Beyond investing

The New Hampshire Public Deposit Investment Pool (NH PDIP) has provided public entities with investment options since 1993. NH PDIP focuses on safety, liquidity, and a competitive yield in order to meet the distinct needs of cities, towns, school districts, and other political subdivisions.

nhpdip.com

1.800.477.5258

1.844.464.7347

This information is for institutional investor use only, not for further distribution to retail investors, and does not represent an offer to sell or a solicitation of an offer to buy or sell any fund or other security. Investors should consider the Pool’s investment objectives, risks, charges and expenses before investing in the Pool. This and other information about the Pool is available in the Pool’s current Information Statement, which should be read carefully before investing. A copy of the Pool’s Information Statement may be obtained by calling 1-844-464-7347 or is available on the NHPDIP website at www.nhpdip.com. While the Pool seeks to maintain a stable net asset value of $1.00 per share, it is possible to lose money investing in the Pool. An investment in the Pool is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Shares of the Pool are distributed by PFM Fund Distributors, Inc., member Financial Industry Regulatory Authority (FINRA) (www.finra.org) and Securities Investor Protection Corporation (SIPC) (www.sipc.org). PFM Fund Distributors, Inc. is an affiliate of PFM Asset Management LLC.

New Hampshire Municipal Association BOARD OF DIRECTORS

NHMA Executive Director A Message from the

Margaret M.L. Byrnes

Happy Town Meeting month! Most of our towns will hold their town meetings on Tuesday, March 12. We are wishing you all snow free, sunny meetings with plenty of debate, discussion, and voting on the many issues that will be on your warrants, from A(ppropriations) to Z(oning amendments)!

Town meeting season also means the production of your annuals report—and ours, too. NHMA’s 2023 Annual Report can be found on pages 25-32 of this issue of Town & City. We hope you enjoy learning about the many successes and initiatives we were able to achieve with your support and engagement, and we’re looking forward to another great year of serving New Hampshire’s cities and towns.

For all local officials elected this year—whether returning or brand-new to serving on municipal government—we encourage you to attend one of our two Local Officials Workshops this spring. This annual workshop, which local officials can attend at no cost on April 3 or May 7 (virtual or in person at our offices), will provide an overview of important municipal law topics; an electronic copy of the “bible” on municipal law, Knowing the Territory; and introduce new local officials to our two fabulous legal services attorneys, who are available to local officials by phone or email Monday – Friday. Learn more about this service by referring to our Legal Services FAQ. You can register for these, and any of our workshops, by visiting our Events Calendar.

Want to get more involved with NHMA? We are very close to starting our 2024 legislative policy process, which officially kicks off on April 5 with our Organization Day meeting. We are still recruiting volunteers to serve on our three legislative policy committees. These committees will review legislative policy proposals submitted by local officials and make recommendations on those policies, which will go to the NHMA Legislative Policy Conference in September. All NHMA’s policies and principles are adopted by our members.

Each of the committees deals with a different set of municipal issues. The committees and their subject areas are as follows (when you contact us, please indicate your first and second choices for a committee assignment.):

• Finance and Revenue – budgeting, revenue, tax exemptions, current use, assessing, tax collection, retirement issues, education funding.

• General Administration and Governance – elections, Right-to-Know Law, labor, town meeting, charters, welfare, public safety.

• Infrastructure, Development, and Land Use – solid/hazardous waste, transportation, land use, technology, environmental regulation, housing, utilities, code enforcement, economic development.

If you are a municipal official in a city or town and are interested in serving on one of the policy committees, please contact the Government Affairs staff at 603-224-7447 or governmentaffairs@nhmunicipal.org ASAP!

Spring is right around the corner!

Warmest regards,

Margaret M.L. Byrnes, NHMA Executive Director

Margaret M.L. Byrnes, NHMA Executive Director

NHGFOA ANNOUNCES FELLOWSHIP PROGRAM 2024

The purpose of the NH Government Finance Officers Association Fellowship program is to develop the next generation of municipal finance officers by creating mutually beneficial partnerships between university students pursuing a career in local government administration and the New Hampshire towns/ cities that can benefit from their services. This program is targeted towards municipalities that can offer a variety of projects and appropriate senior-level mentoring to provide a meaningful experience for students.

The Fellowship should allow the student to participate in a broad range of municipal operations under the Supervision of the Town/City Manager and/or Finance Director. The Fellowship contemplates 400 hours of paid work, with the schedule to be determined between the Municipality and the Fellow. If interested in this program, please contact Shenna Corbett at scorbett@nhmbb.com.

HAPPENINGS Membership Renewal

Membership renewal letters and invoices have been mailed to all NHMA members. Please let us know if you have not received our renewal and feel free to contact us if you have any questions.

NHMA is a membership organization and that is why your support is so critical. By remitting your membership dues, you will continue the tradition that was begun years ago serving all cities and towns in New Hampshire so that no municipality stands alone in the challenges it faces.

Thank you to those members that have already continued their membership with us.

UPDATE YOUR NHMA EMAIL ADDRESSES

NHMA is in the process of switching communications platforms and changing two

REMINDER

Moving forward, please send general communications and questions to info@nhmunicipal.org and event registrations and questions to registrations@nhmunicipal.org. Thank you for your assistance!

What You Should Know About Open Burning Permits

Residents are reminded that even though there may be snow on the ground and a fire permit from the local fire warden may not be required, only brush with branches less than 5 inches in diameter can be burned. The burning of construction and demolition debris is prohibited as well as domestic waste, tires, trash, treated wood and other non-conforming materials. Residents must also check with the local fire department to determine what other restrictions may apply.

Another important reminder is that the fire chief or warden is authorized by RSA 154:2, II to extinguish an illegal fire, even when the resident had a burn permit, and without the consultation of NHDES if the fire chief or warden determines that the fire violates any state or local law. For more information, contact NH Department of Environmental Services at (603) 271-3503 or the NH Division of Forests and Lands at (603) 271-2214.

EPA RECOGNIZES NEW HAMPSHIRE WASTEWATER TREATMENT ENTITIES FOR EXCELLENCE

The U.S. Environmental Protection Agency's (EPA) New England Office recently awarded the 2023 Regional Wastewater Treatment Awards to New Hampshire wastewater facilities and individuals to recognize them for their commitment to improving water quality. The EPA Regional Wastewater Awards Program recognizes personnel in the wastewater field who have provided invaluable public service managing and operating wastewater treatment facilities throughout New England.

2023 EPA Regional Wastewater Treatment Plant Operator of the Year Award - Nate Brown of the Peterborough Wastewater Treatment Facility

Mr. Brown, who is the Utilities Superintendent of the Peterborough Wastewater Treatment Facility, was recognized for his outstanding work over the years operating and maintaining the facility. Mr. Brown was one of only seven individuals across New England to receive this award.

2023 Regional Wastewater Treatment Plant Operation and Maintenance Excellence Award - Hanover Water Reclamation Facility

The Hanover Water Reclamation Facility, led by Superintendent Kevin MacLean, was recognized for exceptional work in operating and maintaining the wastewater treatment plant during the past year. The facility was one of only three facilities across New England to receive this award.

2023 Regional Industrial Pretreatment Program Excellence Award - City of Nashua Industrial Pretreatment Program

The City of Nashua's Pretreatment Program staff, led by Douglas Starr, was honored for exceptional work inspecting, permitting, and sampling industrial users that discharge industrial waste into the collection system.

HEALTH INSURANCE SOLUTIONS FOR NEW HAMPSHIRE TOWNS & CITIES

WHY CHOOSE US

We understand the importance of employee benefits. When it comes to building health plans and wellness programs employees want, we are your team.

Whether you are dealing with a high cost prescription drug, seeking education about your plans, or having trouble getting care approved...we are here for you.

WHAT WE DO

We're committed to offer the highest quality health care to our members through unique and engaging wellness intiatives and outstanding customer service.

We work to reduce the administrative burden of employee health insurance plans for public sector administrators by offering day to day support services.

WHAT WE OFFER

Member Services

Benefit Account Management

Custom Wellness Initiatives

Engaging Programs

Enrollment & Billing Services

info@nhitrust.org

www.nhitrust.org

Upcoming Events

MARCH

For more information or to register for an event, visit our online Calendar of Events at www.nhmunicipal.org. If you have any questions, please contact us at nhmaregistrations@nhmunicipal.org.

APRIL

Informational Session with the Office of U.S. Senator Shaheen on FY25 Congressionally Directed Spending Requests Webinar

Tuesday, March 5

10:30 am - 11:30 am

Local Solutions to the State’s Housing Crisis Webinar Series: Transfer of Development Rights 101: A Primer

12:00 noon – 1:00 pm

Thursday, March 7

National League of Cities Congressional City Conference

Monday – Wednesday, March 11 – 13

Washington, DC

Local Solutions to the State’s Housing Crisis Webinar Series: Attracting Developers

12:00 noon – 1:00 pm

Thursday, March 14

NHMA Board of Directors Meeting

9:30 am – 12:00 noon

Friday, March 15

25 Triangle Park Drive, Concord

2024 Local Officials Workshop

9:00 am – 4:00 pm

Wednesday, April 3

Free to members

25 Triangle Park Drive, Concord

Right-to-Know Workshop on Meetings and Records

9:00 am – 2:30 pm

Wednesday, April 17

Cost: $85 (in-person) and $70 (virtual)

25 Triangle Park Drive, Concord

NHMA Board of Directors Meeting

9:30 am – 12:00 noon

Friday, April 19

25 Triangle Park Drive, Concord

Understanding the Math, Dispelling the Myths

This article, written by Barbara Reid, then NHMA Government Finance Advisor, first appeared in Town and City magazine in March 2013. It has been updated by Katherine Heck, NHMA Government Finance Advisor, where necessary.

The month of March, often described in terms of blustery weather patterns—“it comes in like a lion and goes out like a lamb”—is more aptly referred to by many as just plain old “mud season.” But the month of March also brings to mind other traditional images unique to northern New England: smoke rising from wooden sap houses, filling the air with the sweet scent of maple syrup; snow-laced crocuses opening their petals to the warming rays of an early spring sun; and, of course, the famous Norman Rockwell painting “Freedom of Speech,” which portrays the quintessential image of a traditional New England town meeting.

The convening of citizens at the annual meeting to conduct the town business at hand is a time-honored tradition in New Hampshire. One of the most important items on the agenda for that annual meeting is the adoption of the operating budget along with other appropriations necessary to pay for police and fire protection, maintains roads, and support many other municipal programs and services desired and expected by citizens.

Whether that meeting takes place in March, April or May, and whether that meeting is conducted in the form of a traditional town meeting (as depicted in the Norman Rockwell painting) or through the official ballot voting process known as SB 2, or whether that business is conducted by town or city councilors serving as the elected representatives of the citizens, the adoption of the town or city budget establishes the foundation upon which property tax bills will be based many months from now, when leaves are no longer budding, but falling.

Property taxes—the bill that so many love to hate! It’s the large bill that arrives generally twice each year in most communities, and the property tax rate, as well as the actual amount of tax on a particular property, is not known until long after the budget has been adopted. This often results in a significant disconnect between the spending priorities adopted in the spring and the tax bill that arrives in November or December.

The property tax system is the primary method of financing local governments in New Hampshire and, therefore, worthy of attention to dispel some of the myths and misconceptions associated with it. The property tax is a tax based on the value of real property. Cities, towns, village and special purpose districts along with school districts each raise money through the budget process and asses property tax. Local property tax also pays for a portion of the costs necessary to support county services, as well as the state education tax which every municipality is required to collect.

So how do budget appropriations, assessed value, exemptions, equalization and tax rate all work together to produce the bottom-line figure on the tax bill that every property owner must pay? We will start with the basic formula, and then discuss each component in more detail.

The formula used to calculate the local property tax rate: Voted Appropriations minus All Other Revenue divided by Local Assessed Property Value = Rate

Multiply the rate by 1,000, and you get the property tax rate per $1,000 of property value, which is how the rate is usually stated

Setting the Tax Rate

Every fall, the Department of Revenue Administration (DRA) compiles all the information necessary to certify property tax rates for each municipality, reviewing all appropriations voted on in the spring and all revenues expected. The tax rate is determined by the amount of the tax levy (the amount of tax to be raised). There are several steps involved in determining the tax levy. The city/town develops and adopts a budget. Revenue from all sources other than the property tax (state aid, motor vehicle registration fees, permits and licenses, income from investments, etc.) is determined. These revenues are subtracted from the original budget and the remainder becomes the tax levy. When revenues are greater than estimated when the budget is adopted, the tax rate will decrease by the difference. When revenues do not meet the revenue estimates used when the budget is approved by the legislative body, the difference is made up by taxation.

By law, the property tax bill must show the assessed value of the property along with the tax rates for each component of the tax: municipal, local education, state education, county and village district (if any). Most municipalities receive the certified tax rates from DRA by mid-November, issuing bills that are then due in December—quite a while after the adoption of the budgets that established the basis for those property tax bills.

The amount of money which must be raised through taxes—appropriations minus all other revenue expected to be received—is the major factor which drives the property tax rate. The value of property is the basis on which the tax money to be raised is apportioned to each property owner.

Appropriations and the Budget Process

Every property owner is responsible for paying a portion of the taxes necessary to operate various units of government (municipal, school district, county and village district, if any). Each municipality, school district, village district and county must draft a budget, hold public hearings on the proposal and submit the budget to the legislative body for adoption.

Who are these legislative bodies that approve the necessary appropriations? For a town, the town meeting is the legislative body which appropriates money to operate the town. The school district meeting does the same for the schools, and the village district meeting does the same for districts. For a city, or a town with a town council form of government, the council (or board of aldermen) votes on appropriations. The county delegation, comprising all the state representatives from the county, appropriates the money

necessary to fund county government. These appropriations determine the amount of revenue that must eventually be raised by property taxes in order to fund municipal government, and each municipality’s share of the school, state education and county budgets.

Valuing Property—The Appraisal Process

Property taxes are based upon the appraised value of property as of April 1 of each year. This means that the property tax bill, generally due in December, reflects the value of property on the previous April 1. By law, it is the responsibility of the governing body to annually determine the appraised value of the property within the municipality as of April 1. Most, if not all, municipalities rely on professionally trained assessors to fulfill this statutory responsibility.

Valuing property for property tax purposes is an ongoing process. By law (RSA 75:8-a), a municipality must perform a valuation every 5-years for all properties in the municipality’s boundaries. When, exactly, that occurs for your municipality depends on when it’s first valuation was reviewed by the Department of Revenue Administration (DRA). During a full revaluation, property is physically reviewed and then valued based upon the sale prices of other comparable properties or other approved appraisal methods. The goal of a revaluation is to appraise property at its “full and true” value, often referred to as “market” value.

A complete revaluation establishes base year property values, but is costly and time-consuming and, consequently, is not conducted every year. In the years following a revaluation, assessors perform updates in order to maintain proportionality between the properties in the municipality. They add to the tax rolls what are known as “pick-ups,” for example, new construction and other changes to properties. Depending on the amount of change reflected in recent sales prices and other market conditions, assessors may perform statistical updates, where values are adjusted either up or down based on market data, using a process beyond the scope of this article. Through revaluations and updates, assessors strive to ensure that property within the municipality is appraised proportionally as required by the New Hampshire Constitution, so that each property owner bears their proportionate share of the property tax based upon the value of their property—no more and no less.

Proportionality

A frequent area of misunderstanding is the importance of assessing property values proportionally. It is not as important whether property is assessed at, above or below market value, as it is that values are proportional.

To explain the concept of proportionality, let’s look at a

UNDERSTANDING THE MATH from page 9

few simplified examples below. For the following scenarios, there are only two taxable properties in the town, the properties are very similar in all respects, and the legislative body has approved a $10,000 budget to fund town services, all of which will come from property taxation.

Scenario 1: Both properties have a market value of $250,000 as well as an assessed value of $250,000, for a total townwide assessed value of $500,000. With taxes to be raised of $10,000, the tax rate would be $20 per $1,000 of valuation (10,000 ÷ 500,000 x 1,000). Since there are only two properties and they have the same assessed value, the tax burden would be shared equally: each property would owe $5,000 in property taxes.

Scenario 2: The town budget remains the same at $10,000, but the market has declined since last year so that the market value of each property is now $225,000. However, the assessed value on each property remains unchanged at $250,000. What is the impact of over-assessing these properties compared to market value? None—there is no tax impact, because the proportionality between the properties did not change; both properties declined in market value by the same amount. With taxes to be raised of $10,000 and a town-wide assessed value of $500,000, the tax rate would remain $20 per $1,000 of valuation and each property would again owe $5,000 in property taxes.

Scenario 3: The outcome is the same when the market value of the properties increases above the assessed value, in this case to $275,000.

What happens when one of these properties changes in value, but the other does not? Assume the market value of one of the properties dropped while the other property maintained its value, such as happened several years ago when the market for condominiums fell sharply. The condo, which once had a market value of $250,000, now has a market value of $200,000. If the assessed value of the condo remains at $250,000, both of these properties still would owe $5,000 in property taxes, even though the market value of the condo is $50,000 lower. This would leave the condo owner paying more than his or her fair share of the tax burden because the market value of the condo is less than the market value of the other property. Assessors can correct this lack of proportionality by using a statistical update. The assessor reduces the assessed value of the condo to reflect its drop in market value and to make it proportional to the other property. Now, both properties will be assessed at market value and both will pay only their proportionate share of the tax burden.

The Assessing Process

The assessing process includes the application of statutory exemptions and credits to the appraised values of properties. An exemption is a reduction in the appraised value of a particular property. A credit is a reduction from the tax bill on a particular property. The most common property tax exemptions are for property owned and used for governmental, religious, charitable, educational and other special purposes (for example, the solar exemption), as well as exemptions for elderly homeowners. The most common property tax credit is for veterans and their surviving spouses.

Reasonably 'Proportional'

These three scenarios demonstrate that it is not as important that the assessed value of the two properties remains proportional. In this simple example, because the assessed value of the properties remained proportional, each property's share of the tax burden was 50 percent, or $5,000 regardless of how the assessed values compared to market value.

One of the misconceptions about property tax exemptions and credits is the effect that these have on the amount of taxes to be raised. Granting exemptions and credits for any purpose does not change the amount of property taxes that need to be raised—it merely shifts the responsibility for payment. While the exemption may benefit a particular property or one segment of the population, it will lower the tax base, resulting in a higher tax rate and increased taxes for those properties not eligible for the exemption. The same is true with property tax credits: if one property qualifies for a credit and, therefore, pays less in property taxes, then the amount of that credit must be made up by the taxes assessed on other properties.

Similarly, if a property tax exemption or credit is eliminated, it does not result in additional property tax revenue to the municipality. Rather, it increases the tax base, which lowers the tax rate and reduces the tax burden on other properties.

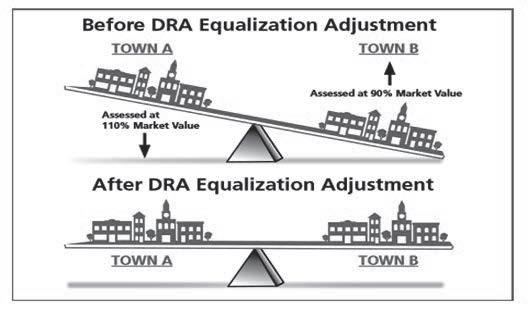

The Equalization Process

Some municipalities may be assessing property close to market value, while others may be assessing above or below market value, all of which is permissible. However, to ensure that public taxes shared by municipalities, such as the state education tax, cooperative school district taxes and county taxes, are reasonably apportioned among municipalities, the playing field must be leveled. This is accomplished by the annual equalization process conducted by the DRA through which each municipality’s assessed values are adjusted to reflect proportionality to other municipalities. This process involves a detailed study of property sales throughout the state, a comparison of those sales with the local property assessments, and an adjustment of the local assessed value up or down to achieve proportionality. The result is called the equalized assessed value.

Once the equalized value of property in each municipality has been determined, those shared taxes can be allocated based upon each municipality’s proportionate share. For

example, if the equalized value of the property in a particular municipality represents 15 percent of the total equalized property value in the entire county, then that municipality would be apportioned 15 percent of the county taxes to be raised. Once the dollar amount of that municipality’s share of the county tax is known, the local assessed value is used to determine the tax rate and how much each individual property owner must pay.

What Will That Add to the Tax Rate?

Before property tax bills are even mailed, the process begins again in many municipalities, as governing bodies and budget committees deliberate on the budget recommendations that will be presented at the next annual meeting. A question often asked at this time is “How much will this add to the tax rate?” To provide a ballpark estimate of how much a certain item will cost on the tax rate, DRA came up with the “three-finger rule.” Taking the prior year’s local assessed property value and covering the right three digits with three fingers provides an estimate of the amount of money that represents $1.00 on the tax rate. Covering the next digit would represent 10 cents on the tax rate, and covering one more digit would be a penny on the tax rate. This works for estimating both a change in appropriations as well as a change in revenues.

For example, in a municipality with $1,400,000,000 of assessed value, $1.4 million would be approximately $1.00 on the tax rate; $140,000 would be about $.10; and $14,000 would be about a penny. So, if a particular item, such as a new police cruiser, is estimated to cost $28,000, then, in this particular municipality, it would mean about $.02 on the tax rate.

Remember, the amount is different for each municipality depending on the net local assessed valuation. Also recognize that this is a rough estimate since it is based upon the prior year's assessed valuation, a value that will change as of April 1. But the three-finger rule certainly provides a reasonable estimate of whether a particular appropriation, or an anticipated change in revenue, will result in pennies - or dollars - on the tax rate.

Katherine Heck is the Government Finance Advisor for the New Hampshire Municipal Association. Contact Katherine at 603-224-7447or kheck@nhmunicipal.org

ACA IRS Reporting Reminder

By Erica Bodwell and David Salois, HealthTrust

The ACA requires Applicable Large Employers (ALEs) to report to the IRS whether they offered minimum essential coverage (MEC) that was affordable and provided minimum value to full-time employees. Employers of any size with self-insured plans must also report months of coverage for all enrolled individuals.

Do Municipalities Have to Complete the ACA Reporting?

For municipalities with HealthTrust medical plan coverage, the Member Group is considered to have self-insured employer health plan coverage for IRS reporting purposes; HealthTrust is a self-insured Multiple Employer Welfare Arrangement (MEWA), not a health insurance issuer or carrier. The IRS instructions for Forms 1094-B and 1095-B provide that plan sponsors are responsible for reporting self-insured employer health coverage.

For this purpose, each participating employer in a MEWA (each HealthTrust Member Group) is considered the “plan sponsor” for the medical coverage offered to its employees.

IRS Requires Electronic Filing for ACA Reporting in 2024

The filing requirements for CY2023 remain the same as in previous years, with the exception that electronic filing is required for all employers filing more than 10 returns (including, in the aggregate, forms 1099 and W-2).

Reporting for coverage provided during the 2023 calendar year is due:

• To employees and other covered individuals by March 1, 2024.

• To the IRS by April 1, 2024 electronically, which is required if 10 or more returns are filed (see details below).

Electronic Filing via the AIR System is Required! In February 2023, the IRS released final regulations that make

electronic reporting for Forms 1094-B and 1094-C and Forms 1095-B and 1095-C mandatory for ALL employers filing 10 or more returns in the aggregate, beginning with the 2023 reporting season. For returns filed in calendar year 2024, employers who are required to file 10 or more Forms 1094-C or 1095-C, Forms 1099, Forms W-2, and many other IRS forms in the aggregate must file electronically. Any employer who has previously filed via paper will either need to file using the Affordable Care Act Information Returns (AIR) system or partner with a vendor that will file on the employer’s behalf.

The new “aggregation of returns” rule means that in calculating whether an employer has at least 10 returns and is required to file electronically, the employer’s Forms W-2, 1099, and multiple other returns (in addition to the Forms 1094-C and 1095-C) are all included together in the 10return count. Given the aggregate nature of the electronic filing requirement, it is highly likely that most municipalities will need to file their ACA reporting documents electronically via the AIR system or through a vendor. HealthTrust strongly recommends that all Member Groups who have previously filed their 1094-B and 1094-C forms, or 1095-B and 1095-C forms, on paper begin the process of setting up an AIR system account as soon as possible or finding a vendor for this service. Filings are due on April 1, 2024, and it can take weeks to months to apply for and receive a transmitter control code (TCC) from the IRS, which is needed for AIR system filings that are not done through a vendor. You would not need to complete the TCC application process if you contract with a vendor that has their own TCC code.

The AIR system only allows for electronic submission of the forms using an “XML” format. This format generally requires the use of a third party vendor to create or convert the ACA forms. If the cost of contracting with a vendor creates an undue financial hardship, a Hardship Waiver can be requested using form 8508. There are specific time frame requirements and requires two cost estimates when submitting the waiver.

“All our thoughts and notions of civil government are inseparably associated with counties, cities, and towns...”

Keep in mind that the penalty for failure to timely file correct forms 1094-B and 1094-C or 1095-B and 1095-C for the 2023 plan year is $310 per form, and transitional good faith relief has been eliminated, unless the ALE has filed for and received a hardship waiver. Thus, Member Groups will incur penalties if they file their forms late, making it imperative that they set up their AIR system account in a timely manner.

Additional Resources

Tax form filing vendors are prevalent through a web search. While we cannot recommend a vendor, two examples are Yearly and Accountability.

HealthTrust Member Groups can access additional resources on the Secure Member Portal (SMP) including recent messages, FAQs, and presentations about how to complete the forms.

For further information on how these IRS reporting requirements apply to your specific circumstances, please consult with your legal, tax or other professional adviser.

Erica Bodwell is the Benefits and Coverage Counsel at HealthTrust. David Salois is the Member Relations Representative at HealthTrust

Cisco Systems, Inc. and one of its authorized resellers, Red River Technology, would like to inform you about the many benefits of using the NVP AR3227 PA New Hampshire #8001458 contract for your procurement of Cisco solutions.

Cisco Systems, Inc. and one of its authorized resellers, Red River Technology, would like to inform you about the many benefits of using the NVP AR3227 PA New Hampshire #8001458 contract for your procurement of Cisco solutions.

You don't need an RFP to purchase Cisco Products and Services!

• May save time & resources by avoiding bids or RFPs since the contract meets many entities’ competitively bid procurement rules.

You don't need an RFP to purchase Cisco Products and Services!

• May save time & resources by avoiding bids or RFPs since the contract meets many entities’ competitively bid procurement rules.

• Pre-negotiated and pre-approved procurement terms and conditions (refer to the contract documents).

• Pre-negotiated and pre-approved procurement terms and conditions (refer to the contract documents).

• Guaranteed minimum discounts, which may be exceeded by fulfillment partners with deeper, additional discounts.

• One-stop-shop for Cisco’s Products and Services.

• Guaranteed minimum discounts, which may be exceeded by fulfillment partners with deeper, additional discounts.

• One-stop-shop for Cisco’s Products and Services.

Buy today with an easy ordering process:

Buy today with an easy ordering process:

1. Request quotes/pricing from multiple Authorized Fulfillment Partners for the contract to receive competitive pricing.

2. Select the Authorized Fulfillment Partner who offers the best value.

3. Issue the Purchase Order directly to the selected Authorized Fulfillment Partner.

1. Request quotes/pricing from multiple Authorized Fulfillment Partners for the contract to receive competitive pricing.

4. Reference the contract #(s) on your Purchase Order.

2. Select the Authorized Fulfillment Partner who offers the best value.

3. Issue the Purchase Order directly to the selected Authorized Fulfillment Partner.

4. Reference the contract #(s) on your Purchase Order.

Take the Next Step and Start Saving Time and Resources Immediately

Take the Next Step and Start Saving Time and Resources Immediately state sourcing team in accordance with that state’s procurement

™

state sourcing team in accordance with that state’s procurement ™

For more information or to speak with Cisco’s contract management team, please email cmo-contracts@cisco.com

For more information or to speak with Cisco’s contract management team,

ARPA Obligation Deadline is Around the Corner

By Michael Gleeson, National League of Cities

By Michael Gleeson, National League of Cities

The American Rescue Plan Act (ARPA) provided cities, towns and villages with a long runway to obligate the allocated funds under the State and Local Fiscal Recovery Funds (SLFRF) program. Under this program, every city, town and village in America was offered a grant out of the $65.1 billion set aside for municipalities.

This bill passed in 2021, and the first money went out the door in May 2021. Now, we are 14 months from the obligation deadline of December 31, 2024. If a municipality has not obligated its ARPA SLFRF funds by the end of 2024, they will have to return the funds to Treasury.

What Is an Obligation?

The SLFRF Frequently Asked Questions published by Treasury explains how this term is used:

As stated in the final rule, obligation means “an order placed for property and services and entering into contracts, subawards, and similar transactions that require payment.” See 31 CFR 35.3.

What this means is that it is not enough for local governments to simply budget the money, they need to go a step further and place an order for property or services that requires payment. In the case of payroll, grantees need to follow state and local established practices.

What Does This Mean for Building Your Budget?

For local government finance directors, this means that they cannot begin identifying expenditures in mid-2024 for fiscal years 2025 or 2026. Contracts or similar transactions need to be executed in the next 14 months, though the dollars do not need to be spent until 2026.

For cities looking to use their money for ARPA Flex (which allows funds to be expended on Community Develop-

ment Block Grants (CDBG), infrastructure projects, and recovery from natural disaster), those contracts or similar transactions, or subawards, will need to be entered into by December 31, 2024. The expenditure deadline is September 30, 2026.

For clerks, town managers and finance officers, one other thing to keep in mind is that it can take some time to structure an agreement for a housing project (CDBG) or an infrastructure project. Additionally, for infrastructure projects, contracts might need to be signed in a sequence.

If an infrastructure construction project will last until October 2026, some of the contracts for materials or labor may not be signed – because of sequencing reasons – until after December 31, 2024, the obligation deadline.

What Should My City Do Now To Prepare?

In 2020, NLC’s City Fiscal Conditions showed that 24 percent of cities, towns and villages have a starting date of January 1 for their fiscal year. There is a little more than a month before the FY24 budget will be put into force. This means that 24% of cities, towns and villages realistically have about a little over a month to incorporate SLFRF funds into the budget.

The easiest way for municipalities to put the SLFRF funds into their FY24 budget is claim it as lost revenue. A municipality can then use the money for government services.

While it is possible to pass budget amendments during the year to include SLFRF spending in the budget, it would be best to incorporate it now.

54 percent of cities have a July 1 start date for their fiscal year. Between July 1st and December 31st they will have six months to obligate the budgeted money.

Best Practices

When obligating and spending your SLFRF funds, keep these best practices in mind:

• Be mindful of the definition of obligation. It is not just budgeting the money, a municipality must go further and create a contract, subaward or similar transaction requiring payment.

• All municipalities should have a plan to obligate by the deadline.

• Calander year budgeters should be examining their budgets to make sure they are plugging in their SLFRF dollars. The easiest way to do this is to claim lost revenue and use the money on government ser vices.

• Remember that it can take time to negotiate and execute a contract. Include that time in your plans.

Michael Gleeson is the Legislative Director of Finance, Administration and Intergovernmental Relations at the National League of Cities.

NHMA has created a new Municipal Marketplace to bring greater member attention to our supporters who provide products and services to New Hampshire ’s municipal governments. Our online Municipal Marketplace provides a wide range of categorized municipal product and service listings that will serve as a quick source of information for municipal officials.

Auctions International

Avitar Associates of New England Inc

Benchmark Office Systems

Cartographic Associates, Inc., dba CAI Technologies

CheckmateHCM

Citizens

Community Heart & Soul

Cordell A. Johnston, Attorney at Law

Donahue, Tucker & Ciandella, PLLC

Doucet Survey, LLC

Drummond Woodsum

Eagle Network Solutions

Environmental Partners, An Apex Company

Freedom Energy Logistics

HEB Engineers, Inc.

Horizons Engineering Inc.

IBEW Local 490

Ideal Concrete Block Co.

JSJ Auctions, LLC

MHEC

Mitchell Municipal Group, P.A.

Municipal Resources, Inc.

Municipal Technology Systems, LLC

NH Municipal Bond Bank

NH PDIP/PFM Asset Management LLC

NH Tax Deed & Property Auctions

NHCDFA

NorthEast Electrical

Northway Bank

Onsite Drug Testing of New England

P3 Advisors Strategy & Finance

Pare Corporation

Primex

R.W. Gillespie & Associates, Inc

Roberts & Greene, PLLC

Santander Bank, N.A.

Sertex Broadband LLC

TD Bank N.A.

Three Bearings Fiduciary Advisors, Inc.

Upton & Hatfield, LLP

Usource Energy

Vachon Clukay & Company PC

VHB

Vision Government Solutions, Inc.

Workshops & Webinars for New Hampshire’s Municipal Officials

Moderators Workshops

One half -day workshop for SB2 Meetings and another half -day workshop for Traditional Meetings held in January and February each year. Includes the Town Meeting/School Meeting Handbook . (Fee charged)

2024 Webinar Series

Held each month, typically from noon to 1:00 pm on a Wednesday, and covers timely municipal topics such as Right -to-Know law, legislative overviews, code enforcement, cybersecurity, elections, and more. (No fee)

Local Officials Workshops

Workshops held in April and May designed for the newly -elected and veteran municipal officials. Includes one copy of the current 250+page handbook Knowing the Territory. (No fee)

Budget & Finance Workshops

Traditionally held each year in September. Includes The Basic Law of Budgeting Handbook, and addresses a variety of topics regarding the municipal budget process . (Fee charged)

Academy for Good Governance

A series of seven courses created by NHMA and Primex, exclusively for elected governing body members (select board, town council, city council, board of aldermen, Attendees receive education and training intended to make them more knowledgeable and effective in their governing body roles. Attendees must attend all courses to receive a Certificate of Completion.

Municipal Land Use Law Conference

Full-day event held in the fall with multiple sessions on land use related topics. (Fee charged)

Annual Conference and Exhibition

Held in October providing two (2) full days of educational programming and training opportunities for every local official on a wide variety of topics and access to over 85 exhibitors. Event is the largest municipal gathering in the state every year. (Fee charged)

Right-to-Know Law Workshops

Held each year on governmental records and public meetings. Separate workshop for law enforcement also provided. Includes publication, A Guide to Open Government in New Hampshire, reflecting the latest developments in the law. (Fee charged)

NHMA has a new member portal and we need you to log-in, create your password, and look around your member profile.

IMPORTANT: You will need this member log-in to get member pricing for NHMA events.

3 EASY STEPS TO LOGIN

STEP 1. Go to: https://nhmunicipal.weblinkconnect.com/portal.

STEP 2: Click “forgot password” if you’ve never logged in be-

STEP 3: One of two things will occur:

a. You will receive an email to set your password if you are already in our system. Please follow the instructions in the email. Check your spam folder!

b. OR you will receive the error message “A user with that email was not found ” if you are not in our system. In this case, email us at info@nhmunicipal.org.

New Hampshire Municipal Association

Free workshops for newly-elected and seasoned municipal officials and employees of member municipalities.

Local Officials Workshops

9:00 am—4:00 pm

Wednesday, April 3, 2024

25 Triangle Park Drive, Concord

9:00 am—4:00 pm

Tuesday, May 7, 2024

25 Triangle Park Drive, Concord

Presented by NHMA's Legal Services attorney, these workshops provide municipal officials with tools and information to effectively serve their communities. Topics will include the Right-to-Know Law, town governance, budget essentials, ethics and conflicts of interest, running effective meetings, municipal roads, and more. This program will also include a presentation on hot topics pending before the New Hampshire State Legislature of concern to municipal officials. Ample time allowed for questions, answers, and discussion.

Virtual attendance available via Zoom

Attendees will receive a complimentary copy of NHMA’s 2024 edition of the publication, Knowing the Territory.

Elevate Your Business Profile!

By becoming a Sustaining Sponsor, businesses position themselves as patrons of New Hampshire cities and towns, earning recognition and brand trust from the community.

With tiered options offering increasing visibility and member access, joining the Sustaining Sponsors program is a strategic investment for businesses aiming to elevate their profile and contribute to the Association’s mission of serving New Hampshire municipalities.

Being a Sustaining Sponsor puts your business at the forefront of the minds of NHMA members, ensuring you the visibility, access, and awareness that will help move your business forward. We thank these businesses for their support of NHMA and local government in New Hampshire.

Providing healthcare coverage to New Hampshire public sector employees, retirees and their families

BOO! WE’RE MOVING . . .

NHMA’S ANNUAL CONFERENCE AND EXHIBITION TO OCTOBER.

SAVE THE DATES OF WEDNESDAY, OCTOBER 30 & THURSDAY, OCTOBER 31

WE PROMISE YOU A SPOOKTACULAR TIME!

Margaret Byrnes, Executive Director

Margaret Byrnes, Executive Director

executive director message

Although we have already launched full speed into 2024, we want to take a moment to reflect on 2023 and another year of working with thousands of local officials across the state to support effective and efficient local government. Our Annual Report is intended to give members a snapshot of what NHMA has been doing to serve the interests of local government over the past year.

NHMA is a staff of nine, serving all 234 cities and towns through legal services, training and education, and advocacy; supporting 50 associate members; and providing association management and legislative tracking services for other organizations of municipal officials. Every year, I am amazed at how our small staff adapts and responds to serve the changing needs and growing challenges affecting local government. 2023, in particular, featured several new initiatives.

Last July, we premiered a beta program: In response to the unprecedented availability of new federal grant programs, NHMA launched the Coaching and Technical Assistance Program (CTAP) to provide technical support to selected municipalities with populations under 10,000 to find and apply for grant opportunities. Thirteen municipal projects were selected, with seven making significant progress towards acquiring funding. NHMA is looking to continue this program in some form in the future.

In October, the board of directors voted to engage in a strategic planning process. Because we are a member funded member founded organization, the newly formed strategic planning committee will be soliciting input and feedback from NHMA members to help us formulate our 2025 – 2028 strategic plan, which will be unveiled at NHMA’s Annual Conference in October, and will set goals and a guiding framework for the association over the next several years.

Then, in December, we launched the new member portal, which allows local officials to more easily update their contact information, change their communications subscriptions, register for workshops, view and pay invoices—and more. If you have not yet visited the portal or created your account, please refer to page 20 for more information.

And since we’re on the topic of annual reports, I would be remiss not to mention that we hosted a webinar with the University of New Hampshire on a very fun, important project: The archiving of all annual reports for New Hampshire cities and towns. This was a huge undertaking and a critical effort to preserve the history of our municipalities. You can learn about everything from the number of horses, oxen, cows, and “neat stock” the Town of Barrington had in its inventory in 1928 to how many forest fires were rec-orded in Whitefield in 1944.

NHMA was founded by municipalities for municipalities in 1941. With 100% municipal membership, NHMA is proud to be your source of education, training, legal guidance, advocacy—and all things local government—as you navigate your municipal role as employee, elected or appointed official, or volunteer.

the year in photos

Hampton Fall’s Town Administrator Karen Anderson Accepts Russ Marcoux Award

100%

Representing all 234 cities and towns in NH

3,000

the year in numbers

50 Associate Members, including 7 counties, 10 regional planning commissions, 6 fire districts, 14 water and sewer districts, 13 village districts

Attorneys handled over 3,000 legal inquires, averaging 12 inquiries per day

27

Affiliate Groups primarily of municipal officials serving a particular position, such as town and city clerks, assessors or road agents

Top 5

Top 5 legal inquiries were Right -to-Know Law, Zoning Board of Adjustment, Planning Board, Select Board Authority and Procedures, and Warrant Articles

Staff presented to 27 outside agencies, including NH Government Finance Officers Association, NH Clerks and Tax Collectors Association, NH Office of Planning and Development, and five workshops with UNH ’s T2

26/315

Number of On-Demand workshops presented to over 315 members

1,050

NewsLink distributed 26 times in 2023 to a base of 1,050 subscribers

1,660/2,000

23/540

1225/26

31 Staff at NHMA

9

Staff presented 23 educational programs to over 540 attendees

1,225 subscribers to Legislative Bulletin received 26 Bulletins and a Final Bulletin in 2023

6 Association Management Services (AMS) provided

2,150

Classified ads posted on behalf of members

Print subscribers to New Hampshire Town and City, and over 2,000 digital copies distributed to members

2,555/1,900

34 webinars 2,555 registrants; 1,900 at-tendees; on variety of topics including elec-tioneering, tax deeding, treasurer training, charter government, municipal immunities

3,000

Nearly 3,000 member views on archived webinars and workshops

400 Legislative team followed nearly 400 bills at the State House

358/125/100

358 members from 125 cities and towns attended our fall Annual Conference and Exhibition in Manchester. NHMA also received generous support from nearly 100 sponsors and exhibitors

government affairs and legal services

The session started out with NHMA following nearly 400 bills and ended with only a handful of committees of conference. Several deeply concerning bills, such as HB 51, the anti-lobbying bill, and HB 647, the immunity repeal bill, were decisively defeated early on in the session.

This session saw bipartisan support in both chambers on many important bills, as well as a willingness to work with stakeholders to improve legislation.

HB 1 and HB 2, the largest bills of the year in both the literal and figurative sense, saw a number of municipal priorities included in its final version. The concurrence of the New Hampshire House with the New Hampshire Senate on the State Budget ( HB 1) and Trailer Bill ( HB 2) marked a historic moment at the State House and an investment in our cities and towns. The bipartisan effort that went into those bills resulted in a number of wins for every -one, including $145 million more for municipalities than in the last biennium’s budget.

Please refer to Final Bulletin for more details!

NHMA staff includes two attorneys who are available to answer legal inquiries and provide general legal assistance by email and telephone to elected and appointed officials from member municipalities. Our attorneys prepare articles, handbooks, seminars, and other educational resources in addition to answering specific legal questions from our members.

NHMA’ s Legal Services handled over 3,000 legal inquires in 2023. This averages out to twelve legal inquires a day.

Please refer to the Legal Q&A section in this issue which provides a more comprehensive overview of legal services provided in 2023.

new programs and publications

Financial Policies Certificate Program

52 local school and municipal officials graduated from the inaugural class of a free, eight course certificate program, the Financial Policies Certificate program , designed for officials who wanted to improve the fiscal operations of their city or town.

Coaching and Technical Assistance (CTAP) Program

NHMA partnered with ADG to pilot a Coaching and Technical Assistance Program (CTAP) providing twelve members with technical assistance to attain funding for local projects. The goal of this pilot project is to help smaller towns successfully access federal, state, and other funding in order to implement impactful projects in their communities.

Volunteer Manual

The Volunteer Manual was developed to assist municipalities with recruiting and maintaining the ranks of elected and appointed officials who serve as officials and members of public bodies. It is designed to be used by managers, administrators and governing bodies who are responsible for shepherding those officials who are elected, and appointing residents to sit on municipal boards and commissions.

Charter Government Handbook

The Charter Government Handbook is a brief overview of selected topics important to effective municipal governance and offers an introduction to New Hampshire municipal government.

Municipal Marketplace

With over 50 businesses participating, NHMA created a new Municipal Marketplace to bring greater member attention to those vendors who provide products and services to New Hampshire’s municipal marketplace. Our online marketplace provides a wide range of categorized municipal product and service listings that serve as a quick resource of information for members.

Sustaining Sponsors Program

With tiered options offering increasing visibility and member access, the new Sustaining Sponsors program is a strategic investment for businesses aiming to elevate their profile and contribute to NHMA's mission of serving New Hampshire cities and towns.

NHMA’s most recently completed audited financials are available on the NHMA website.

Thank you to our Sustaining Sponsors!

board of directors and staff

The New Hampshire Municipal Association is a nonprofit, non -partisan association working to strengthen New Hampshire cities and towns and their ability to serve the public as a member -funded, member-governed and member-driven association since 1941. We serve as a resource for information, education and legal services. NHMA is a strong, clear voice advocating for New Hampshire municipal interests.

Does your auction company cover the costs of your auction and associated legal fees for your tax deed real estate auctions?

Promotion of the auction online, in newspapers, and with custom signage on each property

Notification of the auction to property abutters and our exclusive bidder list

Preparation of bidder materials for download and distribution

Live auction held within your municipality

Handling of bidder inquiries before and after the auction

Collaboration with law firm Sager & Smith, PLLC to conduct closings, prepare deed s, and file “excess proceeds” action s

10% buyer’s premium for most auctions

New Solar Opportunities for New Hampshire Municipalities

By Mark Zankel, Director of Community Solar Farms at ReVision Energy

Why is Everyone Talking about Solar in New Hampshire?

More than ever, municipalities across New Hampshire are exploring the financial and environmental benefits of going solar. How do we know this? Because our co-owners are talking with municipal partners, evaluating municipal lands, responding to municipal RFP/ RFQs, and developing and constructing municipal solar projects every day.

And why is it such a great time for municipalities to look at solar opportunities? There are a host of reasons including:

(1) Lowering electricity costs and saving taxpayer money;

(2) Advancing renewable energy goals; (3) Contributing to climate solutions; and (4) Supporting local businesses and jobs.

Recent federal and state policy changes have made the skies even sunnier. In New Hampshire, HB 281 was passed with strong bipartisan support and signed into law in August. This bill expanded group net metering opportunities for local governmental entities by removing the arbitrary geographic restriction that had been in place for 1-5 megawatt solar arrays. Now, any city, town, county, school administrative unit, water district, sewer district, public housing authority, or other qualified local governmental entity can participate in a solar farm located anywhere within their utility’s service district (previously the array had to be located within the same municipality). No facilities required, no capital expenditure, and an easy way for municipalities to receive solar energy rebate payments while supporting local, clean renewable energy.

Communities can also host solar farms on their lands, with the energy produced going to offset electricity use in the host community or elsewhere in the utility service district. At the federal level, significant financial incentives previously available only to private individuals and businesses have now been extended to municipalities and other public and

nonprofit entities through the 2022 Inflation Reduction Act. Collectively, these policy improvements are helping to democratize access to the economic and environmental benefits of community solar.

Solar Energy – There’s a Lot of it, it is Cheap, and it’s Helping to Save the Planet!

Think about this - the amount of solar energy hitting the Earth in one hour is more than enough to power the world for one year. And while solar previously had a rap as “too expensive” for budget-conscious towns and consumers, that is no longer the case (and hasn’t been for several years). The cost of solar declined by 40% in the last decade. Meanwhile, the cost of electricity in New Hampshire has been rising. Simply put, solar customers are saving a lot of money on their energy costs. For municipalities, this can potentially add up to millions of dollars of savings over the life of a solar project.

With solar costs coming down and electricity costs going up, it’s no wonder that solar is growing by leaps and bounds. In 2022, a new solar project was installed every 44 seconds, and solar comprised nearly half of all new electricity generating capacity built in the U.S. Today, there are more than 4.4 million solar energy systems in the United States, providing more than 5% of U.S. electricity (more than 10x its share a decade ago). Some states have reached 20% or more solar, including in our region. New Hampshire has 234MW of installed solar, enough to power nearly 38,000 homes, and

installations are on the rise (see chart above).

In addition to providing lowercost energy, going solar is good for the planet. More and more New Hampshire communities are setting renewable energy and climate goals, and solar can be one of the most tangible and turnkey ways for a municipality to make progress. Across the U.S., solar energy systems in place today are reducing carbon emissions by 175 million metric tons annually. To give that number some context, it equates to taking 39 million vehicles off the road; not using 20 billion gallons of gas; planting 2.8 billion trees; and retiring 47 coal-fired power plants.

How are New Hampshire Municipalities Collaborating with Solar Developers to “Go Solar”?

Solar developers like ReVision are partnering with communities in a variety of ways:

•Designing and constructing rooftop and ground-mount solar arrays to power municipal facilities;

•Leasing municipal land for community solar farms, providing a new source of municipal revenue and serving residential, business, nonprofit and municipal energy users;

•Re-developing brownfields and other formerly contaminated/ disturbed sites into solar farms, which now benefit from special federal incentives under the Inflation Reduction Act;

•Offering power purchase agreements (PPAs) and community solar rebate programs that allow municipalities to enjoy significant long-term savings on energy costs; and,

•Helping to secure grant funds and other creative financing mechanisms that expand access to solar benefits for low and moderate-income households.

Each of these opportunities for municipalities has been enhanced by the federal and state policies highlighted above.

Looking Ahead

New Hampshire is making progress on solar, however we continue to lag behind our neighboring states as this chart shows:

We expect New Hampshire’s percentage to trend upwards, as policy changes have expanded opportunities for all those interested in going solar, and particularly for municipalities, school districts, public housing authorities and other small governmental entities in the Granite State.

Careful analysis of the value of solar on the grid from the NH Dept. of Energy finds that as more municipalities go solar, they save money not just for themselves but also for the public at large.

To accelerate the transition to clean,

locally generated and lower-cost renewable energy, and to provide even more opportunities for New Hampshire communities to go solar in the years to come, here are a few things that would make a big difference:

•Make further improvements to State policy, particularly in net metering and our renewable portfolio standards.

•Establish meaningful local and statewide climate and clean energy goals (we are the only state in New England lacking such);

•Equitably address the growing challenge and costs of interconnecting renewable energy systems into our electric grid.

Local solar businesses stand ready to help municipalities and policy-makers explore the many economic and environmental benefits of solar energy. With so many new and enhanced opportunities available, there has never been a better time for New Hampshire communities to go solar.

Mark Zankel is the Director of Community Solar Farms at ReVision Energy. He can be reached at mzankel@revisionenergy.com or 603.686.4454

NHMA Gears Up for 2025-2026 Legislative Policy Process

By Natch Greyes, Government Affairs CounselIt’s Never Too Early to Submit Policy Suggestions

Our Advocacy Efforts Matter! Your Voice Matters More!

Established in 1941 as a voluntary association of New Hampshire’s cities and towns, the New Hampshire Municipal Association has served as the primary legislative advocate for New Hampshire’s municipalities, representing its members at the state legislature and before numerous federal and state administrative agencies.

We are a unique advocacy organization in that we do not support or endorse any candidate or political party. Our ability to maintain significant political relevance is tied directly to our advocacy efforts and the relationships we have cultivated over many years with state and municipal leaders, the New Hampshire Legislature, state agency officials and other stakeholder groups.

As many municipal officials already know, our legislative work is a full-time, year-round job. It is an ongoing process and staff members have already been working on laying the foundation for the next legislative biennium. The success of NHMA’s legislative efforts, in large part, depends on you. You work at the level of government that is closest to the citizens and you are uniquely situated to help legislators understand how pending legislation affects your city or town.

Step One: Get Involved –Volunteer for a Policy Committee

As a first step, we are recruiting volunteers to serve on our three legislative policy committees. These committees will review legislative policy proposals submitted by local officials and NHMA affiliate groups and make recommendations on those policies, which will go to the NHMA Legislative Policy Conference in September 2024.

Each of the committees deals with a different set of municipal issues. The committees and their subject areas are as follows:

• Finance and Revenue – budgeting, revenue, tax exemptions, current use, assessing, tax collection, retirement issues, education funding.

• General Administration and Governance – elections, Right-to-Know Law, labor, town meeting, charters, welfare, public safety, other governance and legal matters.

• Infrastructure, Development, and Land Use – solid/ hazardous waste, transportation, land use, environmental regulation, housing, utilities, code enforcement, economic development.

When you contact us, please indicate your first and second choices for a committee assignment. We will do our best to accommodate everyone’s first choice, but we do need to achieve approximately equal membership among the committees. We hope to have 15-20 members on each committee.

There will be an organizational meeting for all committees on Friday April 5, 2024. After that, each committee will meet separately as many times as necessary to review the policy proposals assigned to it—typically three to five meetings, all held on either a Monday or Friday, between early April and the end of May.

The committee process will allow for in-depth review and discussion of policy suggestions so all aspects of each proposal, both positive and negative, will be examined. Based on that review, each committee will make recommendations for the adoption of legislative policies.

Once the committees complete their work, their policy recommendations will be sent to every municipal member of NHMA. Each municipality’s governing body will be encouraged to review the recommendations and establish positions on them. Members will also have an opportunity to submit floor policy proposals in advance of the Legislative Policy Conference in September.

New Hampshire Municipal Association

New Hampshire Municipal Association

2025-2026 Legislative Policy Process

Explanation of Proposed Policy

Submitted by (Name): Date:

Title of Person Submitting Policy:

City or Town: Phone:

To see if NHMA will SUPPORT/OPPOSE:

Municipal interest to be accomplished by proposal:

Explanation:

A sheet like this should accompany each proposed legislative policy. It should include a brief (one or two sentence) policy statement, a statement about the municipal interest served by the proposal and an explanation that describes the nature of the problem or concern from a municipal perspective and discusses the proposed action that is being advocated to address the problem. Mail to NHMA, 25 Triangle Park Drive, Concord, NH 03301; or e-mail to mailto:governmentaffairs@nhmunicipal.org no later than the close of business on April 15, 2024.

At the Legislative Policy Conference, each member municipality is entitled to cast one vote on every policy recommendation submitted and on any floor proposals. Each policy proposal must receive a two-thirds affirmative vote of those present and voting in order to be adopted as an NHMA policy.

Step 2: Create ChangeSubmit a Legislative Policy Proposal

Every NHMA legislative policy begins with a proposal submitted by a local official, board, or committee. If there is a law affecting municipal government that you think needs to be fixed, or if you have an idea for how the functions of local government might be improved through legislation, this is your opportunity to make a change.

On Page 33 there is a Legislative Policy Proposal Form that can be used to submit a proposal for consideration. The deadline for submitting proposals is April 12, although earlier submission is encouraged. Please follow the instructions on the form for submitting your proposal.

We leave you, then, with two assignments, should you choose to accept them:

• Contact the Government Affairs Staff (soon!) if you are interested in serving on a legislative policy committee (send us an email at governmentaffairs@nhmunicipal. org); and

• Submit a legislative policy proposal if you have an issue that you would like to be considered as part of this year’s policy process. If you have a policy suggestion, it is not too early to send it in! Policy proposals may be submitted by a board or a local official from a member municipality. Please use the form found in this issue and email to us at governmentaffairs@nhmunicipal.org.

Policy Review Checklist

In order to make sure that each policy has been thoroughly considered and all pros and cons discussed, the following checklist should be applied to each recommendation.

Where does the policy come from?

What is the need for this legislative change/how widespread is this problem?

What could we lose and what are the risks of pursuing this proposal? What could we gain?

Who would likely be opposed to this proposal? Who would likely support it?

Does this proposal require financial analysis?

Would the policy cost money for municipalities? For the state?

Would the policy be divisive for municipalities? Would it tend to pit one community against another?

Member Highlight: Classified Ads Postings

Member Highlight: Classified Ads Postings

NHMA offers an online job and/or classified ad postings at www.nhmunicipal.org

NHMA offers an online job and/or classified ad postings at www.nhmunicipal.org.

The postings are available to members without a charge and appear on the website for up to two months, or less, depending on your schedule. This can include job postings, bids, for sale items, Request for Proposals (RFPs), and Request for Qualifications (RFQs). Municipal employers posting jobs can include information on the position’s hours, job description, qualifications, pay, application process and deadline.

If you would like to post a classified ad to NHMA’s website, but not quite sure how to do it, please contact NHMA’s Timothy Fortier at 603.226.1305 or tfortier@nhmunicipal.org

The postings are available to members without a charge and appear on the website for up to two months, or less, depending on your schedule. This can include job postings, bids, for sale items, Request for Proposals (RFPs), and Request for Qualifications (RFQs). Municipal employers posting jobs can include information on the position’s hours, job description, qualifications, pay, application process and deadline.

If you would like to post a classified ad to NHMA’s website, but not quite sure how to do it, please contact the NHMA at 603.224.7447 or info@nhmunicipal.org.

We are Bond Counsel for Local Government

Drummond Woodsum’s public finance team provides guidance to municipalities, counties, and schools on a wide range of financing matters, including local authorization and issuance of general obligation bonds, lease purchase agreements, tax anticipation notes, and refunding bonds.

Attorneys Steven Whitley, Greg Im, and Bill Stockmeyer are:

• Approved as local bond counsel by the NH Municipal Bond Bank;

• Listed in The Bond Buyer’s Municipal Marketplace (the “Red Book”) of NH municipal bond attorneys;

• Recognized by financial institutions locally and nationally; and

• Members of the National Association of Bond Lawyers.

The HR REPORT

Employee or Independent Contractor? New Department of Labor Rule Clarifies Classification Guidance and Analysis

By Hannah Devoe, Associate, Labor and Employment GroupOn January 9, 2024 the U.S. Department of Labor (DOL) issued a final rule, effective March 11, 2024, revising prior guidance on how to analyze whether a worker is an employee or an independent contractor under the federal Fair Labor Standards Act (FLSA). The final rule rescinds the DOL’s 2021 Independent Contractor Rule, essentially returning to the 2015 “totality of the circumstances” economic reality test, as discussed below. Employers know the importance of properly classifying employees, and the clarity provided in this final rule is a welcome return to familiarity.

As a bit of background, the FLSA generally requires employers to pay nonexempt employees at least the federal minimum wage for all hours worked and at least one and one-half times the employee’s regular rate of pay for every hour worked over 40 in a workweek (e.g. overtime). The FLSA further requires covered employers to maintain records regarding employees and prohibits retaliation against employees who are discharged or discriminated against for filing wage claims or grievances related to wages. These protections and requirements, however, do not apply to independent contractors. Defining who is and who is not an independent contractor has become a political football, with the definition changing depending on whether the Administration wants to be considered pro-labor or pro-business.

Recent History

In 2015, under the Obama Administration, the Wage and Hour Division (WHD) issued guidance which reiterated the multifactor economic reality analysis for distinguishing between employees and independent contractors that was widely applied by courts. This guidance identified six “economic realities” factors that followed the factors most used by federal courts. These factors were not applied in a mechanical fashion and no one factor was determinative.

While under the Trump Administration, the DOL began the process of further narrowing the independent contractor analysis, a process that culminated in the “2021 IC rule,” which replaced the prior guidance with a formal regulation governing the classification of independent contractors. The 2021 IC rule provided for an economic realities test that included a five-factor, non-exhaustive list which permitted additional factors to be considered if they “in some way indicat[ed] whether the worker [was] in business for himself.” However, the 2021 rule designated two of the five-enumerated factors as “core” factors above the remaining three “less probative” factors. The “core” factors in the 2021 IC rule were: (1) whether the nature and degree of control over the work indicated, by showing substantial control over key aspects of the performance of the work, a worker’s independent contractor status, and (2) the worker’s opportunity for profit or loss. Accordingly, the 2021 IC rule was viewed as an expansion of the independent contractor classification.

In 2022, the DOL, now under the oversight of the Biden Administration, began the process of developing an alternate rule patterned off the prior Obama era 2015 guidance. This process resulted in the new 2024 rule as outlined below.

The Final Rule and Test

What is an independent contractor under the 2024 final rule? Independent contractors are workers who are not economically dependent on an employer for work and are in business for themselves. These workers may also be referred to as self-employed or “freelancers.” The 2024 final rule adopts a multifactor “economic reality test,” essentially a return to the 2015 analysis, and requires employers to consider the totality of the circumstances by applying six factors:

1. Opportunity for profit or loss depending on managerial skill;

This considers whether the worker exercises managerial skill that affects the workers’ economic success or failure in performing the work including:

a.Whether the worker determines or meaningfully negotiates the charge or pay for the work;

b.Whether the worker advertises and markets the work or otherwise expands the business; and

c.Whether the worker hires other workers, purchases materials, or rents or purchases space.

For example, a worker is paid by the town to landscape all town buildings. The worker produces their own advertising, sets their own rates, purchases landscaping material, and decides whether to hire helpers to assist with the work. This worker exercises

managerial skill affecting their profit or loss.

2. Investments by the worker and the potential employer;

This considers whether the worker has investments that are “capital or entrepreneurial in nature” and allows the worker to significantly further the business. For example, a graphic designer who purchases their own software, computer, drafting tools, and rents an office space has invested in capital which allows the worker to do more work and to extent their market reach.

3. Degree of permanence in the work relationship;

The degree of permanence in the workplace weighs in favor of a worker being an employee because the work relationship is indefinite or continuous and

would, thus, imply an exclusive working relationship. Projectbased or sporadic work weighs in favor of a worker being an independent contractor.