The buying group already has a ‘Chef Assured’ own-brand range within its foodservice division. “Last time we looked, 85 of our foodservice range products would work in retail, so we already have some of the frameworks in place,” managing director Tom Gittins explained.

• Member-Owned Buying Group with Diversity and Focus on Growth at its Heart

• Industry Leading Promotions across all Impulse, Grocery, Food Service and Non-Food Categories

• Central Distribution and Central Invoicing Services

• Dedicated Business Development Support

• Events Calendar including two Annual Trade Shows and Overseas Convention

• Personalised Marketing Leaflets

• Full Category Support via Sugro Digital Drive Your Sales Magazine and Online Portal

• Opportunity to Join Sugro Insight Service (SIS)

• Member AI Accelerator Workshops

• Free of charge access to NIQ Brandbank images and assets

• Free of charge access to My Emissions carbon reporting platform

• Free of charge access to Trackable Overrider System

• Digital Signage and Procurement Services

The company has revealed the latest developments in its Chefs’ Selections product range, with the buying group continuing to reduce salt content in Chefs’ Selections products to align with Public Health England’s 2024 targets, as well as eliminating palm oil from further products in its range.

“We are committed to driving innovation and reformulation right across our range, setting the standard in the foodservice sector,” said Joanna Halucha, head of own brand, buying and technical at Caterforce. “Our focus is on creating products that not only align with evolving public health guidance, but also deliver on the flavour, quality and value our customers expect.”

The buying group used its first conference to get across the benefits of the buying group to delegates, explaining that members get access to brands at competitive prices and realistic quantities, while suppliers get access to members through one contact point.

Group managing director David Lunt then described how the group operates as a fully integrated business for both members and suppliers. “Through a combination of messaging techniques such as NBC Express, NDN Offers and the NBC Toolkit, the group now provides more than 7.5 million message opportunities to more than 45,000 outlets every year on behalf of our suppliers brands,” he said.

The firm has signed a service agreement with carbon data and reporting platform My Emissions to deliver Scope 1 and 2 greenhouse gas (GHG) emissions reporting across its wholesale membership. The partnership is enabling the membership to access the My Emissions platform free of charge, helping them to meet sustainability goals and prepare for future regulatory requirements.

Under the agreement, each member will be able to generate Scope 1 and 2 GHG reports, which will be in line with the GHG Protocol, the globally recognised standard for carbon accounting. Members will also have the option to add Scope 3 reporting at a discounted group rate.

Nigel Chadd is to become the new chairman of the buying group following the announcement at the company’s 59th annual conference that John Whitechurch OBE of J&R Foodservice would be stepping down.

Chadd sold his business, Chadd’s Foodsmiths, to fellow Sterling Member J&R Foodservice earlier this year. He said: “I am honoured and delighted to become chairman of the Sterling Supergroup. Sterling has been part of the Chadd’s DNA since the early ’90s. With the recent sale to our local friends and members at J&R Foodservice, this has released the appropriate time to invest in this role fully with dedication and enthusiasm.”

The buying group has published a new Food Waste Recipe Guide that offers tips, ideas and recipes to help chefs cut down on food waste while increasing flavour, texture and nutrition.

Recipes include flattened crispy croissants and crookies made from old pastries; katsu rice balls and pasta frittata for unused rice and pasta; perfect pakora, mac and cheese, potato skins and courgette cake recipes for making the most of surplus vegetables; and a selection of loaded fry and potato dishes using discarded delicacies. Specially created and tested by development chef Paul Dickson, the Country Range Food Waste Recipe Guide can be downloaded online.

The business has launched an AI academy offering to its members and supplier partners, which gives them a starting point to develop their confidence and capability in using AI through the lens of the wholesale sector.

Consisting of three courses – Fundamentals, Proficiency and Mastery – the AI Academy has been formed in partnership with AI educational platform PAIR and was announced at the Unitas annual conference. Before officially launching the Academy, Unitas trialled the approach and content with a number of wholesale members. l

The supplier explains how its innovative product is a must-stock in depots

FUMI is offering something new in the UK‘s growing nicotine pouches sector: bold colours and a range of blockbusting quick-release flavours in a variety of different strengths that offer adult consumers plenty of choice. The UK ban on single-use vapes has disrupted the smoking alternatives market, and nicotine pouches are poised to seize the initiative. With nine bold flavours and a range of nicotine strengths that caters to every preference, Swedish-made FUMI is the perfect addition to the wholesale nicotine pouch category. Welcome to the world of FUMI.

1. Premium positioning: Place high-margin SKUs at eye level to drive value sales. This simple adjustment can significantly impact your category returns.

2. Range innovation: Be first to market with new flavours. Early adoption of NPD helps establish your store as a category destination, building loyal custom.

3. Smart secondary siting: Create additional purchase opportunities by strategic placement beyond the main fixture. Till-point positioning has shown to increase sales.

4. Impactful PoS implementation: Utilise supplier materials effectively to drive awareness and create interest. Well-placed PoS can influence purchases and boost engagement.

Alastair Williams

Commercial business manager, FUMI

“FUMI’s premium pouches are proving increasingly popular with adult consumers who are looking for discretion, and who prefer nicotine products that fit into their lifestyle – whether they’re travelling, at work or enjoying their leisure activity. FUMI isn’t just another product – it’s a carefully crafted brand that carves out its own space in a crowded market. In a world that tells consumers who to be, FUMI believes in curiosity over convention, creating ‘A Space to be Exploring’.”

The chocolate manufacturer gives an overview of why wholesalers need to be stocking its products in depots

As the UK’s biggest chocolate box brand, Lindor is a must-stock. Chocolate is the biggest impulse category in the UK – bigger than crisps, biscuits, sugar and nuts – and at Christmas, boxes are the number-one chocolate gift that shoppers are looking for.

Lindor Pistachio 200g has been the number-one boxed NPD YTD1, and while initially launching in Tesco in 2024, these irresistible chocolates quickly gained immense popularity due to high public demand and had a huge initial success. Off the back of this success, Lindor Pistachio 200g has become the number-one Lindor flavour for household penetration2 .

Prioritise space and range for boxed chocolate, focusing on the most-loved brands to maximise sales. Ensure that the Lindor range is front and centre on shelf and in your front-of-store displays to signpost this valuable mission. Start with Milk 200g, Assorted 200g and Pistachio 200g as your core to unlock the value of Christmas gifting. One in three shoppers purchase Lindor in the UK3, and with Lindor Pistachio being the bestselling Lindor flavour of 2025 within convenience4, it’s a must-have addition to list within your range.

In partnership with

Alex Hillhouse Convenience and wholesale controller, Lindt & Sprungli

“We remain focused on partnering with wholesalers to deliver a tight range of must‑stock Lindor lines that support key shopper missions and grow basket spend. This matters most in the Christmas trading period; as the UK’s biggest Chocolate Box brand, Lindor is a key signpost for the gifting mission. Chocolate is the UK’s largest impulse category and, at Christmas, boxed chocolate is the number one gift shoppers seek. Prioritising availability and visibility of Lindor will help you convert seasonal traffic into premium trade‑up while keeping retailers’ fixtures simple, effective and profitable.”

The supplier lays out why its products are a must-stock for wholesalers’ alcohol ranges

“Henry Westons Vintage Cider 500ml is the UK’s numberone cider SKU – the must-stock choice for wholesalers to cash in on cider,” explains Sally McKinnon, head of marketing at Westons Cider. “Worth more than £44m in convenience sales – more than double the next bestselling product – and growing at 4.1%, it’s a proven profit driver delivering strong cash margins and dependable pull-through, with a bottle sold every 0.75 seconds in the off-trade.”

“Crafted from locally grown cider apples harvested in a single year, it delivers the authenticity today’s consumers seek. With 500ml bottles and multipack formats, including a six-pack up 139.5% year on year in convenience, Henry Westons Vintage turns shelf space into guaranteed sales, driving trade up and repeat purchases all year round.”

“At Westons, we’re here to help wholesalers unlock cider’s full potential year-round,” says McKinnon. “We offer impartial category insight, range advice and online activation support, backed by our annual Cider Report data. In depot, we drive standout with bespoke materials – eye-catching shippers, pallet wraps and at-shelf signposting that keep cider visible and sales strong. Our biggest piece of advice? Stock smart and plan ahead.

“Retailers may overlook cider at Christmas, but bestsellers like Henry Westons Vintage remain essential. With autumn and winter key for sales, wholesalers should keep shelves well stocked and visible to help retailers drive cider’s year-round appeal and category growth.”

In partnership with

Jack Seddon

Trading assistant, Parfetts

“We’ve built a strong and collaborative relationship with Westons Cider, working closely with the team to drive real value across the cider category. Its focus on quality, heritage and premiumisation has helped attract shoppers to trade up from mainstream brands, delivering consistent value growth and healthier margins for our retailers. Westons’ range continues to perform strongly year-round, offering stability alongside genuine category innovation that keeps cider exciting for consumers and relevant in the convenience channel.”

Tamara Birch

The most popular choices within the hot beverages category, according to Isabelle Fournier, head of beverages at Nestlé Professional, are cappuccino, latte, flat white, americano and hot chocolate.

“These favourites not only reflect evolving consumer tastes, but also present a value opportunity for wholesalers to optimise their beverage and drive incremental sales through a wellcurated menu,” she says.

Fournier says that the success of a hot beverage solution relies on product quality and also on seamless execution. As a result, make sure there’s clear, navigational PoS materials to ensure visibility.

It also includes investing in good-quality hot beverage products that will help consumers recreate the coffee-shop culture,

as 49% of consumers say they are visiting coffee shops less in a bid to save money.

“This trend is being proven through the immense growth within the specialities and mixes segment,” Maria Kabalyk, head of category & shopper for JDE Peet’s, says. “We have seen a yearly increase in spend on soluble specialities, gaining greater penetration than other coffee segments in the past five years. The segment is now worth more than £207m.”

As such, Kabalyk recommends wholesalers stock coffee-shop branded products, such as its Tassimo Costa range.

A focus on specialities

Part of the coffee-shop-at-home experience is the rise in demand for premium and speciality coffee, which Thierry Cacaly, chief executive of Delice de France, says reflects a broader consumer

Maria Kabalyk Head of category & shopper, JDE Peet’s

“The beverages category is filled with new innovations, upcoming brands and household names, making it a difficult category to merchandise. With so much on offer, we advise wholesalers to follow some key principles to help educate their retailers and support coffee sales.

“Firstly, allow good shelf space for a coffee display to help maximise visibility and attract more customers to your range.

“Offer a breadth of brand choice to meet evolving shopper needs with two facings per SKU. What’s more, with 80% of shoppers saying brand is the most important factor when choosing coffee, this is pivotal when choosing what to stock. Wholesalers should help retailers encourage trade-up by using our proposed planograms with more affordable options on the

bottom shelf, such as instant granules. They can then add more premium products above, and the likes of frothy coffees and machine pods on top. Finally, use eye-catching PoS to drive interest to the coffee aisle and encourage sales.

“Having a flexible instant option that works hot and cold helps maintain a strong rate of sale, such as Kenco Iced/Hot Latte Sachets.

“This product also helps retailers increase shelf space by offering a multi-purpose product, saving the need to stock multiple iced and hot options.

“As well as offering choice in different formats, we know that consumers are looking for flavoured coffee, fuelling growth within the segment, which now makes up 39% of the speciality sector.”

Text ‘CASH’ to 80800 together with the last four digits from a qualifying case of NESCAFÉ product for a chance to win £1,000. 12 PRIZES AVAILABLE TO BE WON* *T&Cs apply. Open to Wholesale shoppers/Convenience Store Owners in UK only. 12 prizes of £1000 available to be won in total. Max. one entry per Product type/per Wholesale shoppers/Convenience Store Owners. Max. one prize per person. Purchase of one of the qualifying products required to enter (retain receipt). Free entry via Text only from 01.10.25 to 23:59 on 21.12.25. See below for more details. Abridged Terms and Conditions: UK Wholesalers customers & Convenience Store Owners, 18+ only. Normal exclusions apply. Employers/employee consent required to participate. Open from 01.10.25 to 21.12.25. Purchase a qualifying case of NESCAFÉ Original £4.19 PMP; NESCAFÉ Original Decaf £4.19 PMP; NESCAFÉ Original £2.49 PMP; NESCAFÉ Gold Blend £4.79 PMP; NESCAFÉ Gold Blend Decaf £4.79 PMP; NESCAFÉ Azera £4.49 PMP; NESCAFÉ Latte £2.49 PMP; NESCAFÉ Gold Cappuccino £2.49 PMP; NESCAFÉ 2in1 £1.00 PMP; NESCAFÉ 3in1 £1.00 PMP; NESCAFÉ 3in1 Caramel £1.00 PMP; NESCAFÉ Dolce Gusto Americano PMP £3.99; NESCAFÉ Dolce Gusto Cappuccino PMP £3.99; Nescafé Caramel Latte £2.49 PMP; from a participating wholesaler and text the word “CASH”, and the four last digits from the barcode of a case of a participating product, to 80800 to be entered into the prize draw for a chance to win. Participants must retain a valid till receipt/invoice showing the purchase of a qualifying product during the stated promotional dates. 12 prizes of £1000 (payable as a BACs transfer) to be won in total across the duration of the promotion. Texts should be free of charge to send but participants may wish to check with their service provider if in doubt. Participants may enter once per qualifying product type, supported with a new till receipt/invoice showing the purchase of a qualifying product made during the promotional period. However, a maximum of one prize/win per person. Visit https://www.nescafe.com/gb/about-us/wholesaler- text-to-win-2025/terms/ for more details and full terms and conditions.

Promoter: Nestlé UK Ltd, Nestlé House, Haxby Road, York YO31 8TA

shift toward a better-quality cup.

“The addition of specialty coffee, in particular, enables wholesalers to help retailers differentiate their offer from supermarkets and discounters by focusing on quality, provenance and expertise,” he says.

Overall, shoppers are looking for a mix of consistency, quality and innovation in their hot drinks. Cacaly says customers

value specialty beans that reflect ethical sourcing and taste, and they naturally gravitate towards trusted brands or those with a clear message of quality.

“We recommend wholesalers invest in quality by moving away from generic coffee and choosing specialty or premium beans to help elevate image,” he says.

“Think like a café and aim to create an environment that will help

Nescafé Barista – Nestlé has launched two new Nescafé Barista Blends: Espresso, balanced with cocoa notes, and Signature, balanced with subtle citrus notes.

Galaxy Hot Chocolate’s winter campaign – The £150,000 outdoor campaign aims to celebrate the Galaxy Hot Chocolate range and will include roadside and PoS panels.

retailers encourage customers to pause, indulge and return.”

George Burrell, Nescafé OOH brand manager, Nestlé Professional UK & Ireland, recommends that foodservice wholesalers introduce its latest launch, Nescafé Barista, to their offering. “The launch is focused on independent cafés and quickserve restaurants (QSR), and aims to allow operators to elevate their coffee offering, while sticking with a brand that consumers know and love,” he says.

Coffee beans are driving growth in foodservice, he adds, as independent cafés and QSRs increasingly shift from instant coffee to coffee beans. He says this shift reflects a growing consumer preference for freshly grounded coffee, which provides wholesalers with an option to enhance their coffee offering and increase value.

Lipton Hot Tea – Five new flavours have been launched, including Peach Paradise, Smooth Mint, Mango Passion, Berry Bliss and Lemon Ginger Refresh.

Baileys Chocolate Sauce – The Flava People and Diageo have collaborated to launch a Caramel and Chocolate Sauce, with the product available in Booker depots right now.

“Nescafé Barista has been developed to meet this growing demand, giving independent businesses an affordable, high-quality coffee option that consumers recognise and love,” he says. “By redefining the mainstream coffee bean segment, Nescafé Barista makes freshly brewed coffee more accessible and appealing to a wider range of operators.

Wholesalers also need to help retailers communicate value in other ways, and historically, hot beverages and cold brews are largely stocked in stores as price-marked packs (PMP). Almost half (48.4%) of shoppers purchased a PMP from January to the end of March this year. Within the segment, Jimmy’s Myprotein is available as a PMP and was launched in 2024.

“The RTD protein beverages market size is expected to reach $3.68bn by 2033 and PMPs will

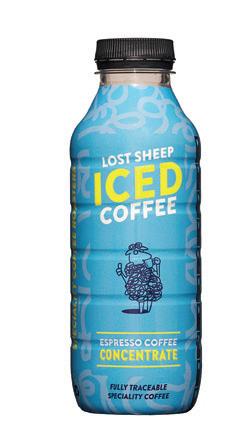

Lost Sheep Espresso Concentrates bottles – The new range of Espresso Coffee Concentrates include Pure Espresso and Caramel varieties in 500ml bottles.

Jimmy’s Caramel Waffle – The new smooth iced coffee offers a biscuity, caramel flavour to replicate the central bite of a stroopwafel. It has a £1.70 RRP for wholesale customers.

not only help wholesalers meet this clear consumer demand for on-the-go drinks, but will also help communicate value and help retailers drive footfall,” says Russell Goldman, managing director of breakthrough brands at Carlsberg Britvic.

The demand for decaf and healthier alternatives

Health is top of the agenda in a multitude of categories, and it’s the same for hot beverages, which is why consumers are opting for decaf options.

“While some segments continue to see decline, total decaf value sales have remained in growth,” says Kabalyk. “Now, the segment makes up a quarter of all instant-coffee sales, showing the opportunity for wholesalers to include high-quality decaf options in their range.”

The manufacturer has Kenco Decaf for wholesalers to stock, and Kabalyk says that offering a decaf version from a trusted brand is a must.

Also under the health mission

is offering protein coffees, as recommended by Bill Randles, managing director at SuperNutrio.

“Similar to protein-fortified snacks, vitamin-enriched waters and ‘better for you’ soft drinks have gained traction, and consumers now expect the same for their daily cup of tea or coffee,” he says.

“Health-conscious families and younger shoppers are seeking nutrient-rich extras that fit seamlessly into everyday routines. SuperNutrio milk, with its 70g of natural protein per litre, makes it easy to add protein to drinks in a way that fits into daily routines while delivering a strong taste.”

Meanwhile, Arla Foods also launched a Starbucks Protein Drink with Coffee range in Chocolate Mocha, Caffe Latte and Caramel Hazelnut varieties. It has a blend of Starbucks Arabica coffee with 20g of protein per bottle. Shoppers are adding creatine to their hot drinks, as it offers benefits in hydration, muscle cramping and injuries

1. Invest in the coffee-shop experience – Shoppers are spending more time at home – and away from coffee shops – in a bid to save money, especially as bills continue to rise. Therefore, the likes of premium hot drinks, cold brews and speciality drinks are gaining traction. In fact, there’s been an increase in spend on a year-toyear basis and the segment is now worth £207m. It also reflects a broader consumer shift towards a better-quality cup in stores, and wholesalers have a strong opportunity to invest and provide for their retailers.

2. Offering value in other ways is just as important – While shoppers are trading up towards premium options, suppliers have reported the rise in demand for PMPs. This is because, historically, hot beverages are largely available to convenience retailers as a PMP format. Consumers are looking to save money where they can, which is where PMP formats offer strong opportunities for wholesalers and retailers, with 48.8% of shoppers purchasing a PMP from January 2025 to March 2025. Showcasing value is also offering larger formats or own-label options, too.

3. Offer a healthier alternative – Health missions are at an alltime high. Shoppers are not only increasing protein, but they are becoming more educated on the ingredients they consume, right down to the hot beverages and cold brew products. The RTD protein market is expected to reach $3.6bn by 2033, according to Goldman, and many suppliers are already focusing on protein coffee drinks. This includes Starbucks, which launched a protein RTD coffee range in 2024. Consumers are also turning to decaf options in a bid to be healthier, and value sales in decaf have continued to grow. l

Tom Gockelen-Kozlowski

Confectionery is worth £8.6bn in the UK, according to Nielsen, making it an essential element of most wholesale and retail businesses.

With both chocolate and socalled ‘fruity’ confectionery in double-digit growth year on year – 13.4% and 11.7%, respectively – suppliers are keen to help wholesalers take full advantage. Here we explore the trends, launches and advice every depot manager needs to know.

Category management is king

While suppliers are busier than ever innovating, updating and perfecting their ranges, great sales in the weeks and months ahead are only guaranteed if wholesalers focus on getting the depot ranges right and providing the right support to retailers.

“Wholesalers should focus on helping retailers create clear shopper missions and pathways to purchase,” says Lauren George, external communications manager at Mars Wrigley.