To our valued Members,

Firstly, please allow me to acknowledge the traditional custodians of the land and rivers on which our Club is situated. I acknowledge the significant contributions made by First Nations people and I note their contribution to the development of our great country. In this regard, I pay respect to the Elders, past, present and emerging, of the peoples of the Dhurawal and Darug Nations.

Before I reflect on the year we’ve had, I would like to pay tribute to former Sporties President Robert (Bob) Fleeton who sadly lost his battle with cancer recently.

Bob dedicated most of his adult life to our Club and to supporting grassroots sport in the Moorebank, Holsworthy, Hammondville and Wattle Grove areas. It was his vision and determination which laid the platform for our organisation which continues to grow year on year, following his enormous contribution.

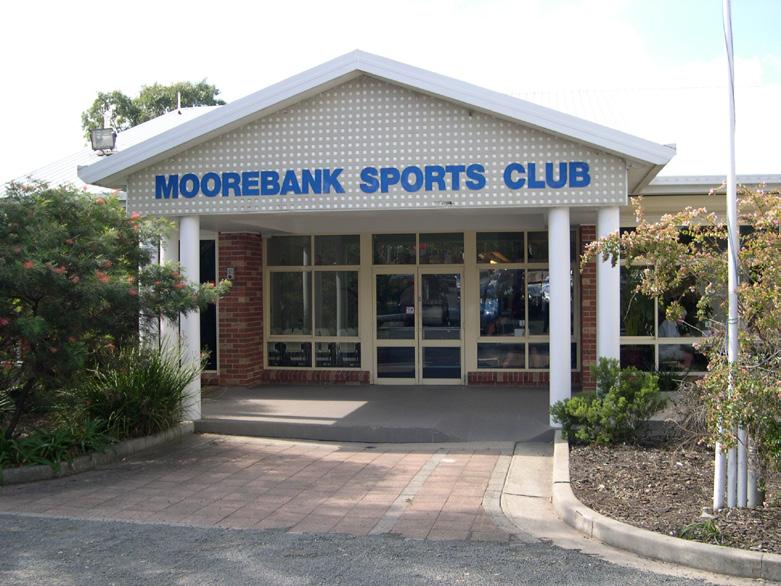

Under his leadership, Moorebank Sports Club built a licenced venue, entered a rugby league team in the Metro Cup in the 90s, underwent multiple renovations and upgrades, and grew our local sporting codes, such that Sporties has become one of the prestigous registered clubs in Sydney’s southwest. Through the crystallisation of Bob’s vision and passion, millions of dollars in funding has been contributed to the sporting codes and dozens of local community organisations, which has allowed them to grow and flourish, adding so much to the lives of so many.

After 29 years as President, and 32 years as Director, Bob resigned due to ailing health. But his dedication to grassroot sports and his efforts to make our local community a better place to live, will live on for many generations to come.

From success on our sporting fields, to multi-million-dollar renovations, to building stronger community partnerships, and creating new customer service facilities to improve the guest experience for everyone who walks through our doors, this year has had something positive for everyone.

We recorded a total profit of $1,745,038 after tax, which is a great result given the extensive building works we undertook. In fact, when we set the revenue budget for this year, we were cognisant the renovations would have a big impact on the bottom line with virtually 50 per cent of the Club shut down for six months. Pleasingly though, we traded well and exceeded budget expectations by 93 per cent; a testament to the fact our members stuck by us. Our on-going fiscal success continues to allow us to re-invest plenty of funds back into the Club, our staff, our sporting codes, and the local community.

This year, we contributed $145,000 to our five associated sporting codes, supporting 1,765 junior and senior players during 2024.

This funding has been used for things like training uniforms for our soccer teams, presentation nights for our junior and senior rugby league teams, representative levies and costs for State Age Championships for our netballers, rewiring the main diamond for the softball club, and new training shirts for our cricketers. We now hold biannual meetings with our Code Presidents, as we strive to build bigger and better connections.

Off the field, we have supported five local community organisations providing $108,605 in funding through ClubGRANTS, focusing on mental health support, all abilities sport, learning support for children in local schools, family and domestic violence survivors, and families of premature or sick babies at Liverpool Hospital.

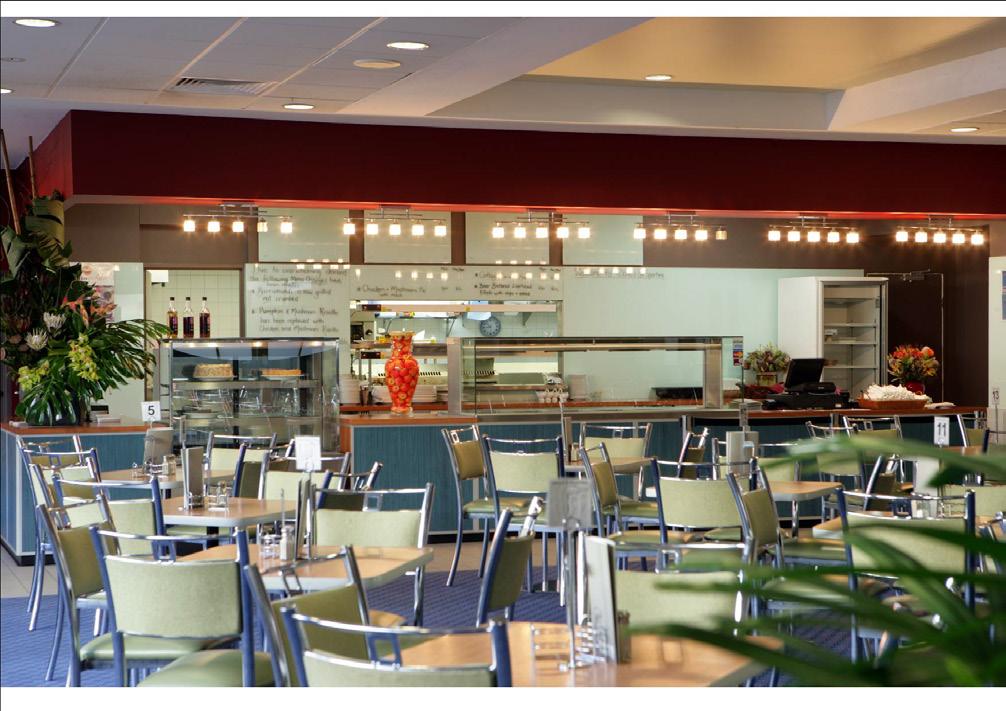

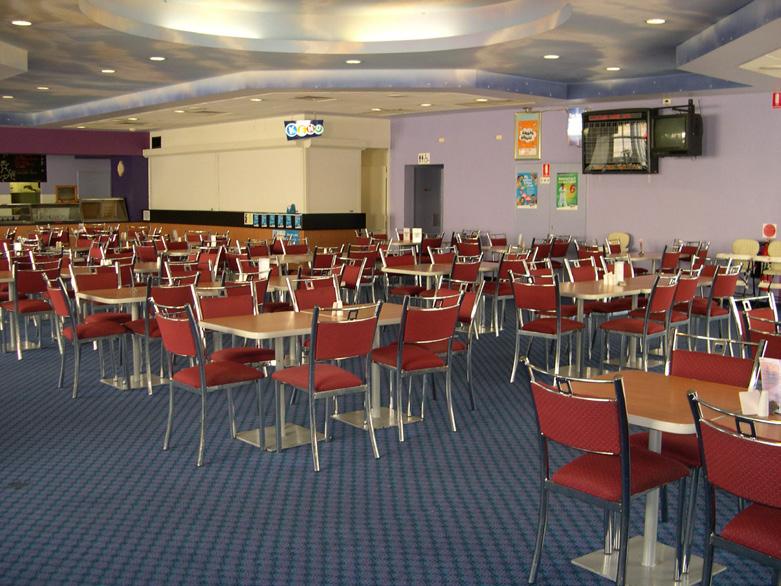

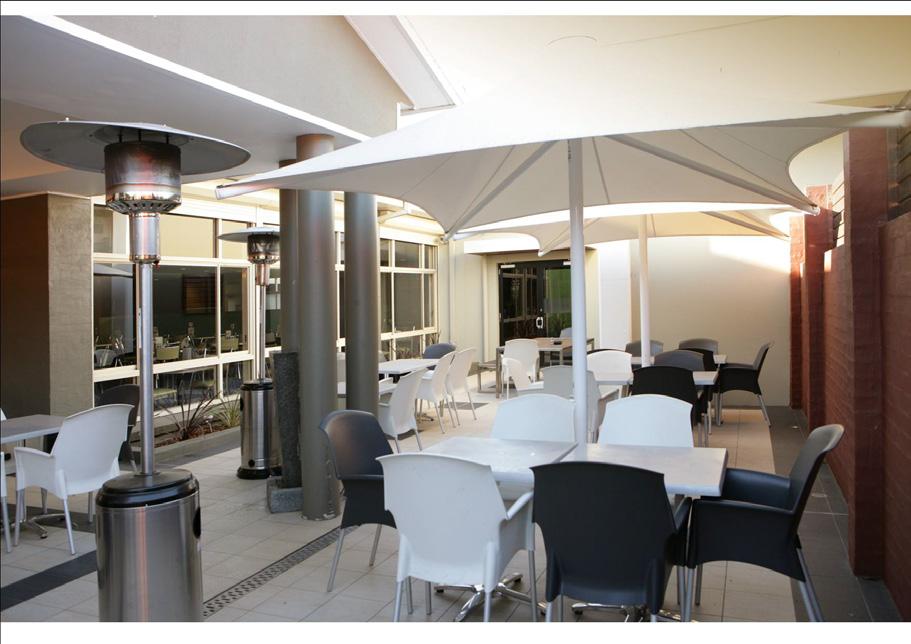

As most of you would have seen, we unveiled our major Club renovation in April 2024. Our aim was to improve the flow inside the venue, freshen up the indoor and outdoor facilities and amenities, and make the overall experience at our Club a more comfortable one for our members and guests. To put it simply we wanted Sporties to be beautiful. We wanted to create a 5-star hotel look and feel, something which I think most people would agree we have achieved, whether you’re sitting in our Lounge Bar enjoying the big screens, dining in our great restaurant, or perhaps having a punt in our new sports bar. The new Sporties is the Club for everyone.

In June 2024, we celebrated Sporties’ 30th birthday with an event in our alfresco dining area. We invited our former Directors, sporting codes and community partners, to join the current Board and managment team for drinks, food and cake. It was wonderful to see so many people who have had an impact on our Club come together for the milestone.

We also held a special event for our Life Members, who joined the current Board and members of the executive team for a luncheon at Lighthorse Kitchen.

At 30 June 2024, the proposed land sale between Liverpool City Council and Sporties was awaiting a vote by the Mayor and Councillors. Our goal remains to secure the land to lock in our future and then commence the project of designing and building a new Club that will serve the needs and wants for generations to come.

I would like to thank my fellow Board members, our CEO Jeff Gibbs, and the entire Sporties team for your dedication and commitment to our Club over the past 12 months. You guys keep the wheels turning day in, day out, and you are the reason our members enjoy their Sporties experience.

To the volunteers who run our sporting codes – thank you for your passion and enthusiasm to grow and develop your chosen sport, and for investing in our kids. You truly are wonderful human beings who deserve credit and recognition for the countless hours you devote to our clubs.

Alby Taylor President Moorebank Sports Club

What a year we’ve had at Sporties!

To begin, I would like to pay tribute to former President Bob Fleeton who recently lost his battle with cancer.

I’ve had the pleasure of knowing Bob for 15 years, working alongside him as he and the Board grew our Club to the fantastic venue it is today.

His ingenuity and out-of-the-box thinking paved the way for our Club to be built back in the 90s and his leadership over the years has seen its unwavering success.

Bob and his wife Lynne were constant fixtures in the Club on a Friday night and were known to most members. Their presence is still felt throughout our organisation and he will be greatly missed.

I would like to thank Bob for playing a vital role in creating this Club that has become an integral part of the community, but also for creating something that is loved by so many.

With over 26,000 members and millions of dollars of funding given to the community, Bob has created a legacy that he and his family should be proud of.

Looking back at the last 12 months and I’m proud to say we’ve had another positive year.

With a total revenue of $18,199,722 and a profit of $1,745,038 we have been able to contribute more than $250,000 to our five sporting clubs and five local community organisations, including Miracle Babies, Southwest Sydney Local Health District, Heroes With Ability, Georges River Life Care, and Learning Links.

In April 2024, after months of construction, we unveiled our $6M renovations. We are thrilled with the outcome and that we’ve been able to pay homage to our military connections and historical ties with the local community.

In June 2024, we celebrated the Club’s 30th birthday with special VIP and Life Member events, and our members were treated to 30 days of giveaways across the month of June.

This also coincided with the release of the Sporties Club History booklet which took a trip down memory lane, back to the inception of our sporting codes to the latest renovations. We spoke to some of the key decision-makers who were instrumental in the development of the licenced venue and paid tribute to the team who kept the Club moving during COVID lockdowns.

Over the past 12 months, we have focused on ensuring a positive and supportive workplace for all employees within our organisation. We have offered our staff several health and wellbeing initiatives, and other team building activities.

We also launched a 12-month leadership development program for our Team Leaders and Customer Service Managers and delivered a comprehensive training program, which included safety and compliance, customer service, train the trainer, industry tours, and invitations to special events.

We had almost a dozen team members reach their five and ten-year work anniversaries with us, and we ran our Staff Opinion Survey again with some fantastic results which are outlined later in this report.

To finish, I would like to thank the Board for their ongoing support, the executive team for their hard work and unwavering commitment to our cause, and to our frontline staff who are the backbone of our operations.

And of course, a huge thank you to our members and guests who continue to support us, so we can support them.

Jeff Gibbs Chief Executive Officer

Moorebank Sports Club

On Friday 21 June, we marked 30 years to the day since Sporties officially opened its doors as Moorebank Sports Club.

To celebrate, we invited our former Directors, sporting codes and community partners, to join the current Board and executive team for an intimate party at the Club, with canapes, drinks, and cake.

And on Sunday 23 June, we invited our Life Members to join the current Board of Directors and members of the manaagement team for a special luncheon at Lighthorse Kitchen.

Ann Cook, Neil Clancy, Roger Crowfoot, Bonita Jones, Shirley McAlister, Ann Richards and Dennis Errington were all in attendance.

It was wonderful to see so many people who have had an impact on our Club – both in the past and present, come together to celebrate the milestone.

Commencing January 2024, Sporties underwent a $6M renovation to revitalise the venue and better showcase its historical ties to the Holsworthy military community. The aim was to position the Club as the jewel of south-west Sydney.

• Better flow from the indoor to the outdoor spaces, with views of the surrounding sports fields now showcased through a much more open perspective.

• The main bar area has additional booth seating for groups and three giant screens across the back wall.

• A wall was removed in the Auditorium to open up the area at the back of the room, and a new cocktail bar has been built to enhance the guest experience.

• The main bathrooms between the lounge and Auditorium areas have been completely refurbished with a sleek new design.

• The alfresco dining area has been given a facelift, with new banquet seating and upholstery, updated LED lighting, and new tiles.

• Part of the gaming room has been redesigned to provide members and guests with additional space, with new carpet, a new cashier area, and more room between machines.

• The main dining area has also been given a revamp with a raft of cosmetic changes, a gelato cart, a stunning ceiling feature, and an enhanced wine bar, giving the space a very luxe feel.

One of the most exciting changes made in these renovations was a rebranding of the Indulge Brasserie to ‘Lighthorse Kitchen’ which pays homage to the mounted brigade attached to the Holsworthy Army Barracks, which used to be housed on the land where the Club now stands.

Special thanks to…

Builders: FDC Constructon and Fitout

Architects: Altis Architects

Furniture: Toga

Our Club’s strength lies in its people and the culture we create together. We are grateful for each employee’s role in shaping our community and look forward to another year of growth, connection and shared success.

Our employees gave us a 4.5 out of 5 stars in the latest opinion survey.

100% of employees received training

As part of the Club’s 30th birthday celebrations in June 2024, we asked our staff to reflect on what they love most about working at Sporties.

“Working at Sporties fills my heart with joy every day. I have never felt more valued and appreciated, and being able to bring my authentic self into the workplace is something I have strived for my whole career”.

“I love and appreciate the opportunities Sporties has given me, allowing me to learn so many different skills and responsibilities whilst being trained to work in all areas of the club”.

“It is the experiences, training and professional development opportunities that Sporties has provided me over the past 9 years that has helped me to achieve these goals, build character to become the person I am today and successfully prepare me to work in any industry”.

“The staff are amazing, their positive attitude and smiles, each and every day, are infectious, you just feel-good coming to work… this has been the most beautiful experience of my working life to date”.

“While there may be challenging times, it is inspiring to see management come together to support their staff. I have also formed lasting friendships with colleagues and patrons, which makes me love my job even more”.

“There are people with all different leadership styles and experience that I can go to for advice or use as a sounding board, I’m trusted to do my job well, but more importantly I have a safe space to admit my mistakes, take accountability and fix them”.

“What do I love the most working at Sporties? Easy answer – EVERYTHING! In my life I have worked in many different workplaces and experienced working with hundreds of staff, management and customers in different industries. Moorebank Sports is by far THE BEST”.

Moorebank Sports Club is primarily a club whose vision is to foster amateur sport in the local Hammondville area.

Annually the club donates directly to our local community through ClubsNSW Club Grants funding, to our local sporting codes and our local schools.

Sporties donated over $145,000 to soccer, netball, rugby league, baseball and cricket. Without this support the codes wouldn’t be able to provide essential sporting equipment, maintain the grounds and develop the young local residents who play in the teams.

Sporties also continues its tradition of developing junior sport by supporting our local Sydney Shield team each year. Go Rams!

In addition to this Sporties sponsors many other community groups in the local area including Heroes with Abilities, Miracle Babies, Learning Links, Georges River Life Care, Liverpool Neighbourhood Connections and more. Sporties is proud to donate these essential funds to such worthwhile causes.

$20,000

Heroes With Ability is a not-for-profit organisation that promotes inclusive sporting opportunities for young people with physical and mental disabilities.

Their aim is to inspire, teach, motivate, and incorporate all aspects of health and wellbeing, social inclusion, and awareness, for individuals and the communities they live in.

THE PROJECT - Varying Abilities Sports Schools Program

$25,000

GRLC is a not-for-profit community organisation that has been in operation since 2007. It specialises in family violence support and emergency relief, and offers a positive creative arts program aimed at vulnerable and disadvantaged children, families, and adults with disabilities.

Life Care utilises a network of trusted community partners to meet the needs of the vulnerable people who seek their help and create pathways and opportunities to support improved lifestyle choices.

Since 2020, GRLC has been developing support services in the Liverpool LGA with particular focus on supporting families and households experiencing hardship. They have been supplying food hampers, Christmas hampers, and school backpacks to some of the most vulnerable families in the area.

In 2022, GRLC began hosting fortnightly lunches at local schools on Sundays where families can come

$25,175

Miracle Babies Foundation is Australia’s leading organisation supporting premature and sick newborns, their families and the hospitals that care for them.

Every year in Australia around 48,000 newborn babies require the help of a Neonatal Intensive Care Unit (NICU) or Special Care Nursery (SCN). 27,000 of these babies are born premature and up to 1,000 babies lose their fight for life.

For families, the experience of having a baby come into the world not as expected or planned is life changing. Without support, this overwhelming and traumatic experience can have lifelong effects on the emotional wellbeing of these miracle families. It affects the entire family unit.

Since 2005, Miracle Babies Foundation has been passionate in developing and providing vital programs and resources to support and enhance a family’s experience from a threatened pregnancy, hospital journey with a premature or sick newborn, the transition to home and beyond.

Australia is home to 23 state of the art intensive care units designed to meet the unique and critical needs of our earliest and sickest babies. Working with health professionals on the joint agenda of better outcomes for families, Miracle Babies provides informative education and insight on a family’s experience and funding for equipment, resources and research.

NurtureTime in-hospital support is facilitated by caring parents who themselves have experienced the birth of premature or sick newborn.

Our qualified NurtureTime volunteers visit the hospital to offer support, guidance and hope. Parents, family and friends can ask questions, share their thoughts and feelings knowing the volunteer has a shared experience.

$2,000

South Western Sydney Local Health District is one of the largest districts in the State and aims to provide a healthcare service that is patient focused, equitable, and responsive to the changing and developing needs of the communities in south western Sydney.

The SWSLHD Mental Health Service provides assessment and treatment services to residents across south western Sydney, with a focus on early intervention and promoting positive outcomes for our community.

Sensory items are specially designed items to engage the senses; sight, touch, sound, taste, and smell. These items stimulate different pathways in the brain and can act as stress relievers, providing calming and soothing effects, reducing anxiety, and promoting emotional regulation and wellbeing.

Every month, an average of 100 people are admitted to the mental health unit at Liverpool Hospital.

The funding provided by Sporties provides sensory items for each of those patients for their use during their stay, and after discharge.

$34,780

Learning Links is a not-for-profit organisation which supports children with learning difficulties and disabilities to realise their full potential in the classroom.

They provide therapy, education, and support services in collaboration with parents, professionals and schools, to ignite a child’s passion for learning through their unique talents and strengths.

THE PROJECT -Psychology in Schools (Mental Health & Wellbeing Program)

neighbourhood, those who make a real difference in the lives of others but rarely get the recognition they deserve.

As a small token of Sporties’ appreciation for their contribution to our community, winners receive $1,000 cash, and our Community Champions get $200 Sporties Dollars.

Belinda Howell was our Nominate A Neighbour winner for her tireless work with the Wattle Grove Scout Group.

Geoff Robinson was named a Community Champion for his dedication to volunteering for Heroes With Ability, despite battling throat and mouth cancer. Sadly Geoff passed away in July losing his battle, and we pass on our condolences to his family.

Fiona Heath was recognised as a Community Champion for her leadership and contribution to the Moorebank Sports Royals baseball club.

And Donna McMillan – who has been the lollipop road safety lady at Holsworthy Public School received the final Community Champion award for her positive approach to her role.

In September 2023, Moorebank Sports was the major sponsor for Hammondville Public School’s 90th birthday celebrations which included historical displays, market stalls, food trucks, vehicle and defence displays, inflatables and kids’ entertainment, and live performances.

In October 2023, several Sporties team members grabbed some tongs, donned their aprons, and spent the day at Bunnings Crossroads in Casula, to support the Rotary BBQ raising funds for the Miracle Babies Foundation.

“Alone we can do so little; together we can do so much.”

- HELEN KELLER

In November 2023, Sporties sponsored the Heroes With Ability Gala Day held at the Michael Clarke Recreation Centre in Carnes Hill, which was attended by 225 students from schools in Sydney’s south west. The event was an opportunity for the students to showcase their ability and represent their schools in a competition-style environment. They participated in basketball, kick tennis, jumping over mini-hurdles, target throwing, and agility poles.

In 2023, Sporties supported the Australian Defence Force Netball team from the Holsworth Army Base, providing their training shirts for competitions including the Combined Services National Championships, held in Darwin.

In December 2023, Sporties supported the Georges River Life Care backpack initiative which aims to provide under-privileged primary and high school kids with the classroom essentials they need to start the school year.

Our Club donated 139 backpacks for local kids and our staff took the time to pack each of the bags.

Members of our team also attended the GRLC Christmas Party to help run the event and do some

In late 2023, Sporties put gift hampers together for patients staying in the Mental Health Unit of Liverpool Hospital over the Christmas period, so they would have something to open on Christmas Day.

Our team purchased the hamper items themselves, including self-care items, craft activities, socks, puzzles, games, and festive treats!

In May 2024, in partnership with Sutherland Shire Council, Heart of the Nation, the Sandy Point Community Hall Committee, Freedom Fitness, Sporties proudly unveiled a new life-saving defibrillator machine at the Sandy Point Community Centre.

Following the major renovations in 2024, Sporties donated its pre-loved furniture from the dining room, main lounge, and Auditorium to two charity partners.

Georges River Life Care accepted dining tables and chairs for their Life Centre, where victims of domestic and family violence, people needing emergency relief, and children and adults living with a disability,

And ReLove, an organisation which helps women and children who have fled family and domestic violence situations to set up a new home, also took some items to support their clients.

$145,000

In early 2024, Sporties announced $145,000 in funding for its five associated sporting clubs, supporting 1,765 junior and senior players for season 2024.

This Category Two ClubGRANTS funding is designed to enhance the growth and development of grassroots sport in our local area.

This season began with the opening of our fantastic synthetic field. Liverpool City Council officially opened the field with a ceremony in April. During the season, this all-weather field proved to be an invaluable asset as the competition was hampered by rain on many weekends. While the grass fields remained closed to recover, Field 1 was open weekends and weeknights for normal and catch-up games.

Our season was extremely busy with a record number of teams. We saw an increase in our senior and female player numbers beyond our expectations and we are proud of what all our teams have achieved this year.

This year MSC introduced Football4All to our community. This all-ability program was open to children between the ages of 5 to 16 years. Our 17 participants came together every Saturday morning and even played in the SNAPP gala day. It was a joy to be part of this wonderful program and see all the children enjoy their football.

I would like to thank all our members, volunteers, our committee for all their hard work, and sponsors for their support. It takes many to keep our club running as successfully as it is and the club’s growth and development is a credit to all of them.

Daniel Flego President, MSC

HIGHLIGHTS

• 82 teams in total

• 1265 total registrations - 20% increase in registrations from 2023 - 336 minis players (5 to 9 year olds) - 488 junior players (10 to 18 year olds) - 225 senior players (19 years and older)

• Minor Premiers Teams – 9 with 2 of these being ladies teams

• Number of teams to make semi finals – 29 with 7 of these ladies teams - 10 senior teams - 19 junior teams

Season Highlights:

• First year of Football4All – all-ability football program

• Opening of the new synthetic field by Liverpool City Council

• 24% increase in female player participation from 2023.

• Holiday clinic held in July school holidays

• 39 different nationalities recognised in our registrations (45 countries of birth)

• Players from 81 Sydney suburbs

THIS YEAR’S FUNDING WENT TOWARDS -

• 875 training and game day uniforms for junior and senior players

• Technical Director for semi-professional teams

• First Aid

• New portable goals

Moorebank Rams performed extremely well across the men’s and women’s league and league tag competitions this season.

RESULTS

U/11 div2 - Plate Grand Finalists

U/12 div2 - Undefeated Minor Premiers (Runners Up)

U/13 div2 - Premiers

U/14 Silver Girls League Tag - Minor Premiers (Runners Up)

U/16 Silver Girls League Tag - Minor Premiers (Runners Up)

Women’s Open League Tag - Grand Finalists

Mark Weller

Moorebank Rams - President

THIS YEAR’S FUNDING WENT TOWARDS -

• Junior presentation day and senior presentation night

• Participation trophies for 466 players

• Field maintenance at Hammondville Park

• Yearbook

With netball numbers down across the Liverpool Association, Moorebank remained the largest Club for the 2024 season with 19 teams.

There were 175 players spread across the following teams:

• 4 Modified Teams [9 years and under] non-competition

• 13 Junior Teams [10 to 17 years]

• 2 Senior Teams

11 Teams made the Semi Finals, with 6 Teams progressing to finals:

• 10As

• 11Bs

• 12Bs

• 2 x Senior Cadet Teams

• Senior Division 6

Jennifer Harris and Luke McGrath have worked tirelessly with our Junior Umpires this season and we saw Caitlin Darby, Chloe Glissan, and Ava Chapman successfully progress through the Whistles in Mouths Program.

These girls, alongside Eleanor Kruger, can now progress towards achieving their National C Umpires Badge, next year.

Our Coaches also had the opportunity to attend a number of Coaching Clinics this season which were hugely beneficial.

A sincere THANK-YOU to Sporties for their continuous support and financial assistance.

Success just does not happen. With an enthusiastic, hard-working committee, and Coaching staff led by our President, Shirley McAlister, we have been able to maintain a progressive and successful Netball Club for another year.

Ann Richards

Moorebank Netball Club - Secretary

THIS YEAR’S FUNDING WENT TOWARDS -

• Representative levies and costs associated with State Age Championships

• Coaching courses and clinics

• Umpiring courses

• Additional equipment and player patches for training and game days

• Club polo shirts

• Presentation trophies and awards

Moorebank Cricket Club experienced another successful season for 2023/24, with 12 teams representing the club, and a total of 139 registered players.

Seven teams made it through to semi-finals, with four teams making it to the grand final stage.

Unfortunately, our Under-9 team was defeated in the grand final, and the Under-11, Under-12 White, and Under-13 teams were defeated in the semi final.

Despite not having the on-field results, our 5th Grade Seniors team were competitive against all competition sides. They are a great bunch of players which is demonstrated by the spirit that they played the game in.

Justin Quigley

Moorebank Cricket Club – President

Moorebank had three teams winning premierships in the Fairfield-Liverpool Cricket Association (FLCA) competitions for 2023/24:

• Under 10 White (Minor Premiers & Premiers)

• Under 12 Blue (Undefeated Minor Premiers & Premiers)

• 4th Grade Seniors (Premiers)

NUMBER OF PLAYERS

The club had players in the following competitions:

• 27 players in the Blasters (Under 5 – 9) competition

• 78 players in the Junior (Under 10 – 16) competition

• 34 players in the 4th and 5th Grade Senior competitions

NUMBER OF TEAMS

There were 12 teams competing for Moorebank, comprising two teams in Blasters, eight Junior teams, and two Senior teams.

STANDOUT PERFORMANCES

• Juniors: Benedict John Sibi (U13) was named the Moorebank Junior Cricketer of the Year for his consistent performances throughout the season, with Ankit Gulavani(U12) and Liam Quigley (U13) finishing 2nd and 3rd respectively. Twin brothers Benjamin and Jackson Davies from U10 both also finished in the top 5 for Juniors.

• Seniors: Anmol Kumar (4th Grade) was named the Moorebank Senior Cricketer of the Year and was also awarded the overall FLCA Senior Cricketer of the Year across all grades in the FLCA Senior competition, a great achievement for both Anmol and Moorebank. In our Senior teams, there were 4 Junior players and 2 other under 16 players who were playing full time. Special mention must be made of Saqlain Haider, who made his Senior debut at the age of 12 during the season & more than held his own against the Senior players of other clubs. For the upcoming 2024/25 season, we are anticipating doubling the number of senior players and teams, which will help in retaining Junior players at the club in the coming years.

• Coaching: Martin Carroll, who coached the Under 12 White team, demonstrated the power of high-quality coaching by helping his relatively inexperienced team of players reach the semi-final.

• Team Officials: All team coaches, managers, and scorers should be congratulated for the support they provided our teams throughout the season.

THIS YEAR’S FUNDING WENT TOWARDS -

• New game day and training shirts for all players

• New signage around the ground at Hammondville Park

The Royals had a fantastic summer season 23/24, with five junior teams and three senior teams performing well throughout the year.

Four teams (two junior/two senior) made finals, with our Senior League (Age 15/16) winning their Grand Final, while our Saturday Seniors were runners up.

We had a number of players representing Macarthur Baseball at Association level, as well as the following high achievers:

· Draven Fatu & Tahlan Cavill - Australian U16 National Team

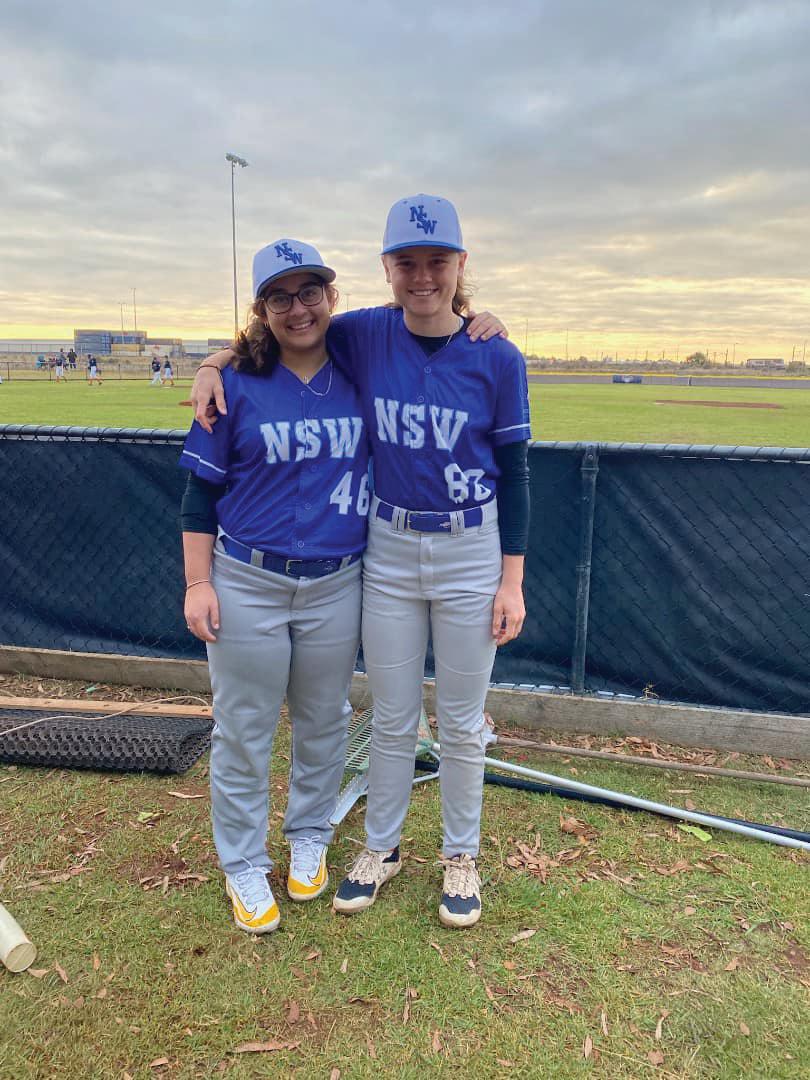

· Maddison Heath - NSW Womens League 1st Grade Hitter of the Year, Women's Emerald's National Team, Coach of the Year (Macarthur Association), Women’s NSW Team Coach

· Mariam Arifaki - NSW Women’s League 2nd Grade Hitter of the Year, Women’s NSW Team

· Ryleigh Delacour-Batch - NSW Women’s Team

· Lachlan Brook - U23 National Team

Season 24/25 began in September with five junior teams and three senior teams competing. We are very proud of our little club and the exceptional talent and achievements of our players. We wouldn't operate if it wasn't for our brilliant Committee and Volunteers.

Melanie Charlton Moorebank Royals - President

THIS YEAR’S FUNDING WENT TOWARDS -

• Rewiring the main diamond at Hammondville Park with heavy gauged wire

• Presentation day for all junior and senior players

Our sporting codes have recorded some wonderful milestones this year.

In August 2023, Moorebank Royals player Maddie Heath represented Australia in the Women’s World Cup in Thunder Bay, playing national teams during an 8-day tournament.

The achievement capped off a remarkable 8-month recovery from major hip surgery, that could have potentially spelled the end of her playing career.

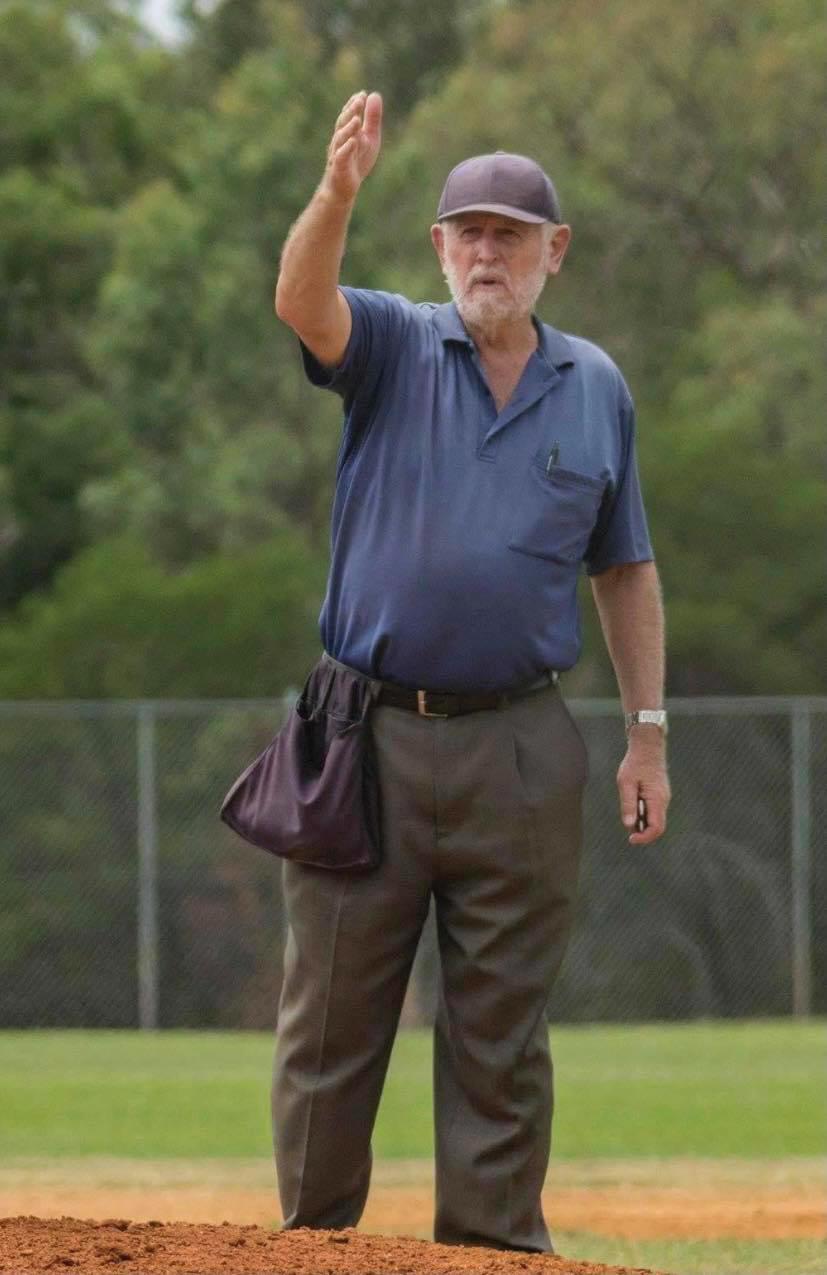

In mid-2023, after 32 years at the Moorebank Royals Baseball Club, umpire Roger Crowfoot hung up his hat to enjoy retirement.

During his career, Roger umpired junior games almost every week and oversaw senior games, when needed. He also took on a mentoring role encouraging players to try their hand at umpiring to extend their skills and build up the club’s roster of whistle blowers.

In April 2024, members of the Sporties board and executive team were joined by the Liverpool Mayor and other local representatives, along with the Moorebank Sports Soccer Club, to officially unveil the new synthetic playing field at Hammondville Park.

This upgrade was undertaken to combat several maintenance challenges stemming from the natural grass field. It has also put Hammondville Park on the map as one of the best venues to play at in our region.

The directors present their report together with the financial statements of Moorebank Sports Club Limited (the company), for the year ended 30 June 2024.

The directors of the company in office at any time during or since the end of the financial year are:

Name Board Status Period of directorship Qualification(s)

Brenton Taylor President Appointed 30 October 2016 Chief Commissioner MPPA, Dip Law (LPAB), GDLP, GCAM, GAICD, Legal Practitioner

Craig McNally Vice President Appointed 25 October 2020 Business Owner, Tradesman

Nal Wijesekera Treasurer Appointed 25 October 2020 Assistant Principal – Director of Catholic Identity and Mission MEd (RE), BEd

Allan Facey Director Appointed 27 November 2023 B.Com, GradDipCA, CAANZ Registered Company Auditor

Francis Griffin Director Appointed 30 October 2016 Advanced Public Administration

Laurence Willoughby Director Appointed 27 February 2017 Semi-Retired

Robert Fleeton Director Resigned 21 July 2023

The number of meetings of the company’s Board of Directors (the Board) and the number of meetings attended by each director were:

* Number of meetings held during the time the director held office during the year.

The Company is a company limited by guarantee and is without share capital. The number of members as at 30 June 2024 and the comparison with last year is as follows:

In accordance with the Constitution of the company, every member of the company undertakes to contribute an amount limited to $20 per member in the event of the winding up of the company during the time that they are a member or within one year thereafter. The total amount that the members of the company are liable to contribute if the company is wound up is $522,580 (2023: $611,180).

The net profit before tax for the year amounted to $1,733,603 compared with profit of $2,286,444 for the prior year. This resulted after charging $1,847,641 (2023: $2,005,671) for depreciation and amortisation expenditure. The net profit for the year was $1,745,038 (2023: profit of $2,194,647) which includes a tax benefit of $11,435 (2023: expense of $91,797).

In the short term the Company’s objectives are to grow revenues through existing revenue streams and look at potential diversification of income and continue to promote and develop sporting activities and expand the Club’s offerings. We will continue to provide quality entertainment and social activities for members to support our principal activities whilst maintaining state of the art facilities and amenities that serve our many members.

In the long term the Company’s primary objective is to investigate and implement successful alternate revenue streams that complement the Club’s core business whilst still maintaining the principal activities.

The Company will strive to continue to be a market leader in the Licensed Club Industry in the current offerings provided to members while undertaking due diligence, extensive research and looking at market demands to determine the viability of any potential alternate revenue streams.

The primary strategies to achieve the Club’s objectives is though sound financial management and the use of financial ratios and key performance indicators (KPIs) to ensure that organisational business plans, budgets and cash flows are current, accurate and relevant.

The principal activities of the company during the year have continued to be that of a sporting and athletic club supported by licensed operations to provide members, their guests and the community with the amenities and facilities usually associated with a sporting and recreational licensed Club. The Club’s activities enhance, support and continue to develop and promote a range of sporting and social activities that have assisted the Club and the broader community. These activities have not been limited to the provision of sporting infrastructure but also to the development and promotion of a wide range of activities including all forms of sport for all levels of players. There has been no significant change in the nature of that activity during the year.

The principal activities assist in achieving the objectives as they are our core revenues and foundations to be able to achieve the objectives.

The Company measures its success in the following areas:

• Satisfaction of its Members and guests through review of:

- Member and guest (customer) satisfaction surveys

• Success of marketing and promotional events, entertainment and major calendar events

• Financial performance through review of:

- Earnings before interest, tax, depreciation and amortisation

- Revenue

- Wages cost as a percentage of revenues

- Profitability

- Targeted budgets being met

- Business Plan targets achieved

- Financial ratios and KPIs

- Patron visitations

Key Performance Indicators (from continuing operations)

A copy of the auditor’s independence declaration as required under Section 307C of the Corporations Act 2001 is set out on page 4

Signed in accordance with a resolution of the directors.

Dated at Moorebank this 30th of September 2024.

Brenton Taylor President

OF INDEPENDENCE BY

As lead auditor of Moorebank Sports Club Limited for the year ended 30 June 2024, I declare that, to the best of my knowledge and belief, there have been:

1. No contraventions of the auditor independence requirements of the Corporations Act 2001 in relation to the audit; and

2. No contraventions of any applicable code of professional conduct in relation to the audit.

Clayton Eveleigh Director

BDO Audit Pty Ltd

Sydney, 30 September 2024

To the members of Moorebank Sports Club Limited

Opinion

We have audited the financial report of Moorebank Sports Club Limited (the Company), which comprises the statement of financial position as at 30 June 2024, the statement of profit or loss and other comprehensive income, the statement of changes in members’ funds and the statement of cash flows for the year then ended, and notes to the financial report, including material accounting policy information, the consolidated entity disclosure statement and the directors’ declaration.

In our opinion the accompanying financial report of Moorebank Sports Club Limited, is in accordance with the Corporations Act 2001, including:

(i) Giving a true and fair view of the Company’s financial position as at 30 June 2024 and of its financial performance for the year ended on that date; and

(ii) Complying with Australian Accounting Standards – Simplified Disclosures and the Corporations Regulations 2001

Basis for opinion

We conducted our audit in accordance with Australian Auditing Standards. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the Financial Report section of our report. We are independent of the Company in accordance with the Corporations Act 2001 and the ethical requirements of the Accounting Professional and Ethical Standards Board’s APES 110 Code of Ethics for Professional Accountants (including Independence Standards) (the Code) that are relevant to our audit of the financial report in Australia. We have also fulfilled our other ethical responsibilities in accordance with the Code.

We confirm that the independence declaration required by the Corporations Act 2001, which has been given to the directors of the Company, would be in the same terms if given to the directors as at the time of this auditor’s report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

The directors are responsible for the other information. The other information obtained at the date of this auditor’s report is information included in the Directors Report, but does not include the financial report and our auditor’s report thereon.

Our opinion on the financial report does not cover the other information and accordingly we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial report, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial report or our knowledge obtained in the audit, or otherwise appears to be materially misstated.

If, based on the work we have performed on the other information obtained prior to the date of this auditor’s report, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

The directors of the Company are responsible for the preparation of:

a) the financial report that gives a true and fair view in accordance with Australian Accounting Standards – Simplified Disclosures and the Corporations Act 2001 and b) the consolidated entity disclosure statement that is true and correct in accordance with the Corporations Act 2001, and for such internal control as the directors determine is necessary to enable the preparation of:

i) the financial report that gives a true and fair view and is free from material misstatement, whether due to fraud or error; and

ii) the consolidated entity disclosure statement that is true and correct and is free of misstatement, whether due to fraud or error.

In preparing the financial report, the directors are responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Our objectives are to obtain reasonable assurance about whether the financial report as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with the Australian Auditing Standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial report.

A further description of our responsibilities for the audit of the financial report is located at the Auditing and Assurance Standards Board website (http://www.auasb.gov.au/Home.aspx) at: http://www.auasb.gov.au/auditors_responsibilities/ar4.pdf

This description forms part of our auditor’s report.

Clayton Eveleigh Director

Sydney, 30 September 2024

The directors of Moorebank Sports Club Limited declare that:

(a) In the Directors’ opinion the financial statements and notes set out on pages 8 to 28, are in accordance with the Corporations Act 2001, including:

(i) Giving a true and fair view of the Company’s financial position as at 30 June 2024 and of its performance, for the financial year ended on that date; and

(ii) Complying with Australian Accounting Standards – Simplified Disclosures and Corporations Regulations 2001

(b) There are reasonable grounds to believe that the Company will be able to pay its debts as and when they become due and payable.

(c) The information disclosed in the attached consolidated entity disclosure statement is true and correct.

Signed in accordance with a resolution of the directors made pursuant to section 295(5)(a) of the Corporations Act 2001.

Brenton Taylor President

Dated at Moorebank this 30th day of September 2024.

For the Year Ended 30 June 2024

As at 30 June 2024

The Statement of Financial Position should be read in conjunction with the accompanying notes set out on pages 12 to 28.

For the Year Ended 30 June 2024

The Statement of Changes in Members’ Funds should be read in conjunction with the accompanying notes set out on pages 12 to 28.

For the Year Ended 30 June 2024

Statement of

Moorebank Sports Club Limited is a company limited by guarantee, incorporated and domiciled in Australia. The financial statements are for Moorebank Sports Club Limited as a standalone legal entity.

The financial statements were approved for issue by the Directors on 30 September 2024

The financial statements are general purposes financial statements which:

• Have been prepared in accordance with the requirements of the Corporations Act 2001 and Australian Accounting Standards – Simplified Disclosures issued by the Australia Accounting Standards Board;

• Have been prepared under the historical cost convention;

• Are presented in Australian dollars;

• Where necessary comparative information has been restated to conform with changes in presentation in the current year; and

• Have been prepared on a going concern basis.

The Company has adopted all new or amended Accounting Standards and Interpretations issued by the Australian Accounting Standards Board ('AASB') that are mandatory for the current reporting period. Any new or amended Accounting Standards or Interpretations that are not yet mandatory have not been early adopted. The following Accounting Standards and Interpretations are most relevant to the company:

The Group has adopted Disclosure of Accounting Policies (Amendments to AASB 101 and IFRS Practice Statement 2) from 1 July 2023. Although the amendments did not result in any changes to the accounting policies themselves, they impacted the accounting policy information disclosed in the financial statements. The amendments require the disclosure of ‘material’, rather than ‘significant’, accounting policies. The amendments also provide guidance on the application of materiality to disclosure of accounting policies, assisting entities to provide useful, entity-specific accounting policy information that users need to understand other information in the financial statements.

The accounting policies disclosed in the financial statements are reflective of the adoption of these amendments.

In the process of applying the company’s accounting policies, management has made a number of judgements and applied estimates of future events. Judgements and estimates that are material to the financial statements include:

Estimation of useful lives of assets

Intangible assets

Note 5

Note 6

For the Year Ended 30 June 2024

Sale of Goods

Revenue from the sale of goods comprises of revenue earned from the provision of food, beverage and other goods and is recognised (net of rebates, returns, discounts and other allowances) at a point in time when the performance obligation is satisfied that is on delivery of goods to the customer.

Rendering of Services

Revenue from rendering services comprises revenue from gaming facilities together with other services to members and other patrons of the club and is recognised at a point in time when the services are provided.

Interest Revenue

Interest revenue is recognised using the effective interest rate method, which, for floating rate financial assets is the rate inherent in the instrument.

Rental Revenue

Rental revenue from leases is recognised on a straight-line basis over the term of the relevant lease.

For the Year Ended 30 June 2024

before income tax includes the following specific expenses:

For the Year Ended 30 June 2024

(a) Income Tax Expense

The Income Tax Assessment Act, 1997 (amended) provides that under the concept of mutuality clubs are only liable for income tax on income derived from non-members and from outside entities.

The amount set aside for income tax in the statement of financial performance has been calculated as follows:

(b) Deferred Tax Assets

The

For the Year Ended 30 June 2024

The company calculates its income in accordance with the mutuality principle which excludes from income, any amounts of subscriptions and contributions from members, and payments received from members for particular services provided by the association. The Commissioner of Taxation accepts this method of calculating income as appropriate for recognised clubs and associations.

Amendments to the Income Tax Assessment Act 1997 ensure associations continue not to be taxed on receipts from contributions and payments received from members.

The income tax expense or benefit for the period is the tax payable on that period’s taxable income based on the applicable income tax rate, adjusted by changes in deferred tax assets and liabilities attributable to temporary differences, unused tax losses and the adjustment recognised for prior periods, where applicable.

Deferred tax assets are recognised for temporary differences at the tax rates expected to apply when the assets are recovered or liabilities settled, based on those tax rates that are enacted or substantively enacted, except for:

Deferred tax assets are recognised for deductible temporary differences and tax losses only if it is probable that future taxable amounts will be available to utilise those temporary differences and losses.

The carrying amount of recognised and unrecognised deferred tax assets are reviewed each reporting date. Deferred tax assets recognised are reduced to the extent that it is no longer probable that future taxable profits will be available for the carrying amount to be recovered. Previously unrecognised deferred tax assets are recognised to the extent that it is probable that there are future taxable profits available to recover the asset.

Deferred tax assets are offset only where there is a legally enforceable right to offset current tax assets against current tax liabilities and deferred tax assets against deferred tax liabilities; and they relate to the same taxable authority on either the same taxable entity or different taxable entity’s which intend to settle the claim simultaneously.

For the Year Ended 30 June 2024

Reconciliation of Cash

Cash as at the end of the financial year as shown in the Statement of Cash Flows is reconciled to the related items in the Statement of Financial Position as follows:

8,859,120 6,492,810 10,419,008

Cash and cash equivalents includes cash on hand, deposits held at call with financial institutions, other short-term, liquid investments that are readily convertible to known amounts of cash without significant cost and which are subject to an insignificant risk of changes in value.

For the Year Ended 30 June 2024

203,297

For the Year Ended 30 June 2024

An independent valuation of the company’s land and buildings was carried out by Nicholas Brady Valuations (Registered API Member 68548) as at 30 June 2023. The stated market of land was $15,400,000 and buildings was $13,100,000.

The Directors’ have reviewed the carrying amounts of land & building assets at 30 June 2024, and determined there to be no material change to the value as determined in the valuation performed at 30 June 2023. The valuations performed by Nicholas Brady Valuations were performed prior to the Club Refurbishment capital works that were undertaken in 2024 and therefore the valuations do not include the revised value of the capital works.

Movements in the carrying amounts for each class of property, plant and equipment between the beginning and the end of the current financial year are set out below:

For the Year Ended 30 June 2024

5 Property, Plant and Equipment (continued)

The company determines the estimated useful lives and related depreciation and amortisation charges for its property, plant and equipment. The useful lives could change significantly as a result of technical innovations or some other event. The depreciation and amortisation charge will increase where the useful lives are less than previously estimated lives, or technically obsolete or non-strategic assets that have been abandoned or sold will be written off or written down.

The gain or loss on disposal is calculated as the difference between the carrying amount of the asset at the time of disposal and the net proceeds on disposal (including incidental costs) and is recognised as revenue at the date control of the asset passes to the buyer.

Property, plant and equipment is stated at historical cost less depreciation and accumulated impairment losses. Historical cost includes expenditure that is directly attributable to the acquisition of the items.

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the company and the cost of the item can be measured reliably. All other repairs and maintenance are charged to the profit or loss during the financial period in which they are incurred.

The depreciable amount of all fixed assets including buildings and capitalised lease assets, but excluding freehold land, is depreciated using the straight line/ diminishing value methods to allocate their cost amounts, net of their residual values, over their estimated useful lives, as follows:

Buildings

Plant & Equipment

Poker Machines

Leased assets

5-40 years

3-30 years

3-4 years

3-5 years

The assets' residual values and useful lives are reviewed, and adjusted if appropriate, at each Statement of Financial Position date. An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount.

Capital works in progress are transferred to other categories and depreciated when completed and ready for use.

The Company leases plant and equipment under agreements between 2 to 5 years. There are no options to extend under these lease agreements.

A leased asset is recognised at the commencement date of a lease. The leased asset is measured at cost, which comprises the initial amount of the lease liability, adjusted for, as applicable, any lease payments made at or before the commencement date net of any lease incentives received, any initial direct costs incurred, and, except where included in the cost of inventories, an estimate of costs expected to be incurred for dismantling and removing the underlying asset, and restoring the site or asset.

For the Year Ended 30 June 2024

Leased Assets are depreciated on a straight-line basis over the unexpired period of the lease or the estimated useful life of the asset, whichever is the shorter. Where the entity expects to obtain ownership of the leased asset at the end of the lease term, the depreciation is over its estimated useful life. Leased Assets are subject to impairment or adjusted for any re-measurement of lease liabilities.

The Company has elected not to recognise a leased asset and corresponding lease liability for shortterm leases with terms of 12 months or less and leases of low-value assets. Lease payments on these assets are expensed to profit or loss as incurred.

Non-financial assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the asset's carrying amount exceeds its recoverable amount.

Recoverable amount is the higher of an asset’s fair value less costs to sell and value-in-use. The value-in-use is the present value of the estimated future cash flows relating to the asset using a pretax discount rate specific to the asset or cash-generating unit to which the asset belongs. Assets that do not have independent cash flows are grouped together to form a cash-generating unit.

The company determines the estimated useful lives and related depreciation and amortisation charges for its property, plant and equipment. The useful lives could change significantly as a result of technical innovations or some other event. The depreciation and amortisation charge will increase where the useful lives are less than previously estimated lives, or technically obsolete or non-strategic assets that have been abandoned or sold will be written off or written down.

6 Intangible Assets

Reconciliations

Reconciliations of the written down values at the beginning and end of the current and previous financial year are set out below:

For the Year Ended 30 June 2024

Poker machine entitlements are considered to be intangible assets with an indefinite life as there is no set term for holding the entitlements. As a result, the entitlements are not subject to amortisation. Instead, poker machine entitlements are tested for impairment annually and are carried at cost less accumulated impairment losses. Poker machine entitlements are not considered to have an active market; hence the fair value is calculated using the value in use method based on management's five-year forecasts.

As discussed above, impairment of poker machine entitlements is recognised based on a value in use calculations and is measured at the present value of the estimated future cash inflows available to the company from the use of these licenses. In determining the present value of the cash inflows, growth rates and appropriate discount factors have been considered.

Key assumptions are those to which the recoverable amount of an asset or cash-generating units is most sensitive.

The following key assumptions were used in the discounted cash flow model for the poker machine entitlements:

a. 6.35% (2023: 7.00%) pre-tax discount rate

b. 3.00% (2023: 3.00%) per annum projected revenue growth rate

c. 5.00% (2023: 5.00%) per annum increase in operating costs and overheads

Management believes that reasonable changes in the key assumptions on which the recoverable amount of gaming division’s poker entitlements is based would not cause the carrying amount of poker machine entitlements to exceed their recoverable amount.

For the Year Ended 30 June 2024

These amounts represent liabilities for goods and services provided to the company prior to the end of the financial year which are unpaid. The amounts are unsecured and are usually paid within 30 days of recognition.

The present value of employee benefits not expected to be settled within 12 months of reporting date have been calculated using the following weighted averages:

Contributions

The company is under a legal obligation to contribute 11% of each employee’s base salary to a superannuation fund. This increased to 11.5% as of 1 July 2024.

Liabilities for wages and salaries, including non-monetary benefits and annual leave expected to be settled within 12 months of the reporting date are recognised in other payables with respect to employees’ services up to the reporting date and are measured at the amounts expected to be paid when the liabilities are settled.

The provision for employee benefits relating to long service leave represents the present value of the estimated future cash outflows to be made resulting from employees’ services provided to reporting date.

For the Year Ended 30 June 2024

The provision is calculated using expected future increases in wage and salary rates including related on-costs and expected settlement dates based on turnover history and is discounted using the market yields on national government bonds at reporting date which most closely match the terms of maturity with the expected timing of cash flows. The unwinding of the discount is treated as long service leave expense.

The company contributes to several defined contribution superannuation plans. Contributions are recognised as an expense as they are made. The company has no legal or constructive obligation to fund any deficit.

A lease liability is recognised at the commencement date of a lease. The lease liability is initially recognised at the present value of the lease payments to be made over the term of the lease, discounted using the interest rate implicit in the lease or, if that rate cannot be readily determined, the Company’s incremental borrowing rate. Lease payments comprise of fixed payments less any lease incentives receivable, variable lease payments that depend on an index or a rate, amounts expected to be paid under residual value guarantees, exercise price of a purchase option when the exercise of the option is reasonably certain to occur, and any anticipated termination penalties. The variable lease payments that do not depend on an index or a rate are expensed in the period in which they are incurred. Lease liabilities are secured over the rights to the hire purchase assets recognised in the statement of financial position which will revert to the lessor if the company defaults.

The carrying amounts of are remeasured if there is a change in the following: future lease payments arising from a change in an index or a rate used; residual guarantee; lease term; certainty of a purchase option and termination penalties. When a lease liability is remeasured, an adjustment is made to the corresponding leased asset, or to profit or loss if the carrying amount of the leased asset is fully written down.

Bank Guarantees

The company has given the following bank guarantees:

For the Year Ended 30 June 2024

(a)

The following persons were non-executive directors of the company during the financial year:

Brenton Taylor

Craig McNally

Nal Wijesekera

Allan Facey (appointed 27 November 2023)

Francis Griffin

Laurence Willoughby

Robert Fleeton (resigned 21 July 2023)

The following persons also had authority and responsibility for planning, directing and controlling the activities of the company, directly or indirectly during the financial year:

Name

Jeff Gibbs

Position

Chief Executive Officer

Troy Crisp Chief Financial Officer

Matthew Cavanagh Chief Operating Officer (resigned 11 September 2024)

Alison Hester People & Culture Manager

(c)

and payments made to the Directors and Other Key

named in (a) and (b)

From time to time, directors of the company, or their director-related entities, may purchase goods from the company. These purchases are on the same terms and conditions as those entered into by other company employees or customers and are trivial or domestic in nature. The Directors’ have been provided with a non-monetary benefit in the form of a Food & Beverage allowance for use in the venue, in performing their duties as Directors.

No director has entered into a material contract with the Company since the end of the previous financial year and there were no material contracts involving directors’ interests existing at year end.

For the Year Ended 30 June 2024

(a)

Disclosures relating to key management personnel are set out in Note 11

(b) Receivable from and payable to related parties

There were no trade receivables from or trade payables to related parties at the current and previous reporting date.

(c)

The Company employs relatives of current directors of the club. The terms of employment for the individuals are in accordance with a normal employee relationship with the Company. The individuals received no conditions more favourable than those which are reasonable to expect that they would have received if there had been no relationship with a Director.

The Club is incorporated and domiciled in Australia as a company limited by guarantee. In accordance with the Constitution of the company, every member of the company undertakes to contribute an amount limited to $20 per member in the event of the winding up of the company during the time that they are a member or within one year thereafter. The total amount that the members of the company are liable to contribute if the company is wound up is $522,580 (2023: $611,180).

At 30 June 2024 there were 26,129 Ordinary Members and 15 Life Members (2023: 30,543 Ordinary Members and 16 Life Members).

The registered office of the company is:

230 Heathcote Road

HAMMONDVILLE NSW 2170

The Club is in negotiation with Liverpool City Council in relation to the purchase of land at Hammondville Park. At the Council meeting, 13th August 2024, Liverpool City Council approved the sale of this land to Moorebank Sports Club, with the purchase terms still subject to final negotiations. The Club expects contracts to be exchanged after the council comes out of caretaker mode following the recent completion of local council elections.

There are no other matters or circumstances that have arisen since the end of the financial year that have significantly affected or may significantly affect the operations of the company, the results of those operations or the state of affairs of the company in future financial years.

For the Year Ended 30 June 2024

During the financial year the following fees were paid or payable for services provided by

the auditor of the company:

As at 30 June 2024

Moorebank Sports Club Limited has no controlled entities and, therefore, is not required by the Australian Accounting Standards to prepare consolidated financial statements.

As a result, section 295(3A)(a) of the Corporations Act 2001 does not apply to the entity.