June 2023 In-depth analysis, insight and advice for convenience and foodservice wholesalers A high-quality, fine-cut blend of rolling tobacco. BEST VALUE, BEST PRICE £15.80 30g RRP INTRODUCING ROYALS GOLD SIGNATURE ROLLING TOBACCO N E W Smoking kills It’s an offence to sell tobacco to any person under 18 years of age. For tobacco trade use only. Not to be left within sight of consumers.

The wholesale sector is evolving, and so are we. Take a look at our new-look website betterwholesaling.com where you will find:

• More news and thought leadership

• In-depth wholesaler profiles and video interviews

• Sector and category reviews

• Easy-to-digest infographics highlighting key industry trends

betterwholesaling.com

Stay informed and get ahead with

June 2023

In-depth analysis, insight and advice for convenience and foodservice wholesalers

Technology and data

A guide to the latest technological trends available to wholesalers and how to take advantage of them

LEADER

Technology equals growth

The same can be said for all of the big players in wholesale, and this report offers a guide on all the latest technological trends available to businesses, and how to take advantage of them.

Paul Hill

Editor

Just before going to press, news came in that Pricecheck has achieved double-digit growth for the second successive year. This adds to eight previous years of turnover growth. This highlights what the adoption of technology and data can do for a wholesale operation, with this having always been important to the Sheffield-based company in its quest to innovate and explore emerging markets.

B2b.store reveals the benefits of split testing with an easy how-to guide, while the wholesale benefits of the right ERP System are laid out by CSB-Systems. Meanwhile, David Gilroy asks the question of whether data is now the new gold in the channel, and Erudus makes the case for interoperability becoming a necessity for wholesalers.

Elsewhere, we have in-depth interviews with five buying groups as each one makes the case of what they bring to their members, as well as all of the latest developments within their operations. I also spoke to three wholesalers – Lomond, The Cress Company and KCS – as they revealed their transformations.

EDITORIAL

Editor Paul Hill

Editor in chief Louise Banham

Head of design

Anne-Claire Pickard

Production editor Ryan Cooper

Sub editors Jim Findlay, Robin Jarossi

Senior designer Jody Cooke

Junior designer Lauren Jackson

Contributors David Gilroy, Tom Gockelen-Kozlowski, Rob

Mannion, Charles Smith, Jon

Shayler, Mathew Simpson

Production coordinator

Chris Gardner

SALES

Head of commercial

Natalie Reeve 020 7689 3367

Senior account director

Charlotte Jesson 020 7689 3389

Account managers

Marie Dickens 020 7689 3366

Megan Byrne 020 7689 3372

Lindsay Hudson 020 7689 3366

Commerical project manager

Ifzal Afzal 020 7689 3382

Newtrade

Better

Join the conversation:

@BW_mag

https://bit.ly/3lvj7FC

P6-7: Viewpoint

Could data become the new gold?

P8-10: Insight

Why you need to focus on split testing

P12-13: Opinion

The benefits of the right ERP System

P14-15: Profile

The Cress Company talks us through its latest developments

P16-17: Insight

Interoperability is becoming a necessity for wholesalers

P18-19: Interview

Lomond reveals its growth strategy

P20-21: Spotlight

KCS goes into detail about an e-commerce transformation

P22-23: Summary

Five ways wholesalers use tech and data to build profits

CATEGORY ADVICE

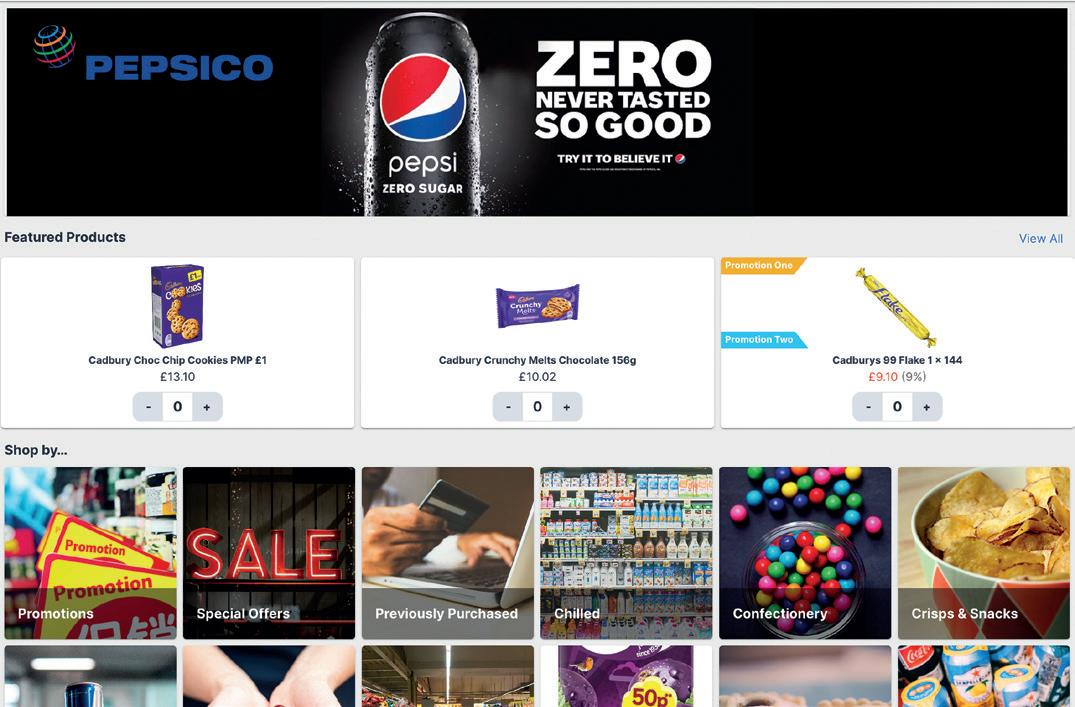

P4-5: Working Together Project PepsiCo on its exciting Doritos product launch

P23: Column

Ferrero on why data transparency is crucial to wholesale

P24-55: Working Together Project CCEP is helping grow sales in the RTD chilled coffee category

P26: Buying groups

Confex speaks about its biggest developments

P28: Buying groups

Unitas on what it is doing for its members

P30: Buying groups

Sugro reveals all of its latest goings on

P32: Buying groups

NBC on how it has achieved growth

P34: Buying groups

Caterforce explains its latest plans

P36-38: Foodservice focus Exploring the opportunities retail offers the channel

P39: Brand introduction

A Spanish gin brand talks through its offering

P42-50: Sector review

A look at the latest trends and NPD in tobacco and vaping

P52-56: Sector review

How to navigate the profitable pricemarked packs sector

2 CONTENTS

Printed by Acorn Web Offset Ltd, Loscoe Close, Normanton Industrial Estate, Normanton, West Yorkshire,

WF6 1TW

Distributor Seymour Distribution, 2 East Poultry Avenue, London, EC1A 9PT

Media Limited, 11 Angel Gate, City Road, London EC1V 2SD Tel 020 7689 0600

Wholesaling Insight is published by Newtrade Media Limited, which is wholly owned by NFRN Holdings Ltd, which is wholly owned by the Benefits Fund of the National Federation of Retail Newsagents. Reproduction or transmission in part or whole of any item from Better Wholesaling may only be undertaken with the prior written agreement of the Editor. Contributions are welcomed and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information.

Wholesaling Insight's publisher Newtrade Media

the environment.

Better

cares about

REPORT

Cover image credit: Getty Images/Filo

Headline partners Supporting partner Shape, strengthen and supercharge your business at the Independent Achievers Academy Learning & Development Festival 2023 3 July 2023 | The Eastside Rooms, Birmingham #IAA23 #ALWAYSIMPROVING Connect and engage with like-minded independent retailers from across the country to share ideas and experiences that will help shape your business for years to come. PLUS: Expert masterclasses • Focus groups • Hands-on trade exhibition • IAA 2022-23 Category Stars and Overall Best Shop revealed For more information, please visit www.betterretailing.com/iaafest or contact kate.daw@newtrade.co.uk / 07886 784465

WHOPPING UP A STORM

Paul Hill finds out how PepsiCo is working with United Wholesale (Scotland) to promote its new Doritos Flame-Grilled Whopper flavour

Brand partnerships have always proven to be important to the exposure of NPD in the wholesale channel. PepsiCo has taken this one step further with the launch of the all-new Flame-Grilled Whopper Doritos, in partnership with Burger King.

As part of its huge in-depot activation at United Wholesale (Scotland)’s (UWS) Glasgow depot, Doritos created an immersive sampling experience, supported by digital and physical marketing materials.

“I have to say a huge thanks to Doritos for bringing this activation to life at UWS – it’s been great having this promotion here in Glasgow and we’re excited to see how the Doritos partnership with Burger King performs,” said Chris Hewitt, impulse trading director at UWS.

Mike Chapman, head of wholesale at PepsiCo, added: “Innovation is key in driving growth within savoury snacks. As a leader in the category, PepsiCo continues to respond to consumer trends with a robust pipeline of innovative NPD. A large part of our success can be attributed to our continued commitment to providing smarter snacking choices, which don’t compromise on taste.”

The new non-HFSS Flame-Grilled Whopper Doritos is PepsiCo’s newest launch and adds to the overall Doritos product range, which grew by 13.7% in terms of value sales growth, while the sharing formats grew by 8.9% in terms of value sales growth1

The product aims to tap into Gen Z demand for new and bold

flavours, and is available in a variety of formats to cater to consumer needs, including RRP price-marked packs (RRP PMPs).

“RRP PMPs offer the reassurance of value to shoppers, which in turn creates confidence in local retailers and how they price their products,” Chapman explained.

PepsiCo was supporting the launch at UWS through a neverbefore-seen level of display and features. “PepsiCo has [previously] had a long-standing relationship with Unitas members, such as UWS, and we’re delighted to have collaborated with design agency Display UK to activate one of our biggest-ever displays in the channel.”

Chapman continues: “This is the first time that we have done something on this scale and activations like this will help to make our new products a success, driving strong category growth. Collaboration is key to us and this activation will ensure that retailers can take advantage from the outset and increase their sales.”

Hewitt added that it was great to see the activation come to life. “We’re always more than happy to work with the PepsiCo team here at UWS. It’s partnerships like these that really help our retailers to stay on top of innovations and trends in the savoury snacks category,” he said.

Projects such as this demonstrate how PepsiCo is continually keeping consumers’ needs in mind. Not only does the new flavour tap into consumer demand for smarter snacking choices, but it also delivers on the promise of bold flavours.

4 WORKING TOGETHER PROJECT

Working Together

Mike Chapman Head of wholesale, PepsiCo

“The wholesale channel is very important to PepsiCo. We are always looking to offer advice and guidance, while working in partnership with wholesalers, so that we can best support them. Our latest in-depot activation is a good example of us working with wholesalers to drive excitement.”

WHOLESALER VIEWPOINT

“Doritos products already perform really well here at United Wholesale (Scotland), and the Flame-Grilled Whopper Doritos brings innovation and excitement to the category. The activation will not only help to create a big buzz in depot, but will also help to increase sales further.”

CATEGORY STATS

• The savoury snacking category is now worth £3.8bn1.

• Doritos is the number-one tortilla-chip brand in the UK2.

• The Doritos product range grew value sales by 13.7% for the year to date1

• The Doritos product range within the sharing format grew value sales by 8.9% year to date1.

To watch a video from PepsiCo’s visit to United Wholesale (Scotland), please head to betterwholesaling.com/working-together-project-pepsico

5

Chris Hewitt

Impulse trading director, UWS

In partnership with

SUPPLIER VIEWPOINT

1NielsenIQ ‘Total Savoury Salty Snacks’ for the 52-week ending 29.04.23 compared with the previous 52-week period ending 30.04.22, 2 Nielsen Scantrack Share of TC August 2022 MAT

Is data the new gold? No, it is not. It is old gold that has been deep buried in wholesalers’ systems for years. It is the extraction and exploitation of the data that is new. This issue of Better Wholesaling Insight is a veritable feast of all things data and digital. A subject gaining in importance and column inches across our industry. This is why data companies such as b2b.store, TWC and Circana want to collaborate with you. To help unlock the power of your data. Wholesale is a simple business. You buy at one price, sell at another and make a turn in the process. Keep the costs tight and profits will flow. Let’s not complicate it. What gives with all this data stuff?

Here is a data story. In 2002, Oakland Athletics was an under-performing baseball team in the American League West. A small-town outfit on a limited budget. General manager Billy Beane was becoming increasingly frustrated with player recruitment. He was never able to attract even half-decent players in the recruitment draft and so perpetu-

ating the culture of loss and mediocrity. Beane knew that he somehow had to break out of this cycle of failure. His panel of senior scouts using their best judgment was not coming up with the right player picks. By chance he met Peter Brand, a Yale economics student, and a mad keen baseball aficionado. Brand’s deep knowledge of the game had prompted him to devise a statistical data model to identify player performance and value. He called this “Sabermetrics” and, after many attempts, Brand convinced Beane to adopt his method for player evaluation. Beane and Brand identified and signed undervalued players and after a poor start to the season, Oakland went on a surge to win the league against all odds.

This quickly came to the attention of John W Henry, the owner of the major league baseball team in Boston, the Red Sox. He adopted the Sabermetrics system and, in 2004, Boston won the Baseball World Series for the first time since 1918. It just so happens that John W Henry led the Fenway Sports Group (FSG), and when they bought English Premier League football club Liverpool in 2010, Henry immediately introduced the data-driven approach to player evaluation at the club.

Football is a simple game. All you need is a ball and a couple of objects to define the goals. The game can be played anywhere and the team scoring the most goals wins. This is its universal appeal. No need to complicate it. Goals are the only statistics that matter right? Yes, and no. Under FSG’s ownership, Liverpool FC has taken the lead on a

digital approach to player acquisition, performance and game time. This gives the coaches serious competitive advantage. For example, those little black vests you see the footballers wearing contain GPS trackers so that coaches can analyse the movement of players throughout the game. Liverpool employs a data scientist and large data team, which has contributed to an upturn in success over the past five years.

Unsurprisingly, all Premier League clubs now employ data teams. They are regarded as an essential part of the management team.

So, what does give with all this data stuff? Elite sport is a multibillion-dollar industry where small margins make a significant difference. Results are all and everything. Simply put, data = information = knowledge = insight = performance. As EY online reports, many businesses consider data to be central and core. Data benefits business – from providing real-time intelligence that empowers private businesses to

6 REPORT

I would argue that delivering high volumes of low-value bulky products is not as profitable as supplying lower volumes but higher-value and physically smaller items

Gilroy’s viewpoint: Is data the new gold?

Times they are a-changing and there is now a role for it in the sector

David Gilroy is the managing director of Store Excel

make better commercial and strategic decisions, to ensuring they run their operations more efficiently, and it doesn’t stop there.

Data also enables organisations to analyse past performance and make insightful predictions about future trends. Take German e-commerce retailer Otto, for example – when it looked for ways to reduce their volumes of product returns and unsold inventory, it used a combination of artificial intelligence and analytics to analyse historical transactions so they could more accurately predict future orders and automatically determine procurement needs from vendors. The outcome? Products were delivered faster, returns were reduced by over two million items a year, and surplus stock declined by a fifth. A massive uplift of financial return on activity.

In wholesale, it is accepted that it is more fruitful to focus on retaining existing customers rather than going hunting for new ones. Yet wholesalers continue to invest in salespeople who tend to

morph into quasi account managers and glorified order-takers. What if some of that resource was diverted to employing a Peter Brand-style customer file data analysist? Taking a digital approach and deep dive into the customer records. So, who are the most valuable customers and how is ‘valuable’ defined? Most certainly, wholesalers know their top 100 or top 10% of customers by turnover. But do they know their top customers by profit or net contribution, and if delivered to, do they know the net profitability by customer?

I would argue that delivering high volumes of low-value bulky products such as bottled water or toilet rolls is not as profitable as supplying lower volumes, but higher-value and physically smaller items, such as toiletries or cleaners. The mix of sales is a key dynamic in a delivered operation. The data analyst would identify those customers under-indexing across the profitable categories prompting the business to take action to broaden purchasing into those

sectors. The business may also need to put in order riders to mitigate against unprofitable activity.

And what is revealed if the customer file is sorted by order frequency? Clearly this will vary by customer type, but if the customer is, say, a retailer and not shopping at least weekly – they are not using you as a primary destination. Taking that a stage further, how is ‘primary’ defined? Some drilling down beneath the surface may reveal that while the customer numbers are holding up, there is attrition in the frequency of purchase. It may also discover a trend of reducing transaction values and an erosion in product mix, leading to lower margins.

Looking at trends and patterns, the data analyst will identify those customers who are gradually spending less either on frequency or value. Those customers are likely to be heading for the door: lapsed or lost. Management can step in to initiate corrective action before it is too late. And the converse to this is true in that the analysis will identify those opportunity customers who are on an upward trend and may welcome a management intervention to help them grow sales in a given category and incentives to broaden their purchases. A nudge upwards will get them into the top tier.

There is also the analysis of what the customers are purchasing. Are they buying across the range, the best products for their business, or focusing on single or limited categories? Do they simply purchase promotions, and how do they respond to your outbound marketing? Which marketing channels are working the best? Brochures, flyers, emails, WhatsApp etc. The insight in these areas will guide management to hone their marketing activity and customer engagement.

We all understand the importance of relationships in our industry. Billy Beane at Oakland was conflicted between his intuitive feel and what the data was telling him. As a leader, he had to overcome pushback from his senior scout panel and to find a balance. He came to realise that data works alongside knowledge and experience, and so it is with wholesale. There will never be a substitute for symbiotic business-to-business relationships, but data offers real insights and does significantly contribute to success. l

7

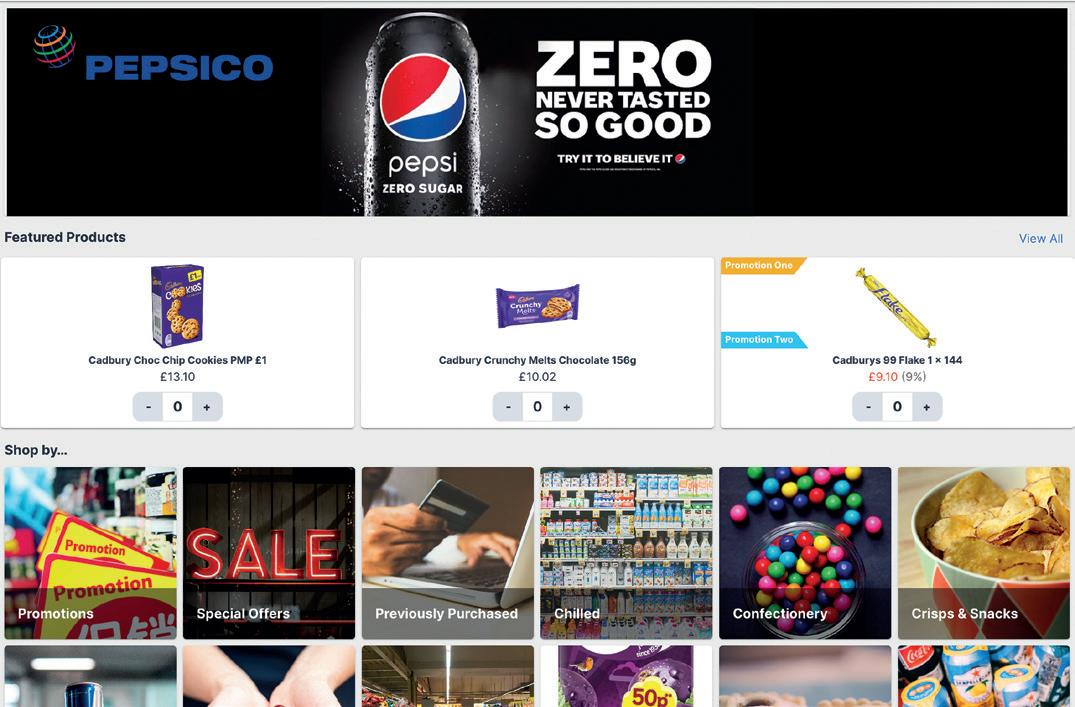

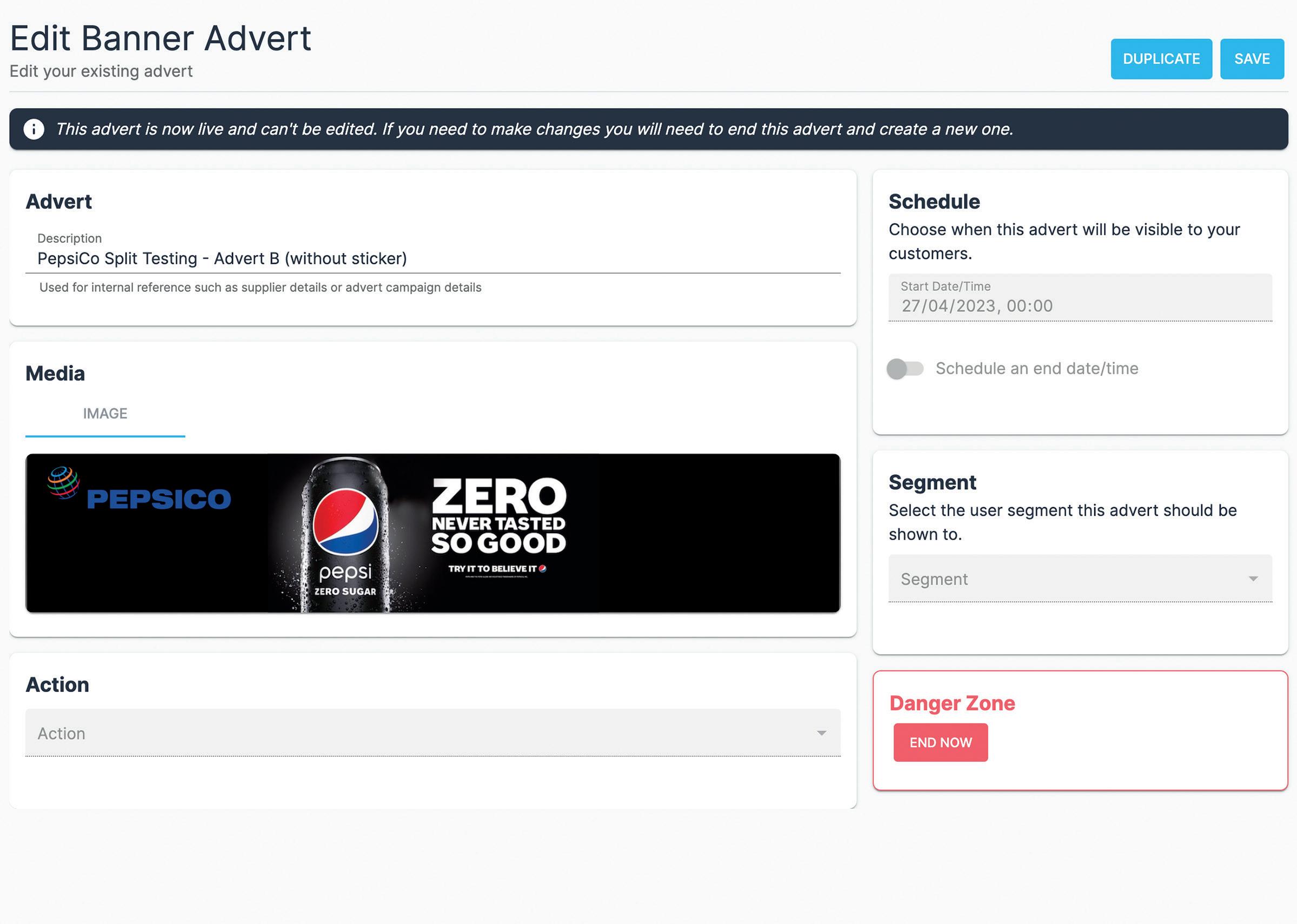

Viewpoint – Don’t be split on digital testing, wholesalers need to do it

Rob Mannion is the chief executive of b2b.store

The world relies on feedback to improve things. Whether it’s the cars we drive, the jobs we do or simply the meals we cook, we can never truly make things better without somebody – or something –showing us how to polish up the bits that could be refined.

So, it makes sense that we should all be doing that with our e-commerce and digital marketing, too, right? Especially since there’s a way to do it that doesn’t include someone telling us their subjective opinion.

The surprising thing is that gathering this sort of feedback through split testing (or A/B testing, as it’s sometimes called) isn’t that common in wholesale circles. While the multiples and a couple of the bigger players in this industry have been doing it for years, a lot of businesses haven’t seriously considered it in the B2B space.

The premise of split testing is simple: we want to know what

works best to sell more products.

The most accurate way to find that out is to pick a variable that features during a customer’s purchasing journey – be that a digital advert, call to action, product image or description – and testing two different approaches simultaneously to see which gets the most engagement.

Customers are split at random, with 50% seeing the original version and the other 50% the changed one – it’s an approach that creates a level playing field to see what hits with customers best. Previously, metrics such as comparing against the same week as the year before or similar times on a day of the week were used to do this, but that doesn’t account for a whole manner of other external factors.

There’s also no limit to the number of tests you can run, so it’s possible to iterate and iterate again to get a real insight into what is working best for any given audience. The numbers will always have the answer.

A STEP-BY-STEP GUIDE TO SPLIT TESTING

1. Upload what you want to test

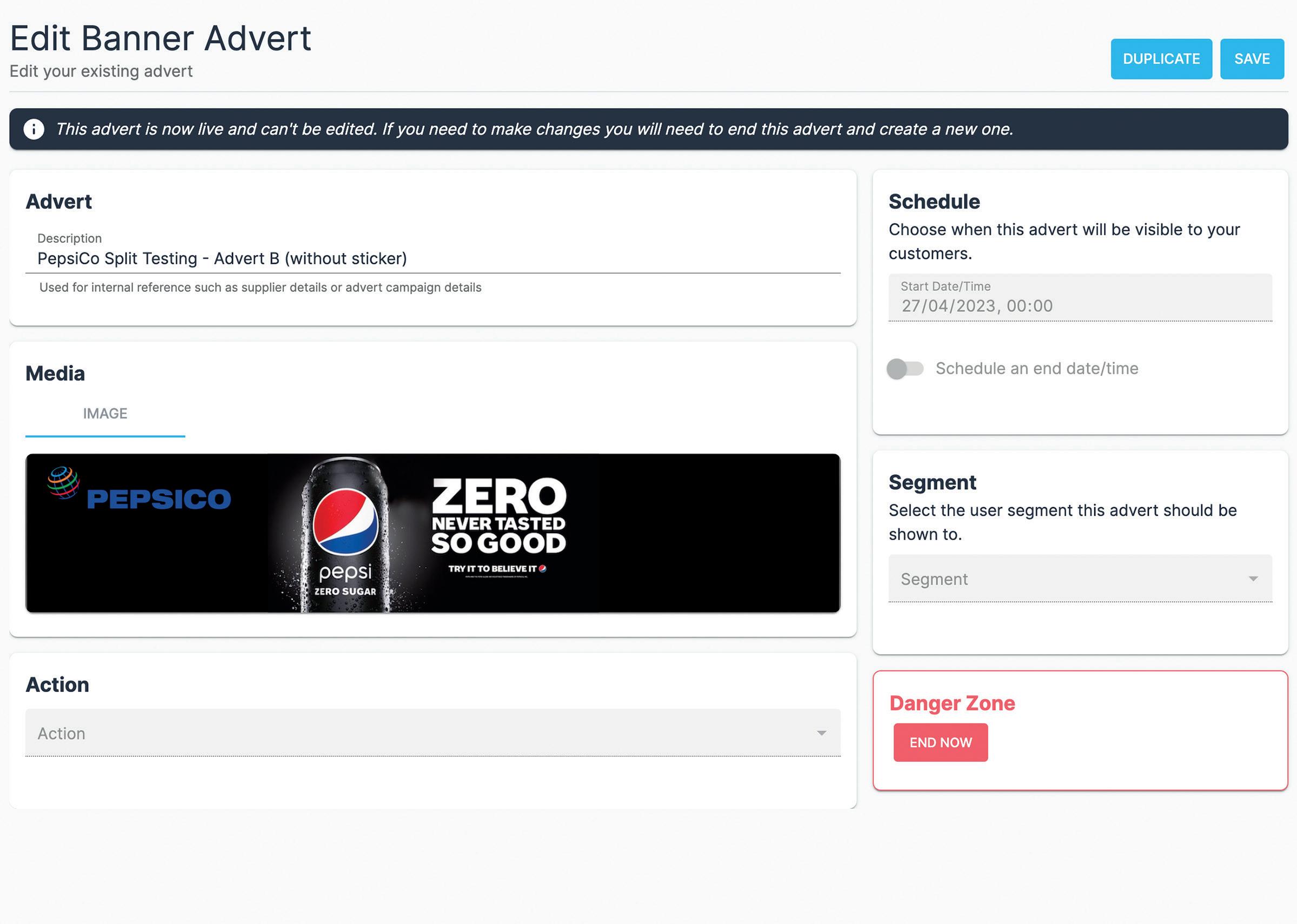

It’s possible to test any e-commerce variable, whether it’s an advert, product image or copy description. In this example, we’re testing a banner advert to find out if the ‘click here for more’ button is more effective than an advert without one. To start, we upload the two adverts to the e-commerce destination we’ve chosen to test before assigning the segments we want them to be shown to.

2. Run the test

Once both adverts are uploaded and assigned to customer segments, they will appear on an e-commerce platform at the same time – half of the visitors to the site will see the advert with the ‘click here for more’ button, the other half won’t.

3. See which version performs best

The split test will remain active for as long as you wish, with instant results appearing in the b2b.store dashboard. If one of the options is more effective than the other, the results will reflect that with greater interaction for the most popular.

4. Keep testing

Split tests can be run again and again to test results and to continually refine adverts, images and copy on an e-commerce platform to ensure products are always displayed to their maximum potential.

8 REPORT

*

For the past 18 months, we’ve been working with suppliers to split test the advertising activity they’re doing on wholesalers’ online-ordering channels. And this year we’ve extended the functionality we offer through our B2B Digital Advertising module to include all the other variables, such as image testing, too.

A great example of this was a project we worked on last year to test the phraseology of the digital adverts they were placing in wholesalers’ platforms. They created one advert that used lingo that’s familiar to the retail community – things such as POR and RRP – and one advert that used language aimed at the layperson, then measured conversions to see which worked most effectively.

Sugro (see page 30) has also recently adopted our split testing capability and is working with PepsiCo to test assets through its group-wide e-commerce platforms. The early tests they’ve worked on have been focused on product images, with the ability to toggle backgrounds, the type of image shared (for example, the product image or the box we see in depots) and adding call-toactions to images.

All of the results are automatically gathered in our dashboard, providing instant insight while the test is still live. It’s really powerful.

As more and more revenue is generated through wholesaler e-commerce platforms, the need for split testing is growing. Spend

VIEWPOINT

Yulia Petitt Head of commercial and marketing, Sugro

“Selling products using e-commerce is now a key part of any top-performing wholesaler’s business, so any means to find out what works best online is welcome. The insight we’re receiving from running the split tests will be incredibly valuable for our wholesalers, with the results mutually beneficial for our members, suppliers and Sugro as the buying group.

“Once we’ve run several tests on different variables, we’ll have a much clearer idea of e-commerce best practice and be able to make changes that will result in selling more products in the future.”

and resource are two commodities that are always in short supply, so making sure you’re getting the maximum return on your investment is really

important.

We all need feedback to help us improve our performance. Well, except if someone tries to comment on my cooking. l

10 REPORT

Please check out the link found at this code for a video on split testing

Please note these are PepsiCo examples and not actual run tests

STOCK UP NOW RAISING THE BAR ON FLAVOUR OVER 18 ONLY THAT’S UNLIT For more information visit our blu bar Knowledge Hub. www.blubarhub.co.uk FOR EXISTING ADULT SMOKERS & VAPERS ONLY. This product contains nicotine. 18+ only. Not a smoking cessation product. © Fontem 2023.

What benefits does a good ERP system bring to wholesale?

Mathew Simpson is the sales manager UK & Ireland at CSB-System Benelux BV

The essence of wholesaling is stock management – and a key part of the service offered by any wholesaler or foodservice business is availability of stock at short notice and in small enough volume to satisfy customer requirements.

In a sense, holding the stock is the service. But as any accountant will tell you, stock is dead money, tied up capital that is to be kept to an absolute minimum.

How do you balance those competing imperatives when you have thousands of sales items and

hundreds of customers?

This is what the wholesale and foodservice businesses have to do every day.

ERP systems can help in many ways – perhaps most obviously by digitalising picking operations. Through the display of customer or route picking items on handheld mobile scanners – and by using these scanners to confirm what has been picked by a quick scan of the barcode label – picking operations can be made faster and more ergonomic while also radically reducing error rates. Moreover, accurate real-time stock records are available to the sales, planning

and purchasing departments.

Furthermore, as customers can be assigned to routes in the ERP software, it is very easy to pick per route, which means there is no need for a secondary collation or pick of the customer ready orders into a route-ready consignment. For example, one of our customers, Robinson Meats, based in Dublin, makes use of both electronic mobile picking and route management to make their picking smart and efficient.

In Germany, food wholesaler FRIPA uses the CSB web shop to take customer orders. As the web shop is effectively a front end to

the ERP system, it is possible to directly display stock and product information without the need for costly interfaces or manual updates. This practically eliminates errors in order processing, and further improves visibility for sales and purchasing departments, who can easily see what is on order and what is going short.

FRIPA also uses a “pick-byvoice” application in its cold stores, allowing pickers to keep their gloves on and maintain concentration in this hostile environment. This technology reads out the pick to the operative, who scans upon picking to confirm

12 REPORT

definitively what has been taken. Another example is Norfisk Wismar in Germany, part of the Polish Suempol salmon processing business, which is responsible for sales and logistics for Germany, Austria, Switzerland and the Czech Republic. Handling 40,000 pallets a year, Norfisk is able to capitalise on the real-time stock visibility and interrogate past sales order patterns to take a look into the future and predict sales vol-

umes and purchasing requirements in the weeks ahead.

According to managing director Günter Rees: “In the past, we had a stock buffer of 30%-40%, but we have reduced the buffer to 5%.

“Thanks to the CSB-System, 90% of the products are just-in-time goods that were produced no more than 24 hours ago.” This means that the right items can be put into stock in the right volumes. l

NORFISK

• Solution overview – procurement, inventory, coverage planning, sales, traceability, EDI, CRM, financial accounting, mobile ERP

BENEFITS

• All material flows up to the Polish parent company Suempol are portrayed electronically

• Mobile picking with scanners minimises picking errors

• Differentiated purchasing planning reduces stock buffers by 30%

• Full traceability across several countries

ROBINSON MEATS

• Solution overview – CSB-Factory-ERP with modules: sales, procurement, inventory, production, traceability, quality management, mobile ERP

BENEFITS

• Electronic sales order processing

• Mobile paperless picking and picking to route

• Traceability and integrated QC checks

FRIPA

• Solution overview – procurement, inventory, sales, coverage planning, accounting and finance, DMS, asset accounting, payroll, EDI, quality management, mobile ERP, route management

BENEFITS

• Pick by scan and pick by voice ensure fast and error-free picking processes

• Efficient order processing from order entry to delivery

• Integration of online shop and ERP system enables automatic availability checks

13

Interview

Paul Hill speaks to Steph Johnstone, head of buying and purchasing at The Cress Company

BWI: Talk us through the history of the business

SJ: The company started in 2004 from a small lock-up in Perth, Scotland, with a handful of artisan producers looking for local distribution.

Since then, the business has grown significantly, and we now deliver thousands of ambient and chilled stock and preorder lines nationwide from our warehouse and distribution depots in Dunfermline, Telford, Leighton Buzzard, Maltby and our newly opened depot in Bristol.

What is your role?

I am responsible for overseeing the buying and purchasing departments. My team are responsible for sourcing new products, creating our ambient, chilled and seasonal brochures, as well as all stock ordering and management.

What products do you trade in and who to?

We have around 3,500 ambient SKUs across various categories

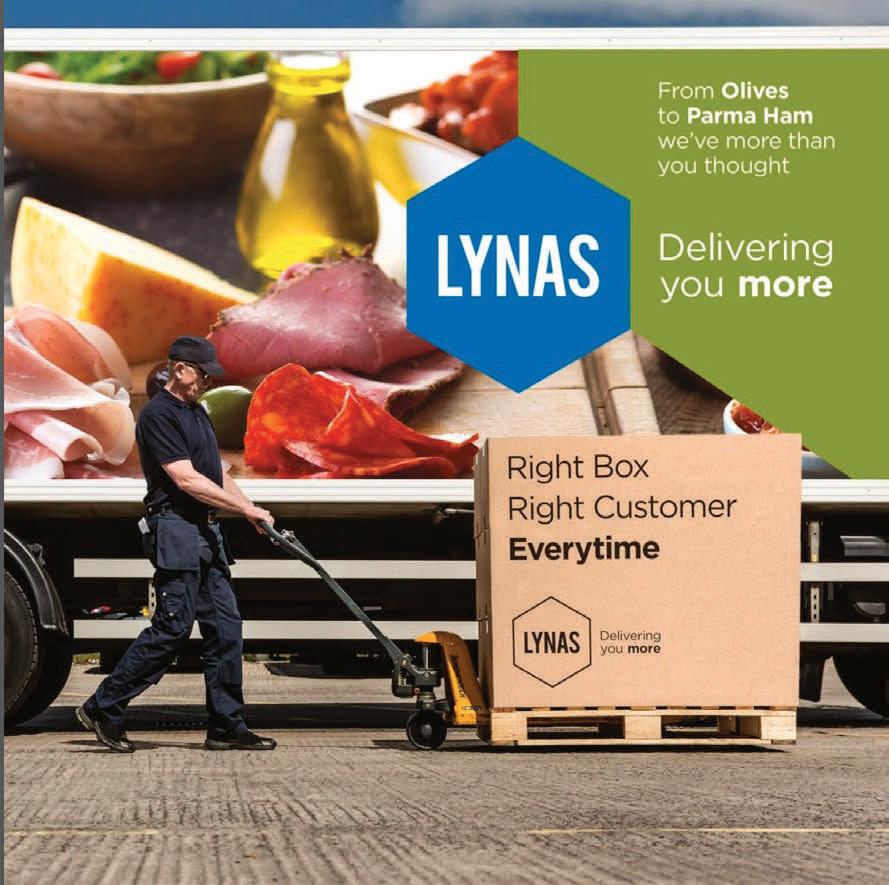

– bakery, soft drinks, snacks, confectionery, larder, alcohol and seasonal gifts, as well as chilled ranges across meats, seafood, pizza, desserts, olives, cheese and counter. We have around 3,000 active customers on our database at the moment, and they include farm shops, delis, garden centres, butchers, hotels and cafés all over the UK. This figure has doubled in size since the end of 2019.

What gives Cress its USP?

Our service promise – at Cress, we aim to deliver high-quality fine foods to our customers on time, every time, and we pride

ourselves in our excellent stock availability. Customer service is our speciality and everyone who works at Cress is focused on delivering a friendly, helpful and efficient service, looking after our customers every step of the way. All our key services are kept in house for better visibility and control. We know our customers and understand they are busy. Our specialist teams in customer service, finance, buying and purchasing, transport and warehousing, work closely to ensure the smooth operation and running of the business.

What are your growth plans for the year ahead?

We have recently opened our new depot in Bristol, which will enable us to expand and grow our reach into the south-west as well as Wales.

Has there been any streamlining of your product portfolio?

We saw a shift in customer demand during the pandemic as everyone adapted to being at home. The increased demand for home-cooking essentials and store cupboard basics became apparent, so we have adapted in line with this. Our ranges will

14 REPORT

Steph Johnstone

change in line with trends and ever-changing customer requirements due to the diverse mix of retailers we service.

What is the overarching fiveto-10-year strategy for the business? How will the business differ then from what it looks like now, and what will it look like in terms of size, compared with today?

To be the leading delivered wholesaler within the speciality retail trade across the UK, continuing to offer excellent service and ranges to these customers.

I would expect to see a growth of our customer base, particularly in the south-west, given the opening of our new depot, but otherwise we experienced significant growth as a company over the past couple of years, so I wouldn’t anticipate a huge change within the business itself.

As we continue to grow, we will always continue to adapt as necessary, but our service promise remains at the forefront.

What is the biggest challenge the business faces?

There are a number of challenges at the moment in relation to

supply shortages and delays, ingredient issues and packaging challenges, and pricing doesn’t seem to be showing many signs of stabilising as yet, either.

What is the best thing about working at Cress?

Everyone is invested in the company and the values. We are a relatively small team, given the size of the operation, and each department works closely with each other to ensure we provide the best service possible on all levels.

What work has the company done to improve its environmental footprint?

We manage all of our own transport in house, which enables us to maximise vehicle space for moving goods around the country, which not only improves efficiencies within the business, but also helps to reduce our CO2 output.

We also ensure there are adequate recycling facilities within the workplace across the office space as well as within the distribution centre.

On top of this, we facilitate the use of reusable crates for supplier deliveries as much as possible and

all chilled deliveries are sent out to customers in recyclable crates.

How do you ensure that the business has a strong gender balance, and is attracting the workforce of tomorrow?

Cress will always ensure that there are equal opportunities for all individuals in the workplace. Everyone will be able to

access and enjoy equal rewards, resources and opportunities regardless of gender.

This is evident across the different departments within the business, inclusive of senior management, and I would hope that this would encourage a diverse range of applicants for any future positions that may arise within the business. l

15

Jon Shayler

The UK wholesale industry has been consolidating over the past few years because it’s had to. During, and post, Covid-19, changes in consumer behaviour and regulatory pressures among other things have changed the sector’s landscape, necessitating technological advancements and triggering a drive to achieve greater efficiency.

And this phase of consolidation within UK food wholesale shows no sign of ending or slowing down in 2023. If anything, it feels like it's gained pace.

As a data platform used by much of the country’s foodservice industry, at Erudus we’re seeing this appetite for technological advancements and drive for efficiency reflected in the needs and wants of our wholesale customers. It’s evident these are the two areas most wholesalers are making moves in, and in particular, we’re seeing a fast-growing requirement for data portability and interoperability.

So, what does this mean?

Well, due to the growth of e-commerce and increased use of digital technologies across the board, wholesalers are facing the challenge of manually collating, managing and distributing vast amounts of product information across multiple systems and channels. This includes online marketplaces and their own internal systems, such as product information management (PIM) solutions, and many more.

For example, deploying a new mobile-ordering platform or e-commerce website would require a wholesaler to manually key in the product information for every product they sell, then overlay that product information with product images, pricing information and stock levels for hundreds, if not thousands, of products. It would be a laborious, timeconsuming task fraught with potential keying errors.

Alternatively, the wholesaler could

stitch together several Excel or CSV data extracts and import the data into the new e-commerce platform. But while overcoming the issues associated with manual keying, a data import introduces its own challenges, including incorrect mapping of attributes between systems, questions about which unique identifiers to use, and the quality of the data.

At Erudus, what’s become crystal clear to us is that wholesalers must be able to manage their product data efficiently to keep up in a fast-paced and rapidly evolving industry, and that’s why, over the past few years, we’ve made it a priority to be able to provide them with the technology to do just that.

By ensuring product data is portable and interoperable, wholesalers can automate many of their processes. Automation allows them to quickly move vast amounts of product data while eliminating manual data entry

16 REPORT

By ensuring product data is portable and interoperable, wholesalers can automate many of their processes

Viewpoint – As the industry evolves, interoperability becomes a necessity

Jon Shayler is the chief executive of Erudus

and thus mitigating the risk of keying errors. This can save time, reduce costs and improve productivity for the business.

Of course, data portability and interoperability doesn’t end at the wholesaler’s own systems and channels – we’re seeing a growing requirement from wholesalers’ customers, too.

These customers have also turned to digital technologies to drive efficiencies in their businesses, and what they’re now asking from their wholesaler is to provide product information directly into the systems they choose

to employ.

Like the wholesalers themselves, their customers are asking this in order to save time, reduce costs and improve productivity.

As the industry continues to evolve, data portability and interoperability will become increasingly important. Most of those in the wholesale industry are already aware of this.

The next step is understanding that for any wholesalers who want to stay ahead of the curve, it’s essential not only to accept these changes, but to embrace them. l

THE BENEFITS ERUDUS BRINGS TO A WHOLESALE COMPANY

• Streamlines your business

• Allows you to use your own product codes

• Creates readable reports

• The ability to know product credentials

• Easy access to product images

• Communicate essential information to customers

ERUDUS OFFERS THE FOLLOWING INFORMATION

TO WHOLESALERS

• General product details

• Component names and codes

• Inner pack information

• Outer case information

• Pallet data

• Logistical information

• Handling instructions

• 14 major food allergens

• Artificial additives

• Dietary advice

• Ingredients

• Nutritional information

• Inner, outer and transport waste packaging

• Accreditations

• Product origin

• Trend analysis

• Shelf life

17

Wholesaler Spotlight: Lomond – The Wholesale Food Co

Paul Hill caught up with director Barbara Henderson at the company’s headquarters in Glasgow

BWI: Talk us through the history and formation of the business

BH: Formed in 1997, we are a foodservice wholesaler delivering ambient, chilled and frozen goods all over Scotland, providing a wide range of high-quality products for all types of caterers.

Taking great pride in being a Scotland-based company, we source many products from local producers and businesses, giving us the freshest produce possible.

We moved to our current headquarters in 2015, and it was then we devised a five-year growth plan, including the aim of acquiring another company, which we did in 2015 with the purchase of Hall’s Direct.

This allowed us to bring together both companies’ existing customer bases and for us to diversify into the retail sector.

This means our customer base

now ranges from education, garden centres, hotels and restaurants, to food-to-go outlets, NHS hospitals and convenience stores.

We serve around 2,500 customers in total and target any outlet where food is served.

What are your growth plans?

The lowest our customer base went down to during the lockdowns was 45% and then back up to 75% after four months. This is because we benefited from our local sourcing offering that not all our competitors could do.

Cut to December 2022, and our turnover was £29m, and we’re on track to do £34-35m by the end of this year.

We’re also getting to the point where we’ve outgrown out current depot and running out of space. This is why we’ve now got planning permission to extend it further and begin a new five-year plan where we plan to double our storage capabilities, and turnover.

We think we’ll be capable of putting £70-75m through this site once it’s been extended. Building work has gone out to tender and

we hope for it to start by June 2023, and realistically we’re aiming for it to be complete in the first quarter of next year.

What are the latest developments at Lomond?

Earlier this year, we launched a sustainability advice product brochure where we offered serving suggestions to make the most of surplus food and leftovers.

The brochure reflects our focus on reducing food miles and it allows customers looking to stock Scottish produce to easily identify

18 REPORT

Barbara Henderson

them in the brochure with a dedicated icon.

Our commitment to being green was reflected in our award for Green Wholesaler of the Year at the 2023 Scottish Wholesale Association Achiever Awards.

In October last year, we also launched our own-label cooked meats range following demand from our customers for locally sourced, top-quality products.

The new range replaced our previous supplier, took half a year to create and reflects our strategy to deliver top-quality locally sourced products.

Furthermore, we achieved record levels of attendance at our first person-to-person trade show since the onset of the pandemic last year. It was held across two marquees at our Glasgow depot with a dedicated area of the show for locally sourced products – something that we are very

passionate about. This year, we are taking it one step further and holding it in the Glasgow SEC in May 2023.

Lastly, we were honoured to be approached by Compass Scotland to produce a locally sourced, low-carbon, sustainable menu for the United Nations Climate Change Conference (COP26), which took place at the SEC in Glasgow in 2021.

The menu required 80% of the products provided, and their ingredients, to be Scottish, with the potential for the remaining 15% to be provided from the wider UK and 5% from the rest of the world. To meet the requirements for the menu, we sourced more than 300 products from more than 60 Scottish suppliers.

To meet the menu criteria, many of the products had to be developed from scratch, a process that took months. l

19

E-commerce spotlight

Paul Hill tracks the e-commerce transformation of KCS following its partnership with b2b.store

The line ‘build it and they will come’ has caused plenty of businesses a headache as they try to get the most out of their investments. The idea and implementation may be sound, but that doesn’t guarantee custom.

It’s a challenge many wholesalers have faced when they set up their online-ordering platform, as they try to convert bricks-andmortar success into the digital world. Build it and they will come? Not necessarily.

That potential pitfall was one KCS co-founder Chander Singh was aware of when he launched his business’s new e-commerce platform with b2b.store last year.

It promised a digital future for the wholesaler, but without a dedicated focus on getting customers to buy in to online ordering, the platform could become a white elephant.

Inspired by that prospect,

Chander sprung into action.

“Within four months of launching our e-commerce platform, online represented about 15% of our overall turnover and we’d got 38% customer adoption,” Chander explains.

“We are still evolving and want to get in touch with more and more new customers to show them ‘this is how it works’. We’ve created a video that I send to customers that shows an idea of how efficient and how quickly you can place an order, and we include the link to our store in our email signatures.”

The hard work started as soon

as the platform launched. It seems simple to point out, but awareness was key to getting customers online – after all, if they didn’t know KCS offered e-commerce, they wouldn’t be able to use it. Chander realised this wouldn’t just be a single hit followed by a host of customer registrations, the communication needed to act as a regular reminder, just as an effective advertising campaign would do.

As part of the message, Chander didn’t just want to tell customers that online ordering existed, but how it works and why they should

be using it. He also devised a series of online-exclusive incentives to convert awareness into registrations.

“We use WhatsApp to share weekly offers with our customers and it gets good traffic – when customers see the offers, they register for the portal,” says Chander. “You can see 60% of our online customers are there by recommendation, which we’ve achieved by asking our customers to suggest the links to any service or promotion we’re offering to people in their networks and asking them to place an order with us.”

Despite achieving some impressive numbers in the early months since adoption, the quest for online sign-ups is always ongoing.

Driving customers to an online store is one thing, but making sure they return is a different ball game entirely. The b2b.store platform is said to provide the

20 REPORT

Chander Singh Co-founder and director, KCS

Kiran Singh Co-founder and director, KCS

We made all out-of-stock items invisible based on customer feedback and saw a 5-8% increase in order values as a result

tools and functionality to run a revenue-driving e-commerce channel, but a wholesaler has to take a certain level of responsibility to make the most of some of the add-ons and get best results.

Chander and his business partner Kiran’s previous experience of running a company in a different sector meant they were familiar with operating a successful online business, so they applied some of those learnings to KCS, too.

VIEWPOINT

Rob Mannion Chief executive, b2b.store

“A successful e-commerce platform isn’t about simply switching it on and watching the orders fly in, there’s work to be done to take it from a small revenue driver to something that can really transform a wholesaler’s business. The KCS story is a great example of seeing the launch of their site as the first step of a long journey where a little-and-often approach can garner big results.”

“The success we’ve had comes down to how we’ve done the graphics and executed categories on our b2b.store, as well as the overall app format,” Chander explains. “From our previous experience, we knew it was important for graphics to be clear and attractive, with each listing having a product image as part of the description. We also have more than 50 categories, making it easier for customers to find what they want.

“We’ve taken inspiration from a few other wholesale e-commerce websites, with Bestway standing out. We noted how others did their CV (computer vision) classification, tried to implement ideas we had into KCS, mapped out all our products and laid down all the categories and sub-categories. We built it to the requirements we needed.” Ideas for development don’t just come internally, though, with customer feedback forming a key part of KCS’s online strategy. There’s no time to switch off, and constantly checking – and asking – for improvements is helping the Hayes-based wholesaler continually move forward.

“We’re constantly testing the

app extensively, so if I put something in a category, I’ll constantly be checking it, even late at night. If I see something and say, ‘OK, this product shouldn’t be there,’ in the morning I’ll change it,” Chander continues.

“We work really hard on our e-commerce to check where things belong and take some feedback from our top five customers to help support us. We get some ideas from them and implement them on the b2b.store. As an example, we

made all out-of-stock items invisible based on customer feedback and saw a 5-8% increase in order values as a result.

“The next part of our development will be to launch a website with good SEO that will link directly to our e-commerce. I’ve seen big brands such as Hollister, Asos and Asda do this pretty much day in, day out, so I’ll take some ideas from them and try to implement that into what we’re doing at KCS.” l

21

Five ways wholesalers have used technology and data to build profits

Smith is a journalist with experience writing for the UK's grocery and foodservice wholesale industry

1. Delivering an outcome-based customer experience and competing on customer experience, rather than price

Wholesalers are using technology to present tailored business proposals that ensure customers feel cared for and see them as essential partners. In retail, wholesalers are analysing individual stores’ data to evaluate sales by SKU and provide an accurate picture of their overall performance. From there, they can identify category trends in each store against the picture across the estate and offer retailers tailored recommendations reflecting their demographics and suggesting optimum ranges to drive sales and profitability, and maximise the performance of the available space. Wholesalers’ tech teams are also using the data to ensure their apps and website order platforms provide a personalised online shopping experience giving access to the best products to maximise the opportunities, and promotional pricing to support margins. Finally, wholesalers are analysing customers’ buying behaviour and implementing CRM strategies that reduce friction in the buying process, so customers feel more supported.

2. Digitising core businesses and bringing together business processes and analytics in real-time to drive smarter and faster trading decisions

Wholesalers are using the available technology to leverage the data and identify opportunities for improvement, spot trends and recognise potential issues, and act promptly. A major benefit of digitising businesses and monitoring processes, including warehouse management systems, is that wholesalers can hold appropriate inventory in the right places around their depot network to improve availability across the range, while making better use of warehouse space and improving order fulfilment.

Customers can be confident wholesalers will provide what they need when they need it. Bringing together business processes and analytics in real-time enables wholesalers to monitor sales performance across categories, SKUs, suppliers and locations, and make smarter buying decisions. The tech also enables wholesalers to work closely with suppliers, sharing key sales data to help suppliers design pricing and promotional structures that provide the highest levels of value for customers, while delivering sales volume and profitability for the suppliers.

22 REPORT

Charles Smith

Charles

3. Supporting a more informed and engaged workforce

Wholesalers are keeping their employees informed and engaged by streamlining systems and processes, and giving them digital access to relevant data. They are using live data to feed company performance figures into a dashboard available to everyone, providing transparent updates on the overall business and different sites. Updates on developments affecting team members are posted on dedicated screens in breakout rooms and rest areas, supported by company-wide Teams meetings. For team members who aren’t present at the time, these sessions are recorded and made accessible to all.

Dedicated HR web and app portals also allow team members to manage training, holiday bookings and schedules, and other HR-related matters remotely, rather than involving managers directly in this routine admin. For buying groups, streamlining systems and processes includes using tech to reduce member queries and speed rebate payments, allowing staff to spend their time on other more fulfilling activities.

4. Enabling more productive collaboration with suppliers

Wholesale buying groups are feeding their data insight platforms with weekly sales out data across the categories, which can be drilled down to SKU level, giving granular detail on gaps in wholesalers’ ranging. Giving member wholesalers and suppliers this data at group and individual wholesaler level, and enabling them to compare brands, is providing incremental sales gains. Application programming interface integration with suppliers enables buying groups to forecast group demand and maintain depots’ stock levels. Wholesalers are giving suppliers access to web portals with reports on sales data, individual SKU performance, category performance and a wide number of other data sets. They are also designing bespoke reports for individual suppliers to help them understand their performance in the business. In addition to managing stock availability, wholesalers are also giving brand owners critical data insight into merchandising, shrinkage, waste and stock rotation, which can then be turned into actionable planograms.

5. Making effective use of the Internet of Things and big data to drive real-time insights and new business models

Wholesalers are using the Internet of Things and connecting enterprise resource planning systems through the internet to track different KPIs in real-time, from sales and marketing through to order capture, warehouse picking, route planning and returns.

The available tech is enabling wholesalers to measure their cash and carry depots and delivered services’ performance against the competition and the wider market, and make timely adjustments, which is key in a competitive market, to improve these functions and maximise sales day-to-day.

These real-time insights also enable wholesalers and buying groups to refine their services and implement new business models, to further increase customer loyalty through continual optimisation, and wholesalers are seeing the results in improved customer feedback ratings. For further comparative insights, wholesalers can also call on various industry bodies, who can provide wider industry performance data reports to help them set goals for improvement. l

With thanks to: Confex, Pricecheck and Parfetts

Working together during challenging times

At Ferrero, wholesale is a vital part of our business, with data support rooted in how we work with customers in this sector. Given the macro challenges facing the sector, it has never been more important for wholesalers and suppliers to work together to support business growth.

Our research into e-commerce within wholesale shows that while wholesalers are optimistic, most believe it will only grow if there is more industry support. The data collected shows that most wholesalers (85.1%) have seen an increase in online ordering over the past 12 months*

Data transparency is crucial to unlocking online opportunities and can help us see which of our products perform best online, which may differ to what is seen in depot. Working together on joint business plans that incorporate the use of online ordering is key, as it has become an increased way in which retailers and wholesalers are managing orders.

The more information suppliers can gain from wholesalers, the better they can plan and put steps in place to help ensure e-commerce in the channel goes from strength to strength.

23

In partnership with

E-COMMERCE ADVICE COLUMN

* Newtrade Insight| Ferrero: E-commerce within wholesale, based on a survey of 54 UK-based wholesale decision-makers between 26 August and 30 September 2022 Ferrero Advice Column.indd 1 18/05/2023 14:17

Andy Edwards Business unit controller – wholesale, Ferrero

EXPLORING A GROWING CATEGORY

Paul Hill finds out how Coca-Cola Europacific Partners (CCEP) and Costa Coffee are helping wholesalers grow sales in the ready-to-drink (RTD) chilled coffee category

CCEP – together with its brand partners in Great Britain – has always been proactive in supporting the wholesale channel, and recently visited Parfetts’ Stockport depot and Dhamecha’s Hayes site to help the businesses grow their sales of RTD chilled coffee, one of the fastest-growing segments within the soft drinks category1. Costa Coffee RTD is manufactured and distributed by CCEP in GB.

“It’s great to visit our wholesale partners to highlight the RTD chilled coffee opportunity, and to offer advice on what they can do in depot and online to drive sales of the segment and of our growing Costa Coffee RTD range within it,” said Matthew O’Hagan, senior portfolio execution manager at Costa Coffee FMCG.

“We’re always more than happy to work with CCEP and its brands here in Stockport. Activity like this is great for us and our customers,” added Jamie Ferguson, head of marketing at Parfetts.

Costa Coffee’s RTD range is currently outperforming the wider segment – up 61% in value and 48% in volume2 – which presents a huge opportunity to wholesalers. The range includes two core Latte variants, a Double Shot Flat White and two tasty, low-intensity 250ml Frappés for treat occasions – covering all the consumer need states identified in CCEP and Costa Coffee’s RTD Coffee Vision, which is designed to identify and unlock opportunities for growth.

Dhamecha Hayes depot manager Vinod Ramgi (pictured above, left) said: “We have a close working relationship with CCEP and its brands in our Hayes depot. We’re always looking for support on how to

gain the most from emerging, fast-growing segments like RTD chilled coffee and look forward to seeing what this activity delivers.”

As well as supporting wholesalers in leveraging the RTD chilled coffee opportunity in depot, CCEP provides category advice and sales tools to help convenience customers maximise sales in stores, during the summer period and beyond. The ambition is that wholesalers and retailers are aligned on the opportunity.

“It’s not just about selling to the end user. There’s more wholesalers can do to raise awareness of this fast-growing category within soft drinks,” added O’Hagan. “Bringing all RTD chilled coffee brands together in one location in depot will make it easier for retailers to locate. We also recommend increasing space to recognise the strong growth the segment is enjoying and to support availability over the key summer period. These principles carry through to convenience retailers.”

“The insight we have gained from CCEP and Costa Coffee has been really valuable, and we’ll look to implement this into our wider operations while also helping to educate our retailers with what we’ve learnt,” explained Ferguson. Ramgi echoed these thoughts: “It’s been great having Costa Coffee here in Hayes. We’re excited to see how the Costa Coffee portfolio and the wider segment performs moving forward.”

By not just offering advice on specific products and rather championing the entire category, CCEP aims to put its wholesale partners in a fantastic position to be successful in what is a hugely exciting and fast-growing segment.

24 WORKING TOGETHER PROJECT

Working Together

RANGING ADVICE

1. Bring all RTD chilled coffee brands together in one location, making the category easier for retailers to locate in depot.

2. Increase space to recognise the strong growth the segment is enjoying and to support availability over the key summer trading period.

3. ‘Brand block’ for

maximum impact, and ensure all key brands, flavours and consumer need states are catered to.

4. Raise awareness through in-depot point of sale and signage.

5. Replicate in-depot efforts online, with prominent branded content that’s easy to navigate.

SUPPLIER VIEWPOINT

“RTD chilled coffee is already worth a massive £276m and up nearly 20% in value, adding £45.5m over the past year alone3. The segment is also in double-digit volume growth4, demonstrating that more shoppers are buying RTD coffee more often.”

RTD COFFEE PERFORMANCE

• RTD coffee accounts for 2% of soft drinks value sales, but 4% of category value growth5 .

• On-the-go packs have grown over the past year – up 31% (£14.5m)6. Value sales of RTD coffee take-home packs have also grown by 72% (£14.8m) over the past year as people consume more in the home7 .

• Costa Coffee RTD is outperforming the segment by some margin, up 60.7% in value and up 47.8% in volume8 .

• The new, low-intensity 250ml Frappé range launched last summer has generated £2.1m of sales in seven months9 .

1Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 2Nielsen Total GB incl. discounters, MAT vol w/e 31.12.22, 3Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 4Nielsen Total GB incl. discounters, MAT vol w/e 31.12.22, 5Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 6Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 7Nielsen Total GB incl. discounters, MAT val w/e 31.12.22, 8Nielsen Total GB incl. discounters, MAT val and vol w/e 31.12.22, 9Nielsen Total GB incl. discounters

To watch a video from CCEP’s visits to Parfetts and Dhamecha, please head to betterwholesaling.com/working-together-project-ccep

25

Matthew O’Hagan

In partnership with

Senior portfolio execution manager, Costa Coffee FMCG

Far left: Matthew O’Hagan, senior portfolio execution manager, Costa Coffee FMCG. Far right: Jamie Ferguson, head of marketing, Parfetts

BUYING GROUPS

Confex

Adams Foodservice

Latest member

BWI: What has been your most significant achievement over the past 12 months?

JD: Confex has just finished its 50th year of trading, and we’ve had a number of big successes that have marked this anniversary. These include groups sales rising by 26%, as well as the addition of 16 new members. We have also added £654m additional buying power to member collective turnover, which is now over £3bn.

Our own brand, Core, has helped to create a point of difference for the Confex wholesaler and is now a multi-award-winning brand rivalling its biggest foodservice competition in the industry. We are currently growing faster than our competitors, which has been driven by our members embracing technology and diversifying in line with the market.

We have also established a great data-insight programme over the past 24 months, which we see as a huge asset to members and suppliers of the group, and a key part of the strategic growth for all parties involved.

What is your unique selling point?

Confex is not only one of the longeststanding wholesale buying groups, but it is also the best value and most diverse. We work with more than 200 suppliers across all product categories and do not operate joining or membership fees, with head office costs funded by a very competitive levy on rebates.

We are governed by a member-led board with profit sharing according to member support and participation.

£3bn

232 Group buying power

Number of members

We have an extremely experienced and passionate head office team, who are always there to help members grow their businesses and work with members and suppliers in a collaborative and commercial capacity. We welcome new membership, providing they are forward-thinking and sign up to our collaborative group ethos.

What are your plans to help members over the next 12 months?

Our ethos at head office is to always be forward-thinking and looking for new initiatives to help our members and supplier partners thrive.

We are continually implementing new projects to ensure our members can continue to compete with the larger national wholesalers, accessing new income streams and helping to drive member business growth.

Our main focuses for 2023 are continuing to develop our retail and foodservice committees, which include up to 12 members who meet quarterly to discuss business and the buying-group opportunities, while sharing best practice.

Following the success of our trade show in March, we have a foodservice fair in September, and our conference in Lanzarote, in October. Confex events are not only great socially, but are also occasions for members to network with suppliers and other members while taking advantage of member-only offers and promotions that help to drive sales.

What are the biggest challenges for your members over the next 12 months?

Availability, availability and availability. For a few reasons, allocation remains heavily swayed to the multiples post-pandemic, making it much harder for wholesalers to get the stock they need to service their customers, which leads to woefully low service levels with the major brands.

Pricing is also something our members need to focus on to stay competitive. Commodities continue to be a challenge, so keeping an eye on core markets will help our members make better buying decisions for future.

There is also the issue of availability of EU brands post-Brexit. This has pushed the demand for UK brands, and our members may struggle to meet customer demand on this until the supply chain settles down. We are there at head office to help and advise on all these issues where possible. l

26

In partnership with

Jess Douglas, director

Representing over 200 Suppliers

£3bn+ Group turnover

50 years experience

224 Members across the UK

Extensive Own Brand CORE

Share in Group Profits

Confex,

the home of progressive wholesalers

FREE Membership

Data-led market Insights

1000s deals across all categories

Carbon neutral Head Office

If you’re a Wholesaler or Supplier and want to find out more about one of the UK’s largest and most diverse buying groups, contact us today on enquiries@confex.ltd.uk confex.ltd.uk

BUYING GROUPS

Unitas Wholesale

Dhamecha Foods

Largest member

£8bn

Group buying power

BWI: What has been your most significant achievement over the past 12 months?

JK: The past 12 months and beyond have shown what we can achieve through collaboration.

Rising costs and low consumer confidence impacted the channel, but our members are resilient. Their ability to make quick decisions has allowed them to build strong relationships with their customers. Now, as their customers’ businesses thrive again, so do our members.

We’ve also had a renewed focus on our own-brand sales, which are up by 29% year on year.

Our Lifestyle range contains 150 products, and offers members up to 79% shared margin, while our foodservice own brand, Caterers Kitchen, which has more than 300 products, has seen 50%-plus growth in the past year.

This year, with escalating operational costs affecting our members, we’re focused on rolling out agreements from third-party service providers that will get our members the best deals in areas including energy, banking and telecoms.

What is your unique selling point?

Being the largest buying group in the UK. Supporting independent wholesale, we pride ourselves on being a true champion of independent businesses, and we will use our position to become the voice of the industry, supporting our members and their customers to thrive in what is currently a challenging trading environment.

Our scale enables us to win preferen-

157

Number of members

tial terms from suppliers, which gives independent businesses the ability to compete effectively. We offer central terms for more than 300 suppliers.

How have you expanded and attracted new members over the past 12 months?

Our focus is on providing maximum benefits to our existing membership. In the past year, our members have grown depot numbers, their logistics capabilities and much more. We will continue to provide excellent services and support to help them grow their businesses.

What are your plans to help members over the next 12 months?

Our priority is to help members remain competitive on price by getting the most competitive terms, promotional and marketing support. To do this, we have revamped our national B2B promotional deals for retail, on-trade and foodservice, focusing on deep price cuts while protecting margin.

We will support our members’ customers with our Unitas Retail

Promotions, which are focused on delivering value to the consumers, something that is very important in the current cost-of-living crisis.

Retail customers also benefit from our category advice service – Plan for Profit – which is based on honest data and focuses on core range. Our app has had more than 10,000 downloads to date.

For foodservice, we are developing channel guides that support our members with information on range, new products, trends and specific promotional activity for the channels they operate in, such as education, leisure and travel, and pubs and restaurants.

What are the biggest challenges for your members over the next 12 months?

The channel is facing the most difficult trading environment for years. Their operations are being squeezed from rising overheads, while consumers demand lower prices. Meanwhile, product availability remains a challenge.

We’re urging suppliers to support the wholesale channel by improving availability, increasing shared margins when CPIs are put in place, but also asking them to ensure that pricemarked packs are competitive with other channels, so the independent trade is not disadvantaged.

We ask that suppliers don’t increase prices that could affect the reputation of the independents in general. l

28

In partnership with

John Kinney, managing director

Retail l Foodservice l On trade l Specialist Contact us TODAY on 01302 249909 or visit www.unitaswholesale.co.uk for more information Better and stronger together Unitas is the UK’s largest Buying Group utilising the scale of over 150 independent wholesalers predominantly trading across Retail, Foodservice and On Trade Why you should join us: l We provide competitive terms from over 300 major supplier partners harnessing the scale and strength of the membership l Powerful B2B and B2C promotional progammes l Sector leading category advice and marketing support across digital and traditional platforms l Support in reducing your business costs through centrally negotiated service contracts l An annual programme of exclusive trade events and networking opportunities

BUYING GROUPS

Sugro

Nasco UK Ltd Latest member

£1.8bn

Group buying power

BWI: What is your unique selling point?

YP: Sugro’s group focus has been and always will be member-centric; utilising our experienced in-house team to provide the very best support in trading, sales, IT, design, digital and marketing. Being incredibly focused on our members is the one thing that gets brought up the most. We have just over 90, and we get to know them and their needs very well. The sense of community between Sugro wholesalers is very strong, with feedback showing that we’ve created a real ‘family feel’ and it’s well liked by suppliers.

How have you expanded and attracted new members over the past 12 months?

Our individual member-centric approach, along with our strong group strategy focus on digitalisation and diversification, has helped us to expand the membership further by bringing new members on board, as well as retaining the existing membership. We have been diversifying into a broader product offering, such as grocery, catering, licensed products and non-food while keeping our impulse categories as a unique selling point. Our e-commerce group offering is unique in many ways and offers many bespoke benefits to the membership.

What has been your most signifi-cant achievement over the past 12 months? And what are your plans to help members over the next 12 months?

90

Number of members

Our all-in-one B2B e-commerce solution is offered free to members, and amid the vital importance of digital in the wholesale channel, we have recently launched B2B Open Banking for our members to take advantage of. It allows wholesalers to accept payment by bank transfer and is an extremely secure way of completing transactions, offering a fast and convenient method to settle account balances at a fraction of credit-card and cash-handling charges. Following the introduction of the Open Banking to the group, we have also launched the Business WhatsApp solution for members and suppliers. This enables them to target wholesaler customers with specific marketing campaigns and promotions, directly linking them to websites and ordering apps.

We have also recently partnered with PepsiCo on a split testing project (see pages 8-10). The initiative is aimed at improving e-commerce performance with targeted advertising focused on different customer groups. The split testing method allows businesses to target multiple versions of an advert at separate customer profiles.

We believe that data will help futureproof the business, which is why we have recently partnered with TWC on the Sugro Insight Service (SIS) platform launch. We are very pleased we can now offer a sales data solution to our members and supply partners. The data platform will enable us to focus on distribution gaps and truly evaluate our performance in the wholesale market.

The key focus over the next 12 months will be on further group diversification and digitalisation as well as working closely with our members and suppliers on sustaining our fantastic track record of growth. Sugro has had 17 consecutive years of growth and it continues with its strong performance in 2023, with year-todate growth of 31%, compared to the same period in 2022.

What are the biggest challenges for your members over the next 12 months?

Consumers’ savvy approach will continue throughout 2023, which is where the importance of promotions and value-for-money offers comes into play. Consumers will be more willing to switch brands and go for less-expensive options.

It’s likely that we’ll see some reduction in out-of-home consumption, which represents an opportunity for wholesalers to drive growth through big-night-in sharing occasions. l

30

In partnership with

Yulia Petitt, head of commercial and marketing

IF YOU’RE LOOKING FOR GREAT TERMS AND PROMOTIONS…

BECOME PART OF THE SUGRO FAMILY BY JOINING OUR TECHNOLOGICALLY DRIVEN, MEMBER-OWNED BUYING & MARKETING GROUP

www.sugro.co.uk 01270 628728

JOIN TODAY AND CELEBRATE OUR 40TH ANNIVERSARY IN 2024

DIVERSE MEMBERSHIP OF OVER 90 WHOLESALERS

ACCESS TO INDUSTRY LEADING PROMOTIONS ACROSS CONFECTIONERY, CRISPS & SNACKS, SOFT DRINKS, GROCERY AND NON-FOOD CATEGORIES

A GROUP THAT LOOKS AFTER INDIVIDUAL MEMBER INTERESTS

ACCESS TO TRADE SHOWS & GROWTH INCENTIVES WITH NETWORKING OPPORTUNITIES

LOYALTY SCHEME WITH DEEPER DEALS FOR RETAIL CLUB MEMBERS

AUTOMATED REBATE MANAGEMENT SYSTEM TO OPTIMISE EARNINGS ACROSS NUMEROUS COMPLEX SUPPLIER TRADING AGREEMENTS, REBATES AND PROMOTIONAL DEALS**

CENTRAL DISTRIBUTION SOLUTION

SUGRO ALL-IN-ONE FREE OF CHARGE* B2B ECOMMERCE SOLUTION WITH ONLINE BANKING & SPLIT TESTING CAPABILITIES AND NEW WHATSAPP FOR BUSINESS**

‘DRIVE YOUR SALES’ EDUCATIONAL DIGITAL MAGAZINE & WEB CATEGORY PORTAL **

*Terms and Conditions Apply

**Coming Soon

BE PART OF THE INDUSTRY’S MOST DIVERSE AND RAPIDLY EXPANDING BUYING & MARKETING GROUP WITH A PROVEN TRACK RECORD OF 17 CONSECUTIVE YEARS OF GROWTH

TOTAL COMBINED GROUP TURNOVER OF £1.8 BILLION

BUYING GROUPS NBC

Candy Hero

Latest member

David Lunt, managing director

BWI: What has been your most significant achievement over the past 12 months?

DL: Continuing to get the basics right in a very demanding channel and an extremely difficult set of economic conditions. We like to think of ourselves as a safe pair of hands – for members and supplier partners. What this means in practice for our members is making sure they continue to get access to major brands at great net prices.

That takes a great deal of collaboration and engagement with members – they are more than just a number. For our supplier partners, this means demonstrating we are a safe route to customers, and that we are able to activate their brand plans with the consumers that we serve in our channels.

What is your unique selling point?

When we first started it was quite clear – we are truly member-owned. As time has passed, we realise that this is a clear benefit to our members as they are shareholders, and membership is an investment, not an annual management fee or a levy that pays for a head office function. This makes us unique, but there is one other feature that fits the bill as it provides significant benefit to both our members and our supplier partners – our National Distribution Network (NDN).

Our centralised warehousing and logistics facility provides a flexible way to great savings for our members and a safe route to customers for our supplier partners. As it is wholly owned by the group, we take a truly independent and fair view of how we trade with our

members and third-party customers. And, of course, we are a people business – a recent new member preferred our approach as they thought they would become just another number with other groups and did not have the time to go away on foreign trips.

How have you expanded and attracted new members over the past 12 months?

This has mainly been through a process of referrals. We have been busy in various forms of media with our presence and we consciously decided that we did not want to do a membership drive just to get the numbers up.

Our approach is one of awareness, referrals, demonstrating our ability to get the basics right and focusing on people. Our latest new member is Candy Hero, a great business based in Bradford, that can see the benefits of our group from membership and business development through NDN.

What are your plans to help members and suppliers over the next 12 months?