BOUTIQUE ASSET MANAGERS

Words of advice and warning from some of SA’s leading specialist investment houses. Can bad news actually be good news?

Page 20 - 23

FINANCIAL FREEDOM

With April being Freedom Month, the importance of financial freedom is at the fore.

Are all your clients where they need to be when it comes to achieving this goal?

Page 24 - 2 6

BY SIOBHAN CASSIDY MoneyMarketing Contributor

The index harmonisation process that took place at the Johannesburg Stock Exchange (JSE) in March should draw a line under complexity that – to quote Michael Dodd, Senior Fund Analyst at Morningstar Investment Management – has meant the simple question “How did the South African equity market do last year?” has not had a straightforward answer for several years.

In addition to cutting through complexity, analysts say, the consolidation of the 'vanilla’ and ‘Swix’ indices into one set of benchmark indices will be good news for liquidity on the JSE. It’s hoped that it will also lead to cost savings for investors over time.

A widely accepted index is a sign of a healthy market. Not only does it allow investors access to index-tracking products that allow broad market exposure, but active investment managers also use an index as a benchmark

2002

The FTSE/JSE All Africa Index Series was introduced as a replacement to the existing JSE Actuaries Indices of the time, heralding the start of the South African index partnership between FTSE Russell and the JSE. It introduced several modernisation elements to the indices, such as free float weighting, hierarchical sector classification and enhanced data.

against which performance can be measured.

An index should be widely accepted, investable and representative of the opportunity set. In pursuit of these objectives, various competing and overlapping indices have been developed for the JSE over the years. The landscape has become muddled, even as the Capped Swix All-Share Index has become the de facto headline index for the JSE.

The vanilla indexes include the FTSE/JSE All Share Index (ALSI), FTSE/JSE Top 40 Index, as well as various industry, sector, total return, and capped variants. Each of these indices has a corresponding Swix (shareholder weighted) variant, such as the FTSE/JSE Swix All Share Index and the FTSE/JSE Swix 40 Index. There are capped versions (maximum exposure to one share), too, making for a very confusing benchmarking system.

2004

FTSE/JSE launched the Capped All Share Index and the Shareholder Weighted (Swix) All Share Index. The two new approaches were cocreated with market participants to provide performance benchmarks that were better immunised from concentration risk.

Harmonisation

“is a really good thing”, says Kelin Pottier, Solutions Strategist at 10X Investments. “Before now, every investor had to choose their benchmark from this whole skittle-box of SA equity benchmarks. You could go All-Share, you could go Swix, you could go Capped Swix, Capped All-Share. You could go Top 40, Swix Top 40, Capped Swix Top 40.” He adds, “There was never a neutral representation of the local market. It also created enormous complexity in trying to assess and compare the performance of different asset managers who all use different benchmarks.”

Continued on next page

2016

FTSE/JSE launched the Capped Swix All Share Index triggered directly by requests from the South African fund manager and asset consultant community, who were concerned with the increasing concentration exposure to Naspers in the Swix All Share Index.

www.moneymarketing.co.za @MMMagza @MoneyMarketingSA First for the professional personal financial adviser INSIDE YOUR APRIL ISSUE 30 April 2024 The value of investments may go up as well as down, and past performance is not necessarily a guide to future performance. There are risks involved in buying or selling a financial product.For any additional information such as fund prices, fees, brochures, minimum disclosure documents and application forms please go to www.lauriumcapital.com Laurium Capital (Pty) Ltd is an authorised financial services provider (FSP 34142). www.lauriumcapital.com Shift the way you think about investing and consider Laurium Capital to diversify your investment portfolio. Our nimbleness as a boutique asset manager and di erentiated investment approach allows us to capitalize on a broad range of opportunities. Funds

across all major platforms. SHIFT YOUR PERSPECTIVE Investing for your future C M Y CM MY CY CMY K MoneyMarket_Nov 2023.pdf 1 2023/12/04 15:48:24 Benefits expected for managers and investors as JSE index harmonisation

ALL THE AWARD WINNERS

available

starts

We celebrate those who came out tops in the most recent industry awards. Page 11-17

1 CONTINUOUS PROFESSIONAL DEVELOPMENT

Indexation: Anything but Passive.

Indices can be actively designed, like our Factor Range

Indices can be geographically diversified, like our Global ETF Range

Indices can be optimally designed like our Multi-Asset Range.

Indices can be designed to target themes, like our Thematic Range.

While indices can take many di erent forms, all are transparent and low-cost.

Take control of what you’re investing in by incorporating indexation into your portfolio. Contact us to learn more at institutional@satrix.co.za

Satrix Investments (Pty) Ltd is an approved financial service provider in terms of the Financial Advisory and Intermediary Services Act, No 37 of 2002 (“FAIS”). Satrix Managers (RF) (Pty) Ltd (Satrix) is a registered and approved Manager in Collective Investment Schemes in Securities.

Continued from page 1

Too many complications

The unique characteristics of the local market, including concentration risk resulting from the dominance of certain heavyweight companies, have prompted the evolution of diverse indices over the years.

According to the JSE: “The FTSE/JSE Africa Index Series is designed to be locally relevant for South African investors, and as such has some idiosyncrasies when compared to global benchmarks.”

The idiosyncrasy that March’s harmonisation talks to is the so-called Grandfathering clause. This special arrangement for certain dual-listed SA companies was agreed by the Reserve Bank during the apartheid era. It is now effectively done away with as the Swix and the vanilla indices have been collapsed into one.

As most South African investors know, National Treasury and the JSE classify companies as either local or foreign (also known as inward-listed) for exchange control purposes. That also determines whether local or global free float is used for the purposes of index placement. During the apartheid era, certain South African companies, under threat of sanctions, moved their primary listings abroad, mostly to London, and did inward listings to the JSE.

These homegrown companies tended to still have big operations in South Africa and local pension funds held a fair amount of their equity. There were concerns that if they were re-categorised as foreign, local pension funds would be forced to sell down their holdings to remain compliant with Regulation 28’s offshore limits. This would potentially prejudice investors and because the Reserve Bank feared a big flow of domestic assets offshore, these companies motivated to maintain their classification as local – the Grandfathering clause.

“Index harmonisation is important for several reasons, including the reduction of confusion among investors and making the comparability of domestic-only South African Equity fund performance more consistent”

Even though many of their shares were trading in other markets, the Grandfathered companies’ global free float of shares was used to determine their weight in the index. Investors couldn’t invest in those companies to the extent they are weighted in the index. “This is not an investable universe for those who were being judged against it,” says Pottier. “They were comparing fund managers who could invest only, say, 10% in one company against the benchmark, where 25% of the returns were driven by one company.”

Pottier adds, “Even if I bought the whole market, I would still not be buying as many shares in the company as I would need to hold to match the benchmark.” In response, the JSE launched the shareholder-weighted index (Swix), which weights the company according to the total number of shares available to trade on the local stock exchange. This is a fairer representation of the investable local universe and, as the JSE FAQ document explains, “over time, the Swix approach was adopted by institutional managers and investors as the local benchmark”.

When Naspers started its rise, the fund management

community became concerned with the increasing concentration exposure in the Swix All Share Index. At its peak, Naspers’ weight in the Swix reached roughly 25% of the index. Morningstar’s Dodd says, “The Swix generally worked as a suitable South African equity market benchmark, up until the meteoric rise of Naspers saw the concentration risk in the Swix increase.” At its peak, Naspers’ weight in the Swix reached roughly 25% of the index. In response, the JSE launched the Capped Swix, which restricts shares to a maximum weight of 10%, in 2016.

The Capped Swix became the preferred industry benchmark for the South African equity market, but its adoption has not been universal, with many managers still benchmarked to the ALSI and the Swix. “The different weighting and capping methodologies across these indices have resulted in some vastly different return outcomes,” he says.

Dodd says that index harmonisation is important for several reasons, including the reduction of confusion among investors and making the comparability of domestic-only South African Equity fund performance more consistent. Harmonisation should also result in a reduction in the number of index-tracking products being offered, which, Dodd adds, “provides the opportunity for product providers to improve economies of scale and potentially lower fees”.

Fixing the mismatch

Bradley Preston, Chief Investment Officer at Mergence Investment Managers, says one of the issues this harmonisation will fix is the mismatch that resulted as the majority of institutional fund managers used the Capped Swix and Swix indices as their benchmarks while the liquid derivatives markets in South Africa are based on the Top 40 Index. “This mismatch has meant that a large volume of derivatives have traded over the counter in South Africa and not on the exchange.” Preston sees the harmonisation potentially aligning these two markets so that the liquid equity benchmark and the liquid derivatives benchmark are the same, which “should be positive for JSE volumes and liquidity in the SA derivatives market”.

Abdul Basit Oldey, Head of Trading for Camissa Asset Management, agrees that index harmonisation should reduce market fragmentation and could improve liquidity. Also, he pointed to recent data published by Alexander Forbes, showing that nearly 90% of the assets under management included in their equity survey are already aligned to the Swix index variants, saying “this may be a reason for the upcoming harmonisation holding less weight among market headlines”.

Welcoming the change, Alexforbes Investments

Deputy Chief Investment Officer Senzo Langa, says, “The index harmonisation is positive, as the Swix free float methodology will now be applied to all the JSE counters, allowing for centralised liquidity, which is great for the market, especially for the passive and derivative market.”

He adds, “The biggest point of contention is that performance has favoured the old construct to a tune of 1-1.5% p.a. over the past 10 years when comparing ALSI versus Swix, which suggests a risk premia for companies with international exposure. We welcome the change, expect dispersion of returns in balanced managers, and some innovation on accessing ‘the lost’ rand hedge bias.”

However, industry sources says market participants have known about the changes for a while, and some have responded proactively by launching their own versions of indices that match the soon-to-be industry standard. Also, bearing in mind the harmonisation that has already taken place, not too much disruption is expected. Finally, Dodd’s question “How did the South African equity market do last year?” will have a straightforward answer.

TEDITOR’S NOTE

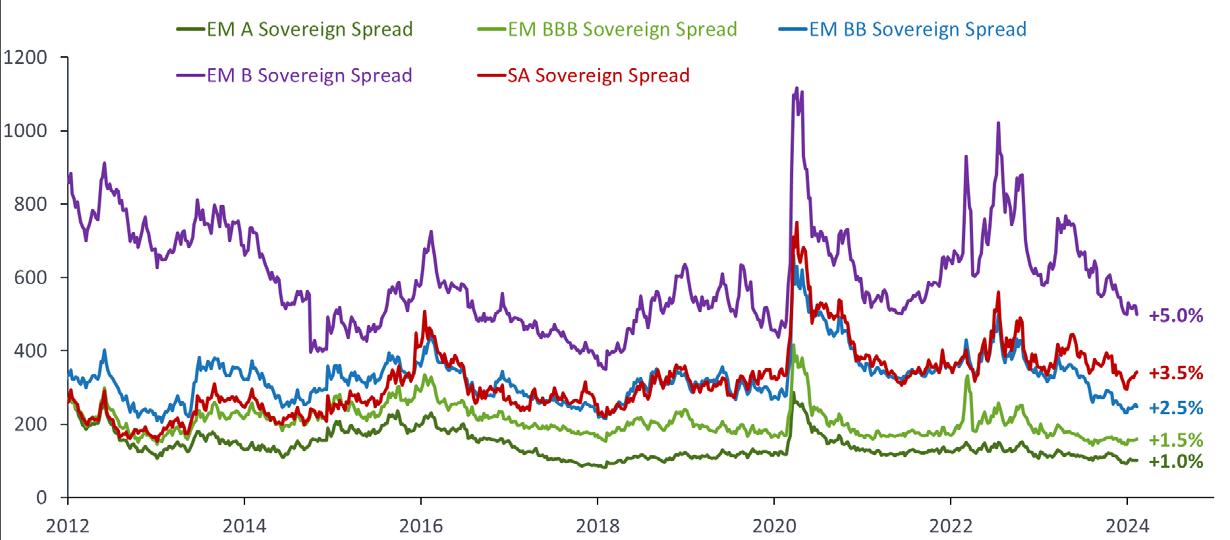

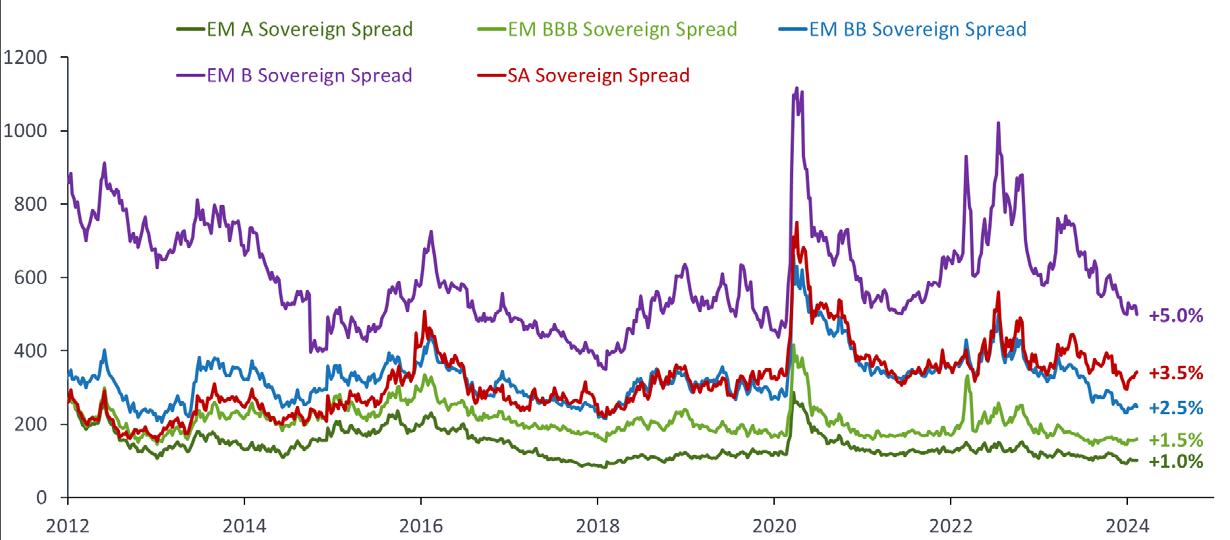

he South African elections taking place on 29 May are going to be the hottest contested since the dawn of our democracy. With new players (including Jacob Zuma’s MK Party) entering the fray pollsters are having a difficult time predicting clear outcomes, although the consensus seems to be that the ANC is likely to lose its outright majority. In these uneasy, unpredictable times, we spoke to some industry players about their thoughts on what to expect when it comes to investing in these times. The good news, apparently, says Izak Odendaal, Chief Investment Strategist at Old Mutual Wealth, is that the market has already taken account of much of the insecurity, so it shouldn’t be too affected by the outcomes.

Diversification is still at the top of everyone’s list – noone wants too many eggs in one basket – but most interesting is that industry players predict there could be a positive upswing for local-facing equities and bonds. Providing nothing gets out of hand, of course, and elections are fair, above-board and peaceful.

It’s the US elections that seem to be causing more sleepless nights, with a Trump victory having a totally unpredictable effect on the world norm, affecting everything from security and long-forged alliances to market volatility and climate change. It’s causing investors to be hesitant, prudent and cautious, waiting it out to see what’s going to happen.

It’s Freedom Day on 27 April, which commemorates our very first democratic elections back in 1994. We’ve decided to focus on financial freedom in this issue, a very important part of any financial adviser’s role. Financial freedom offers your clients the autonomy to make choices without financial constraints and to pursue their passions. It alleviates stress, enhances their wellbeing and drives their personal growth. Ultimately, it empowers them to lead fulfilling and purposedriven lives. Take a closer look at our articles to garner any advice you can to give your clients pointers on achieving this elusive goal.

Happy reading!

SANDY WELCH Acting Editor, MoneyMarketing

Scan the QR code to subscribe to the MoneyMarketing newsletter

NEWS & OPINION 30 April 2024 www.moneymarketing.co.za 3

IMAGES Shutterstock .com

AMANDA DUSSE FRANCHISE PRINCIPAL, LIBERTY

How did you get involved in financial services –was it something you always wanted to do? It's quite an interesting career path for me to end up as a financial planner, as I did technical studies at school, from electronics, physics and technical drawing. I had different aspirations – I wanted to be a geographer. In 2016, I had a life-changing event where I lost my older brother. As a business owner, he had never had a conversation with a financial planner and had never been advised about the importance of estate planning, insurance and investments. He died intestate, leaving his family destitute. This sparked a desire to work in financial services to honour his memory and to help others avoid similar financial hardships. All this led to me pursuing a post-grad qualification in financial planning.

What was your first investment – and do you still have it?

My first encounter with an investment was through a savings account that my grandfather opened for me via Postbank. He saved that money in secret, and only disclosed on his deathbed that he had been saving money for me to become a lawyer. Unfortunately, the funds weren’t used for my studies; however, that thought and memory holds a very special place in my heart.

What have been your best –and worst – financial moments?

better, and cashed out my provident fund (R550K) to start a business that failed dismally. I lost all those retirement savings and I had to start from scratch and build a retirement plan that requires me to save a significant amount of money monthly for me to retire comfortably. To this day, the bulk of my investments go towards my retirement.

What are some of the biggest lessons you have learnt in and about the finance industry?

Both as a financial planner and a business owner I have learnt the importance of research and due diligence. Informed decision-making in finance requires thorough research and analysis. Whether it's evaluating investment opportunities, selecting financial products, or assessing market trends, conducting proper due diligence is crucial for success.

What makes a good investment in today’s economic environment?

My favourite investment vehicle is an endowment. A feature that I particularly enjoy is that during the minimum investment term of five years, clients are allowed one withdrawal and one loan, and given the current economic environment, it helps to be able to loan yourself money interest free, compared to a loan you’ll acquire at the bank with the current prime lending rate sitting at 11.75%. This investment vehicle also serves as a great tool to conduct proper estate planning and legacy creation as it allows one to nominate beneficiaries for inheritance. In addition, this solution allows you to invest 45% offshore, helping you to diversify your portfolio and expose your money to different economic environments. After five years, the endowment becomes an open-ended investment with easy access and investment.

My ultimate and best financial moment was in 2022 when I bought my mother a house without applying for a credit facility at the bank; I had saved enough money to buy the property in cash. I am still savouring this moment to this day. My worst financial moment was when I didn't know any 1

What finance/investment trends and macroeconomic realities are currently on your watchlist?

Currently Artificial Intelligence (AI), where Robo Advice is concerned, is high on my trends list. Last year, I was

“My ultimate and best financial moment was in 2022 when I bought my mother a house without applying for a credit facility at the bank”

Earn your CPD points

fortunate enough to win a Liberty-funded trip to attend a Dreamforce – Salesforce conference in San Francisco. It is one of the biggest tech conferences in the world. This conference was a once-in-a-lifetime experience, and a new world that I’d never been exposed to. A topic that piqued my interest was to understand how South Africans might adopt and implement Robo Advice. It made me think about my mom conversing with a Robot/AI tool, giving her advice on how to spend her last pay cheque.

My view on AI is that I do see it adding value with system optimisations and simplifying the service industry where everything is a click of a button, and solutions are provided. However, it will likely result in job losses. At the San Francisco airport while waiting for our flight, we saw a robot going about its business, cleaning, dusting and mopping surfaces. That had me thinking that AI is here, and I hope we are ready for it as South Africans. My experience at the Salesforce conference got me deeply invested in the evolution of AI.

What are some of the best books on finance/ investing that you’ve ever read — and why would you recommend them to others?

I have two favourites: Firstly, The Psychology of Money: Timeless Lessons on Wealth, Greed and Happiness by Morgan Housel. Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important topics: money. He equips you with interesting ideas and practical takeaways to implement in your money management strategies. This book was gifted to me by my mentor when he realised I had made a successful career out of financial planning. He advised I should also do some introspection to understand my relationship with money. He further explained it will make me a better business owner and financial adviser. It focuses on personal psychology regarding money, and why people make certain financial decisions.

The second book I’d recommend is The Essentials of Personal Finance for Teens and Young Adults: Master Money Management, Gain Financial Literacy and Lay the Foundation for Success by DM Stevens. This book unpacks complex financial concepts in a simplified manner. It is written for young readers and would make a great gift for anyone at any age who needs to improve their financial literacy.

The FPI recognises the quality of the content of Money Marketing ’s April 2024 issue and would like to reward its professional members with 1 verifiable CPD points/hours for reading the publication and gaining knowledge on relevant topics. For more information, visit our website at www.moneymarketing.co.za

30 April 2024 NEWS & OPINION 4 www.moneymarketing.co.za IMAGES Shutterstock .com

CONTINUOUS PROFESSIONAL DEVELOPMENT

Access Bank’s new CEO

Access Bank South Africa has appointed Sandile Shabalala as Chief Executive Officer (CEO). Shabalala brings over three decades of extensive experience in the banking sector, and a proven track record of driving growth and managing risk. He previously served as Chief Executive for Business and Commercial Banking at Sasfin Bank Limited, where he led the establishment and development of the Business Banking division. His responsibilities there included building, enhancing and growing transactional banking and products, and achieving sustainable financial performance. He was also CEO of TymeBank, where he successfully led the bank’s launch and established it as a disruptive force in the South African banking industry. As Access Bank’s new CEO, Shabalala will leverage his expertise in strategic planning, risk management, and stakeholder engagement to propel the bank forwards.

NEW APPOINTMENTS

New CEO for Pernod Ricard

Pernod Ricard Africa has appointed Sola Oke as its new Managing Director for Africa. Oke’s selection follows a rigorous, transparent, and merit-based process aligning with Pernod Ricard’s commitment to upholding the highest organisational standards in recruitment.

Oke brings extensive experience to his new role. With over a decade of tenure within the Pernod Ricard family, Oke’s journey commenced in 2014 as Marketing Director in Nigeria. His strategic insight and leadership have played a pivotal role in driving the company’s growth across the African region, in multiple roles, but most recently as the Managing Director for Pernod Ricard Nigeria and Western Africa. He holds

Un-natural advantage

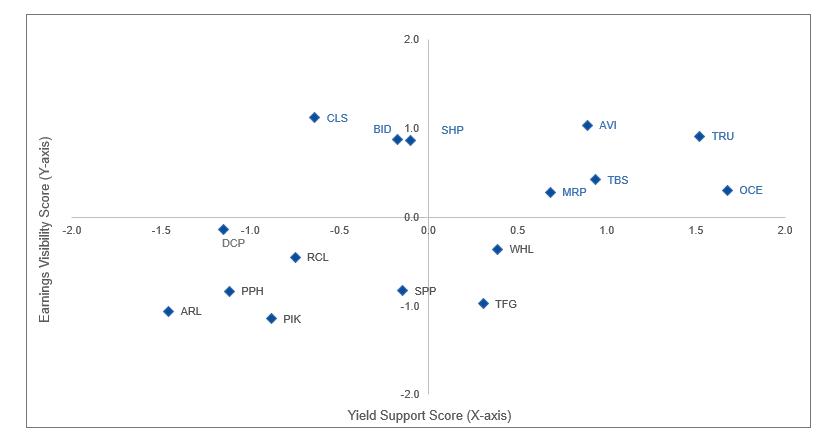

BY AADIL OMAR Head of Equity Research at M&G Investments

Michael Phelps was built to swim fast. Based on nothing more than his physical attributes and his 23 gold Olympic medals, I would not be remiss in suggesting he was born with a natural advantage.

This sort of anatomical advantage is not unusual to observe in the domain of elite physical performance. A simple internet search will reveal all sorts of biometric data on elite athletes, from which one can easily connect the dots to outstanding performance. But the further from physical competition one veers, the less apparent these explicit advantages, and the trickier it becomes to rely on deductive reasoning to predict performance.

Take chess champions, for instance. If you asked me what makes Gary Kasparov or Magnus Carlson the best chess players to have competed in the game, I’m not sure I could answer that question by succinctly identifying an explicit advantage.

We can appreciate that the more complex and multi-faceted the game, the more difficult it becomes to articulate the advantage. Both games, however, occur in a relatively static environment where outside

variables or shocks play no role whatsoever, i.e. there is no random variable. Competitors know exactly what is required to win and what variables are at play at any moment. Trying to determine the explicit advantage in a real-world setting where random variables are present gets even trickier.

Non-explicit

I’ve always found the intuition around an advantage or ‘edge’ in investing tricky. Any advantage a money manager might possess will not be explicit the way a Phelps advantage is. Competitive advantages in the money management industry tend to be rather opaque. Observations are tricky and description almost always must be analogous if not conceptual. A basic internet search seeking the sources of an edge in investing revolves around ideas such as discipline, patience, risk tolerance, analytical rigour and other generalisations. Very rarely can you find an explanation detailing an explicit advantage – unless it is in some way related to the possession of material non-public information1. This is not to say that advantages in money management do

a master’s degree from the University of Manchester and Cardiff Business School.

Promotions at Compli-Serve SA

Compliance and professional services firm to financial services companies Compli-Serve SA has made two new promotions of staff. Tanya van Aswegen, who marks 20 years working at the firm this year, is promoted to Chief Operating Officer, while Kelly Matthews, who has worked for the company for over five years, is promoted to Senior Bookkeeper. They both began their careers at Compli-Serve as receptionists assisting the broader team, and have worked their way up in various roles over time.

“Our Director saw the potential in me and encouraged me to invest in my education and to stay with Compli-Serve, to establish policies, procedures and processes for our head office, most of which are still in use to date,” says Van Aswegen, who has studied Business Management and is nearing completion of a Bachelor of Commerce degree, evolving from a receptionist/PA to Office Manager, General Manager and now into her new role as COO. Richard Rattue, Managing Director and Founder of Compli-Serve, has praised the invaluable work these women do at Compli-Serve SA. “Tanya and Kelly have grown tremendously over the years and have shown true passion

for compliance and the work they do. They are positive, proactive and indispensable members of our team and we wish them all the best in their new roles.”

not exist, but rather that any advantage is unlikely to be explicit in nature.

As much ‘what’ as ‘how’ we play

Unlike professional swimmers and chess players, investors have much greater degrees of freedom. Within the confines of a mandate, an investor can dial up risk or step back based on market dynamics. This means an investor can narrow the ‘field’ to the point where an advantage is more likely. In contrast with Kasparov, who cannot simply eliminate the rooks from the chess board just because he happens to prefer bishops, an investor can opt into the sort of investments they believe offer the best prospects. It’s not uncommon for investors to be labelled along the lines of their preferred ‘playbook’, such as value investor or activist trader. These diminutive labels are not that descriptive in detailing the source of an edge, but closer scrutiny of an investment philosophy and the process can be illuminating. Warren Buffet famously pointed to three key elements that he attributes his investment success to: 1) stay within your circle of competence; 2) invest with a margin of safety; and

3) invest in companies that have a sustainable competitive advantage and are managed by capable stewards of capital. At M&G, we have similarly been focussed on a few key tenets to inform our investment decisions:

1. Focus on long-run anchors of value

2. Minimise the short-term noise

3. Construct portfolios in a risk-conscious manner.

I maintain that explicit advantages are not apparent in the money management industry, but looking back, it appears that an emergent edge may well be prevalent among certain managers. As in any game, a demonstrable and consistent track record is the closest thing we have to proof of an edge.

1 For an example of these explicit advantages

NEWS & OPINION 30 April 2024 www.moneymarketing.co.za 5 SANDILE SHABALALA

SOLA OKE

TANYA VAN ASWEGEN

KELLY MATTHEWS

read

Flash Boys

the book

by Michael Lewis

Satrix shares its 2024 top investment trends

BY KINGSLEY WILLIAMS Chief Investment Officer at Satrix

From strong global growth in indexation, FTSE/JSE index harmonisation to new opportunities for offshore exposure, Satrix recently shared its top investment trends for 2024.

Kingsley Williams, Chief Investment Officer at Satrix*, says despite a volatile 2023 market, Satrix saw considerable business growth. “Our business crossed the R200bn in AUM mark (as at 31 December 2023) despite a very challenging environment and we are grateful to all our clients for their support. We had a busy year onboarding the NewFunds ETFs from Absa that expanded our ETF product range, and we're looking forward to exciting product developments this year ”

Satrix’s Top Trends for 2024:

1. Indexation trends and the shift towards indexed strategies: The shift towards indexed strategies continues to gain momentum globally. As of the end of 2022, 33% of global assets were managed according to an indexed

approach, up from 14% in 2011. In the US, indexed assets now surpass the 50% mark across all asset classes, not just equities. In Europe, indexed funds represent 27% of total AUM, while actively managed funds have seen a decline in AUM. Nico Katzke, Head of Portfolio Solutions at Satrix, says that South Africa is still lagging Europe, but it’s experiencing strong indexation growth, with almost 14% of South African listed equity and property funds now indexed across the collective investment scheme market.

2. ALSI/SWIX harmonisation’s impact on investors: Williams says the March 2024 rebalancing set to align the All Share (ALSI), Capped All Share, and various subsets like the Top 40 with the Shareholder Weighted Index (SWIX) approach will down-weight the remaining grandfathered companies –Anglo American, Mondi, and Investec PLC – in the ALSI-methodology indices. There will be approrate upweight of the

remaining companies. This strategic move, termed 'index harmonisation', aims to eliminate the discrepancies between the ALSI and SWIX indices. Eventually, as the indices fully adopt the SWIX structure, the SWIX indices will be phased out. Williams adds that grandfathered companies have historically undergone organic down-weighting in the ALSI indices as they restructured and lost their grandfathered status. “A comparison of stock and sector weights between December 2021 and December 2023 reveals a significant reduction in the weight of grandfathered and duallisted companies – from 37% to 17% and 46% to 27%, respectively. Companies like Richemont and BHP Group have seen substantial weight reductions following business restructurings during this period, while other shares have increased in weight.” He notes that the transition to a unified benchmark approach is a logical step that reflects the evolving market dynamics and the

need for a unified benchmark for broad market indices.

3. Increased opportunity for offshore exposure: Williams says Satrix is excited about the March listing of the Satrix JSE Global Equity ETF (STXJGE), tracking the FTSE/JSE Global Investor Index. This ETF will offer investors increased exposure to offshore earnings and rand hedge stocks. In addition, the February listing of the Satrix MSCI ACWI ETF (STXACW) tracking the MSCI All Country World Index, offers another building block in an investor’s overall asset allocation, with exposure to countries like China and India in addition to developed markets.

Williams says that as Satrix navigates the evolving investment landscape, its focus remains on delivering innovative solutions that meet the diverse needs of its clients.

*Satrix is a division of Sanlam Investment Management and an approved financial service provider in terms of the Financial Advisory and Intermediary Services Act, No 37 of 2002 (“FAIS”).

Solar gets smarter and more powerful

While South Africans suffer under the relentless pressure of loadshedding and infrastructure limitations, it’s also provided an opportunity for international companies to expand and develop solutions to address the issues we face. One of these is a new three-phase hybrid inverter from Sungrow, a global PV inverter and energy storage system supplier. According to Ezzat Sankari, Channels Business Director for Sungrow Middle East and Africa at Sungrow, South Africa’s real need is for low commercial and industrial applications, and to meet these needs, a three-phase hybrid inverter is required. The three-phase hybrid inverter is available at 15kW, 20kW and 25kW capacity.

These inverters can be paired with Sungrow’s 9.5kWh or 25.6kWh lithium ferro phosphate batteries to create a hybrid solar + storage system. The three-phase design provides more power for energy-intensive appliances and equipment in large homes or smallto-medium businesses. They are also engineered to thrive in South Africa’s diverse weather conditions.

“Our commitment to efficiency, reliability, and user-friendliness ensures that our inverter empowers consumers with newfound control over their energy usage,” says Sankari.

Sungrow’s 3-phase product offers a range of benefits tailored to the South African market:

• More powerful: The SH15-25T with

SBR is a highly powerful solution that can start and run more appliances like heating, ventilation and air-conditioning units, pool pumps, and more during a grid outage.

• More independence: Standalone supply capability, regardless of external network conditions, offers true independence from grid constraints.

• Increased efficiency: Three MPPTs for different orientations operate between 150-950V, optimising roof space and extending working hours. All panel compatibility ensures maximum energy utilisation.

• Better safety: With reliable safety measures,

AFCI 200ms shutdown on system errors with a maximum 200 metres for system safety. NRS and IEC certifications certified by TUV and SGS ensure compliance and reliability.

• Advanced technology: The iSolar cloud app optimises solar energy usage and increases consumption transparency, providing 10 sec data refresh rates on power consumption.

• Improved flexibility: Flexible combination of battery and inverters and easy system expansion at any time.

To date, the Chinese company has installed over 405 GW inverters and converters in over 150 countries worldwide. Sungrow has a state-level post-doctoral research workstation and a national high-tech industrialisation demonstration base. It also boasts an enterprise technology centre, industrial design centre and green factory. While Sankari says there are no plans to enter into or tender for any government or other major partnerships at present, in recent weeks the company did sign a strategic supply agreement with Gulf Energy Development in Thailand. (Gulf is one of Thailand’s biggest independent power producers.) Gulf said that equipment purchased through the Master Supply Agreement (MSA) will be used at a combination of ground-mount solar PV plant, solar-plus-storage hybrids and rooftop PV projects in Thailand.

30 April 2024 6 www.moneymarketing.co.za NEWS & OPINION

IMAGES Shutterstock .com

AIEmbracing AI in your financial planning business

BY FRANCOIS DU TOIT, CFP® PROpulsion

is turning everything on its head, including the financial services industry, and you need to be ready for it. Whether you are a financial adviser, a financial planner, a business owner, or a stakeholder, you need to adopt a mindset that welcomes AI as an opportunity, not a threat. In this article, I will explain the difference between everyday AI and game-changing AI, and why you need to develop your AI communication skills – especially prompt engineering – to succeed in the AI era.

It starts with mindset

The right mindset is crucial for learning and adopting new technologies such as AI. The story we tell ourselves about our abilities and potential can either limit or expand our opportunities. Your mindset influences how you approach new challenges, how you cope with setbacks, and how you grow from feedback. By having a growth mindset, you can embrace AI as a tool for learning and improvement. By having an abundance mindset, you can leverage AI as a source of innovation and value creation. By having a gratitude mindset, you can appreciate AI as a gift of human ingenuity and collaboration. Mindset is the foundation of your learning and growth.

Everyday AI vs Game-changing AI

AI is not a single idea, but a range of technologies that can do activities that usually need human intelligence. Some AI applications are already part of our everyday lives, such as voice assistants, chatbots, facial recognition, and recommendation systems. These are examples of everyday AI, which are designed to augment human capabilities and make our lives easier. Everyday AI is often narrow in scope, focused on specific tasks, and limited by data and rules.

However, there is another type of AI that is more disruptive and transformative, and that is game-changing AI. Game-changing AI is the kind of AI that can create new value, generate new insights, and solve complex problems. Game-changing AI is often general in scope, adaptable to different domains, and capable of learning from data and feedback. Game-changing AI is the kind of AI that can challenge the status quo, create new markets, and redefine the rules of the game.

As a financial professional, you need to be aware of both types of AI, and how they can impact your business and your clients. Everyday AI can help you automate routine tasks, improve efficiency, and enhance customer experience. Game-changing AI can help you discover new opportunities, create new products and services, and differentiate yourself from the competition. You need to embrace both types of AI and leverage them to your advantage.

The importance of AI communication skills

One of the most important skills that you need to develop in the AI era is AI communication skills. AI communication skills are the skills that enable you to interact with AI systems effectively and efficiently. AI communication skills include understanding how AI works, what it can and cannot do, and how to provide feedback and guidance to improve its performance. AI communication skills also include knowing how to communicate the value and limitations of AI to your clients, and how to address their concerns and expectations.

One of the most critical AI communication skills you need to master is prompt engineering. Prompt engineering is the art and science of designing prompts

“By having an abundance mindset, you can leverage AI as a source of innovation and value creation”

that elicit the desired response from an AI system. A prompt is a question, a command, or a statement that you use to communicate with an AI system. Prompt engineering is essential because the quality of the prompt determines the quality of the output. A welldesigned prompt can help you get accurate, relevant and useful information from an AI system. A poorly designed prompt can lead to confusion, errors and frustration.

Prompt engineering is not only a technical skill, but also a creative and strategic one. You need to understand the context, the goal and the audience of your prompt. You need to use clear, concise and specific language. You need to avoid ambiguity, bias and assumptions. You need to test and refine your prompt until you get the optimal result. Prompt engineering is a skill that you can learn and improve with practice and feedback. And best of all, it transcends tools. Once you acquire the skill, you can use it with any AI tool.

AI is here to stay, and you need to be prepared for it. As a financial professional, you need to adopt a mindset that embraces AI as an opportunity, not a threat. You need to understand the difference between everyday AI and game-changing AI, and how they can benefit your business and your clients. You need to develop your AI communication skills, especially prompt engineering, to interact with AI systems effectively and efficiently. By doing so, you will be able to leverage AI to your advantage and stay ahead of the curve in the financial services industry.

Stay curious!

NEWS & OPINION 30 April 2024 www.moneymarketing.co.za

Francois du Toit founded PROpulsion, a thriving community for financial planners and advisers focused on helping them belong, grow and thrive. He hosts the PROpulsion LIVE podcast (every Friday at 8am live on YouTube) with more than 249 episodes and counting, sharing his 2.5 decades of experience and engaging with local and international guests to inspire and inform. Committed to learning and utilising new technology, he is on a mission to change lives at scale. Visit www. propulsion.co.za for more information.

IMAGES Shutterstock .com

Is your finely crafted financial plan a grand masterpiece?

Or will it be let down by traditional life insurance products that don’t match your clients’ needs?

As a highly skilled financial adviser, you know that every financial plan is carefully designed to meet your client’s needs today, and as their life changes. BrightRock’s needs-matched life insurance lets you create a product solution that precisely matches the financial plan you’ve crafted for your client.

For example, we can offer your qualifying clients two benefits in one, thanks to our cover conversion facility. They’ll be able to increase one benefit and reduce another as their needs change.

So, later in life, they could use their disability premiums to buy more cover for another need – without medical underwriting, even if their health has changed*.

Only with needs-matched life insurance do you have unrivalled flexibility and efficiency, so that your finely crafted financial plan becomes an enduring masterpiece in your client’s hands.

Get the first ever needs-matched life insurance that changes as your life changes.

*Terms and conditions apply BrightRock Life Ltd is a licensed financial services provider and life insurer. Company registration no: 1996/014618/06, FSP 11643. Terms and conditions apply.

The FSCA is watching

BY JAMES GEORGE Compliance Manager at Compli-Serve SA

The financial services industry is experiencing action against non-compliance by the Financial Sector Conduct Authority (FSCA). Examples include administrative sanctions of R400 000 on Theuns Vosloo Financial Advisory Services CC (TVFAS) and a sizeable R16m against Ashburton Fund Managers (Pty) Ltd (AFM), a subsidiary of FirstRand Limited – both for non-compliance with the Financial Intelligence Centre Act (FIC Act). As licenced Financial Services Providers and accountable institutions under the FIC Act, both firms are required to adhere to regulations aimed at combating money laundering, terrorism financing, and related criminal activities.

Reflecting on why these penalties have come to pass highlights the FSCA’s commitment to enforcing compliance with the FIC Act and its broader objective of safeguarding the integrity and security of South Africa’s financial system.

TVFAS underwent an inspection by the FSCA in January 2024 while AFM did so in late 2022. These inspections revealed significant shortcomings in implementing their respective Risk Management and Compliance Programmes (RMCP), which, while developed, weren’t being used and were deficient in detailing compliance with the FIC Act.

The firms’ negligence in establishing and verifying the identities of clients as mandated by the FIC Act were top issues. This process, a cornerstone of anti-money

laundering and counter-terrorism financing measures, has left operations vulnerable to misuse by potentially illicit actors.

Neither conducted the necessary screenings of clients against the Targeted Financial Sanctions Lists (TFSL) issued by the United Nations Security Council, as required by sections 28A in conjunction with sections 26A to 26C of the FIC Act. This oversight meant that clients might be listed under the Protection of Constitutional Democracy Against Terrorist and Related Activities Act, No. 33 of 2004 (POCDATARA), but were not reported and those listed did not have their assets frozen, as is legally required. AFM also failed to outline processes for examining complex transactions, performing due diligence, terminating business relationships and determining reportable activities.

The FSCA chose to suspend half of the imposed penalty on TVFAS, R200 000, for a period of three years on the condition that it rectifies the identified deficiencies and maintains full compliance with the critical sections of the FIC Act. It’s good to note that remediation of deficiencies is viewed favourably by regulators. This paused penalty takes away some pressure but remains a costly burden, including on TVFAS’ reputation.

These penalties underscore the necessity for all accountable institutions to implement robust anti-money laundering and counterterrorism financing measures,

including effective risk management, client due diligence, and regular screening against sanction lists. Non-compliance with regulatory requirements will be met with stringent regulatory action to protect the financial system and its participants from criminal exploitation.

The cases are an important reminder to not only develop but also effectively implement a comprehensive RMCP that should clearly outline the procedures and processes to mitigate money laundering and terrorist financing risks, as well as ensure compliance with the FIC Act.

Financial institutions must establish and rigorously implement processes to accurately identify and verify clients at the outset of establishing a business relationship or when conducting transactions.

Proactive engagement and transparency with the FSCA or other regulatory bodies demonstrates commitment to upholding integrity. Regulatory compliance should be viewed as an integral part of any firm’s strategic operations, not just a legal obligation.

Ensuring compliance with the FIC Act and other regulatory standards is a clear way forward as it helps protect against reputational damage, financial penalties, and operational risks.

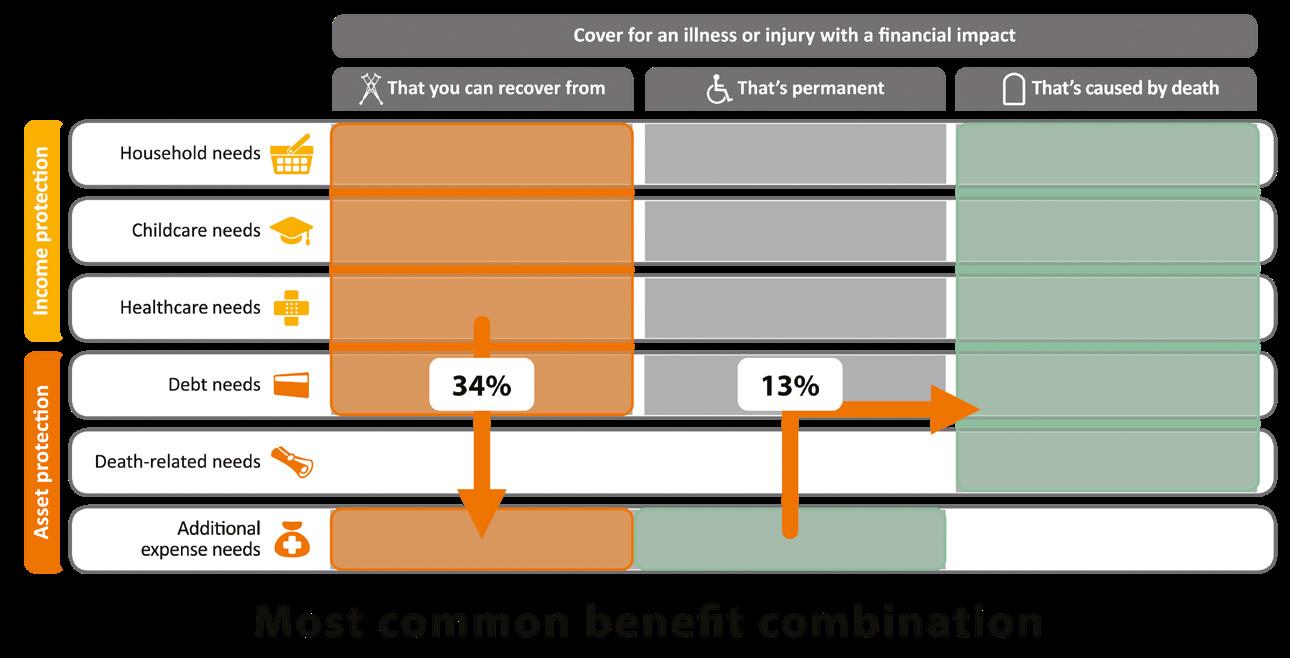

Your clients should be able to claim on multiple benefits for the same condition

BY CLYDE PARSONS Chief Innovation Officer, BrightRock

BY CLYDE PARSONS Chief Innovation Officer, BrightRock

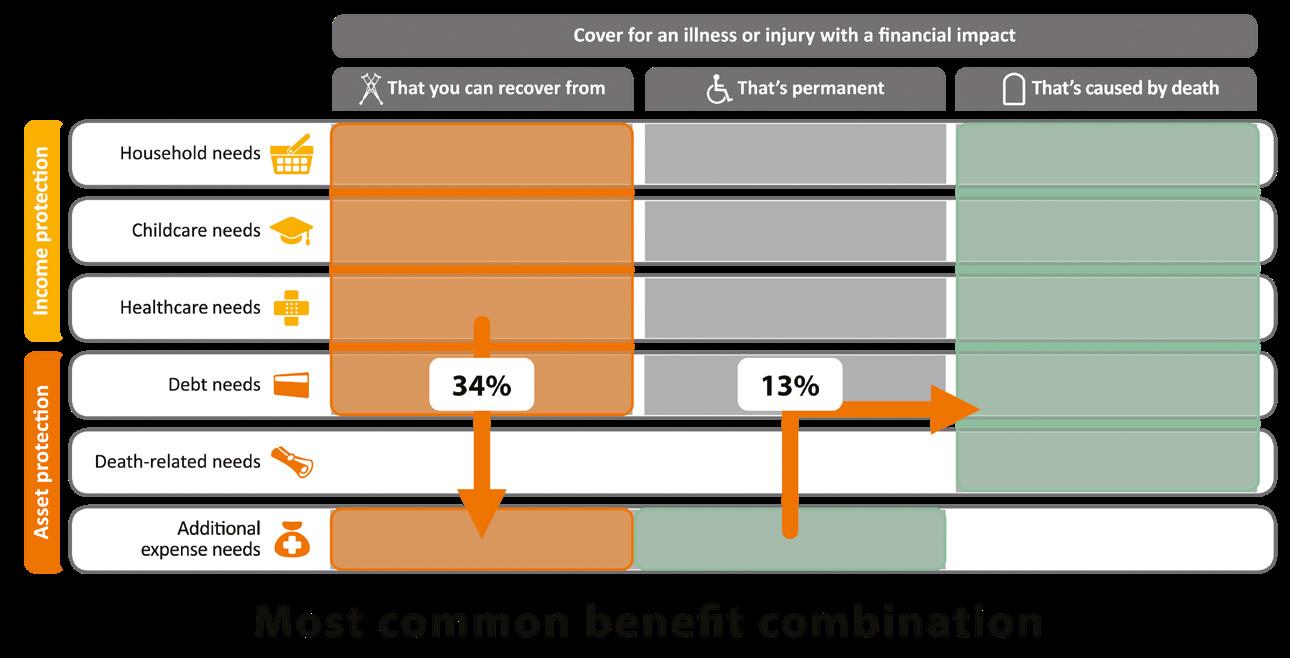

Getting your clients insurance that can precisely match their needs is vital. This ensures that the client can be fully protected when they claim. A comprehensive life insurance policy will include temporary disability, permanent disability, critical illness, and death cover. As these benefits cover different needs, it’s essential to ensure that your clients not only have cover that matches their needs, but cover that they can receive multiple claims for.

At BrightRock, we’re committed to ensuring that clients structure their cover correctly. Our needs-matched product structure enables advisers and their clients to see the cover they need by linking the different insurable events –temporary illness or injury, permanent illness or injury, and death – to the specific financial needs that may arise in each event. Our clients have benefited

from this needs-matched structure and market-leading claims criteria.

One such client was a 64-year-old medical doctor who needed triple bypass surgery. The doctor benefited from unique features, ensuring a higher pay-out and greater claims stage flexibility compared to what he would have received with other providers. The bypass surgery met our clinical criteria for both his temporary disability and additional expense needs cover, or as it is more commonly called in the industry, critical illness cover. We paid a total of more than R3m across these two benefits, resulting in a more comprehensive pay-out that met both his income and asset protection needs.

While the client was booked off for 10 days by his doctor, which met our sickness criteria, we extended his temporary expenses pay-out to a guaranteed four months because his condition met a clinical definition, applying the longer of the two durations. What’s more, BrightRock doesn’t aggregate pay-outs against

active income, offering the full cover amount even if the client resumed earning an income after the period they were booked off for.

Claims statistics for multiple claims

When clients file a claim, we find that they often qualify for pay-outs on different benefits. In fact, our approach is to proactively look across all the client’s benefits to see if they qualify for a pay-out. With us, they only have to complete one form, and we’ll then assess the claim to see if it meets criteria across different benefits.

The most common claim benefit combinations are temporary expenses cover and additional expense needs or critical illness cover, which make up 34% of the multiple claims BrightRock has paid to date. Equally impactful are combinations involving death cover and additional expense needs, constituting 13% of the multiple claims we’ve paid. This emphasises the importance for your clients to have standalone additional expense needs cover that doesn’t accelerate other benefits, ensuring a robust safety net for our clients on their death.

30 April 2024 www.moneymarketing.co.za 9 NEWS & OPINION

Decoding COFI: Giving teeth to TCF

The Conduct of Financial Institutions (COFI) Bill, currently in its second draft, is set to significantly transform the regulatory landscape of the financial industry, and one key area of focus is its impact on the Treating Customers Fairly (TCF) Outcomes. While the bill hasn’t been finalised yet, its approach to TCF is unlikely to change. This allows financial service providers (FSPs) to prepare proactively for COFI implementation.

Presently, various regulations cover TCF principles to different degrees, with some, like the Policyholder Protection Rules (PPRs) for insurers, incorporating more comprehensive requirements than others. This variance results in gaps and differing interpretations of these principles for various role players.

COFI seeks to address this by making TCF principles a universally understood set of requirements to deliver fair outcomes that are consistently implemented and enforceable on all financial institutions.

Giving teeth to TCF

How will COFI strengthen TCF compared to current legislation?

It’s in the detail: COFI provides a more comprehensive breakdown of the TCF Outcomes. While not explicitly listed from one to six, specific sections in COFI delve into the outcomes in more detail.

For instance, TCF Outcome 1 requires customers to feel confident they are dealing with an institution that puts TCF at the core of its culture. This is addressed directly in Section 17 of COFI, which deals with principles relating to culture and governance. It states that financial institutions should promote

BY ANRI DIPPENAAR Masthead Head of Compliance

BY ANRI DIPPENAAR Masthead Head of Compliance

SHANAL BOODIRAM Masthead Compliance Manager

SHANAL BOODIRAM Masthead Compliance Manager

a corporate culture and conduct their business in a manner that promotes the fair treatment of customers.

Another example is Chapter 6: Advertising and Disclosure. This tackles Outcome 2, emphasising the need for selling and marketing financial products based on customer needs.

Unified legislation: The current scattered nature of the TCF Outcomes can leave financial institutions and their customers confused. For example, an insurer is categorised as a product provider but is also licenced as an FSP. This means they must comply with comprehensive TCF requirements outlined in the PPRs, governed by the Long-Term and Short-Term Insurance Acts, and the less detailed and scattered requirements in terms of the FAIS Act regulations. This allows for differing applications. COFI’s purpose is to eliminate this confusion by establishing a singular application and interpretation of TCF across all financial institutions, based on the services they offer rather than their institutional classification.

Evidencing outcomes with data: The Omni-Conduct of Business Returns (CBR) is where COFI really flexes its

LISA TEIXEIRA Masthead Compliance Specialist

LISA TEIXEIRA Masthead Compliance Specialist

TCF muscles. Under the new legislative framework, financial institutions must follow the rules, but there will be a bigger focus on evidencing TCF through customer outcomes.

Financial institutions must report on various conduct indicators – for instance, the business composition, i.e. the number of transactions, type of transactions and client base; reporting on complaints handling and claims management; policy cancellations; etc. – in their Omni-CBR reports.

Financial institutions will have to prove customer outcomes with data. For example, according to TCF Outcome 3, customers must be given clear information and kept appropriately informed before, during and after they sign on the dotted line. Say an FSP meets all its compliance obligations in terms of client communication, but a significant number of its customers complain they weren’t informed of changes to their policies. Even though the FSP followed the rules, the data shows there’s an issue with the way it communicates, and to treat its customers fairly, it needs to address this problem.

Another example: if your Omni-CBR report shows you have a higher-thannormal cancellation rate for a long-term insurance product, there could be an issue. You’ll need to do a root cause analysis to find the crux of the problem and take remedial action. However, if your cancellation rate is within the acceptable range, it suggests the product meets the clients’ needs and you’re treating your customers fairly.

focuses on TCF outcomes and considers the nature of the business, and while there will still be rules governing financial institutions’ actions, the shift allows institutions to demonstrate positive client outcomes rather than just ticking off a list of compliance items, providing more flexibility.

Secondly, COFI provides a more detailed description of the principles and standards that underpin the various TCF Outcomes. Unlike current legislation, financial institutions will have a singular legislative reference for a clearer understanding of the TCF Outcomes and the criteria against which customer outcomes will be assessed. Regardless of whether one is a product provider, FSP, a credit provider, a bank or any combination of these, the uniform application of TCF principles for similar activities ensures consistency across the industry.

Thirdly, incorporating client outcome measurements is a sound business practice. It allows organisations to pinpoint areas of concern, identify root causes and implement remedial action. This results in heightened customer satisfaction and increased client retention.

Preparing for the future

If you run a clean business that operates smoothly and treats clients fairly, you are already well prepared. However, a potential challenge for many FSPs lies in their ability to record the necessary Omni-CBR data and to use and translate this data into evidence that demonstrates the FSP’s commitment towards TCF Outcomes. FSPs need to review their current data-gathering systems to determine whether they can report on and then measure client outcomes.

Benefits of a more robust TCF framework

Requiring financial institutions to illustrate client outcomes with data encourages genuine prioritisation of TCF, and this will significantly benefit consumers.

However, financial institutions can use it to their advantage. Firstly, it can save on operating costs. COFI

Each FSP should have a system –whether a simple Excel sheet, a more complex version or an advanced customer management system – that facilitates the collection, organisation and storage of data, enabling them to seamlessly complete their Omni-CBR reports. A draft of the Omni-CBR report is available, and a revised version of the draft is expected to be published by the FSCA by 1 July 2024.

Another proactive step for smaller FSPs is obtaining customer feedback to pinpoint areas for improvement.

Addressing these areas before COFI takes effect ensures a smoother transition.

FSPs should also prioritise staff training on market conduct indicators, the TCF Outcomes and root cause analysis. By ensuring your team is well-versed in these aspects, a more seamless implementation of COFI regulations and Omni-CBR reporting is likely.

30 April 2024 NEWS & OPINION 10 www.moneymarketing.co.za IMAGES Shutterstock .com

Celebrating the best of the best

March was awards season in the financial industry, and it was a fine time for the top performers to get the recognition they deserved. Here Money Marketing recaps the major awards that took place. Congratulations to all the winners!

Fairtree, a relatively young asset management firm based in Bellville, Western Cape, outperformed the major players in South Africa’s investment industry to win the coveted South African Manager of the Year trophy at the annual Raging Bull Awards. The manager of the year award is based on the risk-adjusted performance of a manager’s suite of qualifying unit trust funds, as determined by the PlexCrown Fund Ratings system, over a five-year period.

The runners-up in the South African Manager of the Year race were last year’s winner, PSG Asset Management, in second place, and Boutique Collective Investments in third place, each of which received a certificate.

RAGING BULL CERTIFICATES

Straight performance over three years

DOMESTIC FUNDS

Best South African Equity Resources Fund

Coronation Resources Fund

Best South African Equity Mid and Small Cap Fund

Sanlam Investment Management Small Cap Fund

Best South African Multi-Asset Flexible Fund

Flagship IP Flexible Value Fund

Best South African Multi-Asset Low Equity Fund

Merchant West SCI Stable P&G Fund

Best South African Multi-Asset Medium Equity Fund

GraySwan SCI Moderate Fund of Funds

Best South African Multi-Asset High Equity Fund

PSG Balanced Fund

Best South African Multi-Asset Income Fund

PSG Diversified Income Fund

Best South African Interest-Bearing Short-Term Fund

Truffle SCI Income Plus Fund

Best South African Interest-Bearing Variable-Term Fund

Saffron BCI Active Bond Fund

Best South African Real Estate Fund

M&G Property Fund

SA-DOMICILED GLOBAL AND WORLDWIDE FUNDS

Best (SA-Domiciled) Global Multi-Asset Flexible Fund

PSG Global Flexible Feeder Fund

Best (SA-Domiciled) Worldwide Multi-Asset Flexible Fund

Blue Quadrant Worldwide Flexible Prescient Fund

OFFSHORE FUNDS

Best (FSCA-Approved) Offshore Europe Equity Fund

Osmosis Resource Efficient European Equities Fund

Best (FSCA-Approved) Offshore United States Equity Fund

Dodge & Cox US Stock Fund

Best (FSCA-Approved) Offshore Far East Equity Fund

Franklin India Fund

Best (FSCA-Approved) Offshore Global Fixed-Interest Bond Fund

Collecting their awards for South African Manager of the Year from

The Raging Bull Award for Offshore Manager of the Year went to Orbis Investment Management, the offshore investment partner of Allan Gray, based in Bermuda, for its suite of offshore funds marketed to South Africans.

Dieketseng Maleke, content editor of Personal Finance, which hosts the awards, said, “Heartiest congratulations to Fairtree, which came in just ahead of PSG Asset Management, in the company PlexCrown Ratings. It’s good to

Allan Gray Africa Bond Fund

Best (FSCA-Approved) Offshore Global Real Estate Fund

Oasis Crescent Global Property Equity Fund

Risk-adjusted performance over five years

DOMESTIC FUNDS

Best South African Multi-Asset Low Equity Fund on a Risk-Adjusted Basis

Amplify SCI Wealth Protector Fund

Best South African Multi-Asset Medium Equity Fund on a Risk-Adjusted Basis

Southern Charter BCI Balanced Fund of Funds

Best South African Multi-Asset High Equity Fund on a Risk-Adjusted Basis

Aylett Balanced Prescient Fund

Best South African Multi-Asset Income Fund on a Risk-Adjusted Basis

Thyme Wealth IP Multi-Asset Income Fund

Best South African Interest-Bearing Short-Term Fund on a Risk-Adjusted Basis

Oakhaven Core Income FR Fund

Best South African Interest-Bearing Variable-Term Fund on a Risk-Adjusted Basis

Saffron BCI Active Bond Fund

Best South African Real Estate Fund on a Risk-Adjusted Basis

Harvard House BCI Property Fund

SA-DOMICILED GLOBAL AND WORLDWIDE FUNDS

Best (SA-Domiciled) Global Equity General Fund on a Risk-Adjusted Basis

Fairtree Global Equity Prescient Feeder Fund

Best (SA-Domiciled) Global Multi-Asset Low Equity Fund on a Risk-Adjusted Basis

Coronation Global Capital Plus [ZAR] Feeder Fund

Best (SA-Domiciled) Global Multi-Asset High Equity Fund on a Risk-Adjusted Basis

Allan Gray-Orbis Global Balanced Feeder Fund

Best (SA-Domiciled) Global Multi-Asset Flexible Fund on a Risk-Adjusted Basis

Global Marathon IP Fund

Best (SA-Domiciled) Global Real Estate

see the better-known, established industry players being challenged by up-and-coming investment firms. The competition is beneficial for investors, keeping costs in check and encouraging portfolio managers to actively seek out worthwhile investment opportunities.”

The other major awards at the event were fund-specific: four for straight performance over three years and four for risk-adjusted performance over five years, to the end of 2023.

Fund on a Risk-Adjusted Basis

Oasis Crescent International Property Equity Feeder Fund

Best (SA-Domiciled) Worldwide Multi-Asset Flexible Fund on a Risk-Adjusted Basis

Blue Quadrant Worldwide Flexible Prescient Fund

RAGING BULL AWARDS

Straight performance over three years

Best South African Equity General Fund

Investec BCI Dynamic Equity Fund

Best South African Interest-Bearing Fund

PSG Diversified Income Fund

Best (SA-Domiciled) Global Equity General Fund

PSG Global Equity Feeder Fund

Best (FSCA-Approved) Offshore Global Equity Fund

Contrarius Global Equity Fund

Risk-adjusted performance over five years

Best South African Equity General Fund on a Risk-Adjusted Basis

Investec BCI Dynamic Equity Fund

Best South African Multi-Asset Equity Fund on a Risk-Adjusted Basis

Aylett Balanced Prescient Fund

Best South African Multi-Asset Flexible Fund on a Risk-Adjusted Basis

Salvo Prime Dynamic Flexible Fund

Best (FSCA-Approved) Offshore Global Asset Allocation Fund on a Risk-Adjusted Basis

Coronation Global Capital Plus Fund

MANAGER OF THE YEAR AWARDS

Offshore Manager of the Year

Orbis Investment Management

South African Manager of the Year – 3rd Place

Boutique Collective Investments

South African Manager of the Year – 2nd Place

PSG Asset Management

South African Manager of the Year

Fairtree Asset Management

Personal Finance

AWARDS 30 April 2024 www.moneymarketing.co.za 11

Editor Dieketseng Maleke (third from right) are, from left to right, Olga Jacobs from Boutique Collective Investments (3rd place), John Gilchrist and Anet Ahern from PSG Asset Management (2nd place), and Herman Sandrock and Kobus Nel from Fairtree (1st place).

M&G Funds recognised at 2024 industry awards

The M&G Property Fund won this year’s Raging Bull Award for ‘Best SA Real Estate General Fund’, recognising its straight performance over the threeyear period to 31 December 2023.

The M&G Property Fund was only launched in July 2020, but has already built up an excellent track record over this period under the management of Yusuf Mowlana (pictured) and Rahgib Davids. Among its ASISA peers, the fund is currently ranked #1 or #2 in its category over the one-, two- and three-year periods (according to Morningstar data to 29 February 2024).

“Using a valuation-based approach, we consider not only individual stock valuations, but also property sector fundamentals, diversification and valuation support from the risk-free rates when building the fund,” says Mowlana. “Stocks must be of high quality, with attractive riskadjusted total return prospects that are underpinned by healthy free cashflow generation.”

Currently, Mowlana is cautiously optimistic about the SA listed property sector going forward, having seen some signs of stabilisation in fundamentals in the most recent reporting period. “The sector should be aided by the strong prospects for global and local interest rates to decline from mid-2024, which could create an environment conducive

for the sector to re-rate. However, this will depend on the pace of interest rate cuts and economic growth – given that it takes time for lower interest rates to make an impact on the economy, earnings growth is likely to be muted over the short to medium term,” he concludes.

Raging Bull award joins several M&G fund nominations

For the 2024 Raging Bull Awards, the M&G Bond Fund was nominated in the category for ‘Best SA Interestbearing Variable-term Fund’ for its straight performance over the three-year period to 31 December 2023. The fund is managed by Roshen Harry and René Prinsloo. The fund was also nominated at the Morningstar Awards in the category of Best Bond Fund.

The M&G Dividend Maximiser Fund was nominated at the Morningstar Awards for ‘SA’s Best Equity Fund’. The Fund is managed by Ross Biggs and Kaitlin Byrne.

The M&G Global Balanced Feeder Fund was also nominated for a Raging Bull Award for its risk-adjusted performance as the ‘Best (SA-domiciled) Global Multiasset High Equity Fund’ over five years to 31 December 2023 – managed by Craig Simpson, Aaron Powell and the M&G Investments (UK) team.

INN8 Invest Diamond Awards

The INN8 Invest Diamond Awards were announced in March but the winners will only be released in April, so we will publish in our May issue. It’s a recognition programme designed to honour excellence in asset management. There is also a category focusing on the adviser. With a commitment to highlighting outstanding achievements within the industry, the Diamond Awards celebrate excellence across three categories and 17 distinct awards.

The categories for the Diamond Awards include:

• Asset Manager Performance Awards

• Qualitative Diamond Ranking Awards

• Adviser awards

According too INN8, each category features specific criteria and guidelines crafted to ensure fairness and accuracy in the evaluation process. The Asset Manager Performance Awards, for instance, evaluate managers over a five-year period using the Diamond Ranking Methodology. Funds considered for these awards include those with a single manager, excluding multi-managers and DFMs. The nominees and winners must hold Silver or Gold ratings through our rigorous manager research process, ensuring that only the most deserving recipients are honoured. Meanwhile, the Qualitative Diamond Ranking Awards assess managers based on comprehensive capability reviews, attribution data, and risk management systems.

Winners in this category have been selected by our esteemed Manager Research team and are recognised as Gold rated funds for their exemplary performance.

“Stocks must be of high quality, with attractive risk-adjusted total return prospects that are underpinned by healthy free cashflow generation”

AWARDS

12 www.moneymarketing.co.za 30 April 2024

IMAGES Shutterstock .com

The M&G Property Fund wins 2024 Raging Bull Award. That’s consistency. That’s M&G. *Best SA Real Estate General Fund for straight for straight performance over the three-year period to 31 December 2023. ASISA South African - Real Estate - General. MandG Investments Unit Trusts South Africa (RF) Ltd is an approved CISCA management company (#29). One can obtain all relevant disclosures on the MandG website. Collective Investment Schemes (unit trusts) are generally medium to long-term investments. The value of participatory interest (units) may go down as well as up. Past performance is not necessarily a guide to the future and the manager provides no capital or return guarantees. Performance calculated net of fees. A Collective Investment Schemes (CIS) summary with all fees and maximum initial and ongoing adviser fees and performance fees is available on our website link here. This information is not intended to constitute the basis for any specific investment decision. Investors are advised to familiarise themselves with the unique risks pertaining to their investment choices and should seek the advice of a properly qualified financial consultant or adviser before investing. Invest in consistency mandg.co.za RAGING BULL CERTIFICATE WINNER 2023 *

22nd Annual JSE Spire Awards Salta Annual Awards

South Africa’s leading capital market participants were celebrated for their client and solutions-focused service. The JSE Spire Awards are dedicated to acknowledging the outstanding achievements of market participants who excel in client service, innovative solutions and overall market contribution.

“We extend our heartiest congratulations to all the winners of the 22nd Annual Spire Awards,” said Thembi Mda-Maluleka, Head of Bonds, Currencies and Interest Rates Derivatives at the JSE. “These accolades not only recognise the winners’ commitment to excellence but also inspire a competitive and transparent market environment, fostering growth and efficiency across South Africa's capital markets.”

The awards are judged across 39 categories, including the Bond Market, Interest Rate Derivatives Market, Currency Derivatives Market and Commodity Derivatives Market. This year, Standard Bank delivered a noteworthy performance, claiming top honours in a third of all categories, including the highly coveted ‘Best Fixed Income & Forex House’ division.

Other notable winners included ABSA CIB, Rand Merchant Bank, Nedbank, Peresec Derivatives, and Tradition – all of whom secured wins in more than one category.

The full list of winners is as follows:

AWARD

Best Broker: Agricultural Derivatives Research

Best Broker: Commodity Options

Best Commodity Broker: Physical Deliveries

Best Broker: Commodity Derivatives

Best Market Making Team: Cash Settled Commodity Derivatives

Best Research Team: Africa

Best Research Team: Forex

Best Research Team: Credit

Best Research Team: Economics

Best Research Team: Fixed Income

Best Agency Broker: Listed Interest Rate Derivatives

Best Inter Dealer Broker: Interest Rate Derivatives

Best Market Making Team: Listed Interest Rate Derivatives

Best Sales Team: Interest Rate Derivatives

Best Market Making Team: Interest Rate Derivatives

Best Agency Broker: Listed FX Futures

Best Agency Broker: Listed FX Options

Best Market Making Team: On-Screen Listed FX Derivatives

Best Sales Team: FX and FX Derivatives

Best Market Making Team: FX & FX Futures

Best Market Making Team: FX Options

Best Agency Broker: Bonds

WINNER

Robinson Mulder

De Waal Fin Services

BVG Commodities

CJS Securities

BVG Commodities

Rand Merchant Bank

Standard Bank

ABSA CIB

Standard Bank

Standard Bank

ABSA CIB

Peresec Derivatives

Tradition

Rand Merchant Bank

Standard Bank

Standard Bank

Peresec Derivatives

Tradition

Rand Merchant Bank

Standard Bank

Standard Bank

Standard Bank

Prescient Securities

Best Inter Dealer Broker: Bonds as voted by Agency Brokers Tradition

Best Inter Dealer Broker: Bonds as voted by Banks Tradition

Best Structuring Team: Fixed Income\Inflation\Credit\FX

Best Structured Notes Issuer

Best Debt Origination Team

Best Team: Credit Bonds

Best Team: Inflation Linked Bonds

Best Repo Team

Best Sales Team: Bonds

Best Bond ETP Market Maker

Standard Bank

Standard Bank

Rand Merchant Bank

Rand Merchant Bank

Rand Merchant Bank

Rand Merchant Bank

Nedbank

Nedbank

Best Market Making Team: Government Bonds Nedbank

Best IDB: Fixed Income Tradition

Best Research House

The SA Listed Tracker Awards (SALTA), are presented to the issuers of Exchange Traded Products (ETPs) that are the top achievers in the industry. They are a joint initiative between four service providers to the ETP industry in South Africa.

The Johannesburg Stock Exchange – JSE Limited

The London Stock Exchange Group – LSEG

Profile Data (Pty) Ltd – Profile

• etfSA.co.za – etfSA

Satrix Managers, the pioneers of the Exchange Traded Funds ETF industry in South Africa, again took the most SALTA Awards this year. Fikile Mbhokota, CEO at Satrix, says, "Winning 10 awards, including both People's Choice Awards, showcases our team's steadfast commitment to innovation and delivering exceptional products that drive financial inclusion and enable all South Africans to 'own the market’. This recognition is a tremendous honour.”

Kingsley Williams, Chief Investment Officer at Satrix, says, "These awards reaffirm our dedication to maintaining the highest standards of performance and transparency, ensuring that our investors' financial goals are at the forefront of everything we do.”

The SALTAs award excellence in:

• Investment returns over the periods of one, three, five and 10 years

Tracking error – the lowest tracking divergence against the relevant benchmarks over a three-year period

• Trading efficiency – tracking at the closest prices to NAV on the JSE over a three-year period

New capital raised – through IPOs or for additional issues of already listed ETPs, for the past three years.

• People’s Choice – the public vote for their favourite ETPs, in both local and foreign markets.

These Awards are judged objectively and quantitatively, using public data, to identify the prime achievers.

There are now 11 issuing houses, that have over 200 products in the form of ETFs, ETNs, AMCs and AMETFs, listed on the JSE that trade on the JSE Main Board and are readily accessible to institutional and retail investors.

ABSA CIB

Best Interest Rate Derivative House Standard Bank

Best Forex House

Best Bond House

Best Fixed Income & Forex House

Standard Bank

Rand Merchant Bank

Standard Bank

New additions to the SALTA Awards for 2024 have been Actively Managed Certificates (AMCs), with the FNB Global Equity AMC, issued under the UBS structure, coming out on top for both 1- and 3-year investment returns. The UBS AnBro Capital (Unicorn) AMC also won an award for trading efficiency, i.e. trading closest to its net asset value over a 3-year period.

A second innovation this year was to extend the ‘People’s Choice’ Award to both local and foreign index tracking products. The public are given the opportunity to vote for their favourite ETPs through a dedicated app set up for this purpose. As usual, there was a very strong response and preferences were shown amongst the investment community for a number of different ETPs, but in the end, Satrix came out top, with the Satrix 40 ETF, winning the local category and the Satrix MSCI World ETF, the foreign category for the People’s Choice.

For the winners, the SALTA Awards are becoming more and more prestigious and the SALTA trophies and certificates are proudly displayed in boardrooms and in the marketing and advertising campaigns of the Award winners.

A rigorous analysis of daily NAV pricing and data generated from trading on the JSE is used to assess the winners of the various categories. The SALTA Awards not only reward investment returns, but also excellence in product performance, in areas such as tracking and trading error, raising of new capital, etc. Only quantitative assessments have been utilised and no subjective judgements are made.

30 April 2024

AWARDS

Summary of Award Winners No. of Awards Satrix Managers 10 Absa NewFunds/NewWave 3 FNB/Ashburton 3 1nvest (Standard Bank) 3 UBS (Union Bank of Switzerland) 3 10X/ CoreShares 2 Sygnia Itrix 1

14 www.moneymarketing.co.za

HedgeNews Africa Awards

These awards recognise the outstanding performance of 60 nominees across 15 categories based on their 2023 calendar-year returns. The Awards measure the best risk-adjusted returns of funds across 15 different categories. They are based on monthly data submitted to the HedgeNews Africa database, which includes South African hedge funds as well as other pioneering strategies applied across the broader markets. The Awards use an established methodology and independently verified data submitted to HedgeNews Africa, the region’s leading independent publisher focused on the hedge fund and alternative asset management industries. “The South African hedge fund industry continues to build on its convincing track record and is worthy of increased investor attention,” says Gwyneth Roberts, the publisher of HedgeNews Africa. “Our database reflects strong riskadjusted returns from many funds in this high-quality industry – not just in 2023, but over the long term.”

The Matrix SCI Fixed Income Retail Hedge Fund was named Fund of the Year, delivering a net return of 20.86% in 2023 on a Sharpe ratio of 1.54%, outperforming its peers and the markets it trades.

In total, 60 nominations were made across the categories, with the one-year awards ultimately going to those funds with the top return, provided their Sharpe ratio was within 25% of the top Sharpe amongst the nominees – a method to judge consistency of returns.

Amongst long/short equity funds, the industry’s biggest category, the Visio Golden Hind FR QI Hedge Fund was the standout performer, with a return of 16.97% on a Sharpe ratio of 1.16.

In the market neutral and quantitative category, the Fairtree Equity Market