Masterclass:

Masterclass:

Hosted by

Learn how to navigate your customers through the disposable-vapes ban. In this masterclass, Helix will discuss how you can help vape shoppers understand the alternative options available and identify which one is right for them.

Join the conversation at the Better Retailing Festival

Secure your place today. Scan the QR code or visit bit.ly/BRfest for more details.

• Store upgrades, sales and sta numbers all plummet for the rst time in years, according to ACS

• Labour’s local growth minister responds to claims government is making shops and customers poorer

Alex Yau, editor

THE ACS’ latest Local Shop Report doesn’t make for the most optimistic reading of the convenience sector.

We have full coverage of the report on p3, but in a nutshell, the trade body attributes a combination of supermarket competition, rising costs and legislation to a reduction in spending both in sales and investment.

This gloomy outlook is also reflected in the many conversations I have with readers each week. In a recent chat I had, a store owner said: “It just feels like everything is getting harder each year, not easier.”

It’s true that the onslaught of legislation is making running a small shop incredibly di cult, but there are some positives to look out for.

From October, the latest stage of the government’s campaign against junk food comes into force, banning multibuy deals like buy-one-get-one-free o ers on products such as chocolate bars, crisps and other snacks.

It applies to businesses with 50 or more employees, meaning major supermarkets will have to comply. While the majority of small shops are exempt, several leading symbol group bosses con rmed that the legislation also doesn’t apply to a large proportion of their partnered retailers, excluding instances where an individual retailer has 50 or more sta .

THERE ARE SOME POSITIVES TO LOOK OUT FOR

Here is an opportunity to take advantage of confectionery and snack sales where your supermarket rivals are unable to.

Although it might seem like a small reprieve, it is refreshing to see government restrictions not punishing small shops for once.

Editor Alex Yau

alex.yau@ newtrade.co.uk 020 7689 3358

News editor Ciarán Donnelly ciaran.donnelly@ newtrade.co.uk 07743 936703

News reporter

Kwame Boakye kwame.boakye@ newtrade.co.uk

Production manager

Chris Gardner 020 7689 3368

Senior production & content editor

Ryan Cooper 020 7689 3354

Copy editor Minhaj Zia

Senior designer Jody Cooke 020 7689 3380

Designer Lauren Jackson

Editor – news Jack Courtez jack.courtez@ newtrade.co.uk 020 7689 3371

Features editor Charles Whitting charles.whitting@ newtrade.co.uk 020 7689 3350

Features and advertorial writer Shyama Laxman shyama.laxman@ newtrade.co.uk

Head of marketing

Kate Daw 020 7689 3363

Head of commercial Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Account director Lindsay Hudson 07749 416 544

Account manager Lisa Martin 07951 461 146

Specialist reporter Dia Stronach dia.stronach@ newtrade.co.uk 020 7689 3375

Editor in chief Louise Banham louise.banham@ newtrade.co.uk

Features writer Jasper Hart jasper.hart@ newtrade.co.uk 020 7689 3384

Finance manager Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital Luthfa Begum 07909 254 949

ALEX YAU

SHOPLIFTING across Scotland has increased annually by nearly 7,000 incidents to 47,381, four years since the landmark Protection of Workers Act came into force.

According to �igures released by the Scottish government last month, the increase

represents a 124% rise from 21,136 crimes in the year the act was introduced to curb violence against retail workers. Many independent retailers told Retail Express that shoplifting crimes have often escalated into verbal and physical abuse against them and their staff.

A similar act was set to be introduced in England last

year, but this has faced delays. Following on from the Scottish government’s latest crime �igures, the Scottish Grocers’ Federation (SGF) has called for more longterm police support to help protect small-shop workers.

The body’s latest Crime Report claimed the average cost of shop theft and vandalism has increased to £19,673 per

store (up 38% from the previous year).

SGF head of policy and public affairs Luke McGarty said: “Shop staff who provide an essential local service are facing abuse and violence every day, and businesses are forking out thousands of pounds for extra security and in lost goods. That is completely unacceptable.”

41,116

ALLWYNis examining ways to help partnered stores personalise the National Lottery for customers.

Asked for further clari�ication by Retail Express, an Allwyn spokesperson said: “One of the things we’ve been

looking at is how to make playing the National Lottery more personalised. For example, by providing players with relevant, local examples of projects near them

COMMISSIONon parcel services for PayPoint-partnered stores is to be slashed, with the cut being blamed on InPost’s acquisition of Yodel.

Letters sent to major chains last month announced commissions for most Yodel parcels will drop by more than a quarter, from 35p to 25p, while store-to-store parcels commission will be set at 20p. This will affect all Yodel stores. For a store accepting 10 Yodel parcels daily, it results in £365 less pro�it per year.

welcomed by a crowd of locals, national and regional press, and Post Of�ice of�icials. Gill was removed from her role in 2015 after �ive years as a subpostmistress when she was wronglyaccused of false accounting and stealing £46,000.

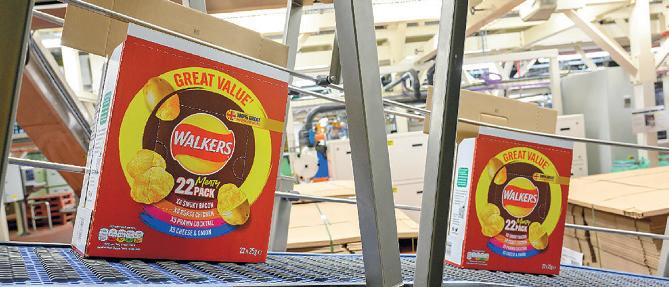

PEPSICO’SWalkers van sales team have been culled, with the �irm blaming changing customer habits and “operating landscape” for its decision.

A spokesperson told Retail Express: “Customer buying habits are changing, and we must regularly review our resources accordingly. We will be continuing to accelerate our focus on supporting the well-established cashand-carry wholesale offering, ensuring our popular snacks ranges are widely available.”

INVESTMENT, sales and employment in small shops have plunged for the �irst time since 2021, as the ACS has warned rising costs and legislation are putting convenience stores under pressure.

The warning was provided by the trade body in its 2025 Local Shop Report, which provides an outlook of the UK’s 50,486 independent (71%) and multiple-operated (29%) convenience stores.

It revealed that the number of jobs provided by small shops fell from 445,000 to 443,000, while the value retailers have made into investments such as re�its plummeted from £1bn to £900m.

Meanwhile, the total projected sales across the convenience sector for the year fell annually from £49.4bn to £48.8bn. The 2021 Local Shop report was the last time investment and sales in the convenience sector experienced a drop.

The trade body blamed the decline on more competition from discounters, pinched consumer spending, a “signi�icant rise” in employment costs and the burden of dealing with legislation around vape recycling and the recent ban on disposable vapes.

Speaking about the pressures of staf�ing costs on her business, Judith Smitham, of The Old Dairy – Pydar Stores

in Truro, Cornwall, said: “Is it fair for me to pay someone £13 an hour to show up and do everything I ask of them? For us, it’s very dif�icult to match what people should earn with what we can actually afford to pay them.”

ACS chief executive James Lowman added: “This has been an extremely challenging year for local shops as the cost of doing business has risen signi�icantly while sales have stagnated due to �ierce competition from discounters, supermarkets and other retailers. These �igures should serve as a warning to government that we cannot continue taking the brunt of additional costs and other burdens without the impact being felt by the communities that these essential stores serve.”

At an event held for the launch of the 2025 Local Shop Report, minister for local growth and high streets Alex Norris addressed concerns the Labour government was making business harder for local shops.

Outlining the support for convenience stores, he said: “The work convenience stores do is crucial in making a huge difference for the community. These aren’t just places people go to do their shopping.

“We are debating the Devolution and Community Empowerment Bill, which will shift the power from parliament to local communities. Small businesses are the experts, and they need the proper tools and resources. It will shift the power to local authorities, so

NISA: Co-op Wholesale removed the case and low-volume levies for retailers in Northern Ireland on 1 September. The wholesaler said the removal is part of a wider strategy to ensure its partnered stores stay “competitive and nancially resilient in a challenging market.”

“ONE of the strategies I use is I limit the facings of high-value stock and remove some lines entirely in one of my shops after a certain time. Customers will have to enquire at the till for the products they want to buy. We knew the items that got stolen during an evening when the store is busy, so we ended up putting a sign telling customers to ask for them at the counter instead.”

Peter Patel, Costcutter Brockley, south London

you can engage with those leaders and tell them what you need. Businesses want a greater say because there’s a sense of powerlessness.

“We’re tackling the scourge of late payments and supporting businesses on the other end of that conversation, and we’re committed to working with banks to address issues around personal guarantees. Often, small-business owners will have to put their house and life on the line.

“Retailers have also seen a signi�icant increase in crime. The Crime and Policing Bill is going through parliament, which will make crimes against retail workers a standalone offence. There’s also a commitment to providing 13,000 more police and community sup-

port of�icers for the visual deterrent.”

Despite the challenges faced by small shops, the 2025 Local Shop Report also revealed positives in the form of increased diversity among store owners and their staff.

The proportion of store owners aged 30 or under was 29%, up from 27%, while female retailers had risen from 36% to 37%. The report also included retailers who identi�ied as “all other gender identities” (1%) for the �irst time. For small shops, 80% have also been involved in community activity, while convenience stores were ranked in the top three services having a positive impact locally, below pharmacies and post of�ices.

For the full story, go to betterretailing.com and search ‘Co-op’

SNAPPY SHOPPER: The rm has become the rst home delivery provider to fully integrate with Google Shopping, unlocking a new sales channel for local convenience stores. The integration enables its retailers to have the opportunity to appear in top Google results, showcasing live product listings, real-time pricing and delivery within the hour.

For the full story, go to betterretailing.com and search ‘Snappy Shopper’

HYGIENE: Cleanliness is turning customers away from convenience stores, according to a survey of nearly 2,000 UK shoppers. The new ndings from shopper research rm Vypr found 40% of those customers surveyed had been ‘put o ’ from shopping in a convenience store owing to concerns surrounding hygiene, compared to a lower 25% with the same response for supermarkets.

DAILY STAR: A customer has cancelled their subscription from a newsagent following concerns that the quality of editorial has declined amid ongoing price rises and sta cuts. Susan Rushton, of Smith Newsagent in Tividale, Oldbury, recently received a letter from a customer stating: “I’ve noticed the same stories in the paper are being repeated over and over four times, yet they continue putting the prices up.”

“WE work with fellow local businesses as it’s a cost-free way of sharing information and keeping the store in better shape. Sometimes, we get information and advice in real time. We generally know the local shopkeepers around the area, so if something is of concern, then we just need to pick up the phone and tell them to be aware. Don’t be afraid to work together with other retailers.”

Jeet Bansi, Londis Meon Vale, Stratford-upon-Avon

“THEFT is not usually a problem, but recently I had an issue over the summer from bored school children on their holidays at two of my sites. It was a group of 12-year-olds nicking vapes and cases of beer. I’ve spoken to the local police and visited the school that they all attend to speak about the impact of theft from convenience stores and how it a ects other local, family-run businesses.”

Susan Connolly, multi-site Spar

retailer

ALEX YAU

THE Deposit Return Scheme (DRS) in Ireland saw more than 1,000 containers returned to shops daily in its first 11 months, but €66.7m (£57m) worth of bottles are yet to be bought back.

The figures were revealed in the latest annual report of ReTurn, the organisation responsible for Ireland’s DRS since its introduction in February

2024. Under the scheme, consumers pay a deposit of 15c or 25c when purchasing a drink in a single-use plastic bottle or aluminium can. The deposit is refunded when they return the container to participating retailers, either via a specialised reverse vending machine (RVM) or manual return point.

Governments in England, Scotland and Wales are set to implement their own DRS from October 2027.

RGDATA is a trade body that represents 3,500 independent retailers across Ireland and sits on the Re-Turn board. Director general Tara Buckley said the number of containers being taken to small shops in the initial stages of DRS were fewer than 100, but this had increased considerably as awareness grew.

She added: “Our members felt it was important to get involved in the scheme because

they are very conscious of their green credentials and their role in the community. Some of our members did adopt a wait-and-see approach, especially if they were in an area where other stores were getting RVMs.”

Buckley advised stores looking to introduce an RVM to operate a trial phase to get customers and their staff used to DRS before it is formally introduced.

RETAILERS across the south of England have a new major wholesaler following the opening of Parfetts’ new depot in Southampton.

The site opened on 3 September, offering cash and carry and delivered services to stores in the immediate area and Greater London.

Several hundred retailers attended the launch day, taking advantage of deals during the opening week. It is the firm’s ninth depot following on from one in Birmingham.

THE UK’s longest family-run post office celebrated both its 175th anniversary and 40 years of its current owner at the helm.

Galbally Post Office in County Tyrone has been operated by the Donnelly family ever since it opened in

Owner Dessie Donnelly said: “Times have changed over the years, and the number of banks has greatly de-

A FAKE trading standards officer failed to fool a London shop owner. The impersonator presented an ID claiming to be Jessica Starkin from Trading Standards, but fled Nilesh

Patel’s store in London after he challenged them. Patel’s London borough council Redbridge confirmed they did not have any records of a trading standards officer matching the name.

The Eastside Rooms, Birmingham 16.10.25

Masterclass:

Supplier relationships can be hugely beneficial, especially when it comes to tackling new legislation such as the disposable vapes ban.

In this masterclass, Velo will discuss:

• How suppliers can help you manage legislation changes

• The questions you should be asking your suppliers

• Working together to prepare for future legislation

Join the conversation at the Better Retailing Festival

Secure your place today. Scan the QR code or visit bit.ly/BRfest for more details.

SHYAMA LAXMAN

PLADIS has unveiled its savoury seasonal range for 2025, comprising returning family favourites as well as a new Carr’s variant.

Carr’s Rich & Savoury Rosemary Crackers joins Carr’s Christmas selection, giving retailers the opportunity to drive highervalue sales among shoppers looking to elevate their savoury biscuit selections during the festive season, according to the supplier.

The new variant will be available to convenience retailers and through wholesale from the end of September at an RRP of £1.99.

Beth Owen, brand manager at Pladis UK&I,

said: “Rosemary is a popular �lavour, which makes our new Carr’s offering perfect for festive snacking.” Also launching is the Christmas-jumper-themed Jacob’s Christmas Caddy range. Mini Twiglets have a reindeer-themed

pack; Crinklys Cheese & Onion feature Santa Claus; Treeselets sport foxes; while Mini Cheddars Original feature snowmen. Jacob’s Christmas Caddies will be available at an RRP of £2.50

Ciaran Conway, senior brand manager at Pladis

UK&I, said: “The new pack designs are synonymous with Christmas, designed to unlock family fun and enjoyment for younger consumers. This fully recyclable and unique pack format is a favourite that people seek out.”

BOBBY’S has added a host of new products to its roster.

Some of the additions include Tongue Painters, Meerkat Gummies, Rainbow Bites and Fizzy Blocks, available in price-marked packs with an RRP of £1.25. As part of the kids’ novelty category, Bobby’s has introduced Double Flush at an RRP of £1, available in three �lavours – Blue Razz, Strawberry and Watermelon.

Sneak Energy’s new �lavour, Candy Floss, also

forms part of the line-up. It’s available at an RRP of £1.70 in a 500ml can.

AG BARR’S Rubicon Raw will launch an on-pack promotion in mid-September, giving one lucky winner the chance to attend the Snowbombing Festival in Austria in April 2026. The winner will receive accommodation and experience a week of snow sports, apresski and VIP tickets to the festival.

Retailers can also take advantage of point-of-sale material.

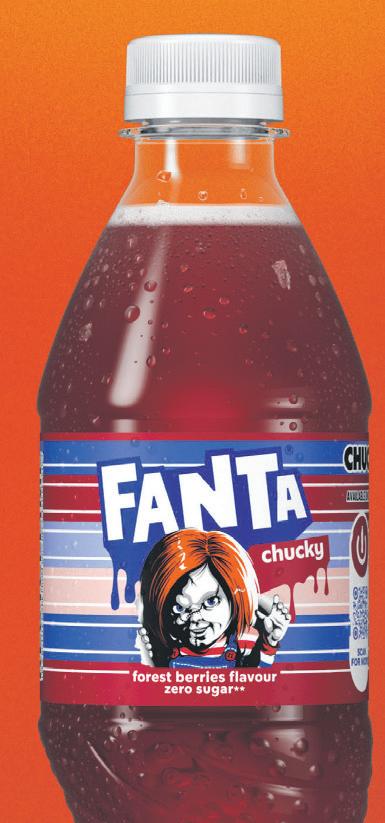

FANTA has partnered with Universal Pictures and Blumhouse to launch limited-edition Halloween bottles featuring four horror icons: Chucky (Chucky franchise), Freddy Fazbear (Five Nights at Freddy’s 2), The Grabber (Black Phone 2) and M3gan (M3gan 2.0).

The partnership also sees the launch of limited-edition cans across the full Fanta �lavour range, featuring Chucky on Forest Berries Zero Sugar; The Grabber on Fruit Twist and Fruit Twist Zero Sugar; Freddy Fazbear on Orange Zero Sugar; and M3gan on Lemon.

Shoppers can scan the QR code on the cans to access exclusive content and experiences.

PHIZZ is adding a new premium range to its growing product portfolio.

Phizz Daily Immune+ offers hydration-focused immune support. Packed with vitamins D, B6, C, A and E – plus other key minerals – it helps the immune system �ight infection and keep consumers healthy and resilient, according to the supplier.

Rolling out on Rubicon Raw’s Raspberry & Blueberry, Orange & Mango and Apple & Guava �lavours, customers can enter by scanning on-pack QR codes.

Launching in a refreshing Orange �lavour – and suitable for vegetarians – Phizz Daily Immune+ is available to independents through wholesalers including CLF and Pharmaplace.

RRP: £9.50

SHYAMA LAXMAN

MARS Wrigley has announced its 2025 Christmas line-up, featuring classic favourites and contemporary additions.

Nostalgia remains a powerful trend this festive season, according to the supplier, with the brand adding to its Maltesers Reindeer range by launching Gingerbread Maltesers Reindeer. It’s coated in smooth milk chocolate, �illed with a creamy malt centre and enhanced with gingerbread �lavour.

Building on last year’s success of M&M’s Crispy Milk Chocolate Santa, the brand is expanding the M&M’s Santa range with the launch of a new M&M’s Crispy Santa �ivepack. This format is perfect

for stocking �illers, workplace sharing or a seasonal selftreat, said the supplier.

This season also marks the national debut of Mars Wrigley’s Maltesers Assorted Truf�les Advent Calendar to cater to indulgent gift-giving missions.

Furthermore, the brand’s popular selection boxes –including The Twix & Friends,

Skittles & Friends and Galaxy Christmas Collection – feature festive packaging designed to stand out on shelves.

Laura O’Neill, senior brand manager, Christmas at Mars Wrigley, said: “Mars Wrigley is providing retailers with the

tools they need to drive sales, grow their audience and make the most of the festive trading period.”

AG Barr has launched two limited-edition ‘Sensations’

�lavours: Sour Sensation Apple & Cherry and Cool Sensation Blue Razz

According to the supplier, the new �lavour combinations have been developed against growing trends, tapping into consumer demand that gravitates towards more complex textures, tastes and �lavours.

Retailers can also access a range of point-of-sale.

Annette Yates, Barr brand director at AG Barr, said the launches will be a “big incremental sales driver.”

Available: now for 12 weeks

RRP: £1 PMP (500ml), £1.99 (2l)

UK&I, said: “This exciting new addition builds on the beloved Jamaica Ginger heritage, refreshing it with a modern twist that brings a fresh, tropical �lavour to the cake aisle.”

RRP: £1.75

PLADIS has launched a Pineapple & Coconut variant of its McVitie’s Jamaica Ginger Cake range. It is the brand’s �irst �lavour expansion since 2009. It is a moist, sweet loaf cake with a fresh, tropical �lavour, perfect for enjoying cold with tea or warm with custard, according to the supplier.

Available from: Morrisons, Spar and Nisa

PASSION fruit liqueur Passoã has launched a range of ready-to-drink (RTD) cans, inspired by its top two cocktails.

Passion Fruit Martini and Pink Lemonade Spritz

RTDs are available in 250ml recyclable cans. They are vegan, gluten-free and lowcalorie, at 150 calories per can. Kaarina Jannin, global brand director at Passoã, said: “With our expanded RTD range, we’re making it easier than ever to enjoy delicious passion fruit cocktails, whether you’re having a movie marathon

Catherine Morgenroth, marketing manager at Pladis

for Halloween, entertaining at home for Christmas or simply toasting to the weekend.”

RRP: £2.30

ABV: 5%

AMERICAN bakery and pretzel brand Snyder’s of Hanover has launched Pretzel Pieces into the UK market, available to convenience retailers. They are distributed by Euro Food Brands, and available in four �lavours – Cheddar Cheese, Honey Mustard & Onion, Hot Buffalo Wing and Jalapeño. Founded in 1909, the brand has a rich herit-

age, rooted in tradition and a dedication to true pretzel craftsmanship, according to the supplier.

Blanca Cerro, Campbell’s growth marketing lead, said: “We exist to make the best pretzels, like we have since 1909, and it’s this heritage that consumers know and love us for today.”

RRP: £2.50

PASTY, pie and savoury supplier The Phat Pasty Co has added two vegetarian bakes to its range.

Chunky Samosa Roll is made with cauli�lower, chickpeas, spinach, red pepper, mango chutney and Indian spices.

The Cheese & Spinach Breakfast Turnover incorporates West Country cheddar and Red Leicester with spinach in a béchamel sauce, topped with herbs and wrapped in a puff pastry. Both products are accredited by the Vegetarian Society, and the Chunky

Samosa Roll is also approved under the Society’s vegan and plant-based trademarks. Available from: Bidfood

THIS Is Skinny, a low-calorie canned RTD cocktail range, has launched into the UK off-trade, available through wholesale.

The range, in 250ml cans, comprises three well-known cocktails with a �lavour twist: Long Island with Earl Grey, Mojito with Rhubarb and Passion Martini with Strawberry. The cans

concept will help convenience retailers boost their food-to-go offering – helping to drive sales – according to the supplier.

CADBURY Brunch has undergone a packaging refresh, highlighting the brand’s taste credentials and ingredients.

contain 65 calories or less, according to the supplier. They have no added sugar, are gluten-free, keto-friendly and suitable for vegans, the supplier added.

Co-founder Janeczka Le Port Tanaka said: “We are not suggesting this is a so-called ‘health product’. This Is Skinny is simply a healthier way to drink – while enjoying alcohol responsibly.”

RRP: £2.50

Available from: HT Drinks and Champers

COUNTRY Choice has launched an ambient sausage roll concept as part of its Bake & Bite brand. Retailers must bake the sausage rolls as normal, allow them to cool for two hours, and then place them in a �ilm-fronted bag. They can be displayed in either the Bake & Bite-branded countertop or free-standing merchandising unit for up to 12 hours. The new

RRP: £3 (x 4)

Available: now

Enhancing Cadbury’s distinctive purple, the new design is set to recruit new consumers while appealing to brand loyalists, according to the supplier.

Moreover, the Cadbury Brunch range now also includes a new value pack for the Chunky Choc Chip variety available to convenience retailers.

PARFETTS has launched Go Local Paracetamol tablets, expanding its own-label medicines offer following the introduction of Go Local Ibuprofen in January.

The new 16-pack line is being positioned to deliver “industry leading” returns for retailers, with a pro�iton-return of 62.1% at a £1 RRP. Parfetts said this is more than double the

average margin achieved on branded equivalents. The tablets come in shelfready trays with branded packaging and blister packs. Shoppers can expect “real value” without compromise on medicinal content, the wholesaler added.

Available: now

It has 10 bars – an additional six bars to the standard pack – and aims to meet the needs of large families and shoppers looking for better value. The Chunky Chop Chip bars are also available in a Light version.

UNITAS Wholesale has launched the latest edition of its Focus On series, designed to help independent retailers prepare for the back-toschool period.

Focus On Back To School is an at-a-glance guide to the bestselling products for the occasion. It covers various key categories such as breakfast cereals, confectionery, crisps, snacks and nuts.

Available via the Plan for Pro�it website and app, the guide also provides merchandising tips, promotional advice and in-store display recommendations, alongside suggested actions for retailers.

Mark Langohr, category controller at Unitas, said: “Focus On Back To School contains essential cat-

egory insight and information to help retailers boost their sales and increase pro�itability, while ensuring their customers can rely on them to stock the products they most want and need at this busy time of year.”

PREMIUM spirits brand Jatt Life has launched a range of ready-to-drink (RTD) cocktails, available to convenience retailers.

The range comprises three vodka-based and one ginbased RTD: Aloha Sunrise, made with Orange and Pineapple Vodka; Forestini, featuring Forest Fruits Vodka; The Mule, made with Lime Zest Vodka; and Jatti Gin & Tonic, featuring Jatti Pink Gin.

The RTDS have an ABV of 5%, with RRPs ranging from £3 to £3.50. A spokesperson for the brand said retailers can expect margins in the region of 25-45%.

Moreover, the brand will also support convenience

stores and independent retailers by offering in-store activations and sampling opportunities, marketing campaigns to build awareness and demand, as well as PoS support, including branded displays, shelf talkers, posters and fridge strips to drive in-store sales.

Founder Baz Kooner said: “Jatt Life was built on the idea of creating a drink that

represents more than just alcohol – it’s a lifestyle. With our new RTD range, we are bringing that same premium experience in a convenient, ready-to-enjoy format that is perfect for today’s consumer.”

Retailers that want to stock the product can contact editorial@newtrade.co.uk.

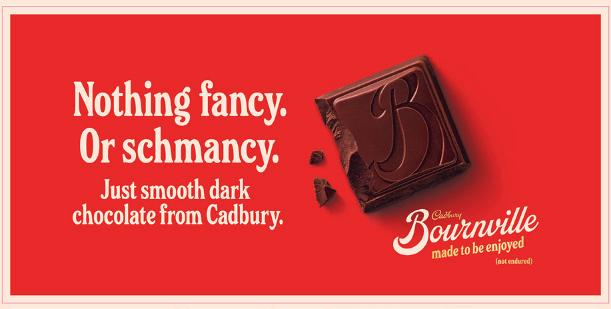

CADBURY has unveiled a major brand campaign for its dark chocolate Bournville, the �irst in almost 50 years.

The campaign follows the launch of new Bournville �lavours, Salted Caramel and Chopped Hazelnut.

The campaign introduces the slogan: ‘Made to be enjoyed, not endured’, positioning Bournville as the antithesis of bitter, hard-toenjoy dark chocolate.

It will roll out across outof-home, radio, YouTube, video-on-demand and social media, with Bournville branding and bold typographic headlines, highlighting the simple pleasure of the chocolate.

CAMPAIGN

ELFBAR has launched Elfx Ultra, an open-pod device that lets adult smokers personalise their vaping experience.

The new device introduces compatibility with InnoGate, an independent app developed in collaboration with

El�bar. Features of the new device include child-safety lock, puff-count monitoring and an option to switch between two vaping modes, both supported by a dual mesh coil system that boosts �lavour by up to 200%. Elfx Ultra uses re�illable Elfx pods

with a 2ml e-liquid capacity, compatible with all nic salts, including El�iq. RRP: £26.99

Newtrade Insight partnered with BREWDOG to trial two cra beer multipacks in four retailers’ stores. Here’s how they got on

DATA: This feature is created by Newtrade Insight. Data is gratefully received from the retailers who participated in a 14-week trial. Any data from other sources is cited.

THE trial’s key objectives were to demonstrate how convenience retailers could maximise their beer pro ts by stocking BrewDog’s Punk IPA and Hazy Jane 330ml four-packs.

The trial ran from midMarch to the end of June 2025, giving the opportunity to review the impact of the Easter and May bank holidays on sales, as well as the e ect of warmer weather on beer sales.

Over 14 weeks, four retailers based across England were supplied with stock and encouraged to dual-site packs to attract customer interest. The

stores used ambient stacks while also chilling packs for shoppers looking for immediate consumption. Sales of the products and the overall beer category were recorded and compared to the same 14week period last year in three of the participating sites, as well as the three-month period immediately preceding the trial across all four sites.

The four retailers each served di erent demographics: these included a workingclass housing estate in east London; a Cornish village that attracts lots of passing tour-

ist trade in warmer weather; an a luent village outside Chester serving delivery customers through Snappy Shopper; and a 24-hour store with a mix of locals, passing trade and workers on a main road in Birmingham. This breadth of locations and shopper types aimed to show the broad appeal BrewDog has when sited in a way that draws customer attention with strong pricing.

Retailers were able to promote the packs during the trial with PoS at an o er price of £6 rather than the usual £6.99. 113

The total combined Hazy Jane and Punk IPA sales in Budgens Greenacre during the trial

THE most successful store throughout the trial was Sajeev Gowrinathan’s Budgens Greenacre. Not only did Gowrinathan sell 113 trial packs, but his sales of BrewDog Cold Beer increased to 60 from 19 during the three months before the trial as a result of the prominence of the BrewDog range and branding. Overall, his beer sales rose by 529 units, equating to £4,400, with the price per unit also increasing from £6.04 to £6.27. The BrewDog lines saw higher sales than those of several traditional lager brands o ering larger can sizes in pricemarked packs (PMPs). His craft beer share rose from 0% to 4% year on year. Sales across the two trial packs in Mohammed ‘Naz’ Nazir’s Go Local Extra Coventry Road store achieved a combined 1.4% share of his beer sales, putting them within his top 10 lines, ahead of more than 150 other lines. This result is comparable to several established beer brands, with the promotional pricing proving attractive for shoppers.

2.2 units per week, respectively. These consistent sales put them above several ale bottles, which sell well in the region. There were also spikes during the bank holidays, showing the impact of strong positioning and PoS on grabbing transient shoppers’ attention and driving incremental sales.

In Cornwall, sales of Punk IPA and Hazy Jane averaged 3.1 and

In Nishi Patel’s Londis Manor Close, the two lines sold 23 units combined. His overall sales declined by 247 units, but sales value was up by £363.32, which BrewDog’s premium positioning contributed towards.

9%

The share of Hazy Jane and Punk IPA volume sales during the trial in Phoenix Stores St Stephen

THE major takeaway from the trial was the importance of having the products both in the chiller and dual-sited in stacks or promotional areas. This strategy not only aided visibility for a brand and category that was previously underrepresented in the stores, but also catered to ‘for now’ and ‘for later’ consumption occasions.

Additionally, the timing of the trial showed the power of

the long weekends at Easter and in May in driving sales. More broadly, key selling periods tended to be evenings and weekends, with 80% of Batten’s sales coming on Saturdays.

These trends emphasise the need for retailers to get deliveries coming at the right time and make sure shelves are faced up appropriately during these times of the week, es-

pecially if a promotional price is in e ect. One of Batten’s shoppers bought Punk IPA on a promotional price and became a regular fortnightly purchaser.

In each store, the BrewDog lines managed to compete with – and in some cases, outsell – well-established branded lager options which have long been a part of convenience stores’ ranges. This is evidence that they

THROUGHOUT the trial, participating retailers introduced other craft beers alongside the trial products, showing an intention to broaden their o er. Some of these were other BrewDog lines, while others were from other craft brands.

Sajeev Gowrinathan, Budgens Greenacre, Tarvin, Chester

“HAVING the products in two locations in store and promo pricing helped us push sales in a store where alcohol does well. It was useful for us to see how products sell with particular pricing, positioning and PoS.”

Gary Batten, Phoenix Stores St Stephen, St Austell, Cornwall

“IF people try something new and like it, they’ll come back to it, but you need to adapt their behaviour, so PoS and pricing help a lot with that. We’ve now got a few customers buying BrewDog on a regular basis.”

managed to add value to the stores and brought in new shoppers by acting as a signpost for a di erent segment to what was usually on o er.

“Once people tried it and liked it, they came back for it,” said Batten. Even if sales didn’t stand out as remarkable, they were strong enough within the context of the retailers’ wider ranges to justify their position on-shelf.

Mohammed ‘Naz’ Nazir, Go Local Extra Coventry Road, Birmingham

“KEEPING the products double-sited de nitely helped sales and we sold more when the weather was better, as customers went to the chiller a er seeing the stacks. We’ll keep them in and track sales.”

In the three months prior to the trial, Gowrinathan only stocked three craft beer lines. During the trial, he also added BrewDog’s Wingman and Orange Crush IPAs, as well as its mixed pack, to his range. Sales of other branded craft beers were also up compared to the period pre-trial. He also saw a strong halo e ect from another BrewDog brand, Cold Beer lager, which more than tripled its sales.

a product, despite the reality of products going through the till.

The trial was also a good example of how perception of sales without proper EPoS analysis can warp a retailer’s view of

While the BrewDog four-packs were an unquali ed success in Gowrinathan’s store, their performance in the other stores showed promise, especially given the breadth of ranges, as in Nazir’s store, where there were more than 250 beer lines. By using EPoS data, stores were able to look beyond perception and use real gures

to show the trialled BrewDog packs were still ahead of several ale and lager brands, and would have performed even better if other craft lines were introduced alongside them. Retailers should closely review their sales and consider creating a dedicated instore craft segment that uses BrewDog as a category signpost, causing sales uplift to other lines.

Nishi Patel, Londis Manor Close, Abbey Wood, east London

“CRAFT beer can build a customer base, but the price has got to be right as pint cans are a big part of our business. A promo price can help with this, and dual siting draws attention to the products.”

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

Pricewatch: discover the most-profitable price points on top-selling Halloween confectionery + Wholesale Pricewatch: beer multipacks

WHATSAPP: How is it helping you run your business?

“I’VE met some retailers at events who are helpful, but on WhatsApp groups, there are people I’ve never met who have offered advice straight away when I’ve asked for it. Some of them have even messaged me personally to give their advice free of charge.”

Minesh Keshwala, Spar Ash Close, Barlborough, Derbyshire

“WE sell two-to-seven copies of the Warhammer 40k Combat Patrol magazine every week for around £10. We all talk to our customers in the store. So, why not get their phone

Some have messaged to give advice free of charge

BACK TO SCHOOL: Do you expect a boost in sales?

“I’VE recently introduced Funko Pops – figurines based on popular franchises such as the Marvel comic universe. Demand has been a bit slower because of schools being off, but I expect this to be boosted as kids return from their holidays. They should also do well ahead of Christmas.”

Kaual Patel, Nisa Torridon Road, south London

“ TRADE is always a bit slower around this time and it hasn’t been helped by roadworks outside the shop. We’ve lost a lot of passing trade. However, we are launching home delivery soon. We’re teaming up with Flash delivery and expect this to help us increase sales for the busier months.”

Vas Vekaria, Kegs N Blades, Bolton

WHOLESALE: Are you looking to renew your partnership?

“I WAS looking at going back to a symbol group after having previously been with one. I had conversations with a national wholesaler, but they’ve put me off. They were overly pushy and demanding that I change many of the things that make my business unique. It’s not for me.”

Anonymous retailer

The rep was really pushy and put me off

PROPERTY: How do you get a store set up after purchase?

“GETTING staff ready takes 10 weeks. You have to recruit them, train them and get them up to speed with your internal processes. From the moment we start discussions about getting a new site to the doors, opening can take anything from three to six months.”

Mital Morar, General Stores, Manchester

“THERE are various things I look for when acquiring a site, including the ‘chimney count’, whether the site is on an arterial road and if there are any schools locally. One of the most crucial things I look for is whether there is parking. Suddenly, your business is a destination store.”

Sasi Patel, Go Local Extra, Rochdale

‘My sta member got attacked over co ee’

RECENTLY, one of my staff members had an altercation with someone who had attempted to leave the shop without paying for a coffee. He came into the store and tried to get a coffee at the machine. The �irst one didn’t work. Our team leader, Kiran, eventually got it to work, but the guy insisted because of

the trouble, he was going to leave with the second one without paying. Kiran tried to stop him and then they had a bit of an altercation. He was extremely shook up and has a very badly bruised arm. I reported the incident to the police on 22 August, but did not hear back until three days later. It doesn’t surprise

COMMUNITY RETAILER OF THE WEEK

‘An absolutely priceless moment’ Bobby Singh, BB Nevison Superstore, Pontefract

“THIS is a moment I’ll never forget. We recently participated in a national campaign launched by CocaCola Europaci c Partners, highlighting the importance of independent retailers. My mum and I had recently been featured on a billboard as part of it. I took her to see it, and it was priceless. We’ve been serving the community for 41 years. I’m grateful to be part of this celebration, and even more grateful for everyone who’s been with us along the way. Here’s to family, community and the memories that last a lifetime.”

me, in fact. I’m pleased that they did actually come back to us eventually. I’d like to see it become statutory that if violence is involved and reported in any shop theft, it is mandatory that police attend within a given period.

Jonathan James, Fresh & Proper, Soham, Cambridgeshire

A Cambridgeshire Constabulary spokesperson said: “We received a report of a common assault at the Fresh & Proper Shop in Ash Road, Soham, at about 7.50pm on 22 August. The matter has been investigated and, in agreement with the victim, the person responsible has been dealt with by an outof-court resolution.”

COMMUNITY RETAILER OF THE WEEK

‘We raised £447 for fantastic causes’

“WE hope everyone had an amazing time at our boot fair that was held last month. Thanks to their generosity – both through the pitches bought by the vendors in attendance and our donation buckets – we proudly raised £447 to support two fantastic causes in the area. These causes were Rye & District Day Centre and Rye & District Community Transport. To our wonderful vendors, we hope the day brought you success and connections. And to all the bargain hunters and treasure seekers, we hope you discovered something special to take home.”

RETAIL crime is a monster that seems to be escalating out of control, whether it’s the growth of in-store the or the rise in sales of illicit products like tobacco and vapes. We are trying to keep our nger on the pulse and work with brands to feed into their campaigns, because it o en feels like Trading Standards don’t know what they’re looking for.

Each issue, one of seven top retailers shares advice to make your store magni cent

We have preventative measures in store, such as Retail AI, which is a CCTV system that tracks shopli ing. It has cost me capital to install, but it measures and monitors products on the shelves, as well as human behaviour. Now, if someone picks up a product and puts it in their pocket or eats it there and then, it turns down the music in the store and res up an alert to let the team know that shopli ing is potentially occurring.

A clip of the incident is then sent to a tablet at the counter, which is reviewed by sta immediately and can be sent to the police. We’re using a process to send videos to the police so they can build pro les and take action if they see too many incidents with the same o ender.

Some shops have turned to physical intervention in the form of security guards, but these can cost £24,00050,000 a year depending on your opening times. There’s no way a store can absorb such a cost, and it rarely serves as a deterrent. The guards are o en trained not to intervene, and proli c o enders know this. It’s almost identifying your shop as an easy target.

It’s important to understand why a shopli er steals if you are to take action against it. It could be austerity, no enforcement from the government or police, the cost-ofliving crisis, or they might be struggling to feed a habit.

Convenience stores are about community rst, so we have to be there as pillars of that community. That means not just selling products at promotional price points, but o ering support, showing people what compliance looks like and giving back to the community. If you do that, you will see immediate changes.

BESTWAY is celebrating ‘Golden Days and Weeks’, featuring unbeatable deals, special o ers, promotions, prize ra les, competitions and exclusive products and flavours – all designed to drive footfall, grow sales and boost pro tability in depot and online

SUPPLIER brands such as Budweiser Brewing Group, Coca-Cola Europaci c Partners, Red Bull, Heineken, Cadbury, JTI, Imperial Brands, Mars Wrigley, Yazoo, AG Barr, Walkers and Carlsberg Britvic – to name a few – have been valued partners throughout Bestway’s evolution into one of the UK’s leading wholesale and retail businesses.

These longstanding relationships are more than commercial – they are built on shared ambition, trust and a commitment to supporting the independent sector, and o en deliver unique and exclusive bene ts for Bestway independent retailing customers.

Through close collaboration with its supplier network, Bestway leverages its nationwide infrastructure, operational excellence and scale to deliver exclusive promotions and seasonal campaigns, rst-to-market new products, category-leading insights, shopper-focused solutions and trusted, in-demand products at consistently competitive prices.

By working hand-in-hand with the industry’s bestloved brands, Bestway ensures its retailers are always equipped to meet shopper demand, drive footfall and stay ahead in a competitive and dynamic marketplace.

AS Bestway celebrates 50 years, Corona (part of Budweiser Brewing Group) celebrates 100 years by launching an on-pack promotion, o ering consumers the chance to win a trip to Corona Island – a stunning natural paradise located o the coast of Colombia, featured on the Beach 100. Other beach prizes are also up for grabs, including coolers and paddleboards.

All consumers need to do is purchase a pack of Corona Extra or Corona Cero, scan the QR code on their pack or bottle cap and they can enter for a chance to win.

What’s more, consumers can enter via Bestway’s retailers to have the chance to win escapes to other Corona Beach 100 destinations. The rst Golden Week drove a 37% volume upli , with Golden Days delivering daily boosts of 101% and 51%.

SPECTACULAR results were achieved during AG Barr’s Golden Week, supercharging sales across its core portfolio including Boost, Barr, Rubicon and Tizer.

SALES of promotional lines surged by an impressive 185% compared to the weekly average, driving a 73% growth in volume and a 80% growth in value.

THE compelling deals didn’t just boost sales – they also helped retailers maximise their margins, making this Golden Week a true win-win for all involved.

AG Barr has launched an exclusive Birthday Cake flavour drink for Bestway’s 50th birthday. It is a fun blend of birthday cake flavour with a zzy, refreshing twist perfect for birthdays, parties or any special occasion.

To boost sales during the high season, AG Barr launched an exciting retailer incentive campaign, o ering a £10,000 prize pot. Retailers receive an automatic entry into the prize draw with every purchase of any ve cases, giving them a chance to win big while stocking up.

The supplier has also unveiled two brand-new limited-edition flavours of Irn-Bru Xtra: Nessie Nectar and Unicorn Tears. Inspired by Scottish folklore, these playful “mystery” variants are now available exclusively in Bestway depots. Paying tribute to the legendary Loch Ness Monster and the mythical unicorn, both flavours aim to capture the bold, quirky spirit that has made Irn-Bru a national favourite. An exciting in-depot incentive for retailers is taking place in depot with a prize pot of £10,000. The campaign o ers generous rewards and adds an extra splash of excitement to the birthday celebration.

MARKING the launch of its Lando Norris Zero Sugar Limited Edition, Monster brought the buzz of the racetrack to Bestway’s Park Royal depot – complete with a McLaren car to wow customers. Multiple Formula 1 race winner Lando Norris spends his weekends blasting 230mph spaceships around the world’s toughest F1 tracks. Now, consumers can tap into that same fearless energy. This zero-sugar Monster packs the fuel you need to power through your day at full throttle – just like Norris tearing through the Monaco streets on his way to victory. The can is wrapped in his iconic helmet design, bringing track style to your fridge. It’s the taste of the future – unleashed in every sip.

Retailers who stocked up on Monster Lando Norris products at Bestway depots had a chance to win high-impact prizes, from helmets and BMX bikes to electric guitars and iPads.

CHARLES WHITTING nds out how retailers are bringing some variety to their teas and co ees

WHEN it comes to take-home hot beverages, most customers are still opting for the big teabag brands and jars of instant co ee. Shelley Goel, from One Stop Gospel Lane in Solihull, West Midlands, says his bestselling teabag brands are PG Tips and Yorkshire Tea, while his co ee sales are dominated by Nescafé.

However, on top of this, retailers have also been reporting a growing demand for options that enable people

to have a co ee-shop experience without the co ee-shop price tag.

“The ‘treat’ occasion is gaining momentum as consumers increasingly seek permissible treats, evident in their preferences for creamy lattes and luxurious hot chocolates,” says Isabelle Fournier, head of beverages at Nescafé Professional UK&I.

Perhaps the most successful variant of the co ee-shop style option comes in the

form of sachets from the likes of Nescafé, which come in varieties such as caramel latte, latte and cappuccino.

“People want their Starbucks or Costa drink, but they can’t a ord it, so they’re buying the sachets and making it at home instead,” says Raaj Chandarana, from Tara’s Londis in High Wycombe, Buckinghamshire. “The sachets are great for people who don’t have Nespresso machines but want that ‘bougie’ co ee.”

WHILE English Breakfast remains the dominant option when it comes to teabags, retailers are reporting an increased demand for herbal teas, as people seek ways to live a little bit more healthily.

For stores with the right customer demographic, o ering matcha and green tea could also be a point of di erence.

“The health bene ts of green tea have been heavily publicised on TikTok, and we’ve seen younger people coming in for green tea because they’ve seen matcha tea online,” says Chandarana. “A younger customer explained it to me and as soon as she left, I double-faced my green tea.”

Chandarana currently o ers

Tetley Green Tea, price-marked at £2, which he says appeals more to his customer base than Twinings options, which cost closer to £3. In contrast, Goel stocks Twinings Mint and Twinings Peppermint in his store.

On top of this, retailers should not ignore the growing demand for deca einated products, with value sales in

growth. According to Maria Kabalyk, head of category and shopper at JDE Peet’s UK, decaf makes up a quarter of all instant-co ee sales.

“With the choice between ca eine and decaf products being one of the main considerations for the health-conscious shopper, many are turning to decaf products,” she says.

Stuart Wilson, founder, Lost Sheep Co ee

“AS more consumers look to recreate co ee-shop quality at home, a trending product set to explode over the next year is co ee concentrate. What concentrate o ers is the opportunity to create cafestyle co ee in the comfort of your own home, with no barista skills or expensive equipment required.

“Single-origin co ee is another trend to watch as we head into 2026. What we are seeing more and more are consumers buying into the story behind the co ee they drink. Single-origin co ee taps into this as the level of traceability is high; it allows for 100% traceability right back to the farm it was grown in. Medium to dark roast levels – best for espresso – are increasingly popular.”

26% CONSUMERS WANT MORE CONVENIENT ICED OPTIONS2

OVER £9.3M IN VALUE SALES IN THE LAST YEAR3

RETAILERS looking to give their range of co ees some more variety can look at the success of the sachets mentioned earlier, but there are also options within tea as well. Roopie Gill, from Wattville Road Post O ce in Birmingham, sells chai teabags to a wide demographic.

“We sell Yorkshire Tea and Tetley, alongside a lot of these Asian teas,” she says.

“To make a chai traditionally, you must have lots of di erent spices all boiling in a pan. But with this, you just put it in a cup and it tastes the same. It saves the hassle, and we sell it quite a lot as a result. People want to make

their lives easier.”

Retailers should also consider the additional extras that co ee shops o er and look to introduce these as part of their take-home offer. Items like syrups, which o er seasonal flavours such as pumpkin spice or hazelnut, can help to boost basket spend and enhance your customer’s shopping experience.

There are also other hot beverage options available beyond tea and co ee that retailers should consider stocking. Leading the way is hot chocolate, with its warming comfort, which is particularly important in the winter months.

Maria Kabalyk, head of category and shopper, JDE Peet’s

UK

“THE co ee-shop-at-home trend continues to grow, with 49% of consumers claiming to visit co ee shops less to save money – and most drinking more at home.

“Consumers are trading up on their weekly shop with products that allow them to easily recreate their favourite co ee-shop experiences in the comfort of their own homes. This trend is being proven through the immense growth within the specialities and mixes segment.

“In fact, we have seen an increase in spend from April 2024 versus April 2025 on soluble specialities, gaining greater penetration than other co ee segments in the past ve years, with the segment now worth more than £207m. What’s more, these products are key to recruiting a younger shopper and expanding the popularity within the co ee category.”

Lynsey Harley, founder, Modern Standard

“THE three biggest trends in the hot beverages market right now are sustainability, the rise of speciality co ee and innovation.

“We’re continuing to see a greater demand for plant-based options, for example. Oat, almond and soy milk continue to dominate, with new alternative milks entering the scene regularly.

“We are also seeing a trend towards home brewing. More consumers are investing in at-home co ee set-ups, meaning retailers need to o er exclusive experiences to keep footfall.

“Looking ahead, we expect further premiumisation, increased demand for sustainable co ee and more stores diversifying their o ering to include co eebased cocktails, unique flavour pro les and functional beverages, like mushroom or CBD-infused drinks.”

JUST as a co ee machine in a store can lead to customers picking up a complementary pastry or snack, so, too, should retailers consider what they are stocking near their hot beverages section.

“By o ering convenient, value-driven pairings, retailers can tap into impulse purchasing behaviour and encourage cross-category

AS people frequent co ee shops less often and try to recreate the experience at home, easy-to-use options such as sachets will grow in popularity.

But the category is also one that can lean even further into premiumisation. Glesni Owen, head of sales at TrueStart Coffee, highlights the growth in co ee sachets, but also in coffee beans.

“Co ee beans are experiencing 22% value growth and 13% volume growth as shoppers look to recreate the co ee-shop experience at home,” she says. “There is also growth in smaller sub-categories, such as coffee bags, where we can see a 5.7% value growth and 6.2% volume growth, driven by the desire for premium-quality co ee, with the convenience

engagement,” says Nestlé’s Fournier.

Biscuits and pastries are well-known pairings for hot drinks, so they would be a good option to place nearby to spark impulse sales. Goel places his hot beverage offer above his cereals, building that connection around a morning breakfast routine.

“We have co ee on the top

shelf, then teas beneath that and then di erent types of sugar and hot chocolate, and then nally breakfast cereals right at the bottom,” he says. “We’ve dedicated about four metres to the section.”

Retailers should also make sure they are presenting their hot beverages in an eyecatching way. Teabags are a product that is often on shop-

ping lists, but they can also be an item that’s purchased when the sight of them prompts the need.

“Allow good shelf space for your co ee display to help maximise visibility and attract more customers to your range,” says Kabalyk. “O er a breadth of brand choice to meet evolving shopper needs with two facings per line.”

of a single-serve, sustainable format.”

Chandarana also sells co ee pods for at-home co ee machines, but says his clientele is more interested in sachets. However, almost a third of the UK population own a co ee machine, so pods could also be a useful premium point of difference for stores, especially as the market continues to diversify beyond Nespresso.

Halloween and Bon re Night are the last events before Christmas, and provide a strong sales opportunity.

TAMARA BIRCH explores what’s trending

HALLOWEEN and Bon re Night have big potential for pro ts, but to get ahead of the competition, retailers say they must introduce speci c product ranges earlier each year.

“We establish our Halloween ranges the rst week of September – and we know supermarkets already have their

Halloween and Bon re Night ranges out – but we are limited to when suppliers release their ranges,” says Matthew Hunt, from Filco Supermarkets in south Wales.

Raj Suchak, of Coldean Convenience in Brighton, East Sussex, explains his range is introduced mid-September, but

says that even this is earlier than previous years.

Parfetts’ retail sales controller, John O’Neill, says orders should be placed now to ensure strong availability for the seasons.

“Retailers should aim to introduce stock by late September, gradually building

visibility. Confectionery and non-food items – such as decorations and accessories – should lead, followed by themed drinks and snacks in early October,” he says.

“Phasing product introductions helps create a sense of momentum and encourages repeat visits.”

Steve Waters, senior brand manager, Mars Wrigley

“IT is crucial for retailers to consider wider consumer behaviour when it comes to the Halloween season so they can capitalise on a wide range of shopper missions. For example, 18% of households keep treats speci cally for trick-or-treaters, so providing bitesize confectionery for shoppers is a must. Considering other at-home celebrations, such as the 23% of households that bake at Halloween, will help retailers ensure their range is stocked with a variety of products that appeal to di erent shopper missions, in turn driving sales.”

“IN our local area, some of the houses organise a map of those participating in trick-or-treat festivities, and we’re on the map year in, year out. We also distribute the maps for the organiser so that everyone knows about it. This way, everyone knows who’s participating in trick-ortreating so they can pick up sweets that evening.”

THE key to capitalising on both Halloween and Bon re Night is understanding the trends. Value continues to be a strong contender, so for some retailers, this means promotions, price-marked packs or simply pricing strategically. But for others, this could be sharing bags or extra-free. Both Hunt and Suchak focus on confectionery, and suppli-

ers recommend focusing on sharing bags – from confectionery to crisps, snacks and nuts (CSN).

“In the lead-up to both events, consumers seek out their favourite snacks for movie nights at home and get-togethers with family and friends, making CSN a critical category to capitalise on,” says Stuart Graham, head of

convenience and impulse at KP Snacks.

Suchak also focuses on alcohol, as he has a predominantly student base. He says:

“The Friday and Saturday around Halloween is our biggest sales period of the year. It’s typically the rst event where students go all out now they’re settled at the university.”

While confectionery and alcohol are key categories, Hunt says there’s also an opportunity to be grasped by stocking makeup, buckets, lights and glow sticks.

“Largely, confectionery is the big thing for Halloween, but you’ve also got non-food. We source them from Morrisons, but also PMS and BJ Toys,” he explains.

Secondary sitings

Bestsellers at eyeline

Dedicated displays

Secondary sitings in store are vital to the category, particularly as they prompt unplanned purchases, which account for 60% of sales in convenience.

Retailers should put bestsellers at eyeline to ensure they are easy for shoppers to spot, encouraging both impulse and repeat purchases.

In the weeks leading up to key events, such as Halloween or Bon re Night, remind your shoppers to pick up the essentials with dedicated displays and PoS material to help grow sales.

HALLOWEEN is one of the biggest seasonal events of the year, but most products for the event are stocked year-round. Therefore, in-store theatre can help visibility.

“It’s an event, so you need to highlight it with posters, PoS for any promotions and decorations,” says Hunt. “Our team will put out spider webs, skeletons and pumpkins around the area we’re selling

Halloween stock in.”

Suchak doesn’t do in-store theatre, but plays themed music and changes his lighting to orange.

“We have colour-changing lighting around the store from our re t a few years ago, so it would be a shame to waste that,” he says. O’Neill says in-store theatre should start appearing in early October, around the same time as

themed ranges go live.

“Starting with subtle touches, such as window decals or themed signage, allows retailers to build gradually towards Halloween,” he says. “By midOctober, stronger visual displays and in-store promotions should be in place to create excitement and footfall.”

Elsewhere, Alexander Wilson, category and commercial strategy director at Heineken

UK, adds that store theatre should also help customers to boost their basket sizes.

“Convenience retailers should consider creating their own display near the front of the store, which signals Halloween-themed promotions,” he says. “For example, a multipack of beer with crisps and snacks to inspire customers to purchase multiple items.”

WHILE reworks and sparklers aren’t a main focus for retailers, they are a good footfall driver. Retailers are open to stocking these, but the challenge is the legalities around stocking them, and some of this is not knowing what you can and can’t stock.

“Retailers can legally sell

reworks for Bon re Night between 15 October and 10 November without needing a special licence,” says O’Neill. “Outside these dates, a yearround licence is required. Fireworks must only be sold to customers 18 or over and must meet UK safety standards. Retailers must also fol-

low strict storage and display regulations.”

Any reworks must be kept in designated, secure display cases or cabinets away from ignition sources, with a maximum of 12.5kg net mass of explosives per cabinet in the sales area, according to the British Fireworks Association.

Another challenge to Bon re Night is planned displays, as noticed by Hunt. “We used to sell a lot of sparklers and reworks, and kids would take the sparklers to these displays, but many have put rules in place that stop that from happening,” he says. “As a result, demand has fallen.”

Launches for Halloween 2025

Chupa Chups Stranger Things lollipop collab Available now, retailers can stock two di erent pack sizes of Chupa Chups Stranger Things. The new collaboration bags are lled with nine mystery flavours inspired by the characters of the hit Netflix show, which airs its nal season later this year. Each pack also features a QR code linking through to a digital experience with competition opportunities.

Mondelez’s 2025 Halloween line-up

Mondelez International has added to its Cadbury Treatsize Sharing Selection for this year’s Halloween range. The Cadbury Treatsize Sharing Selection pack contains consumers’ favourite Cadbury products, including Buttons, Crunchie, Twirl and Freddo. Dairy Milk Freddo & Friends sharing pack and Fudge treatsize pack are also returning.

Swizzels Squashies Tropical and Sour Shooting Stars

Swizzels has launched two new varieties: Tropical and Sour Shooting Stars. Available now at a £1.15 RRP, with price-marked varieties also available, the new flavours aim to capitalise on the rising popularity of sour and tropical flavours. Squashies Tropical features parrot, pineapple and watermelon shapes in Mango & Passionfruit, Pineapple and Watermelon flavours.

World of Sweets Halloween ranges

World of Sweets has expanded its Candy Realms range with Twisted Mallows, a strong-flavoured marshmallow with tongue-painting candy goo. It has also launched Candy Realms Spooky Gummy Pops, fruit-flavoured gummy lollipops in classic Halloween characters such as a ghost, Frankenstein, witch’s hat and a pumpkin. Also from the range is a Candy Realms Skull Mallow Pop.

KATE BAKER takes a look at where retailers can grow sales of medicines over the winter months

Image credit: Getty Images/DimaSobko

WINTER remedies present signi cant opportunities for retailers, with 91% of adults using over-the-counter (OTC) medicines in the past year for self-treatable conditions.

With the arrival of the traditional cough and cold season, retailers should expect a rise in sales of OTC and non-medicated winter remedies. Particularly since the rise of Covid, the category has continued to justify its place on shelves, as people are more aware of

their health.

“As we head into the winter months, retailers should prepare a selection of winter health products to meet a variety of consumer needs,” says Rachel Ramsden, Olbas brand manager. “With cold and flu symptoms likely to peak in winter months – as well as 84% of adults choosing self-care as their rst option for healthcare – there will be a rising demand for e ective remedies.”

Unlike many grocery categories, where products are typically bought on impulse, winter remedies are often purchased with intention. Shoppers head to their local stores because they’re more convenient, easier to shop and typically near home, which is ideal when you’re feeling unwell. However, that doesn’t mean that a well-positioned range can’t drive some impulse sales and add to overall basket spend.

AS we head into the winter months, retailers need to stock a selection of products to meet a variety of consumer needs.

According to the PAGB 2025 Self-Care Census Report, typically, 84% of adults choose self-care as their rst option when it comes to healthcare. In addition, 75% of GP appointments are for self-treatable conditions, resulting in patients being advised to use OTC medicines.

A strong core range of medicated and non-medicated remedies should include trusted decongestants, soothing nasal sprays and natural OTC solutions – key items to ease common winter ailments for the whole family.

According to Elizabeth Hughes-Gapper, Jakemans’ senior brand manager, of the people purchasing OTC medicine, 93% bought branded

varieties, highlighting a signi cant amount of trust in branded products – encouraging retailers to stock them. And while it seems that the slightly higher price is not a deterrent, by o ering a balanced mix of brand and own-label products, retailers can conserve price-sensitive shoppers while still gaining strong margins from brandloyal ones.

“While value remains important, especially during the cost-of-living crisis, brand trust is key,” says Ramsden. “Consumers are increasingly choosing products they recognise and believe in.”

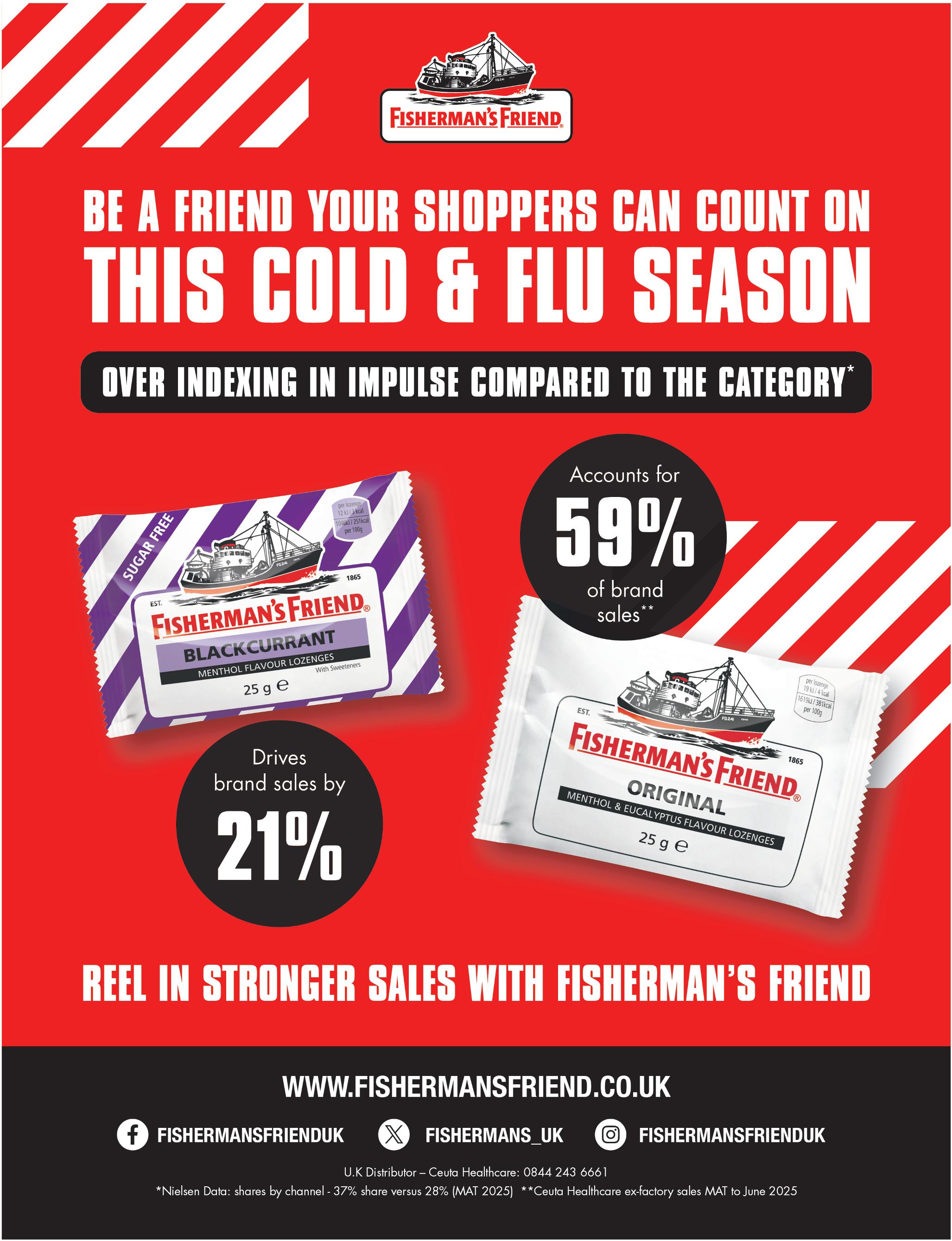

This is reiterated by a Fisherman’s Friend spokesperson, who adds: “O ering value for money is increasingly important. In times like these, shoppers stick with what they know works.”

Olbas

Olbas is launching a brand-new shower gel made with natural essential oils including eucalyptus and peppermint.

Jakemans

SO, where should retailers display their winter remedies to ensure maximum visibility and reduce theft? Convenience and ease of purchase are two key components for consumers, so retailers might want to consider stocking them on shelves in a dedicated section.

“Singles are the most important format across the category, as shoppers look for a readily available relief brand to help continue with

Jakemans launched its limited-edition Spiced Cola in August and extended its permanent sugar-free product range with the addition of a Summer Berries variety. These products join the existing range of Throat & Chest, Throat & Chest Sugar Free, Honey & Lemon, Cherry, Peppermint, Blackcurrant, Menthol & Eucalyptus and Blueberry

Fisherman’s Friend

Fisherman’s Friend has launched PR and influencer campaigns for the 2025 flu and cold season, alongside fresh content across its social channels to reshape perceptions – not just as a winter cold and flu essential, but a year-round go-to.

their day and embrace the moments that matter,” says Susan Nash, trade communications manager at Mondelez International. Placing winter remedies in prominent positions – like the till or a dedicated healthcare aisle – will help consumers locate products quickly and easily, which is important if they are feeling under the weather. In addition, positioning products in clearly marked sections encourages browsing and im-

proves shopper experience, says Olbas’ Rachel Ramsden. As well as medicated brands, like Nurofen, Vicks, Strepsils and Panadol, Mohammed Ibrahim, of Denbigh Food & Wine in Pimlico, central London, stocks OTC remedies such as Hall’s, Jakemans and Lockets. Due to limited space, Ibrahim only stocks bestselling varieties of branded items. However, OTC medicines shouldn’t just be highly visible to customers, but to sta as well, as they are

a category at high risk of theft.

“Medicated remedies are positioned in clear view of the counter, which also deters theft, while non-medicated products are located with sweets near the till,” Ibrahim adds.

Jakemans’ Elizabeth HughesGapper says: “Placing winter remedies in prominent locations ensures products have the best visibility on the shelf and allows retailers to monitor shoppers easily, reducing the opportunity for theft.”

Elizabeth Hughes-Gapper, Jakemans’ senior brand manager, o ers her key pieces of advice

Range

Stock a diverse range of trusted winter remedies, including popular lozenges like Jakemans, which o er a range of flavours and formats to suit customers’ individual needs.

Promotion

Use social media to engage with the community, promote exclusive winter remedy o ers and highlight new products, such as limitededition flavours, to keep the brand front of mind during the colder months.

Positioning

Dual-site products where possible to provide ease of purchase for consumers.

AS well as medications, retailers might also look at the growing interest from customers for healthy products, whether it’s the growth of protein bars or the increased functionality of energy drinks launches.

During winter, consumers often experience lower en-

ergy levels, reduced mood, weakened immunity and widespread vitamin D de ciency, especially in countries like the UK, where sunlight exposure is minimal for several months.

Huib Van Bockel, founder of energy drink Tenzing, observes that while energy drinks are

WITH winter already on its way, retailers should ensure shelves are stocked early to meet demand.

PoS which promotes natural ingredients and product bene ts can help with growing consumer demand for transparency, and will boost customer con dence for those looking for health-conscious choices by guiding shoppers towards the most-suitable remedies for their needs.

Retailers can train their sta to provide recommendations to customers, especially if products are kept behind the counter, as this will help remove the signi cant barrier to purchase and may result in trades up and bigger baskets.

“With nearly 44% of shoppers relying on sta advice when choosing OTC remedies, well-trained team members can play a key role in boosting sales,” says Ramsden.

“Retailers should also create seasonal care bundles – for example, pairing a decongestant with a nasal spray adds value for customers while encouraging multiproduct purchases.”

Keep an eye out for new products and promotions that will raise visibility among your customers, and ensure you are keeping ranges fresh to ensure you’re o ering a greater variety to shoppers and your products stand out on shelves.

typically marketed as all-season, one-size- ts-all products, people’s energy needs actually change throughout the year, especially in the colder months, so certain products could fare better then.

“This presented the opportunity to create the rst energy

drink designed speci cally to meet the real needs of winter,” he says.

Similarly, Warrior recently launched Shilajit capsules, which are made up of 16,000mg of ultra-concentrated shilajit – a traditional herbal medicine.

Thornbury Refrigeration, an Arneg Distributor, has advertised in Retail Express for years. The

The RETAIL EXPRESS team nds out where retailers are tightening things up and reducing their outgoings

Umar Majid, Baba’s Kitchen, Glasgow 1

“WE’VE been a bit smarter with our lighting. We used to have lights in our back stock rooms that were on 15 hours a day. But we’ve installed motion-sensor lights and now they only turn on when someone comes into that area. We’re also looking at the lumens in the lights we have in the store itself to see if we can reduce them without reducing the overall brightness of the store.

“When it comes to our hot food, we’re trying to get things sorted so that we can turn off our ovens far earlier and be more energy ef�icient. We now have all the cooking done and the ovens off by midday, with everything just being heating in the Merry Chef from then on. That’s two hours of electricity per oven each day that we’re saving, which, combined with the lights, is about 13 hours of electricity that we’re saving. Our electricity bill went down 20% in the past nine months.”

2

Andrew Cruden, Market Square News, Northampton

Ushma Amin, Londis North Cheam, Surrey

“THE main thing we’ve done is changed our lighting. It’s taken £120 a month off our electricity bill. All we did was change them over to LED lighting back in September 2024.

“It’s made a massive difference and, to be honest, I didn’t think it would. People are always saying that you should do it, but I was sceptical because we’ve got such a small store. But we’ve seen a 15% reduction in our electricity bill, which has had a big impact. I really do think that it’s something that more retailers should be looking into.

“On top of that, it’s about working with and challenging suppliers to see if you can get some free stock. It’s worth asking the bigger ones for support. Suntory has been the best for us. Twice in the past year, we’ve managed to get free stock from it, which we’ve been able to give away to charities and has been good PR for us.”

“THE main thing that helps us to save money is to join collective groups. I’ve been a Fed member since I bought the business over 30 years ago and it’s been good. They’re now doing Fed Plus, which gives retailers special offers every month.

“I’m part of the Londis Tobacco Club, which gets me better value and prices on cigarettes. That means that I can sell them lower than the RRP and the mark-up is still better. There’s a tobacco club at Booker that will get you lower prices as well.

“We’re also now part of Vikas Buying Group – we get our ice cream, Bobby’s sweets and �ireworks from them. They have a two-week grace period for paying invoices, depending on the deal. That means by the time you’re paying them, you’ve already sold a lot of stock, so you’re not just paying up front. It often doesn’t cost anything to join these things. Although you have to pay for the Fed, your voice gets heard.”

In the next issue, Retail Express nds out what retailers are doing four months on from the

If you have any problems you’d like us to explore, please