P3 • Local shops left with angry customers and lost footfall as new trial by NoteMachine slaps charges on more free-to-use ATMs • Firm claims move will help ‘keep cash machines available’ YOUR ATM COULD BE NEXT HIGH STREET SURVIVABILITY P2 BACK PAGE Retailers reveal what they are expecting this year and how they are preparing New cash deposit limits to tackle money laundering already impacting businesses P4 BUSINESS INSURANCE Stores warned of potential furlough reductions from pandemic payouts STORE ADVICE 10-23 JANUARY 2023 STRICTLY FOR TRADE USERS ONLY

Exclusively for Retail Express readers… betterRetailing Resource For more information, please contact Kate Daw on kate.daw@newtrade.co.uk or 020 3871 6490 Get your copy with the 24 January issue of Retail Express

betterRetailing Resource is a dedicated insert featuring the products and services you need for your store. The easy-to-use format means you can quickly and easily find the products and business solutions you are looking for.

LOW- AND NO-ALCOHOL

CATEGORY ADVICE LOW- AND NO-ALCOHOL 18 THE OPPORTUNITY HIGH EXPECTATIONS FOR LOW & NO As the number of shoppers seeking low- and noalcohol alternatives grows, suppliers and wholesalers say it’s down to retailers to increase their ranges and reap the rewards, writes CHARLES SMITH January and tober xtures, no-alcohol drinks sent major opportunity for retailers Non-alcoholic spirits strength, £125m trade, according Sunny Mirpuri, for convenience weiser Brewing independent convenience chancontributing this. cent Brits looking Public reported with sumers alcohol important part healthier pandemic, hol White UK tried no-alcohol drinks, ‘sober consumers and further P18 10-23 JANUARY 2023 STRICTLY FOR TRADEUSERSONLY HIGH STREET SURVIVABILITY P2 BACK PAGE Retailers reveal what they are expecting this year and how they are preparing New cash deposit limits to tackle money laundering already impacting businesses P4 BUSINESS INSURANCE Stores warned of potential furlough reductions from pandemic payouts STORE ADVICE • Local shops left with angry customers and lost footfall as new trial by NoteMachine slaps charges on more free-to-use ATMs • Firm claims move will help ‘keep cash machines available’ P3 YOUR ATM COULD BE NEXT

How to kick off the year by reaping the rewards of this booming category

THE number of debit and credit card transactions are up 7.1% on the previous year, with spend 5.7% higher. However, according to the ACS’ Local Shop Report 2022, 99% of convenience stores continue to accept cash, with 69% providing cashback, free-to-use ATMs (44%), charged ATMs (18%) and post offices (22%).

I appreciate the popularity of cash took a hit during the pandemic, due to hygiene concerns, but the above statistics are proof that cash remains an essential payment method. You only have to look at the rapidly increasing rate of bank closures on the high street in the past 12 months to appreciate why convenience stores have quickly become local banking hubs.

That’s why its concerning to see it coming under threat by regulation attempts and rising costs. Over on page three, we take a look at how a new trial by NoteMachine has seen local stores be forced to apply a fee to previously free-to-use ATMs, in an attempt to mitigate interchange fee cuts.

Surely it isn’t difficult to understand that any sort of charge placed on a free service is going to have a detrimental impact, because the very reason it’s used is because it’s free. This has the potential to stop a huge proportion of society from being able to access cash.

I appreciate everyone is being faced with rising costs, but how about not cutting footfall to some of the only businesses left going an extra mile to provide vital services to society?

I’ll be keeping a close eye on the results of the above trial, and hoping it doesn’t become more widespread.

Limits on deposits to threaten cash use on high streets

MEGAN HUMPHREY

INDEPENDENTretailers have hit out at new limits on the amount of cash they can deposit to banks and the Post Of�ice (PO).

From 1 January 2023, business owners will only be able to pay £1m in cash every 12 months at the PO. The limit has been introduced to

crack down on criminals who use the service for moneylaundering.

The impact of this has already been felt by the PO, after its cash tracker for November revealed a drop in cash deposits by 2% month on month.

As a result, November was the �irst time since the start of last year that personal cash deposits had fallen for two

successive months.

Last year, the Financial Conduct Authority asked banks to review the limits they impose on cash deposits from customers, which resulted in cash transaction limits falling.

A spokesperson for the PO told Retail Express: “Cash deposit limits [applied by the banks] are a blunt instrument – taking a sledgehammer to

crack a nut and affecting thousands of legitimate businesses that cannot deposit their cash takings without a long journey to a now-distant branch.

“Many businesses have stated they will no longer be able to accept cash, with vulnerable consumers being left behind, and businesses losing trade and, in some cases, their viability.”

Bestway symbols Grocery sales soar

BESTWAYhas revealed plans to consolidate its fascias and focus solely on the Costcutter, Best-one, Bargain Booze and Wine Rack brands.

Managing director Dawood Pervez told Retail Express that the �irm intends to convert existing retailers

rather than of�load stores from its other fascias, and a speci�ic time frame had not yet been decided.

In addition, he con�irmed Bestway has no intention to continue trials of its BBs and Tippl fascias launched in 2019.

TAKE-HOMEgrocery sales are up by 5.9% year on year, marking its fastest growth since March 2021.

Data from market analyst Kantar for the 12 weeks to 27 November 2022 revealed that although grocery in�lation dipped by 0.1% in Novem-

ber, shoppers still needed to spend an extra £60 to buy the same items as last year.

As a result, many customers chose to leave their seasonal purchases to later in the year to help them manage their budgets ahead of Christmas Day.

Alcohol duty freeze

Snappy expansion

HOME delivery �irm Snappy Shopper is set to expand to other high streets, as well as internationally, as it moves away from just focusing on convenience.

The news was shared in a statement announcing it had

raised a seven-�igure sum from existing investors for growth.

Since its launch in 2021, Snappy has sold 50 million products, received more than �ive million orders, and begun a cost-of-living campaign.

@retailexpress betterRetailing.com facebook.com/betterRetailing

five biggest stories this fortnight 01 02

04

The

03

05

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Senior features writer Priyanka Jethwa @PriyankaJethwa_ 020 7689 3355 Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Deputy insight & advertorial editor Tamara Birch @TamaraBirchNT 020 7689 3361 Production editor Ryan Cooper 020 7689 3354 Sub editor Jim Findlay 020 7689 3373 Sub editor Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 020 7689 3367 Senior account director Charlotte Jesson 020 7689 3389 Commercial project manager Ifzal Afzal 020 7689 3382 Senior account manager Lindsay Hudson 020 7689 3366 Account manager Marie Dickens 020 7689 3372 Management accountant Abigayle Sylvane 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say Don’t underestimate the importance of cash

THE government has pledged to extend the freeze on alcohol duty for a further six months until August.

levies were due to be hiked on 1 February following the reversal of Kwasi Kwarteng’s mini-Budget last year, but instead a decision will now be held until the Spring Budget on 15

freeze would have added 7p on a pint of beer and 38p on a bottle of

Features writer Jasper Hart 020 7689 3384 @JasperAHHart

Alcohol

March 2023. Lifting the

wine.

41,206 Audit Bureau of Circulations July 2021 to June 2022 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment. For the full story, go to betterRetailing.com and search ‘Bestway’

News editor Alex Yau @AlexYau_ 020 7689 3358 For the full story, go to betterRetailing.com and search ‘Snappy’

Megan Humphrey, editor

CASH REMAINS AN ESSENTIAL PAYMENT METHOD For the full story, go to betterRetailing.com and search ‘grocery sales’ For the full story, go to betterRetailing.com and search ‘cash deposits’ Specialist reporter Dia Stronach 020 7689 3375

New trial puts future of free-to-use ATMs in jeopardy

MEGAN HUMPHREY

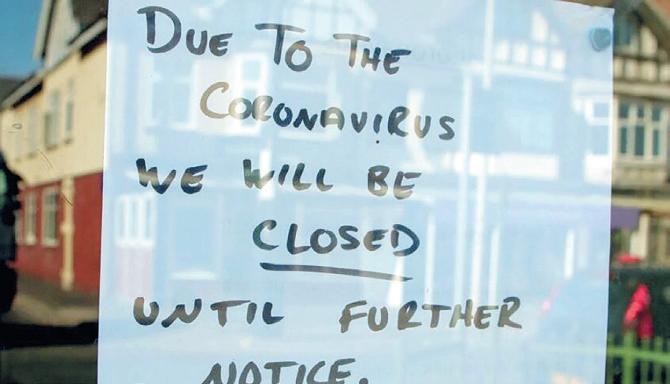

INDEPENDENT retailers are frustrated after being forced to apply charges to their free-to-use cash machines, as part of a new trial by ATM provider NoteMachine.

Retail Express understands the move comes after cuts to the interchange fee – the fee paid by banks to operators for every withdrawal made – left NoteMachine having to consider other ways cash machines could remain accessible.

Tirath Singh, owner of Loco – Solitaire Stores in Worcester, has operated a free-to-use machine for several years, but was told in November that NoteMachine would be applying a 55p transaction fee for the next three months.

“This disappointed us because the main reason we had one in the �irst place was to help our community access cash for free,” he said. “We contested [the fee], but they told us it was in the terms and conditions of our contract that they could start charging whenever they wanted.

“We’ve had to explain to our customers that this wasn’t our choice. Luckily, they understand, but it’s hard for us to have this happen and not be able to do anything about it.”

A spokesperson for NoteMachine con�irmed the three-month trial affects fewer than 30 ATMs around

the UK, and aims to “determine the level of fee that would keep cash machines available while minimising costs to consumers”. “The ATMs included in this trial represent a broad spread of retail customers and locations across the UK so we can ascertain the level of funding needed in a variety of scenarios,” they said.

As a result, Singh con�irmed he has already sent a letter of termination for when his contract runs out in a year. “I asked if we could terminate our contract, but they told us we still had a year left,” he said.

“The most upsetting thing has been their awful bullish attitude over the whole

thing. They’ve been so rude when I’ve tried to speak to them about it. At at one point, I was told it didn’t have anything to do with us and I just had to accept it.

“Although I cant get out the contract yet, I have sent a formal letter explaining I want to terminate as soon as I can. We are going to try to get another ATM afterwards and have communicated to customers that this is out of our control.”

In response, NoteMachine director Charlie Evans explained: “Despite a government commitment to protect free access to cash, these funding issues are far from being addressed. As a result, we have been forced to con-

vert several ATMs up and down the country to payto-use. This is part of a new trial where we’re trying to ascertain the level of fee that would be economical while minimising the cost to consumers.

“Our team spoke to the customer on 11 November to make them aware of this trial and allow for suf�icient time to communicate with their customers. We’ve had a number of subsequent conversations with them and will continue to work closely with the customer to resolve any issues.”

When asked how likely it is that a fee would be applied to every free-to-use ATM across its network,

Evans explained: “NoteMachine is committed to ensuring people can access their cash, but without action to ensure the funding model for free-to-use machines is put on a sustainable footing, these conversions to payto-use will become increasingly commonplace.

“We will be closely monitoring the results of the trial and communicating with customers accordingly.”

According to �igures from Link, the UK’s largest cash machine network, the number of free-to-use ATMs has been steadily decreasing.

Since 2018, the number of ATMs has fallen by nearly 14,000, from 54,599 to 40,942 in 2021.

“We did a hamper over Christmas as part of fundraising for our local football team. The money raised is going to help them buy new kits. This is the first time we’ve done this, with a hamper just from our shop. We always want to reach out to our local community, and we got a lot of support to help us raise more money and reach the fundraising target.”

Parful Kumar, Go Local Extra, Peterfield Drive, Manchester

“Every year, we donate to local primary schools and put together hampers for them to raffle off and raise funds. We also had a letterbox in the shop for Santa. We give out templates for the letter and return address, and we post back a reply. It costs a fair bit with the cost of post, but it’s our local community, so we want to go the extra mile. This year we did around 400 replies, and we’re expecting it to cost more than £500.”

Mo Razzaq, Premier Mo’s, Blantyre, South Lanarkshire

“We had a Santa Clause with a grotto for the children to visit, and we donated 200 gifts. Booker helped us so we had enough for each child to be given a bag with a drink, crisps, a pen or a pencil, sweets and chocolate. It was just something small for our customers, and we didn’t charge for it. We also did gifts for children’s groups like the Scouts and Guides.”

Trudy Davies, Woosnam & Davies News, Llanidloes, Powys

DRS: Independent retailers have been granted an exemption from operating an online takeback service for the Scottish deposit return scheme. At the end of last year, circular economy minister Lorna Slater said only supermarkets would be required to operate the service.

For the full story, go to betterRetailing.com and search ‘DRS’

WALES: Local shops have praised the Welsh government for a newly announced £460m business rates package. Spread over two years from 2023-2024, it will result in the non-domestic rates multiplier being frozen, ensuring there is no inflationary increase in the rates businesses will pay.

GOOD WEEK BAD WEEK

NEWSPAPERS: Publishers Reach and Daily Mail Group slashed retailer percentage margins when implementing price rises at the end of last year. Mainland UK Saturday Daily Mail editions went up 10p, while Mail on Sunday editions rose to £2. All editions of the Mirror, Express, People and Star have jumped by 10p, except the Daily Star weekday, which rose by 5p.

For the full story, go to betterRetailing.com and search ‘newspapers’

E-LIQUIDS: Retailers are losing hundreds of pounds of profit on expired vaping products. Hardik Patel, owner of Svarn News & Off Licence in Stafford, Staffordshire, was forced to lower the price on Edge e-liquids worth £700-to-£1,000 at the end of last year as no reps came to his store to swap out the slowselling lines.

For the full story, go to betterRetailing.com and search ‘e-liquids’

03 betterRetailing.com @retailexpress facebook.com/betterRetailing megan.humphrey@newtrade.co.uk 07597 588972

10-23 JANUARY 2023

express yourself the column where you can make your voice heard Do you have an issue to discuss with other retailers? Call 07597 588972 or email alex.yau@newtrade.co.uk How did you support your community during the festive period?

Trudy Davies

Insurance payouts hit by furlough

MEGAN HUMPHREY

STORE owners could face reduced insurance payouts over closures during the pandemic if they received government support, an expert has warned.

In September 2020, the High Court ruled that small stores suffering a reduction of trade due to Covid-19 closures could claim for losses, subject to policy limits.

Two years on, Capital Law’s senior lawyer, Catrin Povey, revealed that there are average delays to payouts of eight months, alongside “ridiculous” levels of evidence being required.

In October, the High Court threw another spanner in the works, stating that any insurers facing lawsuits relating to business-interruption losses caused by pandemic lockdowns should be able to take

into consideration any support that has been provided to businesses by the UK government under its furlough scheme.

Although no independent retailer has yet been subjected to this, Povey told Retail Express if this were to be considered more widely, it would cause “massive issues”.

“Furlough payments equate to a large sum for a lot of businesses,” she said.

“I saw a claim at the end of last year whereby a claimants payout was reduced by half after taking into account furlough payments.”

She added: “Things are still very much hanging in the balance. At this stage, it is all dependent on how the law is interpreted alongside each individual case, which makes it challenging to predict how this will affect stores. We should know more very soon.”

Waste app growth

MORE shoppers are turning to food-waste app Gander to cut costs, according to its head of business development, Stacey Williams.

More than 600 convenience stores across the UK are seeing their wastage drop by 85% as users view reduced-to-clear

products in real time.

“The cost-of-living crisis is at the forefront of everyone’s minds, and this gives customers the ability to purchase reduced waste locally,” Williams said. “Shoppers are seeing an average saving of 56% on their weekly food shop.”

JISP’S Scan & Save scheme has has more than one million scans, helping retailers generate over £5,500 every week.

Since its launch in 2021, 797,448 money-saving coupons have been issued, and 714,094 shopper redemptions have been made.

Customers have saved more than £637,566.90 from brands with Jisp.

Chief operating officer Greg

Getir acquires Gorillas

RAPID home delivery firm

Getir has purchased rival Gorillas at a discounted price.

The all-stock deal, valued at £1bn, follows months of speculation over a potential takeover.

The Financial Times reported the move would include a clause dictating that Gorillas investors must inject a further £82m into Getir.

In a statement announcing the news, Getir founder Nazim Salur said: “Markets go up and down, but consumers love our service and convenience is here to stay.”

NEWS 04

LOYALTY APP HITS 1M SCANS 10-23 JANUARY 2023 betterRetailing.com

HERE FOR EMOTIONAL SUPPORT TAKE POSITIVE PRACTICAL STEPS #LetsTalkGroceryAid Call our Helpline for ‘in the moment’ emotional support and to discuss what other services may benefit you Receive accurate information on everyday issues, including legal, financial and consumer law Get help managing your finances and budgeting for the future. You may also be eligible for a non-repayable grant GET FINANCES BACK ON TRACK 08088 021 122 Free and Confidential Support Available 24/7, 365 days a year, through the FREE Helpline and website, for grocery colleagues, their partners/spouses and dependants C Y MY CMY GA Day 2022 A4 Double Sided Poster_AW.pdf 2 07/02/2022 16:14 RN Full page ad.indd 1 04/04/2022 15:49

Deacon said: “Scan & Save’s fundamental innovation is how shoppers are interacting with discount and loyalty at physical retail.”

For the full story, go to betterRetailing.com and search ‘Jisp’ For the full story, go to betterRetailing.com and search ‘Gander’

BORN TO MIX

We believe the world becomes a better place when we mix beyond our differences. This bottle design encapsulates the power of unity and how weaving the world’s diverse threads together can break conventions and make us stronger.

editionlimited ENJOY RESPONSIBLY @AbsolutUK

PRODUCTS

Ferrero unveils Easter range

JASPER HART

JASPER HART

FERRERO UK has unveiled its Easter 2023 range, featuring new launches from Thorntons and Ferrero Rocher alongside the return of popular lines.

As part of the expanded range, Thorntons is launching a white chocolate Bunny in a 90g format.

The brand’s 170g Bunny was the third-bestselling branded line in value sales within novelties, worth £1.48m.

Thorntons’ kids eggs will also undergo a full pack redesign.

The brand’s eggs are the third-fastest-growing medium egg gift range,

supported by a 30% rise in penetration in 2022.

Ferrero Rocher is building on its 10.8% annual growth in Easter value sales with the launch of two boxed egg packs: a Ferrero Rocher Egg and a Ferrero Collection Milk Egg. Both products include

a large 175g egg and six Ferrero Rocher. Ferrero is also launching a new 100g Bunny.

Returning Kinder lines include Kinder Surprise (which accounts for 33% of Kinder’s unit sales during Easter), Kinder Joy, Kinder

Egg Hunt and Kinder Figures. Jason Sutherland, UK & Ireland sales director at Ferrero UK, said: “We’re con�ident consumers will still want to spend on Easter and will look towards trusted and well-known names when they do so.”

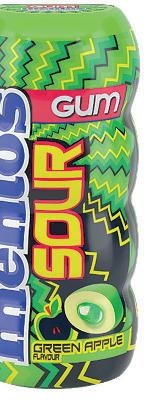

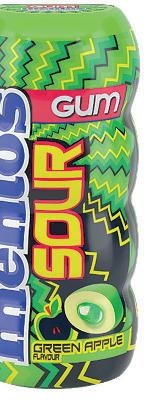

PVM launches Mentos Sour Gum

PERFETTI Van Melle has expanded its Mentos brand with the launch of a Sour Gum range.

The sugar-free range is available in Strawberry and Green Apple varieties. Each �lavour comes in a pocketable bottle with 15 pieces of gum, at an RRP of £1.

Currently, the sour gum segment is growing annually by 45%, with apple and strawberry popular �lavours, especially among younger gum consumers.

Kim McMahon, brand manager of Mentos Gum, said: “Research shows tangy sour �lavours hold more appeal for younger demographics than

Hancocks launches Veganuary range

HANCOCKS has unveiled its selection of vegan sweets for Veganuary.

The wholesaler is urging retailers to consider stocking vegan confectionery, which it says has grown in line with the number of people following a meatand dairy-free diet. Four per cent of people in the UK now follow a vegan lifestyle.

Among Hancocks’ pick-and-mix range is the Kingsway range, featuring Tongue Painters, Giant Strawberries, Sour Dummies and Dracula Teeth. Kingsway also offers a �izzy range, including Fizzy Twin Cherries, Fizzy Blue Jelly Babies, Fizzy Cola Bottles, Fizzy Sour Apples and Fizzy

traditional mint �lavours. Mentos Sour Gum will introduce younger consumers to the Mentos Gum brand and improve category consideration for the rest of the range.”

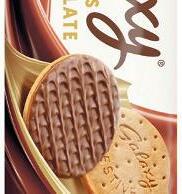

MARS Chocolate Drinks & Treats (MCD&T) has unveiled Galaxy Milk Chocolate and Orange Digestive Biscuits, set to launch in wholesale and convenience in March.

The new biscuits combine the familiar texture of a digestive with a half coating of Galaxy chocolate. They have launched exclusively in Asda at an RRP of £1.89 per 300g pack of each variety.

Michelle Frost, general manager for MCD&T, said: “The Galaxy brand is synonymous with great-tasting chocolate; consumers know the familiarity and quality to expect. Our research shows that 42% of regular chocolate digestive purchasers would prefer Galaxy chocolate on

top of their digestive biscuit, versus their current choice of chocolate digestive.”

SNACKING brand Chika’s has launched a vegan Rice Crisps range to capitalise on Veganuary sales.

The plant-based, glutenfree range will be launching in Salt & Vinegar, Sweet Chilli Samba and Smoky Barbecue varieties. The rice crisps contain fewer than 100 calories are made with white rice and are popped rather than fried.

They will be available to convenience stores through Co-op, Nisa, Cambridge Juice, Epicurium, CLF and Delicious Ideas in a 22g grab bag (RRP 79p) and an 80g sharing bag (RRP £1.79).

As part of Chika’s Snacks4Change programme in partnership with World

Vegan Rice Crisps from Chika’s CJ Lang launches Hard Rock RTDs

Vision, 1p is donated from every pack sale to go towards women’s education in Africa.

New bottle design for Glayva liqueur

SCOTTISH liqueur Glayva has unveiled a new bottle design.

The design nods to the liqueur’s tangerine �lavour with golden tones across the bottle. It also has a textured label which references the honey-spiced �lavours.

Meanwhile, the ‘Not your usual’ campaign celebrates Glayva’s distinctive �lavour to drive trial and purchase, and is appearing across its social media channels now.

It features bespoke serves, such as the Glayva Bittersweet Symphony (30ml Glayva, 30ml whisky, 30ml Campari, two dashes orange bitters, ice and orange twist) and the Grappler (45ml Glayva, 60ml orange juice, 60ml apple juice, 15ml sugar syrup,

ginger beer and crushed ice).

Glayva is available in a 50cl bottle with an RRP of £18.

New Belvita Honey & Nut PMP launched

CJ LANG & Son Ltd, the Scottish Spar wholesaler, has become the exclusive launch partner of ready-todrink (RTD) cocktails from Hard Rock International in Scotland.

The range, which launched in the rest of the UK this summer, is now available to company-owned and independent Spar retailers aligned with the wholesaler.

It consists of Piña Colada, Mojito and Passion Fruit Martini varieties (5% ABV), each available in a 300ml can at an RRP of £2.

Commenting on the launch, Mark Spalding, senior trading manager at CJ Lang, said: “Hard Rock is a truly iconic international brand, and the

eye-catching

MONDELEZ International has launched a pricemarked pack (PMP) multipack format for its Belvita Honey & Nut variety.

The £1.49 PMP’s launch comes as the �lavour is the bestselling breakfast biscuit �lavour in convenience stores. It contains �ive packs of four biscuits each.

Amy Lucas, brand man-

ager for Belvita at Mondelez, said: “A �ifth of shoppers say they would choose a particular convenience store if they knew it stocked PMP products, and 56% of retailers say they have been selling more PMP products during recent times, which emphasises the importance of value within the category.”

07 10-23 JANUARY 2023 betterRetailing.com

Cherry Cola Bottles. The wholesaler also has a branded range, with products from Swizzels, Vimto, Pez and Rowntrees.

Galaxy

Digestive Biscuits

launches

packaging and quality of the liquid did not disappoint.”

PRODUCTS

Swizzels raises PMP prices

JASPER HART

SWIZZELS has increased the prices of its pricemarked packs (PMPs) for the �irst time in its history, citing increased production, packaging and transportation costs.

As of this month, the supplier’s hanging bag PMPs are £1.15, up from £1.

Mark Walker, sales director at Swizzels, said: “We have placed huge value on our relationships with wholesalers and retailers for 95 years, so have thought long and hard about the next steps in the £1 PMP evolution. In order to protect, and in some cases increase retailers’ and

wholesalers’ margins, we have taken the decision to break the £1 hanging bag PMP on sugar confectionery.

The new range will have a PMP of £1.15, which will start to appear in wholesalers in the new year.

“We fully believe the £1.15 PMP offers value for money

and will protect consumer trust in tough economic times, while at the same time protecting our valued wholesale partners and diligent retailers.”

Swizzels said it had partnered with the Fed to conduct research among retailers about the

importance of PMPs before introducing the changes.

“The research proved invaluable and revealed that 74% of independent retailers view PMPs as extremely important to their business, not least because they are a tangible symbol of value to customers,” said Walker.

Kellogg’s expands Crunchy Nut range

KELLOGG’S has expanded its Crunchy Nut offering with the unveiling of a Salted Caramel Flavour Twist variety.

The new line, which marks the �irst time the brand has adapted Crunchy Nut since launching in 1980, will be available to wholesale and convenience in a 460g £3.29 price-marked pack from March 2023.

Crunchy Nut is Kellogg’s biggest cereal brand and is the number-one cereal brand in convenience, according to IRI �igures. The supplier will support the launch with a digital advertising campaign with the strapline ‘The trouble is they

Plant-based Chocomel launched

FRIESLANDCAMPINA has launched a plant-based version of popular chocolate drink Chocomel.

Launching in a 1l tetra pack, the variety uses an exclusive cashew nut and pea milk formulation which the supplier says has been rated as 93% positive in advance taste tests, with 48% of testers unable to fault the product at all.

Its launch comes as the premium milk drink category has grown by 51% year on year, with Chocomel outpacing the overall category at 81%.

The supplier says attracting new users has been key to this growth, so opening the brand up to a new de-

mographic is key to further growth. Recent Mintel research suggests 32% of UK consumers are regularly consuming plant-based milks, with this �igure set to grow.

Pringles to get onpack gaming promo

KELLOGG’S has announced an on-pack promotion across Pringles offering shoppers the chance to win gaming prizes, due to launch in spring.

The promotion, available to convenience and wholesale from March, runs across Pringles’ core �lavours and offers fans the chance to win a PC gaming setup worth more than £1,000, as well as other prizes including a Logitech G Lightspeed Gaming Headset in daily prize draws.

Kellogg’s pushes single snacking

KELLOGG’S intends to drive growth in the cereal snacking segment in 2023 with a focus on its singles offering in convenience and independent stores.

The supplier wants to build on the growth it has seen in 2022, as on-the-go snack missions regained popularity.

Lindsey Kendal, Kellogg’s

away from home sales director, said: “We will be doubling down on our singles snacks offering in 2023, as this continues to be a priority area for us. This will be supported across a myriad of touchpoints – from increasing weeks on promotion and bringing back our ‘free adult ticket’ offer on snacks, to targeting new environments.’’

taste too good…’, launching across YouTube, Instagram and Facebook in February.

It comes as one out of every two people in Europe considers themselves a gamer, with more than 31 billion hours of gaming livestreams viewed in 2021.

The promotion will be supported by in-store PoS.

Imperial’s limited Golden Virginia lines

IMPERIAL Tobacco is marking 145 years of Golden Virginia rolling tobacco with the launch of a limited-edition range of papers with retro packaging.

The range is available to buy within 30g and 50g packs of Golden Virginia Yellow at RRPs of £16.85 and £27.90, and 30g and 50g packs of Golden Virginia

Original at RRPs of £18.55 and £30.75.

Tom Gully, head of consumer marketing UK&I at Imperial Tobacco, said: “The retro papers are available to buy while stocks last. But, when they’re gone, they’re gone, so we’d recommend stocking up now to take full advantage of the additional sales while you can.”

Mentos and Smint get functional

PERFETTI Van Melle has added to its Mentos and Smint brands with the launch of varieties offering functional bene�its.

The launch of Mentos Citrus Vitamin Gum and Smint Defensive comes as 45% of shoppers worldwide are purchasing more food and drink with added health bene�its in the wake of the Covid-19 pandemic.

Mentos Citrus Vitamin Gum (RRP £2.40) is sugarfree and contains 25% of recommended daily vitamins B6, C and B12, with orange, grapefruit and lemon �lavours. A bottle contains 45 pieces.

Meanwhile, Smint Defensive (RRP £1), also sugar-

free, has vitamin B6 and zinc to support the immune system and reduce fatigue. A recyclable �lip-top box contains 18 lozenges.

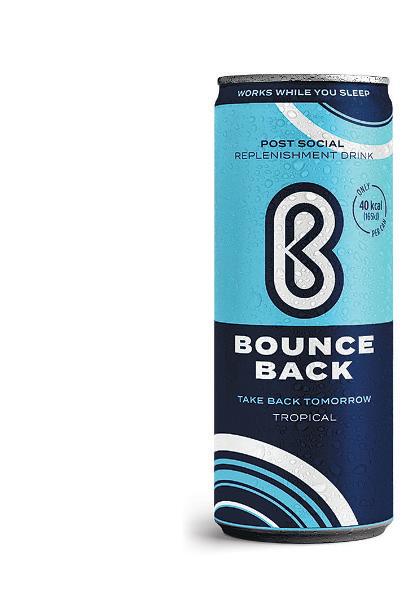

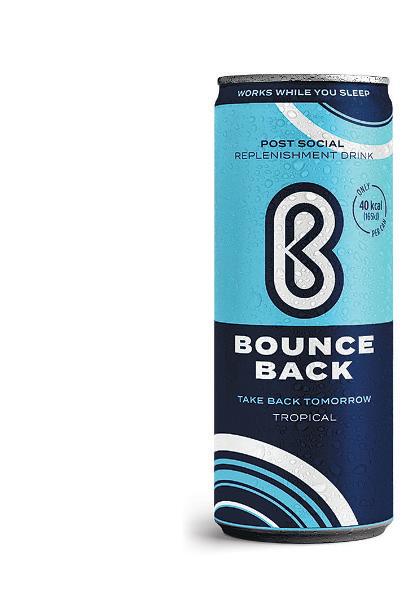

Bounce Back gets Costco listing

BOUNCE Back Drinks, which styles itself as the �irst “post-social replenishment drink”, has announced a listing with Costco.

to grow, we’re focused on securing important listings with key retailers and landing Costco is a signi�icant

step forward for us.”

gow, Birmingham, Leicester,

The wholesaler is stocking 12-pack cases of the brand’s Raspberry variety in its Glasgow, Birmingham, Leicester, Liverpool and Haydock sites.

Bounce Back, available in 250ml cans, is designed for users to drink after a night out to minimise any aftereffects of drinking alcohol.

Kevin Fowler, commercial director at Bounce Back Group, said: “This is a really exciting time for Bounce Back as we drive increased brick-and-mortar listings following consumer demand.

As our brand continues

08 10-23 JANUARY 2023 betterRetailing.com

A MUST-READ FOR PROFIT-DRIVEN INDEPENDENT RETAILERS The Retail Success Handbook RUN A BETTER STORE IN 2023 December 2022 Cost-effective tech investments Community retailing explained Range and merchandise to communicate value INSURANCE The Retail Success Handbook: Run a Better Store in 2023 Win more customers and increase your profits in 2023 with the latest edition of The Retail Success Handbook DON’T MISS OUT Order your copy from your magazine wholesaler today Only £4.99 SHOPPER TRENDS AND MAKE EVERY POUND COUNT PROVIDERS COMPARED On sale now! The cost-of-living crisis is a huge challenge, forcing many retailers to re-evaluate their business operations. This edition of The Retail Success Handbook takes an in-depth look at how you can reduce your overheads, maximise efficiencies and make every pound count. We also look at how you can maintain and grow footfall and basket spend throughout this period of economic uncertainty, including: Shifting shopper trends and missions explained Ranging and merchandising advice to suit tighter budgets Smarter ways to promote your business Creating displays that communicate value How to future-proof your business, from working with suppliers to savvy tech investments and store modernisation PLUS

WHY IS SUSTAINABILITY SO IMPORTANT? 33%1 92%2 1 Unilever international research, cited in Convenience Store magazine, 2019 2 The Innovation Group, The New Sustainability: Regeneration report, September 2018

TO SEE MORE ADVICE AROUND SUSTAINABILITY AND DRS, DOWNLOAD THE STUDY HERE, OR FOLLOW @SUNTORYBF_GBI ON TWITTER AND LINKEDIN 5 TO SEE MORE ADVICE AROUND SUSTAINABILITY AND DRS, DOWNLOAD THE STUDY HERE, OR FOLLOW @SUNTORYBF_GBI ON TWITTER AND LINKEDIN TIPS 1 We’ve already made great progress on our target of 100% recyclable packaging across our range by 2025. Consider the environmental footprint of products you are stocking 5 3 LOOK FOR ENERGY MONITORING SOLUTIONS: 2 OPTIMISE CHILLER TEMPERATURES: increasing the chiller temperature slightly at certain times of day can 4

enterprises save money on www.businessenergyscotland.org

Saving Trust may help your business cut energy usage:

Get Switching provides advice and support on finding the best energy deal: www.getswitchinggroup.com

medium-sized

Energy

www.energysavingtrust.org.uk

OPINION ON THIS FORTNIGHT’S HOT TOPICS

7689

“IT is great news. Our delivery service gets a lot of use, with 20% of sales being generated from online. Making that viable and taking bottles back we sold through this medium was virtually impossible. There is still a clear lack of information overall on what is expected of us.”

Ferhan Ashiq, Levenhall Village Store, Musselburgh, Scotland

“WE trialled this and we had a hard time, so we are relieved to hear we won’t be expected to take part. I’m all for the deposit return scheme, but personally I don’t think we are in a position where we are ready to go live with it as an independent convenience store.”

“THEY haven’t really affected my Evri service in the store. My counter is always busy at this time of year. I did receive some parcels several days late, but that was because of a backlog in the warehouse. Customers haven’t really said anything about the strikes, either.”

Atul Sodha, Londis Harefield, Uxbridge, west London

“WE haven’t been affected by the strikes at all. We operate our parcel service through a courier, and the only time we’ve had to interact with Royal Mail is when we’ve sent flyers. None of our parcels have been held up, which is surprising as usually the Christmas period creates a lot of pressure.”

Samantha Coldbeck, Wharfedale Premier, Hull, Yorkshire

“I DON’T think it’ll make a difference as a large chunk of our turnover is card. We tend to spend the cash we do have at local wholesalers, since we don’t get stock delivered. However, there is likely to be more of an impact on our post office.”

Gaurave Sood, Neelam Post Office & Convenience, Hillingdon, west London

12

OPINION

Anonymous retailer

CHRISTMAS: How did you amend your opening hours?

“WE were open every day as normal, 7am to 7pm, bar Christmas Day, when we closed fully. It’s the same thing that we do every year, and I recommend it to others. It’s a very busy time of year, and a good sales opportunity.”

Hetal Patel, Karan Convenience Store, Walton-on-Thames, Surrey

“I DON’T think it will affect us because we tend to use as little cash as possible for the business. I think it’s going to be more of a concern for those people who are moving money illicitly. The government definitely needed to do something about taxes not being paid.”

POST OFFICE: How will limiting cash deposits affect your business?

It’s also nice to get a bit of a break

We haven’t been affected at all

We tend to use as little cash as possible

DRS: How does made being exempt from online takebacks affect you?

ROYAL MAIL: What effect have the strikes had on your parcels?

RETAILER

What do you think? Call Retail Express on 020

3357 for the chance to be featured

The exemption for us is great news

“I WAS only open for three hours on Boxing Day, and we just did the rounds. We operate no differently than on bank holidays. By only being open in the morning, we are still able to pick up the early trade. It’s also nice to get a bit of a break.” Shailesh Patel, Jan’s, Cockfosters, north London COMING UP IN THE 13 JANUARY ISSUE OF RN Pricewatch: see what other retailers are charging for vegan and vegetarian options and boost your own profits Free from: what demand for free-from options looks like and how to meet it Cost-of-living crisis: How you can help your customers through the cost-of-living crisis without damaging your bottom line + STAY INFORMED AND GET AHEAD WITH RN betterRetailing.com/subscribe ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363 3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shop floor

Dennis Williams, Premier Broadway, Edinburgh, Scotland

Letters may be edited

CHRISTINE HOPE Hopes of Longtown, Hereford

Representing the retail industry

I WAS thrilled to be asked to represent retailers at the Conservative Party Conference this year. Every year I try to experience something new out of my comfort zone and going to a political party conference was my challenge this year. Previously, I have skydived, applied for a scholarship and gone on the Weakest Link.

aren’t helping to

my card machine’

I’VE waited for weeks for a replacement machine from Verifone and Paytek.

The machine itself is usable, it’s just that I can’t move it away from the charging dock. At the moment, I’m only using it in the store, but I get customers who can’t come in or carry heavy bags, and I need to take the machine outside to serve them.

When my machine broke, I contacted Verifone right

away. Verifone supplies my machine, and is responsible for it.

The person I spoke to said I would get a new one delivered in seven days. Seven days came and went, nothing arrived, and there was no further communication.

I phoned Paytek, which is the company I lease it from and pay line rental to, as well as chasing up with Verifone.

I spoke to someone who

COMMUNITY RETAILER OF THE WEEK

COMMUNITY RETAILER OF THE WEEK

said to leave it with them and they would get me one delivered, but more than a week later, I still hadn’t heard back or received a new machine.

I phoned again and I was told the same thing.

When I spoke to Verifone again, I was told that it was getting held up by a supply problem.

At this stage, I wouldn’t even mind getting a refurbished device, if it means I

can get something at least workable.

If a leasing company isn’t holding up its end of the contract, why should I, as a retailer, have to keep up my end?

Prinal Patel, Raj’s Premier, Sandown, Isle of Wight

Verifone declined to comment and Paytek failed to comment by the time Retail Express went to print

We are a small rural retailer, independently owned, but the wider retail landscape is varied and interesting. Wanting to represent everyone before the Conference, I tried to read trade magazines more than usual, and articles I wouldn’t normally make time for. It has been so long since I have been out of the county due to Covid-19 and other personal challenges that even catching a train was exciting. I had a pile of further reading, and texted my MP suggesting we met on the stand, if he was available.

The time passed in a bit of a blur looking at other stands. What were their key messages? Holding conversations with multiple people was the easy bit. Like every retailer, I do that every day. The hard bit was realising, about two hours in, how many people are not in the retail industry or even in business. And when you say something as easy as energy prices are rising, they nod their head, but they don’t know what it means.

I encourage you to share your business knowledge and experience to highlight what you mean to as many people as you can. For example, the 100% increase in energy prices for the last 10 months means, as a business, we are only profitable for half of the year thanks to tourism, so our viability has been undermined.

Mike Sohal, Dallam

at local school’

“DURING anti-bullying week in November, I spoke to one of the teachers from our local school to see how we could play our part in helping boost the mental health of pupils. I was named Nisa’s Charity Champion of the Year and, as a result, I was given some funding from the symbol group’s ‘Making a Difference Locally’ pot. This has helped us buy a bench for the school for children to use to buddy-up with others if they are feeling lonely. We really enjoy giving back where we can and we are really proud of this initiative.”

“WE

COMMUNITY RETAILER OF THE WEEK

COMMUNITY RETAILER OF THE WEEK

£2.99,

75

first

If they are bright MPs and officials, they will ask supplementary questions like ‘why are you the first person telling me this?’. The renewal date will be over the next three years, so pressure will be applied over the next two years as everyone renews contracts, so while I might be the first, I won’t be the last. I hope you were wiser than me and fixed at 28p for three years, and not the one I did thinking it would come down in December 2021.

I may have been photographed with the Chancellor, which was the best part of the day, but the easiest part was sharing what I do in my business and why my risk-managed community approach has given us a future for 20 years. If only the Conservative party could say the same.

99p.

footing

difference

business’ kitty. I’ve just ordered another five boxes of 120. We had to restrict to two per customer as they were so popular. We recognise how tough the cost-of-living crisis is on our community, and we want to help wherever we can. We thought about giving them away for free, but decided against this, as we wanted people to value them still.”

13 betterRetailing.com 10-23 JANUARY 2023

LETTERS

Get in touch @retailexpress betterRetailing.com facebook.com/betterRetailing megan.humphrey@newtrade.co.uk 07597 588972

Paytek

fix

‘Verifone and

(R-L) Christine Hope, ACS chief executive James Lowman, previous chancellor of the Exchequer Kwasi Kwarteng and retailer Amit Puntambekar

Each issue, one of seven top retailers shares advice to make your store magnificent

have subsidised the cost of hot water bottles to help our customers stay warm this winter. They retail at about

but we sold

on the

day for

We are

the

ourselves from the

‘We are selling hot water bottles for 99p’

Harjit Singh, H & Jodie’s, Walsall – @hjodies

‘We paid for a buddy bench

Stores, Warrington – @mikesohal07

NEXT-GEN IN THE NEW YEAR

JASPER HART looks at how retailers can make the category a success in 2023

THE VAPING OPPORTUNITY

ASK any convenience retailer and they’ll tell you vaping sales have come on leaps and bounds in the past few years. The category is no longer the preserve of specialist vape shops and local shops are expected to give it some form of representation.

“The vape market is continually expanding as more consumers seek out alternative nicotine solutions,” says Tom Gully, head of consumer marketing UK&I at Imperial Tobacco. “In the UK alone, the

category is now worth around £1.2bn and is expected to reach £1.47bn in the next three years, with around 35% of current vaping volume sales taking place in the convenience channel.

The number of vapers in the UK has grown by 3% over the past year to 3.6 million, so it’s clear there will be continued demand from consumers for vaping products.”

A report from Action on Smoking & Health (ASH) puts the number of active vapers in

the UK even higher, at 4.3 million. 2023 promises further growth in the category due to a confluence of factors.

The new year brings new year’s resolutions, with quitting smoking often among them, while the rising cost of cigarettes is making them increasingly untenable for even long-term smokers, according to multi-site Go Local retailer Sasi Patel.

With more customers already talking to him about switch-

ing from cigarettes to vaping options, he expects January to bring even more new converts.

Maqsood Akhtar, who runs Blackthorn News & Food in Bramley, Rotherham, says the financial incentive outweighs that of health for some customers. “People want to save money rather than quit smoking,” he says.

“You’re looking at £11.50 upwards for a single packet of cigarettes, or £5.99 for a Jucce bar kit with 1,200 puffs.”

CATEGORY ADVICE NEXT-GEN NICOTINE 14

NOT SO DISPOSABLE

to Imperial’s Gully, the disposables segment is now worth around £132m, with a 10% market share of the vaping market, double what it was in 2021. Disposables have proven a valu-

able point of entry into the category for many retailers thanks to their ease of use and high margins.

“We focus on Elfbars and they’ve captured the market and have taken a chunk of our tobacco sales,” says Richard Inglis, who runs three Welcome Stores in Southampton. “I reckon it’s taken

10-15% of my tobacco sales, but I don’t mind because I’m replacing what was maybe a 10% margin on tobacco with a far higher margin.”

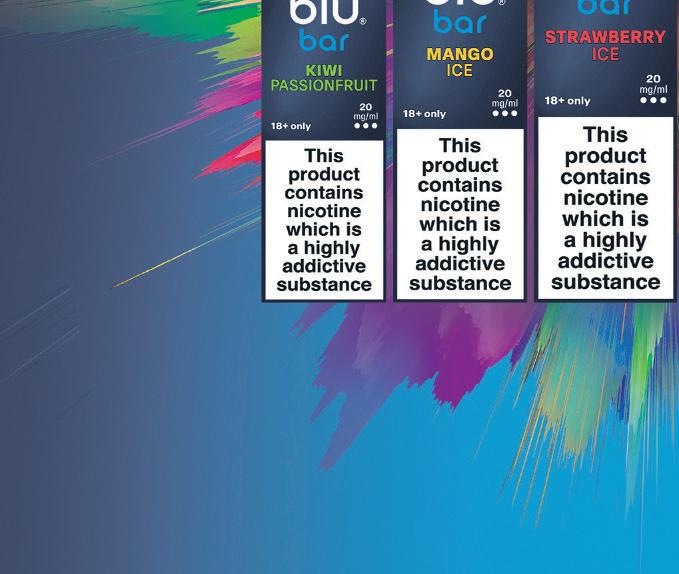

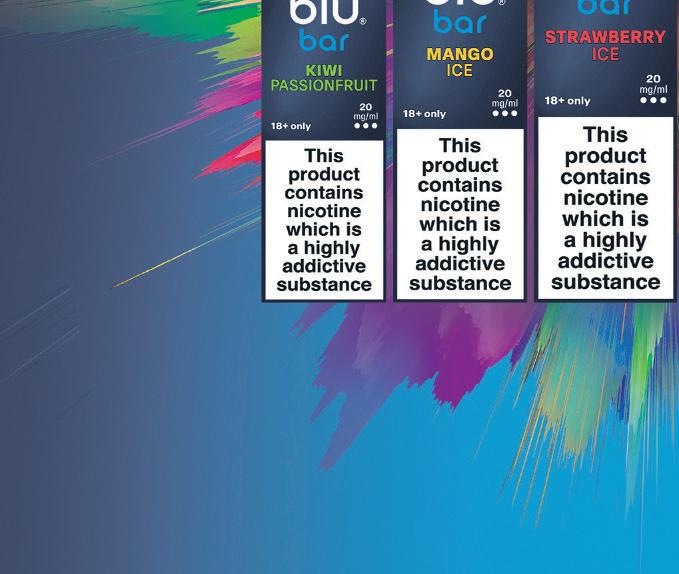

After years of domination from upstart brands such as Elfbar, Geek Bar and Crystal, 2022 has seen major tobacco suppliers get in on the act, in the form of Imperial’s Blu Bar

and British American Tobacco’s (BAT) Vuse Go.

Akhtar believes disposables will remain an important part of his range, but they have fallen under scrutiny due to their environmental impact, as they are technically electronic waste, but are often thrown away in household rubbish.

Trudy Davies, of Woosnam &

Davies News in Llanidloes, Powys, has begun offering to take in her customers’ used disposables, which she sends to a recycler via freepost. She says reminding shoppers they can deposit their used devices at her shop has helped drive repeat custom.

Additionally, the longterm cost of disposables,

while favourable compared to cigarettes, is still less customer-friendly than those of open- and closed-system kits. Akhtar has begun selling rechargeable disposable pod kits from Jucce Bar, which mean consumers are not throwing away their device after depleting its puffs, instead replacing the pod.

Bateson, sales director, JTI UK

“THE next-gen category is growing at a phenomenal rate and will continue to progress and develop over the next 12 months as nicotine pouches and heated tobacco devices consistently grow in popularity. We know nicotine pouches appeal to existing adult smokers and vapers who find themselves in situations where they cannot, or do not want to, smoke or vape. The heated tobacco category represents a huge opportunity for retailers to offer different options to existing adult smokers that are seeking an alternative tobacco experience.

“A key trend within the nicotine pouch category is the continued demand for higher nicotine strengths. A total of 81.1% of nicotine pouch sales in traditional retail in the UK are from the extra-strong or strong strengths, so we advise retailers to provide a good choice of products in this segment. The demand for mint-flavoured products has soared to new heights within the category, with the market currently split 81.6% mint and 17.7% fruit. To keep ahead of this growing trend, retailers should ensure they always stock a range of flavours within the higher strengths.”

FLAVOUR

15 10-23 JANUARY 2023 betterRetailing.com

SUPPLIER VIEW

Gemma

THAT‘S UNLIT FOR EXISTING ADULT SMOKERS & VAPERS ONLY. This product contains nicotine. 18+ only. Not a smoking cessation product. © Fontem 2022.

EXPLORE

A WORLD OF

NEXT-GEN NICOTINE

KEEPING COMPLIANT

WITH disposables experiencing a rapid rise and overseas brands looking to capitalise, illicit devices have proliferated. The UK Vaping Industry Association (UKVIA) estimates that as much as 60% of disposable devices are illicit.

“At first glance it can be hard to spot an illegal vape,” says Ian Howell, fiscal and regulatory affairs manager at JTI UK. “UK law states that ecigarette tanks should have a capacity of no more than 2ml and refill containers are restricted to 10ml. The e-liquids themselves can’t exceed a nicotine strength of 20mg/ml, and colourings, caffeine and

taurine are banned.”

Disposables offering more than 600 puffs should be treated with suspicion, but it’s not just capacity and ingredients retailers need to watch out for. Howell adds: “Several vape products, especially from smaller manufacturers, have also used inappropriate names or packaging designs that could appeal to children. Always remember, the measures in place to prevent sales of tobacco to under-18s must be applied to vapes as well.”

Retailers should also be wary of copyright-infringing lines, such as Geek Bar’s recent Tropical Skittles Blast.

Akhtar says he has been the beneficiary of other stores’ non-compliance, as not only have they lost money on illicit stock being thrown away, but they have lost customers.

RETAILER VIEW

fected. Some shops had

“Recently, in our area, trading standards and police did a lot of busts, but we weren’t affected. Some shops had £5,000-to-10,000-worth of stock taken off them and it hit the local paper. We’ve had new customers who’ve been looking for something legit,” he says.

BEYOND VAPING

WHILE vaping as a whole continues to dominate discussions around alternatives to traditional tobacco, the nicotine pouch and heated tobacco segments are continuing to grow thanks to concerted sales efforts from supplier reps. On the one hand, retailers aren’t faced with a bewildering choice of products, brands and flavours in the same way as the

vaping category.

Philip Morris’ Iqos Originals Duo and JTI’s Ploom X (which is only available to retailers within the M25) are the only heated tobacco options for convenience retailers, while Nordic Spirit from JTI and Velo from BAT are the clear nicotine pouch market leaders. Scandinavian Tobacco Group has also made its nicotine pouch debut

“WE’VE moved away from liquids completely, they’ve died a death. Elf and Lost Mary is where the money is at the moment, but we’re hearing rumours about the Crystal Bar as the next big thing. It’s not being requested at the moment, but the minute it is, we’ll move to it. Nisa carry about 10 Elf lines and no Lost Mary, so we deal directly with a reputable local wholesaler.

“I’ve just increased the price – we were doing £5.99 and two for £10, but I’ve increased that to £6.49 and two for £11.50. We know the Co-op down the road only has a choice of eight, whereas we offer a choice of 30 Elfbars plus Lost Mary. People say they’re cheaper, but they don’t have the flavours they like, so they shop with me. We’re probably doing about £10,000 a month, with a 50% margin – a lot better than cigarettes.”

with Ström, and it is currently being trialled with Manchester retailers, before a planned UK-wide expansion in March.

On the other hand, their appeal, while growing, is still fairly limited, and consumer uptake is by no means guaranteed without a bit of work on the retailer’s part to explain the segments and how they distinguish themselves.

For instance, JTI says Nordic Spirit is worth £600,000 a month in independents and symbols, citing IRI figures, which is less than 20% of its total monthly worth in the UK. Meanwhile, at last count in June 2022, heated tobacco had grown by 14.9% annually to be worth £91m, which pales in comparison with the vaping category.

CATEGORY ADVICE

16 10-23 JANUARY 2023 betterRetailing.com

Gary Batten, Phoenix Stores (Nisa) Nanpean, Saint Austell, Cornwall

Our social channels are the quickest way to keep up to date with all things The Fed. From the latest industry news to upcoming events, membership benefits, partner offers and commercial support. Join our retailer community today #TheFed t h e f e d o n l i n e . c o m Federation of Independent Retailers Fed The E s t . 1 9 1 9 T: 0 8 0 0 1 2 1 6 3 7 6 | E: c o n t a c t u s @ n f r n . o r g . u k @the_fed_nfrn @TheFedOnline YouTube @TheFedNFRN Twitter @TheFedVIP Facebook VIP @TheFedOnline Facebook @The Fed (NFRN) LinkedIn Make money, save money, make business easier! Instagram Follow us Instagram Subscribe to YouTube Follow us Twitter Join us Facebook VIP Like us Facebook Follow us LinkedIn

LOW- AND NO-ALCOHOL

HIGH EXPECTATIONS FOR LOW & NO

As the number of shoppers seeking low- and noalcohol alternatives grows, suppliers and wholesalers say it’s down to retailers to increase their ranges and reap the rewards, writes CHARLES SMITH

THE OPPORTUNITY

WITH Dry January and Sober October now firm calendar fixtures, low- and no-alcohol drinks present a major opportunity for convenience retailers in 2023.

Non-alcoholic wines and spirits sales are growing, but beer continues to dominate, with Nielsen Scantrack figures to June showing low- and no-alcohol beer purchases up 6% to £104m in the total off-trade, while total beer sales slid 14%.

The low- and no-alcohol category has gone from strength

to strength, growing to £125m across the trade, according to Sunny Mirpuri, director for wholesale & convenience at Budweiser Brewing Group, with the independent convenience channel contributing more than £2m.

The cost-of-living crisis is impacting the category, with Nielsen IQ showing 29% of consumers are keen to pay for cheaper drinks, but 14% say low- and no-alcohol is more important to them than before the pandemic.

Health is the principal driver in

this. Seventy per cent of Brits were looking to be healthier, Public Health England reported in 2021, with a third of consumers saying limiting alcohol was an important part of their healthier lifestyles.

Since the pandemic, KAM Media’s Low&No report 2022 shows the percentage of consumers looking to drink less alcohol over the next 12 months has risen from 40% in 2020 to 55% in total in 2022 and 65% of under-25s. According to

AMC Global’s No-Low Alcohol White Paper, 72% of UK adults have tried low- and no-alcohol drinks, sparking an increase in ‘sober curious’ consumers and the quality choices available.

A further motivator, lowand no-alcohol alternatives often contain fewer calories and less sugar, presenting healthier options for shoppers wanting to enjoy the taste of their favourite drink without the effects of alcohol.

CATEGORY ADVICE

18

RETAILER VIEW

Puntambekar, Ash’s Shop, Fenstanton, Cambridgeshire

“OUR low- and no-alcohol sales are relatively small, but growing year on year. We have a dedicated space for beer, ciders and wine. We’ve tried spirits, but the price was too high for our consumers. We tried Seedlip and Warner’s. One customer started buying Gordon’s 0.0, but I’ve delisted it. I think alcohol-free spirits are levelling off, and people are going for taste profiles they recognise. I tried Warner’s alcohol-free gin, and it tasted like cordial. We also stock alcohol-free prosecco.

“Our sales are transitioning to low- and no-alcohol wine a bit more, but the World Cup held up beer sales and our spirits core range. People across the demographics are buying it. Low- and no-alcohol spirit buyers are 30-to-35-plus. Beer is more male-dominated, selling across the age range. Wine buyers are female, or men 30-plus. It’s rarer to get men under 25 buying low- and no-alcohol wine, but the growth is there. The younger generation are drinking less across the market. I’m 30, and don’t touch it now, except when I go to an event.

men 30-plus. It’s rarer to get men under 25 buying

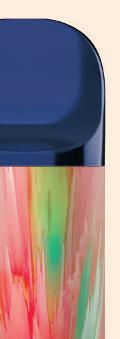

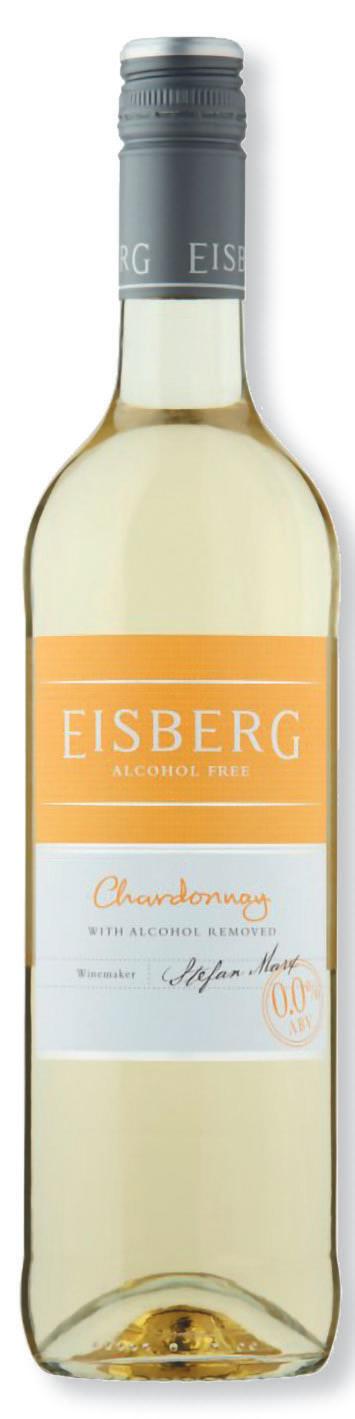

“Normally, we see a small uplift in alcohol-free beer in January, but wine’s more hit and miss. I don’t think Dry January has as much impact here as it does across the market. In beer, retailers should start with Stella, Peroni and potentially Heineken Blue. It’s not the strongest-selling alcohol-free beer, but it’s got a lot of recognition. In cider, stock Kopparberg and Thatchers Zero. In wines, stock Eisberg. Nozeco is quite important around celebrations. It’s the same principle with spirits – the opportunity’s there with the more established brands. If the price came down to £6 or £7, that would help, but they need to make it first, then take out the alcohol.”

HOW RETAILERS CAN GET IN ON THE ACTION

the same principle with spirits – the oppor-

growing demand for lowand no-alcohol products looks good in theory, but there’s work to do if retailers are to make the most of this opportunity.

“These compelling stats make low- and no-alcohol sound promising for retailers, but the category is still evolving, especially in convenience,

where distribution and availability isn’t where it needs to be,” says Miriam Thompson, off-trade category marketing executive at BrewDog PLC.

Despite cost-of-living pressures, this sector is poised to go from strength to strength. Brands are also creating new products with different flavours and are even introducing

CBD-infused drinks to cater to customers seeking healthy options. For retailers looking to entice shoppers to their lowand no-alcohol ranges, it’s important to design a range that is catering your local demographic.

“Premiumisation is our big bet for 2023. We’re seeing it across the total beer category,

and it’s replicated here, with the premium no- and lowalcohol segment growing by 23% year on year. Additionally, the highest number of alcoholfree serves are seen within the 18-to-34-year-old demographic,” says Mirpuri at Budweiser. “Retailers would be wise to target these age groups to capitalise on this trend.”

RETAILER VIEW

Ushma Amin, Londis North Cheam, Surrey

“OUR low- and no-alcohol drink sales are low, compared to alcoholic ones. I don’t know why, maybe it’s the taste. We do a few bottled beers, but not much in spirits – we don’t see a big demand.

“Shoppers are buying the beers across the age range. It’s good that more brands are coming in, there’s a wider choice. People who want to drink and drive can have a beer, and still enjoy the taste without the alcohol.

“January’s a good time to start selling these. People have less money, and have had enough to drink over Christmas. If the alternatives are available, people might think of them.

“Retailers starting from scratch should begin with lowalcohol beers, Bud Lite or Heineken Zero, and Gordon’s 0.0 or alcohol-free vodka – a small range matching their top sellers. My regular customers wanted Gordon’s 0.0, so I’m getting that for them, and others might buy it, too. Retailers should display these next to the alcoholic versions, and include some low-alcohol wines.

“People are much more aware of these products than they were 10 years ago, and there’s plenty of information online. If stores are part of a symbol group or cash and carry, they should display posters or shelf markers to attract people.”

19 10-23 JANUARY 2023 betterRetailing.com

Amit

LOW- AND NO-ALCOHOL

BUILDING AND PROMOTING A RANGE

ONE in three consumers rate the low- and no-alcohol choice in convenience as good/very good versus supermarkets’ three in five, and this gap translates into lost sales. In KAM Media’s 2021 Low & No Report, one in five consumers bought low- and no-alcohol beer in convenience stores, trailing one in three in grocery. But the desire is there, as Thompson confirms. But for shoppers, it’s about range.

“The top three low- and noalcohol off-trade buying missions are dinner, quiet evenings at home and nights in, with shoppers seeking alternatives to soft drinks and water,” she says. “As expectations grow regarding choice and availability, now’s the time to capitalise on this upwards trend.”

Once you have introduced low- and no-alcohol products into your store, it is critical people are made aware of them, particularly if they have requested you stock them in the

first place. PoS and prominent positioning early will put them front and centre of people’s agendas and then cross-merchandising with big-night-in products can start turning impulse sales into regular ones.

“If they haven’t already, retailers should introduce lowand no-alcohol categories to meet demand, and speak to customers about the products available in store,” says Kenton Burchell, trading director at Bestway Wholesale.

“Use gondola ends and the main drink location. Merchandise low- and no-alcohol drinks next to categories such as soft drinks, mixers, crisps and snacks to drive linked sales.

“Use PoS banners and shelf talkers to introduce products, run tasting events in store to get shoppers’ feedback on the brands they prefer, and feature promotions with an introductory lower price.”

Amit

Puntambekar,

Puntambekar,

from

TOP TIPS

Ash’s Shop in Fenstanton, Cambridgeshire, has seen low- and no-alcohol sales increasing, but it’s been built on consumer conversations and being quick to react to preferences and dislikes.

“Retailers should have up to three options in each category,” he says. “You need a bit of range, but if you get it wrong, the customers will tell you. We built our beer selection around what our shoppers want.

Ash’s Shop in Fenstanton, Cambridgeshire, no-alcohol though we’ve made a distinct

“You should merchandise around the same categories, though we’ve made a distinct two shelves for low- and noalcohol, to guide the journey and make it a bit quicker.

“To push sales, you should feature the available promotions across the categories.

“As I see it, it’s up to the market to tell us what to stock and then up to us to work out if it fits our demographic, and do what we can.”

Low- and no-alcohol options that deliver strong sales

Bestway Wholesale is supporting the low- and noalcohol category by stocking Heineken 0.0 Lager Beer and Beck’s Blue Alcohol-Free Beer.

In alcohol-free wine, Nozeco Special Edition Alcohol Free Fine Sparkling, Eisberg Alcohol Free Chardonnay and McGuigan Zero Shiraz are strong sellers.

Budweiser’s Corona Cero launched in March 2022 across grocery and convenience, an alcohol-free version of Corona. Budweiser Zero and Stella Artois Alcohol-Free are growing significantly ahead of the total low- and no-alcohol category, showing doubledigit growth.

Retailers can capitalise on the popularity of craft beer and low- and no-alcohol drinks with BrewDog Punk IPA AF, the alcohol-free version of the UK’s number-one craft beer and the only craft beer in the low-alcohol top 10. BrewDog Punk IPA AF boosts category value, at a higher price per litre than alcoholfree lagers generally. BrewDog’s original low-alcohol product, BrewDog Nanny State, offers a US-style alternative, while its latest alcohol-free launch is 0.5% crusher BrewDog Lost AF.

CATEGORY

ADVICE

20 10-23 JANUARY 2023 betterRetailing.com

NewstrAid Cost of Living Crisis Fund

Created in response to the current Cost of Living Crisis, the fund offers grants of up to £250 per household to help bridge the gap between income and costs for anyone with a newstrade connection. That means people who work or have previously worked in the sale and distribution of newspapers and magazines for a minimum of 2 years, full time. Eligibility criteria apply.

Are you struggling with the Cost of Living? Are you worried about paying your bills and putting food on the table? Have you worked in the sale or distribution of newspapers and magazines in the UK full time for 2 years or more?

For more information scan the QR code, call us FREE on 0800 917 8616 or email: mail@newstraid.org.uk If the answer is yes to the above questions then you could be eligible for a grant from the NewstrAid Cost of Living Crisis Fund.

LOW-SUGAR SOFT DRINKS RISING HIGH

CHARLES WHITTING finds out why soft drinks is the category where low-sugar options are proving a real winner for retailers

WHY RETAILERS SHOULD STOCK LOW-SUGAR SOFT DRINKS

THROUGHOUT our lives, there have always been food and drink products marketed to people looking to reduce their intake of certain products. Products with reduced levels of sugar have been a major trend over the past decade, at least.

The recent introduction of HFSS legislation, with more scheduled for this year, highlights just how important reducing sugar is now seen by government officials and looks set to see more low-sugar options

become more readily available.

In addition to government edict, consumer demand is also driving change, with 72% of consumers actively trying to reduce or avoid sugar in their diets.

This has led to significant growth within this category, with retailers dedicating more space to them in their fridges and on their shelves. Few categories have embraced this change as early or effectively as soft drinks, which were affected prior to HFSS legislation by the introduction of

the sugar tax in 2018.

Now, sugar-free options make up almost 70% of total soft drinks sales, while sugar-free carbonates have grown by more than 5%. According to IRI, HFSScompliant soft drinks make up 52% of total soft drinks sales in symbols and independent convenience stores, and are worth £980m.

“Low-sugar drinks in independents are growing at a faster rate than overall soft drinks, seeing an uplift of 11% year

on year in the latest 52 weeks. Looking at the latest 12 weeks, we are seeing a greater increase, with low-sugar soft drinks up by 7% year on year versus overall soft drinks up by 4% year on year,” says Charlotte Andrassy, head of category development for beverages & impulse at Danone.

“With regard to ‘sugar-free’ claims, we are seeing an overall increase compared to last year, a 13% uplift in the latest 52 weeks and an increase of 5% in

the latest 52 weeks.

“In 2023, we expect to see continued growth in low-sugar soft drinks, following heightened consumer demand and government focus on health.

‘Low in sugar’ is reported as the number-one factor influencing drinks choice, so we expect to see continued reformulation of products and new products in this space.”

This has resulted in brands reducing sugar in existing lines or launching sugar-free versions

to grow the breadth of their HFSS-compliant range.

“Recent HFSS location restrictions have been challenging for both suppliers and retailers, but they have presented an opportunity for categories like soft drinks, that have already innovated at scale to be largely HFSS-compliant. For example, 86% of the CCEP portfolio is HFSS-exempt,” says Amy Burgess, senior trade communications manager at Coca-Cola Europacific Partners (CCEP).

CATEGORY ADVICE

22

LOW-SUGAR DRINKS

RETAILER VIEW

Bobby Singh, BB Nevison Superstore, Pontefract, West Yorkshire

“THE mindset is changing now and we’re seeing that by the growth in demand for low-sugar soft drinks. We’re getting in more of these products and increasing our range because the demand is increasing.

“Coca-Cola Zero Sugar is doing very well and Pepsi Max is a big seller, while Red Bull Sugarfree and the sugar-free Monster drinks also sell well. Sugar-free soft drinks are very popular now.

“We’ve increased the space dedicated to low-sugar in the past year. It’s not yet equal to the space for regular drinks, but it’s growing. If a product is selling less, then you’d only give it two facings, but when you’re selling a lot, you give it five or six facings. It’s quite evident now that we have to do that with low-sugar soft drinks.

“At the moment, we stock the Coca-Cola next to the Diet Coke. But moving forward, as demand and sales keeping growing and growing, I think it might change and we might be in a situation where we’ve got the lowsugar options all together.”

THE PRICING OPPORTUNITY

FOR many categories, like snacking and confectionery, ‘healthier’ options carry at least the perception of higher prices, making them a more challenging sell for retailers unless the suppliers themselves offer promotions or change the ingredients of their products.

But soft drinks were made to go about things in a differ-

ent way when the sugar tax was introduced in April 2018.

By and large, low-sugar options are either the same price as other varieties or indeed cheaper

“You don’t see offers in the cash and carry for healthier options in snack bars, it’s just straight pricing,” says Anish Panchmatia, from One Stop Wylde Green in Sutton Cold-

field, West Midlands.

“When it comes to soft drinks, the low-sugar options are still on mix-and-match pricing while the price of highsugar drinks has increased.

“Volumes of low-sugar drinks have increased and sales are up. It costs more to have full-fat drinks and healthy snacks. It costs less to purchase low-sugar drinks.

“Customers have accepted that full-fat drinks aren’t going to be on the same deals as the low-sugar ones.

“People have generally accepted that they are going to have to pay a premium for high-sugar soft drinks.

“You just tell them it’s the sugar tax and they may not like it, but they generally agree with it.”

23 10-23 JANUARY 2023 betterRetailing.com

LOW-SUGAR DRINKS

PRICE-MARKED PACKS

EVEN with these sugar-tax advantages for low-sugar drinks, the cost-of-living crisis still means that anything retailers can do to provide greater value for their shoppers will be noticed and appreciated.

Larger formats and pricemarked packs (PMPs) will play into wider big-night-in and cost-saving trends.

“We can expect to see a rise

in big nights in as shoppers become more price-conscious and look to spend time with friends and family at home.

In fact, 36% of consumers are reportedly going out less than usual,” says Matt Gouldsmith, channel director for wholesale at Suntory Beverage & Food GB&I.

“As such, retailers should ensure to stock up on larger

soft drinks formats, such as Ribena Sparkling Zero Sugar’s 2l bottles, to meet these shoppers’ needs.

“PMPs will become more important for retailers to demonstrate value and give shoppers confidence they are getting a fair price, and Ribena Sparkling has recently unveiled reducedprice PMP bottles to help retailers tap into this.”

THE PREMIUM OPPORTUNITY

THERE are also upselling opportunities inherent to lowsugar options, as premium brands and lines enter the market, offering customers the chance to not only reduce their sugar intake, but also increase the amount of supplementary vitamins and ingredients they are consuming.

An upselling section focused on increased benefits as well as reduced sugar can create an additional talking and

selling point to your store.

“We expect premiumisation to continue in the category, with shoppers ready to trade up on everyday soft drinks,” says Ben McKechnie, managing director at Epicurium.

“Additionally, ethical and sustainable claims will grow, similarly with gut health and immunity, while sugar reduction and natural energy will only continue to gain greater attention.”

SUPPLIER VIEW

Troy, marketing director, Barr Soft Drinks

Troy, marketing director, Barr Soft Drinks

“AS consumers become increasingly health-conscious in January, bottled water sales see their second-biggest peak after summer.

“Drinking more water is currently the number-one healthy change that shoppers are looking to make, with 40% of consumers vowing to drink more as the new year begins. The demand for both bottled water and low/nosugar soft drinks increases in January, as shoppers look for lower-calorie soft drinks that don’t compromise on taste and give them a fruity flavour hit.

“Rubicon Spring had a 30% uplift last January, highlighting a huge opportunity for retailers to drive incremental sales from the water category with the UK’s number-one sparkling flavoured water.”

PRODUCT LAUNCHES

Shloer Zero

SHS Drinks has introduced its first-ever zero-calorie Shloer products under the sub-brand Shloer Zero. The two new lines are available in White Grape and Red Grape varieties and come with a £2.36 RRP for a 750ml glass bottle. On both the main and neck label, the Zero branding appears in light blue.

Red Bull Sugarfree

With the launch of a new Sugarfree price-marked multipack, Red Bull has extended its multipack range, exclusively available to symbol and independent convenience stores. Red Bull sold 15.2% more sugar-free volume through multipacks, and these varieties are growing frequency by 41.8%.

Ribena Sparkling Zero Sugar

Following the launch of Ribena Sparkling in 2020, new Ribena Sparkling Zero Sugar features the taste of a carbonated soft drink in Ribena’s Blackcurrant flavour, but without the addition of sugar. Ribena Sparkling Zero Sugar is available in 500ml and 2l bottles.

CATEGORY ADVICE

24

Adrian

betterRetailing.com 10-23 JANUARY 2023 25 CLASSIFIED Refrigeration Remote Unit (Motor sited externally) Osaka Finance available Chillers and freezer (available in 3 doors) Licensing Established 2005 prretail.co.uk ALCOHOL LICENSING PREMISES LICENCE APPLICATIONS TO SELL ALCOHOL PERSONAL LICENCE APPLICATIONS PR Retail Consultants Ltd is a long established licensing company Please telephone Robert Jordan BSc ACIB 01279 850 753 or 07774044585 l We can apply for your alcohol licence or vary existing hours and layout of premises l We can also represent you at hearings and reviews of premises licences l Pavement licences l Late night refreshment licences Electronics Advertise with us Contact Natalie Reeve to find out more commercialteam@newtrade.co.uk 020 7689 3372 Thornbury Refrigeration, an Arneg Distributor, has advertised in Retail Express for years. The regular positive response we receive, leads to confirmed sales and contented customers. Robin Ranson, Thornbury Refrigeration

WHAT TO EXPECT FROM 2023

RETAIL EXPRESS finds out what retailers are expecting in 2023 and how they are preparing for the year ahead

Mukesh Patel, Capel News, Dorking, Surrey

Mukesh Patel, Capel News, Dorking, Surrey

“AT the moment, it’s a case of taking things on a month-bymonth basis. Things are very different and always changing, so we can only do our best and see what’s around the corner. But one thing we’ve found is moving fast and that we’re stocking up on is price-marked packs (PMP).

“Most of the ones we’ve found and stocked, people are buying. Most people are cost-cutting these days, saving money for their energy bills, and that’s what’s needed. Our range used to be a 50/50 split between non-PMP and PMPs, but now, around 70% of our stock is PMP. Regardless of what the price is, people will think that a PMP is cheaper than a non-PMP.

“The pro�it margins aren’t as high, though, when you’re using PMPs, so that’s a question for small shop owners. As long as we can continue to pay the bills, then we’ll be here and can start to rebuild after a year or two.”

Holborn, Holborn’s, Redhill, Surrey

Holborn, Holborn’s, Redhill, Surrey

“LIKE everyone else, I think energy bills are going to be at the top of the agenda for us. The short-term help from the government is coming to an end, so we are going to have to look at every part of our store. We’ll look at the range, the prices and examine what �ixtures are actually achieving for us.