Guest expectations are changing, the benefits of upgrading your building’s internet:

Tourism Impact: Discerning visitors now view fast and reliable internet as a key factor when choosing accommodation.

Online Reviews: Guest feedback increasingly reflects internet performance, which can influence future bookings.

Real Estate Appeal: Buyers and tenants are seeking homes that support remote work — high-speed internet is now essential.

Holiday Letting Performance: Buildings with excellent internet tend to enjoy be er reviews, stronger brand recognition, and increased occupancy and revenue.

Option A: New CAT cabling to each room. Improves speed over traditional lines but doesn’t support gigabit performance. Installation is costly.

Option B: Wireless distribution across the building. Cost-e ective but unreliable due to interference from building materials and layout.

Option C: Fibre optic cabling to each apartment.

O ers excellent performance but comes with high installation costs and device upgrade requirements.

Option D – Recommended: Gigabit fibre delivered via existing TV coaxial cables. This solution:

o Delivers speeds up to 1.5 Gbps (1,500 Mbps).

o Involves minimal disruption and cost.

o Is fully managed and warranted.

o Has proven success with existing installations.

…with the flick of a switch our internet services moved to world class Gigabit capable internet. Resident and guest satisfaction has skyrocketed with the availability of fast, reliable industry leading internet, which allows our resort to include phone, video and streaming services never before offered. Absolutely Brilliant!”

– Eric van Meurs, Manager Atlantis Marcoola Beachfront Resort and past ARAMA President (Australian Resident Accommodation Managers Association.)

The views and images expressed in Resort News do not necessarily refl ect the views of the publisher. The information contained in Resort News is intended to act as a guide only, the publisher, authors and editors expressly disclaim all liability for the results of action taken or not taken on the basis of information contained herein. We recommend professional advice is sought before making important business decisions.

The publisher reserves the right to refuse to publish or to republish without any explanation for such action. The publisher, its employees and agents will endeavour to place and reproduce advertisements as requested but takes no responsibility for omission, delay, error in transmission, production defi ciency, alteration of misplacement. The advertiser must notify the publisher of any errors as soon as they appear, otherwise the publisher accepts no responsibility for republishing such advertisements. If advertising copy does not arrive by the copy deadline the publisher reserves the right to repeat existing material.

Any mention of a product, service or supplier in editorial is not indicative of any endorsement by the author, editor or publisher. Although the publisher, editor and authors do all they can to ensure accuracy in all editorial content, readers are advised to fact check for themselves, any opinion or statement made by a reporter, editor, columnist, contributor, interviewee, supplier or any other entity involved before making judgements or decisions based on the materials contained herein.

Resort News, its publisher, editor and sta , is not responsible for and does not accept liability for any damages, defamation or other consequences (including but not limited to revenue and/ or profi t loss) claimed to have occurred as the result of anything contained within this publication, to the extent permi ed by law.

Advertisers and Advertising Agents warrant to the publisher that any advertising material placed is in no way an infringement of any copyright or other right and does not breach confi dence, is not defamatory, libellous or unlawful, does not slander title, does not contain anything obscene or indecent and does not infringe the Consumer Guarantees Act or other laws, regulations or statutes. Moreover, advertisers or advertising agents agree to indemnify the publisher and its agents against any claims, demands, proceedings, damages, costs including legal costs or other costs or expenses properly incurred, penalties, judgements, occasioned to the publisher in consequence of any breach of the above warranties. It is an infringement of copyright to reproduce in any way all or part of this publication without the wri en consent of the publisher. © 2026, Multimedia Publications Pty

February is often the point where good intentions meet realworld pressure, don’t you think? Peak season is still rolling, inboxes are full, and the year has stopped easing in. By now, most of us have a clear sense of which systems are working quietly in the background and which ones are demanding attention, usually at inconvenient moments.

That reality sits right at the heart of this edition.

Our interview with David Assef reveals a grounded leader whose approach is informed by experience, clarity and longterm thinking. In our profile of

Mandy Clarke, Editor editor@resortnews.com.au

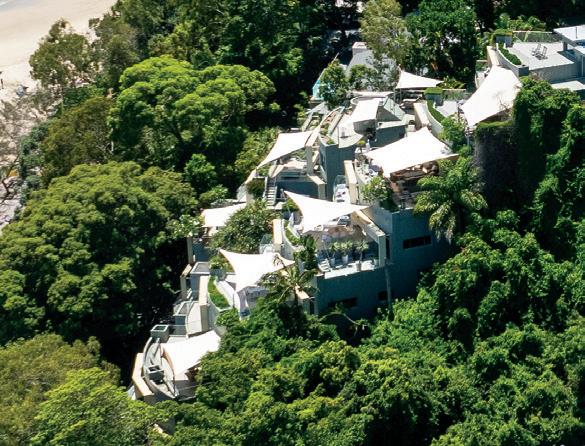

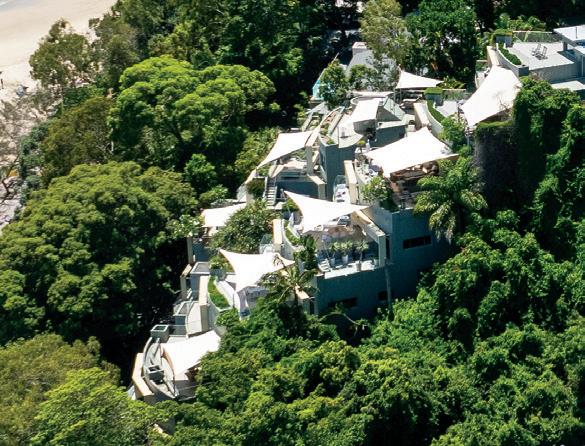

Number One Hastings Street in Noosa, recent building works focused on strengthening foundations and addressing essential structural elements, highlighting the importance of long-term stewardship under Belmo’s operation. In our industry, it reflects the reality

that the work that matters most is often the least visible and rarely the most glamorous. Across the magazine, contributors dig into the less headline-worthy but very real parts of the job. Governance, cost control, tax planning and more. These are the topics that tend to land when things are busy, expectations are high and there is very litt le room for gett ing it wrong.

Looking ahead to our March edition, we will be turning our attention to new entrants to management rights, exploring what first-time buyers should be looking for, common red flags and the realities that do not always show up in listings. It is a timely conversation for anyone considering a move into the sector, or for those fielding

questions from people who are.

And before we get there, a goodbye to Nick Buick at Onsite Manager, who is heading to Dubai and taking his unique set of talents, humour and Aussie management rights thinking into new territory. From Queensland to the Middle East is a fair leap, and it will be interesting to see how both the model and Nick adapt!

The year is moving quickly, routines are forming fast, but there is still time to tighten processes, address small issues and make choices that will help the months ahead run more smoothly.

A litt le attention now can save a lot of eff ort later.

Mandy Clarke, Editor, Resort News

By Trevor Rawnsley, CEO, ARAMA

The management and letting rights industry (MLR) was born in Queensland half a century ago and thanks to diligent managers, it has become one of the great success stories of both the tourism and accommodation sectors.

MLR businesses represent $15 billion in real estate under management, and it is a great business model, not just for holiday accommodation, but for people who are managing residential tenancy.

The Australian population passed 27.5 million recently and government figures indicate it will pass 31.5 million in 10 years.

The prospect of MLR growing alongside this population increase has never been more important.

More and more Australians are living vertically in strata developments, and it has been proven over decades that MLR is the most effective way to look after these properties for owners, tenants and the long-term health of the strata schemes.

The MLR concept has its home in Queensland but it began spreading to other states many years ago and the MLR industry is also finding an international footing as an effective way to run residential and holiday complexes.

New Zealand has embraced an Australian-style model of management and letting rights, and a leading Australian industry figure, Nick Buick, has plans to take MLR to one of the world’s most modern centres for high-rise living: Dubai.

Having a building under management rights gives owners and body corporate committees far more value for their caretaking dollar and has consistently proven to be a more cost-effective and reliable approach than outsourcing caretaking and letting.

That’s why Nick, who has done great things in the business with his company The Onsite Manager, is looking at Dubai and other places in the Middle East as a growth market for MLR. Dubai has an established jointly owned property framework, similar to the Queensland laws which have been shaped by more than 30 years of ARAMA’s consultation with government.

Nick’s view is that a building’s maintenance schedule doesn’t operate in years, but rather in decades.

He says: “In the Middle East, they have facility management contracts, much like we have in the other states, and they have rent rolls or letting pools

much like we have here. But no one seems to have worked out the synergy of combining those two elements, and I think that’s where the value creation exists.

“I’d really like to explore taking that model to the Middle East and seeing if we can create a market by consolidating them into a single asset and selling it.”

We wish him well.

In Australia, the opportunities for MLR have never been more promising.

In Queensland, where the MLR industry was born half a century ago, there are almost 55,000 strata schemes and about 4000 of those schemes are under management and letting rights.

While projections vary, ARAMA has consistently pointed to significant growth in strata living by 2035 and is advocating for the management and letting rights sector to expand in line with that trajectory.

Queensland really does lead the rest of the world for strata but there is great potential for growth of the industry in other parts of Australia, and, as Nick and others believe, a real export market for the concept globally.

In Queensland, having longer term agreements up to 25 years has been a big incentive

for development because you get more value out of the business from the get-go.

The reason management rights grew in Queensland is because the legislation was favourable and that’s because ARAMA was around doing vital advocacy work 35 years ago.

In the early 1990s, the Queensland government was going to completely change the strata laws, but it was the opportunity for lawyers, accountants, and real estate agents to say, “Well, hang on, we're building a nice little business here. You know, I'm selling stuff, it's got some value. It's attractive to the banks because it has these elements that are protecting the business as well as protecting consumers.”

Lawyers and accountants were able to define profit and loss statements, and how value is expressed, so they came up with processes. Real estate salespeople, who were selling house and land packages or waterfront real estate on the Gold Coast, turned their attention to strata, which was really a pretty new concept.

At the time our business model was unregulated and unprotected, and at grave risk of being pulled apart,

but in 1992, we became organised as an industry and recognised as an industry by government and others.

We had people who understood the industry, and who took urgent steps to prevent it being wiped out through legislative change. Our prime directive has always been to protect and defend those long-term agreements.

The Queensland government in the early 1990s became supportive of management rights because Queensland is a tourism state and MLR was the most effective way to run tourism properties. Management rights started on the Gold Coast, and then shortly after became popular on the Sunshine Coast to organise a better way to manage the tourism industry.

Big overseas owned hotels weren't being built, so all of the growth in tourism accommodation in Queensland for about 30 years was mainly in strata title, and mostly small and medium developments.

It was easy to translate the MLR concept into Brisbane, where it's more long-term letting. And then, of course, it was easy to transfer that concept up north to Cairns, Port Douglas and Airlie Beach and other areas where it has been the great driver of tourism accommodation in those places.

Christopher Skase built the Sheraton Mirage hotel at Port Douglas in 1987 but almost 40 years later, 36 of the 38 tourism accommodation businesses in that town are run by ARAMA members. It’s a similar story at Cairns and Airlie Beach where MLR dominates the tourism accommodation sector.

If ARAMA didn't exist and wasn’t constantly advocating for government to support the MLR industry, tourism would look very different in Queensland.

One of the strongest arguments in favour of management rights, particularly when defending the long-term agreements that underpin the industry, is the positive economic impact the MLR model has delivered to Queensland’s tourism sector.

A substantial share of Queensland’s managed accommodation beds operate within MLR buildings. Undermining the MLR industry through legislative change would place a large volume of accommodation at risk of moving away from a proven, professional management model and into far less stable hands.

Those long term agreements protect the consumer as much as they protect industry.

And when you're talking about 4000 MLR businesses in Queensland, we have made a solid argument that tampering with long-term agreements and the business model

in any way could severely impact 4000 solid businesses, mostly family-run and largely operated by working mums.

Management rights work and we’ve proven that in Queensland with a track record going back decades.

In Western Australia, property laws don’t resemble those in Queensland but entrepreneurial operators from Queensland have gone across to the West and have created a MLR business model that fits in with Western Australia law. It’s based on the Queensland principles of onsite letting and onsite caretaking.

It’s the same in Victoria, South Australia, Northern Territory and Tasmania. So, even though the laws don't quite favour a specific MLR business, they do exist in these other states, because somebody from Queensland, either a developer with experience, or an operator, has imported the concept of that business model into other states.

In NSW we did some work where we did create 25-year agreements, and something that resembled management

rights. But because the strata laws are very different in NSW and the MLR industry is so small there, those protections have been eroded over the years.

Going forward with a booming population, there'll be a lot more strata buildings over the next 10 years in Australia and the potential for a lot more MLR operators to run long-term accommodation properties.

MLR businesses are going to become more prevalent and more important over the next decade and beyond because more people are going to be living in strata rather than separate houses.

Living in a unit is far more affordable than living in a detached house and in many cases more convenient if the residents are not a big family. Developers can make more money going vertical rather than horizontal.

For many, strata is the ideal way to live, because you can get an oceanfront apartment for a quarter of the price of oceanfront land, and in some places even a tenth of the price.

The trend of vertical living will only grow higher in the years to come and the MLR industry provides a highly effective business model to meet the demand whether in tourism or residential tenancy. With booming populations around the world and the affordability of housing now out of reach for so many people, the only solution is to go up.

And the MLR industry, born from Queensland tourism operators with a lofty vision 50 years ago, is now looking globally, ready to meet that demand.

By Jane Wilson , Commissioner for Body Corporate and Community Management

Sometimes a body corporate dispute requires an urgent, short-term response. In these situations, waiting for a final adjudication order may not address the immediate issue. An interim order can provide a temporary, legally binding outcome while a final order is considered.

While interim orders may seem like a loophole to fast-track a final adjudication order, the reality is they have no effect on how quickly a final order is decided. You should

An interim order is a temporary, legally binding decision made by an adjudicator

carefully consider whether an interim order application is the right course of action for your circumstances, as not all applications are successful.

So far this financial year, the Office of the Commissioner for Body Corporate and Community Management (BCCM office) has received 164 interim order applications. Of these, 71 were refused or withdrawn and 93 were referred to an adjudicator. Fewer than one in five applications resulted in interim orders being granted. Application fees are not refunded if your application is refused or dismissed.

Many applicants misunderstand the limited purpose of interim

orders. This article explains what interim orders are, the key requirements, common misunderstandings and recent decisions to help applicants make well-informed choices.

An interim order is a temporary, legally binding decision made by an adjudicator. Its most common purpose is to maintain the current situation or prevent something from happening until a final order is made.

You can only request an interim order as part of a final order application. Although both requests are lodged on the same form, the interim and final

orders are treated as separate applications, and you must clearly state the different outcomes you are seeking for each.

If you believe your issue is urgent and requires a temporary solution while you wait for a final order to be decided, you may choose to apply for an interim order.

When preparing an interim order application, you must be able to demonstrate both self-resolution and urgency.

You must attempt to resolve the issue before lodging your interim and final order applications. This may include:

• submitting a motion to the body corporate

• writing to the other party

• following any legislated processes relevant to your dispute.

When assessing whether your efforts meet the self-resolution requirements, ask yourself:

• Have I clearly explained what I want to the other party or the body corporate?

• If my request was rejected, did I ask why?

• Is the respondent aware there is a dispute?

• Have I followed the proper legal process? For example, have I submitted a BCCM Form 1 to the body corporate about an alleged by-law breach?

You can read more about selfresolution on the BCCM office’s website and in Commissioner’s Practice Direction 1 – Internal dispute resolution.

You must show:

• what is happening or about to happen

• when it will happen

• why it is urgent.

For example, if you are seeking to stop a tree from being cut down on common property, you should include correspondence from the committee confirming the date the works are scheduled.

As part of your preparation, you may also find it helpful to read Commissioner’s Practice Direction 4 – Interim orders.

Dispute resolution coordinators (delegates of the Commissioner) assess whether your application meets the criteria to be referred to an adjudicator. They consider:

• Clear outcomes: Requests must be specific. Avoid vague wording such as “all necessary steps” or “whatever the adjudicator deems fit”. Clearly state what work should be done, by whom and when.

• Temporary nature: The outcome you are seeking must be limited in duration, most commonly lasting only until the final order is made.

• Self-resolution: Evidence that you have attempted to resolve the dispute with the other party.

• Urgency: Evidence of what is happening, when it is happening and why it requires urgent attention.

• Interim versus final order: Your interim order

cannot be final in nature. It must address only the immediate issue, not the entire dispute.

If information is missing from your application, a dispute resolution coordinator may contact you to request further details. If the criteria are not met, your interim application will be refused. This does not affect your final order application, which will continue through the usual process.

If the criteria are met, the interim application is referred to an adjudicator.

An adjudicator must be satisfied, on reasonable grounds, that an interim order is necessary given the nature and urgency of the circumstances. When making this decision, the adjudicator considers:

• whether the situation is genuinely urgent

• whether there is a serious legal question that may succeed at final orders

• the impact on each party if the order is granted or refused.

While previous adjudicators’ orders are not binding, they can help applicants understand how similar issues have been assessed.

For example, in Hanflame Court [2025] QBCCMCmr 95, the adjudicator granted an interim order to stop repair and maintenance work on an easement until a final order could determine responsibility for costs because:

• Urgency: The AGM decision to undertake maintenance had occurred two months earlier and works were imminent.

• Serious legal question: Responsibility for maintaining the easement required proper legal consideration.

• Comparative impact: The applicant would suffer greater detriment if funds were spent before responsibility was determined.

Adjudicators commonly dismiss interim applications for the following reasons:

• lack of urgency

• outcomes sought are overly broad or unclear

• insufficient evidence

• no evidence of selfresolution

• greater impact on the respondent if the order were granted.

For example:

• 216 Cypress Street [2025] QBCCMCmr 411: An application to stop gardening works was dismissed because there was no clear evidence the works were approved or imminent, and the request was overly broad.

• Landsborough 65 [2025] QBCCMCmr 322: Applications seeking mould removal were dismissed

due to insufficient evidence and a failure to demonstrate reasonable attempts at self-resolution.

• Riverbend Gardens [2025] QBCCMCmr 358: An interim order restraining spending was dismissed because it would have caused greater harm to the body corporate by preventing necessary financial decisions.

A well-prepared and wellunderstood interim order application has the best chance of success.

To apply:

• complete the Form 15 Adjudication application form

• email it to bccm@ justice.qld.gov.au

• refer to the Adjudication Guide for assistance.

For more information about interim orders and applying for adjudication, visit the BCCM website.

By Ben Ashworth, Small Myers Hughes Lawyers

Keeping your management rights business a healthy and sellable asset should be a priority from the first day you start operating. There are things you can do years before you sell that can make all the difference.

I want to draw your attention to the glamorous world of recordkeeping. In particular, keeping records concerning the meetings held by your body corporate.

In the usual course of selling a management rights business, there will come a time when the buyer’s lawyers will review the records of the body corporate. One of the key things that we hope to find with these reviews is clear records proving that every meeting of the body corporate that dealt with a management rights matter was conducted correctly. Generally, records that prove the outcome of a meeting (the meeting minutes) are easy to find and access. On the other hand, finding records that prove the notice and agenda for the meeting were issued correctly can be difficult.

If everything is working as intended, the records held by the strata manager for the body corporate will include a paper trail for every meeting held by the body corporate. That paper trail should include copies of the notices and agenda that were issued for

Clear records proving that every meeting of the body corporate was conducted correctly

that meeting, plus evidence of how and when the notices were sent to owners. Unfortunately, this is not always the case.

The common problems I’ve encountered are:

• Records being lost when the body corporate changes strata managers.

• Records being destroyed once they are old and assumed to no longer be needed.

• Copies of documents in the records not matching the versions that were sent to owners.

• Records not including enough information to confirm how or when the notices were issued to owners.

Any of these issues could kill the sale of your business. You can help prevent that possible outcome though.

Every time the body corporate calls a meeting, either a committee meeting or a general meeting, keep a copy of the notice. Keep a copy of every agenda and every attachment that is issued with an agenda. If you receive the notices by email, save that email so it shows when you received the notice and what was attached to the notice. If you receive notices through the post, save a copy showing the date when it was sent and ideally make a note of when you received it as well.

The records you keep could be essential to filling a gap in the body corporate records that prove your caretaking and letting agreements entered with the body corporate are valid. Importantly, being able to prove how and when you received the records is essential. A prudent buyer suspects you are biased, and they have no reason to take your word that the body corporate records you

hold are accurate. Your ability to prove that the records are valid will make all the difference.

If you don’t own a lot in the strata scheme and don’t receive all the meeting notices issued by your body corporate, I recommend that you arrange with an owner in your letting pool to regularly provide you with copies of the notices that they receive. This can also be beneficial even if you do own a lot, as it provides arm’s length evidence that a buyer of your business may be more likely to trust as an unbiased source.

Spending a few minutes each month making sure you have these records in order could save you thousands of dollars in the future and will be well worth your effort.

Liability limited by a scheme approved under Professional Standards Legislation

Disclaimer – This article is provided for information purposes only and should not be regarded as legal advice.

Across the industry, holiday parks are investing in communal spaces that elevate every stay. Reliable, high-performing barbecues are central to that shift. Christie gives you appliances that won’t let guests down. They are built for heavy use, long life and great reviews. Step up with barbecues that turn shared moments into reasons to return.

David Assef:

By Mandy Clarke, Editor David Assef talks

about hospitality with the measured clarity of someone who understands both the mechanics and the long view. He did not set out to build a career in the sector, but once he found it, the direction became clear.

“My career in hospitality began very organically,” he says. “I was drawn to the fact it sits at the intersection of people, property and performance.”

Early exposure to accommodation operations gave David a clear view of the realities behind the scenes. Long hours. Fast decisions. High expectations. And a direct link between leadership, culture and financial outcomes.

“That combination really resonated with me,” he says.

Over time, he moved through a mix of operational and commercial roles, building a broad understanding of how accommodation assets perform across diff erent markets and ownership structures. That experience continues to shape how he leads today, particularly when navigating the competing priorities that come with premium accommodation assets.

David’s move into the CEO role at Belmo Group was driven less by ambition and more by alignment.

When he joined the business, Managing Director Ben Orton, along with a senior leadership team including Kylie English and Kiefer Toland, had already laid strong foundations.

David Assef, CEO, Belmo Group

“What ultimately led me to Belmo was the opportunity to work alongside exceptional people,” he says. “Ben had established a business with a clear vision and a culture that strongly aligned with my values.”

David was particularly drawn to Belmo’s approach to management rights and accommodation assets as long-term investments, rather than short-term operational plays.

“Belmo’s growth has been driven

by Ben’s vision, disciplined execution and a genuine respect for owners, guests and team members alike,” he says. “That strategic mindset is critical in this sector.”

Ask David to describe Belmo Group’s approach and the answer is unmistakable. Longterm thinking. Sustainable performance. No shortcuts.

“We focus on sustainable performance rather than chasing short-term gains,” he says. “What sets us apart is our ability to operate across complex stakeholder environments while maintaining values and trust.”

Owners, bodies corporate, investors, guests and onsite teams all come with diff erent priorities. Managing that mix requires structure, clarity and patience.

“We are highly data-driven, but equally people-centric,” he says.

“We invest heavily in systems, governance and leadership capability, but never lose sight of the guest experience or the lived reality of our onsite teams.”

It is a balance he believes many operators talk about, but few achieve.

As Belmo Group grew, one of the most important decisions was what not to pursue.

“We made a conscious choice from the outset to be selective about growth,” David says.

“Quality assets, locations and partnerships mattered more than scale for scale’s sake.”

Another turning point was formalising leadership frameworks and operational standards as the portfolio expanded.

“That allowed us to maintain consistency without losing the individuality of each property,” he says.

Investing in people has been equally pivotal. Building a strong senior leadership team and empowering onsite managers has enabled Belmo to grow without diluting standards or culture.

Integrity, accountability and respect sit at the centre of David’s leadership style.

“In a business like ours, trust is currency,” he says. “People need confidence that decisions are being made transparently and in the best interests of the asset.”

Clarity plays a big role in that. Clear expectations. Clear communication. Clear ownership.

“As complexity increases, clarity becomes even more important,” he says. That philosophy flows directly into operations and strategy. Operationally, the focus is on consistency, service standards and cost control without compromising quality. Strategically, opportunities are assessed through the lens of long-term value creation and resilience, not just immediate yield.

“It also means being prepared to have difficult conversations,” David says. “Avoiding them rarely leads to good outcomes.”

Few markets illustrate Belmo Group’s thinking more clearly than Noosa.

“Noosa is a unique market,” he says. “Supply is tightly constrained, demand is consistently strong and the destination has enduring appeal across domestic and international markets.”

For Belmo, it represents the type of location where longterm asset management, thoughtful capital investment and strong stakeholder relationships can deliver meaningful value over time.

That thinking underpinned the recent renewal of Number One Hastings Street. The works focused primarily on essential external upgrades, including inclinator refurbishment, balcony tiling improvements, concrete remediation and external repainting. Given the location and complexity of the building, the project required careful staging, rope access solutions and constant coordination.

Importantly, the onsite manager remained actively involved throughout, conducting regular apartment inspections to ensure

services and amenities continued to operate as expected.

Alongside the building works, Belmo strengthened the operational platform with expanded housekeeping storage, a new property management system, refreshed photography and broader distribution channels.

"The intention was to protect the building and position it strongly for the future,” David says.

at the top end

From an operational perspective, landmark properties bring opportunity and pressure in equal measure.

“They allow you to build brand equity, drive premium rates and attract repeat guests,” David says. “But expectations are high and tolerance for error is low.”

Hastings Street, in particular, brings challenges around access, congestion and scrutiny.

“Work requires exceptional planning, strong leadership on site and proactive communication,” he says.

Managing expectations across guests, residents and the wider precinct comes down to preparation, communication and respect. Belmo invests heavily in peak-period planning and works closely with local stakeholders to minimise disruption and manage expectations realistically.

Body corporate relationships are central to that approach. Belmo treats them as

genuine partnerships, built on transparency, education and collaboration.

“The most common challenge is differing time horizons,” David says. “Owners may focus on short-term returns, while bodies corporate prioritise asset preservation. Our role is to bridge that gap with clear data, long-term modelling and practical solutions.”

That perspective also shapes how David thinks about leadership pathways in the sector. For those building a career in hospitality and management rights, his advice is grounded in experience. Spend time close to day-today operations, stay genuinely curious and take responsibility from the outset. The industry, he believes, tends to reward people who understand how things really work and who are prepared to think beyond short-term wins.

The same discipline carries through to how Belmo Group approaches growth. Rather than chasing scale, the focus remains on premium city, regional and coastal markets where supply is naturally constrained. In those environments, David sees professional, well-governed management as a key driver of long-term value, and it is that measured, strategic approach that continues to guide Belmo’s next phase.

Over the next five years, success for Belmo Group looks like measured, profitable growth across premium and strategically

located assets, alongside continued investment in people.

“We want to build a business that is resilient to market cycles,” David says. “One that can adapt to changing guest behaviour, regulatory environments and cost pressures.”

He expects the management rights sector to continue professionalising, particularly in premium coastal destinations, with greater scrutiny from investors and a stronger focus on governance and transparency.

Ask David what has influenced his leadership style most, and he points to experience rather than any single mentor.

“Observing leaders who lead with integrity and clarity under pressure has been my greatest teacher,” he says.

The most valuable advice he has received is simple.

“Respect your people,” he says. “Every role matters. Collective success is built on contribution, not authority.”

When he reflects on his journey so far, it is not the portfolio or the growth that stands out.

“I’m most proud of the team we’ve built and the trust we’ve earned,” he says. “Creating an organisation where people are aligned, engaged and committed to shaping meaningful moments into lasting memories is what matters most.”

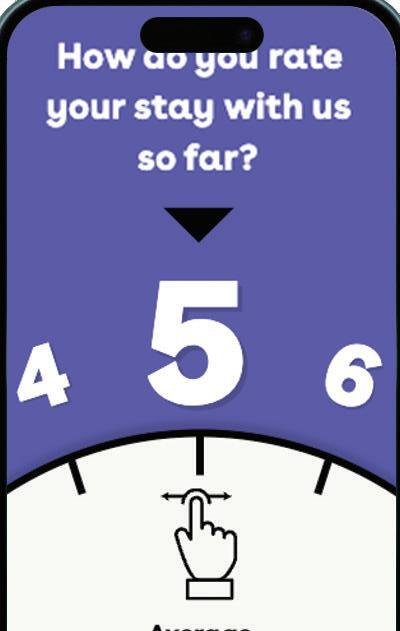

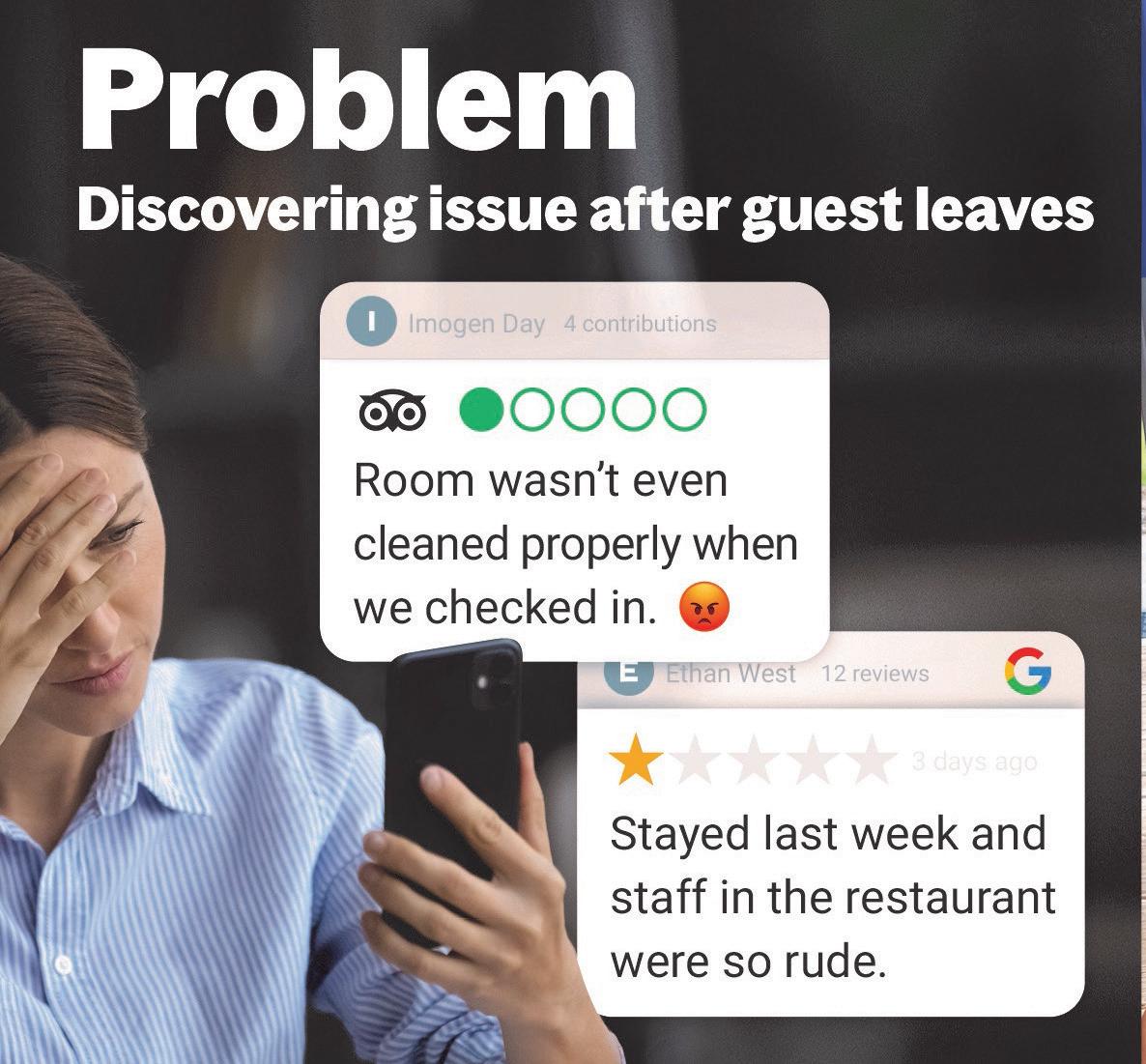

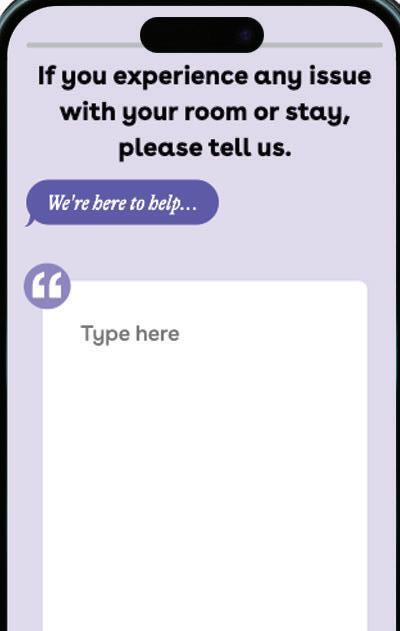

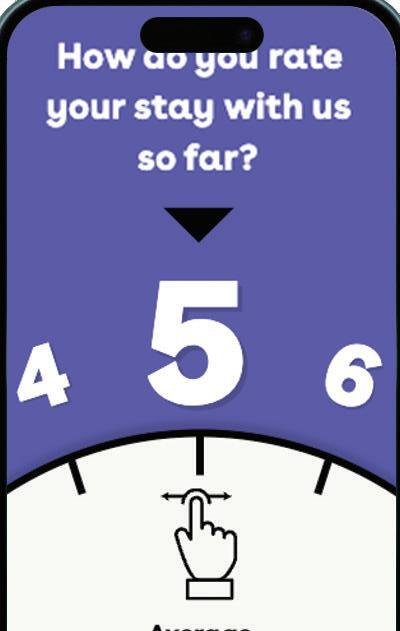

Because the best way to manage reviews isn’t reacting to them — it’s preventing the bad ones from being written in the first place.

The tourism industry is increasingly turning to Pulsi to capture real time feedback from guests, helping to improve their guest experience and public reviews.

Today’s guests are always connected and increasingly comfortable sharing experiences through Google and Tripadvisor, but far less inclined to raise a concern in person. This creates a blind spot in the tourism sector, where staff often don’t know about a problem until it is too late to rectify.

Pulsi is designed to make it effortless for guests to share their experience and opinions, good or bad, directly with you, while they are still a guest. This gives you the opportunity to take corrective action during their stay —ultimately minimising the chance of a negative review being posted later on.

Pulsi uses low-cost patented beacons, that can be branded to your business. Beacons are placed in guest rooms and shared areas such as reception, restaurants or gyms. Guests provide feedback by simply tapping their phone on a beacon. There’s no app, no login, no need for instructions. Within seconds their device becomes their feedback tool, enabling them to share an opinion or provide feedback by answering questions set by you and tailored to a particular location or experience.

If guest feedback raises an issue, Pulsi can send real-time alerts via email and SMS to nominated team members, allowing your team to respond immediately before a minor issue becomes a lasting impression.

No two properties are the same, and Pulsi adapts to suit any property type, brand or service style.

Some clients use Pulsi to simply solicit guest feedback. Others use it to personalise and enhance communication with guests, providing a deeper engagement experience.

Scenic Rim operator introduced Pulsi as a guest feedback tool, and it quickly became an integral part of their guest experience. Guests are now able to upload images of their stay, report issues to management and access key resort information.

Malcolm Darling, the General Manager at Mount French Lodge says of Pulsi:

‘We needed a solution where guests could be supported by

our team when needed. Pulsi has enabled us to offer a way for our guests to give feedback and to inform us if there is any shortfall in their experience.’

For Malcolm the key benefit was the real time alerts that he and the team receive from Pulsi when requests are made or an issue is reported.

‘For us, the alerts are a gamechanger, we’re able to be responsive yet discreet. We can now provide solutions when the guests are still here rather than hearing about it later, ensuring that we maintain our five-star review rating’

Mount French have even started using the Pulsi video feature for post-stay surveys. A personal message is sent by the team to thank guests for their stay whilst soliciting feedback and inviting a future booking, taking the personalised experience to the next level.

At its most simple, Pulsi provides a non-intrusive way for guests to give real-time feedback. At a more customised level it enables a richer, more personalised engagement with guests.

The question isn’t whether guests have feedback — it’s whether they have a simple, efficient and private way to share it at a time when you can do something about it.

Pulsi is cost effective and takes just a few minutes to get started. And for those who are time poor, the team at Pulsi can help with initial setup and configuration.

Where online reviews heavily influence bookings, Pulsi provides something critical: visibility. For less than $2 per day, Pulsi enables you to stay informed, responsive, and in control of the guest experience.

Find out more at pulsi.co.

Online reviews have a significant

impact on future bookings.

Intercepting bad reviews and turning them into good ones is

great for business.

How it works:

Pulsi is easy to setup and simple for phone obsessed guests to tap their own device. Simply place beacons where your guests are (guest rooms, restaurants, reception etc).

Guest taps beacon

Real time alerts sent to key team members Guest responds to your pulse Your informed team resolves any issues

A problem resolved is no problem at all, so after your guests check out you’re not blindsided by a bad review on Google or TripAdvisor.

By Julie Jacobson, Senior Accountant, Holmans

Along with setting resolutions, the start of the year is an important time to review and assess how your business has performed for the first half of the financial year and focus on tax strategies to ensure compliance and financial stability.

A key component of eff ective tax planning involves understanding deductible expenses, staying updated on legislative changes, and maintaining meticulous records to maximise benefi ts and reduce liabilities.

The general rule from the Australian Taxation Office (ATO) is that you can claim a deduction for most expenses incurred in running your

The start of the year is an important time to review and assess how your business has performed for the first half of the financial year

business, provided they are directly related to earning your assessable income and are not private or domestic in nature. For management rights businesses, which typically involve a combination of property caretaking and lett ing services, deductions are commonly claimed across several key categories, and include:

Everyday operating costs form the backbone of most business deductions. For a management rights business, these are the running costs that keep the operation moving smoothly.

Wages and superannuation:

Wages and salaries for cleaning staff, receptionists, or maintenance workers are fully deductible, as are superannuation contributions (provided they are paid on time) made for employees and some contractors.

Management and lett ing fees: Costs associated with managing the lett ing pool, including soft ware for booking systems and

commissions paid to agents.

Marketing and advertising: Expenses for promoting your business and the units you manage are 100 percent deductible, including costs incurred to advertise vacant units, website maintenance and hosting, digital ads, and printed brochures.

Professional fees: Fees for accountants, bookkeepers, lawyers for advice related to business operations or the management agreement, and business consultants.

Insurance premiums: Necessary coverage such as public liability, professional indemnity, workers' compensation, and business interruption insurances are deductible.

Repairs and maintenance:

Immediate deductions for repairing tools, cleaning equipment, or business premises (for instance, the manager’s office). This includes painting, plumbing, and fi xing electrical appliances.

Cleaning and grounds maintenance : Costs for cleaning supplies and services, lawn and gardens, pest control, and pool maintenance for the complex.

It is important to note that should costs such as the above be reimbursed by the body corporate, they are not deductible; only manager’s outof-pocket costs are claimable.

Business-related travel is a common necessity, and expenses incurred for purposes such as travel between properties, meeting clients, or picking up supplies are deductible, provided private use is clearly separated.

Motor vehicle expenses: You can claim costs for business trips and the ATO off ers two methods for a vehicle you own or lease:

• Cents per kilometre method: In 2026, the "cents per kilometre" rate is 88 cents per km (up to 5000 km), covering all running costs.

• Logbook Method: Claiming actual expenses such as fuel, repairs, insurance, and depreciation based on a recorded businessuse percentage over a 12-week logbook period.

General travel: For overnight or longer travel for business (for instance, attending industry conferences) you can claim accommodation, airfares, meals, and incidental costs. If the trip is longer than six consecutive nights, a travel diary is required to substantiate your claims.

Many management rights operators work from their onsite units, making home-based deductions relevant. These include:

• Running expenses: The business portion of electricity, internet, phone, and stationery costs can be claimed using the ATO's fixed rate of 70 cents per hour, which covers energy, communication, and consumables.

• Occupancy expenses: If a specific area of the home is used exclusively for business, a proportionate claim can be made for rent, mortgage interest, council rates, and land tax. Such claims have capital gains tax implications, so professional advice is recommended.

One of the most significant and beneficial provisions for small businesses is the extension of the instant asset write-off threshold. Businesses with an aggregated annual turnover of less than $10million can immediately deduct the full cost of eligible depreciating assets costing less than $20,000 each, simplifying asset management and improving cash flow.

This measure is available for assets first used or installed ready for use for a taxable purpose on or before June 30, 2026.

With only five months remaining, now is the time to take stock of your business assets and consider replacing

ageing equipment or acquiring other items to take advantage of this measure.

• Per-asset limit: Each asset costing less than $20,000 qualifies for immediate deduction, allowing multiple assets to be claimed separately.

• Asset examples: Essential items like new computers, software, office furniture, garden maintenance equipment and machinery.

• Assets over $20,000: Larger assets are pooled and depreciated over time, typically at a rate of 15 percent in the first year and 30 percent thereafter.

• Vehicle cap: Passenger vehicles are subject to depreciation caps, affecting claims for more expensive vehicles.

Having incurred the expense, robust record-keeping is

essential to ensure deductibility can be substantiated.

The ATO mandates retention of records for at least five years, including tax invoices, receipts, bank statements, and logbooks. Digital tools such as the ATO's myDeductions app facilitate streamlined record management, reducing errors and ensuring compliance.

Understanding and applying eligible deductions, staying informed about legislative updates, maintaining meticulous records, and consulting qualified tax professionals are best practices to optimise tax outcomes. By leveraging available measures such as the instant asset write-off, businesses can enhance cash flow, reduce liabilities, and position themselves for sustainable growth in 2026 and beyond.

Editorial note: Tax laws and ATO rates change regularly. This information is general in nature and readers should seek advice from a qualified tax professional.

By John Mahoney, Mahoneys

This is an update of an earlier article regarding leasebacks and other methods of guaranteeing minimum income levels to owners. It follows a private ruling from the Australian Taxation Office confirming the position outlined in the original article regarding GST. That ruling confirmed that if a manager leases apartments from owners and directly sublets them to guests for short-term lett ing (where various other services are provided by the manager), GST is payable on the tariff s paid by guests, as the manager is making the supply in its own right and not as an agent. In these circumstances, there is no GST payable by the manager on the rent or tariff s the manager receives above the rent paid to the owner.

A leaseback, or some other form of guaranteed owner income (typically a standard lett ing appointment with a guaranteed minimum return to the owner) is often used by managers as a way of att racting owners into the short-term lett ing pool, particularly those concerned about inconsistent or potentially lower returns. These arrangements also have the potential to generate significantly greater income for the manager.

For readers unfamiliar with the term “leaseback”, it refers to a lease or tenancy agreement between an owner, as landlord, and the manager or a company related to the manager, as tenant, under which the tenant can sublet the apartment for short-term lett ing.

Because it is a lease, the owner receives an agreed rent as set out in the lease, irrespective of the return achieved from the short-term sublett ing of the apartment by the manager or related tenant.

There are two basic types of guaranteed return lett ing appointments. The first is where the manager simply guarantees the owner a minimum net return, with the owner benefi ting from anything above that amount. The second type is where the manager retains anything received above the guaranteed net return to the owner, usually described as a performance bonus.

I am often asked which option is best: a leaseback or a guaranteed return lett ing appointment? The answer depends on the circumstances. I thought it would be useful to set out a table that both describes and compares the features of each arrangement, to assist readers in determining what may be most suitable for them.

As mentioned above, which one is best will depend on a manager's own circumstances. However, if a leaseback is the preferred option, have regard to the comments above.

In particular do not use an RTA Form 18A, do not have the manager as the tenant but rather the tenant should be an associated company which appoints the manager as its agent to sublet the property and make sure you make disclosure to your other owners in your lett ing pool.

However, you should always take accounting and tax advice from your accountant before sett ling on a structure for you.

Leaseback

No prescribed form (unless it is intended to register the lease), note that a leaseback is not a residential tenancy agreement and the RTA Form 18A should not be used. Mahoneys have developed an appropriate form of lease for our clients.

Letting appointment with a guaranteed return

Prescribed form but with special conditions.

Generally, not assignable to a new manager without landlord consent (but that can be covered in the conditions). Assignable to a new manager.

The existence of even one leaseback requires disclosure to other owners in the le ing pool due to conflict of interest.

Where the manager is the tenant there is the potential that GST is payable on the tari as the accommodation for the guest is being supplied by the manager in the manager's own right, not as agent for an owner, particularly where the manager has a number of leasebacks. Typically, the manager would also need to be providing hotel type services to guests to a ract GST.

Where the manager is the tenant, the tari paid by guests must not be paid to the manager's trust account but must be paid to the manager's general account.

To avoid the two problems above, it is important that the tenant not be the manager but that the tenant appoints the manager to act as the tenant's agent to sublet the apartment.

Excess rent from suble ing received by manager is not subject to GST.

Can be for a fixed term (but in most cases the MIA provisions of the Corporations Act apply and can be terminated on 90 days' notice).

Potentially locked into ongoing liability despite market downturn (e.g. COVID).

Rent received by the tenant above the payment to the owner is not subject to GST.

Seen by some valuers as a liability potentially resulting in a lower multiplier.

Similar disclosure requirement.

No GST on the tari – treated like any other le ing appointment.

Tari s go to the manager's trust account like any other le ing appointment.

Most accountants regard the excess received by the manager is subject to GST.

Can be terminated on no more than 30 days' notice.

30 days termination allows manager to avoid ongoing liability.

Rent received by the manager above the payment to the owner (typically the performance bonus) is subject to GST.

More widely accepted by valuers and likely to be valued at a higher multiplier.

Note that the table relates to Queensland law and there will be some di erences for the other states.

By Andrew Morgan, Motel Broker/Partner, Qld Tourism & Hospitality Brokers

Profit is a key measurement for any business. In the accommodation industry, operators focus on guest experience, service standards and occupancy, but longterm sustainability comes down to a single reality: the business must consistently earn more than it spends.

Breakeven occurs when the room rate (selling price) exceeds the full cost required to make that room available to rent. If the rate does not cover total costs, even strong occupancy cannot prevent financial loss. This is why operators of motels, hotels, and serviced apartments must accurately measure their true cost base and understand the financial implications of each operational decision.

Knowing the breakeven point and cost per occupied room (CPOR) enables operators to assess how pricing influences margins, determine the room night volume needed for profit, identify the impact of occupancy changes, and understand the minimum threshold before losses occur.

This knowledge goes beyond financial housekeeping; it is a key pillar of strategic decision making. Operators who

Knowing the breakeven point and cost per occupied room (CPOR) enables operators to assess how pricing influences margins

understand their cost base are better positioned to price confidently, plan effectively, and protect profitability in a competitive environment.

Today’s operating landscape continues to place pressure on accommodation providers. To set sustainable and profitable rates, operators must:

1. Identify the true CPOR

Accurate pricing begins with calculating the total operating costs divided by the number of rooms sold (CPOR). Once a baseline is established, an appropriate profit margin can be added with confidence.

2. Factor in rising costs

Electricity, insurance, and council rates have increased significantly in recent years. These expenses must be incorporated into pricing to avoid margin erosion.

3. Avoid the high occupancy trap

High occupancy does not guarantee profit. If rooms are sold below cost or heavily discounted through high commission channels, operators may lose money despite strong occupancy figures.

4. Maintain rate integrity

Rate parity, keeping consistent pricing across booking channels, prevents guests from shopping around and helps maintain

control over the net room rate after commissions.

Every accommodation business operates under a unique combination of physical, operational, and environmental conditions. These variations directly affect expenses and profitability. Understanding them is essential for accurate pricing and financial forecasting.

1. Unit size

Smaller studio rooms require less labour, utilities, and cleaning time. Larger family units have naturally higher operating costs. Units with kitchens or laundries involve more labour, increased linen use, and additional consumables, raising the cost of each turnover.

2. Age and condition of the property

Older properties require more maintenance, including plumbing, electrical systems, roofing, painting, and structural repairs. Poorly maintained buildings incur higher recurring costs.

3. Location and environmental exposure

Coastal properties experience corrosion from sea air, while some inland areas may be affected by soil movement,

causing structural issues that increase repair needs.

4. Unit fit out

Furniture, flooring, and window coverings influence replacement cycles. Materials should suit the local climate to maximise longevity, for example, tiles in humid regions.

5. Onsite restaurant

Restaurants often operate as separate revenue departments but add staffing, utilities, inventory, and equipment maintenance costs that impact the overall operation.

6. Facilities and general services

Pools, spas, lifts, landscaped gardens, and saunas improve guest experience but raise utility and maintenance expenses significantly.

7. Business operation factors

Operational decisions have a major effect on a business’s cost base.

8. Leasehold vs freehold

Leasehold operations incur monthly rent, while freehold owners face mortgage repayments and fluctuating interest charges. Each structure affects cash flow differently.

9. Clientele profile

Corporate travellers, families, contractors, and tourists all impact cleaning times, consumable use, and general wear differently.

Onsite laundry increases utilities and equipment maintenance but offers operational control. Offsite commercial laundry reduces labour but raises per item cost.

11. Staffing levels

Overstaffing inflates wages, while understaffing reduces cleanliness and guest satisfaction. Efficient rostering and productivity monitoring are essential.

12. Owner operator vs under management

Management run properties incur additional wage costs. Owner operators should still account for a fair wage in financial analysis to determine true performance.

13. Consumables and amenities

Toiletries, coffee, and amenities directly affect CPOR. Premium products increase costs; bulk options reduce them with careful quality control.

14. Cleaning policies

Cleaning times, cleaning agents, and standardised

procedures affect labour efficiency and operational cost.

15. EFTPOS and credit card fees

Merchant fees vary widely across providers and card types. Regular reviews help ensure these fees do not unnecessarily inflate costs.

16. Marketing, distribution costs, and subscriptions

OTA commissions, chain membership fees, digital marketing, and software subscriptions must be monitored to prevent cost creep.

This includes council rates with high land values. Rising energy prices heavily impact properties with heated pools, commercial laundries, and extensive HVAC systems. Land tax liability varies depending on state legislation and ownership structure. Insurance premiums have increased significantly due to climate impacts and rising construction costs. Operating costs compound quickly when left unmanaged. Even small

inefficiencies in labour, utilities, consumables, or maintenance steadily erode profitability. A precise understanding of the cost base enables operators to set sustainable rates, maintain pricing discipline, and make informed decisions.

Ultimately, knowing your breakeven point supported by accurate CPOR data is one of the most effective tools for ensuring long term financial success in an evolving accommodation market.

By Roland Franz, General Manager, Body

Corporate Headquarters Strata Consulting Services (Qld)

After more than a decade of rapid growth, consolidation and digital transformation, owners are increasingly gravitating back towards something far more traditional: oldschool values, personal recommendations, integrity and genuine trust.

For many long-serving body corporate managers, this shift is unmistakable. The industry is, without doubt, experiencing a full-circle moment. After years of marketing noise, flashy branding and corporate expansion, owners are once again placing their confidence in human connection, reputation and lived experience. Delivering a better customer experience has become central to decisions about changing a strata manager.

This article explores why this shift is happening, how it is reshaping the way committees select body corporate managers, and why owners’ voices, particularly positive ones, now matter more than ever.

Over the past decade, the strata industry has seen:

• Large corporate acquisitions.

• Increased competition.

• Rising expectations from owners.

• Greater regulatory complexity.

For a period, many committees were influenced by polished proposals, corporate branding or promises of technologydriven efficiency. As the industry matured, however, owners began to realise that bigger does not always mean better, and that technology alone does not guarantee service quality.

What owners now seek is clear:

• Responsiveness.

• Honesty.

• Consistency.

• A manager who knows their building.

• A relationship, not a transaction.

These are the same values that defined the body corporate industry decades ago, before

consolidation and automation reshaped the market.

One of the most consistent observations from enquiries over the past 12 months is a shift among larger schemes towards smaller, boutique body corporate management firms.

This trend is driven by several factors:

• Continuity of the strata manager: Boutique firms often retain staff longer, providing stability and deeper building knowledge.

• Old-school service values: Owners want managers who answer the phone, know their names and understand their history.

• Experience over scale: Committees are prioritising seasoned professionals over rotating junior staff.

• Personal accountability: Smaller firms tend to offer direct access to decisionmakers, rather than layers of corporate structure.

For many large schemes, the appeal is simple. They want a manager who knows their

building, not just their file. This shift marks a significant change in the industry. For years, large corporates dominated the market, but owners are increasingly voting with their feet and their referrals.

Despite the rise of digital marketing, social media and paid advertising, many new enquiries for body corporate management proposals continue to originate from referrals and word-ofmouth recommendations.

Committees speak with other committees. Owners talk to friends in neighbouring buildings. Caretakers share experiences with peers.

Based on experience over the past year, around 70 percent of new enquiries originate from referrals. In many cases, a single positive experience shared at a barbecue, AGM or lift-lobby conversation can influence an entire committee’s decision.

Never before has word of mouth, supported by online reputation, been so influential in the decision-making process.

One of the challenges in the strata sector is that negative experiences are shared more loudly and frequently than positive ones. Owners who are unhappy will often tell everyone. Owners who are satisfied frequently say nothing.

This creates a distorted perception of the industry, one that does not reflect the reality that many buildings enjoy stable, professional and supportive management relationships. It also affects how committees choose managers. When only negative stories circulate, good service can appear rare or indistinguishable.

The reality is different. Many body corporate managers go above and beyond to support the communities they manage:

• Staying late to resolve emergencies.

• Guiding committees through complex legislation.

• Managing budgets responsibly.

• Supporting volunteer committees with patience and clarity.

• Building long-term relationships with owners. When owners share these experiences, it helps to:

• Balance the narrative.

• Support high-performing managers.

• Guide committees towards informed decisions.

• Strengthen the industry’s reputation.

While traditional word of mouth remains dominant, the second major source of new business enquiries now comes from Google searches. When committees begin exploring management options, they often start by searching the company name online. Reviews play a significant role in shaping first impressions.

Google reviews have become the digital equivalent of a neighbour’s recommendation, offering:

• Social proof.

• Real-world experience.

• A snapshot of reputation.

• Insight into how a company responds to feedback.

For small and mid-sized firms, authentic reviews from real clients can be particularly powerful. A handful of detailed, genuine reviews often carries more weight than a large volume of generic ones.

As online reviews have become more influential, committees are also becoming more discerning. Common red flags can include:

• Sudden spikes in review numbers.

• Short, vague or generic comments.

• Reviewers with no review history.

• Multiple reviews posted within a short timeframe.

• Reviews lacking detail about the experience. Authenticity matters. Committees increasingly read reviews critically, looking for

substance rather than volume.

As owners seek better community living experiences, relationships are carrying more weight than marketing promises. The most successful management firms over the next decade are unlikely to be those with the biggest marketing budgets. Instead, they will be those with strong reputations, authentic feedback and deep, long-standing relationships. In an industry built on trust, oldschool values are not outdated. They are foundational.

For owners, committees and caretakers, sharing positive experiences plays an important role in shaping the future of the sector. Speaking up when things go right helps support good managers, strengthens the industry and contributes to a more balanced public conversation. A positive recommendation is more than a compliment. It is a contribution to a healthier, more transparent and more resilient strata industry.

By Lynda Kypriadakis, The Diverse Group of Companies & DPX Projects

As caretakers and strata managers, a big part of our job is keeping common property clean and safe. That’s obvious when residents see shiny lift lobbies or swept pathways. But there’s another part of our work that’s just as important and far more legally sensitive: managing sediment and contaminants so they don’t escape into the stormwater system. This article breaks down why sediment control matters, what

tools are available (such as silt socks, filter baskets, drain guards and broom filtration rigs), and how these fi t into everyday cleaning duties on basement carparks, loading docks, plant rooms and other common areas.

When we clean hard surfaces, especially basement carparks, ramps or areas around plant equipment, we usually use water to wash away dirt, tyre dust, soil tracked in by vehicles and general grime. Left unmanaged, this dirty wash water can flow straight into the stormwater system via floor drains or gutters. In Australia, stormwater drains are not sewage systems; they flow untreated into creeks, rivers and coastal waterways.

Under environmental law, including the Protection of the Environment Operations Act and state EPA regulations, materials such as sediment, soil, gravel and suspended solids are classified as pollutants. In many jurisdictions, statutory instruments (including Schedule 10 of applicable environmental regulations) list sediment and suspended solids as

prescribed contaminants when present in water. This means they are regulated, and caretakers or managers can be held accountable if they enter stormwater.

Simply put, lett ing dirt and sediment from cleaning activities run into stormwater drains isn’t just bad for waterways. It can be illegal, and fines may apply.

EPA regulatory schedules (including Schedule 10 in some jurisdictions) identify materials that are considered environmental contaminants when present in water. This includes suspended solids, soil, gravel and organic or inorganic matter, essentially the material washed off carparks and floors.

This classification means that wash water, even if it is “just dirt”, must be contained so it does not enter stormwater. Failing to prevent these pollutants from leaving the site can lead to enforcement action from local councils or the EPA.

This is where practical sediment management devices come in. They allow sediment to be filtered, trapped and removed from cleaning water before it is discharged to sewer or collected for proper disposal.

1. Silt socks and filter logs

Silt socks (also called sediment socks or filter socks) are tubular geotextile devices filled with sand, gravel or recycled media. They filter sediment from flowing water while allowing water to pass through. They are inexpensive, flexible and eff ective.

Silt socks can be deployed:

• Across floor drains in basement carparks before cleaning.

• Along ramp edges to intercept wash water.

• Around stormwater entry points during pressure-washing.

Because they are filled with porous media, silt socks reduce water velocity and capture sediment before it enters pits and drains.

Practical tip: Place socks slightly uphill of the drain entry point so dirty water flows through the sock, leaving most sediment behind before the water reaches the drain.

2. Filter baskets and drain guards

Filter baskets and drain guards are mesh or fabric liners installed inside stormwater pits beneath the grate. They trap sediment, leaves, litter and debris while allowing water through, similar to a pool filter basket.

Advantages include:

• Sitting flush beneath the grate, reducing bypass risk.

• Easy removal, emptying and wash-down between cleaning cycles.

• Acting as a last line of defence if sediment passes exterior controls. Use drain guards whenever a basin or sump is present. After cleaning, empty collected material into a bin or wet/dry vacuum for proper disposal. Never dispose of it into drains.

3. Temporary berms and related devices

Berming involves creating a temporary low wall of sandbags or gravel around sensitive entry points. When paired with silt socks or drain guards, berms can direct wash water to a designated collection point rather than into open drains.

On larger sites, multiple devices can be used in a treatment train. This is a sequence of barriers that progressively filter sediment before water leaves the site.

Basement carpark cleaning

Every time you hose down a basement carpark floor:

1. Assess drains and pits. Identify all stormwater entry points and protect them.

2. Install barriers. Position silt socks, filter baskets and berms where dirty water could flow into stormwater inlets.

3. Collect solids first. Sweep solids into a dustpan before washing, then pressurewash using minimal water.

4. Direct wash water appropriately. Where possible, direct it to sewer connections or designated sump areas for pump-out under a trade-waste agreement.

5. Dispose of filters correctly. Don’t flush collected solids back into drains. Bag them and dispose of them through approved waste services.

The key is proactive protection. Don’t wait for sediment to reach the stormwater system.

Another common task in basements is cleaning suspended pipework, such as HVAC condensate lines and exposed plumbing. This is a legitimate caretaker duty, excluding fire system pipework, which usually requires an occupational licence.

When cleaning suspended pipes:

• Place drop cloths or trays under work areas to catch drips and rinse water.

• Avoid washing directly toward drains; direct runoff into a bucket or container first.

• Use filter baskets at nearby floor drains to capture solids if flushing lines or hosing fixtures.

The same environmental principle applies. Anything washed down a drain must be free of contaminants.

To remain compliant and protect local waterways:

• Train all cleaning staff in sediment control practices and the correct use of filtration devices.

• Document procedures and maintenance schedules to demonstrate due diligence.

• Clean and inspect filters regularly, as

clogged devices won’t function effectively.

• Avoid relying on stormwater drains for wash water; wherever possible, direct water to sewer or collect it for appropriate disposal.

Prevention works best at the source. Reducing dirt before it becomes liquid runoff lowers workload and environmental risk.

Sediment control isn’t just a common property issue. It’s part of everyday caretaking responsibility. The proper use of tools such as silt socks, filter baskets and berms, combined with sound cleaning techniques, protects waterways and helps keep body corporates compliant.

By treating every washdown with containment and filtration in mind, caretakers are not just cleaning common property. They are safeguarding waterways, wildlife, and the legal standing of the property.

• Traineeships

•

• Live Zoom classes

•

•

• Delivered in

Benefits:

• Friendly, Experienced Trainers

• Practical Courses for MR Industry

• Qualifications issued promptly

• Competitively Priced

• Exclusive Online Support Group

By Mike Phipps, Mike Phipps Finance

Welcome to 2026, dear readers. I write this month’s reflections having just boarded a river cruise in Europe. Yes, I am that old!

The managing director couldn’t face another hot and humid Christmas in Oz so here we are. If she utters one word of complaint about the cold, I swear I will suggest she take a swim in the Danube.

The days are going faster than I expected but I’m developing a slight sense of dread as our tour director seems to be softening us up for some unpleasant news regarding possible changes to our itinerary. I’m also developing a theory based on the demographic on board.

The travel company is Australian so no great surprise that the majority of guests are Aussies. It seems that the more dire the economic circumstances of the State of Origin, the more strident the support for the people who delivered that outcome. An almost Stockholm Syndrome state of mind manifests itself among some Victorians, who one might expect would know better. I’m having a lot of fun albeit the MD says I’m just a sh*t stirrer. She might be right.

Of even greater surprise are the number of seemingly sane passengers who argue that out of control electricity prices are

a sure sign that renewables are the cheapest form of energy. Their inability to grasp that government subsidies distort actual costs is a constant excuse to steer conversations toward the many positive attributes of communism. On this the Victorians can all agree.

And speaking of which… As our nation lurches from one crisis to the next it’s hard to focus on any particular challenge, much less contemplate solutions. To some degree I am comforted

by the clear and present evidence that those in power are similarly challenged when it comes to devising positive outcomes. Surely the ruling class are smarter than the rest of us, so perhaps we just need to accept that some problems are indeed intractable.

Or maybe not. In the many debates that range across the vista of public discourse one objective measure appears to be missing. When politicians, bureaucrats and

their many advisors spell out policy positions, they seem to miss one vital ingredient…

The oft-quoted but rarely spotted endangered species known colloquially as common sense.

The term can be traced back to a 1776 essay by Thomas Paine in support of American independence from Great Britain. Since then, the broadest interpretation seems to be an ability to make sensible decisions in daily life.

A capacity to use knowledge and intuition to come to reasonable conclusions. You can see why our political class have trouble here so let’s try and help.

But where to start? Given everyone is entitled to my opinion I guess I could start anywhere, but let’s zoom in on a current buzzword. Productivity it is but what is it?

Economists tell us it’s a measure of efficiency whereby we look at inputs like resources, time and labour and the ultimate outputs achieved. Sounds a bit abstract and here’s where common sense comes to the fore. To me it’s simply being able to do more with less or at least do the same with no more.

Rather than attempt to form a vision of productivity failures and possible solutions via the medium of obtuse economics or policy-speak, let’s examine a few practical examples. Perhaps even apply a bit of common sense.

As luck would have it, I’ve uncovered a spectacular example of a productivity and efficiency killer. And even better, I can guarantee you that you have first-hand experience of this most evil blight on society.

In 2024 Australians spent about 123 million hours on hold in call centre and government contact queues or waiting for businesses to answer the phone. All the while we are subjected to recorded messages extolling the virtues of the company or government department that thinks so little of us as to value our time at zero. Depressingly, the 123 million hours represented a 15 percent increase over the previous year. It is estimated that the negative value impact on GDP as a result is circa $1.28 billion per annum.

Of course, the businesses and government departments that deliver these appalling outcomes will bask in the cost savings and bonuses that result from sacking staff and passing the pain on to taxpayers and consumers. Even so, wasting $1.28 billion a year might be a

good place to start if we are looking to improve productivity.

Oh, and by the way corporate Australia. Having me work for you as a checkout assistant doesn’t save the economy any money, it just shifts the cost from you to me. I await my Xmas party invitation and annual bonus with bated breath. Common sense says I should not hold that breath.

Let’s move on to an emerging threat to productivity. While it’s too early to tell, I predict that the work from home trend will make call centre productivity impacts look like chicken feed. How can this be Mike, you ask? The overwhelming majority of workers and unions support WFH. So what I say! If a two-day working week for a five-day pay packet was proposed I bet the workers and unions would be delighted. Doesn’t make it a good idea as most businesses would be broke within 12 months, and there’d be no pay packet at all.

Work from home might be manageable if a job could be tightly defined and performance metrics set at a highly accountable level. Good luck with that when it’s near impossible to sack even the most incompetent and lazy employees or public servants under current IR laws.