DAIRY MARKET REPORT

9/18/2025

OVERVIEW

Overall domestic commercial use of milk in all dairy products increased by 2.2% year-over-year during the May-July period. Exports also showed strong growth.

U.S. milk production grew by 3% during this period, while total milk solids production increased by 3.9%, as the average solids composition of producer milk continues to increase. Lower average milk prices in July from a month earlier were mostly offset by lower feed costs, resulting in a $0.16/cwt lower DMC margin of $10.94/cwt.

Retail price inflation ticked up in August as overall consumer prices rose by 2.9% from a year earlier. Dairy continued to show its inflation-fighting bonafides, with its average retail prices increasing by 1.3% from a year earlier versus 3.1% for all food and beverages.

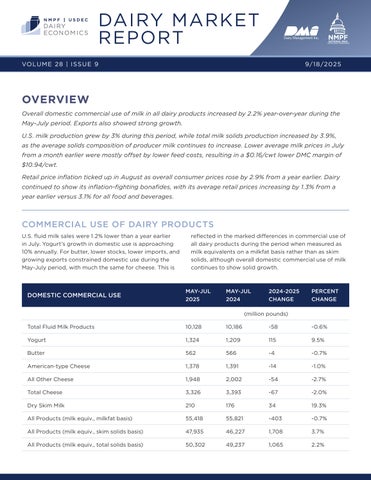

COMMERCIAL USE OF DAIRY PRODUCTS

U.S. fluid milk sales were 1.2% lower than a year earlier in July. Yogurt’s growth in domestic use is approaching 10% annually. For butter, lower stocks, lower imports, and growing exports constrained domestic use during the May-July period, with much the same for cheese. This is

reflected in the marked differences in commercial use of all dairy products during the period when measured as milk equivalents on a milkfat basis rather than as skim solids, although overall domestic commercial use of milk continues to show solid growth.

U.S. DAIRY TRADE

July dairy exports pulled back somewhat from June’s major surge but still amounted to 17.8% of domestic milk solids production, the highest such share, as well as the highest actual solids volume, since March 2023. More than two-thirds of the volume increase over the January–May average came from higher exports of skim milk powder, lactose, whey protein concentrate, and butter.

U.S. dairy imports have remained below the equivalent of 4% of domestic milk solids production every month through July this year, averaging 3.6%. Those monthly percentages were last above 4% on a somewhat sustained basis in early 2009. Among the products that contribute more than half of both the imported milk solids volume, as well as that volume’s share of domestic production, are milk protein concentrate, casein, butter, and cheese.

MILK PRODUCTION

U.S. milk production continued to grow at a relatively fast pace in July, but that pace stopped accelerating, and USDA estimates appear to be catching up with the trend. The department’s National Agricultural Statistics Service preliminary estimate for July shows monthly milk production up 3.4% from a year earlier, little changed from June’s 3.3% annual growth. In its previous report, NASS revised its preliminary May U.S. production estimate up by a significant 142 million pounds. This time, it revised

its preliminary June estimate up by just 5 million pounds. USDA also revised its preliminary May U.S. dairy cow inventory estimate up by 20,000 cows, but its preliminary June estimate was bumped up by only 6,000 cows this report. Milk production was up over a year ago during May-July by 3%. During the same period, total milk solids production rose by 3.9%, and milkfat production grew annually by 4.8%.

DAIRY PRODUCTS

U.S. cheddar cheese production continues to rise at a rapid rate, 8.4% year-over-year during May-July. Butter ran a close second among the major dairy product categories, with production up by 8.1% during the same period. Following several periods during which year-over-year production was mostly lower, production of most dry

skim milk ingredient products increased during the most recent 3-month period, finally showing evidence of the strong growth in U.S. milk production. The major exception was export-focused skim milk powder, which dropped by almost 13%.

DAIRY PRODUCTS PRODUCTION

DAIRY PRODUCT INVENTORIES

Despite the continued fast pace of milk production growth, July-ending stocks of butter and cheese, as well as those of the major skim ingredient products, were nevertheless

stable to lower compared with both a month as well as a year earlier, except for small gains in year-over-year stocks of American-type cheese and whey protein concentrate.

DAIRY PRODUCT AND FEDERAL ORDER CLASS PRICES

The NDPSR-reported prices stayed relatively constant from July to August, except for butter, which lost almost $0.10/ lb and thereby returned to slighly below its price in June. 40-pound cheddar blocks had previously taken their own $0.17/lb fall in July. The net result for the manufacturing class prices were monthly drops of $0.08/cwt and $0.39/ cwt, respectively, in the August Class III and Class IV prices. The August Base Class I Price rose by $0.11/cwt from July

while the effective base Class I price for ESL milk dropped by $0.44/cwt over the same period.

Retail inflation, measured by the year-over-year change in the Consumer Price Index (CPI) for all items was 2.9% in August, an uptick from its 2.7% annual increase in both June and July. The corresponding annual changes for August in the CPIs for all food and beverages and for all dairy products were 3.1% and 1.3%, respectively.

Order Class Prices for Milk (per hundredweight)

Dairy Product Prices

MILK AND FEED PRICES

The July margin under the Dairy Margin Coverage program declined by $0.16/cwt from a month earlier to $10.94/cwt, as the DMC feed cost formula decreased by $0.34/cwt, while the all-milk price fell by $0.50/cwt to $20.80/cwt.

The July DMC feed cost dropped on lower corn and soybean meal prices, while the premium alfalfa price was little changed from June.

*DMC calculations are not revised

LOOKING AHEAD

USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report for September raised its 2025 milk production forecast for the sixth straight month, for a total of 3.8 billion pounds over those months. It has raised its 2026 milk production forecast for the four straight months since it began reporting its estimates for next year, for a total of 3.4 billion pounds. The September WASDE finally began to lower its price forecasts in the face of such bullish production forcasts. The September estimates of the 2025 Class III, Class IV and all-milk prices were $0.69/ cwt, $2.60/cwt and $1.20/cwt lower than their respective

WASDE August forecasts. These three price forecasts for 2026 were reduced from a month earlier by amounts between $0.80/cwt and $0.95/cwt.

The monthly forecasts maintained by the DMC Decision Tool on the USDA website continued to drop in recent months but still show the DMC margin generally increasing from May. Its mid-September forecast shows the margin topping out $11.52/cwt in August, declining during the remainder of the year, and averaging $11.25/cwt for the year.

Peter Vitaliano, National Milk Producers Federation pvitaliano@nmpf.org www.nmpf.org

Dairy Management Inc.™ and state, regional, and international organizations work together to drive demand for dairy products on behalf of America’s dairy farmers, through the programs of the American Dairy Association®, the National Dairy Council ® , and the U.S. Dairy Export Council ®

The National Milk Producers Federation (NMPF) develops and carries out policies that advance dairy producers and the cooperatives they own. NMPF’s member cooperatives produce more than two-thirds of U.S. milk, making NMPF dairy’s voice on Capitol Hill and with government agencies.