The National Outbound Tender Rejection Index (OTRI) is slightly higher than 2019 levels. Based on this year’s trends, we’d expect this to continue to closely follow the 2019 levels for the remainder of Q4. However, with upcoming tariff increases set to take effect in early 2025, many importers are accelerating inventory and volumes. Combined with expected holiday demand surges, this volume could create larger discrepancies from 2019 trends than previously expected

Source: sonar.surf

In October, National Van Spot Linehaul RPM recorded one of its largest year-to-date gains over 2023 levels; however, lower fuel surcharges this year have kept national all-in rates down by 3% year-over-year. With holiday peak season and anticipated import increases on the horizon, the market may see the disruption needed to lift it from the prolonged downturn, potentially giving the truckload market its first national year-over-year (YoY) rate gains in Q4 and early 2025.

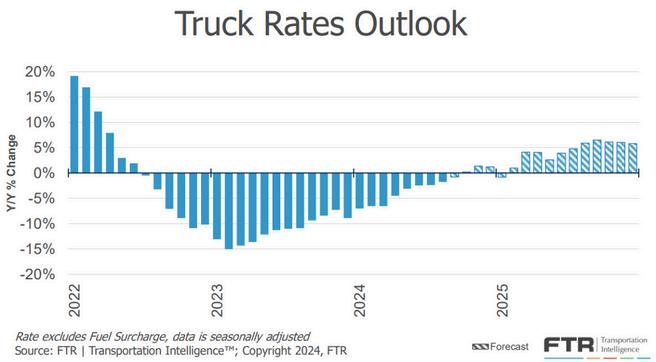

Upward shifts in spot rates has led FTR Intel to boost its 2025 rate forecast Currently, their projections are roughly a 5% increase in long-haul rates from a YoY perspective. If import volumes continue to increase, the truckload sector could see 2025 emerge as a strongerthan-expected return of the truckload market in Q1.

Source: ftrintel.com

Spot rates continue steady climb

Source: DAT.com/trendlines

CPKC and CSX announced a joint new service connecting Mexico with the Southeast. The new service is expected to launch on December 1. The announcement comes three weeks after the U.S. Surface Transportation Board gave approval for the service to commence. CPKC and CSX expect that infrastructure improvements in Mississippi and Alabama scheduled for completion in early 2025 will reduce current transit times.

CSX continues the recovery efforts affected by Hurricane Milton for Winterhaven and Tampa intermodal ramps. The ramps are congested due to a variety of issues. On November 8, CSX brought in additional labor and a sideloading crane to assist with the congestion. We feel that ramp operations have turned the corner with the addition of the side-loader and the additional staffing.

Intermodal volumes continue to outpace 2023 levels at 8 8% for the year Specifically, Intermodal volumes out of California have been at record levels and continue to remain strong after some import volumes switched to the West Coast due to the ILA strike BNSF and Union Pacific (UP) are experiencing increased volumes BNSF recently reported intermodal increases of 16% for the third quarter of the year Similarly, UP reported a 40% increase in September’s YOY in West Coast port volume.

Union Pacific has announced they will increase their current Southern California charge for both Aggregate and MCP customers. The increases will go from $300 to $600 for MCP, while Aggregate will increase from $750 to $850. These increases will be effective November 17.

Here are links to some top stories in the industry for you to check out:

Eric Brandt named new Forward AIR COO

LTL M&A activity heating up

TFII underperforming in U.S. LTL market

Moran Transportation acquires RMX Freight Systems

It’s LTL carrier earnings report time for Q3 2024, and while the results are mixed across the carrier base, the industry continues to experience soft demand as we head into holiday season. SAIA and Knight-Swift both reported YoY and sequential gains in market share, as SAIA continues to take on more retail business post Yellow and Knight-Swift continues its journey in creating a national LTL carrier network. These two companies seem to be the exception at the moment as most other LTL carriers are noting softness in demand for their services and citing declines in shipment count ranging from two to eight percent on average.

States Industrial Production:

U S industrial production weakened by 0 6% in September, marking the largest decline in the last five months recorded. This most certainly is contributing to the continued drag on LTL demand as industrial typically accounts for a major percentage of LTL carrier revenues. The ISM Manufacturing PMI slipped further to 46.5 in October 2024, down from 47.2 in September and undercutting projections of 47.6. This marks the sector's most pronounced contraction since July 2023, signaling sustained soft demand and suppressed production levels. Inputs remain readily available and competitively priced, highlighting an oversupply in the face of stagnant demand.

Source: Trading Economics & Federal Reserve

Knight-Swift has completed its system integration of newly acquired Dependable Highway Express, allowing for network visibility using a single pro number across all LTL brands, which now consists of AAA Cooper, Midwest Motor Express and, most recently, DHE.

TFORCE recently announced that in an effort to improve their service product, they are transitioning a hefty percentage of business off of rail and seeking to increase shipment counts to stabilize network flows in an efficient manner. They also announced they intend to launch a new billing system in 2025 to cure many of their billing woes that have consistently created challenges.

M&A activity continues as Moran Transportation, a Midwest regional LTL carrier, acquires RMX Freight Systems This acquisition extends Moran’s service footprint to now include Ohio and pieces of Michigan and West Virginia

The U.S. national average cost per gallon for on-highway diesel in the month of October 2024 came in at $3.585, which is $.027 or 0.8% lower than September's average of $3.558. The U.S. national average in October of 2023 was $4.507, which is $.922 or 20.5% more than September 2024. We start the first week of November off at $3 536 per gallon for the U S national average

Amidst an abbreviated holiday shipping season, FedEx and UPS are locked in a competitive effort to attract small businesses, extending discounts once reserved for bulk shippers. In a shift to increase volumes and retain profitability, both companies have made price concessions for customers with lower shipping expenditures, capitalizing on new software partnerships. FedEx’s partnerships with platforms like Pitney Bowes and Auctane provide steep discounts for small- and medium-sized businesses, positioning it to better compete with UPS, which has also aggressively retained clients through competitive rate structures.

Amazon continues to diversify its logistics capabilities, integrating drones into its fulfillment network with a new same-day delivery option in Tolleson, Arizona, allowing local Prime members to receive certain items in under an hour. This advancement aligns with recent Federal Aviation Administration approvals, which now permit Amazon to fly its drones beyond an operator’s visual line of sight. Although limited by weight and weather conditions, this service underscores Amazon’s commitment to rapid fulfillment innovations.

In addition, Amazon Shipping has enhanced its ground delivery service, available nationally with two- to five-day coverage and complete residential access. Notably, Amazon’s approach minimizes surcharges, bypassing residential and weekend delivery fees and limiting peak season surcharges to a shortened five-week period. Recent partnerships with EasyPost, ShipStation and ShipBob expand Amazon Shipping’s accessibility to small merchants and third-party sellers, indicating an expansion beyond Amazon’s traditional customer base.

The U S Postal Service continues to gain ground in the parcel delivery market, leveraging competitive pricing and broad coverage. Its role has expanded as Amazon and other retailers develop internal logistics or partner with more cost-effective, slower delivery services to manage shipping expenses. USPS’s steady growth reinforces its market resilience and appeal to smaller e-commerce sellers looking for affordable shipping options.

Demand: Import volumes remain strong – extended peak season

Rates: Asia to U.S. rates remain mostly steady but some uncertainty

Operational: Work stoppage at ports of Canada’s West Coast / Election impacts / ILA Union negotiations resume

Import demand from Asia, which typically tapers down by November, seems to be holding steady, fueled mostly by a resilient Retail sector, some concerns over potential tariff changes and also the January 15, 2025, expiration of the tentative labor agreement at U.S. East and Gulf Coast ports.

U.S. imports from Asia in September totaled 1.72 million TEUs, up 16.7% year-over-year and hovering near a twoyear high, according to PIERS.

Strong volumes are likely attributed to the frontloading of shipments to East and Gulf Coast ports ahead of a possible second strike by (ILA) now with the contract extended to January 15. Retailers are also concerned about a possible spike in tariffs on imports from China based on the outcome of the recent election and the administration change. The frontloading of spring merchandise before an early Lunar New Year in Asia on January 29 is also a factor keeping imports strong.

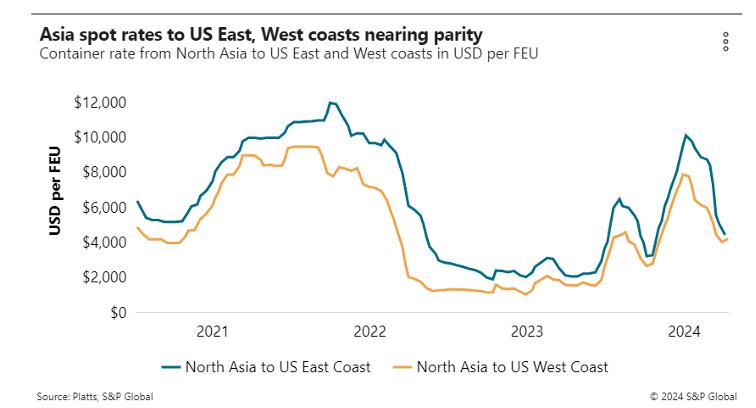

Average rates to the U.S. West Coast have barely moved in the past several weeks with more open capacity and demand remains quite firm. By early November, benchmark Asia-U.S. West Coast CY rates were effectively the same as they were in late September Average rates in the Asia-U S East Coast trade bounced back briefly in early November but are again softening and have retreated closer to mid-October levels

The spot/FAK rate from Asia to the West Coast as of October 28 was $4,200 per FEU, up 133% year-over-year, according to Platts. The East Coast rate of $4,300 per FEU is up 87% from October 2023.

Despite current elevated rate levels, carriers have been signaling general rate increases (GRIs) of about $500 to $600 per FEU could come in November. Normally, spot and FAK rates drop in the final two months of the year after holiday merchandise has been shipped from Asia.

Industry analysts feel that because vessel space is likely to remain relatively tight through November and into December, peak season surcharges (PSS), which are applied to fixed rates are likely to remain in play even though the eastbound Trans-Pacific is technically not in the traditional peak season. However, the $2,000 PSS that many forwarders have been paying since May 1 is softening.

One month after the ILA strike, container terminal operations in Vancouver and Prince Rupert have come to a standstill as the BC Maritime Employers Association (BCMEA) locked out 700 members of ILWU Local 514 over ongoing limited job actions following a final contract offer last week. It is being reported that the union rejected what the BCMEA said was its “final” contract offer. Like the recent ILA negotiations, the union also is objecting to the introduction of automation in port operations

As of November 7, a total of 11 container ships, including seven at Vancouver, were waiting in the region, up from six prior to the lockout. That total is expected to grow as more scheduled ships arrive in the coming days. Currently, carriers are choosing to have their vessels wait at anchor instead of rerouting to U.S. West Coast ports. But no resolution to the shutdown in the coming days could see the first diversions as lines look to avoid costly delays.

With a Trump victory, there are many potential impacts to the U S supply chain that could start after the January 20 inauguration. Given his previous stance on U.S.-China trade, it is likely we should expect an added surge in U.S. import demand in the short term as U.S. importers could target increasing orders prior to any new tariff actions by the new administration. Noone can predict exactly how tariffs could be impacted or when they would be applied, but it is a likely we could see a surge in demand as experienced in the past with the Trump administration’s previous tariff actions.

Longer term, we should expect some changes in supply chain patterns related to trade impacts of new policies. For U.S. imports, this could mean changes in sourcing patterns such as moving away from Chinese manufacturers to other countries.There is also a potential negative impact on U.S. exports if some countries choose to implement retaliatory tariffs on U.S.-produced goods.

ILA / USMX labor negotiations set to resume ahead of the January 15 deadline

Negotiations on a new labor contract, delayed until January 15, for East Coast and Gulf port workers are set to resume this week between USMX and the ILA.

With the wage agreement settled, Port technology/automation remains a key sticking point. The ILA leadership has adamantly opposed the introduction of new port technology that could replace longshore jobs.

A critical element of a new Trump administration is the added question of whether Trump would be willing to invoke Taft-Hartley, which allows the President to intervene and force an 80-day “cooling off” period to continue negotiations. The Biden administration adamantly refused to do so leading up the October 1 strike. With the extended contract deadline of January 15 and the Trump inauguration not coming until January 20, the timing creates an interesting dynamic related to how Trump will engage with ILA and USMX to find an agreement.

ILA President Harold Daggett has met with Trump in the relatively recent past, and it’s uncertain if the new administration would invoke Taft-Hartley to order striking longshore employees back to work and avoiding significant disruption and broad economic impact