AGENT MISSOURI

3315 Emerald Lane, Jefferson City, Mo. 65109

Phone: 573-893-4301 • Fax: 573-893-3708

Email: maia@moagent.org Internet: www.moagent.org

Publisher Matt Barton

Officers of MAIA

President Dennis Luebbering, Jefferson City

President-Elect Matt Speight, Montgomery City

Vice President Deena James, Manchester

Secretary-Treasurer Jim Neuner, Jefferson City

IIABA National Director Brad Greer, Chesterfield

PIA National Director Randy Smart, Marionville

Imm. Past President Darin Banner, Bolivar

Board of Directors

Region 1 Ross Ingersoll, Savannah

Region 2 Matt Alexander, St. Charles

Region 3 Holly Stark, Harrisonville

Region 4 Mark Baker, Platte City

Region 5 Rick Prather, Jefferson City

Region 6 Tony Becker, Crystal City

Region 7 Paul Carcagno, Arnold

Region 8 Heath Greer, Chesterfield

Region 9 Parker Mills, Clinton

Region 10 Richard Ollis, Springfield

Region 11 David Hall, West Plains

Region 12 Jeremy Anderson, Sikeston

At-Large #1 Andy Reavis, Billings

At-Large #2 Clare Zanger, Ozark

At-Large #3 Jon Stahly, Cape Girardeau

Co. Rep. Amber Truskowski, South Jordan, Utah

Co. Rep. Tracey Hagy-Kelly, Creve Coeur

MAIA Staff

Chief Executive Officer Matt Barton

Chief Operating Officer Sheryl Van Leer

Director of Insurance Services Theresa Flippin, AIP, CISR

Director of Education & Events April Underwood

Director of Marketing & IT Joe Lawton

Assistant Director of Insurance Services Hannah Wall

Database Administrator Laura Berendzen

Accounting Specialist Paula Wolken

Customer Service Representative Sarah Wright

Marketing Coordinator Mary Feller

Administrative Assistant Leslie Powell

MISSOURI AGENT (USPS 709-210) is published bimonthly by the Missouri Association of Insurance Agents, 3315 Emerald Lane, Jefferson City, Mo. 65109, Phone: 573-8934301. Periodical postage paid at Jefferson City, Mo. and additional mailing offices.

MAIA does not necessarily endorse any of the companies advertising in this publication. Additional subscriptions are $30 per year.

Address & Other Changes

Notify Missouri Agent if you change your address, change your agency name, or drop or change producers (who are voting members of the association). Write to: Missouri Agent, 3315 Emerald Lane, Jefferson City, Mo. 65109 or email: maia@moagent.org.

POSTMASTER: Send address changes to Missouri Agent, 3315 Emerald Lane, Jefferson City, Mo. 65109. © 2025 Missouri Association of

Agents

I Be a “Proactive” MAIA Member? What Have You Done for Me Lately?

iam so glad you asked! From my very first meeting with MAIA in July 2009 I have been astounded, impressed and even overwhelmed by all the members in this association who care about me! Yes, just me! I am a competitor…or am I? The question is, am I really your competitor? Who is our real threat? Is it your friend, the agency owner down the street? I seriously doubt it! Who is it? I mean, who is it really? You know, I think the reason we all joined this association was with the thought in mind it can help our industry, our clients, our carriers, our staff, the general public and us as agency owners! Our family’s lives can be enriched, our clients can be protected and yet still be our closest friends, our staff can succeed, and humanity can be enriched! What can you think of that would be a greater blessing than that?!

As president of this absolutely wonderful organization I can tell you I have enjoyed the journey, the challenges, the successes…yes!! We have had success!! Okay, I will calm down just a bit. But, hold on, because we have done some amazing things this year. Not because of me, but because of the amazing board members, the MAIA staff and all of you that contribute so much to this association! Sorry, it is 11:15 p.m. and I am just pumped up and ready to shout about how this amazing association is so awesome!

came up to the microphone with about 10 bullet points, and off to the races we went. I realized about an hour before the speech that I didn’t need a script, and threw it away. What I delivered that night was straight from the heart to all of you.

Dennis Luebbering, President, MAIA

"... I think the reason we all joined this association was with the thought in mind it can help our industry, our clients, our carriers, our staff, the general public and us as agency owners!"

Dennis Luebbering

In my inaugural speech in Branson in July 2024 I literally poured out my heart and love for the people in this organization. I did not have a written speech, or too much of anything to direct my discussion. I literally

I recently subscribed to an online book called “D-Day: June 6, 1944: The Climactic Battle of World War II” by Stephen E. Ambrose. I lost an uncle in that war in France. I remember how it affected my mom. I had another uncle that was a gunner on a tank, and I remember how that changed and affected his entire life. I had another uncle that fought in France. So, three in all. When my mom told me how she felt poor, my Uncle Frank said “Lucy, you aren’t poor. You are rich! Until you see what I saw in France, you have no idea what poor is.” My dad was supposed to board a ship that never came back during World War II, but as he was boarding he was escorted off the ramp to become an MP in the Philippines. He would not have survived, and I would not be here. All his friends and comrades perished. The reason I bring up the Normandy France thing is because first of all I am just about done listening to it. I listened to almost 25 hours of narrative of how this battle was planned, the sacrifices that everybody knew they were making and the list goes on. In contrast to all this, we have it made. We are not in jeopardy of dying, etc. But there are things worth fighting for. Now, this is in no way even remotely the same thing that I just described, but please hear me out. We need to stand united and fight to defend the insurance industry!

the topic of focus of this month’s magazine is legal compliance, and while that may sound like a real snoozer to many of you, I cannot stress enough just how important it really is. As most of our members are aware, prior to my tenure here at MAIA, I spent over nine years working for the Missouri Department of Insurance. As an employee of that entity, I gained not only an understanding of laws and how they are made, but also an appreciation for the manner in which they regulate the insurance industry in the state of Missouri.

Many of the emails and phone calls I receive from our member agents pertain to insurance laws in the state of Missouri. They include references to laws that have been in place for decades, as well as those pertaining to legislation that was passed so recently that it has not been codified into volumes of laws yet. The communication from our members often leads to my better understanding of a law, too, as I dive deeper into the verbiage included in the law.

One of the inherent shortcomings of laws, including insurance laws, is that they often do not include such detailed wording to solidly provide an answer to what our members are looking for. That may sound odd, considering just one bill being debated at the federal level at the time of writing this is over 1,000 pages…but that’s kind of how the federal government operates. Bills on the state level tend to be much shorter, but even in 1,000 pages it’s all but impossible to take into account and imagine all situations to which a particular law may apply and draft that law accordingly.

At other times, an insurance law may only address part of an issue. For instance, like numerous other states, there is a law here in Missouri that addresses certificates

of insurance. That law states that you, as an insurance professional, cannot place verbiage upon a certificate of insurance that does not accurately reflect the coverage(s) in the underlying policy. The penalties for that are steep and can include fines and the revocation of your insurance license. In short, don’t chance it because you may also have an errors and omissions claim on your hands. For all the good included in that law, what’s somewhat frustrating at times is the seeming lack of oversight of those individuals who ask you to do this, or worse, those individuals who pressure your clients to request you place the verbiage on a certificate of insurance.

As I’ve joked on more than one occasion, I only play an attorney on TV. I didn’t attend law school, nor even sit for the examination to determine admission to such college classes. I just have a hunger for learning about insurance laws. However, I do know a very intelligent lawyer who just happens to be available to you, our MAIA members. A benefit of MAIA membership is free consultation with Lew Melahn, local legal counsel who previously served as the director of the Missouri Department of Insurance. If I’m not able to assist you with your legal questions, I am more than certain Lew can.

Our members are professional insurance agents, practitioners in a field that requires skills that include sales. I don’t believe I would be very successful at that at all. So, the best I can do is support them in what they do best – provide insurance solutions to their clients. If you have a question about a Missouri law, or a federal law for that matter, reach out to me. Together, we can probably identify how the law will affect you.

Matt Barton Chief Executive Officer, MAIA

while I’m not involved in the daily production of coverage for customers, I do hear from enough producers to know the types of problems producers are facing in the current markets, both as to coverage that’s available and as to how the coverage may be applied when a claim occurs. I’m well aware that the property market is difficult and the movement to percentage deductibles makes conversations with customers very difficult. And if a claim occurs after that deductible is in effect, that conversation may be more difficult. But having the conversation is important so that matters don’t escalate just because there are unfortunate results.

I don’t think it comes as a surprise to anyone in this industry that unhappy customers are the ones most likely to take matters into litigation. Any time things go to litigation anything can happen.

Of course, these issues are all being decided outside of any producer input. There may be great debates about whether storms are more frequent and more violent, but it is not a surprise that hail and wind have occurred in the Midwest for years. Anyone having watched “Little House on the Prairie,” or helped their child read the books, will know one of the big events was complete crop loss by the Ingalls family due to a hail storm. Whether the losses have grown because of worse or more frequent storms, or from climate change, or from just the rapidly rising costs of roofs and home repair, it’s clear insurers think those levels of loss can’t be sustained with current premium levels. The options were to raise premiums or lower loss costs through higher deductibles, mostly on a percentage basis. Customers weren’t going to be happy

with either, but in some ways they get a taste of both, which isn’t well received. And the idea of a percentage deductible doesn’t sound bad, until you realize your deductible is higher than the cost of the new roof. If not fully aware of that potential you may have a customer ready to sue everyone in sight. Nevertheless, companies seem to have determined the percentage deductible was more acceptable than a premium increase to match the risks from wind and hail. Time will tell if this is correct.

Lewis E. Melahn, J.D.

"One of the difficulties for producers is being sure that they understand how the company intends to apply its premium increases or how it will adjust claims under a percentage deductible. "

Lew Melahn

One of the difficulties for producers is being sure that they understand how the company intends to apply its premium increases or how it will adjust claims under a percentage deductible. I have recently seen why that may be difficult, as I’ve seen a policy with multiple different terms for location, value and covered property that made it very unclear as to the amount of the deductible. That is a prescription for an unsatisfied customer. All a producer can do is attempt to explain to the customer the type of losses that have led to the premium increases or the higher deductible. Because these deductibles are generally a newer concept, producers would do well to inquire of their carriers how that deductible will be calculated upon the various types of property covered under the policy. An explanation of that, along with an understanding of how expensive such property losses have been, may soften how the customer feels about the increases in premium and deductibles. That can avoid some unhappiness from the customer and perhaps reduce the potential for litigation in the event of a claim. Even if the producer isn’t named in a lawsuit, it still will likely involve significant time for the producer in providing evidence of the process of the sale.

Lewis E. Melahn is a practicing attorney who provides free legal consultation to MAIA members on a limited basis. He served as the director for the Missouri Department of Insurance from 1989-1993. You can contact Lew Melahn at 573-230-7200.

s mentioned in my last article, about a year and a half ago, a friend and I picked up and moved to St. Louis to help get a new agency off the ground. To top that off, we are also the risk managers of two auto dealerships. Have we had an education quickly on how to protect businesses from loss with strong risk management! Mind you, there are three of us trying to write insurance, manage three captives and provide the proper safety protection for the dealerships. Our days can be long but fulfilling.

By giving you this background and outline below, we hope you can see how you, too, can be successful loss control/risk management consultants for your small to mid-size clients.

We are in an industry dominated by large firms with vast resources, thus small insurance agencies might seem at a disadvantage when it comes to helping clients with risk management. However, their size can actually be a strength, allowing them to offer personalized service, deep expertise and innovative solutions that larger agencies often struggle to provide. Here’s how small insurance agencies can effectively assist clients in managing risk.

One of the biggest advantages of small insurance agencies is their ability to provide tailored risk assessments. Unlike large firms that rely on standardized models, small agencies can take the time to understand each client’s unique situation. By conducting in-depth consultations, they can identify specific risks that might be overlooked by broader assessments.

How to Implement:

• Conduct one-on-one meetings with clients to understand their business or personal risk exposure.

• Offer customized risk analysis based on industry trends and local market conditions.

• Provide regular check-ins to reassess risks as circumstances change.

2. Building Strong Client Relationships

Small agencies thrive on personal connections. Their ability to foster trust and long-term relationships allows them to provide proactive risk management strategies rather than reactive solutions. Clients are more likely to reach out for advice when they feel valued and understood.

How to Implement:

• Maintain open communication channels through phone calls, emails and in-person meetings.

• Offer educational workshops to help clients understand risk management strategies.

• Develop a client-first approach, ensuring that recommendations align with their best interests rather than just selling policies.

3. Leveraging Local Expertise

Small insurance agencies often have deep knowledge of local risks, whether it’s weather-related hazards, industry-specific challenges or regional economic fluctuations. This expertise allows them to craft risk management strategies that are highly relevant to their clients.

How to Implement:

• Stay informed about local regulations and industry trends that impact risk.

• Partner with local businesses and professionals to provide comprehensive risk solutions.

• Offer specialized coverage options tailored to regional needs.

4. Providing Proactive Risk Mitigation Strategies

Beyond selling insurance policies, small agencies can help clients prevent losses before they occur. By offering risk mitigation strategies, they position themselves as

continued on page 28

Deena James MAIA Coverage Advisory Committee, St. Louis Insurance Services, St. Louis

If you encounter any issues with policy forms, coverage gaps or problematic language, please report them to MAIA’s Coverage Advisory Committee so they can work on getting them corrected through their discussions with ISO, NCCI and ACORD.

Expand Your Agency’s Impact with WalkerHughes Insurance

“The WalkerHughes culture is built on community, relationships, and a client-first mindset, ensuring that the core values, service, and people that clients trust remain at the heart of everything we do.”

Mike Swatske, Regional Director IBA joined WalkerHughes in 2024

A Forever Company

Committed to long-term growth and stability, ensuring your success for generations to come with:

CONTACT US

Local Presence

Maintain the brick-and-mortar location and employee jobs in our communities

Employee Ownership

Own equity as a key employee or agency owner

Profit Sharing Program

Participate in a long-term incentive program built for all team members

Financial & Operational Security

Remain family and employee owned

WalkerHughes Insurance

for a confidential conversation about how we can grow together.

in today’s digital-first insurance landscape, recording telephone conversations with customers is increasingly common. Agencies adopt this practice to improve service quality, ensure compliance and document client interactions. However, while call recordings can be a valuable tool, they also introduce significant E&O (errors and omissions) liability risks if not managed properly.

Call recordings can serve as critical evidence in defending against E&O claims. When properly retained and documented, they can clarify what was said, promised or requested during a conversation. For example, if a customer alleges that coverage was promised but not delivered, a recording can confirm or refute the claim. Such recordings can help resolve “he said, she said” disputes more definitively—assuming the agency is on the right side of the facts.

One question I hear frequently is, "Do I have to record all our telephone calls?" If the agency plans to use this technology, then "yes," they need to be consistent and use it for all calls, because if an E&O claim is filed and during depositions the plaintiff’s counsel learns the agency usually records calls but did not for their client in this circumstance, that will create problems for the agency’s defense. If you do it for one, you must do it for all.

Before recording calls, agencies must understand and comply with state and federal laws. Swiss Re recommends agencies consult with their local legal counsel to make sure they adhere to local laws and regulations. Before the recording begins, the client should be made aware of the recording and have the opportunity to withdraw consent from being recorded. Failure to comply can render recordings inadmissible in court or even expose the agency to legal

penalties. In some jurisdictions, even legally recorded calls may not be admissible in civil litigation, which could undermine an agency’s defense in an E&O case.

While recordings are helpful, they should never replace written documentation. Agency management systems and thirdparty vendors are developing add-ons that will automatically record phone calls and store them in the client file. Some vendors market this service as a way to decrease your E&O claims because you won't have to worry about documenting your file. Swiss Re's position is the recording of the telephone call is not a replacement for file documentation and may not be admissible in court for the agency's jurisdiction.

Agencies should follow up all verbal communications—especially those involving coverage changes or discussions about higher limits—with written confirmation. Documenting all forms of communication, including phone calls, emails and texts, is essential to building a defensible customer file.

Recordings can also backfire. If a staff member makes an incorrect statement or fails to follow through on a customer request, the recording becomes evidence against the agency. A recorded conversation captured a staff member either misstating coverage or failing to follow through on a client's request. When the client later filed an E&O claim, the recording became the plaintiff's strongest evidence. Because the error was clearly documented in the recording, the insurer had no viable defense, and the claim was paid out.

In another E&O claim, a recorded call showed that a staff member had not documented a change request properly. The agency had relied on the recording instead of updating the client file. When the issue escalated to litigation, the recording

AIAM

Senior Underwriter & Risk Management Expert, Swiss Re Corporate Solutions

This article is intended to be used for general informational purposes only and is not to be relied upon or used for any particular purpose. Swiss Re shall not be held responsible in any way for, and specifically disclaims any liability arising out of or in any way connected to, reliance on or use of any of the information contained or referenced in this article. The information contained or referenced in this article is not intended to constitute and should not be considered legal, accounting or professional advice, nor shall it serve as a substitute for the recipient obtaining such advice. The views expressed in this article do not necessarily represent the views of the Swiss Re Group ("Swiss Re") and/or its subsidiaries and/ or management and/or shareholders.

Copyright 2025 Swiss Re continued on page 14

continued from page 13

was either inadmissible or damaging, and the lack of written documentation left the agency exposed.

To mitigate E&O exposure while leveraging call recordings, agencies should:

• Establish a clear policy on when and how calls are recorded.

• Train staff on proper call handling and documentation procedures.

• Disclose recording practices to customers as required by law.

• Retain recordings securely and in accordance with data retention policies.

• Supplement recordings with written summaries or confirmations in the agency management system.

As technology evolves, so too must agency risk management strategies. The next

generation of E&O seminars is already exploring how tools like voice analytics and AI-driven transcription can support compliance and reduce liability. But the core principle remains unchanged: Transparency, documentation and adherence to professional standards are the best defenses against E&O claims.

National General, an Allstate company

would like to shine some light on a little secret in the insurance world. A lot of independent agencies are winging it. If I had a dollar for every time I asked an agency owner, "If I was a new hire, what resources would you give me to teach me how to do my job?" and got a version of “we don’t really have anything written down” in response, I’d have enough to insure a yacht.

Nine out of 10 agencies don’t have any written standard operating procedures (SOPs). No guides. No videos. No flowcharts. Nothing. Just a "figure it out as you go" approach that relies on tribal knowledge and instructions discussed over cubicle walls or via Teams.

way, the answer is a shrug and a "because we always have."

3. The Former Captive Agent: In the captive world, everything was decided for them. Now that they’re independent, they have options and freedom...and no idea how to build structure from scratch.

"Standard Operating Procedures (SOPs) are like having GPS for your agency. You don’t have to guess which route to take..."

This is a major problem. Your producers can’t just be told to sell, and your CSRs can’t be told to service without clarity on how to do that efficiently and consistently. The lack of defined processes leads to confusion, inconsistent customer experiences, missed follow-ups and chaos when someone takes a vacation or leaves the agency.

There’s no shortage of reasons why this has happened, and I think the three most common agency origin stories are likely to blame.

1. The Producer-Turned-Owner: They struck out on their own, sold like crazy to survive and built an agency with duct tape and prayers. Now, three years in, they’re profitable but disorganized. They’re still flying by the seat of their commission checks.

2. The Legacy Agency: They’ve been doing it this way since fax machines were useful. If you ask why something is done a certain

- Casey Nelson

Without structure, agencies struggle to implement technology because you can’t automate chaos. You can’t train a new hire to be efficient when every process lives in someone’s head. Staff revert to "the old way" because it feels safer and more predictable. If you don’t have written SOPs, you are handcuffing your agency's ability to grow, innovate, and provide consistent service. It might feel like you’re saving time by not writing things down, but you're setting your agency up to hit a ceiling. It’s time to fix that.

Standard Operating Procedures (SOPs) are like having GPS for your agency. You don’t have to guess which route to take, and you can get new drivers (read: hires) up to speed quickly.

Here’s what SOPs unlock for your agency:

• Scalability: When everyone follows the same process, hiring and onboarding become easier. You don’t have to rely on shadowing or hoping someone remembers to teach the new guy how to issue a cert.

• Targeted Training: If your processes are clear, you can actually evaluate performance. You’ll know who needs help, and in what areas. That’s how you grow great people.

• Accountability: Ever had someone continued on page 31

Brad Greer Chair, MAIA Political Action Fundraising Committee, Arnold Insurance, Chesterfield

if you have known me for more than 10 minutes there are a few things that you would likely know about me: First, I love to sail; also, I hate to be late. If you have known me for a long time, you’d also know that I love writing for the Missouri Agent and I never am at the deadline clueless as to my topic.

What do those have to do with InsurPac?

Good question.

This article is due tomorrow and I have been clueless as to what to write. Also, I am on a sailboat this weekend bringing my new sailboat back to my home port.

Late yesterday afternoon and within a couple of miles of the marina we booked to stay the night, we approached a lovely bridge called the Shands Bridge. Here is a picture…

Another, less pretty, but more important picture of a sign under the bridge is shown to the right…

This was also the sign that a problem had arisen. My mast is 46 feet tall and there was a foot of chop.

We were, of course, aware of this fact from the start. Also, we had planned for the fact that we would not be arriving at low tide; however, an 11-hour, 60-nautical mile journey also means many details beyond our control. We also couldn’t have known that we would arrive at high tide with windy conditions.

We had made plans for this situation. We had removed or lowered weather and radio gear in order to have the lowest possible height, the least resistance to passing this obstacle.

Still, we had no alternative but to wait for low tide, which was at 11:30 last night, a five-and-a-

half-hour wait. Tired from a long day, unable to see for the darkness, not assisted by a waxing crescent moon that threw off little light, we proceeded slowly in unfamiliar waters toward the bridge.

The sign said the gap was at 46 feet, so slowly we proceeded with bated breath. Fortunately, we cleared the bridge. Pitch dark and in unfamiliar waters with two hand-held

spotlights we proceeded cautiously until we found safe anchorage.

My point is that we plan, we calculate and we execute as insurance business people. Despite our efforts, times change and we must accommodate a new plan or at least a modified plan.

This, my friends, is why we should support InsurPac, because few things legislative are certain. Even those we think are certain often change. Our government affairs people are constantly moving, constantly promoting our interests, which as I have often said, nearly always align with our clients’ best interests.

So whether it is one big beautiful tax bill at the federal level, or common-sense tort reform at the state level, you should, no you REALLY should support our PAC efforts today and throughout the year.

continued from page 5

The final thought I have to present to you is this. Your board, the board of the Missouri Association of Insurance Agents, voted at our May 2025 planning session to pursue the task of educating the general public on the issues facing our insurance industry when it comes to tort reform. I am very excited about the plans we have to address this important topic. To be clear, we are not opposed to our clients and friends that need help filing claims to make them whole again. We all want legitimate claims to be paid. I think we are all 100% in agreement with that. The problem we are facing is the general public does not know the facts. They do not know that the people that need the help get very little in the final settlements. We want to get the facts out to the general public, and to our membership. I would encourage all of you to reach out to our association for more information. Grassroots operations have always been the best way to combat political

forces, no matter what they are.

Insurance rates are rising. Reinsurance costs are rising. You all know the routine. Umbrella rates are either rising or becoming nonexistent. Monoline auto carriers are leaving the marketplace. It is becoming harder and harder to place good business that was easy in the past.

I have what I consider a very dear friend who told me as I was taking over the presidency of this association that we do not do a good job of tooting our own horn. When we do something, our membership should know about it. I am not sure that we always share everything with you, but I am sharing from the heart tonight.

Do you need further evidence of why you need to join and support the association? Contact us. We need you. You need us. We are better together!

the short answer is “yes,” but only for a limited amount of time.

Last November, Missouri voters passed what was known as “Proposition A” mandating that employers provide paid sick leave to eligible employees. It also prescribed raises to the minimum wage that must be paid to workers in Missouri. Almost 58% of voters cast ballots in favor of the requirements included in Proposition A, which became effective May 1 of this year.

A “yes” vote to the ballot measure approved:

• Increasing the minimum wage Jan. 1, 2025, to $13.75 per hour, and increasing it to $15.00 per hour Jan. 1, 2026;

• Adjusting the minimum wage based on changes in the Consumer Price Index each January beginning in 2027;

• Requiring all employers to provide one hour of paid sick leave for every 30 hours worked;

• Allowing the Department of Labor and Industrial Relations to provide oversight and enforcement; and

• Exempting governmental entities, political subdivisions, school districts and education institutions.

However, during the final week of the 2025 regular legislative session, the Missouri Senate gave final approval to House Bill 567 terminating the above-referenced schedule that would increase the minimum wage starting in 2027, as well as repealing the sick leave provisions included in Proposition A. The default effective date for legislation in Missouri is August 28 of the year in which it passes the legislature. However, available to the legislature is the ability to include an “emergency clause” in legislation, which would place a bill in effect as soon as the governor signs it. While House Bill 567 passed the legislature and it is expected to be signed by Governor Kehoe, a proposed emergency

clause was not approved by the legislature. As such, the bill becomes effective August 28, setting up a time period between Proposition A’s May 1 effective date and the legislation’s effective date later this summer.

Here's what employers, including insurance agencies, need to know:

• The current minimum wage of $13.75 per hour in Missouri will increase to $15.00 on Jan. 1, 2026, but absent any further approval by voters or legislative activity, no further increases are currently prescribed;

• Effective May 1, 2025, employers must provide employees one hour of paid sick leave for every 30 hours worked. There was no particular time period during which employees must work those 30 hours included in Proposition A;

• The requirement to provide one hour of sick leave for every 30 hours worked ends on August 28 of this year; and

• Currently, there exists no guidance as to whether employers must allow employees to take any sick leave accrued since May 1 after August 28, but that might be forthcoming.

The provisions of Proposition A were repealed due largely to the burden they would place upon employers in the state of Missouri. There is discussion, however, among interested parties with respect to placing this decision before the voters in a future election.

Matt Barton, Chief Executive Officer, MAIA

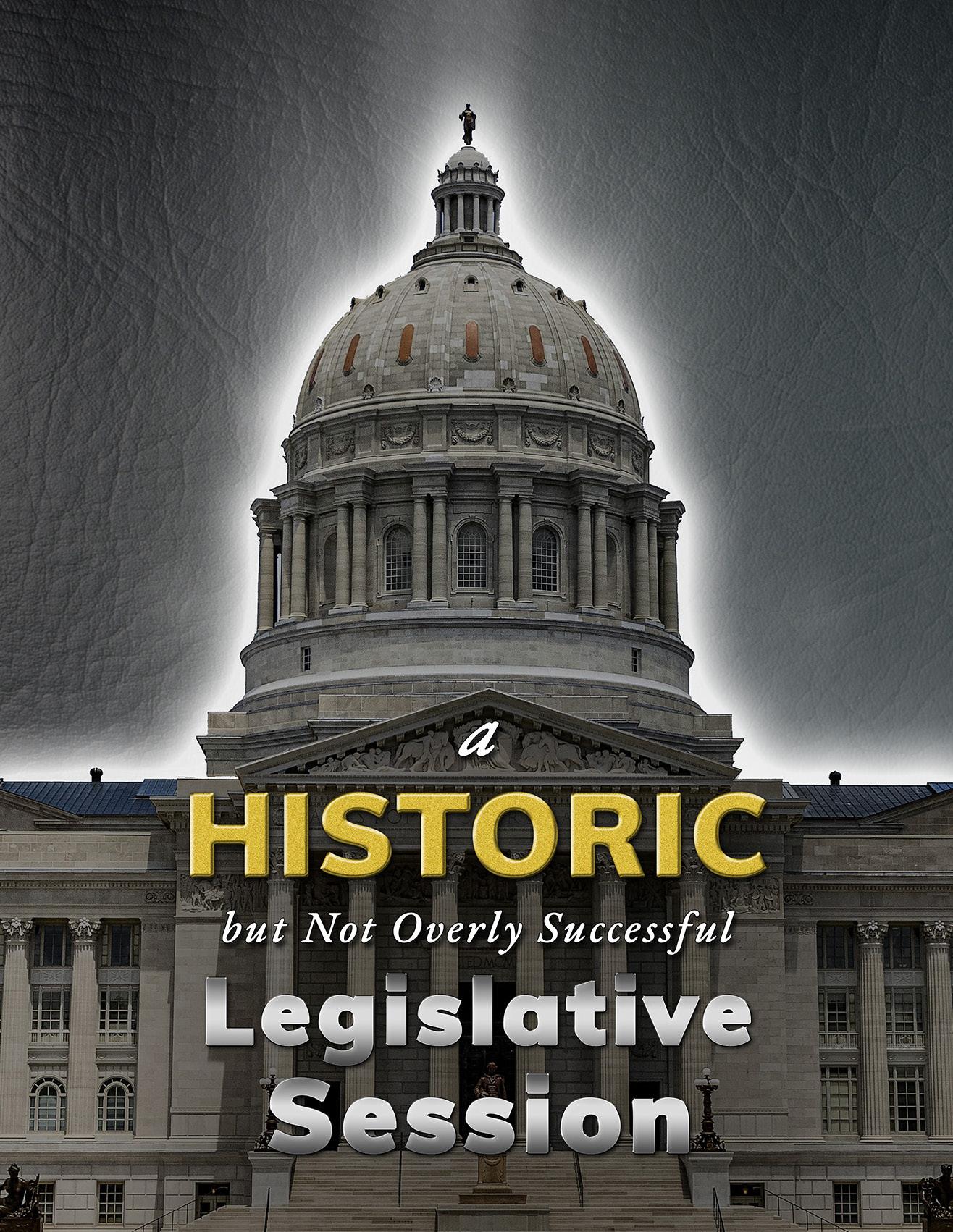

2025 Legislative Session Recap

The 2025 regular session of the Missouri Legislature will be mostly remembered for one thing – the rare usage of a procedural motion that forced an immediate vote on two issues previously passed by Missouri voters. In the waning hours of the session, the majority party in the Senate employed what’s called the “previous question” in order to gain passage of legislation pertaining to reproductive rights and employee benefits. (See page 19 for how the repeal of Proposition A might affect your business.) The point of this article is not to address whether the body should have done that or not, nor to offer positions on the two issues, but instead offer insight into this year’s session and explanation of insurance-related legislation that was successfully passed.

Sixty-seven pieces of legislation were passed during the regular session of the legislature. Of those 67 bills that passed, 16 of them were appropriation, or budget, bills that authorize funding for the many areas of the state’s government. As noted in previous communication, if the legislature does nothing else during a given session, the one thing they are required to do is pass a budget for the state of Missouri. Absent that, the services the government provides citizens on a daily basis cease to continue. We can argue continuously as far as whether government is bloated, but the reality is that there are many vital parts of government that must be funded on an annual basis.

Governor Kehoe called a special session of the Legislature to address several issues, and three bills were passed during that session. Following are the bills that passed both sessions that are of particular interest to those employed in the insurance industry, whether on the agency, carrier or wholesaler side.

House Bill 974, sponsored by Rep. Jim Murphy (R-St. Louis), pertains to insurance for peer-to-peer car-sharing programs, as well as data security in the insurance industry overall. While a number of years ago we helped pass legislation prescribing insurance requirements for transportation network companies (Uber, Lyft, etc.), those requirements did not pertain to peerto-peer car-sharing programs (Turo, Getaround, Zipcar, Hiyacar, RentMyRide, etc.) nor food delivery platforms (DoorDash, Uber Eats, Grubhub, etc.).

HB974 requires peer-to-peer car sharing programs, as defined in the bill, to assume liability for property damage and bodily injury in an amount at least equal to the coverage required under Missouri’s Motor Vehicle Financial Responsibility Law, as specified in the bill, and specifies certain requirements for insurance coverage and the resolution of coverage disputes. The bill also provides that peer-to-peer car sharing programs and shared vehicle owners are exempt from vicarious liability based solely on vehicle ownership, and specifies that motor vehicle insurers have the right to seek recovery against the peer-to-peer car sharing program's insurer for defending certain claims.

While food delivery platforms were originally included in the discussions regarding this bill, a disagreement regarding the point during the delivery process at which insurance coverage must begin resulted in the removal of insurance requirements for those platforms from this bill.

HB974 also requires licensees (carriers and producers) to implement an information security program, as defined in the bill. Each licensee must have a comprehensive information security program that is in keeping with the size and complexity of the licensee and the scope of its activities. The bill specifies data protection objectives for the programs, as well as standards for risk assessment by licensees, and measures to be implemented in the information security programs. The legislation does prescribe exemptions from these requirements for certain entities, including producers that have fewer than 50 employees, less than $5 million in gross annual revenue or less than $10 million in year-end total assets. Other exemptions are included and licensees are encouraged to review the legislation on the House of Representatives website at www.house.mo.gov or call the MAIA office to discuss the legislation.

Most provisions of this bill take effect Jan. 1, 2026, but licensees are granted additional time for the implementation of some of the information security requirements.

Senate Bill 47, sponsored by Sen. Curtis Trent (R-Battlefield), relates to class actions and represents the only tort reform bill that passed this session. It has been well documented that Missouri has an inordinately poor litigation landscape and that the cost of such is a major contributing factor to the rise in insurance premiums and contraction of available insurance markets.

The legislation primarily focuses on aligning Missouri's class action rules with federal law. It makes technical changes to Supreme Court Rule 52.08, aiming to simplify and make the legal process fairer. The bill addresses class action certification, notice to class members and the handling of dismissals and compromises. It also allows for appeals of class action certification decisions.

The bill clarifies the requirements for certifying a class action, including defining the class, class claims and appointing class counsel.

It outlines how notice should be provided to class members, potentially using U.S. mail, electronic methods or other appropriate means.

The bill regulates the process for dismissing or compromising a class action, requiring court approval and notice to class members. By aligning with federal rules, the bill could lead to more efficient and predictable class action litigation in Missouri.

In expressing the need for the reforms in the bill, Sen. Trent said, “Rule 23 was adopted in 2018 by the federal courts to create uniformity in procedures surrounding class action lawsuits, particularly when it comes to the timing of when a class is certified and what the definition of a class is for that certification.” Trent also noted, “These are important landmarks, because they determine whether expensive actions, like discovery, proceed, and it also has impacts on incentives to settle cases and what the value of that settlement is going to be.”

This bill will take effect Aug. 28, 2025.

Senate Bill 79, sponsored by Sen. Kurtis Gregory (R-Marshall), includes several areas that all relate to health care in some form or fashion, but one part is of particular interest to MAIA members and the insurance industry overall. SB79 establishes a regulatory infrastructure to allow membership organizations, namely Farm Bureau, to sell health care benefit plans. The act provides that statutes governing health insurance shall not apply to contracts for health care benefits provided by a qualified membership organization, as such terms are defined in the act, to its members who have been members for at least 30 days, and that the qualified membership organization shall not be considered to be engaging in the business of insurance. Qualified membership organizations providing the contracts shall register with the Missouri Department of Commerce and Insurance as specified in the act.

MAIA initially opposed this type of legislation when it was first proposed a few years ago, but once it became a priority to members of the majority party, our goal shifted to including in the legislation requirements that the consumer be properly informed of what they are purchasing. All applications, forms and renewals must include disclaimer verbiage that states:

• This product is not subject to laws relating to health insurance;

• This product offers fewer benefits than an ACA-compliant health plan;

• The client may qualify for subsidies through the ACA health insurance marketplace;

• The contract is not covered by the Missouri Guaranty Association; and

•The client may be responsible for costs not otherwise covered under the product.

This bill also takes effect on Aug. 28, 2025.

As part of Senate Bill 3 passed during a special session in June, the Missouri Legislature agreed to provide an income tax credit for deductibles paid by residents whose “homestead” was impacted by severe weather during calendar year 2025. The credit, not to exceed $5,000 per taxpayer, may be carried forward to any of the taxpayer's 29 subsequent tax years or until the full amount of the tax credit is redeemed, whichever is earlier. The amount paid for the deductible must be a direct result of a disaster for which a request for a presidential disaster declaration has been made by the governor of the state of Missouri. Residents who have been affected by severe weather this year should consult with their accountants or tax preparers to determine eligibility for the tax credit.

The legislation, which, among other items, also includes tax incentives for select Missouri professional sports teams, was signed by Governor Kehoe on June 14.

Let’s

Customized programs for niche markets

Flexible plans

Cancellation requested at 30 days, not 10

Immediate funding of premiums

Income opportunity for your agency, where permitted FOR

Monthly installments and no lump-sum payment

Low monthly payments to help preserve cash flow

Payment consolidation for multiple policies

Online account access to track balances and make payments CONTACT

the Missouri Department of Commerce and Insurance (DCI) is no longer offering onlineproctored insurance licensing examinations for Missouri. This action is being taken due to issues with the security and integrity of the online examinations, which have been identified by Pearson VUE, DCI’s contractor for exams. The option of an online insurance examination was initially permitted in response to the COVID-19 public health emergency, which has ended. After reviewing the number of applicants who take our exams via this method and factoring in the inherent security risks with onlineproctored licensing exams in uncontrolled environments, we have made the decision to stop offering our licensing exams via this method. Over the past year, many other state insurance regulators have ended the online testing option due to similar security concerns.

Effective May 9, 2025, no new registrations were accepted for online insurance examinations. In addition:

• Candidates who had already registered for an online examination were permitted to take it if it was scheduled to be administered on or before May 18, 2025.

• Any other insurance examination that was scheduled to be taken online was required to be rescheduled and taken in person at one of the authorized Pearson VUE testing centers. There was no additional charge for the rescheduled examination.

• Any applicant who may need an examination accommodation should review the procedures on the Pearson VUE website (www.pearsonvue.com) and contact an authorized Pearson VUE testing center for assistance.

• Pearson VUE contact information can be found at https://www.pearsonvue.com/us/en/ mo/insurance.html#contact.

On May 7, 2025, Missouri Department of Commerce and Insurance Director Angie Nelson released Insurance Bulletin 25-03 notifying resident producers, prospective resident producers and insurance companies of Missouri’s decision to no longer offer the OnVUE testing option for producer examinations. This bulletin is available on DCI’s website at http://www.insurance. mo.gov/laws-rules-guidance/bulletins.

Brogan Dinolfo, Manager, Regulatory Services for the Missouri Department of Commerce & Insurance

This article expresses the official views and opinion of the Missouri Department of Commerce & Insurance, which may not necessarily be those reflected by the Missouri Association of Insurance Agents.

continued from page 11

trusted advisors rather than just policy providers.

How to Implement:

• Conduct risk audits to identify vulnerabilities in a client’s business or personal assets.

• Recommend preventative measures, such as cybersecurity protocols, safety training or disaster preparedness plans.

• Work with clients to develop contingency plans for potential risks.

5.

While small agencies may not have the same technological infrastructure as large firms, they can still leverage affordable digital tools to enhance risk management services.

How to Implement:

• Use risk assessment software to analyze potential threats.

• Offer online portals for clients to access risk management resources.

• Utilize data analytics to track trends and provide informed recommendations.

6. Partnering with Specialized Experts

Small agencies can expand their risk management capabilities by collaborating with specialized professionals, such as legal advisors, financial consultants and safety experts.

How to Implement:

• Build a network of trusted professionals to refer clients for additional risk management support.

• Offer joint consultations with industry experts to provide comprehensive advice.

• Stay connected with insurance carriers to access specialized risk management programs.

Conclusion

Small insurance agencies may not have the vast resources of larger firms, but they have the advantage of having fewer markets, so they may know their products better. They can also offer personalized service, local expertise and proactive risk management strategies. By focusing on relationship-building, tailored assessments and innovative solutions, they can provide exceptional value to clients and establish themselves as indispensable partners in risk management.

he Missouri Association of Insurance

tAgents has partnered with the Ohio Insurance Agents to offer our members access to IA Valuations, an organization that prepares valuations exclusively for independent agency owners. Getting a valuation of your insurance agency is not only an important business decision, but also a tool for understanding the fair market value of what is likely your greatest financial asset. Below is an introduction of who they are, what they do and why they do it:

IA Valuations’ mission is to help agency owners realize and maximize their value while also protecting the independent agency system. Our mission drives what we do and why we do it. We are mission-driven and committed to the relationships we build. The valuation process allows us to get an intimate look into each agency, which builds deep connections and, often, long-term business relationships. In addition to valuation services, IA Valuations provides perpetuation planning, financial modeling, buy-sell advising and other related insurance agency business consulting.

IA Valuations prides itself on providing more than just a number to agencies. We strive to also provide a pathway for growth. The valuation report will give insights to the owners on opportunities to grow, how to maximize value and how to best position your agency for long-term wealth building. Every single agency is different, so each engagement is tailored to the individual agency’s specific needs. After reviewing and analyzing all your data, you will get a customized and individual 40-page report.

The IA Valuations team has completed over 350 insurance agency valuations in their collective careers and is made up of passionate and highly skilled professionals. The team is comprised of financial analysts who have the most practical experience and prestigious education in their field. They each have a deep understanding of the insurance industry and are knowledgeable of relevant benchmarks to accurately measure your agency’s performance.

On top of providing a valuable service to individual

agency owners, the IA Valuations team has been working to build a robust data platform to use to analyze the collective data. The more valuations and consulting engagements performed by IA Valuations, the richer and more detailed data and reports will follow, which can then be used to further help agency owners.

IA Valuations also places a strong emphasis on the fact that these services are accessible and affordable for all agency owners. Many of the valuations are provided to an underserved and overlooked constituency in the IA System: small to mid-sized agencies. These agencies are often not the focus of consultative services and private equity acquisitions and therefore are devoid of insights to help them grow and improve agency value, despite the ever-present need.

Our long-term goal for IA Valuations is to get every insurance agency owner an annual valuation of their agency. The belief is that this is the equivalent of receiving your annual statement on the performance of a financial investment. Your agency is a significant financial asset in your portfolio, and you should have a solid, accurate and up-to-date understanding of the value of that asset.

You value your clients; we value your agency! Reach out to contact@iavaluations.com to get started or learn more about our services.

When it comes to securing your

The Big “I” MEP 401(k) Plan was designed with our Big “I” members’ needs in mind. By capitalizing on our collective size, the Big “I” assembled a line up of best-of-breed retirement providers usually only available to Fortune 500 companies.

With the Big “I” MEP 401(k) Plan, members experience all the benefits of an unbundled plan without having the stress of managing the providers. Big “I” Retirement Services, in conjunction with our administrator, serves as a gatekeeper and provides members with one main point of contact for the operation of your plan.

The MEP is a top-tier 401(k) plan with low cost mutual funds, competitive administrative costs, cutting edge educational tools and plan consulting. Learn how our plan compares; contact us for a complimentary consultation today. Participation in our plans is available exclusively to Big “I” members.

continued from page 15

say, "Oh, I didn’t know I was supposed to do that?" SOPs eliminate that excuse. If someone isn’t using the tech you invested in, it becomes crystal clear.

• Efficiency Audits: Once your processes are written, you can actually analyze them. You’ll spot duplicate work, time-wasters and outdated steps. Then, you can fix them.

And now, let’s introduce the Front Door Theory. Every agency process needs a clearly defined entry point – a "Front Door."

Think of a lead coming in. It doesn’t matter if that lead came from a lender, a website form or a walk-in – the process has to start the same way for everyone. That starting point launches workflows, tracks data, assigns producers and sets expectations. If there are multiple front doors or no front door at all, your data becomes unreliable, your automations break and your accountability disappears.

A unified starting point creates:

• Consistent execution

• Accurate reporting

• Easier training

• Increased automation opportunities

Bottom Line SOPs don’t just make your agency more efficient. They make it workable, teachable and scalable.

Barton Mutual Insurance Company was named Business of the Year at the 2025 Best of Barton County Luncheon, hosted by the Barton County Chamber of Commerce. This award is a reflection of Barton Mutual Insurance’s hard work, dedication to policyholders and ongoing commitment to community.

Columbia Insurance Announces New Vice President of Claims and Expanded Roles for Regional Vice Presidents

Columbia Insurance is pleased to announce Angie Gallo joined the leadership team as vice president of claims on March 31. Gallo is a results-driven and innovative

leader with over 20 years of experience in claims and customer support.

“Angie’s leadership approach focuses on fostering a service-orientated team environment, driving successful operating results and advancing innovation initiatives,” said Todd Ruthruff, Columbia’s president and chief executive officer. “We are thrilled to have her join our officer group to lead our claims team.”

Columbia Insurance also expanded leadership responsibilities for its regional vice presidents (RVPs). These officers will now lead key strategic initiatives in addition to their current roles as heads of their respective regional offices.

“This is an exciting step forward in our strategic growth journey,” said Keith Maciejewski, Columbia Insurance’s vice president and chief underwriting officer. “Our RVPs have been instrumental in shaping our vision and now they will lead

the charge in executing it across critical areas.”

New assignments include:

• Shelly DeVore, vice president of agency distribution and management, will optimize agency engagement and develop new resources to support growth.

• Shane Martinez, vice president of middle market, will guide Columbia’s underwriting, service capabilities and engagement strategies for larger policyholders.

• Byron Smith, vice president of alternative markets, will identify innovative revenue opportunities and expand Columbia’s reach through non-traditional channels.

Todd Ruthruff, Columbia’s president and chief executive officer, said he is confident this team will help lead Columbia into an exciting new chapter.

“Our regional vice presidents have consistently demonstrated our people-first vision which defines Columbia’s values. By expanding their roles, we’re empowering them to drive innovation and growth in ways that will deepen our partnerships and strengthen our market presence.”

According to Ruthruff, Columbia’s core priorities remain unchanged. “We are committed to delivering superior service and building strong, people-first partnerships. These expanded roles will help us do just that in new, strategic ways.”

BMI Company, Inc Rebranded as SurSafe Mutual Insurance Company

BMI Company, Inc., a Missouri mutual insurance company, announced its acquisition of Cameron National Insurance Company, a Missouri stock insurance

company. As part of this strategic development, BMI has rebranded as SurSafe Mutual Insurance Company, and Cameron National Insurance Company will be renamed SurSafe Insurance Company. Together, these name changes unify the operations under a single, trusted brand: SurSafe.

Cameron National is licensed to sell insurance products in six states: Missouri, Iowa, Illinois, Nebraska, Kansas and Arkansas. Through this acquisition, SurSafe will have the ability to expand its operations into these states via its newly renamed subsidiary, SurSafe Insurance Company.

“This acquisition is very important to SurSafe Mutual and our members,” said CEO Aaron Stewart. “The licenses from Cameron National will allow us to expand our operations outside of Missouri and spread our risk, which will strengthen our financial position and enhance our ability to serve our policyholders.”

Charles Smith, who served as CEO of BMI Company, Inc. from 1997 to 2024, will lead SurSafe Insurance Company as its new continued on page 34

continued from page 33

president and CEO.

“We’re excited to bring SurSafe’s commitment to service and innovation to a broader region,” said Smith. “This expansion allows us to reach new communities while continuing to deliver the trusted protection our customers rely on.”

SurSafe Mutual Insurance Company will continue the legacy of BMI Company, Inc. – a tradition of integrity, strength and service that began in 1891. The name change reflects the company’s growth and

forward-looking vision, while reaffirming the commitment to the people and communities it serves.

“This name change will allow us to present a unified identity while continuing to deliver the coverage quality and personal service our policyholders have trusted for over 130 years,” said Crystal Probert, chief marketing officer at SurSafe. “While our name is changing, our dedicated staff and commitment to personal service remain the same.”

CRC Group has continued its aggressive growth strategy with the acquisition of ARC Excess & Surplus, one of the largest specialty wholesale distributors in the U.S., further solidifying its presence in the high-demand professional liability and management lines market.

The deal, announced May 1, brings more than $1 billion in annual premium under the CRC umbrella and significantly enhances the scale and capabilities of the wholesaler’s ExecPro practice group. ARC will become part of CRC Specialty and continue operating under its existing leadership, including co-founder and executive chairman Christopher Cavallaro and CEO Michael Cavallaro.

“This acquisition marks a major step forward as we continue to build CRC's specialty capabilities,” said Dave Obenauer, CEO of CRC Group. “We are excited to welcome Chris, Mike, and the entire ARC team to CRC Group and look forward to the immediate impact they will have in strengthening our ExecPro practice.”

The acquisition not only strengthens CRC’s position in these verticals but also broadens its geographic reach in key regions such as the Northeast and Southeast. The move is the latest in a string of acquisitions by CRC Group as it continues to scale its specialty distribution platform.

Progressive Insurance intends to hire more than 12,000 people in 2025 to support its continued year-over-year growth. In addition to its growth-driven hiring plans, the No. 2 auto insurer in the U.S. continues its commitment to flexible workplace offerings with a mix of remote, in-office and hybrid roles available across claims, customer care, IT, analyst, legal and corporate functions.

Over the past decade, the organization has produced year-over-year increases in the number of policies in force and net premiums written. In 2024, Progressive added just over 5 million policies in force and grew net premiums written by 21% to $74.4 billion. The company has continued its growth in the new calendar year by adding 1.3 million policies in force during the first quarter. To support these continued positive trends, market share gain and growing customer base, Progressive has continued to increase its workforce, and this year is no different as the company is actively seeking qualified candidates to fill a multitude of roles.

Grinnell Mutual, in partnership with its independent agency force, announced the recipients of the 2025 Road to Success Scholarships.

This year, $1,000 scholarships have been awarded to 80 high school seniors with Grinnell Mutual auto coverage who have excellent academic records and have been accident- and violation-free for their high school years.

Since the program began 20 years ago, Grinnell Mutual and its agents have provided college-bound students over $1 million in scholarships through the Road to Success program.

Three Missouri students are among the 80 recipients of the scholarship: Haley

Imhoff of Blackwater, Augustus McCollough of Burlington Junction and Clayton Moore of Fulton.

Columbia Insurance is proud to announce the 2025 recipient of the D. Arlo McNary Living Memorial Scholarship: Auggie Boyt of Rocheport, Missouri.

The McNary Living Memorial Scholarship was established by Columbia Insurance for employees’ children upon the retirement of Arlo McNary (1934-2016), who served as Columbia’s president and chief executive officer from 1983-1999.

The scholarship is a $1,000 merit-based award, evaluated on academic performance, leadership, activities, work experience, career and educational aspirations as well as feedback from their school.

Auggie Boyt is a 2025 graduate of Hickman High School who will specialize in nuclear technology at State Technical College of Missouri located in Linn.

First-Time Attendee Scholarship

Jesse Tucker, Ozark Legacy Insurance Partners in West Plains, was chosen as the recipient of the 2025 MAC Summit first-time attendee scholarship. This scholarship covers the fees for a full registration at the 2025 MAC Summit. Jesse, who has a passion for commercial insurance, believes the networking opportunity to meet in person at MAC Summit will be much more valuable than developing new relationships remotely and is looking forward to learning from the lineup of sessions.

Danielle Margrabe, Ozark Legacy Insurance Partners in Poplar Bluff, was chosen as the recipient of the 2025 MAC Summit first-time young agent attendee scholarship. This scholarship covers the fees for a full registration and a hotel room at the 2025 MAC Summit. Danielle is excited for the opportunity of surrounding herself with strong networks, fresh ideas and forward-thinking leaders – especially those who understand the unique challenges and strengths of women in the independent insurance industry.

David Pope Insurance Services, LLC , Zack Pope, Union

Emerson Rogers, LLC , Brett Hopwood, House Springs

Oerly, LLC, DBA Stuart Vogel Insurance, Kelli Oerly, Columbia

Honor Capital Corporation, Rachelle White, Sunrise, Fla.

National Partners | Premium Financing, Susan Valera, Coral Gables, Fla.

Do you have news you want to share about your organization in the Missouri Agent magazine?

Send your news to:

This could include promotions, charity work, general updates and more. All news is subject to editing by staff and may or may not be included.

Morris Enos Boyd, Cape Girardeau, Mo., refusal to issue license

Tiffany Cherise Brown, St. Louis, Mo., voluntary license surrender

Narciso Zachariah Garcia, Easley, S.C., voluntary license surrender

Amber Hall, El Paso, Texas, voluntary license surrender

Jerome Oliver Harris, Gladstone, Mo., refusal to issue license

Hoang Kim Le, St. Louis, Mo., voluntary license surrender

Miguel Eduardo Romero Mejia, Wesley Chapel, Fla., refusal to issue license

Soon Jen Alagbre Pak, Kansas City, Mo., voluntary license surrender

Theddeus Styles, St. Petersburg, Fla., refusal to issue license

T3 Insurance, LLC, St. Louis, Mo., voluntary license surrender

Matthew Weaver, St. Louis, Mo., voluntary license surrender

Aetna Health Inc, Cleveland, Ohio, stipulation of settlement

Allianz Life Insurance Company Of North America, Minneapolis, Minn., stipulation of settlement

Freedom Life Insurance Company Of America, Minnetonka, Minn., stipulation of settlement

Generali US Branch, New York, N.Y., stipulation of settlement

Great American Alliance Insurance Company, Cincinnati, Ohio, stipulation of settlement and voluntary forfeiture of $500

Insurance Services Office Inc, Jersey City, N.J., stipulation of settlement

National General Insurance Online, Inc., WinstonSalem, N.C., stipulation of settlement and voluntary forfeiture of $39,000

Pharmacists Mutual Insurance Company, Algona, Iowa, stipulation of settlement and voluntary forfeiture of $1,000

Progressive Northwestern Insurance Company, Cleveland, Ohio, stipulation of settlement and voluntary forfeiture of $3,000

Stillwater Insurance Company, Jacksonville, Fla., stipulation of settlement and voluntary forfeiture of $10,000

American Sentinel Insurance Company, Armonk, N.Y., examination report adopted with curative action ordered

Andrew County Mutual Insurance Company, Savannah, Mo., examination report adopted with curative action ordered

Auto Club Family Insurance Company, Costa Mesa, Calif., examination report adopted with curative action ordered

Automobile Club Inter-Insurance Exchange, Costa Mesa, Calif., examination report adopted with curative action ordered

Chariton County Mutual Insurance Company, Mendon, Mo., examination report adopted with curative action ordered

Farm Bureau Life Insurance Company Of Missouri, Jefferson City, Mo., examination report adopted with curative action ordered

Farm Bureau Town & Country Insurance Company Of Missouri, Jefferson City, Mo., examination report adopted with curative action ordered

Farmers Mutual Insurance Company Of Pettis County, Sedalia, Mo., examination report adopted with curative action ordered

Fletcher Reinsurance Company, St. Petersburg, Fla., examination report adopted with curative action ordered

Legacy Life Insurance Company Of Missouri, Jefferson City, Mo., examination report adopted with curative action ordered

Main Street Mutual Insurance Inc, Cole Camp, Mo., examination report adopted with curative action ordered

Medica Central Health Plan, Madison, Wis., examination report adopted with curative action ordered

Medica Central Insurance Company, Madison, Wis., examination report adopted with curative action ordered

New Horizons Insurance Company Of Missouri, Jefferson City, Mo., examination report adopted with curative action ordered

Patrons And Farmers Mutual Of Missouri, Harrisonville, Mo., examination report adopted with curative action ordered

Let us hammer out the sort of custom-made coverages that will keep your contractor customers happy. We cover everything from their tools to their personal belongings and more. Trust in Tomorrow.® Talk to us today.

These companies