DAIRY MARKET REPORT

8/25/2025

OVERVIEW

U.S. fluid milk sales rose 0.5% from a year earlier in June, while domestic yogurt consumption jumped 12.2%. Overall domestic commercial use of milk solids in all dairy products increased 3.0% year-over-year. Meanwhile, exports accounted for 18.7% of domestic milk solids production, a sharp rise compared with recent levels.

U.S. milk production growth accelerated in the second quarter, with milk solids composition also trending higher. Despite this, stocks of major dairy products held steady from May to June, as did the national average all-milk price. The Dairy Margin Coverage (DMC) margin improved by $0.70/cwt, supported by lower feed costs.

At retail, dairy prices have seen little change over the past three years, even as overall consumer prices including food and beverages have climbed at least 9% since peaking in 2022.

COMMERCIAL USE OF DAIRY PRODUCTS

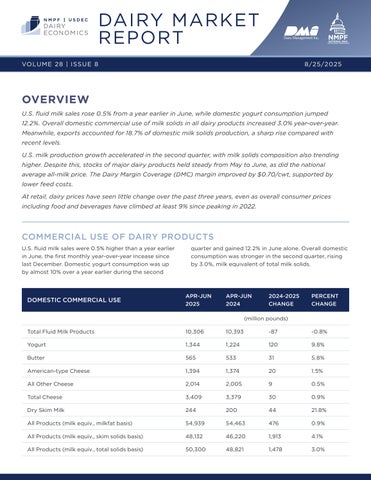

U.S. fluid milk sales were 0.5% higher than a year earlier in June, the first monthly year-over-year incease since last December. Domestic yogurt consumption was up by almost 10% over a year earlier during the second

quarter and gained 12.2% in June alone. Overall domestic consumption was stronger in the second quarter, rising by 3.0%, milk equivalent of total milk solids.

U.S. DAIRY TRADE

June dairy exports surged, reaching 18.7% of domestic milk solids production—the highest share since September 2022 and the largest export volume since May 2022. More than four-fifths of the increase over the January–May average came from higher exports of lactose, skim and whole

milk powder, dry and modified whey and whey protein concentrate.

U.S. dairy imports fell below year-ago levels in the second quarter, as domestic prices generally declined relative to international markets.

MILK PRODUCTION

USDA’s preliminary estimate shows June milk production up 3.3% from June 2024. The department also revised its May figures higher, raising milk output by 142 million pounds to 2.3% above a year earlier. May production

per cow was adjusted upward by 11 pounds, while the preliminary dairy herd estimate was increased by 20,000 head. For the second quarter, total milk solids production rose 3.4% year-over-year, with milkfat output

DAIRY PRODUCTS

U.S. cheddar cheese production rose 8.9% year-over-year in the second quarter. Output of other cheese varieties also

increased, though at more modest rates, while production of most dry skim ingredient products declined.

DAIRY PRODUCT INVENTORIES

Stocks of major dairy products at the end of June were generally slightly below May levels, suggesting that rising

milk production and increased cheese and butter output have not yet led to clear oversupply in the markets.

DAIRY PRODUCT AND FEDERAL ORDER CLASS PRICES

NDPSR-reported prices for 40-pound cheddar blocks fell sharply in June, while prices for other surveyed products— particularly butter—moved higher. Beginning in June, the NDPSR stopped reporting a cheddar barrel price, and the monthly cheese price is now based solely on cheddar blocks rather than a weighted average of blocks and barrels. These shifts pushed July Class II and Class IV prices higher while pulling the Class III price lower.

Retail inflation, measured by the year-over-year change in

the Consumer Price Index (CPI) for all items, held steady at 2.7% in both June and July. However, the CPI provides only a limited view of retail price trends and does not fully capture sector-specific dynamics. In contrast to the broader economy, where prices have continued to climb, dairy retail prices have remained largely stable since 2022. This trend reflects a longer-term pattern, dating back to the 2008 financial crisis, in which consumer dairy prices have consistently risen more slowly than overall costs.

MILK AND FEED PRICES

As expected throughout much of the year, the DMC program continues to report margins well above the $9.50/ cwt threshold for payments, a level last reached in February 2024. The June margin stood at $11.10/cwt, up $0.70 from

May. The all-milk price remained unchanged at $21.30/cwt, while the DMC feed cost formula fell $0.70/cwt, driven by declines in all three feed components, particularly premium alfalfa hay.

LOOKING AHEAD

USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) milk production forecasts continue to reflect its NASS reports, which show faster growth in both cow numbers and production per cow. In the August report, WASDE raised its forecast for this year’s milk production from 1.1% to 1.5% above last year’s level. Despite this relatively strong production growth, the 2025 average all-milk price forecast remained unchanged at $22.00/cwt. WASDE also anticipates firm domestic and international demand next year, raising its 2026 U.S. average all-milk price forecast by $0.25/cwt to $21.90/cwt.

In contrast, individual monthly margin forecasts from the USDA DMC Decision Tool have eased slightly in recent months but still show an increase from May. The mid-August forecast projects the margin peaking at $12.25/cwt in November and averaging $11.86/cwt for the year.

Peter Vitaliano, National Milk Producers Federation pvitaliano@nmpf.org www.nmpf.org

Dairy Management Inc.™ and state, regional, and international organizations work together to drive demand for dairy products on behalf of America’s dairy farmers, through the programs of the American Dairy Association®, the National Dairy Council ® , and the U.S. Dairy Export Council ®

The National Milk Producers Federation (NMPF) develops and carries out policies that advance dairy producers and the cooperatives they own. NMPF’s member cooperatives produce more than two-thirds of U.S. milk, making NMPF dairy’s voice on Capitol Hill and with government agencies.