Beyond investing

The New Hampshire Public Deposit Investment Pool (NH PDIP) has provided public entities with investment options since 1993. NH PDIP focuses on safety, liquidity, and a competitive yield in order to meet the distinct needs of cities, towns, school districts, and other political subdivisions.

This information is for institutional investor use only, not for further distribution to retail investors, and does not represent an offer to sell or a solicitation of an offer to buy or sell any fund or other security. Investors should consider the Pool’s investment objectives, risks, charges and expenses before investing in the Pool. This and other information about the Pool is available in the Pool’s current Information Statement, which should be read carefully before investing. A copy of the Pool’s Information Statement may be obtained by calling 1-844-464-7347 or is available on the NHPDIP website at www.nhpdip.com. While the Pool seeks to maintain a stable

of

per share, it is possible to lose money

in the

An

BOARD OF DIRECTORS

Candace Bouchard - Vice Chair Supervisor of the Checklist, Concord

Laura BuonoImmediate Past Chair Town Administrator, Hillsborough

David Caron Town Administrator, Derry Shelagh Connelly Conservation Commission, Holderness

Phil D’Avanza Planning Board, Goffstown

Stephen Fournier Town Manager, Newmarket

Elizabeth Fox - Chair

Asst. City Manager, HR Director, Keene

David Stack Town Manager, Bow

Neil Irvine Town Administrator, Northwood

Patrick Long Alderman, Manchester

Cheryl Lindner - Treasurer Finance Director, Bow

Conner MacIver Town Administrator, Barrington

Judie Milner City Manager, Franklin

Jim MaggioreImmediate Past Vice Chair Select Board Member, North Hampton

Dale Girard Mayor, Claremont

Michael Malaguti Town Administrator, Londonderry

Jim Michaud Chief Assessor, Hudson

Dennis Shanahan Deputy Mayor, Dover

Holly Larsen Finance Director/Tax Collector, Berlin

Joanne Haight Select Board Chair, Sandwich

Donna Mombourquette Energy Commission, New Boston

Jeanie Forrester - Secretary Select Board Member, Meredith

Joseph R. Devine Assistant Town Manager, Salem

Shaun Mulholland City Manager, Lebanon

Bonnie Ham Planning Board Chair, Woodstock

A Message from the Margaret M.L.Byrnes Executive Director NHMA

By the time this issue of Town & City goes to print, the legislative session will be over! The session this year was about two weeks longer than usual (for a nonbudget year) due to the significant number of bills filed. More than 40% of the 1,000+ bills filed had some municipal component—up from about 30% last year—meaning NHMA was following over 400 bills in the 2024 session.

We will report on the outcome of the session in the Final Bulletin, which typically comes out in August or early September, but here's a snapshot of the wins for cities and towns this year:

• Defeat of HB 1069, which would have required state and local governments to send Right-to-Know Law requests to anyone, anywhere in the world;

• Defeat of statewide zoning mandates, such as mandating additional accessory dwelling units (ADUs) and duplexes;

• Defeat of retirement bills that would have cost taxpayers millions of additional dollars;

• Defeat of yet another bill—in a long line of attacks—to prohibit local officials and their organizations from advocating for their interests at the legislature, lobbied for by out of state special interest groups.

• Authority for municipalities to set seasonal speed limits; and

• Authority for municipalities to use video monitoring at covered bridges to prevent and recoup property damage of these historic landmarks.

We are your eyes, ears, and voice at the legislature, but we can’t do it without you. Many of the successes this session were a direct result of outreach from you. Senators and representatives repeatedly commented that they had heard from local officials on various issues. Your advocacy truly makes a difference. You can stay up-to-date on during the session by logging into our new portal and making sure you are signed up to receive the Legislative Bulletin, a weekly update delivered to your inbox. (If you’ve never logged in before, please follow these instructions.)

Last, but certainly not least, it’s hard to believe our next issue of Town & City will feature NHMA’s Annual Conference! For the first time in recent memory—or perhaps the first time ever! — the conference will be held in October (October 30 & 31). We will be bringing back our dinner and entertainment event for a second year, along with many educational sessions and time for networking. We hope you’ll enjoy a bit of a Halloween theme this year for a spooky good time!

Keep an eye out on our website, in Newslink, and in our other communications for more information about the Annual Conference.

Have a safe and fantastic summer!

Cordell A. Johnston Attorney at Law

Representing towns and cities

P.O. Box 252

Henniker, NH 03242

603-748-4019

cordell@cajohnston.com

Warmest regards,

Margaret M.L. Byrnes, NHMA Executive Director

HAPPENINGS

Bradford Town Hall Reopens After 13 Years of Closure and Extensive Renovations

After being closed for nearly 13 years due to mold issues, the Bradford Town Hall in New Hampshire has reopened. The closure began in 2011, and the building's restoration took over a decade to fund and more than $3 million. This significant investment has revitalized the historic building, ensuring it meets modern standards while preserving its historical essence. The reopening is a major milestone for the community, providing a central venue for town meetings and public events.

Karen Hambleton, the Town Administrator of Bradford, noted, "Interestingly, the Town made a number of efforts at passing funding for the Town Hall over 11 years, most of them failing by a small margin. However, in 2022, the year the NHMA ran our Town Hall on the cover of the March issue of Town and City, it passed easily!!! I like to think that the cover of Town and City brought us good luck at Town Meeting that year.”

WMUR. "Bradford Town Hall Reopens after Being Closed for 13 Years." WMUR, 1 June 2024, https:// www.wmur.com/article/bradford-town-hall-reopens/60969989.

Right to Know Law: Public Meetings & Governmental Records

On Wednesday, April 17th, Legal Services Counsel Stephen Buckley and Municipal Services Counsel Jonathan Cowal hosted an insightful webinar on the 2024 Right-toKnow Law: Public Meetings & Governmental Records. Held at 25 Triangle Park Drive, Concord, NH, this workshop was a crucial opportunity for municipal officials and state employees to stay updated on the latest legal requirements and best practices for public meetings and records management.

Mountain of Demonstrations

Every year the New Hampshire Road Agents Association in cooperation with Mount Sunapee Resort hosts the Mountain of Demonstrations. The Mountain of Demonstrations is recognized for its unique live demonstrations as a one-stop shopping opportunity for public works personnel, parks and recreation departments, state departments of transportation, school facility maintenance personnel and municipal officials from all over New England to speak with representatives and manufacturers about the newest high-tech road, bridge, maintenance, and related construction products, equipment, and services.

This year the event took place on May 23, 2024, and brought in 75 exhibitors and 379 attendees. Each year, the Mountain of Demonstrations, thanks to the generosity of our sponsors and exhibitors, funds the NH Road Agents Scholarship program. This program offers two $2,000 awards given to a graduating senior or to a student currently enrolled in a post-secondary institution who is the son or daughter of a NH Road Agents Association member, which includes entire municipalities and companies. This year’s winners are Allan Rucker and Ivy Zipf. This award stands as a well-deserved tribute for all their efforts and accomplishments. Congratulations!

Interested in learning more about the NH Road Agents Association, the Mountain of Demonstrations, or the scholarship program? Please contact us at nhroadagents@nhmunicipal.org

Upcoming Events

JULY

Independence Day (NHMA offices closed)

Thursday, July 4

AUGUST

Healthcare Cost Containment Strategies with NHIT

Free to members; $20.00 for non-members

12:00 noon – 1:00 pm

Wednesday, August 21

Navigating Tax Deed Traps with NH Tax

Deed & Property Auctions

Free to members; $20.00 for non-members

12:00 noon – 1:00 pm

Wednesday, August 28

For more information or to register for an event, visit our online Calendar of Events at www.nhmunicipal.org. If you have any questions, please contact us at registrations@nhmunicipal.org.

SEPTEMBER

Budget & Finance Workshop (Derryfield)

9:00 am – 4:30 pm

Tuesday, September 10

Budget & Finance Workshop (Littleton) 9:00 am – 4:30 pm

Thursday, September 19

Academy for Good Governance

5:00 pm – 7:00 pm

Wednesdays, September 4 – October 16

Online via Zoom

Legislative Policy Conference 9:00 am – 2:00 pm

Friday, September 27

25 Triangle Park Drive, Concord

For the most up-to-date event and training information, please visit the NHMA website at www.nhmunicipal.org. Event times and dates are subject to change. Thank you.

TCombating the High Cost of Healthcare

By Jeff Reardon, Trust Administrator, New Hampshire Interlocal Trust

own and city administrators are constantly fighting to control costs, and a significant budget item is the cost of employer-sponsored health plans. As the costs of medical services continue to rise at an unsustainable pace, employers must do everything they can to keep these costs under control. In this article, I will share five ways a municipal employer can help control its healthcare costs.

Before we get to strategies, let’s discuss why the cost of care is so high. The cost of health plans is primarily driven by claims experience. Generally, 88% to 93% of the cost directly correlates to the amount of medical claims the plan incurs. Risk pool members benefit from sharing the risk with fellow members, which has a smoothing effect on renewal rating; however, as year-over-year claim costs rise, so will the cost of the plans. It is important to recognize that if we want to control the cost of health plans, we must focus on containing the cost of claims however we can. Here are a few ideas…

Review and Explore Plan Designs

The structure of a health plan is a powerful tool in managing the level of claims it incurs. As decision-makers, you have the power to consider the Medical Loss Ratio (MLR) or the amount of claims a plan incurs in relation to the amount of contributions paid. The higher the MLR, the poorer the plan’s performance; poor performance translates into higher rates. Benefit-rich plans tend to have higher MLRs. You may find that municipalities often offer very rich plans as a recruitment and retention tool or to satisfy collective bargaining agreements. However, this should not deter you from exploring options with higher deductibles, coinsurance, and out-of-pocket maximums to encourage employees to be more mindful of the actual cost of care and become better healthcare consumers. Your decisions can make a significant difference. There are ways to offer these types of plans that are attractive to employees.

Offer a Consumer-Driven Health Plan (CDHP) CDHPs are high-deductible health plans paired with a Health Savings Account (HSA). According to 2024 ACA rules, the minimum deductible to qualify as a consumerdriven health plan is $1,600 for a single plan and $3,200

for a 2-person or family plan. The HSA that can accompany the CDHP is intended to allow the employee to accumulate funds that can be used to cover out-of-pocket costs such as deductibles, office copays, and coinsurance. The employee and/or their employer can contribute to this account. HSAs have a unique triple tax benefit; contributions go into the account on a pre-tax basis (lowering the employee’s income tax burden), investment growth in the account is tax-free, and withdrawals are tax-free as long as funds are used for qualified medical care. Unlike their cousin, the health reimbursement account (HRA), HSAs are owned by the employee, so they keep the account even upon a separation of employment. The ownership element is crucial because those dollars now belong to the employee. As such, we anticipate a shift in how the person views spending out of the account. If it’s my money, I will be more aware of my medical costs. The idea of implementing a $1,600 deductible plan may make you a bit queasy, but remember that the employer can contribute to the HSA. If the employer contributes $600 to the employee’s HSA, the $1,600 deductible plan becomes a $1,000 deductible plan. Set up a contribution matching arrangement, and you have just given your employees another incentive to contribute their own money to the account. CDHPs are attractive to most people, especially if they are designed thoughtfully, with the employee’s best interests in mind.

Consider Adjusting Your Cost-Sharing Agreement

It is common for towns and cities to pay for all or most of their employer-sponsored health plan costs. However, it might make sense to consider adjusting the cost-sharing structure to encourage participation in lower premium plans. Here is an example of how this could look. Let’s say the employer offers a low deductible health plan and pays 85% of the premium regardless of enrollment type. The group wants to implement a consumer-driven health plan (CDHP) but is concerned that there will be little to no participation in it. The employer can sweeten the pot on the CDHP by adjusting the cost-sharing structure of the plan options. For example, the employer could reduce the amount they contribute towards the cost of the benefit-rich, low-deductible plan to, say, 80% and contribute 100% of the cost of the CDHP. Employees who enroll in the CDHP

would experience significant savings in their contribution costs, which they can then contribute to their HSA to cover the potential increase in out-of-pocket costs.

Offer Incentives for Using Lower Cost Options

Navigating the world of healthcare is extremely challenging. Americans tend to be good consumers. Think about how we shop for everything from groceries to appliances to vehicles. We usually look for value in the goods and services we purchase. Now, think of how we consume healthcare. We rarely have an awareness of the actual cost of the care we receive, never mind differences in costs from one provider to another. Even with the implementation of the No Surprises Act and price transparency rules, it remains difficult for the average person to “shop” for value in the healthcare space. To help ease this challenge, most health insurance providers offer tools employees can use to find high-quality, low-cost options and financial incentives for choosing the lower-cost options. An example of this would be our Compare Care program, which easily connects covered employees to qualified medical professionals who do the “shopping” for them and presents lower-cost options, if any, are available. They even take care of scheduling the appointments for them. The subscriber also shares in the savings, which they can use to offset out-of-pocket costs. It is important to note that low cost does not mean low quality, and consumerism tools, like Compare Care, take this seriously. In other words, they will not send your employee to just any cut-rate healthcare provider; quality of care is also a critical factor.

Demand Employee Participation

As healthcare costs continue to rise, rich employer-sponsored health plans are unsustainable. This should be especially concerning for municipal employees because not only are administrators keenly aware of the cost of the plans, but taxpayers are also. With so many eyes on municipal budgets, it is only a matter of time before the public demands change. Therefore, becoming better healthcare consumers should be as important to employees as it is to employers. Helping employees understand their health plans and their associated costs requires attention and intention on education. We understand that people are not usually interested in learning about their health plans until they must use them; however, a commitment to educating employees on this front is especially important today. Strategies for getting employee participation come in many shapes and sizes but here are a few general ideas to get the creative juices flowing.

1. Make Participation Mandatory: Set a policy that every employee must attend an open enrollment session to participate in the plan.

2. Offer Incentives: Make a nominal contribution to an

employee’s FSA, HRA, or HSA for attending an open enrollment or educational session.

3. Offer Many and Varied Educational Opportunities: Hold relatively short, regularly scheduled educational sessions that cover various healthcare topics. Session content can range from healthcare consumerism to a specialty care program for diabetes. You can also incorporate fun events like fitness challenges and cooking demonstrations with the educational piece.

4. Focus On Employees’ Pockets: Explain how increasing costs affect them; when the employer’s costs rise, theirs does too. For example, if an employee contributes $150 on a bi-weekly pay cycle, a 12% renewal increase equals an additional $468 out of their paychecks during the next plan year.

These concepts are not out of this world; they are very much within reach. I would encourage the reader to think about them and to take action to begin your cost-containment journey. A good first step might be reaching out to your current health plan provider and scheduling a time to discuss cost-saving strategies and programs available today. I wish you luck on your journey.

Be well, Jeff Reardon Trust Administrator New Hampshire Interlocal Trust

Sue Sullivan joined New Hampshire Interlocal Trust (NHIT) in November 2023 after working at Harvard Pilgrim Health Care, our partner, as a Sales Executive. With more than 20+ years of experience in the health insurance industry, she has worked with various market sizes and positions. At NHIT she is responsible for driving growth and success by identifying and qualifying new member engagement.

NHMA has created a Municipal Marketplace to bring greater member attention to our supporters who provide products and services to New Hampshire’s municipal governments. Our online Municipal Marketplace provides a wide range of categorized municipal product and service listings that will serve as a quick source of information for municipal officials.

Auctions International

Avitar Associates of New England Inc

Benchmark Office Systems

Cartographic Associates, Inc., dba CAI Technologies

CheckmateHCM

Citizens

Community Heart & Soul

Cordell A. Johnston, Attorney at Law

Donahue, Tucker & Ciandella, PLLC

Doucet Survey, LLC

Drummond Woodsum

Eagle Network Solutions

Environmental Partners, An Apex Company

Freedom Energy Logistics

HEB Engineers, Inc.

Horizons Engineering Inc.

IBEW Local 490

Ideal Concrete Block Co.

JSJ Auctions, LLC

MHEC

Mitchell Municipal Group, P.A.

Municipal Resources, Inc.

Municipal Technology Systems, LLC

NH Municipal Bond Bank

NH PDIP/PFM Asset Management LLC

NH Tax Deed & Property Auctions

NHCDFA

NorthEast Electrical

Northway Bank

Onsite Drug Testing of New England

P3 Advisors Strategy & Finance

Pare Corporation

Primex

R.W. Gillespie & Associates, Inc

Roberts & Greene, PLLC

Santander Bank, N.A.

Sertex Broadband LLC

TD Bank N.A.

Three Bearings Fiduciary Advisors, Inc.

Upton & Hatfield, LLP

Usource Energy

Vachon Clukay & Company PC

VHB

Vision Government Solutions, Inc.

VISIT: https://www.nhmunicipal.org/municipal-marketplace

Zero-cost municipal auction services — Legal support included

Decades of experience conducting real estate and property auctions for New Hampshire municipalities

Comprehensive auction marketing, including custombuilt auction webpage, online and newspaper ads, property signage, and notifications to abutters and our proprietary bidder list

Preparation of bidder materials for download and distribution

Auction held within the municipality by experienced and knowledgeable auction professionals

Dedicated help line for answering bidder inquiries before and after the auction

Included skilled legal support for analyzing pre-auction legal issues, conducting real estate closings, preparing deeds, locating former owners and lienholders, and distributing excess proceeds

10% buyer’s premium for most auctions NHTaxDeedAuctions.com | (603) 301-0185

Richard D. Sager | NH Auctioneer (License #6104) & NH Lawyer (Bar #2236) | rick@nhtaxdeedauctions.com

Weston R. Sager | NH Auctioneer (License #6224) & NH Lawyer (Bar #269463) | weston@nhtaxdeedauctions.com

Bond Bank’s Next Bond Issue will be on July 10, 202

Check our website www.nhmbb.org for interest rate results January 2024 Bond Sale Results - True Interest

Are you planning a capital project for 20

We can assist you with your planning by providing various scenarios based on level debt or level principal payments for different terms. Contact us now for your estimated debt schedules. Basic Loan

To schedule a meeting, obtain debt service schedules, or for details about our schedule, fees, Bond Anticipation Note programs, and current interest rates, please contact Tammy J. St. Gelais, Executive Director, at tstgelais@nhmbb.com.

• Bond issue approved by governmental entity

Avoiding the Pitfalls of Tax-Deeded Property Disposition

By Richard D. Sager, Esq. & Weston R. Sager, Esq. Sager & Smith, PLLC and NH Tax Deed & Property Auctions

Is your municipality ready to dispose of its tax-deeded properties? That’s great. Not only could your municipality recoup past due taxes, interest, and other expenses tied up in these properties, but also it could put unproductive properties back on the tax rolls or develop them for municipal use.

Before selling properties that the municipality acquired by tax collector’s deed or holding onto such properties for municipal purposes, there are several potential pitfalls that should be considered before proceeding.

Should the municipality retain a tax-acquired property without first negotiating an agreement with the former owners and lienholders?

No. Before keeping a property for its own use, the municipality should first attempt to compensate the former owners and lienholders for the difference between what the municipality is owed and the market value of the property.

Pursuant to New Hampshire Supreme Court decision Polonsky v. Town of Bedford, 173 N.H. 226 (2020), as well as the United States Supreme Court decision Tyler v. Hennepin County, 598 U.S. 631 (2023), when the government sells a tax deed-acquired property, it cannot keep the amount generated from the sale beyond what is owed past due taxes, interest, costs, and penalty. If the sale of a property generates more than what the government is owed, these “excess proceeds” must be returned to the former owners and lienholders. Otherwise, the government violates constitutional prohibitions against the government taking private property without just compensation.

The holdings of both Polonsky and Tyler are limited to those circumstances where the government sells a property rather than retains it. However, in support of its central decision, the United States Supreme Court in Tyler suggested that, even if the government keeps the property, it must still compensate the former owners for the difference between the value of the property and what the government is owed.

Under New Hampshire law, former owners and lienholders have an interest in a tax deed-acquired property to the extent its value exceeds the amount owed to the municipality. A tax-acquired property that a municipality wishes to keep permanently could have substantial market value because it may be situated in a central location, has desirable land characteristics, and/or is capable of development. If such a property were to be sold instead of retained, it likely would command a high price, resulting in excess proceeds for the former owners and lienholders.

Although the case law on this issue remains uncertain, if a former owner or lienholder were to challenge a municipality’s decision to retain a tax-acquired property without attempting to distribute excess proceeds, a court may determine that the municipality has failed to provide just compensation to the former owner or lienholder as required by the state and federal constitutions.

To avoid such lawsuits, a municipality should consider doing the following before retaining a tax-acquired property:

1. Analyze potential claims against the municipality. Working with municipal counsel, the tax collector, and the assessing department, municipal leadership and staff should evaluate each property the municipality wishes to retain, including: the length of time the municipality has owned the property, the total amount owed to the municipality, the property’s development potential, the property’s probable market value, and the like. If the municipality is owed more than the property is worth, or if the property is clearly undesirable (such as being adjacent to a landfill or transfer station), a former owner or lienholder may have little basis to claim that the market value of the property exceeds what the municipality is owed.

2. Contact the former owners and lienholders. Before a municipality decides to keep a property, it should contact the former owners and lienholders to discuss payment for excess proceeds. Even though the process is not

yet clearly established by law, the amount of excess proceeds may be determined by calculating the appraisal amount and subtracting what is owed to the municipality for back taxes, interest, costs, and penalty pursuant to RSA 80:88 and RSA 80:90. When distributing excess proceeds to the former owners and lienholders, the municipality should obtain releases from all parties to protect itself from future litigation.

3. Attempt to buy the property at auction. Although counterintuitive, the municipality should also consider auctioning a property it intends to keep. At auction, the municipality may, subject to certain requirements, bid on the property along with private individuals. A well-advertised auction is a reliable way to generate market value for real estate and could protect the municipality from claims by formers owners and lienholders that it did not fairly assess the property. However, this process is risky because the municipality may be outbid and lose the property. In certain circumstances, the municipality may also be at a competitive disadvantage if the municipality’s high auction bid was published in the municipal budget or public meeting minutes.

Should the municipality sell taxdeeded properties with new restrictions such as prohibitions on future development?

Probably not. Tax-deeded properties are subject to the same zoning and building regulations as other similarly situated properties. Such properties generally should not be singled out and burdened by the addition of permanent municipally imposed restric-

tions on development or use.

Adding restrictions to tax-deeded properties likely will reduce the amount the property sells for, thus decreasing the potential amount of excess proceeds payable to the former owners and lienholders. Former owners and lienholders may later sue the municipality for failing to generate sufficient value for the property. Additionally, imposing new property restrictions may hamper the municipality by lowering the probability that it will fully recover what it is owed.

Certain temporary restrictions, however, may be appropriate. If a municipality acquires a tax-deeded property that is non-compliant with local regulations, a municipality may reasonably impose a remedial restriction requiring the new owner to bring the property into compliance within a certain timeframe.

For example, if a structure on the property is dilapidated and requires removal, the municipality could either (1) pay for the structure’s removal and hope to recover those costs from the proceeds generated from the sale of the property, or (2) require the purchaser to pay to remove the structure within a certain time period (e.g., six months, one year) following the sale. The latter scenario is probably preferable because, although the bids likely will be lower to account for the cost of removal, the municipality protects itself from the sale not generating sufficient proceeds to cover its past due taxes, interest, costs, and penalty. Additionally, the amount of excess proceeds will be roughly equal regardless of whether the municipality or the purchaser pays to remove the structure, meaning that the municipality will not unduly expose itself to lawsuits from the former owners and lienholders. Put another way, by imposing a tem-

porary restriction like the one above, the municipality is not devaluing the property—it is, instead, shifting certain costs from itself to the purchaser.

Should the municipality sell adjacent tax-deeded properties together or separately?

It depends. Whether to sell adjacent lots together or separately rests on several factors that should be thoroughly analyzed before the sale.

If the adjacent properties were owned by the same former owner, and it is reasonably likely that selling them together will generate a higher amount than selling them separately, then selling the properties together is probably appropriate. For example, if a tax-deeded waterfront lot has no road access but for a contiguous tax-deeded lot, or if there are multiple tax-deeded lots in an undeveloped subdivision, selling the properties together as a single package is probably preferable: (1) the purchaser benefits because he or she will be acquiring a more desirable piece of real estate, (2) the municipality benefits because, assuming the properties sell for more together than they would have separately, it is more likely to recover what it is owed, and (3) the former owners and lienholders similarly benefit because, if the real estate sells for a high amount, they have a greater chance of receiving a substantial excess proceeds distribution.

If the adjacent properties were owned by different former owners, however, the properties generally should not be sold together. Allocating the sale price between two or more properties for reimbursing the municipality may prove difficult. Moreover, following the sale, former owners and lienholders may complain that they didn’t receive their fair share of the excess proceeds.

Nonetheless, as described above, selling two or more adjacent properties together that were previously held by different owners could be the preferred course of action if it will likely result in higher total sale value. Although challenging, a municipality may be able to calculate fair and accurate distributions after considering the assessed values of the properties, the amounts owed by each former owner, and other factors. Before moving forward with such a sale, however, municipal leadership and staff should consult with municipal counsel, the tax collector, and the assessing department to determine the best approach.

Should a municipality sell taxdeeded properties by auction, sealed bid, or another method?

Nowadays, auctions are generally the safest approach for selling tax-deeded properties.

Under RSA 80:80, municipalities are permitted to sell tax-deeded properties by sealed bid or by auction. Additionally, municipal leadership may, after making an “affirmative finding that disposal by a method other than sealed bid or public auction is in the public interest,” authorize by a warrant article or ordinance to dispose of tax-deeded properties by an alternative method— such as selling to abutters.

RSA 80:80, however, has not been updated since Polonsky and Tyler. Before those decisions, municipalities often did not need to consider the interests of former owners and lienholders because, in certain instances, municipalities could keep all proceeds from the sale of tax-deeded properties. Now, municipalities may invite litigation

from former owners and lienholders if they do not make a concerted attempt to achieve market value when selling tax-deeded properties.

Sealed bids often result in low values because advertising is limited. Many times, municipalities market sealed bids themselves and largely limit advertising to within the local community. Following the Polonsky and Tyler decisions, this may no longer be considered sufficient when selling taxdeeded real estate. Similarly, alternative methods of sale may be challenged for failing to achieve market value.

As with lending institutions selling foreclosed homes, auctions conducted by licensed auctioneers are generally the safest method for municipalities selling tax-deeded properties. Auctions are widely considered a viable method for determining what the market is willing to pay for an asset. Further, because auctioneers typically tie their compensation to what the properties sell for, they are incentivized to obtain the highest possible values. Auctioneers, consequently, advertise extensively to generate widespread bidder interest. But even if the properties do not yield high values at auction, the process by which the properties were marketed shields the municipality from accusations that the sale process was deficient.

Although rare, properties sometimes fail to sell at auction. If this occurs, the municipality is in a better position to dispose of these properties by sealed bid or an alternative method. Because the municipality has already attempted to secure the highest possible price for the property at auction, a former owner or lienholder would have difficulty asserting that the municipality did not do enough to secure appropriate value for the property.

Summary

Following the Polonsky and Tyler decisions, disposing of or keeping tax deeded properties poses a unique set of considerations for municipalities. Municipal leadership and staff are wellserved to consult legal counsel and tax officials before selling or retaining taxdeeded properties.

Richard D. Sager and Weston R. Sager are partners at Sager & Smith, PLLC and co-owners of NH Tax Deed & Property Auctions. Both are dual-licensed attorneys and auctioneers with experience in municipal law, real estate law, and auction law. Rick may be reached at rick@sagersmith.com or rick@nhtaxdeedauctions.com, and Weston may be reached at weston@sagersmith.com or weston@nhtaxdeedauctions.com. The information contained in this article is not intended as legal advice or as a legal opinion.

PROBLEM SOLVING

It’s our strong point.

We’re hiring!

WHO CAN ATTEND?

Select board members

Town councilors

School board members

City councilors Board of Aldermen

Village districts commissioners

TENTATIVE

Governance & Governing

Build Your Leadership Skills.

The Academy for Good Governance is a series of courses created by NHMA and Primex, exclusively for elected governing body members (select board, town council, city council, board of aldermen, school board, and village district commissioners). Courses are taught by experienced attorneys and staff from NHMA, Primex, HealthTrust, and the New Hampshire School Boards Association (NHSBA). Attendees will receive education and training intended to make them more knowledgeable and effective in their governing body roles.

Attendance at the Academy is free and open to governing body members from municipalities and school districts that are members of NHMA, Primex and NHSBA. Registration will open on the NHMA website this summer. Attendees must attend all courses to receive a Certificate of Completion. All classes will be provided by Zoom and run 5:00 pm 7:00 pm. with classes in September and October.

Additional HOP Grant Funds Now Available to Municipalities

The second iteration of the Housing Opportunity Planning (HOP) Grant program is now available to cities and towns across the state. These grants are part of Governor Sununu’s $100 million InvestNH initiative and provide funding for cities and towns in New Hampshire to create local regulations that will help increase housing supply, especially for affordable and workforce housing.

In 2022, $5 million was allocated to support municipalities to analyze and update land use regulations to increase opportunities for housing development. Funds were exhausted in the first ten months. This spring, an additional $2.9 million was allocated to the program. The NH Department of Business and Economic Affairs contracted with New Hampshire Housing to administer this program.

Municipalities may use these funds to hire consultants for the following activities:

• Update the housing, land use, and vision sections of the master plan, and related aspects of the implementation section, as well as the community facilities section or other relevant sections as they pertain to water and sewer in support of housing development.

• Conduct a housing needs assessment or analysis as part of a larger project.

• Audit a municipality’s land use regulations and make recommendations for changes to promote housing development.

• Create new regulations or revise existing regulations with the stated primary goal of increasing the supply of housing in the community, especially affordable and workforce housing.

Grant-funded activities should generally assist applicants to become eligible for New Hampshire Housing Champion designation pursuant to RSA 12-O:71. Community engagement is an essential component of this work, and all applicants will prepare a community engagement plan with support from Cooperative Extension at the University of New Hampshire.

All New Hampshire cities and towns, including those that have received a Community Housing Navigator Grant or HOP Grant, can apply. Applications are due Monday, September 30, 2024 and will be reviewed and approved by a steering committee through a competitive process. Past grantees will receive priority and remaining funds will be available to new municipal applicants.

For additional program details, visit www.NHHOPGrants. org.

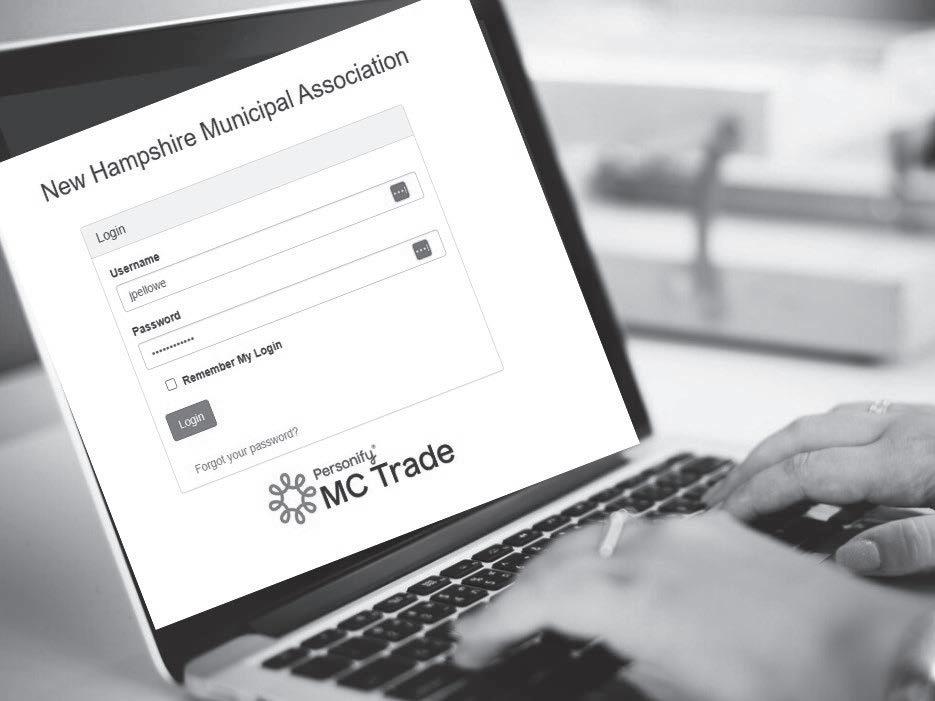

NHMA has a new member portal and we need you to log-in, create your password, and look around your member profile.

IMPORTANT: You will need this member log-in to get member pricing for NHMA events.

3 EASY STEPS TO LOGIN

STEP 1. Go to: https://nhmunicipal.weblinkconnect.com/portal.

STEP 2: Click “forgot password” if you’ve never logged in before.

STEP 3: One of two things will occur:

a. You will receive an email to set your password if you are already in our system. Please follow the instructions in the email. Check your spam folder!

b. OR you will receive the error message “A user with that email was not found ” if you are not in our system. In this case, email us at info@nhmunicipal.org.

The 2024 Legislative Session

By Natch Greyes, Governmental Affairs Counsel

The legislative session has now finished and, once again, municipalities came out ahead. Although there was not much in the way of state surplus, there were a number of policy debates that we were involved in this session. We are happy to report that legislators took our concerns seriously.

For a third-straight year, we fought (and won) a bill (HB 1479) that would have barred the voice of local officials at the legislature. Unfortunately, this bill has seemingly become a perennial bill that requires a significant amount of time and attention. We once again thank all our members who reached out to their representatives to remind them that you, too, have a right to speak to the legislature and that the input of local officials is critical for good governance.

On a more positive note, in a significant shift, the Right-to-Know Law now contains a local option for some cost recovery for production of records. While this provision does not go as far as our members originally requested, the compromise that was reached with the opposition provides a good solution for dealing with the most burdensome requests.

We also weighed in on a record 500or-so bills. That means that the small, two-person, full-time government affairs staff spent the last six months having conversations with 424 different people about 500 different issues. (That works out to be around 212,000 conversations!)

Surprisingly, municipalities faired well

on land use issues. The legislature’s focus is solidly on the nationwide housing shortage and a significant amount of legislation was filed in an attempt to find a solution. We were happy to support some legislation, such as HB 1359, which was backed by solid data and economic principles, but we opposed a large amount of more speculative legislation. We plan on spending a significant amount of time this summer working with returning legislators to consider possible solutions which preserve local control. (Hint: we’ll be asking for more road, water, and wastewater infrastructure funding in next year’s budget.)

We were also pleased to work with election officials to help policymakers craft bills that would enhance our election processes, as well as resolve some significant liability concerns for municipalities. For example, HB 1264 creates a pilot project to help resolve local liability concerns around accessible voting devices and provide a unified system to ensure that disabled voters are able to vote without issue.

It is too early to say, in most cases, whether most of the bills mentioned above or the other 160-or-so bills of municipal interest that passed both the House and Senate will be signed into law by the Governor, but we are beginning to turn our attention to next year. We have already had a number of requests from legislators asking to partner with us on legislation on various topics, and we encourage legislators (and members) who are interested in filing legislation of municipal interest to reach out sooner rather than later.

Looking to the months ahead, NHMA will continue to advocate for building upon the solid foundation of the state-local partnership to deal with the complex issues that are impacting our members and the citizens they serve. We look forward to continuing to enhance the relationships between our members and the legislature through additional outreach efforts, including additional training and educational opportunities, and building upon existing relationships to strengthen New Hampshire cities and towns and enhance their ability to serve the public.

Looking Forward to Serving You: NHMA’s 2024 – 2027 Strategic Plan

As we wrote in the last issue of Town & City, one of NHMA’s major initiatives this year is establishing a strategic plan to guide the organization’s direction over the next several years.

On May 17, the NHMA Board of Directors, NHMA staff, and the local officials serving on the Strategic Planning Work Group (SPWG) convened at Primex to review the draft strategic plan, which consists of five strategic priorities and the goals needed to achieve them. Through a “World Cafe Format,” participants “visited” each strategic priority station to learn the background of each proposed priority and to provide feedback to assist in finalizing the plan. The session was fun, interactive, and full of excellent perspective and content that will help us get over the finish line.

Here are some emerging themes, based on what you, our staff, and our partners have told us:

• Training and education that meets your needs. Sitting in a classroom is no longer the only way to learn, and local officials and employees have an incredible amount of responsibility in the communities that they serve. Add on top of that ever-changing laws, rules, and best practices, and there is no question that training and education must be ongoing and dynamic. Whether you prefer “traditional” in person events, recordings you can watch on your own timeline, or short FAQs on timely topics, how can NHMA provide the information you need in a manner that works best for you?

• Communication that reaches you where you’re at, and when you need it. How can we reach you better with the information you need—when you need it? “Local officials” range from elected officials to full time employees and volunteers serving on a variety of capacities that keep cities and towns running. When we report on changes in the law, legislation of municipal impact, trainings and other resources, they can only help our members if we are getting the message into the hands of the right people at the right time.

• Raise the profile of local government. From promoting careers in local government to supporting regional gatherings for networking and peer learning, what can NHMA do amplify and support the important work of local government?

On June 21, the NHMA Board of Directors voted to approve the proposed strategic plan subject to member comments and and questions. The plan will go into effect on October 18, 2024. You can review the proposed plan here, and send comments or questions to info@nhmunicipal.org.

608 Chestnut Street

Manchester, NH 03104

Phone: (603) 622-7070

Fax: (603) 622-1452

C ERTIFIED PUBLIC A CCOUNTANTS “Experience Counts”

We want to be more than just your auditors! We know New Hampshire governments. Your needs come rst at Vachon Clukay & Company PC, so we’ve structured ourselves to fulfill all of your service needs. We provide the following services:

Auditing • Government Auditing Standards (GAS) Compliance

Single Audits (Federal Compliance Audits) • ACFR Reporting

MS-535 Reporting • Agreed-upon Procedures

Taxes • Reviews and Compilations

We want to be part of your team. Contact: Jarad J. Vartanian, CPA

Housing Supply is a High Priority for Local Governments

Following the 2008 subprime mortgage foreclosure crisis and subsequent Great Recession, housing supply declined precipitously.1 As a result of that recession, fewer new homes were built between 2008 and 2018 than in any decade since the 1960s.2 The mismatch between housing construction and demand continues to widen3 which creates significant affordability challenges for buyers and renters.4

Moreover, pandemic-related setbacks to the housing sector, including disruptions to supply chains and a construction labor shortage,5 have exacerbated already challenging market forces. Local leaders across the country are increasingly under pressure to make up for the gap between housing supply and demand.

This housing supply crisis threatens the economy, limits access to opportunity, reinforces long-standing inequities, and undermines efforts to create positive outcomes for residents and communities.

To learn more about the challenges that cities and towns face regarding their local housing supply needs, the National League of Cities conducted a nationwide survey of local leaders6 between January 18 and March 1, 2023, to better understand their most pressing concerns and perspectives on possible solutions. With this understanding, partners across all sectors— public and private—can better work together to address the critical housing needs across America’s cities, towns and villages.

Endnotes

1 Hayward, J. (October 2022). U.S. Housing Shortage: Everything, Everywhere, All at Once. Fannie Mae

2 Maye, A.A. & Moore, K.K. (July 2022). The growing housing supply shortage has created a housing affordability crisis. Economic Policy Institute. https://www.epi.org/blog/the-growing-housing-supply

3 Cunningham, M. (March 2023). Housing Gap Widens as More Families Confront Fewer Homes. Investopedia.

4 Khan, A., Weller, C.E., Roberts, L. & Zonta, M. (August 2022). The Rental Housing Crisis Is a Supply Problem That Needs Supply Solutions. Center for American Progress. https://www.americanprogress.org/article/th

5 Tita, B. (April 2023). Construction Industry Has Work, Needs More Workers. The Wall Street Journal.

6 The National League of Cities conducted a nationwide survey between January 2023 - February 2023, to learn more about the challenges that cities face regarding local housing supply, and to gauge their responsiveness to policy pathways and solutions. In total, individuals from 301 cities responded.

Court Update

Now available online:

April 2024

By Stephen C. Buckley, Legal Services Counsel and Jonathan Cowal, Municipal Services Counsel

There is No Blanket Exemption Contained in Right-to-Know Law for Records That May or May Not be Subject to Discovery Motion in Pending Litigation, Kenneth T. Michaud v. Town of Campton Police Department, New Hampshire Supreme Court Case Nos. 2022-0328, 04/18/2024

May 2024

The Primex Pooled Risk Management Program is Not Insurance and Statutory Governmental Immunity Remains Intact for Municipalities Covered by Primex, Charles Cole v. Town of Conway, New Hampshire Supreme Court Case No. 2023-0189, 05/03/24

Zoning Rules that Provide Limitations and Restrictions on the Manner of Using Travel Trailers Interpreted to Permit Short-term Rental of Such Trailers, Appeal of Elizabeth Hoekstra, New Hampshire Supreme Court Case No. 20230189, 05/14/2024

Planning Board Improperly Rejected Plan Acceptance When it Conducted a Substantive Review Where it Should Have Only Determined if the Checklist Items Had Been Submitted, Appeal of Town of Hollis, New Hampshire Supreme Court Case No. 2023-0346, 05/24/24

For the most up-to-date court summaries, please visit the NHMA website at www.nhmunicipal.org/court-updates. Thank you.

and Exhibition is moving to Wednesday, October 30 & Thursday, October 31 this year.

These Dates!

N.H. Supreme Court Throws a Curveball on Short-term Rental Zoning Regulations

By Stephen Buckley, Legal Services Counsel

The NH Supreme Court’s recent decision in Appeal of Hoekstra, 2024 N.H. 23 (May 14, 2024) alters the landscape for municipalities that rely on a permissive zoning regulation to control or prohibit short-term rental uses. The court was called upon to examine the Sunapee Zoning Ordinance to determine whether a travel trailer on a lot with a single-family home could be used as a short-term rental.

The Hoekstras own a single-family home in the village residential district in Sunapee and maintain a travel trailer on their property they use as a short-term rental. The town’s zoning administrator notified the Hoekstras that use of the travel trailer as a short-term rental was not a permitted use. The Hoekstras appealed that determination to the Sunapee ZBA which upheld the zoning administrator’s decision. The Housing Appeals Board upheld the decision of the ZBA, and the Hoekstra’s appealed to the NH Supreme Court.

When the court is called on to interpret the meaning of a municipal zoning regulation it renders that determination de novo deciding the question without reference to prior judicial or administrative interpretations. Central to that question for the court was whether Sunapee’s ordinance adequately excluded the use of a travel trailer as a short-term rental in the village residential district as a permitted use.

Most zoning ordinances in New Hampshire are of the socalled “permissive” variety. That is, in the absence of a variance or special exception, such an ordinance functions generally to prohibit uses of land unless they are expressly permitted as principal uses or can be found to be accessory to a permitted use. The Town of Sunapee has a “permissive” zoning ordinance under which any use not expressly permitted is deemed prohibited.

The court’s decision in Hoekstra seemingly abandoned its long-standing approach of first looking at the list of permitted for the applicable zoning district. Instead, the court examined a section of the ordinance titled “Additional Requirements,” and zeroed in on a part of that section labeled “Dimensional Controls,” to determine whether the use is permitted. The court concluded that a sentence in the “Additional Require-

ments” creates new categories of permitted uses, including the use of a travel trailer as a short-term rental. The court determined that under the plain language of the “Additional Requirements” a travel trailer is permitted and may be used for temporary sleeping quarters for not more than ninety days in a twelve-month period so long as it complies with State or Town sewage disposal requirements and all other provisions of the ordinance including building setbacks. The court reached this conclusion even though the title “Additional Requirements” indicated it was intended to impose additional requirements on permitted uses, and not to create additional permitted uses.

Because of the decision in Hoekstra, municipalities will have to carefully examine what other provisions in their zoning ordinances, intended as restrictions on use, might be interpreted instead to create permitted uses.

What Does Work for Zoning Regulation of Short-Term Rentals:

Using the NH Supreme Court decision in Working Stiff Partners v. City of Portsmouth as a guide, consider the following to be included in a local zoning ordinance:

• Include a provision in the general requirements or similar section of your zoning ordinance that states something like the following: “No building, structure, or land shall be used for any purpose or in any manner other than that which is permitted in the district in which it is located.” This will establish that your zoning ordinance is of the permissive variety intended to prohibit all uses of land that are not expressly permitted.

• For residential zoning districts, consider including a provision that states the general purpose of the district is to permit single-family, two-family or multi-family dwellings and then provide a definition of dwelling unit like the following: “a dwelling unit is defined as a building or portion thereof providing complete independent living facilities for one or more persons, including permanent provisions for living, sleeping, eating, cooking and sanitation. This use shall not be deemed to include such transient occupancies as hotels, motels, rooming, boarding houses or short-term rentals.”

Even if short-term rentals are not a permitted use, would they be considered an accessory use? The Supreme Court did not entirely resolve the accessory use issue in Working Stiff. If the zoning ordinance cannot be interpreted to expressly permit short-term rentals, an owner could still claim that a shortterm rental must be allowed as an accessory use to a residential dwelling. An accessory use is one that is “subordinate and customarily incidental to the main use on the same lot.” Forster v. Town of Henniker, 167 N.H. 745, 758 (2015). A common example of an accessory use is a garage on a residential lot. If residential dwellings are permitted and garages are not expressly prohibited, a garage ordinarily will be allowed as an accessory use to the house.

The “subordinate” and “incidental” criteria require that the accessory use be “minor in relation to the permitted use and . . . bear a reasonable relationship to the primary use.” The “customarily” requirement is an important one. It requires evidence that the accessory use “has commonly, habitually and by long practice been established as reasonably associated with the primary residential use in the town.” Becker v. Town of Hampton Falls, 117 N.H. 437, 440-41 (1977).

A homeowner might claim that renting out a room in his or her home is an accessory use to the primary use as a residence. There is no clear, uniform answer to this, but there are some obvious cases: if the homeowner does not actually live there, but merely rents individual rooms or the entire house to short-term occupants, then the rental is not “subordinate”—it is the primary use. Similarly, if the owner occupies just one or two rooms and rents several units to short-term occupants, the rental business is not subordinate and not an accessory use.

A more difficult case is where the owners legitimately occupy the house as their primary residence and merely rent one or two rooms on a short-term basis. That may satisfy the “subordinate” requirement, but the owner would still need to establish that homeowners in the municipality have “customarily” rented rooms to short-term occupants as an incident to their use of the property as a residential dwelling. This seems unlikely in most cases; but these questions need to be resolved on a caseby-case basis. Consultation with the municipality’s legal counsel is strongly encouraged before any conclusions are drawn on whether a short-term rental is an accessory use.

Legislation on Short-Term Rentals

that also must be considered by Municipalities when addressing shortterm rental uses:

• Short-term rental operators must pay rooms and meals tax, and any advertisement for a short-term rental shall include the meals and rooms license number of the operator. RSA 78:4-a. This tax statute also defines a short-term rental as “the rental of one or more rooms in a residential unit for occupancy for tourist or transient use for less than 185 consecutive days. RSA 78-A:3, XXII.

• In 2017 an amendment to the Housing Standards statute, RSA chapter 48-A, prohibited the application of locally adopted housing standard regulations on vacation or short-term rental uses. The legislative history reveals that the purpose of the amendment was simply to state that RSA 48-A cannot be used to regulate vacation rentals, while confirming that that cities and towns are free to regulate short-term under RSA 674, planning and zoning.

Any amendment to a zoning ordinance must be clear and unambiguous. The ordinance must be clear, starting with the definition of “shortterm rental.” The ordinance might establish a separate definition specifically for short-term rentals, or it might fold it into an existing definition of hotel, bed and breakfast, or similar transient uses. If the ordinance is going to allow short-term rentals, the following are some of the issues that should be considered. (There are most likely several others):

• Limit on number of days per year units may be rented

• Owner occupancy requirement

• Allowance only by special exception or conditional use permit

• Restriction to specific zoning districts

It is impossible to address every imaginable situation in a zoning ordinance, but an effort should be made to anticipate and answer as many questions as possible. If the ordinance is going to prohibit short-term rentals, clarity is equally important. The ordinance should be very specific about what constitutes a short-term rental so there is no question about what is and is not prohibited. A statement that “shortterm rentals of residential property are prohibited” will raise more questions than it answers.

Any amendment will need to be tailored to accommodate the municipality’s specific needs and to fit with the existing ordinance. Consultation with the municipality’s attorney and/or a professional planner is strongly recommended.

Stephen Buckley is the Legal Services Counsel with the New Hampshire Municipal Association. He may be contacted at 603.224.7447 or at legalinquiries@ nhmunicipal.org.

The HR REPORT

U.S. Department of Labor Final Rule Increasing Minumum Exempt Salary: Update and What to Expect

By Sarah H. Freeman, Esquire, Associate, Labor and Employment Group

On April 23, 2024, the U.S. Department of Labor (“DOL”) announced a final rule increasing the minimum salary required to properly classify employees as exempt from federal minimum wage and overtime. The first change outlined in the rule is scheduled to go into effect on July 1, 2024, with a subsequent change effective January 1, 2025, and automatic adjustments on a triennial basis starting in 2027 thereafter.

Under state and federal law, employers are required to pay employees minimum wage for every hour worked and overtime for every hour worked in excess of forty (40) hours in a work week, except for employees that the employer can properly classify as “exempt” from these rules. The most commonly utilized exemptions are sometimes referred to as the “white collar” or “EAP” exemptions and apply to employees who perform exempt executive, administrative, and professional, outside sales, or computer duties, and who generally receive a guaranteed salary of at least the minimum required amount. The law also provides a special exemption for certain “highly compensated employees,” who make above a certain amount in total annual compensation and meet a less stringent duties test (“the HCE exemption”). The necessary duties are outlined in detail in the regulations. Notably, even if an employee may qualify for an exemption, the employer is not required to apply an exemption – i.e., it is always lawful to classify an employee as non-exempt and eligible to receive overtime.

The DOL’s newly announced final rule, Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees, once effective, will increase the minimum salary threshold required for most EAP exemptions and the HCE exemption. Of note, the final rule does not modify the exempt duties, which, as referenced above, are also required to properly classify an employee as exempt under the EAP and HCE exemptions. The revised final rule will:

Increase the minimum required guaranteed salary level for the EAP exemption in two steps (as outlined below):

Date Minimum Exempt Salary Level

Before July 1, 2024

July 1, 2024

January 1, 2025

$684 per week

($35,568 per year)

$844 per week

($43,888 per year)

$1,128 per week

($58,656 per year)

Increase the total annual compensation threshold for the HCE exemption in two steps (as outlined below):

Date HCE Minimum Exempt Total Annual Compensation Threshold

Before July 1, 2024

July 1, 2024

January 1, 2025

$107,432 total annual compensation

$132,964 total annual compensation

$151,164 total annual compensation

Adds a mechanism that will provide an automatic update to these minimum salary and compensation thresholds every three years beginning on July 1, 2027.

The first of these changes is expected to go into effect on July 1, 2024 contemporaneously with the publishing of this article.1 Employers who have not done so should immediately identify workers whose classification will be impacted by the July 1st salary threshold increase and take action to avoid being out of compliance.

Looking forward to the January 1, 2025 change and the subsequent automatic adjustments starting in 2027, employers should identify workers who will be impacted by the threshold increases and analyze how best to proceed with clas-

sification changes going forward. Employers may decide to take into account budgetary and other business considerations including the number of hours per week currently worked, anticipated overtime, and the administrative costs of training and enforcing timekeeping and rest/meal break requirements. Employers can then make an informed choice whether to reclassify employees to non-exempt hourly positions or raise salaries to exceed the updated thresholds.

As employers are reclassifying positions, it is important to communicate any classification change clearly to impacted employees. This includes communicating any change of status, rate of pay, and impact on benefits such as leave accrual. Employers will want to clearly explain if there will be changes to how employees are expected to track their hours worked, including how to seek and record authorized overtime. Employers can also clarify that the pur-

pose of any classification change is to ensure compliance with federal law and is not related to the quality or importance of the employee’s work.

This same assessment must be done for employees covered by a collective bargaining agreement. If such an employee’s wages would cause them to lose their exemption, the employer can negotiate a higher salary with the union or, without bargaining, convert them to non-exempt status (as that is required in order to comply with the change in the law). In this latter instance, however, it is likely that the individual will still be subject to a collective bargaining agreement under which they are promised a salary. While it is lawful to have an employee in a salaried non-exempt status, it can make the calculation of overtime complicated. Therefore, it would be prudent for employers to assess the potential impact of these changes on unionized employees carefully.

Finally, given the nationwide shift caused by the modified exemption rule,

•

•

savvy employers may also take this op portunity to engage in a more compre hensive analysis of the primary duties of all positions and make further adjust ments as needed to ensure compliance across their workforce.

This is not a legal document nor is it intended to serve as legal advice or a legal opinion. Drummond Woodsum & MacMahon, P.A. makes no representations that this is a complete or final description or procedure that would ensure legal compliance and does not intend that the reader should rely on it as such.

1 As of the writing of this article, the changes are anticipated to go into effect on July 1, 2024 and the rule may have gone into effect before the publication date. Notably, in the past, changes to the EAP exemptions and salary thresholds have been challenged and injunctive relief has prevented the regulations from being enforced as scheduled. While such litigation is pending at the time of the writing of this article, no court had published a decision staying the implementation of the rule. Towns and cities are encouraged to contact their attorneys for an update on the status of the rule.

maugustine@nhmunicipal.org

UP CLOSE & PERSONAL In the Field

elcome to Up Close and Personal – In the Field, a regular column in New Hampshire Town and City dedicated to giving readers a closer look at staff from New Hampshire municipalities. In this issue, we hope you enjoy meeting Bryce Kaw-uh, Chair of the Manchester Planning Board.

TC: What are your duties and responsibilities as Planning Board Chair?

As the Chair of the Manchester Planning Board, I’m responsible for working with my fellow members to evaluate whether proposed housing, commercial, and industrial developments satisfy the necessary regulatory conditions for approval. We also work together to recommend zoning updates and modify long-range planning documents. I’ve had the privilege of serving in this capacity since December 2021 after joining the Board in February 2020.

TC: What is your biggest challenge in performing your duties?

The biggest challenge I’ve encountered on the Planning Board is that we cannot always make everyone happy. We do our best to find mutually agreeable solutions when stakeholders raise concerns with a project application. However, in the end, our decisions must also adhere to state law and municipal regulations. If an application deserves to be approved based on the criteria, then it is our responsibility to approve it with the appropriate conditions; the same applies if an application fails to meet the necessary standards and must be denied.

TC: What is the public perception about your job and how does it differ from the reality

Contrary to what some folks may think, the Manchester Planning Board does not originate any project applications. We cannot directly solicit housing developments or negotiate to bring new businesses downtown. Rather, we depend on builders, businesses, and homeowners to bring forward their own proposed developments for our review – at which point we strive

TC: Has your public position changed you personally?

In my four years on the Planning Board, I’ve developed a stronger appreciation for the wide array of folks committed to making a difference in our community. This includes our dedicated Planning & Community Development Department staff, community activists like the Manchester Housing Alliance, and regular city residents who decide to offer public comment. Even if we happen to disagree sometimes, their investment is essential for building a

TC: Has your job changed the way you look at the role of government?

Getting a peek behind the curtain has convinced me that local government outcomes are largely driven by the systems we put in place. We set so many things in motion through upstream decisions. Consequently, we must be willing to step back and revisit those decisions when things aren't going as well as we'd like. In short, serving on the Manchester Planning Board has educated me on how we can – and ought to – improve community outcomes by improving the systemic structures we create through our various rules and regulations.

TC: What lessons about human nature have you learned in your role?

At a deeper level, it’s easy for people to feel apprehensive about change. People often dislike the idea of their neighborhoods changing, especially if they chose their community based on how it was when they first moved in. Nervousness about change affects me, too. But at the same time, we have to recognize that healthy communities are always adapting and growing. Our city cannot be frozen in amber if we wish to see it become the best version of itself.

Bryce Kaw-uh

TC: Anything else you would like to discuss about your job?

BK: Serving on a Planning Board is a volunteer role. We need people from all walks of life to step up and participate. This is because folks with different backgrounds will bring their own unique perspectives to the table, which helps lead to illuminating questions and better decisions in the end.

mond

SNew Hampshire’s Changing Demographics: What the Numbers Tell Us

By Rachel Dewey, Strafford Regional Planning Commission

Terry Johnson, Southwest Regional Planning Commission

Zach Swick, Southern NH Planning Commission

Sylvia von Aulock, Southern NH Planning Commission

hocking I know, but not everyone likes to have conversations about demographics: the numbers, the changes in percentages, and let’s not even talk about the graphs. But for this article, we hope you put aside any grievances you may have about numbers in general and consider what they tell us. The statistical data we are sharing includes changes in our state’s population, school enrollment, and diversity in population. Whether you find some of the changes surprising or not, they will beg the question, why are the changes important and what, if anything, should my community do about it? There’s a story here and we hope you are willing to consider what it may mean for your community and New Hampshire.

New Hampshire’s Changing Population

There are two age groups in New Hampshire that are growing: people over 60 years old, which may not come as a surprise, but also people 20-39 years old. The population over 60 years old is up 40% (over 105,000 people) and the population 20-39 is up 11% (or about 34,500 people) from 2012. As of the 2022 American Community Survey (US Census Bureau), New Hampshire was the third oldest state in the US. Continuing to look at 2022 numbers, the statewide median age was 43.1 years (up from 41.1 in 2012). The youngest county was Strafford County, with a median age of 37.7 (up from 36.7 in 2012), and the oldest county was Carroll County with a median age of 53.8 (up from 48.2 in 2012).

The first chapter of the story is simple, New

Hampshire is aging. We are typically one of the top five oldest states along with Maine, Vermont, West Virginia, and Florida. Naturally, as we age our needs and wants change. As planners it’s vital to ask our communities, agencies and businesses if they recognize the growing needs of an aging population. A survey for the NH State Plan on Aging in early 2023 found that 91% of adults over 65 found access to healthcare and ability to maintain physical health as very important to their ability to age in place. When asked to rate their community’s ability to meet their needs to age in place, 19% of respondents over 65 rated their community “Poor”, and another 34% said “Fair”. Only 10% said their community is in a “very good” position to meet their needs.

An age-friendly community is one that embraces the concept that there should be programing, services and infrastructure for people of all ages and abilities. Communities can conduct their own self-assessment of their services by asking questions such as: Do we have walkable streets? Do we have a transportation system for older residents who need to retire from driving? Do we have programs in place to assist older residents to remain safely in their

homes? And on the flip side: can we attract younger adults to work in our many businesses and industries to support our communities?

The Domino Effect of Population Decline

While there are many factors that shape state and regional economies, population change is perhaps one of the most fundamental. During the period between 2010 and 2020 the Southwest New Hampshire region saw its first decline in population in a century, (since 1910 – 1920). Between 2010 and 2020, the total population of Southwest NH declined from 100,751 to 100,307, a loss of 444 people or just under 0.5%. The modest decrease in population occurred against a backdrop of positive yet slowing national growth.

The decline in the region’s population raises a number of economic challenges, something we’ve all noticed especially since COVID: help wanted signs. It seems that in every corner of the business sector, from engineers and planners to grocery store clerks and restaurant staff, there are staffing shortages. The bottom line is that with a shrinking population, employers are limited in their ability to maintain or expand their operations. Could the shrinking population really impact the availability of southwest NH’s workforce? Remember New Hampshire is aging, and unfortunately this means our workforce is aging. As more and more NH’s citizens are retiring, they age out of the workforce. What is the result? In every conceivable office from oak-trimmed boardrooms to back-alley kitchens, you can hear the questions: who’s going to do all the work, how do we fill these vacancies, and how can we attract a younger workforce?

In an environment where many sectors of the economy report significant recruitment and retention challenges, trends in labor force participation signal a competitive disadvantage for southwest NH. The region is more rural, older and stagnant in job growth than other parts of the state. As the limitations on workforce become more severe as the nation ages, local efforts to promote in-migration of working-age households and to utilize the existing workforce to its greatest potential will become more important than ever to ensure a healthy and vibrant economy.

What the Numbers Tell Us About School Enrollment

The aging of NH is visible in school enrollment as well. Public school enrollment in NH peaked in 2000 and has fallen ever since.1 This tracks with the decrease in school-age children statewide. The total number of NH residents under 18 years old was highest in 2000 and has decreased by 53,000 or 17% since then. The percentage of residents who are minors

has been falling for decades, 46% since 1970.2

Towns like Candia experienced a 24% drop in public school enrollment between 2013 and 20233 and a 56% drop in the number of minors per household compared to 1980.4 Even in towns where public school enrollment has grown in recent years, the number of minors per household continues to decline. Enrollment figures for private schools are more difficult to obtain but their general trend is also down. Enrollment numbers are projected to continue declining in the near future.5 However, they could recover somewhat in the 2030s as the children of millennials reach school age.6

New Hampshire and Diversity: Immigrants, Cultural Diversity, People of Color

With the 2020 census, New Hampshire became the fourth least diverse state in the country (previously it was the third). Over 175,000 granite staters identify as a racial or Hispanic or Latino minority. While a minority

New Hampshire Public School Enrollment

CHANGING DEMOGRAPHICS from page 30

rate of 13% is much lower than the national rate of 42%, it is growing quickly, and especially among younger residents. The number of minorities living in NH over the past two decades grew by 192% compared to just 11% for the general public. That’s around 116,350 net new minority residents over a 20-year period. Within the Southern New Hampshire Planning Commission (SNHPC) region the growth rate was roughly the same at 188%. However, looking at these total numbers obscures stark differences when it comes to age. In the city of

Manchester, a person under the age of 18 is twice as likely to be a racial or ethnic minority than an adult. Interestingly, that pattern continues in outlying communities like Bedford, Candia, Deerfield, and Londonderry.7

Looking at the growth graphically, you can see the comparison of net new residents for the past two decades in the SNHPC region, in Manchester, towns in the SNHPC region with a population of at least 10,000, and towns in the SNHPC region with a population of less than 10,000 residents. Growth of new residents is separated into whites and minority

categories. For the past decade, one can see how minority growth has increased substantially and in Manchester, the number of new white residents has actually declined in both 2010 and 2020. Between 2010 and 2020 in towns with a population of 10,000 or more, the number of net new minority residents was more than four times higher than it was for new white residents. The growth in white and minority residents was nearly equal in towns of less than 10,000 during that same period.8