Pricing: There is a right and a wrong

To save significant time, money, and stress, it is essential to set an accurate price for a motel or accommodation business from the outset, rather than pursuing unrealistic expectations. This can be achieved by gathering reliable data, seeking expert advice, and approaching the decision objectively, without emotional bias.

The API states the definition of market value as follows:

“The estimated amount for which an asset or liability should exchange on the valuation date between a willing buyer and a willing seller in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently and without compulsion.”

In essence, anything is worth what a buyer is willing to pay. One buyer may see unique value in the property and offer a premium, while another may not and propose a lower price. Ultimately, the market, comprising both buyers and sellers, determines the value through negotiation. When a willing buyer and a willing seller agree on a price, that transaction reflects the true market value on that day. This dynamic underscores the importance of realistic expectations and objective valuation in any sale.

Pricing is key to a timely sale

Setting the right price when bringing a motel to market is critical to how quickly it will sell. Listing at $1.5 million when the true market value is closer

to $1 million will most likely result in prolonged buyer inactivity. While initial interest may be high, it tends to fade quickly once buyers recognise the price is unrealistic. Even genuinely interested parties may hesitate to make an offer, assuming the seller’s expectations are inflexible. Buyers compare listings and if they perceive better value or more reasonable sellers elsewhere, they will shift their focus accordingly. Overpricing not only delays the sale but can also damage the perceived value of the asset.

The link between pricing and time on market

There is a clear and direct correlation between pricing and the time it takes to sell a motel. So, how long should a sale take? While there’s no definitive answer, a well-priced motel typically sells within four to six months, including marketing, negotiation, and settlement. However, if the asking price is above market expectations, the property may remain unsold for an extended period.

Understanding the market requires upto-date information

Accurately assessing the current market relies on access to timely and relevant data. Buyer activity is influenced by many factors, including interest rates, the performance of the motel and broader accommodation industry, access to finance, business confidence, and the overall economic climate.

Over the long term, there is a clear correlation between the health of the accommodation sector and buyer demand. When the industry is performing well, interest in acquiring motel assets increases. Conversely, when business conditions are poor, buyer interest tends to decline. This pattern reflects a natural intersection of human behaviour and economic fundamentals.

Pricing a motel: An inexact but informed process

Setting the right price for a motel is not an exact science. It requires careful consideration of numerous factors to estimate what genuine, financed buyers in the current market are willing to pay. These factors include physical attributes: land size, location, position, presentation,

and critically, its financial performance. Some elements will carry more weight than others, depending on the priorities of individual buyers. This variability makes it difficult to predict exactly how value will be perceived. However, one thing is certain: if the price is misaligned with market expectations, the feedback, or lack thereof, will be immediate. In such cases, the silence from initially interested buyers can be telling.

Informed decisionmaking in motel pricing

A seller can only make the best possible pricing decision by conducting research and seeking expert advice. This process should include reviewing comparable properties currently on the market, analysing recent sales of similar motels, and considering the insights of an experienced motel broker who understands how the market is likely to respond. Additionally, obtaining a registered valuation can provide an objective benchmark. Each of these elements contributes to forming the most accurate and realistic assessment of value. While no method guarantees precision, combining multiple sources of information significantly improves the likelihood of setting a price that aligns with market expectations.

Information needed to assist in setting an accurate motel price

To determine a realistic and market-aligned price for a motel, sellers should gather and review the following key information:

Financial performance

Accountant’s profit and loss statements: Ideally, provide three years of trading data. One year alone may not reflect typical performance and could skew valuation.

Insight: Just as one good innings doesn’t define a cricket season, one strong or weak year doesn’t define a business’s value. Historical and projected trading both matter.

Plant and equipment list

A detailed inventory of all chattels included in the sale, such as: beds, TVs, fridges and kitchen equipment.

Exclude leased or rented items unless

they will be paid out before settlement.

Lease or rental agreements

Include agreements for leased chattels, signage, waste removal, and so on.

Lease document (if leasehold)

Provide the full lease agreement and any amendments (Form 13 amendments).

Occupancy rates

Monthly occupancy data for the past three years, if available.

Monthly income breakdown

Revenue split by department (accommodation, restaurant, bar etc) for the past three years.

Current tariff schedule

Include the current rate card and note the last increase and percentage change.

Council property rates

Provide the most recent one or two rates notices.

Recent property improvements

List major refurbishments or significant maintenance investments.

External agreements

Copies of contracts with chain affiliations, booking platforms, service providers, etc.

General operational information

Include details on daily operations, such as booking systems, social media presence, office hours, and the structure and roles of staff.

Buyer’s perspective: A critical step in pricing

Failing to consider the viewpoint of a potential buyer when preparing a motel business for sale can be a costly oversight. One of the most effective starting points in setting a price is to ask: “If I were an active buyer in today’s market, what price would I be willing to pay for this business?”

Simply stating: “This is the price I want, regardless of what others think,” ignores the reality that buyers ultimately decide whether to invest and must be convinced. Understanding their mindset and expectations is essential. It’s about shifting focus from the desired outcome to the buyer’s journey and decision-making process.

Andrew Morgan, Motel Broker, Qld Tourism & Hospitality Brokers

Comparison with leasehold motels

Presenting value professionally

Identify the key information a prudent buyer will expect—financials, operational details, asset lists, and present it clearly and professionally. This builds trust and demonstrates that the business is well-managed and transparent.

Return on investment (ROI) and market dynamics

The motel market is dynamic, with ROI expectations shifting over time due to economic conditions, buyer sentiment, and location-specific factors. Over the past 30 years, ROI across freehold motel ownership has typically ranged between 12 and 18 percent. While this may seem like a modest range, the impact is significant. Location plays a major role in ROI expectations. Coastal motels often attract different buyer profiles and pricing dynamics due to tourism demand, lifestyle appeal, and seasonal fluctuations, which result in a lower ROI expectation.

Let’s explore how ROI has varied across the three main motel ownership models over the past 30 years, from coastal to inland locations.

Leasehold motels: High returns, unique considerations

Leasehold motels have consistently offered significantly higher returns on investment (ROI) compared to other motel ownership tenures. Historically, leasehold ROIs have been at least double those of freehold going concern motels and more than three times those of passive investment motels.

Historical leasehold ROI range

The lowest observed ROI was about 25 percent, around 2008, while the highest has exceeded 100 percent in some cases. Why such high returns?

These elevated returns are often due to the nature of what’s being sold. In some cases, the leasehold sale may include minimal or no tangible assets—just the lease agreement itself. Without plant and equipment included,

the transaction resembles more of a rental arrangement than a traditional business sale. This lower capital outlay relative to the profit potential can result in exceptionally high ROI figures.

Key takeaway

While the potential for high returns is attractive, buyers must carefully assess what is actually being acquired. The absence of tangible assets or the lease structure can significantly impact the risk profile and longterm value of the investment.

What is a freehold going concern (FHGC) motel?

A FHGC motel means the buyer acquires the land the motel sits on, the buildings and infrastructure, and the business operation itself — including goodwill, plant and equipment, and sometimes employees.

This contrasts with leasehold motels, where the buyer only acquires the business and leases the property from a lessor.

Return on investment (ROI) trends

FHGC motels have shown lower ROI variance over time compared to leaseholds. A typical ROI ranges from 12 to 18 percent.

Freehold passive investment motels

This tenure, which includes only the land and buildings with a lease in place, has shown even lower variance than FHGC motels. This is probably not surprising, as the variances align with where the ROI sits. In general terms, returns have ranged from below seven percent to above 13 percent.

Please note that the percentages mentioned above do not account for exceptions such as a waterfront property, where the ROI may vary even further due to the higher value of the land or redevelopment potential. The ROI on one motel will be different to the next; the above is merely a guide, and each must be considered on its own merits.

Comparison of motel investment types

Presentation and reinvestment: Key drivers of motel sale value

While pricing is often the headline focus in motel sales, presentation and reinvestment are equally critical in achieving a premium result.

Why presentation matters

A well-presented motel attracts more interest from serious buyers, commands a higher sale price, and reduces negotiation pressure and objections.

Common buyer concerns that impact offers

Buyers often hesitate or lower their offers because of things like a lack of split-system air conditioning, poorly painted or deteriorating surfaces, damaged or outdated benchtops, sagging or uncomfortable beds, and bathrooms in need of complete renovation.

These issues are often seen as cost burdens that buyers must inherit, something most are unwilling to do without a significant price reduction.

Reinvestment is not a cost: It’s a strategy

Investing in upgrades and maintenance is more than just basic upkeep; it’s a value-adding strategy. While some improvements do require capital outlay, they can enhance buyer perception, reduce time on market and help justify a higher asking price. Very few buyers are willing to accept a seller’s generosity in passing their problems on to the next owner.

The power of minor details: Small fixes, big impact

While major renovations can significantly boost a motel’s value, minor repair and maintenance tasks

often make a surprising difference in a buyer’s decision-making process.

Small issues that matter

Buyers often notice and mentally tally up things like overgrown gardens or untrimmed trees, touch-up painting left undone, mouldy or loose tile grout and silicone, worn or stained floor coverings, and general wear and tear. These may seem minor, but to a prudent buyer they signal neglect and add up to perceived costs—often resulting in a lower offer or no offer at all.

Cleanliness: Nonnegotiable

Cleanliness is essential in daily operations, but during inspections it becomes critical. A spotless motel, regardless of age, leaves a strong impression on buyers. Clean, tidy interiors and exteriors signal good management and care, and first impressions build trust. Small issues add up to big costs in a prudent buyer’s mind.

Conclusion: The role of strategic pricing in a successful sale

The success of a motel sale hinges on managing the entire process well, but pricing remains the most critical factor. No matter how much is invested in property improvements, business operations or marketing, setting the wrong price can undermine the whole effort. The goal is to set a high yet realistic price that motivates genuine buyers to act—not just to generate interest, but to spark real offers.

A well-informed, realistic pricing strategy ensures that every other effort—from presentation and reinvestment to promotion—works together to achieve the best possible result. The right price is one that influences a buyer to act while delivering the highest return for a genuine seller.

SOUTH EAST QLD MOTEL – NEW 30 YEAR LEASE

Situated in a main road position, this 11 unit motel has had a large amount of recent upgrading and renovation including new kitchene es and bathrooms. The comfortable 2 bedroom residence has direct internal access to reception, new bathroom, large living room and private backyard. The business is very easy to operate, currently by a husband and wife team and has an excellent trading history over the long term. A brand new 30 year lease is being o ered by the long term owners. This is an excellent motel opportunity that ticks all the boxes and will not be available for long.

11 Units South East Qld

LEASEHOLD $495,000

* Outline is Indicative Only

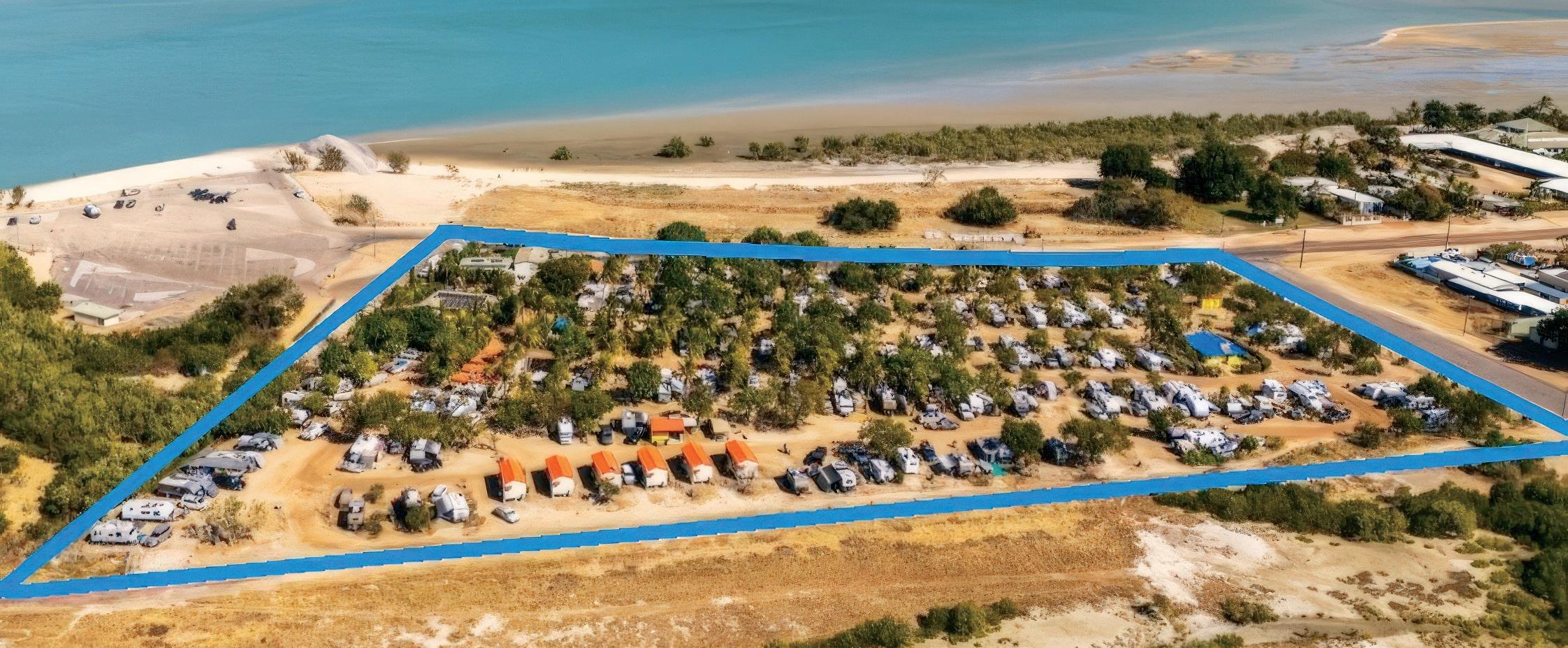

GULF REGION BEACHFRONT DESTINATION PARK

Karumba Point Sunset Caravan Park is located in Karumba Point, a coastal town in the Gulf of Carpentaria at the mouth of the Norman River. The park occupies a prime beachfront site close to the boat ramp and is so popular with tourists they o en book two or three seasons in advance. The park improvements include 163 powered sites, 4 cabins with kitchen facilities, 6 self contained villas, two amenities buildings, camp kitchen & large entertaining area, onsite shop & reception, bbq areas, inground pool and work shed. FY24 Turnover was $1.53M whilst FY25 based on YTD trading is projected to Turnover $1.75M.

173 Sites Karumba Point

+ S.A.V.

IMMACULATE WHITSUNDAYS B&B WITH OCEAN VIEWS

Located in the beautiful Whitsundays Region, with stunning ocean views also overlooking the town centre. This fully renovated, immaculate B&B complex includes a high quality construction with nothing to spend. Each of the 7 units has its own Balinese inspired ensuite. There is a large kitchen and smaller kitchene e for guest use. The complex is located within walking distance to the town centre, restaurant, shops and beach. Occupancy circa 80% FY25 with a Net Profit FY25 $261,580. The income and profits have been increasing year on year. This property is easily operated by one person or a couple. It includes flexible o ce hours of the owner’s choosing, making this a great lifestyle business. The atmosphere around the property is very relaxed inspired by the ocean views and tropical landscaped gardens. The outdoor 1st floor deck overlooks the ocean, gardens and town centre.

7 Units Whitsundays FREEHOLD $2,650,000 GREAT LIFESTYLE BUSINESS IN TROPICAL NORTH QLD

This high quality management rights complex includes 29 fully furnished studio, one, two and family apartments. The property enjoys strong repeat business with a high volume of regular clients and has traded consistently over many years. 15 units are in the current le ing pool with 2 more to be added later this year. Included real estate valued at $525,000 with managers residence comprising 2 x two bedroom apartments. Net Profit $196,187 FY24. There is much potential to increase profits substantially by renting out the second unit currently used as part of the residence. This well established business is priced to sell by a motivated seller with a great lifestyle available for the next owner.

29 Units Far North Qld MANAGEMENT RIGHTS OFFERS ABOVE $990,000