COMMERCIAL ASSETS

Hamilton

Waikato Market Commentary

Hamilton CBD Office Market Rebounds in 2025: Demand for Quality Spaces Drive Market Recovery

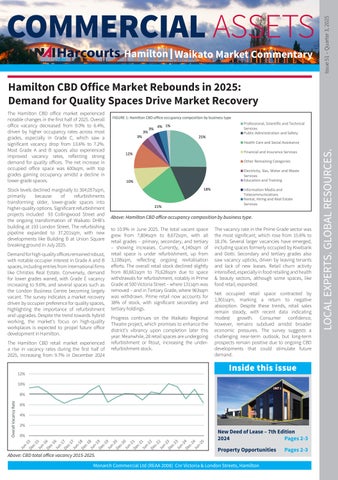

The Hamilton CBD office market experienced notable changes in the first half of 2025. Overall office vacancy decreased from 9.0% to 6.4%, driven by higher occupancy rates across most grades, especially in Grade C, which saw a significant vacancy drop from 13.6% to 7.2%. Most Grade A and B spaces also experienced improved vacancy rates, reflecting strong demand for quality offices. The net increase in occupied office space was 600sqm, with top grades gaining occupancy amidst a decline in lower-grade spaces.

Stock levels declined marginally to 304,057sqm, primarily because of refurbishments transforming older, lower-grade spaces into higher-quality options. Significant refurbishment projects included 93 Collingwood Street and the ongoing transformation of Waikato DHB’s building at 193 London Street. The refurbishing pipeline expanded to 37,201sqm, with new developments like Building B at Union Square breaking ground in July 2025.

Demand for high-quality offices remained robust, with notable occupier interest in Grade A and B spaces, including entries from international firms like Christies Real Estate. Conversely, demand for lower grades waned, with Grade E vacancy increasing to 9.6%, and several spaces such as the London Business Centre becoming largely vacant. The survey indicates a market recovery driven by occupier preference for quality spaces, highlighting the importance of refurbishment and upgrades. Despite the trend towards hybrid working, the market’s focus on high-quality workplaces is expected to propel future office development in Hamilton.

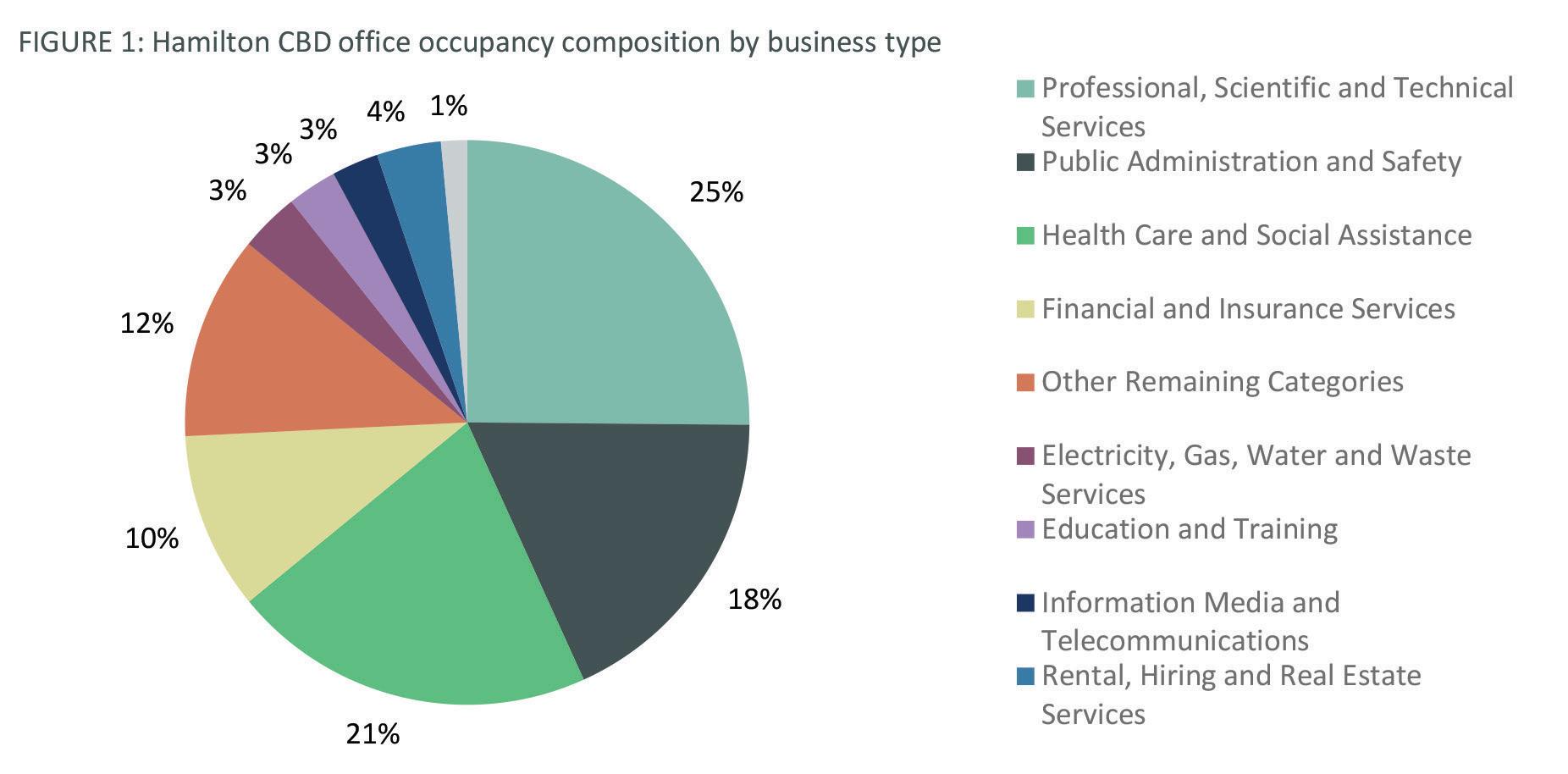

The Hamilton CBD retail market experienced a rise in vacancy rates during the first half of 2025, increasing from 9.7% in December 2024

to 10.9% in June 2025. The total vacant space grew from 7,804sqm to 8,672sqm, with all retail grades – primary, secondary, and tertiary – showing increases. Currently, 4,140sqm of retail space is under refurbishment, up from 3,108sqm, reflecting ongoing revitalisation efforts. The overall retail stock declined slightly from 80,661sqm to 79,628sqm due to space withdrawals for refurbishment, notably in Prime Grade at 500 Victoria Street – where 131sqm was removed – and in Tertiary Grade, where 963sqm was withdrawn. Prime retail now accounts for 38% of stock, with significant secondary and tertiary holdings.

Progress continues on the Waikato Regional Theatre project, which promises to enhance the district’s vibrancy upon completion later this year. Meanwhile, 28 retail spaces are undergoing refurbishment or fitout, increasing the underrefurbishment stock.

The vacancy rate in the Prime Grade sector was the most significant, which rose from 15.6% to 18.1%. Several larger vacancies have emerged, including spaces formerly occupied by Kiwibank and Dotti. Secondary and tertiary grades also saw vacancy upticks, driven by leaving tenants and lack of new leases. Retail churn activity intensified, especially in food retailing and health & beauty sectors, although some spaces, like food retail, expanded.

Net occupied retail space contracted by 1,901sqm, marking a return to negative absorption. Despite these trends, retail sales remain steady, with recent data indicating modest growth. Consumer confidence, however, remains subdued amidst broader economic pressures. The survey suggests a challenging near-term outlook, but long-term prospects remain positive due to ongoing CBD developments that could stimulate future demand.

COMMERCIAL ASSETS Waikato Market Commentary

New Deed of Lease - 7th Edition 2024

The Law Association of New Zealand (formerly known as the Auckland District Law Society) released the latest lease form in November 2024. The real estate leasing landscape has experienced significant shifts since the release of the ADLS Sixth Edition form in 2012, driven largely by external factors such as the Global Financial Crisis (GFC), the Canterbury earthquakes, and most recently, the impacts of Covid-19. Over the past twelve years, feedback from practitioners and the public has led to the creation of the latest edition - Seventh Edition Lease form, which reflects an evolving market and an increased focus on balance between landlords and tenants.

One of the key changes in the Seventh Edition Lease is its emphasis on greater fairness in lease terms. Unlike other standard leases that can be viewed as leaning more heavily in favour of landlords, the Seventh Edition form has been designed to maintain a more balanced approach. Afterall, it is an important long term relationship that both parties are seeking. This is crucial when traversing today’s fluctuating market events and conditions.

Some key changes and topics include:

1. Premises: Clarifies the definition of premises, specifically excluding tenant’s fixtures and fittings during rent review assessments.

2. Rent Review: Introduces the option of Fixed Rent Adjustment Dates, allowing for a combination of market, CPI, and fixed rent reviews. New ratchet options are provided for market reviews and CPI adjustments, including soft and hard ratchets, and the ability to specify custom caps and collars.

3. Renewal: Amends the renewal clause to allow for different notice periods and interlink with various rent review or adjustment types.

4. No Access: Discusses the “No Access in Emergency” clause, which addresses situations where tenants cannot access their premises due to unforeseen circumstances. It provides for a default mid-ground of a Fair Proportion of Rent of 50%, with the option to specify a different amount in the First Schedule.

5. Security for Leases: Highlights the trend toward using bank guarantees or rental bonds instead of personal guarantees.

6. Bank Guarantee: Provides an option for a bank guarantee in the First Schedule, with clauses detailing how it is managed, increased and accessed.

7. Rental Bond: Offers a rental bond option, specifying how it is held, used and released.

Lease Some, Use Some 6-8 LATHAM COURT, FRANKTON, HAMILTON

• Currently leased to two long standing tenants, returning $258,400pa plus GST & Outgoings

• With space available for additional occupants, potential rental could exceed $400,000pa plus GST & Outgoings

• Floor area of 3,768sqm (approx.)

• Land area totalling 8,397sqm (more or less)

Theo de Leeuw 027 490 3248 theo.deleeuw@naiharcourts.co.nz

11am, Wednesday 27 August

Theo de Leeuw 027 490 3248 theo.deleeuw@naiharcourts.co.nz

Jonathan de Leeuw 027 444 6074

jonathan.deleeuw@naiharcourts.co.nz

Occupy or Develop

• Unique opportunity, industrial zone

• Existing 5-bedroom dwelling with a floor area of 135sqm (approx.)

• Strategically located close to local amenities, Hamilton CBD and major arterial routes

• Land area of 570sqm (more or less)

• Sold with vacant possession

Jonathan de Leeuw 027 444 6074 jonathan.deleeuw@naiharcourts.co.nz

Land, Beautiful Land

71 RICHMOND AVENUE, TOKOROA

• Over 7 hectares of freehold land

• Consists of flat and rolling contour

• Located between existing residential to the north and CBD immediately south

• Currently zoned rural, undergoing residential rezoning

Sale closing 4pm, Thursday 28 August 2025, 678 Victoria Street, Hamilton CBD (unless sold prior)

Brad Chibnall 021 448 989 brad.chibnall@naiharcourts.co.nz

Brad Chibnall 021 448 989 brad.chibnall@naiharcourts.co.nz

Theo de Leeuw 027 490 3248 theo.deleeuw@naiharcourts.co.nz

Community Opportunity

75 COOK STREET, HAMILTON EAST

• Currently used as a chapel

• Potential for variety of community uses

• Freehold title of 1,321sqm (more or less)

• Total floor area of 350sqm (approx.)

• Upgraded, fitted-out and well maintained

• 25 marked car parks on-site

• Vacant possession

Tina Boyd 022 196 7007 tina.boyd@naiharcourts.co.nz

Borders are indicative only

Boundaries are indicative only

Deadline

Boundaries are indicative only

Deadline Sale closing 4pm, Wednesday 20 August 2025, 678 Victoria Street, Hamilton CBD (unless sold prior)

Boundaries are indicative only

Boundaries are indicative only

Tenanted Investment 1/14 OSSIE JAMES DRIVE, HAMILTON AIRPORT

• Near new industrial unit featuring office and amenities with a total floor area of 180sqm (approx.)

• 3 on-site car parks

• Located in a complex of four units

• Currently returning $34,506pa plus GST & Outgoings

...continued

8. Costs: Modifies the clause related to costs, ensuring that each party pays the other party’s reasonable legal costs for enforcement.

9. Consent to Alterations: States that written consent is not to be unreasonably withheld for non-structural alterations only.

Auction: 11am, Wednesday 27 August 2025, 678 Victoria Street, Hamilton CBD (unless sold prior)

Sean Stephens 027 478 1669

sean.stephens@naiharcourts.co.nz

Boundaries are indicative only

• Complex layout means this unit has its own parking and access directly outside

Jonathan de Leeuw 027 444 6074 jonathan.deleeuw@naiharcourts.co.nz

Consented Office with Land 16 BOUNDARY

RD, CLAUDELANDS, HAMILTON

• 173sqm floor area plus 38sqm (approx.) separate garage

• Mix of 4 separate office areas plus one open plan area

• Land area of 1,148sqm (more or less)

• 8 on-site car parks (front and rear)

• Vacant possession

Auction: 11am, Wednesday 27 August 2025, 678 Victoria Street, Hamilton CBD (unless sold prior)

Sean Stephens 027 478 1669

sean.stephens@naiharcourts.co.nz

Ray Mitchell 021 990 413 ray.mitchell@harcourts.co.nz

Land, Surplus to Requirement 35-37 KAREWA PLACE, TE RAPA, HAMILTON

• Two freehold industrial sections totalling 6,718sqm (more or less), buy one or both

• Rear site has a 5 bay warehouse with a total floor area of 573sqm (approx. )

• Opportunity for owner occupier or developer

10. Insurance: Includes an obligation on the tenant to pay costs for repairing damage or destruction, where the cost is less than the insurance excess and they result from an act or omission by the tenant.

11. Reinstatement, Removal, and Make Good: Consolidates all lease provisions related to reinstatement, removal, and making good into one clause.

12. Seismic Ratings: Includes the option of a seismic rating clause for the first time.

13. Access for Re-Letting or Sale: Enables the Landlord to erect reasonable signage on the building in both these instances.

14. Notices: Provides the ability to specify email notice addresses for the landlord and tenant.

There are material changes to some key lease terms, although many are clarifications or intended to offer increased flexibility. The Seventh Edition form builds on and updates how current market practices are now being dealt with.

Should you have further questions around this new document, your solicitor will be best able to advise you on the changes and how they could impact your future lease arrangements and obligations.

Introducing...

NAI Harcourts Hamilton welcomes two new commercial agents to the team.

Tina Boyd

Tender closing 4pm, Wednesday 3 September 2025, 678 Victoria Street, Hamilton CBD (unless sold prior)

Theo de Leeuw 027 490 3248 theo.deleeuw@naiharcourts.co.nz

Theo de Leeuw 027

• Close to State Highway connections north or south

Sean Stephens 027 478 1669 sean.stephens@naiharcourts.co.nz

• Floor area of 2,572sqm (approx.) on 21,521sqm of land (more or less)

• Returning approximately $1,295,769pa plus GST & Outgoings

• Low maintenance modern buildings passive investment

• Dual access site from Hamilton’s busiest roads

• Profile to Te Rapa Road and Wairere Drive

Sean Stephens 027 478 1669 sean.stephens@naiharcourts.co.nz

Having worked for three of New Zealand’s largest property and development companies on the NZX and ASX, (Kiwi Property, Stride Investment Management, Westfield NZ – now Scentre Group), as an Asset Manager, Tina has a wealth of experience in working with multiple tenants and stakeholders.

Tina will specialise in sales and leases in the suburban areas of Hamilton.

Jason Hunt

With over two decades of high-level sales and account management experience plus a strong background in B2B solution selling and customer relationship management, Jason knows what it takes to deliver results in fast-paced, high-stake environments.

Jason will specialise in sales and leases in the Hamilton CBD and Fringe areas of Hamilton.

Borders are indicative only

RECENT SUCCESS

Sales

• 931-935 Victoria Street, Hamilton CBD

• 104 Crosby Road, Chartwell, Hamilton

• Unit 12, 37 Brent Greig Lane, Te Rapa, Hamilton

• 11C Norris Avenue, Te Rapa, Hamilton

• 11A Garden Place, Hamilton CBD

Leases

• Unit 6, 49 Tawn Place, Te Rapa, Hamilton

• Level 1, 113 Alexandra Street, Hamilton CBD

• Unit 4, 789 Te Rapa Road, Te Rapa, Hamilton

• 22 Norton Road, Frankton, Hamilton

• T2, 418 Grey Street, Hamilton East

• Unit 1, 71 Tasman Road, Te Rapa, Hamilton

• Part rear Tenancy, 125 Ward Street, Hamilton CBD

• Part 56 Commerce Street, Frankton, Hamilton

• 1st Floor, 170 Collingwood Street, Hamilton CBD

• Unit 2G, 3 Borman Road, Rototuna, Hamilton

• Grnd Flr, Eastern Tenancy, 36 Bryce St, Hamilton CBD

• 905 Victoria Street, Hamilton CBD

Theo de Leeuw 027 490 3248 Frankton

Jonathan de Leeuw 027 444 6074 Frankton

Sean Stephens 027 478 1669 Te Rapa

Brad Chibnall 021 448 989 Suburban

1/60 HARE PUKE DRIVE FLAGSTAFF, HAMILTON

35 CLEM NEWBY ROAD, TE RAPA, HAMILTON

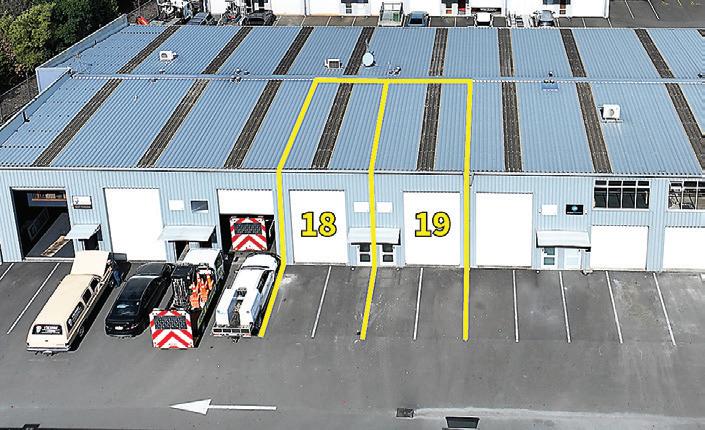

UNITS 18 & 19, 49 TAWN PLACE TE RAPA, HAMILTON

UNIT 3, 247 KILLARNEY ROAD DINSDALE, HAMILTON

TENANCY 1, 372 GREY STREET, HAMILTON EAST