AGENT MISSOURI

3315 Emerald Lane, Jefferson City, Mo. 65109

Phone: 573-893-4301 • Fax: 573-893-3708

Email: maia@moagent.org

Internet: www.moagent.org

Publisher Matt Barton

Officers of MAIA

President Dennis Luebbering, Jefferson City

President-Elect Matt Speight, Montgomery City

Vice President Deena James, Manchester

Secretary-Treasurer Jim Neuner, Jefferson City

IIABA National Director Brad Greer, Chesterfield

PIA National Director Randy Smart, Marionville

Imm. Past President Darin Banner, Bolivar

Board of Directors

Region 1 Ross Ingersoll, Savannah

Region 2 Matt Alexander, St. Charles

Region 3 Holly Stark, Harrisonville

Region 4 Mark Baker, Platte City

Region 5 Rick Prather, Jefferson City

Region 6 Tony Becker, Crystal City

Region 7 Paul Carcagno, Arnold

Region 8 Heath Greer, Chesterfield

Region 9 Parker Mills, Clinton

Region 10 Richard Ollis, Springfield

Region 11 David Hall, West Plains

Region 12 Jeremy Anderson, Sikeston

At-Large #1 Andy Reavis, Billings

At-Large #2 Clare Zanger, Ozark

At-Large #3 Jon Stahly, Cape Girardeau

Co. Rep. Amber Truskowski, South Jordan, Utah

Co. Rep. Tracey Hagy-Kelly, Creve Coeur

MAIA Staff

Chief Executive Officer Matt Barton

Chief Operating Officer Sheryl Van Leer

Director of Insurance Services Theresa Flippin, AIP, CISR

Director of Education & Events April Underwood

Director of Marketing & IT Joe Lawton

Assistant Director of Insurance Services Hannah Wall

Database Administrator Laura Berendzen

Accounting Specialist Paula Wolken

Customer Service Representative Sarah Wright

Marketing Coordinator Mary Feller

Administrative Assistant Leslie Powell

MISSOURI AGENT (USPS 709-210) is published bimonthly by the Missouri Association of Insurance Agents, 3315 Emerald Lane, Jefferson City, Mo. 65109, Phone: 573-8934301. Periodical postage paid at Jefferson City, Mo. and additional mailing offices.

MAIA does not necessarily endorse any of the companies advertising in this publication. Additional subscriptions are $30 per year.

Address & Other Changes

Notify Missouri Agent if you change your address, change your agency name, or drop or change producers (who are voting members of the association). Write to: Missouri Agent, 3315 Emerald Lane, Jefferson City, Mo. 65109 or email: maia@moagent.org.

POSTMASTER: Send address changes to Missouri Agent, 3315 Emerald Lane, Jefferson City, Mo. 65109. © 2025 Missouri Association of Insurance Agents

the older I get the more I realize the need for me to tell others how much I appreciate them. To be honest, at age 67 I have more of my life in the “rearview mirror” than I do the windshield, and I imagine that is where wisdom comes from. Yes, there is hope for me to conquer this skill called appreciation! So, just being transparent, this is something I have had to work on a lot over the past almost 35 years in business.

OK, it’s not like I’m an unappreciative man! I do appreciate everybody and everything that others including family have ever done for me. It’s just that sometimes in the middle of this sometimes “hectic life” I have not always taken the time to express that appreciation to let others know they are appreciated.

"One of the things I hear during interviews is how some of the candidates feel unappreciated at their current job."

Dennis Luebbering

it right every time? Definitely not. But I am a work in progress and have made great progress from when I first started in business in 1991. Several years ago I read a book that I don’t remember the name of, and it really is not that important. What is important is that I took something out of that book and have tried my best to apply it to my everyday life. The writer said to always say “please” and “thank you” when appropriate. That really spoke to me. It must have been a book we read as a team at work because my employees reminded me a lot that I needed to say please and thank you! I guess they helped train me, for which I am appreciative!

So, make it a typical day at the office. Appointments are set, the phones are ringing, problems are arising as usual. Everybody is working to their max capacity. I see something somebody did wrong and tell them about it, not to be mean, but to train so we can get it right the next time. Is there anything wrong with that? Probably not. But, when they do something right, which happens many, many times more than making a mistake, do I “always” compliment them on doing well? I mean, it probably takes much less time to give a compliment than a correction, right?

I am not the only business owner or manager to have ever gone through this! One of the things I hear during interviews is how some of the candidates feel unappreciated at their current job. You know, the sad thing is that the only reason they are shopping for a job is because of a lack of appreciation from their current business owner or manager. This is sort of sad when you think about it.

Now, that past stuff was mostly the old me. The person I have worked hard to be is not as bad as that guy you read about above! Do I get

My wife, Diane, is a recipient of many “please” and “thank you” responses now, so not only does being kind at work seem to be a good idea, it works well in family relationships as well! We both work a lot together and when she brings me coffee, I thank her. If she fixes breakfast, I thank her. I find myself thanking her several times throughout the day for even the smallest of things. I find myself thanking my kids, grandkids and those around me more and more as I get older. Those of you that know me well won’t be surprised at this, but I even thank Tucker, my golden retriever, when I tell him to lay down or something and he does it.

I know this may seem like an unlikely topic for this article, but to be honest, it is a reminder of a very practical way that we can enrich the lives of ourselves and others as we travel through this journey called life. Being kind always blesses people, and those blessings come back to us in many ways! So, to end this article, thank you to everyone who has been patient with me as I have strived to be appreciative for all the times in my life when you have supported and blessed me!

Dennis Luebbering, President, MAIA

if you attended MAIA’s Risk Specialist (RSS) class in January, you were part of an informative class that included the path legislation travels in order to eventually become law. If you weren’t able to attend that class, you really missed out. While the instructors explained numerous specific pieces of legislation that have been introduced over the past few sessions and how they would affect you, your agency or your clients, much time was devoted to illustrating the long path legislation goes down in order to eventually be considered Truly Agreed to and Finally Passed (TAFP) and provided to the governor for his consideration. I would venture that most of our class attendees had very little idea just how many steps are involved in that process. So often I’ve heard somebody, an MAIA member or not, lament “Why don’t we just pass a law to fix…” in referring to a situation that needs to be addressed and the passage of a new law or revision to the current law that would seemingly remedy the situation.

- The House and the Senate meet during the same time of year, but obviously in separate chambers, and often do not see eye to eye, even if controlled by the same political party.

- Rarely does legislation pass in the very first year, or even first few years, in which it is introduced and discussed.

- There will always exist numerous individuals/groups who oppose the legislation that you want to pass; the question is how do you overcome them or work with them to find middle ground.

"There will always exist numerous individuals/groups who oppose the legislation that you want to pass; the question is how do you overcome them or work with them to find middle ground."

Matt Barton

Matt Barton Chief Executive Officer, MAIA

With the beginning of a new Missouri legislative session, I want to not only tell you about what our efforts will entail this session, but also the challenge in getting specific legislation passed in Missouri. As I referred to in the RSS class:

- For legislation to become law, that is, added to Missouri’s statutes, it must pass our legislature (the Senate and the House of Representatives) in the exact same format; not one word can be different in the final version.

- Sometimes those groups have a lot more financial resources than you do, thus making it more challenging for you to pass a bill.

- There will almost always be some unintended consequences of your legislation.

- Even after a law passes, people will find ways around it.

I provide this just to illustrate that MAIA may make an effort seemingly every year to pass specific legislation…and still find challenge in doing so. It could take a decade or more – if ever – to pass specific pieces of legislation that have a larger population of opposition.

How long was Missouri’s auto financial responsibility law stuck at $10,000 for property damage before eventually being increased to $25,000? How long did our state’s valued policy law only reference one peril, that being fire, before being expanded? I could cite numerous examples of current laws that took years to pass, despite MAIA’s best efforts to improve the law.

You will no doubt notice or

continued on page 16

the progression of the insurance agency industry clearly continues to head toward more consolidation, whether through mergers and sales or through affiliation and aggregation systems. All of those transactions involve the necessity of being able to share records or to pass them on to another entity. That prospect leaves the potential of difficulties in determining what records to keep and which to discard, and perhaps whether the record-keeping systems are adaptable in a manner that all necessary records can be properly preserved.

The first issue is to know what records are required to be kept. The specific regulations applicable to agencies are limited, but other regulations applicable to companies could involve some expectations of agencies. The most specific requirement for agencies to preserve records is found in regulation 20 CSR 700-1.140(5) entitled “Minimum Record Keeping Requirements for all Insurance Producers.” Those requirements apply only to personal insurance. The regulation requires producers keep records of all personal policies procured or placed by the producer unless the obligation to do so is assigned to an insurance carrier in a written document kept by the producer. The records to be kept include all applications, binders, declaration pages, endorsements and riders; all correspondence or records provided concerning the policy coverage; any documents filed with the producer regarding a claim; and receipts or other documents regarding payment for premiums. Those documents should be maintained in a way they can be presented within five days after a request of the director of the Department of Commerce and Insurance (DCI). These records must be maintained for at least the period the policy is in effect plus three

years thereafter. These records may be kept digitally as long as they can be reproduced.

With many companies the majority of these records may be kept in the carrier’s system. However, the producer should be certain the contract with the carrier makes clear the carrier is taking on the responsibility to maintain those records. Otherwise, the agency needs to have the records as well.

"... records must be maintained for at least the period the policy is in effect plus three years."

Lew Melahn

Mergers, acquisitions and affiliations with alliances or other aggregators may complicate this record keeping if the systems of the various parties won’t accommodate the record system of the agency or book of business being purchased or absorbed. I know many agencies use similar management systems which should allow merger of records fairly easily. But that may not

always be the case. If a problem is anticipated, then all parties should ensure a method is found for orderly transfer and retention of the records.

In addition to the records specifically required to be preserved, the regulations of the DCI require insurance carriers to maintain a longer list of records for personal lines and similar records for commercial coverages. Because many of those records, like applications and requests for additions and endorsements, originate within the agency, the agency should maintain those records as well since they may be required in some cases to confirm the carrier records in a market conduct examination by the DCI. Those record-keeping requirements are similar in that they require records to be kept for three years after the end of the policy period or the handling of a claim.

As agencies consider mergers, acquisitions and affiliations, the need to preserve records should be on the list of matters to consider.

Lewis E. Melahn, J.D.

Lewis

E. Melahn is a practicing attorney who provides free legal consultation to MAIA members on a limited basis. He served as the director for the Missouri Department of Insurance from 1989-1993. You can contact Lew Melahn at 573-230-7200.

roper placement of the agency's errors & omissions (E&O) coverage is of utmost importance. Protection provided by an E&O policy can be the difference between the agency's continued success and financial ruin.

Errors and Omissions (E&O) Coverage Is of Utmost Importance

Agencies have many options available for the placement of their E&O coverage. For some agencies, one of the options is purchasing E&O coverage directly from one of their appointed carriers. In fact, these carriers constantly solicit their appointed agents, enticing them with exclusive perks for placing their E&O coverage, such as points toward carrier incentive plans, reductions in deductibles for E&O claims and applying the E&O premiums toward overall production.

Before placing E&O coverage with any carrier the agency is appointed to represent, there are several factors that agent principals must consider.

Big “I" considers promoting the value insurance agents bring to their customers as part of its mission. Independent agents know the value they add to customers, so why would the agency not want the benefit of a trained professional liability agent working on its behalf?

"Professional liability can be tricky, and just because an agent knows the coverage needs of their customers doesn't necessarily translate into knowing the nuances of agents' E&O coverage. "

On the surface, this seems like a good deal, especially since the agency already has a relationship with the appointed carrier. The agency trusts them to protect its customers, they are highly rated and they a have a great reputation for paying claims. But serving the agency's clients and defending the agency from E&O claims are two separate and distinct relationships. The line between what is best for the agency and best for the customer becomes blurred; the two aren't always compatible. Further, what is best for the carrier and best for the agency may not be the same either. It's seldom spoken of when this happens, but it's always lurking in the background, and it's called “conflict of interest."

Professional liability can be tricky, and just because an agent knows the coverage needs of their customers doesn't necessarily translate into knowing the nuances of agents' E&O coverage. Big “I" state association personnel whose only focus is professional liability work closely with the agency to service its E&O needs. Yes, even the best agency benefits from the professional service and knowledge offered by a dedicated E&O professional.

The intrinsic value of agencies is their book of business and carrier appointments. A disagreement about the handling of an E&O claim has the potential to severely strain that relationship and may hamper any long-term representation. If the agency is embroiled in an E&O claim involving the same carrier, maybe even forcing the carrier to fight for and against its agent, these discussions and outcomes can harm relationships.

continued on page 18

VU Faculty

how many times have you, as an insurance agent, had a customer to whom you’ve provided great service for many years, but who still does not quite seem to understand the risks associated with their property? Here’s an example: You’ve known Steven, a savvy speculator in aging commercial buildings, for 20 years and have been his insurance agent for 15. In 2012 Steven got a sweet deal on a building for $300,000 that had been built in 2000. He called you and said he needed fire coverage for the building. You began talking about appraised value, but he cut you off, saying. “What appraisal? Look, I paid $300,000, so that should be plenty.” You write the coverage with $300,000 limits as instructed and everyone goes along their merry way.

In 2013, you’re reviewing Steven’s insurance needs, and you realize that you never really discussed with Steven what the value of the building was. You talk to him and ask what he thinks the building is worth. He says $400,000 since he’s put an additional $100,000 in it since he bought it. You ask him if he knows how much the building cost to build and he says, “I’m guessing it was around $1,000,000, give or take – but it’s been beat up since then.” You suspect that the cost to replace the building is probably closer to the $1,000,000 – if not more – so you ask him if he wants to increase the limits to $1,000,000 to cover the replacement cost. But Steven, as you know, is a very difficult customer and doesn’t want to hear that because he doesn’t want to spend the money. You make the recommendation; he rejects it, comments that “You’re always trying to hit me up for more commission!” and tells you to quit bugging him.

In 2018 you are again reviewing Steven’s insurance needs and

know he should have higher limits on the building, but you also know how difficult he is to deal with and that he wouldn’t increase the limits anyway, because he’s constantly looking for ways to drive his premiums down. As a result, you don’t offer the higher limits.

This goes on for several more years. You see Steven from time to time and you mention in passing that maybe he ought to consider reviewing his limits on that building. Every time you do he says, “No, that’s OK, it’s fine.” Or he says, ”Yeah, maybe I should look into that...” and you tell him to call, but he never does. But then again, neither do you call him because you’re certain it won’t do any good.

Unfortunately, your familiarity with Steven and his “insurance buying habits” has become a pitfall. You’ve grown accustomed to telling your customer what he wants to hear rather than what he needs to hear, because frankly, you know that’s where you’ll end up no matter what you say.

It’s now 2024 and Steven gives you a call. His building has burned to the ground and there’s nothing left. The adjuster on site tells Steven that the carrier won’t tender the full $400,000 because replacement cost for that structure is $1.6 million, which brings the coinsurance penalty clause into play... “The ‘go-insure-me-what clause?’” says Steven, right before he picks up the phone...

Ardler, CPIW, DAE, AIAM

Senior Underwriter & Risk Management Expert, Swiss Re Corporate Solutions

This article is intended to be used for general informational purposes only and is not to be relied upon or used for any particular purpose. Swiss Re shall not be held responsible in any way for, and specifically disclaims any liability arising out of or in any way connected to, reliance on or use of any of the information contained or referenced in this article. The information contained or referenced in this article is not intended to constitute and should not be considered legal, accounting or professional advice, nor shall it serve as a substitute for the recipient obtaining such advice. The views expressed in this article do not necessarily represent the views of the Swiss Re Group ("Swiss Re") and/or its subsidiaries and/ or management and/or shareholders.

Copyright 2025 Swiss Re

Yes, you get the call from Steven. “You told me my coverage would be enough to rebuild my building!” Steven complains, voice rising. “You are my agent. Why didn’t you tell me it wasn’t enough?” You get a sinking feeling in your stomach because you’ve certainly known for a long time that he should have had higher limits, and you also know you told him that he should have had higher limits. When you mention that to Steven, though, he seems to have forgotten the times you’ve talked about it. Then you look in your file and can’t find anything that shows you talked to him about higher limits, because you never thought you needed that kind of backup with a friend. And let’s not even talk about coinsurance. The next words out of his mouth are “IT’S ALL YOUR FAULT!” or “I’M GONNA SUE!” And the next call you make is to your E&O carrier.

Unfortunately, this scenario, or something similar, is all too familiar in the world of E&O claims. A normal aspect of human nature –the desire to avoid confrontation – can lead to a far more serious headache when it is not dealt with properly from the start. So how do you prevent this from happening? It’s really quite simple.

1. Annual reviews - Good customer management includes conducting an annual review of your customers’ exposures. That means asking the right questions every year and paying close attention to the answers. The best tool to get that conversation started is a coverage checklist.

2. Coverage checklists - If you have a coverage checklist, use it! If you don’t have one, get one! If you are an IIABA member

and insured by Swiss Re Corporate Solutions, you have one available to you. The “E&O Guardian” website has samples of both commercial and personal lines checklists for you to download and use.

3. Document - After you’ve determined your customer’s exposures through your annual review and use of the coverage checklist, be sure you document what you’ve recommended to them. The best way to document this is to send them follow-up correspondence, either by mail or email, outlining the coverages you’ve recommended, the coverages they’ve accepted, and just as importantly, the coverages they’ve rejected. If they will sign and return that to you, or acknowledge receipt of the email, all the better.

4. Follow up – Was your customer persuaded to accept some additional coverage or increase in limits? Are there questions that need answers before they decide? Did they say they want to think about it...? Followthrough is essential. Keep careful notes and diary entries to ensure that no loose ends are left to hang you.

If you are a Swiss Re Corporate Solutions insured, the documentation process is one that could even save you money. The Swiss Re Corporate Solutions preferred policy includes a deductible reduction feature. If, as in this example, the agent had offered coverages or limits that were rejected, and there was contemporaneous written documentation maintained in the agency file showing that rejection, Swiss Re would waive the deductible payment for the agency up to a maximum of $25,000 – not to mention making it much easier for you to prove what you told Steven.

So, let’s turn back the clock and take another look at Steven and his agent. In 2012, Steven got a sweet deal on a building for $300,000 constructed in 2000 for $800,000. He called you and said he needed fire coverage for the building. You asked him how much and he said, “Well, I paid $300,000, so that should be enough.” You

ask him how much the building cost to build and he tells you $800,000. You ask what it would cost to replace the building in today’s dollars and he answers without hesitation because he knows the square footage and current construction costs: $1 million. You recommend that he insure the building for that much. He, of course, says “No.” He paid $300,000, and plans to do $100,000 worth of improvements, so he chooses to insure it for $400,000. You then send him a letter advising him that you had offered to obtain replacement cost coverage for the building for $1,000,000, but he had chosen to insure it for only $400,000. Each year after that you review his exposures, offer higher limits, Steven rejects them, and you send him a letter confirming both your recommendation and his rejection.

In 2024, Steven calls you and tells you his building burned to the ground and the carrier offered him a check for a fraction of his $400,000 limit even though it will

cost $1.6 million to rebuild. “You told me my coverage would be enough to rebuild my building!” Steven complains, voice rising – but this time you cut him off. You remind of the letters you sent him every year recommending higher limits and you offer to send him copies. A remorseful Steven says, “No, that’s OK. I remember...” Like you, Steven has those very letters sitting on the desk in front of him.

Familiarity can become a pitfall, but it doesn’t have to be that way. Every day, with every customer, it’s your choice.

continued from page 7

be informed that MAIA is again supporting and pursuing select tort reform legislation that would make positive, substantive improvements to Missouri’s litigation landscape. This has proven to be incredibly difficult to pass over the past few years, despite having the support of MAIA, the Missouri Insurance Coalition (insurance carrier lobby), the Missouri Chamber of Commerce and multiple other business trade groups. MAIA supports sensible tort reform measures as a manner in which to keep insurance affordable in this state.

You’ll also notice “any willing provider” legislation (laws that require managed health care plans to accept any qualified provider who agrees to the plan's terms) as well this session. We’ve supported this, as well, for years.

Bottom line is that we could use your help in the legislative process, and in multiple ways. One, attend MAIA’s annual Day at the Capitol where you get to be

part of the legislative process. You have the chance to meet with lawmakers and talk with them about insurance laws that are important to you. Two, visit with your elected senators and representatives outside of MAIA’s events. Talk to them about issues such as insurance availability and affordability. Ask them about their opinion on tort reform and other issues important to insurance agents and their clients. Three, contribute to MAPAC and InsurPac, independent insurance agents’ state and federal political action committees, respectively. MAPAC can accept both corporate and personal contributions, while funds donated to InsurPac must be personal.

Passing legislation that agents and their clients need is difficult. It becomes easier when you do your part.

in the summer of A.D. 64 a conflagration broke out in Rome that destroyed as much as 70% of the city and reportedly left half of the population homeless. Because of the disconnect between Nero and the people, this event gave way to the popular expression that lingers until today, “Nero fiddled while Rome burned.”

Despite the fact that the violin had not been invented yet, the expression reflects the disconnect between a leader and his people.

As I write this article, a conflagration rages largely unchecked in the state of California. It is a sad and devastating event, and we should pray for and financially support those who are affected. That does not negate the fact that much of the devastation has been exacerbated by the action, or in many cases the inaction, of political leaders in that great state.

Once again, our Big “I” is at work leading the way in providing common-sense legislative guidance to protect our businesses and the clients that we serve. This advocacy is the hallmark of the value of your contributions to InsurPac.

"Already we have seen political action that hamstrings insurance companies from nonrenewing homeowner policies. Companies whose sole reason for existence is to sell policies should not need incentive to do what they are created to do, i.e., sell insurance."

Brad Greer

Last year we met our goal of $29,500, which was our contribution to the total of almost $1.3 million raised nationwide to fuel this advocacy. Previously I wrote about the incredibly high success rate among those bipartisan candidates whom we supported in our efforts to continue as a mouthpiece for you and your clients. I would be remiss if I didn’t point out that we

were a single contribution away from hitting $30,000. Were you the agent responsible for failing to contribute last year?

Already we have seen political action that hamstrings insurance companies from nonrenewing homeowner policies. Companies whose sole reason for existence is to sell policies should not need incentive to do what they are created to do, i.e., sell insurance.

Further, I would add that bad policy ultimately restricts the existence of policies. By that I mean poorly crafted laws that seek to coerce or force businesses into bad decisions only lead to more market crisis. You can only regulate a business that has volitionally made the decision to do business in your state. If you force them into unprofitable actions, you leave them with a binary decision: Can we co-exist or not? My concern, of course, is that these sort of knee-jerk reactions will only make matters worse. This is not the first time I have said this about California legislative actions.

Nationwide 3,227 donors gave an average of $400; may I ask you where you stand compared to that average?

Too many agents, I believe, assume that we are political in our beliefs, when in fact we are bipartisan. I serve upon the national Government Affairs Committee of the Big “I” and see firsthand how we support legislators of any stripe who are willing to advance our causes, which happen to align very nicely with the causes of most small businesses, the same businesses who happen to be our clients.

How about getting a jump on your contribution this year and save this old guy more grey hair by not making me beg you in Q4?

Thanks for your support and feel free to reach out with any questions or concerns.

See page 26 for 2024 InsurPac contributors!

continued from page 11

E&O applications contain large amounts of sensitive and proprietary information necessary for underwriting. This data includes premiums by line of business, revenue, staff count, appointed carriers and descriptions of office procedures. In addition to knowing all the carriers with which the agency holds appointments, the E&O carrier will also know the amount of business with each carrier.

Will the E&O department keep this information confidential, or is it shared with other departments? The hope is that the information is kept confidential, but there may be no guarantees. It is easy to imagine the carrier's field underwriter hounding the agency for more business because of this inside information.

Carriers analyze E&O claims data regularly to reveal claims trends. One very clear trend that began nearly two decades ago is the steady increase in carriers suing

agents for mistakes that result in damages to the carrier. Defending an agent against itself creates a clear conflict of interest for the carrier.

Once the carrier decides the agent has created an E&O incident, all the years of a pleasant and profitable business relationship may be quickly forgotten. The carrier only has one purpose in mind – forcing the agent to pay the claim. So, if the E&O is with that same carrier, there is an immediate conflict of interest because the E&O contract places on the carrier the sole duty of defending the

agency. But if the carrier is also trying to lay blame on the agency, how can it, in good faith, also defend the agency? It's rather mind-bending to think about, but what kind of defense can the agency expect when the carrier is defending the agency against itself?

Quality Insurance. Superior Customer Service. The Dairyland Difference.

• Retention tools like easy policy restarts, automatic bill pay, low down payments, annual term, and flexible payment plans

A brand backed by Sentry Insurance, a Mutual Company with an A+ (Superior) AM Best Rating for 33 consecutive years

Affordable car insurance coverage options, including: Physical damage, collision and comprehensive

Uninsured/underinsured motorists

Competitive pricing for touring bikes, mopeds, street bikes, and off-road vehicles:

Value-added coverages, optional equipment up to $20,000 available Transport trailer physical damage

Place up to 12 powersports vehicles on one policy

For more information, contact:

John Barner | Senior Agency Sales Manager | John.Barner@sentry.com

Keith Dieffenbach | Senior Agency Sales Manager | Keith.Dieffenbach@sentry.com

Many potential E&O incidents involve “he said, she said" narratives of the relevant incidents. What happens when a customer written by the same carrier is the subject of a potential E&O incident? Even if the agency didn't make a mistake, the customer may misrepresent the facts in an attempt to secure payment from the E&O policy. The E&O carrier must make the decision to defend the agent or pay the retail customer's underlying claim to appease them. Maybe the carrier just decides to pay the loss as an E&O claim under the agency's account because it is less expensive than defending it.

There are two problems to this approach for the agency: 1) the agency's E&O policy has a deductible, and 2) the E&O carrier can use the claim to justify future rate increases or simply cancel the policy.

Also, the loss will show up on the agency's loss history and will likely have a negative impact on the agency's ability to shop future E&O coverage.

Agencies have a choice to make regarding the placement of their E&O coverage. This article lays out just a few factors that must be considered when making this very important decision. Although placing the coverage with a carrier the agency represents may seem safe and convenient, the ultimate risk may be too high.

Agents are better served placing their E&O coverage with long-term, stable programs focused strictly on agents' E&O coverage. Not

only are these programs more focused, but they also aren't full of the inherent conflicts of interest common when placing coverage with an appointed carrier.

For more information on E&O coverage available through your state association, email insurance@moagent.org or call 573893-4301.

March 19-20, 2025

Visit our booth #28-29 Prize Drawing: Whiskey Basket

Diamond Platinum Gold Silver Bronze

Acuity

AF Group

Aflac

AMERISAFE

AmTrust Insurance

Amynta Work Comp Solutions

Auto-Owners Insurance

Barton Mutual Insurance Company

Berkley Management Protection

Berkshire Hathaway GUARD Insurance Companies

Berkshire Hathaway Homestate Companies

BITCO Insurance Companies

BMI Company, Inc.

CFM Insurance

CHUBB

Columbia Insurance Group

Dairyland

Delta Dental of Missouri

EMC Insurance

FCCI Insurance Group

GAINSCO Auto Insurance

Grinnell Mutual Reinsurance Company, SI

Haulers Insurance Company

ICW Group Insurance Companies

Illinois Casualty Company

Liberty Mutual | Safeco

Madison Mutual Insurance Company

Markel Specialty

MEM

Missouri Farm and Home Mutual Ins. Co.

MOPERM

Mountain Life Insurance Company

National General, an Allstate company

Nationwide

Old Missouri Mutual

Old Republic Surety Company

Patrons & Farmers Mutual of Missouri

Pennsylvania Lumbermens Mutual

Insurance Company

Philadelphia Insurance Companies

Progressive

RCIS

RLI Surety

SECURA Insurance

Selective Insurance

Southern Pioneer Insurance

Steadily | Landlord Insurance

Stonetrust Workers’ Compensation

Swiss Re Corporate Solutions

The Cincinnati Insurance Companies

The Hartford

Travelers Insurance

UBIC

UFG Insurance

West Bend

Agent Support Network of AmericaASNOA

benefitbay

Capital Premium Financing

ClientCircle

EZLynx

HawkSoft

Imperial PFS

Ironpeak

Keystone

Lewis E Melahn - Attorney-At-Law

Malarkey Roofing Products

Midwest Data Center

Mivation

NCMIC Finance Corporation

Peoples Premium Finance

ResourceVAL, LLC

Roof U.S.

ServiceMaster DSI

UMB Healthcare Services

VIAA

Aegis General Insurance Agency

Alternative Risk Company

AMWINS Access

Arlington/Roe

Burns & Wilcox

Chris-Leef General Agency, Inc.

Cochrane & Company

Conifer Insurance Services

CRC Group

Equipment Insurance International

Gateway Underwriters Agency

Graham-Rogers Insurance

Group Benefits Limited

Insurance Program Managers Group

Insurance Specialties

Irwin Siegel Agency

JENCAP

JM Wilson

Med James

Method Insurance Services

Missouri Rural Services

Novatae Risk Group

One General Agency/Cannabis Insurance Wholesalers

Owner-Operator Services

REInsurePro

Risk Placement Services, Inc.

River Valley Underwriters, Inc.

RT Specialty

SafetyCulture Care Insurance Services

Stuckey & Company

Sycamore Specialty Underwriters, LLC

Trean Corp

W. A. Schickedanz Agency

Walter General Agency

Wholesure

Lori Croy Director of Communications for the Missouri Department of Commerce & Insurance

This article expresses the official views and opinion of the Missouri Department of Commerce & Insurance, which may not necessarily be those reflected by the Missouri Association of Insurance Agents.

agreat deal has happened in the Missouri state government in the past few weeks. Mike Kehoe was inaugurated as the 58th governor in January. He quickly announced his priorities during the State of the State address and promptly got to work putting some of those priorities in motion.

For the Department of Commerce and Insurance (DCI), there have been several personnel changes to share with you.

Mick Campbell was appointed by thenGovernor Parson to serve as the acting director of DCI, beginning Jan. 1, 2025. Mick currently serves as the commissioner of finance and will return to that role when the new director arrives.

Governor Kehoe announced the appointment of Angela Nelson as director of the Department of Commerce and Insurance. She will assume her role effective March 1, 2025. The director position is one that requires Missouri Senate confirmation. Most recently, Nelson served as vice president of public affairs and government relations for AAA Missouri. Prior to that, she had an

familiar name to many of you.

Another new face at DCI is Tyler Hobbs, who joined DCI as the legislative director on January 13. Hobbs most recently served as the legislative director for the Office of the Governor.

The department looks forward to serving Governor Kehoe under Director Nelson’s leadership.

Another item of interest we’d like to share is related to our business entity producer licenses.

In order to streamline processes and create uniformity within our records, the DCI began combining business entity producer (BEP) licenses using the same FEIN and NPN into one record on Missouri State Based Systems (SBS).

This will allow your business to have one renewal period, reducing your renewal fees while eliminating the need to track multiple license expiration dates.

You can expect the following:

• All records with the same FEIN and NPN will be rolled into the parent record and/or the record with the earliest first active date.

• All “doing business as” (DBA) names from the non-surviving licenses will be listed in the alias/trade name field of the surviving record.

• All relationships will remain.

Please email licensing@insurance.mo.gov or call 573-751-3518 with any questions.

in recent months, the AI landscape has been upended by the emergence of DeepSeek, a Chinese-based AI company that is redefining the economics of artificial intelligence. Founded in 2023 as a research-focused spinoff of High-Flyer, a Chinese stock trading firm, DeepSeek has positioned itself as a gamechanger in AI, particularly with its release of two cutting-edge models, DeepSeek-V3 and DeepSeek-R1. These models deliver nearparity performance with industry leaders like OpenAI (ChatGPT), Anthropic (Claude) and Google (Gemini) at a fraction of the cost, which could alter the economics of IA being able to adopt AI technologies.

Key Features of DeepSeek Models

DeepSeek’s V3 and R1 models offer capabilities that make them compelling options for businesses looking to leverage AI:

Performance Parity at Lower Costs: V3 is a conversational AI model comparable to ChatGPT and Google’s Gemini. R1, on the other hand, is a “reasoning model,” designed for solving complex tasks like math, logic and coding problems. Benchmark tests show these models perform within a few percentage points of leading systems like OpenAI’s o1 and Google’s Gemini 2.0 but at significantly reduced prices. For example, the cost of R1’s API usage is reported to be 27 times cheaper than OpenAI’s o1.

Accessibility: DeepSeek’s models are freely available to individual users via its website and mobile apps, and the core technology is open-sourced under the MIT license. This democratization of access allows businesses, including independent insurance agency solution providers, to experiment with the models or host them on their infrastructure without incurring high costs.

Efficient AI Architecture: The company’s

proprietary innovations, such as DeepSeekMoE (Mixture of Experts) and DeepSeekMLA (Memory-Limited Architecture) —a bit geeky, I know—enable its models to operate more efficiently. These advancements lower the computational resources required, which could help smaller solution providers integrate AI tools without expensive hardware.

Implications for Independent Insurance Agencies

What does this mean for you? DeepSeek’s tools open up exciting possibilities for smaller players looking to level the playing field. Here’s how:

Enhanced Customer Interactions: With V3’s conversational capabilities, agencies can implement AI-driven chatbots to improve client engagement, streamline policy inquiries and offer personalized recommendations at a lower operational cost. Imagine clients getting instant answers to their policy questions—at any time of day—without needing an extra team.

Improved Decision-Making: R1’s advanced reasoning capabilities could assist with complex tasks like analyzing risk factors, processing claims and identifying fraudulent activities. Tasks that used to take hours are now done in minutes.

Customization Opportunities: DeepSeek’s open-source models allow larger agencies with the resources to fine-tune AI systems

Steve Anderson catalyit.com

specifically for their workflows, ensuring more relevant and practical applications. It’s like designing a tool that fits your agency perfectly—no unnecessary bells and whistles.

While the potential benefits are interesting, independent insurance agencies should be mindful of the limitations and risks associated with DeepSeek’s offerings:

Privacy and Data Security: DeepSeek’s terms of service allow data processed through its models to be sent back to China and used for future model training. For agencies handling sensitive client information, this raises concerns about data privacy and compliance with local regulations.

Censorship and Bias: Tests seem to show that DeepSeek’s models self-censor on politically sensitive topics and align with official Chinese government positions. While this may not directly impact most insurancerelated tasks, it highlights potential bias in specific contexts.

Geopolitical Risks: As a Chinese-based company, DeepSeek’s future availability and usability could be affected by international

trade restrictions or regulatory actions, particularly in the United States. Solution providers adopting these tools should have contingency plans in case of sudden access limitations.

Real-World Reliability: While DeepSeek’s models perform well in benchmarks, anecdotal evidence suggests occasional inconsistencies in real-world applications. Their models should be thoroughly tested for specific use cases before full implementation.

The Broader Context

DeepSeek’s emergence is also reshaping the existing AI industry. By demonstrating that cutting-edge models can be developed with lower budgets and older hardware, the company is challenging traditional assumptions about the high costs of AI development. DeepSeek has sparked competition and forced major players like OpenAI, Anthropic, Meta and Google to rethink their strategies, potentially accelerating innovation.

The geopolitical implications of DeepSeek’s success cannot be ignored. The company’s advancements will likely increase tensions in the global AI race as the U.S. and other countries grapple with the rise of Chinese AI capabilities. This uncertainty may influence how American companies, including insurance agencies, view the adoption of Chinese-developed AI solutions.

DeepSeek is changing the AI space. Its models’ affordability and open-source availability could democratize access to advanced AI capabilities, enabling smaller agencies to compete more effectively in an increasingly data-driven market. However, potential adopters should weigh these benefits against privacy, bias and geopolitical stability concerns.

By staying informed and vigilant, independent insurance agencies can leverage DeepSeek’s innovations while mitigating associated risks.

et's face it, everyone likes to get money back. While most people are familiar with tax refunds and rebates from home improvement stores, did you know a portion of your marketing expenses can also qualify for reimbursements of up to $1,000? Wouldn’t it be nice to get a portion of your online advertising expenses reclaimed, including ads on YouTube and Hulu? Or maybe offset some of the costs of having your website redesigned? As a Big "I" member, you have access to an array of Trusted Choice marketing resources designed to help you amplify your local marketing.

With the Marketing Reimbursement Program, Trusted Choice will reimburse a portion of expenses made in either digital marketing, marketing education or services provided by select TechCompare vendors.

Trusted Choice’s reimbursement options in digital marketing can help you reach customers in new ways! Funds can be utilized for social media advertising, graphic designer costs, digital display ads, targeted ads on YouTube and Hulu, in-app ads like Nextdoor, and countless other digital options.

For 2025, marketing education has been added as one

of the approved reimbursement categories! Reimbursement funds can now be used toward approved marketing education courses or marketing conference registration costs. Recommended course topics include general marketing, small business marketing, social media marketing, SEO and other marketing-related topics.

TechCompare services is another popular reimbursement category that connects you to vendors offering services such as websites, SEO, digital marketing, automation, social media management and more! This allows you to take advantage of specialized services to help your agency stand out from the rest.

Reimbursements are made at 50% of final cost with a maximum reimbursement of $1,000. Members can only be reimbursed a maximum of $500 for any one TechCompare vendor with the MRP designation. To qualify for the full $1,000 reimbursement, the member must provide documentation showing that $2,000+ was spent.

For full program details or to submit a reimbursement request visit https://trustedchoice.independentagent.com/MRP today!

insurPac raises and distributes approximately

$2.4 million each election cycle, making it one of the largest small business PACs in the country. Established in 1975 as a complement to IIABA's legislative program, it has since also become one of the largest property-casualty insurance PACs in the country, funded by voluntary personal, LLC and partnership contributions from independent agents, brokers and agencies across the country.

MAIA would like to thank our members who collectively contributed over $29,700 in individual contributions to InsurPac in 2024.

PLATINUM CLUB ($2,500 - $4,999)

Mitchell Mills, Mills & Sons

CENTENNIAL CLUB ($1,000 - $2,499)

Darin Banner, Acrisure Midwest

Tony Becker, Custom Insurance Services

Tom Berra, Charles L Crane Agency Company

Scott Brothers, The Insurancenter

Brad Greer, Arnold Insurance

Dennis Luebbering, Luebbering Insurance Agency

Tami Mills, Mills & Sons

Ryan Sanders, Rich & Cartmill

Paul Schroeder, Schroeder Insurance Agency

GOLD CLUB ($500 - $999)

Randy Baker, TR Baker Insurance Agency

Steve Butz, Crawford-Butz & Associates

Doug Clift, Arnold Insurance

David Hall, Ozark Hills Insurance

Brian Harrison, Harrison Agency

Keith Inman, Inman Insurance

Deena James, St. Louis Insurance Services, LLC

Randal Kraft, Kraft Insurance Services

Jim Neuner, Winter-Dent & Company

Richard Ollis, Ollis/Akers/Arney

Randy Smart, Smart Insurance Agency

Brent Speight, Scott Agency

Jean Sundlof, Kraus-Anderson Insurance

PIONEER CLUB ($250 - $499)

Zac Abell, The Zac Group

Sandy Andrew, Andrew & Associates LLC

Matt Barton, Missouri Association of Insurance Agents

Belinda Brenizer, Hawkins Insurance Group

Chase Brenizer, Hawkins Insurance Group

JL Brenizer, Hawkins Insurance Group

Nick Brenizer, Golden Rule Insurance Agency

Charlie Brown, Baker Welman Brown Insurance & Financial Services

Paul Carcagno, Southern Insurance Services - Arnold

Christian DeLozier, Mike Keith Insurance

Heath Greer, Arnold Insurance

Kay Johnson, The Daniel & Henry Company

Chris Liese, Burton-Liese Government Relations

Paul Long, Ollis/Akers/Arney

Lee Lottes, Lakenan

Kyane Marble, Hawkins Insurance Group

Tom Montileone, Barker-Phillips-Jackson

Charles Rush, Cook Insurance Agency

Darren Smiley, Gallaher Insurance Group

Jon Stahly, WE Walker - Lakenan

Cansada Stark, Jenks/Long Insurance

FOUNDERS CLUB ($150 - $249)

Devona Allen, Nimmo Insurance Agency

Jim Baxendale, MGI Risk Advisors

Steve Beimdiek, Beimdiek Insurance Agency

Grant Bowen, Custom Insurance Services

Frank Curotto, Kreismann-Bayer Insurance Agency

Ryan Gerstner, Prime Insurance Agency

Laura Green, Anderson & Green Insurance Agency

Gary Holeman, Benchmark Insurance Agency

Ross Ingersoll, Ingersoll Insurance Agency

Louis Landwehr, Winter-Dent & Company

Melodie Smith, Lindenwood Agency

Matt Speight, Scott Agency

Doug Twigger, Auto-Owners Insurance Company

Sheryl Van Leer, Missouri Association of Insurance Agents

Mollie Wells, O'Connor Insurance Agency

Brent Westhoven, Beimdiek Insurance Agency

GENERAL CONTRIBUTOR (up to $149)

Chase Aldrich, JM Wilson

Wayne Alexander, Alexander Insurance

Robert Alldredge, Fairfax Agency

Brandi Anderson, Nationwide

Jed Angell, Angell & Company

Mike Block, Barton Mutual Insurance Company

Lucinda Burton, Abel Insurance Agency

Gabe Carlock, Madison Mutual Insurance Company

Jean Castaldo, EMC Insurance

Jennifer Creed, J Creed Agency LLC dba Black Swan Solutions

Dorian Culver, Stafford-Leavitt Insurance

Bill Eads, MGI Risk Advisors

Stacey Eickhorst, Luebbering Insurance Agency

Ruth Elledge, Risk Placement Services, Inc.

Theresa Flippin, Missouri Association of Insurance Agents

Kelsey Flynn, K Flynn Insurance Agency

Barrett Glascock, Glascock Agency

Tyler Goecker, JM Wilson

Linda Hathaway, Corner Stone Insurance Agency of SW City

Mark Hill, Windmill Insurance Agency

Matt Kujath, Winter-Dent & Company

Steve Lang, Lang Insurance Service, Inc.

Mark Lohrman, MGI Risk Advisors

Diane Luebbering, Luebbering Insurance Agency

Steven Mallow, Acrisure Midwest

Karen Mantle, Mills & Sons

Charles Moffitt, Morse-Harwell-Jiles Insurance Agency

Brian Mouse, All American Agency Group

Glenn Muenks, Muenks Insurance Agency

Todd Obergoenner, WE Walker - Lakenan

Regan Ours, JENCAP

Lisa Oxenhandler, Recruiting for Growth

Jeremy Pounds, BUI

Shelli Rainey, Graham-Rogers Insurance

John Riddle, Saint Joseph Insurance LLC

Colleen Signorelli, The Daniel & Henry Company

Jessica Simpson, DECO Insurance Agency

Kimberly Smith, Mid USA Insurance Agency

Aaron Stewart, BMI Company, Inc.

Caleb Sumner, Sumner Insurance Services

Stacy Sweany, Horace Mann

Jared Underwood, Ozark Hills Insurance

Tara Varner, Varner Insurance Agency, LLC

Richard Volk, Volk's Avanti Insurance Agency

John Walsh, MGI Risk Advisors

David Wiersma, West Bend Insurance Company

Sheryl Van Leer Chief Operating Officer, MAIA

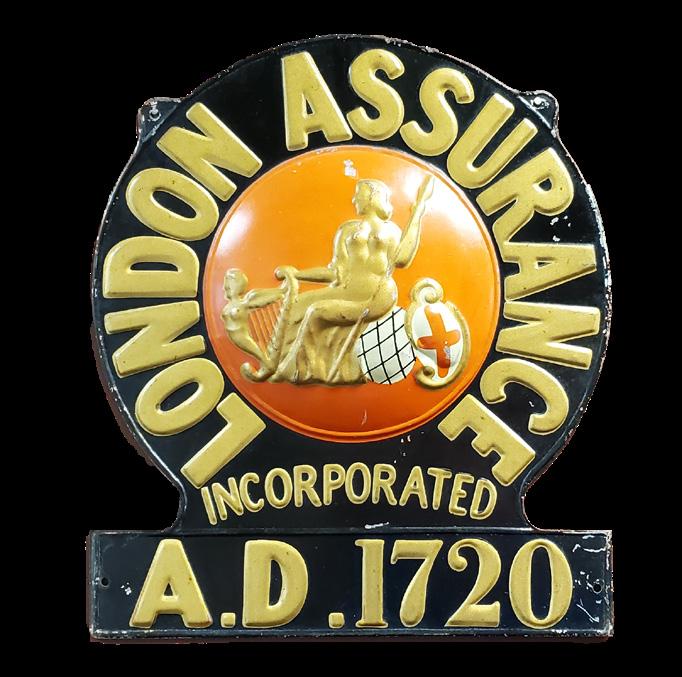

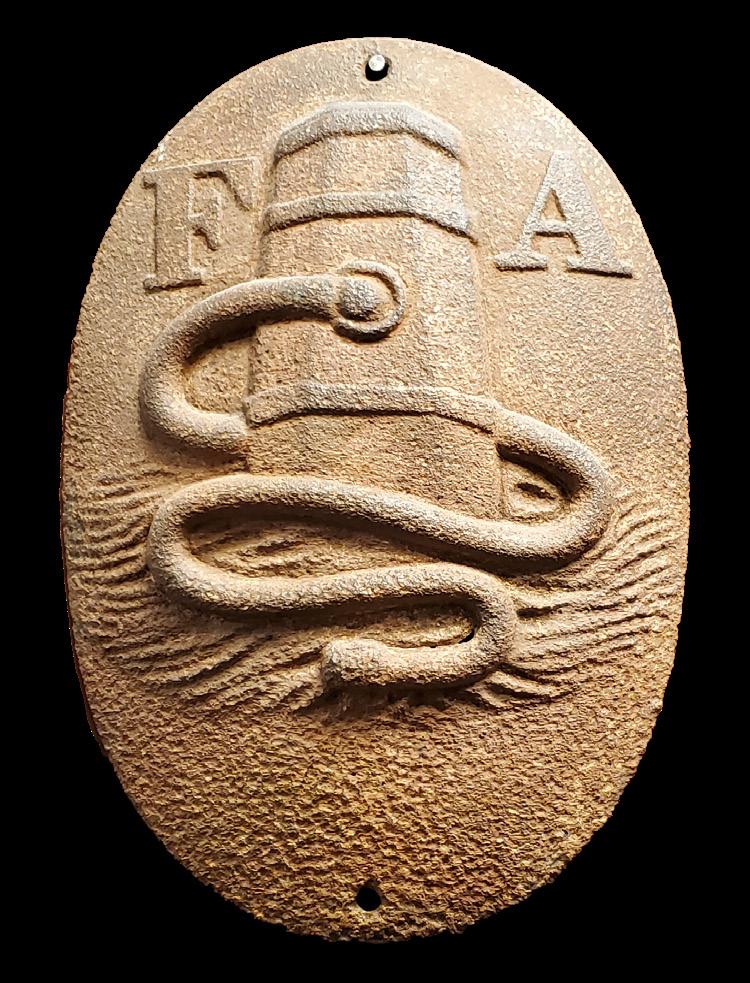

imagine your house is on fire, the fire department shows up, but not finding the proper fire mark on your house, they turn around and let your house burn. Sound crazy? In today’s world it is (can you imagine the lawsuits from potentially countless property owners if that happened today?). In 17th-century England, however, your home may have actually been left to burn.

After the Great Fire of London in 1666, insurance companies started forming to provide financial security in case of fires, and these companies created their own private fire brigades. Each company provided a plaque (what we now call a fire mark) for their customers to display on their homes showing that they were covered by that company, so the fire brigades would know at which houses to extinguish fires.

The first fire insurance in the United States dates back to 1752 when Benjain Franklin and associates created the Philadelphia Contributionship, which still operates as an

insurance company to this day. By this time, however, volunteer fire departments were prevalent, and they would extinguish all fires, not just those at properties insured by a specific company.

This did not diminish the use of fire marks, however. These often-colorful plaques, typically made of lead, iron or some other metal, were still distributed to insureds to place on their homes and businesses. These not only provided advertising for the insurance companies, but they were also seen as a sign of responsible property ownership and were thought to be a deterrent to arsonists. If an arsonist’s goal was to cause monetary loss for the property owner, the fire mark showed that the owner would be made whole. There was also a fear that an insurance company might pursue the arsonist in order to recoup their losses.

Fire marks continued to be used as advertising by some insurance companies well into the 20th century. And while it’s likely you never received one from your insurance company, if you look up at some

of the historic buildings throughout the country, you will still find these plaques displayed.

If you’ve ever been to the MAIA office and looked at the wall outside the board room, we have a collection of fire marks from around the world. This collection was donated to us many years ago by Morton Werner.

And in case you were wondering, yes, there is a name for those that collect and study fire marks: signevierists.

every day, lawmakers are being presented with new bills by groups, committees and lobbyists with the hope that they will become law. While many of these bills start with the best of intentions, have they considered every aspect of whom or what this proposed law would affect? In January, we took a behind-the-scenes look at the intended and unintended ways some laws relate to you, your agency and your clients. Some of these laws were specific to the insurance industry, while others generate unforeseen impacts from other areas.

Take “SB 398 – Enacts Provisions Related to Motor Vehicles” for example. While the original purpose of this bill, which was signed into law by then-Governor Mike Parson on July 6, 2023, and became effective on Jan. 1, 2024, prescribed how motor vehicle franchisees are to be compensated for warranty and other factory compensated repairs, the bill ballooned into one that addressed a myriad of issues generally pertaining to motor vehicles, including prohibiting the use of cellular devices while operating motor vehicles. Also included in this bill was the requirement that licensed automotive dealerships collect sales tax at the time of sale before receiving a temporary tag for the vehicle instead of allowing the purchaser to pay the sales tax at the time of registration at a license office. One would have hoped this would curtail the number of expired temporary tags seen on the roadways; however, this bill did not take into account the fact that the customer must provide proof of insurance among other documents at the time of registration. Sure, the state will have received its share of tax income on the sale of the vehicle, but nothing changed as far as requiring insurance at the time of sale. Another insurance-related impact is now the automotive dealerships are handling more money and it is up to the dealership to maintain security of those funds as well as the responsibility of submitting them to the Missouri Department of Revenue. While this may not seem like a huge difference compared to the current prices of new and used cars and the amount of money the dealership takes in on sales every day, the risk of theft increases with the additional money held on-premise. In turn, this increased risk could potentially affect the insurance coverage of the automotive dealership. This was just one of many examples discussed at the Risk Specialist Series class “Wait…That Insurance Law Would Affect My

On May 8, MAIA is holding the next class in the Risk Specialist Series on “Insuring NonProfits.” Attendees will get an eye-opening perspective that delves into the unique insurance needs of non-profits and the essential risk prevention services that agents can offer. Uncover the key coverage needs, common gaps and essential risk management tips for different types of non-profits. Also covered will be the similarities and differences between social service operations and sports and recreation operations. Take a deep dive into directors and officers coverage for nonprofit entities and explore the intriguing realm of claims exposures, risk management techniques and real-life claim scenarios organized by line of coverage. This class will be offered both in-person at the MAIA office in Jefferson City as well as online and is approved for one general and seven property-casualty CE credits in both Missouri and Kansas. Register today by scanning the QR code or by going to https://moagent.org/RSS.

Joe Lawton Director of Marketing & IT, MAIA

Scan to register for the May 8 session RSS: "Insuring Non-Profits"

Kandis M. Bass, Odessa, Mo., voluntary forfeiture of $850

Bob Naucke Insurance Agency, LLC, Cedar Hill, Mo., voluntary forfeiture of $850

Geoffrey Brady, St. Charles, Mo., refusal to renew license

Amanda Burnham, Carthage, Mo., refusal to issue license

Alexander DeVonte Demmings, Peachtree Corners, Ga., refusal to issue license

Chelsie Renee Maas, St. Ann, Mo., refusal to issue license

Timothy R. Vonder Haar, Fenton, Mo., voluntary forfeiture of $5,100

Advantica Insurance Company, St. Louis, Mo., examination report adopted with curative action ordered

CSD Insurance Pool Inc., Manchester, Mo., examination report adopted with curative action ordered

Delta Dental of Missouri, St. Louis, Mo., examination report adopted with curative action ordered

American Bankers Insurance Company of Florida, Miami, Fla., stipulation of settlement

GEICO Casualty Company, Fredericksburg, Va., stipulation of settlement and voluntary forfeiture of $29,750

Good Health HMO Inc, Kansas City, Mo., stipulation of settlement and voluntary forfeiture of $4,500

Nationwide Mutual Insurance Company, Columbus, Ohio, stipulation of settlement and voluntary forfeiture of $500

Nationwide Mutual Insurance Company, Columbus, Ohio, stipulation of settlement

Permanent General Assurance Corporation, Nashville, Tenn., stipulation of settlement and voluntary forfeiture of $6,000

Grounded in our commitment to the agent-broker distribution channel and to small businesses nationwide, we are excited about a refreshed approach to our products, pricing, service, and so much more in 2025!

(You should be, too.)

This course reviews property deductibles, including a discussion of flat, percentage and catastrophe deductibles as well as deductible buyback policies. We will discuss the different types of general liability deductibles that may apply, as well as how the selfinsured retention in an umbrella policy functions. Lastly, we will address the application of deductibles for auto physical damage coverages.

MAIA is offering two scholarships for the Missouri Agents Connection Summit in July. You can find applications for the scholarships at www.moagent.org/MACS. Deadline to apply is May 1, 2025, with winners to be announced by May 15.

This scholarship consists of a full registration fee for the MAC Summit and two nights’

hotel stay at Chateau on the Lake, Branson. The applicant must be between the ages of 21 and 40; employed by an MAIA member retail agency; have never attended the MAC Summit (or Joint Leadership and Young Agents Conference); and the scholarship must be used for the 2025 MAC Summit.

This scholarship consists of a full registration fee for the MAC Summit. The applicant must be employed by an MAIA member retail agency; have never attended the MAC Summit (or Joint Leadership and Young Agents Conference); and the scholarship must be used for the 2025 MAC Summit.

The Missouri Insurance Education Foundation (MIEF) was formed as a nonprofit corporation in 1991 to promote public insurance education. MIEF offers four $1,500 scholarships to Missouri high school graduating seniors interested in or intending to pursue an insurance, risk management or actuarial science course of study at a Missouri college or university. There are also scholarships available to deserving Missouri resident students majoring in insurance or a related area of study at a Missouri college or university. There is one $2,500 C. Lawrence Leggett Scholarship and five $2,000 scholarships available, one of which is named after former long-time MAIA employee, Judy Bish. To qualify for these, the applicant must be a junior or senior at an accredited college or university in Missouri during the fall semester of 2025. There is also one $2,500 C. Donald Ainsworth Scholarship for a

deserving college student from the St. Louis metropolitan area majoring in insurance or a related area of study at a Missouri college or university.

Applications for these scholarships must be received by March 31, 2025. The selection of recipients is made by the MIEF scholarship committee. Find the applications at mief.org.

MAIA’s annual awards are one way to recognize and promote the valuable role that independent agents and companies fulfill on the local and state level as small business owners, employers, consumer advocates, industry professionals, civic leaders and community volunteers.

MAIA presents four awards each year that are nominated by our membership: Insurance Person of the Year, Young Agent of the Year, Company Representative of the Year and Top Partner. Members are encouraged to nominate deserving individuals and companies for one or more of these awards. Nomination forms can be found at www. moagent.org/awards. The 2025 honorees will be recognized Thursday, July 24, at our Missouri Agents Connection Summit. Nominations will be accepted until May 1, 2025.

The Risk & Insurance Education Alliance mourns the loss of two remarkable leaders and cherished colleagues, Dr. Victor Puleo and Kevin Brady, who both passed away in early January. Their contributions to the risk and insurance industry, as well as to education and mentorship, have left an indelible mark on our community.

Kevin Brady, CIC was a regional director for ARTEX Risk Solutions, a division of Arthur J. Gallagher Co., where he specialized in the development and marketing of captive insurance programs. With expertise spanning group, rent, segregated cell, single-parent captives and program business, Kevin was a trusted authority in the field.

Kevin’s dedication to the industry extended to his nine years of service on the Society of Certified Insurance Counselors

Board of Governors, including a term as chairman, from 2008 to 2013.

Dr. Victor Puleo, Jr., Ph.D., CIC, CFP, served as the Davey Chair of Risk Management and Insurance at Butler University’s Lacy School of Business in Indianapolis, Indiana. A distinguished scholar and educator, Dr. Puleo earned his doctorate in risk management and insurance at Florida State University. His academic work has been published in esteemed journals such as the Journal of Insurance Issues, Risk Management and Insurance Review, Managerial Finance and Best’s Review.

Victor served on the Risk & Insurance Education Alliance Research Academy Board from 2016–2022 and was chair in 2019 and 2020. During his service, his friendship, educational insights and support were irreplaceable.

The passion he had for education and innovation will continue to inspire future generations of industry professionals. His mentorship, vision and dedication will be deeply missed.

Aflac, Logan Bax, Lee’s Summit benefitbay, Ian Still, Grain Valley EZLynx, Stacey Eickhorst, New Bloomfield Mivation, Seth Preus, Spokane, Wash. Peoples Premium Finance, Andy Turley, Lee's Summit

ResourceVAL, LLC , Jonathan Eickhorst, New Bloomfield

Roof U.S., Logan Reuter, Columbia Trean Corp, Alon Cohn, Wayzata, Minn.

WalkerHughes Insurance Acquires Independent Brokers Agency LLC

St. Louis-based Independent Brokers Agency LLC (“IBA”) has been family-owned and -operated for more than three decades. IBA’s ownership saw an opportunity to accelerate their growth through the investment and support of WalkerHughes. Heather Wessels, principal of IBA, and Mike Swatske, partner of IBA, will continue managing the St. Louis, Missouri, office as valuable members of the WalkerHughes team.

“We are excited to have IBA become part of the WalkerHughes story as we continue to expand our capabilities and geographic footprint,” said Benjamin Schoettmer, CEO of WalkerHughes. “IBA has an excellent reputation in their local community. WalkerHughes is proud to bring them on board and welcome Heather and Mike as key leaders in our expansion to Missouri.”

The IBA team will join the WalkerHughes family with Heather and Mike assuming local leadership and continued business development roles as regional directors,

focused on supporting the agency’s continued expansion efforts in Missouri.

“We met WalkerHughes and realized nearly immediately that our values and heart for people, community and service aligned beautifully with theirs,” said Heather Wessels. “We found in them an amazing partner with which we can enhance our client service through our combined expertise and shared culture. We are so excited for the next steps together!”

Mike Swatske added, “Joining WalkerHughes opens a world of opportunities for clients, allowing us to provide even greater value. We are thrilled to bring WalkerHughes to Missouri and build a differentiated regional platform.”

Brawner Insurance Agency, Inc., Jared Brawner, Kirksville

Hereth Insurance Consulting, Richard Hereth, Columbia Jain Insurance Agency, Priti Jain, Ellisville Petre Insurance LLC , Tony Petre, Macon Wholesure, Nick Schnarre, St. Peters

Travelers Recognized for Military-Friendly Culture

Toward the end of 2024, the Travelers Companies, Inc. earned the Gold rank on VIQTORY’s Military Friendly® Employer list, in addition to maintaining recognition on VIQTORY’s Military Spouse Friendly® Employer, Military Friendly® Supplier Diversity Program and Military Friendly® Company lists. Travelers was also once again named to the Military Times Best for Vets Employer list.

“We have a long-standing tradition of supporting the military community, and it’s an honor to be recognized for our efforts,” said Diane Kurtzman, executive vice president and chief human resources officer at Travelers. “We are proud to uphold a number of initiatives designed to create an inclusive workplace where military families feel welcomed and have the opportunity to thrive.”

Travelers has been named a military-friendly workplace for nearly two decades because of its robust suite of programs aimed at supporting the military community. Initiatives include:

• An employee resource group focused on building awareness of veterans’ skills and experiences. Since its launch in 2013, the Military/Veterans & Allies Diversity Network has grown to more than 3,300 members.

• A recruiting initiative designed specifically to help military spouses build their careers. Since 2020, the company has hired more than 300 military spouses and recently created a forum where they can come together to share tips, exchange resources and offer support to one another.

• An alliance with American Corporate Partners, a national nonprofit that helps veterans discover their next careers. Since 2010, Travelers employees have completed more than 900 mentorships with post-9/11 veterans.

• Comprehensive benefits for employees deployed on active duty, including full benefits that are in addition to supplementing employees’ military pay for up to five years of their deployment.

The company has signed the Statement of Employer Support of the Guard and Reserve at both state and national levels and participates in the Department of Defense Military Spouse Employment Partnership, which connects military spouses with partner employers

committed to recruiting, hiring, promoting and retaining military spouses. Travelers has also been recognized as Partner of the Year by Code Platoon, an Employer for Outstanding Support by the U.S. Navy Reserve, and a Beyond the Yellow Ribbon company by the Minnesota National Guard.

To learn more about military-friendly programs at Travelers, visit Travelers.com/ military.

Acuity announced that in 2024 the company surpassed $3 billion in annual revenue for the first time in its 99-year history. The insurer’s growth rate of nearly 20% generated more than a half billion-dollar increase in topline revenue, an all-time record.

Acuity’s 2024 revenue increase was paired with the highest policy count growth in the insurer’s history with gains in both personal and commercial lines.

In personal lines, the company grew over 34% to surpass $820 million in revenue, which included an all-time high of nearly $184 million in new business written premium. In commercial lines, Acuity wrote nearly $470 million in new business premium, helping fuel a total commercial written premium increase of over 15% from 2023. The insurer’s strategy of increasing its workers’ compensation business also saw strong results, with new business written premium growth for the line of over 50%.

Importantly, Acuity’s increase in revenue continues to be supported by financial strength. The insurer’s A+ financial strength ratings were reaffirmed by both AM Best and Standard & Poor’s in 2024.

At a December 2024 Town Hall meeting, Acuity employees determined the distribution of $500,000 among six different charitable organizations. Those organizations included Conquer Cancer, the ASCO Foundation; Fresh Meals on Wheels; Mental Health America (MHA); Safe Harbor; The Salvation Army; and Sharon S. Richardson Community Hospice.

Based on employee votes, MHA Lakeshore received the largest allocation of over $170,000. The other five groups each received

donations ranging from nearly $45,000 to more than $90,000. Each employee was also invited to choose any qualifying charity to receive a $100 donation from Acuity, equaling an additional contribution of nearly $180,000.

This is the 12th consecutive year that Acuity employees have directed a special year-end contribution, which adds to the company’s longstanding tradition of philanthropy.

Several of Acuity’s communication projects have earned awards for creativity in national and international competition in 2024. In the educational videos category, AVA Digital Awards were presented for several educational videos including Only Ethics in This Agency, When Disaster Strikes, Work Comp Confidential and several others. Other award categories included Annual Report Awards and Other Creative Awards, where they received awards and recognition for their 2022 and 2023 annual reports as well as their happy birthday and happy holidays videos.

JM Wilson Announces Promotions and New Hire

JM Wilson is pleased to announce the promotion of Lesley Boles to senior personal lines underwriter. She is responsible for underwriting new and renewal personal lines risks and strengthening relationships with carriers and independent insurance agents in all states where JM Wilson writes business. With an increased level of product knowledge, Lesley is a leader and resource to other underwriters in her department.

Also recently promoted is Paige Craft, who is now a surety renewal underwriter. She is responsible for the renewal process of commercial bonds and will be preparing and presenting surety quotes as well as negotiating with carriers for optimal rates and coverage for independent insurance agents in all states that JM Wilson serves. Returning to JM Wilson is property and casualty underwriter, Ethan Vandermarliere. Ethan, who previously served JM Wilson as a transportation underwriter, is now taking on responsibilities to include underwriting

a wide variety of new and renewal commercial property and casualty risks, as well as maintaining relationships with carrier underwriters and for independent insurance agents in all states served by JM Wilson.

SECURA Insurance Promotes Wedig

SECURA Insurance has promoted Carol Wedig to vice president–chief information officer. Wedig joined SECURA's human resources department in January 2002. During her time with the company, she has held a variety of roles in HR, personal lines, commercial lines, continuous improvement, and most recently as vice president–information technology.

"Carol embodies the qualities we look for in a great leader," said Larry Wright, SECURA SVP and chief claims officer. "She brings valuable insights through her years of industry experience, and she will continue to play an important role as SECURA grows."

Osborn named VP of Actuarial Services

Grinnell Mutual has named Rick Osborn as its new vice president of actuarial services, a new division at the company, effective Jan. 17, 2025.

The division was created last year to bring all the company’s actuarial expertise under one umbrella, and to expand capabilities in the granular pricing and predictive modeling that is becoming more and more important in the industry.

Osborn joins Grinnell Mutual with more than 29 years’ experience in actuarial work for the insurance industry, 16 of those at an assistant vice president or vice president level. He worked for more than 20 years at Nationwide Insurance in various roles.

Osborn started his career as an assistant actuary and worked at Grinnell Mutual from 1998 to 1999, and the company is excited to have him back on the Grinnell Mutual team.

The position is the top leadership position in the actuarial services division and reports to the president. Osborn’s role includes overseeing product pricing, valuation, capital modeling, actuarial analysis and reporting for both direct lines of business and assumed reinsurance. He will also oversee strategic and operational activities for the actuarial teams.

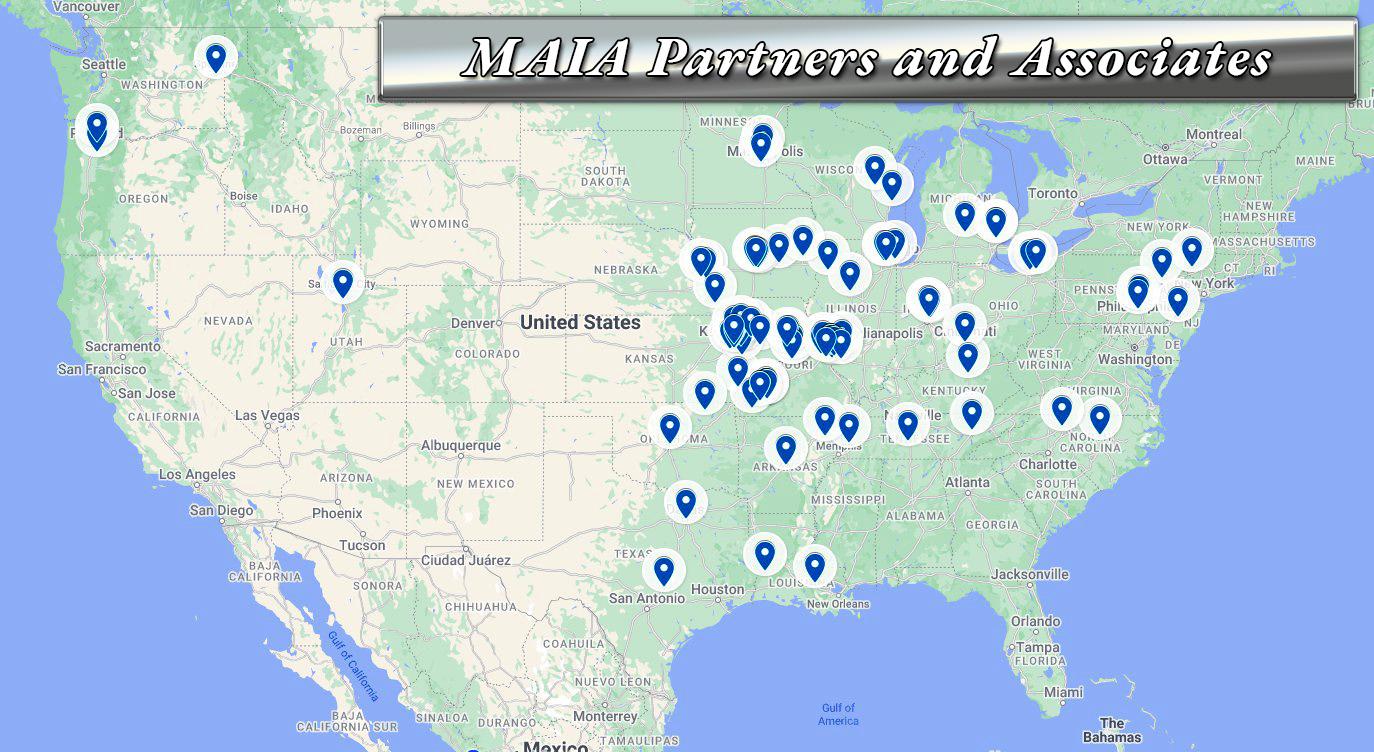

These companies

support the independent agency system and the Missouri Association of

Agents.