FAKE VIEWS, REAL THREATS

IAA LEARNING & DEVELOPMENT FESTIVAL Find out this year’s Category Stars and the biggest lessons from the day P27 NATIONAL LOTTERY P2 BACK PAGE Retailers reveal how they decide which new products to stock P4 AGE-RELATED SALES Convenience stores achieve higher ID pass rate than supermarkets STORE ADVICE 25 JULY-7 AUGUST 2023 STRICTLY FOR TRADEUSERSONLY Allwyn gives update on retailer survey progress ahead of its takeover next year P3

to

Retailers hit back at viral shop-crime hoax likely

spark copycat incidents

Megan Humphrey, editor

No one should ever make a mockery of crime

In a video uploaded to TikTok by a prankster who goes by the name of ‘Mizzy’, a shop was the focus, and he lmed himself knocking dozens of products o the shelves. Multiple news outlets understandably sympathised with the store owner, who last week came out and admitted he was in on it.

Naturally, retailers have branded the incident as “irresponsible” and, to be honest, I don’t blame them. This one incident undoes a lot of work that goes into championing independent retailers and the communities they serve. Although we don’t know why the retailer agreed to this, I just hope they learn their lesson. Crime remains one of the biggest challenges local shop owners face every single day.

On a separate note, I wanted to inform you that I’ll be taking a six-week sabbatical over the summer to go travelling. I’ll be leaving you in the very capable hands of our news editor, Alex Yau, so please do give him a call on 020 7689 3356 if you want to discuss anything during this time.

Allwyn reinforces devotion to indies ahead of takeover

ALEX YAU & MEGAN HUMPHREY

ALLWYN has described independent retailers as “vital” in its takeover plans as National Lottery operator next year.

The �irm is gearing up to oversee the fourth licence for a decade from February 2024, following success with its “digital �irst” plan pitched

IT WAS REASSURING TO SEE ACTION TAKEN IN RESPONSE

Although I’ll be on the other side of the globe, I’ll still be on the lookout for any convenience hacks and trends that UK stores can bene t from, and I promise to tell you all about them when I’m back. Until then, I hope you all have a great summer season, both personally and in your business.

in the bidding process.

At the time, some store owners expressed concern about whether this would exclude them from being a priority. However, retail director Katharine Challinor told Retail Express: “We see supporting retailers as a vital part of our role as operator. We want to empower them to grow sales of both the National Lottery and

their own products. A thriving retail channel means a thriving National Lottery.”

The �irm is currently carrying out site surveys across its 43,000-site estate, examining equipment and determining the type of lottery terminal retailers will receive, with options to upgrade or downgrade from three available choices.

So far, 7,000 stores have

been visited, with a 2% fail rate, due to the retailer either being unavailable or asking Allwyn to return at a later date. In addition, Challinor con�irmed that “new technology” will be introduced in stores eventually, enabling retailers to provide feedback through regular surveys and receive data to help increase sales, more of which will be revealed soon.

Alcohol duty rise Tequila slush

RETAILERS are to be hit with alcohol-duty changes in August, altering the prices and demand for hundreds of alcohol lines.

Features and advertorial writer Priya Khaira

Specialist reporter

Dia Stronach

@IndiaStronach 020 7689 3375

From 1 August, the current alcohol-duty system will be scrapped and replaced by a simpler system based on just

alcohol strength and volume. Till data analysis on nearly 250 lines from Atul Sodha’s 650sq ft Londis Hare�ield in Uxbridge, west London, showed he will pay more than £650 extra duty per month, with some categories seeing prices fall while others rise.

Eco-beer packs

RETAILERS have expressed ongoing frustration over eco-friendly beer packaging breaking apart during deliveries.

plastic packaging on multipack beers. Just like Asahi and Budweiser, store owners are reporting losses from stock damaged due to the cardboard tearing when moved, and stressed it’s “becoming a persistent issue”.

PROXIMOSpirits has revealed plans to invest in convenience with its Jose Cuervo-tequila-branded frozen cocktail machine.

Amit Patel, owner of GoLocal Town Street Sandiacre in Nottingham, is currently undergoing a trial with the

brand this summer. Storing up to 18 litres of liquid, Patel sold 15 litres of product in just six hours in sealed cups. “We sell 16-ounce cups for £5, and it costs us £28 to produce 10 litres, so the mark-up for us is huge,” he said.

For the full story, go to betterretailing.com and search ‘tequila’

05 Delivery slot strain

RETAILERS are struggling to secure delivery slots due to wholesalers facing a rising number of delivery requests.

Multiple wholesalers told Retail Express the uplift was due to retailers no longer having to visit multiple cash

Cover image: Getty Images/Adrian Vidal

For the full story, go to betterretailing.com and search ‘delivery’

and carries to �ill gaps as they did during the pandemic.

United Wholesale Scotland managing director Chris Gallacher said the �irm had seen a 20% increase in retailers using delivered wholesale compared with last year.

@retailexpress betterretailing.com facebook.com/betterretailing

biggest stories this fortnight 01 02

04

The ve

03

Editor Megan Humphrey @MeganHumphrey_ 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Senior features writer Priyanka Jethwa @PriyankaJethwa_ 020 7689 3355 Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Production editor Ryan Cooper 020 7689 3354 Sub editor Jim Findlay 020 7689 3373 Sub editor Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 020 7689 3367 Senior account director Charlotte Jesson 020 7689 3389 Commercial project manager I y Afzal 020 7689 3382 Account director Lindsay Hudson 020 7689 3366 Account managers Marie Dickens 020 7689 3372 Megan Byrne 020 7689 3364 Management accountant Abigayle Sylvane 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our

say

41,206 Audit Bureau of Circulations July 2021 to June 2022 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment.

Last month, Tennent’s became the latest supplier to face criticism for replacing News editor Alex Yau @AlexYau_ 020 7689 3358

IT was shocking to hear that an independent retailer admitted to being complicit in a social media hoax earlier this month, arguably making a mockery of crime.

For the full story, go to betterretailing.com and search ‘alcohol’

Deputy insight and advertorial editor

Jasper Hart @JasperAHHart 020 7689 3384

020 7689 3379

Indies blast online hoax for making ‘mockery’ of crime

ALEX YAU

INDEPENDENT retailers have expressed fears that a staged shop attack that went viral on social media will fuel copycat crimes across convenience stores.

This month, notorious social media prankster Mizzy posted a video of himself and a gang terrorising staff and knocking stock off the shelves in Where 2 Save, an independent convenience store in London.

The video, originally posted on Twitter, gained thousands of views, with major publications such as the Daily Mail drawing attention to it. It was also shared on popular contentsharing platform TikTok.

Less than a week after it was posted, Mizzy – who had previously been arrested for harassing the public – then posted a video of one of the store’s staff members admitting it was a hoax. The employee said: “The whole video [of Mizzy] smashing up the shop was planned. I gave consent to Mizzy. I don’t have any problems with him.”

A caption by Mizzy on the video said: “Reality is merely an illusion. I’m just showing you how the media like to twist a narrative.”

In response, the retailer was criticised by fellow store owners for “making a mockery” of shop crime, bringing about fears that the video could in fact spark

copycat incidents. Bobby Singh, of BB Nevison Superstore in Pontefract, told Retail Express: “I’m more disappointed with the retailer involved than I am with Mizzy.

“Shop crime is a reality retailers face on a regular basis, and they should fully know this themselves. Whether it’s real or not, posting a video like this on the internet is irresponsible and could lead to others trying to imitate it.”

Multi-site London retailer Mehmet Guzel said that a lack of police enforcement acts as encouragement for would-be criminals. “The retailer in the video is moronic,” he said. “What Mizzy has done is horrendous, and there’s a chance it could in�luence groups of kids to do similar.”

“There’s a �ine line. If teenagers terrorise your store, you don’t want to take it lightly, but you also don’t want to be seen on social media being heavy-handed to stop them.”

Best-one retailer Kay Patel knows the �inancial and emotional impact teenagers terrorising stores can have.

Several incidents at his old store led to him hiring a security guard on £10 per hour, �ive hours a night, six days a week.

The annual cost to keep his shop secure and staff safe was leaving him nearly £16,000 a year out of pocket.

He told Retail Express: “People like Mizzy don’t care they are affecting people who are trying to make a living. I have to pay for the mess, but staff can also be traumatised.”

The Fed’s national president, Muntazir Dipoti, added: “It is neither funny nor cool to cause this disruption in stores. Independent retailers work long hours, and many have a fragile economic existence.

“We welcome any moves by social media companies to curb this trend and we would welcome support to install CCTV to monitor behaviour in shops.”

The Met Police con�irmed to Retail Express that it was investigating the incident involving Mizzy and Where 2 Save. Retail Express has since alerted the force that the video was a hoax.

This isn’t the �irst time Mizzy has posted videos of himself being a nuisance in convenience stores. He had previously entered the staff room of a Tesco Express

without permission, and caused distress to staff in a Co-op by throwing milk on the shop �loor.

Retail Express found several videos associated with Mizzy on social media sites such as TikTok, Instagram, Twitter and Facebook. TikTok – which banned Mizzy’s of�icial account – has since taken down these posts for breaching its community guidelines after being alerted by Retail Express.

Mizzy’s of�icial account was also banned on Twitter, but videos associated with the prankster were still on the website as well as Instagram and Facebook.

Twitter and Meta – Facebook and Instagram’s parent company – failed to comment as Retail Express went to print.

What in-store changes have you made to encourage spend from the younger generation?

“WE’VE positioned our confectionery kids’ zone next to the till for maximum impulse sales. My countertop is full of impulse buys, such as Toxic Waste and Brain Lickers, that kids love, and adults hate. And underneath that I’ve got a glass front with bags of 50p sweets, already made up, with pick’n’mix and all the varieties of sweets we can t under there.”

Gerald Thomas, Arcade News, Ammanford, Carmarthenshire

“OUR kids section is at the end of the confectionery aisle. Weekday afternoons are the busiest in terms of footfall as kids look for sweets after school. We put extra sta working the tills to deal with the rush, and I’m also looking at self-service to ease pressure within that hour. We have gone big with single sweets that cost less than £1, and we achieve a margin of around 30%.”

Anish Panchmatia, One Stop Wylde Green, Sutton Cold eld, Birmingham

“WE got out of the high-end products, like train sets and Scalextric, and instead stuck with high-turnover gifts and collectables, such as Pokémon and football cards. We have a section for party bag toys, and that’s always worked well. We have to be very tough on which comics to get, but we sell an enormous amount. The Lego magazines bring them in regularly – they have an RRP of £4.99 with a free gift inside, which is a real draw.”

David Worsfold, Farrants Newsagent, Cobham, Surrey

LONDIS: Booker Retail Partners is relaunching a refreshed Londis format next month. Nishi Patel’s store in London will act as the blueprint for future refurbishments. It’s expected to feature more ‘premium’ imagery of products on the shopfront and inside, with more pro table categories, such as food to go, vaping, and fresh and chilled given dedicated areas.

For the full story, go to betterretailing.com and search ‘Londis’

FWIP: The ice cream supplier has secured new funding, giving reassurance to retailers about its future after losing its previous investor last month. Companies House documents revealed it had appointed Rocking Horse Group as a new lender.

For the full story, go to betterretailing.com and search ‘Fwip’

GOOD WEEK BAD WEEK

STORY HOUSE EGMONT: The children’s magazine publisher faces action over its return to giving most independent stores unsold magazine copies from supermarkets. Analysis and test purchasing by Retail Express this month revealed independent stores are being given copies of Go Girl and Toxic two editions behind those ranged by major retailers.

For the full story, go to betterretailing.com and search ‘Egmont’

TOBACCO: Retailers lost out on cash margin this month when Philip Morris Limited (PML) increased its prices, but failed to notify stores for several days. On 7 July, PML increased the RRP of 11 cigarette and rolling tobacco lines ranging from 30p to 35p. King Size variants of Marlboro Red, Gold, Bright and Silver Blue are now £14.10.

03 betterretailing.com @retailexpress facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

25 JULY-7 AUGUST 2023

express yourself the column where you can make your voice heard Do you have an issue to discuss with other retailers?

megan.humphrey@newtrade.co.uk

Call 020 7689 3357 or email

David Worsfold

Photo credit: Twitter @mizzythemenace

C-stores rank the best in ID checks

MEGAN HUMPHREY

CONVENIENCE stores have a higher ID-check pass rate for age-related sales compared to supermarkets, according to new statistics.

Compliance and age-veri�ication �irm Serve Legal published its latest audit �igures this month, showing an 82% pass rate for convenience stores, 3% ahead of the total off-trade rate of 79%,

while supermarkets fell behind at 78%.

The �irm uses 18- and 19-year-olds to help companies test the robustness of their ‘Challenge 25’ policies without breaking the law and scores them a pass rate based on their success in making prompt ID requests.

The �igures also revealed that the pandemic worsened pass rates for both conveni-

ence stores and supermarkets. Previously, they achieved 83% and 82%, respectively.

Forecourt pass rates, which cover petrol station stores that are not part of a symbol group or supermarket chain, fell from 78% to 74% during Covid-19, but have since improved to 79%.

CEO Ed Heaver said: “A decline in pass rates could be attributed, at least in part, to the transitional period dur-

ing which new staff members are adjusting to their roles and acquiring the necessary knowledge and skills to address age-restricted sales challenges.”

Heaver added that the numbers highlight the need for increased diligence and effective age-veri�ication measures to ensure that retailers act responsibly and ask for ID when enforcing ‘Challenge 25’ policies.

Just Eat partners Nisa

NISA has teamed up with Just Eat, giving partnered stores the opportunity to enhance their offering and provide an on-demand home delivery service.

Shoppers will be able to order items from participating Nisa stores for delivery in less

than 30 minutes via the Just Eat app and website. Retailers will also be provided with in-store marketing support to promote the offering, including shelf-talkers, posters, and window and door stickers, and access to a dedicated telephone support team.

A POLICE community support o cer (PCSO) “refused” to attend a shoplifting and assault incident last month.

A passer-by alerted the PCSO, who was sitting in a police car next to where the incident took place in a Co-op store in Sussex.

The PCSO explained that if he responded, “then I’ll have to deal with it”. The local police and crime commissioner,

Katy Bourne, branded the response “disappointing”, and said it was “lacking and could have been a lot better”.

One Stop multibuys

ONE Stop has extended the removal of multibuy promotions on high fat, sugar and salt (HFSS) products to franchisees, despite a ban on promotions being delayed until next year.

The removal started as a

trial last year in several centrally managed stores.

Several One Stop franchisees con�irmed to Retail Express the trial has since been extended, but added they hadn’t noticed an impact on sales.

NEWS 04 25 JULY-7 AUGUST 2023 betterretailing.com

For Tobacco Traders Only. *Based on ITUK RRP as at April 2023. For the avoidance of doubt, customers are free at all times to determine the selling price of their products MODERN FILTER For a premium smoking experience REDUCED SMOKE SMELL PAPER For limiting lingering smoke and odours on hands and clothes RESEALABLE FOIL To protect & secure FINEST TOBACCO BLEND Signature quality in a modern blend THE REVOLUTION CONTINUES MORE EXCLUSIVE FEATURES RRP £11.60* AVAILABLE FOR A LIMITED TIME ONLY, GET YOURS WHILST STOCKS LAST Embassy_Silver_Signature_KV_NEW (OPEN PACK) Mini Page 172x240.indd 1 26/04/2023 09:12

POLICE IGNORE SHOP THEFT

Become a Better Retailing

Club Member and access:

GET 30% OFF

Margin-boosting pricecomparison data

Exclusive supplier deals and discounts

Industry-leading insight and advice

Get started now by visiting bit.ly/3ldSDsB or scanning the QR code

Better margins, better ideas, better products. Better Retailing.

Unlock your store’s full potential with Better Retailing Club Membership

ANDTODAYUP

SIGN

PRODUCTS

Spar gets YouTube star bars

JACK COURTEZ

SPAR UK stores have gained exclusive access to new confectionery lines from YouTube superstar MrBeast.

Working with Icon Foods Ltd, Spar is to be the exclusive convenience distributor of the four lines in the icon’s Feastables chocolate bar range: Original Chocolate, Milk Chocolate, Bar Crunch and Deez Nutz.

The US-based MrBeast has the biggest number of subscribers of any individual on YouTube with more than 168 million, well over double the number of Prime Hydration backers KSI and Logan Paul combined.

Enya McAteer, store manager at Mulkerns Spar Jonesborough in Newry, County Armagh, told Retail Express: “We got it through on presell in June and have ordered a big amount. After seeing the success of Prime, the opportunity of brands backed by in�luencers is very clear to independent retailers.”

Spar told Retail Express the 60g bars carry a recommended price of between £2 and £2.49, and are supported by in-store PoS and a full online advertising campaign.

The symbol will retain exclusivity in convenience until January 2024.

Spar UK trading controller Henry Goodchild said:

“[We are] thrilled to have the

Badger Beers’ brand-new look

INDEPENDENT brewer

Badger Beers has undergone a rebrand, with new designs across its bottled ale range set to appear from August.

Initially, seven of the supplier’s top-selling ales –Master Stoat, Hopping Hare, Blandford Fly, Cranborne Poacher, Fursty Ferret, Golden Champion and Tangle Foot – will feature the new design.

The new designs feature an illustration of a wildlife character above a clear, brief taste description. They will be followed by more lines, including two multipacks.

The rebranding comes following a review of the Badger range and consumer research by IGD, which led

to the supplier launching the Outland sub-brand of canned craft beers.

According to the supplier, it intends to tackle obstacles facing entry to the premium bottled ale category, such as dif�iculty to navigate and oldfashioned imagery.

opportunity to be the �irst in convenience to supply customers with the range of Feastables chocolate bars.”

Icon Foods Ltd, backers of

Burts builds out Ridges range

BURTS has added a Beef & Mustard variety to its Ridges range of ridge-cut crisps.

The new addition will be available from September in a 40g bag alongside Burts’ Reaper Chilli & Lime Ridges variety.

It is gluten-free, and free from arti�icial colours and arti�icial �lavourings.

Its launch comes as Burts focuses on growing its brand into the hand-cooked crinkle crisp market. The brand saw total revenue up by 48% last year, fuelled by growth in both grocery and convenience.

“Expanding into the crinkle cut market will allow us to harness the opportunities that the sector offers and will

keep consumers engaged,” said Dave McNulty, CEO of Burts Snacks.

the MrBeast confectionery launch, said Spar “was our �irst choice” and praised its “agility” in quickly getting the product out to stores.

McVitie’s launches White Choc Digestive

PLADIS has unveiled a White Chocolate variety of McVitie’s Digestives biscuits.

The new variety is a permanent addition to the range, driven by popular demand. The supplier says it is likely to be the brand’s most signi�icant launch in a decade, attracting younger shoppers and families seek-

Swizzels celebrates 95 with cash prize

SWIZZELS is celebrating its 95th birthday by offering one retailer the chance to win a £,1000 cash prize when they purchase any three cases of the supplier’s hanging bag range as part of its ‘Super retailer’ campaign.

The range includes Curious Chews, Drumstick Squashies, Scrumptious Sweets, Refreshers Choos and Luscious Lollies.

To enter, retailers need to upload their invoice or receipt at swizzels.com/ superretailer-competition. The competition closes at 11:59pm on 30 September.

The supplier has launched the competition as sugar confectionery has grown by 9.9% over the past year, despite challenging conditions and HFSS regulations, indicating its importance.

Pukka launches single frozen pie

PUKKA has launched its �irst single-pack frozen pie, created speci�ically for the convenience channel.

The Shortcrust Chicken Pie is available in a £1.49 pricemarked pack (PMP). According to Nielsen �igures, PMPs represent three-quarters of sales in the convenience channel, despite making up just 12% of products.

Its launch comes as Pukka aims to tap into the fast-growing frozen food category. Currently, Pukka accounts for two of the top 10 biggest frozen pie sellers, having grown its share in frozen by 100% in the past year.

“Convenience shop-

pers still expect quality, affordability and full-on �lavour in equal measure, which is why we’ve created a format – for independent retailers – which tick all of these boxes,” said Isaac Fisher, managing director at Pukka.

ing new �lavours. Available in a 232g pack at an RRP of £1.89, McVitie’s Digestives White Chocolate will be available to convenience and wholesale from 14 August, following initial grocery launches this month in Sainsbury’s and Co-op. A £1.99 price-marked pack is also set to launch.

Best of Poland adds to Ngine range

IMPORTER and distributor

Best of Poland has added to its Ngine range of energy drinks with Original Zero Sugar and Mojito Zero Sugar varieties.

Both varieties contain 20% juice, and join the Ngine Original variety on offer from the distributor.

All are available in 250ml cans at an RRP of 45p.

“Energy drinks are increasingly popular and it’s a rapidly growing category, but consumers are also seeking healthier options across all aspects of their diet, so these two new zero-sugar options are the ideal way to meet both requirements while delivering extra shopper choice,” said Debbie King,

retail sales & marketing director at Best of Poland. Best of Poland plans to support the launch with promotions, PoS, online and social media marketing.

BuzzBallz Cocktails launches limited line

BUZZBALLZ Cocktails has added a limited-edition Pornstar Martini to its readyto-drink (RTD) alcohol range. The launch comes amid Google data revealing the Pornstar Martini as the UK’s second-most searched-for cocktail.

The supplier recommends enjoying the new launch (13.5% ABV, RRP £3.99) either on its own, served over ice, garnished with a wedge of lime, or with a prosecco chaser on the side.

BuzzBallz Cocktails country manager UK and Ireland David Relph said: “Pornstar Martini arrives just in time for the bumper summer season. The popularity of the Pornstar Martini endures

in the UK and we know it’s dangerously drinkable especially over summer as garden parties, meet-ups in the park, barbecues, pizza nights and on-the-go occasions spike.”

06 25 JULY-7 AUGUST 2023 betterretailing.com

Shining

retail

Deadline for entries: 14 August 2023

michael.sharp@newtrade.co.uk

To find out more and take part: visit betterretailing.com/30-under-30, scan the QR code or contact

Supporting partners Headline partner

Nominate yourself, a member of your team or a fellow retailer who deserves recognition

RN 30 Under Thirty recognises and celebrates the young retailers shaping the future of independent retail with their innovation, commitment and drive a light on the rising stars of independent

2023 entries now open

PRODUCTS

Win a weekend o with SBF

JASPER HART

SUNTORY Beverage & Food GB&I (SBF GB&I) has brought back its ‘Win the weekend’ competition for a second year, offering retailers the chance to win a break away from their business.

This year, the competition has expanded to give two retailers the chance to win a two-day break at a local spa, while eight runners-up will win a cash prize towards taking time off to relax.

To be in with a chance of winning, retailers have until 5pm on 29 September 2023 to email their name, store name, address and contact phone number

with the subject line ‘Win the weekend’, to sbftrade@ hanovercomms.com.

Andrew Pheasant, head of key accounts at SBF GB&I, said: “We launched ‘Win the weekend’ because our research told us a lot of retailers were struggling to take time away from their business, and we wanted to help raise awareness of that.”

Leading convenience retailer Paul Cheema (pictured), of Malcolm’s Stores in Coventry, will return to help run the winners’ stores during their absence.

“When SBF GB&I came up with this idea, I knew I had to get involved because I know a lot of retailers are in their stores for 12 or 16

New Bottlegreen cordial and pressé

BOTTLEGREEN has launched a new Orange & Lemon cordial and three new sparkling pressé varieties to build on strong sales growth.

Orange & Lemon Cordial is available in a 500ml bottle at an RRP of £4.05.

Meanwhile, Raspberry Lemonade and Ginger Beer join the brand’s sparkling pressé range permanently, with Blood Orange Spritz available as a limited edition.

All three pressé varieties come in 750ml bottles at an RRP of £3.20.

Sarah Lawson, head of marketing at Bottlegreen owner SHS Drinks, said: “Our consumers love to try innovative and interesting �lavours, and with a new

cordial combination, a pair of permanent additions to our range of ‘light’ pressés, and a 2023 limited edition, we’re adding �lavours that will refresh both �ixtures and consumers.”

Coors launches on-pack promo

MOLSON Coors Beverage Company has launched an on-pack promotion and TV advertisement for its Coors brand as part of its ‘Keep it fresh’ campaign.

Shoppers can scan QR codes on promotional packs until September 2023.

This will enable them to have a chance of winning a mountain experience, tickets to Snowbombing festival in Austria or one of 1,000 Bluetooth speakers.

Retailers will have access to PoS materials including aisle �ins, shelf frames and freestanding display units.

The accompanying TV ad will run across Channel 4 through Coors’ Comedy on 4 sponsorship.

hours a day, seven days a week,” he said.

“They’re not getting time

with their family, and they’re not even getting time for a break.”

Kestrel rebrands to widen appeal

HIGH-STRENGTH lager Kestrel Super Premium has undergone a packaging redesign to modernise the brand and appeal to a wider audience, according to its UK distributor, Brook�ield Drinks.

The updated branding features a ‘clean’ design with an updated typeface and minimalist appearance.

It retains the brand’s black and gold colourways, but makes the Kestrel head logo more prominent with the removal of the traditional roundel design.

Additionally, its Extra Premium and Premium varieties have also been rebranded.

Nigel McNally, managing

Crosta & Mollica makes UK TV debut

ITALIAN food brand Crosta & Mollica has partnered with Channel 4 for its �irst national TV campaign.

The campaign includes the brand’s sponsorship of the public service broadcaster’s ‘Channel 4 food’ strand of programming.

This includes sponsorship of Come Dine With Me across social media platforms as well as the channel’s selec-

tion of culinary programming. It consists of adverts set in Italian settings, depicting friends and family enjoying Crosta & Mollica’s range of products, including pizza, aperitivo snacks and gelato.

Dean Lavender, head of marketing at Crosta & Mollica, said the partnership would allow the brand to reach more than 18 million consumers in the UK.

director of Brook�ield Drinks, said updating the packaging was the “last piece of the jigsaw” for the brand, following a focus on premiumisation.

Spar enters flavoured spirits market

SPAR is entering the �lavoured spirits market with the launch of an own-label raspberry-�lavoured vodka.

The new variety is available in a £14.99 price-marked 70cl bottle. Its launch comes as raspberry-�lavoured vodka has a 37% share of the �lavoured vodka market.

Additionally, Spar’s own-label Imperial Vodka is currently performing well, it added.

Adam Georgiou, senior brand manager for own-label beer, wine and spirits at Spar UK, said: “Flavoured vodka is a growing sector of the spirits’ market, and within the category, raspberry has proven to be the consistent crowd favourite.”

The symbol is supporting the launch with PoS and graphics, as well as digital comms to Spar stores.

Crowning moment for Knights cider

PEPSI Max has taken aim at its rivals in the carbonated cola space with the launch of its ‘You probs prefer Pepsi’ campaign in the wake of its 2022 Pepsi Max ‘taste challenge’.

According to the supplier, last year’s blind taste-testing with more than 34,000 consumers revealed that 70% of the UK preferred the taste of Pepsi Max compared to the

UK’s biggest-selling fullsugar cola.

The tongue-in-cheek campaign includes a TV advert, radio, digital and outdoor advertising, including a partnership with the London Underground.

Pepsi Max has also partnered with rapper, TV personality and DJ Big Zuu for radio, social media and immersive content.

ASTON Manor’s Knights

Cider brand has become the wholesale market leader in the UK, according to �igures cited by the supplier.

Despite total cider sales declining by 7% in the UK, and the strong amber market down by 4%, Knights Cider has seen a 54% sales increase, per Nielsen statistics.

The brand has also seen an 11% annual increase in new shoppers.

The supplier says the increase in demand for Knights is the result of shopper preference towards Britishsourced products and the cost-of-living crisis.

Grace Anthony, brand marketing manager at Aston Manor Cider, said: “This year

has caused many to pay more attention to what they are spending their money on, and, as a result, shoppers are looking to make savings with our affordable cider.”

08

‘You probs prefer Pepsi’, says ad

Anthon Berg unveils Christmas range

DANISH chocolate supplier

Anthon Berg has unveiled its Christmas gifting confectionery range.

The range, distributed in the UK by World of Sweets, includes two advent calendars alongside a range of chocolate liqueurs and marzipan.

The Chocolate Liqueur 24-piece Advent and Marzipan 24-piece Advent are both available at an RRP of £21.99.

Other launches include Chocolate Cocktails, dark chocolate bottles with �illings inspired by popular cocktails, and Chocolate Liqueurs, bottle-shaped dark chocolates with liqueurs.

Yazoo launches TV and social campaign

Both varieties are available in packs of four (RRP £3.49), eight (£6.49), 12 (£8.99) and 16 (£10.99). Chocolate Liqueurs are also available in 21- (£13.49) and 24-piece (£19.99) formats.

Other launches include a Single Malt Scotch Collection and Fruits in Marzipan.

Optimum rebrands for 2023

SPORT nutrition brand

Optimum Nutrition has launched a new range of protein bars, along with a money-back guarantee as part of a 2023 revamp.

The supplier has added three new varieties to its range: Chocolate Sweet Coconut, Chocolate Sea Salt Crunch and Chocolate Berry Crunch. These new additions join

existing lines Nutty Chocolate Caramel, Chocolate Brownie Crunch and Marshmallow Crunch.

The revamped range aims to deliver snacks packed with protein, low on sugar and high in taste.

The range is available to purchase from the supplier’s website at £2.75 per bar. It will be available to wider retail in the months ahead.

FRIESLANDCAMPINA has launched a new campaign for Yazoo.

Yazoo TV adverts will broadcast on ITV, Sky channels and Channel 4 until the end of August. Advertisements will also air alongside Love Island.

The campaign is set to reach 67.6% of adults in the UK, and will be ampli�ied across Yazoo’s social media

DrinkWell with lowcal, low-carb range

channels. With an investment of £3m, it is the brand’s largest investment yet in TV marketing.

Maren Fuhrich, brand manager at Yazoo, said: “Summer is a notoriously busy season for �lavoured milk drink sales.

“With Yazoo on TV screens in millions of homes across the nation, the brand will be more visible than before.”

Butterkist launches Hazelnut Chocolate

KP SNACKS has expanded its Butterkist popcorn range with the addition of a Crunchy Hazelnut Chocolate variety.

Available now, it offers consumers a low-calorie snack option that capitalises on the growing popularity of hazelnut �lavours in confectionery.

The product is available in a 155g sharing and a 70g £1.25 price-marked pack (PMP) format.

Sharing and large PMP snacking formats are currently growing by 12.1% and 34.4%, respectively. However, the sharing format is currently only available to Co-op, Tesco, Asda and Sainsbury’s, at an RRP of £2.

Snickers

MARS Chocolate Drinks and Treats (MCD&T) has launched its �irst television campaign for Snickers Ice Cream in the UK.

The £1.26m campaign, titled ‘Nothing satis�ies more’, will broadcast across mainstream TV channels and online broadcast streaming platforms until the end of August.

It will advertise Snickers Ice Cream products during the UK’s peak ice cream season.

The campaign is set to reach 60% of adults this summer.

It comes as the supplier’s ice cream range has seen strong growth, according to Michelle Frost, general man-

ager at MCD&T.

“Across the overall ice cream market in 2022, our portfolio of Mars branded ice creams grew by £11.5m, equating to a 41% share of the total ice cream market growth,” she said.

The supplier is supporting the launch with a social media campaign called ‘Go grab the Butterkist!’.

DRINKWELL has launched a new range of alcoholic beverages that maintain �lavour and ABV, but are low in calories and carbs.

The range includes Lean Brew (4.1% ABV), containing 4g of carbs, zero sugar and 99 calories per can. In addition, DrinkWell has added a red Cinsault variety (11% ABV) to its Traces Wines collection to join its existing zero-sugar Traces Sauvignon Blanc and Rosé wine.

The Traces Wines range is suitable for customers who are vegan, coeliac and for those following a lowcarb diet.

Tom Bell, founder of Drink-

Well, said: “The low- and no-alcohol drinks market has grown exponentially over the past 12 months, but options are still limited when it comes to lower-calorie, carb or sugar beverages.”

Dairylea Lunchables now Lunchers

DAIRYLEA has relaunched its Lunchables range under a new name, Lunchers.

The new name brings the range in line with the rest of the Dairylea range, which includes Dunkers, Snackers and Filled Crackers.

Additionally, Lunchers contain less salt and saturated fat than their predecessors, according to Ria Rianti, senior brand manager at Mondelez International.

“The Dairylea range has been trusted by parents to deliver tasty and convenient cheese snacks for more than 70 years, with 91% brand awareness,” said Rianti.

“Snacking Cheese has been a key driver of category growth over the past

Pukpip’s White Chocolate banana

FROZEN banana brand Pukpip is continuing to expand its range with the launch of a White Chocolate variety and a singles range.

Pukpip White Chocolate is available via CLF and Suma Wholefoods. Like the existing Milk Chocolate and Dark Chocolate varieties, it is available in multipacks of

three at an RRP of £3.99.

The supplier says its singles range will be launching later this summer. It recommends placing them in the handheld ice cream freezer as a permissible on-the-go snacking alternative.

Pukpip also uses wonky bananas that would otherwise go to waste.

number of years, adding £56m since 2020, and Dairylea has contributed signi�icantly to this growth through performance on our core range and innovation.”

Cobra Beer rebrand aimed at foodies

COBRA Beer is rolling out a rebrand across its entire range in an attempt to reinforce its reputation as a strong pairing with PanAsian cuisine.

According to the supplier, 61% of 18-to-34-year-olds report they are adventurous in trying new cuisines, while more than half add spice to most of their savoury meals.

Cobra’s new graf�iti-style design is meant to appeal to a generation of urban “foodies” who are open to trying new cuisines and seeking out premium brands.

“Britain’s tastebuds are evolving and becoming more adventurous, and there’s an opportunity here for Cobra to sit at the heart of the

09 25 JULY-7 AUGUST 2023 betterretailing.com

Ice Cream hits TV in new ad

Pan-Asian food revolution in the UK,” said Lord Karan Bilimoria CBE, founder of Cobra Beer.

WIN THE WEEKEND

How we helped one lucky couple take some well-earned time off – and why it is important

Time off in retail can sometimes feel like the impossible dream. Research tells us that 49% of retailers hadn’t had a day off between September 2020 and September 2021; figures backed up by independent research from SBF GB&I, makers of Lucozade and Ribena, which showed that 27% of retailers had not had a day off in more than three years.

In a survey of 500 retailers, 78% told us they “value the health of their business over their own physical or mental health” – and a third of all retailers say they simply “don’t want to leave their business in the hands of anyone else”.

To raise awareness of this, SBF GB&I gave one lucky retailer a cash prize and the help they needed to take two days out of their business to unwind, recharge and relax. The winning store was Greens of Bassingham in Lincolnshire, run by Tracy Raybould & Michael Saunders.

SBF GB&I partnered with high-profile award-winning retailer Paul Cheema, who has more than 30 years’ experience in retailing and runs two stores near Coventry, to manage Tracy & Michael’s shop while they spent their prize money and took some well-earned time off.

While they spent time away from their daily responsibilities of newspapers, deliveries, cashing up and locking up, Paul and his team of SBF GB&I support staff looked after their store, allowing them peace of mind to relax knowing their store was in good hands.

40%

OF RETAILERS SAY PAPERWORK AND FINANCE ARE THE BIGGEST DRAINS OF THEIR TIME

64%

OF INDIE RETAILERS SAY NO-ONE ELSE CAN RUN THEIR STORE CORRECTLY

52%

It's so important that retailers take time out of their business so they can recharge, reset, and take stock of the hard work they do. Win The Weekend started out with the idea that we could change one person’s life. If we could do that and help them understand how they can take some time out of their business and look after their mental health a little bit better, then why not raise that issue right across the wider convenience community?

There's been a brilliant response from Tracy & Michael’s customers, who recognise that they do so much for their community and rarely take a break away from the store.

We really do hope that by seeing how Tracy & Michael can take time out of their own store and reading the advice we’re pulling together in our Win The Weekend handout, other retailers will take a step back, look after themselves and put the steps in place to make sure they are doing so on an ongoing basis.

From talking to our retail friends, we’ve learned that it can be hard to make this change, but everyone can help train staff and put new processes in place to encourage time off. Not only does it allow retailers to save their own time, but also to realise they're not putting anybody out by taking a little bit of time for themselves and stepping away from their business.

OF INDIE RETAILERS SAY THERE IS NO-ONE ELSE AVAILABLE WHO CAN MIND THE SHOP IN THEIR PLACE

We never managed to go on family holidays because my mum and dad did everything in the shop. They went home literally just for sleep. A lot of retailers are in their store for 12, 16 hours a day, seven days a week. They're not getting time with their family; they're not getting time for a break. Their break sometimes is going to the Cash & Carry.

It’s very important for retailers to take time away. It’s easy to get stuck in a box seven days a week. But when are you slowing down, giving yourself time to think, spending time with family?

There are 1,001 things that go on in a convenience store every day. Is someone taking a chocolate bar, nicking a bottle of wine or driving off with fuel?

We need to take it away from thinking “is this going to happen?”. If you keep thinking of the “what if?”, you're never going to give your brain that time to switch off.

It's very easy to focus on the negatives within your business. But let's focus on the positives. How do we make our businesses better? How do we give our ourselves more time? How do we give responsibility to our teams, and help them get better as team members and people as a result?

1 ACS Local Shop Report, 2021

ANDREW PHEASANT HEAD OF KEY ACCOUNTS, SBF GB&I

PAUL CHEEMA SPECIAL GUEST RETAILER

TRACY RAYBOULD & MICHAEL SAUNDERS GREENS OF BASSINGHAM

Why did you enter Win The Weekend?

It's important in retail to keep up with current thinking, how products are changing, how customers are changing and what's happening in the economy. Reading trade press is really important – and occasionally we come across these competitions which we like the look of. Win The Weekend was attractive because we thought we might win!

What did you do with your time off?

We took a mini spa break, some nice relaxing time out in a place with no phone reception – which really helped! We also got some great people to come and support our own team, so we could go with peace of mind – which we very, very rarely get. This time out gave us the ability to be able to think about and plan the extra things we can’t usually contemplate because of the day-to-day running of our business. Although we live here and we love it here, you've got to have a wider perspective otherwise you don't run your business to the best of your ability. And that's really important, not just for us, but for the customers we serve.

How difficult is it for you to get time off?

It is very difficult to get time off purely because of the number of hours we cover between us. We've got a fab team but there are certain things they can’t do. Even when we do get time off, it's not really time off. We still do the ordering, we're still looking at messages, responding

to customers on the Facebook page and the website, sorting out the figures, answering questions.

WIN THE WEEKEND II

How have your customers responded?

We've been blown away really by the reaction of our customers. We got more than 200 comments from people on a Facebook post we made telling them about our trip away. It is so kind that those customers have all told to us “You deserve it” and “we wouldn't have wanted anybody else to win it”. It’s truly amazing.

Would you encourage others to enter?

Definitely. This has been really good for us. It's a really good opportunity for retailers to do things they perhaps wouldn't be able to do.

Do YOU struggle to get time off? Or do you know another store owner who is deserving of a break for their hard work? We are delighted to announce that SBF GB&I will be running Win The Weekend again later this year – and we are expanding the scheme to help even more retailers get the time off they so richly deserve.

We will offer 10 lucky retailers a two-day break at a local spa near to them, and we will help cover their absence in store through our network of experienced retailers and SBF GB&I retail experts. To be in with a chance of entering simply email your name and your store name and address, with the subject line “WIN THE WEEKEND 2” to SBFTrade@hanovercomms.com

To download our Win The Weekend booklet, containing hints and tips from six leading retailers talking about how they manage to get time away from their business, go to www.suntorybeverageandfood-europe.com/enGB/gbi/competitions/win-the-weekend/

"For a lot of people that run small businesses, it’s their life, their livelihood. It's where you live, where you work, and where the people that you care about are. And that means it's really difficult to just switch off."

OPINION

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

STAFF: What are you doing to retain your employees?

“IT’S the magic of being included. We include them in our journey about what our plans and targets are, and what we expect, right down to the most junior member of staff – you’re only as good as your most junior person.”

“I MAKE sure my staff are involved in business decisions. They know if the business grows, they are going to do better out of it. I try and consult with them because, at the end of the day, they speak to more people than I do. ”

We include them in our journey

FASCIA: How does this help you connect with your customers?

“THE fascia makes the shop look a lot more presentable and sets a certain standard for your store. Customers know what they’re getting. But we’re lucky to have that Three Singh’s sign above the door because people know it’s still our store.”

Reuben Singh-Mander, The Three Singh’s, Selby, West Yorkshire

WORLD FOOD: How are you ranging spices and condiments successfully?

“WE offer wholefoods that are organic and mostly vegan. We sell Biona Worcester sauce, which is vegan, and the majority of spices and condiments we stock are local and organic. Honey is our bestseller – it’s produced in the next town.”

Davies, Woosnam & Davies News, Llanidloes, Powys

“WE’VE always kept a core range of spices and have an extensive selection. This includes pepper, thyme, dried rosemary, curry powder and garam masala. The spices �luctuate seasonally, so we change things around for events, such as Christmas.”

Nishi Patel, Londis Bexley Park, Dartford, Kent

“THERE are �ive other stores near us, so competition is high. We look for things to differentiate our store from them. I’ve always been interested in having a fascia name above the store to pull people in because I believe certain fascias attract people.”

Guarave Sood, Neelam Convenience Store & Post Of�ice, Uxbridge, west London

The spices fluctuate seasonally

NEWSTRADE: How are you growing your home news delivery?

“THE one secret to success is the delivery charges. These should represent at least 50% of your revenue, with the remainder being newspaper margins. As the retail margins fall, we compensate with equal change to our delivery charges for these titles.”

Richard Brighton, Brighton’s Newsagents, Reading

“THE way to make it work is to get out there and knock on doors. Face-to-face works better, especially with businesses. The points to hit in the conversations are guaranteed delivery times, easy billing and easy management, always by debit card or standing order.”

Rory O’Brien, Papersdirect, Glasgow

12

Get out there and

I believe certain fascias attract people

knock on doors

Susan Connolly, Spar multi-site retailer, Wiltshire

Sue Nithyanandan, Costcutter Epsom, Surrey

COMING UP IN

28 JULY

Pricewatch: see what other retailers are charging for RTD alcohol and boost your own profits Single confectionery: what’s next for on-the-go impulse options? How to increase loyalty: top tips to keep customers coming back + STAY INFORMED AND GET AHEAD WITH RN betterretailing.com/subscribe To ADVERTISE IN RN please contact Natalie Reeve on 07824 058172 3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shop floor ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363

Trudy

THE

ISSUE OF RN

FOCUS ON:

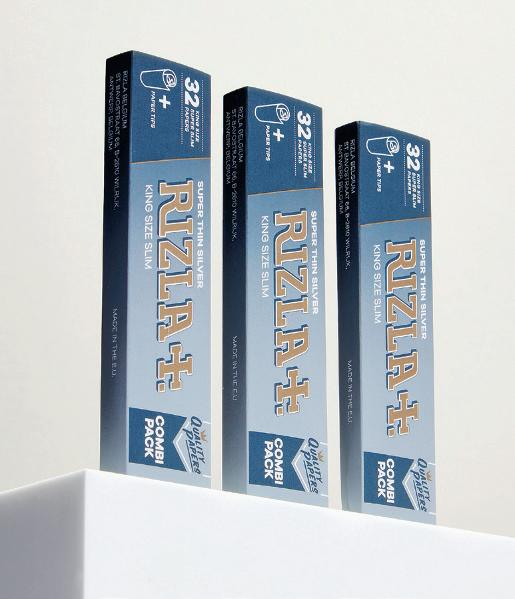

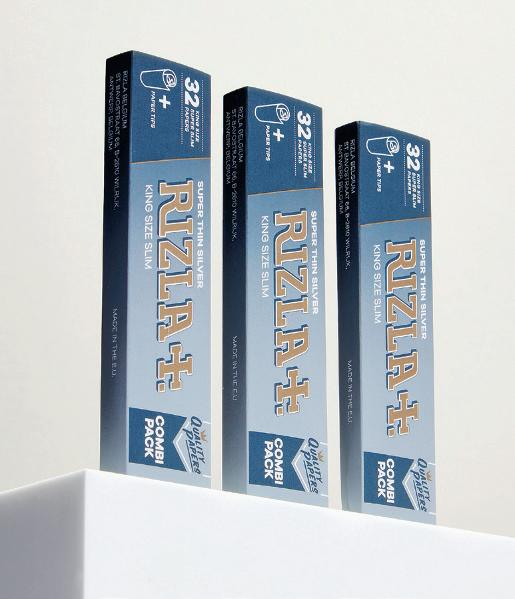

RIZLA

What’s new with Rizla?

AS many shoppers reduce their household spending, we’re seeing a rise in RYO sales. In fact, the category now accounts for nearly a half (46%) of all tobacco sales1. This trend towards RYO means there’s a signi cant sales opportunity for tobacco accessories. With over 200 years of heritage, Rizla is the number-one rolling paper in the UK2 and the perfect brand to stock to tap into this trend.

Shoppers will be looking for products that o er added value, so it is of key importance that retailers and their sta know what products they stock that tap into this trend. One product that is proving popular with value-savvy tobacco customers is Rizla King Size Combi Silver. With an RRP of £1.203, it o ers both papers and tips in one pack to provide shoppers with the ultimate convenience, so is a must stock product for any retailer.

Three key stats

Rizla is the number-one rolling paper in the UK4 and the world5.

Rizla is sold in more than 120 countries globally and has more than 200 years of heritage6

Rizla invented the world’s rst handrolling machine, was the rst to launch rolling papers with gum and the rst to launch King Size Papers7.

There’s now a wide range of tobacco accessories available on the market, so make sure you have a solid understanding of which products you have so you can advise shoppers.

Many shoppers will be looking for added-value products from recognisable brands, so make sure you stock Rizla King Size Combi Silver to tap into this demand.

Jamie Burns-Smith, Rizla brand manager, Imperial Tobacco

Jamie Burns-Smith, Rizla brand manager, Imperial Tobacco

The Rizla-branded trade outers are display-ready, so place them with eye-catching PoS to signal to customers that you stock a range of high-quality tobacco accessories.

“AS the tough economic climate continues to put pressure on household budgets, it’s likely the need for value products is going to continue to be a dominant trend in the category for some time. But it’s important to remember value means di erent things to di erent shoppers.

“Some will be seeking out products with the lowest out-of-pocket spend, while others will be seeing added-value formats from brands they know they can trust, such as Rizla King Size Combi Silver.”

In partnership with RETAIL PAID FEATURE BRAND SPOTLIGHT 25 JULY-7 AUGUST 2023 betterretailing.com 13

As demand for roll-your-own (RYO) tobacco grows, the tobacco accessories category and products such as Rizla King Size Combi Silver increasingly provide a substantial sales opportunity for retailers. RETAIL EXPRESS nds out more

Check out Imperial Tobacco’s Ignite app for useful information on Rizla King Size Combi Silver or speak to your Imperial rep to nd out more

In action

1 ITUK Report on Trade, September 2022, 2 EPoS Data March 2022-2023, 3 Based on ITUK RRP as at June 2023. For the avoidance of doubt, customers are free at all times to determine the selling price of their products, 4 EPoS Data March 2022-2023, 5 Imperial Estimates 2023, 6 Imperial Sales Data 2023, 7 KSUKI estimates 2023

‘I’ve made savings from ditching ITS, and retailers should be aware’

I HAVE recently switched my EPoS provider. Previously, I was with ITS, but I found out they were being restrictive with certain terms.

For example, they would not allow me to switch card terminal provider, even if there were better rates.

Since changing EPoS companies, I’ve managed to save £200 per month by changing my card provider.

The other issue I had

when I was with ITS was the 1p charge they applied to every single card transaction.

This was a hidden charge that was never communicated to me, and I was provided with no explanation about what it was for.

This was on top of other charges I was paying.

Since switching, I’ve managed to save £800 in total costs.

The point of what I’m saying is that retailers should

WIN £50-worth of Ribena

make sure they are shopping around to get the best deal.

Anonymous retailer

An ITS spokesperson said: “We are partnered with a number of card merchants who all offer very competitive rates and we save our retailers money on merchant services. We never hold anybody to one merchant as our service has links with all major providers. All EPoS providers need accreditation

Is your wealth worth more than your health?

I HAVE hay fever and it’s been particularly bad this year.

The other week, I started wheezing similar to an asthma attack and my wife woke me up and said I needed to do something about it. I said it would be ne and would sort itself out – sticking my head in the sand – but I was struggling to breathe, so we called A&E. They said the wait time was seven hours, and I had deliveries the next morning, so I didn’t go. I thought I had to be in the store. I put my health second to my work.

I’ve been to the doctor since – they were able to see me quite quickly – and they con rmed what had happened was linked to my hay fever. The pollution and pollen count have been high this year so he gave me an inhaler.

to prove they have the correct security measures in place to prevent hackers from stealing personal data, such as debit or credit card details. If a retailer asked to switch to a card merchant we don’t work with already, we’d decline as we would lose this accreditation. We also have charges associated with the accreditation and we have to pay staff who support the business. The fees we charge retailers are to support those in our business.”

COMMUNITY RETAILER OF THE WEEK

Retailers need to stop putting their personal well-being to one side for the sake of the business. Suntory Beverage & Food GB&I run a competition where you can win a weekend away from the store, and they’ll come in and look a er it while you’re away. This is a fantastic idea because we need time away from work. It’s important to take that step back.

For the past 15 years, I’ve had a health check up in March, a body MOT where they check blood pressure and address any niggles I’ve built up over the year. But I think now I should be going to the doctor for this twice a year. When I went recently, my blood pressure was up and if I hadn’t gone then, it would have been missed.

As long as you’ve got a good team around you, you should be able to take a step back. What’s the worst that could happen? Don’t sweat the little things, and accept that nothing will be done 100% the way you want it every time you step away from work.

But it’s better to come back fully refreshed and revitalised than to be stuck in the shop day in day out. It’s time to put your health before your wealth.

RETAIL Express has partnered with Suntory Beverage & Food GB&I to o er ve retailers the chance to win £50-worth of Ribena, plus a selection of games from the Hasbro portfolio, to mark the return of Ribena’s on-pack promotion with the global gaming brand. The Ribena brand is currently worth almost £120m, and its ready-todrink range is growing at 5.3% annually.

TO ENTER

Fill in your details at: betterretailing.com/competitions

This competition closes on 22 August.

Editor’s decision is nal.

“WE’VE worked with the homeless charity Helping Hands UK for over a year now. We have a drop-o point in a couple of our stores where people can donate clothes and food, but strictly no cash. A friend of ours in the local community told me about the cause, and we wanted to do as much as we could. I went down to the shelter this month with my team, and it was a real eyeopener. I chatted to so many families, and it made me more motivated to continue making a di erence.”

14 LETTERS Letters may be edited

Each issue, one of seven top retailers shares advice to make your store magni cent

Bobby Singh, BB Nevison Superstore & Post O ce, Pontefract – @NevisonBb

Get in touch @retailexpress betterretailing.com facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

‘We have a homeless donation point’

Harj Dhasee Mickleton Village Stores, Gloucestershire

GROW SALES WITH SIGNATURE

To celebrate the 60th anniversary of Signature, the world’s rst small cigar, STG UK has launched a range of limited-edition packs to bring excitement and interest to the cigar category

WHAT’S THE OPPORTUNITY?

THE new limited-edition packs have been designed to celebrate the brand’s anniversary and give retailers a talking point to their customers, as well as give consumers something new and di erent.

The pack messaging highlights not only the longevity of the brand, but also the consistent quality that has made it a preferred choice for well over half a century.

Retailers should take the op-

portunity to stock up, as limited-edition packs usually prove popular with regular smokers and will be in demand. They may even become collectors’ items in the future.

And remember, cigars are ex-

WHAT’S TRENDING?

CUSTOMERS who buy cigars and cigarillos are quite varied and are probably looking for di erent things. Some, of course, will be looking for value, so point them in the direction of a good-quality value brand, such as Moments. Oth-

1

2 3 4

empt from the plain-packaging legislation, so STG UK recommends stocking them on the middle shelf of the gantry where they are visible, and more likely to be purchased by adult smokers who can see them.

mUST-STOCK PRODUCTS

SIGNATURE Blue is the UK’s bestselling ‘traditional’ cigar *

SIGNATURE Original is the original fullstrength cigar

SIGNATURE Red Filter is the UK’s number-one traditional aromatic cigar *

SIGNATURE Action is the fastest-growing peppermint click lter cigarillo*

MOMENTS Blue is the value-for-money miniature cigar 5

SUPPLIER

SUPPLIER

VIEW

Nataly Scarpetta, marketing manager, STG

ers will be looking for flavour, so a peppermint cigarillo such as Signature Action is a good option.

Particularly during the summer, many adult smokers will be looking for a larger cigar, such as STG UK’s Henri

Wintermans Half Corona to enjoy outside. STG UK’s advice to retailers is to talk to your customers about what tobacco products they are looking for and what you have on o er, and train your sta accordingly to be able to have those

kinds of conversations. Some former cigarette smokers may potentially be interested in cigarillos, or even happy to treat themselves to a larger cigar, but you’ll only nd that information out if you talk to them.

For more information on the cigar category, visit stgtrade.co.uk or email enquiries.uk@st-group.com to request a rep visit

“CIGARS remain an important category for any convenience retailer, driving both footfall in store and pro t in tills. And when it comes to which brands to stock, the rst on any list should be Signature, as it’s the UK’s number-one miniature cigar, representing 60 years of quality, experience and cra smanship. It’s become a truly global brand which is now sold in more than 80 countries worldwide.

“Here in the UK, the Signature brand portfolio is currently worth nearly £50m in annual sales, making it a must-stock for any tobacco retailer, with strong products in both the miniature and cigarillo segments*. We’re proud to celebrate such an important anniversary for Signature and want to thank all the convenience retailers who have played such a vital role in its continued success.”

betterRetailing.com 25 JULY-7 AUGUST 2023 betterretailing.com 15

PAID FEATURE GROW YOUR SALES

*IRI MarketPlace, Value and Volume sales, Time Period: w/e 16.04.2023 In partnership with

GROWING SALES IN BEER AND CIDER

CHARLES WHITTING nds out how retailers can take advantage of changing customer habits this summer within beer and cider

CRAFT AND PREMIUM OPTIONS

BEERS and ciders can be divided by flavour, type and country of origin. But it is the price tag and provenance that can have major impacts on sales. With many customers steering clear of the on-trade because of the cost-of-living crisis, they are looking to convenience stores for their beer and cider, but are willing to spend a bit more to get something with craft or premium credentials.

“The growth of craft cider demonstrates this trend per-

fectly. This sub-category is in strong growth (16.3%), which is all the more impressive considering many other cider subcategories are struggling to annualise against the highs of 2020 and 2021. What’s more, craft is increasingly stealing share within total cider (from 17.2% to 20%),” says Sally McKinnon, head of marketing at Westons Cider. However, while there is scope for some stores to lean into local and smaller brands

for their stores, within craft and premium, there are more recognised and familiar brands that enjoy a far greater share of sales. Retailers should start with these and then look at stepping further into the craft world depending on customer feedback and sales data.

“The emergence of craft beers 20 or so years ago transformed the beer market and customer behaviour within it. Drinkers are now more adventurous with their beer drink-

ing, but the majority still have rm favourites, both in beer styles and brands within them, which should be kept in mind when designing a beer xture,” says Giles Mountford, drinks marketing manager at Badger Beers.

“Having a lot of di erent craft beers will meet the needs of a hardcore craft drinker, but much of the core volume still comes from the more straightforward beers that appeal to a mainstream audience.”

CATEGORY ADVICE BEER & CIDER 16 25 JULY-7 AUGUST 2023 betterretailing.com

THE HEINEKEN® BEER AND CIDER PORTFOLIO HAS THE HIGHEST REACH IN THE CATEGORY, PUTTING MORE MONEY IN YOUR TILLS* Enjoy responsibly *Kantar worldpanel 52 weeks to 16th April 2023. “Heineken®” is a registered trademark. Heineken® 0.0 contains no more than 0.05% alcohol. All rights reserved.

new products

CATEGORY ADVICE BEER & CIDER

RETAILER VIEW

Kirti Patel, Londis Ferme Park Road, north London

“IN our demographic, people are going more towards the premium, world beers in bottles. And now that the premium brands are going into cans, we’re doing well with those as well. The more traditional brands, such as Carling and Foster’s, are selling, but not as well as before and not as well as premium options like Estrella and Birra Moretti. Even Le e is now available in cans.

“We stock our cans together and our bottles in a di erent section because customers will go looking for beers within their preferred packaging. The multipacks are also selling really well, especially when the weather’s good and when we can o er good value for money.

Latest beer launches

Carlsberg 0.0

Carlsberg is launching an alcohol-free beer. Carlsberg 0.0 is currently available in 4x330ml format in Tesco, with wider rollout planned later in the year. It has 63kcals per 330ml bottle.

Badger Beers’ new design

Badger Beers has revealed new designs for its premium bottled ales, with packs set to appear from August for Hopping Hare, Blandford Fly, Cranborne Poacher, Fursty Ferret, Golden Champion, Tangle Foot and Master Stoat, which was launched this year. The redesign aims to help revitalise the PBA category, and present Badger as a unique and innovative brand within it. The new designs feature an illustration of a wildlife character – including a mouse, ferret and hare, among others – above a clear, brief taste description.

BrewDog Black Heart

BrewDog has added Black Heart, a stout with a 4.1% ABV, to its core range. Available in 4x440ml can multipacks and launching exclusively with Booker in the convenience channel, Black Heart is a dry, Irish-style stout. The stout category is currently worth £150m in the o -trade.

BrewDog pack redesign

Brewdog has updated its design to di erentiate between the various beer styles and make it easier for customers to pick out the beers they want. The refresh sees the packs move from all white, to integrate the can creative of each of its beers, making them easier to di erentiate in the chiller. The new packs will also provide three-word descriptors focusing on taste, along with a visual of the beer in a glass.

MERCHANDISING BEER AND CIDER

WHILE the larger multipacks of beer o er customers a sense of greater value for money, ultimately tighter budgets and the convenient nature of independent stores mean that retailers will see the majority of sales coming in smaller pack formats. With this in mind, retailers should focus on stocking four-pack and six-packs of their

bestselling options.

“We are seeing smaller multipacks – such as small and mid-packs – growing their share of spend, and expect this trend to continue over the coming months as many look to continue shopping but with a more restricted budget,” says Alexander Wilson, category and commercial strategy direc-

tor at Heineken. “Since shoppers started reverting to these habits of making smaller, but more frequent shops, retailers should be looking to supply customers with choice, and o ering a range of beer and cider multipack sizes to help cater to a variety of consumer occasions.”

Additionally, if retailers are

“The four-packs are still the best, but 12-pack sales really accelerate on a nice day because people feel they can get them at a really good price. Multibuy o ers on beer de nitely helps with sales.

“The cra beer sales are still doing well, but it’s a specialist market.”

to attract sales from people seeking beer and cider conveniently, then they need to be showcased in the fridges for maximum impact. Putting multipacks in the fridges as well will help to drive sales, particularly in summer as people look for something to pick up on their way to barbecues and summer parties.

“Cider is the impulse drink of choice, so retailers can respond to this by o ering a 100% chilled range, stocking a wide range of options in cans and bottles,” says Calli O’Brien, head of marketing at Aston Manor Cider. “If a store has limited chiller space, then it’s worth retailers at least ensuring there are a good se-

lection of flavoured ciders available chilled alongside topselling ciders. When a shopper buys cider on impulse, having it chilled and ready to drink are often more important than price – however, promotions still play an important role in communicating value for money that will help to win longerterm customer loyalty.”

18 25 JULY-7 AUGUST 2023 betterretailing.com

STOCK UP FOR A CHANCE TO

NO. WIN £1,000

TO ENTER: PURCHASE ANY CASE OF CRUMPTON OAKS. SCAN QR CODE AND UPLOAD RECEIPT.

*SOURCE: NIELSON, VOLUME (HL’S), GB IMPULSE, TO 31.03.2023. TERMS & CONDITIONS APPLY. PROMOTIONAL PERIOD 01.06.2023 – 31.08.2023. MUST BE AGED 18 YEARS OR OVER. RESTRICTED TO TRADE CUSTOMERS ONLY. COPY OF INVOICE/RECEIPT REQUIRED. SMARTPHONE REQUIRED FOR ENTRY.

FOR MORE INFO VISIT: WIN-CRUMPTONOAKS.CO.UK

VALUE CIDER BRAND IN THE IMPULSE CHANNEL* SCAN TO ENTER

SUPPLIER VIEW

CATEGORY ADVICE BEER & CIDER

NO AND LOW

“WE’VE seen categories such as cra bitter, ale and stouts continuing to gain share of spend year on year, but this growth is predominantly being driven by major brands. Core cra beer shoppers make up 47% of spend within the cra category, and retailers should be targeting these customers with a strong, small range of rotating 440ml-can formats to maintain their interest and encourage spend.

“As we move into warmer months, it’s important retailers consider warm-weather purchases by providing chilled o erings. We recommend placing single cans and bottles in chillers and positioning them alongside products such as slimline gin & tonic cans, or with single beer and cider options.

“Multipacks should be stocked in the beer-andcider aisle between mainstream flavoured and premium flavoured, and should be easily accessible and signposted clearly in store to drive sales and satisfy customer needs.”

ONE of the major evolutions within beer and cider has been the growth of no- and low-alcohol options from a niche alternative to something that most major brands now produce. With younger generations especially reducing their overall alcohol intake and others looking to reduce their calorie intake as well, the growth of low and no has been a strong one.

“From a category point of view, the no- and low-alcohol trend has also continued its growth, with 70% of consumers agreeing they are proactively trying to lead a healthier lifestyle and 68% of UK drinkers saying they have tried a low- and no-alcohol beverage,” says Heineken’s Wilson. While retailers shouldn’t yet feel the need to stock as

their

extensive a range of low and no as they do for their alcoholic counterparts, not having anything on o er can actively cost your store customers –not to mention return visits. Talk to your customers about their preferred brands and then make sure to have them stocked both in single and multipacks,

in the fridge and out on the shelves for take-home. For beer specialist stores, there are craft breweries out there that specialise in no- and lowalcohol beers, which could give your store an added point of di erence for craft customers.

new products

Sheppy’s Low Alcohol Cider with Raspberry

Sheppy’s has launched a Low Alcohol Cider with Raspberry (0.5% ABV), the second low-alcohol cider in its range. The new cider will initially be available via the Sheppy’s webshop, as well as to on-trade, in cases of 12x500ml bottles (RRP £21.50).

Two flavoured ciders from Cornish Orchards

Cornish Orchards has launched two fruit ciders that are available now. Cornish Orchards Raspberry & Elderflower Cider and Cherry & Blackberry Cider have an ABV of 4% and are o ered as accompaniments to at-home al-fresco drinking occasions.

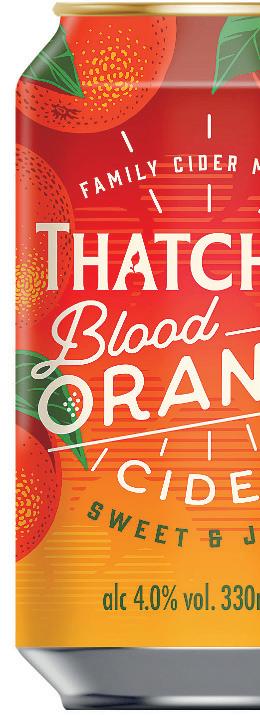

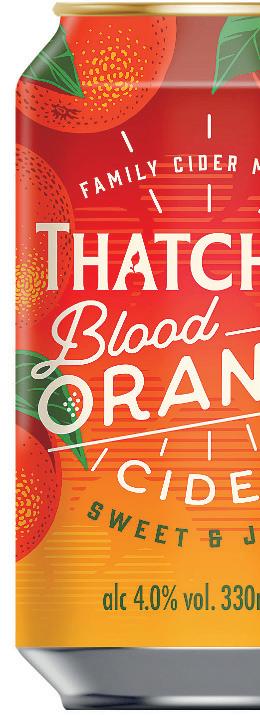

Thatchers Blood Orange Cider

Thatchers Cider has extended the format range for its Blood Orange Cider to include a 10x330ml can pack. Thatchers Blood Orange was launched in spring 2022, and attracted more shoppers than any other innovation within the beer, wine and spirits category. The Somerset-based cider maker has packaged its cider in a 10x330ml can pack.

Strongbow Tropical Cider

In March, Heineken released Strongbow Tropical Cider, which features a blend of mango and pineapple, alongside a range-wide packaging update.

Brothers Raspberry Ripple

Brothers Cider has introduced a Raspberry Ripple flavour. It is available in 500ml and 330ml glass bottles, and in 6x330ml and 10x330ml multipack can formats. The launch of Brothers Raspberry Ripple is being supported with a disruptive marketing campaign comprising influencer partnerships, social media activations, and PoS materials available to drive visibility in depots and in-store.

20

Latest cider launches

Alexander Wilson, category and commercial strategy director, Heineken

DRIVE SALES WITH HEATED TOBACCO

PRIYA KHAIRA nds out what heated tobacco can do for your business and how you can drive sales of this next-generation nicotine product in your store

WHAT YOU NEED TO KNOW ABOUT HEATED NICOTINE

AS the tobacco industry continues to innovate, heated tobacco products are becoming increasingly popular among consumers. The devices work by using an electronic heating system to heat the tobacco sticks, rather than burn them, o ering users a smokefree alternative to traditional cigarettes.

As the next-generation nicotine market develops, retailers can nd plenty of sale opportunities within the heated tobacco category.

RETAILER

VIEW

Shisan Patel, Jasp, Birmingham

A recent survey commissioned by Philip Morris Limited (PML) found that 65% of convenience retailers agreed adult smokers were switching to smoke-free products, such as e-cigarettes and heat-not-burn products, to save money in the current economic climate.

Tobacco sticks for a heated tobacco device cost less than half the price of a pack of cigarettes, which are now priced at £12.77 (on average) per pack.

“Retailers agreed that smokers would prioritise a ordabil-

ity above all else when choosing a smoke-free alternative this year – with roughly half believing customers would select the cheapest products available,” says Duncan Cunningham, external a airs director at PML.

The product has gained traction among adult smokers looking for alternative options to smoking that provide a similar experience to smoking traditional cigarettes without the smoke. With the category still being fairly new,

it is important for suppliers to provide support to retailers interested in selling heated tobacco devices.

“The category is now worth nearly £2m a week in traditional retail,” says Gemma Bateson, sales director at JTI UK. “There were more than 17.8 million heated tobacco unit sales in the past year in traditional retail. This represents a huge opportunity for retailers, especially those with a competitive range and strong product knowledge.”

The hurdles

Three main challenges for retailers

Lack of awareness

Heated-tobacco products are typically less wellknown among consumers compared to e-cigarettes or vape products. This makes the devices trickier to introduce and sell to customers, especially if sta are not given su cient training in how to do so.

Competition

Many customers might reach for disposable vapes instead of heated tobacco. Customers might not be accustomed to heated tobacco products and assume that disposable vapes products are more convenient or easier to use.

“Price, ease-of-use and convenience all ranked highly when UK retailers were asked recently what adult smokers would prioritise if choosing a smoke-free alternative in 2023. It’s a fast-growing category, but to ensure retailers provide the best service to their customers as well as ensure they stock the right products, education is key,” says Cunningham.

“IT was di cult to sell heated tobacco products at rst. Iqos sta came into our store to run promotions of their heated-tobacco products. They came in and explained what exactly the device was and how to use it. Since then, sales have picked up a bit.

“While it is not our most popular product, we now have regular customers who come back to buy re lls. While disposable vapes are popular, our margins on heated tobacco can sit at 15%, which is better than the margins we make on cigarettes.”

Slower sales

“When we rst introduced it, it was hard to sell as not many people knew what it was. But people at Iqos helped us by coming into the store and explaining the products. We’ve seen a lot of repeat sales of heated tobacco over time,” says Amrit Singh Pahal, from H & Jodie’s in Walsall, West Midlands.

21 25 JULY-7 AUGUST 2023 betterretailing.com CATEGORY ADVICE HEATED TOBACCO 21