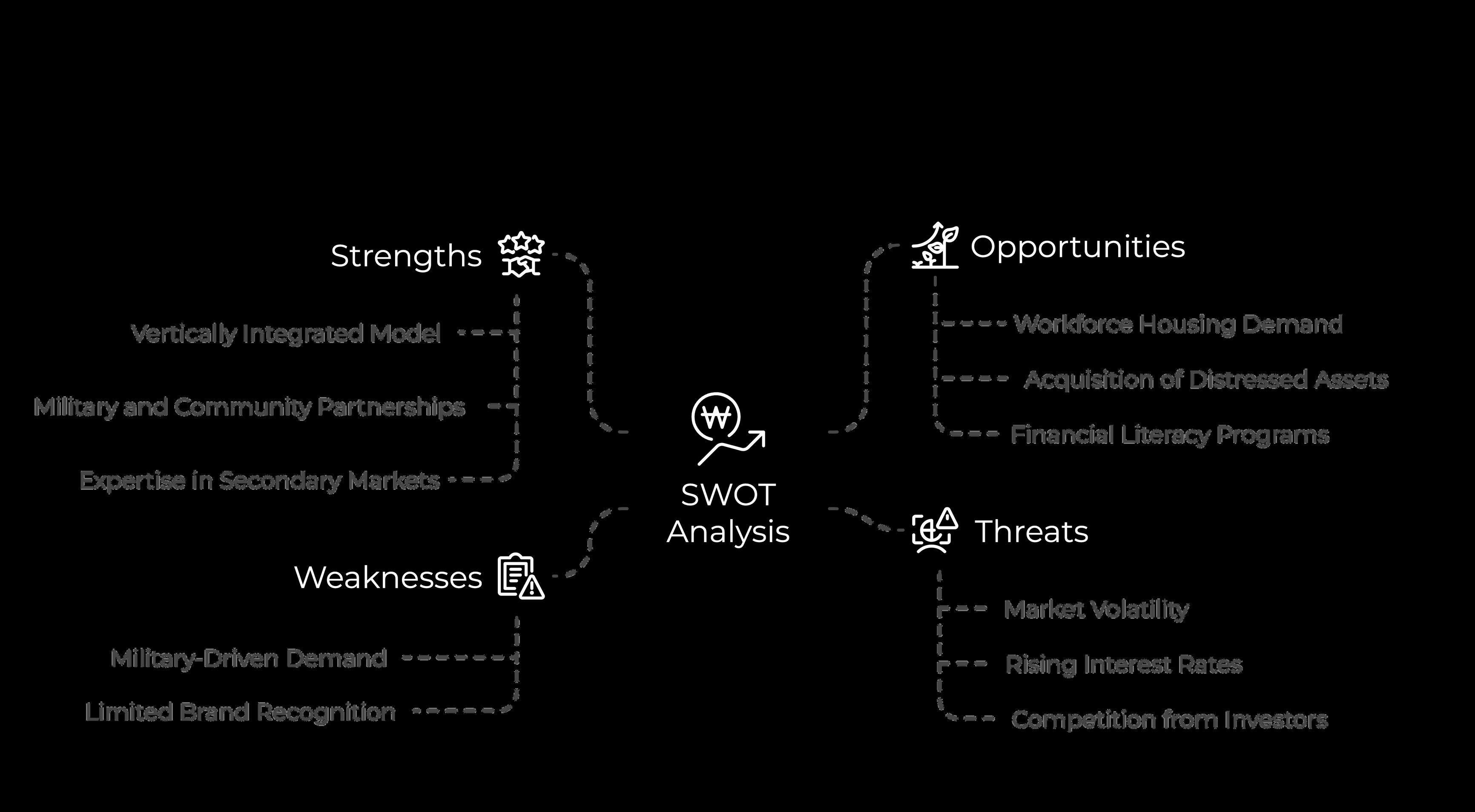

This due diligence plan highlights the collaborative strengths of three key organizations:

Blair Allen Financial, Incorporated (BAF): The strategic and operational hub, integrating subsidiaries across real estate, property management, mortgage lending, insurance, and technology.

United Needs (UN): The mission-driven arm, addressing housing accessibility, financial literacy, and wealth-building opportunities for underserved populations.

Blair Allen Capital Fund, Incorporated (BACF): Launching in early 2025, serving as the financial engine, driving large-scale acquisitions and investments.

Independently strong yet strategically aligned, these entities form a vertically integrated ecosystem that addresses inefficiencies in fragmented industries. Together, they deliver scalable profitability, sustainable growth, and measurable community impact. By harmonizing their financial objectives and operational strategies, this unified model creates a low-risk framework for innovation and long-term success, blending purpose and profitability to transform industries and communities.

As the operational nucleus, BAF provides the foundational infrastructure for the entire ecosystem. By integrating its subsidiaries across real estate, property management, mortgage lending, insurance, and technology, BAF ensures streamlined operations, centralized governance, and enhanced profitability.

$20M

Drive operational efficiencies by integrating advanced technology platforms, shared resources, and robust governance structures. Scale subsidiaries strategically to maximize market penetration while maintaining operational excellence.

Provide a cohesive operational backbone, enabling feedback loops for innovation and continuous improvement.

In exchange for 20% equity BAF to scale operations, develop new markets, and enhance its proprietary technology.

The mission-driven arm of the ecosystem, United Needs addresses critical challenges in financial literacy, housing accessibility, and wealth-building, particularly for underserved populations such as military families. By combining education-first initiatives with real estate investment opportunities, United Needs fosters social impact while creating pathways for financial independence.

$20M

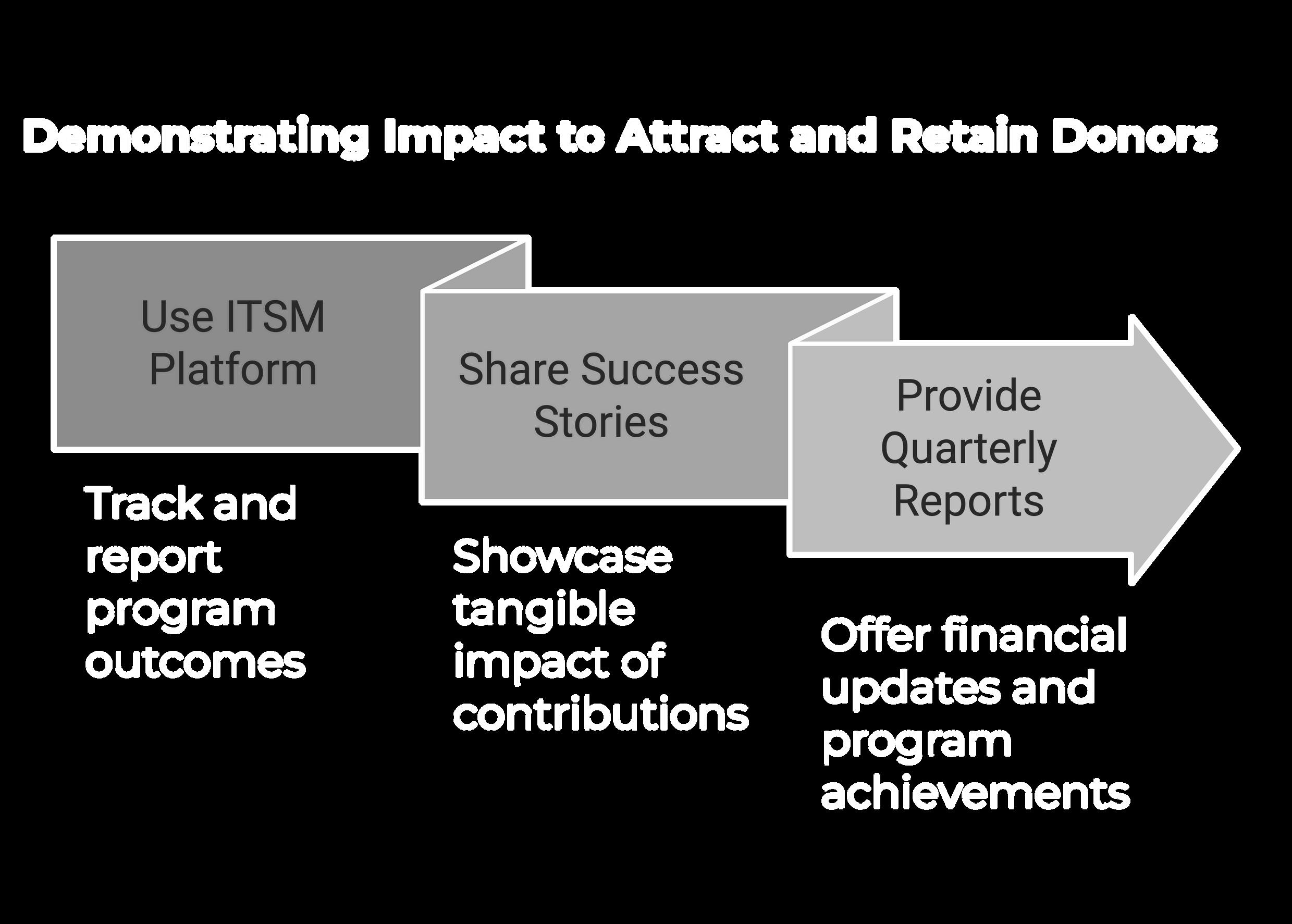

Launch a Learning Management System (LMS) to deliver gamified training, certifications, and financial literacy tools.

Empower military families and underserved communities to achieve rental housing stability, homeownership, and real estate investment.

Leverage its dual-purpose mission to attract donor funding, enhancing its ability to enact meaningful change.

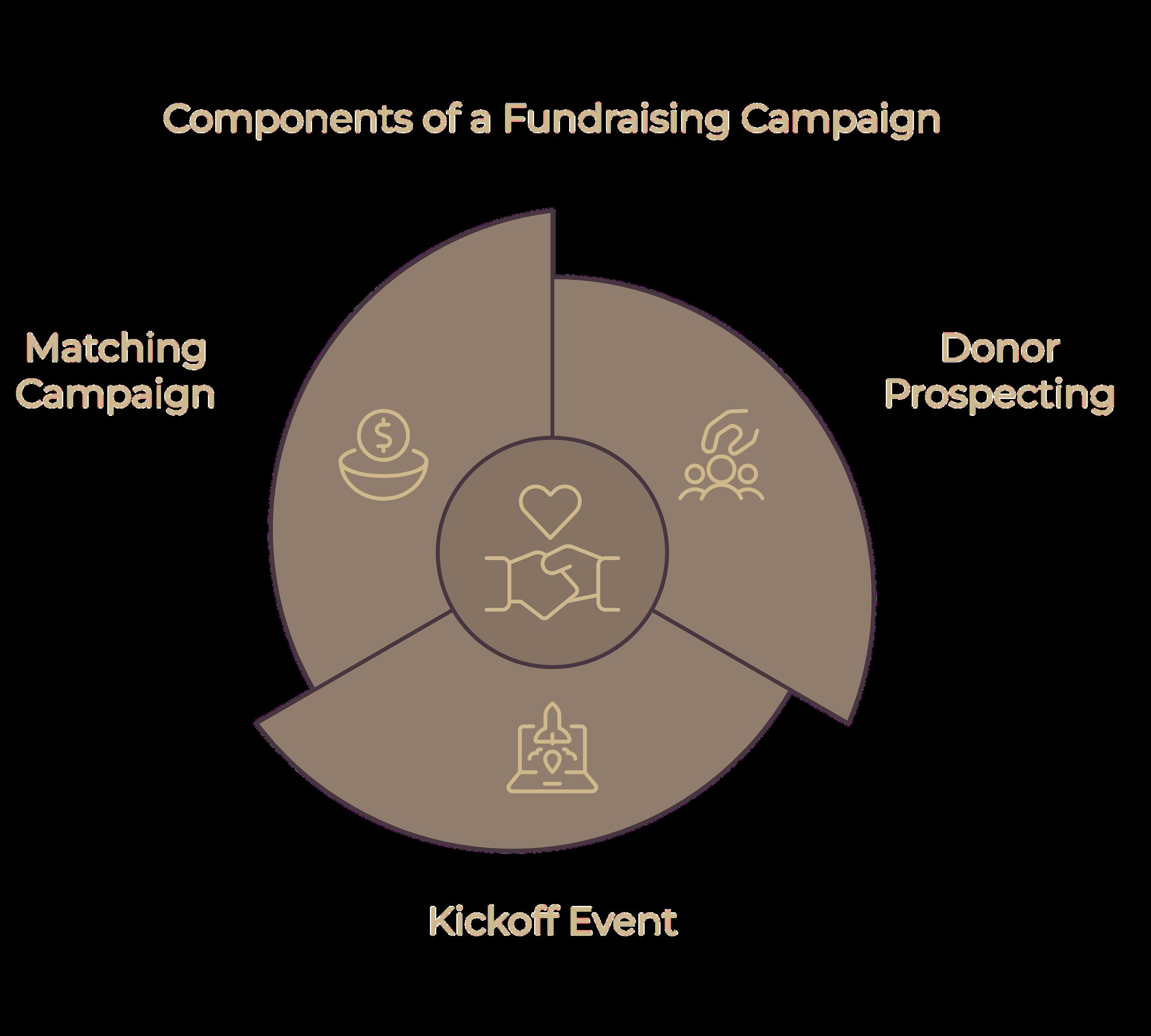

United Needs aims to secure $20 million in grants and donor contributions to fund educational programs, community outreach, and operational expansion This funding will also create a pipeline of financially empowered customers for the broader ecosystem.

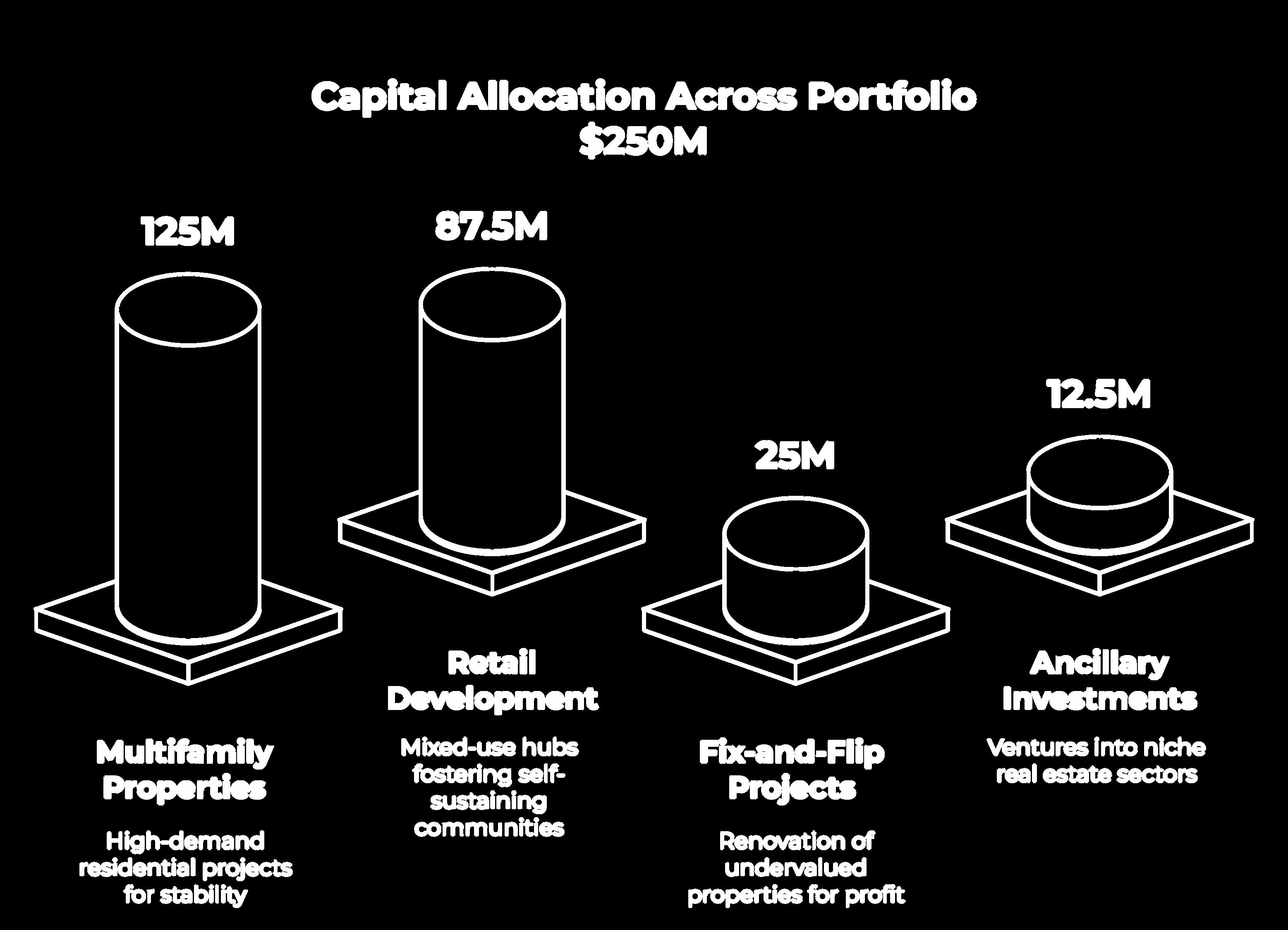

As the financial growth engine, BACF is designed to acquire and manage capital for large-scale real estate acquisitions and investments BACF underpins the operational success of BAF and United Needs, ensuring their strategic initiatives are fully funded and executed.

Raise and deploy capital to acquire high-value assets and fuel large-scale development projects such as the Liberty Project in Rapid City.

Build a diversified investment portfolio that supports BAF’s subsidiaries while delivering superior financial returns to investors.

Align financial strategies with the ecosystem’s broader mission of profitability and community impact.

BACF seeks to raise $100 million in private equity to fund acquisitions, support subsidiary growth, and drive mission-aligned investments that deliver measurable returns.

$100M

This vertically integrated ecosystem reduces risks commonly associated with standalone entities by fostering collaboration and mutual reinforcement: 1 2 3 4 5

Operating across multiple verticals real estate, property management, lending, insurance, education, and capital investments ensures stability and reduces reliance on any single sector.

BAF’s centralized governance and technology platforms minimize redundancies and enhance resource allocation, driving consistent performance across all entities.

BACF’s investments directly fund initiatives across BAF and United Needs, ensuring a steady flow of financial support and reducing uncertainties.

United Needs' focus on education and housing accessibility drives customer loyalty and enhances market penetration, creating long-term value for all stakeholders.

By leveraging shared resources and market insights, the ecosystem adapts quickly to emerging opportunities, ensuring agility and resilience in the face of challenges

The combined strength of BAF, United Needs, and BACF creates a transformative model that integrates financial success with social impact. Each entity plays a distinct but complementary role in driving growth and innovation:

BAF provides the operational infrastructure and leadership necessary to scale subsidiaries efficiently and effectively.

United Needs delivers education-first initiatives that empower underserved populations, creating a financially empowered customer base for the ecosystem.

BACF secures the capital required for acquisitions, large-scale development, and mission-aligned investments, fueling the ecosystem's growth.

The integration of BAF, BACF, and United Needs creates a unified approach to addressing inefficiencies in real estate and financial services while fostering economic growth and social responsibility.

BAF drives operational excellence, leveraging proprietary technology and centralized management to streamline processes across real estate, mortgage, insurance, and property management.

BACF capitalizes on BAF’s infrastructure to efficiently acquire and manage assets, delivering enhanced returns to investors while supporting the ecosystem’s operational goals.

United Needs bridges the gap between financial opportunity and community impact, ensuring underserved populations benefit from the ecosystem’s resources and initiatives.

This ecosystem achieves what few others can: delivering superior financial returns while addressing systemic challenges. Investments through BACF are not only profitable but also strategically targeted to address housing shortages and empower underserved populations. By integrating financial goals with mission-driven initiatives, BAF, United Needs, and BACF collectively set a new standard for scalable, sustainable, and impactful business operations.

Blair Allen Financial, Incorported (BAF)

Est. 2023

Pages 14-56

A family of companies designed to improve how people buy, sell, rent, and finance real estate all while safeguarding their most valuable assets, and educating them to continue their wealth building journey.

Blair Allen Financial, Inc. (BAF) is a pioneering, vertically integrated Delaware C-corp holding company headquartered in the United States

We are redefining the real estate and financial services industries by offering a unified ecosystem of luxury real estate, property management, mortgage lending, insurance, technology, and capital investment

BAF’s mission is to provide clients with an end-to-end service experience that integrates traditionally fragmented services into a cohesive, seamless journey Our model leverages cutting-edge technology, operational efficiency, and industry expertise to eliminate inefficiencies, improve client satisfaction, and unlock new revenue streams This consolidated structure allows BAF to elevate service quality and optimize financial performance across all business areas.

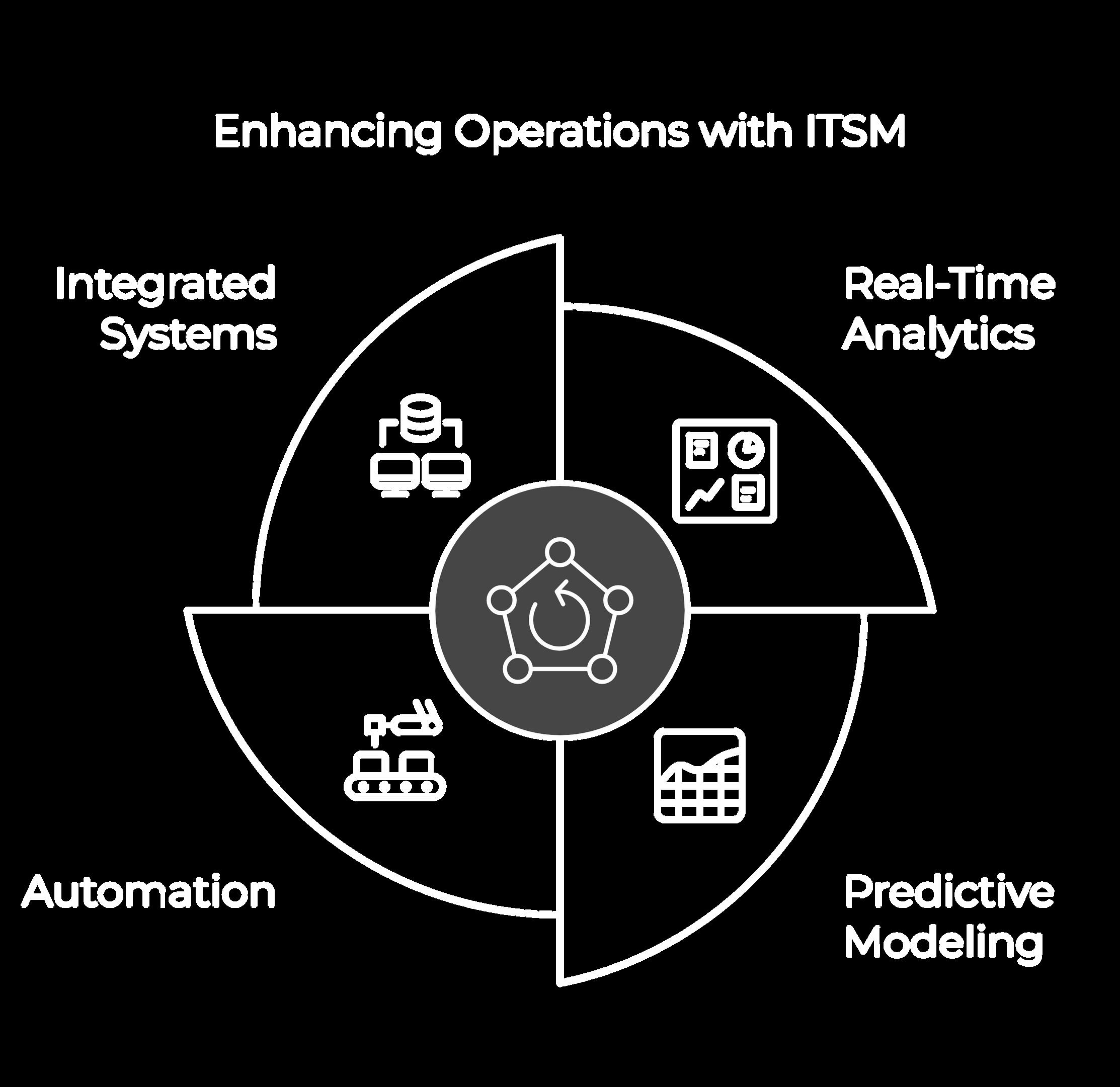

Our model is purpose-built for today’s market, which demands transparency, responsiveness, and personalization. Through Blair Allen ITSM, our proprietary technology platform, BAF ensures clients and team members benefit from hightouch service and data-driven insights at every stage, from property acquisition to asset management Our approach is not just about delivering services; it’s about creating a continuous, streamlined experience that anticipates client needs and fosters lasting relationships.

BAF is reshaping the real estate and financial services landscape by covering every phase of the client journey through six specialized subsidiaries: Blair Allen Luxury Real Estate (BALR), Blair Allen Property Management (BAPM), Blair Allen Mortgage (BAM), Blair Allen Insurance (BAI), Blair Allen Capital (BAC), and Blair Allen Technologies (BAT). Each subsidiary operates independently while contributing to BAF’s larger interconnected ecosystem, ensuring clients receive consistent, high-quality service across all interactions

From initial real estate transactions and property management to financial advisory, mortgage solutions, insurance products, and asset management, BAF’s integrated approach allows us to anticipate and meet client needs. Through our Blair Allen ITSM platform, each division has real-time access to the data, workflows, and client insights needed to enhance client interactions and streamline processes. This enables us to maximize client retention, increase cross-selling opportunities, and provide a level of service unmatched in traditionally fragmented models.

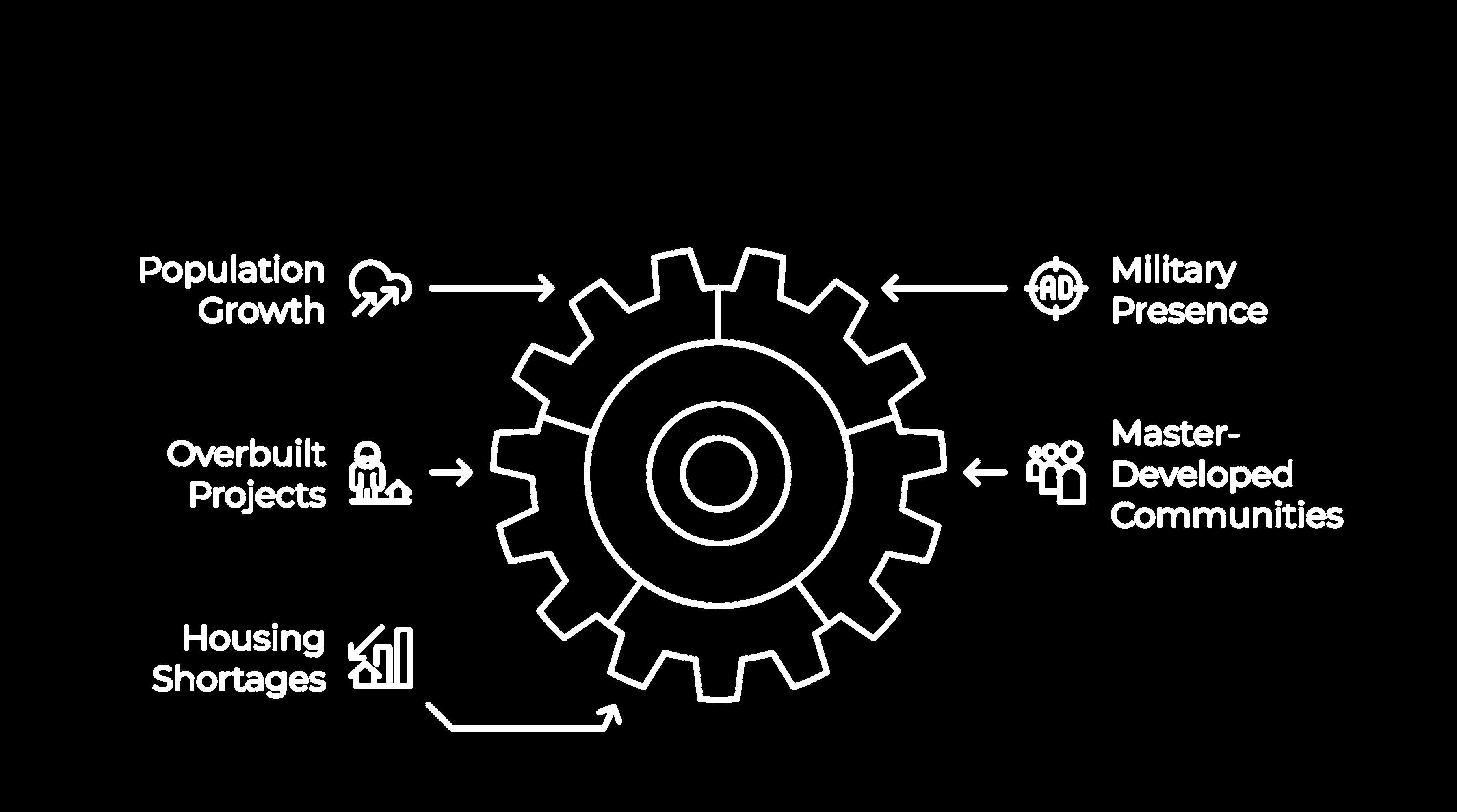

OB L E M

The real estate, mortgage, insurance, and property management industries face critical inefficiencies and fragmentation that impact both customers and the professionals who serve them. Disconnected service providers, reliance on outdated systems, and a lack of integration result in prolonged transaction timelines, rising costs, and inconsistent service quality. These challenges disproportionately affect underserved markets, particularly rural and secondary regions, where the need for seamless, high-quality services is greatest.

Lack of Transparency:

Working with multiple providers for real estate, mortgage, insurance, and property management often leads to miscommunication, delays, and errors Legacy systems make it difficult to track the status of transactions, leaving clients frustrated and uninformed.

Rising Costs:

Inefficiencies in the process inflate costs for buyers, sellers, and renters

Limited Access:

In rural and secondary markets, customers face a scarcity of comprehensive, high-quality services tailored to their needs, despite growing demand.

Fragmented processes make cross-department collaboration cumbersome, leading to inefficiencies and delays

Reliance on legacy technologies reduces productivity, creates bottlenecks, and limits datadriven decision-making The lack of integrated systems and professional support contributes to burnout and high employee attrition rates

Limited integration across service lines reduces cross-sell potential and revenue generation

$4.2 trillion annually

Despite these challenges, demand for real estate and related services continues to grow. The U.S. real estate market is valued at $4.2 trillion annually (NAR, 2023), with mortgage originations reaching $2.6 trillion in 2023 (MBA, 2023). Highgrowth secondary markets such as Arizona, Texas, and Montana are experiencing 20% year-over-year increases in housing demand and a 15% rise in median home prices. However, legacy providers often overlook these regions, leaving significant gaps in service availability.

This environment highlights the urgent need for an integrated, technology-driven solution that addresses inefficiencies, empowers team members, and delivers exceptional customer experiences. BAF’s vertically integrated model and proprietary technology directly solve these pain points by uniting real estate, mortgage, insurance, and property management services under one cohesive ecosystem, transforming the way customers and team members experience these industries.

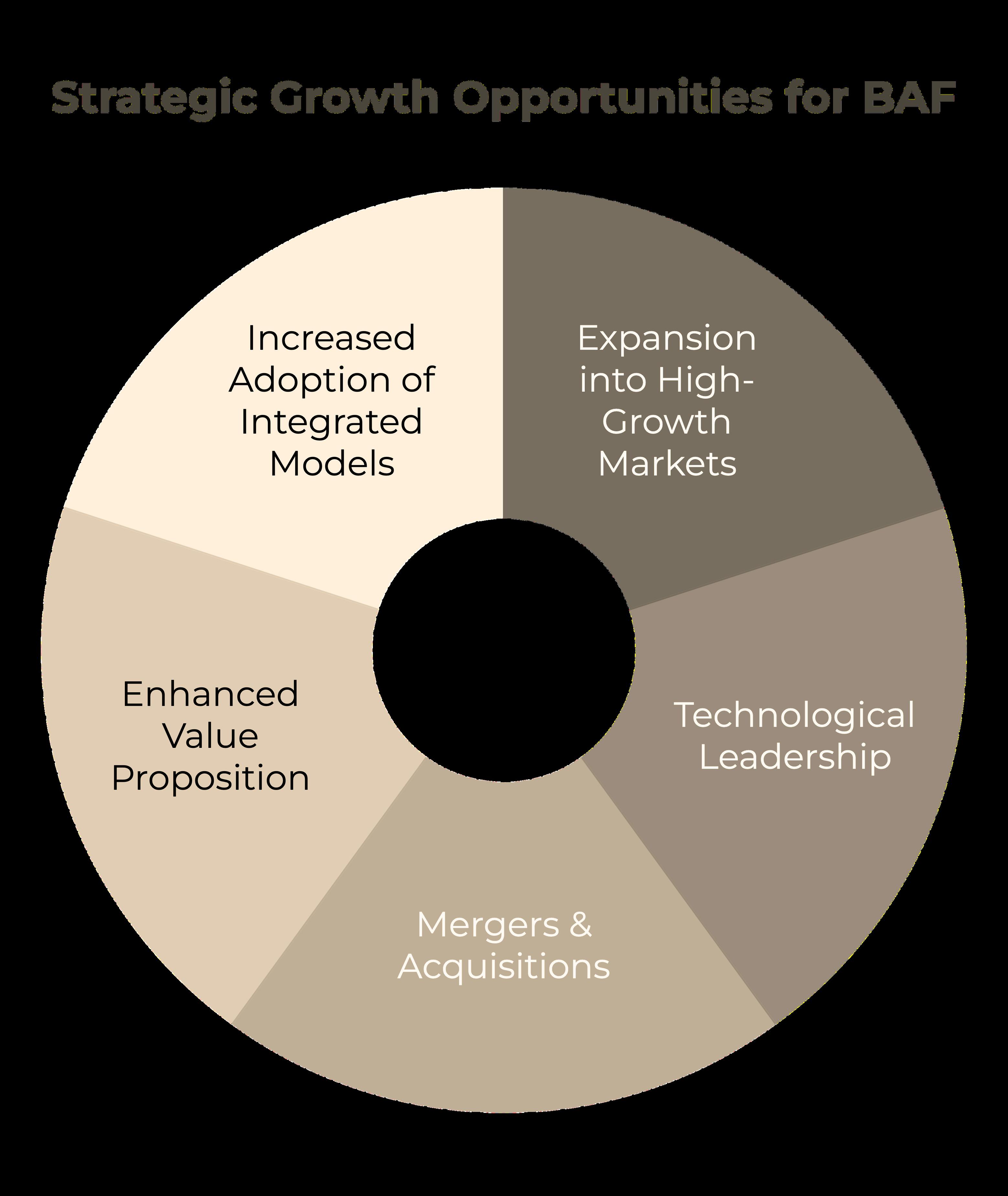

BAF stands at the intersection of several high-growth sectors, each offering significant opportunities for disruption. Leveraging its vertically integrated model, innovative technology, and focus on secondary and underserved markets, BAF is uniquely positioned to capitalize on unmet demand and rising market trends across real estate, mortgage, insurance, property management, and investment.

$4.2 trillion annually

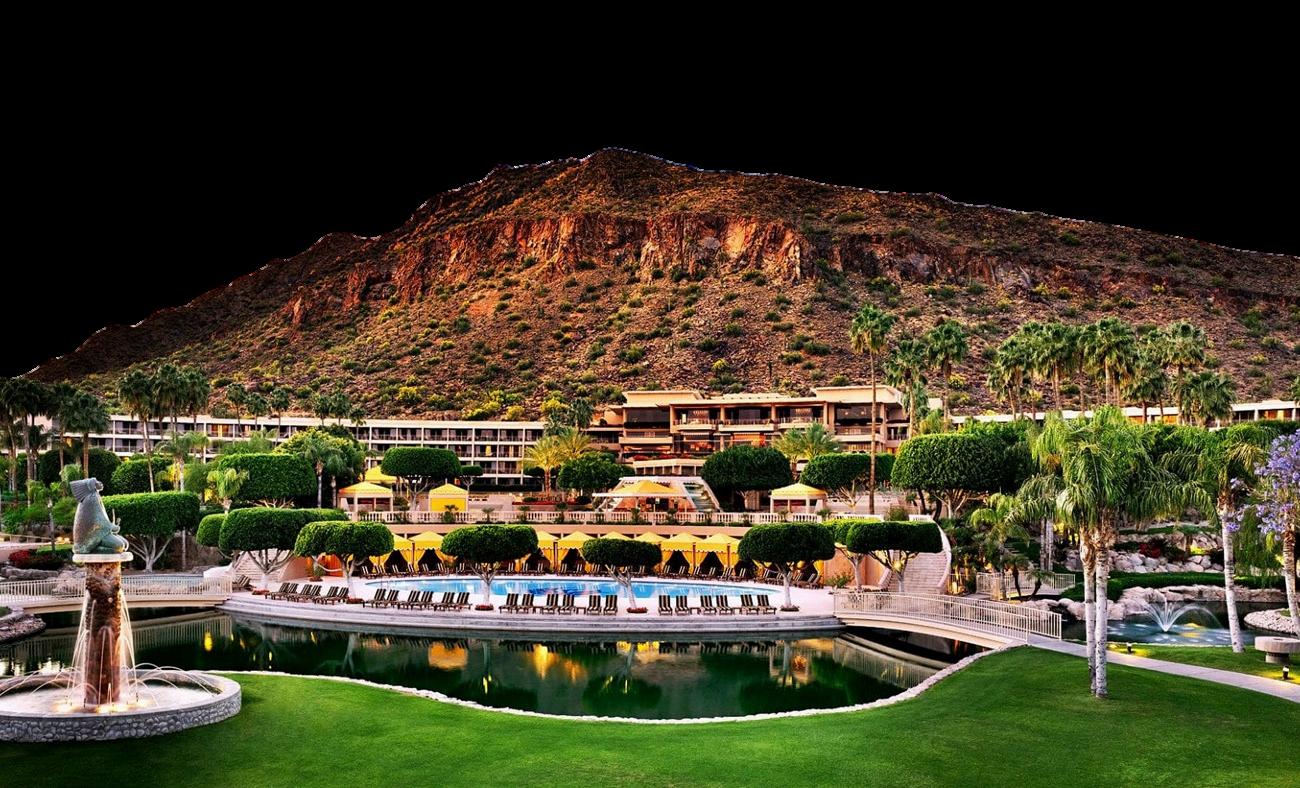

The U S real estate market, valued at $4 2 trillion annually (NAR, 2023), continues to expand, driven by population growth exceeding 5% annually in secondary markets such as Arizona, Texas, and Montana. These regions are experiencing 20% year-over-year increases in housing demand and a 15% rise in median home prices, creating opportunities in both affordable and luxury housing segments. Blair Allen Luxury Real Estate (BALR) is strategically positioned to meet this demand by offering premium real estate services in these high-growth areas.

The property management market is projected to grow at a CAGR of 8.3%, fueled by increasing demand for professional management of residential and multifamily properties (IBISWorld, 2023). Blair Allen Property Management (BAPM) capitalizes on this growth by providing comprehensive services, including tenant placement, maintenance, and optional tenant insurance. BAPM’s approach enhances tenant satisfaction, reduces vacancies, and generates recurring revenue, particularly in secondary markets with rising rental demand.

With $2.6 trillion in annual originations (MBA, 2023), the mortgage sector presents a significant opportunity, particularly in middle-income and rural markets underserved by traditional lenders. Blair Allen Mortgage (BAM), operating in 42 states, addresses this gap by providing personalized lending solutions. Innovative financing structures, such as ownerfinanced options and flexible loan products, further enhance BAM’s ability to serve diverse client needs and drive growth.

$1.4 trillion annually (premiums)

Generating $1.4 trillion annually in premiums (NAIC, 2023), the insurance industry offers significant integration opportunities with real estate and mortgage transactions Research shows that 75% of homebuyers prefer bundled services that simplify transactions (Zillow, 2023). Blair Allen Insurance (BAI) meets this demand with tailored insurance products integrated directly into real estate and mortgage offerings, driving convenience, customer retention, and recurring revenue

Valued at $24.3 billion globally, the PropTech sector is growing at a CAGR of 9.2% (PwC, 2023), emphasizing the critical role of technology in optimizing operations and enhancing customer experiences. The Blair Allen ITSM platform empowers BAF to lead this space, offering advanced analytics, automated workflows, and compliance tools that improve efficiency across all subsidiaries while providing actionable insights for decision-making.

Blair Allen Capital (BAC) targets the high-margin wholesale and fix-and-flip real estate markets, valued at over $60 billion annually in transaction volume (ATTOM, 2023). Activity in the fix-and-flip segment increased by 30% in 2023, with secondary markets experiencing even higher growth.

$60 Billion annually

BAC focuses on acquiring undervalued properties, implementing strategic enhancements, and achieving rapid turnarounds with 65% average margins. This agile approach generates consistent short-term profits and strengthens BAF’s overall portfolio performance

By focusing on these sectors, BAF is uniquely positioned to deliver comprehensive, efficient, and innovative solutions. The company’s vertically integrated ecosystem allows it to capture value at every stage of the client journey, from initial property transactions to ongoing management and service delivery. This holistic approach aligns with rising market demand, creating significant growth opportunities and establishing BAF as a leader in real estate and financial services.

BAF’s vertically integrated ecosystem is designed to deliver comprehensive, end-to-end solutions across real estate, mortgage, insurance, property management, technology, and capital investment. This unique structure, supported by United Needs (not for profit arm of BAF) and the Blair Allen Capital Fund (BACF), ensures seamless operations, maximized efficiency, and exceptional value for customers and investors. Together, these entities form a cohesive network that drives innovation, operational excellence, and sustainable growth.

Blair Allen Luxury Real Estate (BALR):

Focused on high-value real estate transactions, BALR delivers luxury service quality in underserved markets, providing top-tier solutions for high-networth clients

Blair Allen Property Management (BAPM):

Offers property management services for residential, commercial, and multifamily properties, enhancing tenant satisfaction, reducing vacancies, and improving asset value

Blair Allen Mortgage (BAM):

Operating in 42 states, BAM partners with a network of over 120 investors to offer personalized mortgage solutions, ensuring clients secure financing aligned with their goals.

Blair Allen Insurance (BAI):

Integrates comprehensive insurance products into real estate and mortgage transactions, creating a seamless client experience while protecting assets and investments.

Is building their proprietary Blair Allen IT Service Management (ITSM) platform that will deliver advanced analytics, automation, compliance management, and operational efficiency across all subsidiaries.

Focuses on value-add real estate investments, achieving a 65% average margin on short-term projects by identifying, acquiring, and transforming underperforming assets.

Operating as a separate entity, United Needs collaborates with the BAF family of companies to drive social impact initiatives, including workforce housing, military housing, and community development projects. By aligning its mission with BAF’s strategic goals, United Needs ensures that every development reflects a commitment to sustainability and social equity, enhancing the overall value proposition for investors and communities.

BACF serves as the private equity arm supporting BAC and its value-add real estate projects BACF strategically transforms "B-Class" properties into premium "A-Class" assets, focusing on long-term investments with an IRR of 15–17% BACF leverages investor capital to finance development initiatives while maintaining operational synergy with BAF subsidiaries to create highvalue, market-leading properties.

This cohesive ecosystem eliminates fragmentation, reduces inefficiencies, and enhances operational synergy. By uniting BAF’s subsidiaries with the strategic efforts of United Needs and BACF, the family of companies ensures that every client touchpoint is optimized, every investment is maximized, and every project reflects the innovation and quality that define Blair Allen Financial Together, this integrated network delivers exceptional value to customers, investors, and communities

BAF delivers a transformative solution to the inefficiencies of the real estate and financial services industries through a vertically integrated, data-driven model. By uniting technology, talent, and strategy under a cohesive IT Service Management (ITSM) framework, BAF and its family of companies provide seamless end-to-end services that maximize client value, optimize revenue generation, and ensure consistent service excellence.

At the core of BAF’s operations is a fully integrated approach that streamlines real estate, mortgage, insurance, property management, and capital investment services. This comprehensive structure minimizes handoff delays, optimizes cross-sell opportunities, and delivers an unparalleled client experience. By eliminating fragmentation, BAF maximizes the lifetime value of each client, driving service revenue from transactions across all subsidiaries. This approach ensures operational efficiency and positions BAF as a market leader.

The Blair Allen ITSM platform is the technological engine behind BAF’s success. This proprietary system integrates marketing management, lead management, communications management, document management, transaction management, financial management, training management, and business intelligence (BI) management into a single, scalable platform The result is enhanced operational efficiency, real-time insights, and improved responsiveness to client needs. By reducing transaction times by 25% and improving valuation accuracy by 18%, Blair Allen ITSM empowers BAF to deliver exceptional service at every client touchpoint while capturing maximum transactional and service revenue.

BAF’s commitment to long-term success is supported by its Three-Tiered Framework of Technology, Training, and Financial Empowerment. Employees are equipped with cutting-edge tools, receive ongoing professional development through Blair Allen University (BAU), and are incentivized through innovative compensation and equity models. This approach attracts top talent, aligns employee goals with company growth, and fosters a highperformance culture that drives operational excellence across the family of companies.

BAF’s family of six subsidiaries Blair Allen Luxury Real Estate (BALR), Blair Allen Property Management (BAPM), Blair Allen Mortgage (BAM), Blair Allen Insurance (BAI), Blair Allen Technologies (BAT), and Blair Allen Capital (BAC) work together to deliver comprehensive solutions Led by experienced industry leaders with over 150 years of collective expertise, each subsidiary is designed to capture service revenue at every stage of a transaction, from real estate sales and mortgage origination to property management and insurance policies. This integrated model ensures that all revenue opportunities are maximized, creating a sustainable ecosystem of growth.

BAF strategically targets high-growth rural and suburban markets, addressing demand in underserved areas often overlooked by larger urban-centric firms. These markets, including Arizona, Texas, and Montana, are experiencing significant population and housing demand growth, with 20% year-overyear increases in housing needs. By delivering luxury-quality services to clients in these emerging markets, BAF not only meets growing demand but also secures its position as a trusted provider and innovative leader. With its vertically integrated model,

cutting-edge technology, proven leadership, and strategic market focus, BAF’s solution ensures sustained growth, consistent revenue generation, and exceptional client satisfaction across its family of companies. This comprehensive approach revolutionizes the real estate and financial services industries, driving long-term value for clients, employees, and investors alike.

T H E L E A D E R S H I P T E A M

BAF’s leadership team combines over 150 years of collective experience across real estate, finance, mortgage lending, insurance, technology, and investment management.

150+ YEARS

Jason Blair, Founder and CEO, drives innovation with over 25 years of experience and a proven track record building and managing technology and financial services teams

Gary Lorenz, COO, has managed a $33 billion loan portfolio and successfully exited a $350 million startup.

Angie Ison, CFO, has executed high-stakes M&A activities and managed $150 million real estate portfolios.

Alex Nahai, CLO and President of BACF, oversees compliance and fund operations.

Meredith Weber, President of BAU, leads workforce and client training programs

Zachery Blair, President of BAM, expanded mortgage operations to 42 states.

Michael Monteleone, President of BAI, scaled an insurance agency to serve 3,500 clients.

Monty Miller, CTO, developed the Blair Allen ITSM platform.

Josiah LaFrance, President of BAC, manages high-value property transformations, completing 200+ transactions annually.

Advisors John Weber (Ret. Full Bird Colonel) and Paul Stroud (Ret. SMSgt) provide expertise in military services development and social impact initiatives. This powerhouse team ensures scalability, innovation, and operational excellence.

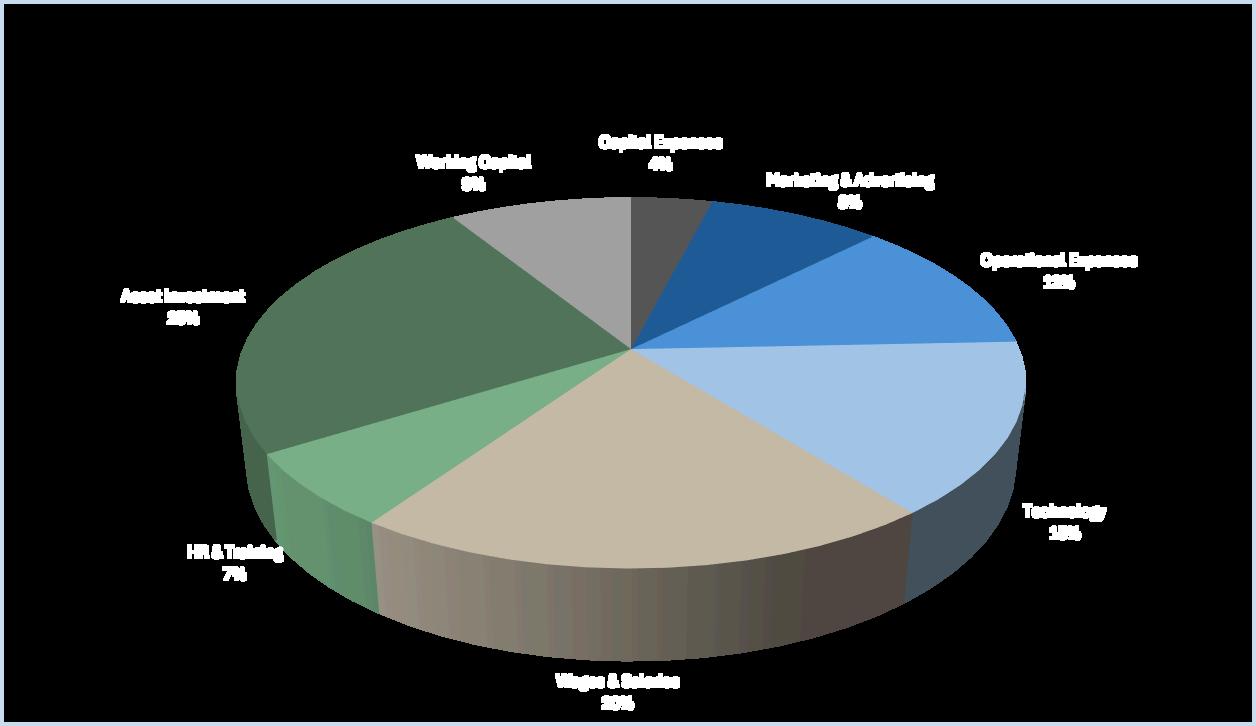

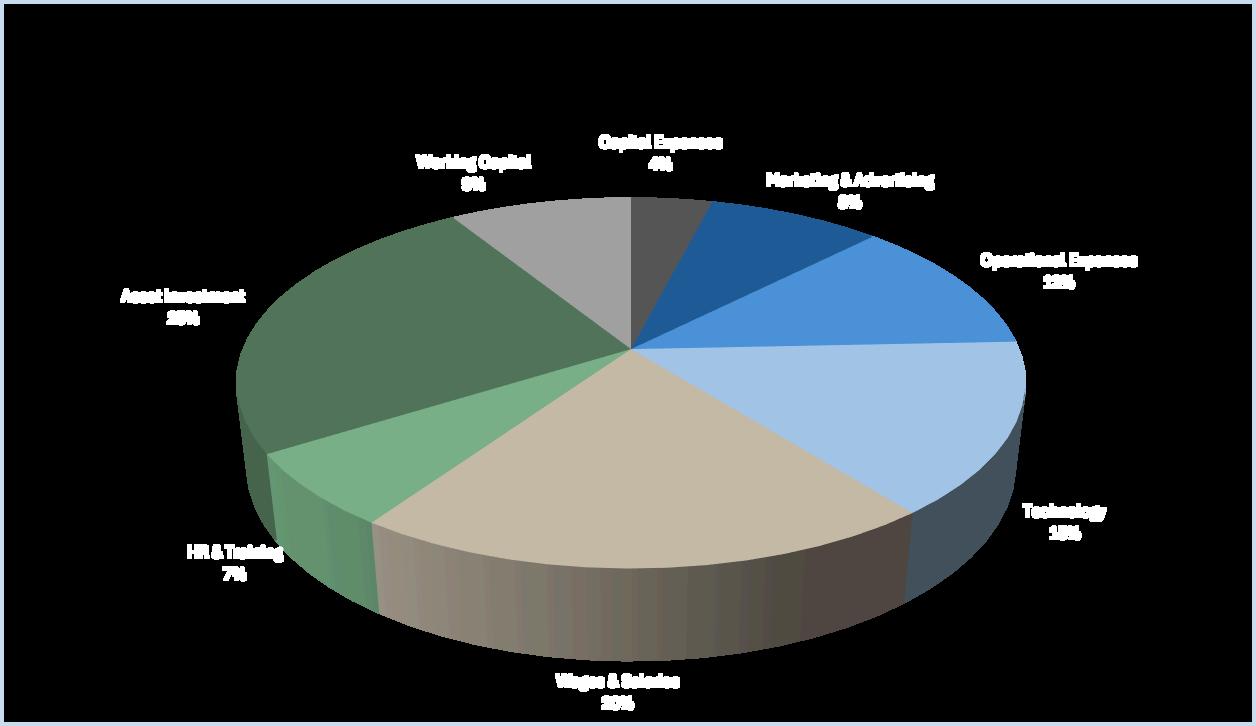

BAF’s integrated business model eliminates inefficiencies and creates diversified revenue streams:

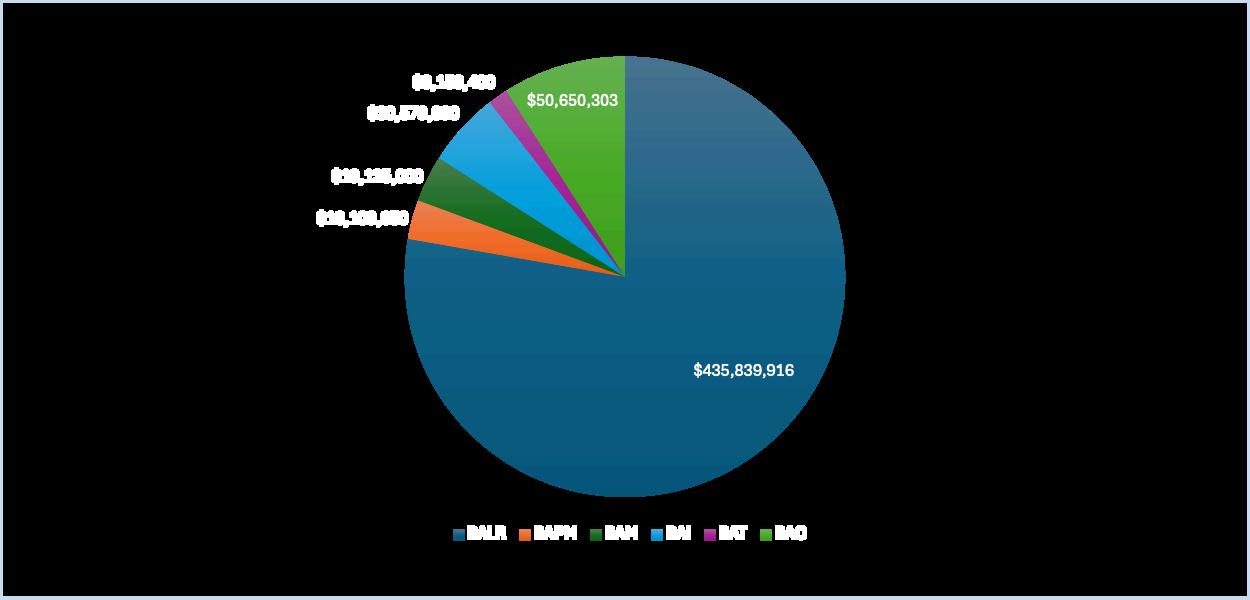

PERCENTAGE OF REVENUE BREAKDOWN:

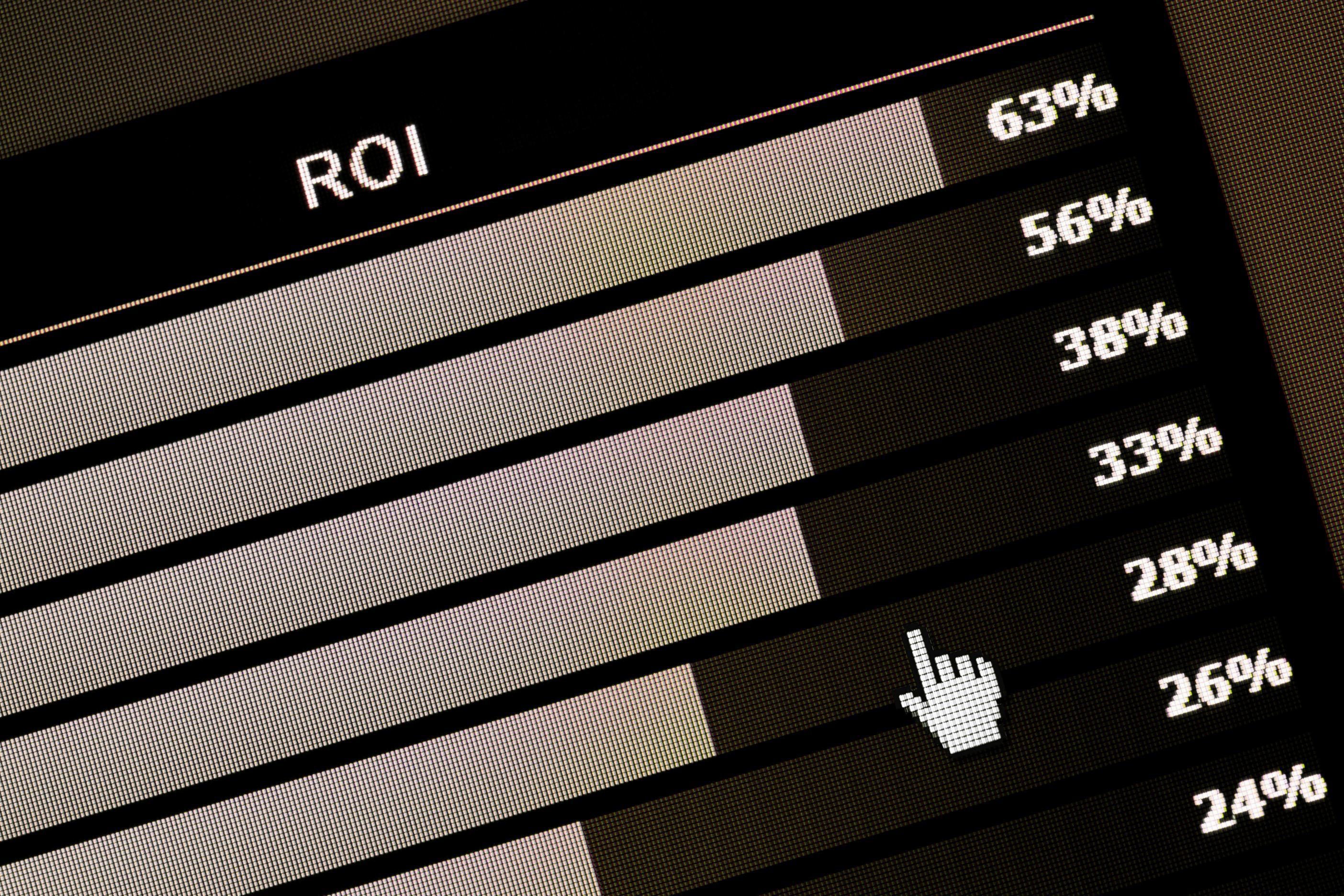

BAC achieves 50-80% margins on short-term property transformations, while BACF delivers a 15-20% IRR over 7–10 years. This model ensures consistent revenue and scalability across economic cycles.

BAF’s go-to-market strategy leverages its integrated ecosystem, technology, and market expertise to capture underserved opportunities effectively:

1 2 3 4 5

Target Secondary Markets:

Focus on high-growth regions such as Arizona, Texas, and Montana, where demand for affordable and improved housing is high.

Leverage Technology:

Deploy the Blair Allen ITSM platform to streamline transactions, enhance decision-making, and reduce operational inefficiencies

Channel Partnerships:

Build strong relationships with brokers, agents, and local service providers to ensure seamless operations and increased market penetration.

Customer-Centric Approach:

Provide bundled solutions combining real estate, mortgage, and insurance services to create a one-stop-shop experience for clients

Brand Awareness:

Invest in digital marketing, public relations, and localized campaigns to strengthen brand recognition and attract clients and investors

Blair Allen Financial differentiates itself from competitors through its unique integrated model and technology-driven approach.

Competitors like RE/MAX and Keller Williams focus primarily on real estate transactions without integration with mortgage or insurance services BAF’s bundled offerings eliminate this fragmentation.

Platforms like Zillow and Redfin emphasize PropTech but lack the operational infrastructure to deliver end-to-end solutions. BAF combines PropTech with operational execution

Mortgage providers and insurance agencies operate in silos, often disconnected from real estate processes BAF integrates these services, enhancing customer convenience and satisfaction.

By combining its integrated ecosystem with the Blair Allen ITSM platform, BAF provides superior operational efficiency, a seamless client experience, and significant cost savings, positioning itself as a leader in the real estate and financial services sectors.

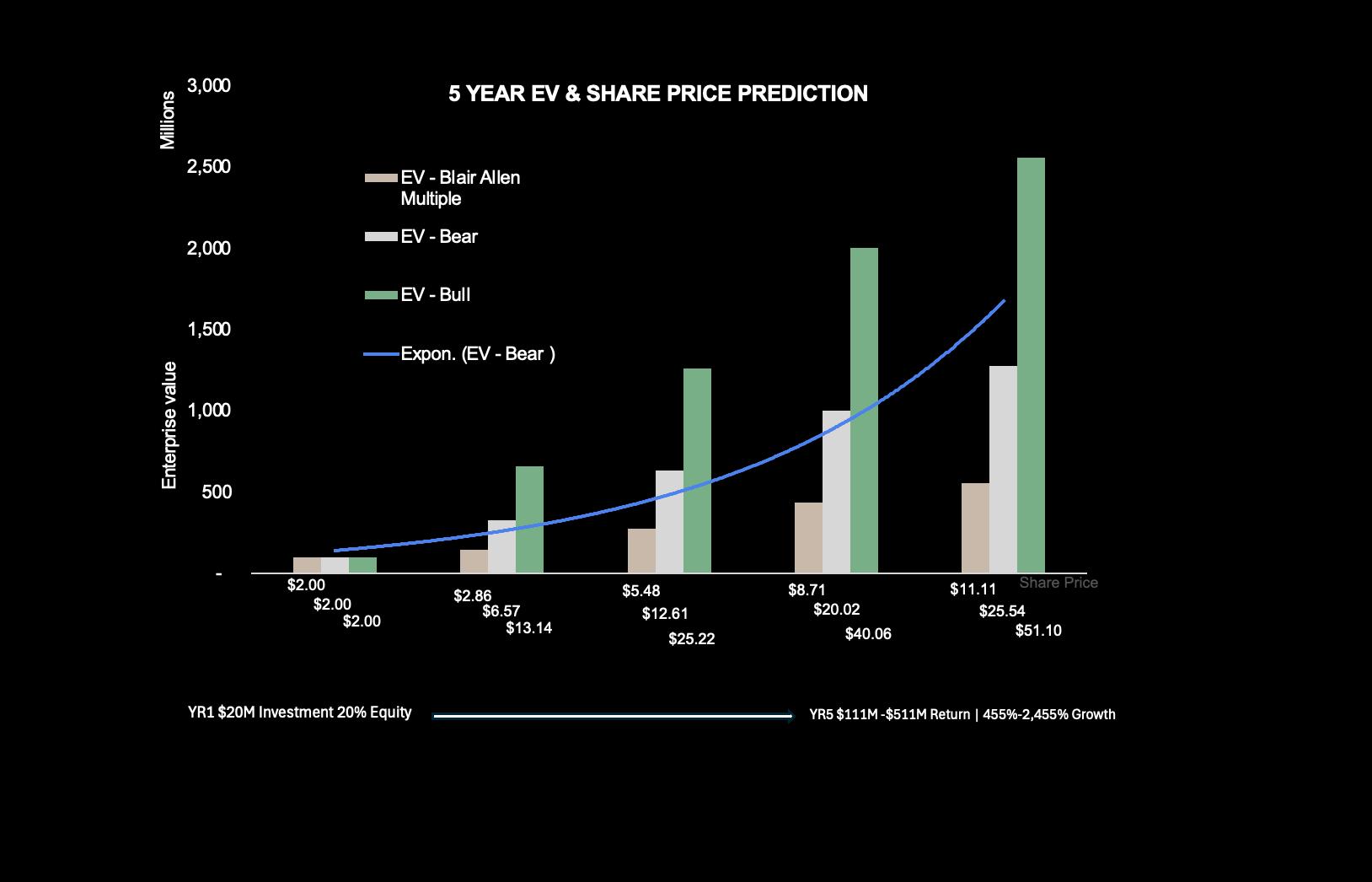

Blair Allen Financial, Inc. (BAF), is a Delaware C Corporation, is seeking $20 million in capital to fuel growth, enhance proprietary technology, and scale its operations. Investors will receive 20% equity in BAF through common stock or have the option of a structured debt investment. BAF owns 100% of its six subsidiaries Blair Allen Luxury Real Estate (BALR), Blair Allen Property Management (BAPM), Blair Allen Mortgage (BAM), Blair Allen Insurance (BAI), Blair Allen Technologies (BAT), and Blair Allen Capital (BAC) all contributing to a robust, diversified business model poised for significant growth.

$20M

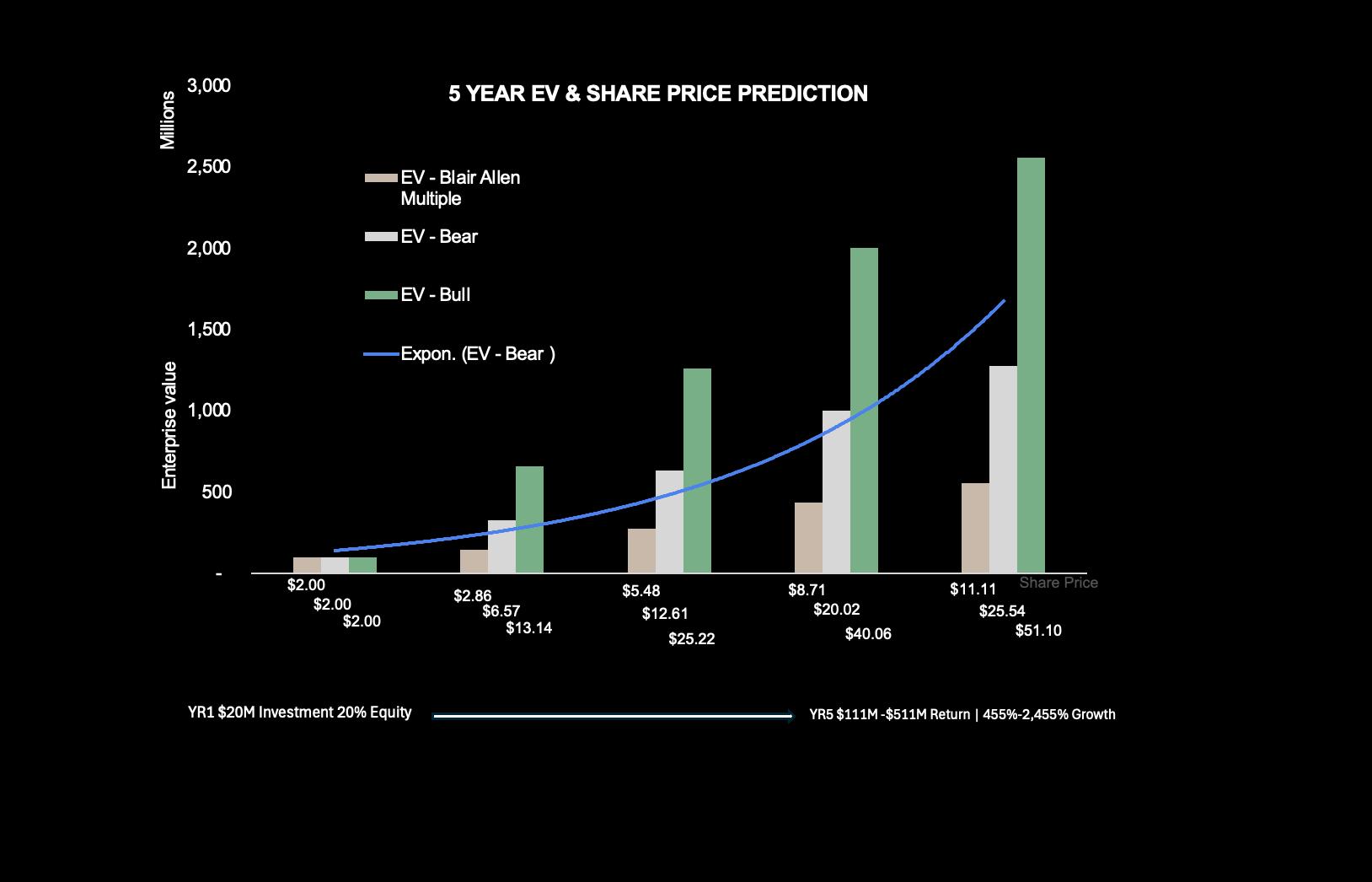

As the Chief Financial Officer (CFO) on behalf of Blair Allen Financial (BAF) I am pleased to present an exclusive and extraordinary investment opportunity designed to generate substantial returns while supporting the company’s strategic growth objectives. This offer provides investors with an opportunity to invest in an array of real estate and financial services investments, each supported through vertical integration, and underpinned by proprietary AI technology. The unique framework that has been developed, mitigates risk, generates high sustainable profit margins and provides provisions for liquidity through strategic exit strategies, within five years

Having participated in various international start-ups, M&A’s, listings and held executive positions across various industries, including multi-billion-dollar enterprises, I possess the knowledge and expertise to analyse and undertake the required due diligence to validate this exceptional investment opportunity. I am extremely confident and privileged as the CFO to present and endorse this investment Critical to and a key aspect to the business model is the ability to mitigate risk, whilst scaling in a rapidly growing and competitive market, achieved through innovative technology and diverse revenue streams

Investment Amount: $20 million

Equity Stake / Debt Terms: 20% equity

Use of Funds: Expansion, Technology, Acquisitions, Working Capital

High Potential IRR: 70%+/-

Scalability: Robust business model, leveraging technology, acquisitions and industry expertise, along with our economic ability to eliminate barriers to entry into the market

Strong Market Position: Existing market traction with a proven competitive advantage against peers and new entrants to the market

Strategic Exit Opportunities: Acquisition, IPO, Private Equity

Additional Investment Opportunities: Additionally, investors have the opportunity to participate in two distinct investment vehicles, incorporating a lucrative investment fund and the rare opportunity to align with one of the most innovative corporate social responsibility projects in the United States today:

Blair Allen Capital Fund (BACF) – $100M REIT Investment: BACF is a separate $100 million real estate investment trust (REIT) designed to create long-term asset wealth through strategic acquisitions, development, and management of real estate assets in the United States This institutional-grade investment opportunity is backed by the infrastructure, expertise, and financial strength of Blair Allen Financial, ensuring a high-yield, risk-adjusted return for investors

United Needs – $20M Social Impact Fund: United Needs is seeking $20 million in grants and donor funds to support its mission-driven initiatives focused on economic development, housing accessibility, and financial inclusion Investors in United Needs are not only supporting meaningful social change but also participating in a resultsdriven model that quantifies and measures impact at scale.

Next Steps & Closing: I invite you to further discuss this investment opportunity by perusing our detailed financial plan and complete business plan.

I look forward to your consideration and at the prospect of a value-driven successful partnership.

Sincerely,

Ison

Angie Ison Chief Financial Officer | Blair Allen Financial

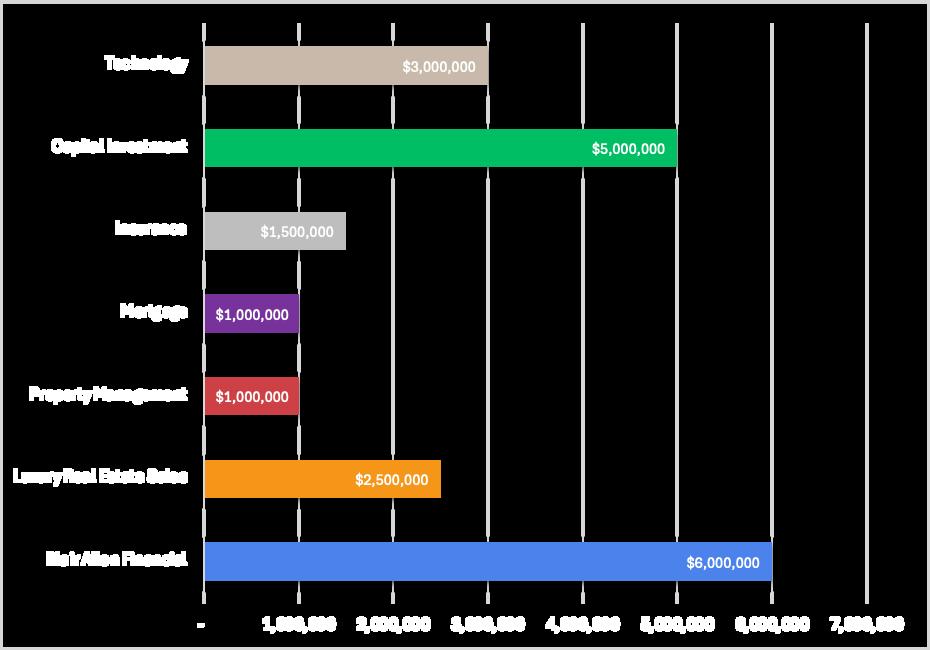

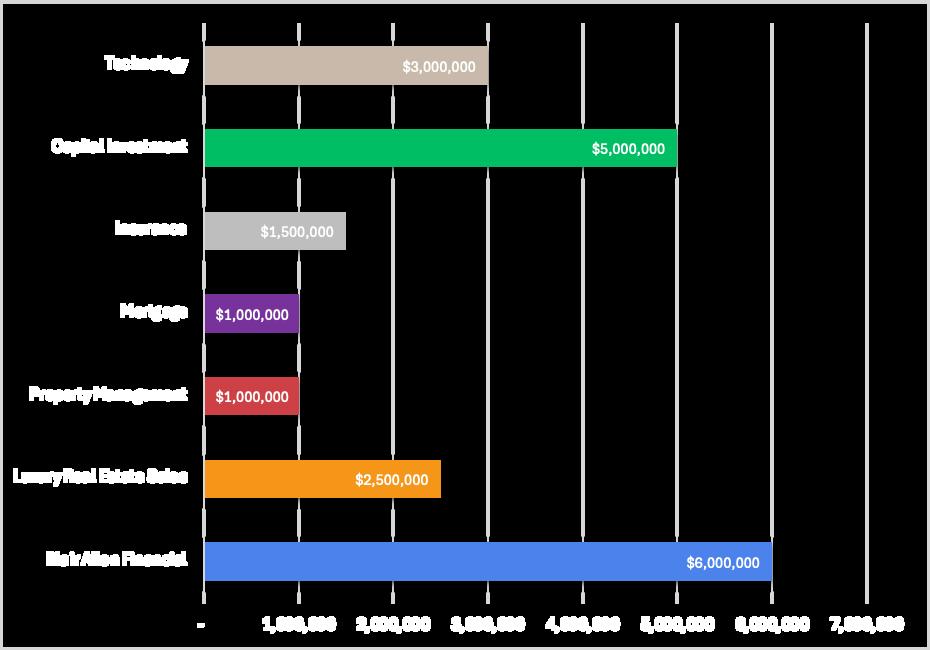

The $20 million capital raise will be strategically allocated to ensure operational efficiency, technological advancement, and market expansion:

Management: Strengthening leadership and strategic oversight across all subsidiaries

Recruiting: Hiring top-tier talent to support operations in real estate, mortgage, insurance, and property management.

Blair Allen University (BAU): Expanding employee training programs focused on compliance, negotiation, customer relationship management, and leadership development.

Marketing: Increasing brand awareness and client acquisition through targeted campaigns, digital outreach, and public relations.

Financial and HR Services: Streamlining operations to support scalability and ensure alignment with growth objectives.

Blair Allen ITSM Platform: Expanding capabilities over 24 months, including AI-driven analytics, real-time market insights, and compliance automation to improve efficiency across all subsidiaries

SaaS Development: Enhancing the platform for external licensing opportunities, creating additional revenue streams.

Market Expansion: Scaling operations in high-growth secondary markets like Arizona, Texas, and Montana

Service Enhancements: Investing in tools, infrastructure, and resources to optimize service delivery across real estate, mortgage, property management, and insurance.

Initial Acquisitions: Funding the acquisition and improvement of wholesale or fix-and-flip properties.

Debt Service: Supporting short-term debt obligations to maximize liquidity and project turnaround.

Value Creation: Targeting properties in high-demand markets with strong ROI potential.

Investors can participate in this high-growth opportunity through:

Equity Investment:

20% ownership in BAF common stock, aligning with the company’s projected >$200million in annual revenue by year ending five (EOY5) and anticipated equity appreciation.

Debt Investment:

A structured option with competitive terms for investors seeking fixed returns.

1,500,000

5,000,000

3,000,000

BAF anticipates exceptional returns across its integrated family of companies, leveraging short-term profits, long-term appreciation, and consistent revenue streams to maximize value for investors By uniting real estate, mortgage, insurance, property management, technology, and capital investment under one cohesive framework, BAF offers a diversified portfolio of opportunities with compelling financial outcomes

BAF drives strong financial performance through its diversified family of companies, each contributing to the company ’ s projected revenue and growth

Focused on underserved luxury markets, BALR delivers higher commissions by offering premium services and exceptional client experiences This division contributes 78% of BAF’s projected revenue, driven by high-value transactions in high-growth regions.

BAPM generates recurring revenue through management fees, tenant insurance, and maintenance services for residential and multifamily properties. With a focus on optimizing tenant satisfaction and asset value, BAPM delivers 5–7% annual returns on managed properties and contributes 3% of BAF’s projected revenue.

Operating in 42 states with a network of over 125 top mortgage investor partners, BAM ensures competitive rates and tailored lending solutions This division contributes 3% of BAF’s projected revenue, bolstered by its ability to secure financing for diverse client needs in underserved markets.

With operations in 23 states and partnerships with 30 top national carriers, BAI integrates insurance solutions directly into real estate and mortgage transactions. This seamless integration drives client satisfaction and recurring revenue, contributing 7% of BAF’s projected revenue

Specializing in short-term real estate investments, BAC focuses on acquiring undervalued properties, enhancing them, and selling within 12–36 months. With 14% margins per transaction, BAC contributes 8% of BAF’s projected revenue, showcasing its agility and profitability in the real estate investment market

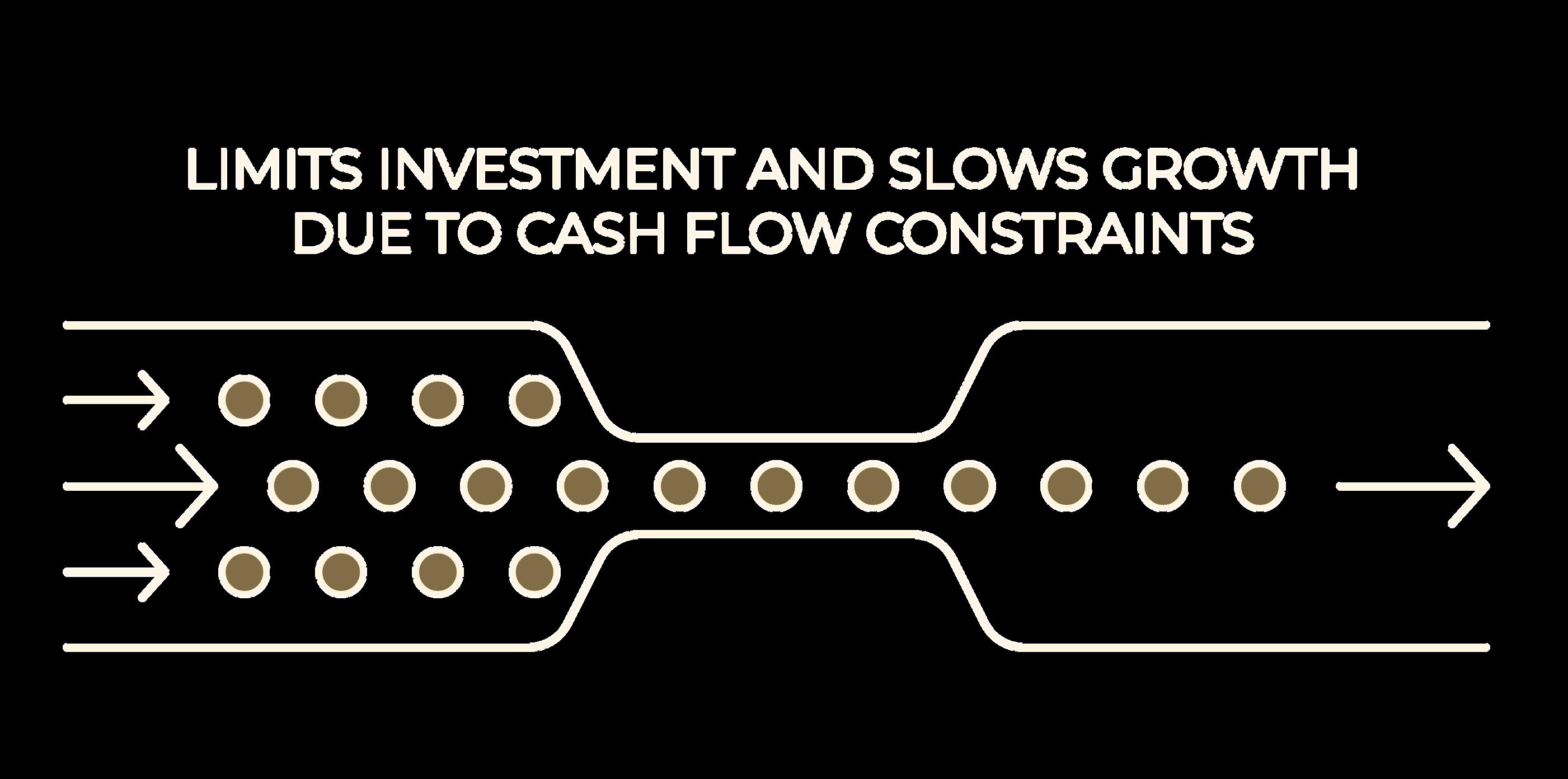

This diversified revenue model ensures a balanced blend of short-term gains and long-term value creation, aligning with BAF's strategic goals and delivering strong, sustainable returns for stakeholders. By integrating multiple income streams across real estate, mortgage lending, insurance, and technology, BAF mitigates risk while maximizing growth potential Investors benefit from stable cash flow, asset appreciation, and scalable opportunities, all supported by a data-driven approach to market trends, risk management, and capital allocation. This holistic strategy not only enhances portfolio resilience but also positions BAF as a leader in real estate-backed financial innovation, ensuring consistent value creation and long-term wealth accumulation.

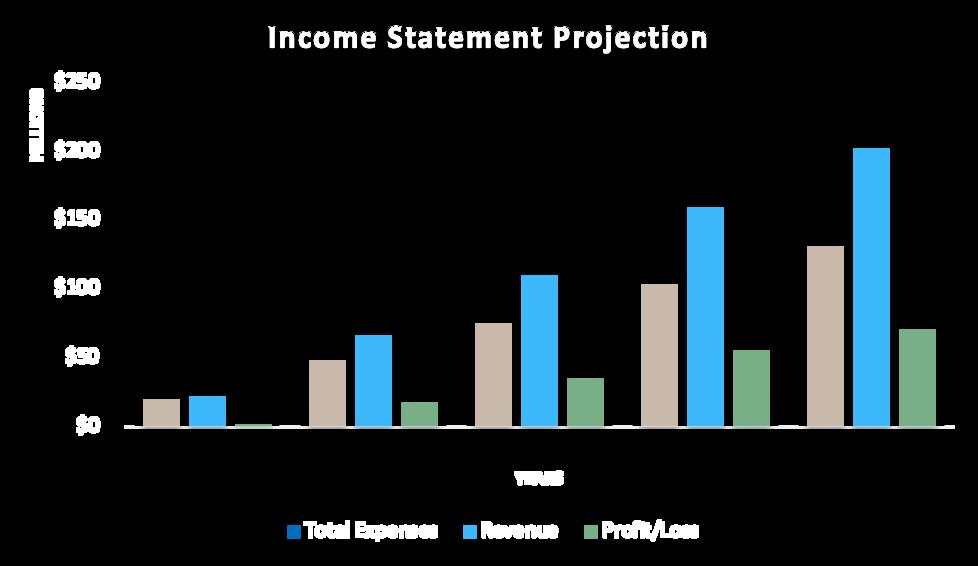

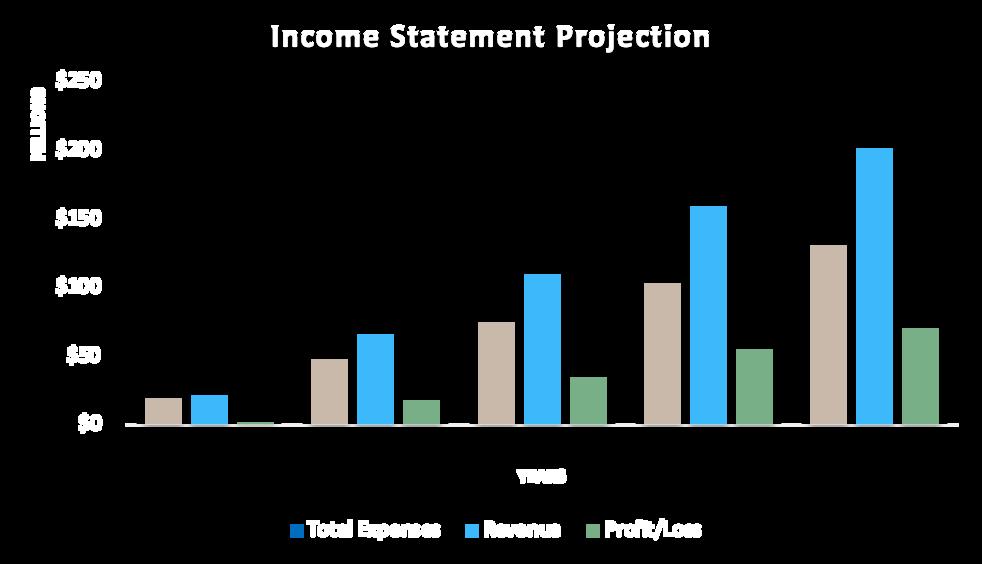

BAF projects >$250 million in annual consolidated revenue by 2032, supported by its diversified revenue streams. The blended IRR across the BAF ecosystem is estimated at 70-80%, driven by short-term profits, long-term appreciation, and steady operational growth. Equity appreciation is expected to grow significantly as BAF scales its integrated model and strengthens its market leadership.

BAF is structured with a forward-thinking ownership model designed to drive long-term growth, reward performance, and attract strategic investment. With 50 million authorized common shares, ownership is strategically allocated to balance control, incentivize leadership and team members, and provide opportunities for accredited investors.

The leadership team and subsidiary executives participate in a performance-based stock incentive plan, where stock grants are tied to achieving financial milestones and subsidiary profitability. To align management's interests with the company’s growth objectives, these stock grants vest over a seven-year period, fostering long-term commitment and sustainable success.

BAF aims to position itself for an IPO by 2032, leveraging its vertically integrated model and financial performance.

The cohesive ecosystem and profitability of BAF’s subsidiaries make them attractive acquisition targets.

Investors may benefit from future dividends and share buyback programs as profitability stabilizes.

Blair Allen Financial, Incorported (BAF)

2023

The real estate and financial services industries stand at a pivotal moment, awaiting a leader bold enough to address their deep-rooted complexities and inefficiencies For decades, these sectors have been constrained by fragmented solutions, outdated processes, and the absence of truly integrated innovation. The challenge has always been the same: the technology wasn’t advanced enough to tackle the intricacies of these industries

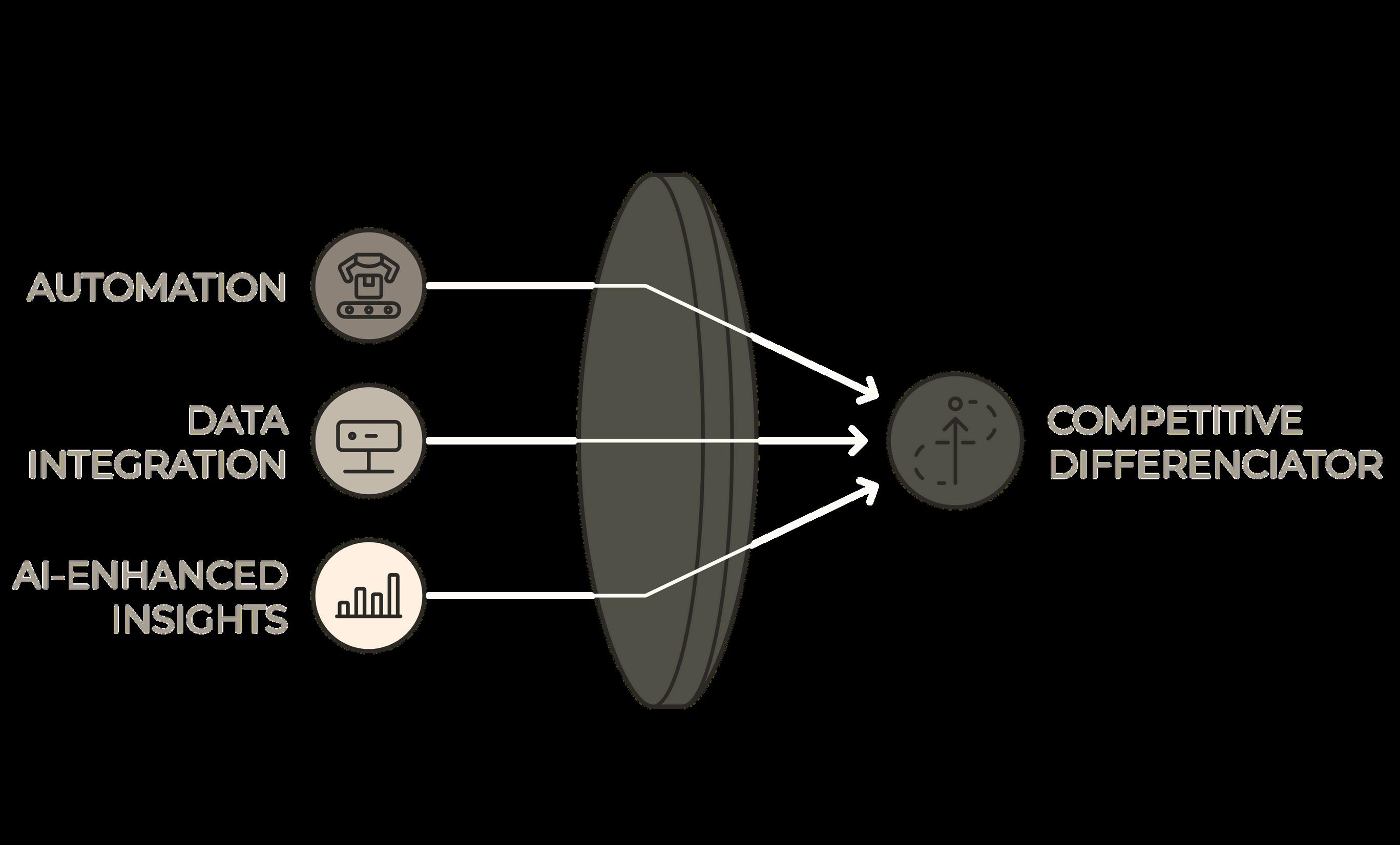

Blair Allen Financial, Inc. (BAF) is pioneering the future of real estate, mortgage, insurance, and financial services through innovation, execution, and cutting-edge technology. At the core of our ecosystem is a proprietary AI-driven technology platform, seamlessly integrating our family of companies to redefine how customers and team members buy, sell, lease, and finance real estate all while safeguarding their most valuable assets and building long-term wealth.

BAF is not just improving industry standards; we are fundamentally transforming them. By leveraging automation, data intelligence, and strategic execution, we empower clients with faster transactions, smarter decision-making, and enhanced financial security. Our model eliminates inefficiencies and outdated processes, replacing them with a streamlined, technology-first approach that sets a new benchmark for the industry.

Through expertise, precision, and a commitment to innovation, BAF is revolutionizing the way people engage with real estate, finance, and insurance delivering solutions that create lasting value and sustainable success.

The real estate, financial services, and insurance industries are built on outdated, fragmented models that fail to meet the demands of modern clients and professionals. This disjointed structure has created inefficiencies, driven up costs, and limited opportunities for growth. Now, the landscape is shifting under mounting legal, technological, and consumer pressures, exposing the cracks in this longstanding framework.

87% 45% 30%

OF CLIENTS PREFER A SINGLE PROVIDER. OF COMPANIES LACK DATA-SHARING SYSTEMS. OF REVENUE LOST TO INEFFICIENCIES.

Clients engaging in real estate transactions often face a labyrinth of disconnected providers, including real estate agents, mortgage lenders, insurance brokers, and property managers Each operates independently, leaving the burden of coordination on the client. This fragmented approach results in:

The lack of integration drives up fees and redundant expenses, with no clear oversight to optimize services

Siloed providers create bottlenecks in workflows, increasing transaction timelines and leading to client frustration.

Without cross-functional collaboration, clients lose out on opportunities for better deals, faster service, or customized solutions that align with their goals

According to industry reports, 87% of clients prefer an integrated, single-provider experience, yet such a solution remains unavailable on a meaningful scale.

For industry professionals, the challenges are equally significant:

Real estate agents and other professionals rely heavily on commission income from completed transactions Seasonal fluctuations and market downturns expose them to financial instability, leaving many struggling to sustain their careers.

Current compensation models focus on immediate transactions, offering no mechanisms for long-term financial growth, equity participation, or profit-sharing.

Regulatory scrutiny, such as the National Association of Realtors (NAR) lawsuit, is compressing commissions and disrupting traditional brokerage models. Part-time agents and those unwilling to adapt to these changes risk being pushed out of the industry

Many firms operate on outdated software that fails to integrate workflows across real estate, mortgage, insurance, and property management services.

Without centralized systems, professionals cannot access or share critical insights, limiting their ability to provide tailored solutions or identify cross-sell opportunities.

Modern clients demand seamless, AI-driven digital experiences, yet the industry remains behind the curve. Approximately 45% of firms lack the basic CRM and datasharing tools necessary to deliver on these expectations.

The lack of modern, integrated technology in these industries exacerbates inefficiencies and creates a disconnect between client expectations and provider capabilities.

The industry is undergoing a seismic transformation due to regulatory, legal, and market pressures:

Lawsuits targeting traditional commission structures, such as the NAR lawsuit, threaten to reduce agent income and disrupt established practices.

Rising interest rates, climate risks in insurance markets, and increased scrutiny on mortgage lending have created significant operational challenges across sectors.

Clients now prioritize speed, transparency, and personalization, putting pressure on firms to modernize or risk obsolescence.

These changes are forcing the industry to undergo what some are calling the "Great Reset," where outdated models are replaced by more efficient, tech-enabled solutions. However, the transition is leaving many firms and professionals struggling to adapt.

Disjointed processes lead to higher costs, delayed transactions, and an overall poor experience.

Legal pressures and income uncertainty push part-time agents out of the industry, while fulltime agents face increasing demands to specialize and deliver greater value.

Outdated systems and siloed operations create inefficiencies, limit scalability, and reduce profitability in an increasingly competitive environment.

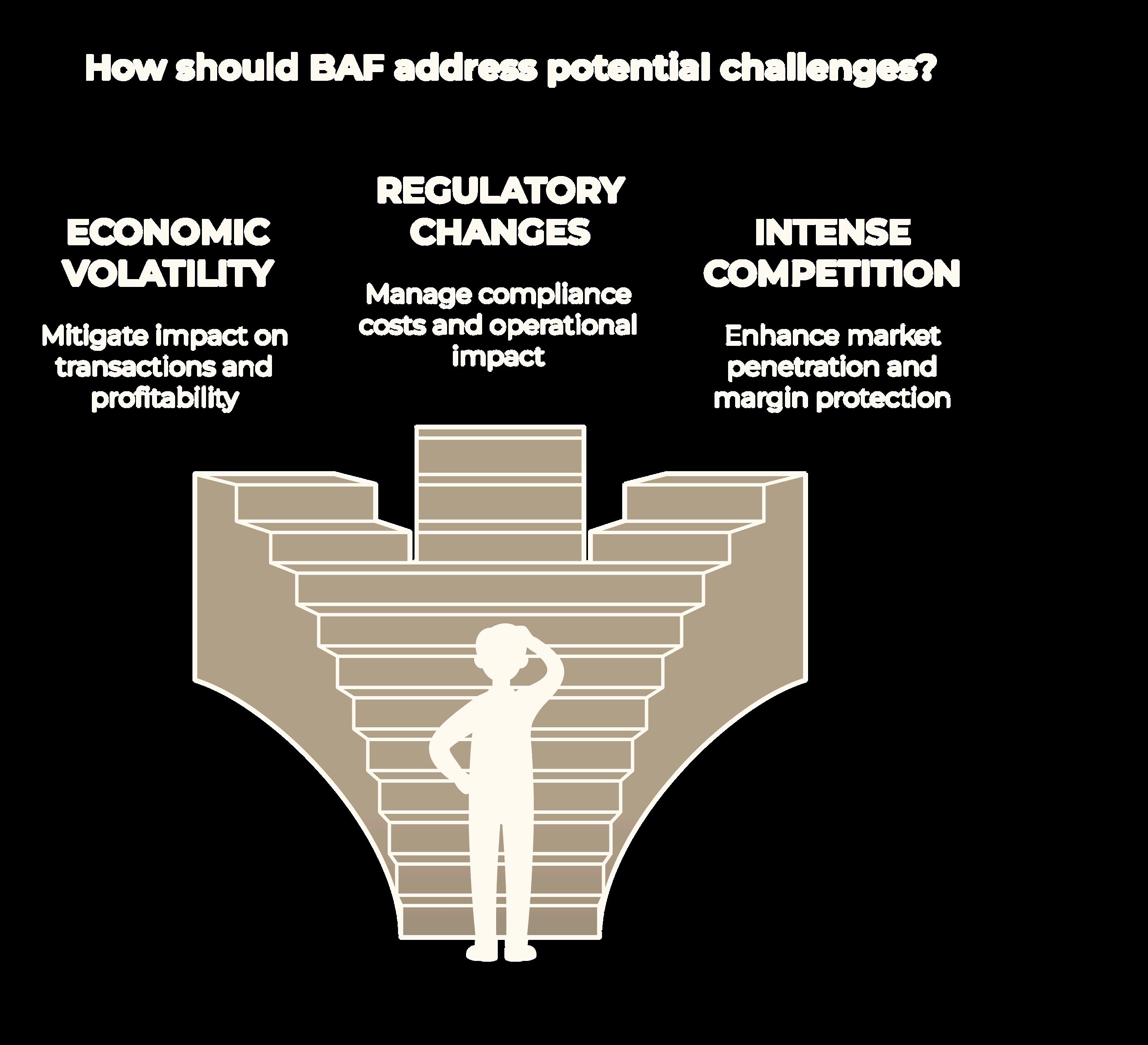

Challenge

Fragmented client experiences

High operational costs

Outdated technology

BAF’s Solution

Integrated client journey platform

Automated workflows save time/money

ITSM enables data visibility

BAF’s vertically integrated model addresses these challenges by consolidating the client journey under one seamless platform. Our Blair Allen ITSM system supports each subsidiary with realtime data access, automated workflows, and compliance features, ensuring a smooth client journey from initial contact to transaction close and beyond. This integration reduces operational costs, enhances data visibility, and improves client retention. By owning the technology, data, and processes, BAF delivers a high-touch, streamlined experience that sets us apart from traditional industry competitors.

Blair Allen Mortgage, LLC

Blair Allen University

Military Focus: Not-For-Profit (501c3)

Blair Allen Capital Fund, Inc

BAF acts as the operational backbone for its fully owned subsidiaries BALR, BAPM, BAM, BAI, BAC, BAT, and BAU providing centralized training and educational resources in technology, sales, compliance, and industry specific services. This integrated structure ensures seamless oversight, aligning each subsidiary’s operations with BAF’s strategic goals while maintaining high standards of efficiency and consistency

BAF’s 100% ownership facilitates streamlined financial management, training, and decision-making, allowing revenue from all subsidiaries to flow directly to the parent company. This consolidated approach reduces investor risk, strengthens financial stability, and enhances overall valuations. BAU plays a pivotal role as the hub for training and education, equipping team members with skills to excel while delivering consumer programs that empower clients to navigate real estate, financial, and insurance opportunities.

United Needs complements this framework as BAF’s philanthropic initiative, targeting veterans and active-duty military families Partnering with BAU, it delivers educationfocused programs that promote financial literacy and wealth-building, ensuring longterm impact. Revenue streams from subsidiaries, such as property management fees through BAPM or investment gains from BAC, further support United Needs’ mission

Blair Allen Capital Fund (BACF) serves as the funding arm, raising donor and investor capital to fuel growth and amplify impact. Together, this unified ecosystem ensures operational excellence, scalable growth, and meaningful social contributions.

Delaware C-Corporation | 100,000,000 Common Shares

Directors: Jason

Blair (Chairman), Alex Nahai(CEO), Gary Lorenz (COO), Angie Ison (CFO)

BACM LLC issued 51M shares with 49M treasury shares to be issued to investors

BACF Invests Into BAC

By

Blair Allen Capital Management, LLC (BACM) Fund Manager

Long-Term Holds Class B to A

GP/Investment Advisor - 2% Management Fees, 10% Cashflow Mortgage (REI)

BAF’s vertically integrated model provides operational and financial control across its subsidiaries, fostering collaboration, cross-selling opportunities, and enhanced client lifetime value. Each business unit plays a strategic role in delivering a seamless and comprehensive customer experience BALR specializes in high-end property transactions, while BAM offers tailored financing solutions to streamline property acquisition. BAI provides personalized asset protection, and BAPM delivers robust management services for residential, multifamily, and commercial properties. BAC focuses on strategic real estate wholesale opportunities and short-term fix-and-flip projects, while the BACF supports long-term real estate acquisitions through BACM who manages BACF growing investment portfolio

The foundation of this integrated multi-tenant structure is the Blair Allen ITSM platform, developed by BAT. This proprietary technology automates workflows, delivers real-time data insights, and scales operations efficiently. By combining advanced technology with deep industry expertise, BAF ensures that each subsidiary functions seamlessly within a cohesive ecosystem. This innovative model not only delivers exceptional value to clients and team members but also positions BAF as a leader in technology-enabled solutions across the real estate, financial, and insurance industries.

The real estate and financial services sectors are experiencing a major transformation, a shift we call the “Great Reset.” This evolution is fueled by dynamic economic conditions, new regulatory pressures, and rapidly shifting consumer expectations, which present both challenges and unprecedented opportunities for adaptable, tech-forward companies. With consumer behaviors increasingly driven by technology, data insights, and the demand for streamlined digital interactions, BAF is strategically positioned to leverage these trends and set a new standard in service delivery.

The real estate, insurance, property management, and capital markets form the backbone of the U.S. economy, collectively contributing over 18% of GDP, or $4.9 trillion annually. These industries are at the forefront of transformative shifts: rising housing prices, fewer active realtors, and a growing need for integrated, technology-driven solutions

Blair Allen Financial is uniquely positioned to capitalize on these trends. By combining an integrated service model with cuttingedge technology, BAF addresses inefficiencies across fragmented industries while creating long-term value for clients and investors alike. Our subsidiaries align seamlessly to capture opportunities in these vital markets, ensuring both scalability and stability in a rapidly changing economic landscape

$100 Billion in annual commissions.

$1.65 New mortgage originations annually. Trillion

$3.79 Trillion to GDP annually. PROPERTY MANAGEMENT

ESTATE INSURANCE

$128 Billion brought in annually. MORTGAGE

The U.S. real estate market is one of the largest sectors of the economy, contributing over 12.4% of GDP annually. Despite rising home prices and shrinking realtor numbers, the demand for housing continues to grow, with significant opportunities in both urban and suburban markets.

Key trends include a 15% increase in housing prices from 2021 to 2023 and a 13% growth in rural/suburban demand as remote work drives relocation. However, challenges such as rising transaction complexity and fragmentation have created inefficiencies in the market. BAF, through BALR, is perfectly positioned to address these challenges with an integrated, tech-enabled approach that simplifies transactions and improves client outcomes.

Market Size:

$14 1 trillion in Single Family Residence (SFR) mortgages and $2.2 trillion in Multifamily Residence (MFR) mortgages.

Active realtors have dropped by 5% due to increasing transaction complexity

Growth in Suburban /Rural Demand:

+13% (2021-2023).

Housing Price Surge:

+15% growth over three years, driven by limited inventory and high demand

Real estate commissions generate $100 billion annually.

Suburban and rural growth aligns with BAF’s targeted strategy.

Rising transaction complexity creates demand for integrated service providers like BAF

As real estate remains the cornerstone of the U.S. economy, BAF’s ability to integrate real estate transactions with mortgage and insurance services sets it apart in a fragmented market. But real estate is just the start our comprehensive model extends far beyond property transactions

The property management industry plays a critical role in the U S housing market, generating $128 billion in annual revenue in 2023. With over 51% of the 48.2 million rental units in the U.S. professionally managed, the demand for streamlined, tech-enabled property management solutions is rising

Generated by the property management industry annually.

10% Rent Increase:

Reflects rising rental demand since 2022.

Rising rents create demand for professional management.

BAPM’s tech-enabled solutions optimize tenant satisfaction and operational efficiency.

Integration with BAF’s ecosystem enhances owner and tenant experiences.

51%

Professionally managed rental units in the U.S.

Many property owners rely on disconnected services, creating inefficiencies.

With $128 billion in annual revenue and growing demand for professional management, Blair Allen Property Management is positioned to redefine the tenant and owner experience. By integrating technology and services, BAPM ensures scalable growth and maximized value for clients.

A $16.3 Trillion Market Opportunity

$14.1 trillion in single-family residence mortgages represents the largest segment of consumer debt.

BAM’s ITSM integration cuts approval times and simplifies compliance.

Rising housing prices drive demand for seamless, high-quality mortgage services.

Market Size:

$14.1 trillion in Single Family Residence (SFR) mortgages and $2.2 trillion in Multifamily Residence (MFR) mortgages

New Originations:

$1.65 trillion in annual mortgage originations

Refinance Market:

$0.36 trillion in annual refinance transactions.

Housing Price Surge:

+15% growth in housing prices since 2021, driven by limited inventory and high demand.

BAM connects clients to the largest financial asset class in the U.S. By simplifying the process through technology and integration, BAM delivers seamless, client-focused solutions in a $16.3 trillion market.

The U.S. insurance industry is one of the largest and most stable sectors of the economy, contributing $1.89 trillion annually to GDP and generating >$1 trillion in annual premiums. Property insurance, driven by rising housing prices and increasing climate risks, has seen demand grow by 8.7% annually, aligning perfectly with BAF’s integrated offerings.

By bundling home and property insurance directly into real estate and mortgage transactions, Blair Allen Insurance (BAI) simplifies the process for clients while reducing inefficiencies. The integration of BAI’s offerings into BAF’s technology platform enables seamless compliance, faster processing, and a unified client experience positioning BAF as a leader in this growing market.

The United States Insurance Market Size is expected to reach USD 3.71 Trillion by 2033

The Market is growing at a CAGR of 6 98% from 2023 to 2033

+8% annually, driven by housing price growth and climate risks

Property insurance increasingly bundled with real estate services.

Rising housing prices and climate risks drive demand for bundled property insurance.

Integration with real estate services addresses inefficiencies in fragmented markets.

Seamless compliance automation through BAF’s technology enhances client trust and operational efficiency.

By embedding insurance directly into real estate and mortgage transactions, BAF not only reduces complexity but also strengthens client relationships. Our approach ensures that insurance isn’t just an add-on it’s a seamless, integrated part of the customer journey.

The recent legal victory against the National Association of Realtors (NAR) is upending traditional real estate commission structures. Historically, sellers paid both the listing and buyer agents’ commissions, often splitting a 5-6% total fee. The lawsuit’s outcome could significantly reduce buyer-agent compensation and their role in transactions. This shift aligns with current trends: the number of buyer agents is projected to decline, while home sales are expected to grow 3.5% annually and housing inventory continues to rebound, reaching nearly 13 million active listings in late 2024.

These changes present substantial opportunities for seasoned listing agents and for companies like Blair Allen Luxury Real Estate (BALR) and Blair Allen Mortgage (BAM). Listing agents will take on more responsibility for transactions, handling tasks previously supported by buyer agents. BALR is poised to benefit from this transition, as its proprietary training programs and technology enable agents to manage higher transaction volumes efficiently. For example, BALR’s technology integrates marketing automation, virtual tours, and analytics tools that allow agents to scale their services while providing unmatched client value.

are making it easier for buyers to navigate transactions independently A recent Zillow study found that 79% of homebuyers prefer online tools for property searches and financing.

BAM is positioned to serve these digitally empowered buyers through its robust platform, which connects clients to over 120 competing investors for tailored mortgage solutions This model ensures buyers receive competitive rates and streamlined approvals, with BAM reporting a 15% faster average closing time compared to industry standards.

As the real estate landscape shifts, BALR’s emphasis on high-value listings and BAM’s focus on simplified, accessible financing enable both companies to thrive. By addressing the growing market demand with innovative solutions and expertise, BALR and BAM are set to lead in this new era of real estate

Regulatory demands in the mortgage and insurance sectors are intensifying, with 52% of firms reporting compliance challenges due to outdated systems.

BAF’s Solution: The proprietary Blair Allen ITSM platform automates compliance checks, risk management, and reporting. BAF’s ITSM automates 90% of compliance processes, ensuring seamless operations in highly regulated industries.

Key Market Trends and Opportunities Continued

The Blair Allen ITSM platform enables real-time insights, streamlined communication, and access to a unified client journey across real estate, mortgage, insurance, and property management.

70% OF CLIENTS PREFER FIRMS WITH DIGITAL TOOLS FOR SEAMLESS, DATA-DRIVEN EXPERIENCES.

80% OF REAL ESTATE CLIENTS START THEIR SEARCH ONLINE (MCKINSEY & COMPANY)

Seamless, data-driven experiences are the new standard for client engagement.

In a data-driven world, companies that leverage analytics to understand client needs, predict trends, and optimize strategies gain a competitive edge. BAF uses its integrated platform to deliver tailored solutions, strengthen client engagement, and unlock crossselling opportunities within its ecosystem.

Automation has reduced the demand for sales agents by 20%, yet the industry continues to see growing demand for high-quality service BAF’s model embraces this shift by equipping a streamlined, highly trained team with technology to meet evolving client needs.

The assertion that automation has led to a 20% reduction in sales agents by 2024, while demand for high-quality service has grown by 15%, lacks direct support from available data. However, industry trends indicate that automation and artificial intelligence (AI) are significantly impacting the real estate sector A report by the Altus Group reveals that 75% of commercial real estate executives believe automation will eliminate jobs, yet 71% anticipate it will create new roles focused on value-added tasks (Source: Forbes).

Additionally, 85% of real estate professionals expect AI to substantially influence the industry by 2030.

These insights suggest that while automation may reduce certain positions, it concurrently fosters demand for highly skilled professionals adept at leveraging technology to deliver superior client services BAF embraces this evolution by equipping a streamlined, well-trained team with advanced technological tools to meet and exceed evolving client expectations.

BAF’s integrated, technology-driven approach uniquely positions us to thrive within the Great Reset. By delivering a cohesive, high-touch client experience powered by real-time data and automation, BAF not only meets but exceeds the expectations of today’s digitally inclined clients. Our model streamlines operations, reduces costs, ensures compliance, and provides a seamless experience across highgrowth markets, putting BAF in prime position to capture increased market share and set the industry standard as traditional models struggle to adapt.

The vast scale of the U.S. mortgage and real estate market underscores the opportunity for an integrated player like BAF. With $14.1 trillion in Single Family Residence (SFR) mortgages and 70% of consumer debt tied to housing, the demand for streamlined, efficient service providers has never been higher. BAF’s vertically integrated model positions the company to dominate in these key areas.

$14.1 trillion in SFR mortgages: BAF’s Mortgage division (BAM) is built to serve this critical segment

$1.65 trillion in new mortgage originations annually: BAF’s tech-enabled mortgage solutions streamline this process for agents and clients.

70% of consumer debt linked to mortgages: BAF’s comprehensive services offer clients a one-stop solution for managing their largest financial obligations

BAF’s technology and operational control enable it to capitalize on the mortgage sector’s $1.65 trillion market, simplifying transactions and delivering unparalleled value”

BAF’S POSITION IN THE MARKET continued...

With finance, insurance, and real estate sectors contributing a combined 20.7% of GDP, BAF is strategically positioned to capitalize on these high-value markets. By integrating services across real estate, mortgage, property management, and insurance, BAF stands out as a leader in creating seamless client experiences and optimizing revenue generation.

$1.7 trillion l t ib ti f finance and like BAI an market with $100 billio commission (BALR) div share by markets.

$3.79 trillion GDP: Blai integrates insurance in With service insurance, an 20.7% of th growth.

BAF’s embrace of technology and property management trends positions it as a market leader in innovation. With $1.9 trillion in technology contributions to GDP and $128 billion in annual property management revenues, BAF’s proprietary ITSM platform and integrated service offerings allow it to capitalize on these evolving markets.

$1.9 trillion technology GDP contribution: BAF’s Blair Allen ITSM platform integrates tech-driven efficiencies across all subsidiaries.

$128 billion in property management revenues: BAF’s Property Management (BAPM) ensures effective asset oversight for a growing rental market.

51% of rental units under management: BAF’s property management solutions offer comprehensive oversight for this $48.2 million-unit market.

BAF operates on a foundational Three-Tiered Framework of Technology, Training, and Financial Empowerment, designed to enhance operations, empower its workforce, and educate its customers. This holistic approach ensures both employees and clients are equipped with the tools, knowledge, and resources necessary for success, fostering a seamless, high-quality experience across all BAF services

At BAF, we are committed to building and protecting wealth for our customers and team members through our foundational Three-Tiered Framework. Technology, Training & Education, and Financial. By combining cutting-edge tools, comprehensive education, and meaningful financial opportunities, we create a seamless, high-quality experience that equips everyone we serve with the resources and confidence to achieve lasting success.

~ Jason Blair - CEO, BAF

2 3

Technology: At the core of BAF’s framework is its proprietary Blair Allen platform This innovative solution integrates operations across real estate, mortgage, insurance, and property management, providing real-time data, seamless communication, and automation. For clients, this means a streamlined process with greater transparency and faster decision-making. By simplifying complex workflows, the Blair Allen platform empowers both team members and customers to focus on achieving their goals efficiently and confidently

Training for Workforce and Customers: BAF places a strong emphasis on training, leveraging Blair Allen University (BAU), a dedicated division of BAF, to provide comprehensive educational programs for both its workforce and customers. Internally, BAU enhances team members’ expertise through advanced training in compliance, negotiations, technology utilization, and customer relationship management, ensuring they remain skilled and adaptable in a dynamic industry Externally, BAU empowers clients through workshops, digital resources, and personalized consultations, equipping them with the knowledge to navigate real estate transactions, evaluate mortgage options, and make informed insurance decisions This dual commitment to workforce and client education fosters confidence, reduces inefficiencies, and streamlines processes, resulting in exceptional service delivery and more empowered, satisfied customers. By integrating this robust training model, BAF sets itself apart as a leader in delivering consistent, high-quality experiences in the real estate, finance, and insurance sectors..

Financial Empowerment: BAF’s innovative financial model creates alignment between employee success and organizational growth. Team members benefit from performance-based incentives, equity participation, and clear career pathways, fostering a motivated and accountable workforce For clients, financial empowerment takes the form of tailored mortgage solutions, competitive insurance products, and accessible investment opportunities. These initiatives enable clients to overcome financial challenges and achieve their long-term objectives with confidence

Proprietary Technology Platform, Exclusivity & Capital Deployment

Blair Allen Financial (BAF) holds exclusive rights to a proprietary adaptation of the Maestro® ITSM Framework originally developed by Orchatect specifically for the real estate and financial services industries. This exclusive licensing prohibits any other entity from using or competing with this technology in these sectors, positioning BAF with a durable and defensible technological moat. Often described as “ServiceNow on steroids,” the Blair Allen ITSM Platform is uniquely designed to optimize and scale complex operations across real estate, mortgage, insurance, property management, and capital investment

Through a strategic joint venture with Orchatect, BAF has cloned and reengineered the Maestro® framework to align with its vertically integrated service model All technology, code, processes, and future enhancements are 100% owned by BAF, providing long-term IP control, platform independence, and the potential for a high-value technology exit.

To realize the full potential of this asset, BAF is currently raising capital to complete development, deploy the MVP (minimum viable product), and scale the Blair Allen ITSM Platform across its suite of operating companies This capital will be used to finalize the platform’s infrastructure, integrate core service lines, and enhance automation, analytics, and compliance capabilities

The platform is being developed and managed by BAF’s dedicated technology subsidiary, Blair Allen Technologies (BAT). BAT ensures the platform evolves with the needs of BAF’s clients and workforce, delivering continuous innovation, efficiency, and data-driven performance. By consolidating multiple operational verticals into one intelligent system, the Blair Allen ITSM Platform empowers BAF to deliver consistent, high-quality services while unlocking significant operational and economic scale

This proprietary platform is a cornerstone of BAF’s growth strategy fueling scalable operations, protecting market share, and creating a high-value, monetizable technology asset within the BAF ecosystem.

1. Enhanced Productivity and Efficiency: The ITSM platform eliminates manual and redundant tasks by automating workflows, enabling employees to focus on high-impact work. For example, tasks like data entry, compliance checks, and customer communication are streamlined, which frees up time for employees to concentrate on client engagement and strategic initiatives.

2. Data-Driven Insights: The platform provides team members with actionable insights through real-time analytics. By understanding client behavior, engagement trends, and operational metrics, employees can anticipate needs, optimize services, and proactively address potential challenges This data-centric approach ensures our team can deliver personalized, timely support, setting BAF apart in customer experience.

3. Comprehensive CRM and Client Management: Blair Allen ITSM integrates CRM functions, allowing team members to access comprehensive client profiles, track interactions, and manage cross-departmental handoffs. This fosters a seamless client journey across all BAF services whether the client is navigating a real estate transaction, mortgage process, or insurance inquiry.

4. Scalable Infrastructure: As BAF grows, the platform scales with it, ensuring employees have consistent access to the tools and resources they need without interruptions. This scalability also supports our recruitment efforts by providing a unified platform that is intuitive and accessible for new hires, reducing training time and accelerating productivity

At the core of our operations is the Blair Allen ITSM platform, a centralized digital hub that empowers employees to work with precision and efficiency. This proprietary technology provides tools for CRM, advanced data analytics, and workflow automation, transforming day-to-day tasks into streamlined, data-informed actions that maximize client satisfaction.

Blair Allen ITSM serves as the central “hub” of our operations, seamlessly connecting each service division as a “spoke” in a single, integrated framework. This structure enables a streamlined client experience, where data flows freely between divisions, allowing clients to navigate smoothly through each phase of their journey from purchasing a property to securing financing, insurance, and property management. By consolidating these services under one cohesive network, BAF builds trust, loyalty, and engagement, creating a platform that is client-centered and operationally optimized.

The BAT ITSM framework revolutionizes how BAF connects with, converts, and continuously engages its customers and team members. By harnessing real-time data insights, automated workflows, and predictive analytics, BAT enables each BAF subsidiary to streamline operations and deliver exceptional service. For customers, the platform ensures a frictionless journey, tracking their progress from inquiry to completion whether buying or selling real estate, securing financing, insuring valuable assets, or exploring investment opportunities. BAT enhances engagement through personalized recommendations, automated follow-ups, and real-time updates, fostering trust and loyalty at every stage.

For team members, BAT functions as both an operational and educational powerhouse. It equips staff with the tools, metrics, and resources to excel in their roles, while integrating Blair Allen University’s gamified learning system to foster ongoing professional growth. By seamlessly connecting operational efficiency, customer engagement, and education, BAT creates a cohesive environment that drives productivity, improves client outcomes, and ensures BAF remains a leader in its markets. Its multi-tenant architecture further supports adaptability, enabling rapid expansion and alignment with shifting industry demands. As the technological backbone of Blair Allen Financial, BAT propels innovation and collaboration, ensuring long-term success for its subsidiaries, clients, and team members alike.

To maximize the ecosystem’s effectiveness, BAF has developed proprietary engines within Blair Allen ITSM that drive insights and performance across all services. Each engine plays a unique role in enhancing BAF’s capabilities:

Operational Insight Engine: Tracks and optimizes workflows, ensuring resources are effectively allocated. It provides actionable data on productivity and service metrics, enabling continuous improvements to operations.

Performance Engine: This engine monitors critical KPIs, including conversion rates, response times, and client satisfaction Real-time visibility into these metrics allows BAF leadership to make data-driven adjustments and meet strategic objectives

Engagement Engine: Analyzes client interactions and feedback, helping BAF proactively enhance the client experience and increase engagement. By identifying preferences and potential issues, we deliver more personalized, responsive service

Financial Insight Engine: Provides a comprehensive view of financial performance across subsidiaries, supporting efficient budgeting, forecasting, and risk management. Centralized financial oversight ensures each division operates within optimal financial parameters, driving profitability and scalability.

Single Sign-On

Single View of All Data

Improved Customer Journey

Improved Team Member Journey

Website Management Engine

Customer Lead and Communications Engine

Transaction Management Engine

Training Management Engine (LMS)

Financial Management Engine

HR Management Engine

Business Intelligence Engine BAT ITSM Framework

True OrchestrationWeb-hooks

No need to recreate eXp products

Faster GTM

Single domain for all customers

To access Intelligent data

To share transaction data with team members & business leadership

Blair Allen Technologies (BAT) serves as the technological backbone for BAF providing a unified, proprietary platform the Blair Allen ITSM—that connects and catalyzes all subsidiaries By seamlessly integrating real estate, mortgage, insurance, property management, and capital investment operations, the ITSM platform ensures operational cohesion, enhancing both client and agent experiences.

The platform enables cross-functional collaboration between subsidiaries like BALR, BAM, BAI, BAPM, and BAC. This integration reduces inefficiencies, supports real-time data sharing, and fosters an interconnected ecosystem

BAT's technology allows BAF’s subsidiaries to scale rapidly, automate routine tasks, and focus on high-value activities, directly contributing to market dominance and profitability.

100% Owned & Operated

The Blair Allen ITSM Framework delivers substantial efficiency improvements by automating routine, manual tasks that often consume a significant portion of team members' workdays. On average, our framework has demonstrated efficiency gains of 2530%, allowing employees to focus on higher-value activities and manage multiple functions simultaneously. This streamlining not only reduces the need for additional staffing but also drives down operational costs as team members become more versatile and productive. By reducing redundancy and enhancing team agility, the Blair Allen ITSM Framework transforms daily operations, helping us maintain a leaner, more efficient workforce without compromising on quality or output.

The Blair Allen ITSM platform is being built on a multi-tenant infrastructure, enabling subsidiaries, agents, and clients to operate within a unified yet customizable system. This approach allows for scalability and adaptability, ensuring efficient resource use across all subsidiaries

Features and Benefits:

Customizable Modules: Each subsidiary can tailor workflows to specific needs while maintaining alignment with the BAF ecosystem

Real-Time Analytics: Subsidiaries and agents gain access to instant insights, improving decision-making and customer satisfaction

Cross-Vertical Integration: Shared data enhances synergy, enabling seamless service delivery from property purchases to insurance and beyond.

Orchatect>$3 Million in AI Enhancements: Leveraging machine learning and predictive analytics to drive personalized services.

Orchatect>$$1M MVP Deployment: Launched the platform to franchise ready businesses for testing and refinement, ensuring a seamless rollout

Orchatect>$$2 Million in Multi-Tenant Infrastructure: Built a scalable foundation for nationwide franchise deployment

Operational Enablement: Power seamless operations for BAF subsidiaries.

Customer Empowerment: Deliver personalized, frictionless experiences.

Agent Productivity: Automate routine tasks, allowing agents to focus on clients.

BAF’s vertically integrated ecosystem operates on a hub-and-spoke model, where Blair Allen ITSM functions as the central hub, connecting and powering each subsidiary as a spoke. This setup delivers multiple advantages:

Blair

Allen ITSM consolidates key operational functions data storage, analytics, compliance, and customer management so each subsidiary can access shared resources without duplicating systems This structure minimizes overhead costs and optimizes resource utilization across BAF

Enhanced Scalability and Flexibility: The hub-and-spoke model allows BAF to adapt and expand efficiently. Each subsidiary can add or enhance services in response to market changes while drawing on the centralized ITSM hub for data, compliance, and operational support. This adaptability allows BAF to introduce new services or expand into new markets without incurring substantial additional infrastructure costs

Insights-Driven

, Engagement, and Financial Health: Blair

Allen ITSM comprises a suite of proprietary engines custom-built modules that provide insights into operations, performance, client engagement, and financial health. These engines enable each subsidiary to improve service quality, identify revenue opportunities, and manage costs effectively.

BAF’s integrated model offers significant advantages in attracting and retaining top professionals across all service areas. By owning and managing a centralized platform, BAF provides consistent standards, robust support, and growth opportunities that are appealing to high-caliber talent:

Customizable Compensation Models: Insights from Blair Allen ITSM enable BAF to develop competitive, performance-driven compensation packages, rewarding productivity and engagement. This flexibility in compensation aligns employee success with BAF’s goals, helping attract and retain top professionals.

BAF’s integrated structure supports diverse career pathways, allowing team members to explore roles across real estate, mortgage, insurance, and property management Through Blair Allen University, employees receive continuous training and development aligned with the ecosystem’s datadriven operations, empowering them to grow within a unified company framework.

In summary, BAF’s vertically integrated ecosystem creates a robust foundation for enhanced client experiences, risk management, operational efficiency, and talent support. The hub-and-spoke model with Blair Allen ITSM at its core —enables seamless coordination across subsidiaries, allowing BAF to deliver unmatched value in a competitive, evolving market. Through proprietary engines that provide insights and operational controls, BAF achieves a level of efficiency, adaptability, and client engagement that sets a new standard in the industry.

In partnership with Orchatect, BAF is developing the Blair Allen ITSM, a bespoke IT Service Management platform designed to meet the specific demands of North America’s real estate, mortgage, insurance, and property management sectors This platform forms the backbone of our operations, enabling seamless interactions across our service divisions and ensuring that data, workflows, and compliance are managed efficiently and securely.

1. Full Control Over Technology and Data: Ownership of the Blair Allen ITSM Framework gives BAF complete autonomy over the technology, allowing us to scale, modify, and innovate without relying on third-party limitations. This ensures data integrity, security, and scalability as our operations expand.

2. Competitive Moat with Patentable Processes: The proprietary processes within Blair Allen create significant barriers to entry, establishing BAF as a unique player in a competitive market. Our platform’s design and features offer a differentiated solution that is difficult for competitors to replicate, adding to BAF’s competitive advantage.