the of

We Celebrate forempoweringdiverse communitiestoachieve homeownership,build wealth,andcreate lastinglegacies.

the of

We Celebrate forempoweringdiverse communitiestoachieve homeownership,build wealth,andcreate lastinglegacies.

NewAmericanFundingisoneofthetoplenderstoHispanic andBlackborrowers(per2022HMDAdata).

Thecompanyoriginatesbillionsinloans eachyearandservicesapproximately90% oftheConventional,FHA,andVAloanswe originate,allowingdiverserevenue streams,customerloyalty,andsuccessful navigationofmarketconditions.

90%

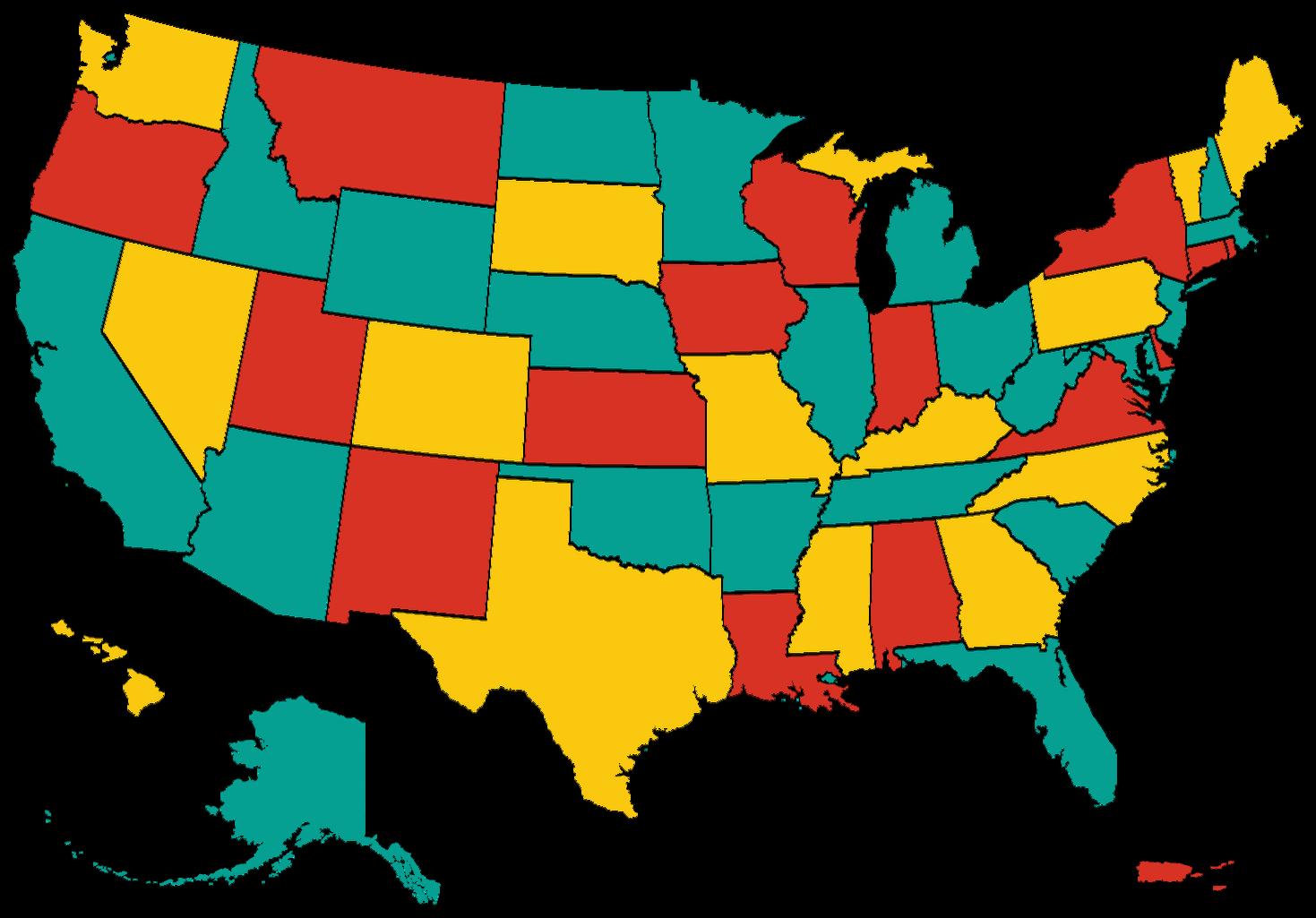

AFoperatesinall50 ates,providingtailored ortgagesolutionsthat eettheuniqueneedsof ommunitiesacrossthe ountry.

Purposedrivescouragetoreachbeyond,overcome obstacles,findsolutions,anddeliverexceptionalservice.

NAFthinksbeyond”whatis”andenvisions“whatcould be”beforecompetitors.

InnovationisattheforefrontofeverythingNAFdoes, leadershipencouragescalculatedrisks,newideas,and strivestoexceedexpectations.

NAF’scorevaluesaffectpositive,groundbreakingchange anddeliverexcellencetothecustomers,colleagues,and communitiestheyserve.

Asaleaderinthemortgageindustry,wehavealways leadwithintegrity.

Achampionofapositiveandinclusiveculturethatfosters open,honest,andmeaningfulrelationships.

DearHousingCounselingProfessionals,

YourworkisthefoundationofBlackhomeownership.Youmeet homebuyerswheretheyare,guidingthemtowardtheirgoalswith expertise,patience,andcare.AtNewAmericanFunding(NAF),we recognizeandhonorthatwork.

Blackhomeownershipisn’tjustabouttransactions it’sabouttrust.Fortoo long,systemicbarriershavekeptBlackfamiliesfromaccessingthesame homeownershipopportunitiesasothers.Buttogether,wecanchangethat.

Housingcounselingagenciesprovideessentialsupporttofuture homeowners,ensuringtheyhavetheguidanceandresourcesneededto takethenextstep.Byworkingtogether,wecanexpandaccessto homeownershipandincreasethenumberofBlackfamiliesachievingtheir homeownershipgoals. Thankyoufortheworkyoudo.Weareproudtostandwithyouinthis mission.

Withappreciation,

Together,wehelpfamilies achievehomeownership andmaintainit,creating lastingfinancialstability andgenerationalwealthin Blackcommunities.

Blackhomeownershipdoesn’t increaseinisolation—itgrows throughcollectiveaction. Housingcounselingagencies playacrucialroleinshapingthe futureofBlackhomeownership byprovidingtrustedguidance, financialinsights,andaclear pathforward.

Housingcounseling agenciesareoftenthefirst pointofcontactforBlack homebuyers,providing personalizedsupportthat buildsconfidenceand trustinthehomebuying process.

Byaligningefforts,we ensurehomebuyersreceive clearfinancialdirectionand seamlesssupport,making thetransitionfrom preparationtopurchase easier.

PartnershipshelpBlack homebuyersnavigatecredit concerns,misinformation, andlendingoptions, ensuringtheyhavethetools tomoveforward.

“Forus,thisismuchmorethanarebrandin s anecessarysteptodemonstrateourrespo community.”

PattyArvielo,Co-founder&CEOof NewAmericanFunding,inBlackEnterprise.

PattyArvielohasbeenaleaderinthemortgageindustryfornearly40 years.Shehasworkedherwayupfromthebottomrungandgained extensiveknowledgeoftheentireindustryalongtheway.Overthe courseofhercareer,shefunctionedinavarietyofcapacities,from underwritingtoprocessingtohercurrentroleasCo-FounderandCEOof NewAmericanFunding.Shealsooversawthecreationandexpansionof thecompany’sretaillendingoperation,whichgrewasmalllocal operationtoanationalpowerhousewith282locationsandmorethan 4,700employeesacrossthecountry.PattyhasalsodrivenNewAmerican Fundingtobecomeanindustryleaderinlendingtodiversecommunities. Inthatspirit,sheestablishedthecompany’sLatinoFocusandNAFBlack ImpactinitiativestoimprovethelendingexperiencesofLatinoandBlack homebuyers,respectively.

https://www.blackenterprise.com/national-mortgage-lender-extending-20b-in-loans-to-black-borrowers-through-2028/

“Theindustryinthepasthaspigeonho “assistanceoraffordablehousing,”bu morethanthat,andtheBlackcommun fromapplicationtoclosingthatismorethantheyvebeenprovidedin thepast.”

MosiGatling,SVP,StrategicGrowthandExpansion ofNewAmericanFunding,inBlackEnterprise.

Mosi“Mo”Gatling(NMLS#557166)theSeniorVicePresidentofStrategic GrowthandExpansionatNewAmericanFunding.Inthisrole,Gatling transcendstheroleofatop-tierloanoriginator.

Inherstrategicleadershiprole,Gatlingbringsawealthofknowledgeto NewAmericanFunding.Notably,shecreateda$100,000,000mortgage businesswhileactivelyaddressingthecurrentdisparitiesinBlack homeownershipaswellasotherunderrepresentedcommunities. Recognizedconsistentlyinthetop1%bytheScotsmanGuide,Gatling achievedaremarkablenationalranking,highlightingherdedicationto empoweringpotentialhomebuyers.

BlackImpactisacommitmenttoaction.ItwascreatedtoincreaseBlack homeownership,closetheracialwealthgap,andensurethatmoreBlack familiescanachievefinancialstabilitythroughhomeownership.

Thisinitiativegoesbeyondjustlending it’saboutreshapingthewayBlack homebuyersexperiencethehomebuyingprocessbyaddressingbarriers, increasingaccess,andfosteringtrust.

Throughcollaborationwithindustryprofessionals,housingcounseling agencies,andcommunityleaders,BlackImpactworkstoensurethat Blackhomebuyersreceivetheguidance,resources,andopportunities theyneedtosucceed.

TostandwiththeBlackcommunity byengagingwithBlackemployees andconsumers,offeringongoing culturalcompetencytraining, acknowledginghistoricalchallenges andsystemicbarriersfacedbyBlack individuals,andusingintentional languageinourmarketingeffortsto empowerBlackclientsinachieving homeownership.

Toshapeadiverseandinclusive landscapeforhomeownership.Black Impactrepresentsourcommitment totakingdirect,action-orientedsteps toaddresscreditaccessibilityand promotesustainableandequitable homeownershipforBlackindividuals andcommunities.Werecognizeand celebratetheresilience,creativity,and leadershipofBlackcommunitiesin overcomingsystemicobstaclesand discrimination.

ACCESS & OWNERSHIP GAPS

45.9%Blackhomeownership ratevs.70.1%white homeownershiprate

50%+ofBlackhomebuyers arefirst-generationbuyers

CREDIT & FINANCING DISPARITIES

80%morelikelytobecredit invisibleorunscorable

677avg.FICOscoreforBlack borrowersvs.742forwhite borrowers

2.5xhigherdenialratefor Blackapplicantsvs.white applicants

MISTRUST & DISCRIMINATION CONCERNS

BlackAmericanshavefoughtfor generationstoaccess homeownership.Thesenumbers revealboththechallengesweface andtheopportunitytobuild somethingbetter.

MOMENTUM & MARKET OPPORTUNITY PATHWAYS

58%ofBlackrentersworryabout discriminationduringthe homebuyingprocess

Blackbuyersarelesslikelyto discloserace/ethnicitydueto fearofbias

$2.1trillionprojectedBlack buyingpowerby2026 2.4x growthsince2000

70%offuturehomebuyerswill comefromdiversecommunities Blackmillennialsareamongthe fastest-growingsegmentsof first-timebuyers

Realchangehappens whenwerespondtothe datawithalignment, trust,andintention.

Thenumberstellaclearstory—but therealimpacthappenswhenwe usethemtoguideourapproach.

Housingcounselingagenciesare criticaltoshiftingoutcomes.By workingtogether,wecanhelp moreBlackbuyersovercomethe obstaclesandmoveforwardwith confidence.

Blackhomeownershiphas increased,butsystemicbarriers stilllimitaccesstofinancing, equity,andstability. Creditchallenges,down paymentconcerns,andlender mistrustremaintopconcerns amongBlackbuyers. Manyqualifiedrentersdon’t believehomeownershipis possible showingagapinboth accessandbelief.

MoreBlackfamiliesareactivelyexploring homeownershipthaneverbefore.

Housingcounselingagenciesplaya criticalroleinbuildingtrustandbridging thatgap.

Homebuyerassessmentsprovidea judgment-freestartingpoint helping buyersunderstandtheirreadinessand takeclearnextsteps.

Theresultcouldbeapreapproval,a referraltoUqual,orareferraltoyour agencyforcontinuedsupport.

BlackImpactisn’tjustaninitiative—it’samovementdesignedtohelpreal estateprofessionalslikeyoumakearealdifferenceinBlackhomeownership.

Rootedintheunderstandingofhistoricalchallengesandsystemicbarriers, BlackImpactprovidesthetools,knowledge,andpartnershipstohelpmore Blackfamiliesachievehomeownership.

BILLION

8% INCREASEIN BLACKHOMEOWNERSHIP OVER5DECADES*

TheBlackImpactHousing AdvocateCertification(HAC)

TheBlackImpactHousingAdvocate Certification(HAC)isatransformativetraining programdesignedtodeepenourcommitmentto promotingequitablehomeownership.This initiativeisn’tjustabouttrainingoursalesforce; it’samovementtowardsfosteringamore inclusiveanddiverselandscapeinthemortgage industry.Whenyouseethebadge,itmeansthat theindividualwhoearneditisproudly showcasingtheircommitmentandexpertisein servingBlackhomebuyers.

WegotourHouseinorderfirst!

HISTORICALPERSPECTIVE CULTURALCOMPETENCE

ReviewofHistoricalContextand Challenges

BarriersBeyondRedlining FinancingandSocialImpact

BuildingAuthenticRelationships withBlackorganizations

Ensuringrealestateagentsand loanofficersworktogether seamlessly Aligningmarketingand outreachstrategieswithreal estateagents

Morethana“BlackStory” AdoptingEffective CommunicationStyles

ConnectiveMarketing

GenerationalandFamilial Influences

Avoidingcommonmisstepsthat createmistrust

MORETHANTHE1003

MitigatingModernDayBiasin Lending

InclusiveMortgageSolutions

ExaminingKeyCaseStudies ApplyingKnowledgetoReal-Life Scenarios

AtNewAmericanFunding,werecognizethatlanguageplaysapowerfulrolein shapingabuyer’sexperience ManyBlackhomebuyershavefacedhistoricalbarriers andpresent-daybiasesinrealestate Overtime,we’vebeenintentionalabouthow wespeakabouthomeownership becausesmallshiftsinlanguagecanmakeabig difference.

Insteadofsayingthis:

Underserved

PeopleofcolororBIPOC

Minoritiesorminority

Financialliteracyorhomebuyereducation

Prequalification

Affordablehousing

Downpaymentassistance

Creditrepair

Saythisinstead:

Underrepresented

BlackindividualsorBlackcommunities

Diversecommunities

Mortgagepreparedness

Homebuyerassessment

Entry-levelhome

Leveragingavailableresources

Optimizeyourcredit

‘Underserved’WeacknowledgethatBlackhomebuyersfacesystemicbarriers,butwealso knowthatsolutionsexistShiftingourlanguagekeepsthefocusonaction,notobstacles

BIPOCisabroadterm,butinrealestate,specificitymattersWenamethecommunitywe’re committedtoserving.

‘Minority’canimplyinferiorityorlesserstatus.‘Diversecommunities’ismoreinclusiveand recognizesvariousculturalgroupswithoutmarginalization

‘Financialliteracy’or‘homebuyereducation’Thisshiftremovesanyimplicationthat buyerslackknowledgeandinsteadempowersthemasproactivedecision-makers.

‘Prequalification’cansoundrigidandtransactionalwhilehomebuyerassessmentfeelslike aguidednextstep,notapass/failtest

‘Affordablehousing’canmakebuyersfeelliketheyhavelimitedoptions‘Entry-levelhome’ keepsthefocusonpossibilitiesandfuturegrowth

‘Downpaymentassistance’Manyhomebuyersusefinancialresources it’snotjustfor thoseinneedReframingthisensuresbuyersdon’tfeelsingledout

‘Creditrepair’Weframecreditassomethingthatcanbestrengthenedratherthan somethingbroken

MarketingtoBlackhomebuyersrequiresmorethanjustdiverseimagery itrequires authenticity,trust-building,andculturalawareness We’vebeenintentionalaboutshifting thewayweapproachmarketingtoensureitresonates,reflectsrealexperiences,and buildstrust

Throughlistening,learning,andadapting,we’verecognizedkeyareaswheremarketing caneitherreinforcetrustorcreatedistance

TokenRepresentation–AddingoneBlackpersoninamarketingcampaignisn’ttrue inclusivity.Representationshouldbeconsistentandauthenticyear-round.

StereotypicalMessaging–“HelpingminoritiesachievetheAmericanDream.”While well-intended,theycanfeelpaternalisticorperformative.Instead,focuson empowermentandopportunity

OveruseofFinancialHardshipNarratives–Marketingthatoveremphasizesstruggle canmakehomeownershipseemoutofreach.Whileit’simportanttoaddress challenges,balanceitwithsuccessstoriesandaccessiblesolutions.

ExcludingLuxuryorMove-UpBuyers–NotallBlackbuyersarefirst-timehomeowners. Ensurethatmarketingmaterialsreflectafullrangeofhomeownershipopportunities

Housingcounselingagenciesarethecornerstoneoftrustinthecommunitieswe serve.AtBlackImpact,webelieveincreasingBlackhomeownershiptakesmore thanguidance—ittakesalignment.That’swhywe’recommittedtopartnerships thatextendyourimpact,reinforceyourmessage,andsupporttheworkyou’re alreadydoingtomovemorefamiliesintohomeownership.

CustomMarketingfor YourAudience

We’llworkwithyoutodevelop community-centeredmaterials thatreflectthevaluesand realitiesoftheclientsyouserve

Culturallyalignedflyers, digitalcontent,andevent templates

Messagingthataffirmsand empowersBlackhomebuyers

Inclusivevisualsthatreflect realfamiliesandrealgoals

Co-brandedoptionsto elevateyouragency’s visibility

CuratedEventsThatMeet ClientsWhereTheyAre

Fromin-personworkshopsto virtualinfosessions,wecan helpyoucreateeventsthatare meaningfulandalignwithyour mission.

Co-hostedsessions

Topicsincludecredit, preparation,lending,and more

Planningsupportand promotionalmaterials provided Customizableformats: panel,Q&A,orworkshopstyle

AccesstoHAC-Certified LoanOfficers

Weconnectyouwithloan officerstrainedtounderstand thespecificneedsofBlack homebuyersWhenyourclients arereadytotakethenextstep, they’llbemetwithaligned language,culturalawareness, andcontinuedsupport.

Seamlesshandoffthat honorsthetrustyou'vebuilt

Fewercommunication breakdowns,more successfulclosings

Buyersfeelsupportedfrom starttofinish

Ourgoalisn’ttoduplicatetheworkyou’redoing it’stosupportandscaleit. Theseadditionalpartnershipopportunitiesaredesignedtohelpyouservemore families,builddeeperalignmentwithloanofficers,andcreateasmootherpath tohomeownershipforthecommunitiesyoucareabout.

&LearningOpportunities

Weofferoptionalwaysforyour teamtostayconnectedto industryshiftsandbest practiceswhenservingBlack homebuyers.

Invite-onlystrategysessions andmasterminds

Roundtableswithother agenciesandadvocates

Insightsoninclusive languageandoutreach

Optional notrequired resourcestosupportyour staff

Weworkwithyoutoensurethe transitionfromcounselingto lendingisseamlessOurgoalisto complementyourprocess,not complicateit.

Sharedtimelinestoreduce gapsbetweenreadinessand action

Customworkflowsbasedon howyouragencyoperates

Toolslikehomebuyer assessmentstokeepclients informed

Flexibilityinhowweconnect, refer,andfollowup

Webelievetheworkyour agencydoeseverydayshould beseen,supported,andshared Throughourpartnership,we’ll helpincreaseyourvisibilityand strengthenyourpresenceinthe community.

Socialmediamentionsand collaborativeshout-outs

Invitationstospeakorbe featuredatindustryevents

Opportunitiesforjoint communityengagement

Referralopportunitiesfrom alignedlendingteams

Toolsthatmeetclientswheretheyare—whetherthey’rebuying,rebuilding, orunlockingwhattheyalreadyown.

AtNewAmericanFunding,weoffertraditional mortgageprogramslikeConventional,FHA,VA,USDA, andJumbo butwealsorecognizethatnotevery clientfollowsatypicalpathtohomeownership.

Whetheryourclientsarerebuildingafteradisaster, self-employed,renovating,oraccessingtheirequity, wehaveflexiblesolutionstosupportthematevery stage

FHA203(k)RenovationLoan

Purchaseandrenovatewithasingleloan Idealfordistressedorfixer-upper properties

Canincludecosmeticandstructural repairs

Helpsclientsbuildequitythrough improvements

FlexibleOptionsforSelf-Employed Buyers

Bankstatementandalternativeincome programs

Designedforentrepreneursandfreelancers

Manualunderwritingavailable

Helpsbuyerswithnon-traditionalincome qualifywithconfidence

Flexiblelineofcreditsecuredbyyourhome

Quickaccesstofundsforrenovations, investments,orlargeexpenses

Keepsfirstmortgageintact Adjustabledrawandrepaymentoption

FHA203(h)DisasterReliefLoan

Nodownpaymentrequired Availablewithinoneyearofa federallydeclareddisaster

Forhomeownersorrenterswholost theirhome

Designedtoassistinrebuildingor relocating

ReverseMortgage(HECM)

Forhomeownersaged62andup

Accessequitywithoutmonthly mortgagepayments

FHA-insuredandnon-recourse

Requiresindependentcounseling foreligibility

NAFCash

Empowersclientstomake competitivecashoffers

Removesfinancingandappraisal contingencies

Helpsoffersstandoutincompetitive andinvestor-heavymarkets

Jumpingstraightintoapreapprovalcanbe intimidatingoroutofstepwithwhereaclienttruly is Thehomebuyerassessmentoffersamore approachablestartingpoint achancetoexplore theirgoals,askquestions,andunderstandtheir optionsbeforeanypaperworkbegins.

20-minuteconversationwithatrainedloan officer

Nocreditpullrequired

Leadstoapreapprovaloracustomplanto getready

PathwaysmayincludeUqualforshort-term coachingorareferraltoyouragencyformore comprehensiveguidance

NewAmericanFunding'sindustry-leadingloan readinessprogramisoursolutiontohelpclient’s qualifyforamortgage Poweredbyourfinancial wellnesspartner,Uqual,weprovidesupportin crucialareassuchasenhancingcreditscores, optimizingdebt-to-incomeratios,savingfora downpayment,andmore.

Personalizedguidancefromloanreadiness experts

Budgetingtoolstohelptrackspending& savingforadownpayment

Intuitivedigitalportaltoeasilytrackprogress Idealforclientswhodon’tneedextensive counselingbutneedaclearnextstep

Over45%ofclientsenrolledinUqualfor3+months seeanaverage36-pointcreditscoreincreaseacross allthreebureaus,with14itemsremovedfromtheir creditreportsonaverage

InOctober2023,acustomerfromLansdale,PA, startedhisjourneywithUqualwithacreditscore of553,unsureifhecouldeverownahome.

Here’sabriefoverviewofhissuccessstory:

InitialConsultation:Identifiedinaccuraciesinhis creditreportandoutlinedimprovement opportunities.

CreditScoreBoost:Improvedhisscoreby65 pointswithinfourmonths,makinghimeligiblefor amortgage.

SuccessfulHomePurchase:Closedonhishome inMarch2024,fasterthanheeveranticipated AdditionalBenefits:Earneda$500lendercredit atclosing,thankstocompletingtheUqual program.

NYSDepartmentofFinancialServices NAFCashisfulfilledbyNAFCashLLCMIRealEstateBroker#6502431375,anaffiliatedrealestatecompanyofNewAmericanFundingthatismanagedandoperatedincompliancewith applicablelegalandregulatoryrequirementsNAFCashLLCdoesnotoriginateloansorissueloancommitmentsandchargesatransactionfeethatvariesbystateTermsandconditions applyNotallapplicantswillqualifyNotavailableinallstates41050W11MileRdSuite220,Novi,MI,48375Phone844-344-0531

ServicesdescribedinthiscommunicationareprovidedthroughUQUALLLC,aloanreadinesscompanyprovidingfinancialtools,loanreadinesscoaches,andcustomizedplanstoget consumersreadytoqualifyforaloanUQUALLLCisnotacreditrepaircompanyanddoesnotprovidecreditrepair,debtsettlement,legalortaxguidanceThisisnotmortgageadviceora commitmenttolendTherearenoguarantees,promises,representationsand/orassurancesconcerningtheresultsyoumayexperience Borrowermustoccupyhomeastheirprincipalresidence Anewloanwillrequireanewcreditcheckappraisal,titlesearch,initialmortgageinsurancepremiumclosingcostsandfeesConsult yourtaxadvisor