WELCOME TO LIBERTYLAND USA

Blair Allen Financial (BAF) is a vertically integrated financial services firm that owns a family of companies across real estate, mortgage, insurance, property management, technology, and capital investment. Blair Allen Capital, LLC (BAC) serves as BAF’s capital asset division, focused on fix-and-flip opportunities, short- and long-term holds, and ground-up development. Each project is syndicated through individual LLCs, with BAC acting as General Partner (GP) and raising Limited Partner (LP) equity.

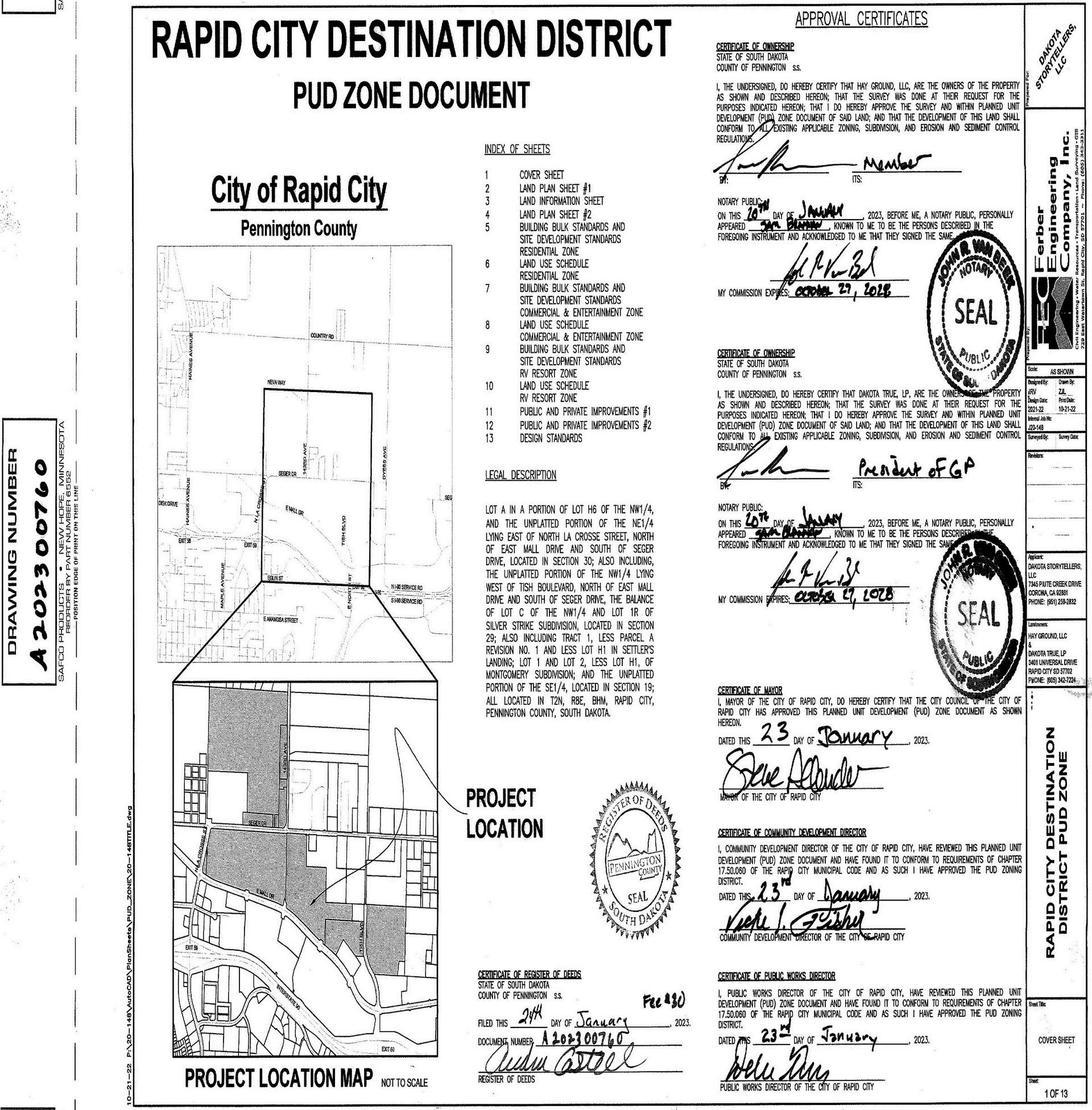

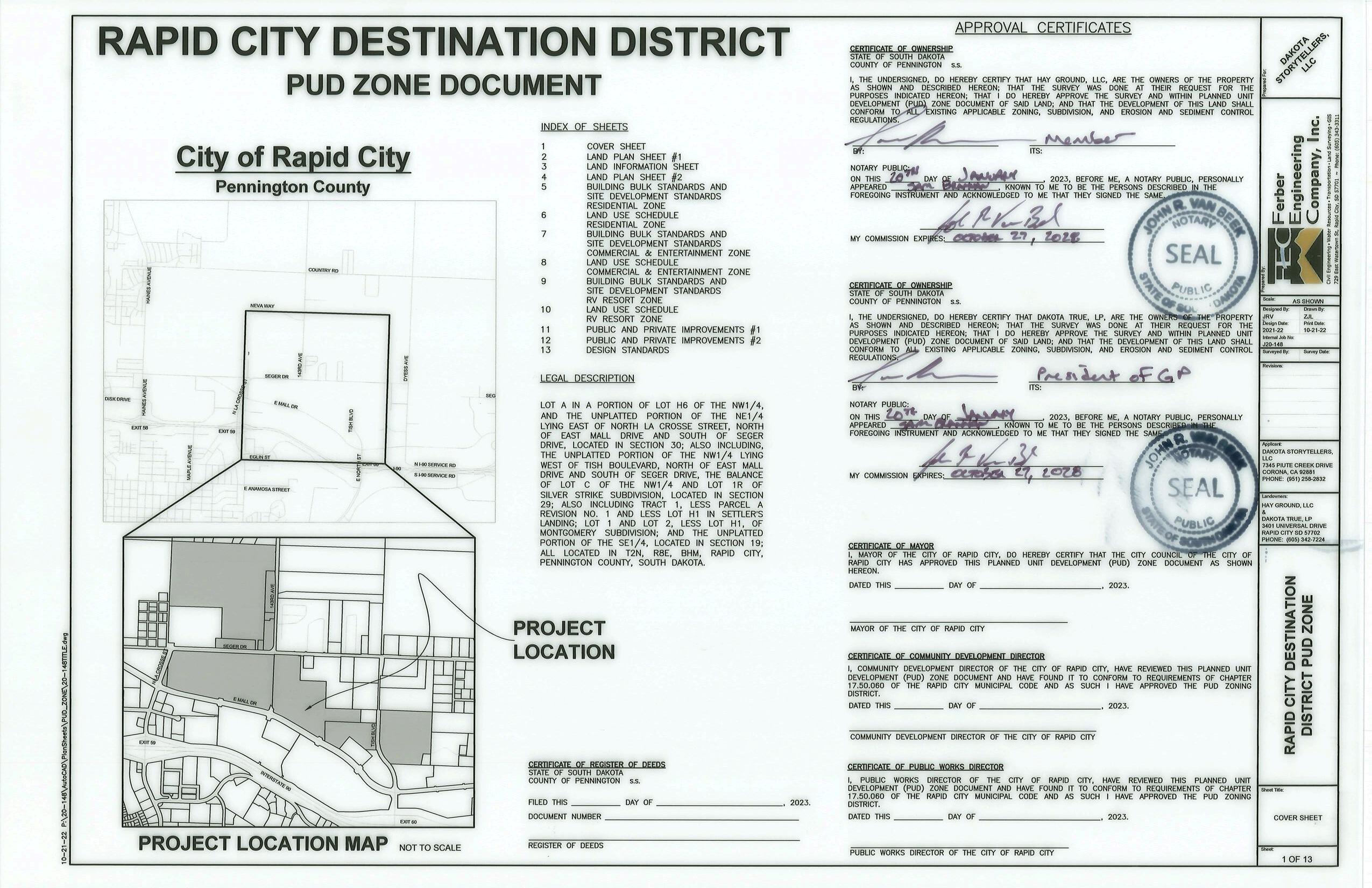

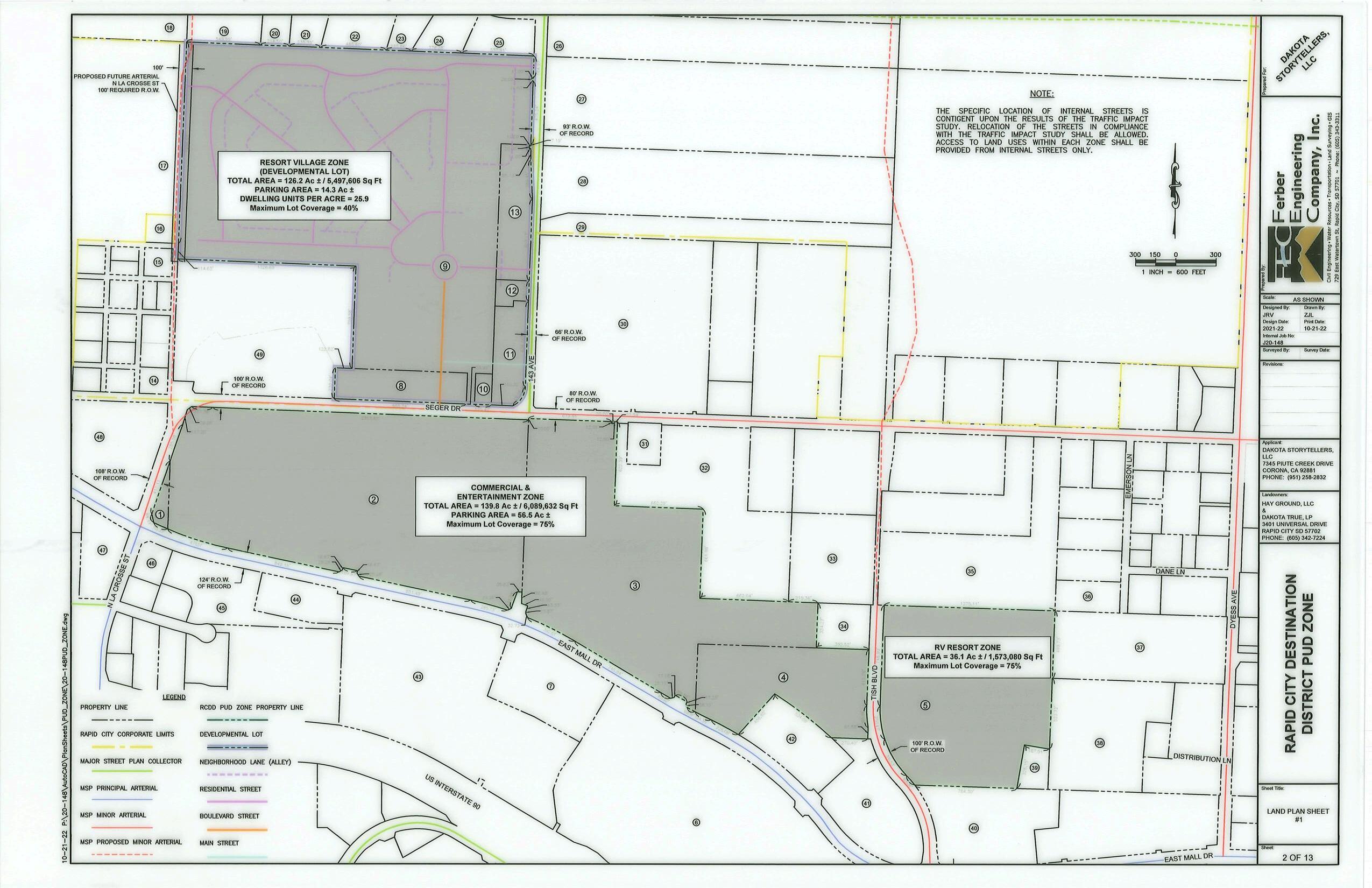

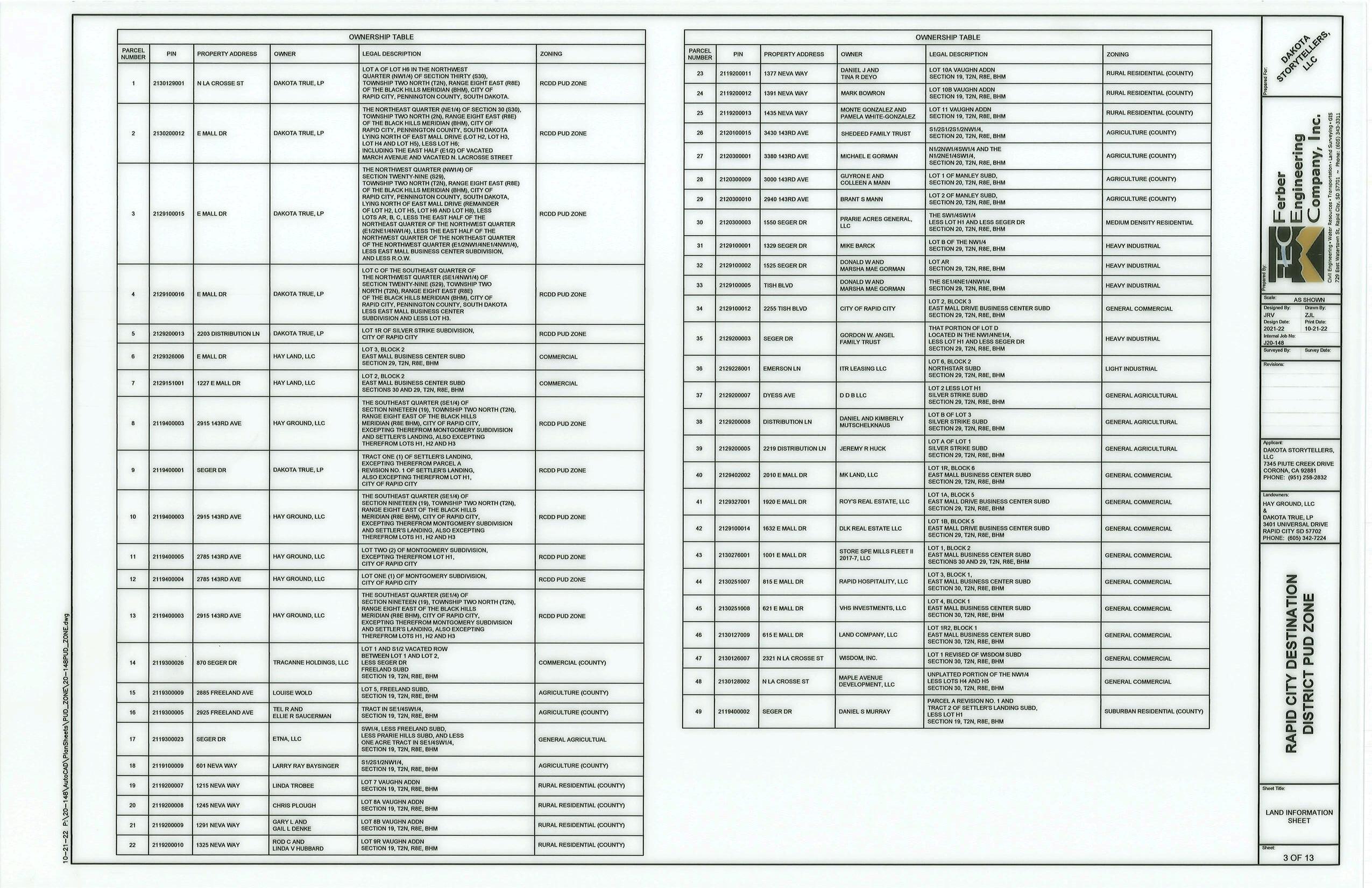

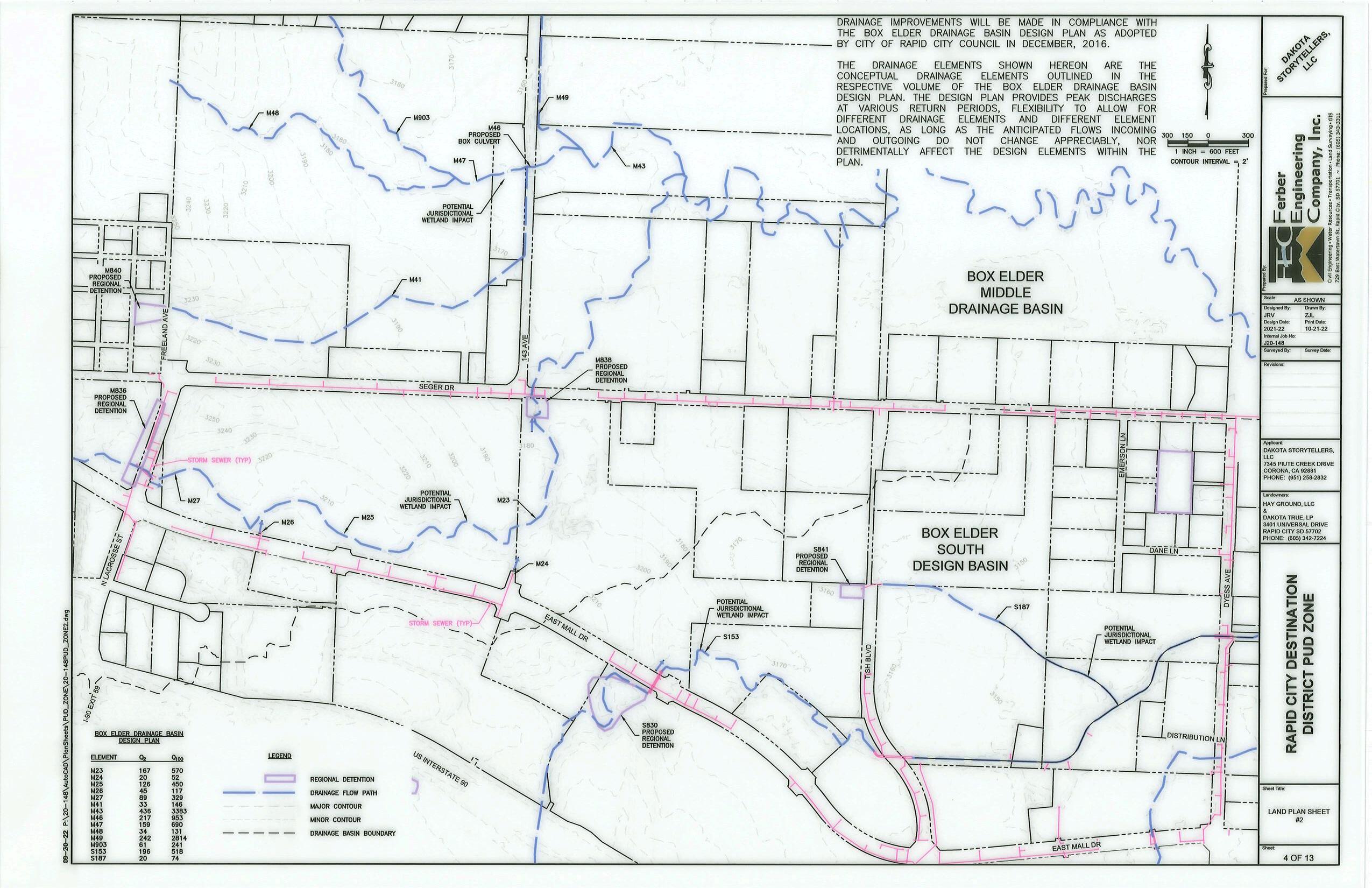

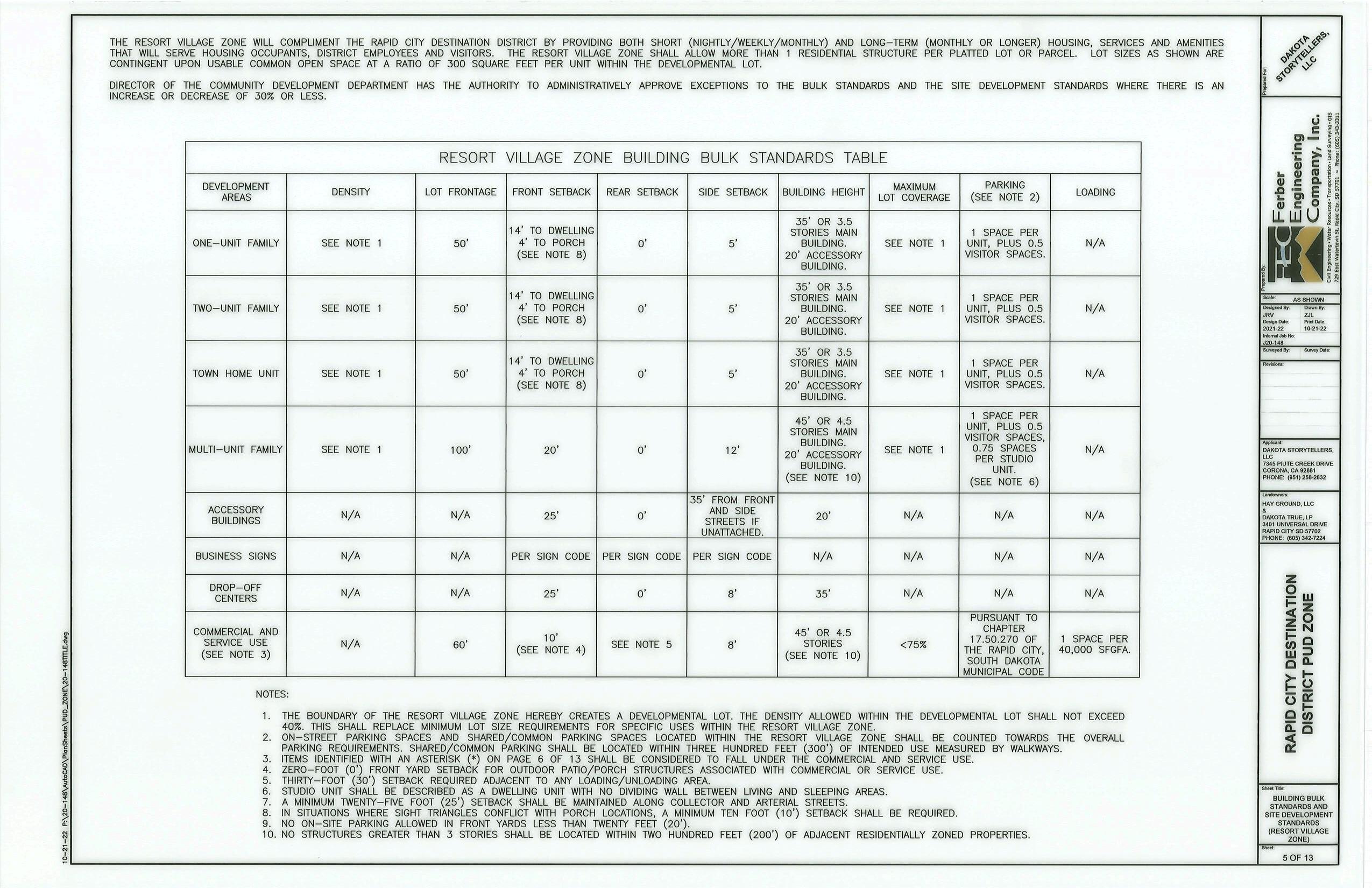

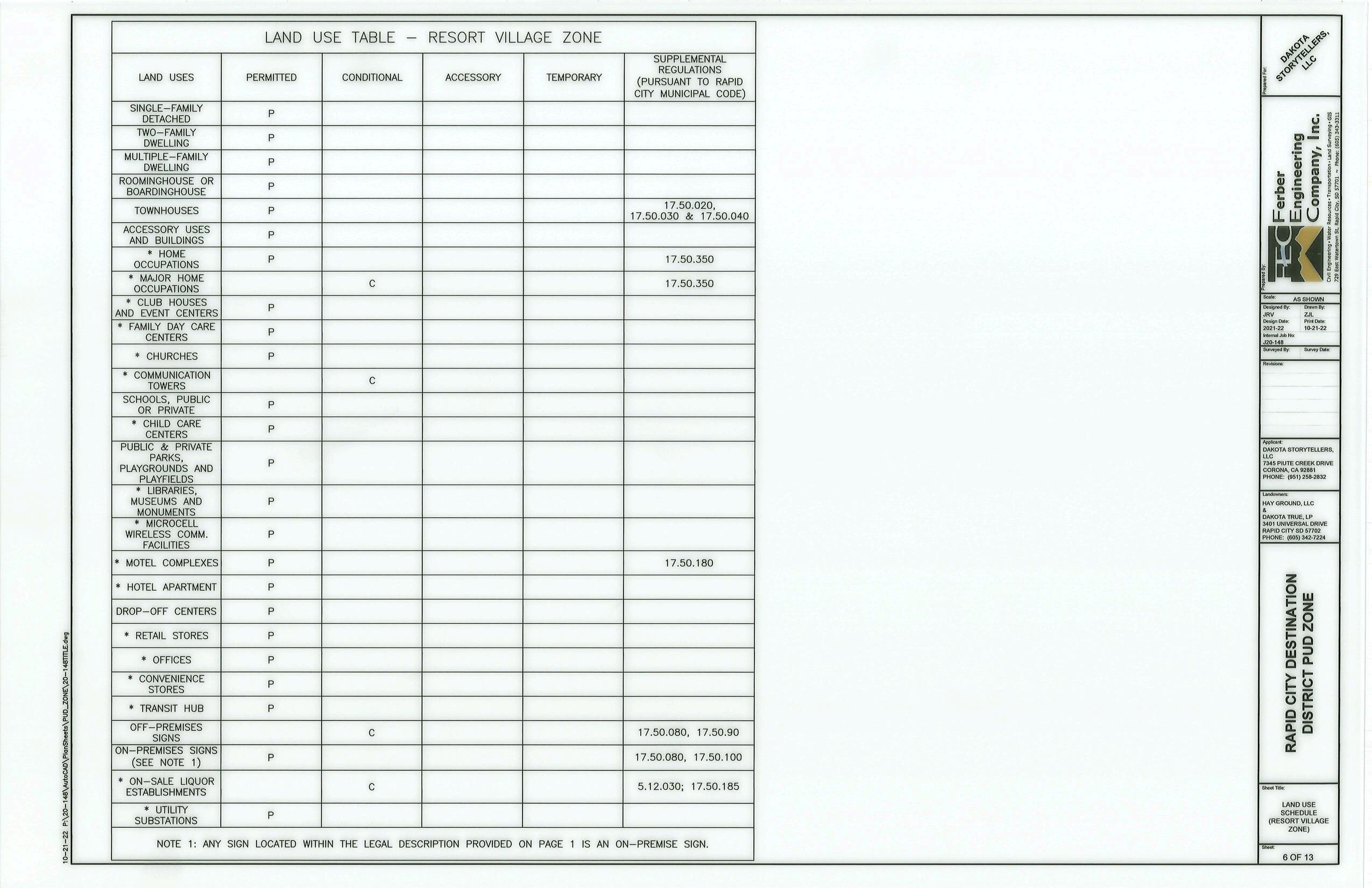

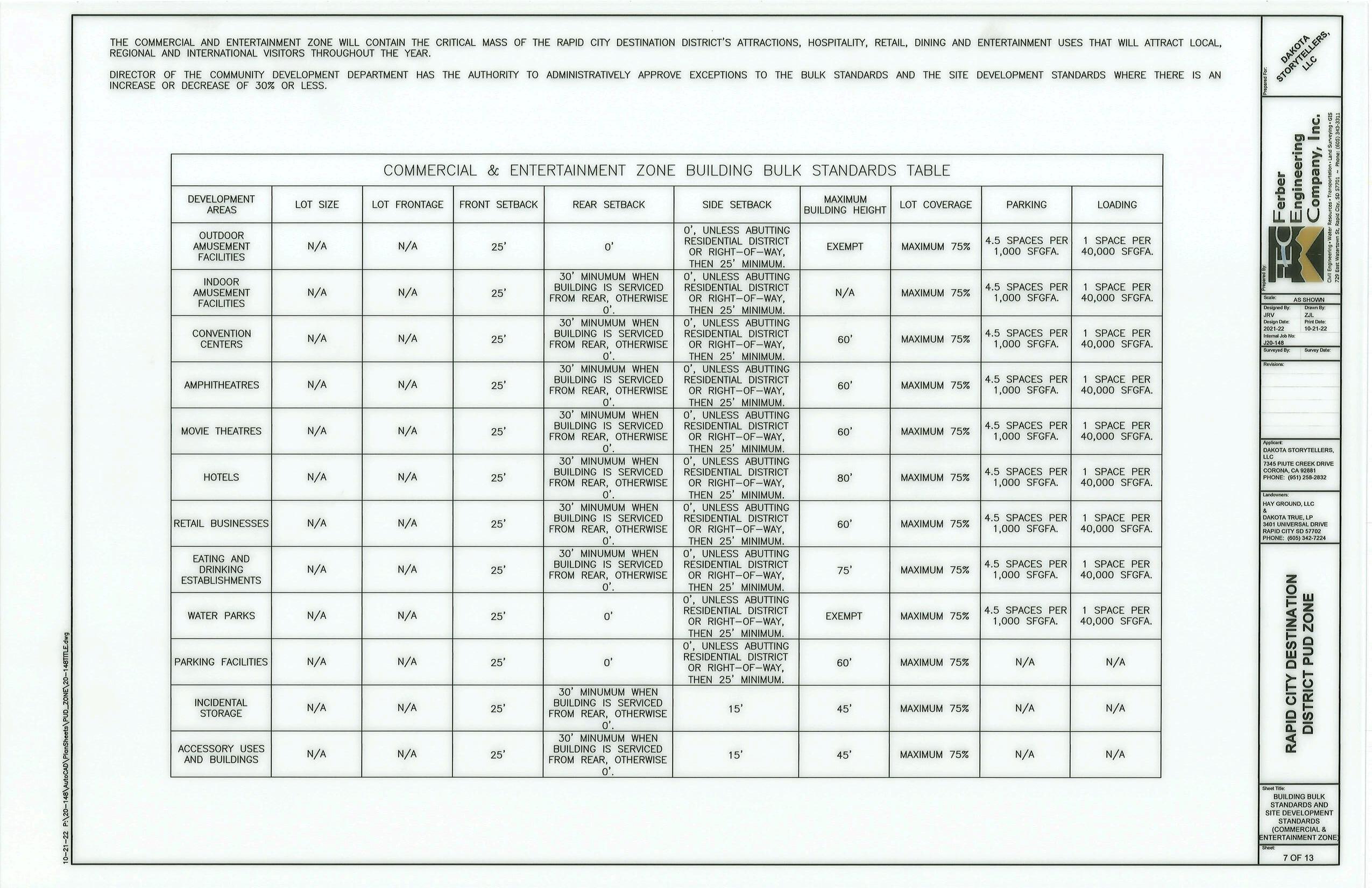

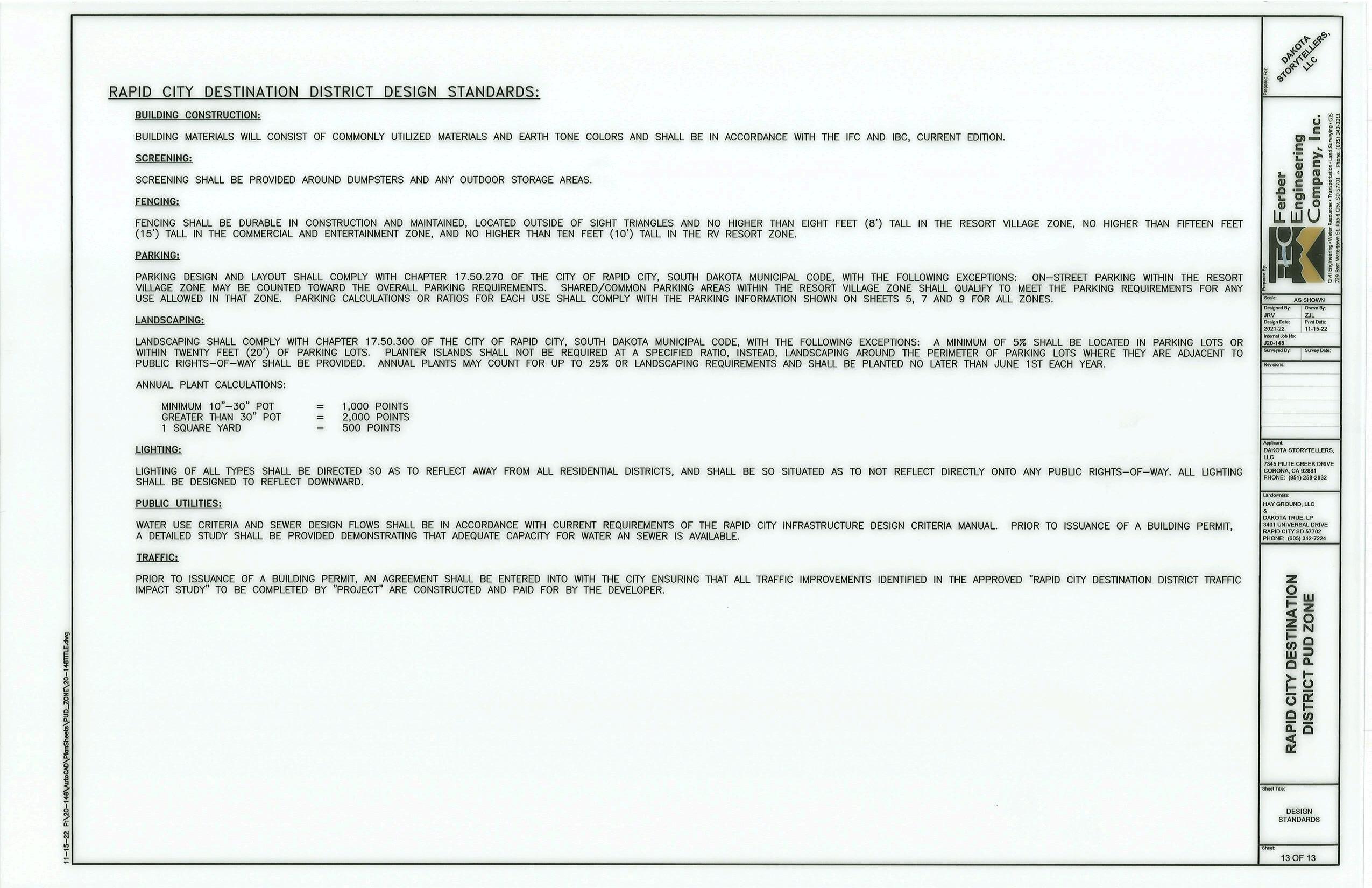

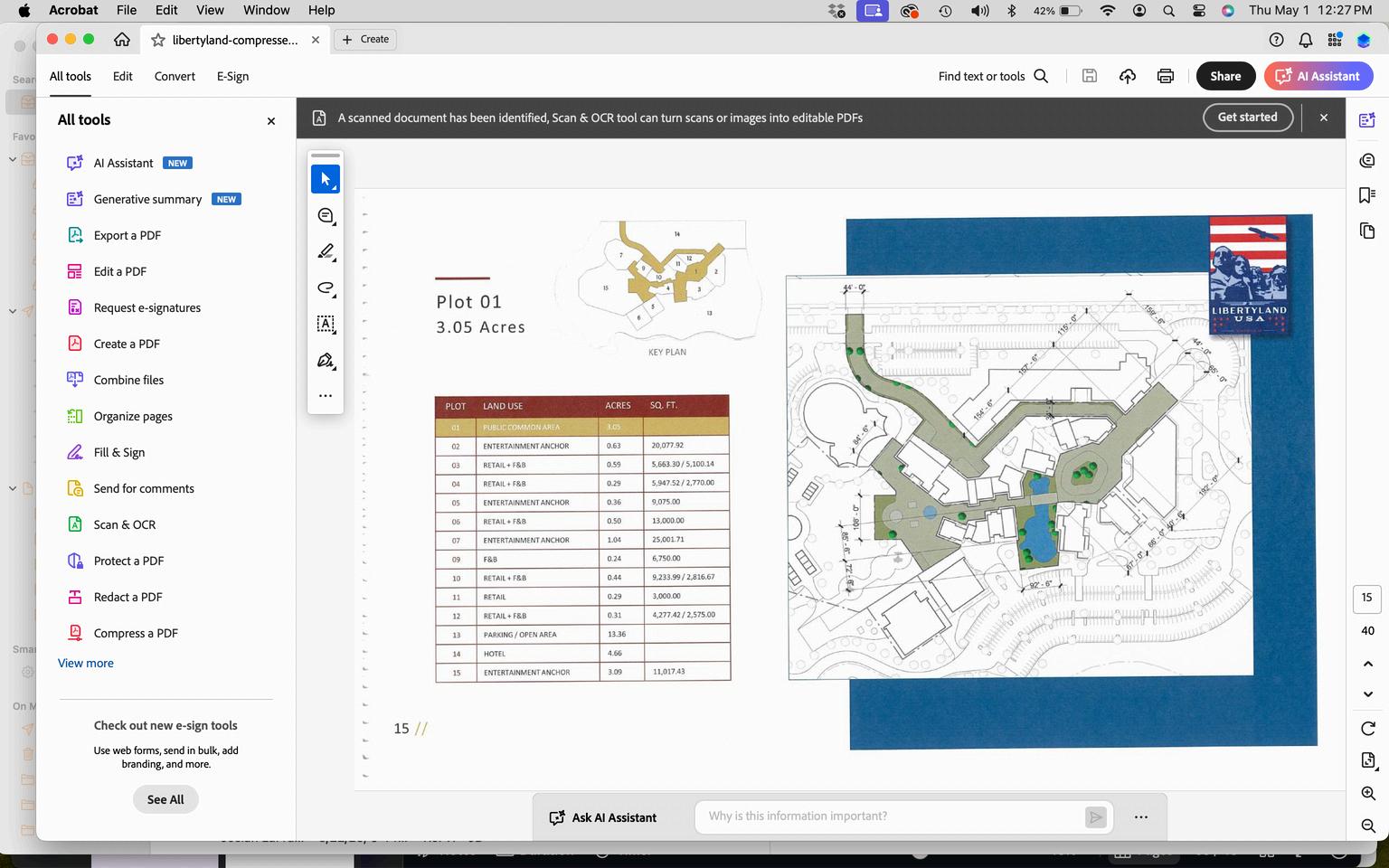

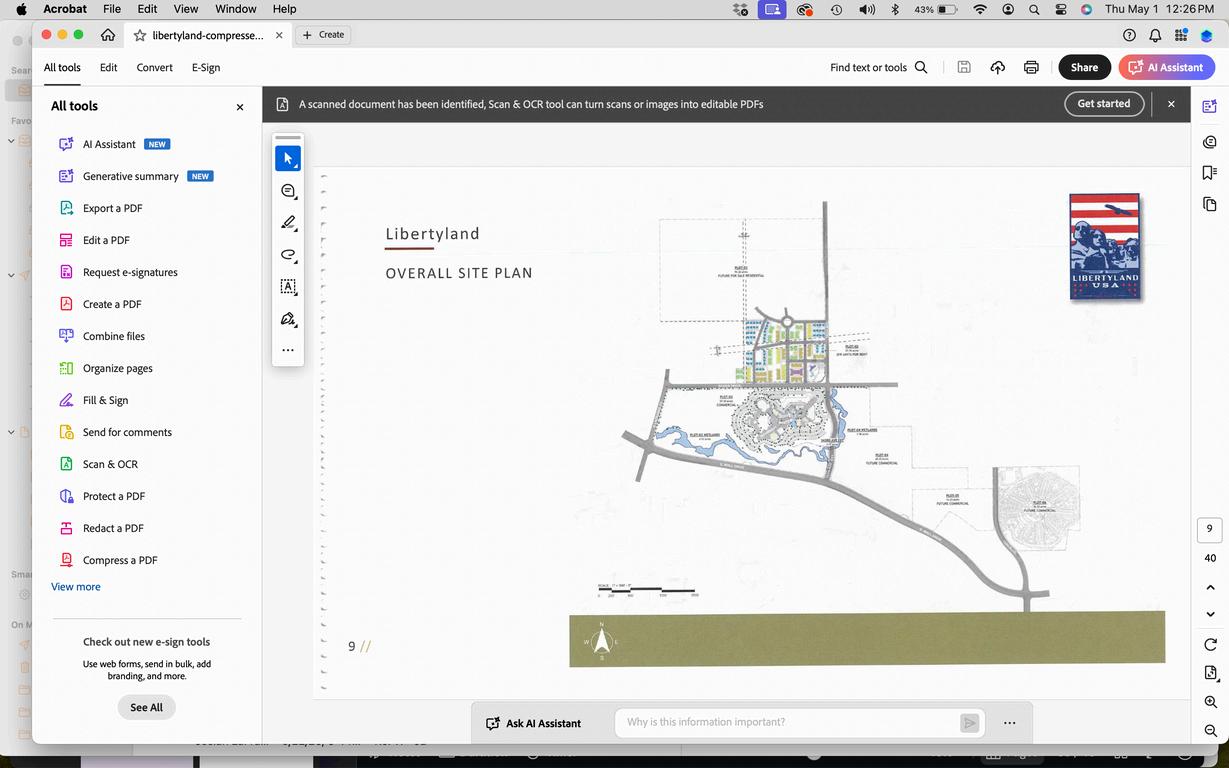

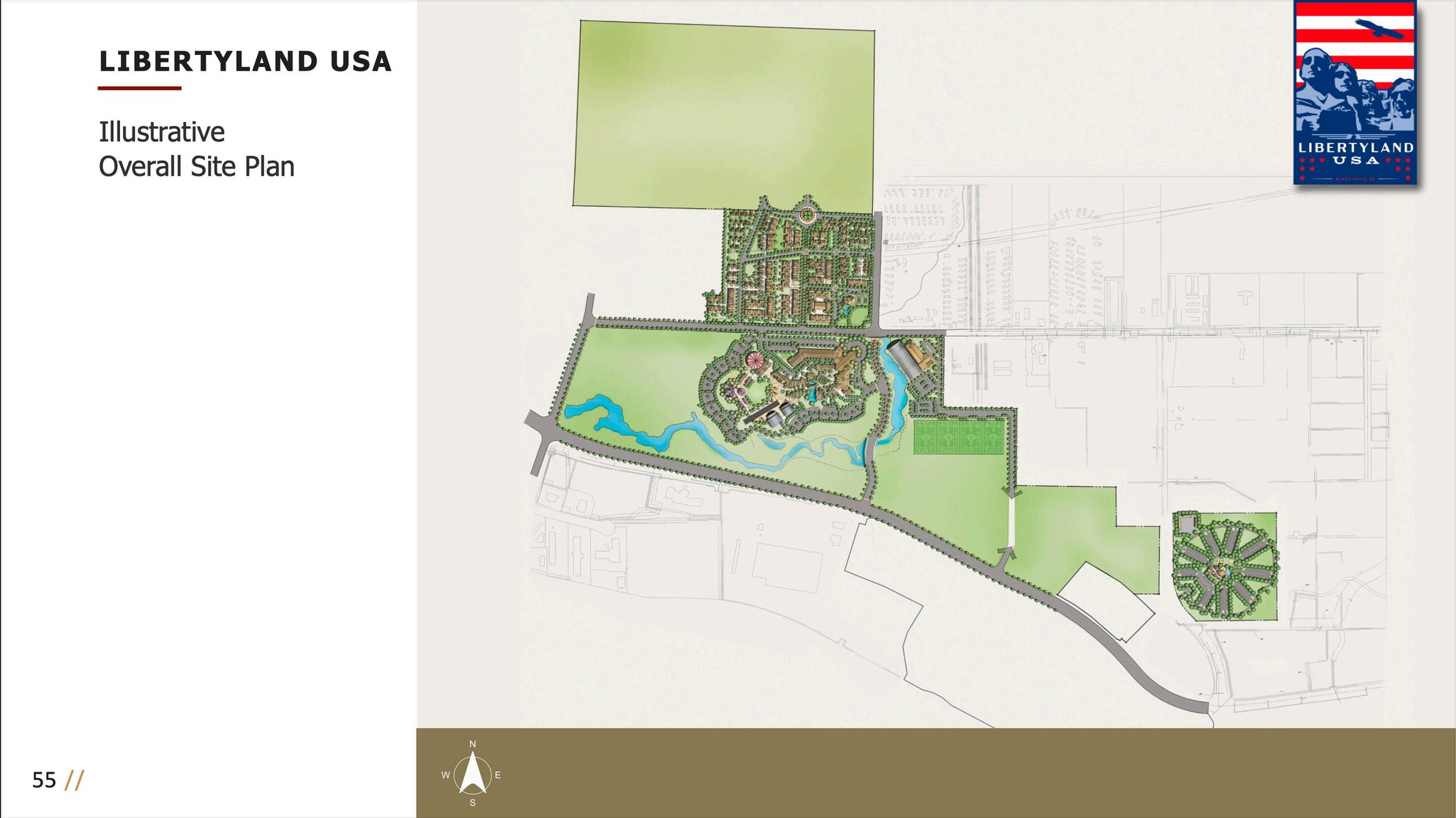

For the Libertyland USA project—a $1 billion, 302.1-acre master-planned community in the Black Hills BAC has partnered with (TBD) to form Liberty Development Company (LDC), which will serve as GP across three verticals: single-family residential, multifamily build-torent, and a destination RV park. Designed in collaboration with Storyland Studios and backed by an $80 million TIFD (in process) being approved by the City of Rapid City, Libertyland will feature parks, trails, a visitor center, and an amphitheater, making it the largest private development in South Dakota and one of the most innovative community destinations in North America.

Estimated Master Planned Project

Largest privatereal estateproject inSouthDakota history

Home to BlackHills, Mount Rushmore, andEllsworthAir ForceBase.

Master Development community combines housing, retail, tourism, and immersiveentertainment

Liberty Development Companies (LDC) Strategic Collaboration

Proven Partnerships to Execute the Vision

BlairAllenCapital,LLC(BAC):

TBD

Strategicleadership,fullecosystemintegration,andcapitalmanagement. {InsertCo-GPinformation}

DarrenSloninger

StorylandStudios

Nationallyacclaimedmasterdeveloperspecializinginvisionarycommunityprojects Designleadersbehindiconicimmersiveexperiences(Disney,Universal)

LienFamily

J2CapitalManagement

Regionallandownerswithdeepgenerationalcommunityroots Expertlocalconsultantsdrivingrelationshipsandjointventures.

BlairAllenCapital,Inc(BAF)

FullyintegratedrealestateandCapitalservicesplatformcomposedoffivecore companies:luxuryrealestatebrokerage,propertymanagement,mortgagelending, insuranceservices,andcapitalforacquisitionsandassetmanagement.

Transforming Rapid City into a Destination Powered by BAC's On-Site Vertical Execution

302 Acre

150 Pad MasterCommunity Development ProjectinRapid City,SD

1,200 Homes

600 Units

150,000

Sq.Ft.RetailSpace

Master-plannedbyStorylandStudios(creatorsforDisney&Universal),setagainsttheiconicbackdropoftheBlackHills&MountRushmore.

147M+ annual visitors to the South Dakota region and continuing to grow

Special $80 million designation by the City of Rapid City as a Tax Increment Financing District (TIFD) enhancing infrastructure funding and increasing investor return potential.

Ellsworth Air Force Base will not be expanding its on-base housing facilities, placing increased pressure on the local market to meet incoming residential demand

Approximate visitors to visit Mount Rushmore the Bad ands, Deadwood and the Black Hills

Expanding military presence (5000 B-21 personnel + 20,000 new residents) located just 8 minutes from the project site offering an unparalleled proximity advantage.

Libertyland USA is a landmark master-planned development initiated by the Lien Family, longtime landowners and key contributors to Rapid City’s growth. Strategically located near a new medical corridor and Ellsworth Air Force Base, the project features gated security, interconnected trails, parks, a vibrant village center, visitors center, and year-round outdoor amphitheater. As the first community of its kind in the region, it blends world-class design with meaningful local impact setting a new standard for residential living in the Black Hills and shaping the city’s future through legacydriven investment.

Black Hills

Liberty Landing

Fair

Dakota Territory

The Libertyland themed district supports a repeatable, walkable green space, immersive experience and garden development style.

Thesethemedzoneswilldriveuniqueprogramming,consistentvisitorengagement,andretail/diningactivation.Thecombinationofthecommunity anddevelopcontributorswillmakethisprojectaoneofkindinvestmentopportunityandregionalattraction

The region hosts over 147 mil ion annual visitors drawn by Mount Rushmore the Black Hills, and national parks Libertylands immersive offerings will transform these short-term visits into extended stays, boosting the local economy

Rapid City serves as the regional economic hub with major retailers draw ng consumers from a 200-mile radius that includes four states South Dakota North Dakota Wyoming and Nebraska

The development is only 8 minutes from Ellsworth Air Force Base which is expected to add 5,000 personnel and up to 20,000 residents due to the B-21 Raider rollout With no additional on-base housing planned Libertyland is positioned to capture significant residential demand

E G I O N A

The City of Rapid City has designated the Libertyland development area as a Tax Increment Financing District (TIFD), approved 80 million dollar community, providing infrastructure funding and enhancing early investor returns

Despite its high visibility and growing population, the Black Hills region lacks large-scale immersive, mixed-use developments Libertyland USA is first to market with an integrated, experiential mode

Located with n the ancestral home and of the Lakota Nation and featuring uniquely American storytelling zones, the project benefits from both regional authenticity and broad emotional appeal

RapidCity’smetroareaisprojectedtogrow 2.5%annually,oneofthefastestinthe region.

TheDepartmentofDefenseprojectstheadditionofupto5,000active-duty(up to 20,000 new Residents) service members, support personnel, and contractors. Importantly, Ellsworth Air Force Base has publicly stated it will not expand its on-base housing, placing increased pressure on the private sector to providequality,proximatehousingandservices.

Libertyland is the only large-scale development within the immediate range of thebasecapableofabsorbingthisdemand.

Existinghousingisstrained,military expansionalonewillrequireover5,000new unitsinthenext5years.

Withover14.7milliontouristsperyear,the retailcenterwillserveboththelocal communityandseasonalvisitors.

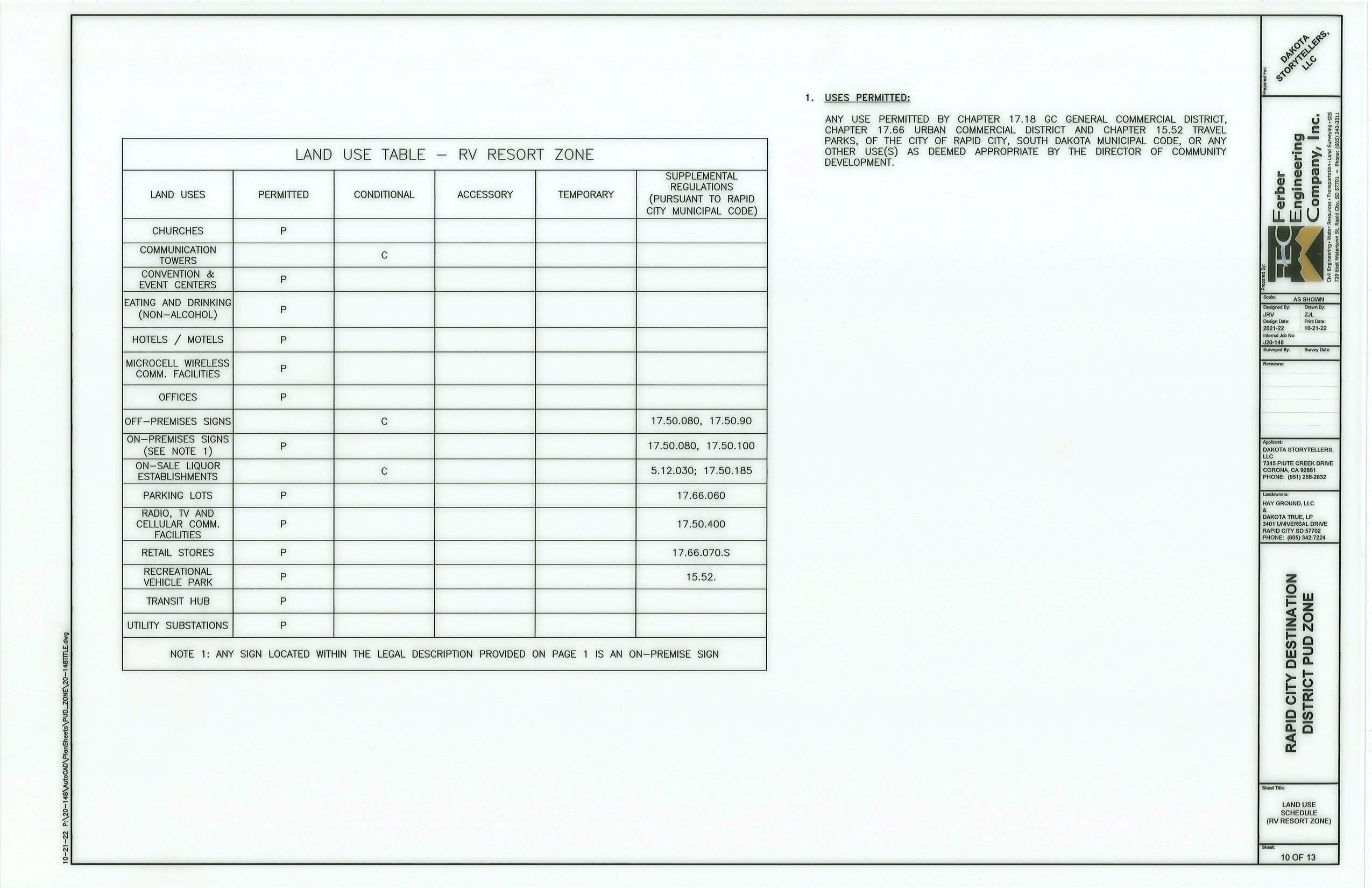

NationalRVtourismhasgrown7%CAGR overthepastfiveyears.Libertyland’sRVpark capturesunmetdemand.

LDC will leverage the full power of the Blair Allen Financial, Inc (BAF) ecosystem— bringing proven local expertise, on-site operational offices, and a deep understanding of the region to drive targeted sales, marketing, and execution.

Top 1% sales talent in luxury and residential real estate

1000+ of homebuyers and investors served

Powers sales across single-family and multifamily assets

Blair Allen Property Management (BAMP)

25+ years’ experience

2,000+ units under management

On-site leasing and maintenance.

Supports stabilization

Vertically integrated operations driving sales, management, and performance

Blair Allen Insurance (BAI)

Active in 23 states

30+ carriers and 1,000+ products

Asset, tenant, and homeowner coverage

Fully integrated insurance solutions

Blair Allen Mortgage (BAM)

Licensed in 43 states

140 SFR and 700+ commercial lenders

Offers Bulk Rate Buydowns

End-to-end lending across residential and commercial verticals

Blair Allen Technology (BAT)

In-house tech stack for sales, marketing, and leasing

AI-driven tools to connect convert, and optimize

Centralized platform driving ecosystem-wide performance

LibertyDevelopmentCompany(LDC)willactasthe

GeneralPartner:

OwnershipSplit:BAC(60%),TBD(40%)

Role:Equityraising(50%),Debtplacement(50% non-recourse),andDevelopmentManagement.

LDCWillEstablishLibertyHomes,LLC, LibertyLeasing,, LLC&LibertyRV,LLC:

GeneralPartners:

LDCwillown10%ofeachLLC

LimitedPartners:

LienFamilywillown10%(BTRandRVpledge)

J2Capital:2%(vestedthroughadvisoryservices)

LDCwilloffer88%toLPInvestorsforLiberty Homes,LLC

LDCwilloffer78%toLPInvestorsforLiberty LeasingandLibertyRV

AI

Angie

Gary Lorenz COO BAF & BAC Director Alex

Marketing, Sales, and Financing from BALR, BAM, and BAT Proforma Assumptions/P&L

1,200 homes total; 240 homes built and sold annually @ $450,000 per home

$100M

$50M

$50M

Proforma Assumptions/P&L

BAC offers Limited Partners a rare opportunity to invest in a multivertical, master-planned development backed by institutional sponsors and public-private support. LPs can allocate capital directly into one or more verticals Single Family, Multi-Family, or RV each with its own dedicated capital stack and phased development timeline. Investors receive pro rata equity and an 8% preferred return, with additional upside through refinance events, asset sales, and long-term cash flow. A performance-based waterfall ensures the General Partner earns promote only after LP thresholds are met. With land fully pledged and debt structured as non-recourse, Libertyland presents a de-risked yet high-impact opportunity, executed by seasoned partners with a proven track record.

$107,000,000 $250,000 15% to 18% 6 year

(Stabilization Phase - Years 5–7)

(BAC’s Growth Objectives)

(BAC Becomes the Sole Owner)

1.All verticals (SFR, Multifamily, Retail, RV) stabilize

2.Triggers: occupancy & leaseup benchmarks

3.LPs receive cash flow via:

a.Refinancing

b.Partial asset sales

1.Buy TBD 40% GP stake in LDC

2.Buy out LPs (78%) across verticals

3.Funded via:

a.New LP syndication through BAC

1.Full control of Libertyland SFR, BTR, and RV verticals

2.Long-term revenue from stabilized assets

3.Control of asset appreciation + reinvestment

A Defining Opportunity in American Development

A once-in-a-generation chance to shape a legacy destination at the intersection of innovation, culture, and growth.

1,200+ Single-Family Homes

600 Multifamily Units

Experiential Entertainment Districts

RV Resort

Themed Hospitality

Master-Planned Lifestyle

BAC powered by a uniquely aligned team of institutional strength, creative leadership, and regional trust. As co-GP, TBD brings deep development experience, while Storyland Studios and Darren Sloniger lead the project’s visionary design and planning. The Lien Family’s legacy land contribution reflects deep community alignment, and BAC’s long-term consolidation strategy ensures committed stewardship well beyond the build-out phase. With execution supported by the vertically integrated BAF ecosystem, Libertyland is positioned to deliver unmatched speed, scale, and operational excellence setting a new standard for transformative community development.

Offered by Blair Allen Capital, LLC (BAC) Confidential Private Placement Memorandum (PPM), Copyright © 2025. All Rights Reserved BAC.

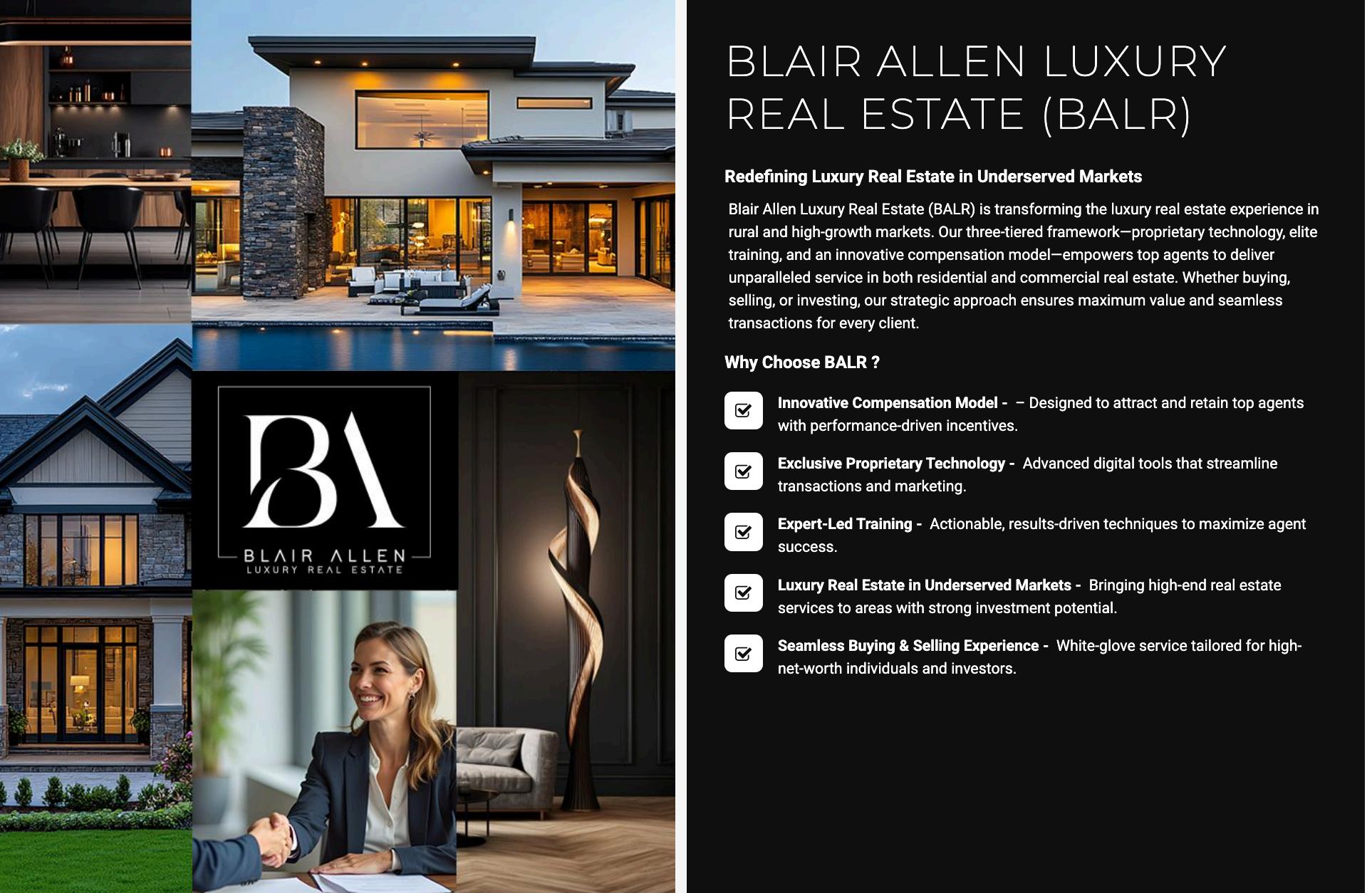

FLYER 1: BALR – Single Family Homes at Libertyland

Driven by: Blair Allen Luxury Real Estate (BALR)

Strategy Concept: Luxury Rural Expansion + Local Market

Penetration

What It Means: This flyer markets 1,200 high-end single-family homes in South Dakota's largest planned community. BALR leads the residential sales strategy, combining award-winning national design aesthetics with deep local expertise. It demonstrates BALR’s ability to capture rural growth demand and execute highend development in secondary markets, reinforcing BAC’s scalable housing model.

BAF Value: BALR will bring on the top 1% producers In the market to drive local sales with established local builders

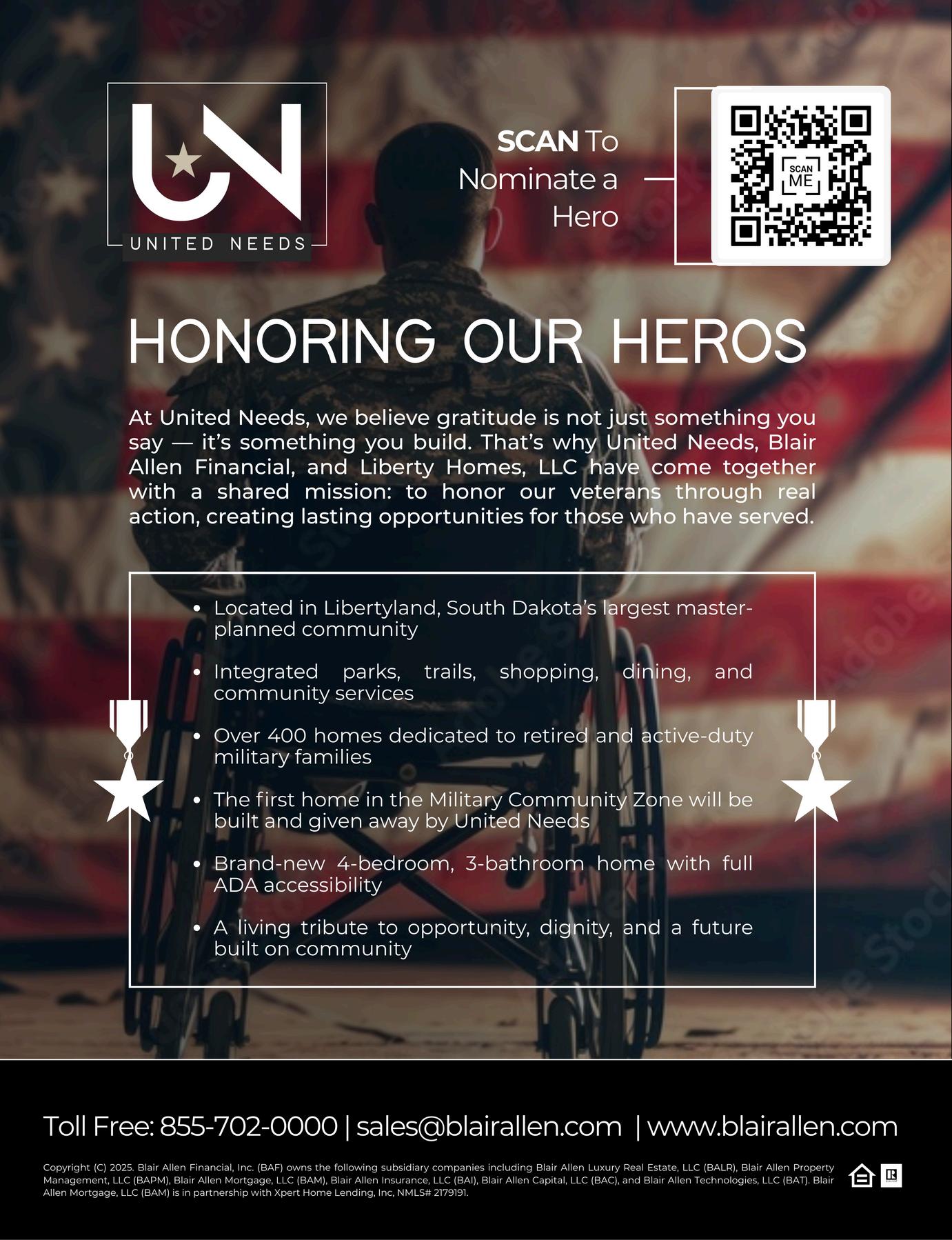

FLYER 2: BALR – Military Community Zone

Driven by: Blair Allen Luxury Real Estate (BALR)

Strategy Concept: Social Impact Development + VeteranFocused Product Segmentation

What It Means: This flyer introduces Libertyland’s Military Community Zone, offering 400 homes with accessible layouts and special pricing for retired military families. It highlights BALR’s precision in serving mission-driven housing needs while BAC delivers community-enhancing returns a clear alignment of social impact and profitability.

BAF Value: Has 2 SD Senior Ret. Military Advisors,, Access to Military Reserve & Base Database -Relationship

FLYER 3: BAM – Financing at Libertyland

Driven by: Blair Allen Mortgage (BAM)

Strategy Concept: Incentivized Lending + Military-Friendly Financing Solutions

What It Means: BAM showcases how its lending team has negotiated exclusive builder-paid rate buydowns to drop mortgage rates to as low as 4.99%. This flyer positions BAM as the Capital lever behind Libertyland’s homeownership accessibility and speed-to-close, enhancing absorption and reducing deal friction for both buyers and investors.

BAF Value: BAM has 145+ Investors and 700+ Commercial Investors, Special Bulk-Rate Buydowns UWM

FLYER 4: BAPM – Multifamily Lease-Up

Driven by: Blair Allen Property Management (BAPM)

Strategy Concept: Fast Lease-Up Execution + Veteran-Focused

Multifamily Operations

What It Means: BAPM launches leasing of 600 apartments starting at $1,500/month, with digital tools and on-the-ground support. This flyer emphasizes BAPM’s operational role in activating Libertyland’s rental income streams while supporting tenant satisfaction and occupancy. It also cross-sells rental support via United Needs, creating a loop of impact and performance.

BAF Value: BAPM team has 25+ years management experience, local offices will be established.

FLYER 5: United Needs(In-Progress 501c3) – $5,000 Assistance Program

Driven by: United Needs + Blair Allen University (BAU)

Strategy Concept: Education-Based Access to Housing

What It Means: This flyer outlines a Capital assistance pathway for veterans and active-duty renters. Participants complete BAU’s literacy courses to unlock up to $5,000 in move-in assistance. It reinforces BAF’s mission to merge education, equity, and empowerment, and drives qualified leasing traffic into BAPM’s multifamily pipeline.

BAF & United Needs Value: BAU, BAPM and United Needs will collaborate together along to place local military into the BTR by using multiple assistance programs.

FLYER 6: United Needs – Home Giveaway

Driven by: United Needs + BAC + BALR

Strategy Concept: Philanthropy Meets Place-Making

What It Means: United Needs is gifting the first Libertyland

home a custom ADA-accessible house to a disabled veteran.

This flyer is the emotional anchor of the Libertyland campaign, showcasing how BAC’s partnership with United Needs transforms capital into compassion. It builds brand trust and demonstrates stakeholder alignment.

BAF & United Needs Value: 2 Senior Ret. Military Advisors, Access to Military Reserve & Base Database -Relationships.

Join us in being part of the greatest development In South Dakota’s History.

Josiah LaFrance - President BAC, BAC Director

josiah@blairallen.com, (605) 786-3098

Jason Blair - CEO & Chairman BAF, BAC Director jb@blairallen.com, (253) 670-3080

Gary Lorenz - COO & Director BAF, BAC Director

gary@blairallen.com, (319) 429-4796

Angie Ison - CFO BAF, BAC Director angie@blairallen.com, +61 408 015 248

Alex Nahai - CLO BAF, BAC Director alex@blairallen.com, (310) 869-9866

John Flint - Senior Advisor jflint@blairallen.com, (319) 575-2976

(855) 702-0000 www.blairallen. com

info@blairallen.com