Insurance Agency Network

Current Carriers Represented

Carriers in Process and Consideration

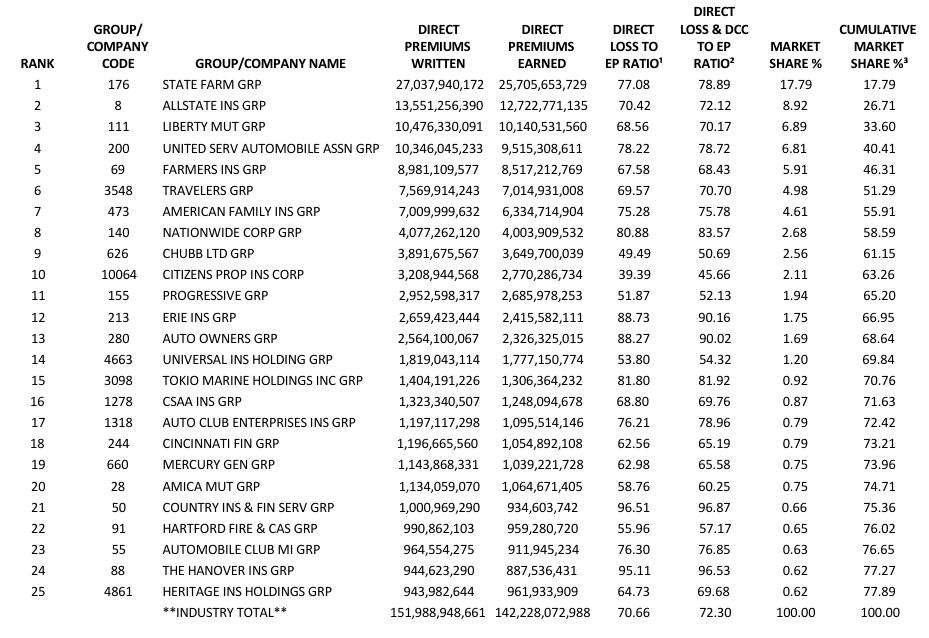

Insurance Industry at-a-glance

Top 25 P & C Companies/Groups

National Companies

Super Regional Companies

Regional Companies

Company Profiles

Summary

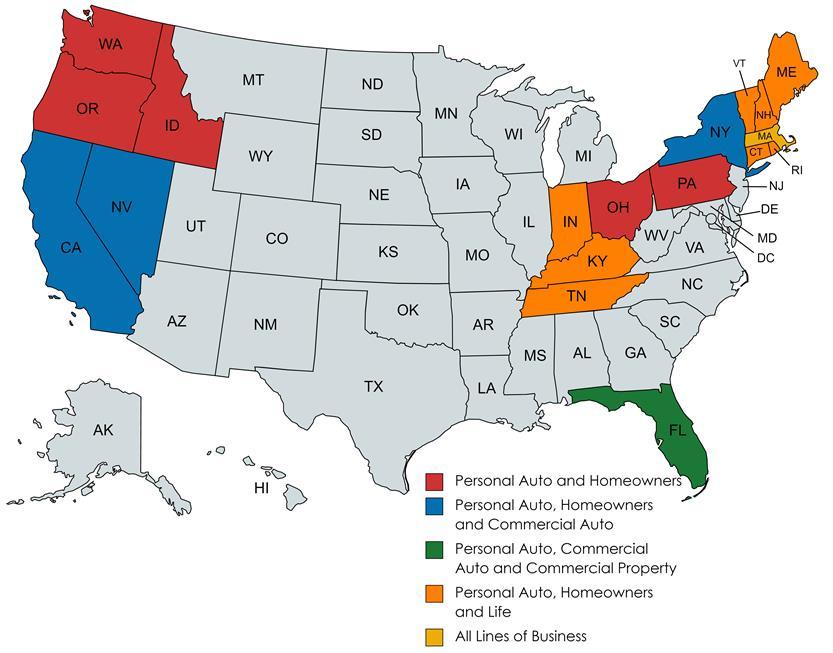

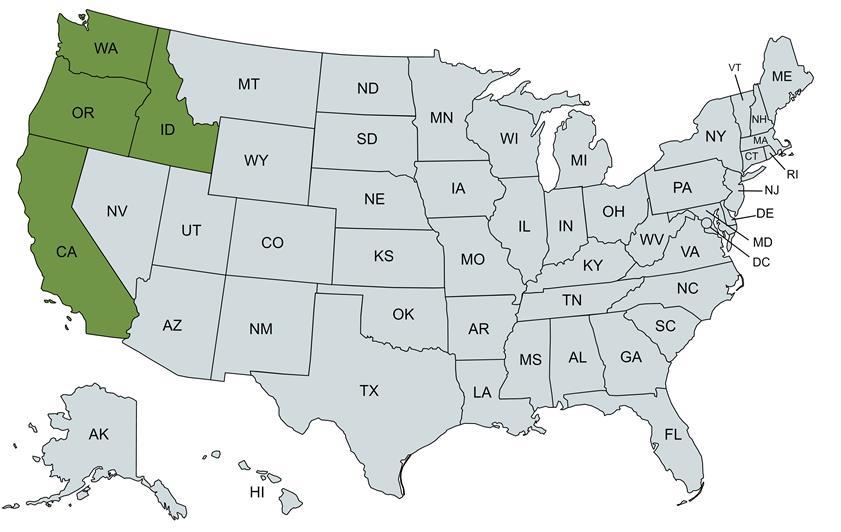

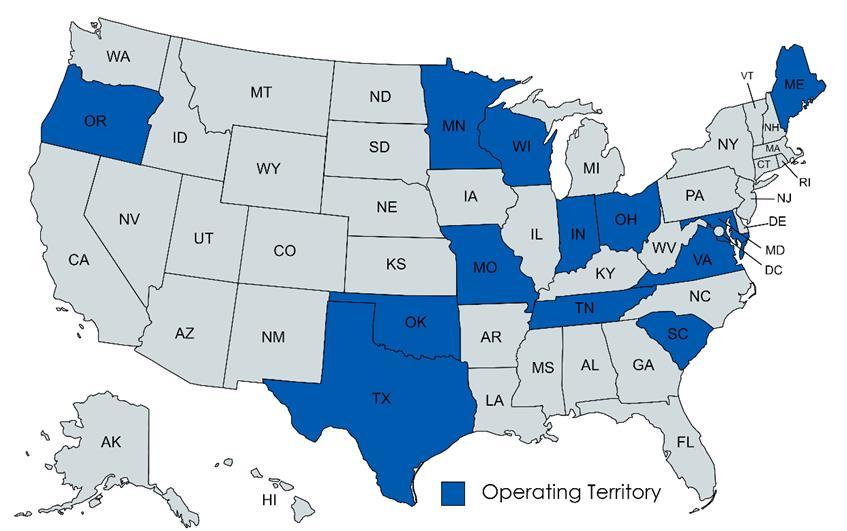

Products Offered

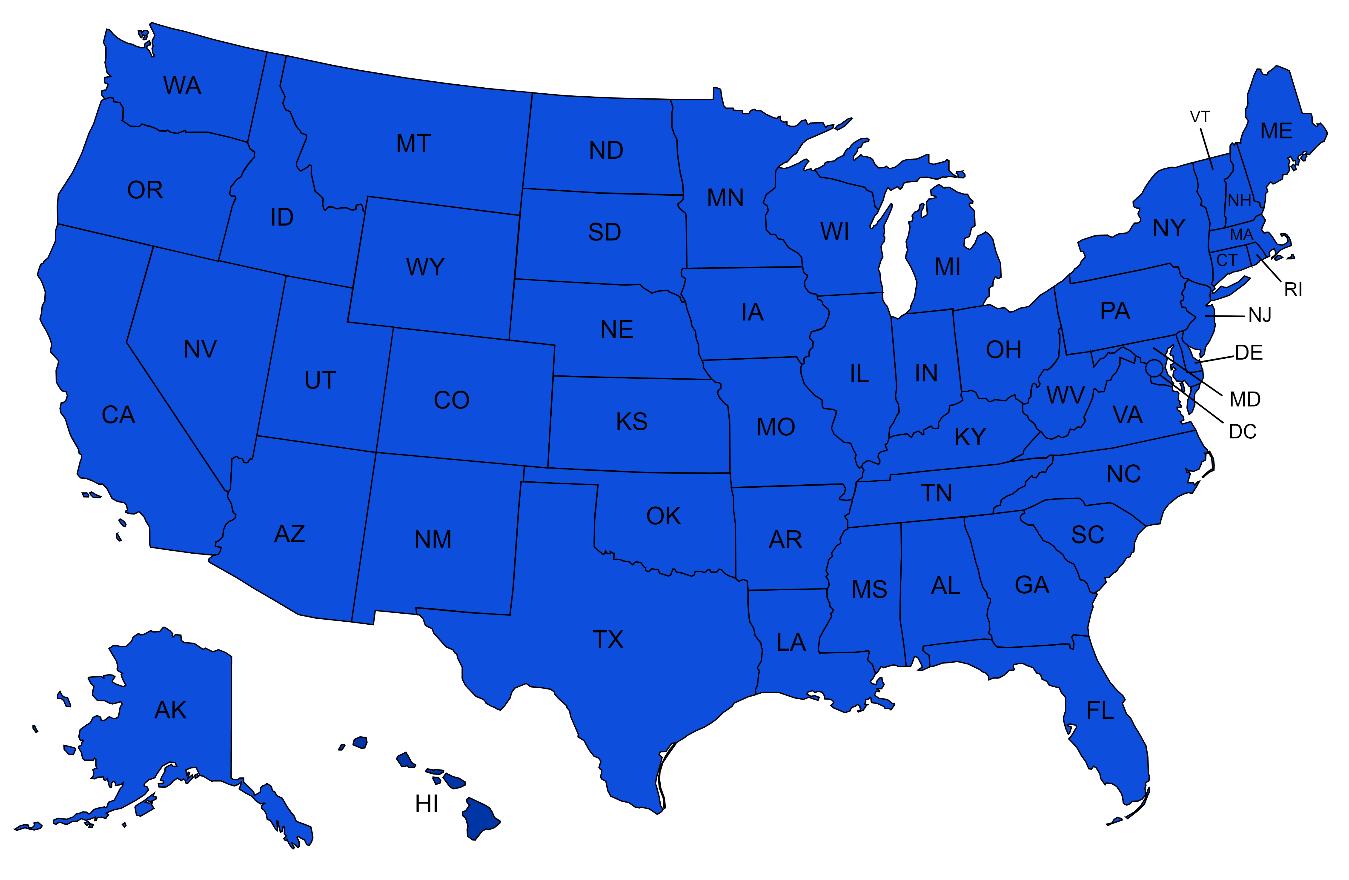

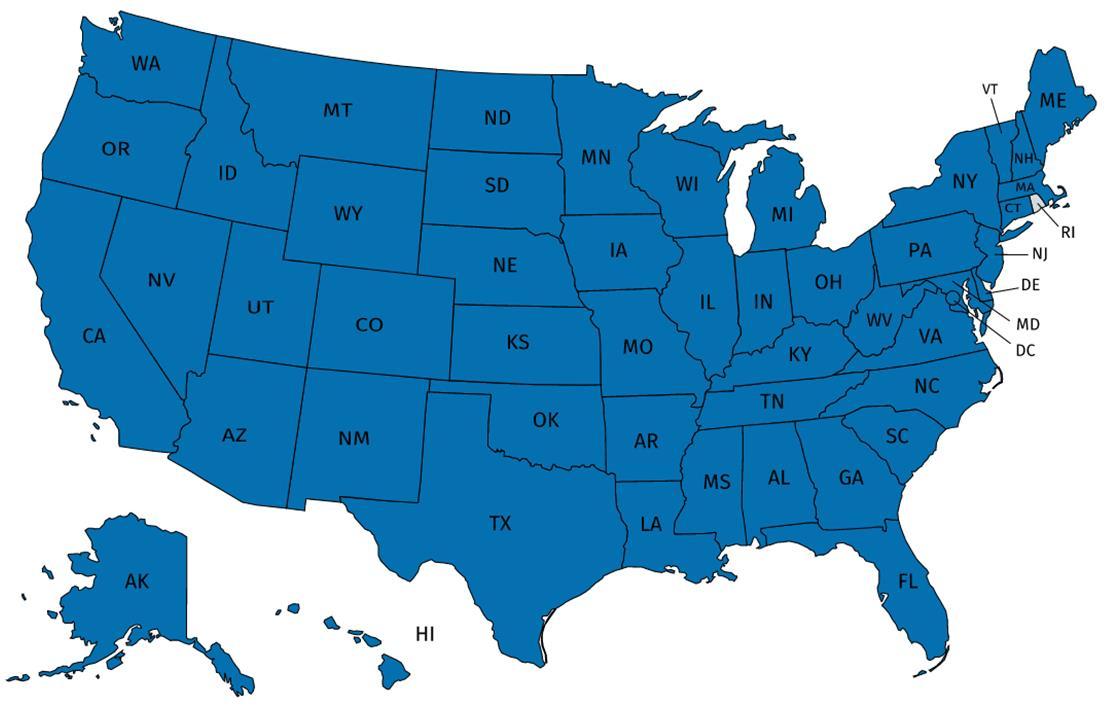

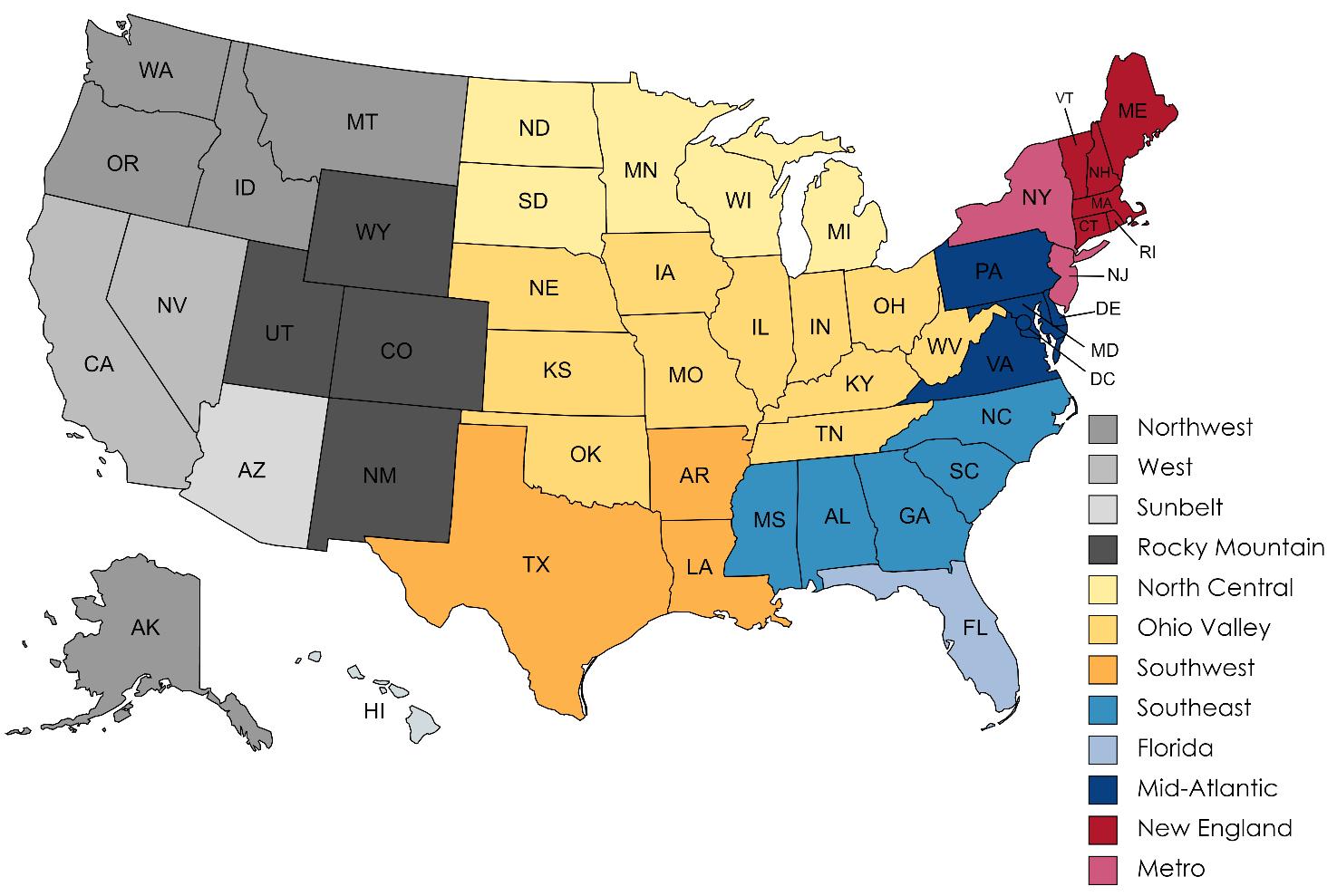

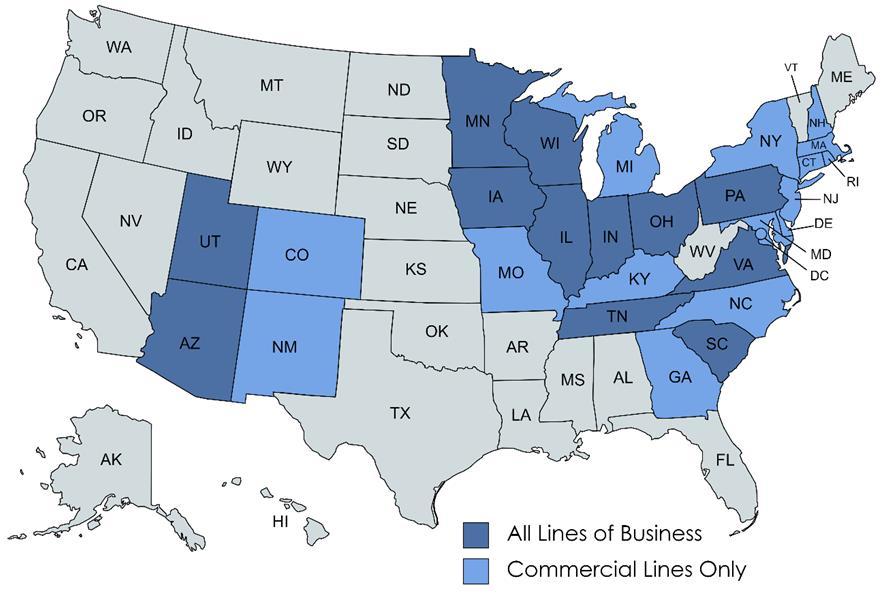

Territory of Operation

Commission Schedule

Specialty Companies

MGA’s

IAN - Insurance Agency Network provides Associate’s access to a broad selection of top national and regional carriers and other organizations that provide increased commissions, profit share and growth bonuses which are important in funding agency operations.

Allstate's® history began in the fall of 1930 when Sears, Roebuck & Co. President and Board Chairman, General Robert E. Wood, got the idea to start an auto insurance company and sell insurance by mail. It was the beginning of something big. The Allstate Corporation is an American insurance company, headquartered in Northfield Township, Illinois, near Northbrook since 1967. Founded in 1931 as part of Sears, Roebuck and Co., to start an auto insurance company and sell insurance by mail. It was spun off in 1993.

Allstate® has been a pioneer of the insurance industry. Americans have trusted Allstate to help protect their families and their belongings for over 80 years and is the nation's largest publicly held personal lines insurer. Its leaders, employees and agency owners have been an integral part of Allstate's heritage. Today, Allstate is reinventing protection to help consumers better prepare for tomorrow and protect what matters most.

milestones:

• 1931 – Allstate Insurance Company begins on April 17, 1931.

• 1933 – Richard Roskam became Allstate’s first agent at the Chicago World’s Fair.

• 1939 – Began tailoring auto rates by age, milage and use of car.

• 1940’s – Developed a series of training courses to help women replace male agents on military leave, created the “Illustrator Policy” so customers could easily understand their policy and ends with Written Premiums of $45.3 million, 708,763 policyholders and more than 2,800 employees.

• 1950’s – Created the “You’re In Good Hands With Allstate”® slogan, opened their first drive-in claim office and introduced Residential Fire Insurance.

• 1960’s – Good Driver Discount Plan introduced in many states, moved its home office to Northbrook, Illinois and written Premiums of $1.47 billion, 11.4 million active polices and more than 30,000 employees.

• 1974 – Forms Allstate Indemnity Company serving customers considered “high risk”.

• 1976 – Created the “Helping Hands” program for community causes and created the “You’re in Good Hand with Allstate” logo.

• 1978 – North Brook Property and Casualty begins offering products to commercial risks.

• 1980 – Introduced the IBM 8100 enabling employees to communicate electronically.

• 1982 – Became part of the Sears Financial Network, a one stop financial services concept.

• 1993 – Allstate went public when Sears sold 19.8% of the company with largest public offering to that date in U.S.History.

• 1996 – Launched its consumer website, www.allstate.com

• 1999 – Expands market reach with acquisition of personal lines insurance business from CNA and renames to Encompass Insurance, Written Premium of $20.4 billion,14 million policies in force and 40,000 employees.

• 2000 – The Good Hands Network℠ goes live. Customers are able to purchase auto insurance on the Internet, over the phone or through an agent.

• 2001 – Became the Official Home and Auto Insurance Sponsor of the 2002 Olympic Games, the 2002 and 2004 U.S. Olympic teams.

• 2005 – Became an official sponsor of NASCAR, with the “Allstate 400 at the Brickyard”.

• 2006 – Celebrated 75th Anniversary, became the title sponsor of the Allstate Sugar Bowl, introduced “Your Choice Home” and launched “Keep the Drive”

• 2019 - Written Premiums of $35.4 billion, 46.3 million policies in force and 45,700 employees.

Financial Stability:

• Allstate® is rated A+ (Excellent) by A.M. Best which reflects solid capitalization, favorable operating profitability, disciplined underwriting initiatives and conservative reserving philosophy, which has resulted in favorable reserve development.

• 2019 - $35.4 billion in gross premiums.

Employee, Customer and Community Oriented:

• Allstate® has thrived for 89 years by adapting to better serve customers. They believe Purpose-driven companies are powered by purpose-driven people. Through collective power, they harness diverse talent to better serve customers and make the world a better place.

• Allstaters take a stand to empower youth, uplift and educate survivors of domestic violence and support the communities where they live and work. The National Association of Insurance Commissioners (NAIC) received fewer complaints regarding Allstate than average in the last year.

• Advertising and sponsorship strategies help connect with people in relevant and meaningful ways. With national ad placements and corporate sponsorships, Allstate is able to support local communities and show how they can keep people protected through the Good Hands® commitment.

Company Highlights:

Allstate® is grateful and honored to be at the top of many national lists. Take a look at some of the awards received in recent years.

• 1998 - Fortune’s list of “Best Companies for Asians, Blacks and Hispanics and Forbes “World’s Top 50 Companies”.

• 2000 - Top company for Executive Women by Working Woman

• 2005 - Nations’ top 50 innovative users of information technology by InformationWeek, second most-admired company in the Property & casualty industry by Fortune magazine and “Top 50 Companies for Hispanics” by Hispanic Business magazine.

• 2009 – 2012, 2014-2016 – Recognized by Newsweek on its “100 Greenest Companies in America” list.

• 2013 – 15 (24-time award winner) - Working Mother Magazine annual list of “100 Best Companies for Working Mothers”.

• (2015 – 20) - Ethisphere Institute’s World’s Most Ethical Companies

• 2017 - Forbes’ America’s Best Employers

• 2019 - 2020 Forbes’ Best Employers for Diversity and Women.

• 2020 - Fortune’s World’s Most Admired Companies.

Industry Rankings:

• Allstate® is the 5th largest Property and Casualty Insurer in the United States based upon premium written per 2020 NAIC reporting.

• 2nd largest writer of Homeowners coverage in the United States.

• 4th largest writer of Private Passenger Auto coverage in the United States.

• 10th largest writer of Commercial Auto in the United Sates.

Auto Insurance Coverage

Auto Policy Discounts

Your Choice Auto®

Bumper-to-Bumper

Homeowners Insurance

Condominium Insurance

Renters Insurance

Landlord Property Insurance

Personal Umbrella Policy

Flood Insurance

Motorcycle Insurance

Boat Insurance

Motorhome Insurance

Snowmobile Insurance

ATVs and 4x4s

Business Insurance

Roadside Assistance

Pet Insurance

Event Insurance

Company Profile: AmTrust® began in 1998 with a commitment to innovation in small business insurance and has grown into a global property and casualty provider with a broad product offering. The company has grown, but their commitment to innovation and service remain the same.

AmTrust® today has over 5,000 employees serving 60 countries and has become a top U.S. commercial insurer and a leading global provider of warranty products and specialty risk. Their investments in people and proprietary technology allow us them to offer customers the most innovative insurance products to meet their needs today and anticipate their needs for tomorrow.

AmTrust® features a balanced mix of business lines, the portfolio endures by maintaining strong retention rates and benefiting from both lower pricing pressures and volatility. The more they learn from historical claims data, the better they can build programs, products, and services to help prevent loss, prepare for risks, and prevail when the unexpected occurs.

AmTrust® unified portfolio of products includes:

• Small Commercial Business Insurance and Workers’ Compensation

• Specialty Risk and Extended Warranty Insurance

• Specialty Middle-Market Property and Casualty Insurance and Surety.

• 1998 - AmTrust® Financial Services was founded.

• 2001 – Enters the small business workers’ compensation market.

• 2002 – 2005 -Acquires Princeton Agency in the Northeast, Covenant Group in the South and Alea and enters specialty middle market property and casualty business.

• 2006 - Becomes publicly traded on the NASDAQ Global Market under the symbol AFSI, acquires Murfield with workers’ compensation business in the Midwest and Wesco Insurance Company which is licensed in all 50 states.

• 2008 – 2010 - Acquires Unitrin Business Insurance, CyberComp™ workers' compensation business unit of Swiss Re, and Majestic, marking AmTrust’s entrance into the California workers’ compensation market.

• 2011 – 2013 - Acquires BTIS, CardinalComp, Car Care Plan Holdings with warranty business worldwide, and Sequoia and Tower Group International solidifying market leadership in small commercial business segment.

• 2014 – 2015 - Acquires Comp Options Insurance Company, Inc., Insco Dico Surety who does business in all 50 states, completes integration with AmTrust IT operating platform, acquires Warranty Solutions, a Wells Fargo business and ranks 11th largest commercial lines writer in the U.S.

• 2016 – Completes 14 acquisitions and acquires ANV Holdings B.V. a specialty insurance company and Nationwide Title Agency, LLC, and its subsidiaries.

• 2017 - Named to the Fortune 500, with a ranking of 475 on the 63rd annual Fortune 500.

• 2019 - Announces agreement with Swiss Reinsurance America Corp (“Swiss Re”) for covering U.S. small commercial business totaling approximately $2.9 billion in projected written premiums.

• AmTrust® Financial is rated “A-” from A.M. Best and well positioned to provide coverage for those in need of a strong, agile partner.

• AmTrust business model is focused on generating steady, stable, and positive growth. A disciplined, conservative, and opportunistic path to achieving long-term, sustained profitability. milestones:

• AmTrust® remains focused on profitable growth based upon a philosophy of niche diversity, low-hazard risk and offering the best service experience, driven by innovation, transformative technology, and excellence in data analytics. They are expanding in businesses where they have unique expertise to generate the most profitable returns.

• 2018 Direct Written Premiums more than $5.9 billion.

• AmTrust® Financials’ commitment to excellent customer service is the foundation of their products and capabilities. The experienced, reliable staff of expert underwriters and salespeople remains steadfastly dedicated to treating agents and policyholders with the individual attention they deserve, regardless of the size of their businesses. Their commitment to excellence is at the root of all AmTrust products and capabilities.

• Clients can always be assured that they’re working with one of the most financially secure insurance providers in the market.

• Employee accelerated growth rate means unparalleled career advancement opportunities and a chance to be a part of continuous innovation, because Your Success is Our Policy®!

• AmTrust® Financial works with a network of independent insurance agents, MGAs and claims administrators who rely on AmTrust to reduce, mitigate, and transfer risk.

• Market focus continues to be on Multiline Small Business including lumber, restaurants, automotive service centers, financial institutions and many more, Program Business such as retail and wholesale operations, service operations and non-profit organizations and Specialty Risk and Extended Warranty serving manufacturers, retailers, and thirdparty warranty administrators around the world.

• AmTrust recently announced an organization-wide program called AmTrust Forward, aimed at building on their successful history in order to remain strong and profitable for the future. The initiative sharpens focus and leverages unique strengths to continue to be a leading provider of specialty commercial P&C products and services in the U.S. and internationally.

• AmTrust® Financial is the 23rd largest Property and Casualty Insurer/Group in the United States based upon 2018 revenue.

• 5th largest writer of Workers Compensation Insurance in the United States.

• 11th largest writer of Commercial Auto Insurance in the United States.

• Ranks 475th on the current Fortune 500 list of largest corporations in the United States.

Insurance

Workers' Compensation

Businessowners Policy

Commercial Package

Cyber Liability

EPLI

Specialty Programs

State Disability

Specialty Risk

Agricultural and Heavy Equipment

Automotive

Consumer Products

Financial Institutions

Home Warranty

Service Providers

Software Companies

Commercial Property Insurance

Excess & Surplus

General Liability

American Strategic Insurance (ASI) was formed in 1997. Its initial offering was homeowner’s insurance in Florida. The company has experienced rapid growth and is now expected to offer coverage nationwide, establishing its place in the top 15 homeowner’s insurance providers in the United States. ASI is headquartered in St. Petersburg, Florida. These expansion goals are largely attributed to its acquisition by PROGRESSIVE® in April 2015. The strategic partnership between the two companies is meant to allow them to compete in the coveted insurance "bundling" market.

ASI is now part of the PROGRESSIVE®Group of Insurance Companies. They set big goals and achieved them by paying close attention to the details. ASI cares most about people and their local communities and work hard to go above and beyond everywhere they offer coverage. They are passionate about insurance and people and believe these two interests go hand-in-hand, which is why they cherish every relationship they create. Their success relies on the combined efforts and impacts of partners, independent agents, team members and policyholders.

milestones:

• 1997 - Founded by John F. Auer, incorporation of ASI and ARX Holding Corp and began offering coverage in Florida with the Goal: Become the Progressive of Residential Property Insurance

• 1998 - First Homeowners Policy issued

• 1999 - First Umbrella policy issued.

• 2000 - First Flood policy issued.

• 2001 - Earns A.M. Best Rating "B++" and Expanded to offer coverage in Texas.

• 2002 - 100,000th policy sold.

• 2004 - The first set of catastrophes that showed ASI was financially stable; Hurricanes Charley, Frances, Ivan, and Jeanne

• 2005 - ASI outperformed competitors and increased reputation with independent agencies; Hurricanes Wilma, Rita, and Katrina

• 2007 - Earns A.M. Best Rating "A-"

• 2008 - Expands coverage to five states.

• 2009 - Progressive Home Advantage® launches

• 2010 - Earns Florida Trend’s “Best Mid-Sized Company” award, 500,000th policy sold and Expands coverage to 10 states.

• 2011 - Earns No.1 spot in Tampa Bay Times’ “Top Workplaces” program, Wins the National Flood Insurance Program’s 2010 Administrator’s Club Award and Named one of Florida Trend’s “Best Companies To Work For.”

• 2012 -EarnsA.M.Best Rating"A", ASIandProgressivemakereciprocal investments, Namedoneof Florida Trend’s “Best Companies To Work For” and Expands coverage to 20 states.

• 2013 - $1 billion in earned premium, $500 million of policyholder surplus, earns No.1 spot in Tampa Bay Times’ “Top Workplaces” program, and Named one of Florida Trend’s “Best Companies To Work For.”

• 2014 - First catastrophe bond issued, 1 millionth policy sold and Named one of Florida Trend’s “Best Companies To Work For.”

• 2015 - PROGRESSIVE® purchases majority interest in ASI, becomes one of the 15 largest residential property insurers in U.S. and expands coverage to 30 states.

• Today - Expands coverage to 40 states and Launches Auto program in California (ASI Select)

• ASI became a majority-owned subsidiary of PROGRESSIVE®Corporation, on April 1, 2015.

• They have proudly held a rating of A (Excellent) from A.M. Best Co., the leading independent rating organization for insurance companies.

• 2019 - Parent Company PROGRESSIVE® Direct Written Premiums over $35 billion.

ASI believes in never settling for less than the very best, so you don’t have too either. Their goal is to provide an insurance experience that allows you to rely on supportive, fast, and progressive services every time.

• Community Involvement - Their goal is to be the best in the industry, and this means going above and beyond not just for staff, partners, and policyholders, but for local communities too. They are more than simply a team; they are a family and care about each other and eagerly seek opportunities to be active members of the places in which they live and work.

• Green Initiatives - They are committed to innovation, especially when it comes to reducing the carbon footprint. They have adopted many keyways to carry out eco-friendly practices.

• Organization Support - Whether raising funds for a new cause or volunteering with a local non-profit organization, they know that they can have a bigger impact when we work together. They proudly support many Charitable Organizations have many community campaigns that run throughout the year.

ASI values dictate every decision made, big and small. Core values are the building blocks of the ASI culture.

• Attitude - We live and breathe positivity. Our optimistic, supportive, and respectful nature is at the heart of our company’s success.

• Speed - From fast underwriting experiences to first responders during natural disasters, we are committed to enhancing every product and service we offer as quickly as possible.

• Innovation - We transform ideas into realities. Our inspiring, creative, and clever team challenges the status quo by seeking improvement every chance we get.

• 2015 - American Strategic Insurance (ASI) selected as one of the Top Workplaces in Tampa Bay.

• 2015 - ASI Celebrates its 18th anniversary and is named on the Top 100 Best Companies List.

• PROGRESSIVE®is the 3rd largest Property and Casualty Insurer and ranks 99th on the Fortune 500 list of largest corporations in the United States based on 2019 revenue.

• 12th largest writer of Homeowners coverage in the United States.

• 3rd largest writer of Private Passenger Auto coverage in the United States.

• Largest writer of Commercial Auto coverage in the United States.

• 40th on 2016 InformationWeek Elite 100 – a list of the top business technology innovators in the U.S.

Homeowners

Home

Home

Home

Mobile

Company Profile: W. R. Berkley Corporation founded in 1967, is one of the nation’s premier commercial lines property casualty insurance providers. Each of the operating units in the Berkley group participates in a niche market requiring specialized knowledge about a territory or product and has the expertise and resources to utilize their strengths in the present environment, and the flexibility to anticipate, innovate and respond to whatever opportunities and challenges the future may hold.

W.R.BerkleyCorporation’s®competitiveadvantageliesinalong-termstrategyofdecentralizedoperations,allowing each of their units to identify and respond quickly and effectively to changing market conditions and local customer needs. This decentralized structure provides financial accountability and incentives to local management and enables them to attract and retain the highest caliber professionals.

milestones:

• 1967 – Berkley Dean & Company was formed, precursor to W. R. Berkley Corporation.

• 1970’s - Acquired Houston General Insurance Company and entered the insurance market, organized Union Insurance Company and tri-State Insurance Company, acquired General Insurance Company, Union Standard Insurance Company, Signet Reinsurance Company, Reinsurance Underwriters Corporation, Admiral Insurance Company, enters the specialty insurance market and goes public.

• 1980’s - Acquired Fireman’s Insurance Company of Washington, D.C., Carolina Casualty Insurance Company, Continental Western Insurance Company, establishes Fireman’s Habitational Division to write coverages for highend real estate in the northeast and forms Nautilus Insurance Company to write smaller excess and surplus lines risks, forms Berkley Risk Administrators Company entering the risk management and administration sector and total assets surpass the $1 billion mark.

• 1990’s – Forms Monitor Liability Managers and Enters the Directors’ and Officers’ business, acquired 80% of Independencia Insurance Company of Argentina and established Berkley Surety Group and Berkley Insurance Company of the Carolinas established.

• 2000 – Regional companies were consolidated to reduce costs, enhance size and scale, and to provide better competitive positions, while maintaining operations close to the customer.

• 2004 – Joins the ranks of the Fortune 500.

• 2007 – Named Best Managed Insurance Company by Forbes Magazine.

• 2008–2013–ContinuedtoexpandthroughthecreationofnewbusinessessuchasBerkleyAssetProtection,Berkley Canada, Berkley Professional Liability, Berkley Agribusiness, Berkley North Pacific Group, Berkley Oil and Gas, Berkley Technology Underwriters, Berkley Public Entity Managers and Berkley Southeast Insurance Group.

• 2015 – Forms Berkley Construction Professional Liability and Global Product Recall.

• 2016 – Announced entry into High End personal lines market with Berkley One.

• 2017 – Marks 50th Anniversary.

• 2019 - Added to the S&P 500 with $7.9 billion in revenue and $6.1 billion in stockholders’ equity at year-end and forms Berkley Prime Transportation.

• W. R. Berkley Corporation® is rated by A+ by A.M. Best, A+ by Standard & Poor’s

• The business is operated with an ownership perspective and a clear sense of fiduciary responsibility to shareholders. Risk exposures are managed proactively. A strong balance sheet, including a high-quality investment portfolio, ensures ample resources to grow the business profitably whenever there are opportunities to do so.

• 2019 Direct Written Premium was more than $6.3 billion.

• W. R. Berkley Corporation® trademarked phrase “Everything counts – Everyone matters”:

• Values the diversity of perspective, talent, and experience that employees bring to the organization and utilizes consistent and objective standards to measure performance

• Provides a diverse workforce that reflects communities and clients and fosters innovation and creativity that empowers employees to positively contribute to the company’s success. At the heart of their inclusion efforts is the development of talent within the organization that will perpetuate the company’s culture and philosophy

• Shows commitment to developing the next generation of insurance professionals to continue the work of providing creative solutions to the insurance needs of clients. To this end, various operating units are involved in organizations that promote young people in insurance, while others offer programs for mentoring, interning, and coaching

• From local food banks to disaster relief efforts throughout the world to the creation of a charity dedicated to helping the children of injured workers, they embody a culture of doing the right thing and giving back to the communities they serve.

• W. R. Berkley Corporation® combines the expertise of underwriting, risk management, claims handling and investing to deliver outstanding risk-adjusted returns. How they are different:

• Accountability-Thebusinessisoperatedwithan ownershipperspectiveandaclearsenseoffiduciaryresponsibility to shareholders.

• People-Oriented Strategy - New businesses are started when opportunities are identified and, most importantly, when the right talent is found to lead a business. Of Berkley's 52 companies, 45 were developed internally and seven were acquired.

• Responsible Financial Practices - Risk exposures are managed proactively. A strong balance sheet, including a high-quality investment portfolio, ensures ample resources to grow the business profitably whenever there are opportunities to do so.

• Risk-Adjusted Returns - Management company-wide is focused on obtaining the best potential returns with a real understanding of the amount of risk being assumed. Superior risk-adjusted returns are generated over the insurance cycle.

• Transparency - Consistent and objective standards are used to measure performance – and the same standards are used regardless of the environment.

• W. R. Berkley Corporation® is the 22nd largest Property and Casualty Insurer/Group in the United States based upon 2019 revenue.

• Ranks 369th on the current Fortune 500 list of largest corporations in the United States.

• 19th largest writer of Medical Professional Liability coverage in the United States.

• 12th largest writer of Workers’ Compensation Auto coverage in the United States.

• 9th largest writer of Commercial General Liability coverage in the United States.

• 16th largest writer of Commercial Auto coverage in the United States.

• Named to the 2019 Ward’s 50® list of top performing property casualty insurance companies.

• Named a Five-Star Carrier on Insurance Business America’s Brokers on Carriers’ report. Berkley earned a five-star ranking in all 10 survey categories ranging from underwriting expertise to claims processing to commitment to broker distribution channel.

Berkley North Pacific is a regional, commercial insurance provider servicing business in the Northwest. With local leadership, conversational underwriting, as well as consultative risk management and claims services, they are we truly are a relationship driven company. Partnering with a select group of Independent Agents they pride themselves on the ease of doing business.

Continental Western Group® (CWG) has been a trusted insurance carrier since 1886. They offer a broad array of commercial insurance products for businesses in 13 states from the Rocky Mountains to the Great Lakes and their goal is to be the strong, local, and trusted choice for independent insurance agents and customers. They live and operate in the same communities as customers and available when needed most. Such local presence provides in-depth understanding of the businesses and communities they insure.

Berkley Mid-Atlantic Group knows needs are changing, the world is shifting, and are here to help. They understand you need consistency, transparency, and the fast delivery of value. They manage risks for small, medium, and large businesses and their expertise is delivered by talented independent insurance agents and backed by exemplary service from claims, underwriting, risk management, audit, sales, and marketing teams.

Acadia INSURANCE specializes in commercial property casualty insurance. The company began in 1992 insuring businesses in Maine and today offers insurance programs for small and midsize businesses throughout New England and NewYork Statewith local offices in Connecticut, Maine,Massachusetts, NewHampshire,New York andVermont.

UNION STANDARD works with independent agents to tailorcoverageto meet theuniqueneeds ofavarietyofbusinesses. They believe your Insurance coverage should be as unique as your business and with local underwriting, claim, loss control and audit services, they’ve got you covered!

Berkley Southeast Insurance Group, (BSIG), is a regional commercial lines property and casualty insurance provider. They partner with a select group of independent agents in Alabama, the Carolinas, Georgia, Mississippi, and Tennessee to provide commercial products and services for small and mid-sized businesses. With the resources of W. R Berkley Corporation, a Fortune 500 company, they can provide assurance to policyholders that BSIG will be there when you need them most.

Commercial Insurance

Property

General Liability

Commercial Auto

Inland Marine

Umbrella

Cyber Liability

Employment Practices

Liability

Workers’ Compensation

Commercial Industries

Agribusiness Auto Care & Service

Breweries

Building Material Dealers

Construction Golf Courses

Hotels & Motels Janitorial

Manufacturing Offices

Real Estate Restaurants

Retail Stores Service Businesses

Wholesalers Wineries

Risk Management Services

Property (ADP) Ren

Company Profile: Berkshire Hathaway GUARD® Insurance Company was established in 1983. Products are now available through a nationwide network of 5,500 carefully selected, highly trained professional Independent Insurance Agents The group’s insurance companies currently insure over 250,000 businesses. Since 2007, the company’s annual premiums have more than tripled (despite very challenging economic times) while maintaining a combined ratio well below industry peers and diversifying into new lines of property and casualty coverage.

Berkshire Hathaway GUARD® currently offers insurance products from coast to coast with focus on their main insurance products:

• Worker’ Compensation

• Businessowner’s Policies

• Commercial Umbrella

• Commercial Auto

• Berkshire Hathaway GUARD® is rated A+ (Superior) from A.M. Best. Assigned to insurance companies that has a superior ability to meet their ongoing insurance obligations.

• The ratings reflect solid capitalization, favorable operating profitability, disciplined underwriting initiatives and conservative reserving philosophy, which has resulted in favorable reserve development. The ratings also acknowledge the implicit and explicit financial support provided by GUARD’s ultimate parent, Berkshire Hathaway Inc.

• 2020 Direct Written Premiums over $2 billion.

• Berkshire Hathaway GUARD® satisfaction of customers is very important. To create a positive experience, the company provides secure coverage enriched by a full range of value-added services. One of their proudest accomplishments is the fact that nine out of ten of their policyholders choose to renew their policies with them year after year. Below are just a few of the reasons:

o Flexible Pricing/Payment Options - They give policyholders the greatest possible savings and provide favorable billing terms reflecting today’s cash-flow realities and offer FLEXIBLE alternatives that allow customized solutions designed to satisfy the individual needs of customers.

o Local Connection - The staff is highly trained and expert in the handling of all aspects of their products and recognize that customer convenience often starts at the local level. As a result, their product through a network of independent agents and brokers from communities throughout the United States; these carefully selected, and highly trained professionals are able to acquaint customers with the full range of options available and help create customized insurance solutions that feature the best possible price and a plan for taking advantage of appropriate services.

o Ease of Use - Doing business with Berkshire Hathaway GUARD Insurance Companies couldn’t be easier. From fulfillment of requests for quotes via GUARD E-Z Rate through the issuance of policies, billing of premium, and management of claims, the focus is timely, convenient, AND effective service. When you have questions or require help, a range of resources allow you to select the method best suited to you. Via the Internet and secure Agency and Policyholder Service Centers, transactional account information is available as well as extensive viewable/printable materials. Alternatively, a Customer Service call will get you directly to a member of the staff who is trained to offer the kind of personalized attention you deserve.

o Safety Resources - Safety benefits everyone, facilitating an efficient, productive, and safe environment. Therefore, the best way to reduce expenses incurred as a result of claims is through prevention. Berkshire Hathaway GUARD Insurance Companies staff has the educational background, general expertise, and hands-on experience to assist our policyholders in creating and maintaining an environment free of hazards. Not everyone wants or needs extensive assistance from their insurance company, so a broad selection of easy to use and understand resources (such as online, streamed videos and safety flyers) are available.

o Expert Claims - Claims happen and the reason insurance is purchased is for those unpredictable misfortunes. Their staff of trained experts is dedicated to resolving claims as quickly, fairly, and painlessly as possible. Some of the factors that contribute to success are toll-free, 24-hour claims reporting and a national network of highly specialized business partners (including medical providers, emergency service vendors, appraisal services, etc.) that can be accessed when circumstances dictate.

• Berkshire Hathaway GUARD® values each employee. They understand that attracting and retaining high-quality talent is essential to the success of their company.

• Named a Ward’s 50 Top Performer. Ward's 50 company has passed all safety and consistency screens and achieved superior performance over the five years analyzed.

• Employees are allowed to volunteer work time with nonprofit agencies. They believe volunteerism is investing in your human capital, which is a company’s most valuable asset. At the same time, it strengthens the community.

• Health care initiative, WellGUARD, was recognized by the Greater Wilkes-Barre Chamber of Commerce. The award recognizes the numerous health-conscious programs GUARD has put into place since launching WellGUARD in January of 2006.

• Berkshire Hathaway GUARD® is in the top 100 largest Property and Casualty Insurers in the United States on their own.

• Berkshire Hathaway Group:

o 2nd largest Property and Casualty Insurer in the United States with Premium in excess of $43 billion.

o Owns GEICO® InsuranceCompany is the2nd largest PrivatePassenger Auto Insurerin theUnitedStateswith Direct Written Premium in excess of $33 billion.

o 4th on the current Fortune 500 list of largest corporations in the United States.

Personal Insurance

Homeowners

Personal Umbrella

Commercial Insurance

Businessowner’s Policy

Commercial Auto

Commercial Package

Commercial Property

Commercial Umbrella

Disability

General Liability

Professional Liability

Accountants

Architects & Engineers

Lawyers

Miscellaneous

Workers’ Compensation

Company Profile: BRISTOL WEST INSURANCE GROUP started in Florida in 1973 as a private passenger automobile insurance carrier for Florida residents and kept expanding its reach to more customers in more states. Since that time, it has grown to be a leading provider of liability and physical damage insurance - focusing exclusively on private passenger vehicles across the United States with insurance policies now available to customers through agents and brokers in 45 states across the country.

BRISTOL WEST INSURANCE GROUP became a part of Farmers Insurance Group of Companies, one of the largest property and casualty insurer groups in the United States in July 2007. Farmers Insurance proudly serves more than 10 million households with over19million individualpoliciesnationally,throughtheeffortsofmore than48,000 exclusive and independent agents and approximately 20,000 employees.

Financial Stability:

• BRISTOL WEST INSURANCE GROUP is a member of the Farmers Insurance Group of Companies.

• Farmers Insurance Group of Companies financial strength Rated A (Excellent) by A.M. Best.

• 2020 Direct Written Premiums for all companies more than $20 billion.

Customer Oriented:

BRISTOL WEST INSURANCE GROUP provides Auto Insurance with you in mind.

• Whether you are a customer seeking auto insurance, or you are an agent or broker looking for a solid insurance carrier for your customers, Bristol West focuses on delivering high-quality and responsive service to customers through product innovation and a broad array of systems to support customers, and agents and brokers.

• For customers, they offer a range of automobile insurance coverages at competitive prices with responsive customer service and, should the need arise, claims professionals. They also have convenience features to help you easily manage your insurance coverage, like flexible billing and pay plan options including paperless billing, text alert bill payment reminders, and eSignature for new policy documents.

• They know today’s world demands having many options to pay your insurance premium, file a claim or manage your coverage – whether online, on the phone or in person with your agent or broker. We’re here to serve you and your insurance needs with ease however you’d like to do business with us. Easy as that.

• For agents and brokers, Bristol West’s ongoing investment in technology and an eEverything mindset provides leading-edge tools to manage your business, improve efficiency and deliver service with ease at the point of sale.

• How Bristol West can help you:

o Helps customerswith poorcredit andnocredit findtheauto insurance they’relookingfor. If you’re facing this challenge, give them a try.

o Helps help you get the auto insurance coverage you want whether you have no prior insurance, little or no driving history or have only had minimal prior coverage.

o Helps by giving you discounts when you sign-up for automatic payments, go paperless, maintain a good driving record or buy multiple policies from Bristol West, Farmers® or Foremost® Insurance.

o Helps if you’ve had multiple traffic violations, accidents or even a DUI. They offer coverage options for a variety of challenging situations.

• BRISTOL WEST INSURANCE GROUP is part of Farmers Insurance Group® which was founded in Los Angeles, California in 1928. Farmers is the nation's 9th largest insurer, and offers a wide variety of home, life, specialty, commercial and auto insurance products, and services across the United States. Farmers is the trade name of Farmers Group, Inc., which is a wholly owned entity of the Zurich Financial Services Group and is represented by more than 38,000 agents across the country.

• Farmers Insurance® 2021:

o Named One of the FORTUNE Best Companies to Work For by Great Place to Work and Fortune

o Earns Top Marks in Human Rights Campaign's Corporate Equality Index

o 40 Best Large Workplaces in Financial Services and Insurance

o Diversity, Inclusion + Equity Awards: Organization of the Year (Enterprise)

o 28 Best Remote-Friendly Companies for Women

• BRISTOL WEST INSURANCE GROUP is part of the Farmers Insurance Group of Companies , the 9th largest Property and Casualty Insurance Group in the United States.

• 5th largest writer of Homeowners Insurance in the United States.

• 7th largest writer of Private Passenger Auto Insurance in the United States.

• 22nd largest writer of Commercial Auto Insurance in the United States.

Company Profile: BTIS® was founded in 1998 in Rocklin, California, Builders & Tradesmen's Insurance Services, Inc. (BTIS). Originally built around a Small Artisan Contractor General Liability program, BTIS was focused on speed and ease of use for insurance producers. BTIS is now a nationwide wholesale intermediary with a small business attitude, that believes in building and fostering solid relationships through communication and genuine concern for customers.

BTIS offers a wide range of commercial lines and are focused on developing and implementing cutting edge technology to provide individual service, exceptional value, ease of use and rapid turnaround times. They believe in building and fostering solid relationships through communication and genuine concern for our customers. Although we now offer a wide range of commercial lines, we remain focused on individual service, exceptional value, ease of use and rapid turnaround times.

• BTIS is part of the Amynta Group, a premier insurance services company with more than $3.5 billion in managed premium and 2,000 associates across North America, Europe, and Australia.

• Amynta serves leading carriers, wholesalers, retail agencies, auto dealers, original equipment manufacturers, and consumer product retailers with innovative insurance and warranty protection solutions

• BTIS is committed to providing quality, robust, individualized products and the highest level of service. We ensure each client feels confident and secure in selecting us as their provider and are dedicated to the success of our customers. By offering education and sales tools we allow our producers to be a trusted source for insurance that their clients, in turn, can rely upon.

• BTIS takes pride in providing insurance for the construction industry. The entire executive team has past experience working in this arena. Collectively, BTIS has over 127 years of experience in the insurance industry within its management team. Their professional staff of underwriters has insurance company backgrounds with more than 75 years of experience underwriting commercial/contractor risks.

• Since the beginning, they have had one steady goal in mind; providing outstanding service to customers. With the use of the internet, they are able to deliver unmatched turnaround time on quotes and policy issuance. By utilizing the latest in technology, they achieve what few other organizations have: immediate turnaround, unbeatable service, and great value for our clients.

• Solutions through technology - Get real-time access to the BTIS quoting and submission system and expert underwriting team. The BTIS platform is a powerful and easy-to-use tool you can depend on to help drive your business forward.

• Innovative online price indication system - Quote and bind capability, and email correspondence paired with unparalleled customer service made for the fastest and simplest way for producers to quote and bind commercial accounts.

• Product lines include – Contractor General Liability, Workers’ Compensation, BOP & Small Business Insurance, Commercial Auto, Builders Risk, Inland marine, and Contract Bonds.

o GENERAL LIABILITY - Contractor General Liability programs are underwritten by Admitted A rated carriers and are available in most states. Please see the Products tab above for the complete list of carrier options.

o WORKERS’ COMP - Workers’ Compensation programs offered from many Admitted A rated carriers that are available in most states. Please see the Products tab above for the complete list of carrier options.

o SMALL BUSINESS - With several preferred classes underwritten by multiple A rated carriers, you are sure to have what you are looking for. Programs feature many different coverages to fit your needs.

o COMMERCIAL AUTO - Commercial Auto programs are underwritten by multiple A rated carriers, specializing in coverage for a variety light-duty to medium-duty vehicles that are used for local to intermediate distances in many businesses.

o BUILDERS RISK - With names like Navigators, Great American and Everest, you'll find coverage for many different kinds of residential and/or commercial risks and is available in many states.

o INLAND MARINE - Inland Marine programs offered from multiple A rated carriers offering great rates, high limits, and variable deductibles. Plus, they are currently available in most states.

o EXCESS - Excess Programs underwritten by multiple A rated carriers. These programs feature online price indication and/or online applications and are available in most states.

o BONDS - Bonds are available for almost any surety situation you'll encounter and are underwritten by multiple A rated carriers.

Please see the Products tab at my.btisinc.com for the complete list of carriers and states available.

Company Profile: The origins of CHUBB® Corporation date back to 1882 when Thomas Caldecot Chubb and his son Percy opened their marine underwriting business in the seaport district of New York City. By 1900, Chubb had established strong relationships with the insurance agents and brokers who placed their clients’ business with Chubb underwriters. Products are now distributed through more than 14,000 independent agents and brokers in North America and employs more than 30,000 people worldwide.

CHUBB® is the world’s largest publicly traded P&C insurance company and the largest commercial insurer in the U.S. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance to a diverse group of clients. As an underwriting company, they assess, assume, and manage risk with insight and discipline and service and pay claims fairly and promptly. They combine the precision of craftsmanship with decades of experience to conceive, craft and deliver the very best insurance coverage and service to individuals and families, and businesses of all sizes.

ACE was established in 1985 in response to an availability crisis in the U.S. insurance marketplace for excess liability and directors’ and officers’ insurance coverage. From its inception through the 1990s, ACE grew rapidly through product diversification, strategic partnerships, and acquisition. A true turning point for ACE was its 1999 acquisition of Cigna Corporation’s international and domestic property and casualty business. The acquisition gave ACE an instant global network and simultaneously transferred INA’s 200-year history to the company.

By the time, ACE acquired CHUBB®, ACE had grown into a leading global insurer serving customers from the largest multinational companies to individuals and families around the world.

milestones:

• 1792 - Investors meet at Independence Hall in Philadelphia to organize the Insurance Company of North America - INA

• 1794 - First U.S. insurer to cover the contents of a house from fire.

• 1808 - Appoints agents on the U.S. frontier and launches an advertising campaign.

• 1821 - Predecessor fire insurer Aetna Insurance Company becomes the first U.S. insurer to enter Canada.

• 1848 - Appoints an agent in San Francisco as the California Gold Rush begins. Premiums are sent to the home office in the form of gold dust.

• 1882 – Chubb & Son opens for business in New York City.

• 1887 - Appoints agents in London, Vienna, and Buenos Aires, the beginning of CHUBB Overseas General business.

• 1897 - Becomes the first U.S. insurer to appoint an agent in China.

• 1912 - Three predecessor insurance companies (Aetna, Federal, INA) suffer losses from the sinking of the Titanic.

• 1928 – Opens its first branch outside the U.S. in Montreal, Canada.

• 1950 - Invents the definitive multiple-line homeowners’ policy.

• 1956 - Forms a personal lines department and installs their first computer, the IBM 705.

• 1965 – IAN debuts on the New York Stock Exchange.

• 1967 – Incorporates and acquires Pacific Indemnity Companies.

• 1980 - Insures the Olympic Winter Games in Lake Placid, NY.

• 1982 - INA Corporation and Connecticut General Corporation complete a merger to create CIGNA Corporation.

• 1984 – CHUBB is listed on the New York Stock Exchange

• 1985–ACE Limitedwasestablishedby34insurancecompaniesseekingdifficult-to-obtainExcessLiability and Directors and Officers (D&O) insurance coverage.

• 1986 - Chubb launches the Masterpiece personal lines policy, becoming the company's definitive high net worth product.

• 1993 – ACE goes public on the New York Stock Exchange.

• 1996 - Acquires the first of its Lloyd's syndicate managing agencies and acquires Tempest Re, a major global reinsurer.

• 1999 - Acquires CIGNA Corporation and Insurance Company of North America (INA) for $3.45 billion.

• 2008 – Acquires Combined Insurance Company of America from AON Corporation for $2.56 billion and the high-net-worth personal lines business of the Atlantic Companies.

• 2010 – Acquires Rain and Hail, LLC in Iowa for $1.1 billion.

• 2012 – Claim’s service shines after Superstorm Sandy, settling the largest number of claims in company history and acquires Asuransi Jay Proteski in Indonesia for $130 million.

• 2015 - Acquires Fireman’s Fund high-net-worth personal lines business from Allianz for $365 million.

• 2016 – ACE and Chubb become one and adopt the Chubb name

• 2017 - Celebrates 225 years of business with the birth of INA in 1792.

• 2019 - Evan Greenberg awarded Insurance Company CEO of the Year.

• CHUBB® is rated AA by Standard & Poor’s, A++ by A.M. Best and AA by Fitch and has more than $174 billion in assets and reported $38 billion of gross premiums written in 2018.

• Chubb Limited, the parent company of Chubb, is listed on the New York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index.

• 2018 - $24.4 billion in gross premiums, in North America operations

• CHUBB® is defined by its extensive product and service offerings, broad distribution capabilities, exceptional financial strength, and local operations globally. The company serves multinational corporations, mid-size and small businesses with property and casualty insurance and risk engineering services; affluent and high net worth individuals with substantial assets to protect; individuals purchasing life, personal accident, supplemental health, homeowners, automobile, and specialty personal insurance.

• Provides claims handling service renowned for its quality, promptness, and fairness Industry-leading loss control services and more than 400 risk engineering professionals serving commercial clients in the U.S. and globally Residential risk consulting and appraisal services.

• The Chubb Charitable Foundation believes that meaningful contributions that support communities globally provide lasting benefits to society, employees, and the company. Through philanthropy, global partnerships and company sponsored-volunteer activities focused on giving the gift of time and donations, the Chubb Charitable Foundation supports clearly defined projects that solve problems with measurable and sustainable outcomes with a commitment to assist those less fortunate and to be stewards of the planet. In 2016, the company’s foundations made grants and matching gifts of nearly $7.0 million to support innovative initiatives around the globe.

• Chubb encourages the development of initiatives that reflect employees’ commitment to the needs of their local and regional communities. Employees from around the globe participate in hundreds of volunteer activities annually that have a direct impact on the local communities where employees live and work.

• Through national campaigns, local volunteer projects and other initiatives, Chubb supports employee giving and volunteerism with a variety of programs such as:

o Matching Gift Program - matches donations made to eligible charitable organizations by employees in the U.S., Canada, and Bermuda.

o Disaster Relief Matching Gifts - conducts fundraising campaigns that raise money to provide assistance and matches employees’ donations in support of relief efforts in global disasters.

o IICF Week of Giving - combines the collective strengths of the insurance industry to provide grants, volunteer service, leadership and contributes to local non-profits in a wide variety of areas, including education, disaster preparedness, the environment, health and human services, military veterans, and atrisk children.

o Regional Day of Service - provides an opportunity for Asia-Pacific employees to rally together and give time to local community projects.

Industry Rankings:

• CHUBB® is the 7th largest Property and Casualty Insurer in the United States based upon premium written per NAIC.

• Number 1 writer of Other Liability coverage in the United States.

• 9th largest writer of Homeowners coverage in the United States.

• 15th largest writer of Medical Professional Liability coverage in the United States.

• 6th largest writer of Workers Compensation coverage in the United States.

• 10th largest writer of Commercial Auto in the United Sates.

• The world’s largest publicly traded property and casualty insurer with operations in 54 countries.

• 48 commercial P&C branch offices, and another 220 locations and nearly 18,000 employees who write commercial and personal P&C and A&H coverage for businesses and individual consumers, the CHUBB® North American division is larger than the clear majority of U.S. insurers.

Personal

Home Auto Insurance

Excess Liability

Valuables

Boats & yachts

Travel

Natural Disasters

Cyber

Bespoke Services

Commercial

Commercial

Event Insurance

Global Casualty

Management Liability

Medical Liability

Product Recall

Property

& Surplus

Liability

Reinsurance Small Business

Specialty Casualty

Trade Credit Umbrella & Excess Casualty

Workers Compensation Workplace Benefits

Company Profile: Encompass™ began selling personal insurance in 1897 as Continental Casualty Company, backed by a clear simple promise: "Protection and Security." Today, well over a century later, it's still a foundation of their business. Since officially becoming the Encompass Insurance Company in the 1990s, they've had several notable events that have helped make us into the proud company we are today.

Encompass™ Insurance is a subsidiary of Allstate Corporation and one of the largest personal property and casualty insurance brands sold exclusively through a network of more than 2,400 independent agents. Each agent is committed to delivering superior service and quality products to their discerning policyholders. Encompass knows that value is important to you, which is why they give you the ability to tailor solutions to fit your price and coverage needs.

milestones:

• 1999 - 2000 - Illinois-based Allstate Insurance Company purchases personal lines insurance business from CNA and introduces the Encompass name. Although the name is less than a quarter-century old, the EncompassOne® Package Policy traces back to 1897.

• 2000 - Present - Continued commitment to independent agents, customer service and innovative insurance solutions is reflected in our numbers more than ever, with more than 2,400 Independent Agents in 39 states.

• Encompass™ is rated A+ (Superior) Assigned to insurance companies that have a superior ability to meet their ongoing insurance obligations.

• Ratings are based on the following factors Profitability, Adequacy of capital liquidity, Company management and Investment risk.

• 2019 Parent Company Allstate® Direct Written Premiums over $35 billion.

• Encompass™ is partoftheAllstate advertising and sponsorship strategy helping connect with people in relevant and meaningful ways. With national ad placements and corporate sponsorships, Allstate is able support local communities and show how to keep people protected through the Good Hands® commitment.

• What matters most to customers matters most to Encompass and it shows. Whether it's exceptional service or personalized protection. Being a customer means having access to an experienced local agent. From helping you find available discounts to talking you through your coverage options, they're here to help you stay protected through every stage in life. Agents don't just go above and beyond for you and your loved ones; they're also dedicated to doing good in their communities.

• As an industry leader, Allstate/Encompass continue to take a public stand on issues that are important to the insurance industry and consumers. The company's advocacy advertising campaign is designed to broaden awareness on significant issues such as Teen Driving, Preparing and Protecting America from Catastrophe, The Role of Insurance in America, and Retirement Funding.

Company Highlights: Encompass™ Insurance Package Policy, EncompassOne®, gives you protection for the things you value, all under a comprehensive plan. Whether you're pursuing your passion, supporting your family, or planning for what's next, life can be busy. You deserve insurance that makes protecting what you love simple and each of the three signature policies offer you coverage for your home, car, and important possessions.

• Why EncompassOne®?

o Easy insurance - One premium. One deductible. One agent. When it comes to insurance, EncompassOne® is as simple as it gets.

o Personalized protection - With varying limits and features, EncompassOne® gives you freedom to build the policy that fits your life.

o Comprehensive coverage – EncompassOne® robust package helps fill risky coverage gaps that other policies may not.

o Personalized insurance made simple - Only you can know the coverage that's right for you.

• EncompassOne® offers three tiers of protection each designed to fit your unique needs:

o Special Insurance Policy – Provides solid protection with a simple insurance experience. The Special Policy offers homeowners and auto insurance in a single package, with policy limits, coverage options and insurance discounts.

o Deluxe Insurance Policy - Provides higher limits of for homeowners and auto insurance plans, along with many product features to provide even more protection. Plus, you get the convenience of one deductible1, one premium and one trusted advisor.

o Elite Insurance Policy – Provides the highest-level home and auto insurance with additional features all with the convenience of one deductible1, one premium and one agent. High Net-Worth and High-value possessions require higher levels of protection. The Elite Insurance Policy provides the highest-level home and auto insurance with additional features all with the convenience of one deductible1, one premium and one agent.

Encompass™ Insurance parent company Allstate®

• 2019 - Fortune Magazine’s “World’s Most Admired Companies”.

• 2015, 2016, 2017, 2018, 2019 – “World’s Most Ethical Company® per the Ethisphere Institute.

• 2017, 2018 and 2019 - Fortune “Change the World” company.

Industry Rankings:

• Encompass™ Insurance parent company Allstate® is 5th largest Property and Casualty Insurer in the United States based upon 2019 premiums.

• Allstate® is the 2nd largest writer of Homeowners Insurance in the United States.

• Allstate® is the 4th largest writer of Private Passenger Auto Insurance in the United States.

• Allstate® is the 10th largest writer of Commercial Auto Insurance in the United States.

• Allstate® is72nd on the current Fortune 500 list of largest corporations in the United States..

Personal Insurance

The EncompassOne Policy

• Special

• Deluxe

• Elite

Home Insurance

Auto Insurance

Personal Umbrella Protection

Encompass Lifestyle Endorsement

Home Business Insurance

Motorcycle Insurance

Recreational Vehicle Insurance

Boat & Watercraft Insurance

Identity Theft Protection

CompanyProfile: FOREMOST® was foundedbyafewinvestorsin 1952.Theirmotivationwasnovel:toprovide insurance to the thousands of American families who lived in mobile homes. The mobile home industry was in its infancy and people needed financing and insurance for these new homes. With their involvement, mobile home manufacturers created improved construction standards for homes, banks started lending for mobile home purchases, and park owners were able to expand and improve communities.

FOREMOST® insurance company serves markets by providing insurance choices that may not be offered by other companies. From the people who create their policies to the representatives who process claims, they strive to serve customers to the best of their abilities. If you're looking for in-person service right in your community, then turn to one of the thousands of highly trained and exceptional agents that represent Foremost across the country. Agents that write Foremost can help you choose the best policy for your situation and get you all the available discounts applied to your policy.

FOREMOST® has spent the last 68 years getting to know the markets they serve exceptionally well. They understand the coverages you are looking for with the specific types of policies you may want or need. They have taken what they learned and turned that expertise into a solid business.

milestones:

• 1952 - Foremost Insurance founded.

• 1960’s - Wise up tie down creates coverage for Motor Homes.

• 1970’s - Creates policies for Boats, Motorcycles, Mini-Bikes, Snowmobiles and All-Terrain Vehicles.

• 1980’s - Creates specialized services for owners over the age of 50.

• 1989 - Endorsed to offer Mobile Home Insurance to AARP members.

• 1990s - Builds a Mobile Home Fix-It Guide website.

• 1996 - Foremost.com goes live.

• 2000 - Acquired by Farmers Insurance Group®

• 2000’s - Contracted with J.C. Taylor to handle new collectible auto program.

• 2004 - Endorsed to offer Motorcycle Insurance to AARP members.

• 2007 -Acquires Bristol West. Foremost Auto available in 43 states.

• FOREMOST® is a member of the Zurich Financial Services Group and Farmers Insurance Group of Companies.

• Financial strength Rated A (Excellent) by A.M. Best.

• 2018 Direct Written Premiums for all companies more than $32.7 billion.

• FOREMOST® agents and employees care about the communities in their own backyards and have been giving back to local charities for decades, supporting charities like Habitat for Humanity, FoodShare, United Way, and Salvation Army who provide needed assistance to the under-served. Together they strive to make our communities better places to live.

• Employees strive to serve customers to the best of their abilities, from those who create policies and provide customer service to the representatives who process claims.

• Farmers Recently named a Great Place to Work®.

• FOREMOST® commissioned a study to determine the effects of strong winds on mobile homes and worked with state legislators to create mandatory tie-down laws. Research and hard work helped minimize the damage done to mobile homes during windstorm.

• As a specialty insurance company, serves markets by providing insurance choices that may not be offered by other companies. If you're wondering if Foremost can insure a product, check them out. Their extensive insurance options may surprise you!

• Should you have a claim, from frozen pipes to an automobile accident, rest assured, a team of professionals is on hand 24/7/365 to take your call.

• As part of Zurich Financial Services Group, one of the world's largest insurance groups, and one of the few to operate on a truly global basis. Founded in 1872, Zurich is headquartered in Zurich, Switzerland and operates in more than 170 countries.

• Aspartof Farmers InsuranceGroup® was founded in LosAngeles,Californiain 1928. Farmersis the nation's third largest insurer, and offers a wide variety of home, life, specialty, commercial and auto insurance products, and services across the United States. Farmers is the trade name of Farmers Group, Inc., which is a wholly owned entity of the Zurich Financial Services Group. And is represented by more than 38,000 agents across the country.

• FOREMOST® is a member of the Zurich Financial Services Group and Farmers Insurance Group of Companies

• Zurich Financial Services Group and Farmers Insurance Group of Companies is the 6th largest Property and Casualty Insurance Group in the United States based upon the 2019 NAIC Report.

• Farmers Insurance Group of Companies is the 9th largest Property and Casualty Insurance Group in the United States.

• 5th largest writer of Homeowners Insurance in the United States.

• 7th largest writer of Private Passenger Auto Insurance in the United States.

• 20th largest writer of Commercial Auto Insurance in the United States.

• Zurich Financial Services Group is the 12th largest Property and Casualty Insurance Group in the United States.

• 3rd largest writer of Workers Compensation Insurance in the United States.

• 10th largest writer of Other Commercial Liability Insurance in the United States.

• 7th largest writer of Commercial Auto Insurance in the United States.

Home

Seasonal

Renters

Vacant

Vacant Property

Landlord

Owner-Occupied Condominium

Landlord Condominium

Flood Auto

Collectible Auto Commercial Auto

Boat Personal Watercraft

Motorcycle Scooter

Off-Road Vehicle

Snowmobile

Golf Cart Neighborhood Electric Vehicle

Motor Home

5th Wheel

Mobile Home

Travel Trailer

Luxury Motor Coach

CompanyProfile: HAGERTY® was invented in 1984 by Frank and Louise Hagerty to provide coverage for their treasured wooden boats. They launched the first Agreed Value policy for boats, completely changing the way collector boats were insured. This specialty coverage was a big hit, and within a few years, half of all vintage boat owners were Hagerty clients.

HAGERTY® decided in 1991, that classic cars deserved better coverage, and they introduced the first specialty auto policy that combined Agreed Value, flexible usage, and in-house claims handling. Today Hagerty is an insurance company specializing in classic car, classic boat, vintage motorcycle, motorsports, business insurance and Private Client Services based in Traverse City, Michigan.

• 1984 – Hagerty invented/founded.

• 1991 – Classic Car coverage introduced.

• 1995 – Hagerty children take over family business.

• 2000 – Launches Overseas Shipping and Touring Coverage.

• 2002 – Debuts Private Client Services (PCS), a suite of products and services designed for high-end collectors.

• 2005 – Founded the Collectors Foundation, a non-profit organization with the goal to “Protect the past. Build the Future.”

• 2006 – Publishes first issue of Hagerty Magazine.

• 2008 – First issue of Hagerty Price Guide issued.

• 2008 - Introduced commercial coverage, designed exclusively to protect businesses that serve the collector car community.

• 2009 - Established the Historic Vehicle Association®, North American's FIVA affiliate. The HVA is committed to celebrating and advancing our automotive heritage and its place in American culture.

• 2009 – Crossed the border into Canada.

• 2010 - Invented Guaranteed Value, an evolution of our legendary Agreed Value policy Employee and Customer Oriented:

HAGERTY® employees recently participated in the restoration of a 1967 Sunbeam Tiger. This past year, over 107 employees put in a total of 1,216 hours toward the complete restoration, and work has already begun on another employee restoration for a 1960 Plymouth Fury. These hands-on projects, totally unique to Hagerty, provide our employees with valuable restoration skills, enhancing their appreciation for the vehicles we protect.

• Donates 10% of net revenue to programs and organizations devoted to preserving the hobby.

• Employees get 16 hours of paid community service each year.

• Has been recognized at both state and national levels for our employee volunteer efforts.

• Imagine a world without driving - No key turning the ignition, no engine roaring to life. No steering wheel to grip down a twisting mountain road. No teenage rite-of-passage first drive, brand new license in your pocket, feeling freedom like you’ve never felt before. Imagine a world where there’s nothing on the road but self-driving, robot cars. All driverless. All the time. Is this the future? Not on their watch. milestones:

• Driverless cars and human drivers will coexist - Driving is who we are, and there’s too much at stake to stop. Things like heritage, community, and the sheer joy of doing a burnout. In the future, we won’t be driving because we need to get from A to B. We’ll be driving because we want to. Because it’s fun.

• Put People Behind the Wheel – Nothing builds car lovers faster than a hands-on experience.

• Keep Cars on the Road – Each time we issue a policy, handle a claim, or help you make a purchase, we put a car back on the road and give you a license to enjoy the ride.

• Fuel a Community of Car Lovers – We entertain, inform, engage, and connect people who love cars. We’ve got to think big if we’re really going to save driving and with the full force of the passionate automotive community behind this movement, there’s no way we can lose.

• We Share the Road - At Hagerty, we share the road. An inclusive automotive community where all are welcomed, valued,and belong regardless ofrace,gender,age,orcarpreference. Weare united byourshared passionfordriving, our commitment to preserve car culture for future generations and our desire to make a positive impact in the world.

HAGERTY® believes in enriching the lives of employees, members, clients, and neighbors through business practices. They drive progress through people, protection of the environment, and investment in the community.

• Initiatives supported serve more than 100 people, and the organization should demonstrate commitment to equality and inclusion, while aligning to 1 of these pillars:

o Community stewardship of environment - We support organizations that demonstrate environmental stewardship in the community.

o Sustainable/Green Businesses - We support organizations that demonstrate environmental stewardship and innovation.

o Regional Parks & Recreation - We invest in organizations that provide public access for community benefit near our offices.

o Small business & entrepreneurship support - We invest in the development and resiliency of small businesses and innovation.

o Local economic development - We support business attraction and retention efforts in the regions near our offices.

o Community Resilience & crisis relief - We support the community through natural disaster relief and crisis relief efforts.

• HAGERTY® protects over 1,000,000 vehicles, 12,000 boats, and 30,000 motorcycles worth a total of $30 billion.

• Talks to 80,000 clients and agents each month on average.

• HAGERTY® is bigger than all specialty competitors (combined).

Collector and Classic Car Insurance: Hagerty is as passionate as you are. A deep knowledge of cars and their owners allows Hagerty to offer better Classic Car coverage for less.

Classic Boat Insurance: Hagerty is the world’s leading provider of classic boat insurance. Hagerty was the first and continues to be the best to offer Agreed Value boat insurance.

Vintage Motorcycle Insurance: You want to ride with the freedom that Hagerty offers for classic motorcycles. Does your motorcycle qualify for Hagerty insurance?

Motorsports Coverage: Some vehicles were born to be raced. Hitting the track in a nostalgia dragster, vintage race car, street legal muscle car, or pro street – it’s always an adventure. Hagerty has created affordable Guaranteed Value™ coverage to protect race cars while they’re not on the track.

Museums: Whether your collector vehicle museum is for-profit or non-profit, Hagerty can design a policy that meets your unique needs. Protection for loaned vehicles, museum-owned vehicles, and more.

Dealerships: AsaCollectorCarDealer,youneedadditionalprotection.Hagertycantailortheircommercial insurance to meet your specific needs. Coverage provided that protects your business and the classic vehicles in your care.

Storage Facilities: Hagerty has designed unique coverage to suit you and the vehicles under your care. The policy provides custom coverage for the collector vehicle storage businesses.

Car Clubs: Hagerty can customize our commercial policies to suit the needs of your club and help make your events as successful as possible. Policy helps ensure your club’s events are as safe and secure as possible.

Hagerty's Private Client Services (PCS): Hagerty Private Client Services is a suite of best-in-class services created specifically to suit collectors' unique needs.

Company Profile: The Hanover Insurance Group®, Inc., founded in 1852 and based in Worcester, Massachusetts, is one of the oldest continuous businesses in the United States still operating within its original industry.

The Hanover Insurance Group® is the holding company for several property and casualty insurance companies, whichtogetherconstituteoneofthelargest insurancebusinessesin theUnitedStates. Thecompanyprovidesexceptional insurance solutions in a dynamic world. The Hanover distributes its products through a select group of independent agents and brokers. Together with its agents, The Hanover offers standard and specialized insurance protection for small and mid-sized businesses, as well as for homes, automobiles, and other personal items.

• 1852 – The Hanover Fire Insurance Company opens and appoints first independent agent

• 1864 – Forms General Agency to service new frontier and expand west.

• 1866 – Pays all its claims from the Portland Maine fire that burned 1800 buildings.

• 1871 – Meets all obligations from The Great Chicago Fire.

• 1872 – Passes another difficult financial challenge from Fire in Boston.

• 1911 - Expands charter to write inland marine and automobile insurance.

• 1915 – Writes first auto policy in Michigan. Early customers included Babe Ruth.

• 1935 – Doesn’t layoff a single employee during Depression and continues to pay dividends.

• 1958 – Change’s name to The Hanover Insurance Group.

• 1969 – Moves headquarters from NYC to Worchester, Massachusetts.

• 1974 – Acquired Citizens Mutual Insurance Company.

• 2003-2007 – Identified by The Wall Street Journal as number one in the P&C industry for increasing shareholder value over a five-year period.

• 2009 – Acquires OneBeacon Insurance Group enabling Western U.S. expansion and A.M. Best upgrades company rating to "A" (Excellent).

• 2010-2011 - Completes strategic U.S. and international acquisitions. Lloyd's of London Chaucer Holdings adds capabilities, geographic diversity, and underwriting expertise.

• 2013 – Crosses the $5 billion written premium threshold and is writing business in 179 countries.

• 2015 – Standard & Poor’s upgrades the financial rating to “A” and Forbes recognizes The Hanover as one of America’s best employers and most trustworthy financial companies.

• 2018 – Sells Lloyd's of London Chaucer Holdings.

• The Hanover Insurance Group® is rated “A” (Excellent). Assigned to insurance companies that have an excellent ability to meet their ongoing insurance obligations.

• Recognizes the need to continuously adjust portfolio mix, directing capital and other resources in the most effective way, while growing in areas with a sustainable, competitive advantage.

• 2020 Direct Written Premiums more than $4.6 billion. milestones:

• The Hanover Insurance Group® heart is its people, which is why they invest significant resources to attract and retain the best people in the business.

• Currentlycomprisedofmorethan5,000dedicated, innovative,andknowledgeableprofessionals, focusedonasingle goal - delivering value to policyholders and independent agent partners.

• Committed to delivering on promises and being there when it matters the most. The Hanover Insurance Group employees live their values every day, demonstrating they “care”:

o Collaboration–Theybringa positive attitude anda passion forworkingtogether.Theyaresupportive, inclusive and rely on the contributions of all team members to achieve results no matter what the challenge.

o Accountability – They do the right thing by being responsive, demonstrating ownership and showing courage. They hold themselves to the highest standards of excellence and honor our commitments to agents, customers, shareholders, communities, and one another.

o Respect – Integrity and honesty are at the heart of everything they do. They create an environment of trust by listening first and welcoming diverse perspectives.

o Empowerment – They help develop talent and encourage creativity that is entrepreneurial and resilient. They believe in the power of people to innovate and take calculated risks to drive our company's future.

• The Hanover Insurance Group® is committed to building a premier property and casualty insurance company, adapting to the dynamic industry environment. Focused on building their unique agency-centric distribution platform, enhancing specialized capabilities, and investing in technological and analytical capabilities to capitalize on emerging market opportunities.

• Firmly believes in the value of quality independent agents and professional advice in the insurance marketplace because increased consumer demands and digital preferences. This unique consultative approach to agency partnerships, combined with product and service enhancements, earns additional “shelf space” with agents.

• Partners with the best independent agents and brokers providing them with a broad and growing portfolio of innovative products, local underwriting expertise, and unparalleled service to help meet their customers’ insurance needs.

• The Hanover Insurance Group® is the 25th largest Property and Casualty Insurer in the United States based upon 2019 revenues.

• Named One of "America's Best Mid-Size Employers" for fifth consecutive year

• Earns Perfect Score on Corporate Equality Index

Valuable