AGENT MISSOURI

Matt

to

Matt

to

3315 Emerald Lane, Jefferson City, Mo. 65109

Phone: 573-893-4301 • Fax: 573-893-3708

Email: maia@moagent.org Internet: www.moagent.org

Publisher Matt Barton

Officers of MAIA

President Dennis Luebbering, Jefferson City

President-Elect Matt Speight, Montgomery City

Vice President Deena James, Manchester

Secretary-Treasurer Jim Neuner, Jefferson City

IIABA National Director Brad Greer, Chesterfield

PIA National Director Randy Smart, Marionville

Imm. Past President Darin Banner, Bolivar

Board of Directors

Region 1 Ross Ingersoll, Savannah

Region 2 Matt Alexander, St. Charles

Region 3 Holly Stark, Harrisonville

Region 4 Mark Baker, Platte City

Region 5 Rick Prather, Jefferson City

Region 6 Tony Becker, Crystal City

Region 7 Paul Carcagno, Arnold

Region 8 Heath Greer, Chesterfield

Region 9 Parker Mills, Clinton

Region 10 Richard Ollis, Springfield

Region 11 David Hall, West Plains

Region 12 Jeremy Anderson, Sikeston

At-Large #1 Andy Reavis, Billings

At-Large #2 Clare Zanger, Ozark

At-Large #3 Jon Stahly, Cape Girardeau

Co. Rep. Amber Truskowski, South Jordan, Utah

Co. Rep. Tracey Hagy-Kelly, Creve Coeur

MAIA Staff

Chief Executive Officer Matt Barton

Chief Operating Officer Sheryl Van Leer

Director of Insurance Services Theresa Flippin, AIP, CISR

Director of Education & Events April Underwood

Director of Marketing & IT Joe Lawton

Assistant Director of Insurance Services Hannah Wall

Database Administrator Laura Berendzen

Accounting Specialist Paula Wolken

Customer Service Representative Sarah Wright

Marketing Coordinator Mary Feller

Administrative Assistant Leslie Powell

MISSOURI AGENT (USPS 709-210) is published bimonthly by the Missouri Association of Insurance Agents, 3315 Emerald Lane, Jefferson City, Mo. 65109, Phone: 573-8934301. Periodical postage paid at Jefferson City, Mo. and additional mailing offices.

MAIA does not necessarily endorse any of the companies advertising in this publication. Additional subscriptions are $30 per year.

Address & Other Changes

Notify Missouri Agent if you change your address, change your agency name, or drop or change producers (who are voting members of the association). Write to: Missouri Agent, 3315 Emerald Lane, Jefferson City, Mo. 65109 or email: maia@moagent.org.

POSTMASTER: Send address changes to Missouri Agent, 3315 Emerald Lane, Jefferson City, Mo. 65109.

© 2025 Missouri Association of Insurance Agents

hy are we members of the Missouri Association of Insurance Agents? I often ponder this question when people ask me why I believe in our association. The reason I ponder this question is I have been trying to find a quick one- or two-liner response that tells the story. I simply can’t come up with anything in a short version. I end up giving an entire page of reasons, but I have no quick answers. The reason I am interested in this is I would love to add a link or two in the membership section on the www.moagent.org website that we can point prospective members to in order to whet their appetite and give some practical reasons to belong to our association. We already have a cool flyer called “Why MAIA?” Check it out. I guess what I have in mind are some testimonials and things of that sort that can bring it down to a personal level. There are many business reasons, but what are our personal reasons for belonging? We all join for some of the same reasons, but there are also variations among our memberships as to the why we belong. If you think of some cool things, email me! I would love your feedback!

wSo, what is your “why” and how would you convey that to a prospective member if they point-blank asked why you belong? I will spend the rest of our time together explaining my “why” and what it is that gives me such a feeling of greatness simply by belonging to this association. I am going to condense this a lot because I could list probably 50 to 75 reasons why I love this association. I’ll name some of my top whys, and not necessarily in order of importance to me.

The first thing that comes to mind is the people I have met that are in this organization. It would be you, the members. We are competitors, but good friends that help one another strive to reach higher levels of accomplishment. As an industry we tend to be well-trained in what we do, knowledgeable, compassionate to others, and yet we help one another. How cool is that?

The second reason that comes to mind is the training and educational events that are available to members. We attend classes with our peers, we share with one another, and we learn from

instructors and mentors. Our organization brings top quality training programs to the membership, and we are always striving to bring more value by expanding educational opportunities. We have inperson, virtual and hybrid training, where some people attend in person and some are online at the same time.

The third thing I love is we take all that we know and have learned and impart that knowledge to our clients and the public in order to secure their future by selling our insurance and related products. We provide a service that is much needed. As you all know, sometimes what we do is not appreciated until there is a claim. But, what we do on a daily basis really does keep the families and businesses protected and able to thrive even during or after a major loss. We allow America to “keep the lights on and remain open for business” no matter the claim that causes a temporary setback.

The fourth area of satisfaction comes from knowing we are involved in the legislative process. This is what makes America great! We have a legal process that helps us to pass laws that protect and guide businesses’ and individuals’ rights and freedoms. No, it is not perfect, but if we all stay involved and work together it creates a better future for all of us!

The fifth and final reason I am going to list today is our association staff. Matt Barton’s heart and passion for this association and his dedication to “the cause” is second to none, and Sheryl Van Leer has that same tireless dedication to our association. Those folks, along with the other nine staff members, have our backs day in and day out, and my appreciation for our association staff is immeasurable. They are awesome!

So, my top five “whys” are members, education, clients, government involvement and association staff. When you break it all down it pretty much comes down to relationships!

Thank you to all the members, association staff and board members for all your support and dedication to MAIA.

Dennis Luebbering, president, MAIA

ican’t recall a year when I’ve heard more people comment that they are glad that the elections are over. Whether it was the primary election or the general, it’s hard to argue that there was a previous election that was more contentious than this year, and it wasn’t present only on a national scale, as state elections (Missouri included) displayed a level of vitriol that I highly doubt has ever been exceeded. As some of you know, I enjoy reading about presidential history, and I read a book a few years ago about the 1800 election between John Adams and Thomas Jefferson. It was an election that changed politics forever, being the first highly contested race with allegations including infidelity, treason and being obese thrown about. Wow, if they could see today’s elections!

to advocating for independent agents and had already secured an exemption from the reporting requirements for insurance agencies on the basis that agencies already report this information to state departments of insurance, the actual entities that have regulatory jurisdiction over the insurance industry. As such, you are not subject to the reporting requirements found in this part of the CTA.

"... the Big 'I' was ahead of the game, as usual, when it comes to advocating for independent agents and had already secured an exemption from the reporting requirements for insurance agencies..."

Matt Barton

However, even though I do enjoy reading about a good political scandal, more useful to me and to MAIA’s members are substantive actions that actually assist us in our daily lives. In that vein, I want to call your attention to three particular areas in which your association has been active during the past year in advocating on behalf of independent agents.

A decision was handed down by a Texas federal appeals court in December that blocks (at least for now) the implementation of the Corporate Transparency Act (CTA) and the onerous obligations it places upon the financial services industry. The crux of the lawsuit that was heard is that Congress exceeded its authority when it passed the CTA, as the act attempts to regulate incorporated entities whether those entities conduct commercial activity or not. The language of the CTA would have required that tens of millions of entities disclose their beneficial owners to the U.S. Treasury Department’s Financial Crimes Enforcement Network.

That decision notwithstanding, the Big “I” was ahead of the game, as usual, when it comes

Another area in which you directly benefit from the action of our government affairs team is in the area of protecting your book of business. The U.S. Federal Trade Commission (FTC) introduced a draft rule in January 2023 which would have sought to severely limit the instances in which a business owner, including an insurance agency owner, may utilize noncompete agreements to protect their books of business. While noncompete agreements are not used by all member agencies, according to just an informal poll of agencies, many agency owners indeed require these agreements be in place between themselves and staff in order to ensure that departing staff do not attempt to pirate clients and business from the previous employing agency.

The Big “I” government affairs team lobbied the FTC regarding independent insurance agents’ use of the agreements, requesting that the rule be either rewritten or struck altogether. The rule that includes the ban on noncompete agreements was scheduled to go into effect Sept. 4, 2024; however, in July a Texas court issued a preliminary injunction blocking the rule from going into effect. While the FTC initially indicated that it would appeal the decision, I estimate that highly unlikely with a Trump administration taking office in January. So, until further notice, MAIA members may continue use of noncompete agreements. I would be remiss if I did not caution you, though, to ensure such agreements are drafted in a

Matt Barton chief executive officer, MAIA

note: The following article is a reprint from 2010, showing that some things change very little. There are some updates noted in the article.

The advice remains generally the same. Producers are still often confronted with requests for certificates with specific language that is outside what a producer should prepare, but for a client that can’t perform the contracted work without a certificate including the specific language requested. In those cases I advise producers to contact the carrier involved to see if the carrier will approve the certificate language, which removes the producer from the responsibility of deciding what language is acceptable.

coverages and how those coverages will affect the certificate holder, even requiring the certificate to show the certificate holder as an additional insured without any other policy endorsement or acknowledgment.

"Many of the problems are the result of misunderstandings by the public as to the purpose of a certificate of insurance."

Lew Melahn

For a number of years certificates of insurance have presented problems for producers, including how to describe coverages, how to identify the insured and what, if anything, to do about notice of cancellation to the certificate holder. The new ACORD forms adopted in September 2009 were meant to address those issues. In addition, the Department of Insurance, Financial Institutions and Professional Registration issued Bulletin 10-02 on Feb. 8, 2010, addressing the use of certificates. Among other matters, the department bulletin made clear that a standard certificate could not be altered without consent of the insurer and should not misrepresent the benefits of the policy. (Update: The Missouri Legislature passed legislation in 2011 which generally makes the bulletin language part of Missouri statutes. However, it has proven difficult to enforce, leaving producers in limbo.)

In spite of these steps, and in some respects because of them, problems continue to result. Many of the problems are the result of misunderstandings by the public as to the purpose of a certificate of insurance. They are meant to show that coverage exists at the time issued for the insured named. But many certificate holders expect an elaborate explanation of

The additional insured issues seem to occur frequently. The new certificate has a column where the producer can clearly indicate the certificate holder is an additional insured. However, this apparently does not satisfy many certificate holders who want specific rights enumerated in the certificate, or want the certificate to indicate the additional insured exists without specific evidence of such. If a specific additional insured endorsement has been issued by the insurer, either the attachment of that endorsement or the description of the additional insured directly off the endorsement in the certificate section for description of operations and locations should be permissible and resolve the issue.

However, many contracting operations leave numerous opportunities for problems. Many contractors desire a broad form additional insured endorsement which adds additional insureds automatically when the insured and the contracting party agree in writing the insured will add the contracting party as an additional insured. But the existence of that endorsement does not advise the producer as to whether a certificate holder is an additional insured since the producer does not see the written contract. So if the producer marks the additional insured column “yes,” the producer may indicate coverage where it may not exist, because a contract may not exist. And even if the producer reviewed one contract, that doesn’t mean that another project won’t be undertaken during the coverage period indicated on the certificate when no contract exists, so coverage wouldn’t exist. It is not the producer’s job to interpret contracts between their insureds and their insureds’ clients or customers. At best, the producer could indicate the endorsement

continued on page 16

Lewis E. Melahn, J.D.

Lewis E. Melahn is a practicing attorney who provides free legal consultation to MAIA members on a limited basis. He served as the director for the Missouri Department of Insurance from 1989-1993. You can contact Lew Melahn at 573-230-7200.

BEST REMEDY FOR WORKERS’ COMPENSATION

West Bend has a long history of writing workers’ compensation insurance. Our underwriters are knowledgeable and experienced. Our loss control reps have the expertise and tools to help keep employees safe. And our claims practices are the best in class.

From Main Street-type businesses to specialty businesses like food trucks, West Bend has the experience and expertise to protect businesses of many kinds and many sizes. We want to write all of your workers’ compensation business, small to large!

When you select West Bend for your valued customers, you can rest assured you made the right choice. After all, we are the best remedy for workers’ compensation.

To find an agent near you, visit thesilverlining.com.

the best investment I’ve made in my insurance career was the Certified Insurance Counselor program. Two of my early insurance mentors, Ron Tagge and John Hogan, were graduates of the program, so I set out to put those letters after my name as well.

I finished the program in just over two years, traveling to MAIA courses in Springfield, Kansas City and St. Charles. How lucky I am to have taken the courses in person pre-COVID, pre-Zoom and largely pre-smartphone. Hands were raised. Questions asked. Lessons learned.

I distinctly remember going back to the office after the Commercial Casualty course. We had discussed the commercial auto coverage symbols and rating classifications that day. I had several files on my desk with fleets and dove headfirst into their policies to apply the lessons learned over the 2 ½-day course

Commercial auto designation symbols

Many accounts have been won and lost over the years due to incorrect symbols. Underwriters use designation symbols to broaden or restrict coverage based on the characteristics of the insured.

Both producers and insureds can get tunnel vision focusing on premium. If you’re a CIC graduate, page one of the ISO Business Auto Coverage Form is likely the first of many data points to verify the premium on the quote or policy accurately reflects the risk profile of your insured. Requesting Symbol 1 liability coverage doesn’t mean the underwriter’s terms are offering it.

If you have clients outside of Missouri, Symbols 5 and 6, addressing no-fault and compulsory uninsured motorists coverages respectively, may come into play. Symbol 7 is used to restrict coverage when not all owned vehicles are scheduled on the policy, or the applicant has a more hazardous class of business, perhaps trucking or waste hauling. We often see Symbols 8 and 9 for hired and non-owned liability. Remember, it’s preferable to have hired and nonowned auto liability coverage on a commercial auto policy that is not subject to an aggregate limit, rather than adding it to a general liability

policy.

Symbols 10 and 19 both address mobile equipment but go about it in different ways. Symbol 10 can be added to any coverage part on page two of the ISO BAP (liability, physical damage, etc.), but requires that you provide a description of the mobile equipment to be covered, and that description be scheduled on the policy form. This is both flexible and onerous at the same time. While you can add it to both liability and physical damage coverage with underwriting approval, the description must be all encompassing for your insured, or your wording of the description can create the potential for an uncovered claim. Symbol 19, on the other hand, can only be added to the liability insuring agreements, but it provides coverage for mobile equipment subject to financial responsibility or compulsory laws, which vary by jurisdiction. Symbol 19 turns all mobile equipment into a covered auto when driven on public roadways.

Don’t just rely on the commercial general liability policy to provide coverage for that contractor operating equipment near a public roadway, performing snow removal or street cleaning, or otherwise operating vehicles that meet the definition of mobile equipment. Mobile equipment being used on a public roadway could technically be deemed an auto and excluded under the general liability policy, necessitating the inclusion of either Symbol 10 or 19 on the insured’s policy. Don’t give the carrier a free pass to decline an expensive and complex claim.

Finally, garages, motor carriers and trucking risks all have specialty ISO Commercial Auto coverage forms, with several additional designation symbols more appropriate for their operations. Check out the Big “I” Virtual University or the Insurance Risk Management Institute (IRMI) to find more on these specialty forms and their coverage symbols.

Fleet classifications codes

Symbols are important, but what I really took home after that CIC class were a different set of numbers, found next to the vehicle schedule in the policy. Stay in the insurance business long enough, and you’ll find a contractor who has their fleet rated as “commercial” use. If

continued on page 27

John Higdon, CIC chair, MAIA coverage advisory commitee, RCP, Alera Group, LLC

If you encounter any issues with policy forms, coverage gaps or problematic language, please report them to MAIA’s Coverage Advisory Committee so they can work on getting them corrected through their discussions with ISO, NCCI and ACORD.

hen a potential E&O matter is brewing and the plaintiff’s attorney is doing their due diligence to determine any potential liability, agencies can be assured that their website will be reviewed and heavily scrutinized. Its content has a significant possibility to be a key issue in determining the direction of E&O claims. In many actual E&O claims, the language in the website has impacted the degree of legal liability the agency has been held to.

Agencies often contract with a marketing firm to design their website. In the vast majority of instances, the website is impressive and may play an important role in attracting new business opportunities. So, what’s the problem? Many websites include language that sounds like “promises” and “commitments,” such as:

"Imagine how it would look to find out that the commitments made on the website are not really being performed and are merely 'marketing fluff.' "

How many of the agency staff even know what your agency website says? In many situations, it has been determined that the staff had no actual knowledge and understanding of what the website was committing them to do. So, they were essentially going about their daily tasks without knowing that they were not doing what their website suggested they would. It is highly suggested that all agency staff be required to review the site to be aware of the commitments they are expected to honor.

Curtis M. Pearsall, CPCU, AIAF, CPIA

• “We will make sure you have the coverage you need.”

• “Our staff will analyze all of your risks.”

• “We will periodically review your coverage to ensure you have the protection you need.”

While these statements sound powerful and holistic, there are two basic issues with them. Let’s take the first statement, “We will make sure you have the coverage you need.” How would your agency actually do that? Can your agency actually ensure that the client has the right protection at the time of a loss? Not really, since at the end of the day, isn’t it up to the client whether they want to secure the suggested coverages? Your agency can really only suggest coverages for the client to consider.

In addition, if you commit on your website that you will review the client’s coverage to ensure they have the right protection, do you have a process to do that? Is that process performed for all clients or only for certain clients based on the size of their premium? Imagine how it would look to find out that the commitments made on the website are not really being performed and are merely “marketing fluff.”

To impress the public with your agency’s expertise, words such as “expert” or “specialist” often appear. Once again, these sound powerful, but are the exact words that could be used by the plaintiff’s attorney to allege a “special relationship” between your agency and your client. “Special relationship” is a common allegation in many E&O cases and, if it can be proved, there is a greater potential for a heightened standard of care, which may increase the level of legal liability for your agency.

Agencies should review their website at least annually to determine whether the agency is truly doing what their website says they are. This does not mean “some of the time.” It is best to put yourself in the client’s position to determine whether “the agency did what their website said they would.” But don’t stop with your website. All agency marketing material should be reviewed periodically for this same level of scrutiny.

The commitments your agency makes on your website are much more than just “marketing fluff.” They are commitments your clients may look to hold you to.

This information is provided solely as an insurance risk management tool. Utica Mutual Insurance Company and the other member insurance companies of the Utica National Group (“Utica National”) are not providing legal advice, or any other professional services. Utica National shall have no liability to any person or entity with respect to any loss or damages alleged to have been caused, directly or indirectly, by the use of the information provided. You are encouraged to consult an attorney or other professional for advice on these issues.

n a decisive 2024 presidential election, former President Donald Trump defeated Vice President Kamala Harris by a comfortable margin of 312 to 226 in the Electoral College. This victory, which also includes a nearly 2.5 million vote lead in the popular vote, marks a historic moment as Trump becomes the first Republican since George W. Bush in 2004 to win the popular vote. With a shift in the political landscape and major wins down-ballot for Republicans, this election reflects a deep transformation in the country's political and demographic dynamics.

imedia, podcasts, influencer appearances and widespread press coverage, was able to create a strong narrative that resonated with voters. His direct engagement with the public gave him an edge in messaging, despite Harris’s higher campaign spending.

"The Harris campaign, which had a substantial financial advantage — spending $1.9 billion compared to Trump’s $1.6 billion — struggled to maintain its footing."

Economic concerns drive the election

The results reflect what many analysts have described as a mandate for change, particularly in how the country handles economic issues, immigration and foreign policy. Exit polling data reveals that the economy, concerns about democracy and immigration were the top issues on voters’ minds. For many Americans, inflation and the rising cost of living became critical factors leading up to election day. Over 50% of voters reported financial hardship due to inflation in the past year, making economic recovery a top priority for the new administration. Trump's "America First" agenda, which promises to focus on domestic issues, resonated with voters who felt left behind by the status quo.

The Harris campaign, which had a substantial financial advantage—spending $1.9 billion compared to Trump’s $1.6 billion—struggled to maintain its footing. Despite outspending the Trump campaign, Harris was unable to effectively counter Trump’s grassroots outreach and media strategy. Trump, leveraging the power of social

Nathan Riedel

Trump’s electoral success extended to Republicans' control of Congress, with the GOP netting four seats in the Senate to secure a 53-47 majority. Republicans successfully defended all of their vulnerable seats, while winning Democrat-held seats in Montana, Ohio, Pennsylvania and West Virginia. In the House, Republicans managed to hold onto their majority, albeit by a slim margin.

With Trump back in the White House and Republicans firmly in control of both chambers of Congress, the political agenda is poised for significant shifts. Trump's administration will likely prioritize economic reforms, stricter immigration policies and a more isolationist foreign policy. The early results suggest a strong appetite for change, particularly among voters who feel disillusioned with current economic and political conditions.

The 2024 election has undoubtedly reshaped the American political landscape. It signals a new era of GOP dominance, with potential long-term consequences for how the country addresses key issues like inflation, healthcare and national security.

For voters, the next few years will be crucial in determining how well the new administration can deliver on its promises, particularly as the nation continues to grapple with its economic challenges and geopolitical uncertainties.

continued on page 30

vice president of federal government affairs for the Independent Insurance Agents & Brokers of America

continued from page 7

manner that is defensible as far as fairness to the staff members.

The final area of federal government overreach that I want to mention where our government relations team advocated for the insurance industry relates to the U.S. Department of Labor (DOL) overtime rule, the second step of which was set to go into effect Jan. 1, 2025. In April 2024, the DOL released its final rule changing the salary threshold at which employees can qualify for “white collar” and “highly compensated employee (HCE)” exemptions for overtime requirements. The rule increased the standard salary level from $35,568 per year to $43,888 per year effective July 1, 2024, and would have increased that to $58,656 per year effective Jan. 1, 2025. The HCE threshold increased from $107,432 to $132,964 on July 1, 2024, and was set to increase to $151,164 on Jan. 1, 2025. Now, to be sure, the Big “I” never argued against employees receiving adequate or fair pay for their work; instead, what was argued was that

continued from page 9

exists and attach it to the certificate for the certificate holder to interpret. Unfortunately, many parties requesting certificates are not satisfied with this procedure, even though for the producer to indicate the certificate holder in that situation is always an additional insured could be false and violate the department’s bulletin by misrepresenting the coverage.

Another problem occurs when certificate holders want specific descriptions of the coverage provided for specific operations. While the certificate allows a description of the operations insured, that description should be nothing more than what the policy lists as the operations of the insured. For the producer to be more elaborate requires the producer to interpret the contract between the insured and the certificate holder as to what operations the contract demands. That is beyond what the producer is authorized to do, and exposes the producer to potential claims.

The new certificate was meant to end the issue as to whether notice of cancellation would be sent to the certificate holder by eliminating that reference in the certificate. The certificate now

the aforementioned thresholds were increased in drastic measure and without proper due diligence in arriving at market-proper levels.

However, in November 2024, the U.S. District Court for the Eastern District of Texas invalidated the DOL’s 2024 overtime final rule. As a result of the court's decision, the minimum salary threshold for exempt employees is now set back to the previous level of $35,568. For HCEs, the threshold has reverted to $107,432. For agency owners, this ruling provides some relief from the impending increases in salary thresholds that would have required a reevaluation of employee classifications and possible salary adjustments.

Our national government affairs team is one of the most successful parts of the Big “I” and is regularly recognized as a leading group of lobbyists on Capitol Hill. Without their consistent advocacy, it is certain that numerous laws, regulations, etc. would have a detrimental effect upon insurance professionals.

says only that cancellation notice is governed by the policy. However, many certificate holders still want a guarantee of notice. This clearly would be an alteration of the certificate without an insurer’s authorization. However, I understand several insurers will now file and make available an endorsement guaranteeing the notice. This is an unusual development considering that almost no companies actually sent the notice with the old certificates, and now that the issue is eliminated from the certificate, they volunteer to send one.

I would advise producers never to check the additional insured column without the specific additional insured endorsement because of the uncertainty of the broad form endorsement. If the broad form is used, it can be indicated in the descriptions box and even attached to the certificate for review by the certificate holder. The producer should not be determining what the contract between the insured and the certificate holder provides. And I would advise producers not to attempt descriptions of particular jobs or operations, but to show only what the policy lists as operations of the insureds.

bang—the starting gun fired, and off we went. Ahead of me stretched 26.2 miles, a distance I once thought impossible. As I surged ahead, my mind flashed back to the moment this dream was born—in a hospital bed, fighting for my life.

The journey began on Sept. 11, 2002. I was a senior at Emporia State University with dreams as big as the Kansas sky. My future was filled with promise until a call from my doctor shattered everything: “You have leukemia.”

Insurance, like a marathon, is an endurance event. Each day tests your focus, persistence and resilience. Navigating demanding clients, shifting markets and complex claims can feel like mile after mile of unrelenting challenges. At times, it can be easy to get discouraged. At times, life knocks us down.

My diagnosis marked the start of a marathon I never signed up for. Over two years, the cancer returned twice, eventually spreading to my brain. On Valentine’s Day 2004, my condition plummeted. I slipped into unconsciousness with a 104-degree fever, failing kidneys and a brain infection. Doctors told my family to prepare for the worst—they didn’t expect me to survive the night.

I pushed through, crossing the finish line and achieving my victory that at one time felt almost impossible.

From my journey, I’ve developed what I call the Marathon Mentality—a mindset to push through walls of negativity, setbacks and obstacles. Here’s how you can build it:

1. Visualize your victory

“Where there is no vision, the people perish.” While lying in that hospital bed, I visualized myself crossing the finish line of a marathon. That vision became my lifeline, giving me the strength to take my first steps.

In insurance, having a clear vision sustains you through the challenges. Whether it’s growing your agency, landing a major account or guiding clients through tough times, keeping your finish line in sight helps you stay focused.

2. Take action every day

How do you complete a marathon? One step at a time.

As Dr. Martin Luther King Jr. said, “You don’t have to see the whole staircase. Just take the first step.”

After visualizing my marathon, I took small, consistent steps toward my goal. In insurance, progress comes from daily actions. Each call, policy review and strategy session moves you closer to your victory.

Against all odds, I did. But damage had been done: I couldn’t walk, my memory was foggy and my speech was slurred. I vividly remember staring at my untied shoes, unable to remember how to tie them. My dad knelt beside me, tied them, and with one arm around him and another around my therapist, I took my first shaky steps.

That day, I visualized my victory: running a marathon. It seemed impossible. My first goal was to take one step and then to be able to walk down the hospital hall. After being discharged, I focused on walking one block, then two. Slowly, one step at a time, I rebuilt my strength.

Two years and four months later, I stood at the starting line of the San Diego Rock ‘n’ Roll Marathon. As doubt crept in, a little voice whispered, “You can’t do this.” But step by step,

3. Elevate your attitude

Charles Swindoll said, “The single most important decision we can make is our choice of attitude.” Our success is determined not by what happens to us but by how we respond to it.

In insurance, as in life, attitude is everything. A positive mindset transforms obstacles into opportunities and keeps you moving forward, even in the toughest times.

Insurance, like life, is a marathon. Success comes from having a clear vision, taking consistent action and maintaining a positive attitude. When challenges feel overwhelming, remember: The finish line is closer than you think.

To your victory, and keep moving forward.

Success starts here for Missouri agents. - CE-Approved Courses and Sessions - Trade Show- Networking Opportunities - Crawfish Feast -

To access the online registration.

THURSDAY BREAKOUT SESSIONS

Hard Market or Hard Opportunity? - Scott Howell

This course is designed to assist independent agents with navigating the hard insurance market that they currently face, the timing of when it may “soften” and educate them on ways to increase their retained ratio of current and future clients. Cyber Security Threats, Tips and Tricks and What to Do if a Breach Happens - JR Chaney

The content of this session starts with why we are targets of cyberattacks and how they can happen, including a demonstration and what we can do to prevent them from happening. Then we will go into what happens if we are compromised, from the starting process to the aftermath.

The insured’s commercial property insurance policy is broken. This course provides several tools (tips and endorsements) which should, with a little help from the insurance company, fix it. Examples of issues discussed include debris removal, vacancy/ reduced occupancy, types of property covered and not covered, ordinance/law compliance, and several others.

Wednesday, March 19

E&O Loss Control Seminar: Coverage Essentials

- Policy Analysis: Reading, Interpreting and Understanding Insurance Contracts

1:00-4:00 p.m

This new course is the first module in a new risk management series that is designed to familiarize new and seasoned agents about insurance coverage concepts. The Policy Analysis module covers contract law basics, general laws of insurance, unique characteristics of insurance contracts, rules of reading any insurance policy, how to read an insurance policy, a review of key words and phrases commonly found in insurance contracts, a few risk management strategies for agency personnel, and much more!

- Brandi Anderson - Approved for 3 ethics CE credits in Mo. & Kan.

Crawfish Feast

5:00-7:30 p.m.

The Crawfish Feast, sponsored by the Young Agents Committee, has become a conference tradition. In addition to crawfish, the menu will include an assortment of other meats and sides! The complimentary shuttle will transport you to and from the hotel and the Knights of Columbus building, 2525 N. Stadium in Columbia.

Thursday, March 20

Registration Opens

7:30 a.m.

Breakfast

7:30-8:45 a.m.

Sunrise Session: E&O, Social Media & The Insurance Agent

8:45-9:45 a.m.

Having an online social media presence for your agency is not only a great way to reach customers and potential policyholders, but it is something they have come to expect. Social media sites like Facebook, X, LinkedIn and others can help you and your agency stand out from the competition, but these networks also can cause an E&O claim. In this course we will discuss ways that your agency has E&O exposure because of an agent’s use of social media, and how an agent can ensure that they do not get sued over their social media usage.

- Angela Kain - Approved for 1 ethics CE credit in Mo. & Kan.

Keynote: Insurance Is a Marathon: How to Stay Motivated

10:00-11:00 a.m.

Matt Jones is a living testament to the power of resilience and determination. Aft�er being diagnosed with cancer on Sept. 11, 2002, and facing a grim prognosis as the disease spread to the fluid around his brain, Matt� was told survival was unlikely. Defying all odds, he not only conquered cancer three �times but also underwent a bone marrow transplant and had to relearn how to walk. Today, he has completed eight marathons on eight continents, including the icy terrain of Antarctica and the newly discovered continent of Zealandia. - Matt Jones

Chair, Tami Mills, Mills & Sons, Clinton • Vickie Goodin, Cannabis Insurance Wholesalers/One General Agency, Oklahoma City, Okla. • Ryan Sanders, Rich & Cartmill, Ozark • Kyane Marble, Hawkins Insurance Group, Edina • Dorian Culver, Stafford-Leavitt Insurance, Harrisonville • Christine Starr, MGI Risk Advisors, Saint Louis • Marissa Dirnberger, VanGennip Insurance & Financial Services, Advance • Andy Reavis, Missouri Insurance Services, LLC, Billings • Jared Underwood, Ozark Hills Insurance, West Plains

Networking Luncheon

11:30 a.m.-12:30 p.m.

All registered guests are invited to attend this luncheon where you are able to network with fellow industry professionals.

Afternoon Breakout Sessions

12:30-2:20 p.m.

Hard Market or Hard Opportunity?

- Scott Howell

Cyber Security Threats, Tips and Tricks and What to Do if a Breach Happens

- JR Chaney - Approved for 2 general CE credits in Mo. & Kan.

Broke as a Joke: Diagnosing & Repairing Busted Commercial Property Coverage

- Kevin Amrhein - Approved for 2 p-c CE credits in Mo. & Kan.

Repeat Afternoon Breakout Sessions

2:30-4:20 p.m

Company Reception/Trade Show

4:30-7:30 p.m

With more than 90 exhibitors expected, the trade show will provide more information, knowledge and business opportunities for Missouri agencies than you’ll find anywhere else. This is an outstanding opportunity to network with other agents, to establish or strengthen company relationships, and to find out what the excess and surplus lines market has to offer. Watch our website for an upto-date list of exhibitors.

8:00-10:00 p.m

Continue networking with various vendors after the trade show by visiting their hospitality suites.

Friday, March 21

Breakfast

8:30-9:00 a.m.

Breakout Sessions

9:00-11:00 a.m.

Lead, Motivate & Inspire Others

This course will empower you as a leader in bringing out the best in yourself and others by exploring the most critical success factors of strong leadership that will help you bring your people together, motivate them and inspire them to achieve their full potential.

- Angela Kain

Slamming the Back Door Shut - Why Retention & Life Cycle Mean So Much

Dive into why the money in insurance is NOT in new business but in the life cycle of each client, which equals retention. This course provides agents with actionable steps to utilize to increase the life cycle of their current clients and slam the back door shut!

- Scott Howell

MAIA has a contracted room rate of $116/night for a guest room for reservations made by February 16, 2025. After February 16, 2025, the hotel will release all unreserved rooms.

Wyndham Executive Center (formerly Holiday Inn Executive Center) 2200 I-70 Drive SW, Columbia, Missouri 65203, 573-445-8531

independent agency owners can leverage their agency's book of business to support a broad range of growth goals, not limited to mergers and acquisitions (M&A) and agency perpetuation.

With a specialized banking partner—one that understands the true value of independent agencies—agency owners can secure out-of-thebox financing solutions for additional growth needs, such as buying specific books of business, securing more real estate, hiring extra staff, upgrading technology and meeting more unique needs.

Here are three examples of customized financing solutions for some of the more unusual situations that independent agencies find themselves in:

1) An agency wanted to buy another agency's book of business — but only the part written with particular insurance carriers.

Typically, when lenders underwrite financing for an acquisition, they require a complete financial picture of both the buyer and the seller, using tax returns, balance sheets, income statements and more. However, when an agency wants to buy part or all of another agency's book of business, such as a specific line of business or accounts written with certain carriers, specialized lenders take a different approach and focus their underwriting around that specific book of business.

In this instance—where an agency wanted to buy another agency's book written with certain carriers—the underwriting was straightforward. Both parties had relationships with the same insurance carriers, and as a result, the acquisition was deemed unlikely to pose any major business disruption or risk.

But for an out-of-the-box transaction like this to be successful, both the buyer and seller must have their financial houses in order, as the lender will rely on their internal reporting to underwrite the loan. It is also critically important that agencies fully utilize their agency management systems (AMS) and keep their reporting current because lenders will analyze this data.

2) A second-generation family agency wanted to split the business between two owners.

Splitting an agency in two is often more complicated than it sounds. Once separated, both entities need an ownership and leadership structure, working capital, staff, AMS and other essential business systems, as well as a brick-andmortar location. They may also require financing for any or all of those elements.

This particular agency wanted one owner to take the commercial lines and employee benefits part of the business and the other the personal lines. The lender had to determine whether there was sufficient cash flow coming out of each line of business to support each entity's growth goals and financing needs.

In the buildup to this unique financing need, both owners had to run their respective books of business almost as separate divisions. They had to maintain robust internal accounting and reporting to give loan underwriters the best possible picture of what their business units could look like and achieve as standalone businesses.

Financing is available if an agency owner is looking to divest a piece of their business, segment their agency lines for perpetuation, or even buy a line of business from a larger company. What lenders and underwriters are looking for in those scenarios is comprehensive internal reporting that supports those growth goals.

continued on page 28

Scott T. Freiday senior vice president and division director of InsurBanc, a division of Connecticut Community Bank, N.A.

Courtyard by Marriott

610 Bolivar St

Jefferson City, Mo.

All attendees - particularly young agents and first-time attendees - are invited to join us Wednesday morning for coffee and greetings at the Courtyard by Marriott before taking a shuttle to the Capitol for a tour. This is a great way to connect and network with other agents!

The Trolley Company will then take you from Courtyard by Marriott to the Capitol for a short tour and history, provided by MAIA’s lobbying team.

Coffee & Greeting

9:00 a.m. - 9:30 a.m.

Shuttle to the Capitol for the tour

9:30 a.m.

History and tour 10:00 a.m. - 11:30 a.m.

Lunch on your own 11:30 a.m. - 12:45 p.m.

Shuttle back to the Courtyard 1:00 p.m.

Registration

1:00 p.m. - 1:30 p.m.

Briefing - Matt Barton 1:30 p.m. - 2:30 p.m.

Need lunch recommendations?

Scan the QR code to take a look at some of Jefferson City’s downtown dining options! This event is FREE to MAIA members, but advance registration is requested.

Shuttle to the Capitol 2:30 p.m.

Meet with legislators and attend hearings at the Capitol 2:45 p.m. - 5:30 p.m.

Shuttle available to get back to Courtyard

5:00 p.m. - 5:45 p.m.

Cocktails

5:30 p.m. - 6:00 p.m.

Dinner & legislative panel 6:00 p.m. - 7:30 p.m.

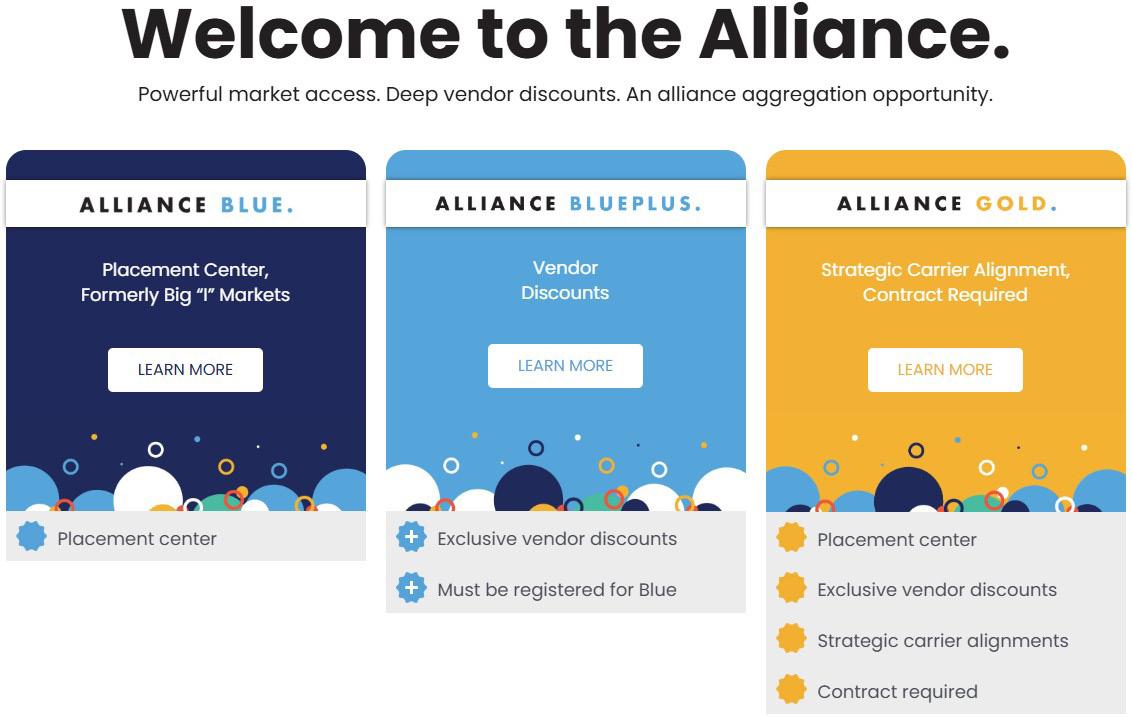

ig “I” Markets has a new name and is now part of a powerful new suite of market access solutions for independent agents: Big “I” Alliance. While Big “I” Markets primarily provided markets for specialty or niche coverages, the goal of Big “I” Alliance Blue is to be more of a true market access program, with access to standard markets as well. They are continually working to add more markets and carriers to aid members in placing risks for their clients.

The Alliance program encompasses three program tiers to serve agencies:

Big “I” Alliance Blue, formerly Big “I” Markets, is IIABA’s online market access program, which is available FREE to Big “I” member agencies. Members may access personal and commercial lines, including auto and home, bonds, cyber, small commercial, habitational and more.

Benefits include:

• No initial access fees

• No ongoing monthly fees

• No termination fees

• No minimum production requirements

• Ownership of expirations

Alliance Blue’s placement center staff assists with quoting, issuing and binding accounts for agents. Visit www.bigimemberalliance.com/ blue for more details, including a complete list of markets and carriers.

Existing registered Big “I” Markets agents may access available Big “I” Alliance Blue products

through the familiar platform, now hosted at www.bigimemberalliance.com (formerly www. bigimarkets.com). Big “I” member agencies not yet registered for the placement center may do so online.

Big “I” Alliance Gold is an evolution of the legacy Eagle Agency program. Alliance Gold agents get direct access to carriers and underwriters, profit sharing and incentive eligibility, ownership of expirations and much more. Big “I” Alliance Gold is a true agency alliance designed to benefit agents by aggregating premium and expanding market access opportunities for our members. For more information, or to fill out the preapplication, visit www.bigimemberalliance.com/ gold.

Big “I” Alliance Blue Plus is an optional addon opportunity to receive discounted pricing from featured vendors offering operations and technology solutions, education and marketing support and more. Blue Plus status is automatically conferred on Alliance Gold agencies; Alliance Blue members may enhance their Blue registration with Blue Plus by paying an annual access fee. To view the list of vendors and see more information, visit www. bigimemberalliance.com/blue-plus.

The new Big “I” Alliance program has evolved from IIABA’s longstanding commitment to and experience with independent agencies. Together, we thrive.

in its 14th year, the November 2024 CSR Development Conference held in Jefferson City was a great success! There were 20 attendees in person and two online from both large and small retail agencies from around the entire state. Nikki Sherrill Wyatt gave a captivating presentation, and post-conference surveys show she received a 10 out of 10 rating and scored 9.9 for each of the three sessions: The Claims Department and Your Agency, How to Maintain Your Motivation and Increase Sales, and Customer Experience and Your Agency. All survey respondents indicated they would attend another CSR Development Conference! Thursday evening, several of the attendees participated in a fun-filled evening of bowling and pizza at Strikers.

Be sure to mark your calendars for Nov. 6-7, 2025, to attend the next CSR Development Conference in Jefferson City! Brandi Anderson will be leading the conference, and will also be teaching the E&O class before the 2025 Small Agency Conference. See pages 20-21 in this issue for more information on the 2025 Small Agency Conference.

you’re a CIC graduate, you know “service” use vehicles are largely parked most of the day, while “commercial” use vehicles are, in general, moving constantly during the workday. This kind of mistake can skew premium for a vehicle drastically, with one carrier having 50% higher liability rates for a “commercial” use vehicle than a “service” use vehicle.

In addition to the use class, both radius and gross vehicle weight are also indicated in the fleet classification, with the larger vehicles and longer radiuses commanding higher premiums.

These codes once told how to modify the base premiums in a rating manual to issue a quote, work now done instantly by computers. However, there’s still a person entering the data at some point, and people make mistakes. So, whether you see codes or descriptions inside the policy’s vehicle schedule, double-check the fleet classification codes. You just might find a huge premium savings that helps turn a prospect into a grateful insured.

continued from page 11

attached equipment. In many cases the specialty equipment values can exceed the purchase price of the vehicle itself. Be sure to review the values of the vehicles and ask about any specialty equipment attached to the vehicles during the discovery process. You can also request agreed value as a settlement basis for these modified vehicles that are mission-critical to the operations and hold their value longer than traditional vehicles.

“Anyone who stops learning is old, whether at 20 or 80. Anyone who keeps learning stays young.” – Henry Ford

"As a young producer seeing many things for the first time, I constantly went back to the CIC binders on the shelf of my office, finding real-world applications for the lessons learned."

John Higdon, CIC

As a young producer seeing many things for the first time, I constantly went back to the CIC binders on the shelf of my office, finding real-world applications for the lessons learned. More than once those lessons helped to differentiate myself as a student of the industry who could provide impactful advice businesses could use to guide their decision-making process.

Business owners and their executives are regularly furnished company-owned vehicles for personal use as a fringe benefit. Often these vehicles are listed under the commercial auto policy. This is all well and good so long as they have a personal auto policy. In the absence of a personal auto policy these individuals are not insured for various everyday scenarios involving renting or borrowing vehicles for personal use from the garage, the auto rental company or their neighbor. This endorsement can extend coverage in these cases, providing liability and uninsured motorist bodily injury coverages.

Providing a vehicle identification number (VIN) helps carriers and producers identify the cost for a new vehicle of the same make and model. However, relying solely on VIN numbers can result in underinsured values of combined vehicles and

I’m grateful to MAIA for supporting the CIC program and encouraging young producers to apply for scholarships toward class tuition, which I was fortunate to receive in 2010. The course work has evolved to offer classes focused on insurance companies and specialty lines that weren’t as mainstream 15 years ago. I’m also grateful to the many instructors and ed consultants I’ve learned from over the years. Most of all, I’m grateful to Ron Tagge and John Hogan for sharing their wisdom and encouraging me to learn something new every day.

3) An agency needed bank financing for new space to house new hires. Independent agencies don't have to settle for standard commercial mortgages from conventional banks when they're looking to build up their real estate portfolio. A specialized lender can often provide the mortgage in addition to other financial products that can augment an agency's growth.

In this case, the independent agency seeking financing was experiencing rapid organic growth in its retail business and required more physical locations to support that growth. They managed to secure an out-of-thebox financing solution that combined a commercial mortgage with a term loan, using the real estate and the agency's book of business as collateral. The agency owner then used that term loan to hire more staff and further enhance the agency's growth goals.

continued from page 23

"Conventional banks often struggle to understand the value of independent agencies and how to use those mostly intangible assets to collateralize loans."

Scott Freiday

Understanding what is possible is the first hurdle. Agency owners need to connect with an industry lender—one that can understand their business, speak their language and follow the market trends—to discuss their growth goals and unique financing needs. Often, all it takes is honest and open communication, collaboration and a problemsolving mindset to craft a financing solution together. These out-ofthe-box solutions may require extra work from the agency owner upfront to maximize their financial reporting and AMS to paint the best possible picture for underwriters. However, the return on investment and the ability to push through with an agency's growth goals should far outweigh any extra effort required to get these unique financing solutions in place.

Of course, the agency owner could have secured a commercial mortgage from a conventional lender, but they may have struggled to negotiate the same blended product, which opened up additional capital to support the agency's growth.

Conventional banks often struggle to understand the value of independent agencies and how to use those mostly intangible assets to collateralize loans. Banks need to look to historical growth data, profitability, the book of business, retention rates and the agency's methods of operation.

Put away the cookie cutter

With the right banking partner, independent agency owners can be creative about how they finance their growth goals. The first thing they must do is set aside any notions of cookie-cutter products.

ast fall I had the pleasure of meeting with the administrator of the Alternative Residual Market (ARM) program here in Missouri. If you are not familiar with the ARM, that’s perfectly okay; it probably just means that you rarely, if ever, have the need to write a workers’ compensation risk that has experienced a claims history, whether by way of frequency or severity. For those employers who are unable to obtain coverage in the standard market, the ARM was established. The Missouri Workers' Compensation Assigned Risk Plan (or “pool”) provides Missouri employers an alternative option when coverage cannot be obtained in the traditional market. While the administration of the pool is “let out” for bid every so often by the state of Missouri, one entity has handled the administrative duties for many years.

lThe ARM serves an important purpose in Missouri, as it does in numerous other states. Insurance is regulated at the state level, and so by virtue the laws regarding insurance, including workers’ compensation, vary from state to state. However, workers’ compensation coverage is required by most states. This “grand bargain,” as it is often referred to, protects both employers and employees if injuries to staff occur while in the course of business.

Some jobs are just inherently more dangerous than others. While I work in an office where the opportunities for injury are relatively limited, provided I don’t go out of my way to operate in a dangerous manner, my father worked in construction and farmed on the side for almost 60 years, both occupations presenting countless opportunities for injury on a daily basis.

While these annual meetings with the administrator provide updates on new features relating to agent communication and interaction with the company, including making it easier to secure coverage through the portal, perhaps the most interesting part of the discussion relates to the top occupations and industries written through the ARM in Missouri. It’s probably not surprising that the construction industry tops

the list as far as the industry with not only the most premium running through the program, but also the highest number of policies. Also not surprising is that the specific class code that accounts for the most premium in the program is 5551: Roofing – All Kinds and Drivers. Roofing is perennially recognized as one of the most dangerous occupations in the nation. Aside from the very obvious risk that comes with working from heights, roofers face risks related to flying debris (eye injuries), heavy lifting, electrocution, sharp materials, power tools, among others. To be sure, some roofing contractors don’t take all necessary precautions to protect workers from these risks, but the bottom line is that the job is just dangerous by nature. Between $2 million and $2.6 million in annual premium dollars flow

Top class codes by premium for the 2022-2023 policy year, according to the filing made with the DCI:

1. 5551: Roofing – All Kinds and Drivers

2. 7711: Firefighters and Drivers – Volunteers

3. 5645: Carpentry – Construction of Residential Dwellings not Exceeding Three Stories in Height

4. 7720: Detective or Patrol Agency and Drivers

5. 9403: Garbage, Ashes or Refuse Collection and Drivers

6. 4410: Rubber Goods Manufacturing, NOC

7. 4484: Plastics Manufacturing – Molded Products NOC

8. 7219: Hydraulic or Pneumatic Device/Pump Manufacturing

9. 9178: Athletic Team or Park – Non-Contact Sports

10. 7380: Drivers, Chauffeurs, and Their Helpers

continued from page 29

through the ARM to cover the roofing industry. Perhaps also not surprising is that the class code with the highest number of policies in the program is 5645: Carpentry – Construction of Residential Dwellings Not Exceeding Three Stories in Height, accounting for almost 600 policies in the program. Interestingly enough, the premium for class code 5645 in the program averages about $3,000.

Via a public search through the Missouri Department of Commerce and Insurance (DCI) agents can identify class codes that account for the most premium that runs through the pool.

The overwhelming majority of policies in the ARM (almost 70%) have an associated premium of less than $2,500, a relatively low premium. Fewer than 0.2% of the policies in the program are included in the $200,000+ premium range.

If you find difficulties in utilizing the agent portal or have suggestions for improvement, you are welcome to send those to me and I will ensure they are delivered to the pool administrator. You can find out more about the ARM, including the current rates, how to file an application for new business and how to file a claim on the Missouri Department of Commerce and Insurance website at https://insurance.mo.gov/consumers/wc/wcarp. php.

continued from page 15

A

Charles Symington, Big “I" president & CEO, and Nathan Riedel, Big “I" senior vice president of federal government affairs, recorded a video shortly after the election (https://vimeo. com/1029762857) to unpack the outcome of the election and its impact on the insurance industry and independent insurance agents. They discuss the new administration's plan to push tax reforms, potentially extending the 2017 Tax Cuts & Jobs Act and safeguarding the 20%

small business deduction, which is great news for independent agencies. Additionally, they say that agents can expect a lighter regulatory touch from federal agencies.

We have consistently supported those members of Congress that help us reach our goals for our members and our clients. InsurPac supported 278 campaigns and achieved a 96% win rate, so you may have confidence that your PAC dollars are being put to effective use.

Just because the election is now in our rear window does not mean our work is done. It’s time to start thinking about the next election, so please write your check and help us meet our goal for 2025. The work of representing you and your clients in D.C. is never done.

On Nov. 15, the U.S. District Court for the Eastern District of Texas invalidated the U.S. Department of Labor's 2024 overtime final rule. This decision has wide-reaching implications for both employers and employees across the country because it alters the criteria for determining overtime eligibility under the Fair Labor Standards Act (FLSA).

Among other things, the rule included a twotiered increase to the minimum salary threshold and threshold for highly compensated employees (HCEs), the first of which went into effect on July 1 with another update scheduled to take effect on Jan. 1, 2025.

As a result of the court's decision, the minimum salary threshold for exempt employees is now set back to the previous level of $35,568. For HCEs, the threshold has reverted to $107,432. These figures represent the salary requirements for employees to qualify for exemption from overtime pay under the FLSA's "white-collar" exemptions.

For employers, this ruling provides some relief from the impending increases in salary thresholds that would have required a reevaluation of employee classifications and possible salary adjustments. However, businesses will still need to be cautious in determining whether their employees meet the required duties tests for exemption. The ruling doesn't change the underlying duties test, which remains the primary criteria for overtime exemption.

In his decision, U.S. District Judge Sean D. Jordan acknowledged that, while the DOL has the authority to define and delimit the terms of the overtime exemption, this authority isn't unlimited. Specifically, the court found that the DOL's approach under the 2024 rule “effectively eliminates" the evaluation of an employee's job duties in favor of a salary-only test.

Judge Jordan's ruling criticized the DOL for using a fixed salary threshold as a determinant for exemption eligibility, stating that it disregarded whether employees were actually performing executive, administrative or professional duties— key components of the exemption under the FLSA. This "salary-only test," the judge noted, effectively undermines the law's intent to focus on the nature of an employee's work.

The ruling also addressed another contentious

aspect of the 2024 rule: automatic updates to the minimum salary threshold every three years. According to the court, this mechanism violates the notice-and-comment rulemaking requirements set forth by the Administrative Procedure Act (APA). This procedural oversight renders the automatic updates invalid, adding another layer of complexity to the DOL's approach.

While the current DOL could appeal the ruling to the 5th Circuit, it is widely anticipated that it will not defend the 2024 rule under the incoming Trump administration.

In the coming years, employers may see new rulemaking from the DOL that could propose updated salary thresholds or alternative methods for determining overtime eligibility. However, any such changes would likely involve a lengthier rulemaking process, which would include public input and a more thorough examination of the policy's impact on businesses and workers alike.

We have all seen the news reports of the devastation hurricanes Helene and Milton have left in their wake, and many of the victims are from areas that have never experienced hurricane fury, being located far from any coastal areas.

The Trusted Choice Relief Fund offers financial assistance to insurance industry personnel impacted by catastrophic occurrences. MAIA's Executive Commitee voted to match members' donations up to the sum of $15,000. This means that we are in a position to respond to our insurance brothers and sisters in Georgia, South Carolina, North Carolina, Tennessee and Florida with up to $30,000 of aid from the Show-Me state.

Some of you have already donated, but each Executive Committee member has pledged to give and has voted unanimously to financially match your efforts.

Let’s show our fellow Big “I” members in the impacted areas that we care and that we remember their generosity to us in our time of need. Trusted Choice will identify those giving from Missouri and pass along the totals so we can match your generosity.

The Trusted Choice Relief Fund is a 501(c)(3) entity and contributions are tax deductible to the extent permitted by law. To contribute, visit www.independentagent.com/disaster-relief.

Congratulations to Alice Davis, K Flynn Insurance Agency, who was selected by the MAIA Education Committee to win the CIC scholarship for 2025. Alice has been in the industry for two years and believes it is crucial to learn and expand her knowledge in commercial lines to better serve her clients.

Watch our website for information on how to apply for the 2026 CIC scholarship.

MAIA was the recipient of two awards at Utica National Insurance Group's annual conference in October. The association was honored to be recognized for the second year in a row for having the lowest loss ratio for a partner state affiliate. MAIA also received the New Business Award for writing the most new business over the last year.

MAIA, alongside our partners, strives to provide comprehensive E&O coverage, risk management tools and excellent customer service for our members and clients.

MAIA will attend career fairs spring to promote the insurance industry and ensure new talent is entering the industry. Resumes will be collected at each career fair from those seeking internships or full-time positions. If you’re interested in receiving resumes from those who intend to live/work in your area, please email mfeller@moagent.org.

UMB Healthcare Services, Brad Christensen, Kansas City

Acuity honored with the 2024 PIA National Company Award of Excellence for the third time

The National Association of Professional Insurance Agents (PIA) has awarded Acuity the prestigious 2024 PIA National Company Award of Excellence, marking the third time Acuity has received this top honor.

“Independent agents have high demands from their clients. They want an easy, seamless, fast insurance process that will provide them with the protection they need. Agents can’t meet customer expectations alone. They need strong partnerships with insurance organizations,” said Ariel Rivera, PIA National president, adding that Acuity was recognized for being a true agent partner. “Not only are they dedicated to helping the agencies they work with succeed, but they understand the value of the agency distribution channel and continue to help this channel thrive,” Rivera said.

“We are honored to have earned the PIA National Company Award of Excellence,” said Acuity president, Melissa Winter. “Acuity recognizes the value of independent agents and the importance of building strong partnerships with them. To receive national recognition for our efforts is a wonderful validation of the efforts of everyone at Acuity.”

PIA National’s top award recognizes a carrier that demonstrates a commitment to the independent agent insurance distribution system and supports the interests of professional independent insurance agents. In selecting Acuity, the PIA highlighted that the insurer continues to provide agents with a stable, viable market, which is crucial in today’s hard market, and works to improve the agent experience and business environment.

Menary inducted into Insurance Hall of Fame

Jeff Menary, CEO of Grinnell Mutual, was inducted into the Iowa Insurance Hall of Fame (IIHOF) in a ceremony on Oct. 8, 2024, at the Meadows Events Center in Altoona, Iowa.

“I am humbled and honored to be one of this year’s Hall of Fame inductees,” Menary said. “While I am being recognized I must point out that the credit for my accomplishments, at Grinnell Mutual or in our industry, goes to all of those who helped me along my personal and

professional journey. All great accomplishments belong to a team and not an individual.”

Jeff Menary joined Grinnell Mutual in 1980 and has served in leadership roles at the company for over 25 years, working his way up through the company as a marketing and reinsurance manager, director of underwriting and production, assistant vice president of commercial lines, vice president of direct underwriting and production, and vice president of reinsurance.

He was tapped to take the helm at Grinnell Mutual as president and CEO at the end of 2017, succeeding the late Larry Jansen.

Menary has proved his mettle repeatedly as a compassionate and effective leader, steering the company through a global pandemic, historic losses from a derecho and some of the toughest years the insurance industry has ever seen. One of Menary’s proudest accomplishments is the creation of the company’s Care & Share program that helps employees cover unexpected needs such as medical bills and emergencies through a local 501(c)(3).

SECURA Insurance named a Great Place to Work

SECURA Insurance was named a Great Place to Work®-certified company for the ninth consecutive year. This certification is based entirely on what employees say about their experience working at SECURA, which is collected through an anonymous survey. This year, 91% of employees said SECURA is a great place to work — 34 points higher than the average U.S. company.

“We are proud to be named a Great Place to Work company once again,” said Sarah Krause, SECURA vice president–human resources. “Our associates all play important roles in creating a positive workplace culture, and these survey results show they are consistently having positive experiences in many areas of SECURA.”

According to Great Place to Work research, employees of certified workplaces are 93% more likely to look forward to coming to work, and are twice as likely to be paid fairly, earn a fair share of the company’s profits and have a fair chance at a promotion.

SECURA’s Great Place to Work survey results ranked the company’s strengths and evaluated employee feedback on leadership, fairness, rewards and career opportunities. The results showed 97% of employees say they are made to

feel welcome when joining the company, 94% said they are proud to tell others they work at SECURA, and 96% say they are able to take time off from work when they think it is necessary.

Acuity and Vertafore® were recognized with an ACORD Implementation Excellence Award at ACORD Connect 2024. ACORD is a nonprofit organization recognized as the global standardsetting body for the insurance and related financial service industries.

ACORD presents Implementation Excellence Awards to organizations that have made significant impacts in implementing ACORD standards over the past year, improving business processes internally and in conjunction with independent agents. Acuity was recognized as the first insurer in the industry to partner with Vertafore to bring a real-time bind capability within PL Rating™, Vertafore’s personal lines rating solution. This capability empowers independent agents to bind and fully issue policies directly, close business faster, and deliver an improved customer experience.

“Acuity understands that for independent agents to operate efficiently and deliver the best customer service in a highly competitive market, they need seamless connections with their insurance carrier partners. Acuity is committed to building those connections using ACORD standards and being the easiest company for agents to do business with,” said Melissa Winter, Acuity president.

“The bind capabilities in PL Rating further strengthen the connection between carriers and agencies, making it faster and simpler for them to place risks, grow their businesses and serve the needs of their personal lines clients,” said Gordon Kendall, senior director of product management at Vertafore. “We appreciate Acuity’s partnership in developing this industry-first capability and their commitment to ACORD standards that further insurance distribution.”

Columbia Insurance Group announces new vice president of excess and surplus

Aaron Rieth joined the leadership team at Columbia Insurance Group (CIG) as vice president of excess and surplus (E&S) on Nov. 18.

Rieth’s 20-year career has honed his expertise in

risk assessment and management, underwriting and product management as well as cultivating relationships with independent agents.

“We are thrilled to have Aaron join our officer group to lead the development of our excess and surplus company,” said Todd Ruthruff, CIG president and chief executive officer. “Aaron brings great experience both in E&S underwriting and in working directly with retail agencies, which will be a key element of our E&S strategy.”

In this newly created position Rieth will lead the development of CIG’s direct-to-agent E&S solution.

“We know the process of launching an E&S capability will take time to ensure we bring unique value to our agents, and we are excited for Aaron to join us so we can get our E&S journey started,” Ruthruff said.

Rieth said it is an incredible opportunity to help guide the CIG team in this new endeavor.

According to Rieth, Columbia is ready to expand thanks to its rich history of successful agency partnerships and its energetic and collaborative leadership team.

“Columbia's financial resilience, combined with their trusted agency partnerships and a collaborative team approach, will empower us to uphold and strategically expand the company's footprint into new markets and technology.”

Rieth joins CIG after serving most recently as the product director at a U.S.-based property and casualty insurance carrier.

Iroquois Group is now Ironpeak ™

The Iroquois Group is changing their name after nearly 50 years. When they introduced the concept of networking almost 50 years ago, they needed a name that explained what an independent agency network is and the Iroquois confederacy of independent First Nation tribes was a great analogy. However, the network concept is well understood these days and they wanted a name that reflected who they are and how they work. The shift to Ironpeak allows them to emphasize their identity as a strong, established, performance-driven national network.

Ironpeak believes their new name highlights both their commitment to strong financial and relational foundations and their quest to help their members reach new heights of success. Iron speaks to the company’s strength, stability and resilience. It represents their ability to

weather challenges and help their members and carrier partners succeed even in tough industry conditions like the ones we have been experiencing recently. It symbolizes the strong foundation they provide their members and carrier partners to help them grow and prosper.

Peak represents their drive for superior performance. They are dedicated to delivering great results for their members and carrier partners, year after year. They know that the more their members and carriers succeed, the more Ironpeak succeeds, making it the winwin-win of peak performance as they all grow stronger together.

While their name has changed, nothing else has. They are the same independent, familyowned organization with no outside investors. They have the same expert regional team members, the same outstanding home office staff, and the same commitment to helping their members and carrier partners achieve their goals.

Safeco Insurance and Columbia Insurance Group announce personal lines transfer agreement