MARKET REPORT EOFY

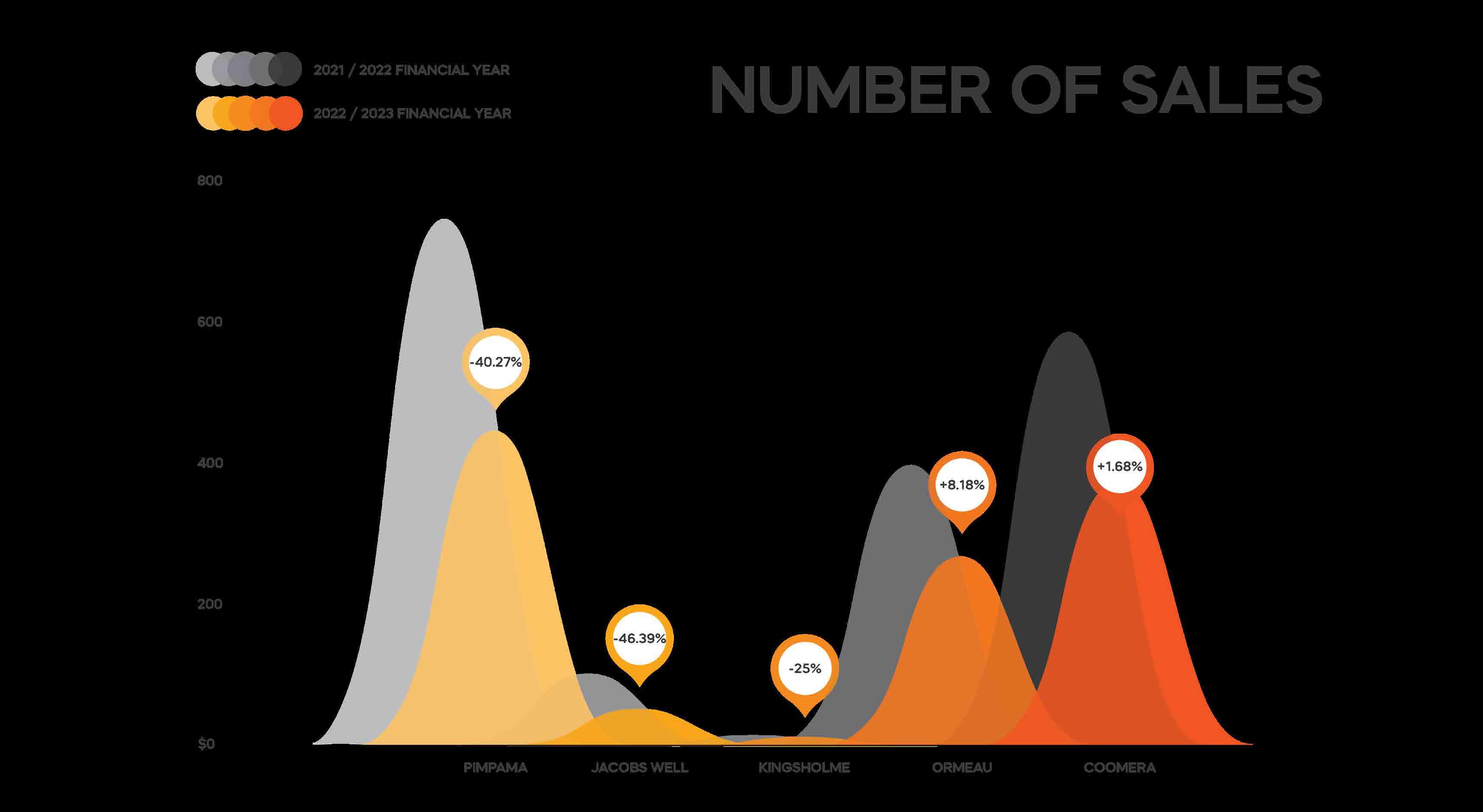

In the 2022-2023 financial year the Gold Coast property market faced some challenges.

This was namely due to the 12 cash rate rises reducing buyer affordability and decreasing borrowing capacity by over 40%. However, limited property supply prevented both a market crash and significant drops in property values. Demand for turnkey ready properties increased, driving up prices, while instability in the building sector caused a decline in demand for land purchases.

Looking ahead to the remainder of 2023, over 800,000 mortgages in Australia are expected to shift from fixed to variable rates, potentially leading to mortgage stress and an increased chance of distressed selling. Additionally, if the number of properties on the market increases with buyer demand remaining consistent, there could be a softening in prices. This could create a more balanced market, giving buyers more options and potentially moderating price growth.

- Nathan

Our latest blog on the Gold Coast Budget and how it may boost the property market

Check out our feature in the Home + Life podcast discussing how transparency increases sale price

DON’T SEE YOUR SUBURB? FIND OUT MORE HERE

Coomera connector early works continuing in Coomera for stage 1

Exit 49 Upgrade tracking on time

Costco and Costco service station now open

The Good Guys announced for Pimpama Home hub

Construction underway for new Coomera Toyota dealership

The Australian property market has faced significant challenges in the past year, particularly for mortgage holders. The Reserve Bank of Australia (RBA) has raised the cash rate multiple times since May 2022, and it currently stands at 4.10%. However, there is some hope on the horizon, as experts predict that interest rates may start to decline in 2024. This news will bring relief to many homeowners and potentially stimulate activity in the property market once again.

Despite the current national slump, economists believe that this is a temporary situation, and they anticipate a potential rise in property prices of up to 5% in 2024. This projection is encouraging for those who have invested in the property market and are hoping for a positive turnaround.

The primary driver behind the RBA’s decision to increase rates is inflation. The rising cost of living has become a concern for many Australians, who have grown accustomed to the era of extremely low-interest rates and a booming property market. To address this issue and control inflation, the RBA implemented the decision to raise interest rates in May 2022.

In light of these developments, it is essential for mortgage holders to take action. One course of action is to negotiate with your current lender to secure the best possible interest rate available. If your lender is unwilling to reduce your rate, it may be worth considering refinancing to another lender. In this regard, Ur Wealth Advisory can provide assistance and guidance throughout the process.

To further support individuals aiming to enter the property market, the federal government has extended and expanded the Home Guarantee scheme. This scheme now includes

• an additional 5000 spots across Australia in FY24,

• catering to non-first home owners (subject to eligibility criteria) and permanent residents. These measures aim to facilitate homeownership and make it more accessible to a broader range of individuals.

• Permanent residents such as New Zealand citizens are also able to apply

In conclusion, property remains Australia’s largest market and continues to be a secure store of wealth for many Australians. Although there will always be ups and downs in the market, the consensus among experts is that property will continue to experience long-term growth. Those who can weather the short-term fluctuations and remain invested in the market are likely to come out on the other side more prosperous than those who choose not to participate.

Navigating the Australian property market requires careful consideration and strategic decision-making. Seeking professional advice from a mortgage broker or financial advisor can provide valuable insights and support in making informed choices. By staying informed and taking proactive steps, homeowners and potential buyers can position themselves to take advantage of the evolving property market conditions.

to have contributed to so many local sporting clubs and given back to our community. Along with that and our support of many charity events, we have been a part of over

raised for multiple charities across the Gold Coast! We could not do this without the support of our amazing clients. If you’re looking to sell this financial year, choose the Agents supporting the local community!