BARBADOS’ PREMIER BUSINESS & INVESTMENT PUBLICATION 2026

Considering expansion to a safe and thriving domicile?

Consider Barbados!

BARBADOS’ PREMIER BUSINESS & INVESTMENT PUBLICATION 2026

Considering expansion to a safe and thriving domicile?

Consider Barbados!

One of the highest-ranked developing countries on the UN’s Human Development Index, Barbados has: excellent quality of life

a longstanding record of political, social and economic stability an excellent education system healthcare that’s amongst the best in the Caribbean direct connections to major international cities world-class telecommunications other reliable utilities island-wide expanding treaty network no capital gains, wealth or inheritance tax

Trident Insurance Financial Centre

Hastings, Christ Church Barbados, BB15156

E-mail: info@investbarbados.org Website: www.investbarbados.org

Barbados: 1-246-626-2000

Canada: 1-647-977-5996

The USA: 1-347-433-8942

The UK: 011-44-203-318-9036

Key Investment Opportunities

» Financial and Insurance Services

» Niche Manufacturing

» ICT

» Global Education

» Film

» Renewable Energy

» Fintech

» Medical Tourism

» Research & Development

» Life Sciences/Bio Pharma

» Special Residency Programme

Design: Neil Barnard at 809 Design Associates

Main photographer: Jaryd Niles-Morris

Assisted by: Ryan Austin, Anika Millington

Illustrations: Nicola Blades

For the latest articles, news and events check out: BusinessBarbados.com

And join the conversation on the following social networks:

Business Barbados is published annually by Miller Publishing Company Limited, 10 Stonehaven, The Crane, St Philip, Barbados

Tel: 1 (246) 421-6700

Email: info@businessbarbados.com

Deloitte in Barbados offers alternative risk solutions for captive insurance structures, primarily for clients based in North America, Latin America and the Caribbean. Services include a full suite ranging from captive insurance health checks, pre-feasibility and feasibility studies, company set-up and licensing, ongoing management, re-domiciling, run-off, to communications and even company closures.

Clarke Managing Partner | Tax & Consulting idclarke@deloitte.com

Steve Clarke Partner|Consulting & Assurance stclarke@deloitte.com

Jordan Director | Consulting kjordan@deloitte.com

BUSINESS

28-29 - Latin America and Caribbean International Economic Forum, Panama City https://www.caf.com/en/specials/international-economicforum-latin-america-and-the-caribbean-2026

SAILING

15-22 - Barbados Sailing Week roundbarbados.com

10-11 - Barbados Sailing Week Junior Dinghy Regatta 21 - Mount Gay Round Barbados Race 22 - Rum to Spice (Barbados to Grenada Race)

POLO

10 – Club Match, Barbados Polo Club

17 – Club Match, Apes Hill

24 – Soroptimist Charity Match, Barbados Polo Club

31 – Rest of the World vs Barbados

NATIONAL HOLIDAYS

1 - New Year’s Day

21 - Errol Barrow Day

BUSINESS

4-6 - World Captive Forum, JW Marriott, Orlando FL https://events.businessinsurance.com/wcf26

POLO

7 – Mervin & Bobby Barnes Trophy / Arentfox Schiff vs Barbados, Apes Hill

14 – Arentfox Schiff vs Barbados, Apes Hill

21 – Heart and Stroke Charity Match, Barbados Polo Club

28 – Andy Dowding Trophy / Canada vs Barbados, Barbados Polo Club

SURF

23-1 Mar – Barbados Surf Pro & Live Like Zander Junior Pro

TRIATHLON

15 – World Triathlon Development Cup (Youth Olympic Qualifier)

CULTURAL

15-22 - Holetown Festival • holetownfestivalbarbados.org

28-1 Mar – Agrofest – The National Agricultural Exhibition, Queens Park, Bridgetown • basonevoice.org

Barbados Surf Pro. Photo courtesy Barbados Surfing Association

Horse racing at the Garrison Savannah

BUSINESS

8-10 - CICA 2026 International Conference, Palm Desert, California https://www.cicaworld.com/international-conference/ 26-27 - BRIM 2026, Wyndham Grand Barbados - Sam Lord’s Castle brim.biba.bb

HORSE RACING

7 - Sandy Lane Gold Cup, Garrison Savannah barbadosturfclub.org

POLO

5 – Canada vs Barbados, Apes Hill

8 – Tony Archer Trophy / Canada vs Barbados, Apes Hill

14 – Club Matches, Apes Hill

21 – Andrew Philips Trophy / Argentina vs Barbados, Barbados Polo Club

26 – Argentina vs Barbados, Apes Hill

28 – Mickey Hutchinson Trophy / Argentina vs Barbados, Barbados Polo Club

POLO

4 – Kings Lane vs Barbados, Apes Hill

9 – Kings Lane vs Barbados, Barbados Polo Club

11 – Rotary / Kings Lane vs Barbados, Apes Hill

18 – Scotland vs Barbados, Apes Hill

25 – R. Gooding / T. Davis Cup, Apes Hill

FISHING

14-18 — Sir Charles Williams International Fishing Tournament, Port St. Charles Marina

NATIONAL HOLIDAYS

3 — Good Friday

5 — Easter Monday

28 — National Heroes’ Day

MAY

BUSINESS

3-6 — RIMS Annual Conference, Philadelphia, PA, USA https://www.rims.org/annual-conferences/ riskworld-2026/home

12-15 — Caribbean Travel Marketplace, Antigua & Barbuda https://chtamarketplace.com/

26-28 IDB Invest Sustainability Week, Barbados idbinvest.org/en/sustainability/sustainability-week-2026

POLO

2 – Sir Charles / Kent Cole Challenge Trophy, Apes Hill 2 – Kearns / President’s Trophy, Barbados Polo Club

SQUASH

12-17 – BCQS International Masters Tournament, Barbados Squash Club

TRIATHLON

17 – National Duathlon, Bushy Park, St. Philip triathlonbarbados.com

MOTORSPORT

23-24 — The Rally Show & First Citizens King of the Hill 29-31 – BCIC Rally Barbados rallybarbados.net

NATIONAL HOLIDAYS

1 – May Day (Labour Day) 25 — Whit Monday

BUSINESS

22-26 – Connect Barbados, Bridgetown, Barbados

CULTURAL

July-August Crop Over Festival https://ncf.bb/crop-over/

HORSE RACING

TBC (late July) — Barbados Derby, Garrison Savannah barbadosturfclub.org

SCUBA DIVING

TBC — Barbados Dive Fest divefest-barbados.com

HOCKEY

23-29 — Annual Barbados International Hockey Festival, Sir Garfield Sobers Sports Complex, Bridgetown barbadoshockey.org

NATIONAL HOLIDAYS

1 — Emancipation Day

7 — Kadooment Day

CRICKET

TBC – Caribbean Premier League Twenty20, with final in Barbados

Scan for the latest event dates and registration details throughout the year.

BUSINESS

18-21 - RIMS Canada Conference, Quebec City, Quebec, Canada

https://www.rims.org/canada/rims-canada-2026/

25-30 - BIBA Global Business Week gbw.biba.bb

CULTURAL

14-18 - Barbados Independent Film Festival barbadosfilmfest.com

GOLF

TBC – Diamonds International Rotary West Charity Golf Tournament, Royal Westmoreland

TRIATHLON

19 — BFIT National Triathlon, Mighty Gryner Highway triathlonbarbados.com

CULTURAL

5-8 – Food & Rum Festival (tentative)

GOLF

7 - Fourth Annual BIBA Charity Ben Arrindell Intl Golf Classic

SWIMMING

4-8 - Barbados Open Water Festival, Carlisle Bay barbadosopenwaterfestival.com

Senator the Honourable Lisa Cummins speaking at the launch for Global Business Week 2025

TRIATHLON

22 - National Aquathlon in association with the BiiG Games, Mighty Gryner Highway triathlonbarbados.com

CULTURAL

1 — Independence Lighting Ceremony, National Heroes Square, Bridgetown

30 — 60th Independence Day Parade, Garrison Savannah

NATIONAL HOLIDAY

30 — Independence Day

RUNNING

4-6 — Run Barbados Marathon Weekend

HORSE RACING

26 — Boxing Day the Races, Garrison Savannah barbadosturfclub.org

NATIONAL HOLIDAYS

25 — Christmas Day

26 — Boxing Day

Diamonds International x Rotary Club of Barbados West Charity Golf Classic

Barbados: A Smart and Compelling Choice for Global Business

- Kaye-Anne Greenidge, CEO, Invest Barbados

Business Barbados BUZZ:

The Pierhead Barbados – An Old Soul with a New Heart

Business Barbados – Building a New Foundation for Growth

- Connie Smith, Chair, Business Barbados

Why We Chose Barbados

Investor Testimonial: Paul Doyle and John Doyle, The Crane Resort

Business Barbados BUZZ: Apes Hill Barbados – Refined Living Rooted in Nature

A Strategic Leap Toward Regional Growth and Resilience

- Connie Smith, Managing Director, Vistra Barbados

Barbados – A Maritime Nexus in the Making

- George Michanitzis, CEO, Minotaur Shipping and Project Management

Un Solo Puente: The Barbados-Panama Connection

- HE Amanda Martinez, Ambassador of Barbados to the Republic of Panama

Panama-Barbados: A Gateway to the World

- HE Xiomara Perez, Ambassador of the Republic of Panama to Barbados

Business Barbados BUZZ:

Soaring from Vision to Reality – the SCHSBM Ground School ATO

- Dr Dion Greenidge, Sagicor Cave Hill School of Business and Management, The University of the West Indies

The Land of 1000 Labs – Barbados as a Living Innovation System

- Tamaisha Eytle Harvey, Director, FutureBARBADOS

The

We are unique in the way we combine the scale and capability of a large global bank, with the continuity and genuine commitment to service of a boutique firm. Our expertise crosses three integrated service areas:

With an uncommon commitment to personalized service, we approach every challenge as an opportunity to make life simpler

Let’s connect.

Captive Insurance, ESG and the Barbados Paradigm

- Kerry Jordan, Director, Consulting (Strategy, Risk & Transactions), Deloitte

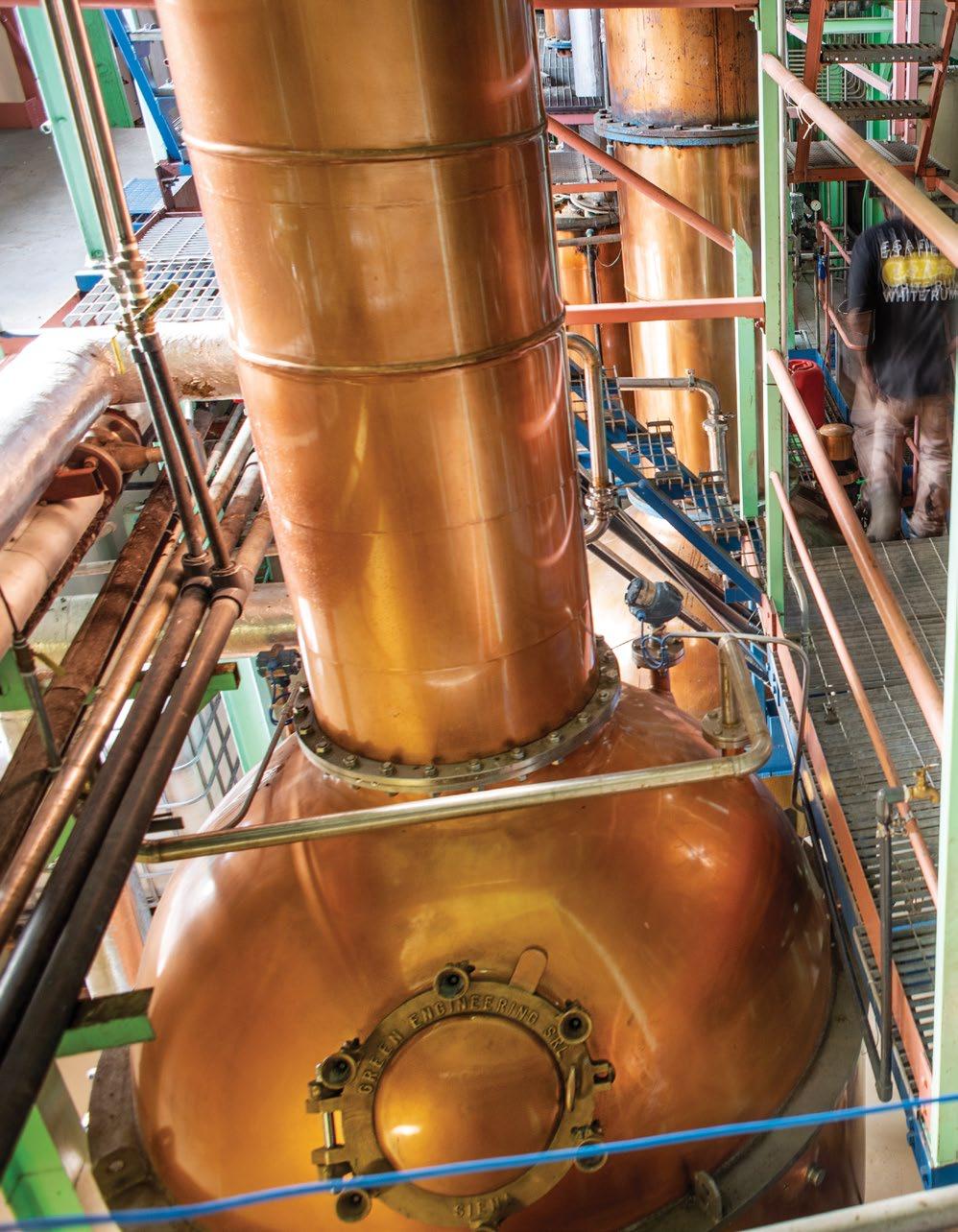

The Route to a One Billion Dollar Rum Industry

- Richard Seale, Distiller, Foursquare Distillery

BIBA

Barbados at the Crossroads – Digital and Transfer Pricing Tax Transformation

- Amanda Layne, Transfer Pricing Tax Director, PwC

Business Barbados BUZZ:

The Healthy Taste of Resilience – How the Caribbean Turned Crisis into Creation

- Dr Kim Quimby

Global Tax Reform – The Integration of BEPS 1.0 and Pillar Two

- La-Tanya Phillips, Partner, Tax, EY

Barbados: A Hub for Climate Resilient Healthcare

- Chris Brome, Office Managing Partner, KPMG in Barbados and Eastern Caribbean, Head of Advisory, KPMG in Caricom

- Dr. Lee Ann Salandy, Senior Manager, Healthcare Advisory, KPMG Islands Healthcare Centre of Excellence

Business Barbados BUZZ: BOHO Beautiful – Family, Business and Lifestyle in Harmony

Empowering SMEs, Attracting Global Capital – Barbados’ Blueprint for Inclusive Market Growth

- Marlon E. Yarde, Managing Director, Barbados Stock Exchange

Business Barbados BUZZ: COT Holdings – 50 Years of Innovation and Family Legacy

Enhancing Barbados’ Third Sector through Standard Certification

- Beatrix Holder, CEO (Interim), ASPIRE Foundation

In an increasingly unpredictable world, agility has become the most valuable currency. Nations that thrive today are not the largest or the wealthiest, but those able to adapt and innovate.

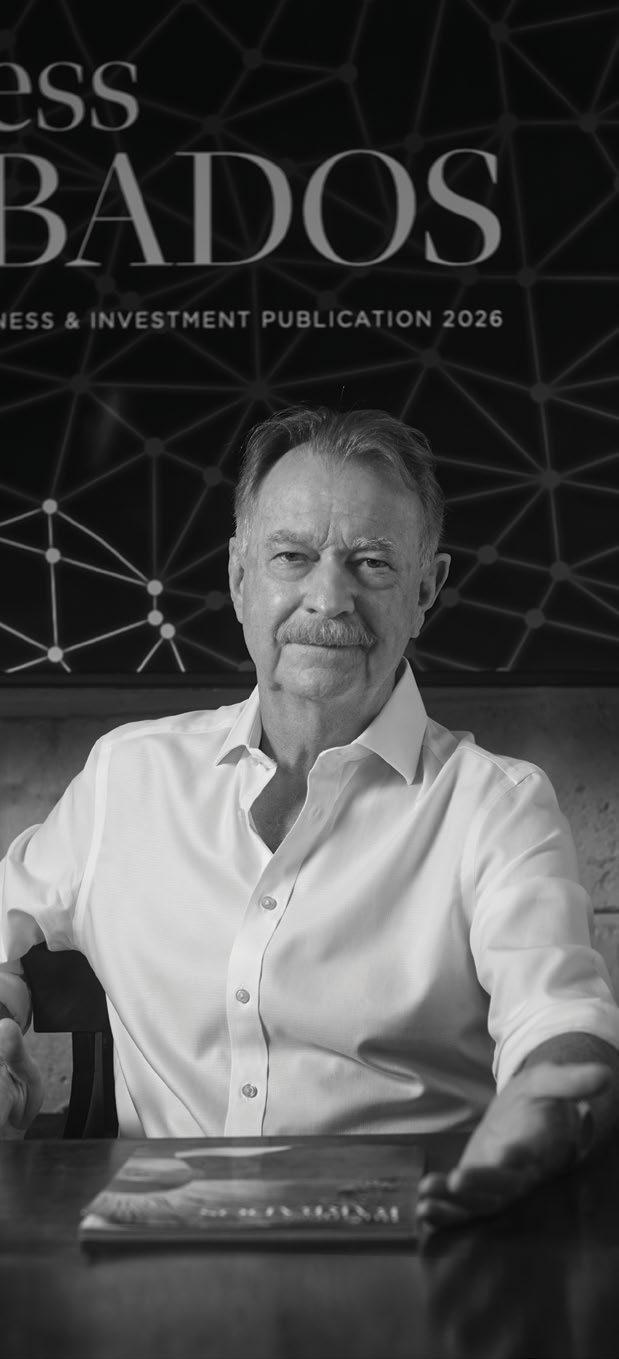

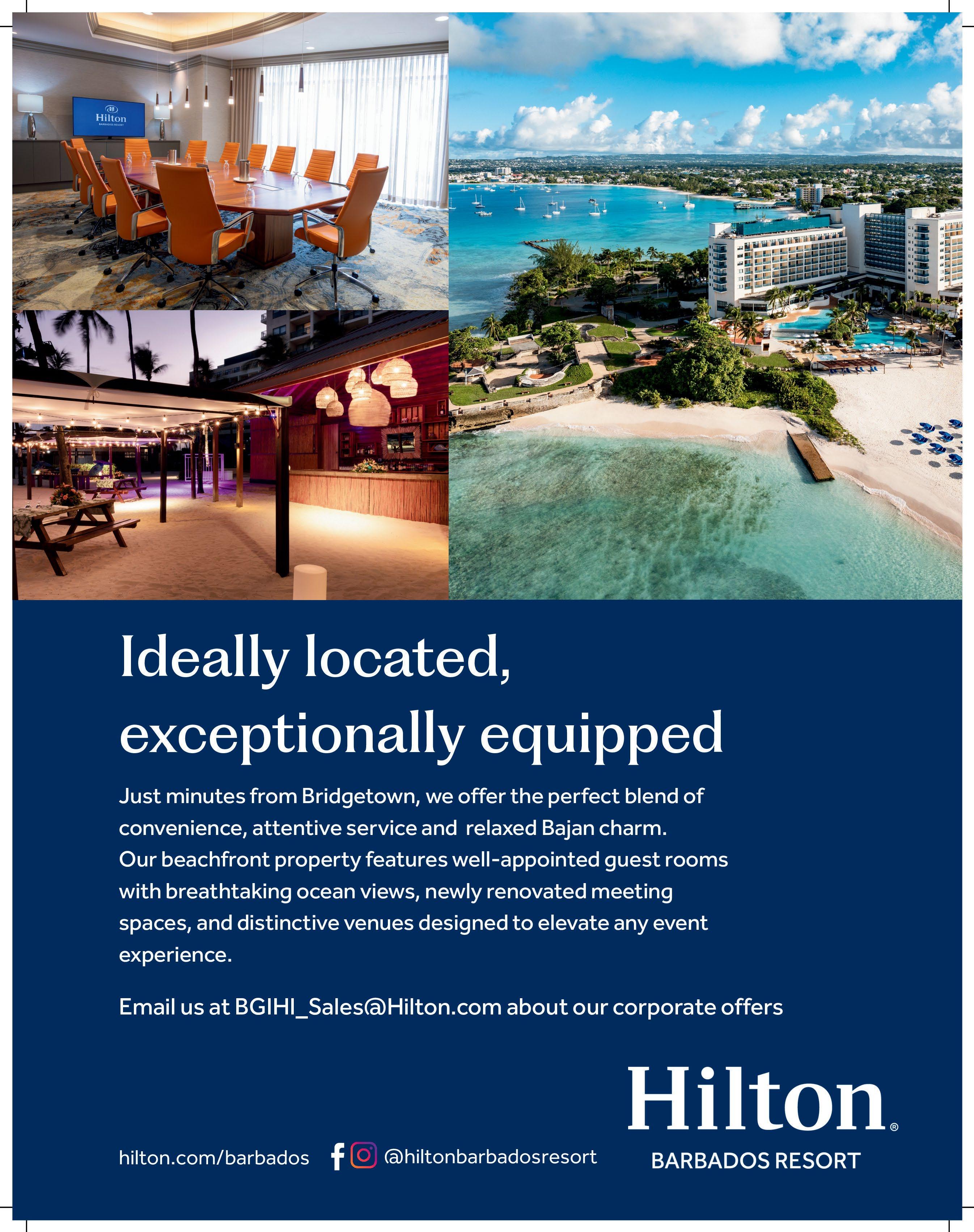

When the 2026 Business Barbados Editorial Board met in The Boardroom of the Hilton Resort Barbados, the words hub and centre kept surfacing, ultimately shaping our 2026 theme “A Smart Hub”. This goes beyond the island’s digital trajectory. It reflects intelligence in every sense: how we think, how we build, how we respond to global challenges, and how we prepare for the future. Being a Smart Hub is not a slogan; it is a lived reality, shaped by our institutions, our private sector, and above all, our people.

A key part of Barbados’ evolution has been its commitment to modern, responsive governance. The establishment of Business Barbados, the new government entity dedicated to business facilitation, signals a meaningful shift toward efficiency and transparency. Our publication, Business Barbados, will support that mandate.

Reforms in digital government, cybersecurity and regulatory modernisation continue to build confidence among local businesses and international investors. From streamlined business processes to smarter tax policy frameworks around BEPS, Pillar Two and Transfer Pricing, Barbados is proving that sound governance, integrity and innovation go hand in hand. And it’s not smart to be isolationist. Barbados made a bold

move in October 2025, opening its borders with CARICOM neighbours Dominica, St Vincent and the Grenadines, and Belize for the free movement of people – and the skills and ideas they bring. Diplomatic relations have also expanded and strengthened, particularly southsouth partnerships with regions where historic ties run deep, such as Africa and Latin America. Barbados is also capitalising on its location – an ideal physical hub for trade, transport and the movement of people and resources.

Barbados as a Smart Hub is most visible in the energy and imagination of its private sector. Across industries, companies are rethinking traditional models and using technology to create new value and opportunities for entrepreneurs and investors.

We have reinsurance firms using Bitcoin as regulatory capital. Printeries are automating production lines. Hospitals – both state-owned and private – are investing in new facilities and technologies to treat the ailments of tomorrow. Property developers are designing communities that integrate sustainability, wellness and smart infrastructure. We are training pilots, reversing diabetes, and exploring how captive insurance can channel investment into ESG-focused opportunities. Even the rum industry is redefining competitiveness through quality, heritage and added value.

These stories, all featured in this edition, show that “smart” in Barbados is not just technological; it

Danielle Miller Editor, Business Barbados

is strategic, purposeful and peoplecentred.

A smart nation plans not just for the next quarter, but for the next generation. Barbados’ leadership in renewable energy, climate resilience and sustainable financing demonstrates that progress and environmental stewardship must align. Our commitment to a full renewable transition and global advocacy on climate justice has earned international attention. Our Prime Minister, the Honourable Mia Amor Mottley, was once again named by Forbes as one of the 100 Most Powerful Women in 2025. And in May 2026, Barbados will host IDB Invest’s Sustainability Week, the first time this global platform comes to the Caribbean.

On 30 November 2026, Barbados celebrates 60 years of independence. In six decades, the country has built a trusted international financial services sector, a resilient democracy, strong education and health systems, and an economy increasingly defined by innovation.

As you explore this edition of Business Barbados, you will encounter stories of intelligence in many forms – digital, human, environmental and entrepreneurial. Together, they reveal a country charting its own course with confidence and clarity.

We are not just a hub. We are a Smart Hub.

Kaye-Anne Greenidge CEO, Invest Barbados

Barbados offers a compelling value proposition for investors looking to expand their global footprint from a safe, stable and progressive jurisdiction. As part of its vision to become a top-tier location for global business, Barbados actively welcomes foreign direct investment that drives sustainable development and long-term value creation. The government remains committed to attracting business that is economically viable, environmentally and socially beneficial as well as investments that bring new technologies, create high-quality jobs and contribute meaningfully to national development. Whether it be in emerging sectors or traditional industries, Barbados provides the right environment to grow and thrive.

The country has evolved into a globally respected jurisdiction for international business, underpinned by decades of sound economic management, a transparent regulatory environment, a commitment to good governance and the continuous improvement

to the ease of doing business. The legal framework, based on English common law, supports transparency and investor protection, while a well-regulated, business-friendly environment ensures compliance with global standards. Strategically positioned as a gateway to North and South American markets, Barbados presents a broad spectrum of investment opportunities across sectors such as financial services, insurance, wealth management, fintech, ICT, renewable energy, niche manufacturing, global medical schools, cultural industries, sports and research and development. But beyond its investment opportunities, the country distinguishes itself with a unique blend of professionalism, good infrastructure and an enviable lifestyle. The island also boasts a highly educated, English-speaking workforce and a deep pool of qualified professionals across legal, tax, finance and advisory services. Global accounting giants like Deloitte, EY, KPMG and PwC have a strong local presence and there are reputable international banks and expert service providers on

island, ready to support the business establishment and expansion process. Barbados not only enables seamless international operations, but also offers a high quality of life, modern telecoms infrastructure, reliable 5G connectivity and daily direct flights to major global cities. It is more than a beautiful island, it is a smart investment location.

Barbados currently offers islandwide 4G LTE coverage, ensuring businesses, residents and visitors enjoy fast and reliable mobile connectivity. Building on this strong digital foundation, the island began its 5G rollout in October 2025, taking a major step toward next-generation communication technology. With full 5G coverage expected by 2026, Barbados is set to deliver even faster speeds, reduced lag times and more stable connections, enhancing everything from mobile streaming and remote work to smart infrastructure and tourism experiences. This technological advancement positions Barbados as a regional leader in digital innovation and connectivity.

In today’s fast-evolving global market, advanced technology

infrastructure is a key consideration in selecting a location for business, and as the global economy evolves, Barbados continues to position itself as a progressive hub that embraces technological transformation and digitisation, supporting new cuttingedge opportunities for innovationdriven investments and partnerships across fintech, digital services and other smart infrastructure. By creating an enabling environment, Barbados increases its appeal to investors and makes it a compelling choice for investors seeking a safe and trusted jurisdiction.

As global business models shift toward agility, technology and impact-driven growth, Barbados’ continued emphasis on digital transformation, sustainable development and regulatory innovation ensures that investors benefit from both operational efficiency and long-term value creation.

Supporting this wave of innovation is the Government of Barbados, which continues to modernise the way business is conducted on the island. Business Barbados, the newly established government entity (formerly CAIPO), has taken significant steps toward digital transformation. By shifting key services online, including company registration, business name searches and document filings,

Business Barbados is enhancing transparency, reducing processing times and making it easier for local and international investors to establish and operate companies on the island. These advancements align with global best practices and reflect Barbados’ commitment to building a seamless, efficient and investorfriendly environment.

The island’s growing digital ecosystem is opening new opportunities within the creative and orange economies, including gaming, app and content development, digital media and software services, empowering local and international creators to build, scale and export their content faster than ever before. By combining robust infrastructure with a progressive business environment, the country offers a fertile ground for innovation and investment, where returns are driven not just by location, but by vision, capability and connectivity.

And, as Barbados continues its digitilisation journey, the adoption and integration of artificial intelligence (AI) present the next logical step. The country stands to benefit by strategically adopting AI across government, business and education, strengthening Barbados’ position as a modern, technology-driven economy. As a trusted, well-regulated and globally connected jurisdiction, Barbados

Overall, Barbados’ competitive advantages position the jurisdiction as an ideal gateway for global business, establishment and expansion.

has the capability to be a leader in the Caribbean’s AI transformation, demonstrating how small island states can harness smart technology to deliver big results.

Overall, Barbados’ competitive advantages position the jurisdiction as an ideal gateway for global business, establishment and expansion. For global investors and enterprises seeking stability, innovation and strategic market access, Barbados presents a compelling proposition. We at Invest Barbados are here to provide personalised support to investors, from offering sectorspecific guidance to coordinating business meetings and site visits. The Corporation ensures a seamless investment experience through timely, relevant information, tailored facilitation services and dedicated aftercare to help businesses establish, grow and thrive in Barbados’ dynamic and investorfriendly environment.

We welcome your business!

As evidenced by its UNESCO inscription as a World Heritage Site, Bridgetown is steeped in a rich and consequential history. In 1628, recognizing the ideal circumstances of Carlisle Bay as an expansive sheltered mooring, with an inlet offering a natural inner harbour, the early English settlers chose this location to be the island’s capital city. Originally named ‘Indian Bridge Towne’, Bridgetown rapidly evolved into a pivotal hub in colonial transAtlantic mercantile trade, and a strategic headquarters for the Royal Navy. The main working area of the port, always bustling with stevedores loading and offloading ships, was known as the Pierhead.

Today – almost 400 years later – that same iconic location is undergoing a landmark transformation as part of a BB$200 million urban revitalization project. With Phase One currently under construction, The Pierhead will provide a modern, vibrant, and one of a kind mixed-use development

where culture, community and commerce meet. Sensitively designed to honour the past while shaping the future, this visionary project will deliver a unique version of modern day life in a waterfront setting – a city vibe with lots of green spaces, on a magnificent beach bordering a protected marine park with shipwrecks.

Occupying some 39,000 square meters when completed, The Pierhead will feature 178 apartments, 35 food and beverage, retail and cultural spaces, a gym, a beach club, and a visitor attraction dedicated to the story of Barbados Rum, all thoughtfully integrated with shaded walkways. The historic Blackwoods Screw Dock will remain central as a proud witness to the heritage of The Pierhead.

Phase One, The Steel Building, is expected to deliver 39 apartments, dining and retail outlets, the beach club, transport links, a water taxi station, and public spaces including a heritage trail. In due course, The

House of Pillars (2027-2028) and The Bridge House (2029-2031) will complete the district, layering even more depth and character into the waterfront.

Fully endorsed by Prime Minister Mia Amor Mottley as being, “essential to the revitalisation of Bridgetown”, The Pierhead seems well poised to successfully deliver on its enormous potential.

“Years ago, sitting at the old Waterfront Café, I felt the energy of this place – alive with conversation, music, and possibility. That’s when I knew I wanted to invest here. The Pierhead was once a vibrant port, full of stories – from trade and travel to struggle and resilience. This project is about honouring all of that and giving the site the future it truly deserves.”

– Neville Isdell, Founder & Investor, Former Chair and CEO of the Coca Cola Company

www.pierheadbarbados.com @thepierheadbb

For nearly four centuries, The Pierhead has been part of Bridgetown’s story. Now, it’s shaping the next one — a vibrant new district on Bridgetown’s historic waterfront, within the island’s UNESCO World Heritage Site of Historic Bridgetown and its Garrison, overlooking one of Barbados’ most beautiful beaches.

Be part of the next chapter.

Barbados has taken a bold step toward building a stronger, more businessfriendly future with the creation of Business Barbados — a modern, customerfirst, national agency reengineered from the Corporate Affairs and Intellectual Property Office (CAIPO). Its mission is simple but transformative: to make it easier to start, maintain, grow and protect a business in Barbados, whether local, regional, or global.

Barbados has always been a hub for global business, attracting companies from around the world based on our competitive tax structures, strong talent pool, international travel links and high standard of living. Innovating to be a smart hub is a part of the constant evolution of being a jurisdiction of choice.

Business Barbados is playing its part in ensuring Barbados is the smart hub local and global businesses need to succeed. In today’s world where business is built on technology, moving our companies and intellectual property registries into a digital space is the right move to make. Building on evolving technology, making use of AI and data to drive customer focused interventions/ solutions, we are changing the way we offer services, providing a more streamlined experience with us. In 2026, we expect to see significant change, improving turnaround times and providing omnichannel access for our customers to carry out business.

For years, our predecessor, CAIPO, was known primarily as a companies’ registry, often constrained by slow, manual processes and administrative backlogs. The Government of Barbados has heard the concerns of the business community and responded decisively. Business Barbados is not a rebrand, but a complete transformation — one that expands its mandate to include investment support, regulatory improvement, and business advocacy as part of the Government’s broader modernisation agenda.

This transformation also aligns with global realities. As the world adjusts to new international tax frameworks such as the Global Minimum Tax, Barbados must compete more on efficiency, transparency, and the overall ease of doing business. Business Barbados is designed to deliver that competitive edge.

We are also proud to announce the establishment of the Business Barbados Intellectual Property Office (BBIPO) — the Intellectual Property sub-brand of the agency. BBIPO is charged with fostering a culture of innovation and creativity while ensuring that the rights of creators and innovators are recognised and protected. It will oversee the protection and administration of intellectual property rights, including patents, geographical indications, industrial designs, trademarks, and copyright.

Equally important, BBIPO will help businesses identify, secure, and commercialise their intellectual

property assets through education and outreach. It will also manage IP enforcement and disputes, working with law enforcement agencies and facilitating mediation and arbitration for IP-related conflicts. In this way, BBIPO becomes a key driver of innovation-led growth.

Business Barbados also plays a pivotal coordinating role within the wider economic ecosystem. Invest Barbados attracts and facilitates new investment to the island, while Export Barbados promotes Barbadian products and services to the world. Business Barbados bridges these two — streamlining the processes and regulatory touchpoints that make it easier for business to be done, and done well, in Barbados.

Finally, it’s worth noting that Business Barbados, the agency, is distinct from Business Barbados, the magazine. The magazine, under publisher Keith Miller, has for over 25 years highlighted Barbados as an ideal investment destination. The agency complements that legacy by making the business environment it promotes even more accessible and responsive.

As its inaugural Chair, my vision for Business Barbados is to embed a culture of service excellence, collaboration, consistency and continuous improvement. Big change begins by getting the simple things right — and doing them well. Together, we can deliver on Brand Barbados: efficient, trusted, and globally competitive.

When Canadian born Paul Doyle first saw the historic Crane Hotel in 1988, it was nothing more than a tired, run-down 18-room property. But, thanks to his astute entrepreneurial instinct, Paul saw way beyond the crumbling façade and recognized a major development ‘waiting to happen’.

Suitably motivated and brimming with self-belief, he took the bold step of selling his home in Canada to raise the required deposit, purchased The Crane, then set out to transform his compelling vision into a reality.

Fast forward to 2018, by which time The Crane Resort was widely acknowledged as one of the world’s top, private residence resorts, having attained the highest global ratings for both the RCI and the exclusive Registry Collection’s fractional ownership programmes.

In September that year, Hilton Grand Vacations Inc. purchased timeshare inventory at The Crane Resort for an anticipated total transaction value of US$54.6 million. In addition to being a monumental vindication of Paul Doyle’s inspired decision to risk investing his life in a fading brand, the fact that Hilton Grand Vacations chose to invest so heavily in The Crane Resort also represented a very significant vote of confidence

in Barbados.

So, why did Paul Doyle choose Barbados in the first place? And why has his son, John Doyle, made the same decision?

Paul Doyle

In 1988 I was looking to relocate to an international business jurisdiction, so I took a sheet of paper and made a list of about 10 countries, with tick boxes for all the benefits I was looking for. These included the prerequisite business incentives, as well as security, political and social stability, law and order, wellregulated financial system, excellent telecommunications, ease of travel, good healthcare, and so on. At the end of the process Barbados stood out at the top. So, I came here for the first time and immediately felt comfortable and welcome.

This country, with its own identity and Caribbean culture, offers a rare combination of first-world civilization with the benefits of living in a beautiful tropical environment, within an integrated society.

It was never my intention to get involved in the hotel sector but, at the suggestion of my Canadian attorney, I went to view The Crane which was quietly for sale. Everything just felt right. Such a stunning clifftop location, magnificent beach, incredible blue ocean, fresh sea breeze – beautiful,

peaceful and close to nature. Even though the price was attractive, it was still a lot of money for me. But it had to be done. Four months later I relocated to Barbados, and it’s been my home ever since. Fortunately, my plans have for the most part all worked out well. Sound government management and a sophisticated business infrastructure have provided a solid platform to build and expand our operations. Thankfully, I now have my son John working alongside me as our Director of Business Development. While I have loved making Barbados my home, I never tried to influence where John would choose to live and build his career. He had his own decisions to make.

John Doyle

My big decision moment came in 2011 when I graduated from business school in Canada. Most of my friends were lined up for lucrative positions with top companies in Toronto and other financial centres around the world. Having been offered some exciting opportunities myself, a part of me was tempted to go down that route with them – but the lure of Barbados was stronger. Growing up in Barbados, I had enjoyed a very happy, activity-filled, outdoorsoriented ‘island-style’ childhood. Even when I went to high-school and university in Canada, every single vacation, I’d be on the earliest available flight back home.

When people think of Barbados, they often picture a place of relaxation and a laid-back lifestyle, not necessarily somewhere to build a serious career. But for me, it’s been both.

Choosing to develop my career within the family business in Barbados rather than pursue professional growth in the traditional corporate world abroad felt like choosing lifestyle over professional opportunity at the time. But what I found was quite the opposite — Barbados has offered far greater professional growth and business opportunity than I might have found elsewhere. It also gave me the rare chance to learn directly from my father, an entrepreneur whose vision and discipline helped shape my own approach to business.

Fifteen years on, that decision has proven strategically sound. The island remains rich with potential, with ample scope to scale our business and foster entrepreneurial ambition in ways the corporate world rarely allows. It is now much easier to get things done than when I first joined the company, and our growth trajectory is better than I once expected. Which is why we have invested in more land along the St. Philip coastline, ready for future development.

There are new expectations and greater confidence amongst investors and developers, and I see Barbados getting even better. The

country is attracting increasing numbers of entrepreneurs and highly accomplished talent in all sectors –internationally experienced people who view Barbados as a bona fide opportunity to settle, enjoy a good life and operate their business. Barbados is developing into a cosmopolitan community despite its modest size.

Even when I see how well some of my friends have done in Canada, there’s no question that Barbados is the best place for me. With a healthy attitude towards work-life balance, Bajans place great value on their leisure time, even at times to the detriment of their financial status. But it works. Here it is possible to succeed in business, while still enjoying life to the full – all of which adds up to improved health and wellbeing. I love the fact that I can finish a day’s work at 5:00 pm and still take my son to the beach for an hour’s quality time together.

Barbados is a great place to raise kids, with a wide variety of screenfree, cost-free entertainment options. The education system is strong at all levels, including several private schools that are excellent by any standards, while being remarkably affordable compared to larger countries.

Now that I have a family of my own, I am already thinking of what kind of future lifestyle would be best for my children. And I can’t think of anywhere better than Barbados.

For two decades, Summit Asset Management has managed wealth with intelligence, integrity, and purpose, creating tailored investment solutions for families and institutions around the world from its base in Barbados.

Founded on the principles of capital protection, prudent growth, and absolute confidentiality, Summit has evolved from its origins as a private bank into one of the region’s leading independent asset management firms. Today, it stands as a testament to Barbados’ growing reputation as a smart hub for global finance – a place where expertise, innovation, and trust converge.

For the firm’s President and Chief Investment Officer, John Howard, Barbados is both home and headquarters. Originally arriving in the mid-1990s with Coopers & Lybrand on a two-year assignment, John met and married his Barbadian wife – and never left. “With all three

children born here, I’m outnumbered at home 4 to 1 by Bajans” he jokes. “But it’s a privilege to build a global business in a country that’s also an exceptional place to live.”

John’s career spans more than 25 years across accounting, corporate finance, and asset management.

A Chartered Accountant and CFA® Charterholder, he previously served as Finance Director for Barrick International Bank Corp., the global treasury arm of Barrick Gold, and later as President of Summit International Bank, established in 2006 for a Canadian family following a major liquidity event.

Guided by three golden rules – protect capital, deliver the best risk-adjusted returns, and maintain confidentiality – the bank weathered the 2008 global financial crisis unscathed. When international tax frameworks evolved in 2014, John led a management buyout, transforming the institution into Summit Asset Management.

Today, Summit’s clients include high-net-worth individuals, trusts, family offices, captives, and institutions across multiple jurisdictions. With fifteen full-time investment professionals, including four CFA® Charterholders, it is one of the largest and most qualified investment teams in the Caribbean.

The Executive Leadership Team

John M. Howard, ACA,

CFA –President & Chief Investment Officer

As CEO and CIO, John leads Summit’s investment philosophy and client strategy. His disciplined approach has shaped Summit into a trusted, independent firm that always puts clients’ interests first.

“We view our relationships with our clients as long term partners. This spirit of partnership is forged through the alignment of having our own money invested in many of the same strategies, ‘eating our own cooking’ as Warren Buffett likes to call it.”

Claire Barker, Dip CII –VP, Client Relations

With over 25 years of experience advising high-net-worth individuals, corporates, trusts, and captive insurance companies, Claire brings a wealth of expertise. A Chartered Insurance Institute (UK) Level 4 Financial Advisor, she spent 13 years with HSBC and Lloyds Bank International, managing private client portfolios across the Caribbean, Channel Islands, and Asia. Since joining Summit in 2022, Claire has enhanced the firm’s client-first culture, grounding each relationship in understanding, trust, and personal connection.

“Our clients are our priority. We listen to their unique requirements and create tailored solutions each time – no cookie-cutter approaches here. By combining global insight with local knowledge, we support and empower our clients in making financial decisions.”

Edward Majewski, CFA –VP, Investments

Edward (Ed) Majewski leads Summit’s investment team, bringing institutional strength and global insight from his decade at Legal & General Investment Management in London – one of Europe’s largest asset managers. There, he managed relationships with major pension funds, including FTSE 100 companies and multinationals.

At Summit, he ensures portfolios are designed and managed with precision — balancing risk, opportunity, and long-term vision.

“Our open platform provides clients a gateway to ‘best in class’ global managers, with experience in diverse markets and across a range of strategies. We aim to deliver bespoke portfolios designed around our clients’ individual circumstances. We do this by ensuring we fully understand their requirements from the outset, then working with them to design and maintain sophisticated, personalised portfolios.”

Kamara Simpson, FRM –VP, Operations

Behind Summit’s seamless client experience is Kamara Simpson, Vice President of Operations. Kamara joined the company after earning her degree in Mathematics from the University of Waterloo. Now, some 15 years on, she is a Certified Financial Risk Manager, leading the investment operations team responsible for portfolio compliance, reporting, and governance. Her analytical precision ensures Summit’s infrastructure supports both performance and peace of mind.

“At Summit, we’ve invested heavily in top class institutional systems for portfolio management and robust reporting capabilities. This ensures our clients can trust that their investments are monitored meticulously, giving them confidence and a sense of security.”

A Smarter Approach to Wealth

Summit’s vision is to be the leading choice for international wealth management in this hemisphere, while its purpose remains simple yet profound –providing peace of mind to enjoy a purposeful life.

With its growing team, forwardlooking investment strategies, and unwavering values of teamwork, integrity, and excellence, Summit continues to set the standard for sophisticated wealth management for its clients.

As the company marks its 20th anniversary, it does so with the same quiet confidence that has guided it from the start – committed to prudent growth, enduring relationships, and the ability to compete on the world stage from its home in Barbados.

Summit Asset Management

+1 (246) 436-1280

info@summitassetmgt.com www.summitassetmgt.com

Jina Scheper General Manager, Barbados Golf Club

We live in an era where almost anything we desire can be acquired at the click of a button. The internet, smartphones, and the relentless advance of technology have delivered unprecedented convenience, efficiency, and global connectivity. Our workplaces have evolved too. Today’s offices are ‘smart hubs’ — digital ecosystems designed to let employees collaborate from anywhere in the world. Meetings unfold on screens, contracts are signed electronically, and even casual exchanges have moved online. Life has, in many ways, never been easier — or more relentless. Yet there remains one environment refreshingly different from this digital din — a space where technology enhances but does not dominate; where presence, conversation, and focus still prevail: the golf course.

While innovation has found its way onto the fairways — from swinganalysis apps and launch monitors to high-tech simulators and GPSenabled carts — its purpose is clear: to elevate the player’s experience, not overwhelm it. Golf endures as one of the few pursuits where phones are still (mostly) unwelcome and where the most meaningful connection is human, not digital.

In many respects, the golf course is the original smart hub for business. It offers a rare chance to step away from the constant ping of notifications and engage in genuine, face-to-face dialogue. Here, ideas are exchanged, partnerships are forged, and deals are shaped against the backdrop of open fairways and fresh air. Unlike the boardroom, the golf course levels the playing field — both literally and figuratively. It is neutral ground, free from hierarchy

and formality, where authenticity prevails. You can often learn more about someone in 18 holes than in 18 meetings.

Playing golf in Barbados – with our year-round sunny and warm but breezy climate, optimum playing conditions on championship-level courses, and stunning natural beauty – can be particularly enjoyable and relaxing. While Barbadians are as keen as other golfers around the world to play well and hand in a good score, it is also important to enjoy the social experience. So, while golf etiquette and adherence to the rules remain fully intact, we also recognize the benefits of playing in an easy-going, respectful atmosphere. And, no matter what happens on the course, the 19th hole is always there for post-golf socialising.

While many of the world’s most prestigious residential communities distinguish themselves through the superior quality of their architecture and facilities, and others are more renowned for their beautiful natural surroundings, Apes Hill Barbados has achieved an ideal balance between the two – a rare duality of refined living rooted in nature.

Barbados is blessed with many beautiful locations, but the moment you drive into Apes Hill you feel as if you’ve entered a different world. Located in the central highlands of the island, at the convergence

of the three parishes of St. James, St. Thomas and St. Andrew, the 475-acre property occupies an extraordinary natural environment with geologically unique landscapes. Positioned some 1,000ft above sea level, in addition to sweeping views of the magnificent scenery of both the Atlantic Ocean on the east coast and the Caribbean Sea on the west coast, Apes Hill is also blessed with refreshing cool breezes that keep daytime temperatures about 2°C lower than the surrounding lowlands. With its own micro-climate and varying topography of undulating

hills, craggy cliffs and meandering ravines, the natural vegetation ranges from open grasslands to wooded areas, stands of majestic towering palms, and lush undergrowth of tropical plants. All in all, a veritable ‘paradise on earth’. Discreetly nestled within the richness of this spectacular environment, the Apes Hill Barbados community has been sensitively planned around what is arguably the most spectacular 18-Hole Championship Golf Course in the Caribbean.

Acutely aware of their pivotal role and fundamental responsibility

as the current stewards of this remarkable national treasure, the Apes Hill Barbados development team has adopted a must-do approach to protecting and enhancing the property for future generations. Driven by a sense of pride and commitment to the vision of Apes Hill and its heritage, there is a strong emphasis on carefully controlling the extent and character of the built environment, while prioritizing the protection and sustainability of the natural environment.

In keeping with a commitment to offer residents an unparalleled amount of open green space and privacy, the designers have gone to great lengths to locate house lots and villa locations in strategically optimum positions that blend seamlessly into their surroundings. An individual home might occupy a 20,000 sq. ft. lot, but it is surrounded by 475 acres of natural beauty with stunning views in every direction.

This biophilic approach to the master planning of the community and its chosen architectural styles actively promotes the connection between nature and human wellbeing. Originating from the Greek for ‘love of life’, biophilic design incorporates natural elements into built environments – such as plants, natural light, water features, and natural building materials – all of which are known to improve our health, productivity and contentment.

As a direct extension of that ethos, Apes Hill encourages the strengthening of community spirit through a wide range of family and nature-centric activities, such as hiking and fishing, as well as outdoor yoga and Pilates, all under the attentive care and guidance of approved professionals. Even massages and meditation can be conducted outdoors, surrounded by the peace and tranquillity of nature.

Sheer bliss!

Members are also invited to participate in several ‘healthy eating’ sustainability initiatives, including farming organic produce, raising free-range chickens, and beekeeping. All of which can be great fun, educational and spiritually rewarding. With access to the Championship Course, the fun Little Apes 9-hole par-3 course, the golf Performance Centre, top of the line illuminated tennis and padel courts, and a gym, members and guests at Apes Hill have a wide choice of recreation and exercise options. For a complete change of scenery, very much in keeping with the duality of lifestyle experiences at Apes Hill, the resort’s recently opened beach facility is just a 10-minute drive down to the coast,

close to Speightstown.

With an emphasis on maximising the pleasures of Caribbean indooroutdoor living, Apes Hill Barbados comprises a broad range of residences. In addition to luxurious individual built homes and house lots with a turn key land and build option, there is also a selection of villas available for both purchase and short-term rental.

Apes Hill Barbados offers the highest standards in architecture, golf and resort facilities, within a sophisticated yet warm, authentic and entirely unpretentious environment.

Discover life on a higher level at apeshill.com

In a market defined by opportunity and evolution, the smartest move a buyer or investor can make is choosing the right partner. With over fifty years of expertise and deep Barbadian roots that stretch back generations, Alleyne Real Estate stands as one of the island’s most trusted names in luxury sales and purchases, holiday rentals and property management.

Founded on the West Coast, this family-owned company has been at the heart of Barbados’ real estate story since the Platinum Coast first rose to international prominence. Today, the second generation of the Alleyne family continues that legacy

with pure heart and soul, while using modern, data-driven insight to help clients make confident, intelligent property decisions.

“At Alleyne, relationships are at the core of everything we do,” says Shane Johnson, CEO of Alleyne Real Estate. “Buying or selling is only one part of the journey. Our focus is on people –understanding their goals, matching them with the right opportunities, and building partnerships that last well beyond the transaction.”

A Smart, Connected Approach

Alleyne Real Estate’s success is built on a deep understanding of market data, trends, and property values across the island. This intelligence-driven approach allows the team to guide clients with precision, whether they are seeking a beachfront villa along the beautiful coast, a golf estate in Apes Hill or Royal Westmoreland, or an incomegenerating investment property in another fabulous location on the island. Their tailored offering extends from initial consultation to post sale or purchase services such as property management and holiday

rentals, ensuring every client benefits from continuity, expertise, and discretion.

Behind the company’s longevity is also a powerful network – both internal and external. Alleyne collaborates with trusted partners in law, tax, and estate planning to deliver seamless support at every stage of ownership. “Our clients appreciate that we can connect them with the right professionals across every aspect of the process,” says Mandy Mahon, Director of Sales. “It’s about giving them confidence that every detail is handled with care and integrity.”

From their offices in Holetown, Alleyne Real Estate continues to set the standard for personalised, intelligent service. Whether you’re buying, selling, renting, or investing, choosing Alleyne means choosing a partner that values insight as much as integrity – the smart choice in a smart hub.

Alleyne Real Estate

+1 (246) 432-1159

sales@jalbarbados.com

alleynerealestate.com

In an era when the tendency of many political leaders is to turn inward, Barbados’ bold decision to adopt a progressive policy of free movement with its Caribbean Community (CARICOM) partners of Dominica, St Vincent and the Grenadines, and Belize, effective October 1, 2025, stands out as a seminal moment in the island’s modern history, second only to its transition to a republic in 2021.

Guided by the forward-thinking leadership of Prime Minister Mia Amor Mottley, Barbados is again demonstrating its preparedness to lead the region through another period of transformation. It could be argued that her decision carries with it some political risks. However, the vision of deeper economic integration, and a recognition that the Caribbean’s strength lies in collaboration, serve to significantly diminish any political uncertainty or peril.

The Caribbean Community (Free Movement of Nationals) Act 2025 provides the legal foundation in Barbados for the initiative. It grants nationals of Belize, Dominica, and St Vincent & the Grenadines the right

to live and work indefinitely in any of the four countries without the need for work permits or residence authorisations. But this is part of a broader legislative transformation.

In August 2025, the Government of Barbados introduced two complementary bills: the Barbados Immigration Bill 2025 and the Barbados Citizenship Bill 2025. These are intended to modernise outdated laws and position immigration as a strategic tool for national development.

• The Immigration Bill introduces a points-based system for skilled migration, streamlines permanent residency pathways, and creates new permit categories – “Reside” and “Reside & Work” – to facilitate economic participation.

• The Citizenship Bill expands eligibility to descendants of Barbadians up to greatgrandchildren and offers accelerated citizenship pathways for CARICOM nationals after two years of permanent residency. It also enshrines gender equality and explicitly rejects citizenship-byinvestment schemes.

Together, these reforms reflect a cohesive national strategy to reverse population decline, close skills gaps, and strengthen Barbados’ competitiveness in a changing global economy. At the time of writing, these Bills are under review by a Joint Select Committee.

For policymakers and business leaders alike, the Act signals a shift from aspiration to implementation. What was once a long-discussed ideal of regional movement has become a reality, even though it does not extend to the entire CARICOM grouping. With it has come a new chapter in Caribbean economic development.

A reciprocal arrangement ensures that Barbadians will enjoy the same rights and privileges when they choose to live and work in any of the participating nations. This effectively creates a new four-country economic space within CARICOM.

At the heart of Barbados’ rationale is the need to address labour-market gaps. Like many small island economies, we face an ageing population, a low birth rate, and the continued outward migration of many skilled young workers exploring opportunities in developed nations. According to CARICOM statistics, the old-age dependency ratio—measuring the number of people aged 65+ per 100 working-age individuals—is steadily rising. The United Nations projects that the old-age dependency will rise from 14.3% in 2020 to 25.4% by 2050. This trend threatens the sustainability of pension systems, healthcare infrastructure, and labour markets.

By embracing regional free movement, the island can access a broader, more diverse Caribbean talent pool, bringing new energy, ideas, and expertise into the economy and the ability to scale operations across borders with greater ease. For employers, this translates to faster recruitment, reduced costs, and a larger base of

skilled labour.

Hospitality and tourism represent the anchor of the island’s economy, around which many other subsectors such as construction, agriculture, renewable energy, and information technology thrive and can now gain significantly. Businesses are expected to find it easier to match talent with opportunity and already the open regional market is paying dividends.

For the business community, the free-movement policy also represents a deeper integration of the CARICOM Single Market and Economy (CSME) through enhanced cooperation. By allowing this coalition of member states to move faster toward full economic integration, the four-nation bloc is creating a more unified market of almost 1 million strong.

This approach aligns with the Montevideo Consensus on Population and Development, which advocates for managed migration as a tool for sustainable development. By facilitating intraregional migration, CARICOM can redistribute human capital where it is most needed, easing pressure on overburdened systems and revitalizing underpopulated areas. Free movement is expected to encourage professionals to stay within the region, contributing to economic activity while remaining close to home. This may prove more appealing at this stage given the less than welcoming environment existing in traditional pull markets.

For our businesses, this translates into a larger and more stable talent pipeline and stronger cultural ties within teams operating across the Caribbean.

Prime Minister Mottley has framed the policy within the broader context of Caribbean resilience. The ability to marshal skilled people quickly across different borders allows the region to better respond to crises.

For companies with regional operations, free movement simply

For individuals relocating to Barbados under the new regime, the government has outlined clear steps for several key areas.

• Entry: Nationals of the participating countries will be permitted entry on a one-way ticket, reflecting their right to stay indefinitely.

• Employment: Those seeking employment must obtain a National Identification Card and register with the National Insurance & Social Security Service as well as the Barbados Revenue Authority.

• Driving: Valid driver’s licences from home countries will be accepted for up to 12 months or until expiry.

• Education: Dependent children enrolling in local schools must submit education and health records and register with the Ministry of Education.

• Residency: Citizens of Belize, St Vincent and The Grenadines, and Dominica already residing in Barbados before October 1, 2025, will no longer need to apply for extensions of their stay through the Immigration Department.

makes it easier to move talent and open offices in the four participating nations. In essence, actioning genuine free movement makes the business environment of the grouping more interconnected.

Such a major policy shift is not without its sceptics and critics. Some Barbadians worry that greater mobility might alter the social fabric or strain local resources. The government acknowledged these concerns, but it also emphasised that several administrative systems are in

place to manage the transition. Each country retains the right to refuse entry or remove individuals who pose security or publichealth risks or are likely to become a burden on public services. Additionally, data-driven monitoring will track migration flows and labour trends, thus ensuring that decisions remain transparent. The CARICOM Implementation Agency for Crime and Security (IMPACS) will play a key role in coordinating this oversight and maintaining regional stability.

For Barbados and its partners, the 2025 free-movement initiative is more than a political milestone. It is a strategic business opportunity. It opens new options for trade and investment, while strengthening our competitiveness in a period of increasing uncertainty about the global economy. As the region

moves toward full implementation of the CARICOM Single Market and Economy (CSME), the success of this pilot initiative will serve as a blueprint for broader integration. If managed effectively, freedom of movement could become one of the most powerful tools in the Caribbean’s arsenal for sustainable development.

Business Barbados readers, from corporate leaders to entrepreneurs and investors, should view this as an invitation to build partnerships, expand operations, and think regionally. The framework is in place, the policy is live, and the potential is real. The time to invest and innovate is now.

As Prime Minister Mottley remarked, the Caribbean’s future will be defined not by borders, but by bridges.

Business Barbados readers, from corporate leaders to entrepreneurs and investors, should view this as an invitation to build partnerships, expand operations, and think regionally.

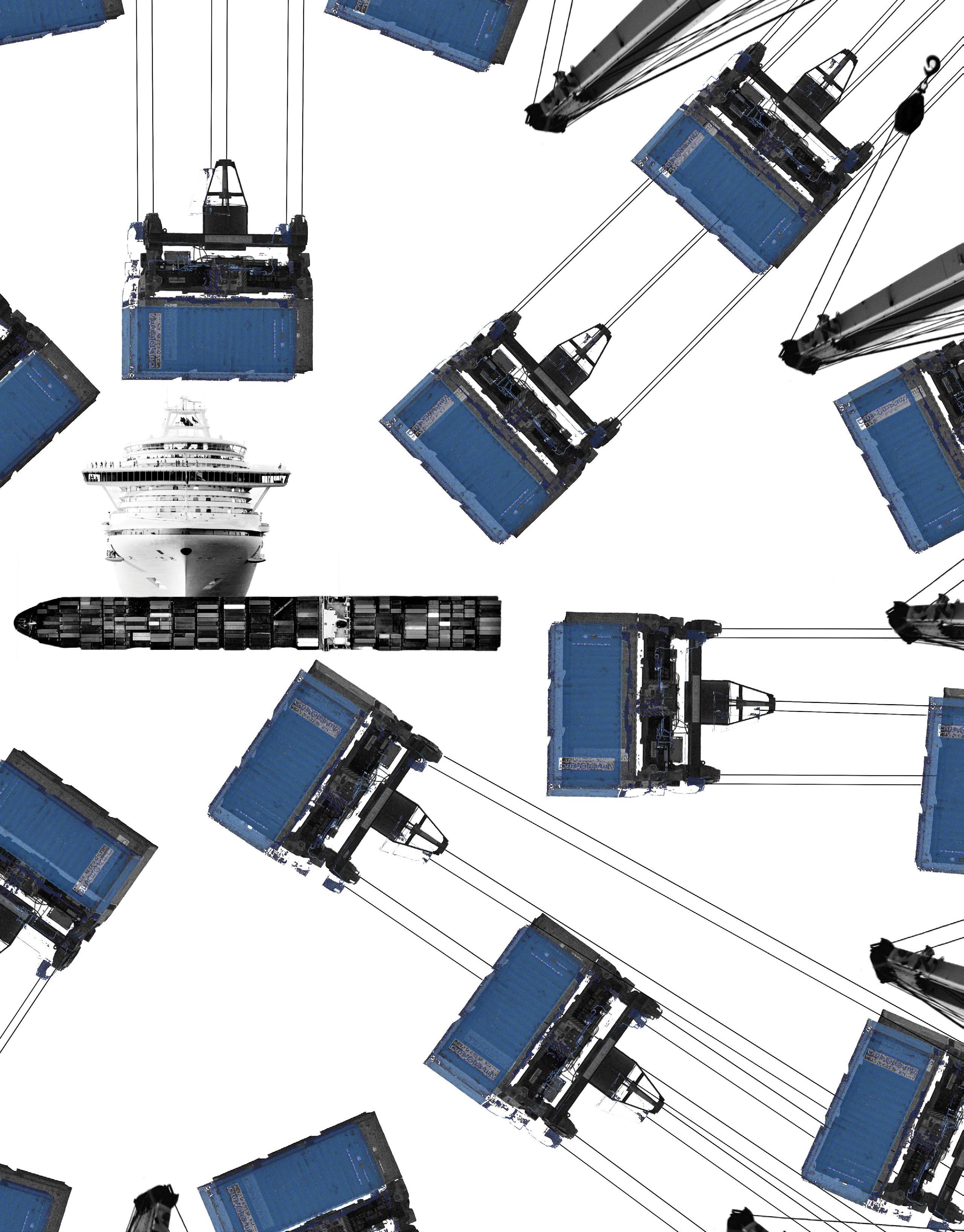

In the heart of the Caribbean, where turquoise waters cradle a mosaic of island nations, maritime connectivity is more than a logistical necessity – it is the lifeblood of regional integration, economic resilience and sustainable development. Among the many vessels that traverse these waters, liner services stand out as the unsung heroes of interisland trade, mobility, and cohesion. Liner services – meaning scheduled cargo and passenger vessels operating on fixed routes – form the backbone of maritime logistics in the Caribbean. Unlike tramp shipping, which operates on demand, liners offer predictability, frequency, and reliability. For island nations with limited land-based infrastructure and fragmented supply chains, this consistency is vital not only for Trade Facilitation and Economic Diversification, but also Disaster Resilience, by providing critical lifelines for humanitarian aid and recovery logistics.

Barbados, with its highly advantageous strategic location and rich maritime heritage, is uniquely positioned to lead a renaissance in Caribbean liner connectivity. As regional stakeholders push for ‘ferries not flights’ to reduce costs and carbon footprints, Barbados can emerge as a central node in a revitalized maritime network based on:

• Gateway Potential – with its proximity to both the Windward and Leeward Islands, Barbados can serve as a transshipment hub and feeder port.

• Tourism Synergy – integrating luxury liner services with cruise itineraries and water taxis enhances visitor mobility and experience.

• Green Logistics – Barbados can champion eco-friendly vessels and offshore bunkering stations (refuelling of ships) aligned with MARPOL and OPA 90 standards. Maritime operations hinge on the quality of port facilities and

systems, so regional growth can only be achieved through the robust strengthening and modernization of each country’s port infrastructure. This would include – but not be limited to – upgrading cargo handling equipment, digitizing customs processes, and expanding berthing capacity to accommodate larger vessels and faster turnaround times.

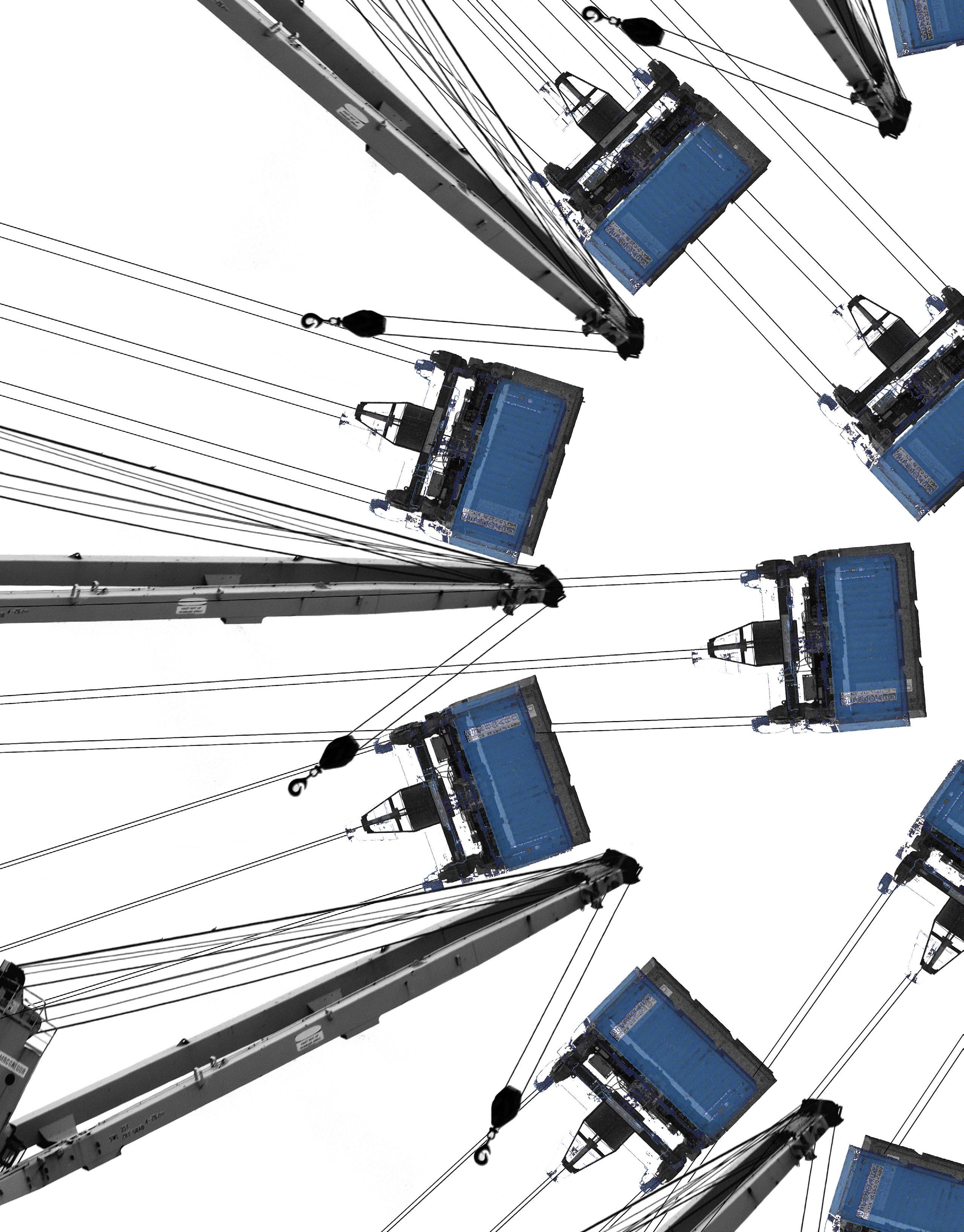

The ongoing upgrade of the Port of Bridgetown in Barbados could mark a significant milestone in enhancing the efficiency and competitiveness of the region’s maritime operations, while potentially providing a blueprint for other Caribbean ports to follow. This initiative will feature the implementation of state-of-the-art automated systems to control port cranes, which will streamline the loading and discharging of cargo, thereby reducing turnaround times and improving overall productivity. Additionally, advanced software solutions will be integrated into port operations to optimize the management of cargo handling processes.

This project will be a collaborative effort involving both the private and public sectors, ensuring comprehensive stakeholder engagement and resource sharing. Notably, local stevedores will also be invited to participate as shareholders in the company overseeing this upgrade, reflecting a commitment to inclusive growth and investments that benefit the community as a whole.

For Barbados, investing in port infrastructure will unlock new

George Michanitzis

Maritime Consultant & Strategic Planner CEO, Minotaur Shipping and Project Management Ltd

opportunities in transshipment, cruise tourism and regional ferry services. It will also position the island as a leader in maritime innovation and resilience, in keeping with its declared aspirations to become a major transshipment hub for / gateway to the Americas and Africa.

While vessels and ports form the physical backbone of connectivity, true regional integration requires the free movement of people. Interstate agreements that facilitate visafree travel, streamlined customs protocols, and mutual recognition of identification documents are essential to unlocking the full potential of liner services.

The Organisation of Eastern Caribbean States (OECS), comprising Dominica, St. Vincent, Grenada, St. Lucia, Antigua & Barbuda, and St. Kitts & Nevis, has allowed free movement among its members since 2011. More recently, as of October 2025, Barbados has aligned with Belize, Dominica, and St. Vincent to implement full free movement of people and labour among themselves, whereby: (i) Nationals can live, work, and reside indefinitely in any of these countries without a work permit or visa. (ii) Access to public services such as healthcare and education is granted on par with locals. (iii) Family members (spouses, children, dependent parents) can also move freely.

This four-nation pact is seen as a pilot or ‘enhanced cooperation protocol’, that could encourage other regional countries to follow suit, thereby moving closer to

CARICOM’s ultimate goal of achieving full free movement of all nationals across all member states, as outlined in the 2001 Revised Treaty of Chaguaramas.

With such a fragmented geography, the only way to effectively bridge the Caribbean archipelago is through a cohesive maritime strategy, founded upon the full collaboration of governments, chambers of shipping, and private operators to:

• Establish regional liner corridors with harmonized schedules and tariffs.

• Invest in port infrastructure and digital tracking systems.

• Promote public-private partnerships to fund vessel procurement and operations.

• Align with international

standards to attract global registrars and superyacht traffic.

• Advance interstate agreements for seamless movement of people and goods.

As climate change and global trade dynamics continue to reshape the maritime landscape, the need increases for the Caribbean to anchor its future in sustainable, inclusive and innovative liner services. Barbados, with its visionary leadership and strategic ambition, can be the compass guiding this transformation.

*Minotaur Shipping and Project Management Ltd is the appointed Managing Consultant for the St. Lucia Chamber of Shipping

As climate change and global trade dynamics continue to reshape the maritime landscape, the need increases for the Caribbean to anchor its future in sustainable, inclusive and innovative liner services.

Modest in size and vast in remit, the Embassy of Barbados in the Republic of Panama is an intermediary ready to facilitate dialogue and commercial connections between Barbados and the Latin American nations bordering our shared Caribbean waters. Brimming with potential for greater bilateral commercial engagement, trade and investment, the Embassy of Barbados in Panama City maintains concurrent accreditation to eight dynamic Latin American countries: Colombia, Costa Rica, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, and, of course, Panama. The Barbados Mission first opened its doors in 2019 with two broad objectives: first, to engage the large and diverse community of Panamanians of Barbadian descent, whose ancestors travelled from Barbados more than a century ago to assist in the construction of the Panama Canal and Railway. These

Barbadians, estimated at roughly one-quarter of the island’s total population at the time, departed their homeland and helped lay the literal foundation for the development of the multicultural society and commercial hub that modern-day Panama has become. Secondly, the Mission sought to advance commercial relations and deepen South-South cooperation among Barbados and the countries within its jurisdiction.

Early on, the Government of Barbados saw the strategic importance of expanding its diplomatic footprint in Latin America. Hemispheric neighbours with shared values and similar challenges, the eight nations within the Embassy of Barbados’ remit are non-traditional trading partners to whom our doors and shores remain open for business amidst evolving global challenges and changing geopolitical landscapes.

Barbados and Panama – two distinct smart hubs in their own

right – seemingly lie at the centre of a regional commercial relationship defined by untapped potential and promise. Serviced by four direct passenger flights a week via Copa Airlines, increasing to five weekly in January 2026, the jet bridge connecting Barbados and Panama, and consequently the wider Caribbean and Latin America, continues to expand. These flights bring thousands of Barbadians and other Caribbean nationals, largely from our Eastern Caribbean sister isles, to Panama seeking to discover ancestral connections, shop and sightsee, and transit onward to other Central and South American destinations. Similarly, this air service brings scores of Latin American visitors to Barbados’ beautiful shores, eager to explore

an unrivalled tourism product and keen to tap into our nation’s growing economy, welcoming climate, desirable lifestyle and bold vision for a more resilient and sustainable future. Increased airlift between Barbados and Latin America, namely a daily passenger flight between Bridgetown and Panama City and the launch of direct flight options to other Latin America markets like Colombia, remain priorities for Barbados in the year ahead. With the September 2025 addition of a weekly Copa Airlines Cargo flight, Barbados-Panama air connectivity continues to trend in the right direction, as trade by airfreight presents myriad new possibilities for Barbados’ commercial sector and the expansion of trade ties across the Latin American region.

Over the past year, Barbados has fortified its relationships with key Latin American partners bilaterally and through multilateral fora. In August 2025, both Panama and Colombia officially opened (or reopened in the case of Colombia, having closed its previous Embassy in 2002) their diplomatic missions in Barbados with formal ceremonies attended by high-level dignitaries, including Panama’s Minister of Foreign Relations and the Vice President of Colombia. Within the same month, the Barbados Port Inc. and the Panama Maritime Agency finalized a Memorandum of Understanding intended to create new opportunities for economic growth, promote technical cooperation and knowledge exchange, encourage sustainable

maritime practices, and position Barbados as a vital transshipment hub, connecting Latin America with Africa. Moreover, the Barbadian government, through the Caribbean Community (CARICOM), remains actively engaged in discussions with Colombia on strengthening trade relations and the expansion of preferential market access under the CARICOM–Colombia Trade Agreement, with Barbados hosting the third round of these negotiations in November 2025.

In the years ahead, Latin America’s diplomatic footprint in Barbados is poised to expand further –undoubtedly bringing with it new trade and investment opportunities – with the Cabinet of Barbados approving Mexico’s request to establish a diplomatic mission in 2024. As the second largest

economy in Latin America prepares to enhance its physical presence in the Caribbean, Barbados, once again, serves as a strategic hub for deepening hemispheric engagement, demonstrating, as Minister of Foreign Affairs and Foreign Trade, the Hon. Kerrie Symmonds, M.P. once stated, “a growing of confidence and interest in doing business in Barbados and with Barbados”.

Increasingly, Barbados is looking towards non-traditional partners, including its closest Latin American neighbours, to address the current challenges and unique vulnerabilities it faces as a small island nation, such as supply chain disruptions, unstable prices, and rising shipping costs. To this end, the Embassy of Barbados in Panama City continues to work closely with diplomatic counterparts, government agencies, and private

sector associations. The Barbados Mission remains intent on exploring new connections with local, regional and international innovators, influencers and changemakers with the aim of strengthening existing commercial ties; fostering innovative academic partnerships, language exchange programs and cultural cooperation agreements; and identifying new, mutually beneficial trade and investment opportunities across targeted sectors.

Now in 2026, the year in which Barbados celebrates its Diamond Jubilee, the Embassy of Barbados in the Republic of Panama does so with a renewed commitment to advance the Government of Barbados’ commercial diplomacy mandate, serving as a single bridge – Un Solo Puente – between Barbados, the Caribbean and Latin America.

Below: Barbadian and Panamanian delegations following the ceremonial signing of the Memorandum of Understanding between the Barbados Port Inc. and the Panama Maritime Authority. L-R: Mr. David Marie-Jean (CEO, Barbados Port Inc.), H.E. Xiomara Pérez (Ambassador of Panama to Barbados), H.E. Javier Martínez-Acha (Minister of Foreign Affairs of Panama), Senator the Hon. Lisa Cummins (Minister of Tourism and International Transport of Barbados (Ag.)), Mr. Jamar White, (Permanent Secretary (Ag.), Ministry of Tourism and International Transport), and H.E. Amanda Martinez (Ambassador of Barbados to Panama)

Why Panama in Barbados?’ is a question that many people ask in both countries. The answer is simple and obvious: the Government of Panama has chosen to strengthen its strategic position alongside Barbados because it is an important country and a vital partner in the region. This step strengthens bilateral ties and projects Panama as a reliable and dynamic ally. Today, with Panama being an associate member of Mercosur and on the verge of joining the OECD, it can offer many useful benefits to Barbados and the entire Eastern Caribbean.

The presence of our President, José Raúl Mulino, and our Foreign Minister, Javier Martínez-Acha, at the opening of the Panamanian Embassy in Barbados in August 2025 underscored the importance

of strengthening Panama’s presence in this country. In line with our government’s foreign policy strategy that seeks to expand Panama’s reach beyond Central America and Latin America, towards the Eastern Caribbean, this strong relationship can provide a bridge between two continents.

The shared history between Panama and Barbados is living proof of the ties that unite our people on a human and cultural level that have existed for more than a century. It is well documented that more than 20,000 Barbadians travelled to Panama during the construction of the Canal, leaving an important mark on Panamanian identity. Today, that bond has been strengthened with the opening of embassies in both countries.

Throughout the period when approximately one-third of the population of Barbados emigrated to Panama to work on the Canal, many of them sent remittances back home to financially support their families on the island. This economic flow, often referred to as ‘Panama Money’, was fundamental in the creation of a solid and successful middle class in Barbados. This historical link is a reminder of how economic cooperation can transform societies. Today, by strengthening commercial and political ties, Panama and Barbados honour that memory and project it into the future. ‘Panama Money’ symbolises the ability of both nations to build shared prosperity, and its legacy must continue to be strengthened with new initiatives in investment, trade and cultural cooperation.

“The opening of the diplomatic headquarters in Bridgetown is not only a symbolic gesture, but also a strategic decision that will allow Barbadians to learn more about Panama, a Caribbean sister country that offers opportunities for business, investment, and cooperation. The Caribbean is part of our identity. From Barbados and the Eastern Caribbean, Panama presents itself as a gateway, bridge and port for those who wish to approach Latin America and the world.”

- H.E. Javier Martínez-Acha, Panama Minister of Foreign Affairs

The relationship between Panama and Barbados is undergoing a period of strategic renewal. The opening of Panama’s first embassy in Barbados and the Eastern Caribbean marks a milestone that transcends diplomacy: it opens the door to economic and trade cooperation that will bring tangible benefits to both countries and their citizens.

The Benefits for Barbados include:

• Access to a global hub: Panama offers Barbados the possibility of connecting with Latin America and the world through its logistics and financial platform.

• Economic diversification: The alliance with Panama makes it possible to attract investment and expand sectors such as tourism, financial services and international trade.

• Business strengthening: Barbados can now explore ways to leverage Panama’s experience in infrastructure and logistics.

• International projection: From Panama, Barbados can expand its ties to Latin America through joint cooperation and attending major international trade fairs held in Panama, such as EXPOCOMER.

Benefits for Panama include:

• Political and regional consolidation: Strengthening economic and trade ties not only generates material benefits but also consolidates the bonds of friendship. Barbados’ cooperation and leadership open the door to a closer relationship with CARICOM, allowing Panama to establish itself as a relevant player in regional integration. From this platform, both countries can project their interest towards the African continent, broadening their diplomatic and commercial horizons.

Reaching out to Africa and Beyond Panama’s strategic vision includes

not only the Caribbean and Latin America, but also Africa. Barbados, with its history and cultural ties, can serve as a platform for Panama to strengthen commercial, diplomatic and cultural relations with African countries. This outreach multiplies opportunities for cooperation, trade and investment, positioning both Barbados and Panama as relevant players on the international stage. Working together from Barbados will allow Panama not only to show the entire region the benefits we have mentioned as the Hub of the Americas, but also to strengthen Barbados as a reliable partner and a point of connection to new horizons through the unique bridge that unites us. The bilateral relationship thus becomes an engine of regional integration and openness to the world.

From Panama’s Logistics Hub to Barbados’ Smart Hub

A particularly interesting aspect of the bilateral relationship with Barbados is how an extraordinary path, full of possibilities, is being forged to unite our two countries. Panama is positioning itself as the ‘Hub of the Americas’, while Barbados is moving forward to become a ‘Smart Hub’ in the Caribbean. The synergy between these two goals opens up space for innovation and modernisation of our economies. In this field, Panama can offer its experience in logistics, transport and financial services, while Barbados contributes its commitment to digitalisation, sustainability and technological innovation, as well as its expertise in tourism. Together, they can build a model of cooperation that combines physical infrastructure with digital infrastructure, creating a business ecosystem capable of competing on the global stage.

As a member of Mercosur and the OECD, which we are hoping