Buying Your Home

Melisa Jones

BranCh Manager | nMLS# 965518

I have been in the mortgage industry since 2006 and currently rank in the Top 1% of Mortgage Professionals in the Country.

I originally went to college with hopes of being a teacher but I quickly learned that I’m most passionate about helping people with their finances. After buying my first home, I realized that most banks treat their clients like transactions and they aren’t offering guidance or education and I set out to do mortgages differently. I also volunteer at a local High School, with their Varsity Volleyball Team as their Assistant Varsity Coach.

I have a husband and two daughters, who also keep me very busy!

Our Team

Paige Westhoff TeaM Lead/Loan offiCer aSSiSTanT

Douglas

Lead Processor

Our Goal

Lori Harmon Loan offiCer aSSiSTanT

Our Process keeps everything organized and everyone informed.

• Texting Is Quick But Information Gets Lost.

• Phone Calls Are GREAT To Explain Complex Ideas. More Personal

• Email Is Best: REPLY ALL Is Great.

• Lots Of Paperwork - Documents Need To Be Sent In As Requested.

• No Screenshots

• Photos Can Difficult

• Web Pages Need A Url

Dawn

Credit Income Assets

Requirements for Loan Approval Credit Credit

• Credit Score is Important!

• But we also need to know about:

• Judgements

• Bankruptcy

• Foreclosure

• Delinquent Federal Debt - Payment Plans

• Disputed Accounts and Authorized User Accounts

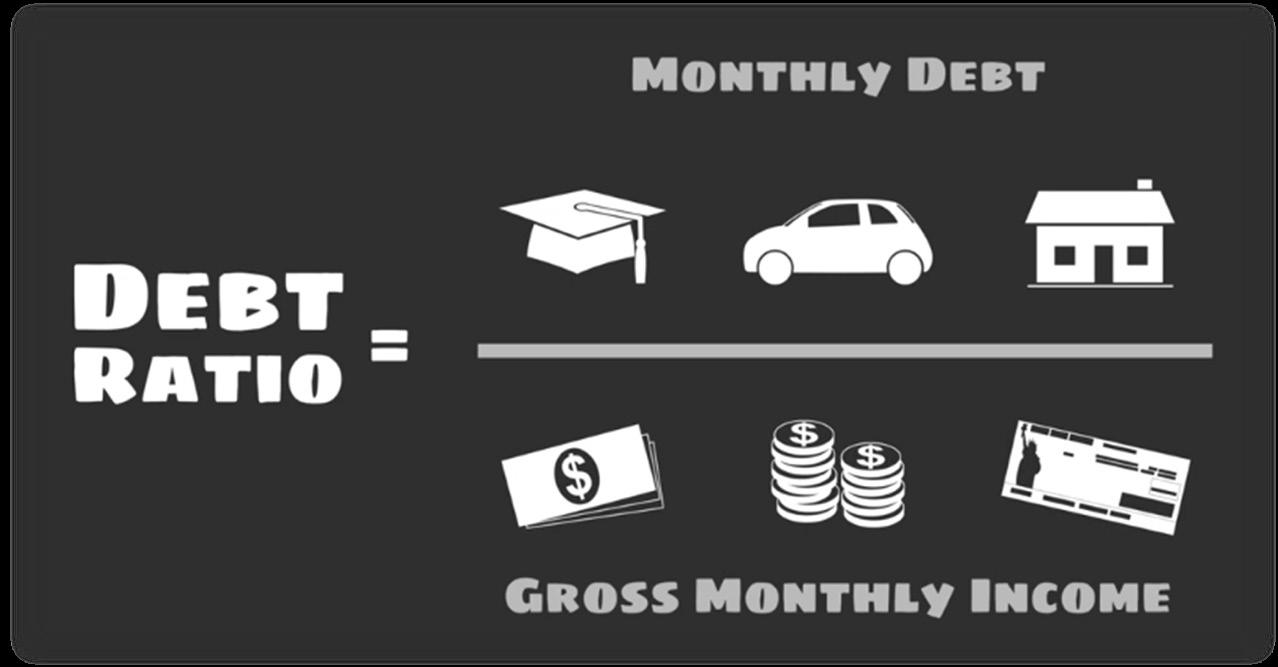

Debt-to-Income Ratio

Please Confirm the Following:

• You are a Permanent/Full-time Employee

• Are you paid Hourly or Salary?

• Relocation? Job Changes?

• Self-Employed Income – please do not file your tax returns during this process

• Grants and VA loans – additional household income or residual income

We need to account for all liabilities, that can include:

• Mortgage/Rent

• Student Loans

• Credit Cards

• Collections

• Child Support/Alimony

• IRS Payments – Past Due Taxes

• Childcare (VA Only)

• NEW ACCOUNTS

Down Payment Options

• 0% Down

• 3% Down

• 3.5% Down

• 5%-20% Down

• >20% Down

Conventional

• Renovation

• New Construction

• Jumbo

• Portfolio

• Grants and Down Payment Assistance

• NAF Cash

Payment & Down Payment Scenarios

• Principal & Interest

• Real Estate Taxes

• Homeowner’s Insurance

• Private Mortgage Insurance (PMI)

• Homeowner’s Association Fees (HOA’s)

Strategies & Getting Your Offer Accepted

• Normal Contingencies

• Inspections/Title/Insurability

• Financing Contingencies

• Loan Type/Down Payment/Appraisal

• Local Lender/Pre-Qualified vs Pre-Approved vs Unwritten

• NAF Cash - Our Cash Buyer Program