KEYASSETS

Welcome to the Winter 2025 edition of the NAI Harcourts Key Assets eBook.

As we have now passed the halfway mark of 2025, the New Zealand commercial real estate market continues to navigate a complex and evolving landscape. Economic uncertainty, high interest rates and shifting occupier needs are all shaping activity across sectors. While sales volumes and rental growth have softened, particularly in the office and retail spaces, we’re also seeing encouraging signs of resilience and recovery, albeit slow.

Investor appetite has been impacted by elevated interest rates and wider economic concerns, leading to a drop in transaction volumes and property values. In the office sector, we’re seeing a clear “flight to quality,” with businesses prioritising premium, welllocated spaces and leaving lower-grade stock with higher vacancy levels. Retail is also being reshaped by the rise of remote work and online shopping, contributing to increased vacancies and a need for adaptation.

On a more positive note, the industrial and logistics sector remains a standout performer, supported by low vacancy and prospects for future rent growth. Retail rents, though under pressure, are expected to stabilise as inflationary effects ease.

Looking ahead, a gradual recovery is on the horizon as interest rates potentially ease and confidence improves. Investor interest in commercial property remains strong, with many seeing long-term value in today’s market conditions.

Occupiers continue to focus on high-quality spaces and hybrid-ready environments and the lending landscape is slowly improving, especially with increased activity from non-bank lenders. Expansionary demand remains present, whilst more tempered than in previous years.

It’s an exciting time to stay connected and I encourage you to work with our NAI Harcourts team of experts in commercial real estate as they lead with insight and confidence. This is where this winter edition of Key Assets comes in. Presenting you with a diverse selection of commercial properties across New Zealand and opportunities to acquire businesses, designed to simplify your search for the latest commercial prospects nationwide as well as contributions from our business partners over at realestate.co.nz, AMLHub and Spark. Our regional commentary comes from our Top NAI Harcourts sales consultant Pete Peeters and the fantastic team at NAI Harcourts Whangarei.

Thank you for the wonderful feedback on our previous editions of Key Assets. We hope you find this one equally valuable. If you have any questions or need further information about the listings in this eBook or beyond, our knowledgeable NAI Harcourts sales consultants are ready to assist you promptly and efficiently.

Warm regards,

Bryan Thomson Managing Director, Harcourts New Zealand

CEO AMLHUB

The commercial property sector in New Zealand represents significant wealth and investment, with stock boasting an impressive $350 billion valuation as of 2024. Where large sums of money are being moved around, criminals see opportunities to exploit it and for money launderers looking to ‘wash’ their illegitimate funds, the commercial real estate sector represents an opportunity too good to pass up.

Why is commercial property attractive to criminals?

The objective of money laundering is to funnel illegally obtained funds through multiple transactions to disguise their origins and create ‘clean’ funds for the ultimate beneficiary. Commercial properties often involve high-value transactions that make it easier to move large amounts of money in one go, which makes it a prime

nai.harcourts.net/nz/key-assets

target for money launderers. Commercial property values are also readily able to be manipulated, allowing further exploitation of the assets. For example, a money launderer buying an office block for $20 million will go a long way in the process to convert their illicit wealth into a legitimate asset through reputable channels and this asset can be later on-sold and further laundered.

To avoid detection, criminals will often add layers of complexity to the deal by using shell companies, trusts, or nominees. In some cases, they even act through foreign companies to make it difficult to identify who ultimately benefits from the transaction.

Money laundering in the commercial property space can take several forms:

• Above or below market value transactions to illegitimately transfer value

• Rapid buying and selling (property flipping) with little commercial logic, often across related parties

• Use of third-party intermediaries, such as international and/or local lawyers and accountants, to obscure the source of funds

• Use of complex ownership structures involving multiple entities and/or international parties.

While these behaviours may occur in legitimate circumstances, a pattern of transactions lacking clear commercial rationale will raise red flags and prompt further questioning.

New Zealand’s Anti Money Laundering / Countering the Financing of Terrorism (AML/CFT) Act applies to a broad range of professions, including real estate, law firms, accountants, and financial institutions, all of whom often play a role in commercial property deals. These gatekeepers are expected to carry out a number of obligations under the legislation, including performing customer due diligence, verifying beneficial ownership and monitoring accounts and transactions for suspicious activity.

The Department of Internal Affairs (DIA) has made it clear that compliance expectations are increasing. In recent years, several enforcement actions have highlighted the need for more robust systems, particularly when dealing with high-risk clients, complex structures, or foreign entities.

New Zealand’s commercial real estate professionals are increasingly at the forefront of the country’s efforts to prevent money laundering. By complying with the AML/CFT Act, this sector is helping to close off high-risk channels and protect the integrity of New Zealand’s financial system.

Under the AML/CFT regime, commercial real estate professionals play a critical role. Their obligations include:

• Identifying and verifying clients, typically vendors, including the beneficial owners behind companies and trusts

• For higher risk vendors, verifying source of funds/ source of wealth and whether wealth aligns with the customer’s profile

• Ongoing monitoring of accounts and transactions to identify unusual activities and transactions

• Red flags (transaction or activity based) need to be evaluated, and when deemed suspicious, reported to the NZ Police Financial Intelligence Unit

• Policies, procedures, risk assessments, and staff training records etc. must be documented, recorded and readily accessible for auditing purposes.

By embedding these practices into day-to-day operations, the commercial property sector is not only meeting its compliance obligations, it’s actively helping to protect New Zealand’s reputation as a clean and trusted place to do business.

Business Development and Commercial Property Manager NAI Harcourts, Whangarei

Long viewed as a gateway to Northland, Whangārei is steadily transforming into one of New Zealand’s most dynamic regional commercial hubs. Underpinned by sustained population growth, significant port expansion and a deepening pipeline of infrastructure investment, the city is fast becoming a key player in the national property and logistics landscape.

At the centre of Whangārei’s commercial growth narrative is Northport at Marsden Point, New Zealand’s northernmost deep-water port. Long operating as a key bulk cargo facility, Northport’s expansion plans are now gaining national attention. nai.harcourts.net/nz/key-assets

A major container terminal development is planned, alongside a new shipyard featuring a large floating dry dock. Together, these projects are projected to create up to 2,600 direct and indirect jobs by 2060, spanning port operations, logistics, engineering and marine services. This scale of industrial growth represents a fundamental shift in Whangārei’s economic base and has significant flow-on effects for local property markets.

The expansion is also positioning Northport as a growing destination for the cruise sector. Following its first successful cruise season in 2023–24, the port is attracting a growing number of cruise ship visits, diversifying tourism revenue and drawing additional visitor demand into Whangārei’s CBD and retail sectors. While cruise activity remains a smaller piece of the puzzle compared to cargo, it’s contributing to growing confidence in hospitality and mixed-use developments.

The long-discussed Northland–Auckland growth corridor remains a critical part of the conversation. Enhanced roading and rail connections, particularly the proposed Marsden Point rail spur linking Northport to the North Auckland Line, are seen as essential enablers of the port’s full economic potential.

Complementing these strategic transport upgrades are major investments at the city level. The Whangārei District Council’s 2024–34 Long-Term Plan outlines substantial spending on public infrastructure: wastewater, drainage, civic amenities and urban renewal projects. A new civic centre has already opened, and ongoing work to improve urban resilience is supporting a growing residential and commercial footprint.

Adding further momentum to Marsden Point’s industrial growth is the new bitumen import terminal, being developed by Higgins Group (part of Fletcher Building) in partnership with Channel Infrastructure NZ Ltd. Located within the Channel Infrastructure Energy Precinct (ex-refinery site), the facility will import, store and distribute bitumen for the upper North Island’s roading and infrastructure sectors.

With an investment of NZ$17–21 million and a 15-year lease contract (with extension options), operations are expected to commence by late 2026. The plant will strengthen regional resilience by reducing dependency on distant sources of bitumen supply and directly support New Zealand’s ongoing transport infrastructure programmes. This development forms part of Channel Infrastructure’s broader NZ$55–66 million investment into Marsden Point, enhancing its role as a diversified logistics and energy hub. The project will also generate increased freight volumes, stimulate demand for industrial

land and create employment opportunities in logistics, storage and related industries.

This convergence of port expansion and public infrastructure investment is driving renewed interest from commercial property investors. Several sectors are emerging as growth nodes:

• Industrial and logistics: Proximity to Northport is attracting warehousing, freight-forwarding, and marine servicing businesses. The Port Nikau redevelopment, adjacent to the CBD, is also unlocking large tracts of waterfront land for commercial and mixed-use opportunities

• Office and service sectors: As population growth fuels demand for healthcare, education, and professional services, commercial office space in Whangārei is experiencing steady absorption. The planned $200 million KEA/Arts Hub, integrating tertiary education and the creative industries, is expected to further stimulate demand for CBD office and ancillary uses

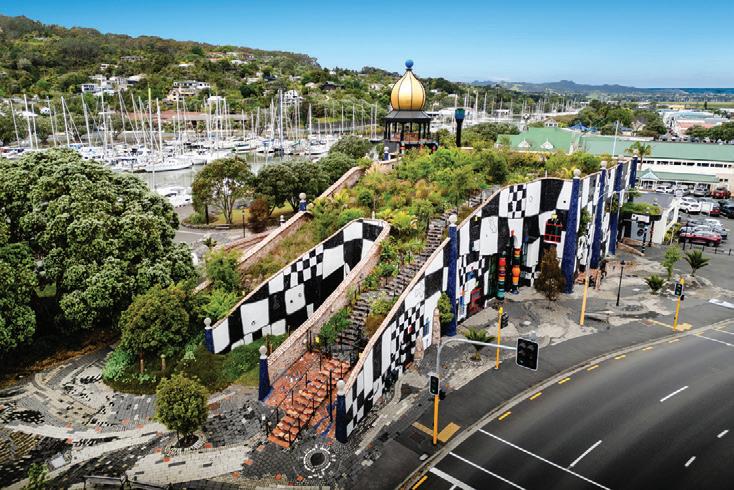

• Retail and hospitality: The combination of rising tourism volumes, cruise activity, and population growth is strengthening demand for food and beverage offerings, boutique retail, and short-stay accommodation. New developments in the Town Basin and Quality Street precincts are already reshaping the urban core.

Sustained population growth underwrites confidence

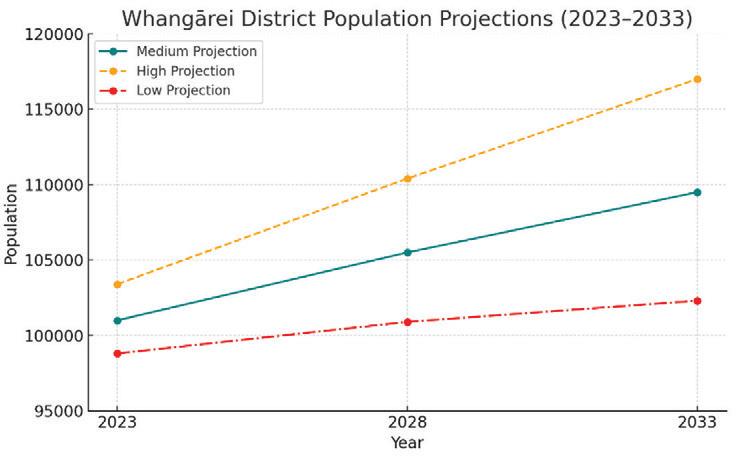

Whangārei’s population reached 53,800 in the 2023 census which is a 20% increase since 2013, with the wider district now housing over 101,900 residents. Forecasts suggest the district could see population rise to as high as 139,000 with ongoing infrastructure delivery. Importantly for investors, these are not speculative growth projections but supported by actual development activity: new subdivisions are active across Springs Flat, Kensington and The Avenues, among others.

Whangārei District population projections (2023–2033)

This graph illustrates the low, medium and high population growth scenarios for Whangārei District, reflecting potential outcomes depending on infrastructure delivery, migration and economic conditions.

For commercial property stakeholders, Whangārei and surrounds represents a classic convergence opportunity: the intersection of core infrastructure, expanding port activity, workforce growth, and a deepening investment pool. While many national conversations continue to focus on Auckland, Wellington, and Christchurch, Whangārei’s quiet but steady transformation offers a strong case study in regional urban resilience.

With Northport expansion underway, public infrastructure rolling out, and multiple sectors aligning to underpin demand, Whangārei is increasingly positioned as a serious player in New Zealand’s future commercial property landscape.

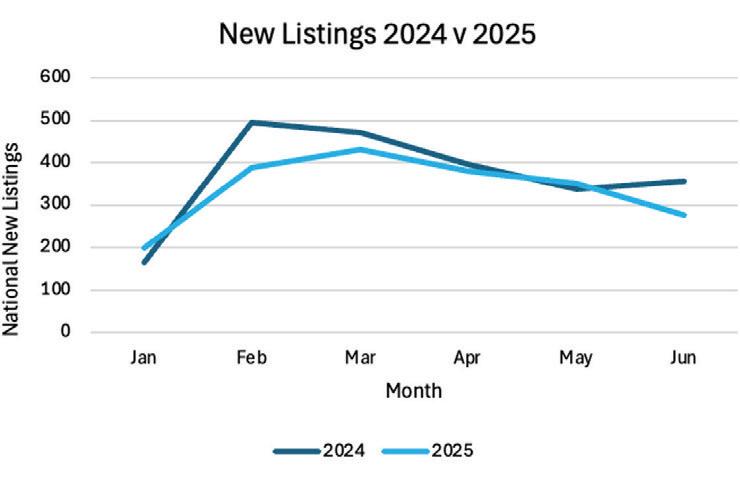

The commercial property market continues with the steady direction it’s been moving in throughout 2025.

The number of new listings coming onto the market each month is tracking just below 2024, and June was no exception.

A total of 278 new commercial listings were advertised nationwide during June, down 21.9% year-on-year.

This dip in new listings was evident across all asset classes, with new listings for office buildings down most significantly by 38.0%. New investment listings took the smallest hit but were still down by 10.3% year-on-year.

The national average asking price for commercial property reached $2.96 million during June, reflecting an 18.2% year-on-year increase despite a 9.1% dip on May.

Office buildings stood out, with asking prices surging 70.7% year-on-year. This was largely driven by a couple of high-value assets being listed for sale during the month, including a Newmarket cornersite and a Wellington central tower.

All sectors saw a lift in asking prices compared with last June, except for retail property, which averaged $2.12m, down by 34.1% year-on-year.

People searching for commercial properties for sale on realestate.co.nz were up by 24% compared with June last year, a recurring trend throughout 2025.

Additionally, enquiries on commercial properties for sale rose 23% year-on-year, signalling steady buyer intent despite fewer listings on the market.

June data highlights a market where demand remains strong amid tightening supply. As interest rates continue to ease, the key question will be whether growing buyer interest translates into transactions. If demand continues to outpace supply, the second half of 2025 could see mounting pressure on prices, particularly for high-demand assets.