New American Funding is a one-stop shop that offers loan products for every type of client. No matter how unique a situation, we have the right home loan solution. Some of these options are Non-Qualified Mortgage (Non-QM) loans for self-employed borrowers, programs for first-time homebuyers, as well as loans for savvy real estate investors and those looking for vacation homes.

Low down payment, convenient monthly payment

USDA

Zero down loans for rural areas

NON-QM

For self-employed borrowers

FHA

Great for first-time homebuyers

JUMBO

Loans up to $4 million

VA

Zero down for those who served our country

DOWNPAYMENTASSISTANCE

Assistance for those who qualify

INTERESTONLY

Gives buyers more control over cash flow.

70.4BILLION

Our extensive line of loan programs is as diverse as your clients. While we have competitive rates and industry-leading turn times, we take it one step further in our commitment to increasing and sustaining homeownership among underserved communities across America.

Help Buyers Ease into Homeownership with a Lower Payment

Can reduce buyers’ first-year, second-year, and third-year payment rate

Customizable Payment Terms to Meet Buyers’ Needs Offers terms from 8 to 30 years Upfront Savings with Lower Introductory Interes Rate Eases higher market rates with lower introductory rate Numerous Options to Fund Renovations Cash out refinance, HELOC, FHA 203(k) loans

Your clients can save and win.

Help your clients tap into certainty and convenience in today’s housing market.

Sellers love the certainty of cash buyers. Buyers love having their offers accepted — especially if it’s below asking price. Everyone loves a quick closing, including real estate agents, who can receive their full commission in seven to 10 days.

With NAF Cash, your buyer’s dream home is purchased with cash and sold back to them. Give your clients the cash buyer advantage and close more homes more quickly.

BORROWER

UNDERWRITING

CLOSING

Hello [[BorrowerAndCoBorrowerFirstName]],

We received your application and your file is in the initial stages of the review process! Our Operations Team is working diligently to move your loan into the next phase. On behalf of the entire New American Funding team, we look forward to working with you!

Hello [[BorrowerAndCoBorrowerFirstName]],

Hello [[BorrowerAndCoBorrowerFirstName]],

Congratulations! Your loan has funded for [[PropertyAddressLine1]].

Here’s a look ahead at some of the major milestones you can expect while your loan is being processed:

We received your application and your file is in the initial stages of the review process! Our Operations Team is working diligently to move your loan into the next phase. On behalf of the entire New American Funding team, we look forward to working with you!

Hello [[BorrowerAndCoBorrowerFirstName]],

Congratulations! Your loan has funded for [[PropertyAddressLine1]].

Here’s a look ahead at some of the major milestones you can expect while your loan is being processed:

Reminder: During

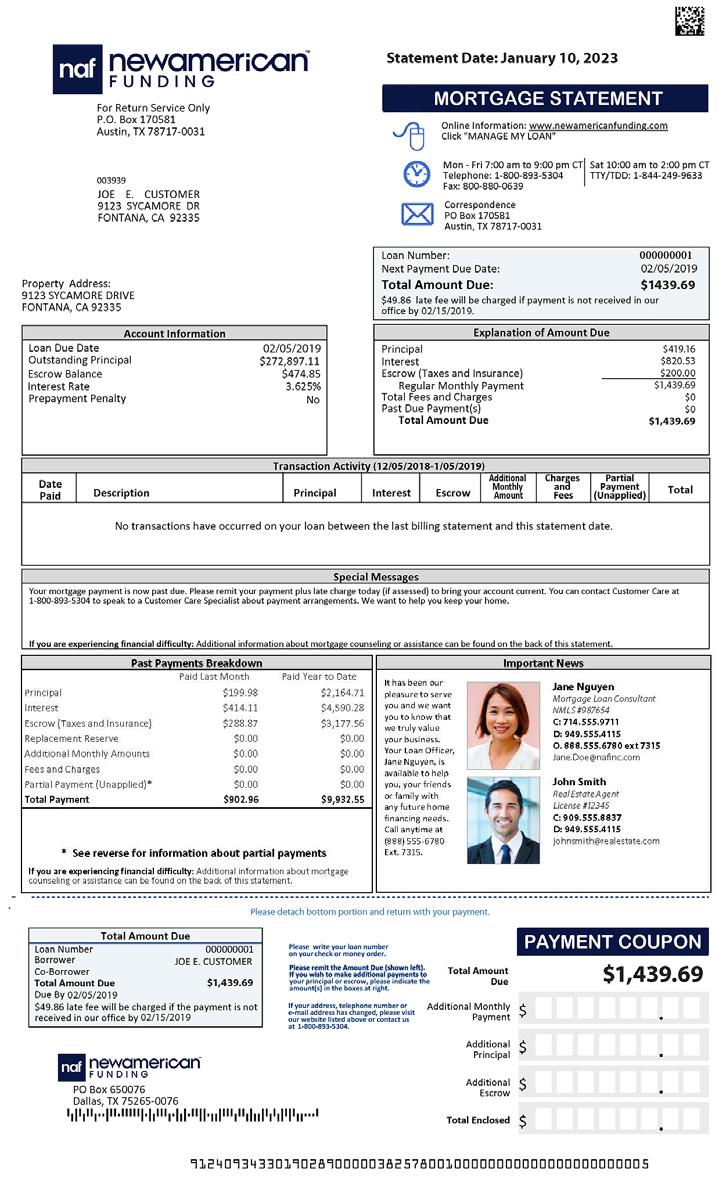

Prior to your first payment due date, you will receive a payment statement with details for remitting your payment.Reminder: There is a first payment coupon with your closing documents. If you have any questions, please feel free to contact our Loan Servicing Center at +1 800-893-5304 or by email at customercare@nafinc.com

It’s been a pleasure working with you, thank you for your business!

JAMES SMITH Sr. Loan Consultant NMLS# 555555 555.123.4567 james.smith@nafinc.com

JANE DOE

Prior to your first payment due date, you will receive a payment statement with details for remitting your payment.Reminder: There is a first payment coupon with your closing documents. If you have any questions, please feel free to contact our Loan Servicing Center at +1 800-893-5304 or by email at customercare@nafinc.com

Reminder: During your loan process DO NOT make any major purchases, job changes, credit requests, or financial transactions without consulting with us first. Please note, employment and credit will be refreshed within 48 hours of closing.

Reminder: During your loan process DO NOT make any major purchases, job changes, credit requests, or financial transactions without consulting with us first. Please note, employment and credit will be refreshed within 48 hours of closing.

It’s been a pleasure working with you, thank you for your business!

Real Estate Agent BRE# 555555 555.123.4567 jane.doe@realestate.com

[[SignatureBlock]]

Reminder: During your

We keep you front & center on client marketing materials through cobranding opportunities.

Post-close email campaigns

Post-close mailers

Monthly mortgage statements

Co-branded closing cards are mailed to our mutual clients with information on how to download closing documents.

Personalized co-branded greeting cards sent to clients for years after a loan closes on birthdays and loan anniversaries.

Co-branded closing cards are mailed to our mutual clients with information on how to download closing documents.

Virginia’s extensive professional experiences make her uniquely qualified in finding solutions for today's challenging mortgage market. With over three decades of experience in the mortgage industry, Virginia has enjoyed helping clients find the loan that fits their long and short term goals for budget and equity growth. She is very focused on service and believes in putting the members’ needs first. Virginia concentrates on making sure the member gets the very best loan for their current situation. She is available to her clients before, during and after the loan transaction Virginia likes to think of herself as keeping her clients for life and being "their lender for life". Her depth of knowledge in the industry and loyal Realtor relationships confirm her commitment to the home buying process

Mortgage Advisor for over 3 decades

10 years experience originating All-in-One

Construction Loans

Mortgage Delivery Manager for Rogue Credit Union

Review credit reports, analyze income statements and perform underwriting of income versus debt and combined asset worth

@loansbyvirginialewis

@loansbyvirginialewis

Customizes loan programs tailored to meet the financial needs of the individual clients.

Provide customer with desired payment level and cost level associated with buying a new home. Ensure timely closing of loans by maintaining constant communication throughout the entire loan process amongst borrower, realtor, loan team, Title Company, and Escrow Company

“Virgina Lewis. Her expertise and attention to detail was excellent. But, beyond that, her personal care and concern for my wife and I was very much appreciated. My wife has chronic health problems and Virginia went out of her way to make the process as easy as possible for her. We can't thank her enough for that Give this lady a raise!"

We close loans quickly (even the really hard ones) and turn clients into raving fans in the process.

Digital Mortgage Application

Fully Underwritten Pre-approvals

Industry Leading Closing Times (14 business day close guarantee)

24 hour Lock Desk

Local Support

We know that sometimes things don’t go to plan with a buyer’s loan, and we’re prepared as your ‘Loan Rescue’ solution when it does happen.

In-house Appraisal Panel

Industry Relations (MBA, NAHREP, VAREP)

New American Funding Initiatives (Latino Focus, NAF Black Impact, NAF Heroes

Licensed in 50 states

Why us? As a direct leader we have less overlays than big banks, allowing us to close quickly. Our in-house operations, product offering, knowledge and commitment to customer service make us the perfect place to come when you need to get your transaction back on track.

We’reLocal

NAF Cash is fulfilled by NAF Cash LLC MI Real Estate Broker #6502431375, an affiliated real estate company of New American Funding that is managed and operated in compliance with applicable legal and regulatory requirements. NAF Cash LLC does not originate loans or issue loan commitments and charges a transaction fee that varies by state. Terms and conditions apply. Not all applicants will qualify. Not available in all states. 41050 W 11 Mile Rd, Suite 220, Novi, MI, 48375. Phone 844-344-0531.

Equal Housing Opportunity. 2023 New American Funding, LLC. All Rights Reserved. NMLS ID #6606. For state licensing, please visit: newamericanfunding.com/legal/state-licensing/. Licensed Mortgage Banker—NYS Department of Financial Services Corporate office 14511 Myford Rd., Suite 100, Tustin, CA 92780. Phone: (800) 450-2010. This is not a loan commitment or guarantee of any kind. Loan approval and rate are dependent upon borrower credit, collateral, financial history, and program availability at time of origination. Rates and terms are subject to change without notice. Not intended for distribution to consumers as defined by Section 1026.2 of Regulation Z which implements the Truth-In-Lending Act. This information is to inform the real estate industry only and is not marketing material to be provided to consumers. 7/2024