Hamilton CBD Office Market Overview

INTRODUCTION

This publication provides a summary of the Hamilton office occupier survey conducted in December 2022.

The survey is based on comprehensive building by building analysis of the Hamilton CBD area, reporting on stock volumes, vacancy rates, absorption rates and floor space use by business type.

This study is undertaken on a bi-annual basis by CBRE Research and NAI Harcourts.

Summary

While there has been no new office supply completed in the second half of 2022, we have extended our survey coverage by adding five buildings not previously included, to our monitored office stock, increasing the total Hamilton CBD stock size by almost 10,000sqm.

The overall office vacancy rate decreased from 8.5% to 8.2% with the amount of vacant space remaining essentially stable and the reduction being driven by the largely occupied additional buildings increasing the amount of occupied stock.

Despite a reasonably active market, net absorption was muted in the second half of last year, with the growth in occupied stock only amounting to about 200sqm, excluding the newly added buildings.

Office stock and additional supply

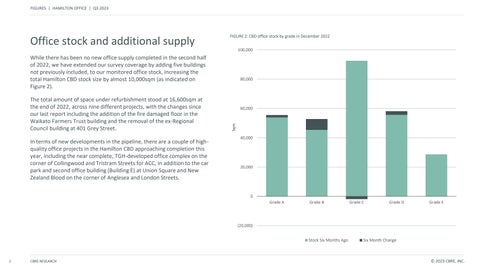

While there has been no new office supply completed in the second half of 2022, we have extended our survey coverage by adding five buildings not previously included, to our monitored office stock, increasing the total Hamilton CBD stock size by almost 10,000sqm (as indicated on Figure 2).

The total amount of space under refurbishment stood at 16,600sqm at the end of 2022, across nine different projects, with the changes since our last report including the addition of the fire damaged floor in the Waikato Farmers Trust building and the removal of the ex-Regional Council building at 401 Grey Street.

In terms of new developments in the pipeline, there are a couple of highquality office projects in the Hamilton CBD approaching completion this year, including the near complete, TGH-developed office complex on the corner of Collingwood and Tristram Streets for ACC, in addition to the car park and second office building (Building E) at Union Square and New Zealand Blood on the corner of Anglesea and London Streets.

Vacancy

Overall office vacancy in the Hamilton CBD has fallen 0.3% to 8.2% in the six months to December 2022, with the amount of vacant space remaining essentially stable and the reduction being driven by the largely occupied additional buildings increasing the amount of occupied stock.

After holding relatively stable over the past 18 months at 3.1%, Grade A vacancy has since seen a decrease of 0.3% to 2.8% following the full occupation of the NZI building at 225 Collingwood Street.

Grade B also saw a decline in vacancy, falling from 6.3% to 5.7%. There have only been four new vacancies, ranging from just over 160sqm at Vero House to 250sqm at Anglesea Imaging Centre. Previously vacant space at 54 Bryce Street has since been occupied by Spec Savers Audiology.

Grade C experienced an increase of 1.6% in vacancy to 9.9% in the second half of 2022. This is largely due to level 9 becoming available in the KPMG Tower, in addition to a couple of smaller new vacancies at 360 Tristram Street and 919 Victoria Street.

Grade D saw a sizeable decrease in vacancy, falling from 13.6% to 9.1% between June and December last year. This was largely attributed to the near 1,000sqm recent take up of levels 1 and 2 at 18 London Street by the Electoral Commission, in addition to two commitments of over 550sqm at 17 Liverpool Street and 505 Grey Street by Waikato Women’s Refuge and Empower Gym respectively.

Finally, Grade E vacancy increased from 12.9% to 15.9%, following the departure of the School of Tourism from the Tower Building at 48 Ward Street, in addition to a new 315sqm vacancy at 36 Bryce Street, previously used by the UCKG Church.

Demand

Despite a reasonably active market, net absorption was muted in the second half of last year, with the growth in occupied stock only amounting to about 200sqm, excluding the newly added buildings.

In Grade A, the only uptake of previously vacant space was in the NZI building on Collingwood Street, where engineering and environmental consultancy firm Pattle Delamore Partners are moving from 36 Bryce Street.

Leasing activity remained reasonably quiet in Grade B and C, with three previously vacant spaces taken up (the largest at 54 Bryce Street by Spec Savers Audiology) and a similar amount of space vacated. The loss in net absorption amounted to over 1,000sqm, in a large part influenced by the WDHB vacating level 9 in the KPMG Tower in addition to a couple of smaller new vacancies in Perry House on the corner of Tristram and Liverpool Streets.

At the lower end of our quality spectrum, Grade D experienced a noticeable gain in absorption, supported by the Electoral Commission’s requirement at 18 London Street, Empower Gym’s new occupancy at 505 Grey Street and a handful of smaller commitments in the Waikato Farmers Trust building. On the other hand, in Grade E we recorded a sizeable vacancy increase, as a result of tenants vacating 1,300sqm across two floors in the Tower Building at 48 Ward Street.

Conclusions and outlook

Although the latest survey results of the Hamilton CBD office market show a relatively stable occupier market in the higher quality stock (Grades A and B) and more activity in lower grades, this is more a reflection of tight availability in good quality stock, than a lack of demand for new and efficient workplaces by occupiers.

Flight to quality has been a strong theme in the past few years, accentuated by the pandemic, as businesses aim to create workplace environments that help not only to attract and retain talent, but to maintain and improve employee morale and company culture.

Undoubtedly, Hamilton is going through a major transformation period with a plethora of developments under construction and in the pipeline, in a wide range of sectors from infrastructure to arts and recreation, including various office and mixed-use developments in the CBD. We believe that occupier demand for high-quality office accommodation will remain strong (as evidenced by some large precommitments in under construction developments), increasingly including national and multinational businesses evaluating their growth opportunities outside of Auckland and government from Wellington.

While hybrid working and more employee flexibility is here to stay, it doesn’t seem to be a major issue in smaller population centres where commuting to and from the office is perhaps less stressful, which together with the city quickly becoming the focal point of the golden triangle economic area, bodes well for the future of the Hamilton office market.

Mike Neale

Managing Director – Commercial

P: 07 850 6666

M: 027 451 5133

E: mike.neale@naiharcourts.co.nz

Kara Gerrand

Commercial Sales & Leasing

P: 07 850 6660

M: 021 527 211

E: kara.gerrand@naiharcourts.co.nz

Brad Martin

Commercial Sales & Leasing

P: 07 850 6663

M: 027 889 3018

E: brad.martin@naiharcourts.co.nz

Ra Piripi

Commercial Sales & Leasing

P: 07 850 6669

M: 021 838 887

E: ra.piripi@naiharcourts.co.nz

Zoltan Moricz

Executive Director - Research

P: 09 359 5399

M: 021 595 399

E: zoltan.moricz@cbre.co.nz

infringe