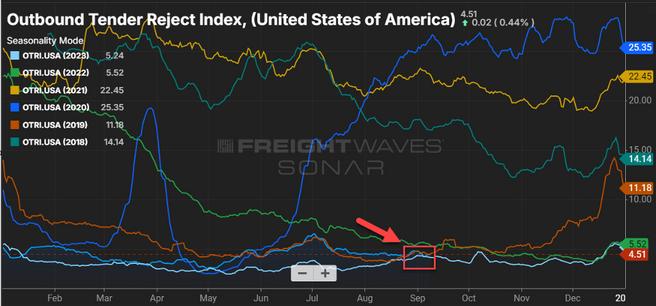

National Outbound Tender Rejections (OTRI), a key indicator tracked by major TMS providers in the transportation industry, continue to remain below the 5% mark. This metric offers valuable insight into the proportion of truckload freight entering the spot market. Outside of a major event, like mass port labor strikes, there are no macro-economic indicators that there will be a significant change in OTRI in the near future This is a promising sign for shippers that they will have relatively low-price variability during holiday peak season in comparison to bull market peak seasons.

Source: sonar surf

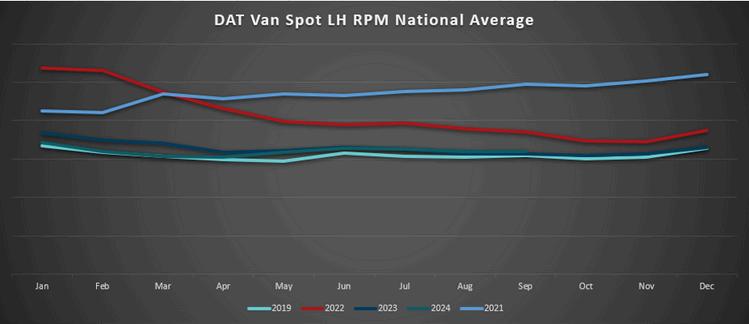

August marked the second month since March 2022 where we did not see a year-over-year decline in National Van Spot Linehaul Rate-per-Mile (RPM) While this is another significant milestone, it's important to note that fuel surcharge levels were higher YoY in 2023, resulting in an overall YoY decline in total RPM. Again, aside from a major disruption, such as a labor strike, rates should remain stable for September and have a low variability in this bearish peak season.

FTR Intel's forecast of a YoY linehaul RPM shift in August came to fruition. Again, an important note is that the projected gains in linehaul rates are still resulting in YoY declines in total RPM, due to lower current fuel surcharge prices.

FTR’s future rate forecast has declined recently for the remainder of 2024 and 2025. For 2024, they are projecting 2% decreases, down from the 1.5% projection in August. FTR is currently projecting a 4 2% increase in rates for 2025, down from 5 1% projection last month If these projections also come to fruition, we could experience another full year of a bear market in the truckload sector.

Source: ftrintel.com

Spot Market Slows Post-Holiday

Source: DAT.com/trendlines

Many import shippers have moved forward ship dates for inbound U S container loads in an attempt to avoid potential supply chain disruptions. This has led to double-digit increases for the railroads on intermodal traffic resulting in several intermodal providers levying peak season surcharges on the West Coast. Read more here.

Norfolk Southern has reached a tentative agreement with SMART-TD who represents train conductors across the U.S. This brings the total agreements to nine out of 13 unions for the NS. Get the full picture in this AJOT article. In our discussions with NS leadership, we feel that the strike and associated service disruptions will be avoided.

Source: aar org/data-center/rail-traffic-data/

Here are links to some top stories in the industry for you to check out:

LTL Volumes Soft in August

Jack Cooper Getting into the LTL Game

Saia Still Taking on Increased Market Share through Q3

August brought us some exciting M&A action with DC Logistics acquiring the freight division of GLS and Knight Swift furthering their reach into the West Coast with the acquisition of Dependable Highway Express (DHE), the LTL division of Dependable Supply Chain Services It seems we are primed for further M&A activity and industry consolidation, so buckle up! It was recently announced that Jack Cooper Transport is in talks to acquire Illinoisbased LTL carrier, Standard Forwarding. If you recall, Cooper had made an unsuccessful bid to revive Yellow as it was winding down operations in late 2023 as part of its bankruptcy. This acquisition of Standard Forwarding would effectively position Jack Cooper to launch its LTL product on the back of a 90-year-old established company with 14 terminals across five states, 350 tractors and 800 trailers.

In other news, the National Motor Freight Traffic Association (NMFTA) plans to convert over 5,000 NMFC item numbers in 2025 to reflect density-based classification application. The major changes associated with the NMFTA aren’t expected to become effective until the second quarter of 2025, but there will be meetings in Q1 to review the changes associated with Docket 2025-1 and to discuss them publicly. Be sure to check out all the resources on their website for the most up to date statuses of the project.

The mid-Q3 2024 public LTL carrier check-ins are reflecting a cooling against previous 2024 earnings reports from a shipment count and tonnage perspective. Sequentially in Q2 2024, tonnage and shipments increased for most public carriers by a mid-single digit clip (~6%), which has largely been attributed to the Yellow exit, still. Halfway through Q3’24, YoY growth has slipped to small single digits, or even negative depending on the carrier, signaling a weakening in demand for LTL services.

The United States ISM Manufacturing Purchasing Managers Index (PMI) came in at 47.2 in August of 2024; up from 46.8 in the previous month, but below market expectations of 47.5. It was the 21st decline in activity during the last 22 periods and business confidence remains low

Source: Trading Economics & Institute for Supply Management

On the other hand, and after back-to-back months of expansion, the industrial sector slid back into contraction during July (dropped 0 2% YoY), and we aren’t seeing or hearing much that would make us think the rest of the quarter will be much different

Source: : U S Bureau of Labor Statistics

Interestingly enough, and against an increasingly sluggish industry backdrop, LTL carriers continue to exercise pricing discipline and remain steadfast in their yield management initiatives Rate renewals are still averaging in the mid-single digits, with the most recently announced GRI from ABF coming in at 5 9%, set to take effect on September 9, 2024.

The U.S. national average cost per gallon for on-highway diesel in the month of July came in at $3.81, which is $.09 or 2.4% higher than June’s average of $3.722. The U.S. national average in July of 2023 was $3.882, which is $.072 or 1.9% more than July 2024. We start the second week of August off at $3.704 per gallon for the U.S. national average, which is $.36 or 8.8% lower than the second week of August 2023.

USPS will reinstate peak season rate hikes in 2024, with increases starting October 6 and lasting until January 19, 2025. Rates will rise by:

6.4% for Ground Advantage

5.5% for Priority Mail

4.9% for Priority Mail Express

The rate hikes are expected to generate $77 million in additional revenue and align USPS with FedEx and UPS, which also implement holiday surcharges. USPS continues to face financial struggles, reporting a $2.5 billion Q3 loss. On-time performance during the 2023 peak season fell due to operational issues and facility mismanagement. USPS is enhancing automation and technology, but its ability to maintain service levels remains a concern.

FedEx is expanding its e-commerce fulfillment services through a partnership with Nimble, an AI robotics company. This alliance enables FedEx to use Nimble's fulfillment centers, boosting efficiency for small and medium-sized businesses (SMBs). With more than 130 fulfillment facilities, FedEx is streamlining operations to attract more e-commerce merchants. The investment is part of FedEx’s broader digital transformation to enhance its supply chain solutions, aiming for faster, more efficient service

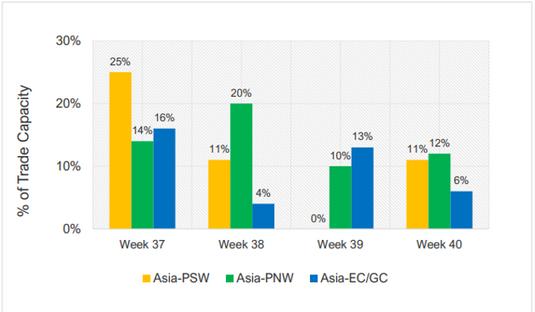

Supply: Capacity reductions likely upcoming in October as Transpacific demand weakens and port uncertainty grows, especially for U.S. East Coast services

Demand: As expected, West Coast services now filling as shippers avoid Asia-East Coast routings

Rates: Decline in demand causing spot rate decline – in just three weeks Asia-East Coast spot rates have fallen by nearly 35% due to West Coast re-routed bookings

Operational: Not a lot of optimism being reported related to the possibility of an East Coast/Gulf port strike resulting in significant shifts in cargo volumes to the U S West Coast

Carrier capacity management will likely be challenged as we move through September and into October. With a potential strike at the East Coast and Gulf ports, carriers will need to deal with declining/lower volumes compared to recent higher levels. On the opposite coast, with volumes increasing rapidly due to this shipper shift, more capacity will be required

Some ocean carriers have announced and are already scheduled to deploy 28 “extra-loader” vessels to the ports of Los Angeles and Long Beach over the next two months in response to these shifted import volumes coming to the U.S. from Asia during this new peak shipping season.

Source: M+R Spedag Group

The added capacity (14 extra loaders at each port) comes as a result of the anticipated increase in cargo diverted from ports along the U.S. East and Gulf coasts. Shippers are trying to protect themselves from the potential port labor disruption.

Ports on the U.S. West Coast, most notably the Pacific Northwest (PNW), are already seeing an increase in freight diverted from Vancouver in response to the threatened rail strike with the Canadian rail carriers.

Moving through September, as shown below, carrier blank sailings will decrease throughout the month, but still significant numbers of blanks will be present in the PNW as congestion has been building. Some carrier “extra loaders” (mentioned below) will certainly help with surging volumes to LA/LGB. But in total, most of the blank sailing activity is due to the loss of sailing integrity resulting from the Red Sea situation and longer vessel transit times as reported previously.

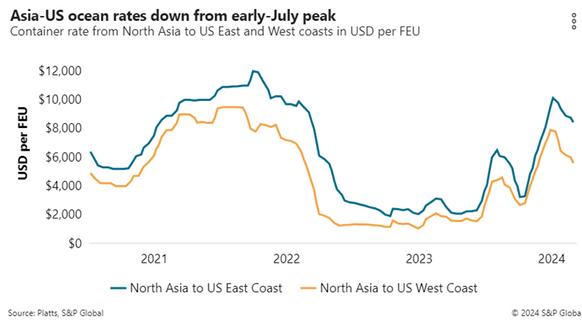

Through August, the average Asia to U.S. Ocean rate index has seen a sharp decline from the higher peak levels of late June and July. Early September rates are also being impacted by the potential of a port strike.

Due to the recent decline in volumes for Asia-U.S. East Coast, spot rates have dropped significantly. In just three weeks, the Asia-East Coast spot rate index has fallen between 28-35% as shippers began to scramble to re-route bookings to West Coast services. Some shippers have chosen to just suspend bookings for early September bookings until there is more clarity on International Longshoremen’s Association (ILA)/ United States Maritime Alliance (USMX) contract negotiations.

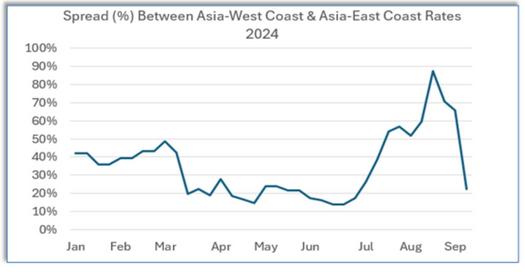

As reported previously, given the current shift away from U.S. East Coast services, the gap between East and West coast rates has continued to shrink. The graph below shows this spread, which is falling sharply, now sitting at only about a 30% difference, which is below normal.

Blank sailings and overall service disruptions are likely to increase in the second half of September, setting the stage for the likelihood of larger scale spot-rate increases on U.S. West Coast rates and/or carrier GRIs in October.

Source: M+R Spedag Group

U.S. import shippers have started to prepare for a potential strike at East and Gulf Coast ports in early October, with booking volumes on all-water East Coast services collapsing at the end of August and into September. On the opposite side, volumes are surging in the ports of LA and Long Beach with importers shifting away from potential problems, and that surge is likely to continue as we move through September and closer to the October 1 labor contract deadline.

As shown below, the Inbound Ocean TEUs Volume Index, shows import volume to the U S from China was slightly up in August (blue shaded area) over the same period in 2022 and 2023 and steadily ahead of 2023 for the past several months

There are several theories that explain these volume levels. Analysts believe that it is possible that U.S. consumers are not necessarily in a “recessionary” frame of mind even given the current state of the economy. Some analysts feel that U.S. consumers may still be buying but shifting away from high-end retailer purchases and moving more toward discount retailers.

Some also believe that many U.S. importers may be advancing orders now to avoid any potential future tariff impacts that could come with a Presidential administration change after the election later this year.

More specifically, U S importers of solar panels and related products from China that are subject to pending U S tariffs have been advancing their orders, including imports of electronic components moving to data centers in the U S

Additionally, as the U.S. West Coast volumes have grown, roll pools of bookings/containers at Asian origin ports also have begun to grow, which is likely also creating a sense of urgency among retailers to secure vessel space wherever they can.

Less than a month before dockworkers on the U.S. East and Gulf coasts could walk off the job if a new contract is not agreed to by September 30 at midnight, there is much greater concern across the entire industry.

There have been reports that the USMX port management group has made several attempts to engage in more negotiations with the ILA, no new talks have been scheduled and there appears to be little motivation on the part of either side to secure a deal to avoid a strike.

There are obviously several points to discuss, but there is one point that both sides agree on, it is that the two sides are still very far apart and the wage issue which seems to be the core issue in this negotiating round

USMX’s reported current offer of a nearly 32% pay increase over six years is significantly below the union’s current demand for a 78% increase based on its view that it deserves a share of carriers’ historic profits earned during the pandemic boom.

With no negotiations scheduled currently and the two sides remaining far apart on terms, the focus will begin shifting to Washington, D.C. in the coming weeks. Multiple federal agencies are aware of the current situation and