Are you managing a resort or apartment complex struggling with slow, unreliable internet? It’s time to upgrade to a worldclass connectivity solution that enhances guest satisfaction and maximises your return on investment.

We partner with resorts and apartment complexes that:

Need to eliminate poor internet performance and transition to high-speed, private fibre connectivity.

Have forward-thinking management that values long-term upgrades and cost-e cient solutions.

Want to reduce costs per apartment while benefi ing from economies of scale with low CAPEX investment into enterprise grade networks (not NBN).

Desire ultra-fast speeds of 100-300 Mbps per apartment, backed by real success stories and testimonials.

Seek to optimise existing infrastructure and leverage the latest WiFi technologies, including the path to WiFi 6

Aim for higher guest reviews, strong word-of-mouth referrals, and repeat bookings by o ering seamless connectivity.

As digital demands rise, we are commi ed to cutting-edge innovation that ensures top-tier connectivity for resorts and apartment complexes. Our private fibre solutions deliver:

Ultra-fast speeds with low latency for seamless streaming, remote work, and smart home integrations.

The latest WiFi technologies, ensuring strong coverage across all apartments.

99.95% service level guarantees for reliable, uninterrupted internet performance.

Upgrade today and join a network of satisfied resorts enjoying premium connectivity. Let’s make your internet a selling point, not a problem!

…with the flick of a switch our internet services moved to world class Gigabit capable internet. Resident and guest satisfaction has skyrocketed with the availability of fast, reliable industry leading internet, which allows our resort to include phone, video and streaming services never before offered. Absolutely Brilliant!”

– Eric van Meurs, Manager Atlantis Marcoola Beachfront Resort and past ARAMA President (Australian Resident Accommodation Managers Association.)

The views and images expressed in Resort News do not necessarily refl ect the views of the publisher. The information contained in Resort News is intended to act as a guide only, the publisher, authors and editors expressly disclaim all liability for the results of action taken or not taken on the basis of information contained herein. We recommend professional advice is sought before making important business decisions.

The publisher reserves the right to refuse to publish or to republish without any explanation for such action. The publisher, it’s employees and agents will endeavour to place and reproduce advertisements as requested but takes no responsibility for omission, delay, error in transmission, production defi ciency, alteration of misplacement. The advertiser must notify the publisher of any errors as soon as they appear, otherwise the publisher accepts no responsibility for republishing such advertisements. If advertising copy does not arrive by the copy deadline the publisher reserves the right to repeat existing material.

Any mention of a product, service or supplier in editorial is not indicative of any endorsement by the author, editor or publisher. Although the publisher, editor and authors do all they can to ensure accuracy in all editorial content, readers are advised to fact check for themselves, any opinion or statement made by a reporter, editor, columnist, contributor, interviewee, supplier or any other entity involved before making judgements or decisions based on the materials contained herein.

Resort News, its publisher, editor and sta , is not responsible for and does not accept liability for any damages, defamation or other consequences (including but not limited to revenue and/ or profi t loss) claimed to have occurred as the result of anything contained within this publication, to the extent permi ed by law.

Advertisers and Advertising Agents warrant to the publisher that any advertising material placed is in no way an infringement of any copyright or other right and does not breach confi dence, is not defamatory, libellous or unlawful, does not slander title, does not contain anything obscene or indecent and does not infringe the Consumer Guarantees Act or other laws, regulations or statutes. Moreover, advertisers or advertising agents agree to indemnify the publisher and its’ agents against any claims, demands, proceedings, damages, costs including legal costs or other costs or expenses properly incurred, penalties, judgements, occasioned to the publisher in consequence of any breach of the above warranties. It is an infringement of copyright to reproduce in any way all or part of this publication without the wri en consent of the publisher.

2025 Multimedia Pty Ltd

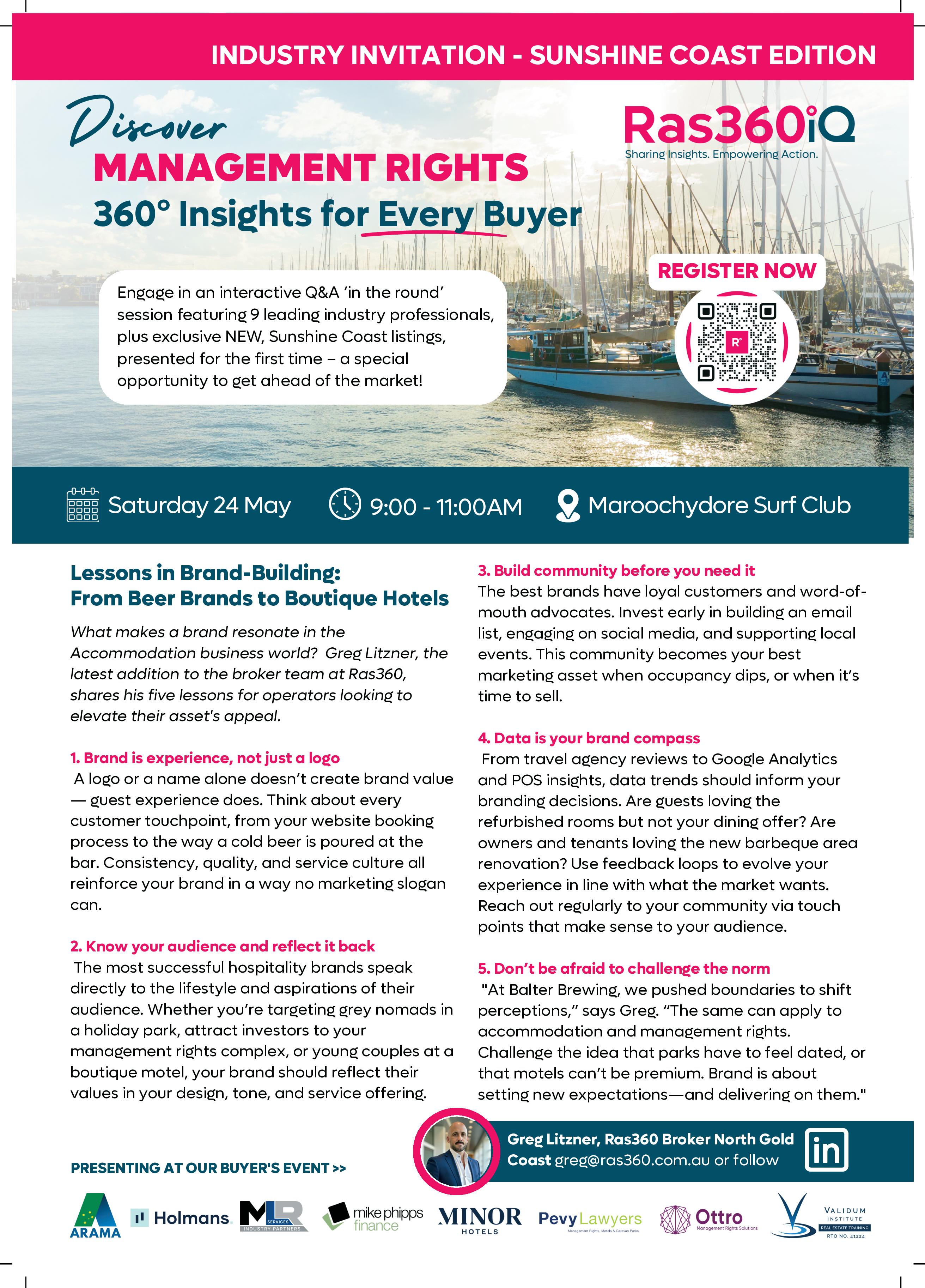

If last month was all about staying scamsavvy, this one’s about standing firm in the face of new pressures— particularly the growing calls for bed taxes.

It’s the hot topic no one really asked for. While some Queensland councils argue that tourism levies are about fairness and funding, most of us in the accommodation world know it for what it is—yet another burden on operators already navigating rising costs, insurance headaches, and the ongoing challenges of postpandemic recovery. In this issue, we unpack the debate with insights from ARAMA’s Trevor Rawnsley and Accommodation Australia’s James Goodwin. Love it or loathe it, the conversation is gaining traction—and now’s the time for operators to make their voices heard.

On a much brighter note, I had the pleasure of speaking with some incredibly inspiring people this month. Kate Mitchell, the new manager of Element on Coolum Beach, shared her career pivot story.

If you’ve ever thought about making a big change, Kate’s journey is a lovely reminder that new beginnings can be equal parts brave and rewarding.

We also profile Stuart McMullan, a quiet achiever who, alongside his wife Mandy, has built a diverse and family-led management rights portfolio. His take on partnerships, risk, and legacy is pure gold for anyone in the industry— whether you’re just starting out or well into your journey.

As always, Trevor Rawnsley brings his signature insight (and a few well-timed zingers) as he reflects on the resilience of our industry, while legal

expert Ben Ashworth helps untangle one of the most common points of confusion in MLR—options versus topups (yes, they’re diff erent!).

And of course, as we go to print, the federal election is taking shape. By the time our next issue lands, the political landscape may look a litt le diff erent—hopefully with clearer direction for our sector.

Thanks, as always, for reading. I hope this issue brings a few lightbulb moments, a litt le reassurance, and maybe even a smile.

Here’s to speaking up, backing yourself and each other, and heading into winter with purpose.

Warmly,

Mandy

Clarke, Editor, Resort News

By Mandy Clarke, Editor

It’s the tax no holidaymaker wants—and many accommodation operators fear.

After years of debate, bed taxes—also known as visitor levies—are creeping into Australia’s tourism policy discussions. While they haven’t yet been legislated in most regions, momentum is building. Supporters say it’s about fairness and funding. Critics call it a misguided move that could damage tourism just as the sector begins to stabilise post-pandemic.

So what’s really happening—and what does it mean for operators?

A bed tax is a fee added to a guest’s nightly bill—either a flat amount or a percentage of the room rate. Internationally, it’s nothing new: cities like New York, Paris, Bali, and Rome all charge visitors to stay overnight, using the revenue to support infrastructure, marketing, and public services.

In Australia, the concept is far more contentious. Accommodation providers already contribute significantly via GST, land tax, council rates, and licensing fees—without a widespread dedicated bed tax or tourism levy (yet).

On January 1, 2025, Victoria introduced

a 7.5 percent state-imposed levy targeting bookings of fewer than 28 consecutive days made via short-term rental platforms like Airbnb and Stayz.

The levy is statewide, with funds going toward aff ordable and social housing initiatives. Hotels, motels, and traditional commercial accommodation providers are exempt from the levy—for now.

Elsewhere in Australia, discussions around bed taxes are ongoing. While no other states have implemented such levies, the conversation continues, particularly in regions heavily reliant on tourism.

Several Queensland councils— Brisbane, Gold Coast, Cairns, and the Whitsundays—have publicly backed the introduction of a visitor levy, arguing it is essential to fund tourism infrastructure in regions facing high visitor numbers and growing ratepayer fatigue.

However, as of April 2025, the Queensland Government has declined to legislate for such a tax, instead advising councils to utilise existing mechanisms if they wish to pursue a levy.

Without new legislation, councils have limited options for introducing and collecting a visitor levy. For now, the push remains political and advisory rather than practical.

The case for levies: “It’s a fair contribution”

Advocates argue that bed taxes provide a sustainable funding source for managing tourism impact. As pressure mounts on public beaches, parks, roads, and local infrastructure, some local leaders say it’s only fair that tourists contribute to the destinations they enjoy.

A Courier Mail editorial ( April 2025: “Bed Tax could secure our tourism future” ) supported the idea, suggesting a welldesigned levy could help future-proof the state’s tourism economy, without overburdening local ratepayers.

However, opposition from industry is vocal and growing.

Australia CEO James Goodwin warned:

“Tourism operators in Queensland work hard to make the state, and their region, the best place to visit–so it’s surprising local mayors would renew calls for a ‘bed tax’ at a time when many operators are struggling.”

He highlighted a perfect storm hitt ing the industry:

James Goodwin

• Rising cost-of-living pressures.

• Spiralling energy and insurance bills.

• Natural disasters like Cyclone Alfred. Mr Goodwin pointed to March 2025 data showing hotel occupancy in Queensland at just 55 percent, saying: “Why would anyone believe that applying a tax to a holiday would help boost tourism demand and fill hotel rooms? It’s a false economy.

“We should be putt ing the welcome mat out for tourists, not hitt ing travellers and the accommodation sector with a short-sighted tax grab to cover local government budgets.”

stance: “A tax on a tax

Trevor Rawnsley, CEO of the Australian Resident Accommodation Managers Association (ARAMA), labels a bed tax the “worst kind of tax”.

“ARAMA is against a bed tax. We believe it’s insidious and the worst kind of tax, as it discriminates against the tourist accommodation industry in favour of the rest of the tourism industry.”

Accommodation providers are already burdened by:

Victoria’s Short Stay Levy: State-imposed. Council rate hikes for short-term rentals: Several local governments across Australia have implemented increased council rates for properties used as short-term rentals.

The so-called “view tax” on the Gold Coast: Gold Coast City Council has introduced higher general rates for high-rise apartment owners, charging a premium for properties located above the fourth floor.

Goods and Services Tax (GST) (federal): GST where it applies under federal tax law.

Speaking about calls for a bed tax, Mr Rawnsley said: “It seems various councils have formed the view that these taxes are victimless—since guests pay them, and they’re often not eligible to vote in the state or council imposing the tax.

“It is a tax on a tax on a tax—with no direct correlation to government services. It’s just consolidated revenue.”

Mr Rawnsley called for a more transparent, equitable approach: “If a bed tax is designed to benefi t the entire tourism industry, then it should be levied on the entire tourism industry—not just one portion of it.”

If you operate accommodation in Queensland, now’s the time to step up. Join industry bodies like

Accommodation Australia and ARAMA to stay informed, advocate for fair policies, and have a direct line into discussions that aff ect your business.

Across the country, more councils may pursue bed taxes in 2026 and beyond. A united industry response now could influence what happens next.

James Goodwin puts it simply: “Now is the time to stand up and make your voice heard.”

Many coastal and regional destinations depend on tourism, not just for revenue, but for jobs, small businesses, and entire communities. Surely, adding more costs to the travel experience risks killing demand at the worst possible time, while the industry is still recovering.

The challenge is to fund sustainable tourism without pricing people out of the very regions that need tourism the most.

Let the balancing act begin…

Note: The so-called ‘view tax’ is a colloquial expression used by residents and media to describe the Gold Coast City Council’s higher rates for apartments above the fourth floor.

By Trevor Rawnsley, CEO, ARAMA

For the last few weeks the world’s economies have been on a financial rollercoaster ride that has left many investors nervous and queasy.

The on-again, off-again tariff impositions by the Trump government in the United States have seen stockmarkets behave like dodgem cars without steering wheels.

Markets hate uncertainty.

But those of us who work in management and letting rights have always admired the extraordinary resilience of our industry. In this time of global uncertainty, we can be glad we work in a business with strong foundations and a proven track record to weather storms of any kind.

Buying into management and letting rights is a bit like buying gold—one of the few assets that goes up during volatile times because it is seen as a safe place to park your money.

The business of management and letting rights has been operating in one form or another for more than 50 years, and in that time, it has developed an enviable track record, matching the growth of the community and strata title industry.

There are well over 4000 management and letting rights operators in Australia, reflecting

an industry that not only attracts holiday and residential visitors but also investors.

MLR has not only survived several major upheavals that destroyed other industries, but with every crisis it has faced, our industry has come through glowing on the other side.

It is also a lucrative business model offering many benefits to its operators.

What started decades ago as an improved service delivery model for holidaymakers on the Gold Coast has now blossomed to include other states and long-term residential tenancy accommodation schemes right across Australia and in many other parts of the world.

The MLR industry generates close to $60 billion for the Australian economy annually, and that number is only rising as more Australians embrace high-density living options in both the long-stay residential and short-stay tourism accommodation sectors.

Valuers will always say that certainty equals value. So anything that’s uncertain—and we’ve seen a lot of uncertainty coming out of America in recent weeks—is going to have some impact on the economy.

But regardless of all the hot air from the White House and the ill winds it has produced recently, everyone involved in our industry knows that MLR businesses are stable investments that have proved to be good long-term businesses with little risk and high rewards.

No matter what is thrown at the management and letting rights industry, it has proved time and time again to be resilient and stoic.

Over the last few decades, the MLR industry has faced the Ansett pilots’ strike, which we came through quite well. There was a little upheaval, but only for a moment, when we faced SARS (severe acute respiratory syndrome), a viral respiratory disease that

terrified the world and severely interrupted travel. But we came through that okay, with only a little short-term hurt.

And then, of course, there was the Global Financial Crisis, which people feared would become another Great Depression.

If that wasn’t bad enough, we then faced a couple of years of COVID—a time of lockdowns and masks, which cancelled major events around the world and, in some parts of Australia, even made it illegal to have a holiday.

The impact on tourism and the management and letting rights industry could have been terminal, but here we are on the other side of the pandemic, and business has been better for many operators than before COVID struck because of all the pent-up demand.

Today there is uncertainty about what President Trump might do next and who might win the federal election in Australia.

Traditionally, elections put a handbrake on spending and have some impact on holiday letting and investment.

It’s not a direct correlation, but things are tough out there.

Because of financial hardships in Australia, a lot of shops are closing, and there’s plenty of bad news about retailers in particular.

Our industry had a very sluggish lead-up to Easter, and part of the reason for that was Cyclone Alfred. Some people hear about a cyclone in North Queensland and ring up to cancel their bookings on the Gold Coast.

Or they hear about Alfred and cancel their holiday to Cairns.

That’s just the way some people are.

Uncertainty is not good for business

It doesn’t really matter where Trump lands with these tariffs.

The fact that he’s playing around with them like it’s a game dissuades investment.

The management and letting rights industry is not immune to economic uncertainties or the unpredictability of major weather events, but it stands up to whatever gets thrown at us in a wonderful way.

Providing you get the fundamentals right, management and letting rights is a profoundly resilient business that has withstood the test of time and continues to get through these disturbances.

Ours is a business model that is the envy of the world. There are very few businesses in the world that offer such a high return on investment while also offering the investor a beautiful place to live and without the worries that come with many other endeavours.

Consider the fundamentals of the business model that make the MLR industry so resilient.

The economics work when you have a dedication to onsite delivery of service.

And that’s what the business of management rights really is delivering service, letting services, and caretaking services, onsite and dedicated to that scheme.

It doesn’t mean that if you live there you’ll be successful, or if you don’t live there you’ll fail.

It’s just the concept of dedicating both the letting and the facility management or caretaking by one entity, focused on that one site.

The corporate model is that they might have 161 sites or buildings, but each of their management teams is dedicated to that one building.

It’s not like a property manager in a real estate company who might have a property portfolio of 400 lettings, looked after by Brittany, who’s driving a clapped-out 1985 Laser while looking at her GPS trying to find where the properties are. Or the carpark cowboys the offsite letting agents who have little to do with a property except handing out keys to guests in the carpark when they arrive.

We know where our properties are. We know the investorowners. We know the tenants. And we check in the guy who’s booked his stay.

It’s these fundamental principles of onsite letting management, onsite holiday management, or onsite real estate management coupled with onsite maintenance of grounds and facilities that make management rights such a resilient business, particularly during uncertain times.

If you do all your due diligence and you use specialist lawyers, accountants and financiers when looking to buy into an MLR business and if all the numbers stack up management rights is a very sound investment.

MLR businesses provide a great return on investment, a very good income, and they generally give you a wonderful place to live in a very good environment that you manage.

When I was a residential manager, my logic for buying into MLR was that I was in control of the business. There were certain advantages that the MLR business delivered that were unique. I was an ex-retailer, and in MLR I didn’t have to carry stock, whereas someone with their own retail store might have a couple of hundred

thousand dollars’ worth of stock on their shelves.

If you buy a fast-food business, you will have thousands of dollars’ worth of perishable stock that you have to sell quickly before it goes bad. In food businesses, there are endless but necessary health and safety concerns and stringent cleaning requirements that can do your head in.

From a staffing point of view, many MLR operators need very few staff.

I engaged an outside contractor to do my cleaning. I did a lot of the maintenance myself and then put a guy on to do some mowing and odd jobs.

I only had one or two staff and a contract cleaner.

Compare that to retail or most other businesses, where you usually need a lot more staff than that.

In many MLR properties, a husband-and-wife team can often run the place quite efficiently themselves and control the business well.

And while you might

occasionally meet a whinger or a guest who plays up, in the tourism business most people on holidays are in a good mood and pleasant to deal with.

The best managers realise they are in a service industry, and that by doing the best job they can, they are enhancing the community they live in.

Whether that community is a community of holiday guests, long-term residents or owneroccupiers, it doesn’t matter. You’re enhancing a community when you have a dedicated approach to that scheme with all of the operational services the scheme requires.

When you link that all together with good, positive communication and you understand the importance of the triangle of management bingo.

There’s the secret to success.

And the secret to a business that, for so many operators, has been a solid gold investment during times of major upheaval and uncertainty.

By Ben Ashworth, Senior Associate, Small Myers Hughes Lawyers

This isn’t the first time I’ve written an article about knowing the difference between exercising an option in a building manager agreement and topping up a building manager agreement.

And history teaches that it won’t be the last.

What motivates me to raise this again is that every year new managers come into the industry and every year similar mistakes get made. But the people who make these mistakes are not always the rookies.

A building manager agreement that includes one or more option terms is an agreement that needs an event or a trigger to

Do not fall into the trap of assuming that topping up an agreement has the effect of exercising an option

occur so that the agreement keeps functioning and doesn’t prematurely expire. Some options can exercise automatically without you needing to do anything. But for most managers, you will need to follow a specific process set out in your building manager agreement. Usually, the manager needs to give at least three months’ notice to the body corporate before the current term ends so that the option term can commence. Be aware that for many agreements, it is also possible to give notice too early. An option notice provided before the correct date will not work as intended, and you will need to send the notice again.

If you fail to complete the option exercising process by the deadline set out in your agreement, you lose that option, along with every other unexercised option after it. This means, for example, that an

agreement with a total term of 25 years (as you often find in Queensland) could end after just five years if the first option is not exercised correctly.

For people new to the industry, the difference between phrases like “current term remaining” and “total term remaining” may not be obvious, but these are very significant distinctions. “Total term remaining” refers to the total duration of the building manager agreement if all the option terms are exercised at the correct times. In contrast, “current term remaining” refers only to the current period the agreement will remain in force and effect, and does not include any extensions available under the remaining options in the agreement.

When you “top-up” your building manager agreement, you are typically asking the body

corporate to add a new option term to the agreement. If you are successful with your topup, it extends the “total term remaining” of the agreement. A top-up does not extend the “current term remaining.”

Do not fall into the trap of assuming that topping up an agreement has the effect of exercising an option. Sometimes, you might find that you want to top up your agreement but also, at the same time, need to exercise an option. These are two separate tasks. Be sure not to lose sight of this, and check that everything you need to do to exercise the option is not lost in the shuffle when going through the significantly more involved process that is a top-up.

If you are ever unsure which is which and what you need to do, ask your legal advisors – the sooner, the better.

By Jane Wilson, Commissioner for Body Corporate and Community Management

Living in a community titles scheme can be an overwhelming experience for new residents.

It means thinking about how your everyday behaviour might aff ect other occupants, and it can take some time for newcomers to a body corporate scheme to adjust to their new lifestyle.

Perhaps the most striking diff erence is the proximity to others in your scheme.

Behaviour that might seem perfectly normal to you can be an annoyance or nuisance to others.

For instance, watching a movie late at night with the volume up high, allowing your dog to roam around the communal garden off-leash, or smoking on your private balcony might interfere with another resident’s right to the peaceful enjoyment of their lot or the common property.

Another point of contention in community living tends to be decision-making.

Naturally, not everyone is going to agree with decisions made by their committee or with other lot owners at general meetings.

While there are those fortunate enough to be part of a harmonious body corporate, the reality is that a low-conflict body corporate requires a conscious eff ort on the part of all owners and occupiers.

If there is a dispute—and particularly a dispute that the Office of the Commissioner for Body Corporate and Community Management (BCCM) has jurisdiction to resolve—it is crucial to understand self-resolution.

Self-resolution involves taking reasonable steps to sett le your issue internally, without recourse to formal dispute resolution.

Choosing the correct path to self-resolution can depend on who the dispute is with and what it is about. It might involve:

• submitt ing a motion to the committee;

• submitt ing a motion to a general meeting of owners;

• communicating with another owner or occupier.

In line with the fundamental legislative objective of selfmanagement essential to community living, selfresolution must be attempted before lodging a dispute application with the BCCM.

Internal dispute resolution has two key benefi ts—efficiency and preserving relationships.

Submitt ing a formal application involves completing paperwork, paying a lodgement fee, and waiting for the matter to be considered.

On the other hand, selfresolution is a chance to sett le issues simply and cheaply.

Prematurely escalating a problem to dispute resolution through the BCCM may harm already fragile relationships.

In a community living situation, poor relationships can be a source of considerable and ongoing stress. Keeping a matter within the body corporate goes a long way to maintaining harmony in the scheme.

If you have a dispute with your body corporate, a trail of emails discussing the issue will not be sufficient evidence to support eff orts of self-resolution.

An application lodged against a body corporate may be rejected from the outset if there is no evidence of a body corporate decision on the issue in dispute.

If you want your body corporate to address something, first propose it as a motion (a formal way of making a request).

Guidance about submitt ing motions and draft ing motions can be found on our website.

The elected committee can make day-to-day decisions as the body corporate unless it is a restricted issue for the committee.

The committee has a legislative obligation to act reasonably when making decisions.

If the committee can vote on your issue, you can submit your written motion or written request if you are a tenant to the committee for their consideration as part of your self-resolution.

If your motion or request is rejected, you may wish to write

to the committee seeking the reasons for their decision. Or, if the committee has already provided reasons and you disagree, respectfully provide your reasons for disagreeing.

When drafting correspondence, bear in mind that the purpose is to encourage healthy dialogue towards change.

Owners and occupiers often express concerns about the committee stonewalling them or delaying decisions.

To prevent this, the legislation places clear timeframes on committee decisions. Specifically, the committee must decide an owner’s motion within six weeks after the day the motion is submitted (called the ‘decision period’), unless they have notified the owner that they need more time (no longer than an additional six weeks).

If the committee does not decide an owner’s motion within the six-week decision period (or extended decision period if they request additional time), it is automatically deemed declined, leaving the path to dispute resolution open.

Although the legislation specifies that this timeframe applies to an owner’s motion, an occupier can still use the decision period as a guideline for what is a reasonable period to wait before lodging a dispute application.

Different timeframes apply to committee decisions where an owner or occupier submits a request to keep an animal.

The legislation requires the body corporate to act reasonably when making decisions at general meetings. Lot owners typically vote on more significant body corporate matters at general meetings.

If the committee does not have the authority to vote on an issue for example, changing the scheme’s registered by-laws or approving a maintenance proposal that exceeds the committee’s spending limit

an owner can submit a motion to be decided at the next general meeting as part of their self-resolution.

An owner may also prefer to submit a motion for an upcoming general meeting if they believe the owners are more likely to vote in favour of their motion than the committee.

One of the main difficulties with general meetings especially in larger schemes is that they may be few and far between.

Depending on the size of the scheme, the preparation associated with holding a general meeting can be both time-consuming and costly.

If a general meeting decision is required but one is not scheduled for some time, an extraordinary general meeting (EGM) can be called by either:

• a committee resolution; or

• a written request signed by owners of at least 25 percent of lots or their representatives (called a ‘requested EGM’).

Although non-owner occupiers cannot submit a motion to a general meeting, either an owner or the committee may be willing to submit a motion on their behalf.

Some of the more common disputes that arise between owners or occupiers relate to alleged nuisance behaviours, such as claims of excessive smoking or noise, or potential by-law breaches.

Depending on your relationship with the person causing your grievance, you may feel more comfortable expressing

your concerns face-toface or over the phone.

Remember to document any verbal attempts to resolve the issue, as you may need this for evidence later.

However, it may be preferable to communicate in writing by issuing a polite informal letter or email sharing your concerns.

Written communications can more easily be used as evidence of self-resolution if the matter escalates.

If you believe another owner or occupier has breached the by-laws, you must follow the preliminary requirements for by-law enforcement before lodging a dispute application.

The first step is to give a BCCM Form 1 notice to your committee, alerting them to the by-law breach.

You can read more about enforcing by-laws as an owner or occupier on our website and in Issue 47 of our Common Ground e-newsletter.

Open communication is vital for promoting a lowconflict body corporate.

Of course, how you communicate your initial concerns sets the tone. Accusatory or hostile communication is only going to inflame the situation.

An effective method of maintaining control over disputes is for a body corporate to develop its own dispute resolution mechanisms. The committee or an owner may submit a motion to a general meeting to approve these processes.

Establishing processes such as mediation or meetings either formal or informal may prove especially useful for managing grievances.

In addition, smaller steps, like making a particular committee member the first point of contact for residents in demanding situations, may also defuse conflict.

Implementing internal dispute resolution processes means owners or occupiers who feel aggrieved will have an internal forum for voicing their concerns.

Without these mechanisms in place, residents may feel that lodging a formal application is the only avenue for their issue to be addressed, as there is no support within their own body corporate.

Proof of having participated in these processes may also be used as further evidence of self-resolution should the issue remain unresolved and progress to a dispute in the BCCM office.

If efforts to resolve the dispute internally are unsuccessful, the aggrieved person may consider lodging a formal conciliation or adjudication application with the BCCM.

Conciliation involves an impartial conciliator equipped with knowledge of body corporate legislation assisting parties to navigate their issues either by teleconference or, less often, face-to-face.

While the ideal outcome of conciliation is a good faith agreement, an adjudication application results in a binding and enforceable order.

In most cases, conciliation must be attempted first.

As emphasised throughout this article, it is critical to remember that lodging a formal dispute resolution application for conciliation or adjudication is a last resort, not a starting point.

With that in mind, it is important to stress again that selfresolution is mandatory. If an application is lodged with the BCCM without appropriate evidence of self-resolution, it is more likely to be rejected.

By Mandy Clarke, Editor

Some people stumble into a new business venture. Others run toward it with open arms and a calculator. Stuart McMullan might tell you his journey into the management rights (MLR) industry began with a curious holiday chat — but it’s his sharp business instinct, relentless drive, and belief in partnerships that have carved out his reputation as a quiet achiever and mentor to many.

“Intrigued by the management of a resort we stayed at while on holiday on the Gold Coast many years ago, I asked an MLR agent named Rhonda Perkins (now a management rights consultant at Property Bridge) about the industry,” Stuart recalls. “She explained the model to me — and something just clicked.”

That spark led Stuart and his wife Mandy to buy their first building in Currumbin nearly twenty years ago. They managed the property for two years, sold it for a tidy profit, and semi-retired. But, as Stuart candidly puts it, “I got bored.”

After briefly returning to manufacturing (his original industry), Stuart found his way back to MLR. The turning point came with the purchase of management rights at Marrakesh Apartments in Surfers Paradise. Initially, the couple managed the property themselves. But as their children grew and their ambitions expanded, they decided to sell a share to raise capital and diversify.

Today, the Marrakesh Apartments is run by an active partner. Both daughters and their respective partners are involved in other parts of the business — with one managing the family’s interest in a regional motel in Roma and the other overseeing a holiday-let building in Burleigh.

“We are still owners/part owners of several management rights businesses, but we’ve branched out into all sorts of assets — regional motels, student accommodation, leaseholds, and freeholds,” Stuart explains. “It’s a diverse portfolio and a model that works well for us.”

Stuart and Mandy McMullan

It’s more than a family business — it’s a family calling. With each new venture, the McMullans have demonstrated that MLR isn’t just about location or lifestyle. It’s about building a sustainable business and empowering others to come along for the ride.

Stuart now focuses on a business model that leans heavily into partnerships — but that wasn’t always his preferred route.

“I used to think you had to go it alone, but the truth is, most people don’t have the capital to scale that way.

That’s where partnerships come in.

I’ve learned that sharing the pie gives you more slices — smaller ones, maybe — but more opportunities.”

His model is simple yet clever: identify passionate, driven managers who can’t afford the buy-in, and help them get started. He provides capital support, mentorship, and a profit share — all with the goal of developing independent business operators who can take the reins of a property with confidence.

“We support them, we mentor them, and yes, we let them make a few mistakes along the way. That’s how they grow. Ultimately, they run the property their way.”

From Airlie Beach to Roma, the business model is replicating successfully.

The family’s involvement in a student accommodation property at Sippy Downs and their motel assets are part of a wider strategy: use profits from all projects to build equity for the next and ensure that every investment adds to a diverse, resilient portfolio.

“You don’t need to take huge risks — just smart ones,” he says.

“Buy a piece of something good, improve it fast, take the profits and plough them into the next project. Onwards and upwards.”

“I’m a numbers guy,” Stuart says. “It’s always a numbers game for me. But it’s also vital to surround yourself with people who have the right attitude. I’d rather hire a hard worker with a curious mindset and a hunger for the industry — no experience needed — than a ‘know-it-all’ who won’t listen.”

His advice for anyone looking to enter MLR? Be ready to go beyond your management contract. “If you think you’re just going to do what’s written in black and white, you’re not going to last. It’s a business — not a lifestyle.”

Interestingly, he finds motel management offers more structure and clarity.

“There’s less grey area in motels. You know exactly what’s expected. MLR is an incredible business model, but you really need to work beyond your contract and exceed expectations. It means doing everything from maintenance to mediation — and gett ing called out at midnight for an emergency.”

Stuart revealed that in his 30s, he was inspired by The Four Quadrants, a book that shifted his financial mindset from a PAYG manufacturing worker to an investor, business owner, and independent wealth builder.

Stuart’s investment advice is grounded and pragmatic: “Don’t put all your money into one project. Take small pieces of multiple pies. That way, if something goes wrong, your whole portfolio doesn’t collapse.”

He speaks passionately about bringing the next generation into the fold. “We need young people in MLR. They’ve got the drive and the ideas — we’ve got the capital and experience. Together, that’s a really powerful combination.”

The model they’ve set up off ers exactly that. Every manager they recruit has

skin in the game, the freedom to operate their way, and access to an experienced mentor on speed dial.

Throughout their journey, Stuart and Mandy have kept a low profile. “We’re not flashy. We’ve built a solid business, made some good money, and we’re not bored,” he laughs. “That’s a win.”

He att ributes much of their success to having trusted business partners — one in particular who has been by their side through many ventures — and to surrounding themselves with a strong circle of reliable professionals.

“Mark Ryall at MRM Finance has my back — he talks my language. I’ve worked with him for eight or nine years. For some projects, we’ve also worked with Joshua Haylen from Mike Phipps Finance. Trent Pevy and his team at Pevy Lawyers are incredible — we work with them every day. Our accountants — David Jackson at Hospitality and Strata, and Karl Beste at Treysta Accounting — handle diff erent aspects. Between them all and our bankers, Peter Child from CBA in particular, we’ve got great people who back us and allow us to make fast, confident decisions.”

Now, with both daughters and their partners managing assets, excellent managers in place, and solid systems (including REI cloud-based tech), Stuart and Mandy are slowly beginning to explore the idea of travel. “We’ve never really taken time to travel, not properly. But now we can — remotely overseeing things while enjoying a bit of life.”

That said, he’s still excited by the chase. “I love spott ing a good business opportunity. When you see something with potential, act fast — do the due diligence, but don’t drag your heels. Better to lose a deposit than miss out on something great.”

Stuart’s advice for those considering MLR as a career path is refreshingly honest:

“Forget what everyone else is doing — focus on your own business. There’s enough opportunity out there if you keep your eyes open and your financial goals clear.”

“Inch by inch is a cinch, yard by yard is hard.”

Sage words from a man who has built a multi-faceted business empire — one careful step at a time — while mentoring the next generation and enjoying the ride.

By Jonathan Hanaghan, Principal, Count Gold Coast

Today, I’m discussing what most of you will be wondering when contemplating selling your small business: Will I have to pay Capital Gains Tax?

Well, this depends on how you paid for the business and how much you end up selling the business

for. The potential capital gain (or loss, if you’re unlucky) will also be reduced (or increased, with a loss) by your associated purchase and sale costs—for example, stamp duty, sales agent’s commission, legal fees, and accounting fees. If, after taking these calculations into account, you have made a capital gain, then Capital Gains Tax (CGT) may apply. When selling a business, small and medium-sized business owners may be able to access one or more of six tax breaks to reduce or eliminate the taxable capital gain that would otherwise arise.

Outlined below is a summary of the concessions and some important conditions that must be met to access them.

The first question to consider is

whether the business commenced before September 20, 1985.

If it did—and essentially the same business has been carried on since inception—there is no capital gain on the sale of business goodwill.

While not available to companies, a general 50 percent CGT discount is effectively available to all other business (and non-business) owners who have held the relevant assets for more than 12 months.

Although a company selling its business cannot access this 50 percent discount, an individual shareholder selling shares in the company may be able to. Regardless of whether the above concessions apply, the remaining capital gain might be further reduced by the CGT Small Business Concessions.

To qualify for SBC, the small business owner must have turnover of less than $2 million or a net worth of less than $6 million.

into a superannuation fund as a non-concessional contribution.

This payment does not attract the 15 percent superannuation fund “contributions tax” but has a lifetime limit of $500,000.

If the recipient of the remaining capital gain is over 55 at the time their tax return needs to be lodged, there is no requirement to cash-flow any amount into superannuation to receive this exemption.

Strict timing conditions apply, so care must be taken.

Replacement Asset Rollover— where the remaining capital gain (say, 50 percent or 25 percent) is reinvested in a replacement active business asset or assets, tax on the remaining capital gain can be deferred until the replacement asset is sold. However, as with the retirement concession, strict timing conditions apply.

| Property Manager | Real Estate Agent | Resident Letting Agent

• Traineeships

• Small face to face classes

• Live Zoom classes

• Delivered in English and Mandarin

• Flexi Learning at own pace

• Recognition of Prior Learning

• Friendly, Experienced Trainers

• Practical Courses for MR Industry

• Qualifications issued promptly

• Competitively Priced

• Free CPD Workshops for Graduates

• Exclusive Online Support Group

The asset sold must also be an active asset, as opposed to a passive asset (for example, goodwill).

The four CGT Small Business Concessions are:

15-Year Exemption—a full CGT exemption on the disposal of a business held for 15 years.

If this concession is not applied, one or all of the remaining three CGT concessions can be applied.

50 percent Active Asset

Discount—a further 50 percent discount on any capital gain.

This means that if the general 50 percent discount also applies, the taxable capital gain can be reduced to just 25 percent.

(07) 3878 8513

Retirement concession—to the extent any capital gain remains (say, 50 percent or 25 percent, as noted above), it is not subject to tax if it is paid

The interaction of the small business CGT concessions—other than the 15-year exemption— means a small business owner could make a capital gain of $2 million on the sale of the business and pay no tax in the year the gain is made.

This is achieved by claiming the 50 percent general discount, the 50 percent active asset discount, and the retirement exemption of $500,000.

It may also be possible to access additional rollover deferrals.

While these concessions offer generous opportunities to eliminate capital gains on the sale of small and medium-sized businesses, correct structuring— especially at the time of establishment—remains critical.

Business owners should always consult with their professional accountant before signing any purchase contract, as getting it wrong initially can be far more expensive than the cost of early professional advice.

By

Relations between a body corporate and a scheme manager can break down for any number of reasons, but the moment a body corporate issues a remedial action notice, it is effectively a declaration of war. These notices from a body corporate — sometimes referred to as breach notices — cannot be ignored and must be dealt with immediately. The legislation sets down a specific timeframe in which a manager must respond. Failure to respond to any allegations detailed in the notice may not be deemed as acceptance, but it certainly won’t help when defending the accusations down the track.

Managers should seek legal advice the moment they receive a notice.

As lawyers, when a client receives such a notice, we start a process. Managers need to understand what is going to happen next and how the process works.

The remedial action notice should detail what it is alleged that the manager has not done and also sometimes what is required to remedy the situation.

QCAT and the courts have dealt with so many of these disputes over the years— and each one is distinct in its own way—that some inconsistency has crept into how they should be managed.

If there are some breaches that are arguable but easily fixed, just go and fix them

Part of the art of dealing with these actions is making sure that they’re approached in the right manner, taking all those decisions into account in the circumstances of each alleged breach of the management rights agreements.

For example, a manager may have a remedial action notice that includes, say, nine performance-related complaints.

The first thing we suggest is if there are some breaches that are arguable but easily fixed, just go and fix them. That takes those issues immediately off the table.

If there are some “breaches” that aren’t a duty under the management rights agreements or related to the code of conduct, then those can be refuted on the basis that the manager is not obliged to deal with them.

We had one memorable breach notice, which alleged the manager had been improperly trapping cats roaming around the common property and taking them to a cat refuge. There was definitely no duty in the management rights agreements to trap or not trap cats, so that was easily dealt with at law.

As with most of these types of disputes there are usually other underlying issues—in this instance, it was that the roaming cats belonged to the chairperson. Who could have guessed?

The third class of breach are the more difficult ones: those that are arguable and potentially grey. Those are the ones where most time is required to ensure the response is appropriate.

But either way, all of those issues need to be dealt with methodically and with the required evidence to refute the allegations. The body corporate (usually the committee) will then decide whether it’s appropriate to call a general meeting to terminate the agreements or to accept the responses.

If the body corporate resolves to try to terminate the agreements, the manager needs to apply to

QCAT for an order preventing any resolution to terminate being acted on until such time as the dispute about the validity of the remedial action notices, or the duties that they’re alleging weren’t performed, is dealt with.

That is a proper court process.

In summary, if a manager receives something that looks like a breach notice or a remedial action notice—something formally on letterhead saying that they are not doing their job—make sure legal advice is sought straight away. The clock is ticking in terms of the timeframe to respond.

It’s vital that a manager responds in the right way, and forcefully if needed, to make sure the body corporate knows the manager’s position.

The worst possible response is no response at all.

For Sue Baradel, comanager of Crystal Beachfront Apartments, the perfect beach holiday begins in Tugun—a laid-back Gold Coast suburb named after the Aboriginal word for “breaking waves.”

Nestled right on the sand, Crystal Beachfront Apartments is a boutique complex off ering guests a front-row seat to the Pacific Ocean. With spacious, self-contained apartments, a heated pool, and direct beach access, it’s the kind of place where families return year after year—and where Sue, her brother, Tim Falloon and his partner Tam, have built a thriving accommodation business.

“It’s the perfect place for a perfect beach holiday,” Sue says. “The atmosphere is relaxed, the beach is right outside your door, and we’ve created a space where guests can really unwind.”

But behind the beautiful views and smooth guest experiences is a powerful system helping Sue,Tim and Tam keep everything running seamlessly: GuestPoint.

“We’ve been using GuestPoint for about three and a half

years now,” Sue says. “The pay and trust accounting systems are incredibly user-friendly, and the support team is just fantastic. You just pick up the phone and there’s always someone there to help. It’s such an easy system to use.”

For busy managers, GuestPoint’s intuitive all-in-one platform is a true game changer. It delivers real-time solutions without the stress of switching between systems or dealing with clunky integrations.

Among GuestPoint’s many features, Sue says the GuestPoint Pay system and its integrated Trust Accounting functionality stand out as particularly valuable.

GuestPoint Pay allows Sue and her team to take payments directly from the PMS, eliminating the need to use third-party portals or manually reconcile records. The system automates payment schedules for deposits, balances, and cancellations, and stores card details securely in line with PCI DSS compliance standards.

“We don’t have to worry about

juggling multiple platforms,” Sue says. “GuestPoint takes care of that.”

It also simplifies reconciliation and ensures every transaction aligns with booking activity—making reporting and audits far easier.

For operators like Sue, Trust Accounting is another huge plus. As a legal requirement, GuestPoint’s built-in system provides accurate tracking of guest funds, automated ledger management, and secure logs with full transaction histories.

“It keeps us fully compliant without the hassle,” Sue says. “And if we ever have a question or issue, the support team is just a call or email away.”

According to David Sawers, General Manager at GuestPoint, the goal was always to build an intuitive, integrated solution that made life easier for accommodation providers.

“We designed GuestPoint to be as easy to use as possible,” David says. “Everything— from the channel manager to payment gateway—is built right into the PMS and linked together seamlessly.

By Andrew Morgan, Motel Broker/Partner, Qld Tourism & Hospitality Brokers

After twenty-nine years of selling motels and therefore staying in them regularly, you tend to form an opinion based on your own preferences as to what makes a good motel from a guest’s point of view.

The way I like to look at it is to break down the features of any given motel and see how it stacks up in those areas.

This not only goes for the motel room itself but everything else that goes into making that motel what it is—good, bad or indifferent.

Everyone will have a different opinion on what makes a motel great, compared with others they may not have enjoyed so much.

Everyone will have their own non-negotiable features that must achieve a ten out of ten, whereas others may not see these as important and will value different features more.

Here’s how I see the value of each area ranked one to nine to make a great stay for me.

This does not mean the ninthranked item is not important—it is—just not as important as those ranked above.

Not everyone will agree, but these are simply individual preferences that suit one person’s travel needs.

This one gets top billing in my book.

I feel we can overlook a lot of things that may not

We can overlook many things, but a motel room that has not been cleaned properly is not one of them

be ideal, but a motel room that has not been cleaned properly is not one of them.

It doesn’t need to be modern or new, but it does need to be clean.

Cleaners can at times overlook things going from one room to the next, or perhaps rush through a room if on a short time schedule, but it cannot be forgiven.

Just edged out by cleanliness, but to have a good night’s sleep anywhere, you need a good bed and good pillows.

So often, people complain about having a poor night’s sleep due to a sagging bed or uncomfortable pillows.

Now, the bedding side of things is an easy fix— replacement when required. However, pillows are a difficult one.

Everybody has a different pillow requirement—hard, soft or in between—who can know exactly?

We could all test ten and still not be happy.

This heading covers a lot of items, so it comes in third.

Clean shower and toilet facilities have been covered, but good water pressure and hot water on demand are high on the list after a long day driving or working.

Noise minimisation is desirable but can be difficult to achieve.

Carpark vehicle noise and other guests can only be addressed by soft floor coverings (depending on the actual floor), solid walls, and doors and windows sealed properly and/

or double-glazed windows.

Appropriate window coverings that keep out the light at the crack of dawn are a small thing but really appreciated by the majority.

Wifi and tea, and coffee facilities are the minimum.

A long-term client of mine who has been in the motel industry for over 50 years told me many years ago: “The bigger the TV the better. No one appreciates a small TV.”

I believe he is right!

Depending on one’s requirements, the importance of this one varies.

Studio, self-contained, separate rooms, families, singles or couples—it all depends.

As a single person travelling, it may not be high on the list, but for a family with three or four young kids, the room type may be top of the list.

Space, bedding, and the ability to cook or at least knock something up for the kids to eat or snack on makes a big difference.

A quick, easy check-in to access your room and relax is so good after a long drive or workday.

Being greeted with a smile and friendly chat, banter or even just some additional information on what is available is great.

I am sure everyone wants their car and room to be secure and safe overnight.

Theft or damage will ruin anyone’s day.

Carpark numbering or not,

undercover or not covered, off-street or on-street—the only deal breaker here is off-street carparking at a minimum.

My preference is to have my car close by, even outside my door, if possible, but I can live without that—hence why it sits only sixth on the list.

Large vehicle parking may be very important to some guests, and I can see why this could be much higher on others’ lists.

Just like unit/room type, I think the reason for travel makes the difference here.

If you’re passing through, a highway location to get that early start works.

In town for work purposes, the highway or CBD is fine.

On holiday or an extended stay for recreation, riverfront or beachfront would be preferred.

My kids might say I am “too tight” when they don’t get everything they want, and at heart, I do love a good bargain.

However, I am quite happy and prepared to pay for all the above items to get a good night’s sleep and enjoy the stay while on the road.

What the motel offers outside one’s room, such as a restaurant/dining, swimming pool, outdoor patio area, kids’ playground and so on…

Again, who the traveller is and the reason for travel will determine how high this one sits on anyone’s list.

The first thing I will say is that I thought this would be a lot easier than it was. Right from the start, I typed the number one, then hit the wall. I had about four items I wanted to rank as my most important, and it did not get easier from there. Anyway, that’s the list in order of preferences... I think!

By Mike Phipps, Mike Phipps Finance

For the five regular readers, my mum, and the sprinkling of assorted insomnia sufferers who read this column, you may recall that last month I was planning a road trip to western Queensland. Through a miracle of coincidence and divine benevolence, the area of my planned excursion had just received record levels of rainfall.

Nevertheless, I was keen to visit our many motel and caravan park clients out west, and to spend a bit of time reacquainting myself with regional economies and demand drivers. The opportunity to drop in a few business cards and hopefully

gain some new clients will not be lost on the agents and reps who ply these territories. 4000 kilometres and 21 nights later, what have I learned?

Let’s start with mother nature. The west can be a pretty depressing place in drought with much dust, distressed livestock, wildlife risking life and limb to graze beside highways, and many dry creek beds. On the other hand, after record rains, it’s amazing. Creeks and rivers in flood, dams full, spectacular vistas reminiscent of an African savanna landscape during the wet season, healthy livestock, and near zero roadkill.

I had plenty of time to reflect on the amazing conditions while sitting on the highway between Roma and Injune waiting for flooding levels to fall and the police to give the all clear. I had spent the previous night in a Darling Downs motel and was booked into a cabin at the Big 4 park at Carnarvon Gorge for the following three nights. The park managers had already phoned me and warned that the journey might take longer than expected, and so it turned out to be. The delayed travellers now queued up on highway A7 were made up mostly of road trains and high clearance 4x4s. For those of you unfamiliar with trucking in the outback,

a road train typically consists of a prime mover and three trailers. Average total length 55-60 metres and can weigh more than 130 tons, depending on cargo. A lot of fun when overtaking, albeit the drivers are usually super courteous and will signal when it’s safe to pass—always check of course, coz you never know when a psychopath might be driving one.

Needless to say, with time to kill, the “If It’s Flooded Forget It” mantra sprung to mind. Do the same rules apply to a 130-ton road train as a 1240 kg Corolla? I didn’t need to wait long for an answer.

The local coppers turned up on the other side of the water, where it appeared just as many heavy vehicles were waiting. I should point out that prior to the arrival of the law, some trucks and 4x4s had crossed safely, and the water was dropping fast. Being the risk-averse, cautious person that I am, I waited… I should have sat behind the last road train going through, but as always, hindsight is a wonderful thing.

For the next two hours we waited while being advised by travellers on the other side that the water level needed to be low enough for the bloke in said Corolla to get through. Our CB communications also informed us that the coppers had told everyone that fines would be issued to anyone who entered

the water from either side before a formal clearance was given. If this isn’t the best example of the lowest common denominator I’ve seen, I don’t know what is. We must walk as slow as our slowest person, and it would seem drive that way as well.

As you would expect, when we finally got the go ahead, the Corolla driver’s popularity was clear to see. But here’s the thing. It’s not his fault. The blame for these idiotic oneliner, one-size-fits-all mantrabased rules lie squarely with the bureaucracy. We can’t be bothered differentiating risk across a broad range of variables, and we don’t trust the punters to have a brain, so a one-sizefits-all policy will suffice. Same goes for the 60 km/h roadworks signs on open highways when no roadworks is in progress coz it’s the weekend. I could go on, but I’m sure you share my frustration. Anyway, the water hazard and several others are negotiated, and I’m on the road into Carnarvon Gorge. Having been here a few times before, I’m familiar with the one-lane sealed dead-end road in, the unfenced livestock grazing, and the magnificent sandstone cliffs and gorges that frame this incredible landscape. I’m less familiar with the storm I’m heading into, the biblical rain that’s making the road very hard to navigate, or the fast-rising

multiple floodways and creek crossings. By the time I reach the sidetrack to my destination, the Carnarvon Creek is an impassable torrent. Bugger! I call the park and they confirm that there’s no chance of getting in and best to hightail it outta there.

Two creek crossings back toward the highway, and it’s clear I’m going to get stuck. A quick U-turn and up to higher ground for what I expected to be a night in the truck. I found some mobile reception and called the managing director. A less sympathetic response I cannot recall, albeit she did appear somewhat relieved that my immediate demise was unlikely.

Then I recalled that the day use area at the entrance to the many gorge walks had toilets and covered areas. A better option for a rough night, if I could get there. The double back proved only slightly perilous, and I made it through the final floodway into the Carnarvon National Park. It was here that divine providence stepped in. A light… and not just any light. The lights of a bar and restaurant. The Carnarvon Wilderness Lodge, previously closed, had reopened for the hiking season. As I emerged from the darkness to seek accommodation, the

shock and surprise of my arrival garnered various comments from the staff. Some cannot be repeated, but a general “where the hell did you come from?” Best summarises the response. Now trapped with the staff and two other guests, but safe and very happy in my deluxe glamping tent, the situation went from a bit scary to quite cool. I got out three days later while the Carnarvon Creek continued to deny access to walking tracks and the Big 4 van park.

From Carnarvon I travelled via Barcaldine and Longreach to Winton and back with a further three nights at the Wilderness Lodge. To my earlier point, what have I learned?

I’ve travelled out here a bit in my life, and it always strikes me that it’s a hell of a long way with vast areas of nothing much. Magnificent after rain, but the further west you go, perhaps less appealing in dry weather. In terms of accommodation options, the proprietors of the Barcaldine Country Motor Inn have done something clever. They’ve added prefabricated villas, a pool and a laundry, plus a few powered van sites to their motel and created an absolutely immaculate oasis for travellers. A town with much

history and a nice vibe if you want a taste of country life. Longreach is well worth a visit but go in winter and not after lots of rain. The Saltbush Retreat has beautiful rustic-themed cabins and is close to the Qantas Founders Museum and the Stockman’s Hall of Fame. In Winton, I stayed at the Boulder Opal Motor Inn. A pretty typical country motel managed by very helpful people. They even lent me a blower to get the dust out of the back of the truck.

Having grown up out west, I have an affinity with these places that may not resonate with city folk. Regardless, do yourselves

a favour and visit Carnarvon Gorge and the related sandstone region national parks. A truly world-class natural wonder, a place of special Indigenous cultural significance, with a very nice glamping lodge and a nearby Big 4 park.

In closing, I’ve learned something else on this trip. Things can go sideways in a big hurry out here, and no amount of bureaucratic sloganeering will save you if you’ve become reliant on Big Brother to keep you safe. Common sense, life experience, and a deep fear of dying and inconveniencing the MD in your life are way better strategies.

By Lynda Kypriadakis, The Diverse Group of Companies & DPX Projects

In a residential strata complex, whether it be apartments or townhouse villas, the smooth operation and ongoing maintenance of common property are essential to the residents’ quality of life and the asset value of the complex.

When the management rights (MR), which may include both the caretaking and letting agreements, are sold from one building manager (caretaker) to another, a well-organised and professional handover is critical.

This transition involves not just a change in personnel but a complex handover of contractual, operational, and practical responsibilities, often under the close scrutiny of the body corporate and its committee.

This article outlines the key steps, legal frameworks, and best practices that should be followed during this handover process.

1. Understanding management rights and the role of the caretaker

Management rights are a bundle of rights that allow a business operator to reside onsite (typically in a manager’s unit) and to manage and maintain the common property of a strata complex. These rights usually include:

• A caretaking agreement, which outlines the maintenance responsibilities.

• A letting agreement, allowing the manager to let units on behalf of investors.

• Ownership or leasing of a manager’s unit and possibly an onsite office or storage areas.

The caretaker is usually responsible for maintaining lawns and gardens, managing rubbish removal, cleaning shared facilities, making minor repairs, and acting as a liaison between residents and the body corporate. In the case of letting, they also manage tenancies for units in the letting pool.

2. Pre-handover due diligence

Before the sale of management rights is finalised, both the incoming and outgoing managers must perform due diligence:

• Contract review: The incoming manager must review the caretaking and letting agreements to understand the terms and the duration of the appointment. Legal advice is essential here.

• Financial records: Examination of profit-andloss statements, current rental rolls, maintenance schedules, and any outstanding invoices.

• Compliance check: Ensuring the caretaker has been fulfilling all obligations—noncompliance could affect

the value or renewability of the agreements.

• Body corporate approval and assignment interview: Most MR agreements require body corporate approval before assignment. This may include interviews and performance reviews of the current manager.

A comprehensive inventory of tools, equipment, and supplies should be compiled and verified. This may include:

• Gardening tools and equipment (mowers, blowers, etc.).

• Cleaning products, plant, equipment and machinery.

• Keys, fobs, remote controls, PIN codes, and security passes for all common areas.

• Manuals and warranties for equipment.

• Contractor details (plumbers, electricians and so on).

• Contract details (a register of contracts on foot with the body corporate).

• Login credentials for building management software, CCTV, and access systems.

The transfer of these assets must be documented, often with photos and signatures to confirm condition and completeness.

A thorough operational handover involves passing on detailed knowledge of the day-to-day running of the complex. This can include:

• Maintenance schedules: Detailed logs and upcoming tasks, both routine and urgent.

• Contractor relationships: Introduction to trusted service providers

• WHS Plan: Induction into the documented safety system for the common property workplace.

• Caretaking Operations Manual: Including utility shut down procedures and all other relevant operational information held in the head of the outgoing caretaker.

• Resident information: Understanding common issues or needs of residents, current disputes, or special requests.

• Letting roll: If applicable, the rental agreements, tenant contacts, maintenance history, and tenancy issues must be handed over securely and in compliance with privacy laws.

Some best practices include maintaining a Facilities Management Plan, compiling a resident welcome pack, and keeping a handover checklist to avoid oversights.

5. Communication with the body corporate and residents

Transparent and timely communication is crucial. The outgoing manager should:

• Notify the body corporate of the intent to sell the management rights and introduce the potential buyer early in the process.

• Arrange a handover meeting: With the committee to formally introduce the incoming manager, discuss any concerns, and agree on the timeline and expectations.

• Write to residents: Inform residents of the change, reassure them of continuity, and offer contact details for the new manager.

The incoming manager may also benefit from holding a meet-andgreet event with residents to start building rapport and trust.

6. Formal handover documentation

The formal handover should be documented in writing and ideally witnessed by a third party such as a representative of the body corporate, a

specialist project manager or the strata manager. Key documents might include:

• Signed handover checklist.

• Signed inventory and asset transfer form.

• Current copy of the Caretaking Operations Manual (or updated Facilities Management Plan).

• Latest Building Manager’s Report detailing status of projects, works in progress, quotes awaiting approvals, work orders issued, etc.

• Confirmation of login credentials transferred.

• Updated insurance certificates (public liability, professional indemnity).

• Updated contact list of residents, contractors, and committee members.

This documentation helps protect both parties in case of disputes and ensures continuity of service.

7. Training and shadowing period

Depending on the agreement between the buyer and seller (and sometimes required by the body corporate), a transition period may be arranged where the outgoing manager provides hands-on guidance for a few weeks. The minimum period is typically two to four and this allows the new manager to:

• Shadow the outgoing manager on key tasks.

• Ask questions about specific nuances of the complex.

• Gradually take on responsibilities.

A supportive transition fosters goodwill and helps maintain high service standards.

8. Strata and legal compliance

Throughout the transition, legal compliance is critical so all parties to the transfer of management rights are encouraged to seek and take legal advice, which may include such as the following:

• The assignment of management rights must be approved by the body corporate under the conditions in the contract and relevant legislation.

• The incoming manager must ensure their business is properly licensed, registered for tax, and insured.

• Letting agents must hold the appropriate real estate license.

Strata managers or lawyers should be consulted to ensure compliance with state legislation and the specific community management statement of the complex.

9. Post-handover responsibilities

Once the handover is complete, the incoming caretaker should:

• Review and prioritise tasks for the first 30–90 days.

• Become inducted into the body corporate WHS Compliance Management Plan.

• Become familiar with the details within the Facilities Management Plan and the latest Building Manager’s Report.

• Conduct a condition audit of common areas.

• Engage with residents to understand key concerns.

• Begin tracking KPIs and reporting to the committee as per the performance requirements of the caretaking agreement.

Ongoing transparency and proactive communication will help solidify the relationship with the body corporate and residents.

The transition of management rights in a strata complex is more than a simple change of hands—it is a critical moment that can shape the success of the new caretaker and the ongoing satisfaction of residents. A structured handover process involving legal due diligence, detailed documentation, strong communication, and a clear understanding of caretaking responsibilities is essential. With proper planning and a cooperative approach, the handover can be a seamless process that sets the stage for continued excellence in building management.

By Roland Franz, General Manager, Body Corporate Headquarters Strata Consulting Services (Qld)

Disputes are inevitable in any community living situation but handling them effectively can prevent escalation and foster a harmonious environment. Here are some strategies for managing disputes with your strata manager or within the strata community.

1. Stay calm and objective

When a dispute arises, it’s important to stay calm and objective. Avoid letting emotions drive your actions or communications. Take a step back, assess the situation, and approach it with a clear mind.

2. Gather all relevant information

Before addressing the dispute, gather all relevant information and documentation. This includes emails, meeting minutes, and any other records that pertain to the issue. Having all the facts at hand will help you present a well-informed case.

3. Communicate clearly and respectfully

Clearly articulate your concerns and desired outcomes. Use respectful language and avoid personal attacks or blame. Focus on the issue at hand and how it can be resolved.

4. Seek mediation or third-party assistance

If direct communication does not resolve the dispute, consider seeking mediation or third-party assistance. Strata managers can suggest independent mediation services that can help facilitate a resolution.

5. Refer to the BCCM Act or other related legislation

Use the BCCM Act or other relevant legislation as a reference point for resolving disputes. Understanding the legal framework and your rights and responsibilities can provide clarity and support your position.

6. Be willing to compromise

Be open to compromise and finding a middle ground. Resolving disputes often requires flexibility and a willingness to consider alternative solutions.

Being solution focused generally results in positive outcomes representing the best interests of all parties.

1. Maintenance request

Scenario: An owner is frustrated because a common area light has been out for a couple of weeks without repair, presenting what they consider is a safety risk.

Approach: The owner emails the strata manager, clearly outlining

the issue, and the impact on residents. They suggest a specific timeframe for repair and offer to assist by providing access for the electrician if needed. The email is respectful and acknowledges the strata manager’s workload and that they may not be aware of the issue previously.

Outcome: The strata manager appreciates the clear communication and proactive approach, leading to a prompt resolution.

2. Noise complaint