Hamilton

Waikato Market Commentary

Latest Hamilton CBD Retail Market Overview: Adjustments and Hopeful Outlook

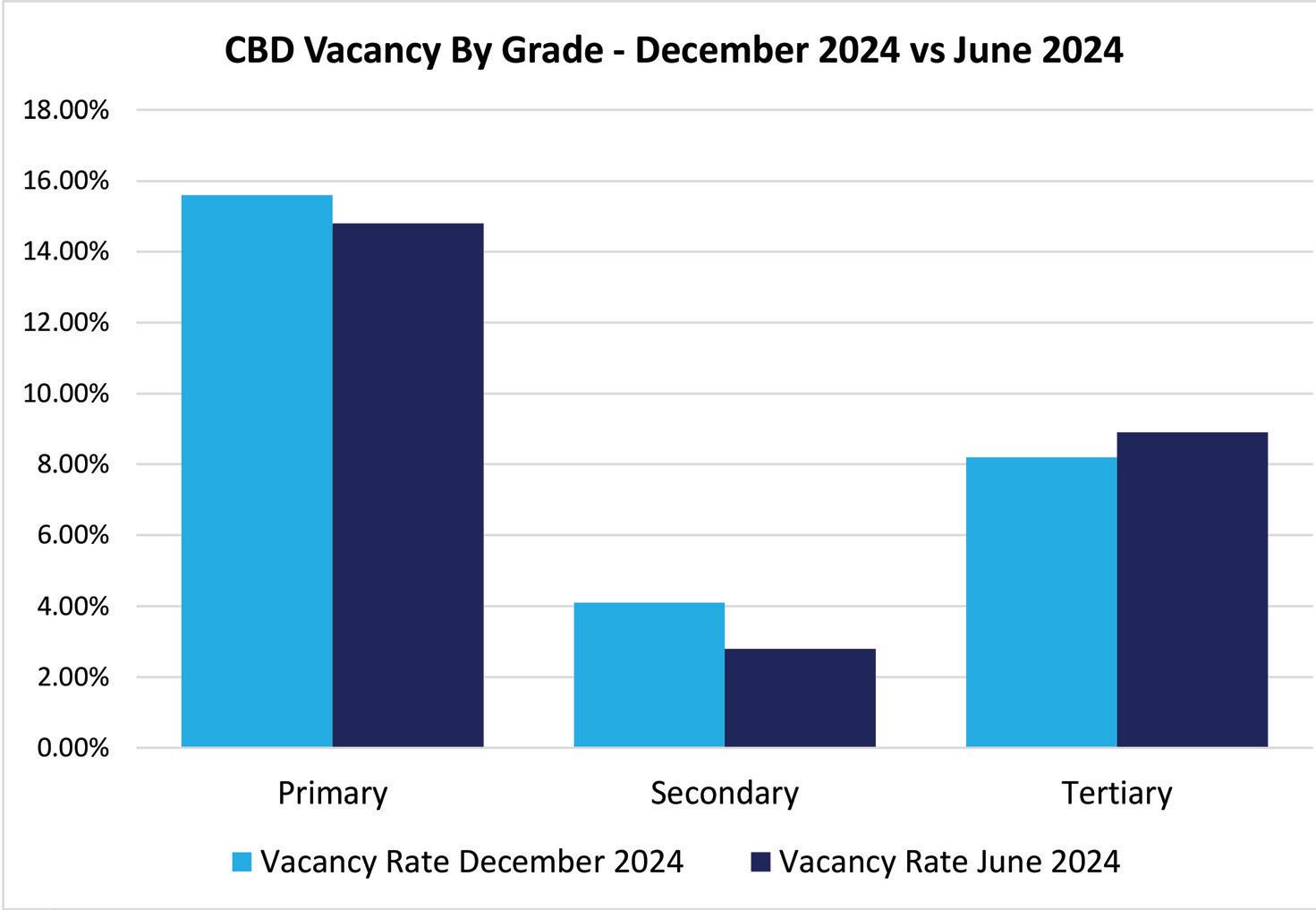

The Hamilton Central Business District (CBD) has experienced noticeable shifts in its retail sector throughout the second half of 2024. The most recent figures reveal a slight uptick in the retail vacancy rate, climbing from 9.3% in June to 9.7% by December. This increase translates to a rise in vacant retail space, from 7,407sqm to 7,804sqm. Both prime and secondary grade spaces have contributed to this increase, while more cost effective tertiary grade vacant stock showed a notable decline.

Over the 6 month period to December 2024, within the surveyed stock, there were 12 new vacancies, balanced by 11 new leases and 10 churns.

Despite the rise in vacancies, retail churn activity, representing the turnover from one retail business to another, slightly eased during this period compared to the first half of the year. Among the sectors, Health & Beauty emerged as the most active, demonstrating significant vibrancy with notable turnover. Food retailing and services sectors also underwent changes, though to a lesser extent. This included Thai Grandma House at 313 Barton Street, previously The Shake Shack and Halwai Sweets & Restaurant at 829 Victoria Street, previously Al Baik Restaurant

However, the larger picture of occupancy reflects a mix of contractions and expansions. The first half of 2024 saw the food retailing, services, and fashion & soft goods sectors contract. Meanwhile, the Health & Beauty sector expanded its presence considerably by adding 662sqm, bringing its share to 6% of Hamilton’s total retail stock.

A challenging trading environment endured through 2024, despite some recovery signs from the adverse impact of rising interest rates throughout 2023. In the latter half of 2024, notable trends included reduced large occupier departures and stable levels of moves and vacancy take-ups. This trend underscores a strategic focus by operators to remain proactive and optimize physical locations. One NZ (previously Vodafone) relocated from Centre Place to 25 Ward Street, while Lawrenson Group completed its fit-out at 185 Victoria Street to open Tipsy Putt for the Christmas trading period, some 700sqm in total.

Hamilton’s CBD retail market’s recent survey

might appear unremarkable, yet it shows a city poised for future growth. Although there has been a slight drift toward higher vacancy rates, this trend isn’t viewed as a permanent shift. Instead, it reflects an economy currently in a trough, expected to rebound as national economic conditions strengthen through the second half of 2025. It appears likely that lower grade premises may struggle to remain viable, as was the the case with Town & Country Food vacating 325sqm at 454 Victoria Street. Conversely, cost effective premises are providing an opportunity for growth, as Little Split P relocating from 11 Liverpool Street, to take up in excess of 400sqm at 540 Victoria Street.

The city’s longer-term growth prospects remain robust, buoyed by continuous development activities.

Ongoing projects in hotel, cultural, office, and residential developments within the CBD are poised to drive new demands and invigorate the central area over time. These dynamics suggest a strong underlying foundation for Hamilton to solidify its position as a niche retail destination. In conclusion, while 2024 posed certain challenges, the Hamilton CBD retail market demonstrates resilience. The minor fluctuations in vacancy rates and churn suggest adaptability among retailers, and a readiness to capture

future opportunities presented by economic recovery. With continued development and strategic planning, Hamilton’s retail sector is well-positioned to embrace positive trends and evolve as a dynamic urban centre.

As the broader economy edges toward recovery, Hamilton’s potential for growth and transformation remains undeniable, promising a vibrant future for its retail landscape.

For a full copy of the latest CBD Retail Occupancy Survey, email: hamilton@naiharcourts.co.nz

COMMERCIAL ASSETS Waikato Market Commentary

It Seems Clearer Now - What does 2025 Hold?

By Mike Neale, Managing Director, NAI Harcourts Hamilton

Hopefully you enjoyed your break with friends and family over Christmas and New Years, for the last twelve months was turbulent to say the least. As 2024 was the year of opportunity, 2025 will increasingly become the year heading towards prosperity.

At the end of 2023 we were about to welcome a new government, although we didn’t quite know how the negotiations were going to pan out - but now we do.

What can we expect in 2025?

The commercial property environment is likely to be a game of two halves, moving from survival mode to prospering.

Q1 & Q2 2025:

• Business failures will unfortunately continue, with hospitality the most likely to be impacted.

• Vacancy rates will peak, having slowly risen over the last couple of years.

• Unemployment will continue to rise, as businesses ‘right-size’.

• While interest rates are falling and will continue to do so, finance will remain a challenge, particularly when it comes to

business and development finance.

Q3 & Q4 2025:

• Consensus seems to be that the Official Cash Rate will end up in the 3.0% - 3.5% range (currently 4.25%), which should finally provide some much needed stability.

• Businesses will start to see the light and look to slowly reemploy, as confidence for the future and a positive outlook returns to the market.

• Vacancy rates will start to decrease, particularly for well located, modern and/or quality redeveloped properties. Businesses will be preparing for growth and positioning themselves accordingly.

• Access to finance will improve, as banks re-enter the market and the recent reliance on private capital eases.

A year on from when commercial and industrial investors and owner occupiers had two issues - access to capital and the cost of capital, its now largely only about access to capital. Private capital and lending has increasingly filled the void that has been left by major trading banks. Recapitalizing Kiwibank has to be a good thing, although one wonders what the impact will be on the

all Owner Occupiers 71 SEDDON ROAD, HAMILTON CBD

• Freehold 816sqm (more or less) land area

• 474sqm (approx) of office space over 2 self-contained levels

• 13 on-site car parks available

• Freshly renovated throughout with new carpet and paint

• Large open plan office plus separate meeting rooms/ offices

Vendor has called time – so book your inspection now!

Piripi 021 838 887

ra.piripi@naiharcourts.co.nz

Mike Neale 027 451 5133 mike.neale@naiharcourts.co.nz

Mike Neale 027 451 5133

mike.neale@naiharcourts.co.nz

Investment

• Longstanding professional tenant

• Currently returning $56,000pa plus GST & Outgoings

• Total floor area of 239sqm (approx)

• Freehold site of 480sqm (more or less) providing valuable onsite car parking

• Neighbours include OPSM, BNZ and various medical businesses

• Constructed in 2015

Nicola Hudson 027 447 7966 nicola.hudson@harcourts.co.nz

Control Your Destiny

• 281sqm (approx) ground floor and first floor amenities, including 183sqm of warehouse

• Enclosed mezzanine with suspended ceiling of 52sqm (approx.)

• Large roller door access, easy on-site car parking

If your requirement is for a high quality property as an investment, make your move today!

Sean Stephens 027 478 1669 sean.stephens@naiharcourts.co.nz

...continued

Vendor Committed Elsewhere

11A GARDEN PLACE, HAMILTON CBD

• Established tenant with an extensive fit-out

• Currently returning $34,150pa plus GST net income (approx)

• Tenancy consists of 244sqm (approx) including mezzanine

• Versatile north facing ground floor tenancy which had previously been a successful hospitality business

• Building recently upgraded seismically

Phone now to arrange an inspection.

Auction: 11am, Wednesday 19 March 2025, 678 Victoria Street, Hamilton CBD (unless sold prior)

Brad Chibnall 021 448 989

brad.chibnall@naiharcourts.co.nz

Mike Neale 027 451 5133

mike.neale@naiharcourts.co.nz

Vendor Retiring

1158 RIVER ROAD, FLAGSTAFF, HAMILTON

• Profile suburban location

• 393sqm (approx.) of office space

• 11 on-site car parks plus 86sqm carport

• 1,1544sqm (more or less) of Neighbourhood zoned land

• Seismic report - 100% NBS

• Holding income of $89,100pa plus GST

• Future owner-occupier opportunity

Vendor wants to move on – so phone us now!

business, commercial and industrial sectors.

The bell has tolled and we are already seeing increased levels of activity from investors and owner occupiers with access to capital - and those businesses working towards a more positive future.

This activity will gain momentum as we navigate through 2025.

What will happen to commercial property yields?

Just as we won’t see the double digit yields of the 1990’s return, neither will we see the historic lows of 2021 and early 2022. We are however, likely to see more sustainable yields, along the lines of traditional expectations and norms.

“You don’t have to see the whole staircase, just take the first step”

- Martin Luther King

Advice for 2025, and starting right now:

• If you are considering purchasing, whether you are an owner occupier or investor, now is absolutely the time. Take action today with a view to the future.

• If the deal works today, then it’s only going to look better in hindsight.

• Position your business for the future.

• Set your list of criteria and then get active – but be prepared to compromise where necessary.

• Quality property is always quality property in the long term.

The Waikato region is a powerhouse and as New Zealand’s fastest growing city, we have more and more reasons to be proud Hamiltonians.

Harcourts Property Management

Deadline Private Treaty closing 4pm, 10 April 2025, 678 Victoria Street, Hamilton CBD (unless sold prior)

Mike Neale 027 451 5133

mike.neale@naiharcourts.co.nz

Brad Chibnall 021 448 989

brad.chibnall@naiharcourts.co.nz

• Fully tenanted investment returning circa $160,000pa plus GST

• Two national tenants with quality fit-outs in place

• A Grade seismic rating

• Handy profile CBD fringe location

• Two level office building with 23 on-site car parks, including internal secure basement

• Near neighbours include DB Chartered Accountants and St John Ambulance

Whether it be just facilities management or full property management, we have the expertise, knowledge and systems to also assist you with:

• Strategic planning for your property

• Compliance with all regulatory requirements

• Leasing management & property inspections

• All repairs and maintenance

• Management, monitoring & negotiating service contracts

• Annual budgets, rent collection & debtor control

• Property accounting services

• Body Corporate management

• Statutory compliance and insurance

Our management fees are often included as part of the operating expenses for a commercial property and therefore are recoverable from the tenants.

We can take the day to day responsibility away from the client by managing the entire process and freeing up the owner’s time to concentrate on other opportunities.

If you would like to discuss how we can help with any of your property management requirements, please contact:

RECENT SUCCESS

Sales

• 38B Hood Street, Hamilton CBD

• Unit 5F, 1st Floor, 152 Horsham Downs Rd, Rototuna

• Unit 6, 15 Earthmover Crescent, Te Rapa, Hamilton

• Unit 1, 15-17 Earthmover Cres, Te Rapa, Hamilton

• 25 Richmond Street, Whitiora, Hamilton

• 35 Ward Street, Hamilton CBD

• 37 Ward Street, Hamilton CBD

• 64 Storey Avenue, Forest Lake, Hamilton

Leases

• Level 1, 31 Harwood Street, Hamilton CBD

• 2 Kells Place, Frankton, Hamilton

• Part 29 Gilchrist Street, Frankton, Hamilton

• 81 Ruffell Road, Te Rapa, Hamilton

• 60 Alexandra Street, Hamilton CBD

• Level 5, 149 Alexandra Street, Hamilton CBD

• 21C Somerset Street, Frankton, Hamilton

Kara Gerrand 021 527 211 CBD & Fringe CBD

Mike Neale 027 451 5133 CBD & Fringe CBD

Ra Piripi 021 838 887 CBD & Fringe CBD

Theo de Leeuw 027 490 3248 Frankton

Jonathan de Leeuw 027 444 6074 Frankton

Sean Stephens 027 478 1669 Te Rapa East

PROPERTY & BODY CORPORATE MANAGEMENT TEAM

Brad Chibnall 021 448 989 Suburban Greg Wills 021 896 585 Director Property Management

Leanne

Tiaan

Adelle Rees 027 210 3292 Body Corporate Manager

IT’S NOT WHERE YOU ARE, IT’S WHERE YOU’RE GROWING.