KEYASSETS

Welcome to the Summer 2025 edition of the NAI Harcourts Key Assets eBook.

As we move through summer there’s a growing sense of optimism among our businesses. The New Zealand commercial property market in 2024 has faced challenges due to higher interest rates, similar to the broader economic landscape and finished the year on a record low, which gave everyone a sense of doubt as to how the start of 2025 would fare.

In attempting to form a view on what the market could do in 2025, significant price growth isn’t something many are predicting. As market conditions remain constrained by high living costs, a weakened labour market, credit restrictions and an oversupply of property relative to demand. On the positive side, however the continuing reductions in lending rates are giving us reasons to be optimistic that a lift in market activity from the extremely low levels of 2024 are likely.

No matter your view of the market if you are looking to buy, sell, rent or lease in the year ahead you would be well advised to take counsel from an experienced professional who operates in your market. Call your local NAI Harcourts specialist, they are ready to assist.

This edition of our eBook features a diverse selection of commercial properties across New Zealand and opportunities to acquire businesses, designed to simplify your search for the latest commercial prospects nationwide.

Thank you for the wonderful feedback on our previous edition! We hope you find this one equally valuable. If you have any questions or need further information about the listings in this eBook or beyond, our expert NAI Harcourts sales consultants are ready to assist you promptly and efficiently.

Bryan Thomson Managing Director,

Harcourts New Zealand bryan.thomson@harcourts.net

General Manager of Property Finance BNZ

BNZ’s outlook for commercial property investors in 2025

The economic environment remains challenging for individuals and businesses, with post-recession effects evident in rising business closures and unemployment rates.

We expect monetary policy responses will lead to an OCR trough of 2.75%, however, growing offshore geopolitical challenges and New Zealand’s weak potential growth rate are potential complicating factors. Borrowers should expect only modest further retail interest rate reductions, as financial markets have already priced in future OCR cuts. For example, the 2-year swap rate is now 3.50% versus the RBNZ’s 3.00% estimate for the long-term neutral OCR. nai.harcourts.net/nz/key-assets

Lower borrower rates are directly impacting cash investors through reduced deposit rates, with 2-year rates now around circa 4.35%. This may prompt investors to shift passive funds from term deposits to higher yielding investment property, potentially supporting market stabilisation and eventual capital growth.

When we consider the outlook for the business sector and the occupancy demand for commercial real estate, the latest NZIER quarterly business survey suggests confidence that growth will resume this year. In recent analysis, our Chief Economist, Mike Jones, discusses how this may bring some improvement to what is currently dire profitability. This is consistent with our forecasts for a modest 1.2% expansion in economic output over 2025. That expected modest growth, and New Zealand’s relatively more stable economic and political system, may result in new opportunities

potentially supported by offshore businesses and fund managers looking to invest here. We expect this to gradually show up through an increase in transactional activity in commercial property.

Development activity remains subdued due to rising unemployment, tough trading conditions, ongoing working from home, and economic uncertainty. However, lead indicators are starting to show some signs of activity growth, such as an improvement in construction costs, particularly from sub-trades. These conditions are providing some positivity on what would have previously been uneconomic feasibilities. As in past cycles, we anticipate there may be a point where well-capitalised developers seize these improved conditions to “build for the future”, commencing spec-builds for improved tenant confidence in an expected future improved economy.

Our specialist commercial real estate team is seeing that today, as we work with a number of key clients on a growing pipeline of development projects across all sub-sectors, including land subdivision, office, medical, and industrial. Depending on the scale, some of these projects will commence this year while others will be a 2026 commencement.

As the economy transitions from recovery to expansion in the economic cycle, coupled with the benefits of lower funding costs, we’re cautiously optimistic about an improvement across the commercial real estate market in the second half of 2025. This article contains general information only, not professional advice. BNZ is not liable for any losses resulting from this article.

“Lower rates and renewed investor confidence may support market stabilisation and capital growth in 2025.”

Commercial Sales Manager

NAI Harcourts Grenadier - Christchurch City

When I first started in Commercial Real Estate in 1997 I was given a desk, a phone with a curly cord and a small block of wood with a metal spike on it - to spear the little pink slips that came from reception with messages from missed callers.

How times have changes… or have they really?

In the intervening years much has changed. Things moved fast in the late 1990s and within a year the office went from having one company email address (the inbox was checked regularly twice a week) to desktops, email addresses and a website. The fax machine and its thermal imaging paper grew slowly redundant and would have been thrown out years earlier but for the lawyers and their endearing fondness for them.

In those days, when you got a new listing, you sat down and called your buyers – the whole team did.

You posted them out the IM if they were interested or dropped round with a copy and to have a coffee and a chat.

The speed and effectiveness of today’s business communications has made things easier for us and our clients, but the job has not really changed that much. Connecting people with opportunity is still the main thing we do. Much of our success comes down to these connections and the trust and relationships we have with our clients. Many of our successful deals still start with a phone call.

Conveying information is now easier but the complexity, importance and sheer volume of it hasn’t simplified the decision-making process to the extent we may have hoped. Experience, technical understanding and expertise still matter - perhaps now more than ever. Connecting with our market is made easier and faster but there are challenges also in an increasingly crowded online space, a victim perhaps of its own success.

So, what for the future for Commercial Agency and Business Broking? Artificial intelligence? We’ll wait and see. How do we reach people better and connect them with opportunity? How do we cut through the noise and make these essential connections, to serve our clients, to oil the wheels of commerce and get the business done? If the last few decades have taught me anything then it might be a lot like how we always have… by picking up the phone and making the call.

That’s why relationships are so important in our business. Buyers, sellers, developers, landlords, tenants – they are all hungry for opportunities and solutions. They need to be able work with effective, capable, hard-working people they can trust to make those connections and achieve success.

Collaboration is key to the strength of the NAI Harcourts network. And this also is about relationships. The nationwide coverage of the Harcourts network is unrivalled. But it’s not just about the colour of the sticker on the door. The network means that anyone in our team has a partner on the ground almost anywhere in New Zealand - where their client needs one to be. And chances are we’ll know them personally and can vouch for them honestly – something our competitors will struggle to match.

At NAI Harcourts Grenadier our Christchurch City Commercial team is the largest in the Harcourts group operating in the South Island, covering Commercial Sales and Leasing, Business Broking and Commercial Property Management.

This puts expertise and resources where they need to be, serving the needs of our business community, helping to drive business growth and economic success for our region.

These are exciting times, especially for Christchurch which continues to grow at pace, boasting both economic and lifestyle advantages which are hard to match anywhere else. A city whose foundations are strong in every sense. Economically and culturally - with leading edge tech, key distribution infrastructure, a highly productive heartland economy, tourism gateway, education sector and a broadening and diverse population and business community – as well as the solidity of the concrete and steel beneath our feet.

Christchurch, New Zealand’s second largest city, a place perhaps where the strength of its buildings and infrastructure is matched only by the optimism and aspirations of its community.

The changing dynamics of residential rental investment and a focus from a gradually aging population towards income return are factors contributing to a new breed of commercial investor. Attracted to the higher returns, commercial transparency and sound investment fundamentals of commercial property, investors are looking for opportunities to gain a foothold in the commercial market.

To assist first time commercial investors NAI Harcourts Grenadier are running a series of seminars showing investors how to get a foot on the rung and climb the commercial investment ladder.

Those interested in finding out more about this can register here: https://nai.harcourts.net/nz/office/naichristchurch-city-commercial/business-workshop

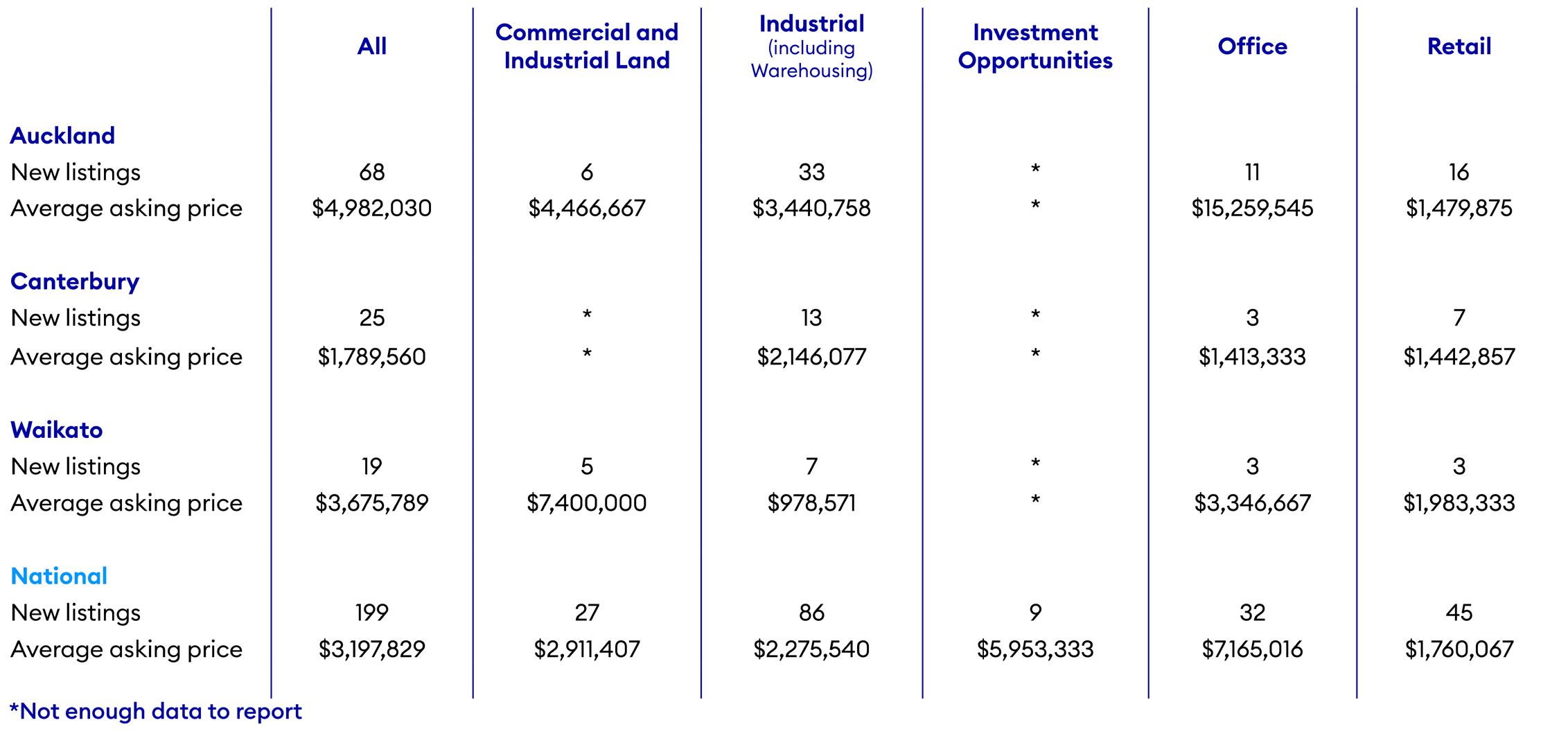

After a very quiet end to 2024, the commercial market rebounded in early 2025, with the highest number of new listings in January since 2021.

Nationally, just shy of 200 new listings came onto the market for sale, an increase of 21.3% compared to January last year. While the number of investment opportunities remains low at nine new listings nationwide, this is up from 5 in January last year. New industrial listings were also up from 64 to 86, an increase of 34.4% year-on-year.

Across our main centres, the Waikato region saw the biggest increase in new listings (up by 72.7%), followed by Canterbury (up 31.6%), while new listings in Auckland were up by 15% year-on-year.

At $3.2 million, the national average asking price across all commercial assets listed in January was up by 33.8% compared to last January. This increase

was largely driven by the Auckland market, which was up by close to 150% year-on-year, with two highvalue CBD office towers being listed for sale during the month.

Potential buyers were also more active this January compared to January 2024. The number of people searching for commercial opportunities on realestate.co.nz was up by 20.5% year-on-year, with searchers in the for-sale category up by around 25% and searchers for leasing opportunities up by 15%. International interest in the commercial market was high during January; people searching from overseas was up by more than a third compared to January 2024.

With plenty of opportunities out there for commercial investors, owner-occupiers, and tenants, and further mortgage rate cuts on the horizon, it’s already shaping up to be a busier year in the commercial market.