National Outbound Tender Rejections (OTRI), a key indicator tracked by major TMS providers in the transportation industry, continue to hover below the 5% mark. This metric offers valuable insight into the proportion of truckload freight entering the spot market. According to basic economic principles, increased spot market activity typically drives up carrier rates; however, the current low OTRI suggests that August pricing is likely to remain stable.

Source: sonar surf

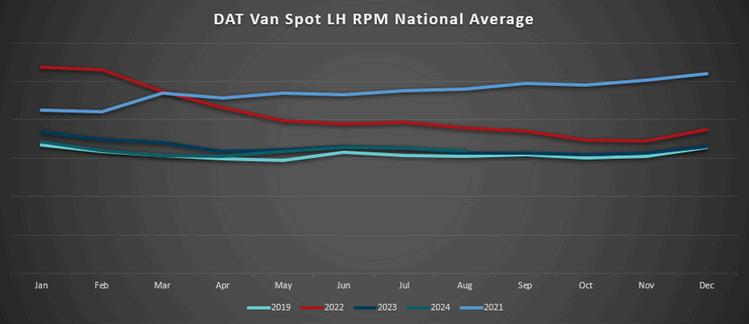

July marked the first month since March 2022 where we did not see a year-over-year decline in National Van Spot Linehaul rate-per-mile (RPM) While this development is noteworthy, it's important to recognize that the freight recession is far from over. Fuel surcharge levels were higher in 2023, resulting in an overall year-over-year decline in total rates. Shippers can expect rates to remain stable in August, with potential seasonal increases in the final week of the month due to Labor Day.

FTR Intel's forecast of a year-over-year rate shift in August–September is on the verge of materializing from an RPM linehaul perspective; however, this market reversal is not expected to mirror the volatility seen in 2018 or 2020, which were marked by significant tender rejections and sharp spot rate increases. The projected 5% gains in linehaul rates, while notable, could still result in a year-over-year decline in total costs due to lower current fuel surcharge prices.

Source: ftrintel.com

Truckload markets moving sideways $2

Source: DAT.com/trendlines

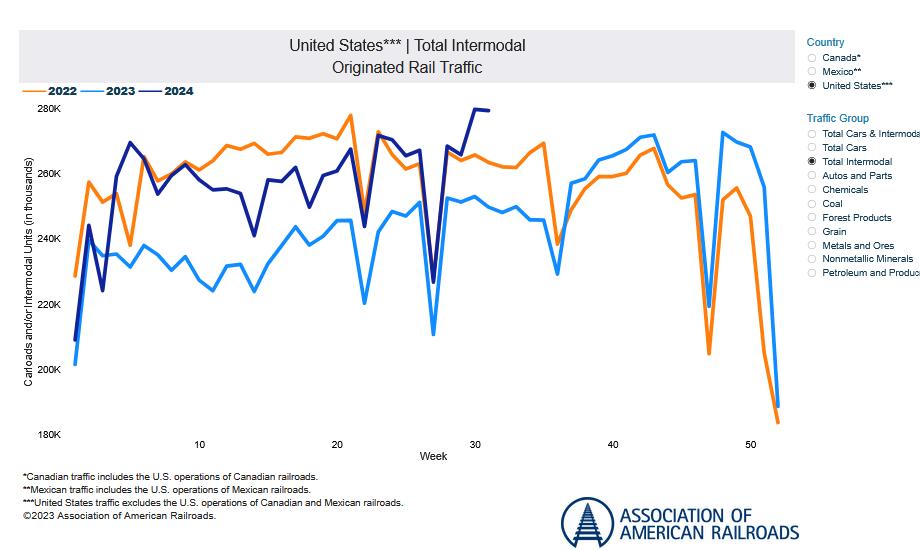

The Canadian railroads Canadian National (CN) and Canadian Pacific Kansas City (CPKC) are making preparations for a work stoppage on August 22, 2024, due to a labor agreement with Teamsters Canada Rail Conference (TCRC). Plans for a shutdown have been issued including embargoes for hazardous commodities as well as an early stop of some freight from the U.S. to Canada. More information is available through the articles linked below:

Canadian National Starts Phased Shutdown

Industry Shippers Brace for Canada Rail Stoppage

Canada’s Major Railways Will Halt

Rail Strike Concerns Reach Fever Pitch

Canada Possible Rail Strike

CPKC Information

CN Information

Inbound volumes at ports across the nation have been increasing as many shippers have been bringing imports in early as well as shifting cargo to the West Coast ports to avoid a potential International Longshoremen’s Association (ILA) strike that could shut down East Coast and Gulf Coast ports.

The influx of import volumes into Southern California combined with higher seasonal truck rates has resulted in more transloading, which has created tighter capacity and increased intermodal spot rates into the summer and early fall shipping season.

You can get more information here:

bloomberg.com/news/newsletters/2024-08-12/supply-chain-latest-us-port-strike-and-labor-talks labornotes.org/2024/08/east-coast-longshore-contract-clock-ticks-down

freightnews.co.za/article/us-retailers-stock-ahead-potential-strike

Here are links to some top stories in the industry for you to check out:

TFI focusing on LTL costs

Knight-Swift acquires DHL LTL

DC Logistics acquires GLS Freight

SAIA’s network expansion

We’ve had an eventful few weeks since our last publication and things are heating up in West Coast LTL land. Knight-Swift acquired Dependable Highway Express (DHE), the LTL division of Dependable Supply Chain Services, thus filling in parts of the West Coast as Knight-Swift continues in its pursuit of establishing a national footprint. It was also recently announced DC Logistics is acquiring the freight division of GLS, the legacy Mountain Valley business. With plans of unifying the DC Logistics and GLS Freight crests under the historically solid Mountain Valley brand, this will be a carrier to keep your eyes on out on the West Coast.

Notwithstanding the impact interest rates are having on goods demand – and therefore manufacturing production – it feels like we are picking up some steam! The industrial sector is showing signs of life with back-to-back months of year-over-year expansion as of June and Q2 2024 public LTL carrier earnings reports are reflecting mid-singledigit sequential increases in tonnage and shipments. Major carriers, such as SAIA, XPO, Estes and Knight-Swift will be hopeful that demand recover quickly as they all intend to significantly increase their terminal and door counts in 2024 and beyond.

The United States ISM Manufacturing Purchasing Managers Index (PMI) dropped to 46.8 in July 2024, down from 48.5 in June, falling significantly short of market expectations of 48.8. This marks the steepest decline in U.S. manufacturing activity since November 2023. The index has now declined in 20 of the last 21 months, highlighting the strain high interest rates are placing on demand for goods, which is further exacerbated by a fresh dip in new orders (47.4 compared to 49.3 in June). Meanwhile, backlogs continued to decrease at the same rate (41.7), leading to a substantial drop in production (45.9 compared to 48.5). The reduced demand for capacity caused employment to decline for a second consecutive month (43.4 compared to 49.4), consistent with other indicators of a cooling labor market At the same time, factory input prices increased more rapidly (52 9 compared to 52 1), driven primarily by rising metal costs and pressures on the availability of electrical components

Source: Trading Economics & Institute for Supply Management

Industrial Production in the U.S. increased 1.6% YoY in June 2024, marking the biggest rise since November 2022 and back-to-back months of expansion. With industrials contributing up to about 70% of LTL volumes, this is a welcoming sign, and the positive momentum in the sector is being reflected in carrier reporting metrics. Fingers crossed for continued expansion in the space. Lou Brown once said, “OK, we won a game yesterday. If we win today, it's called ‘two in a row’. And if we win again tomorrow, it's called a ‘winning streak’.”

Source: Federal Reserve; Forecast by Witte Econometrics, FTR Transportation Intelligence

To no one’s surprise, carrier pricing discipline remains intact and is expected to persist through the 2024 calendar year It is still common to see contracts renewing at 4-7% increases on average, with that number slowly ticking up as demand for carrier services increases Carriers are taking a more equitable position against unfavorable pricing provision requirements – such as broad-banded FAKs – and extending more competitive provisions to customers who allow for actual class rating and billing. Actual class rating allows the carriers to more closely align the charges they assess with the charges they incur. This will continue to be the trend, especially considering the major changes the NMFTA is making in 2025 under their “Classification Reimagined” initiative. For more information on the upcoming classification changes, please read: A Guide to the NMFC Changes Coming in 2025: How They Will Affect You and How to Prepare.

The Producer Price Index (PPI) for Long Haul LTL, which gauges average prices paid to transportation service providers, came in at 416.578 for July 2024. This is 22.392 points or 7.07% higher than July 2023 and 9.081 points or 2.21% higher than June 2024's index of 407.560. July 2024’s index is the highest in two years, dating back to the summer months of 2022 when the index reached its highest points in history.

Source: U.S. Bureau of Labor Statistics

The U.S. national average cost per gallon for onhighway diesel in the month of July came in at $3.81, which is $.09 or 2.4% higher than June’s average of $3.722. The U.S. national average in July of 2023 was $3.882, which is $.072 or 1.9% more than July 2024. We start the second week of August off at $3.704 per gallon for the U.S. national average, which is $.36 or 8.8% lower than the second week of August 2023

Revenue and Growth: UPS reported strong Q2 revenue of $24 1 billion, up 8 6% year-over-year, driven by a 10 2% increase in average daily package volume.

Strategic Investments: The company is investing in automation and electric vehicles to enhance operational efficiency and sustainability.

UPS's net income rose 11.5% to $2.9 billion, reflecting improved margins and cost control.

Market Focus: UPS continues to expand its international footprint, focusing on growing ecommerce and B2B segments.

Financial Performance: USPS reported a significant loss of $2.8 billion in Q2, although revenues increased by 6% to $23.2 billion.

Delivery Service Partner (DSP) Issues: Amazon's changes to delivery routes and algorithms have led to the shutdown of two DSP companies in Orland, California, impacting more than 170 workers.

1 Cost Reduction Focus: Despite missing Q2 sales expectations, Amazon increased profits and is committed to further cost reductions to remain competitive. 2. Expansion in Rural Areas: The company is expanding its delivery capabilities into more rural areas to improve service coverage. 3.

Technology Investment: Amazon continues to invest in route optimization and safety technology, though challenges remain with driver satisfaction and operational efficiency.

Pitney Bowes

E-Commerce Business Shutdown: Pitney Bowes is closing its e-commerce business unit due to ongoing market challenges and profitability issues

Impact on Employees: The shutdown will result in job losses, with the company providing support for affected workers 2 Focus Shift: Pitney Bowes is refocusing on its core parcel shipping and logistics services to drive future growth 3

Financial and Strategic Reorientation: The company anticipates short-term financial impacts but aims to strengthen its market position through strategic realignment.

Rates: After highs in June/July, rates have slid downward and stabilized moving into August Carriers GRIs unlikely to be successful.

Capacity: Carriers forecasting more blank sailings in August as schedules begin to slip, notably in the Pacific

Northwest Capacity to U S West Coast improved

Volume: Asia-East Coast demand remains steady as retail orders continue to be strong. Demand to U.S. West Coast should increase toward the end of August.

Operational: ILA contract negotiations stall and fear of strike continues Panama Canal restores full daily transit capacity amid improved water levels.

As mentioned above, capacity from Asia into the U S West Coast has been readily available, compared to the U S East Coast since July The primary reason for that is introductions of some new services that have expanded booking options.

The Asia to Pacific Northwest (PNW) trade will likely see significant blank sailing activity through August, with 29% of its total capacity suspended during mid-month. This comes as rail dwell times at Seatle/Tacoma and West Coast Canada ports increase to up to 8.4 days, while rail dwell times at LALB are increasing as well, on average between 4-5 days.

Source: M+R Spedag Group

Although supply has grown in the Asia-U.S. West Coast lane in June and July, volumes are starting to grow into this expanded capacity

Carriers may be looking at some expanded blank sailing plans moving through August As shown below, the PNW corridor will certainly see increased voided sailing Rail issues in the PNW have not improved and thus some carriers are blanking those services. Carriers continue to struggle with schedule integrity, which leads to more blank sailings, but they may also use them if rates continue to erode at a faster pace moving into September.

Ocean spot rates kept pace with June’s record volumes from Asia to the U.S. West Coast and U.S. East Coast, soaring by 144% and 139%, respectively, between April 30 and July 1, according to Xeneta data.

Record volumes in May and June contributed to a spike in rates, as shippers spent more to manage risk in their supply chains Import shippers imported Christmas goods as early as May with the hope of avoiding potential future disruptions, most notably a possible labor strike at East Coast and Gulf Ports

However, the record demand may have peaked, as average spot rates from Asia to U.S. West and East Coast ports have dropped by 17% and 3.2%, respectively, since July 1.

The differential between spot rates from Asia to the U.S. West and East coasts is at its widest in almost two years. Container spot rates to the West Coast began easing in early July thanks to the launch and reintroduction of at least 10 services.

Spot rates from Asia to the East Coast as of August 2 were $9,500 per FEU, while the West Coast spot rate was $6,400 per FEU (see below chart from Platts). The $3,100 differential between the rates is the widest since October 2022.

East Coast rates (and the differential) will likely decline in the second half of August because all-water services to the East and Gulf coasts longer transit would preclude goods being available for holiday shopping, notably, Black Friday sales

Carriers – eager to prevent rates from nosediving – have tightened up capacity in early August following a relatively inactive July for blank sailings They are also seeking to increase spot rates by $1,000 per FEU on August 15 but the current market will likely not support that level of increase.

Carriers had planned a GRI effective August 1, but that didn’t stick due to softening market conditions. Carriers did have some success implementing peak season surcharges, but the recent downward slide has allowed importers are able to reject those as well. Most analysts feel a significant GRI for U.S. importers in August will overall be unsuccessful.

Container traffic from China to North America set a monthly record in June as shippers looked to get ahead of supply chain disruptions closer to the holiday retail season.

An eastbound total of 1.36 million TEUs made June the eighth-highest month ever, behind only the all-time volumes seen during the COVID-19 fueled volumes of late 2020 and 2021.

The June 2024 volume of 800,000 TEUs moving from China to North Europe was the highest on record.

This high-volume demand seems to be a result of U.S. importers advancing orders to avoid any disruptions that may be caused due to the ILA labor negotiations and the upcoming September 30 contract deadline.

Retailers are concerned by the possibility of a strike at ports on the East and Gulf coasts because contract talks have stalled U S retailers have taken precautions including earlier shipping and shifting cargo to West Coast ports to avoid issues in Q4

July volumes represented a 26-month high since the alltime high set in May 2022. This also marks the first time in 22 months that volumes have been above the 2.4 million TEU level that created port congestion and delays during the pandemic years

Source: Descartes Datamyne

ILA Union Not Satisfied with Most Recent Labor Negotiation Offer

Maritime employers along the U.S. East and Gulf coasts say they are prepared to offer “industry-leading wage increases” and other benefits as part of a new master contract for longshore workers. But the dockworkers’ union says talks on a new six-year deal remain at an impasse over salary questions and the ongoing dispute with APM Terminals over its use of automated gate technology at the Port of Mobile.

The ILA dismissed the latest wage proposal from the U.S. Maritime Alliance as inadequate. The union, which has 85,000 members in the U.S., Canada and Bahamas, is reportedly looking for a nearly 80% wage increase for dockworkers. The union and the UMSX appear to be very far apart, particularly on the wage issues, and close to an impasse

While specifics of the latest wage proposal were not disclosed, a source close to the negotiations said the U S Maritime Alliance is offering East and Gulf Coast dockworkers an increase higher than the 32% raise that West Coast dockworkers received in 2023.