In-depth analysis, insight and advice for convenience and foodservice wholesalers

Taking on tech

How to take advantage of AI and other operational technologies, and implement them efficiently into your business

How to take advantage of AI and other operational technologies, and implement them efficiently into your business

No longer a choice, but a necessity

Paul Hill

Editor

It seems only last month I was discussing how far the industry has come on a technological level. Granted, wholesale was forced to accelerate its digital credentials after the onset of the Covid-19 pandemic, but the channel stepped up and managed to evolve at a rate it had never encountered before.

But just as the industry begins to grow accustomed to its new digital landscape, artificial intelligence (AI) has made its presence known and slowly begun to reshape the industry. And in this fast-paced world, where consumer demands fluctuate and

EDITORIAL

Editor Paul Hill

Editor in chief Louise Banham

Head of design

Anne-Claire Pickard

Production editor Ryan Cooper

Sub editors Jim Findlay, Robin Jarossi

Senior designer Jody Cooke

Junior designer Lauren Jackson

Contributors Mathijs Baron, Tamara Birch, Lorenzo, D'Arcie, David Gilroy, Tom GockelenKozlowski, Rob Mannion, Dan Migliozzi, Edward Nappier-Fenning

Production coordinator

Chris Gardner

market trends shift swiftly, it won’t be long until embracing AI is no longer a choice, but a necessity for survival and success in wholesale.

From optimising supply chain management to enhancing customer experiences, the technology is revolutionising every aspect of operations.

Furthermore, by leveraging AIdriven automation, wholesalers can automate repetitive tasks, allowing employees to focus on higher-value activities such as strategic planning, customer relationship management and product innovation.

However, it’s crucial to acknowledge the challenges it brings, with concerns around data privacy, algorithmic biases and job displacements.

All of this along with insight into numerous other technological advances and how to effectively implement them into your business is the focus of this report.

P4-5: Viewpoint

Why ChatGPT could be the most consequential invention this century

P6-8: Insight

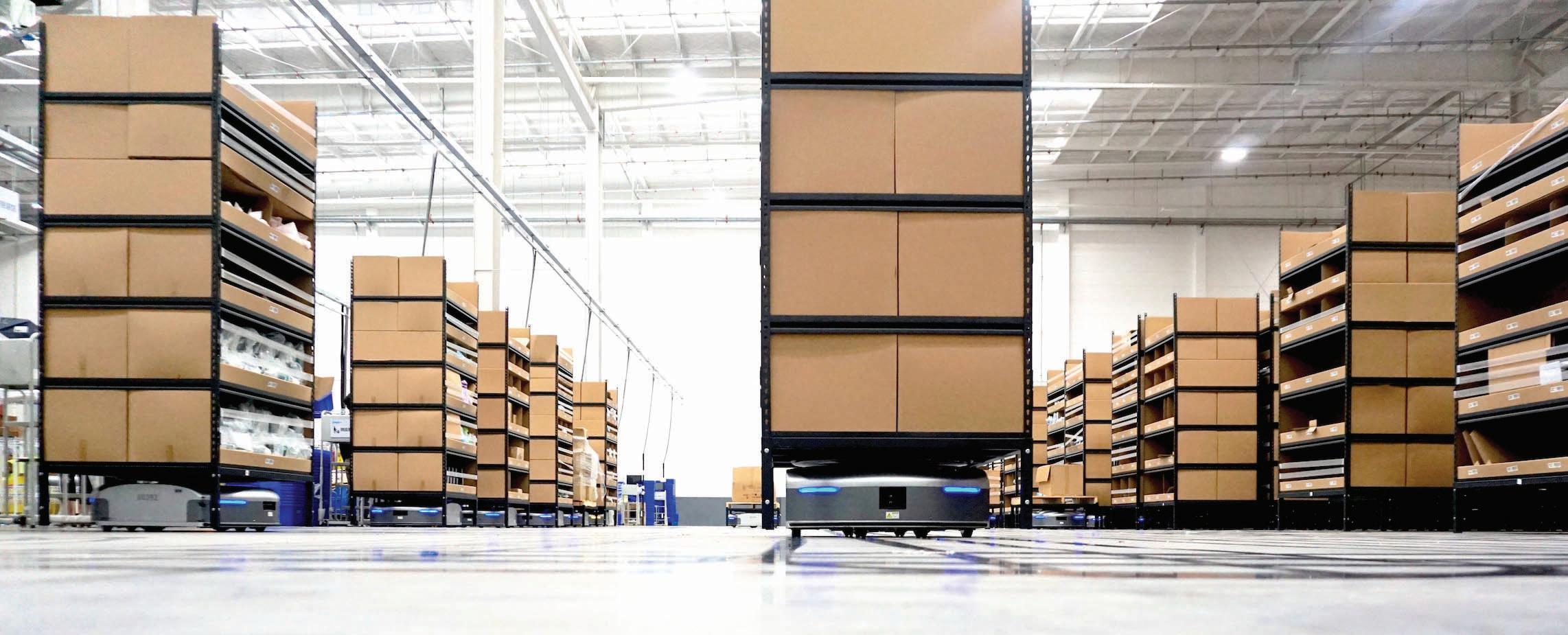

How AI has unlocked efficiency and is playing a transformative role in warehousing

P10-11: Profile

We speak to Parkview

Provisions from its fast-growing headquarters

P12-14: Viewpoint

How image-based tracking can positively affect depot operations

P16-17: Spotlight

Northern Confectioners reveals the growth behind recent expansions

P18 Opinion

Why the time is now for wholesalers to push the button on AI

P20-21: Interview

Bobby’s Foods explains why the Northern Irish market has untapped potential

P22-23: Opinion

Is a complete or phased approach to warehouse automation the best for wholesalers?

P24: Manifesto

The FWD offers a wholesale manifesto for the UK government CATEGORY ADVICE

P25-28: Foodservice Focus

Analysing the latest trends in the hotel and restaurant sectors

P29-32: Sector review

The latest developments and opportunities within the breakfast sector

P34-39: Sector review

How to navigate the quickly evolving soft drinks and sports & energy categories

https://bit.ly/3lvj7FC

“Your generation thinks it invented protest marching, long hair, free love, and heavy metal,” said my old music teacher, Mr Wilkins, after I told him the news that I had decided to drop the viola in favour of the electric guitar. He cranked it up another notch. “Black Sabbath and Led Zeppelin? Light weights. Tchaikovsky would blow them away. This is the genius who wrote cannon fire into the score of the 1812 Overture. Tchaikovsky, the giant who created panoramic soundscapes for 100-piece orchestras. Why so big? Power, volume and attitude. Imagine what he could have achieved with a stack of Marshall amps and a million gigawatts of electricity behind him.” Mr Wilkins was ex-military with honours – D-Day landings. He was passionate, he was formidable and, because it was 1970, he

could assert his considerable physical presence. You didn’t disappoint him.

Taylor Swift is the greatest poet of the 21st century. It’s good to disrupt sometimes and I am sure that, like me, you’ve done this “greatest” thing at gatherings. Greatest ever: movie, female artist, album, author, James Bond (Sean Connery), footballer and so on.

The greatest-ever discovery or invention? There are options such as the combustion engine, crude oil production, petroleum or plastics technology.

One could also make a case for vaccines and immunology, which subsequently eradicated debilitating diseases such as smallpox and polio. This was enabled by another great discovery in the form of germ theory, which initiated diagnostic microbiology in medicine. However, this would not be possible without optical-lens expertise, which also gave rise to glasses, telescopes and microscopes.

The internet could also make a case for totally transforming the way we live today with personal computers, smartphones and broadband. But the thought of metallicising and plugging in Tchaikovsky with synths, guitars and amps is just too exciting. Anyone living in the late 19th century would be aware of electricity, but most would be amazed at how we rely on it today. Electricity is my choice as the most consequential discovery of all time.

That is until now – Frankenstein’s progeny has arrived in the form of artificial intelligence (AI). Regulate

it, politicise it, promote it, oppose it, but you won’t deny it. It was defined by Russell and Norvig in 2021 as “a machine able to solve a wide variety of problems with the breadth and versatility of human intelligence”. Will it prove to be as impactful as electricity? Elon Musk has no doubt. “We are seeing the most disruptive force in history,” he said. Ian Cowie says that AI today is what steel was in 1856 when Sir Henry Bessemer invented a way to make steel stronger, more cheaply and quickly than previously possible. Steel was central to the production of railways, cars, planes and skyscrapers. Cowie reckons AI is the “Bessemer” moment for the “Famous Five” tech giants: Alphabet, Apple, Meta Platforms, Microsoft and YouTube.

The BBC reports that Microsoft attributes its 2023 accelerated sales growth to its AI tools. Microsoft’s chief executive, Satya Nadella, says that the company is applying AI “at scale”. Danny Forston, meanwhile, reckons the release of ChatGPT is a “big bang” moment. Capable of conversations, writing code, music, poetry, realistic images and producing multilingual swathes of copy. He reports that OpenAI is on track to bring in $2bn in annual sales in just 14 months after launching ChatGPT. As the potential of AI becomes better under-

stood, there are serious concerns about the threat it poses. The International Monetary Fund (IMF) predicts that AI will have the ability to perform key tasks currently executed by humans thus lowering demand for labour and eradicating millions of jobs. Musk is more succinct. “Tech will make paid work redundant,” he said. There are also huge AI concerns around deep fake, cloning, copyright infringements, plagiarism and intellectual property theft. Hence the introduction of the new Institute of AI Safety and the inaugural safety summit in November 2023.

Nadella describes Siri, Alexa and Cortana as “dumb as rock” compared to AI potential. We have all experienced the limitations of the current generation of bots on service provider websites. GPT-4 takes this machine engagement to a far higher level. John Thornhill (Financial Times) states that these new generative AI models have endless possibilities.

For certain, AI will enter the wholesale sector. It will become integral for order placement, file management, customer file optimisation, delivery efficiencies, payment and credit control. Imagine machine-driven telesales where the difference between a human and ma-

chine is indiscernible. Wholesaler and supplier interfaces where AI offers both parties significant efficiencies.

The heavy lifting of promotional scheduling, order placement and file updates will be undertaken by machines. It is not inconceivable that negotiations and joint-business planning will be streamlined by the deployment of AI machines. Machine-led deep analysis of product sales performance will provide management with the tools to objectively appraise SKU performance and space efficiency.

Wholesalers have a wealth of valuable customer data on their systems. To date relatively under-exploited. AI will enable wholesalers to gain a deep understanding of customer behaviours, patterns, trends and propensities highlighting the opportunities in the customer file. Identifying the important customers and those with the highest potential, offering true profit visibility and the insights for sales and margin improvements. AI machines will recommend marketing strategies to properly unlock the value in the customer base. AI marketing will provide the intelligence to determine which media work the best and at which times. Machines will supply the pre- and post-promotional analysis facilitating activation decisions and signposting the pathways to the best

use of product investment.

At the checkouts, AI will take scanning and front-end service to a higher level. Expect AI-driven machines to significantly speed up throughput: scanning, invoicing and payment. Given the ability to search through records at speed, AI will seriously improve outstanding and overdue payments. Customer delivery efficiency will be enhanced by the application of AI: route planning, vehicle loading, product selection, and profit per vehicle and customer.

Site evaluation for warehouses and retail stores will be significantly improved by the application of AI. Given the ability to search through a myriad of variables, machines will be able to break open a location to offer real insights to management as to the best place to set up new units.

Launching new products is always high risk and the failure rate is high. Brand owners are already using AI-powered machines to trawl the social media sites for trends pertaining to consumer lifestyle preferences, tastes and product formulations to decide in which sectors to invest and build out on NPD. The likelihood of success is increased and the product launch de-risked. An evidence case is built to persuade retailers and wholesalers to commit early to NPD. AI offers manufacturers the cues for the advertising and marketing campaigns to ensure chances of success.

All service companies including wholesalers need to understand that AI has the potential to shift the balance of power between sellers and buyers in favour of the buyers. It is quite likely that meaningful price comparisons will be available on open source in the very near future. And through the ChatGPT app it is already possible to get service sector comparisons across a range of variables. This effectively neutralises price as a competitive advantage and places the emphasis on other loyalty and retention tools with service being the key component.

As Cowie says: “The digital revolution (AI) will create winners and losers, destroying millions of old jobs, but providing millions of new jobs and better services just like Bessemer steel did.” AI is already writing stories, poetry and music. I don’t know if Mr Wilkins or Tchaikovsky would approve, but it is going to happen, and soon. l

Edward Napier-Fenning

Edward Napier-Fenning

Artificial Intelligence (AI) is suddenly everywhere. As with the early days of many other revolutionary technology, there is a lot of overclaiming, and a lot of what is currently touted as ‘AIenabled’ is really only a sequence of, admittedly very fast and very clever, algorithms, following logical pathways devised by the humans. The ability to process immense amounts of ‘big data’ at lightning speed is impressive and extremely valuable, but it doesn’t in itself constitute artificial intelligence. True AI has the ability to learn from historic data and from current activities, and, in a sense, rewrite its own algorithms.

The pace of development of AI is accelerating, and we can already see some key areas in warehousing and logistics where it can be applied to wholesalers.

Until now, drivers have set off with fixed routes –perhaps regular rounds, or ones planned a day or two earlier – and it has been up to them to work out the best responses to accidents, traffic jams or other events when they arise. Now, traffic management can be linked in real time to resources such as Google, working out not just the work-around a current problem, but also using its learning to predict where the congestion is likely to occur, which often isn’t at the site of the actual incident. This makes a more robust avoidance recommendation and helps keep deliveries to and from the warehouse on schedule.

A lot of the noise around AI in the supply chain is around issues like inventory and ordering. Improvement here is clearly important, but we have barely begun to touch on how to run the warehouse more efficiently, which is where some really big labour and administration costs lie – as well as potential savings.

Pick path optimisation is a hot topic in wholesale, although at the low end this amounts to little more than putting orders into a sequence and chopping them up into blocks of work.

It is nice to be able to do this really quickly, but true AI is beginning to be able to look at the whole situation more intelligently: where goods are in the warehouse, what goods can or cannot be combined on a given trolley or container (and where those containers are), what the priority orders are (which has clear links to the routeing question above), and thus building the most efficient pick routines possible.

This approach to route planning can work in tandem with dynamic load building. Currently, there isn’t a full order file at the beginning of the day, or at the point where drivers and routes have to be fixed for the next day’s operations. The route, therefore, may include destinations where there isn’t actually a drop to be made, or leave out drops that could usefully have been made. Intelligent systems can continually replan, modify and optimise the routes as the order profile builds up. That in turn can assist with the next topic, that of efficient order picking, which, of course, has its own pathing and routeing issues.

AI will be able to improve the choice and operation of picking strategies – and the optimum may differ according to the type of goods, or even the time of day. Strategies are many and varied: for example batch picking, which involves walking a route, picking one product at a time for a batch of orders.

Or it could be zonal or ‘cluster’ picking where the operator picks all the products in one ‘zone’ for a batch of orders, and the tote – with or without that operative – moves on to the next zone.

In current conditions, the greatest challenge for increasing efficiency is that of where to allocate scarce and expensive labour. A facility with good warehouse management software (WMS) and other systems should have a great deal of data from end to end: what is happening in receiving, put away, picking, replenishment and so on. That should tell the operator where they need to put their people, but it is complex. A traditional WMS manages this, up to a point, but relies heavily on people creating, inputting and maintaining data, from standard times

for elements of work, to who is allowed to perform certain tasks, and so on.

To some extent we are already able to marshal goods, activities and resources more effectively using historical records and current data capture to allow more complex labour management models. AI could certainly make a further contribution in pulling data from the various different sources and making sense of it.

Effective deployment will become even more important as companies take up the use of robotics in the form of ‘cobots’ – ma-

Balloon is involved in applying AI in the supplychain space. Activity in the sector is growing quickly. It has to be remembered that everyone’s environment is different, especially among SMEs, which is one of the reasons why AI’s ability to learn from the situation, rather than merely process an externally derived algorithm, is so attractive.

Another consideration is that a lot of the data is text-based, so one of the things we are doing is to pull data from multiple sources into a Microsoft analytics package with a data model that tells the system how to relate data to different objects.

We can create a dashboard and on top of that we can layer some ChatGPT-type functions – ‘show me a pie chart of my staff picking by day and by person’ – so managers don’t have to ask IT to build them a report.

AI-based systems can lift a lot of the cost and burden of manual record keeping and analytics, not to mention eliminating – or at least detecting – errors that arise in manual systems. Ultimately, there may even be savings to be had in integrating all the different systems that warehouse and distribution operations use. AI may be able to ‘learn’ how to get data from one system to another, despite apparently incompatible formats, rather than having someone have to write code for every eventuality.

chines working collaboratively with people. This is perhaps particularly pertinent for small businesses such as wholesalers, which can increasingly afford this type of automation, and need it to be a lot more flexible than the big ‘goods-to-person’ automated systems operated by large operations. For example, workers could be ‘tagged’ with a Bluetooth device to locate them relative to the current or intended position of a robot and the position and current status of priority orders, but taking full advantage of this requires intelligent systems.

AI-based systems can lift a lot of the cost and burden of manual record keeping and analytics, not to mention detecting and eliminating errors

5. Enhanced image

AI is already making a difference here. For example in data entry, including optical character recognition and image scanning – making sense of it, relating it to other elements in the system, and particularly in looking for errors and discrepancies.

That might be a quantity difference between a sales order and the relevant pick note; or it might be a delivery address that doesn’t exist or doesn’t make sense, in which case it may be possible to configure AI to make intelligent suggestions about what the address should be, before the delivery driver sets off on a wild goose chase.

There is a lot going on with AI in the wholesale environment. At present, the landscape is a patchwork of small developments helping people to fit bits of AI to their operations, often to start with just eliminating smaller pieces of work at the interfaces between systems, which is where, for instance, data discrepancies tend to manifest. However, this patchwork will surely coalesce in fairly short order. l

It’s

Paul Hill speaks to Parkview Provisions managing director Martin White, and sales and procurement director Leeann White, from the company’s fast-growing headquarters in Newry

PH: Tell us about the business

MW & LW: We are a foodservice provider delivering fresh, frozen, ambient and non-food products, with 40% of our turnover coming from mini supermarkets/deli counters. Over the past couple of years we’ve introduced a new management team to allow the pair of us to stay in the background and focus on implementing our company’s growth strategy of expanding our geographical reach as well as product range. This consists of a general operations manager, a telesales and office manager, as well as an accounts manager.

Where are your customers based?

We operate within a 45-mile radius from our depot in Newry within Northern Ireland and go as far south as Drogheda in the Republic of Ireland. This means that we touch Belfast with a couple of big

drops, but our main areas of focus are Newry, Portadown, Dundalk and Lisburn.

Do you have plans to expand further south of the border?

Obviously south of the border offers a lot more opportunity for growth as it’s four-to-five times bigger, but the Northern Ireland protocol makes it a lot more challenging.

Getting products over from Great Britain is also proving costly these days. For example, we were recently looking into importing a dairy product because it was £2 a block cheaper over there. However, once we factored in delivery and vetting, it came out as 80p more expensive, which is a £2.80 switch.

On top of this, not having an active government doesn’t help the situation [there wasn’t an active government at the time of

interview], but there is nothing we can do about it, so we continue to trade on both sides of the border.

What part do convenience stores play in your business as a foodservice wholesaler?

A large market for us is the deli bars within convenience stores, which are unique to Northern Ireland compared to the rest of the UK. These act as mini supermarkets and delis, and even have chefs working in them. A lot of chefs we partner with moved over to these types of outlets from restaurants

in Covid-19 and haven’t gone back because it’s a better lifestyle for them working nine-to-five in a store rather than the unsociable hours of restaurants. You find foodservice and convenience wholesalers each supply different sections of these types of stores.

How has the business been performing financially?

We have grown significantly over the past few years. Turnover was £14m last year, and we have a target of £15.5m this year, but it looks like we’ll be hitting around

£16m for the 12 months ending in May. Since we’ve extended our facilities by 5,000sq ft and expanded our warehouse capabilities, we’re targeting 10%-15% growth annually. A new roof extension was put in two years ago and the warehouse extension took place in 2022, taking the overall size to 13,000 sq ft. This gives us a lot more ambient space.

Our next challenge will be to extend our frozen space, and that might be at another location in Newry. With the money we’ve spent, we’re now seeing the benefits and our next move is to

introduce night picking, which we get additional staff in for 6pmto-2am shift work.

What are your long-term targets?

Our next major target is to get to £20m turnover by 2025/2026 and we plan to double the sales team on the road. We’re looking to add to the orders of customers we already have rather than just getting completely new business.

What are the biggest challenges the industry faces?

Huge price increases have affected

us, so the focus needs to be getting prices down and convincing suppliers to reduce them. Petrol, electric and so on have all slightly improved since their peak. I like to think we’ve gone through the worst period in the sector’s history and things will get better.

So, 2024 is about working with our suppliers to get prices down. We didn’t increase our prices when everything was going up last year, which brought us a lot of loyalty. This is also one of the reasons why we extended our warehouse as it allowed us to stockpile more products. l

Fleet 11 (two smaller and nine larger vehicles)

Warehouse space 13,000sq ft

Founded 2004

Turnover £14m

Location Newry

Turnover target £20m by 2025/26

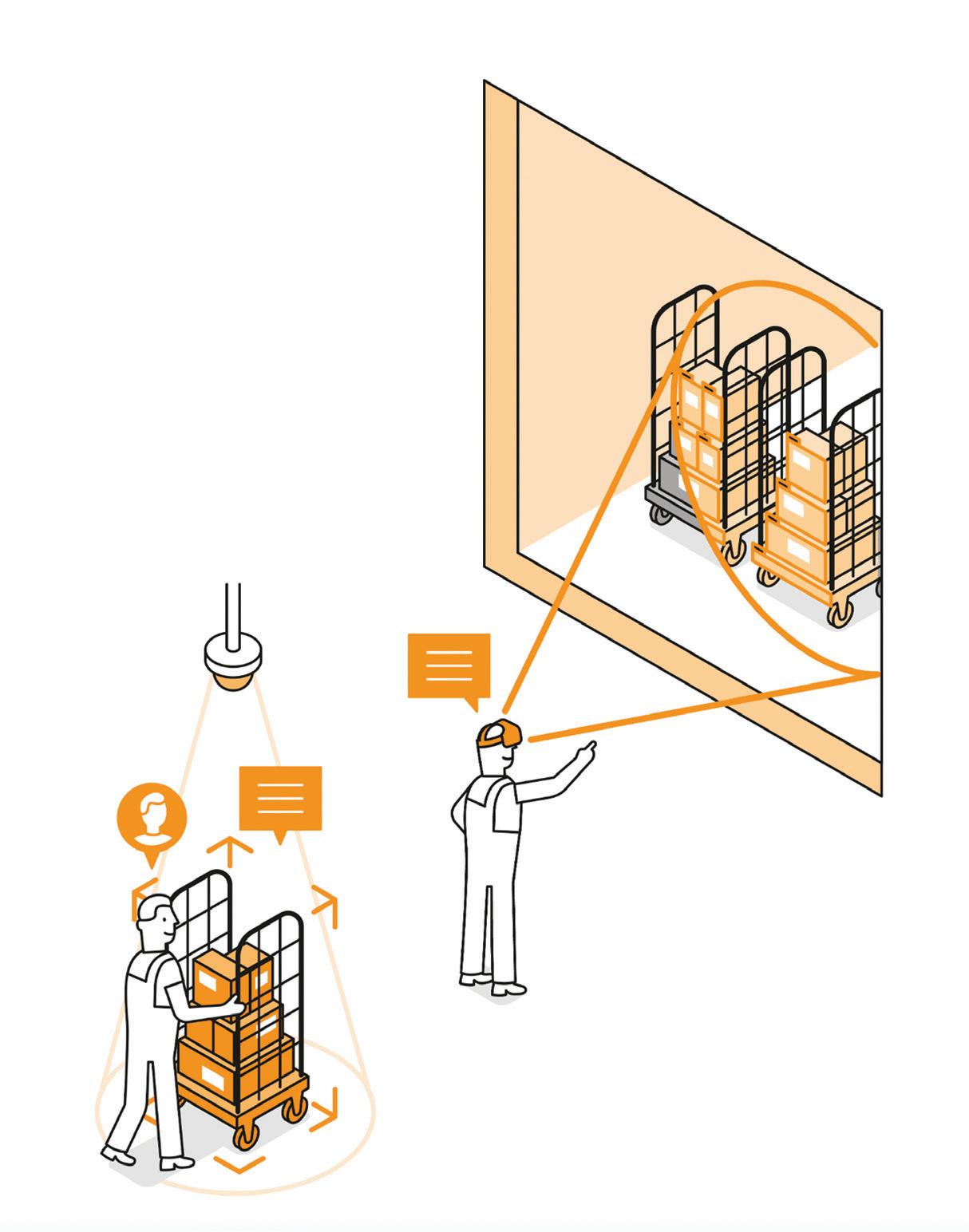

Two senior leaders at Netherlands-based computer-vision-integration-androbotics business Prime Vision outline the benefits of image-based tracking technology for wholesale-depot operations

The human eye is a marvel of nature, but it is often now complemented by the cameras and machines. In warehouse logistics, this technology has the potential to enable operators to validate the logistics process – reducing human errors, tracking deliveries and providing real-time feedback for improvements. This is giving businesses the opportunity to see the bigger picture.

Smart scene understanding is the ability to visualise the exact location of an item within a warehouse at any time. To achieve this, cameras must capture all goods passing through the facility.

Reading labels on inbound goods ready for sorting can be achieved with optical character recognition for recording

stock-keeping units, purchaseorder numbers, best-before dates and more.

Similar technology can be used at picking stations to validate a successful sorting process, imaging barcodes to check order completion. Cameras installed on ceilings or areas where actions take place provide complete coverage of items in the warehouse.

These cameras are smart enough to offer mapping and overlap, enabling the tracking of objects. All imagery can then be stored in a central location and combined with other parcel data for total

traceability. All this can be done safely and securely and compliant with GDPR and privacy rules. With this set up, operators can get a complete picture of every single item or order journeying through the warehouse. The benefits of this monitoring are manifold.

This technology has the potential to enable operators to validate the warehouse logistics process and reduce human error

Image-based tracking reduces manual actions and reasoning in processes such as data input or sorting, with the overall aim of minimising human error. However, another important benefit is that it can provide proof of sorting. This level of validation enables operators to identify where problems have occurred during the process.

A centrally stored database of images means every action is documented, so records can be accessed to spot mistakes. Operators can identify sorting errors or where an item has become

damaged. This can help reduce the number of customer claims by verifying the authenticity of complaints with video evidence.

However, a system shouldn’t just be reactive, it needs to provide real-time feedback to prevent sorting mistakes before an item leaves the warehouse. If an error occurs, an alert should be quickly delivered via a flashing light, alarm or notification to an operator. Staff can then double-check the current location of the item against where the vision system knows it should be. In this way, mistakes are resolved quickly, well before an order is loaded onto the wrong conveyor or delivery truck, saving time and cost.

The function and technological capabilities of an image-based tracking system are highly flexible, depending on the application’s requirements. A recent project for an Italian fulfilment company illustrates this.

Prime Vision was asked to improve a process whereby products were selected from storage, verified and prepared for shipment. Historically, this step had been prone to human error, resulting in mispacked items or incorrect quantities. This translated to delays, additional costs and customer dissatisfaction. However, Prime Vision had technology ready to transform this process by carrying out double-checks.

Prime Vision’s Proof of Pick & Pack is a warehouse technology that uses a combination of cameras and voice-recognition systems to ensure the accuracy of the picking-and-packing process. In this system, forklift trucks or pickers are equipped with cameras that capture images and videos of the selected products during the picking phase. These images and videos are then cross-referenced with a comprehensive reference database containing tens of thousands of product records.

Proof of Pick & Pack was a game-changer for warehouse operations at the Italian company.

By combining camera technology with a vast reference database and a pick-by-voice system, it offered an efficient and error-free solution to the age-old problem of mispacked items and incorrect quantities.

As the logistics and distribution industries continue to evolve, embracing innovative technologies like Proof of Pick & Pack is essential for staying ahead of the curve and delivering exceptional service to customers. More than that, the flexibility of image-tracking systems also brings benefits to warehouse employees.

Contrary to the story of automation taking jobs, computer vision is proving highly beneficial for warehouse workers, making tasks easier and more attractive. This is especially important for a sector facing a chronic labour shortage.

Monitoring warehouse activities lets businesses identify best practices and new efficiencies.

Personal innovations like better sorting routines can be shared with the rest of the team, making work easier for everyone.

Additionally, data from image-based tracking can greatly simplify sorting. Devices such as Prime Vision’s Flow Projector eliminate boring, time-consuming label reading by imaging the label, determining the correct destination and projecting a number onto the item that corresponds to it. Therefore, it is much faster for workers to move parcels to the right place, improving job satisfaction and efficiency.

Intuitive systems that simplify processes also expedite training.

Prime Vision engineers have witnessed this first-hand. A new starter at a customer’s site was able to begin work immediately with a Flow Projector as it was quick and easy to provide adequate training. As well as getting up to speed almost instantaneously, staff enjoy collaborating with exciting technology that adds game-like elements to the most mundane

tasks. This helps to attract and retain workers, helping warehouses overcome the challenges of the labour shortage.

Seeing into the future Computer vision and machine learning technology is developing rapidly, and Prime Vision works with academics to harness the latest research and deliver new, innovative image-tracking technology. By collaborating with the wider computer vision community, the business develops state-of-the-art, customisable systems to benefit any operation.

Validation is critical in any logistics process, but modern image-based tracking goes a step further, enabling operators to take a more proactive approach to enhancing warehouse efficiency and profitability.

As well as minimising errors, the technology is enabling humans to excel, augmenting operations with a third-person perspective for a deeper understanding of the mise-en-scène. l

Paul Hill speaks to Maurice Devlin, the managing director of Sugro member Northern Confectioners, from the company’s recently extended warehouse in Dungannon, Northern Ireland

Maurice Devlin Managing director, Northern Confectioners

Maurice Devlin Managing director, Northern Confectioners

PH: How was the business formed?

MD: My dad initially ran the business in 1967 with two partners who passed away back in the 1970s and 1980s. We lived in a family house next door to the depot (where my parents still reside), so I was literally immersed in wholesale from an early age; it’s in my blood, with my mum also playing a huge role in the running of the operation over the years. There were five kids in our house and we all worked in the business at some stage growing up – evenings, weekends, school holidays etc. My sister Sharon still works in the office and I was the one who ended up taking over. My father is still involved, but I’m now in charge of the day-today running of the operation. When my parents moved to the house in the 1960s, they built a small warehouse and it has gradually been extended over the years. We are still the only convenience wholesaler in the town of Dungannon and the other nearest

We’re in a fortunate position where we’ve had nine years of consecutive turnover growth, and this warehouse will enable us to grow our turnover and product range further

wholesalers are in Belfast or Newry, around 45-60 minutes away.

What do you stock and who do you supply to?

We distribute confectionery, soft drinks, crisps, grocery, household lines and snacks all over Northern Ireland, and our range extends to more than 2,000 items. We have a diverse customer base with around 90% of this convenience stores and the remaining 10% coming from newsagents, garage forecourts, takeaways, pubs, cafés, schools and sports clubs, to name but a few.

Would you consider going south of the border to the Republic of Ireland?

We’ve grown quite significantly over the past six or seven years and it would be good to go down, but it’s far too much paperwork and admin if you wanted to expand in relation to

tariffs and taxes at the moment, not to mention the problems DRS has also caused. The plan was to go south, but the legislation has made it extremely difficult, so the focus is on Northern Ireland for the time being.

How does the Northern Irish market work?

It is a very independent, competitive market and rare for a retailer to just have one supplier. And although you have certain big players involved, much of the market is very independent and field-sales-force-based, with relationship between retailer and wholesaler playing a key role.

How did The Troubles affect the sector?

The Troubles were obviously an horrific time for everyone, but because of the danger in operating over here, it kept away the big supermarkets such as Tesco and Sainsbury’s until the

Founded 1967

1990s, allowing the smaller independents to establish themselves in the market, which is why they are still so prominent to this day.

Do you have any recent developments?

We completed an extension on our warehouse in January last year, and doubled warehouse space from 20,000sq ft to 40,000sq ft. It took around a year to build and because we had a hilly field out the back, we had to build it on steel bracing. We’re in a very fortunate position where we’ve had nine years of consecutive turnover growth and this warehouse will enable us to grow our turnover and product range further, with plans to take on more grocery and household lines such as sauces, cereals and pastas, which are already performing very well.

What is your USP?

I believe service is our USP. We’re completely customer driven, we never let anyone down, and know the market and customers inside out, which allows us to serve them well. I also believe we have a key ability to react and adapt quickly to changes within the market and a lot of this is down to the outstanding contribution of our staff to the running of the business.

What are the biggest challenges for the industry?

Increases in costs is the biggest chal-

Warehouse size 40,000sq ft (previous 20,000sq ft)

lenge now, on things such as electricity and fuel. On top of this, more and more suppliers are going down the road of price-marked packs (PMPs) to the point where us and our retailers can’t get any more from them. Obviously, some suppliers have increased their price-mark and it’s all right saying the cash margin has gone up, but we need the percentage margin to go up as well. Don’t get me wrong, PMPs can work very well, but at the moment we’re absorbing too much of the costs across the board in all categories.

What is the five-to-10-year plan of the business?

We aim to continue growing our range and customer base. The range will prove easier as it will mainly be a case of selling new products to existing customers, which they would mainly already be getting anyway from another source, so it’ll be up to us to convince them to make the transition to us once we stock it.

What has the company done to improve its green footprint?

Our new warehouse is all LED lighting, and we’re also at the start of implementing a new software system, which will allow us to go paperless within a year. This is a Windows-based system, designed specifically to our requests and needs. Warehouse management and voice picking will be key components of this.

How has the company embraced digital?

After implementing it over two years ago, around 40% of our business now comes through digital. You can clearly see our customers spending more when using online and a lot of this is down to my wife, Kathy, who joined the business after we got married. She was a software engineer previously and has been key to the IT development within the business – online ordering, app, as well as our warehouse management and software systems.

How has Brexit and the Northern Ireland Protocol affected the company?

The government left it to wholesalers to sort ourselves out, and although Sugro was very helpful in trying to gain the information for us, we encountered problems out of our control, such as delays in orders from some suppliers, products being delisted from the Northern Irish market, as well as supplementary declarations required for deliveries from some suppliers. There was also a lack of information from HMRC and a seeming lack of knowledge on its behalf. l

Rob Mannion Chief executive, b2b.store

Rob Mannion Chief executive, b2b.store

Don’t let the movies scare you into thinking artificial intelligence (AI) is a bad thing. Talk in the news about AI having the potential to take over the world might make good headlines, but the likeliness of it going full Terminator is a little far-fetched –yet if wholesalers don’t embrace what the technology has to offer, they could still be saying ‘Hasta la vista, baby’.

There’s no denying the genie is out of the bottle when it comes to AI being used across a raft of industries, and wholesale is no different, along with the rest of the supply chain. Particularly due to the nature of the way our sector operates, the threat of automation and efficiencies naturally lead us to think about how it could impact the humans doing the work now

– perhaps even the longevity of entire businesses in the long term.

I can understand why that’s a frightening thought for some business owners, but considering an extreme example of what might happen is no reason to shirk from exploring the positives AI can provide, too.

Machine learning can already have a positive impact on product recommendations on e-commerce, online searches, an ability to identify meaningful insights from messaging inboxes, and marketing and communications.

It’s not big and it’s not scary, but it will encourage higher spends from customers and bring you higher engagement. What’s so bad about that?

The irony is the solutions I’ve mentioned use the same technology that is leaving some people quaking in their boots – it’s all

generative AI, which learns from its experiences to improve output.

The idea of creating a series of programmes or machines that can self-improve is clearly where the Terminator comparisons are drawn from. Yet, this technology, while impressive, is still relatively unrefined and will need much greater development before it hits the levels of influence some people are talking about.

But if the upward trajectory that AI is on is only going to pick up speed, forward-thinking wholesalers and suppliers should be recognising that advancements are coming (whether they like it or not) and playing a role in identifying where AI can give them an edge.

There’s no point in simply slinging this technology into your business for the sake of it without working out how best to

use it. Pooling industry resources to carry out testing on how AI is used within wholesale businesses is the way the industry can help cultivate something that enhances what we do rather than taking away from it.

Naturally, we at b2b.store consider ourselves to be at the forefront of this activity and we’re already talking to leading suppliers and wholesalers to see how we can join up the dots for some trials in the not-too-distant future. If we do this together, then it’s going to safeguard the future, instead of leaving a gap for others without the knowledge or passion for the sector to notice gaps where AI could be implemented.

Because mark my words, if we shun the idea of wholesale AI in the short term, there’s no way it won’t be saying ‘I’ll be back’ in the years ahead. l

This product contains nicotine and is addictive. For adult nicotine consumers only.

THE WEIRDLY WONDERFUL NICOTINE POUCH

Paul Hill speaks to Bobby’s Foods’ regional business development manager, Peter Aikman, and national sales manager, Shaun Spendlow, about the opening of the company’s Northern Ireland depot on the outskirts of Belfast

PH: Tell us the story about the opening of Bobby’s Northern Ireland depot

PA: We opened our first depot in Northern Ireland – 12th overall – to better serve our 500 retailers in this region. Over the past four years, our teams have made remarkable progress in supplying retailers across the country.

We’ve been helped by Maxwell Freight, which provides invaluable guidance and support throughout our journey.

Starting from a modest corner of its warehouse in 2019, Bobby's gradually expanded its footprint, eventually culminating in the realisation of a newly built warehouse and offices at Crumlin.

How does Bobby’s structure work?

We supply our range consisting of around 200 products made up of sweets, snacks, nuts, popcorn,

cakes and freezer items direct to retailers, and we deliver these from our 105 vans on the road to more than 22,000 local stores nationwide. Bobby’s is part of a group that includes Hancocks and World of Sweets.

What made you set up a permanent base here?

There has always been a demand and huge potential in this market, but we needed a physical base to fully realise this, and have seen huge growth in the past three years as a result.

Building a depot and having a sales team here shows retailers we are committed to the market and are in it for the long haul. It also shows we’re confident with the Northern Ireland market.

How has this depot performed financially?

Our sales have grown every year since starting here, and we achieved a 47% increase in 2023. As for many businesses, it was a difficult time during Covid-19, and this affected some of our plans, but we supported local retailers as best we could, and we are now looking to build on recent success. We’ll introduce a fifth van in Northern Ireland in 2024 to sustain the growth and serve more customers.

How are you recruiting retailers across the country?

Our primary focus revolves around independent retailers and

symbol groups, given Bobby's reputation in the convenience market. However, we maintain flexibility in our target audience, extending our reach to any business equipped with a point-of-sale system.

While most of our customers consist of convenience stores, we also cater to pubs, bars, farm

shops, and cafés. Our exceptional service drives customer acquisition, largely through word-ofmouth referrals and our proactive field sales efforts.

Sales representatives engage with customers every two weeks, with more frequent visits in busier cities like Derry and Belfast.

How does the Northern Irish market differ to the rest of the UK?

It is a lot different here, with fewer independent retailers and not the same strength of the bigger supermarkets you see in the rest of the UK. There is a mid-ground of small supermarkets managed by a symbol group such as Eurospar or Nisa. These are much bigger than convenience stores we typically serve, and they give us great scope to display our products and attract local consumers.

Is there scope to move into the Republic of Ireland?

At the moment, we are focusing our efforts here and moving goods

for sale in Northern Ireland only. We are keen to understand the complexities around operating within the EU and working with some price-marked products in sterling, and we see a great opportunity in moving into the Republic of Ireland. Hopefully, that answer will become a ‘yes’ in future years.

How do you source your products?

We have a product-sourcing team with extensive industry experience and an extensive network of contacts. We work closely with manufacturers to develop products tailored to the convenience market’s needs and work alongside handpicked brand partners.

We are committed to providing revenue-generating products and exceptional service to our customers. We pride ourselves on knowing the products we sell are exclusive and offer retailers products they can’t get from local cash and carries, giving them points of difference from multiples. l

Fleet across the UK

105

Depots

12

Northern Ireland location

Crumlin, near Belfast

Northern Irish customer base 500+

Dan Migliozzi Head of sales, Invar Group

Dan Migliozzi Head of sales, Invar Group

There can be little doubt that automation is the future for all but the smallest of warehouse operations. New affordable technology is now within reach of most wholesalers, and this technology, which often involves robotics and AI, is transforming performance across intralogistics processes.

Driven by poor labour availability and increasing customer demands, many businesses will be thinking about a comprehensive review of their operations, and may be tempted to go for a full turnkey approach – introducing a set of systems at the same time. However, while this may be appropriate for some companies, others may be exposing themselves to unnecessary levels of risk, and a more considered approach could yield greater gains.

For a major corporation with the luxury of multiple warehouses or distribution centres, and facing challenges or changes to their current operational model, it may be practical, even desirable, to take facilities offline one by one and rebuild them.

For smaller businesses, though, this could be a high-risk strategy and may be unviable – a considered, step-by-step approach to the end goal of significant automation may be preferable, financially and operationally.

Financially, moving towards automation in planned stages limits the need for often significant up-front capital expenditure, a particular concern for start-ups and other companies in a phase of rapid growth when other demands on working capital can be considerable. A stepped approach that

quickly takes advantage of ‘low hanging fruit’ can achieve an early return on investment and bring many other benefits – potentially helping to fund subsequent phases of automation.

Even if capital funding isn’t an issue, the risks of an ‘all-in’ approach are significant. Some degree of disruption is inevitable during installation, and even with the most careful planning, highest-quality equipment, it’s rare for everything to work straight out of the box. The risk of a major delay or disruption could have a far-reaching impact on the business and may lead to lost sales and reputational damage.

A further consideration is, with a complete turnkey approach, it’s usually not possible to revert to the old ways of working while the fixes are undertaken. There is no redundancy in this situation.

Rather than playing with the en-

tire operation in a giant sandbox, better by far to identify and address the most urgent or compelling challenges and opportunities as they arise.

That way, processes can be better defined and understood, employees at all levels trained and other necessary capabilities –maintenance, for example – built up at a manageable pace.

‘Step-by-step’, however, does not mean ‘piecemeal’. The planning for a stepped migration to more automated operations is just the same as it would be for a turnkey project – indeed the ultimate goals will be just the same – it’s merely a question of how to get there.

Firstly, and obviously, the company needs to know its objectives and requirements. Is automation needed because the business is

in, or is anticipating, a period of rapid growth? Growth is good, but for many companies, perhaps in a mature or niche market, higher volumes and throughputs may not be the issue – greater efficiency, lower costs and, perhaps particularly, better use of scarce labour may be the imperatives.

The wholesaler needs to map and understand its processes from cradle to grave, including processes which are unlikely to be directly addressed by automation. Where are the biggest wins, the greatest challenges, the most acute pain points? Address these first –paradoxically, trying to optimise a process you know to be already very good often carries a larger downside risk.

The automation plan can’t just address short-term issues. The business may need to consider the extent to which the automation is scaleable – can a robotic installation, for example, be scaled up for future growth just by leasing more units, or will there be a point at which the racking and other physical attributes of the warehouse require major change? If so, should that be done now, even though it may not be needed for some years?

The plan also needs to consider the pace of technological change. Evolution in fields such as robotics is lightning-fast. There is no

shame in buying last year’s model if it does the job, but there are risks that equipment and systems may become obsolete – or worse, unsupported – much quicker than expected. This means that some of the steps in the automation road map may need to cover replacing or upgrading earlier and relatively recent investment steps. Robust continuity planning, in partnership with reputable vendors and integrators, is crucial.

Planning a stepped approach to warehouse automation cannot

be just a top-down, or bottom-up, process. It requires the involvement of every stakeholder in the business. Clearly, it needs high-level strategic direction to ensure the plan is aligned with the company’s goals, its financial capacity and its appetite for risk.

Operational input – will the proposals actually meet the requirements of, for example, seasonal peaks. Engineering – does the business have, or can it expect to establish, an adequate maintenance capability, or will this have

New affordable technology is now within reach of most wholesalers and AI is transforming intralogistic processes

to be outsourced. HR may have views on how staff can be trained, and whether new staff with new skills need to be hired.

Then there is installation. Even modest steps in automation are likely to involve systems and equipment from multiple manufacturers and vendors, and will require some level of integration, both with each other and with existing equipment and systems.

‘Plug and play’ is a muchvaunted term, but it’s hard to find evidence that it really exists in the modern warehouse.

Therefore, it’s important to find an independent integrator that has the necessary technical capability and in-house software skills to deliver a project successfully over several planned stages. l

With the UK now in an election year, the Federation of Wholesale Distributors (FWD) has released a manifesto that sets out deliverable actions to the UK government across five themes – growth, employment, sustainability, communities and supply chain – that it says will help transform the UK economy and lead to the wholesale sector playing an active role.

The FWD explains that with an annual turnover of £25.6bn, the wholesale sector is a fundamental part of the UK economy. However, like much of the country, wholesalers have not been immune to the shocks that have been felt right across the economy, with a recent survey of FWD members finding they have, on average, seen a 14% rise in the cost of buying goods this year, with overall business costs rising by 10%.

The FWD manifesto included a list of requests for the UK government across the five themes:

• Abolish the annual inflationary increase to the business rate multiplier.

• Ensure regulatory alignment across the devolved nations.

• Alleviate pressures for wholesalers in the use of the Windsor Framework by offering resources and support to businesses to en-

sure they are fully compliant with the new trade rules.

• Expand the Apprenticeship Levy into a wider Skills Levy to stimulate greater investment in skills and training, supporting the workforce of the future. Giving businesses more flexibility to allocate the money to train staff will bring significant benefits to the wholesale sector.

• Expand the Shropshire Review so it takes into account the whole supply chain, including the wholesale sector, which is currently excluded from the review. Shortages in labour are still causing key issues for wholesalers. Public-sector routes have also been subjected to ‘efficiency’ changes, with fewer deliveries. This has meant far larger volumes of food being delivered at once, but no place for a raft of public-sector settings to store these goods due to limited kitchen capacity. In a number of cases, this has led to less fresh food being delivered and menu changes to compensate. The Shropshire Review, which looks at addressing labour shortages in the food supply chain, should therefore include the wholesale sector.

• Take a measured approach when setting new employment policies to ensure the impacts of new legislation take account of the needs in the wholesale sector.

• Offer a clear and consistent strategy for road freight decar-

bonisation to facilitate investment in zero-emission vehicles.

• Standardise corporate reporting requirements of scope 3 emissions data to ensure greater availability, consistency and quality data.

• Ensure a dialogue that guarantees accurate, science-based communication around climate change, net-zero emissions and sustainability, while fostering climate literacy and preventing the dissemination of false information and policies.

• Ensure the Criminal Justice Bill tackles wholesale crime, to guarantee it is afforded the protections it requires. FWD would also welcome an addition to the bill to introduce a specific offence for assaulting a retail and wholesale worker.

• Commit to a real inflationary increase in funding for publicsector catering and ring-fence the funding for catering costs,

to allow the continued supply of healthy food to schools.

• Introduce a condition that allows contract price increases more regularly than once a year if a threshold is met (for example, inflation is more than 5%) to ensure contract terms are favourable in the procurement market.

• Ensure a joined-up approach to food-and-drink regulation across the devolved regions as any divergence leads to significant added costs and complexity for wholesalers operating in the four nations of the UK. Wholesalers already operate within extremely tight margins.

• Support the development of a more efficient and effective supply chain by delivering a more hands-on approach to support the industry’s adoption of automation and digitalisation.

• Work closely with the industry so we can build a resilient and sustainable food system. l

In the dynamic world of hotels and restaurants, in which culinary excellence and service is more important than ever, the role of wholesale has never been more pivotal. Following the Covid-19 pandemic, foodservice wholesalers and their respective buying groups have grown in significance in ensuring a seamless supply chain for what are two hugely profitable sectors.

The UK hotel industry is everevolving and characterised by a diverse array of establishments ranging from boutique bed-andbreakfasts to luxury chains that are all increasingly focusing on elevating their food and beverage

offerings. This shift has created significant opportunities for wholesalers, who play a vital role in supplying hotels with quality ingredients, ranging from locally sourced produce to international delicacies.

Moreover, with sustainability and ethical sourcing gaining prominence, wholesale is the part of the supply chain tasked with meeting the demand for eco-friendly and ethically sourced products, aligning with the values of hoteliers and their guests.

Meanwhile, in restaurants, a rich tapestry of cuisines are now prevalent across the entire country, and not just large cities. With consumers increasingly

valuing quality, authenticity and innovation, restaurants are continually seeking unique ingredients and culinary concepts from their wholesaler to differentiate themselves in a competitive market. For wholesalers, this presents both opportunities and challenges. Additionally, they’re having to navigate the complexities of regulatory compliance and sustainability.

The importance of the two sectors to Bidfood’s overall business model was recently highlighted after it appointed Vicki Philpott as its business development controller for hotels and restaurants.

She will now be responsible for leading the national sales teams in those two specific areas.

“The past few years have been challenging for hotels and restaurants. However, I’m optimistic that as we approach 2024, the sector will continue to flourish and bring with it a number of opportunities,” she says.

“My passion for the foodservice industry has always been at the forefront of the work I do and I’m extremely excited to have joined Bidfood.

“This role will allow me to put my existing relationships and knowledge to good use, while working with the team to continue the outstanding work they do to deliver service excellence and help our customers grow.”

JJ Foodservice, meanwhile, has made a move to extend from its traditional customer base of takeaways with the launch of dedicated microsites for each of the various foodservice sectors it serves, including hotels and restaurants. Each Shop By Sector site highlights popular products, recommendations, customer testimonials and product videos.

They have also coincided with the introduction of a World Food Asia range to target South, East and South-east Asian menus, covering products such as Thai jasmine rice and bao buns.

Baris Kacar, chief sales officer for JJ Foodservice, says: “Our mission is to make it easy to recognise JJ Foodservice as your trusted foodservice partner. Whether you are launching a new

(All stats from IBIS World Hotels in the UK –Market Size 2011–2029 report)

Hotels in the UK market size in 2023 £16.4bn

Hotels in the UK market size growth in 2023

20.3%

Hotels in the UK annualised market size growth 2018–2023

-2.9%

Ranking of accommodation and foodservice activities industry by UK market size 4th

hotel menu or managing a gastro pub, we have everything you need under one roof.”

“I feel like I have spent the past 10 years telling people that JJ supplies more than just takeaways. But we have now hit a milestone. We have finally launched Shop By Sector, highlighting how far we have come in developing the right products and service for at least 12 different foodservice sectors,” adds head of communications Elit Rowland.

Foodservice buying groups continue to play a vital role in the industry, and Bidcorp’s new Caterfood Buying Group has in-

troduced a quarterly foodservice magazine specifically created for professional chefs and commercial caterers.

‘Infuse’ launches 12 months after the creation of Caterfood Buying Group following Bidcorp’s acquisition strategy, with seven foodservice companies now within the group; Caterfood South West, South Lincs Foodservice, Cimandis, Nichol Hughes, Elite Fine Foods, Harvest Fine Foods and Thomas Ridley.

Phil Atyeo, managing director of Caterfood Buying Group, says: “Crafted with real passion, Infuse

is a fresh and vibrant solution for foodservice caterers and one of the first ways in which we’re really putting the Caterfood Buying Group brand out there. We’re focusing on the power of community and food innovation, bringing together seasonal inspiration and offering expertise and solutions that go beyond conventional culinary content. We’re excited to hear what our customers think of Infuse.”

Sysco, meanwhile, has partnered with foodservice tech company Nutritics to introduce its Foodprint carbon-labelling solution for the wholesaler’s customers and their aforementioned need for a sustainable offering.

Foodprint is a fully automated environmental-impact scoring system that allows customers to track, manage and publish the water and carbon impact of their menus and will become part of Brakes’ Virtual Chef concept.

The software works by taking the most reliable data available across agriculture, processing, packaging and transportation, linked back to peer reviewed academic research. It then delivers this in a format that

can be translated into a consumer-friendly label.

Paul Nieduszynski, chief executive of Sysco GB, says: “Over 90% of our carbon footprint is the food that we sell, so educating our team and supporting customers on the design and development of menus and the products they are sourcing is vital to us playing our part in tackling climate change.

“With thousands of customers and the industry’s largest development chef team, we are very excited about the opportunity to build on Sysco’s global science-based targets and be at the forefront of transforming the food system and what ends up on the menus of tomorrow.”

Stephen Nolan, chief executive of Nutritics, says: “Fresh from helping the organisers of COP28 deliver climate-friendly menus across the conference, this is another opportunity for

us to provide food sustainability experience that helps hospitality businesses. We’re proud to work alongside Sysco GB, creating a path towards shared goals and becoming part of its sustainability journey.

“By becoming part of Brakes’ Virtual Chef concept, we’re able to support the company in its broader mission to reduce emissions and educate customers.”

Meanwhile, Pilgrim Foodservice, a wholesaler with its own butchery to cater to its restaurant customers’ premium needs, is to open a new depot in Colchester, Essex, this spring with the building underway on the £3m construction of a purpose-built warehouse that incorporates seven loading docks and will create 20 new local jobs.

The facility forms part of the wider company’s £11.5m investment strategy, which also includes investment in operating

systems and facility enhancements at the company’s main site in Boston, Lincolnshire, alongside the renewal and expansion of the company’s fleet.

Charles Bateman, managing director at Pilgrim Foodservice, comments: “The opening of our first satellite depot marks another step forward for our growth plans. The addition of this depot will support our vision and ensure we continue to provide our customers with the finest products and first-class customer service.”

Santa Maria, one of the country’s leading out-of-home food providers, has announced the launch of its new salsa range – a category worth £212m – designed to help restaurant and quick-serve operators elevate their menu offering and increase the average spend per head.

With Creed Foodservice’s Plates to Profit 2023 Report revealing that nearly half (47%) of pub and restaurant operators have seen the number of bookings reduce, it’s increasingly important that operators maximise average spend per visit – and Santa Maria claims salsa can help do just that, with the average spend on salsa reaching £16.50, compared with £11.20 in the wider market.

Santa Maria’s new salsa range is a trio including Mexican Salsa Roja, Salsa Rio Grande and Mexican Salsa Verde, which are all vegan, and gluten- and lactose-free, and are ready for chefs to serve.

Its taste creator, Barnaby MacAdam, says: “Customisation has increased across menus by 49% year on year – it’s absolutely huge. Consumers are looking for ways to elevate their food choices with twists and upgrades to their dishes.

“The hurdle for many operators is having the time to re-engineer their menus and come up with new ideas and also have the skill and time among their teams to create the dishes.

“This is where our new salsa range comes into its own – it’s ready to be served, no prep required, and incredibly versatile so can be dolloped on top of nachos, smothered over burger patties, the perfect accompaniment to Mexican salad bowls or can be offered as a topping choice for loaded burritos, tacos or taquitos.”

Within the alcohol world, Caribbean drinks brand Wha Gwan continues to expand its product range with the introduction of its latest limited-edition NPD, Glidin.

The brand’s first infused wine combines its Melon Cherry Rum Tonic with sparkling Glera wine to make a flavour that it claims is unlike any other in the UK drinks

market. The new addition will be available to the entire wholesale channel across the UK.

Nostalgia is also a key element of many foodservice outlet menus, and Lamb Weston is claiming its Twisters range is filling that consumer need with an interesting origin story.

Trade marketer Craig Wescott says: “In 1983, Lamb Weston invented a patented knife to create the curly shape, which gave more taste, better flavour and more natural goodness.

“The product then yields 15% more portions per kg – equivalent to 3,000 extra portions per year. The shorter cooking time results in less energy consumption, too.

“Consumers are increasingly seeking affordable, comforting and nostalgic food experiences that soothe the soul. There’s an ongoing evolution of nostalgia-driven comfort-food innovators.

“In foodservice, a new wave

of comfort-centric restaurants and pop-ups is gathering momentum across the UK as demand for creatively ‘grown-up’ spins on comforting classics grows, with innovators boldly elevating time-honoured dishes, from fried chicken to potato smileys, with subtle nods to generation-specific childhoods.”

According to Bidfood’s 2024 Food & Drink Trends report, consumers are now looking for playful experiences as well as adventurous flavours and healthy and hearty recipes.

The findings of the report show 77% of consumers and operators see value for money as imperative to decision-making when choosing where to eat and drink out as inflation hits discretionary spending. Foodservice wholesalers and buying groups need to keep this in mind when sourcing, promoting and distributing their ranges to their hotel and restaurant customers. l

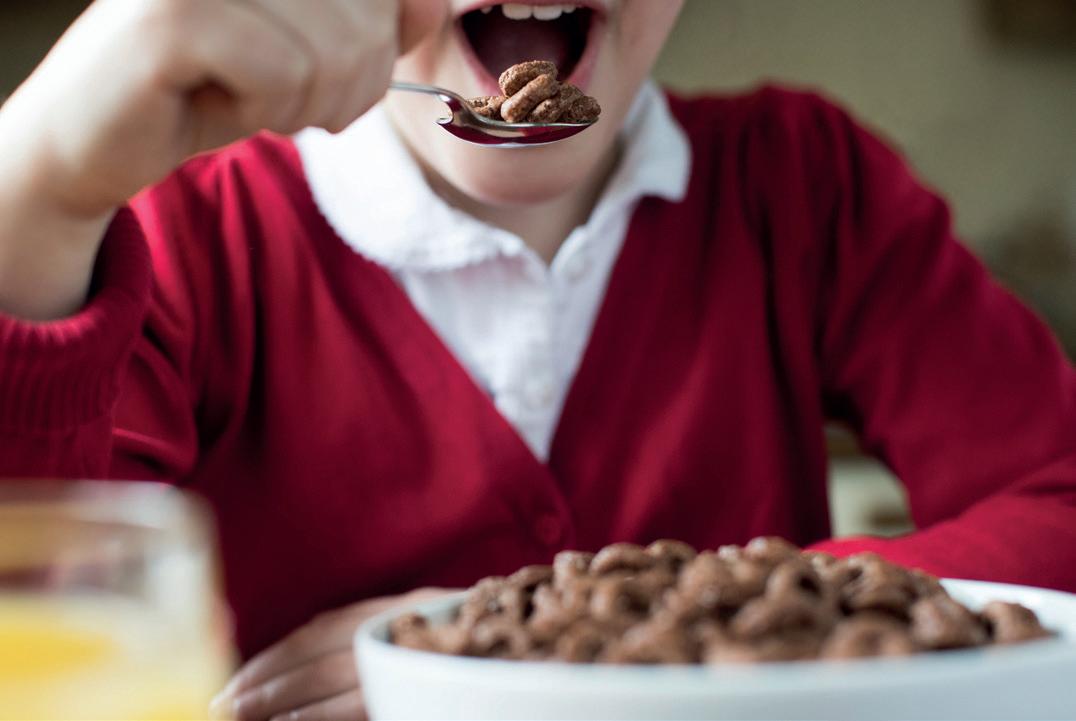

It may be a cliché, but there’s some truth to the belief that breakfast is the most important meal of the day. According to data from YouGov, 62% of UK consumers make time for it five days or more a week.

“Research shows the leading consumption driver is ensuring that we start the day nourished and ready for action,” says Tony Holmes, chief operating officer at Glebe Farm.

With breakfast offering so many opportunities for wholesalers and retailers, it is understandably the subject of significant supplier investment and changing trends.

The rise of RTD

One recent trend has been the rise of ready-to-drink (RTD) chilled coffee, which has become an increasingly popular choice –particularly for breakfast – both at home and on the go. Nielsen data suggests the category is now a key driver of growth within soft drinks, up 10.3% in value over the past year

According to Coca-Cola Europacific Partners (CCEP), this growth is being driven by Costa Coffee RTD, now worth £24.4m – up almost 32%. The company credits this success with the strength of the Costa brand, pointing to the Allegra Project Café report, which has found Costa to be the nation’s favourite coffee shop for the past 13 years. The company also says it is one of the only full ranges in the segment to be 100% HFSScompliant.

“RTD chilled coffee is incredibly diverse,” says Amy Burgess, senior trade communications manager at CCEP. “Featuring

“Wholesalers can make the biggest possible profit on breakfast by ensuring they are following trends and have a good selection of healthy and reasonably-priced breakfast options available.

“Data from Mintel shows that fruit is the fourth-most-popular food to be eaten at breakfast, after cereal, bakery and porridge. After all, who doesn’t enjoy some natural Greek yoghurt with fruit on top, as a tasty and nutritious start to the day?

“We can’t ignore the current cost-of-living crisis, however, which continues to impact consumers’ shopping behaviours, encouraging them to be more conscious of value for money – incorporating quality, waste,

convenience and choice. This is where ambient products can increasingly have a role to play.

“While fresh fruit can come at a premium price, shoppers now understand that ambient goods not only offer value and have longer shelf lives, but in the case of our Dole packaged fruit range, can also be one of your five-a-day and a healthy part of their overall diet. So, while some breakfast products may have risen significantly in price over the past 12 months, consumers can buy a four-pack of Dole’s fruit in juice cups for just £2.29 or our 227g small pineapple chunks can for just £1, both of which offer a great-tasting and healthy product at a price most can afford.”

lattes, flat whites and frappés, Costa’s range caters to a broad variety of different tastes and occasions, offering shoppers a choice of low-, medium- and high-intensity caffeine options as well as different coffee flavours and levels of sweetness to kickstart the day.”

At the start of 2024, CCEP launched PMP versions of the Costa Coffee Latte and Caramel Latte RTD ranges, which the company says will enhance the range’s competitive edge when it comes to the RTD chilled coffee segment.

Pastry opportunity

For many, a morning cup of coffee goes hand in hand with a pastry or other snack, and Stéphanie Brillouet, marketing director at Délifrance, believes depots should be ready to support retailers who want to capitalise on this important opportunity.

“Wholesalers should be

Dole Fruit Cups – Priced at £1, these 198g cups provide a portable and healthy snack – with a wooden tooth pick for eating on the go. Each cup has a shelf life of over 90 days.

Glebe Farm Granola – The revamped range includes Choco Chip, Maple & Banana and Strawberry flavours. Each product is HFSS-compliant, while its Choco Chip flavour is vegan.

focused on the £7.8bn UK bread market, which is forecast to grow by more than £1bn by 2026. And, we know from our recent bread report – Prove It: Breaking Bread – that almost two-thirds of UK consumers eat bread regularly for breakfast,” she says. “So, there is a huge opportunity for wholesalers to take a slice of this growth by aligning with innovative solutions and embracing the evolving trends in the bread category.”

Délifrance has conducted research highlighting the top three trends in breakfast, including taste, convenience and health. “Those looking for something on the go are most likely to grab something on their way to work,” says Brillouet. “That’s why pastries are more likely to be chosen and even though they are seen as a treat, they put people in a better mood for the day. Within our esteemed Délifrance

Délifrance Héritage Premium Croissants and Pain au Chocolat – The company says it has “meticulously crafted” this range for customers looking for something on the go.

Nesquik Choco Waves – Nestlé launched a health campaign in February to promote its non-HFSS Nesquik Chocolate, Nesquik Mix and Nesquik Choco Waves cereals.

Héritage Premium range, we’ve proudly created our easy-to-bake Croissants and Pain au Chocolat, meticulously crafted to meet the highest standards of quality.”

While the cost-of-living crisis continues to affect all areas of the economy, ‘treat’ products such as these will still offer many consumers the opportunity to enjoy an ‘affordable luxury’. For breads, this has led to the continued emergence of one trend in particular.

“Sourdough has been experiencing strong growth in recent years as consumers become more and more familiar with its health benefits, increased quality and flavour. Therefore, wholesalers should consider stocking products that can tap into this demand. At Délifrance, we have developed our own mother dough [sourdough starter] to be able to produce real sourdough breads at

Costa Coffee Latte PMP – At the beginning of the year, CCEP launched PMP versions of its Costa Coffee Latte and Caramel Latte RTD range in the wholesale channel.

Kellogg’s Corn Flakes Chocolate flavour – The cereal giant has adapted the recipe of its most iconic brand for one of the first times in its more than a century. Available as a PMP (£3.29).

scale,” says Brillouet.

And while it is easy to understand the allure of a freshlybaked pastry or loaf of bread, the demand for great-tasting breakfast options extends to every part of the market – even those that also offer great health benefits.

“While healthy, clean and nutritious rank highly [in what consumers want from their breakfast options], 79% of adults cite ‘enjoyment’ as a key driver for their food and drink purchases, so products that balance the two are in high demand,” says Tony Holmes chief operating officer at Glebe Farm. “At Glebe Farm Foods, we produce the purest, British gluten-free oats that deliver not only on quality, but also taste. Our broad portfolio of products therefore helps retailers offer delicious breakfast options that also deliver against certain lifestyle needs. Our PureOaty brand of gluten-free oat drinks, granola and porridge oats are Coeliac UK-certified and a tasty, accessible way to follow a varied gluten-free diet.”

Breakfast also offers the opportunity to think outside the box with what to offer in depot, with a small number of ambitious underdog brands now being made readily available in the wholesale channel. These suppliers offer differentiation, which is the perfect tool for helping progressive wholesalers steal a march over their pondering peers.

Coldpress, for example, offers a range of HPP juices whose commitment to everyday af-

fordable price points means they not only offer great value, but reduced wastage, with high-pressure processing said to offer extended best-before dates without flavour compromise. “Many of the Coldpress juices also offer added vitamins B, D and E,” adds Coldpress founder Andrew Gibb.

Childhood classics with ‘grown-up’ elements directly appealing to nostalgia-seeking diners are another trend within the breakfast category, with companies such as Lamb Weston innovating old-school originals such as hash browns.

“Our products come in a range of shapes and sizes – including Rosti Round, Potato Puffs and three mini Hash Browns – which perfectly complement other breakfast meal components,” explains Craig Wescott, trade marketer at Lamb Weston.

Finally, the opportunity to treat yourself at breakfast is also showing signs of affecting some of the biggest names in breakfast cereal – perhaps the most iconic of breakfast sectors. Recent months have seen the arrival of Kellogg’s Corn Flakes Chocolate while February saw Nestlé’s Nesquik brand return to TV screens as part of a media campaign to highlight the brand’s nutritional benefits. While ‘chocolate for breakfast’ will be on the wish list for millions of children and adults alike, both products are non-HFSS, proving that a ‘treat’ can be healthy, too.

“We’ve seen a shift in consumer trends, and chocolateflavour cereals have emerged as the most-preferred flavour in global cereal launches,” explains Sarah Fordy, head of marketing at CPUK – manufacturer of Nestlé cereals. “And to meet consumer needs, in 2023, we launched KitKat Cereal – a delicious breakfast option that brings the taste of the popular chocolate bar straight to consumers’ cereal bowls.

“The crispy cereal squares provide the taste of chocolate and

wafer. We developed the cereal for consumers who are looking for an occasional, indulgent breakfast option that can be enjoyed as part of a balanced diet. KitKat Cereal is now available in a price-marked pack,” she adds.

Consumers, at the start of 2024, have these seemingly opposing demands for the industry – to provide healthy yet indulgent breakfast options that can be delivered without breaking the bank. Wholesalers will be relieved to know suppliers have managed to meet these demands.

1. Customers want a great start to the day – While the economic climate continues to be uncertain, every depot manager knows that there are some categories where consumers will continue to spend for the right product.

Whether it is with RTD coffee that utilises a much-loved coffee brand (CCEP’s Costa range), or an emerging porridge and granola brand such as Glebe Farm, suppliers are investing to make their products great-tasting, convenient and easy to have on the go. Consumers can then be ready for whatever the day brings.

“Research shows the leading consumption driver is ensuring that we start the day nourished and ready for action,” says Tony Holmes, chief operating officer at Glebe Farm.

2. Options with health benefits are crucial – Indulgent options don’t need to mean sacrificing on health benefits, however. Two of the most recent moves in the all-important cereal market demonstrate this point clearly: the arrival of a HFSS-compliant chocolate flavour Kellogg’s Corn Flakes as well as a new media campaign emphasising the health benefits of Nestlé’s Nesquik brand, which is also HFSS-compliant.

Fresh fruit is another area where taste and health benefits come together neatly. “Wholesalers can make the biggest possible profit on breakfast by ensuring they are following trends and have a good selection of healthy and reasonably priced breakfast options available,” says Gareth Roberts, sales manager at Dole Sunshine Company.

3. Stock a wide range – Focusing on breakfast bakery, wholesalers should stock a wide range of bestselling morning goods and other sweet bakery items from premium brands such as St Pierre, says its customer development director, Louise Reynard.

“Depending how their cash-and-carry depots are laid out, they should stock them in the dedicated bakery section, and, if possible, dual-site them in fresh food sections with other ‘eat now’ items,” she says.

She adds that wholesalers should also advise their retailers to look at where their store’s growth is coming from and dedicate additional product facings to recognised brands and strong sellers. l

The UK soft drinks market is now worth £10bn and while reported volumes fell slightly in the first half of 2023 by 4.2%, the category increased in value last year.

This is partly due to financial constraints affecting consumer confidence and influencing buying patterns, according to Jonathan Kemp, commercial director at AG Barr.