Editor

Jack Courtez

jack.courtez@newtrade.co.uk 07592 880864

News editor

Alex Yau

alex.yau@newtrade.co.uk 020 7689 3358

News editor

Ciarán Donnelly

ciaran.donnelly@newtrade.co.uk 07743 936 703

Features editor

Charles Whitting

charles.whitting@newtrade.co.uk 020 7689 3350

Features & advertorial writer

Shyama Laxman

shyama.laxman@newtrade.co.uk 07395 260007

Senior designer

Jody Cooke

Designer

Lauren Jackson

Senior production & content editor

Ryan Cooper

Copy editor

Minhaj Zia

Production manager

Chris Gardner 020 7689 3368

Editor in chief

Louise Banham

louise.banham@newtrade.co.uk 07592 880864

Deputy insight & advertorial editor

Jasper Hart

jasper.hart@newtrade.co.uk 07597 588975

Reporter

Kwame Boakye

kwame.boakye@newtrade.co.uk 07597 588955

Editor

Jack Courtez

jack.courtez@newtrade.co.uk 020 7689 3371

AFollow RN on X Visit the website

Head of commercial

Natalie Reeve 07856 475788

Account director

Lindsay Hudson 07749 416544

Senior account manager

Tommy King 020 7689 3387

Finance manager

Magdalena Kalasiuniene 020 7689 0600

Managing director

Parin Gohil 020 7689 3363

new low for publishers was hit last week when Newsquest slashed retailer margins on its national papers to as low as 16.7%, even besting Reach Plc’s position as Britain’s most miserly newspaper publisher.

The common argument from publishers is that these insulting cuts are necessary due to challenges in the newspaper market. Let’s see how that stacks up.

Newsquest’s retailer margin changes come in the same year that its aptly named US parent company Gannett Media gobbled up £21.6m in dividends from Newsquest.

The year before, Newsquest paid Gannett a whopping £30m – higher than Newsquest’s entire operating profits for the period.

If there’s no money for Newsquest and Gannett to pay retailers a fair cut, I certainly know where they can find it.

The Fed described Newsquest’s retailer margin cuts as being made from Gannett’s “ivory tower”. It’s hard to disagree, especially as the Fed claims retailers were given less than 48 hours’ notice of the change.

A decade or two ago, these levels of cuts to newspaper margins would have spelled serious trouble for many stores. Today, they are met with mild frustration for most. The world of independent retailing has changed, and these products no longer sit on the pedestal of profit for most retailers.

All of this is testament to the ingenuity and resilience you have shown in evolving what your business offers.

While Newsquest and others are certainly hammering nails in their own coffins, for shop owners, the sound gets fainter with every tap.

The silver lining is the knowledge that local shops can survive and thrive even amid the slow death of a mainstay category.

It’s a good lesson to remember as the Tobacco and Vapes Bill continues its progress through parliament this week.

3 INDUSTRY NEWS

Stores accuse distributor of Pokémon betrayal

Free AI tool for shop owners prevents underage sales

5 SYMBOL NEWS

Inside SimplyFresh’s new store format

6 NEWSTRADE NEWS

Morrisons sells newspaper delivery customers to NewsTeam Group

7 YOUR VIEWS

‘Please help solve my missing scratchcard mystery’

8 PRODUCT NEWS

The 10 top new products worth £116 missing from your aisles

12 PRICEWATCH

£1,400 extra profit on top-selling rums with these five price changes

14 STORE PROFILE

Hot food, a beer cave and regional lines are driving this shop’s success

16 FED FOCUS

How the Fed helped Hamalata Patel overcome a tough start in retailing

17 BUILDING YOUR GROCERY RANGE

Discover changes that will win extra spend from your shoppers

21 BETTER RETAILING FESTIVAL

Future-proof your store with the top lessons from this year’s event

30 PRICE-MARKED PACKS

Retailers share their tips for balancing prices and margins

33 INDUSTRY PROFILE

Why KP Snacks has gone nuts for darts

34 HOME DELIVERY FIRMS COMPARED Every major platform’s terms and fees

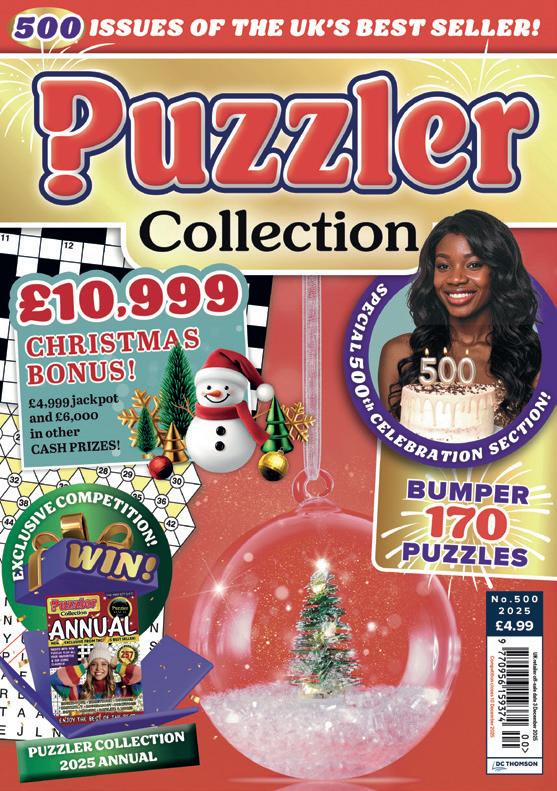

37 THIS WEEK IN MAGAZINES

Unlock extra sales with Puzzler Collection’s 500th edition

by Ciarán Donnelly ciaran.donnelly@newtrade.co.uk

Shop owners have accused Pokémon and its official distributor Asmodee of cutting supply to independents in favour of more major chains that recently started stocking the brand.

As shown by RN’s exclusive sales data on page 8, Pokémon’s Mega Evolution collection, released on 10 October, is the top-selling new product across thousands of independent shops.

However, both Smiths News and InPost Distribution have placed unprecedented caps on shop owners’ orders, leaving them unable to meet demand. In some instances, retailers’ orders were cut at short notice. Several retailers also reported being turned away by Asmodee. An email from Asmodee, seen by RN, stated: “We have currently reached capacity of new accounts, so we are no longer accepting new registrations.”

Despite blocking supply to independents, shop owners claimed Asmodee simultaneously began sending Pokémon stock

to more retail chains. One retailer told RN: “I was fobbed off by Asmodee, who said they aren’t looking for more partners, but suddenly supermarkets like Tesco are doing a bigger range – and even Currys and Sports Direct are getting hold of stock.”

Mark Dudden, of Albany News in Cardiff, also noted that shorter supply of Pokémon cards to his store coincided with more stockists appearing. He said: “All the Tesco Expresses and everything around me were all sent one or two boxes. They’ve never sold them before. They’ve just put them on the shelves with all their newspapers”.

Many shop owners spoken to by RN said their biggest frustration was the prioritisation of these new groups over loyal independent retailers that had supported the Pokémon brand for decades.

For instance, Dudden took “about £6,000” over a year from Pokémon’s previous Evolving Skies series, but only £1,000 from the latest collection, as he ran out of stock in a matter of hours. He commented: “It’s frustrating for an agent like me, who has been massively strong with collectables historically. Now I can’t get the support, but that’s the nature of the beast.”

“Sounds like a stitch-

up,” said another shop owner, who received just four boxes of Pokémon card packs this year, despite attempts to order from their wholesaler.

Asmodee and The Pokémon Company failed to respond when asked whether major chains were receiving preferential treatment.

While most stores have been unable to secure more stock of the latest collection, many have reported that older Pokémon collections are also selling out. Wholesalers supplying these collections include InPost Distribution, Smiths News, Bliss Distribution and Plus Marketing.

Convenience store owners have ranked trading standards, councils and police authorities as some of the least-trusted sources of advice, according to new research.

A recent survey by MTJ PR – which represents leading brands including AG Barr and Kepak – asked shop owners to rank the trust they place in information from police forces,

local councils, trading standards, wholesalers, trade bodies, trade press and leading brands.

Two in five shop owners put local government in last place, one in four gave trading standards the lowest ranking and one in five named the police as their least trusted source of information.

At the top end of the rankings, 58% of stores

listed suppliers in their top three sources of information, 62% named trade bodies, 67% did the same for their wholesalers and 75% put trade media in their top three choices.

The low rankings for public authorities come as shop owners struggle with a litany of related issues, including recordhigh rates of shop theft, recent and upcoming

Spar UK Rewards is rolling out across hundreds of stores across the north of England, with tens of thousands of customers estimated to have downloaded the app.

More than 250 Spar stores supplied or owned by wholesaler James Hall are now offering rewards and points through the app. An estimated 20,000 customers are thought to have downloaded the app, nearly 10 times as many as in early September.

Jonathan Collinson, of Spar Scorton in Lancashire, told RN: “The early signs are promising. It’s having a positive impact on customer spending and frequency as well.”

One app user reported going to Spar “most days of the week”, while another reported spending £60 in a single visit.

James Hall confirmed the rollout and said the app had seen an “encouraging start”.

tobacco and vaping restrictions and changes to business rates relief.

Shop owners urged brands to play an active role in tackling these issues. MTJ PR director Claire Murgatroyd said: “They want brands to move beyond just talking about their own initiatives and engage in the issues they care about, like crime and legislation.”

Booker symbol retailers, including Premier, Londis, Budgens and Family Shopper, will gain access to faster delivery services through Just Eat Go after the platform agreed a partnership with Tesco. The deal means Tesco’s Whoosh service will run through Just Eat Go. One Stop stores will also be included.

Tom Baxter, commercial director for Just Eat Go, said the partnership will benefit a “diverse range of retailers utilising our service, from community retailers such as One Stop to big brand grocers”.

Retailers face increased competition for parcel services after Evri and Asda agreed a deal to install ParcelShops in all 1,200 Asda stores by April 2026.

The rollout will enable customers to collect and return parcels from thousands of retailers at their local Asda store.

The service is already available in more than 300 locations, including Asda Express sites and selected supermarkets.

The move follows Evri’s £50m investment, announced in June 2025, to double its network of ParcelShops and lockers to 25,000 by 2030.

However, retailers near Tesco stores could benefit as the supermarket’s 1,200 Evri lockers are discontinued to make way for the Asda estate.

Tesco said it is yet to announce end dates for Evri services at specific branches, after first launching with Evri in 2021.

The government has launched a redress scheme for postmasters affected by faulty Capture accounting software that was used in branches from 1992 to 2000.

As the predecessor to the Horizon IT system, Capture was also found by an independent investigation to have “created financial shortfalls for postmasters”, the government said.

Postmasters who worked prior to 2000 can apply for a preliminary payment of £10,000, as well as a “final award” based on individual circumstances.

by Jack Courtez jack.courtez@newtrade.co.uk

A free AI-powered agechecking tool is now available for all shop owners, helping them to prevent underage sales and diffuse confrontations at the counter.

Newly launched app AgeGate Pro can be installed on Android devices such as phones or tablets.

When positioned at the counter, it uses the device’s camera to check customers’ ages and sound an alert if they are likely to be under 25.

The app was developed by vape industry expert James Van Aalst, who has worked for a vape magazine and industry body.

He told RN: “It’s trained on around 250,000 faces. It sits there throughout the day flagging up if someone is under 25.”

While similar tools such as MyCheckr are already available to shop owners, AgeGate Pro is the first free system.

“Many convenience stores are just about breaking even at the moment; they’re not Tesco, they don’t have the deep pock-

ets to invest in the other options,” said the founder.

Asked how stores will benefit from the app, Van Aalst said: “I’ve been involved in test purchasing. I’ve seen the look of fear on the shop assistant’s face when a group of youths attempt an underage purchase.

“There’s that threat of conflict underneath that can discourage people from challenging someone on their age.

“Tools like AgeGate Pro help take away the fear and potential conflict. The shop assistant can simply defer to the technology and say, ‘I’m sorry, the machine has said I need to check your ID. I’ll get in trouble if I don’t.’”

Updates to the app are also on the way, including a flashing light visible only to the shop assistant to also indicate potential underage customers.

Another update will introduce an age challenge log, helping shop owners to check staff compliance and to fulfil their alcohol licence objectives.

Van Aalst said the new app is already in operation in a vape shop and a

convenience store. Asked how the free app will be sustainable for him to run, the founder said a longer-term ambition is to charge brands for displaying adverts and promotional messages to customers on the devices’ screens in stores.

What do you need to set up AgeGate Pro in your store?

The app does not store any customer data or images, does not require internet access once installed

and is “completely GDPR compliant”, according to the founder.

The retailer’s device and the app work best when mounted on the counter using a desk or car phone holder, which are available for less than £10.

If the retailer does not have a spare Android device, these can be purchased for as little as £40.

l Store owners can find the app by searching ‘AgeGate Pro: Smart Age check’ on the Google Play store

Vape products could be subject to a minimum legal price of £30 under a proposals to the Tobacco and Vapes Bill that was heard as the bill was debated in the House of Lords this week.

Retailers could be also required to use age-verification technology under one proposal tabled as RN went to print.

The third scheduled day of Committee Stage

on 3 November saw amendments suggesting warning notices for shops caught breaking the upcoming law for the first time instead of fixed penalty notices, as well as a ban on the supply of cigarette filters in England and Wales.

Lords also reiterated broader calls for “an impact assessment before further regulation” of tobacco, as well as

clarification on how the government will define a vape flavour.

The Lords had previously tabled amendments, including raising the age of sale for all tobacco products to 21 years until the ‘Smoke-free Generation’ law comes into place, and a ban on manufacturing high-strength oral nicotine products.

During the first day of debate on 27 October,

Conservative peer Lord Bethell proposed a complete ban of all tobacco products from 2040, regardless of customer age or shop licences.

Retailers could benefit, however, from a proposed criminalisation of all online sales of tobacco, proposed by Lord Young. All amendments will be debated for three more scheduled days, ending on 17 November.

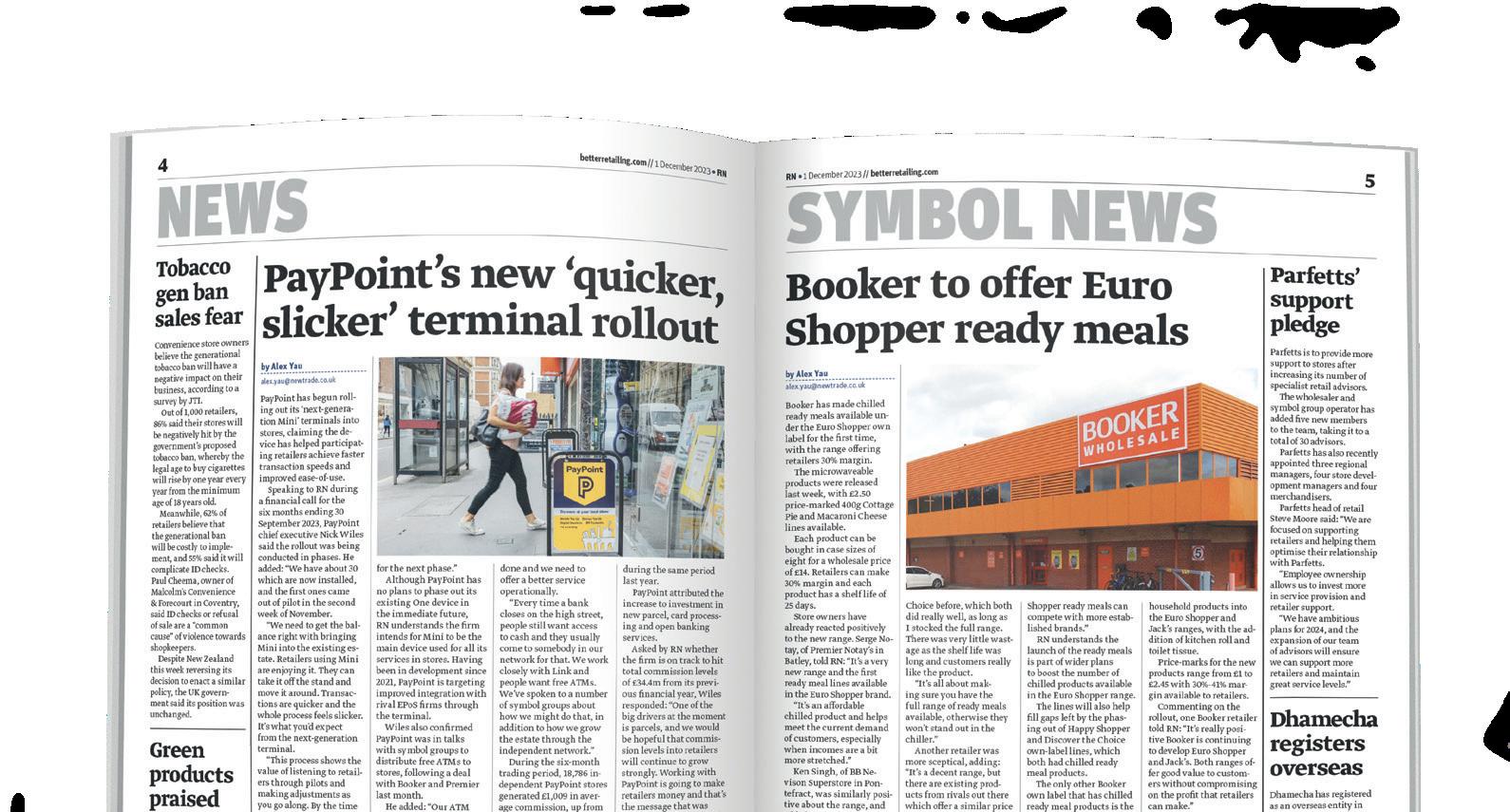

by Alex Yau alex.yau@newtrade.co.uk

SimplyFresh has undergone a major rebrand, with the symbol group’s new direction to “redefine the future of convenience retailing”.

The company launched its flagship store under the rebrand on City Road in central London on 31 October.

Run by SV Retail, it adds to the operator’s 13 stores across England.

It represents a new brand direction for the symbol group, with the colour scheme and layout brighter than previous sites.

Standout features of the 2,000sq ft site include food to go, digital screens and freshly baked goods as well as supermarketstyle segmenting and signposting of product categories including proteins, ready meals, frozen foods and desserts.

Ambient goods are situated in the middle of the store, while a large alcohol range is displayed towards the back.

It also marks the potential revival of the SimplyFresh food hall concept, which enables

independent fresh food operators to have stalls within the stores.

A fresh-sushi maker is to offer its services at the site within the coming months.

The store is located below luxury new-build apartment blocks, as well as offices and major transport links.

A range of healthier products caters to healthconscious consumers frequenting nearby premium gyms.

SimplyFresh store development director Michael Boakes told RN the store was one of a few to have been rebranded, with more to follow in the coming months.

The rebrand has been in development since February.

SV Retail co-founder Ashok Trada told RN the new shop will be unlike any other convenience store. He added: “It’s taking urban convenience forward and will enable us to compete with the likes of Marks & Spencer and Waitrose.”

Commenting on the new concept, SimplyFresh founder and chief executive Kash Khera told RN: “When SimplyFresh first entered the sector, we transformed how retailers and shoppers saw convenience in our store design.

“The timber tones,

natural materials, and darker palettes that are now standard across all symbol groups and multiples alike all started with us.

“Our new store on City Road, London, represents the next evolution of SimplyFresh – lighter, brighter and more welcoming.

“It’s a space designed around modern shopping habits, blending great design with the efficiency and freshness our customers expect, and that is still relevant for the next 10 years.

“We’re proud to be redefining what the future of convenience retail looks like once again.”

EPoS company ShopMate has partnered with wholesaler United Wholesale Grocers (UWG), expanding its presence throughout Scotland.

Partnered stores using the system will get instant updating of stock levels and pricing, digital media screens and centralised promotions, helping to reduce time dedicated to administrative tasks.

ShopMate managing director Brian Eagle-Brown told RN the partnership represents wider plans for the company to expand throughout Scotland.

UWG retail director Tom Slaven added: “Our retailers are front and centre of our business and we need to ensure we have the right support and tools to enable them to have a best-in-class conveniencestore operation.”

The partnership with UWG adds to ShopMate’s relationships with other major wholesalers, such as Booker and Parfetts.

Southern Co-op is looking for a new head of its Welcome franchise due to the upcoming departure of Mike Fitton.

More than £6m owed to 200 suppliers by collapsed wholesaler SOS Wholesale is not expected to be paid back, a new report has revealed.

The report by administrators Interpath revealed the wholesaler, one of the biggest discount suppliers to the convenience sector, owed more than £10.5m to suppliers, lenders and the company’s founders

at the time of its collapse. Interpath stated cashflow and lending issues had contributed to SOS Wholesale’s eventual demise. It said: “In FY24, the company generated £42.7m in turnover, delivering a profit before tax of £1m.

“While gross margins have softened over time, the business remained profitable and maintained

a positive net-asset position. However, liquidity pressures intensified in FY25, with cash reducing from £1.9m at October 2024 to £516,000 by May 2025.”

Following the issues, Interpath was appointed to review SOS’s cashflow forecast. However, a “worldwide freezing order” was imposed on the company, prohibit-

ing it from disposing or dealing with assets on a worldwide basis. This meant SOS was unable to complete a refinancing process with its lenders. Despite its collapse, wholesaler Dairyfresh purchased SOS Wholesale’s assets last month, allowing it to continue providing services to affected retailers under the SOS brand.

The industry veteran will retire in January after spending 14 years with Southern Co-op.

His successor will be responsible for “growing and expanding the Welcome franchise” and “overseeing operational performance and brand standards to maximise sales and profitability for franchisees and Southern Co-op”.

Local publishers are protesting plans to remove the mandatory requirement for alcohol licencing notices to be placed in local newspapers.

From 30 October to 3 November, “hundreds” of weekly local papers ran ‘Defend Your Right to Know’ cover adverts attacking the plans, which would cost publishers millions in lost advertising revenue.

The consultation on licencing reform closed on 6 November. A government taskforce had described mandatory ads for premises licence applications and full variations in England and Wales as “serving no meaningful purpose” except helping publishers.

However, the News Media Association said the plans would “shroud the sale of alcohol in local communities in secrecy”.

Thousands of shop owners will no longer be able to check how their local newspaper is performing after publisher National World withdrew more than 200 of its titles from public auditing.

The publisher of the Express & Star, Yorkshire Post and The Scotsman said it had abandoned its Audit Bureau of Circulations (ABC) membership because of ABC’s focus on print circulation.

National World was the subject of a hostile takeover earlier this year. New owner Media Concierge also announced plans to change National World’s name to Iconic Media.

by Jack Courtez jack.courtez@newtrade.co.uk

Morrisons has sold its home newspaper delivery (HND) rounds to NewsTeam Group (NTG) for an undisclosed sum.

The deal affects the 25,000 households which received newspaper and magazine deliveries from the supermarket each week. All of these customers will be automatically moved over to NTG supply by 9 November.

Morrisons, which inherited most of these rounds when it acquired McColl’s in 2022, described ceasing its newspaper deliveries as a “difficult decision”.

A spokesperson for the supermarket added the sale to NTG would “protect the service for customers, including vulnerable customers, who rely on their daily newspaper delivery”.

Letters sent to customers by Morrisons said the change would bring a “positive impact” as NTG has “a faster reliable delivery service”.

The supermarket made many of its newspaper delivery staff redundant as part of the sale, though

some transitioned to working for NTG. NTG said the deal would create jobs in the UK, highlighting that onboarding the Morrisons customers had resulted in 130 new NTG rounds.

The agreement with Morrisons means every national retailer that had HND rounds has now sold up to NTG.

Describing the impact of the Morrisons deal, a spokesperson for NTG told RN: “This takes our UK geographic coverage to 87% and our run-rate turnover to more than £100m – that’s up from £20m per year four years ago and we have no intention of stopping here.”

NTG also revealed it has added a further 2,500 customers this month

by acquiring Kent and Sussex HND firm Garners News, with former owner William Garner taking up a board seat on NTG’s Cypriot parent company Suonal as part of the deal.

What the deal means for shop owners

NTG said its growing number of deliveries would also support its ambition to expand the number of stores it supplies with newspapers and magazines. The NTG spokesperson said: “The synergies from having HND and supplying retailers in one organisation are really clear.”

Some independent HND providers also stand to directly gain from NTG’s Morrisons deal. RN understands NTG has part-

nered with some larger independent HND agents to deliver to customers in areas NTG does not currently reach, especially in south-east England.

NTG is now the only national HND service provider, and it has a significant share of publishers’ all-important print subscribers.

One analyst described NTG as a “friend and foe” relationship with publishers and wholesalers.

It gives publishers greater security over a continued supply route, but also gives NTG unprecedented negotiating leverage, potentially enough to upend the decades-long tradition of retailers being forced to begrudgingly accept worsening commercial terms.

Wholesalers and publishers are exploring ways to solve retailers’ newspaper voucher crediting concerns.

The Press Distribution Review Panel’s September meeting discussed how “changes in voucher practices and the introduction of electronic vouchers” had “amplified” the “contentious issue”.

Trina Passmore, of Pass-

mores in Yeovil, Somerset, explained: “Some weeks, Smiths News processes vouchers two weeks behind, then it processes two lots at once. Late voucher processing was rare until this year, which has been a nightmare.”

The Fed, Smiths News, InPost Distribution and publisher representatives attended the meeting, and discussed three potential

changes.

The first would give shops a rolling accounting statement listing credits received and due.

The second is a quicker method for challenging voucher issues that “avoids” making formal complaints, which give wholesalers 28 days to respond.

Lastly, the meeting said publishers should

“reconsider” late voucher rejections caused by “consumer issues”.

Fed news operations committee member David Robertson said his wholesaler’s service is currently “outstanding”, but accepted longer waits for credits could cause issues for some stores. He urged shops to treat vouchers “like cash” and have firm processes for returning them.

For many months now, I have been missing various scratch cards from Allwyn, and I cannot understand why. Some I have never had an allocation of, others are good sellers, yet have not been replaced in a timely manner.

This results in a number of windows of my unit being empty and this obviously has a detrimen-

tal effect on my turnover and also, I believe, on my profits.

I would like someone, anyone, at Allwyn please to either sort it out or at least give me an explanation as to why I am being shortchanged on the delivery of scratch cards.

Jim Moorhead Top Cards, Johnstone, Renfrewshire

An Allwyn spokesperson said: “Allwyn colleagues have now spoken with Mr Moorhead to let him know how they’ve resolved this for

Pete Cheema, chief executive, SGF

The UK Department of Health and Social Care recently launched a call for evidence on measures included in the Tobacco and Vapes Bill. The department’s call for evidence covers areas such as the substances, ingredients and flavourings used in vapes and nicotine products; nicotine levels and the size, shape, design and appearance of vaping devices, as well as the call to establish a UK licens-

ing scheme. Though the latter will not apply to Scotland, which has its Register of Tobacco and Nicotine Vapour Product Retailers, which may be updated somewhat.

SGF recognises that nicotine vaping products are a critical cessation aid for those who wish to quit smoking.

Our members in convenience stores across the country have previously told us that their customers say that the

The past week has been busy, especially with children in the run-up to Halloween. It’s a fantastic opportunity to decorate the store and engage with brands to launch activations around Halloween themes, or else just decorate to bring some extra theatre to the shop. The kids absolutely love it – anything with pumpkins, cobwebs or a bit of spooky music seems to go down well. Parents often pop in for last-minute bits like sweets for trick-or-treaters or a few cans for their own get-togethers, so it’s a nice boost for sales, too.

him, and he is happy with the outcome. The reason he wasn’t getting the newest Scratchcard games had to do with a delayed delivery – it looks like the stock has been held up at a depot –and the fact that the store still had some older games on sale and these were still showing as active in our system. These have now been amended in the system to enable new games to be sent. The team has placed a special order for him, which includes the replacement games plus additional packs to ensure they get back to a full dispenser. These will be landing in store very soon.”

range of flavours – and finding one that works for them – has been the key factor in them stopping smoking. If those flavours are not there, it will reduce choice and potentially make it more difficult for smokers to quit, if they wish to.

It then raises the scenario where any restrictions on flavours could drive even more people to access harmful illicit vape products.

This would directly hit hard working, responsible community retailers who could see a drop in footfall as a result and therefore impacting their ability to run viable stores and to provide key local, valued services. Ones which all sections of our communities benefit from.

These are challenging

There are a couple more awards events coming up, which we are looking forward to. It’s always good to see what others in the industry are doing and share ideas. Ever since our refit, it is important to continue to assess how new features are performing. The new chiller layout has made a noticeable difference. We’re learning as we go, making tweaks to the flow of the store and seeing what works best.

Bonfire night was another opportunity to bring some seasonal themes to the shop. It was important to tell customers to stay safe with fireworks and for any shops that sell them to always be aware of safety precautions and rules around stocking them.

times for convenience stores through cost shocks caused by the increase in Employer National Insurance contributions, National Living Wage, supply chain costs, not to mention energy bill hikes.

SGF advocates for a balanced regulatory approach that protects public health while supporting the adult smoking cessation effort and recognising the role the vaping category must play. Any future action by government must therefore be evidenced and balanced, or risk public health objectives and the viability of the convenience sector, which is the embodiment of the everyday economy.

The call for evidence is open until 3 December.

you be stocking health and fitness lines ready for the new year?

by Jasper Hart jasper.hart@newtrade.co.uk

Pokémon Mega Evolution is the best-performing new line in stores, surpassing brands such as Topps Match Attax and Pringles.

According to RN’s exclusive sales data from around 13,000 stores, the trading cards are offering the highest average sales per week among stores stocking them, but distribution

is low. In fact, across the top 10 new products, only two – Pringles Santa’s Secret Flavour and Galaxy Miniatures Smooth Milk & Caramel Pouch – are stocked by at least 20% of stores.

Additionally, Pokémon Mega Evolution is the only launch seeing double-digit weekly sales. Its £75.81 is more than eight times higher than Match Attax Season 2025/26, indicating both the high demand for

sales and the difficulty retailers are having getting hold of stock. This marks the third time a Pokémon launch has topped the charts this year.

Snacks and confectionery account for five of the top 10 products, and festive lines causing early excitement for the season are also represented by Pringles and Terry’s.

The average shop stocking all 10 lines achieved £116 in extra weekly sales.

Pokémon Mega Evolution

Topps Match Attax Season 2025/26

Sterling Dual Double Capsule Xtra Yellow PMP

Pringles Santa’s Secret Flavour 165g

Galaxy Miniatures Smooth Milk & Caramel Pouch 260g

Terry’s Chocolate Caramel Ball 145g

Smirnoff Crush Lemon & Lime 440ml

Smirnoff Crush Mango & Peach 440ml

Doritos That’s Nuts Chilli Heatwave 160g

Wotsits That’s Nuts Really Cheesy 160g

American energy drinks brand Ghost Energy has set its sights on growth in the UK convenience channel after securing major listings. Since launching in the UK in July, the brand has secured a distribution partnership with World of Sweets and is available from Scotmid Co-operative and Motor Fuel Group stores. Current available varieties include OG Original, Blue Raspberry, Cherry Limeade and Warheads Sour Watermelon.

RRP £2.25 (500ml)

Delice de France has unveiled its winter range of limitededition sweet and savoury products, and is increasing stock levels of popular sellers to help retailers maintain availability this Christmas. New products include Apple Pie and Chocolate Orange Doughnuts, and Spiced Stollen, Gingerbread and Cranberry & Orange Muffins. Stock levels of Stollen and Gingerbread Muffins have also been increased.

Available now

JTI UK has launched Nordic Spirit Frosty Mint Max, a 17mg variety that is the brand’s strongest nicotine pouch to date. It is available now from wholesalers and symbol groups, as well as the supplier’s retailer platform, JTI 360. The launch also marks the debut of Nordic Spirit’s new pack design for Max, with ‘dialled-up’ design elements and a darker colour scheme to make the packs stand out on shelf.

RRP £6.50

STG UK is continuing to expand its XQS nicotine pouch range with the launch of Cola Lime and Fizzy Peach varieties, exclusively available from Vape Supplier. Both varieties have an 8mg strength. The addition of these two flavours brings the total number of XQS variants in the UK to 11 since it first launched in April 2024. STG UK’s head of marketing, Prianka Jhingan, said they catered to growing flavour trends.

RRP £5.50

Imperial Brands has extended the availability of its Paramount value cigarette brand to Northern Ireland after a successful rollout in the rest of the UK. According to the supplier, Paramount has become the fastest-growing cigarette brand in the UK in 2025, achieving more than 5% market share in independent stores, while the value sector has grown in Northern Ireland by 18% in the past year.

RRP £12.50

Jimmy’s has added a limited-edition Caramel Waffle variety to its ready-to-drink (RTD) iced coffee range, available to convenience retailers via the brand’s online B2B wholesale platform. This follows the brand’s limited-edition Donut variety launched in May this year, as Jimmy’s seeks to use a seasonal offering to build on its status as the UK’s fastest-growing RTD coffee brand.

RRP £1.70

Casillero del Diablo has entered the sweeter red wine segment with the launch of the Jammy Red Devil variety. A blend of shiraz and carménère, it aims to tap into the growth of the ‘jammy’ red blend segment, which is worth more than £200m. Supplier VCT Europe said this style is popular with both under-30s and over-60s, giving retailers a product with dual age-group appeal.

RRP £8.50 Available from Bestway, Unitas, AF Blakemore

Heineken UK has rolled out a £2.4m campaign for premium Italian lager brand Birra Moretti. The campaign includes a new TV advert, out-of-home activations and limited-edition packaging which features on 10x330ml, 12x330ml and 18x330ml multipacks of Birra Moretti L’Autentica. In the final four weeks of 2024, Birra Moretti generated £24.5m in offtrade sales, up by 4.2% annually.

Campaign spans TV, out-of-home, packaging

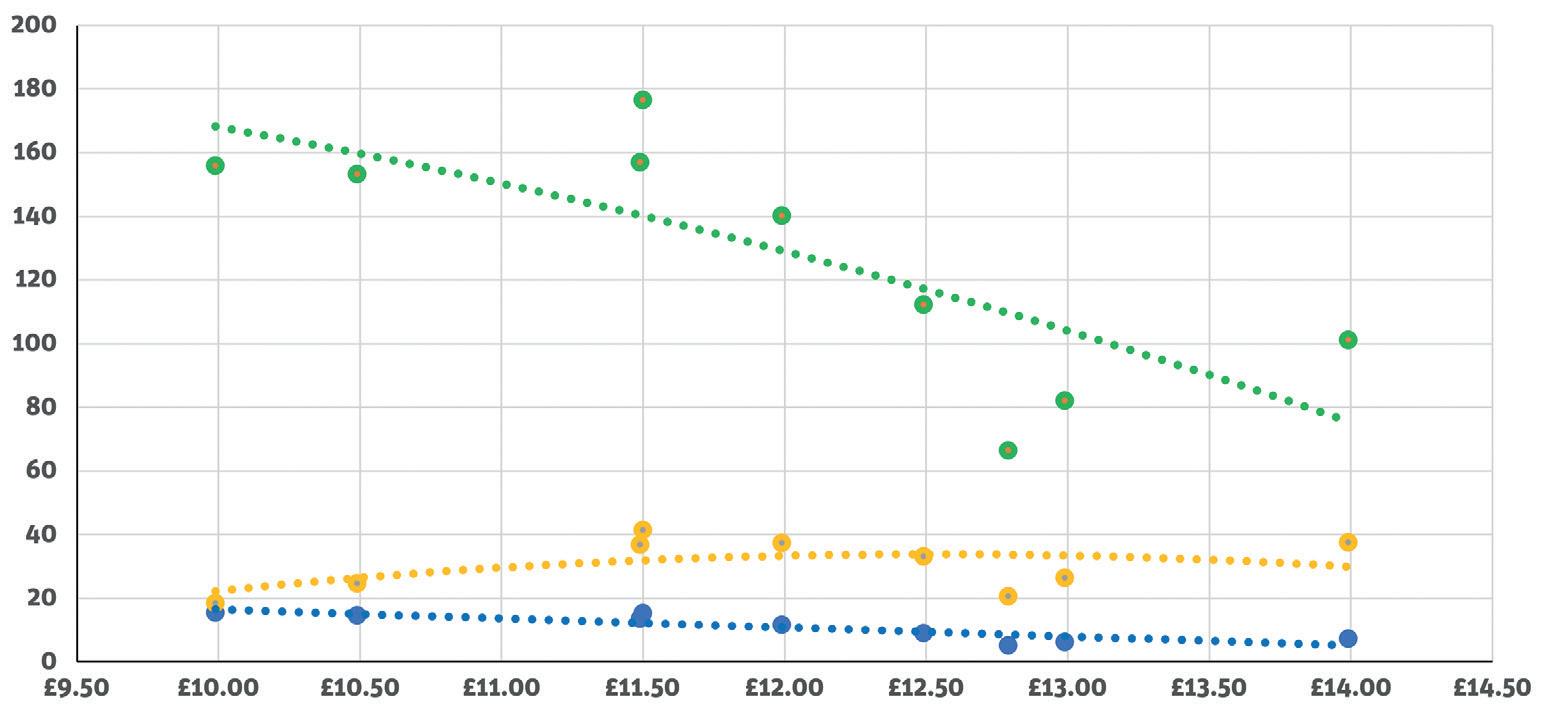

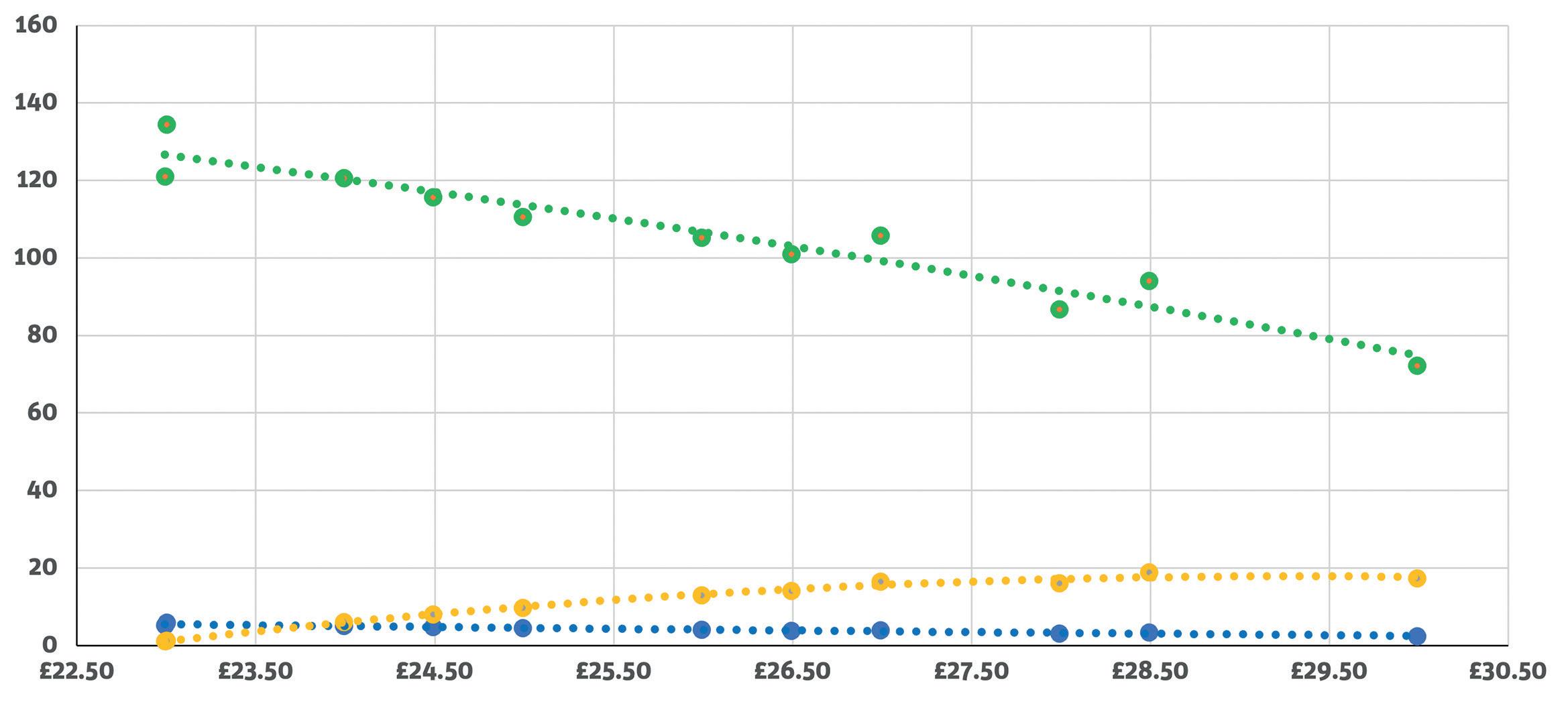

£11.50 delivers best weekly profit (£41.54) and best weekly revenue (£176.58)

Price with best rate of sale (£9.99) delivers £18.66 profit per week

Wholesaler RRP (£12.99) delivers £26.51 profit per week

£15.03 difference between best weekly profit and profit at wholesaler RRP CAPTAIN MORGAN

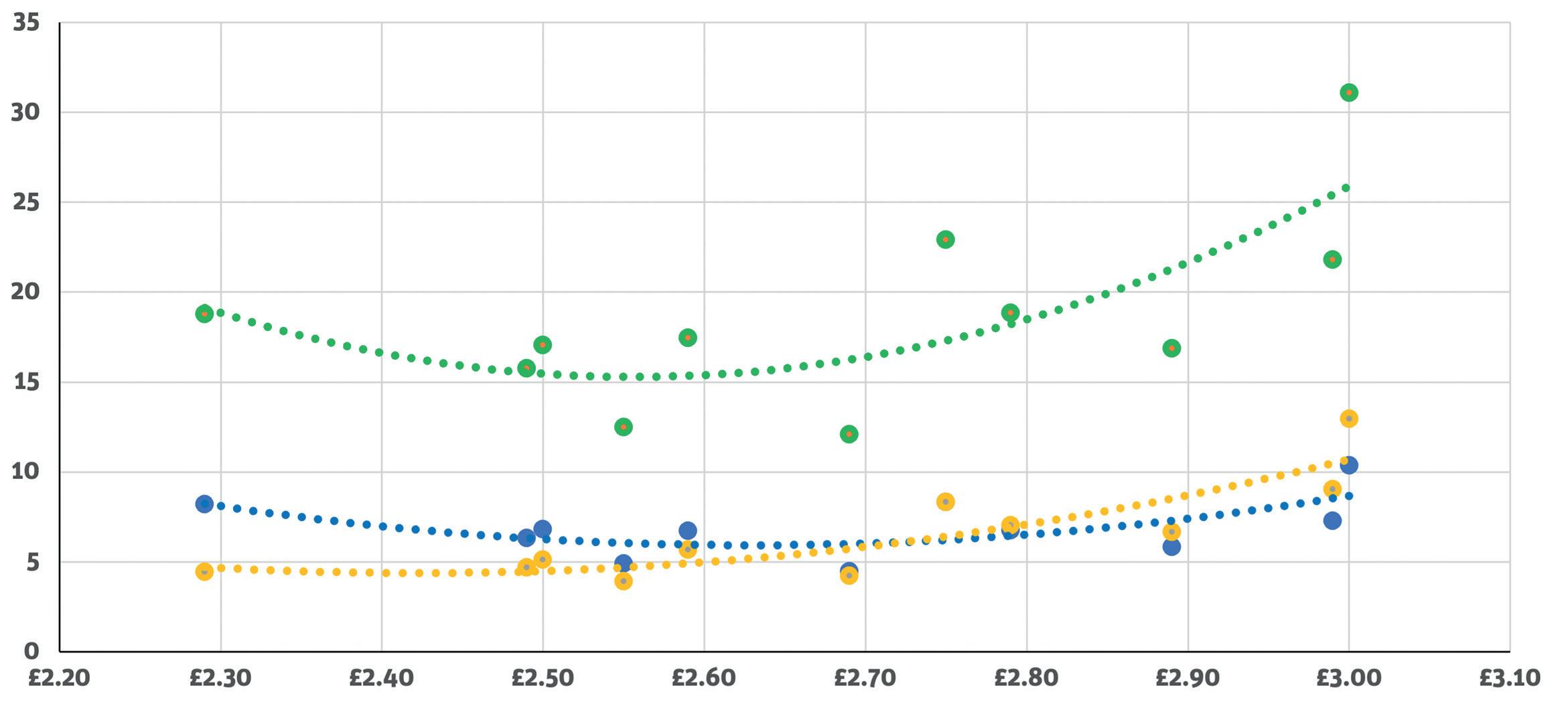

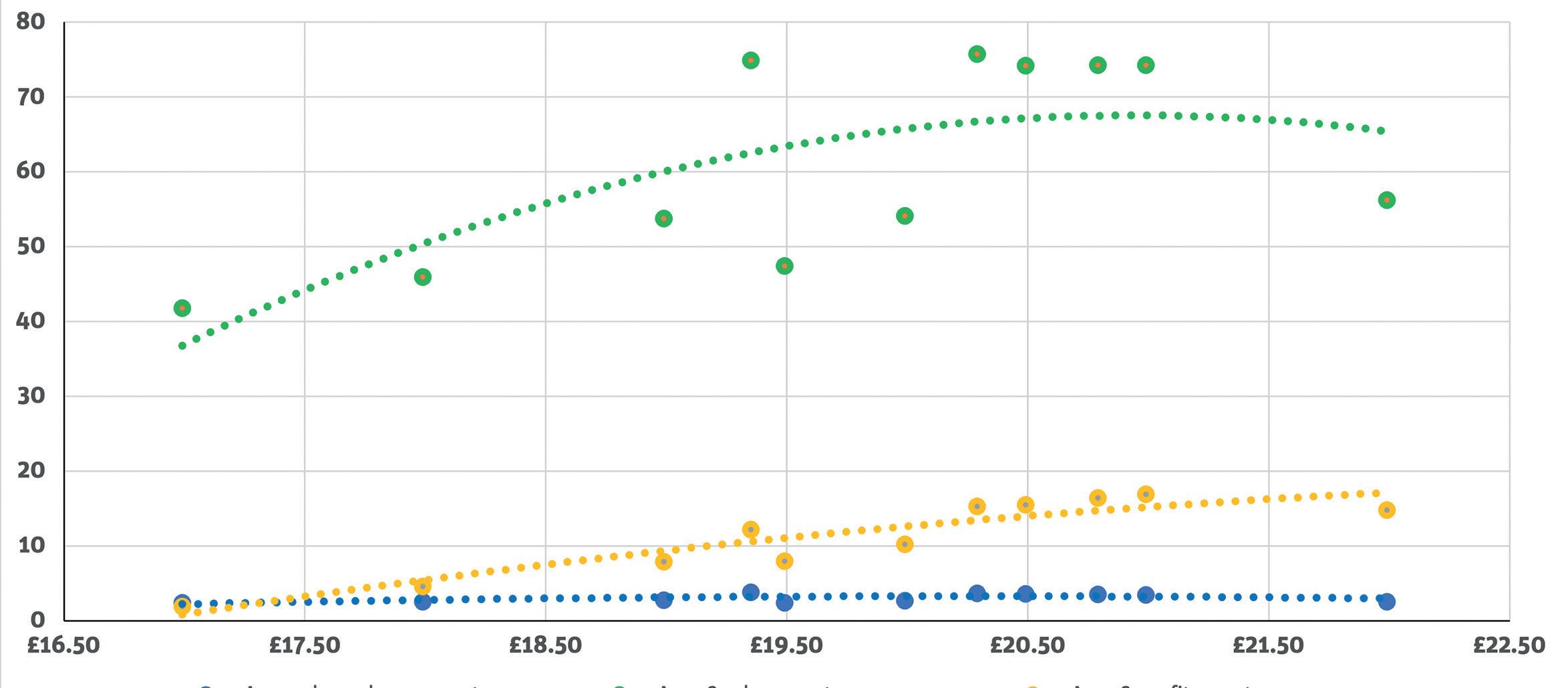

£3 has best rate of sale, and delivers best weekly profit (£12.96) and best weekly revenue (£31.07)

Wholesaler RRP (£2.75) delivers £8.34 profit per week

£4.62 difference between best weekly profit and profit at wholesaler RRP

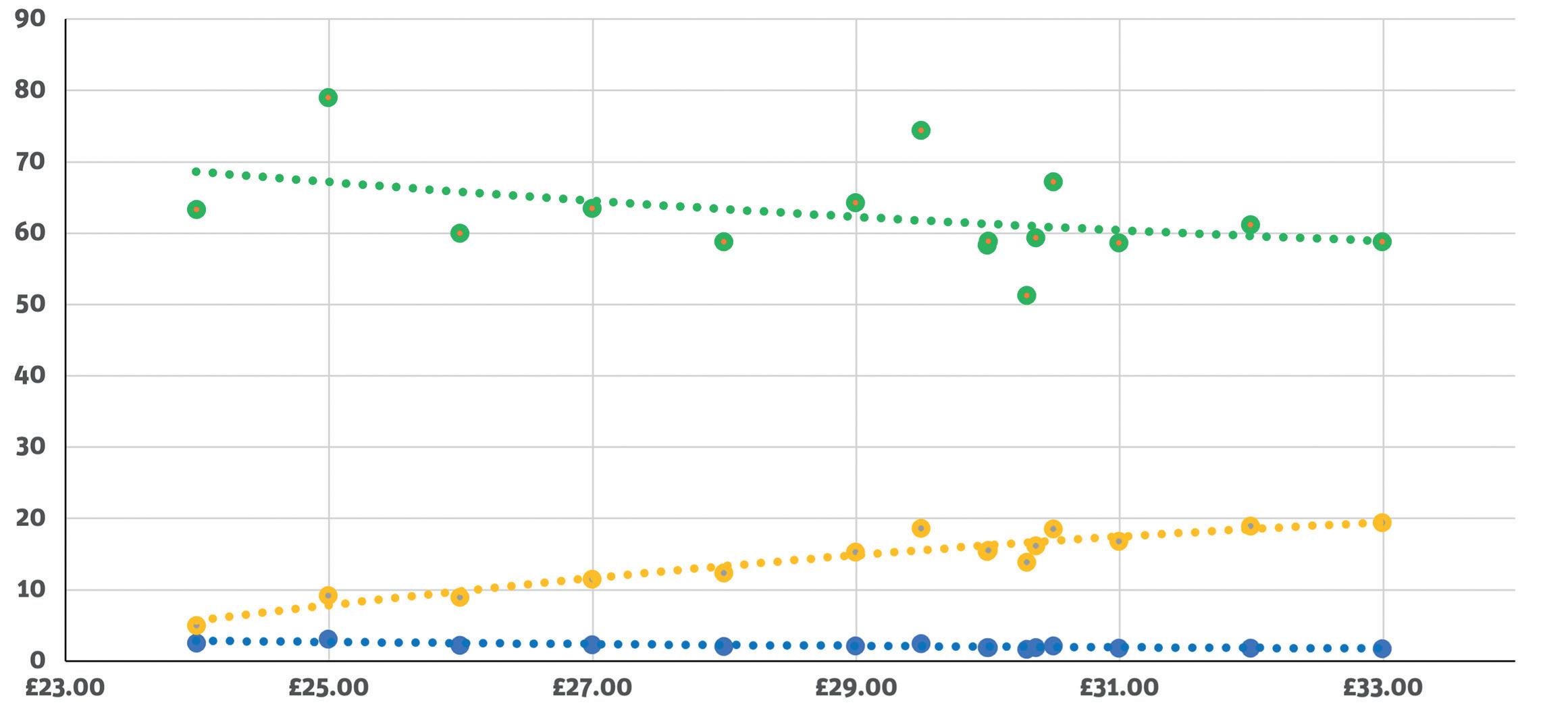

£2.36 difference between best weekly profit and profit at wholesaler RRP MAKE £1,400.88 MORE PROFIT PER YEAR: Check data from

£28.49 delivers best weekly profit (£18.83)

£23 has best rate of sale and delivers best weekly revenue (£134.46)

Wholesaler RRP (£26.99) delivers £16.47 profit per week

Boost your margins with real-time pricing data across 350 core convenience products, exclusively on Pricewatch – the only price-comparison tool for independent retailers. Free one-year access for RN readers – visit https://hubs.ly/Q02P565P0 to redeem your offer or scan the QR code:

Visit the website betterretailing.com/ pricewatch

Data supplied by InTouch Group, based on sales from nearly 11,000 independent convenience stores

£32.99 delivers best weekly profit (£19.50)

£24.99 has best rate of sale and delivers best weekly revenue (£79.08)

Wholesaler RRP (£30.36) delivers £16.24 profit per week

£3.26 difference between best weekly profit and profit at wholesaler RRP

£20.99 delivers best weekly profit (£16.99)

Price with best rate of sale (£19.35) delivers £12.24 profit per week

Wholesaler RRP (£20.29) delivers £15.32 profit per week

£1.67 difference between best weekly profit and profit at wholesaler RRP

Suki

How does your ranging compare?

Rum isn’t a massive proportion of our spirits sales. Captain Morgan 70cl is our frontrunner, but it’s price-marked at £17.59. The 35cl and 20cl bottles are also price-marked, which we won’t divert from as people are price-conscious in this category. We’re going bigger on those formats where we can. Shoppers are going for them more often just to save money.

What guides your pricing?

We have a small shelf for minis, which we chop and change depending on what’s on offer – a vodka, whiskey and another spirit. We also stock Kraken at £29.99 and Malibu is £18.99, because we bought a few cases a while ago when it was cheap. The margins are around 20%, but we know it’s not a big category, so we focus on the smaller formats that are moving more quickly.

Kwame Boakye finds out how investing in the local community has paid off for store owner Kash Retail

Su rrounded by housing estates, this renovated Nisa Local store on Edgemoor Road in Darlington, County Durham, is now better equipped to serve the needs of its community following a full redesign.

The refit included the installation of a beer cave and upgraded chilled and frozen food section.

The new store also features an expanded range of local products with an emphasis on civic pride, a theme that runs throughout the renovated store.

Kevin Polley, operations manager at Kash Retail, says: “We’ve refitted three stores before this one. This store had a bad fire about 10 years

ago and was shut for nearly a year and, while it’s our busiest, it just didn’t look like a top store.

“ The biggest change on design was we needed to open up fresh food given the trend in the marketplace.”

The nearby housing estates provide the store’s core customer base, and it has made a point of catering to them by stocking a wide range of products from the north-east including beers, soft drinks, ready meals, crisps, cakes and desserts.

Polley adds that with several other convenience stores nearby, the fact it prioritises stocking local products not only caters to its customer base, but also helps it stand out from the competition.

He notes: “I want our new niche, our big point of difference, to be local products. This area has got a lot of convenience stores – there’s probably five convenience stores on this estate alone, but we’re the biggest. Now we’ve shown we look the best, our goal is to start getting a greater share of local spending.

“We’re not on any of the main thoroughfares, so we wouldn’t get any get passing traffic. We very much serve the estate – we just need to serve them more.”

To see what other stores are doing, go to betterretailing.com/ store-profile

Name

Nisa Local Edgemoor Road

Location Darlington, County Durham

Opening hours Mon-Sun 7am-10pm

The store stocks an array of fresh food and local produce, including sandwiches sourced from a local supplier, hot pies from Scarborough, cheesecakes from Bradford, and meat from Yorkshire and Bedale.

That commitment to local produce is extended to cakes and desserts from nearby Whitby, crisps from potatoes grown in Yorkshire to alcohol with gin, beers and flavoured vodkas all sourced from within eight miles of Darlington.

Polley says it was a blend of familiar favourites and a strong focus on local that helps the store foster its own identity. “My question was, ‘why would I shop here, what’s different to the Co-op across the road? Why would I come in?’ We needed something different and that’s where the Yorkshire thing was born,” he adds.

“It’s great working with local suppliers. People want to buy local – so long as it’s not overly expensive.”

The location of the shop plays a key role in its pricing structure, as overall footfall is not driven by passing trade. The shop is primarily residential and serves the nearby estates with a clear understanding of customer habits and spending patterns. Polley explains that to achieve affordable prices, the shop sacrifices the margin it makes on products.

“We take enough to live on, but I don’t like to break price barriers – I’d prefer to stick to £1.99 than go above £2.

For example, it’s £10 for a case of beer – if I broke £10 and charged £10.49, my sales would probably drop by a third. It’s all mentality.”

Polley adds that the use of price-marked products fosters trust between the shop and its customers. “They don’t want to feel like they’re being robbed,” he says. “They come here and see they are not being robbed because it says ‘the price’ on it.”

Food to go is an important part of the store’s strategy, and in particular, the hot food counter, which features an array of pies, pasties and sausage rolls.

“We sell a lot of hot pies – we’re just getting another cabinet because they’re that popular,” says Polley. The store also stocks several Yorkshire ready meals. These include parmo, which consists of a breaded cutlet of chicken topped with bechamel sauce and cheese. “They’re really popular,” adds Polley.

Sandwiches are also a key part of the food-to-go range, with the store using a local supplier after previously stocking Coop sandwiches. “They weren’t selling that well; the waste was through the roof,” he says.

“We found a good local sandwich supplier. We have doubled our sandwich sales overnight and get no waste. We’re trying to bring local products into stores at prices people can afford.”

One of the shop’s standout new features is its beer cave, which offers a range of ales, including Corona, Stella Artois and San Miguel on PerfectDraft, as well as bottled local brands such as Battleaxe and Theakston Lightfoot. The addition of the cave is central to the store’s strategy to boost the sales of alcohol, with a substantial increase anticipated.

“It’s always been a strong alcohol shop, so if we can get the 30% lift they reckon you get from putting a beer cave in, that would be great,” says Polley. “Customers love the idea that they can buy drinks cold to take home and drink.”

Early indications point to the beer cave proving popular with customers, with a high demand for alcohol particularly noticeable on weekends following people being paid. Keeping prices competitive has been essential to the initiative’s success so far. “They love the £10 strategy, that’s going down really well,” he says. l

Hamalata Patel K & L Newsagents, Winsford Cheshire

After a hard start in retailing, this resourceful shop owner has built a loyal customer base by seeking out the perfect products and carefully curating specialist ranges

My husband used to work in a hospital equipment factory until he had to have surgery on his spine and couldn’t work – I was doing three jobs with two little ones.

His uncle had a shop in Winsford. We got interested in the idea and then we came across another shop for sale. We bought it in 1984 and we’ve been here ever since. It was a big risk, we had to sell our property in Wolverhampton to make the leap.

When we started, we didn’t know anything about running a shop.

The previous owner said the shop was taking £3,000 per week. In our first week, we took £225. It was only then that we realised what we were sold was different to what we were promised.

This meant we had to build the shop from the bottom up, and we’re

We had to build the shop from the bottom up

qualified as a chartered account at the age of 13 in India. I used to tutor him, and it was through his connection with another shopkeeper that we found the Fed.

We had a lot of help in those days – we had people from the Fed come in and help us out. They showed us how to sort papers and supplied us with magazine racks and many more fixtures. They literally used to visit me every month just to make sure everything was right. I’ll never forget that support.

I go to the Fed’s branch, district and national meetings, and I’m also a branch secretary.

Today, some of the Fed offers are great, but sometimes it still pays to look around. I enjoy this part of being a shop owner – finding an opportunity and then negotiating with the supplier. We’re very committed to the cash and carry run because I like to know what I’m buying. If you order online, they’ll only send what they’ve got, plus

replacements for out of stocks. That doesn’t work for us.

Nowadays, my greetings card sales are probably stronger than my newspaper sales. I have four racks and I curate the range myself.

D espite all the updates in our sector, what makes for a good shop is still the same: give customer what they want. One way we did this was taking orders on chocolates for Christmas. We used to wrap them up for customers and label them. They made really nice gifts.

Whereas we were a much more traditional newsagent, that mission of keeping customers happy has helped us to develop.

O ur customers have changed, too. They were more traditional about how and what they ate and drank, and their tastes didn’t change. That generation has gone, and it’s now a younger generation that wants faster food. We stock more frozen goods and instant meals because this is what youngsters buy.

S

• We were getting our milk from the same source as another nearby retailer. They had it on discount, and a lot of it seemed defective. People kept bringing it back to us for a refund. We couldn’t prove it wasn’t from us, so we ended up switching to a local dairy. It was a blessing in disguise. We get better margins, and no one has brought anything back. We always buy local bread, eggs and fresh produce. It’s better and customers love supporting the community.

• For the past two years, we’ve been stocking noodles for the growing local Malaysian community. We get product like ABC Sauce that comes from Indonesia as well. I get customers to show me the products they want from overseas and then I find a way to get them on our shelves. You don’t need to be an expert in every cuisine, you just need the help of your customers who are. l

Shyama Laxman speaks to retailers across the board to understand what’s working in grocery and how to offer the right range

Several retailers who spoke to RN regarded groceries as a “boring” category. Goran Raven, of Raven’s Budgens in Abridge, Essex, says he doesn’t invest time thinking about how to grow the category. This is despite groceries making up around 60-70% of Raven’s business.

L ondon-based multi-site retailer Kay Patel says categories such as impulse and next-gen nicotine, for example, are bolstered by new products, whereas not many changes happen within groceries. “In grocery, t here are just price increases and shrinkflation, and they’re not interesting things,” says Patel.

Regardless, he says a grocery offering is important as otherwise convenience stores “would be going back in time to becoming CTNs again”.

Grocery is a core part of a store’s offer – with certain sub-categories, like milk and bread, absolute essentials, and others, such as fresh fruit and vegetables, a key point of difference for the store in the right spot.

CAN LOCATION GIVE CERTAIN PRODUCTS AN EDGE?

Imtiyaz Mamode, of Wych Lane Premier in Gosport, Hampshire, runs a 2,400sq ft store, with groceries

forming 15-20% of the business. He has reduced his range of fresh fruit, vegetables and meats, as shoppers compare his prices to supermarkets, which tend to be cheaper.

Milk is a fast-moving line, he says. With one bottle priced at £1.65, he does a two-for-£3 offer, moving more volume that way.

Mamode offers ambient products such as baking supplies, cooking oil, sauces, tinned goods, ketchup and rice, but deems cup noodles as his bestseller because of nearby schools. He offers Pot Noodle, Soba, Ko-Lee, Namdong and Batchelors, selling upwards of 20 units a day. Priced between £1.10 and £2.35, he takes around £241.50 a week.

Mamode has reduced his ready meals range, but now offers samosas, onion bhajis, Jake & Nayns’ Loaded Naan, sandwiches from Rustlers and lines from Jack’s.

David Wyatt, of CostcutterBargain Booze in Crawley, West Sussex, runs a 2,000sq ft forecourt which offers a range of own-label and branded options. Located in a more transient location, he doesn’t cater to shoppers looking to do a weekly shop, selling more chilled ready meals than ambient groceries. He optimises his chilled ready meal range by catering to two missions:

the average customer whose impulse is an on-the-go meal, and the one looking for a “meal for tonight”.

Wyatt’s ambient groceries occupy four metres, comprising jams, tinned goods, tea and coffee, curry sauces, pasta and tomato ketchup. Six metres of chilled space is given to dairy products, vegetables, fruits, meat, processed meats and Co-op ready meals such as pizza, pies and pasta.

CAPITALISING ON AFFLUENCE IN RESIDENTIAL AREAS

Sonny Saini, of Barnes Pantry in south-west London, has an affluent demographic, so he’s able to offer products from boutique suppliers such as Suma Wholefoods, Europa Foods and Carnevale, in his 1,600sq ft store.

He says shoppers are looking for easy meal solutions, so his ready meal sales have increased. In addition to Charlie Bigham’s, Saini also sells meals prepared in-house. He takes between £700-£800 daily in ready meal sales, which includes sandwiches and sushi sourced from Simply Lunch and Tanpopo, respectively.

Canned and jarred goods are fastselling, with increased sales of Biona soup at this time of year. Saini also offers tinned fish from Ortiz, as well as Mexican and Asian products such as tacos and kimchi.

“With where the economy is going, all the big brands are doing price-marked products,” says Saini. “The profit margin is less. The size

goes down and price goes up. It’s very hard for a retailer to justify that to the customer. As such, we avoid price-marked goods wherever possible.”

Like Saini, Joe Williams’ 2,200sq ft The Village Shop & Post Office is in an affluent, residential part of Banbury, Oxfordshire, but unlike Saini, his customers are more interested in cooking from scratch, as opposed to getting ready meals, meaning that fresh meat and vegetables are key parts of his offer.

In addition to Booker and Budgens, he uses the local Mudwalls Farm to get stock, taking about £15,000 a month. He says as the turnover of fresh produce is high, wastage is not an issue seeing as smaller quantities can be ordered between his three suppliers.

Williams says offering a few premium products, sourced from specialist stores, adds a layer of excitement to groceries. While shoppers will buy staples, like tinned tomatoes from Napolina, offering off-kilter options such as Grey Poupon Dijon mustard or Potts’ gravy stocks keeps shoppers interested.

For the past five years, Raven has been trying to turn his 3,000sq ft transient store into a neighbourhood store. He says “fresh is a big driver” helping with the transition, as it sets him apart from competitors. Raven has since witnessed a 15% sales uplift across the store.

We’ll have three types of baked beans

In addition to fresh fruits, vegetables and meat, he also offers meal solutions, such as chicken and potatoes, ranging from £6.99 to £9.99. Raven also sells local products, such as fruits sourced from a farm shop, handmade pies, scotch eggs, sausage rolls, smoked fish and cheesecake.

Raven says with fresh lines, there must be a balance between ordering and wastage: “You shouldn’t be too keen nor too frugal with the ordering.”

Raven’s wastage sits between 3% and 6%. He doesn’t do “reduced to clear” as, in the past, shoppers ended up coming in when the items were reduced, resulting in losses.

Andrew Cruden, from Market Square News in Northampton city centre, runs a 452sq ft store on a high street, so “quick” is the buzzword when it comes to grocery. It comprises essentials such as tea, coffee and pot noodles. He refrains from tinned goods, condiments and sauces, and instead focusses on “things that people would use in an office”. Supermarkets in this environment often make good use of instant rice pouches, noodles, chilled soups and other microwave and kettle-friendly options.

Groceries comprise 1.5% of Cruden’s business, and he takes a little over £500 each month. He says it’s best to have a smaller range and offer premium brands. He also offers sandwiches and ready meal solutions, such as chicken pasta bake and chicken tomato bake, sourced from the local JD Supplies. Priced between £1.80 and £3.50 per sandwich, he sells around 120 a week, taking between £216 and £420.

“It’s purely distress purchases –they’re not really buying baskets of that stuff,” says Kay Patel, who has a 950sq ft store in Stratford, east London. Milk, bread and tinned goods, such as beans, tend to be staples, though Patel also offers processed meats, dairy products, sausages and bacon.

As the store is surrounded by supermarkets, shoppers come to Patel’s store only for top-ups. As such, he doesn’t offer any fresh fruit and vegetables. While he previously sold fresh chicken, he stopped postpandemic as “cost of wastage and pilferage shot up”.

Groceries comprise around 20% of Patel’s business averaged across all his stores. He says offering core brands is key, though retailers should make the category “interesting” by offering new products and flavours. Having said that, Patel says if he’s looking to recoup space, it’s grocery lines that are reduced.

Like Cruden, Patel says “brand leaders” tend to work better in a transient store.

Conversely to his east London shop, Patel’s residential store in Wanstead caters to shoppers who have bigger grocery spends. As a result, he offers a far greater range of options.

“We’ll have three types of baked beans: HP, Heinz and own label,” he says. “In Stratford, we’ll just give them Heinz baked beans. It’s more expensive, but customers don’t complain.”

The average grocery takings per month in the Stratford store are £12,000, while the figure is around £22,000 in Wanstead. Some of the premium lines in Wanstead include Union Coffee, Dorset Cereals and Rude Health.

“It’s harder to source because it’s not available through Booker or Bestway, but there’s more margin to it, and people do come to find it from you,” he says.

Jonathan Cobb, of Miserden Stores & Post Office, runs a 350sq ft store in Gloucestershire. He believes community stores, especially in rural areas, must have a “good grocery range” because the closest supermarket is a drive away.

Despite declining sales, groceries form 40% of Cobb’s business. As his demographic comprises a significant elderly population, he sells a lot of fresh produce sourced from Bramleys Wholesale and Bisley Farm Shop. He also sells premium lines such as Mr Organic, and sauces from suppliers such as Holleys Fine Foods and Cotswold Fayre, and Pasta Garofalo. The premium lines make up about 10% of the weekly sales.

While his fruit and veg have a fast turnover, Cobb’s not able to sell through his chilled range so buys less. He’s now focused on optimising the fresh range by offering things like fresh pies from Frocester Fayre Farm Shop. Every other week, Cobb also gets ready meals such as lasagna and quiches from Portway Farm Shop. Priced at £6 per meal, he orders two of each meal, available that week, and sells through by Friday.

Cobb also offers hummus, deli meats from Unearthed and unusual things like vegan butter from Be Better, which he says becomes a talking point among his shoppers. Jams and chutneys made by a local resident, as well as sourced from Selsley Foods, priced between £4.49 and £4.59, brings up to £180 a month.

“Although it is risky for shops to only offer a premium end, you’ve got to weigh up the location of the shop to competitors,” says Cobb. “We are a small shop, so we can’t cater to both. If I put the cheaper product on the shelf, although I’ll be making the same percentage margin, I’ll be making less money.”

Cobb also sells frozen meals from Frocester Fayre. Priced between £4.40 and £5, he sells around 10-12 units a month, taking £52 a month on average.

Ruth Marshallsay, who runs the 581sq ft Churchingford & District Community Shop in Devon, says that for every core grocery line, she’s got local options as well. Marshallsay takes around £560 a week with just the bakery products from Dough Taunton and Sarah’s Kitchen.

“Our customers want to support local businesses,” she says, adding that out of 40-plus suppli-

Sarj Patel, who runs mid-size rural Pasture Lane Stores in Sutton Bonington, Leicestershire, says grocery makes up 60% of his business, with 15% dedicated to fresh, including dairy products. He spends around £600 a week buying stock, with fresh vegetables bringing up to 40% margin. Tinned goods such as soups, fish and corned beef, and pantry stapes make up his ambient aisle.

Patel also experiments with his lines – for example, baked beans from Branston over Heinz, which are spicier – to see if it finds traction. He tries one case to see if the product sticks so as not to be lumbered with stock.

ers, around 27 are local. “That has enabled us to pull in a customer base that’s quite far and wide,” she explains.

Marshallsay, who takes upwards of £9,000 a week in grocery sales – fresh and ambient combined – says her demographic comprises low-end and high-end income people, therefore has to offer a vast grocery range to cater to both.

In addition to elderly shoppers, Patel also has university students in the area who buy tinned goods, bread and frozen products, like smashed potatoes, mixed veg and fish fingers.

Patel says shoppers will go to supermarkets for weekly grocery shopping, but retailers in a similar set-up like him should focus on offering everyday things that shoppers might run out of mid-week, such as frozen chips, mushy peas or tins of soup. Patel also offers things like spam and chutneys from a brand called Drivers, which cannot be found in the local supermarket and finds favour among his shoppers. l

The team at RN rounds up insights from the six masterclasses and two retailer and industry panels at this year’s Better Retailing Festival

Now in its second year, the Better Retailing Festival delivered for the independent convenience channel once again, with a host of lessons for retailers to take back to their businesses.

The themes of the day were resilience and building a business that’s set up for the future, which were highlighted in two panel sessions featuring retailers and industry experts.

Attendees heard from keynote

speaker Simon Gray, founder and former chief executive of Boost Drinks. He spoke about leadership and how retailers need to process quickly, and, if they’re going to fail, “fail fast, then move forwards”.

There were six masterclasses, run by key industry suppliers, including balancing core products with innovation with Coca-Cola Europacific Partners, the future of convenience in association with Mondelez International, the value of supplier partnerships with Velo, retail crime

with the National Business Crime Centre, driving footfall to your store run by Allwyn and educating your shoppers in association with Helix. Several supplier-run workshops also helped retailers share and gather ideas during the day.

Here, the RN team has rounded up key lessons from the day that you can implement in your business from today to support sales, protect profits and address some of the greatest challenges facing local shop owners.

With the help of four industry titans, Stefan Appleby, head of retail engagement at Newtrade Media, explored answers to the problems keeping shop owners up at night.

A survey of 200 retailers by Newtrade Media found price rises, theft and wages to be top concerns. Appleby explained that store margins dropped by two percentage points over the past five years and, based on trends, stores that do not adapt will take 5% less by 2030.

For Chloe Taylor-Green, of Spar Western Downs in Staffordshire, the big issue is crime. Her response relies on her customers. Taylor-Green explained: “You support the community, they’ll support you back. Customers will help you identify offenders and tell you where they live.”

Simon Gray, founder of Boost Drinks, added that brands need to recognise the pressures crime and legislation put on retailers. “My message to suppliers is to make things simpler for retailers. They’ve got a lot on their plate,” he said.

James Lowman, chief executive of the ACS, suggested three legislative changes to watch. A key retail rate relief will be replaced next year by a permanent discount for small shops. He advised: “If they use their full powers, you could get a rates reduction. If they don’t, you will see your rates go up next year.”

Lowman also urged stores to plan for the UK’s 2027 Deposit Return Scheme. “Do you want to offer a reverse vending machine, take containers back manually or get an exemption? Thinking about that now is really important,” he told attendees.

The ACS boss’ last point was on upcoming licences to sell tobacco and vapes. Lowman said: “The best outcome is it takes out a lot of the illegal trade. The worst outcome would be it would be very difficult to open a shop if there are others around you and very hard to keep the rights to sell tobacco and vapes.”

Gray remained positive about the future. “You’ve seen unique flavours for the channel and investment in more price-marked packs. That’s because brands see the attractiveness of the local shops,” he said.

Ashan Chaudry, of Triple ‘a’ Foodhall in Nuneaton, said his main focus is on “keeping the consumer interested”. He said: “Consumers’ expectations are now higher. That’s why we steered towards high-quality food with our prep kitchen.

“It allows us to be first in the UK to trends like gelato cakes. We had a lot of retailers ask us, ‘are these just fads?’. It doesn’t concern me because we are seeing a surge in our customer base.”

Taylor-Green highlighted becoming more “meal focused”, and added: “There are 21 meal moments in a week per customer. Are you prepared so when they come in, they buy from you?”

According to Appleby, there are 27% more chain grocery stores than in 2021, but the ACS says independents have crucial advantages. Lowman explained: “You can pick up on trends quickly. You can use social media in a way that is so authentic, that it drives sales. The best independents use social media to create events. They tease a launch stating the time it’s going to appear. They are building that demand.”

Chaudry and Gray are advocates of electronic shelf-edge labels. “The cost and complexity is coming down all the time,” said Gray.

Giving an example of the impact in his award-winning store, Chaudry added: “On our promotional cycle change, that was 10 staff updating labels. Those 30-40 hours per month are saved straight away. Pricing errors are nearly non-existent. It’s a substantial outlay to start with, but it’s one of the best investments we’ve made.”

Taylor-Green highlighted her store’s automated cash handling courtesy of tech provider Glory. This means “cashiers never handle cash”, staff don’t need to cash-up tills and the team know how much cash is in the store at any time.

By installing self-checkout, hybrid and a manned till, a lone worker can now still get on with the routine shop floor tasks. “Technology is about reducing cost and improving productivity,” the award-winning retailer explained.

The Retailer Surgery panel featured experienced retailers Benedict Selvaratnam, of Freshfields Market in Croydon; Bisi Osundeko, of Go Local Junction Lane in St Helens; and Kaual Patel, of Nisa Torridon Convenience in south London.

Each retailer shared their wisdom on the best ways to engage with communities, how to get ahead of upcoming legislation and improve the way they run their own businesses.

Prior to becoming convenience store owners, Osundeko and her husband had a background as retailers on Amazon.

Explaining how this previous experience has helped her run a successful small shop, she said: “We’re coming from an online business that is very customer-centric. We understand that listening to your customers is key.

“Even though online has a very different community, it’s still public facing, so there are a lot of intersections with convenience. We’ve brought a lot of ideas from Amazon, and I think this is the reason why our store has been so successful.”

The Deposit Return Scheme is scheduled to become legislation in October 2027, but Patel has prepared early by introducing a reverse vending machine (RVM) into his store.

The unit allows customers to return empty single-use drinks containers to his store, where they receive a cash voucher.

He said: “We’re really laying down that footprint and creating that impression with customers, 18 months before anybody else. It guarantees the future of your business.

“You can have the best product range and best price, but this doesn’t make a difference if you don’t have people coming through the door. I can guarantee every supermarket will have an RVM.

“Electronic shelf-edge labels is also one of the best investments we have made. They can be costly in the short term, but in the longer term, investment pays off.”

Selvaratnam is a co-founder of the Croydon Business Association, a body that represents the interests of more than 400 businesses within the area.

Explaining how the collective power of the organisation helps businesses, he explained: “No matter how big you are as an individual business, you never really have a voice within the council or the government, but you can get one once you join up with others. It’s about bringing everyone together and giving them a platform.

“It was unplanned, but it was about trying a new idea and not being afraid to have a go.

“As retailers and a community, we shouldn’t be afraid to take these kinds of risks because all you need is one good idea, and this can catapult into something bigger.”

The panel was also asked how they motivate staff, especially in an environment where available working hours are under pressure from rising costs.

Osundeko responded: “The success of a business is down to your staff, and we try to keep ours motivated through different methods.

“One incentive is an upselling competition where we have a leaderboard. It’s not really about competing, but motivating each other. I also know personal things, such as a staff member’s favourite drink.

“We also have a Christmas get-together and other social events where it gives employees an opportunity to bond.”

The session wrapped up with the panelists sharing what had recently made them feel proud as a retailer. The panel agreed that sometimes, the smallest contribution can have the largest impact. For example, Patel highlighted how he utilised his network of other retailers to secure a unique teddy bear for a customer.

He said: “This is what makes independent retail so unique. It might not be the biggest thing, but small acts like these are what customers remember and what will keep them coming back to your store.”

Amy Burgess, from Coca-Cola Europacific Partners (CCEP), invited retailers to “put yourself back into your store and look at your soft drinks cooler”, asking “do your customers see choice or confusion?”. While finding a balance between core and innovation, retailers should be guided by asking if it’s easy for customers to find their favourites and make a decision.

The soft drinks category, with its large shelf space and core lines needing double facings, creates a fight for space, Burgess said, as she was joined by Bobby Singh, of BB Superstore in Pontefract, and Bay Bashir, of Go Local Extra – Belle Vue Convenience Store in Middlesbrough, to discuss how to balance core range and new products.

It’s easy to think “innovation is the sexy, fun bit and think, ‘I just want to see Bobby Singh dressed up as Beetlejuice’”, according to Burgess. But retailers were told that 96% of total sales in the soft drinks category are from core lines – meaning lines that are more than two years old.

Maybe more surprisingly, 42% of sales growth also comes from core lines, showing that it is not at all a stagnant segment, but rather a category with appeal to diverse shopper missions.

“There are a lot of key missions that they tap into – whether it is top-up, planned and distressed, meal occasions like breakfast on the hoof, lunchtime and meal for tonight, for example,” Burgess said.

While core accounts for the lion’s share of sales, innovation is the bedrock of sales growth, providing 58%.

Curiosity in new lines drives sales, and Bashir said multibuys can capitalise on this. He said: “If someone is buying a multibuy of, say, Coca-Cola, they will always pick up one core product and one new one –without fail.”

However, emerging categories are showing more reliance on innovative lines, with retailers hearing that the alcoholic ready-todrink category is seeing 89% of sales come from innovation rather than core lines.

This is due to it being an emerging category, as opposed to the mature soft drinks category.

Data is the retailer’s best friend when it comes to the tough decisions of allocating limited shelf space between core and innovation.

Singh told the audience: “We’re reviewing our core range more than ever at the end of the day, through our tools, data and sales. We’re always looking to sweat the space, to use every nook and cranny of our store productively.”

When a new line comes in, he continued, shops don’t have “elasticated shelves”, so using sales data to choose a low-performing core line to replace is key.

How can retailers bring excitement to their core range? According to Bashir, merchandising plays a key role. “At the moment, everyone’s bringing really smart, slimline, visual magic to the market, and putting this merchandising in there disrupts that shopper mission and engages customers in the store,” he said. “Then, you can always move it around and take it out, put it back in and test things out with new products that are coming in.”

Burgess told retailers classic Coca-Cola is a great storyteller, with Christmas theatre activations packages, such as mini cutout Coca-Cola trucks, available soon from CCEP.

Pontefract’s Singh, famed for his theatrical launch activations on social media, agreed that core sales are the “backbone” of his sales, but reminded retailers that new products don’t just affect sales of that line. Instead, retailers should view it as an opportunity to publicise the store as whole.

“With innovation comes energy and excitement, and through creating that buzz comes reach. And not just reach through social media, not just reaching to your local community, but further afield, too,” he said.

Marta Ziolkowska-Sequeira, senior customer category development manager at Mondelez International, acknowledged that times have been challenging for the convenience sector, exacerbated by high inflation rates, the impact of global politics and a rise in National Insurance and retail crime.

“Customers are losing confidence,” Ziolkowska-Sequeira said, adding that shoppers are conscious about spending and are budgeting more. More than 50% of retailer votes on Slido revealed that convenience stores didn’t witness a footfall increase this year.

She said soft drinks, confectionery and food-to-go categories were exhibiting value growth, despite declining footfall of 4%. She also said basket size decreased by 7%. However, Ziolkowska-Sequeira predicted the channel is set to grow by 2.9% in the next five years, with 80% of sales deriving from four missions: top-up, food to go, treat and meal occasions.

Ziolkowska-Sequeira said top-up shops comprise between 20-25% of the shopper mission and will continue to grow in the next five years. Retailers should offer right proposition, focusing on a range of chilled, dairy and bakery products. She said, however, that “fresh offering” will be important to cater to younger shoppers and families who are increasingly using convenience stores for top-ups. Therefore, having good-quality fresh products would be key to drive footfall.

“Food to go has grown in the past five years, and is the third-biggest mission in convenience stores,” said Ziolkowska-Sequeira. While one would typically think of a sandwich and a drink as an on-the-go solution, this mission is “evolving”, and shoppers are looking for “sophisticated propositions” in this day and age. Retailers can tap into that by offering hot food options, for example. Additionally, food to go also extends to meal solutions for later, such as dinner. Ziolkowska-Sequeira said the best way to drive sales of meal solutions is by ensuring retailers have a frozen and chilled range of meals for later, such as pizza or pasta. When combined with confectionery, crisps and soft drinks, it becomes an “attractive meal-dealfor-later proposition” for the shopper, helping retailers differentiate their store from competitors, grow average basket spend and offer shoppers better value.

Ziolkowska-Sequeira said that while ‘treats’ is an impulsive-driven category – with confectionery regarded as the mainstay – it will evolve as shoppers are looking for healthier alternatives, with clearly listed ingredients, whether that’s protein, vegetarian or free-from.

Additionally, things such as slushies, bubble teas and ice creams will help drive footfall and attract customers, especially the younger demographic. “The younger shopper is snacking two to three times a day, and they even tend to replace some of the meals by snacking,” she said.

By 2030, 75% of total convenience shoppers will be aged between 25 and 54, said Ziolkowska-Sequeira. How retailers interact with the younger shopper is key to winning them over.

“Winning online will be key. That’s how the younger shopper is shopping,” she said, adding that the younger shopper is “very impulse-driven”, so retailers must win them over before they step into the store through social media, and while they are in the store, through displays and activations.

“If you want to convert them to buy something they didn’t come to your store to buy, they will need to be convinced by amazing displays,” she said.

A modern retail experience that includes self-checkouts is crucial to appeal to this demographic.

Lastly, younger shoppers are also sustainably minded and seek brands with purpose. “If they don’t support what the brands you have stand for, it probably will be difficult to convince them to purchase,” she said

“How you interact with your community… what you bring and how you give back to the community is a unique selling point for convenience stores, and therefore should continue in order to engage with your local shopper,” said Ziolkowska-Sequeira. Towards that end, retailers shouldn’t shy away from seeking manufacturer support in furthering their community initiatives.

She recounted that the Mondelez team does “volunteering days” in stores, involving working in store or fulfilling a delivery.

Moreover, the brand also runs campaigns – like Community Game Changers, which ran from May until September this year –inviting ideas from retailers on what they can do to support their local community, information that will soon be available to all retailers.

Participating in such campaigns and using the assets provided by the brand can help bring shoppers to one’s store. »

Eddie Devine, head of symbols and independents at BAT UK, said confusion over vape regulations and new products entering the market is creating a challenging environment for retailers.

“My prediction is there’s going to be more changes coming again. We’ve had the disposable vapes ban, and people are still buying devices and using them like disposables,” he said.

“We don’t want that, but the consumer probably isn’t educated enough on what’s going on in the market right now.”

He added that suppliers can offer guidance on regulation and category management to help retailers stock the right items. Devine also stressed the importance of educating consumers on legislative changes to ensure shoppers understand shifts are regulatory rather than store-driven and help guide them towards compliant products.

Devine criticised the implementation of the disposable vapes ban, describing it as getting rid of one problem only to replace it with another, amid further legislative changes currently being considered under the Tobacco and Vapes Bill.

He added: “They should have gone a bit harder at the disposables ban and brought everything in at one time; all they’ve done is got rid of one product and replaced it with another. It does the exact same thing and causes the exact same problems.”

Devine highlighted that nicotine pouches are the fastest-growing category in the market, driven by increasing awareness from consumers and a growing demand for smokefree alternatives.

He explained that while this area is expanding rapidly, vape sales continue to be shaped by customer familiarity and habit, with many users moving towards closed-system devices following the disposable vapes ban. This, he said, shows that customer behaviour remains steady even as legislation continues to change.

Devine also noted that making products visible through displays and signage can boost sales and improve a store’s image, helping retailers showcase new categories and educate shoppers on their options.