(OTRI) surpassed the 5% mark, a level typically seen in Q4 during the holiday season over the past two years. This uptick appears tied to recent extreme weather conditions and, if sustained, could signal a more volatile holiday shipping period than anticipated.

Source: sonar surf

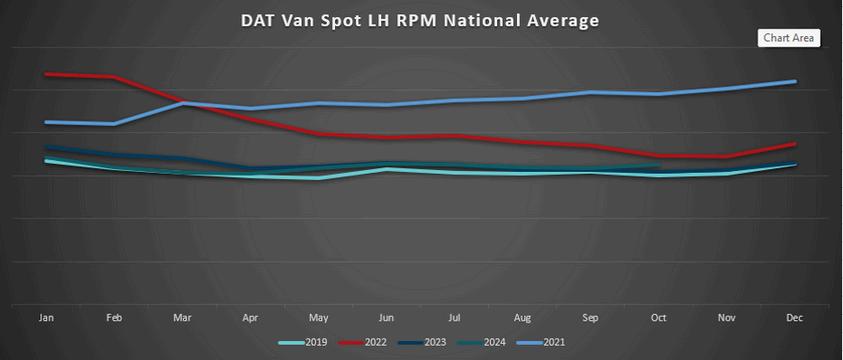

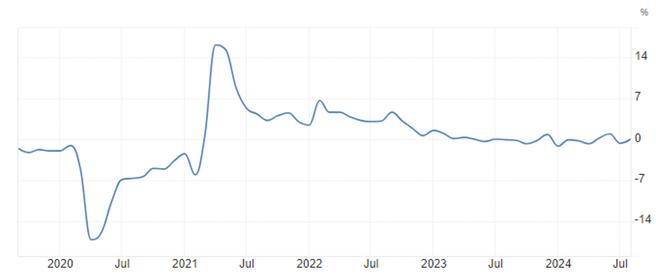

In September, National Van Spot Linehaul RPM recorded its second consecutive year-over-year increase. Higher fuel surcharges in 2023 contributed to a seven percent drop in year-over-year, all-in rates. The International Longshoremen's Association (ILA) strike, coupled with extreme weather events in the Southeast, has generated sufficient disruption to drive Van Spot Linehaul RPM rates above previous October forecasts.

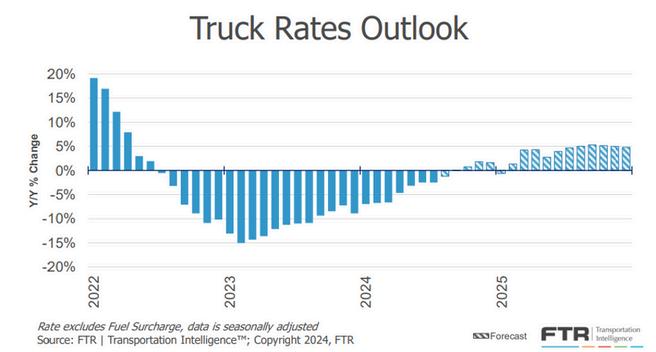

FTR’s rate outlook for late 2024 and 2025 has recently eased, though these forecasts were made prior to the latest market disruptions With the holiday season approaching, the period of elevated rates could extend. This volatility may present an opportunity for the carrier market to rebound in truckload pricing for 2025, particularly as a significant portion of annual RFPs will take place during this time of disruption.

Markets still feel storm’s impact

Source: ftrintel com

Source: DAT.com/trendlines

Intermodal volumes continue to remain strong out of California with both BNSF and UP showing growth over last year. The eastern carriers didn’t fair that well and experienced a big drop in volume due to the effects of the ILA Labor Strike and Hurricanes Helene and Milton. Looking forward, we anticipate a strong push on BNSF/UP through the end of the month while the eastern carriers should start to see a recovery in the next couple of weeks.

Overall, yearly intermodal volumes are up ~8% YTD.

Source: aar org/data-center/rail-traffic-data/

The CSX Winterhaven intermodal terminal felt the brunt of Hurricane Milton and the recovery has been slow Projections are it will take another week or two before the terminal is back up to normal operations Currently, no gate reservations are being taken in Chicago for Winterhaven CSX is targeting next week before they open gate reservations

Tampa did not receive as much damage and is operating normally.

Last week, the CN received government approval to proceed with the construction of a new larger intermodal facility in Toronto to accommodate the growing intermodal market Completion of the terminal has not been announced, but it is expected to take two years

As most of us are aware, theft within the transportation industry continues to rise and that goes for both intermodal and truckload While the railroads are spending millions of dollars each month to slow the problem, the criminals seem to be still winning When it comes to cargo theft on the rails, there are several factors contributing to cargo theft: Illegal immigration, cashless bail cities, organized crime, lack of railroad resources, inside job theft and lack of resources when it comes to prosecuting and incarceration once a criminal is apprehended. In many cities, rail police will arrest the same person multiple times in one day. Many local jurisdictions/municipalities simply do not see cargo crime as a big deal and fail to prosecute. All of the railroads are working with federal authorities on how to make cargo-related theft domestic terrorism; thus, making the charges federal versus local/state; however, any update as it relates to domestic terrorism will not take place until the next administration.

Here are some high-level updates of what each railroad is currently doing to combat cargo theft:

Union Pacific

AI technology to detect suspects using infrared tec

60+ LVT cameras in LA Basin

Drone surveillance

LATC – 4,400 feet of concreate walls and barriers

BNSF

Monitored CCTV with AI capabilities

Aviation train monitoring (manned and unmanned)

Installed a 10-foot masonry wall in the Hobart Yard

BNSF police escorts through known criminal locati

CSX

Memphis fencing project

Norfolk Southern Cameras

UAV Drones

Here are links to some top stories in the industry for you to check out:

Daylight Transport emerges as Mastio and Co.’s 2024 #1 Carrier

NMFTA and LTL carriers partnering to drive performance

Remaining Yellow terminals being auctioned in January 2025

Soft LTL outlook for the remainder of 2024

Forward Air being pressured to sell OMNI

As we kick off Q4’24, demand for LTL services continues to soften. Economic activity in the manufacturing sector has now contracted for a sixth consecutive month, contributing to a continued dip in shipment volumes And on the other hand, industrial activity continues to be flat, and we haven’t seen much movement in terms of contraction or expansion for almost two years now. We are not expecting any meaningful changes in either category as we round out 2024.

Source: Trading Economics & Federal Reserve

LTL Carrier pricing trends in 2024 reflect a cautious balance While LTL carriers have maintained pricing discipline due to ongoing market pressures and rising operational costs, this has led to increases in procurement activity as shippers seek to cut expenses. Carrier pricing is expected to remain firm, though some competitive adjustments could arise in the coming months as capacity expands and volumes fluctuate.

Looking ahead, the LTL industry remains in a holding pattern, with modest increases in demand and capacity expected. The upcoming auction in January for Yellow’s remaining terminals could unlock new capacity channels, though any significant shifts will take time as carriers reorganize these assets. A potential shift in the truckload market cycle could also impact LTL volumes and pricing, depending on how larger shipments flow between these two sectors. The LTL market will continue to adapt to the evolving landscape, but substantial change remains on the horizon as the industry waits for clearer economic signals.

The U S national average cost per gallon for on highway diesel in the month of September came in at $3 558, which is $.142 or 3.8% lower than August’s average of $3.70. The U.S. national average in September of 2023 was $4.563, which is $1.005 or 22% more than September 2024. After three consecutive weeks of increases in the average cost of fuel, we find ourselves in the second week of October at $3.631 per gallon for the U.S. national average.

Key Insights on FedEx, UPS and USPS

As we approach the holiday rush, shippers must focus on carrier capacity, contingency planning and building long-term relationships with delivery partners to secure timely deliveries and equitable rates into 2025 FedEx and UPS are already implementing peak season surcharges, with both carriers "double-dipping" this year; however, the weak freight market may present opportunities to negotiate discounts in exchange for volume commitments.

Spreading out holiday promotions can help control costs and avoid delivery bottlenecks.

Recent hurricanes, like Helene and Milton, have caused significant delays and disruptions across the Southeast. FedEx Freight and Ground services were severely impacted, with more than 1,200 ZIP codes seeing service suspensions. UPS and USPS have also experienced delays in the affected regions. Roadblocks, flooding and fuel shortages, particularly in states like Florida, have worsened logistics challenges. These disruptions often persist for weeks, making contingency planning essential for shippers during hurricane season

FedEx is closing the gap with UPS in serving SMB customers by expanding platform rates through Auctane. These rates will cover FedEx 2Day®, FedEx Ground® Economy and FedEx® International Connect Plus, offering more competitive options to smaller businesses.

Meanwhile, UPS's Digital Access Program (DAP), which offers platform rates through partners like Shopify and Auctane, has been a strong driver of growth, contributing $3 billion in annual revenue. This partnership helps UPS retain its lead in this segment.

USPS has issued sharp pricing increases for Parcel Select Lightweight (PSLW) services, with rates rising by up to 74% in July 2024 The USPS is also removing PS DDU discounts, causing concerns about longer transit times and reliability

For lightweight shippers, both FedEx and the USPS now face higher shipping costs and potential service degradation Shippers may need to explore alternatives like Ground Advantage or regional/final-mile carriers, though costs remain elevated compared to previous PSLW rates.

UPS has announced a 5.9% GRI for 2025, matching FedEx’s increase but with additional complexities. These changes, effective December 2024, will impact zip code pricing zones, DAS and handling surcharges. UPS customers will need to carefully assess the full impact of these adjustments on their shipping costs.

Supply: Late September capacity stable as carriers scramble to build roll-pools to West Coast

Demand: East Coast demand craters as shippers divert more toward West Coast ports. Slight increases forecasted for the rest of the year.

Rates: USEC rates slip due to strike fears, and gap between East Coast and West Coast rates continues to shrink

Operational: International Longshoremen's Association (ILA) port workers officially went on strike – ended after three days with a salary agreement.

At midnight on October 1, the ILA officially went on strike, essentially shutting down all major U.S. ports from Maine to Texas. The ILA and the United States Maritime Alliance (USMX) were not able to negotiate a new contract and thus the ILA promise to strike was realized.

The work stoppage lasted three days in total causing significant disruption across the East Coast and Gulf region Industry analysts believe that for every day of a strike, it can take up to a week to unwind the congestion and delays that build up within the supply chain Workers reported back and by Friday, October 4, vessels being held outside the ports were moving again

The two sides reached a tentative agreement on the wage increase issue and have agreed to extend the master contract until January 15, 2025. The 100day extension will allow both sides to return to the bargaining table to negotiate all other outstanding issues while not crippling the U.S. economy. Under this new tentative agreement, ILA wages will increase 61.5% over the six years of a new contract.

There are still some significant hurdles that need to be negotiated by both sides to finalize a full contract – the most notable being the automation issue at the ports. Many U.S. ports are lagging well behind on automation compared to the rest of the world. The ILA has used aggressive rhetoric in discussing this topic, saying they will accept no new automation Between now and January 15, 2025, both sides will try to find some middle ground on where and how much automation will be implemented at U S East Coast and Gulf ports

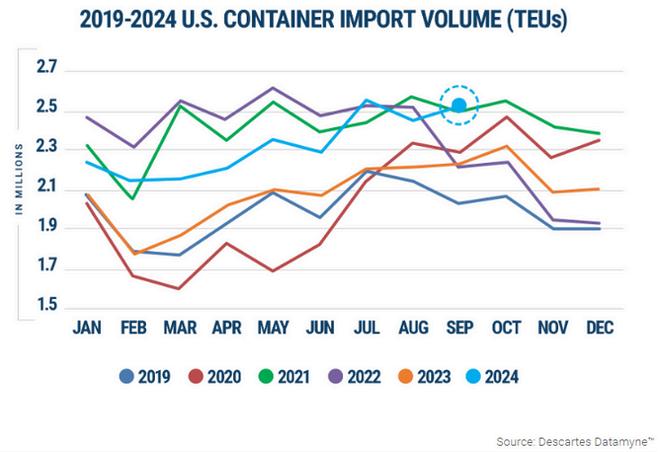

As reported previously, it is now clear that most of the U.S. retail segment planned ahead and moved their seasonal volumes earlier this year (June/July/August) with the expectation that the ILA work stoppage would happen. Traditionally, the majority of imported retail goods comes through the U.S. East Coast. Because of this forward planning, the impact of the ILA port work stoppage has been lessened because retailers have been accelerating import orders.

Several U S retailers said in a recent article that they chose not to change their plan and divert East Coast cargo as they felt that if the work stoppage did happen, it would be short lived That gamble looks to be a good one at this point These retailers commented that although diversions (away from planned ports) would avoid the uncertainty, they most always make things worse, and certainly more costly.

Asia to U.S. East Coast booking volumes saw moderate increases toward the end of September as some importers seemed less worried about a long and protracted work stoppage.

Analysts are forecasting that U.S. imports in October will be up 3 1% from October 2023, which is higher than the 1 3% increase forecasted in last month’s report.

November imports are now expected to be up 0.9% year over year, down from the previous forecast of a 1.6% increase, while imports in December are projected to be up 0.2%, compared with the previous forecast of a 1 6% increase from December 2023

Current load factors are mixed, with East and Gulf Coast utilizations understandably lower than West Coast services; however, despite the Labor strike on the East Coast, carriers have still struggled to build enough volume to create roll-pools on West Coast services. Overall bookings and load factors for Asia to U.S. West Coast have been underwhelming and far below expectations

Vessel capacity for the first two weeks of October should remain abundant Some carriers are reporting utilization rates on ships leaving Asia hovering in the 50-60% range In the last two weeks of September, carriers attempted to overbook some vessels in advance of the Golden Week holiday break, but demand was too weak to support roll-pools.

Blank sailing activity increased in anticipation of a strike. Moving into mid- and late-October, fewer blank sailings are planned by the ocean carriers.

Source: M+R Spedag Group

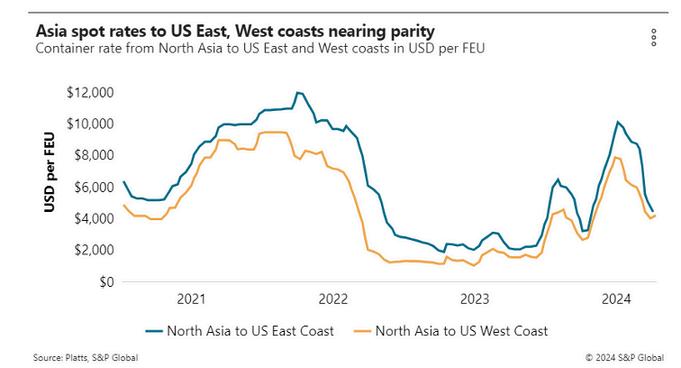

Asia to U.S. East Coast rates continue to slip backward, losing another nine percent in the last two weeks of September, based on the lack of volumes related to the potential labor issues. On the other hand, the average Asia to U S West Coast rate index rose slightly in mid-September as lower-tier carriers increased rates; however, in the last two weeks of September, those rates slipped back to where they were coming into September

Moving into October, average spot index rates for Asia to the U S East Coast, as of October 7, were about $4,300 per FEU with the West Coast sitting near $4,200. The closing gap in the rates is unusual because the East Coast typically carries a nearly $1,000 per FEU premium to the West Coast rate.

Due to the ILA Strike, most carriers began announcing and implementing significant additional operational surcharges related to the U.S. East Coast and Gulf ports directly impacted by the work stoppage. The carriers filed congestion-based surcharges of $1,000 to $3,000 per FEU on shipments destined to East and Gulf coast ports. With the end of the strike, the carriers have since canceled those surcharges.

Some Trans-Pacific carriers have announced a $600 GRI to the West Coast effective October 15, but there is skepticism that the GRI will hold because imports are expected to drop next month. Overall, expected sharp volume increases from Asia to the U.S. West Coast ports simply did not materialize in early October.