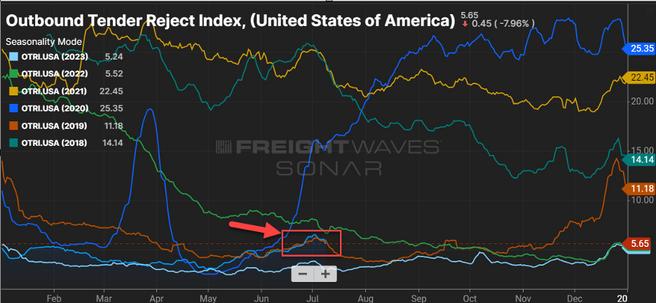

The OTRI, which measures carrier tender rejections across some of the largest TMS providers in the transportation industry, continues to follow the 2019 trendline very closely. Since May, we’ve been observing a larger OTRI variance on YoY averages from 2023 than previously this year. This is a promising sign that we could begin to see rates eclipsing previous year levels and ending the downward cycle.

In June, we were just $0 02/mile away from the first YoY National DAT Van Spot LH RPM increase since March 2022 This is the closest we’ve been to ending the YoY downward cycle, from a National Dry Van LH RPM perspective, in more than 24 months. This doesn’t indicate that we’re anywhere close to becoming a bear market, but this is a sign that there is a potential light at the end of the tunnel for this downward market.

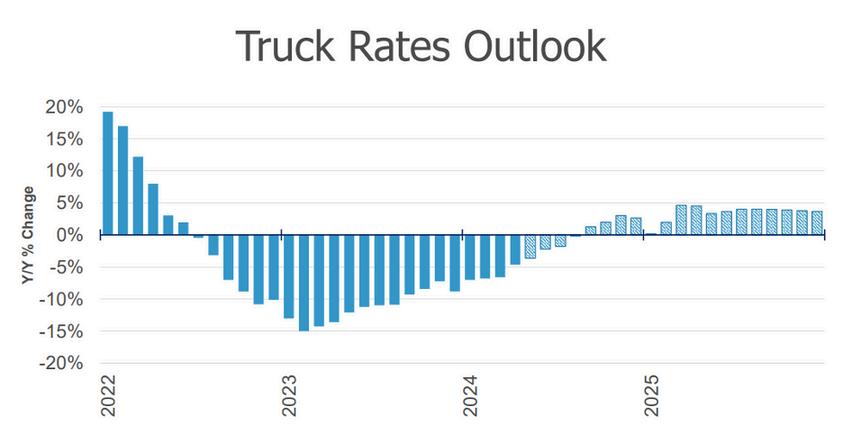

FTR Intel has been projecting an August–September date for the first YoY rate increase since December of 2023. This projection is very close to becoming reality. There are indicators, such as increased imports, that could continue to drive OTR rates upward for the first YoY gain.

Source: ftrintel.com

Spot market activity slows for holiday $2

Source: DAT.com/trendlines

The Canadian National and Canadian Pacific Kansas City Southern voted in favor of going on strike unless they get a new labor deal in place. The overwhelming majority (98.6%) of the 89.5% of members who voted between June 14 and June 29 favored going on strike, per the union. Members previously approved a strike on May 1, which positioned the union to begin a work stoppage on May 22 but the Canadian Minister of Labour closed that window. Until the Canadian government makes a ruling, the union cannot legally strike. Canadian law requires another vote because the previous strike authorization was only valid for 60 days and expired June 30. The union is now positioned for another 60 days to legally strike A work stoppage cannot start until 72 hours after the government announces a decision

Direct Chassis Link Inc. (DCLI) has now added chassis, previously with the Union Pacific, with the following prefixes: PAHZ, PBRZ, UPDZ & UPHZ. Chassis with these marks should be treated the same as any other DCLI chassis mark moving forward. As of the effective date of June 27, 2024, all UMAX/EMP or rail-controlled containers on the UP network will be supported by DCL53. Administratively, no changes will occur for customers using a UP network chassis, with customers and their selected motor carriers continuing to be managed and/or billed through UP's railroad programs Operationally, road service requests for these chassis will now be managed through DCLI’s Road Service program (available 24/7/365). In addition to submitting service requests on their website, Road Service requests can also be made via email at roadservice@dcli.com or by calling (704) 256-8067.

The National Transportation Safety Board (NTSB) released its findings on the probable cause of the 2023 East Palestine, Ohio, derailment and related safety recommendations “NTSB investigators have spent over a year analyzing the derailment’s causes to inform recommendations aimed at preventing similar accidents,” said Michael Rush, Senior Vice President of AAR Safety and Operations. “Railroads implemented substantial, industry-wide improvements in response to the NTSB’s initial findings. With the final report, railroads will carefully evaluate key learnings and determine next steps to meaningfully advance safety.” Among the recommendations, many of the NTSB findings align with positions the industry has long maintained, including the need to aggressively phase out DOT-111 tank cars from hazmat service and other tank car improvements, a focus on Wayside Detectors & Inspections and an emphasis on more first responders training.

Here are links to some top stories in the industry for you to check out:

Major NMFC and LTL classification changes coming in 2025

LTL carrier Tony’s Express files bankruptcy

FedEx considering spin off or sale of freight division

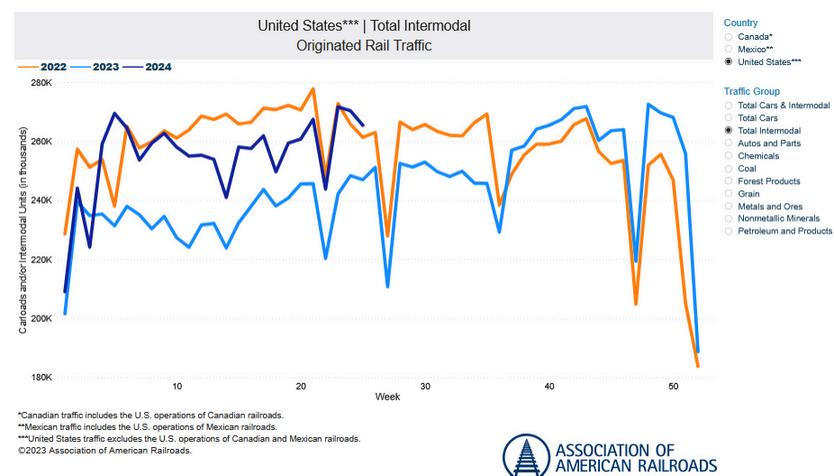

We are halfway through the 2024 calendar year and still very little to be excited over regarding freight volume and demand drivers thus far We experienced some slight expansion within industrials to end Q2, but far from what any optimistic person would have projected overall at the beginning of the year Many are calling for a better second half of 2024 from a demand perspective, but full-year measurement is likely to be low single-digit growth at best We will look for expansion in the industrial sector to compound and improved manufacturing outputs to get us there.

The United States ISM Manufacturing Purchasing Managers Index (PMI) for June came in at 48.5, which once again fell short of the market expectations of 49.1 for June. This marks the third consecutive month of declines for the index and 19 of the last 20 months in contraction territory. All components of the PMI experienced MoM declines, except for new orders. New orders increased around four points, but remained in contraction at 49.3 for June.

Source: Trading Economics & Institute for Supply Management

LIndustrial Production in the U.S. expanded .4% YoY in May 2024, marking the first increase in five consecutive months and only the second increase in the last 10 months. We’ve essentially been flat over the past two years and the freight market will remain weak in the absence of more robust manufacturing activity.

Source: Federal Reserve; Forecast by Witte Econometrics, FTR Transportation Intelligence

Six months into the calendar year and the LTL pricing environment remains rather stable in 2024, with carriers retaining any leverage derived via the Yellow exit Mid-single digit rate increases are persisting on contract renewals and could easily be twice as much where the freight profile and/or business requirements aren’t “carrier friendly.” While the outlook on demand drivers for the remainder of 2024 isn’t exciting, you can expect pricing to continue to increase at a similar clip, with the possibility of rates increasing at a high single-digit clip should we see any meaningful recovery regarding demand.

The PPI for Long Haul LTL, which gauges average prices paid to transportation service providers, came in at 412.717 for May 2024. This is 22.392 points or 5.74% higher than May 2023 and -3.327 points or -.9% lower than April 2024's index of 416.344. The MoM decline is mainly attributed to declines in fuel costs for the period.

Source: U.S. Bureau of Labor Statistics

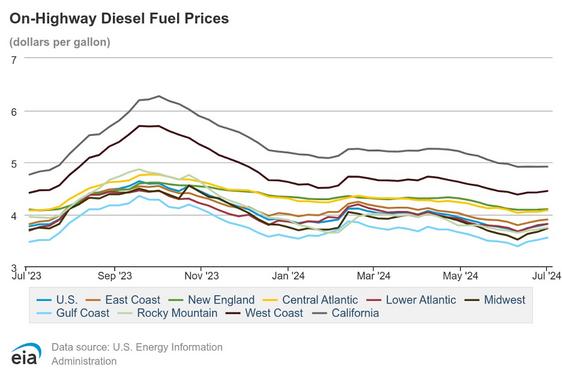

The U.S. National average cost per gallon for on highway diesel in the month of June came in at $3.722, which is $.10 or 2.6% lower than May’s average of $3.822. The U.S. National average dropped nine consecutive weeks until the trend reversed and we hit $3.735 per gallon on June 17. We have since experienced three consecutive weeks of increases as we start the month of July at $3.813 per gallon.

has seen ders, indicating a growing customer preference for convenience and positioning Walmart to better compete with Amazon.

Impact of Walmart+: The subscription service Walmart+ is driving significant customer engagement and higher spending, contributing to a strong performance in e-commerce sales.

Strategic Refocus with Coyote Sale: UPS sold its truckload brokerage business, Coyote Logistics, to concentrate on its core small package delivery and logistics operations, aligning with its strategy to be a premium provider in this sector.

Operational Streamlining: The sale of Coyote Logistics is part of UPS's broader effort to streamline operations and focus resources on its most profitable and strategic business areas. pushing lect volume earlier in the shipping process to better utilize its facilities, despite concerns from stakeholders about potential delivery delays and service disruptions.

Rate Increases: To incentivize the new operating model, USPS plans significant price hikes (~43%) for Parcel Select shipments, aiming to improve its capacity utilization and operational efficiency.

Potential Sale or Spinoff of FedEx Freight: FedEx is considering selling or spinning off its LTL division, FedEx Freight, to streamline operations, enhance revenue stability, and align with industry trends toward pure-play operations.

Cost Reduction and Operational Integration:

FedEx's exploration of options for FedEx Freight is part of its broader strategy to reduce costs and merge its Ground and Express units, aiming for significant savings and improved operational efficiency

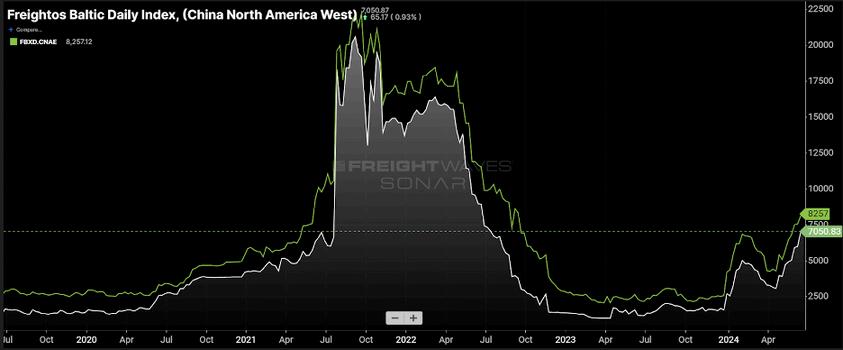

Rates: Ocean spot rates from China to U S hit their highest levels since the summer of 2022 and are still climbing

Supply: Asia-U.S. West Coast capacity growth is being offset by blank sailing. New vessel capacity being delivered with more coming.

Demand: Stable overall import volume growth Retailers revise 2024 import volume projections to 15 2%, doubling from the January forecast.

Operational: The Panama Canal situation continues to improve. Houston Port impacted by Hurricane Beryl. Port of Vancouver strike averted

Rising freight rates continue to be a concern in the global supply chain with forecasts warning that ocean cargo prices could reach $20,000 potentially even approach the COVID era peak of $30,000 and stay elevated into 2025.

Spot ocean freight rates from the Far East to the U.S. increased between 36%-41% month over month of June, and ocean carriers increased additional charges known as general rate increases by roughly 140%.

The below graph from Freightos shows index values for rates from China to the U.S. East Coast in green and China to U.S. West Coast in white. The next two months will provide a clearer picture as to how peak season volumes will impact any continued upward pressure on import rates from Asia.

Unlike the COVID era rate spikes, the current cause is mostly related to ocean carrier capacity constraints that have been driven primarily by the longer transit times caused by the ongoing challenges in the Red Sea. There is also an opinion that there is a degree of “panic buying” by the retail sector happening to ensure inventory levels remain available for the holiday season and the avoidance of potential even higher rate levels in the future.

After months of sharply increasing rate levels, reduced shipper allocations, and flat YoY capacity growth in the Transpacific trade, relief may now be coming into the market. Several new or restored services have been introduced into the Asia to U.S. trade, amounting to a capacity increase of more than 10%.

Since early June, more than 12 new Neo-Panamax (large capacity) vessels have been delivered to shipyards in Asia. This comes at a time where rates have spiked to near COVID-era levels so the timing may seem a bit suspicious. But overall, this capacity increase is part of a larger growth plan that has been expected and reported widely by trade analysts. There is still a large book of open vessel orders over the next 18 months that could inject up to five million more TEUs of capacity.

Even with the new vessel and service deployment, the capacity removed through blank sailings in June still exceeded capacity increase from extra loaders and new services Congestion and delays at Asia ports are impacting schedules by a week or longer, forcing carriers to cancel scheduled sailings to get ships back on their normal rotation.

Source: M+R Spedag Group

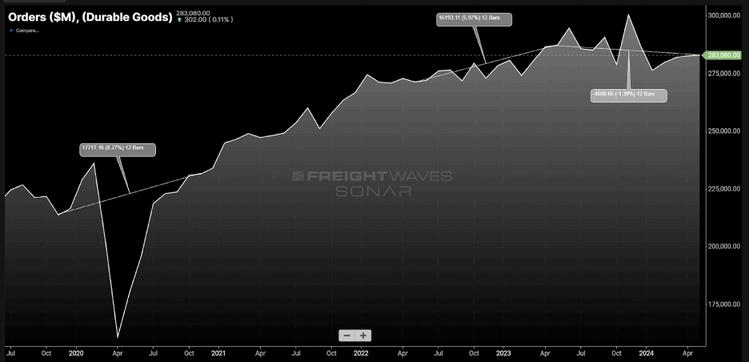

Goods demand has been relatively stable over the past few years, though it has been better than many economists expected. Orders for durable goods fell slightly year over year in May.

In late June, the National Retail Federation (NRF) revised its annual containerized import growth forecast to over 15%, up from 10% in May and double the 7% figure the NRF provided to the market in February.

The Inbound Ocean TEUs Volume Index (IOTI), which measures bookings of twenty-foot equivalent units from Asia to the U.S., is up 15% YoY. This index is still 13% below the 2023 peak levels in August 2023 when rates were roughly a quarter what they are now. Demand has been increasing steadily since May, but at a moderate pace.

Peak season for ocean imports from Asia is typically between July and August. As mentioned above, some analysts question whether current demand growth is the result of “panic buying” or advancing orders to ensure on-time delivery

If that is the case, the TEU Index over the next two months should be mostly flat However, if the index continues to increase, this would indicate additional growth and thus more pressure on rates and capacity The U S transportation market will also feel the impact as the growing imbalance of goods adds to international container shortages.

In June, the Panama Canal Authority (ACP) announced that it would continue with its April 15 plans to move to 32 transits per day and increase from 31 transits prior to the maintenance work at the Gatun locks from May 7–15. The increase in slots will still be shy of the normal operating capacity of 36. Water levels have greatly improved and no significant delays are being experienced with transits via the Panama Canal.

Texas ports along the Gulf Coast closed operations and vessel traffic before Hurricane Beryl made landfall in southeast Texas at 4:30 a m Monday, July 8 as a Category 1 storm with 94 mph winds, heavy rainfall and the potential for life-threatening storm surges.

Ports in Houston, Corpus Christi, Galveston, Freeport and Texas City were all shuttered after the Coast Guard declared that all vessel movement and cargo operations were restricted.

Canada’s labor tribunal on Sunday ruled that a strike vote by union longshore foremen against DP World’s terminal at the Port of Vancouver was illegal, heading off maritime employer’s threat to shut out workers at Canada’s largest container gateway in response.

The British Columbia Maritime Employer’s Association (BCMEA) called on the Canada Industrial Relations Board (CIRB) to hold a hearing on Sunday after Local 514 of the International Longshore and Warehouse Union (ILWU) Canada issued a 72-hour strike against DP World Centerm last Friday

The CIRB found that Local 514 “failed to bargain in good faith when it conducted a strike vote amongst the employees of only one member employers of the BCMEA and issued a strike notice based on that strike vote ”

The strike vote came ahead of a CIRB hearing scheduled for August about a complaint the BCMEA filed against Local 514 alleging the union was “protracting negotiations” over a new contract. In the event the union prevailed at the CIRB, the BCMEA said it was prepared to issue a port-wide lockout that would have shut down all cargo operations, except grain and cruise ships. Although both are part of the international union, ILWU Canada negotiates separately from the ILWU on the U.S. West Coast.